Business Update

December 13, 2005

Forward-Looking Statements

The information contained in this presentation includes certain estimates and other forward-

looking information that reflect our current views with respect to future events and financial

performance

These estimates and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences

between such estimates and actual results, and those differences may be material to

HealthSouth

There can be no assurance that any estimates or forward-looking information will be realized

All such estimates and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein

You are cautioned not to place undue reliance on the estimates and other forward-looking

information in this presentation as they are based on current expectations and general

assumptions and are subject to various risks, uncertainties and other factors, many of which are

beyond our control, that may cause actual results to differ materially from the views, beliefs and

estimates expressed herein

Forward-Looking Statements (cont.)

Some factors that may affect the accuracy of such forward-looking statements are as follows:

Regulatory changes, including the implementation of the 75% Rule and the recently-

adopted rule updating the IRF-PPS for federal fiscal year 2006

Resolution of outstanding litigation, including certain class action litigation alleging

violations under federal securities laws and certain qui tam actions

Our ability to successfully refinance our existing public indebtedness as it becomes due

Changes, delays in or suspension of reimbursement by payors

Completion of the investigations by the United States Department of Justice

Competitive pressures

General conditions in the economy and capital markets

Completion of the reconstruction of our financial records

References may be made to information relating to periods up to and including

December 31, 2004 and information relating to periods after December 31, 2004

Information relating to periods up to and including December 31, 2004 is taken from

the financial statements contained in our 2004 Form 10-K, which have been audited

Information relating to periods after December 31, 2004 is unaudited and remains

subject to change based upon the ongoing efforts to reconstruct our accounting

records. Actual results may differ materially from the results presented herein for

those periods

Cautionary Statements Regarding

Presentation

Cautionary Statements Regarding

Presentation (cont’d)

Amounts shown for periods after December 31, 2004 were prepared on a basis

consistent with amounts shown for periods up to and including December 31, 2004,

with the following exceptions. Amounts shown for periods after December 31, 2004:

Exclude “Restructuring Charges” unless otherwise noted, even though such

charges may be of a recurring nature

Exclude the results of the discontinued operations

Do not include charges relating to the impairment of assets, if any

May differ materially from the results presented herein for those periods

following the completion of our reconstruction process

The financial data contained herein includes non-GAAP financial measures, including “Adjusted

EBITDA,” to assist in assessing projected and actual operating performance and to facilitate

quantification of planned business activities

As used by HealthSouth, “Adjusted EBITDA” is consistent with the definition of Adjusted

Consolidated EBITDA in our Amended and Restated Credit Agreement dated as of March 21,

2005. In general terms, this definition allows us to add back to EBITDA charges of the type

classified as “Restructuring Charges” on or prior to June 30, 2005. These charges are generally

not consistent with the definition of restructuring charges as defined under GAAP

Costs which we classify as “Restructuring Charges” are: professional fees associated with

litigation including the class action and shareholder derivative litigation, financial restructuring,

government investigations, forensic accounting, creditor advisors, accounting reconstruction,

audit and tax work associated with the reconstruction process, and the implementation of

Sarbanes-Oxley §404 and non-ordinary course charges incurred after March 19, 2003 and

related to the company’s overall corporate restructuring

Under the Amended and Restated Credit Agreement, we are permitted to continue to add back

to EBITDA professional fees associated with the class-action and shareholder derivative

litigation after June 30, 2005

Notes Regarding Presentation of Non-

GAAP Financial Measures

Adjusted EBITDA may be useful to stakeholders because it is commonly used as an analytical

indicator within the healthcare industry to measure leverage capacity and debt service ability.

While it may be useful to measure debt service capacity, it should not be considered as a

measure of financial performance under GAAP

Because HealthSouth currently does not have a balance sheet or other financial statements for

any period after December 31, 2004, we are currently unable to reconcile non-GAAP financial

measures for such periods to a financial measure calculated in accordance with GAAP. In

addition, once our reconstruction process is completed for periods after December 31, 2004,

changes could occur in the results indicated for such periods

Notes Regarding Presentation of Non-

GAAP Financial Measures (cont’d)

There are a number of disclaimers and other cautionary statements set forth in the filings we

have made with the Securities and Exchange Commission. We urge you to carefully review

those statements, particularly those contained in our 2004 Form 10-K, which was filed on

December 2, 2005; however, we highlight the following:

We are highly leveraged and our substantial indebtedness may limit cash flow available

for our operations and could impair our ability to service our debt or obtain additional

financing

We derive a substantial portion of our net operating revenues from the Medicare and

Medicaid programs and our operating results could be adversely affected by changes in

laws or regulations governing these programs, as evidenced by the recent promulgation

of the 75% Rule and the updated IRF-PPS for federal fiscal year 2006

HealthSouth, as well as certain of its past and present officers and directors, is also

subject to a number of class action, derivative and individual lawsuits relating to, among

other things, allegations of violations of federal securities laws

We are in the process of reconstructing our accounting records for periods after

December 31, 2004

Considerations Involving Our Current

Situation

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

I. Opening Remarks

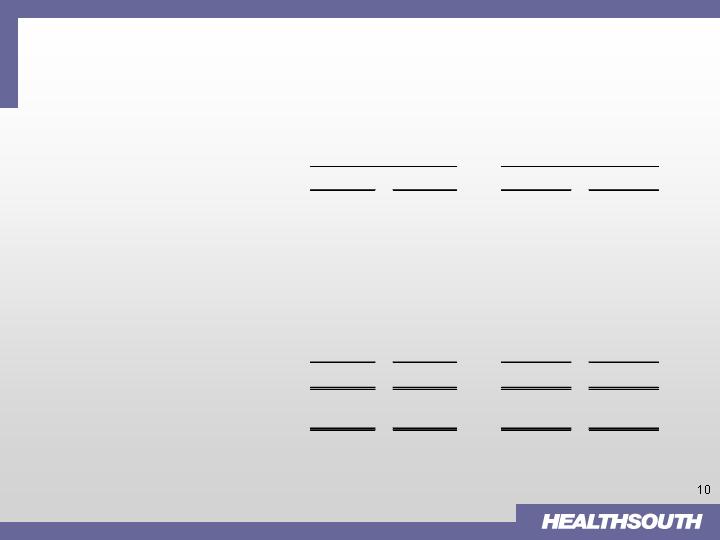

3Q 2005 Results(a)

(dollars in millions)

(a) Amounts are unaudited, before Restructuring Charges, impairments and subject to restatement

(b) HealthSouth collected $37.9 million in August 2005 of amounts deemed uncollectible in 2001 and 2002

(c) Budget revised to remove discontinued operations; primarily in Outpatient & Corp/Other

3Q 2005

3Q Year-to-Date

Actual

Budget

(c)

Actual

Budget

(c)

Net Revenue

$828.8

$915.4

$2,626.2

$2,748.5

Expenses:

Personnel Costs

378.3

422.9

1,176.8

1,251.9

Cost of Sales

76.3

87.7

256.1

262.3

Other

219.2

230.5

678.2

690.1

Recovery of Advances

(b)

(37.9)

-

(37.9)

-

Depreciation and Amortization

49.8

43.2

151.4

129.4

Minority Interest

19.5

23.5

66.9

73.6

Operating Earnings

$123.7

$107.6

$334.6

$341.3

Adjusted EBITDA

$173.5

$150.7

$486.1

$470.6

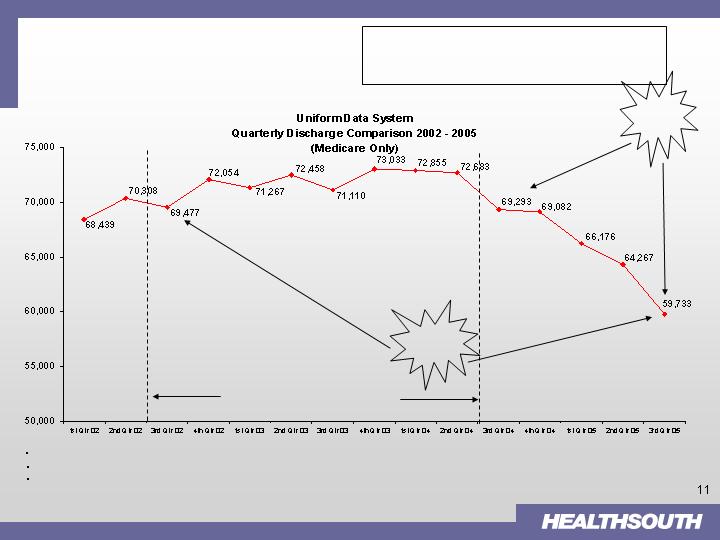

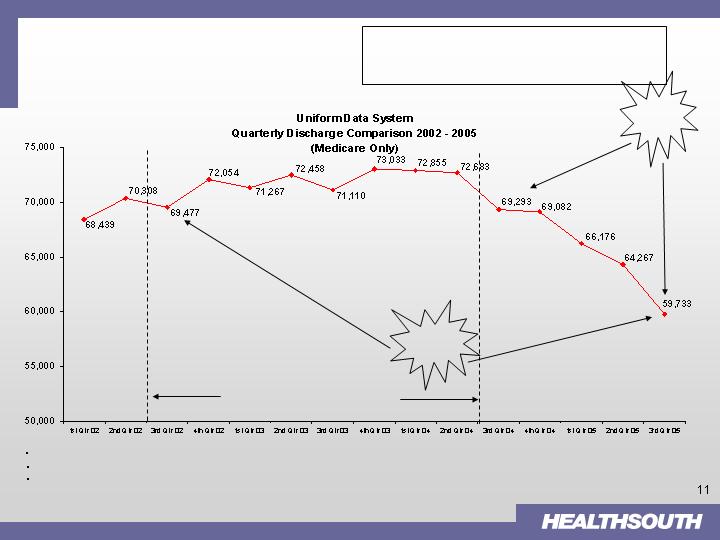

Percentages reflect variance from corresponding prior year quarter

Data derived from facilities reporting discharges in each quarter (603). Data represents approximately 64% of Medicare IRF discharges

This summary information was provided by UDSmr, for the benefit of the rehabilitation field, and is used with prior written permission of UDSmr

Updated November 29, 2005

IRF

Discharges

-14.0%

3Q 2002 vs.

3Q 2005

-13.8%

3Q 2004 vs.

3Q 2005

Suspension of Enforcement of 75% Rule

75% Rule Update

Moran Report: 52,000 Medicare beneficiaries

affected in 2005

Clinical Differences of Post-Acute Care Settings

75% Rule Update

Characteristic

IRF

SNF

1.

Attending physician visits

2-3 times/week

At least every 30 days

2.

Multi-disciplinary team approach;

Required

Not required

Coordinated Program of Care

3.

MD or DO designated as Rehabilitation

Required

Not required

Director

4.

RN oversight and availability

24 hours/day

At least 8 consecutive

hours/day

5.

Nursing hours per pt-day

5.0 – 7.5

2.5 – 4.0

6.

Nursing training, expertise

Rehabilitation

None

specialty expertise

7.

PT, OT, and/or Speech Therapy

3 hours/day

No minimum

level of service

(minimum)

Advocacy

Participating with coalition to implement meaningful 75% Rule reform

We support S.1932 which would maintain the Rule at the 50%

threshold until July 2007

During this time, research should be conducted to provide clinical data

from which policy decisions can be made

$2.5 million JOINTS study with National Rehabilitation Hospital and

the Institute for Clinical Outcomes Research

Compares outcomes for 2,800 IRF and SNF patients nationally

Additional research re: suitability of refining 75% Rule to include

other patient conditions

75% Rule Update

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

Volume decline primarily due to 75% Rule

Some general acute weakness in certain markets

EBITDA impact of hurricanes ~ $1.4 million

28 bed LTCH in New Orleans remains closed

Total compliant cases up 5% vs. 3Q 2004

All facilities meeting compliance thresholds

11 facilities advanced to 60% in 3Q 2005

Lewin Group analysis corroborated HS pricing impact

(a) 2005 amounts are before restructuring, impairment, corporate overhead and subject to restatement

(b) Based upon results from 3Q 2005, corporate overhead is approximately 4.3% of revenue excluding D&A & one-time gain/loss

Operating Statistics

Financial Overview (in millions)

Highlights

Division President: Mark Tarr

3.1%

1.27

1.31

Medicare Case Mix Index

4.2%

$14,427

$15,036

IP Rev/ Discharge

(12.9%)

545,066

474,498

SS OP Visits

(9.6%)

30,013

27,144

SS IP Discharges

Change

3Q 2004

3Q 2005

%

II. Operations Update – Inpatient

3Q 2005

3Q 2005

Actual

(a)

Budget

Net Revenue

$471.2

$517.0

Personnel costs

224.2

249.5

Cost of sales

27.0

30.2

Other

90.1

99.1

Total operating

expenses

341.3

378.7

Depreciation and

amortization

15.0

11.2

Minority Interest

8.1

10.6

Operating Earnings

Before Corp. OH

$106.9

$116.5

Memo:

Corporate OH

(b)

$20.3

$19.2

II. Operations Update – Surgery

Division President: Joe Clark

Highlights

Financial Overview (in millions)

Operating Statistics

EBITDA impact of hurricanes ~ $0.8 million

33 re-syndications completed through 3Q 2005

Expect to achieve 2005 target for re-syndications

Re-syndication backlog substantially eliminated

Portfolio dispositions substantially complete by

12/31/05

Operational focus: volume, pricing labor and

supplies

(a) 2005 amounts are before restructuring, impairment, corporate overhead and subject to restatement

(b) Based upon results from 3Q 2005, corporate overhead is approximately 4.3% of revenue excluding D&A & one-time gain/loss

(3.8%)

$927

$962

Op. Exp./Case

5.3%

$1,144

$1,205

Rev/Case

(2.1%)

158,416

155,107

SS Cases

(7.9%)

178,366

164,356

Total Cases

Change

3Q 2004

3Q 2005

%

3Q 2005

3Q 2005

Actual

(a)

Budget

Net Revenue

$198.0

$207.8

Personnel costs

67.7

69.1

Cost of sales

44.3

46.4

Other

46.2

47.2

Total operating

expenses

158.2

162.8

Depreciation and

amortization

8.7

9.4

Minority Interest

10.3

10.9

Operating Earnings

Before Corp. OH

$20.9

$24.7

Memo:

Corporate OH

(b)

$8.5

$7.7

(a) 2005 amounts are before restructuring, impairment, corporate overhead and subject to restatement

(b) Based upon results from 3Q 2005, corporate overhead is approximately 4.3% of revenue excluding D&A & one-time gain/loss

(c) Budget revised to remove discontinued operations

5.2%

$91

$86

OP Exp/ Visit

2.3%

$98

$100

Rev/ Visit

(5.3%)

978,877

926,509

SS Visits

(15.4%)

1,115,432

943,506

Total Visits

Change

3Q 2004

3Q 2005

%

II. Operations Update – Outpatient

Division President: Diane Munson

Highlights

Financial Overview (in millions)

Operating Statistics

EBITDA impact of hurricanes ~ $0.4 million

Closed/consolidated 10 sites in 3Q 2004

Portfolio dispositions substantially complete by 12/31/05

Further consolidated back office billing/collection

Developed sales program and organization to focus

on growth opportunities

3Q 2005

3Q 2005

Actual

(a)

Budget

(c)

Net Revenue

$94.6

$107.4

Personnel costs

53.5

61.2

Cost of sales

0.8

1.2

Other

26.8

31.7

Total operating

expenses

81.1

94.1

Depreciation and

amortization

3.0

3.4

Minority Interest

(0.0)

0.1

Operating Earnings

Before Corp. OH

$10.5

$9.9

Memo:

Corporate OH

(b)

$4.1

$4.0

II. Operations Update – Diagnostic

Division President: Karen Davis

Highlights

Financial Overview (in millions)

Operating Statistics

(a) 2005 amounts are before restructuring, impairment, corporate overhead and subject to restatement

(b) Based upon results from 3Q 2005, corporate overhead is approximately 4.3% of revenue excluding D&A & one-time gain/loss

(1.6%)

$244

$248

Op. Exp./Scan

(4.3%)

$302

$289

Rev/Scan

(3.2%)

180,338

174,521

SS Scans

(5.1%)

184,129

174,650

Total Scans

Change

3Q 2004

3Q 2005

%

Hurricane impact ~ $0.7 million

Same store volume growth (1.3%) normalized for

impact of hurricanes

Centralization of collections causing increased

exposure in start-up phase

3Q 2005

3Q 2005

Actual

(a)

Budget

Net Revenue

$50.4

$56.1

Personnel costs

14.6

16.3

Cost of sales

2.6

3.0

Other

26.0

26.4

Total operating

expenses

43.2

45.7

Depreciation and

amortization

5.4

6.9

Minority Interest

0.9

1.4

Operating Earnings

Before Corp. OH

$0.9

$2.1

Memo:

Corporate OH

(b)

$2.2

$2.1

II. Operations Update – Corporate/Other

Financial Overview (in millions)

Highlights

D&A based on restated numbers

Transaction with UAB Health System for

purchase of HealthSouth Medical Center

proceeding; closing date has been delayed due

to regulatory issues

Digital Hospital disposition expected in 2006;

timing unclear due to regulatory issues

HealthSouth collected $37.9 million in August

2005 of amounts deemed uncollectible in 2001

and 2002

(a) Amounts are unaudited, before Restructuring Charges, impairments and subject to restatement

(b) HealthSouth collected $37.9 million in August 2005 of amounts deemed uncollectible in 2001 and 2002

(c) Budget revised to remove discontinued operations

3Q 2005

3Q 2005

Actual

(a)

Budget

(c)

Net Revenue

$14.6

$27.1

Personnel costs

18.2

26.8

Cost of sales

1.6

6.9

Other

30.2

26.2

Recovery of Advances

(b)

(37.9)

-

Total operating

expenses

12.1

59.9

Depreciation and

amortization

17.8

12.4

Minority Interest

0.3

0.5

Operating Earnings

($15.5)

($45.6)

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

1Q 2006

2Q 2006

1Q 2007

2005 Form 10-K Filed

Access to 144A Debt Mkts

Access to Public Mkts

Completed

2004 Form 10-K Filed

Completed

Comprehensive 2000-2003 Form

10-K Filed

III. Filing Timeline

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

IV. 2004 Form 10-K

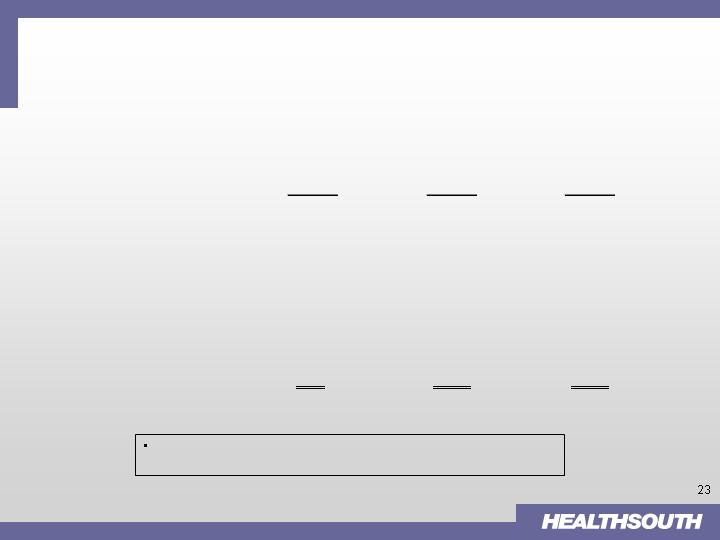

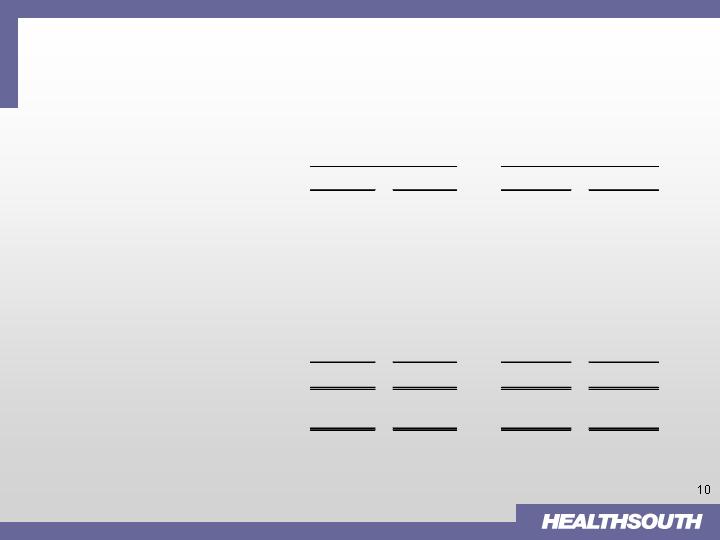

Operating Earnings

(dollars in millions)

Overall improvement from Surgery, Outpatient, Diagnostic, and

Corporate / Other; Inpatient remained flat

2004

2003

2002

Inpatient

$437

$437

$341

Surgery

$89

($54)

$109

Outpatient

$37

($51)

$16

Diagnostic

($10)

($36)

($28)

Corporate / Other

($406)

($513)

($598)

--------

--------

--------

$147

($217)

($160)

IV. 2004 Form 10-K (cont’d)

Consolidated Adjusted EBITDA

(dollars in millions)

Previously Reported in April Business Update

on "Consolidated" Basis

$631.9

As Reported in 2004 Form 10-K

Consolidated Adjusted EBITDA (p. 74)

$621.1

Out-of-Period Adjustments (p. 66)

$13.7

Amount Attributable to 2004

$634.8

Restructuring Costs

(dollars in millions)

Amount Estimated in December

$195.0

Business Update

Amount per 2004 Form 10-K

$206.0

IV. 2004 Form 10-K (cont’d)

Selected Balance Sheet Highlights

(dollars in millions)

2004

2003

Total Cash

$639

$615

Accounts Receivable

$452

$499

Property and Equipment

$1,405

$1,447

Income Tax Receivable

$264

$295

Goodwill, Intangibles

$976

$984

All Other

$347

$370

Total Assets

$4,083

$4,210

Payables

$171

$152

Accruals, Refunds

$316

$301

Due Government, Class Action

$419

$426

Insurance Reserves

$181

$165

Long-term Debt

$3,511

$3,521

All Other

$594

$609

Shareholders' Deficit

($1,109)

($964)

Total Liabilities

$4,083

$4,210

IV. 2004 Form 10-K (cont’d)

Selected Cash Flow Highlights

(dollars in millions)

From Operations

2004

2003

Form 10-K

$414

$557

Prof. Restructuring Fees

$206

$71

Before Prof. Restructuring Fees

$620

$628

Investing Activities

($206)

($60)

Financing Activities

($225)

($117)

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

V. Liquidity

Interest payments were $34.1 million for 3Q 2005

CMS/DOJ - Civil settlement payments were $22.3 million for 3Q 2005

(a) Restricted cash includes non-consolidated partnership accounts, deposits related to captive insurance account and other risk

management deposits

$445.3

$358.2

Consolidated Cash

$248.3

$225.3

Restricted Cash(a)

$197.0

$132.9

Available Cash

September 30, 2005

June 30, 2005

(dollars in millions)

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

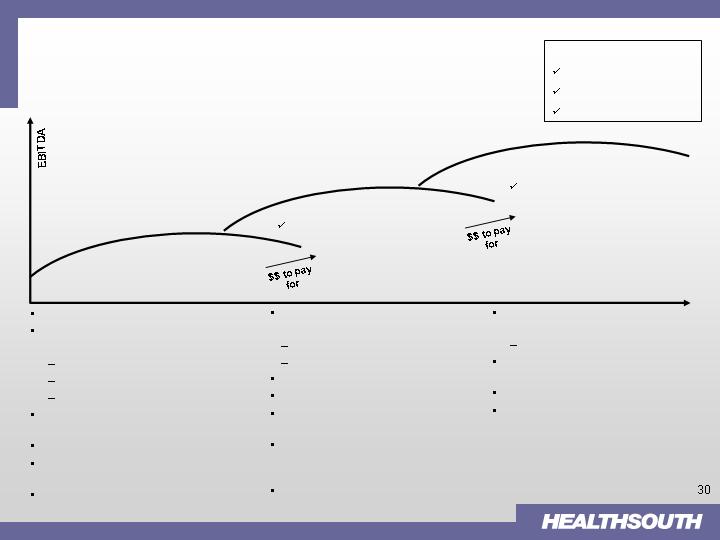

Mitigate 75% Rule

Drive operational improvement in all BUs

(pricing, labor, supplies)

Bring O/P divisions to peer group

Reduce variability within all divisions

Focus on quality

Ramp-up business development

capabilities (IRF, ASC)

Pilot Home Health; refine LTCH

Establish appropriate internal control

environment

Evaluate Diagnostic Division inquiries

Expand into other post-acute

segments

LTCH

Home Health

Acquire or build IRFs in target markets

Develop new ASCs

Continue to drive operational

improvement

Re-evaluate expansion / market

opportunities in Outpatient and

Diagnostics

Establish appropriate internal control

environment

Expand into other post-acute

segments

Potential M&A

Acquire or build IRFs in target

markets

Develop new ASCs

Continue to drive operational

improvement

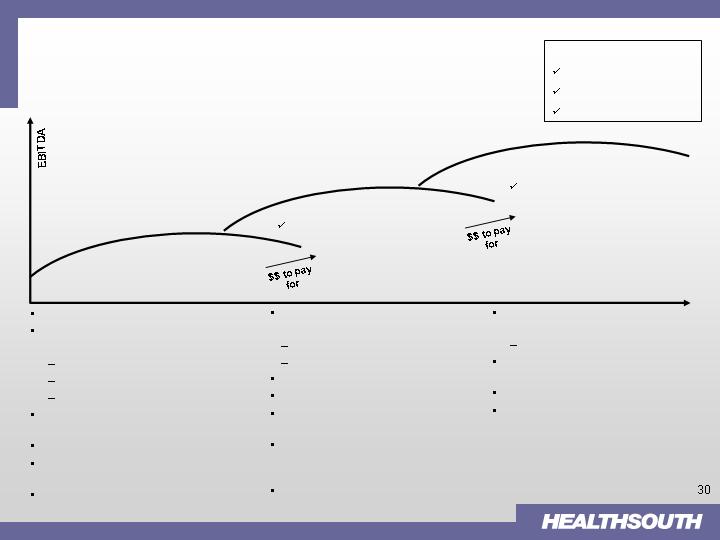

Phase 1:

0 to 24 months

Phase 2:

12 to 36 months

Phase 3

24 to 48 months

Operational focus

Operational and development focus

Pay down debt

Operational, development,

and new business focus

Pay down debt

Time

Strategic Horizons

Metrics

Volume growth (SS)

Margin expansion

Debt reduction

Strategic Plan – Summary

Agenda

I.

Opening Remarks

Jay Grinney

II.

Operations Update

Mike Snow

III.

Filing Timeline

John Workman

IV.

2004 Form 10-K

John Workman

V.

Liquidity

John Workman

VI.

Closing Remarks

Jay Grinney

VII.

Questions & Answers

Business Update