Unlocking Value

November 2006

Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and

other forward-looking information that reflect our current views with respect to future events

and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are

reasonable. Inevitably, there will be differences between such estimates and actual results,

and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will

be realized.

All such estimates, projections and forward-looking information speak only as of the date

hereof. HealthSouth undertakes no duty to publicly update or revise the information

contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other

forward-looking information in this presentation as they are based on current expectations

and general assumptions and are subject to various risks, uncertainties and other factors,

including those set forth in our Form 10-Q for the periods ended March 30, 2006, June 30,

2006 & Sept. 30, 2006, the Form 10-K for the fiscal year ended December 31, 2005 and

current report on Form 8-K dated May 26, 2006 and in other documents that we previously

filed with the SEC, many of which are beyond our control, that may cause actual results to

differ materially from the views, beliefs and estimates expressed herein.

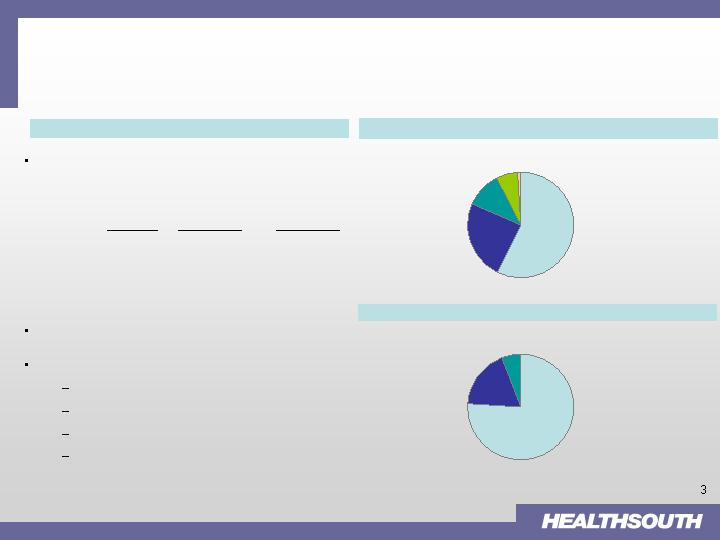

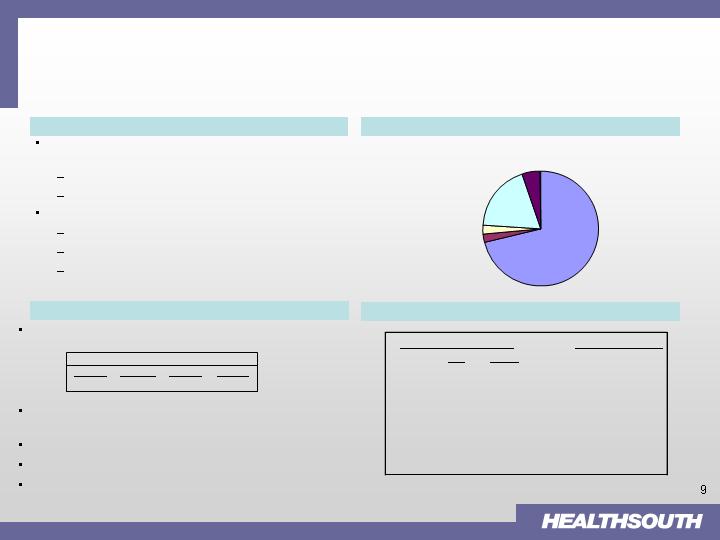

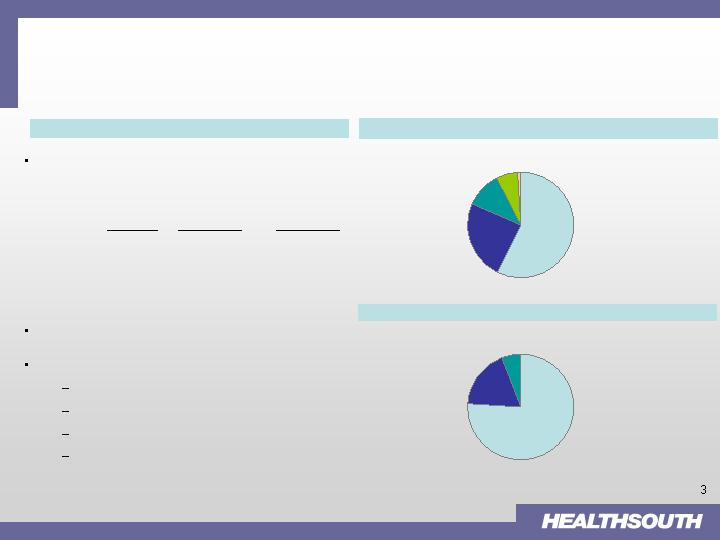

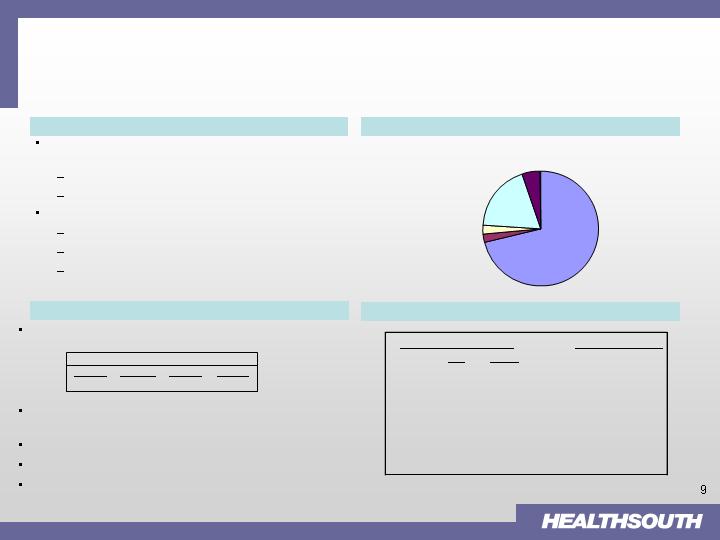

Diversified Healthcare Services Provider

The Company is a leader in each of its four major

operating divisions

Approximately 1,003 facilities in 45 states

YTD Performance (09/30/06)

Net Operating Revenues: $2.3 billion

Operating Earnings of $119.7 million

Adjusted Consolidated EBITDA: $411.8 million

Adjusted Consolidated EBITDA margin:

18.0%

Diagnostic

(6.9%)

Outpatient

6.3%

Surgery

19.7%

Inpatient

81.0%

National Provider of Healthcare Services

Diversified Business Portfolio (b) (c) : % of Net Operating Revenues

Other

0.8%

Inpatient

57.1%

Surgery

24.3%

Outpatient

11.0%

Diagnostic

6.7%

(a) Based on facility counts as of Sept. 30, 2006.

(b) Percentages do not include Intersegment Revenues; operating earnings include operating

divisions only

(c) Nine months ended Sept. 30, 2006.

% of Operating Earnings (b) (c)

Market

YTD Net Rev.

YTD Op. Earn.

Share

(a)

(09/30/06)

(09/30/06)

Inpatient

#1

$1,303.3 M

$277.7 M

ASC

#1

$555.2 M

$67.5 M

Outpatient

#2

$251.4 M

$21.5 M

Diagnostic

#2

$153.6 M

($23.8 M)

Q3 2006 Earnings Call Re-cap

Consolidated

Net Operating Revenues of $731.2 million

Pre-tax loss from continuing operations of $68.3 million

$28.4 million provision for government, class action and related

settlements expense

$28.7 million loss on interest rate swap

Re-listed on NYSE on Thursday, October 26th

Divestiture Process

Extremely pleased with level of interest from potential bidders

Process on track; remain optimistic to announce transactions in early

2007

Q3 2006 Earnings Call Re-cap (cont’d)

Inpatient

Net Operating Revenues 3Q 2006 $420 million vs $440 million 3Q 2005

Acute-care weakness; 75% Rule; Pricing

Q3 Compliant Case growth approximately 4.9%

Post-acute strategy; several development milestones:

Closed market consolidation in Tucson; admissions in market up

24%

Broke ground on new 40-bed hospital in Fredericksburg, Virginia

Internal approval for new 50-bed IRF in Phoenix

Announcement of acquisition in Wichita Falls, Texas

Q3 “Normalized” EBITDA(1)

Q3 2006 Earnings Call Re-cap (cont’d)

(1) Adjusted Consolidated EBITDA is a non-GAAP measure that we use to assess our operating performance;

See appendix for non-GAAP financial reconciliations

Shortfall in line from 75% Rule and CMS pricing

(pricing changes favorably as of October 1, 2006)

($ millions)

Q3

2006

2005

Adjusted Consolidated EBITDA per 10-Q

141.9

$

174.9

$

Non-recurring gains

(35.0)

(37.9)

Non-core Diagnostic

4.2

(5.4)

Inpatient - new system implementation

6.0

Adjusted EBITDA

117.1

$

131.6

$

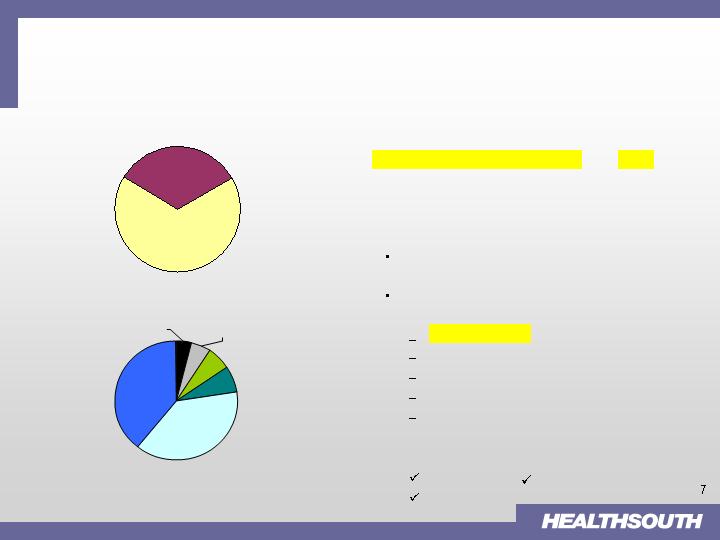

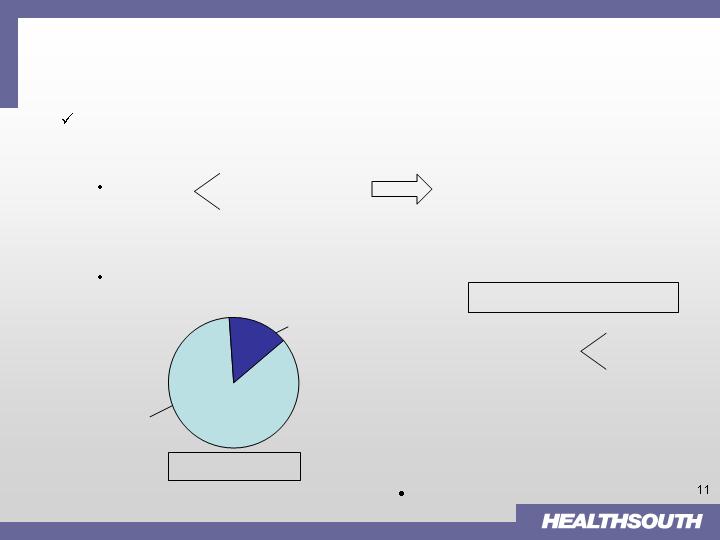

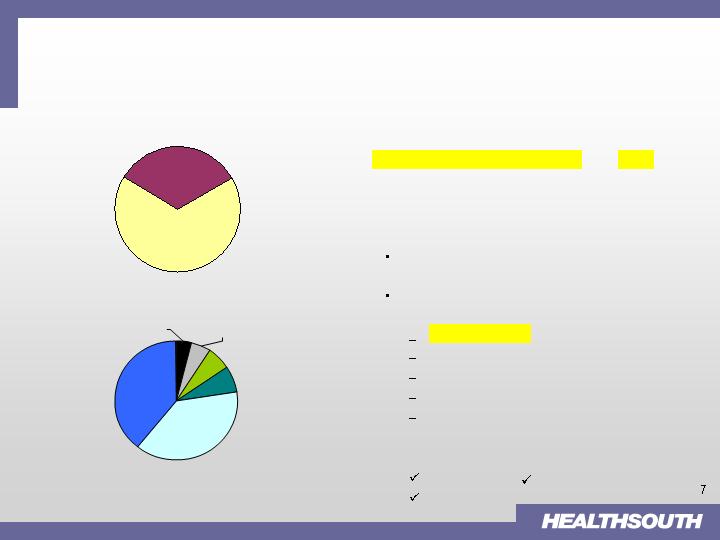

Repositioning: Post-Acute; Focus: IRFs

The Post-Acute Market is Sizeable and Remains Highly Fragmented

Post-Acute Usage After Hospital Discharge

Post-Acute Market (2004)

2004 Market Size: $126 B

Source: 2005 CMS, MedPAC and Wall Street research

Post Acute Care

33%

No Post Acute Care

67%

IRF 7%

Skilled Nursing

38%

Home Health

37%

IPF6%

Outpatient 5%

Hospice 4%

Approximately 1/3 of all hospital

patients require Post-Acute Care.

Top 3-5 players in each sector hold

the following market share:

Post-Acute Growth Opportunity

Segment

Projected Growth

Inpatient Rehab Facilities (IRFs)

4-6%

Home Health

5-9%

Hospice

12-15%

Long Term Acute Care (LTCH)

10-15%

Skilled Nursing

4-6%

<25% in IRFs

<10% in Home Health

<20% in Hospice

<20% in Skilled Nursing

~50% in LTCH

Non-core segments

Surgery

Diagnostic

Outpatient

Notes:

1. Source: Annual Reports; Verispan data; management analysis

2. Typically a 15 – 30 bed wing / unit of an acute-care hospital

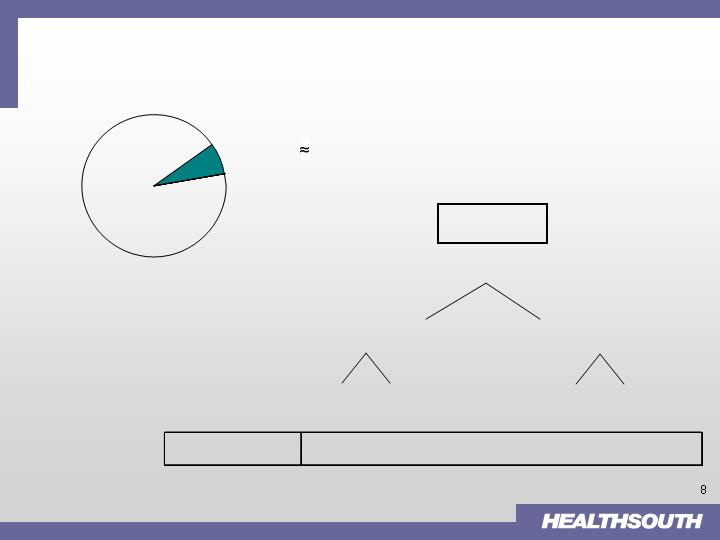

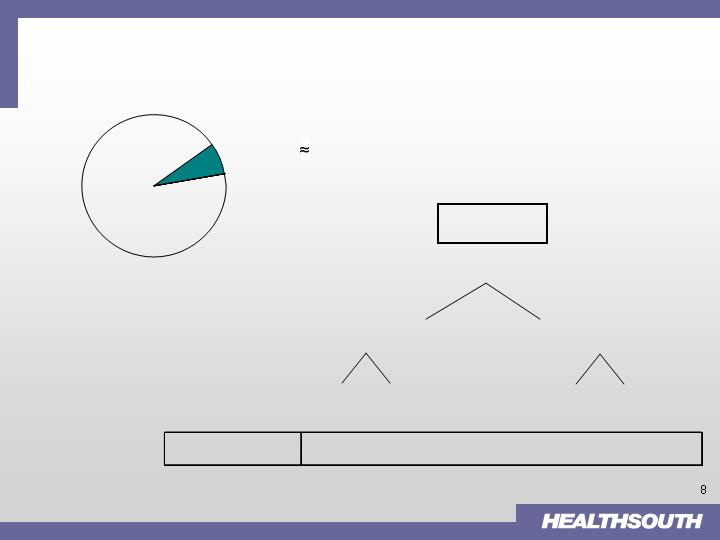

Post Acute Market

IRF Segment Profile

U. S. IRF

Market (

2004

)

(1)

1337 IRFs

Free-standing = 334 (25%)

In-hospital Unit

(2)

= 1003 (75%)

HLS

All Others

For-Profit

Not-for-Profit

Hospitals

Hospitals

Number of IRFs

92

242

266

737

IRF 7% $9 Billion

Inpatient Division

Managed Care

18.7%

Medicare

71.2%

Patients

0.2%

Other 3

rd

Party

5.1%

Medicaid

2.1%

Workers Comp

2.7%

16

66

1

9

May 31

Dec. 31

Sept. 30

June 30

HealthSouth Cost Reporting Year

Overview

102 Hospital Locations

75% Rule/ Reimbursement

Nation's largest provider of inpatient rehabilitation

services

193 locations (92 IRFs, 91 outpatient satellites)

10 LTCH facilities

YTD Performance (09/30/06)

Net Operating Revenues: $1,303.3 million

Operating Earnings: $277.7 million; Margin: 21.3%

Compliant Case Growth approximately 5.4%

Threshold frozen at 60% for an additional year (07/01/07)

HealthSouth outperforms the market with compliant case

growth

Research underway; Symposium Q1 2007

Administrative “fix”; legislative remedy (1H 2007)

Rule creating consolidation opportunities for HealthSouth

Payor Mix(1) for the nine months ended 9/30/2006

State Concentrations

(2)

Cummulative %

(2)

IRF

LTCH

TX

15

1

16%

PA

9

2

26%

FL

9

1

36%

AL

6

42%

TN

6

48%

LA

2

3

53%

AZ

5

58%

SC

5

63%

(1)

Net Patient Revenue

(2)

Number of IRF's & LTCH's Only

Strong cash flow characteristics

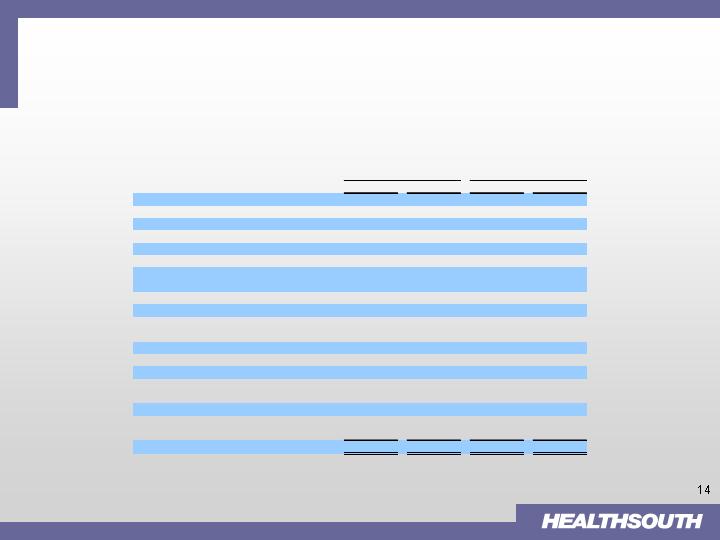

Inpatient Division (cont’d)

Inpatient Division

($ in millions)

(1) Current overhead calculation of 4.25% of net operating revenue may not be comparable to stand alone entity

(2) 2005 numbers adjusted for discontinued ops facilities in 2006

YTD 9/30/06

2005

(2)

Net Operating Revenues

$1,303.3

$1,776.3

Operating Earnings

277.7

388.3

Corporate OH (as a % of revenue)

(1)

(55.4)

(75.5)

Depreciation

47.5

65.4

Available Cash Before CAPEX & Debt Service

$269.8

$378.2

CAPEX (maintenance only)

(30.0)

(38.8)

Cash Available for Growth CAPEX

$239.8

$339.4

and Debt Service

Growth Opportunities

Post divestiture, HealthSouth’s growth will occur through organic and

development initiatives

Organic*

2-3% Pricing

1-2% SS Volume

Development: Current IRF/LTCH pipeline:

~ 40+ projects

*After full implementation of 75% Rule

IRF

LTCH

IRF

1.

Consolidation

(Existing markets)

2.

De-novo (Existing or New markets)

3.

Acquisition (New markets)

LTCH (to supplement IRF presence)

De-novo

J.V.

Acquire

Mid-to high-single digit

EBITDA growth

Development Strategies

85%

15%

Growth Potential – Illustrative Examples

($ in thousands)

(1) % includes estimated corporate overhead of 4.25%

(2) Assumes HLS owns 80% of JV

Higher Margin from Platform Efficiency

Ramp-up Period though Strong IRR

Incremental EBITDA with No Investment

Capacity Rationalization

“Win - Win” Situation for Both Parties

Consolidation - Joint Venture

DeNovo - Proforma (40 Bed)

Revenue

EBITDA

%

(1)

Revenue

EBITDA

%

(1)

Stand Alone

$10,000

$2,000

16%

Year 1

$8,500

$1,275

11%

Joint Venture

(2)

$14,000

$3,200

19%

Year 2

$10,500

$2,500

20%

- Minority Interest

($640)

Run Rate

$11,500

$2,900

21%

After Consolidation

$14,000

$2,560

14%

Incremental

EBITDA

$560

Investment

$14,000

Investment

$0

5-year Annualized ROI

~ 18%

Summary

HealthSouth has emerged from a period of unprecedented uncertainty and

upheaval with a new Board, a new management team, a new balance sheet and a

new direction.

By divesting its non-core assets, the Company will be well-positioned to become a

“pure-play” post-acute provider and a consolidator in the fragmented $126 B post-

acute space

These divestures – along with any proceeds we may receive from tax refunds and

certain derivative litigation – will significantly strengthen the Company’s Balance

Sheet through deleveraging.

Re-listed on NYSE (symbol: HLS) in late October, completing our “rehabilitation”

and we have begun a new chapter in the history of HealthSouth.

Near Term

Longer-term

IRFs

LTCHs (supplemental to IRFs only)

Home Health

Hospice

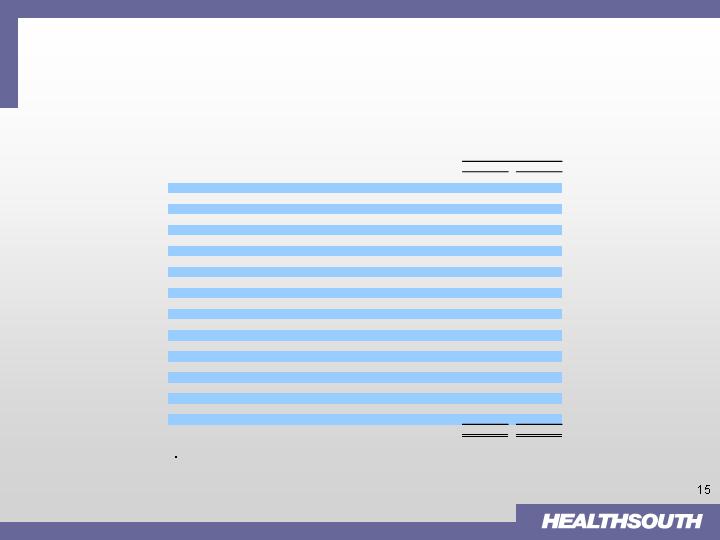

Appendix

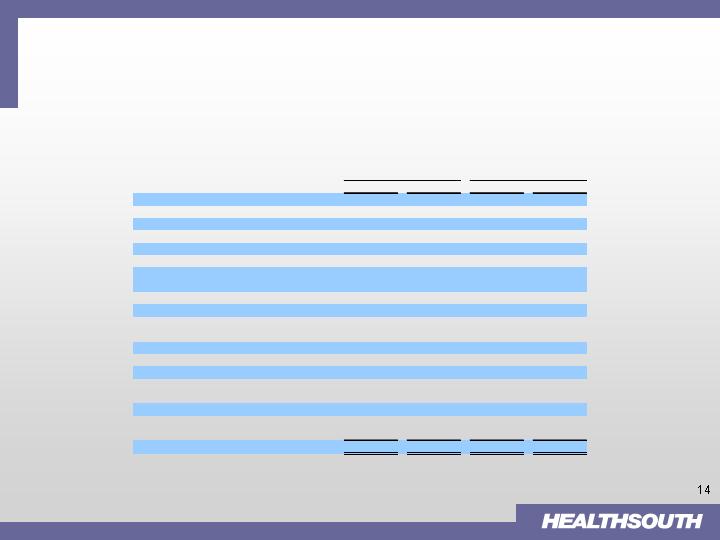

Non-GAAP Financial Reconciliations

(In Thousands)

Reconciliation of Net Loss to Adjusted Consolidated EBITDA

2006

2005

2006

2005

Net loss

(76,144)

$

(11,541)

$

(553,718)

$

(332,158)

$

Loss from discontinued operations

3,291

11,735

20,191

30,830

Provision for income tax expense

4,582

10,339

31,457

29,209

Loss on interest rate swap

28,711

-

13,922

-

Loss (gain) on sale of marketable securities

107

-

121

(10)

Interest income

(1,253)

(3,739)

(9,610)

(10,618)

Interest expense and amortization of debt

discounts and fees

82,493

82,904

250,647

253,530

(Gain) loss on early extinguishment of debt

(6)

-

365,636

33

Professional fees—accounting, tax, and legal

23,774

33,072

100,402

113,429

Government, class action, and related

settlements expense

28,420

-

45,733

215,000

Impairment charges

200

1,460

4,022

26,375

Net non-cash loss on disposal of assets

3,448

2,385

8,830

16,672

Depreciation and amortization

38,473

40,249

113,726

128,694

Compensation expense under FASB Statement

No. 123(R)

3,595

-

11,630

-

Sarbanes-Oxley related costs

861

7,738

4,237

22,965

Restructuring activities under FASB Statement

No. 146

1,348

249

4,579

7,456

Adjusted Consolidated EBITDA

141,900

$

174,851

$

411,805

$

501,407

$

Three Months Ended

September 30,

Nine Months Ended

September 30,

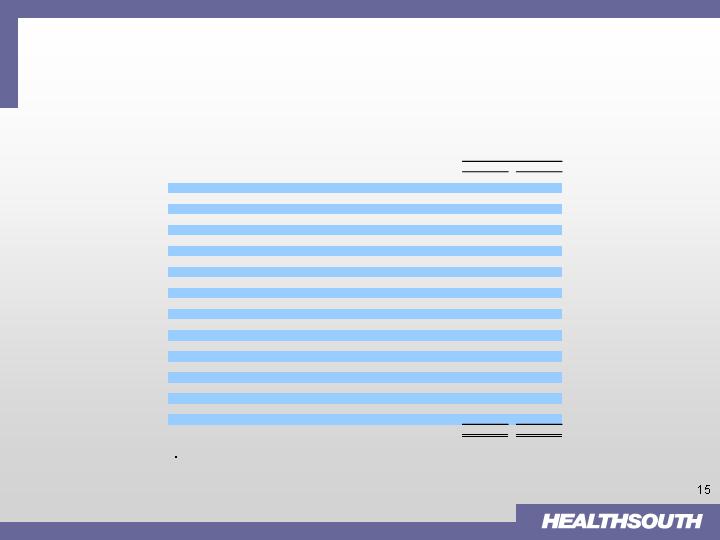

Appendix (cont’d)

Non-GAAP Financial Reconciliations

The change in operating cash and assets and liabilities during the nine months ended September 30, 2006 primarily

resulted from declining volumes in each of our operating segments, increased receivable balances (due to current

collection trends, the $35.0 million receivable recorded as a recovery from Mr. Scrushy, and a delay in Medicare

payments), and non-cash reductions in various accrued expenses, including a reduction in estimates associated with

legal fees owed to Mr. Scrushy.

Reconciliation of Adjusted Consolidated EBITDA to Net Cash (Used In) Provided By Operating Activities

2006

2005

Adjusted Consolidated EBITDA

411,805

$

501,407

$

Professional fees—accounting, tax, and legal

(100,402)

(113,429)

Sarbanes-Oxley related costs

(4,237)

(22,965)

Interest expense and amortization of debt discounts and fees

(250,647)

(253,530)

Interest income

9,610

10,618

Provision for doubtful accounts

86,364

68,583

Net gain on disposal of assets

(7,977)

(2,656)

Amortization of debt issue costs, debt discounts, and fees

16,312

30,371

Amortization of restricted stock

2,654

1,358

Accretion of debt securities

(53)

(117)

Loss on sale of investments, excluding marketable securities

1,103

3,420

Equity in net income of nonconsolidated affiliates

(16,841)

(21,115)

Distributions from nonconsolidated affiliates

10,455

15,615

Minority interest in earnings of consolidated affiliates

78,367

78,895

Stock-based compensation

8,976

-

Compensation expense under FASB Statement No. 123(R)

(11,630)

-

Current portion of income tax provision

(10,670)

(16,244)

Restructuring charges under FASB Statement No. 146

(4,579)

(7,456)

Recovery of amounts due from Richard M. Scrushy

(35,000)

-

Net cash settlement on interest rate swap

1,448

-

Other operating cash used in discontinued operations

(25,271)

(42,879)

Change in government, class action, and related settlements liability

(87,171)

(133,548)

Change in assets and liabilities, net of acquisitions*

(148,251)

(7,766)

Net Cash (Used In) Provided By Operating Activities*

(75,635)

$

88,562

$

Nine Months Ended

September 30,

(In Thousands)