Unlocking Value

Investor Presentation

March 2007

Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections

and other forward-looking information that reflect our current views with respect to future

events and financial performance. These estimates, projections and other forward-

looking information are based on assumptions that HealthSouth believes, as of the date

hereof, are reasonable. Inevitably, there will be differences between such estimates and

actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking

information will be realized.

All such estimates, projections and forward-looking information speak only as of the

date hereof. HealthSouth undertakes no duty to publicly update or revise the

information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other

forward-looking information in this presentation as they are based on current

expectations and general assumptions and are subject to various risks, uncertainties

and other factors, including those set forth in our Form 10-Q for the periods ended

March 30, 2006, June 30, 2006 & Sept. 30, 2006, the Form 10-K for the fiscal year

ended December 31, 2006 and current report on Form 8-K dated May 26, 2006 and in

other documents that we previously filed with the SEC, many of which are beyond our

control, that may cause actual results to differ materially from the views, beliefs and

estimates expressed herein.

(In Millions)

Form 10-K / 4th Quarter Consolidated Results

Note: Adjusted Consolidated EBITDA amounts are before professional fees, impairments and government,

class action and related settlements expense. See Appendix for Non-GAAP Financial Reconciliations

4th Quarter

Full Year

2006

2005

2006

2005

Net Operating Revenues

$730.2

$733.4

$3,000.1

$3,117.0

Expenses:

Salaries and Benefits

$354.4

$343.5

$1,398.4

$1,386.1

Supplies

72.5

72.7

287.8

294.2

Other

181.1

207.1

721.0

1,027.3

Provision for Doubtful Accounts

34.2

26.2

119.3

94.3

Recovery of Amounts Due

(12.8)

-

(47.8)

(37.9)

Depreciation and Amortization

35.5

35.4

148.2

162.6

Occupancy Costs

37.0

32.3

141.4

113.1

Minority Interest

13.9

18.3

92.3

97.2

Operating Earnings

$14.4

($2.1)

$139.5

($19.9)

Adjusted Consolidatd EBITDA

$125.7

$125.5

$535.5

$627.6

Adj. Consolidatd EBITDA Margin

17.2%

17.1%

17.8%

20.1%

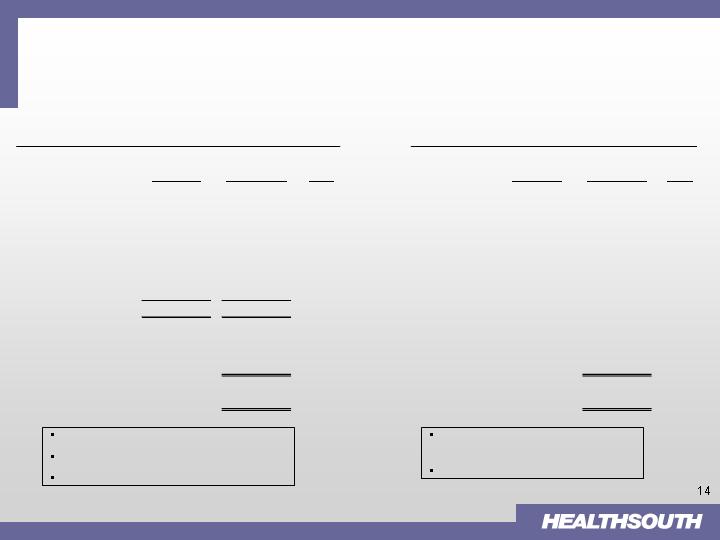

Form 10-K / 4th Quarter Highlights

Fourth quarter signaled a turning point for the Company as we

experienced improved Net Operating Revenues and Operating

Earnings in our two largest segments

Inpatient

Net Operating Revenues were up both sequentially and

quarter-over-quarter

Compliance case growth up 4.7%; increase in Case Mix

Index resulting in stronger unit pricing and a 1.9%

increase in Net Operating Revenues

3.2% increase in Operating Earnings vs. 4Q 2005

(1) Implied EBITDA is before Corporate Overhead

(In Millions)

4Q 2006

4Q 2005

% ?

Net Operating Revenues

424.6

$

416.5

$

1.9%

Operating Earnings

80.7

$

78.2

$

3.2%

Depreciation & Amortization

17.4

14.7

18.4%

Implied EBITDA

(1)

98.1

$

92.9

$

5.6%

Implied EBITDA Margin

(1)

23.1%

22.3%

80 b.p.

Form 10-K / 4th Quarter Highlights (cont’d)

Surgery

Net Operating Revenues were up 3.1% vs. 4Q 2005

Operating Earnings showed both quarter-over-quarter

and sequential improvement

Increased by $12.8 million quarter over quarter as a result

of improved revenues and labor and supply cost

management initiatives, including the standardization of

non-physician preference items

0.9% increase in cases at those ASCs that were open for

at least twelve months

(1) Implied EBITDA is before Corporate Overhead

(In Millions)

4Q 2006

4Q 2005

% ?

Net Operating Revenues

182.4

$

177.0

$

3.1%

Operating Earnings

25.8

$

13.0

$

98.5%

Depreciation & Amortization

6.3

7.8

(19.2%)

Implied EBITDA

(1)

32.1

$

20.8

$

54.3%

Implied EBITDA Margin

(1)

17.6%

11.8%

580 b.p.

Strategic Repositioning

August 14, 2006: In an effort to deleverage its Balance Sheet

and reposition the Company as a “pure-play” post-acute

provider, HealthSouth announced it would seek strategic

alternatives for its Surgery and Outpatient business segments

Diagnostic business segment previously designated as “non-core”

Strategic alternatives = sale, spin, IPO, or some variation

thereof

Independent processes for each segment

Company will be disciplined in its approach to optimizing dual

objectives:

Reducing Debt

-and-

Obtaining Fair Value

Strategic Repositioning (cont’d)

Sale of Outpatient segment announced January 29, 2007

Purchaser: Select Medical

Sales Price: $245M

Closing: Estimated April 30, 2007

The “new” HealthSouth = Near-term focus on Inpatient

Rehabilitation Facilities (“IRFs”)

Future growth in other post-acute segments:

Long-Term Acute Care

Home Health

Hospice

In part, driven by development of integrated, post-acute payment

system (Medicare)

Future: Focus on Inpatient Rehabilitation

Overview

102 Hospital Locations

Nation's largest provider of inpatient

rehabilitation facilities (IRFs)

173 locations (92 IRFs, 81 outpatient

satellites)

Typical IRF: 40 bed 60 bed

Size (sq. ft.): 42,000 62,000

CAPEX: $15-17mm $20-24mm

Major services offered:

Nursing Care (24/7)

Inpatient/Outpatient Physical Therapy

Occupational Therapy

Speech Therapy

Also operate 10 long-term acute care

hospitals (“LTCH”)

YTD Performance (12/31/06)

Net Operating Revenues: $1,724.8 million

Operating Earnings: $359.5 million;

Margin: 20.8%

Compliant Case Growth approximately 6.0%

Payor Mix(1) for the year ended 12/31/2006

State Concentrations

(2)

Cummulative %

(2)

IRF

LTCH

TX

15

1

16%

PA

9

2

26%

FL

9

1

36%

AL

6

42%

TN

6

48%

LA

2

3

53%

AZ

5

58%

SC

5

63%

(1)

Net Patient Revenue

(2)

Number of IRF's & LTCH's Only

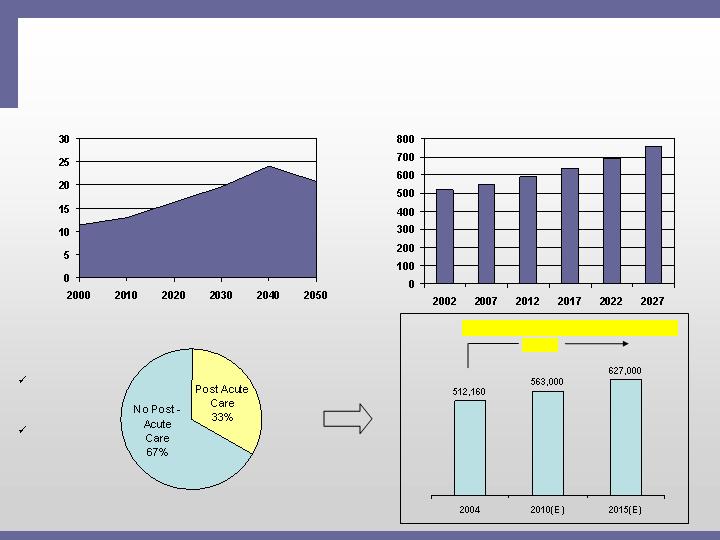

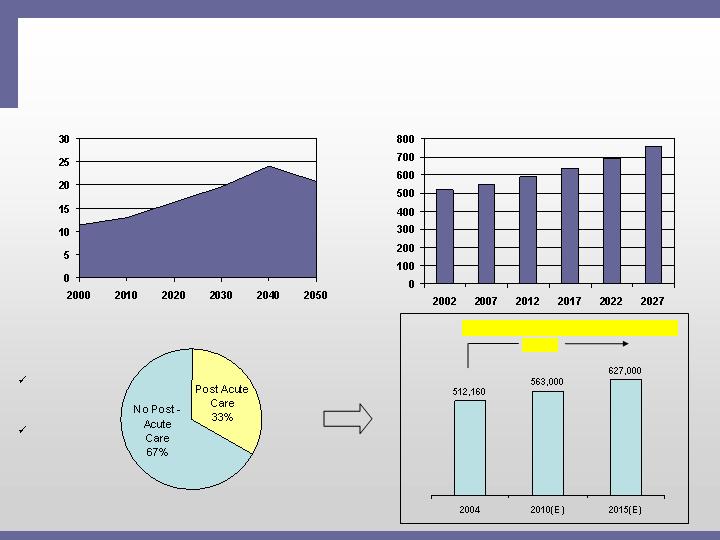

Aging “Baby Boomers” will Continue to Fuel

Demand for IRF Services

National Annual Acute Care Bed Demand in US

2002-2027 Projections (2)

Projected percentage of US population

65 years or older through 2050 (1)

%

Population

Beds per

Thousand

Post-Acute Usage After Discharge

(1) Source: US Census Bureau, 2004

(2) Source: Solucient, LLC: National and Local Impact of Long-Term Demographic Change

on Inpatient Acute Care; Represents demand for additional utilization, not additional beds

(3) Source: Medicare Provider Analysis and Review File (2004); Claritas

Projected Medicare Compliant Case Growth(3)

+ 22%

Post-Acute

Industry

~ $125B

IRF Segment

~ $9B

9

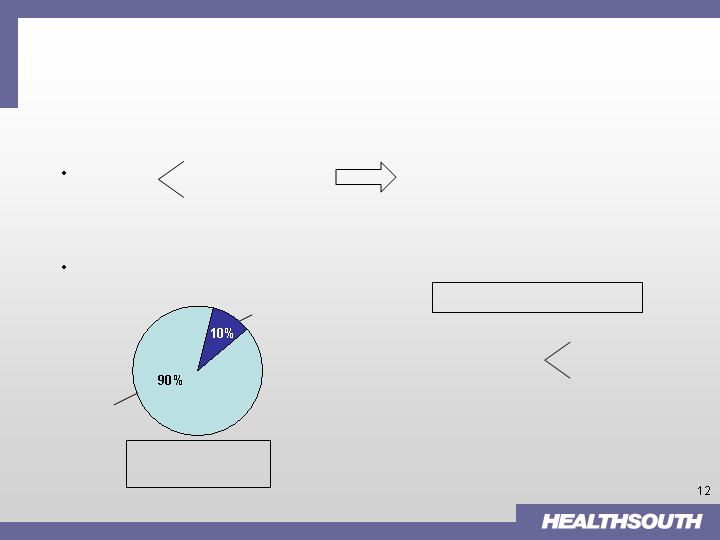

Not All Potential Compliant Cases Go To IRFs

NOTES: Internal assessment of compliant case yields; HealthCare Concepts

On average

~16% of

Potential

Compliant

Cases

“Convert” to

an IRF

Admission

10

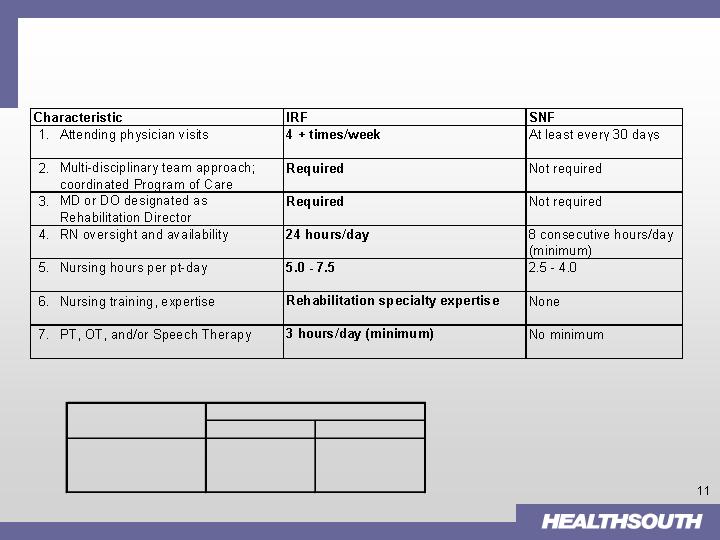

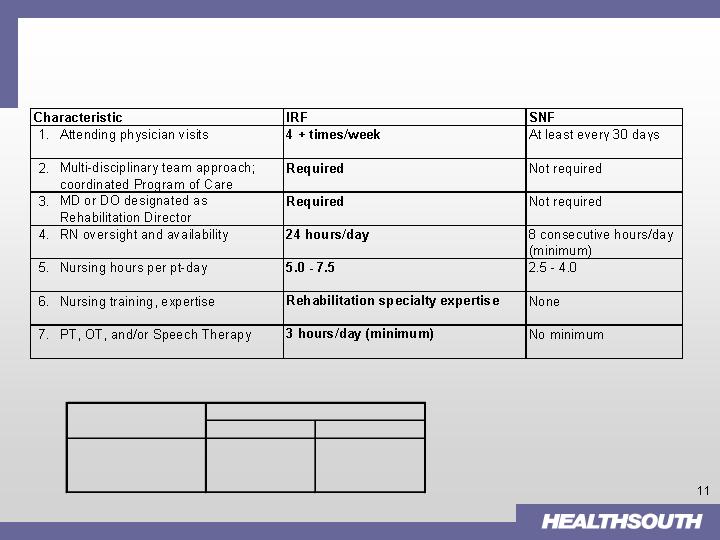

IRFs Provide Greater Nursing and Rehabilitative

Patient Care to Patients…

with significantly shorter length-of-stay (“LOS”)

(1)

NOTE:

(1) Source: Post-Acute care providers: An Overview of Issues. MedPAC analysis of cost reports.

Providers with Consistently

Days

Low Costs

High Costs

SNF average LOS

37.4

30.1

IRF average LOS

10.9

13.3

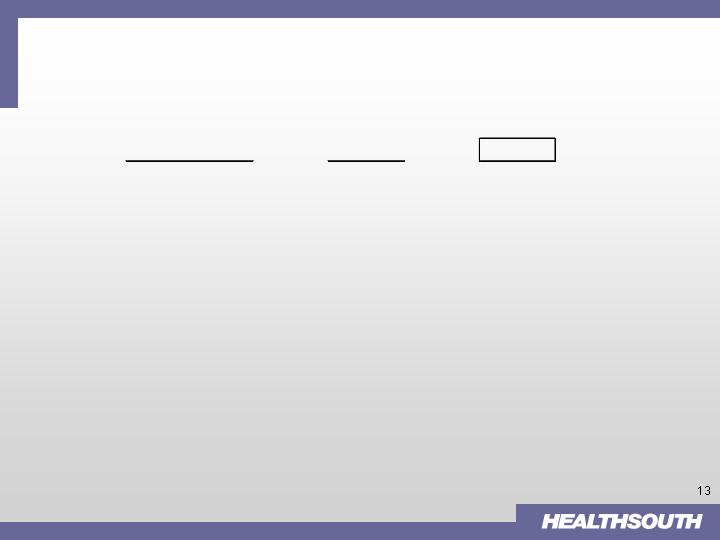

Growth = Significant Organic and Development

Opportunities

Organic*

2-3% Pricing

1-2% SS Volume

Development: 5-8 new facilities per year

Current pipeline

~ 40+ projects

“Steady-state” basis

IRF

LTCH

IRF

1.

Consolidation

(Existing markets)

2.

De-novo (Existing or New markets)

3.

Acquisition (New markets)

LTCH (to supplement IRF presence)

J.V.

Acquire

Mid- to high-single

digit EBITDA growth

Development Strategies

IRF Segment Highly Fragmented = Creates

Consolidation Opportunities

(1) Source: Report to Congress: Medicare Payment Policy; March 2007 MedPAC analysis of Providers of

service files from CMS

(2) Typically a 15-30 bed unit/ department of an acute care hospital

Type of IRF

(1)

2005

HLS = 92

All IRFs

1,231

7.5%

Urban

1,000

Rural

231

Freestanding

217

42.4%

Hospital-Based

(2)

1,014

Non-Profit

765

For-Profit

305

30.2%

Government

161

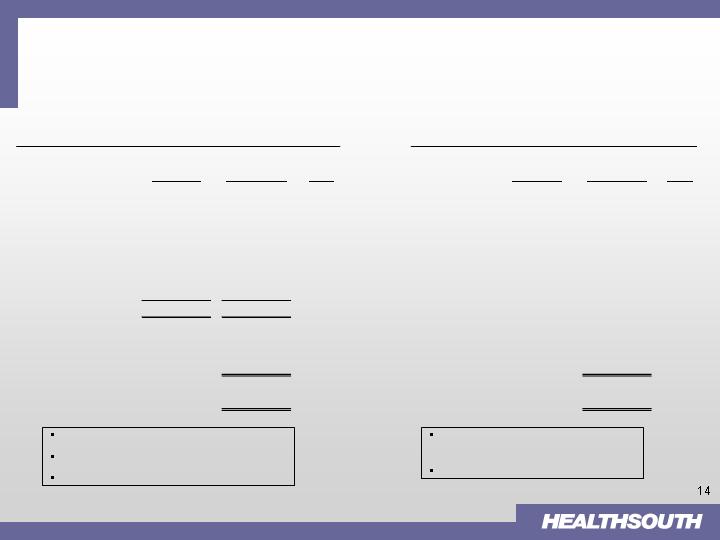

Illustrative Development Examples

(In Thousands)

(1) Does NOT include estimated corporate overhead of ~4.5% of Net Operating Revenues

(2) Assumes HLS owns ~80% of JV

Higher Margin from Platform

Efficiency

Ramp-up Period though Strong IRR

Incremental EBITDA with No Investment

Capacity Rationalization

“Win - Win” Situation for Both Parties

Consolidation - Joint Venture

DeNovo - Proforma (40 Bed)

Revenue

EBITDA

(1)

%

(1)

Revenue

EBITDA

(1)

%

(1)

Stand Alone

$10,000

$2,000

20%

Year 1

$8,500

$1,275

15%

Joint Venture

(2)

$14,000

$3,200

23%

Year 2

$10,500

$2,500

23%

- Minority Interest

($640)

Run Rate

$11,500

$2,900

25%

After Consolidation

$14,000

$2,560

18%

Incremental

EBITDA

$560

Investment

$15,000-17,000

Investment

$0

5-year Annualized ROI

~ 16-18%

Development Achievements: Growth is

Occurring Ahead of Plan

Opened new 40-bed IRF in Petersburg, VA

Created joint venture/market consolidation in Tucson, AZ

Merged competitor’s 20-bed IRF with existing HLS 80-bed IRF

Broke ground on new 40-bed IRF in Fredericksburg, VA

Approved new 50-bed IRF in Phoenix, AZ

Announced acquisition/market consolidation in Wichita Falls, TX

Acquired competitor’s 48-bed IRF; will consolidate patients to HLS

63-bed IRF

Opened 18 new beds at two facilities

New 40-bed IRF in Puerto Rico

Scheduled to open by end of March for commercial patients

Bed expansion projects approved at five of our hospitals

Total of 54 beds

Four of these expansions will come on-line in the second half of 2007

with the final project scheduled to open in 2008

2007

2006

2007 Guidance: Focus on Inpatient Segment

Inpatient

Volume growth: 1–2%

Net Revenue growth: 2-3%

Operating Earnings

Growth: 3-4%

We will move Surgery and Diagnostic Divisions to “Discontinued

Operations/Assets Held for Sale” as soon as they qualify under FASB

Statement No. 144

Investors should focus on four metrics to evaluate ‘07 performance:

1.

Deleveraging the Balance Sheet through the successful divestiture

of our non-core Divisions

2.

Achieving Inpatient Net Operating Revenues growth of 2-3%

3.

Achieving Inpatient Operating Earnings growth of 3-4%

4.

Consummating 5-8 development projects by year end

Corporate will still have “noise”

Continuing restructuring costs (winding

down substantially by year-end)

General Ledger upgrade costs

Transition services for divested

segments

Goal: ~4.75% of Net Operating

Revenues by ’08 year-end

Summary

The “new” HealthSouth: new Board; new management team; new

balance sheet; and new direction.

By divesting of three divisions, the Company will be well-

positioned to become a “pure-play” post-acute provider and a

consolidator in the fragmented $126 B post-acute space.

These divestures – along with any proceeds we may receive from

tax refunds and certain derivative litigation – will significantly

strengthen the Company’s Balance Sheet through deleveraging.

The “new” HealthSouth will present a compelling investment

opportunity with EPS growth driven by organic growth,

development and de-leveraging.

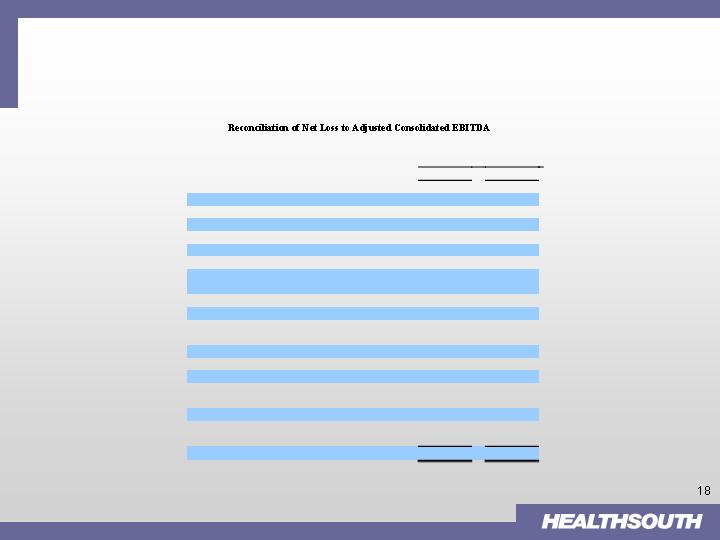

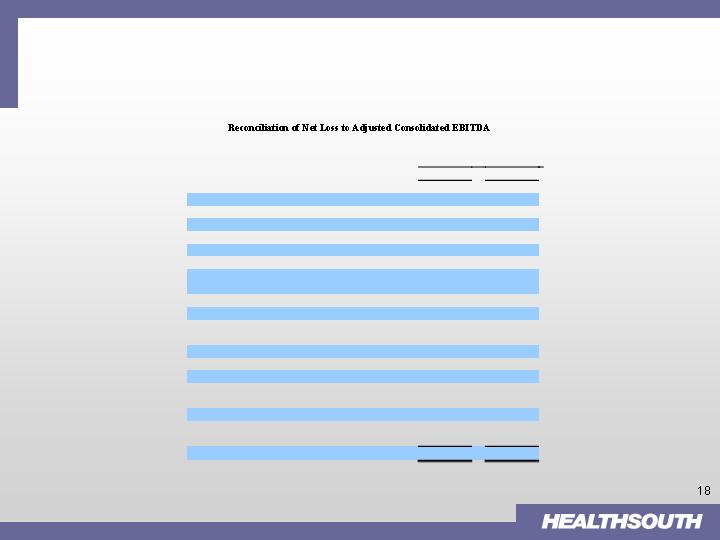

Appendix

Non-GAAP Financial Reconciliations

For the Year Ended

December 31,

2006

2005

(In Millions)

Net loss

$

(

625.0

)

$

(446.0)

Loss from discontinued operations

26.0

67.2

Provision for income tax expense

41.1

38.4

Loss on interest rate swap

10.5

–

Loss on sale of

marketable securities

0.3

–

Interest income

(15.7)

(17.1)

Interest expense and amortization of debt

discounts and fees

335.1

337.5

Loss on early extinguishment of debt

365.6

–

Professional fees

—

accounting, tax, and lega

l

163.6

169.8

Government, class action, and related

settlements expense

38.8

215.0

Impairment charges

15.2

43.3

Net non

-

cash loss on disposal of assets

6.4

16.6

Depreciation and amortization

148.2

162.6

Compen

sation expense under FASB Statement

No. 123(R)

15.5

–

Sarbanes

-

Oxley related costs

4.8

32.2

Restructuring activities under FASB Statement

No. 146

5.1

8.1

Adjusted Consolidated EBITDA

$

535.5

$

627.6

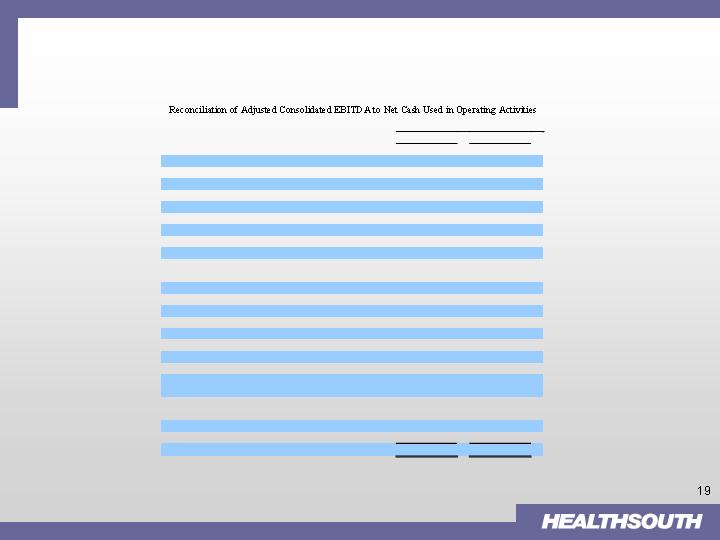

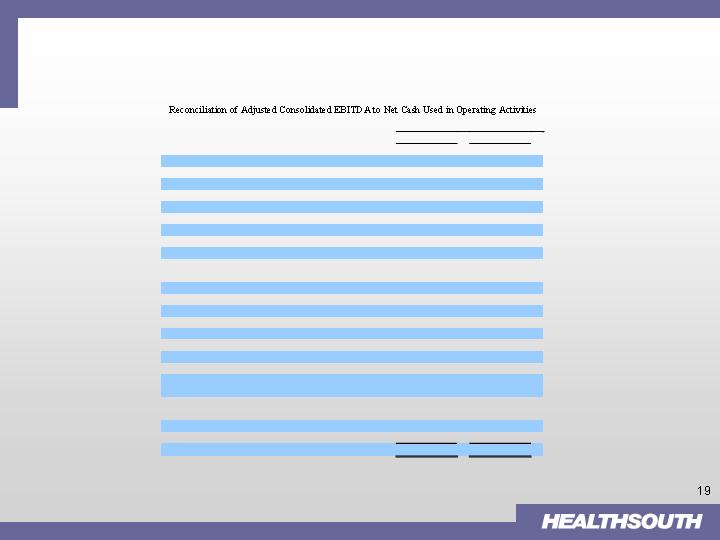

Appendix (cont’d)

Non-GAAP Financial Reconciliations

For the year ended December 31,

2006

2005

(In Millions)

Adjusted Consolidated EBITDA

$

535.5

$

627.6

Compensation expense under FASB Statement No. 123(R)

(15.5)

–

Restructuring charges under FASB Statement No. 146

(5.1)

(8.1)

Sar

banes

-

Oxley related costs

(4.8)

(32.2)

Provision for doubtful accounts

119.3

94.3

Net gain on disposal of assets

(10.9)

-

Professional fees

—

accounting, tax, and legal

(

163.6

)

(169.8)

Interest expense and amortization of debt disco

unts and fees

(335.1)

(337.5)

Interest income

15.7

17.1

Loss (gain) on sale of investments, excluding marketable

securities

1.6

0.1

Equity in net income of nonconsolidated affiliates

(21.3)

(

29.4

)

Minority interest in earn

ings of consolidated affiliates

92.

3

97.2

Amortization of debt issue costs, debt discounts, and fees

18.3

39.0

Amortization of restricted stock

3.4

2.0

Distributions from nonconsolidated affiliates

14.1

22.5

Stock

-

based compen

sation

12.1

–

Current portion of income tax provision

(7.9)

(21.4)

Change in assets and liabilities, net of acquisitions

(215.4)

(

101.8

)

Cash portion of 2006 g

overnment, class action, and related

settlements expense

(14.9)

–

Change in government, class action, and related settlements

liability

(118.4)

(165.4)

Other operating cash used in discontinued operations

(

19.6

)

(

36.5

)

Other

(

0.2

)

(

0.6

)

Net Cash

Used In

Operating Activities

$

(1

20.

4

)

$

(

2.9

)

Appendix (cont’d)

Non-GAAP Financial Reconciliations

2006

2005

Net loss

(71.4)

$

(113.9)

$

Loss from discontinued operations, net of tax

0.9

29.9

Income tax expense

9.4

7.8

Depreciation and amortization

35.5

35.4

Interest expense, net

78.5

77.4

Other debt related items

(3.6)

-

Other adjustments under Debt Agreements (a):

Professional fees

63.3

56.4

Impairment charges

12.8

17.4

Government, class action, and related

settlements expense

(6.9)

-

All other (b)

7.2

15.1

Adjusted Consolidated EBITDA

(1)

125.7

$

125.5

$

December 31,

HealthSouth Corporation and Subsidiaries

Supplemental Non-GAAP Disclosures

(In Millions)

Three Months Ended

(1) Adjusted

Consolidated

EBITDA is a non

-

GAAP financial measure. We believe Adjusted

Consolidated

EBITDA is

an important measure that supplements discussion and analysis of our results of operation. We believe that it is useful

to investors

as it is used in our covenant calculations under our 2006 Credit Agreement

.

Adjusted

Consolidated

EBITDA is not a measure of financial performance under accounting principles generally

accepted in the United States and should not be consider

ed as

an

alternative to net

loss

as an operating performance

measure

or to cash flows from operating, investing, or financing activities as a measure of liquidity. Because Adjusted

Consolidated

EBITDA is not a measure determined in accordance with general

l

y

accepted accounting principles and is

susceptible to varying calculations, Adjusted

Consolidated

EBITDA, as presented, may not be comparable to other

similarly titled measures presented by other companies.