HEALTHSOUTH

Current Investor Presentation

November 2007

Exhibit 99

1

The information contained in this presentation includes certain estimates, projections and

other forward-looking information that reflect our current views with respect to future events

and financial performance. These estimates, projections and other forward-looking

information are based on assumptions that HealthSouth believes, as of the date hereof, are

reasonable. Inevitably, there will be differences between such estimates and actual results,

and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking

information will be realized.

All such estimates, projections and forward-looking information speak only as of the date

hereof. HealthSouth undertakes no duty to publicly update or revise the information

contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other

forward-looking information in this presentation as they are based on current expectations

and general assumptions and are subject to various risks, uncertainties and other factors,

including those set forth in our Form 10-Q for the periods ended March 30, 2007, June 30,

2007 & Sept. 30, 2007, the Form 10-K for the fiscal year ended December 31, 2006 and

current report on Form 8-K dated March 30, 2007 and in other documents that we previously

filed with the SEC, many of which are beyond our control, that may cause actual results to

differ materially from the views, beliefs and estimates expressed herein.

Forward-Looking Statements

2

3

Operations Remained Focused on Providing High Quality Patient Care

Massive Internal Control Weaknesses Identified & Mitigated

New Management Recruited

New Board of Directors Recruited

A Look Back……

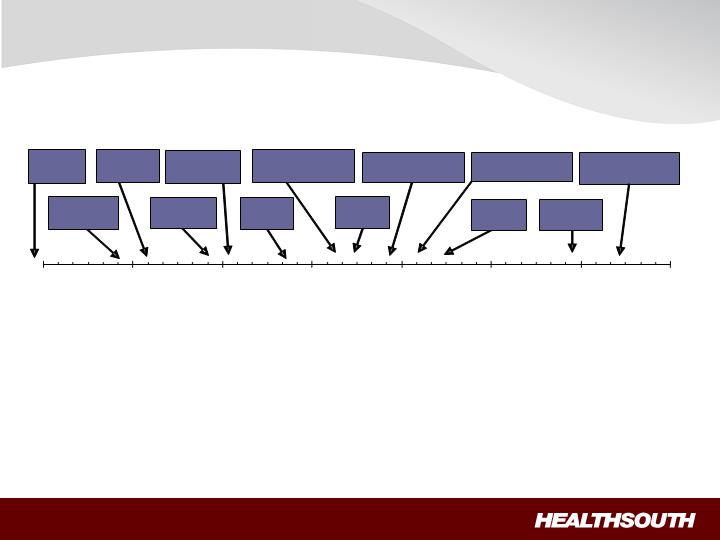

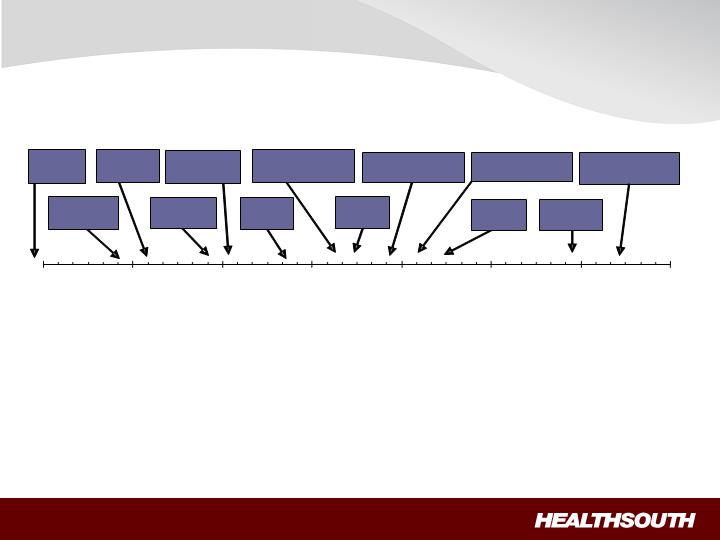

June-04

December-04

June-05

December-05

June-06

December-06

June-07

Cured Bond

Defaults

Reached CMS

Settlement

Cured Bank

Defaults

Reached SEC

Settlement

Filed 2000 -

2003 Form 10k

Filed 2004

Form 10k

Refinanced Balance

Sheet $2.55B

Filed 2005

Form 10k

Completed $1B

Senior Notes Offering

Announced Strategic

Repositioning

Relisted on

NYSE

Divestitures

Completed

$440M Tax Recovery

Received

Leadership Franchise: largest provider of inpatient rehabilitative care in the U.S.

Market share gains realized despite 75% Rule headwind

Attractive industry: demand for post-acute services expected to grow (favorable

demographics)

Earnings growth: through organic and disciplined development initiatives

Positive EPS

Strong cash flows: shareholder value enhanced through strategic use of FCF

Focused management: proven track record of achieving objectives

HealthSouth Today

4

The “New” HealthSouth

Our Goal: To be the preeminent provider of inpatient

rehabilitative care in the U.S. through:

clinical, service and operational excellence;

growing market share in existing markets;

building new hospitals in new markets; and

acquiring or joint-venturing competitors.

Longer term, we will evaluate expanding into other,

complementary post-acute services on an opportunistic basis.

5

Leadership Franchise

Current Portfolio and Services

Current Portfolio:

94 inpatient rehabilitation hospitals

6 LTCH Hospitals

25 Licensed Home Health Agencies

Major Services Offered:

Specialized nursing care (24/7)

Three-hours intensive therapy per

day (minimum)

Physical Therapy

Occupational Therapy

Speech Therapy

Physician (Medical Director)

oversight

Key Statistics:

$1,314M Net Revenue (thru Q3 ’07)

$236M EBITDA* (thru Q3 ’07)

$25.2M Capex (thru Q3 '07)

22,000 current employees

* Adjusted Consolidated EBITDA - see appendix

6

FIM Gains

LOS Efficiency

Source: UDSmr Database –On Demand

Reports - Q2 2007

***Benchmark = Risk Adjusted Expectancy

Leadership Franchise

Value Proposition

7

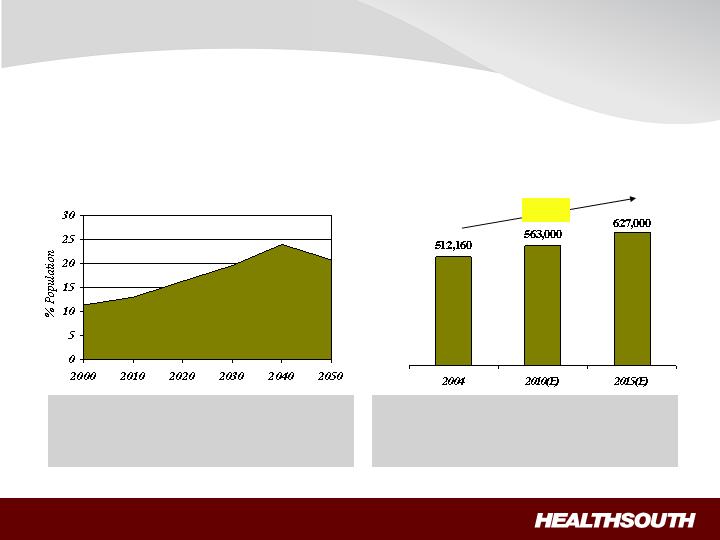

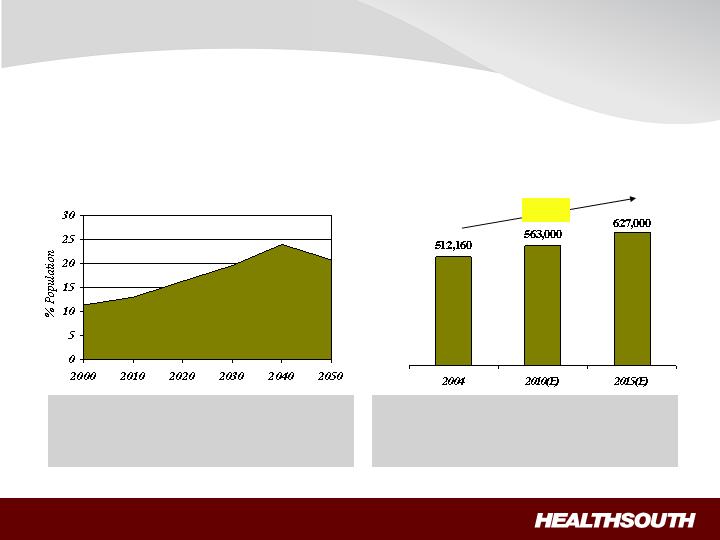

Projected percentage of US population

65 years or older through 2050 (1)

(1) Source: US Census Bureau, 2004

(2) Source: Medicare Provider Analysis and Review File (2004); Claritas

Projected Medicare Compliant Case Growth (2)

+ 22%

Attractive Industry

Expected Increased Demand

Demand for post-acute services will increase

as the U.S. population ages

“Compliant Cases” are expected to grow

~2% annually for the foreseeable future, creating

an attractive market.

8

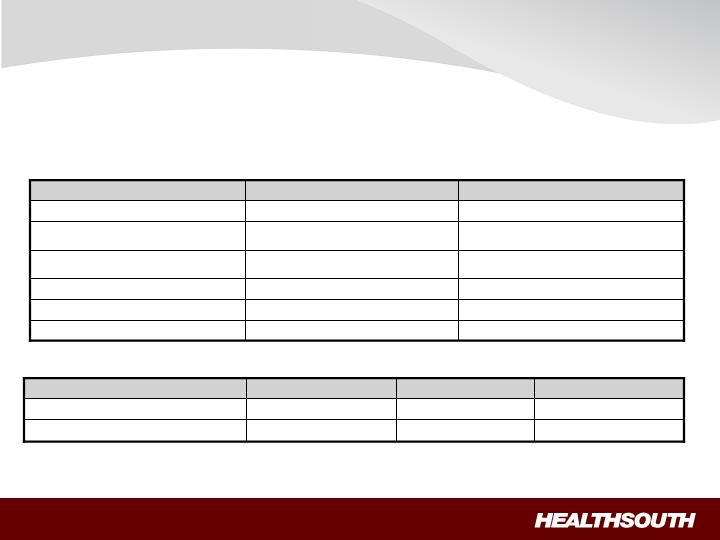

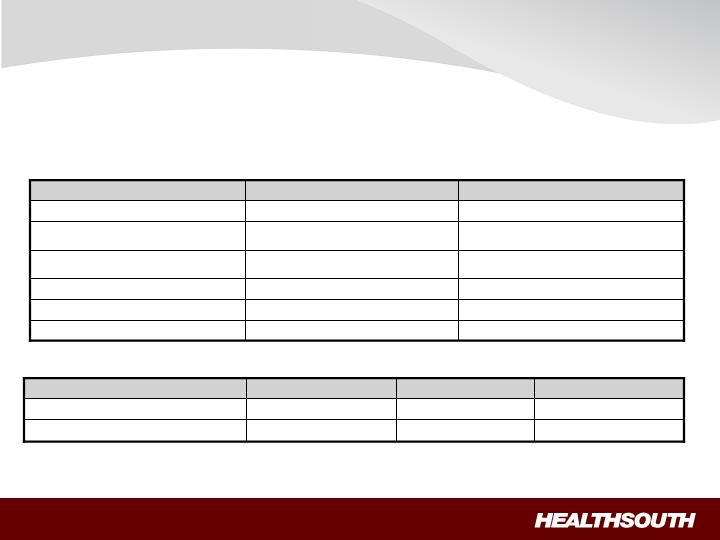

IRFs provide a Higher Level of Service…

Attractive Industry

Better Outcomes at a Comparable Cost

8 consecutive hours per day (min)

24 hours per day

RN oversight and availability

None

Rehabilitation specialty expertise

Nursing training, expertise

2.5 – 4.0

5.0 to 7.5

Nursing hours per patient per day

Not required

Required

MD or DO designated as

Rehabilitation Director

Not required

Required

Multi-disciplinary team approach;

coordinated Program of Care

At least every 30 days

4+ times per week

Attending physician visits

SNF

IRF

Characteristic

at Comparable Cost …

~$400

~$900

Average Cost/Day

~$12,000

~30

SNF

~$13,500

~15

IRF

Cost / Admission

Average LOS

9

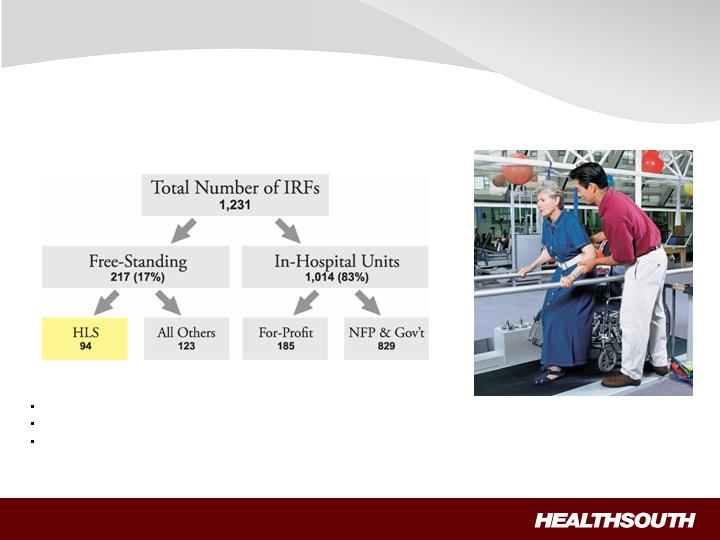

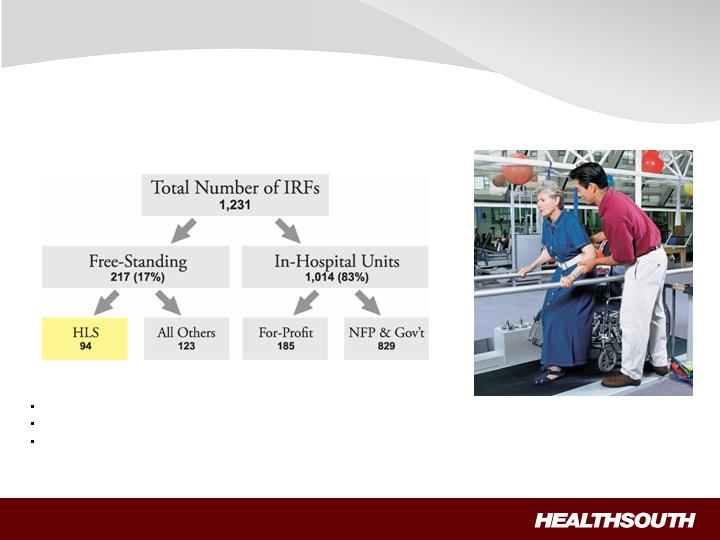

(1) Source: Report to Congress: Medicare Payment Policy; March 2007, MedPAC analysis of Providers of service files from CMS

(2) Typically a 15-30 bed unit/department of an acute care hospital

The inpatient rehabilitative sector is highly fragmented = consolidation opportunities

Inpatient rehabilitation is HLS’ core business -vs- one of many, secondary services provided by acute-care competitors

HLS hospitals can attract patients from multiple referral sources -vs- being dependent on just one source

Attractive Industry

Fragmented Sector with Consolidation Opportunities

1

2

2

10

After July 1, 2008, 75% of patients must come from one of thirteen qualifying

conditions (i.e. Compliant Cases)

75% Rule limits access to inpatient rehabilitative care

Cost Reporting

Year End

# of Consolidated

HLS Hospitals*

Minimum Compliance Threshold

50%

60%

65%

75%

June 30

9

7/1/04 – 6/30/05

7/1/05 – 6/30/07

7/1/07 – 6/30/08

7/1/08 – Forward

December 31

65

1/1/05 – 12/31/05

1/1/06 – 12/31/07

1/1/08 – 12/31/08

1/1/09 – Forward

May 31

17

6/1/05 – 5/31/06

6/1/06 – 5/31/08

6/1/08 – 5/31/09

6/1/09 – Forward

HLS implementation schedule:

Industry Issue

75% Rule

HealthSouth is gaining market share despite 75% Rule “headwind”

Compliant Case Growth (Q2)

HLS = +6.7%

Competitors = -1.8%

11

Proposed legislative relief (“CHAMP”):

“Freeze” threshold at 60%

Co-morbidities included as qualifying conditions

Study inpatient rehabilitation across all post-acute settings

Adjust payments for knee/hip replacements and hip fractures

Industry-wide initiative to adopt legislation (except knee/hip payment adjustments)

House Bill (H.R. 1459) = 226 co-sponsors

Senate Bill (S. 543) = 60 co-sponsors

Will seek to include 75% Rule relief in year-end Medicare “package”

Industry Issue

75% Rule (continued)

12

Earnings Growth

Positive EPS

“Steady State”:*

J.V.

Acquire

1-2% SS Volume

2-3% Pricing

Labor @ 3-4%

Other Op Exp @ inflation

Organic

Post 75% Rule

= Mid- to high-single digit

EBITDA growth

12

Fully implemented 75% Rule

Primary focus: Consolidations in

existing markets

Opportunistically: Acquisitions

(existing and new markets)

Amended 75% Rule (i.e. 60%)

Primary focus: De-novo hospitals

(existing and new markets)

Opportunistically: Acquisitions

(existing and new markets)

Development

13

Third Quarter Highlights

14

(dollars in millions)

Dollars

Change

2007

2006

Inpatient Hospital Revenues

(a)

$384

$365

5%

Outpatient Satellites & Other

(b)

48

49

Flat

Total Revenues

$432

$414

4%

2007

2006

Consolidated Adjusted EBITDA

$88.7

$107.3

Non-recurring Items

($8.6)

($35.0)

Normalized

$80.1

$72.3

(a)

94 hospitals in 2007; 92 in 2006

(b)

70 satellites in 2007; 91 in 2006

15

Solid Financials

Strong Cash Flow

Significant turnaround from 2006 FCF =

($208M)

All Settlement Payments completed by

12/31/07

FCF will be used for:

Reducing debt

Building new hospitals

HLS-financed =

$15-20M per IRF

Off-Balance Sheet =

$3-5M per IRF

Acquiring competitors

Note: Consolidations/JVs typically do not

require any CAPEX

Free Cash Flow

(a) Q3 Total of G&A to all revenues (continuing and discontinuing)

(b) Targeted rate of 4.75% (not including 123R costs)

(c) $190M cash run-rate post tax refund proceeds

(d) Before Preferred Stock Dividend

(in millions)

at 5.6%

(a)

of Rev.

at 5.2%

(b)

of Rev.

2007 Nine Months Adj. Consol. EBITDA

236.0

$

236.0

$

Source Medical Gain

(8.6)

(8.6)

Add: Normalization of G&A

33.6

38.9

Sub-total

261.0

$

266.3

$

Less: Capital expenditures

(25.2)

(25.2)

Cash interest cost

(c)

(142.5)

(142.5)

Excess

93.3

$

98.6

$

Annualized

(d)

124.4

$

131.5

$

Normalized

Gen & Admin Expense

Debt Balance

(in millions)

Debt Balance Per December 31, 2006 10K $3,411.4

Debt Balance Sept. 30, 2007 $2,401.0

Post Sept 30, 2007:

Additional Proceeds from Outpatient Sale $ 23.0

Tax Refund (Portion to pay down debt) $ 405.0

Final SEC & CMS/DOJ Payments ($ 47.3)

Derivative Proceeds from Litigation TBD

DEBT BALANCE POST SEPT 30, 2007 ~$2 BILLION

Tax losses available for future years ~ $2.5B

For foreseeable future, will allow all cash flow to be available for maximizing shareholder value

Solid Financials

Ongoing Debt Reduction

10.75% Senior Notes

Purchased ~$51M of

Notes during Sept/ Oct

timeframe at an average

price of 103.8

Will continue to

opportunistically look at

high cost debt to be

retired

16

Investment Considerations

Focused management: proven track record of achieving objectives

Attractive industry: demand for post-acute services expected to grow

(favorable demographics)

Strong presence: largest provider of inpatient rehabilitative care in the U.S.

Market share gains realized despite 75% Rule headwind

Earnings growth: through organic and disciplined development initiatives

Positive EPS beginning in 2008

Strong cash flows: shareholder value enhanced through strategic use of FCF

17

Appendix

18

Three Months Ended

September

30,

Nine Months Ended

September

30,

2007

2006

2007

2006

(In Millions)

Net income (loss)

$

287.6

$

(76.1)

$

699.2

$

(55

3.7)

(Income) loss from discontinued operations

(37.6)

18.0

(475.7)

35.4

Provision for income tax (benefit) expense

(281.1)

2.1

(288.2)

21.0

Loss on interest rate swap

21.4

28.7

6.8

13.9

Interest expense and amortization of debt discounts

and fees

60.2

56.8

177.9

176.8

Loss on early extinguishment of debt

2.2

–

19.9

365.6

Government, class action, and related settlements

3.9

28.4

(31.7)

49.9

Net noncash loss on disposal of assets

0.6

1.1

2.2

5.3

Impairment charges

0.

4

–

15.1

–

Depreciation and amortization

19.9

20.7

57.8

63.3

Professional fees

—

accounting, tax, and legal

9.2

23.1

44.3

99.4

Compensation expense under FASB Statement

No.

123(R)

2.0

3.6

8.1

11.6

Restructuring activities under FASB S

tatement No.

146

–

–

–

0.3

Sarbanes

-

Oxley related costs

–

0.9

0.3

4.2

Adjusted Consolidated EBITDA

(1)*

$

88.7

$

107.3

$

236.0

$

293.0

(1)

Adjusted Consolidated EBITDA is a non

-

GAAP financial measure. We believe it is useful to investors as it

is used in our

covenant calculations under our Credit Agreement.

Adjusted Consolidated EBITDA is not a measure of financial performance under accounting principles generally accepted

in the United States and should not be considered as an alternative to ne

t

income (

loss

)

or to cash flows from operating,

investing, or financing activities. Because Adjusted Consolidated EBITDA is not a measure determined in accordance with

generally accepted accounting principles and is susceptible to varying calculations, Ad

justed Consolidated EBITDA, as

presented, may not be comparable to other similarly titled measures presented by other companies.

Appendix (cont'd)

19

Our Credit Agreement allows certain items to be added to arrive at Adjusted Consolidated EBITDA that are viewed as not

being on

going costs once the Company has completed its restructuring.

After consummation of the divestitures of our surgery centers, outpatient, and diagnostic divisions, and in accordance with

our Credit Agreement, Adjusted Consolidated EBITDA is calculated to gi

ve effect to each divestiture, including adjustments

for the allocation of corporate overhead to each divested division.

However, these allocations are estimates and are not

necessarily indicative of the Adjusted Consolidated EBITDA that would have resulte

d had the applicable divisions been

divested as of the beginning of each period presented. Accordingly, t

hese adjustments are not included in the above table.

In

addition, we are allowed to add other income, including interest income, to the calculation of

Adjusted Consolidated

EBITDA under our Credit Agreement. This includes interest income associated with our federal income tax recovery. This

amount has not been included in the above calculation as it would not be indicative of our Adjusted Consolidated E

BITDA

for future periods.

Adjusted Consolidated EBITDA for the three and nine months ended September 30, 2007 includes an $8.6 million gain on

the

sale of our

remaining

investment in Source Medical Solutions, Inc. Adjusted Consolidated EBITDA for the three

and

nine months ended September 30, 2006 includes

a

$35.0 million recovery of incentive bonuses from Richard M. Scrushy,

our former chairman and chief executive officer.

*

Adjusted

Consolidated EBITDA includes general and administrative

expenses for all

divisions. G

eneral and administrative

expenses approximated

6.4

%

and

8.

2

%

of consolidated net operating revenues

for the three and

nine

months ended

September

30, 2007

, respectively

.

However,

these percentages decrease by 60 basis points and 260 basis poin

ts,

respectively

, if you include the revenues of the divisions reported in discontinued operations.