HealthSouth

Investor Day

November 10, 2008

Exhibit 99.1

Note Regarding Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and are

subject to various risks, uncertainties and other factors, including those set forth in our Form 10-Q for the

quarters ended March 31, 2008, June 30, 2008, and September 30, 2008, Form 10-K for the fiscal year

ended December 31, 2007, and in other documents we previously filed with the SEC, many of which are

beyond our control, that may cause actual results to differ materially from the views, beliefs and estimates

expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. The Appendix at the end of this presentation includes

reconciliations of the non-GAAP financial measures found in the following presentation to the most directly

comparable financial measures calculated and presented in accordance with Generally Accepted

Accounting Principles in the United States. Our Form 8-K, dated November 10, 2008, to which the following

presentation slides are attached as Exhibit 99.1, provides further explanation and disclosure regarding our

use of non-GAAP financial measures and should be read in conjunction with these presentation slides.

Cautionary Statements

HealthSouth Leadership

Jay Grinney

President and Chief Executive Officer

John Workman

Executive Vice President and Chief Financial Officer

Mark Tarr

Executive Vice President, Operations

John Whittington

Executive Vice President, General Counsel and Secretary

8:30 a.m. Strategy and Landscape

Questions and Answers

9:40 a.m. Break

9:45 a.m. Operational Model

Questions and Answers

10:40 a.m. Break

10:45 a.m. Financial Model

Questions and Answers

11:50 a.m. Litigation Update

Questions and Answers

12:00 p.m. Closing Remarks

Questions and Answers

Agenda

Jay Grinney

Mark Tarr

John Workman

John Whittington

Jay Grinney

Strategy and Landscape

Jay Grinney – President and Chief Executive Officer

Topics Covered:

HealthSouth: Past and Present

Post-Acute Industry and Inpatient

Rehabilitation Sector

Strategy and Business Model

Political & Regulatory Landscape

Investment Considerations

Questions and Answers

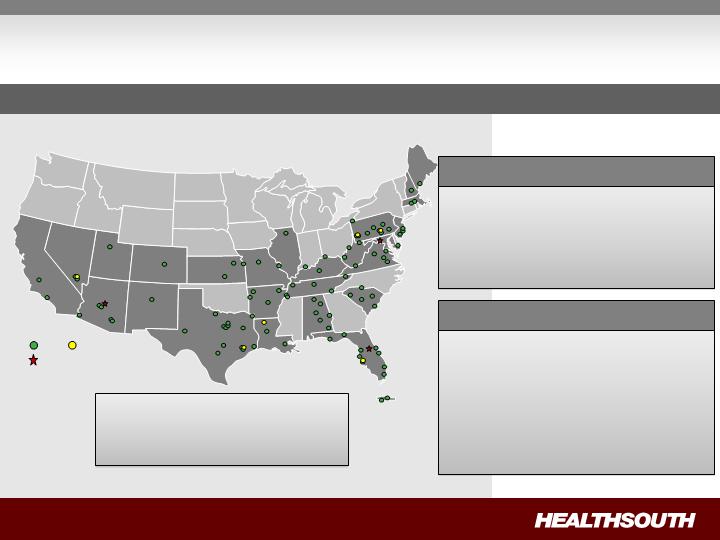

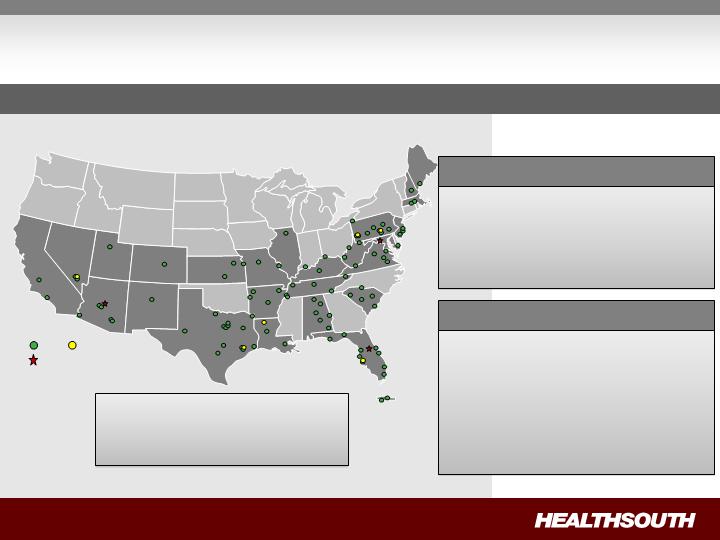

HealthSouth Today

IRH

LTCH

93 Rehabilitation Hospitals and

Outpatient Departments

6 LTCH Hospitals

55 Outpatient Satellites

25 Hospital-Based Home

Health Agencies

Operational Components

$1.38B Net Operating Revenues

$254.1M Adj. Consolidated EBITDA

$47.4M Adj. Income from Continuing Ops.

$0.50 Adj. EPS from Continuing Ops.

Q3 YTD Key Statistics

Largest Provider of Inpatient Rehabilitative Healthcare Services in the U.S.

Development Sites

Employees: 22,000

Corporate Office: Birmingham, AL

Exchange (Symbol): NYSE (HLS)

(1) Reconciliation to GAAP provided on slide 61

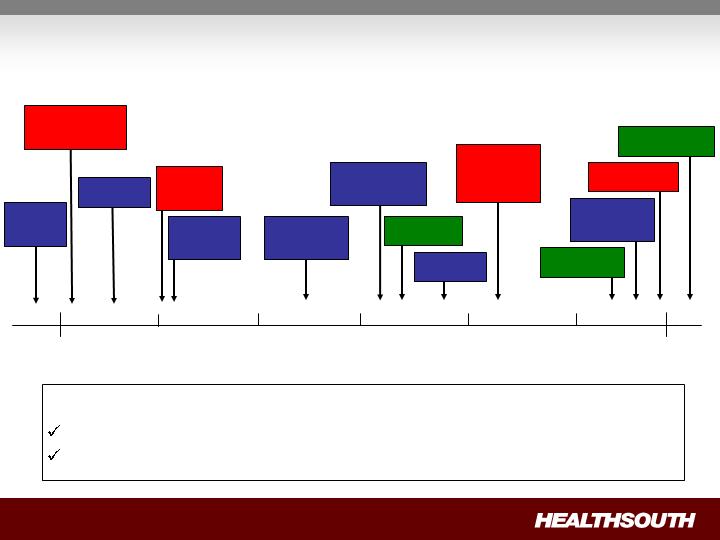

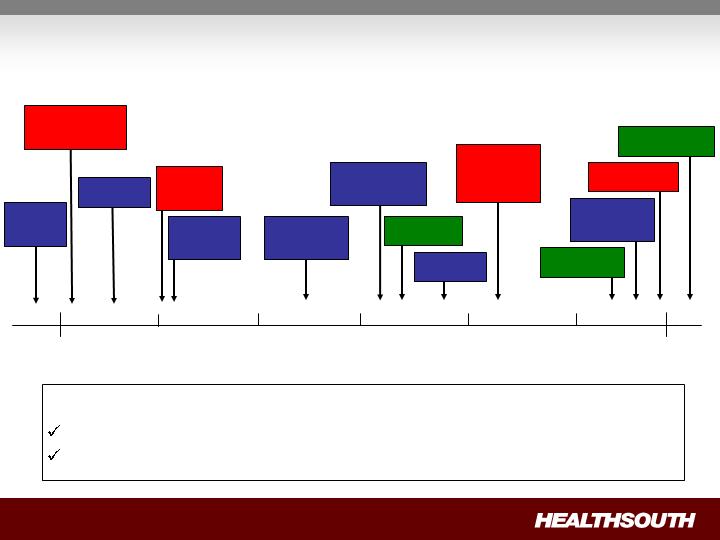

June

2007

December

2007

December

2005

June

2006

December

2006

HealthSouth spent over $1 billion to effect turnaround

Settlement payments (CMS, DOJ, OIG, SEC)

Reconstruction / restatement of financial statements (1+ million man-hours)

December

2004

Reached

SEC

Settlement

Filed 2000 –

2003 Form

10-K

Secured New

Bank Credit

$2.55B

Completed $1B

Senior Notes

Offering

Announced

Divestitures

$440M Tax

Recovery

Received

Relisted on

NYSE

Completed

Divestitures

All Settlements

Paid in Full

Reached

Securities

Litigation

Settlement

Corporate

Campus Sold

Turnaround Complete

Cured Bank

Defaults

Reached

DOJ/CMS

Settlement

June

2005

Cured

Bond

Defaults

Healthcare Services Continuum

Wellness

Programs

Disease

Management

Genetic

research

O/P Surgery

O/P Imaging

O/P Rehabilitation

Renal dialysis

O/P Cardiac

O/P Laboratory

General, acute

care hospitals

Specialty hospitals

(e.g. Cardiac,

Orthopedic, etc)

Inpatient

Rehabilitation

Long-term acute

care

Home Health

Hospice

Skilled Nursing

Preventive

Ambulatory

(Outpatient)

Acute-Care

Post-Acute

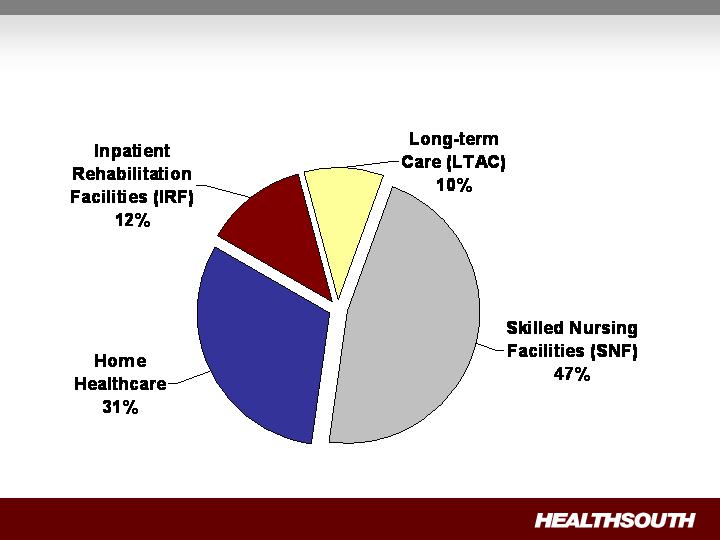

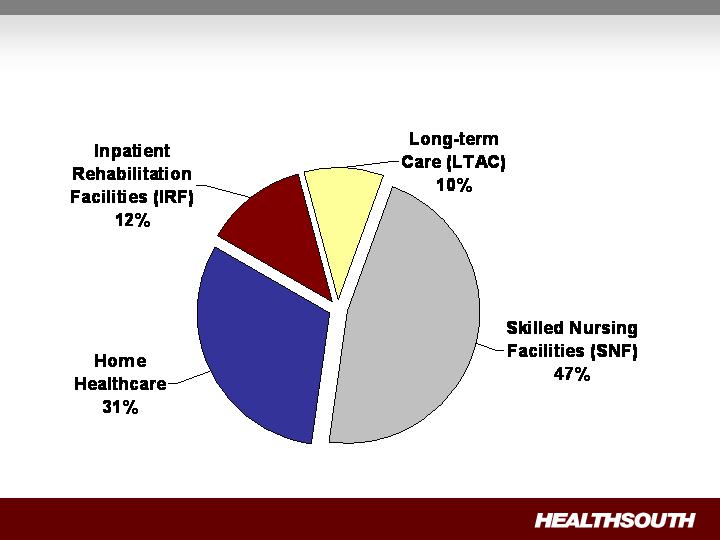

Post Acute Industry Components

(1) Source: MedPAC, A Data Book: Healthcare Spending and the Medicare Program, June 2008 (Section 9).

(2) These percents are Medicare spending only and do not include beneficiary copayments or other payors.

2007 Medicare Spending $45.1 Billion

IRF Segment: Fragmented Industry

Total Inpatient Rehabilitation

Facilities (IRF): 1,201

Total Free-Standing Inpatient

Rehabilitation Hospitals: 218

(HLS = 43%)

Total Inpatient Rehabilitation Revenue: ~$9 Billion

(1) Source: Medpac, Modern Healthcare, press releases and internal analysis

5

Vibra (Private)

125

93

All others

2

Reliant (Private)

Facilities

Free-Standing

Competitor Examples

2

Gulf States (Private)

2

Five Star Quality Care

(Public)

4

Centerre (Private)

5

Select (Private)

6

RehabCare (Public)

6

Ernest (Private)

Hospital-Based

983 (82%)

Free-

Standing

HealthSouth

93 (8%)

Other

125 (10%)

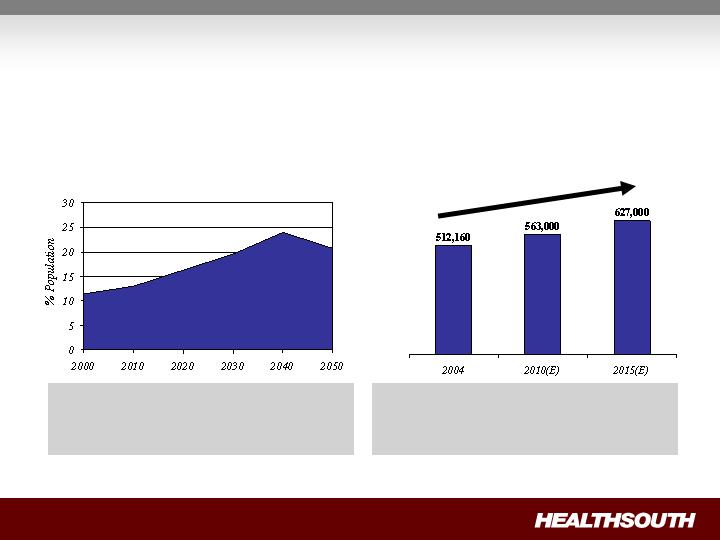

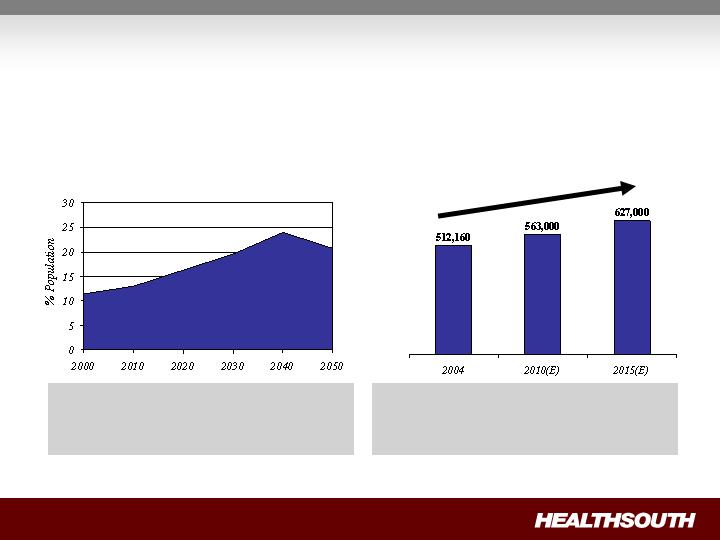

Projected percentage of US population

65 years or older through 2050(1)

(1) Source: US Census Bureau, 2004

(2) Source: Medicare Provider Analysis and Review File (2004); Claritas

Projected Medicare Compliant

Case Growth(2)

IRF Segment: Aging Demographics = Increased

Demand

Demand for post-acute services will

increase as the U.S. population ages.

“Compliant Cases” are expected to grow

~2% per year for the foreseeable future,

creating an attractive market.

+22%

Strategy:

To create shareholder value as the preeminent provider of

rehabilitative care in the U.S. by:

Creating a strong balance sheet through deleveraging;

Driving organic growth through operational excellence; and

Disciplined opportunistic growth.

Longer term, we will pursue complementary acquisitions in the

areas of Long-Term Acute Care Hospitals, Home Health, and / or Hospice

provided they are accretive to HealthSouth.

Target 5-8% annual Adjusted Consolidated EBITDA growth

Margins will expand modestly

Target 15-20% annual Adjusted EPS growth

Achieve leverage

of 4.5X or below

by 12/31/10

Target ~ $35M

maintenance

CAPEX

Target $15-20M for

bed expansion

Disciplined

opportunistic

growth

Ensure hospital

leadership inspires

/ motivates all

constituents

Differentiate by

being the

“Employer of

Choice”

Standardize best

practices; deploy

through

TeamWorks

Maintain

commitment to

Compliance and

Internal Controls

Define, and excel

in, standards of

care

Measure clinical

outcomes and

drive continuous

improvement

Integrate the

patient and family

experience into

the treatment plan

Grow market

share in all

markets

Differentiate

through

exceptional clinical

quality and patient

experience

Build local

HealthSouth

“brand”

Target 4+% annual

Same Store

Discharge growth

Target 4±% annual

growth in SWB

Performance

Market

Position

Clinical Focus

Organizational

Culture

Business Model

Balance Sheet

1

~ $5-10M

infrastructure

enhancements

Consolidations /

Acquisitions

“CAPEX lite” de

novos

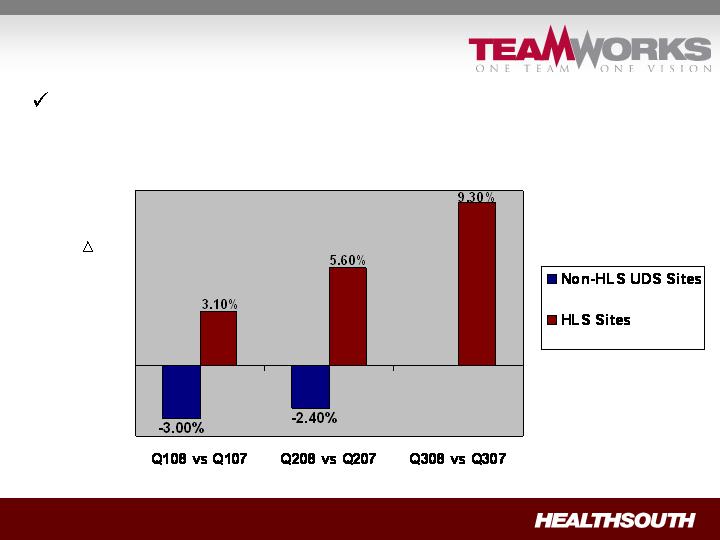

Highlights…

HealthSouth has increased volumes, while competitors

have shown declines.

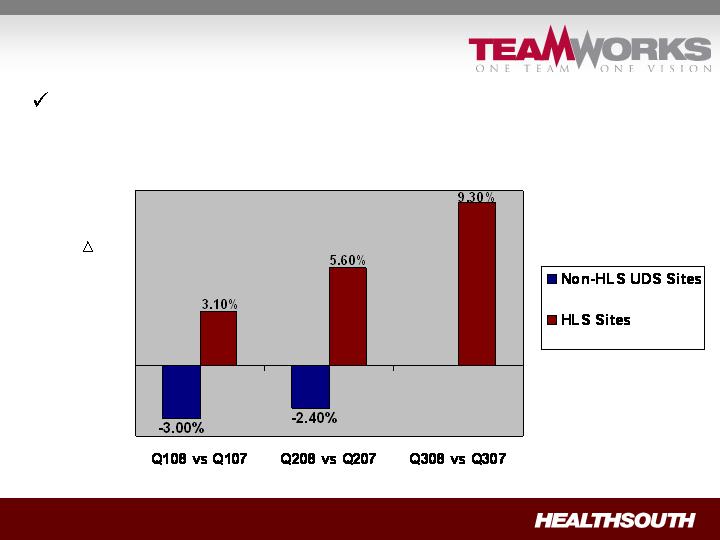

Change is Same-Store Discharges of HLS vs Non-HLS UDS Sites(1)

% in

Discharges

(1) Data provided by UDS MR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry.

N/A

Highlights…

HealthSouth has added new hospitals.

(2)

(1) Plan to work with a developer to obtain a lease arrangement

(2) CON is being appealed; Operational Date may change

154 additional beds in total, 34 of which apply to third quarter 2008

Revenue contribution starting in Q3 2008 through Q3 2010

Location

Announced

Type of Investment

Installed Beds

Operational

Date

Vineland, NJ

Aug-08

Acquisition of free

standing

34 Beds

Q3 2008

Arlington, TX

Aug-08

Acquisition and

consolidation

n/a

Q3 2008

Midland, TX

Sep-08

Acquisition and

consolidation

n/a

Q3 2008

Ocala, FL

Aug-08

De novo

(1)

40 Beds

3Q 2010

Loudoun County, VA

Aug-08

De novo

40 Beds

2Q 2010

Mesa, AZ

Oct-08

De novo

(1)

40 Beds

3Q 2009

Highlights…

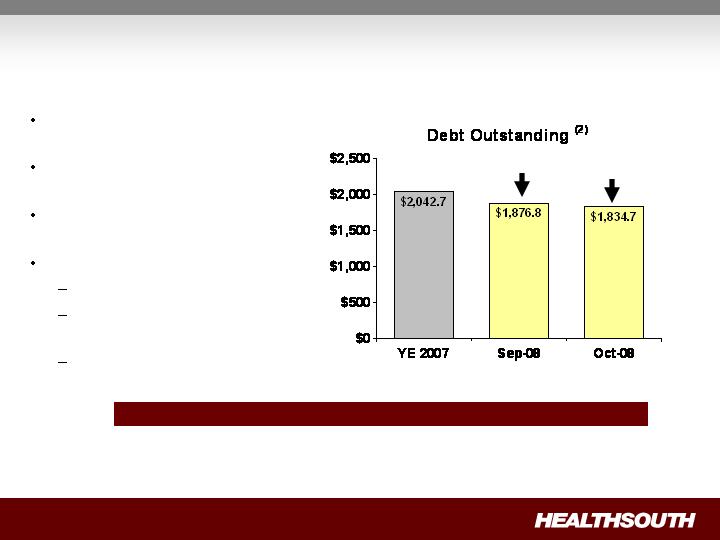

HealthSouth has repaid significant debt and reduced its

leverage.

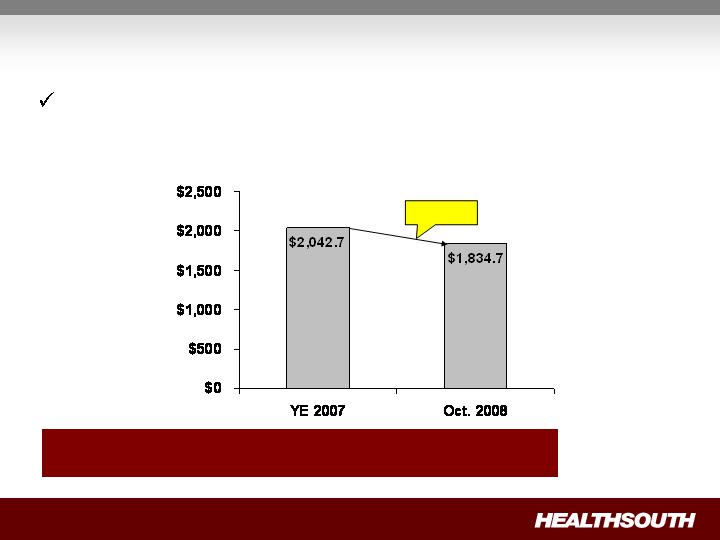

Debt Outstanding

(in millions)

$208.0

Debt to Adjusted

Consol. EBITDA 6.3x 5.5x

(1) Reconciliation to GAAP provided on slide 45

Political and Regulatory Landscape: “How the

sausage is made…”

NOTE: CMS provides recommendations to HHS on Medicare and Medicaid policies / regulations

(e.g. Congress establishing

new IRF payment

methodology)

Healthcare

Policy &

Regulations

Health &

Human

Services

Legislative

Directive

President’s

Annual Budget

Legislative

Authority

(e.g. Congress directing

CMS to change 75%

threshold)

CMS solicits public input to proposed new policies via Publication of Notice of Proposed

Rulemaking (“NPRM”)

CMS sponsors “Open Door Meetings”

Final Rules published after comment period

Provides opportunity

for industry input

=

Political and Regulatory Landscape: Looking

forward

CMS’s IRF-PPS staff currently focusing on report required by

Medicare, Medicaid and SCHIP Extension Act of 2007 (“MMSEA”)

Impact of 75% Rule on access to care

Alternatives / refinements to Rule

Analyzing types of patients best served by IRFs

HealthSouth is active in numerous industry advocacy groups

1.

American Hospital Association (“AHA”)

2.

American Medical Rehabilitation Providers Association (“AMRPA”)

3.

Federation of American Hospitals (“FAH”)

4.

Acute Long-Term Hospitals Association (“ALTHA”)

5.

State Hospital Associations

For Fiscal Year 2010, no major regulatory /

policy modifications are expected for IRFs

Investment Considerations:

Turnaround Complete: all “legacy issues” resolved,

management focused on operations and growth

Strong Cash Flows: CAPEX spend is discretionary

Deleveraging as Priority: reduce leverage to 4.5x or less by

YE 2010

Solid Organic Growth: TeamWorks initiative will help us

meet or exceed our EBITDA targets

Expand opportunistically in a disciplined manner

Focus: Delivering shareholder value

through strong EPS growth

Questions & Answers

HealthSouth

Investor Day

BREAK (Back at 9:45 a.m. EST)

Operational Performance

Topics Covered:

Our Business – “The Basics”

“Typical” HealthSouth Rehab Hospital

Patients We Serve

Payors and Reimbursement Methodologies

Sources of Patients

Explained

Our Competitors

IRF vs SNF

Quality Measures

Operational Agenda (2009 – 2011)

Mark Tarr – Executive Vice President, Operations

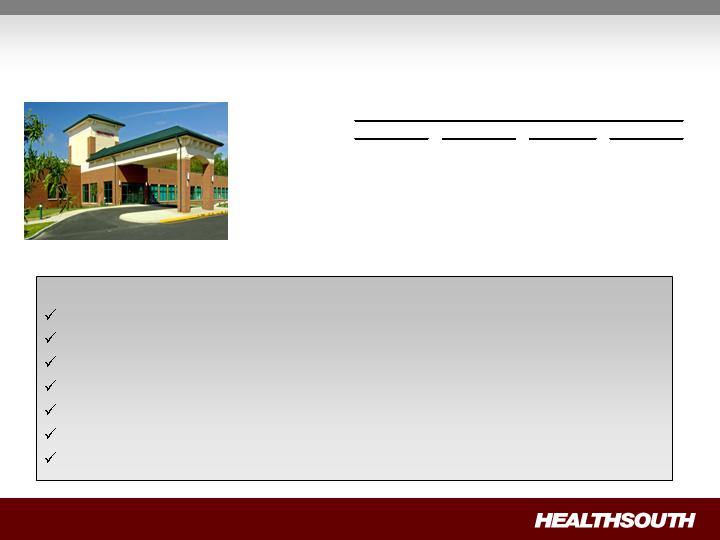

“The Basics”: What is a “typical” HealthSouth

rehabilitation hospital?

Major Services

Physician: manages and treats medical needs of patients

Rehabilitation Nursing: oversees treatment program of patient

Physical Therapy: addresses physical function, mobility, safety

Occupational Therapy: promotes independence and re-integration

Speech-Language Therapy: treats communication & swallowing disorders

Case Manager: coordinates care plan with physician, caregivers, family

Post-discharge services: outpatient therapy and home health

(1) We have seven hospitals of less than 40 beds

Number

(1)

37

31

8

10

Ave. FTEs

128

178

174

263

Ave. Net Rev.

$

11.2

$

15.8

$

15.8

$

22.5

(millions)

Bed Size

40 - 60

61 - 80

81 - 90

91+

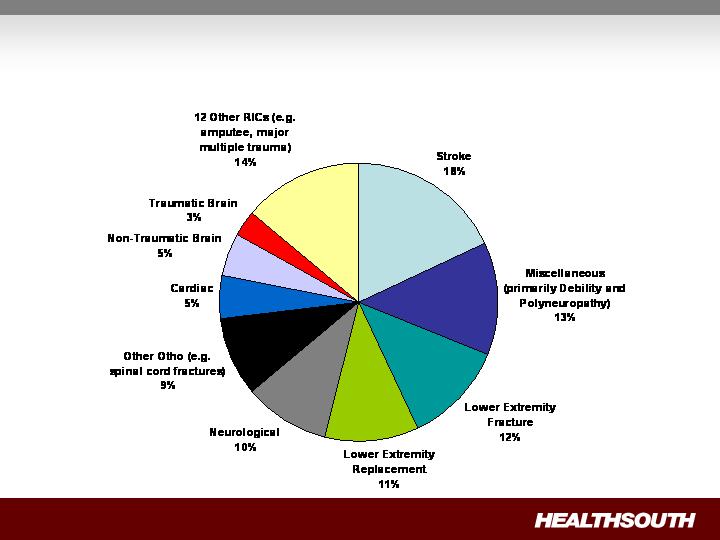

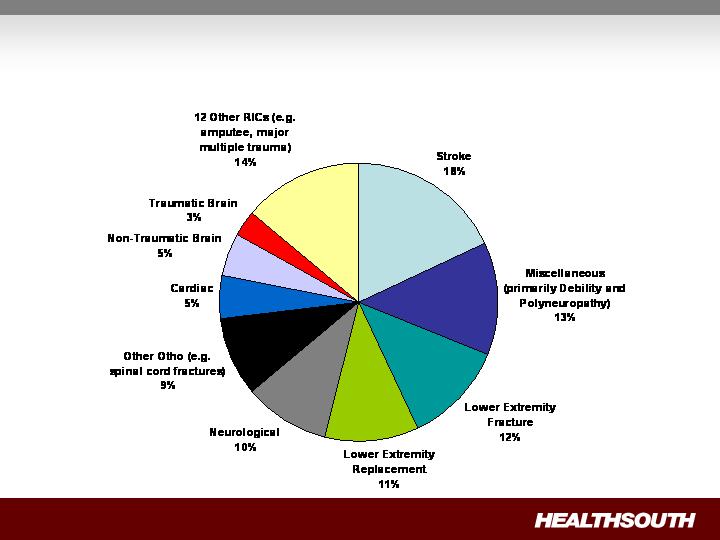

Medicare Inpatient Rehabilitation Categories (RICs)

“The Basics”: What Kind of Patients Do We Treat?

“The Basics”: Who Pays Us and How Are We Paid?

Prospective Payment Systems (“PPS”)

Payments based on Case Mix Groups (“CMGs”)

Diagnosis of patient’s illness

Fixed payment per CMG adjusted for:

Acuity / severity

Regional wage differential

Per diems for “short stays”

Variety of methodologies

Varies by State

Variety of methodologies

Medicare

67.2%

Managed Care

19.0%

Other Third-Party Payors

6.9%

Medicaid 2.2%

Workers’ Comp /

Patients / Other 4.7%

Q3 YTD Payor Mix

Payment Methodology

Per Diem

Negotiated rate

Some are “tiered” for acuity/severity

Acute care hospital

attending physician and

Case Managers play key

role

All IRF patients must meet

medical necessity criteria

All IRF patients must be

medically stable and have

potential to tolerate three

hours of therapy per day

(minimum)

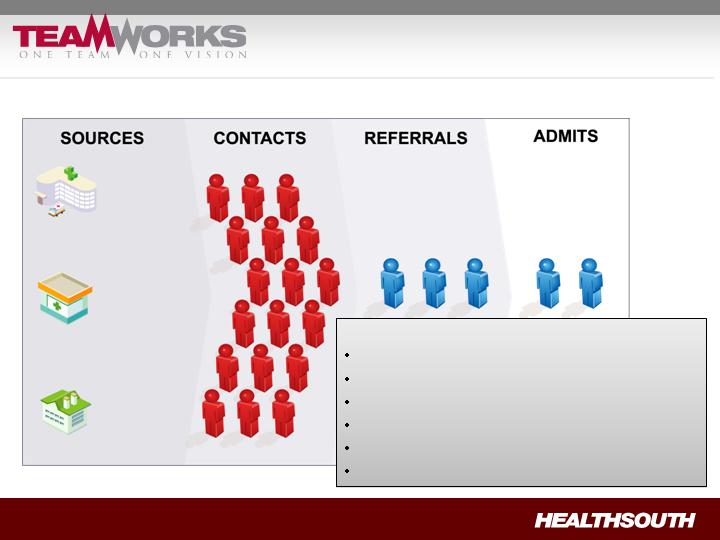

“The Basics”: How Do We Get Our Patients?

94%

5%

1%

Referral Source

Acute Care Hospitals

Physician Offices

Skilled Nursing Facilities

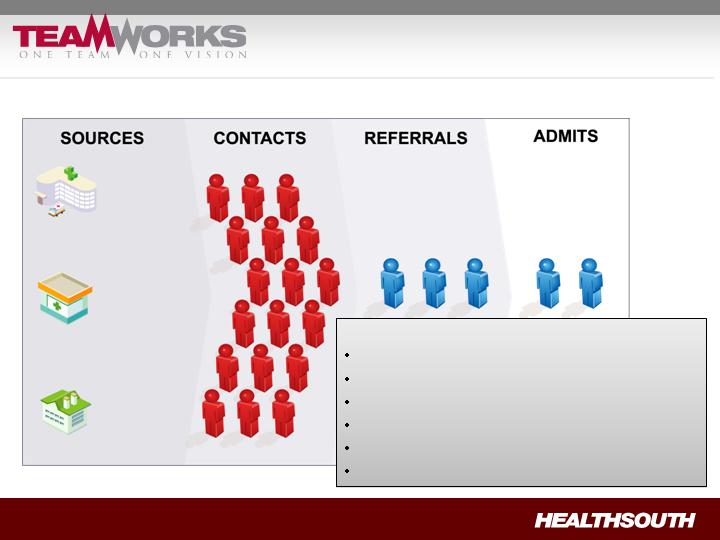

= Standardized Best Practices

Phase One: Sales and Marketing

What We Did:

Flowcharted activities

Assigned HLS “experts” to drive process

Streamlined processes

Created new job descriptions

Decentralized decision-making

Developed comprehensive reporting

Acute Care Hospitals

Physician Offices

Skilled Nursing Facilities

(cont’d)

Piloted in nine hospitals

Made adjustments / refinements

Began roll-out in Q4 2007

Realigned and trained employees

Aligned compensation / rewards

Monitored results

Full installation effect seen after 60 days

Implementation

Cumulative # of

Hospitals Fully

Installed

Quarter-over-

Quarter

Year-to-Date

Q1 2008

44

2.6%

2.6%

Q2 2008

76

5.6%

4.1%

Q3 2008

92

9.3%

5.8%

% Increase in Total Discharges (All Hospitals)

Our Hospitals Still Have Room for Growth

Number of Hospitals at Varying Occupancy Levels

Hospitals with greater than 85% occupancy are candidates for

bed expansion

We expect to add 65-75 beds by the end of 2009 and at least

another 44 beds in 2010

Average cost per bed:

With new construction = $100 – 250K

Internal renovation, only = $15 – 45K

(1)

(1) Includes Vineland, NJ and excludes Dallas, TX

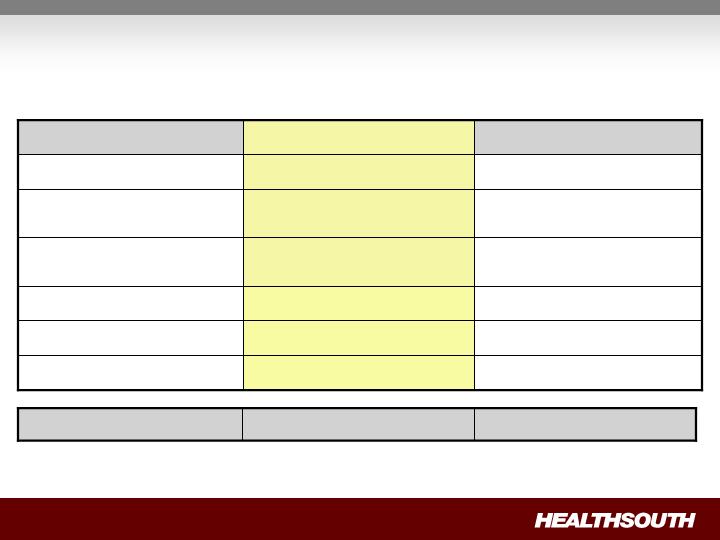

Occupancy

Q4 2007

Q1 2008

Q2 2008

Q3 2008

High (85% or greater)

10

22

17

16

Medium (60% to 85%)

42

37

42

43

Low (Less than 60%)

41

34

34

34

Total

93

93

93

93

“The Basics”: Who Are Our Competitors?

Competitor IRFs

Typically smaller units (10–20

beds) inside acute care hospital

Often are orthopedic–focused

Nursing Homes

Primarily treat simple knee / hip

replacements

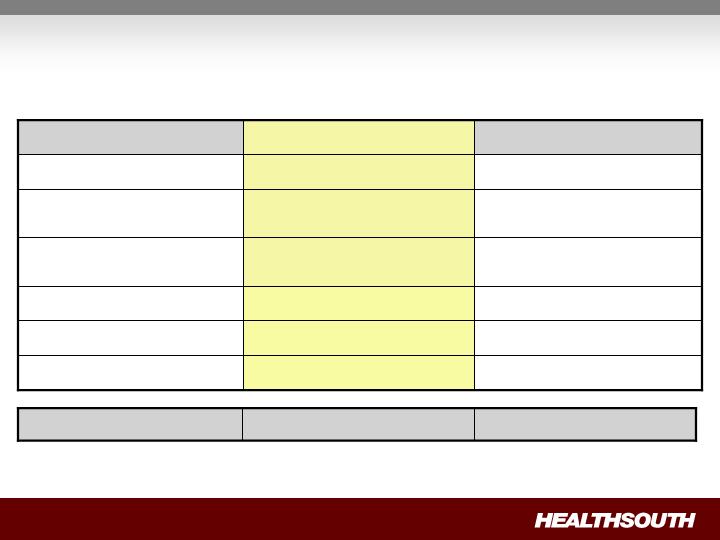

“The Basics”: How Are We Different (Better!) Than

Nursing Homes?

8 consecutive hours per day (min.)

24 hours per day

RN oversight and availability

None

Rehabilitation specialty expertise

Nursing training, expertise

2.5 – 4.0

5.0 – 7.5

Nursing hours per patient per day

Not required

Required

MD or DO designated as

Rehabilitation Director

Not required

Required; 3 hour (min.) therapy per

day

Multi-disciplinary team approach;

coordinated Program of Care

Once every 30 days (min.)

4+ times per week

Attending physician visits

Nursing Home

Inpatient Rehabilitation Hospital

Service

~ 15 days

~ 30 days

Average Length of Stay

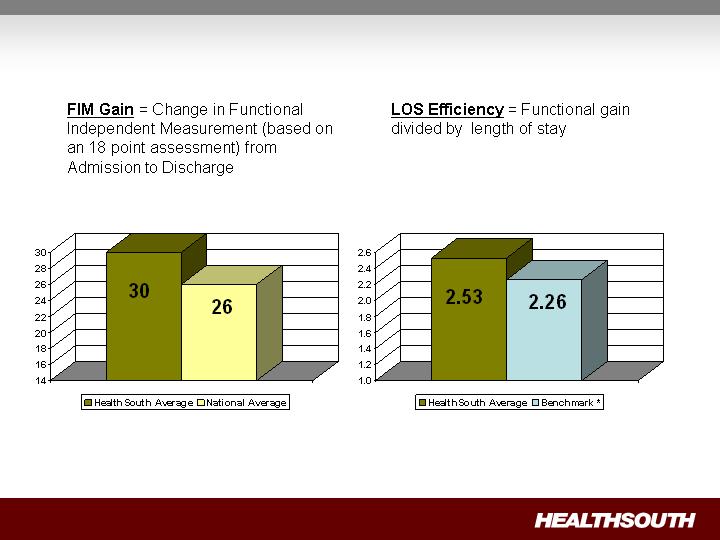

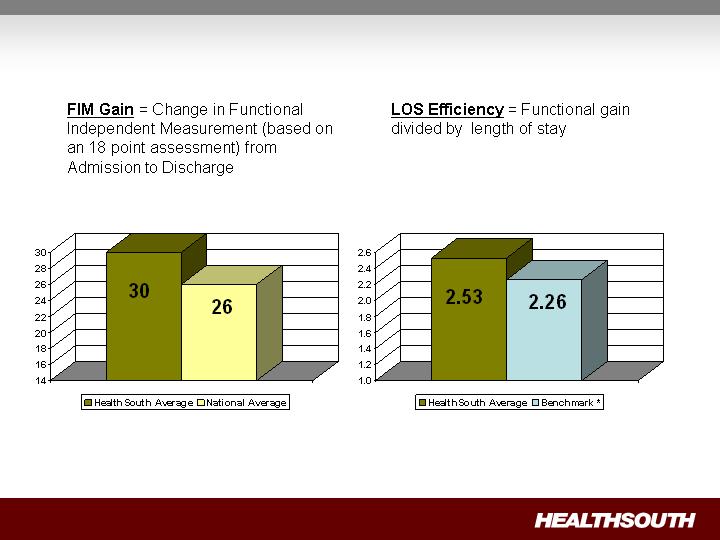

FIM Gain

LOS Efficiency

Source: UDSmr Database – On Demand

Reports – YTD September 2008

* Benchmark = Expected, Risk Adjusted LOS Efficiency

“The Basics”: How Do We Measure Quality?

– Phase II

Operational Objectives (2009 – 2011)

Most effective

processes:

Clinical

Support

Financial

Highest productivity

and most effective

labor management

programs

Paperless and

automated

Customized clinical

experience through

differentiated intake

and assessment

process

Best total family

experience

Most prepared patients

(education, etc.)

Highest satisfaction

rating

Best quality and

outcomes with in

targeted clinical

treatment categories

Highest FIM gain

Minimize practice

variability

Best care coordination

Clinical Excellence

(Target: Stroke, Hip Fracture, Joint

Replacement, Spine/Neurological

Conditions and Cardiac)

Efficient Operations

Differentiated Service

Questions & Answers

HealthSouth

Investor Day

BREAK (Back at 10:45 a.m. EST)

Key Financial Information

Topics Discussed:

YTD Earnings and Adjustments

Revenue & Expense Trend

Free Cash Flow

Liquidity

Use of Cash

Debt Reduction

Interest Expense and Swap Settlements

Government, Class Action, and Related Settlements

Tax Refunds & NOL’s

Questions and Answers

John Workman – Executive Vice President, CFO

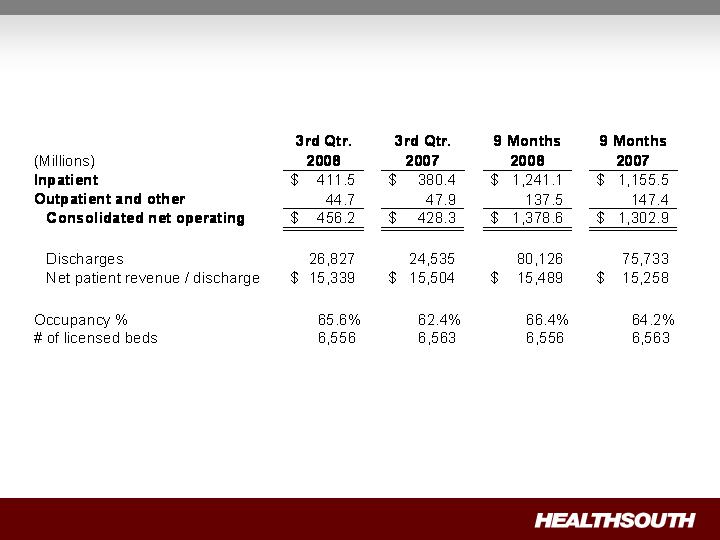

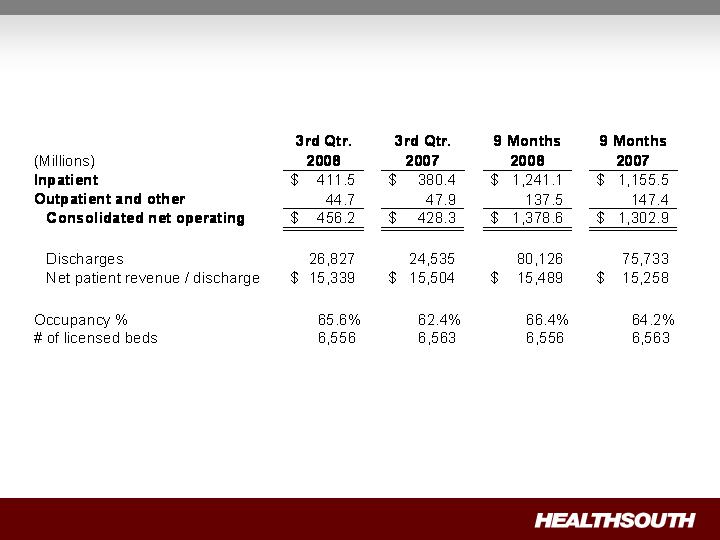

Revenues

Adjusted Consolidated EBITDA Results

(1) Reconciliation to GAAP provided on slide 59 and slide 61

(2) Includes an $8.6 million gain on the sale of our investment in Source Medical

(3) Adjusted EBITDA guidance was revised upward in the second quarter 2008 earnings release

No change; benefit and nonproductive labor costs (e.g. PTO accruals) won’t change

significantly until new benefit year

(Millions)

Adjusted Consolidated EBITDA

(1)

$

79.3

$

88.3

(2)

$

254.1

$

234.8

(2)

3rd Qtr.

2008

3rd Qtr.

2007

9 Months

2008

9 Months

2007

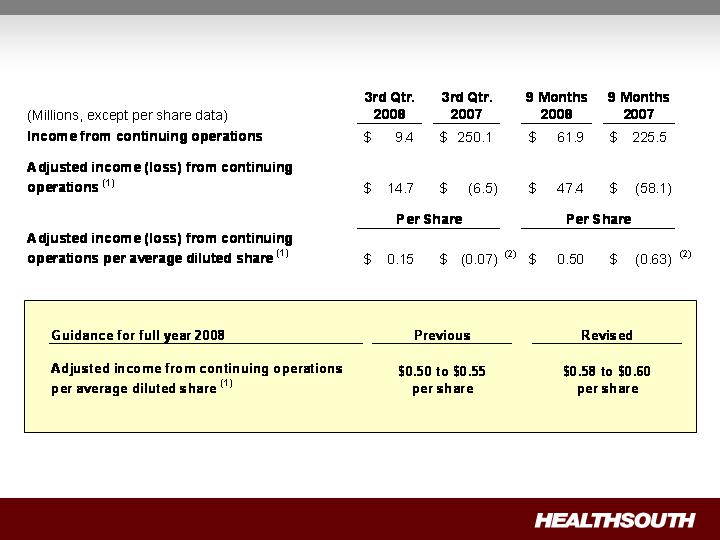

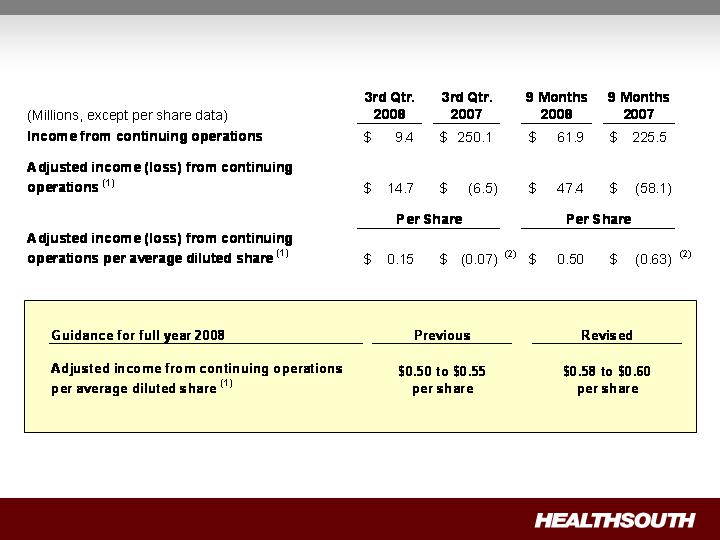

Adjusted Income per Share Results

(1) Reconciliation to GAAP provided on slide 59 and slide 61

(2) Q3 2007 calculated ignoring the antidilutive impact of negative EPS

Nine Months 2008 Statistics

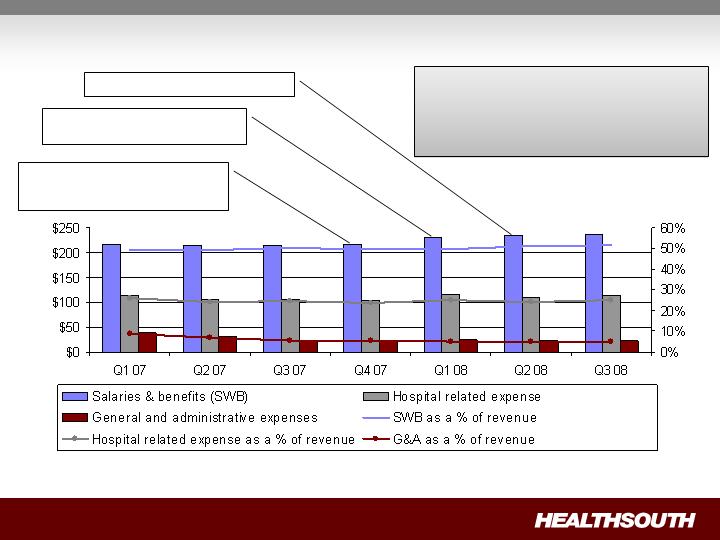

Revenue Volume Occupied Bed FTE EBITDA

+ 5.8% +5.8% -2.4% 7.6% 8.2%

Revenue and volume reflecting strong growth.

Improving productivity (EPOB) helps to offset increase in salaries

and benefits per employee. Actions being taken (including benefits

and PTO) to mitigate cost per employee rise.

On a year-to-date basis, margin rate has improved.

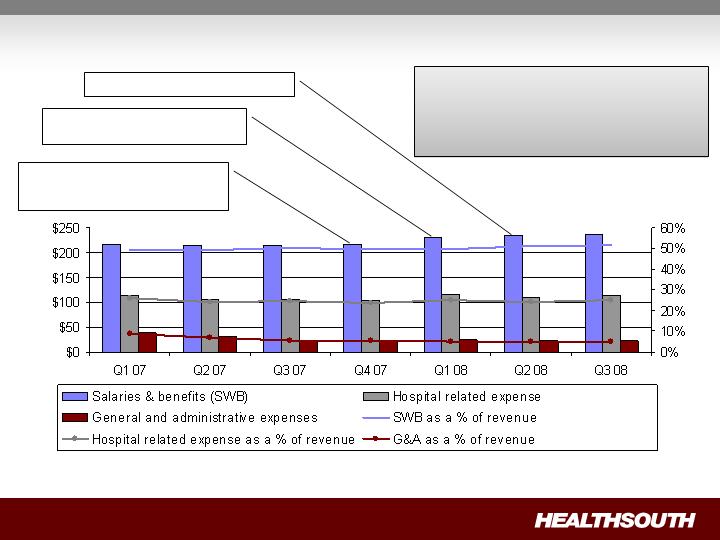

Employees per SWB per Adjusted

Expense Trend

Q4 07 ~2.8% CMS price increase;

3.7% employee merit increase

Q2 08 ~2.8% CMS price roll back

Q1 08 – Employee benefit

enhancement and consolidation

Some modifications made to benefit

plans on November 15, 2008 with

additional modifications on

January 1, 2009

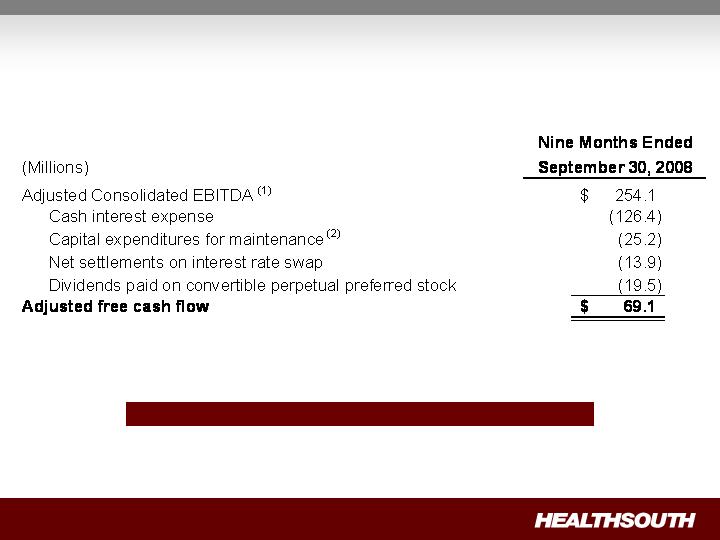

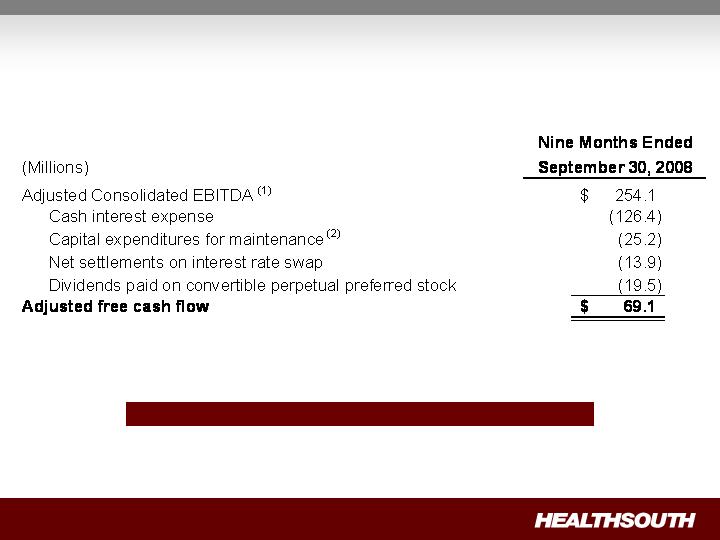

Free Cash Flow Year-to-Date

Strong Normalized Free Cash Flow

(1) Reconciliation to GAAP provided on slide 61 and slide 63

(2) Includes capital expenditures for the refresh program

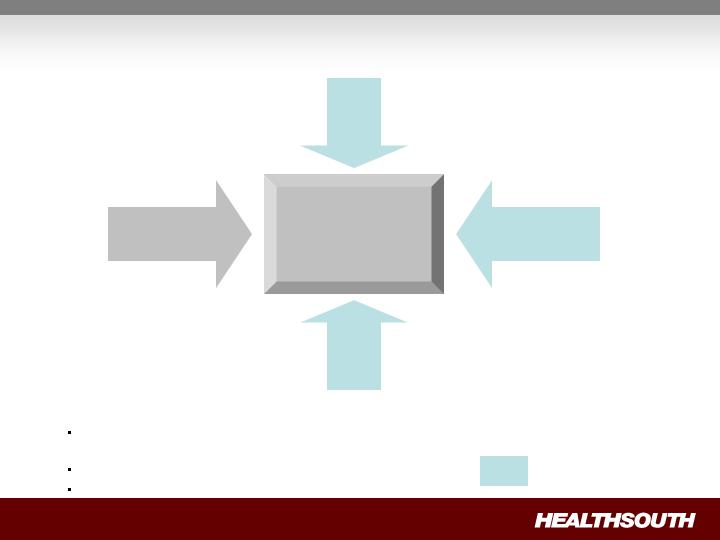

Sources and Uses of Cash

Operating Cash

Cash flow from

operations

Non-operating Cash

Tax refunds

Derivative proceeds

Digital Hospital

proceeds

De novo’s

Acquisitions/

Consolidations

Debt

Reduction

Bed

Expansions

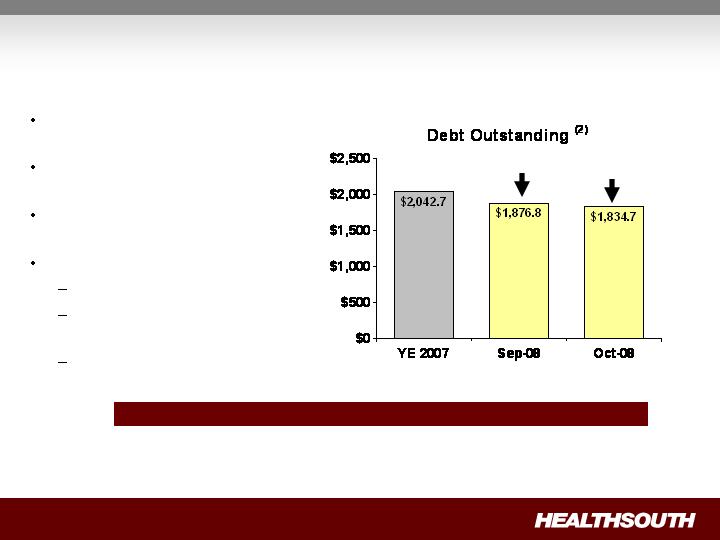

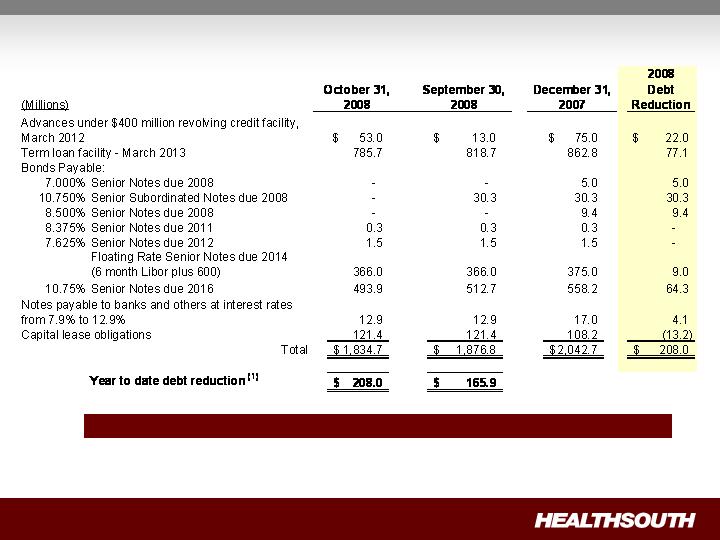

Debt Reduction

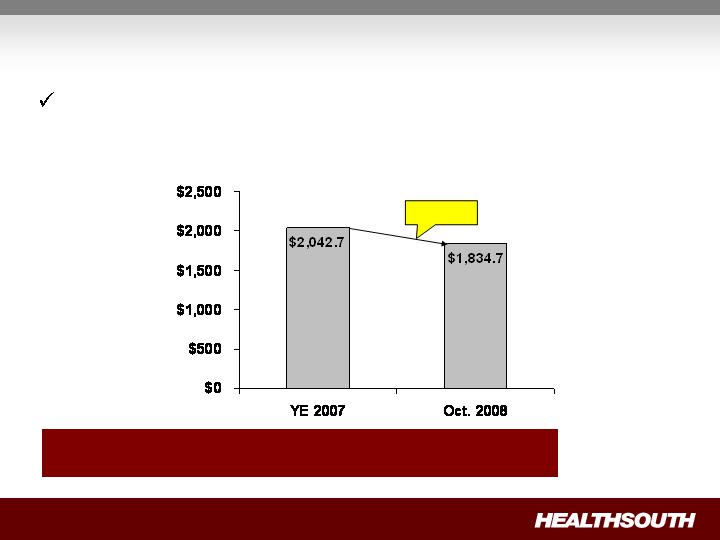

(Millions)

Significant debt reduction since

2004

$208 million paid down in first 10

months of 2008(1)(2)

No near-term refinancing

requirements

Future debt reduction from:

Excess cash from operations

Additional income tax

recoveries

Derivative proceeds

$165.9

$208.0

Debt to EBITDA on September 30, 2008 = 5.5X ; Target = 4.5X

(1) Credit Agreement limits debt pay down on non–term loan balances to $50 million per year with the addition of a lifetime basket of $100 million. As

of Sept. 30, 2008, the $50 million yearly limit had been reached for 2008, and we have used approximately 1/3 of the $100 million lifetime basket.

(2) A reconciliation can be found on slide 45

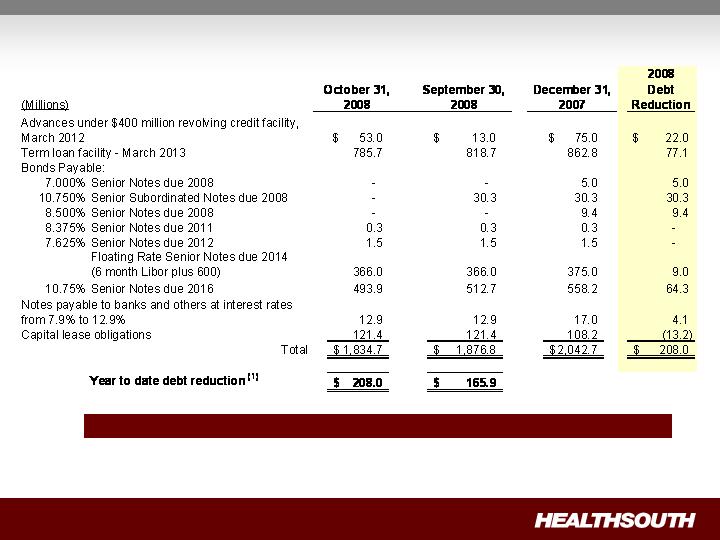

Debt Schedule

Debt to Adj. Consol. EBITDA on September 30, 2008 = 5.5X ; Target = 4.5X

(1) Credit Agreement limits debt pay down on non–term loan balances to $50 million per year with the addition of a lifetime basket of $100 million.

As of Sept. 30, 2008, the $50 million yearly limit had been reached for 2008, and we have used approximately 1/3 of the $100 million lifetime basket.

The Value of Debt Pay Down

Lower Interest Expense =

Higher EPS

Debt = $50 million

Interest Rate = 10.75%

Federal Taxes = 0

Earnings Per Basic Share = $0.06

Net Debt

Equity

Debt pay down increases

equity value

Enterprise Value

De novo: 40–Bed Proforma Example

(1) Does not include estimated corporate overhead of ~4.75% of net operating revenues.

(2) Assumes state income taxes only for first five years, then federal and state income taxes.

De novo’s attractive for future growth.

We evaluate based on commitment (cash or leased).

Leasing maximizes cash-on-cash returns in uncertain economy.

Revenue

EBITDA

%

(1)

Revenue

EBITDA

%

(1)

Year 1

8,500

$

1,275

$

15%

8,500

$

150

$

2%

Year 2

10,500

2,500

24%

10,500

1,300

12%

Run-Rate

11,500

2,900

25%

11,500

1,575

14%

Cash Investment

Five-Year Investment Return

76%

172%

Internal Rate of Return

(2)

14%–18%

Build and Fund

Leased Real Estate

$15,000–$17,000

$3,000–$4,000

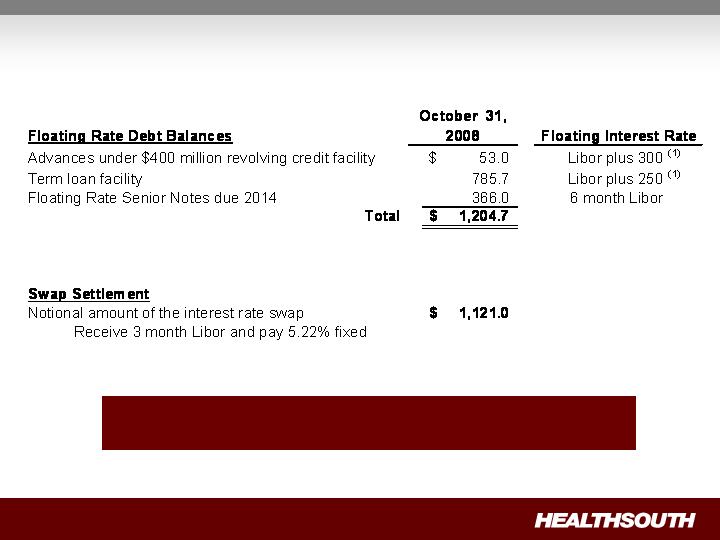

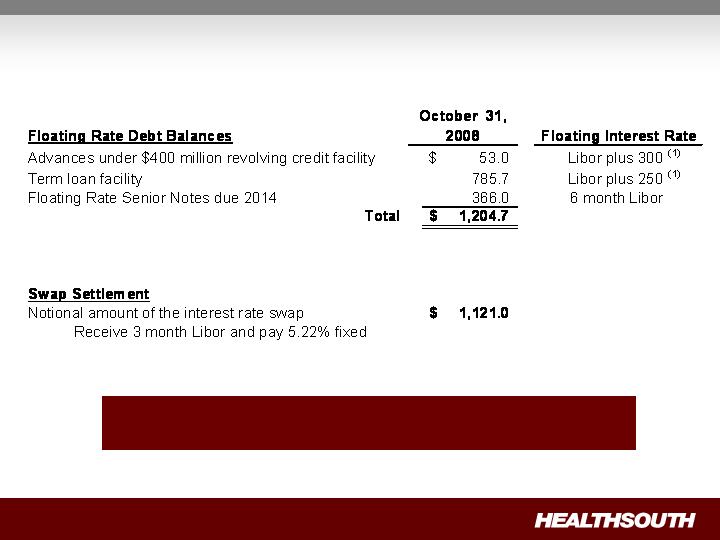

Interest Expense and Swap Settlements

(Millions)

As of September 30, 2008, we were in compliance with the

covenants under our Credit Agreement.

(1) We have the flexibility to peg 1,2,3 or 6 month Libor, or prime

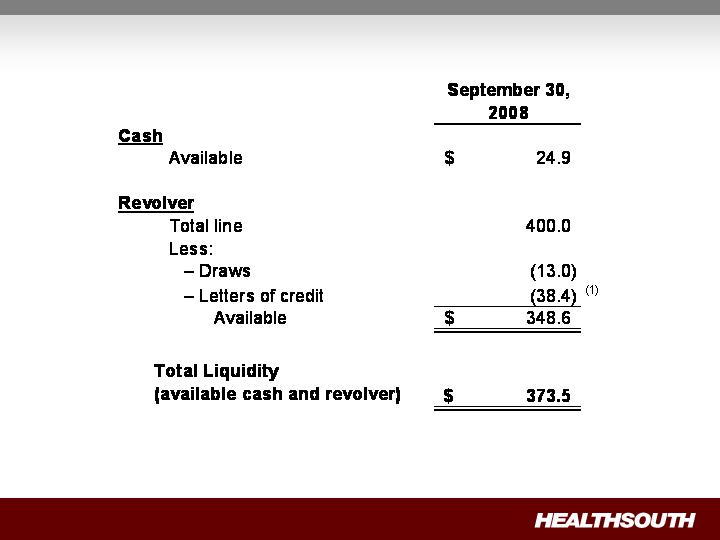

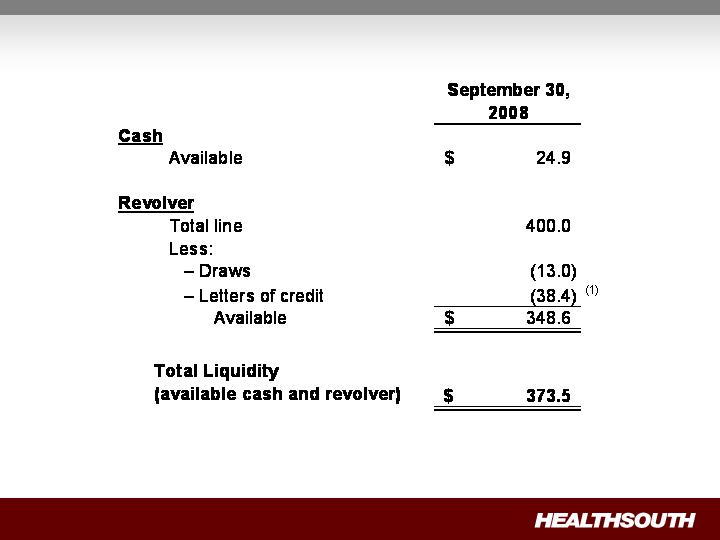

Liquidity

(Millions)

(1) Letters of credit will be reduced by $33.6 million when we have court approval of the UBS settlement

As Settled

Liability goes to “0”

Shareholders equity (paid in

capital) goes up

Outstanding shares go up

Cash effect “0”

Expected Settlement Date

2009

Currently under Appeal

Government, Class Action, and Related Settlements

Today

Under appeal

Shares are not issued

Change in fair value flows

through income statement

Share price goes up, liability

and expense go up

Share price goes down,

liability and expense go

down

Cash effect “0”

The class action Securities Litigation Settlement included 5.0

million shares of common stock and 8.2 million warrants at a strike

price of $41.40.

Convertible Perpetual Preferred Stock

400,000 shares 6.5% Series A preferred stock is convertible, at the

option of the holder

At initial conversion price of $30.50 per share

If converted represents 13.1 million shares

On or after July 20, 2011, we may cause conversion, if;

Closing price of our common stock exceeds 150% of the

conversion price ($45.75) for 20 of the last 30 consecutive

trading days

Tax Position Update

Cash Refunds

$63 million on balance sheet at September

30, 2008

Relates to years 2003 or earlier

$46 million received on October 1, 2008

(used for debt reduction)

Remainder expected to be later in 2008

or early 2009

Future Cash Tax Payments

Due to $2.5 billion in federal and state NOLs

and tax deductions, we do not expect to pay

significant federal income tax for the next 10-12

years

Expect to pay about $5-7 million per year state

income tax

Some exposure to Alternative Minimum Tax

(AMT)

GAAP Considerations

HealthSouth’s balance sheet currently reflects

a valuation allowance for the potential value

of NOLs and future deductions. The valuation

allowance is over $1.0 billion

GAAP tax rate will net to small amount for

foreseeable future as there will be a reduction

in the valuation allowance when NOLs are

utilized

NOL Usage

HealthSouth does not have an annual use

limitation (AUL) under section 382

If we experienced a “change of ownership” as

defined by the Internal Revenue Service we

would be subject to an AUL. However, even

with a change of ownership we do not expect to

pay significant federal income tax for the next

10-12 years

Questions & Answers

Litigation Update

Topics Discussed:

General Medicine

UBS Settlement

E & Y Arbitration

Claims against Scrushy

Questions and Answers

John Whittington – Executive Vice President,

General Counsel and Secretary

Concluding Remarks

HealthSouth's Value Proposition

Attractive industry

Industry leader

Strong operating cash flows

Excellent growth opportunities

~ $2.5 billion NOL's

Appendix and

Reconciliation

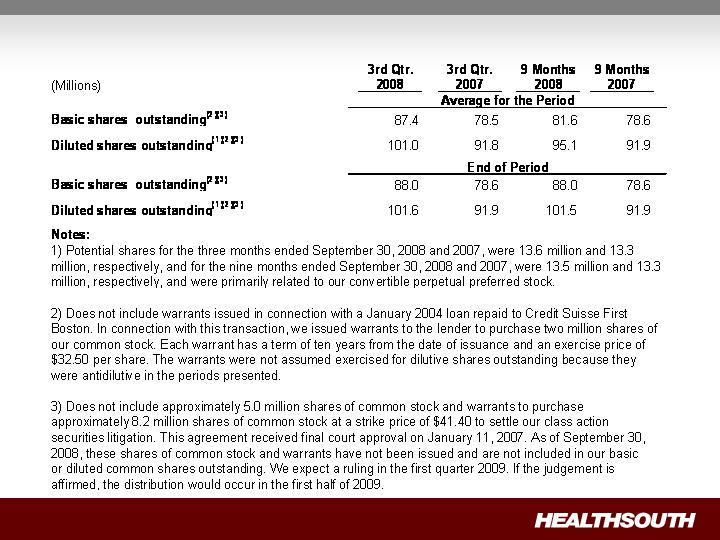

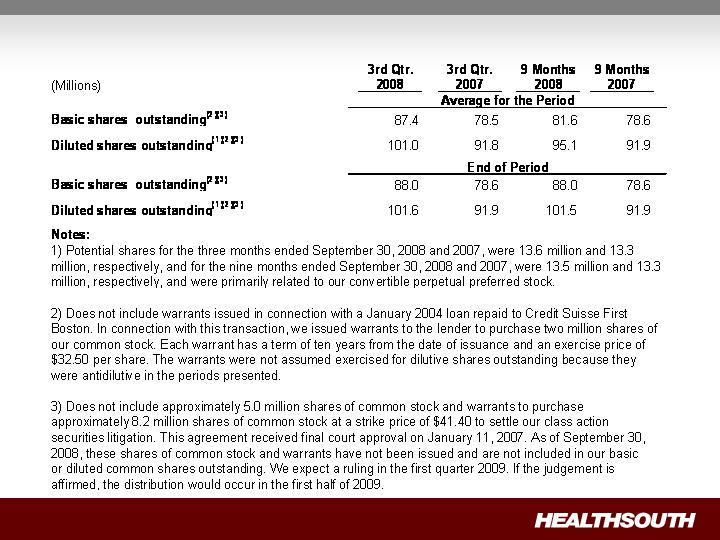

Outstanding Share Summary

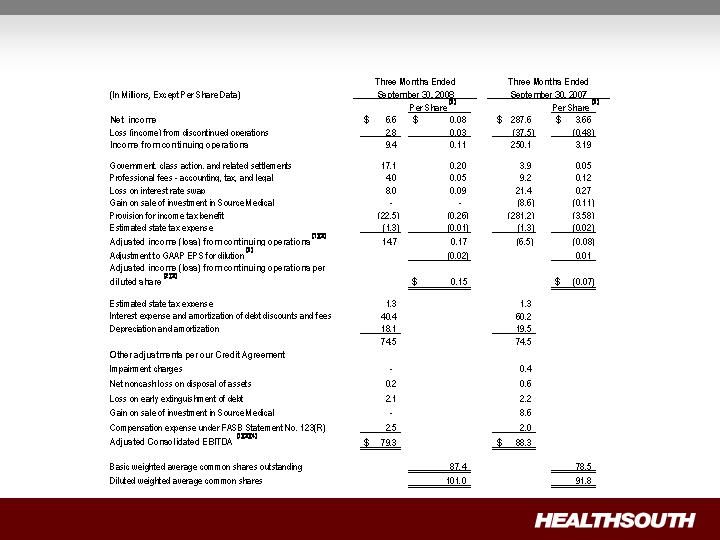

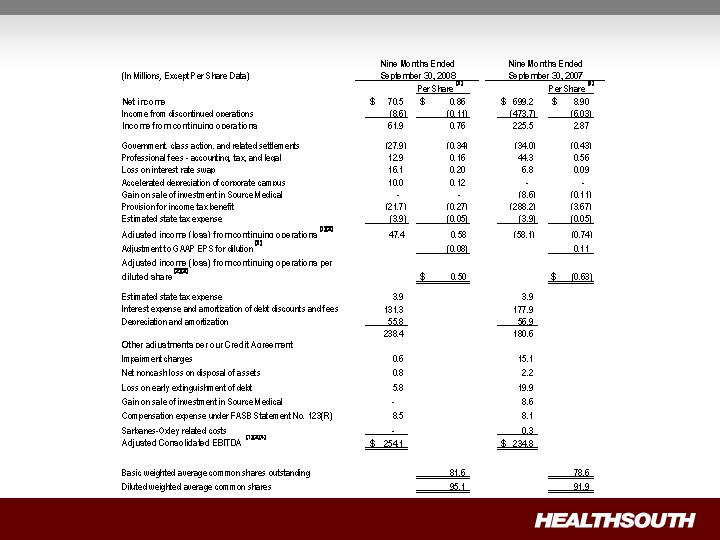

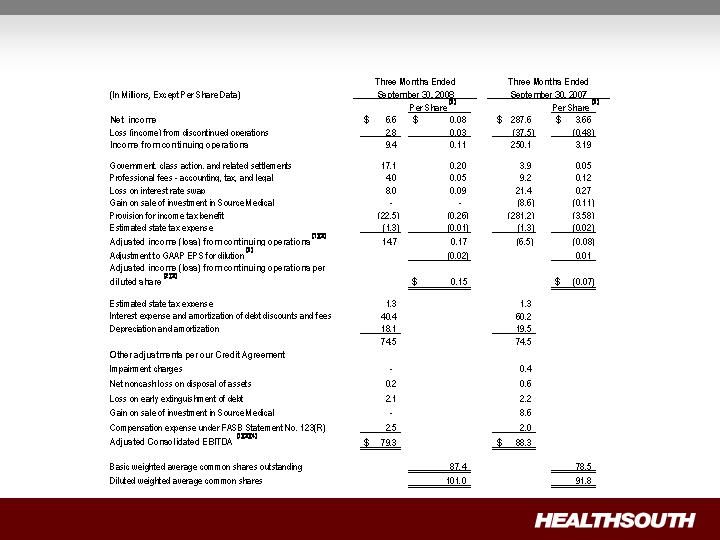

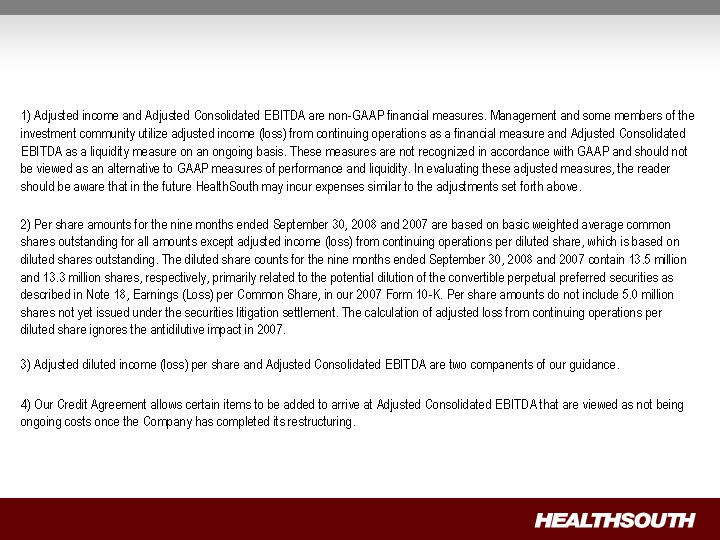

Q3 2008 Reconciliation of Net Income to Adjusted Income from Continuing

Operations and Adjusted Consolidated EBITDA (1)(3) – (Notes on following page)

Q3 2008 Reconciliation of Net Income to Adjusted Income from Continuing

Operations and Adjusted Consolidated EBITDA – Notes

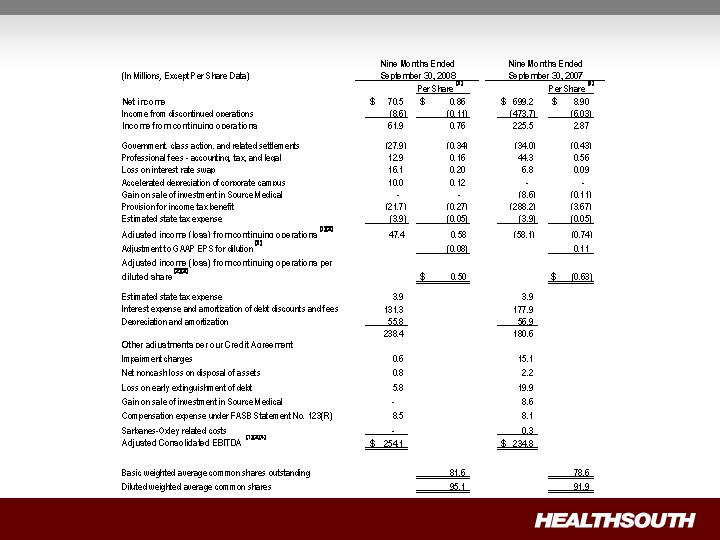

9 Months 2008 Reconciliation of Net Income to Adjusted Income from Continuing Operations

and Adjusted Consolidated EBITDA (1)(3) – (Notes on following page)

9 Months 2008 Reconciliation of Net Income to Adjusted Income from

Continuing Operations and Adjusted Consolidated EBITDA – Notes

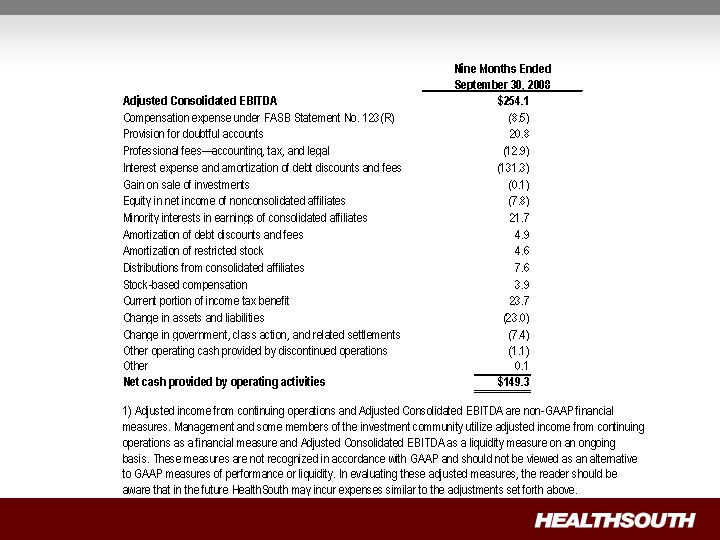

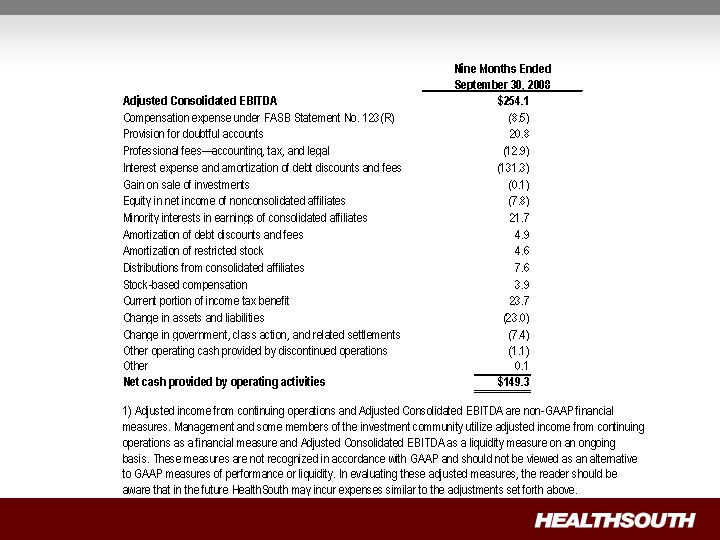

9 Months 2008 Reconciliation of Adjusted Consolidated EBITDA(1) to Net Cash

Provided by Operating Activities