HealthSouth

J.P. Morgan Global High

Yield & Leveraged Finance

Conference

Miami, Florida

February 3, 2009

Exhibit 99.1

Note Regarding Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and are

subject to various risks, uncertainties and other factors, including those set forth in our Form 10-Q for the

quarters ended March 31, 2008, June 30, 2008, and September 30, 2008, Form 10-K for the fiscal year

ended December 31, 2007, and in other documents we previously filed with the SEC, many of which are

beyond our control, that may cause actual results to differ materially from the views, beliefs and estimates

expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under

the Securities Exchange Act of 1934. The Appendix at the end of this presentation includes reconciliations of

the non-GAAP financial measures found in the following presentation to the most directly comparable

financial measures calculated and presented in accordance with Generally Accepted Accounting Principles

in the United States. Our Form 8-K, dated February 2, 2009, to which the following presentation slides are

attached as Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP

financial measures and should be read in conjunction with these presentation slides.

Cautionary Statements

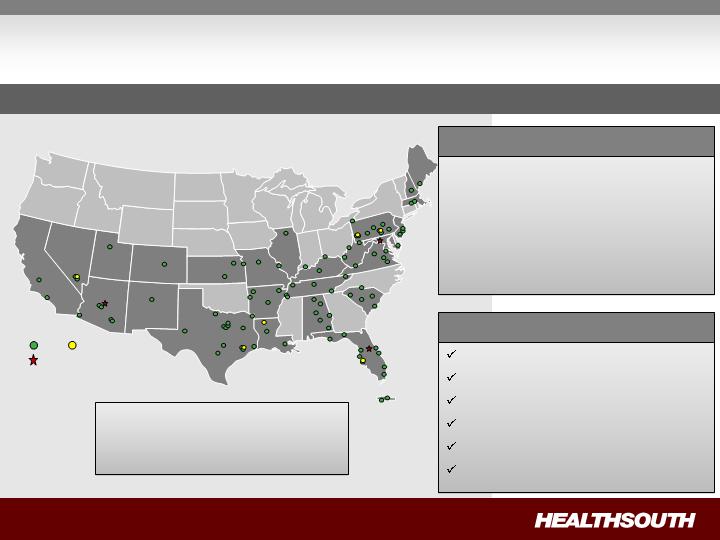

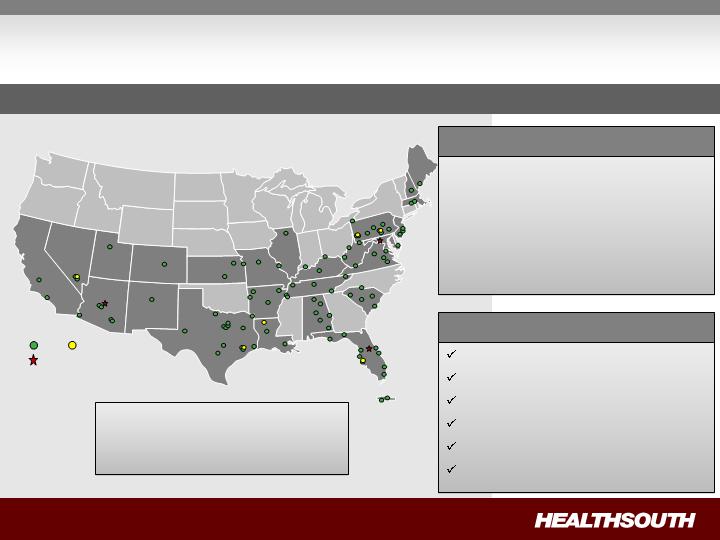

HealthSouth Today

IRH

LTCH

93 Rehabilitation Hospitals and

Outpatient Departments

6 LTCH Hospitals

55 Outpatient Satellites

25 Hospital-Based Home

Health Agencies

Operational Components

Rehabilitation Nursing

Physical Therapy

Occupational Therapy

Speech-Language Therapy

Case Management

Specialized Technology

Major Services

Largest Provider of Inpatient Rehabilitative Healthcare Services in the U.S.

Development Sites

Employees: ~ 22,000

Corporate Office: Birmingham, AL

Exchange (Symbol): NYSE (HLS)

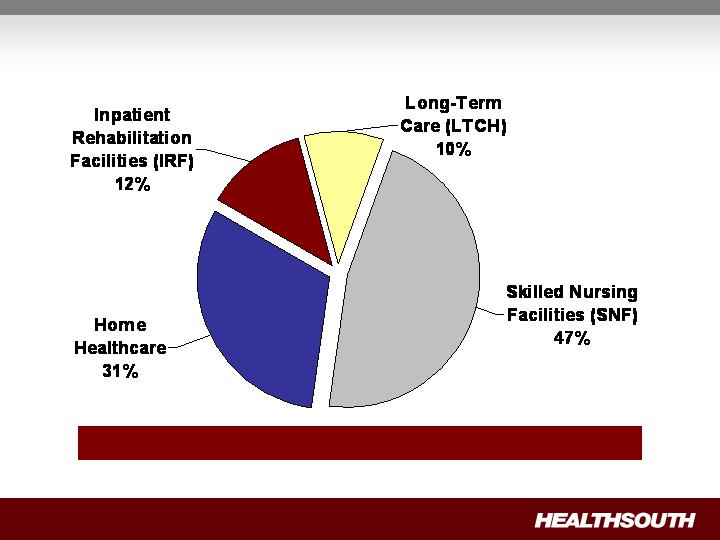

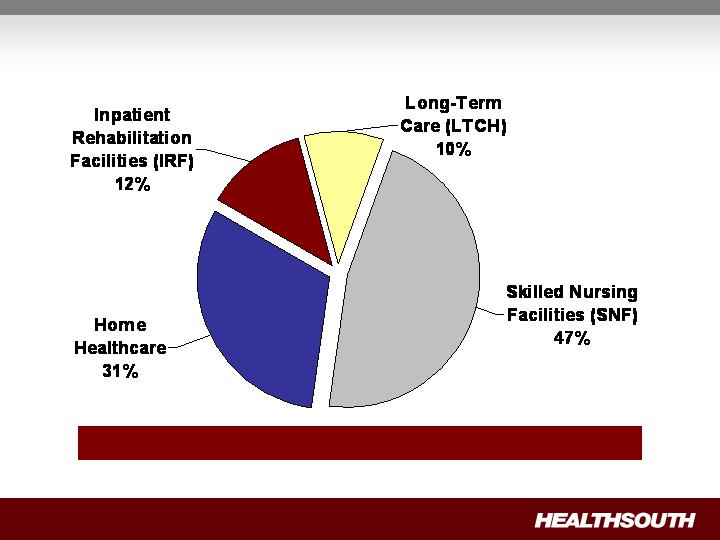

Post-Acute Industry

(1) Source: MedPAC, A Data Book: Healthcare Spending and the Medicare Program, June 2008 (Section 9).

(2) These percents are Medicare spending only and do not include beneficiary copayments or other payors.

2007 Medicare Spending = $45.1 Billion

Total Inpatient Rehabilitation Sector: ~ $9 Billion

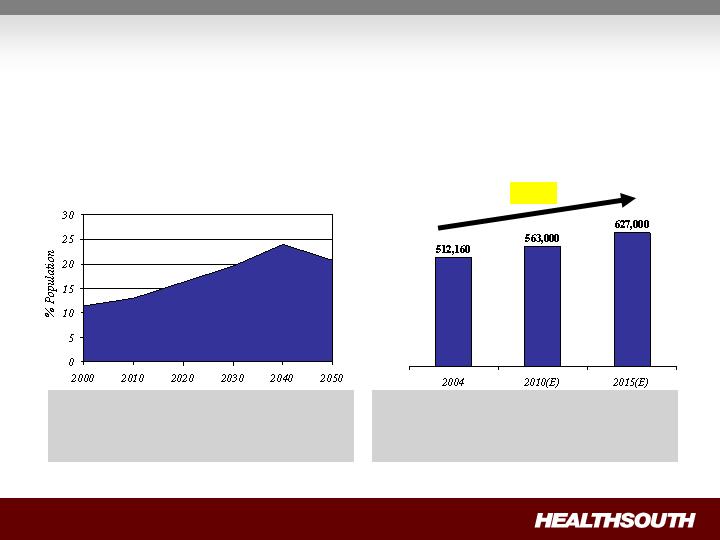

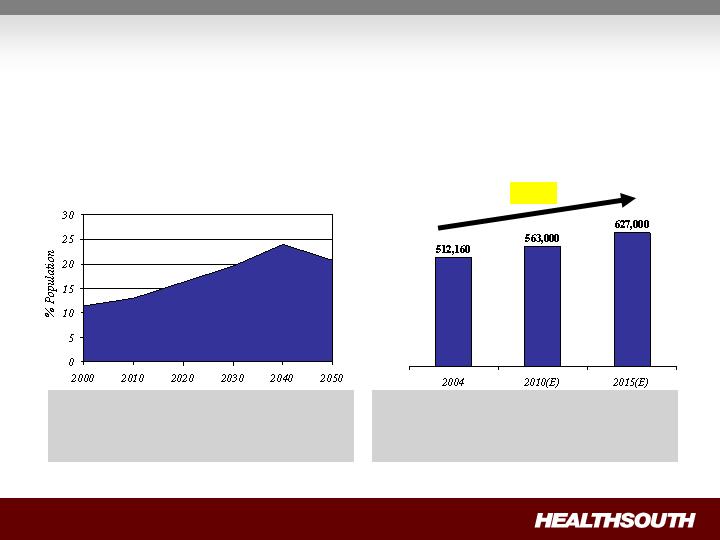

Projected percentage of US population

65 years or older through 2050(1)

(1) Source: US Census Bureau, 2004

(2) Source: Medicare Provider Analysis and Review File (2004); Claritas

Projected Medicare Compliant

Case Growth(2)

Inpatient Rehabilitation: Aging Demographics =

Increased Demand

Demand for post-acute services will

increase as the U.S. population ages.

“Compliant Cases” are expected to grow

~ 2% per year for the foreseeable future,

creating an attractive market.

+22%

Inpatient Rehabilitation: Fragmented Sector

Total Inpatient Rehabilitation

Facilities (IRF): 1,201

Total Freestanding Inpatient

Rehabilitation Hospitals: 218

(HLS = 43%)

(1) Source: Medpac, Modern Healthcare, press releases and internal analysis

5

Vibra (Private)

125

93

All others

2

Reliant (Private)

No. of

IRFs

Freestanding

Providers

2

Gulf States (Private)

2

Five Star Quality Care

(Public)

4

Centerre (Private)

5

Select (Private)

6

RehabCare (Public)

6

Ernest (Private)

Hospital-Based

983 (82%)

Freestanding

HealthSouth

93 (8%)

Other

125 (10%)

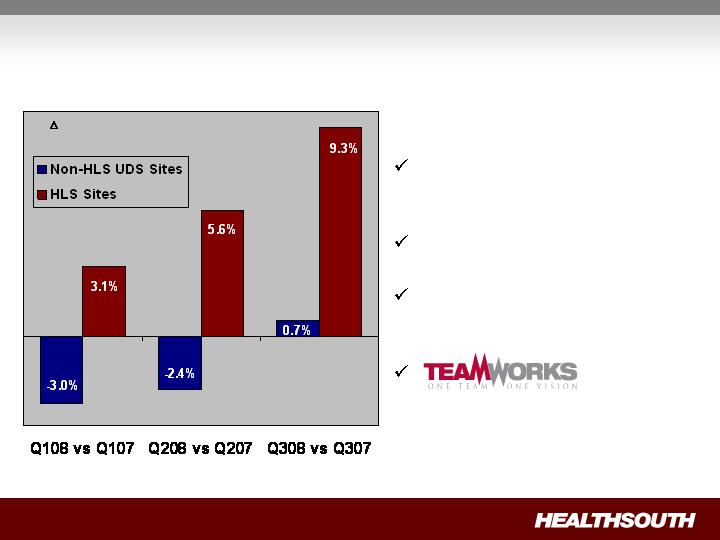

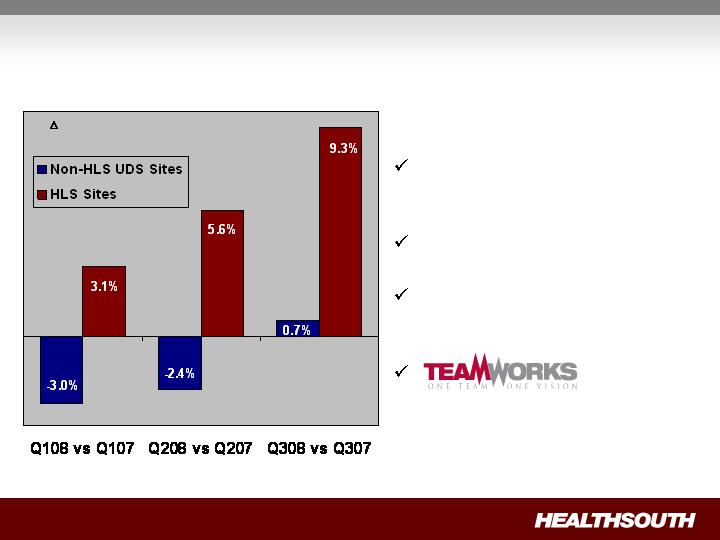

HealthSouth’s volume growth

continues to outpace

competitors’ growth

Same store discharges were

+8.1% for HLS in Q308

Projected sustainable discharge

growth: 4+% annual same

store

.

% Discharges of HLS vs. Non-HLS UDS Sites(1)

Strong Organic Growth

(1) Data provided by UDS MR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry.

Nine Months 2008 Statistics

(YTD Q307 vs. YTD Q308)

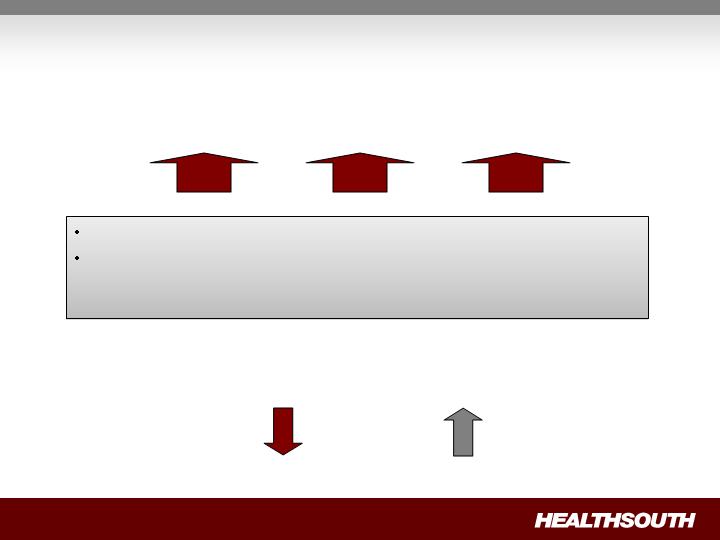

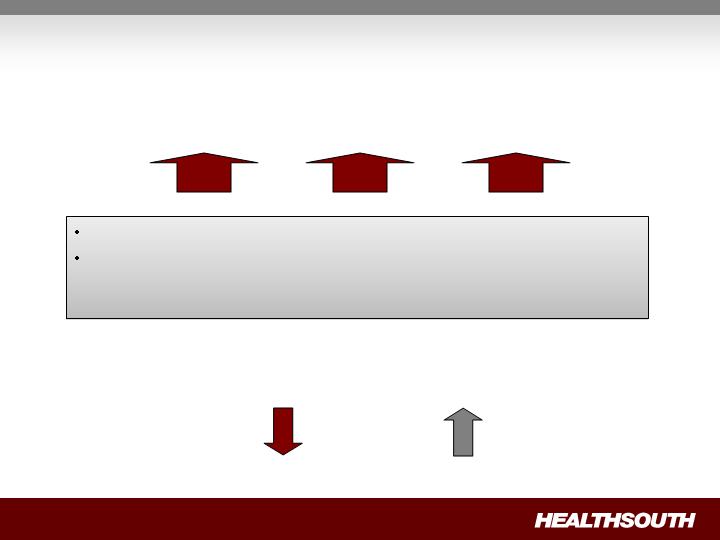

Volume Revenue EBITDA

+ 5.8% +5.8% +8.2%

Volume and revenue reflect strong growth.

Improving productivity (EPOB) helps offset increase in salaries

and benefits (SWB) per employee. Actions taken to mitigate

labor costs.

Employees per

Occupied Bed (EPOB) SWB per FTE

-2.4% 7.6%

Q408 Initial Observations

Volume:

Continued solid same-store discharge growth

Reminder: Q407 had hospitals limiting admissions due to phase-in to 65%

threshold which will favorably impact quarter-over-quarter comparisons.

Pricing:

No significant sequential change in pricing vs. Q308

Reminder: Quarter-over-quarter comparables will show decline due to April

1st pricing roll-back.

Expenses:

Continued improvement in productivity and managing labor costs

Reminder: An average 3% merit increase went into effect on October 1,

2008 for non-management employees; benefits changes were effective

January 1, 2009.

Year-End Initial Observations

(1) See supplemental information on slide 33

The Company has not yet finalized its audited results for the fourth

quarter and year-end 2008. At this time, the Company is not aware of

anything that would cause it to miss the previously disclosed guidance.

Q408, year-end results and 2009 guidance will be provided on

earnings conference call scheduled for 9:30 a.m. EST on February 24, 2009

Year-over-year growth in inpatient

discharges

5% to 6%

Consolidated net operating revenues

$1.825 billion to $1.875 billion

Net income per diluted share

$0.23 per share to $0.25 per share

Adjusted income from continuing

operations per average diluted share

(1)

$0.58 to $0.60 per share

Adjusted Consolidated EBITDA

(1)

$330 million to $335 million

Previous Guidance for Full-Year 2008

Longer term, we will pursue acquisitions of complementary,

post-acute services provided they are accretive to HealthSouth.

Target: 5-8% annual Adjusted Consolidated EBITDA growth

Margins will expand modestly

Target: 15-20% annual Adjusted EPS growth

Strategy:

To create shareholder value as the preeminent provider of

rehabilitative care in the U.S. by:

Creating a strong balance sheet through deleveraging;

Driving organic growth through operational excellence; and

Pursuing disciplined, opportunistic growth.

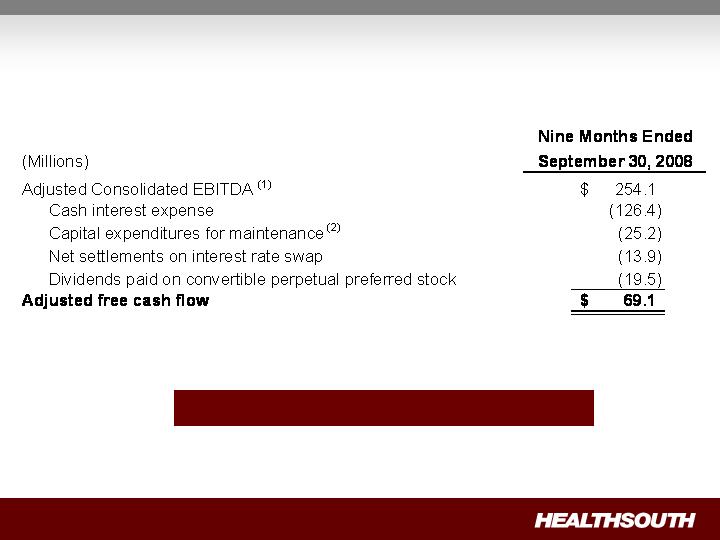

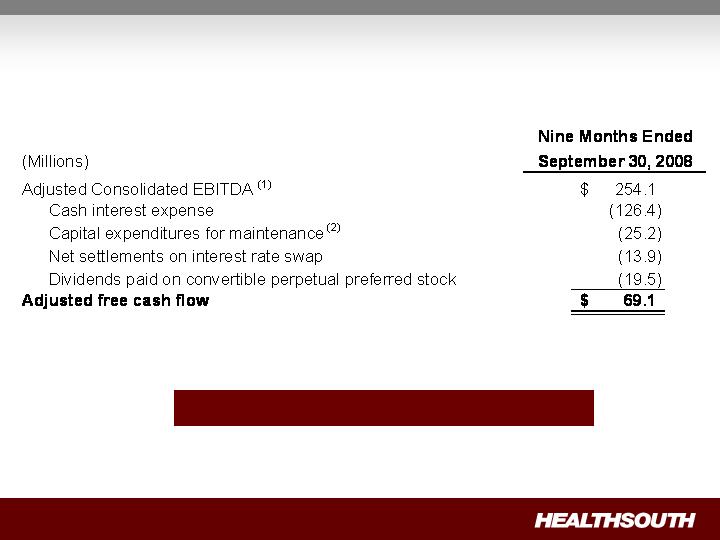

Free Cash Flow Year-to-Date

Strong Normalized Free Cash Flow

(1) Reconciliation to GAAP provided on slides 30 through 32

(2) Includes capital expenditures for the refresh program

Non-Operating Cash / Tax Position Update

Cash Refunds

$63 million on balance sheet at September

30, 2008

Relates to years 2003 or earlier

$46 million received on October 1, 2008

(used for debt reduction)

Additional $24 million tax refund +

applicable interest approved by Joint

Committee on Taxation; cash expected

Q109

Future Cash Tax Payments

Due to $2.5 billion in federal and state NOLs

and tax deductions, we do not expect to pay

significant federal income tax for the next 10-12

years

Expect to pay about $5-7 million per year state

income tax

Some exposure to Alternative Minimum Tax

(AMT)

GAAP Considerations

HealthSouth’s balance sheet currently reflects

a valuation allowance for the potential value

of NOLs and future deductions. The valuation

allowance is over $1.0 billion

GAAP tax rate will net to small amount for

foreseeable future as there will be a reduction

in the valuation allowance when NOLs are

utilized

NOL Usage

HealthSouth does not have an annual use

limitation (AUL) under section 382

If we experienced a “change of ownership” as

defined by the Internal Revenue Service we

would be subject to an AUL. However, even

with a change of ownership we do not expect to

pay significant federal income tax for the next

10-12 years

Non-Operating Cash / Derivative Proceeds

UBS Settlement

Net proceeds of ~ $60 million

Expect cash to be received in first half of 2009

E&Y Arbitration(1)

Expect arbitration to be completed in 2009

11% fee cap for the derivative plaintiffs’ attorneys

Claims Against Scrushy(1)

Trial scheduled for May 2009

35% fee cap for the derivative plaintiffs’ attorneys

(1) 25% of the net proceeds will go to the plaintiffs in the Securities Litigation pursuant to existing settlement agreements.

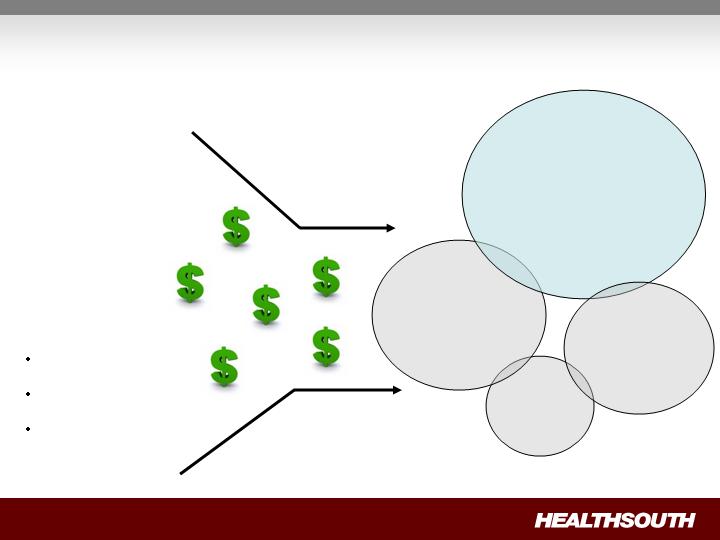

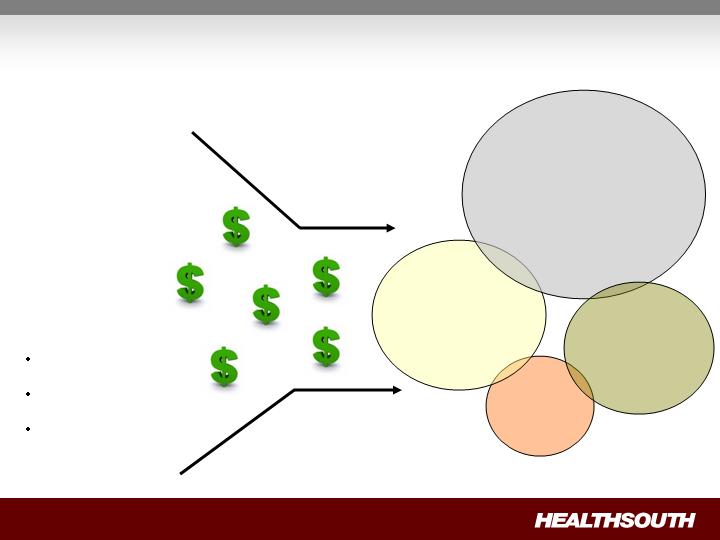

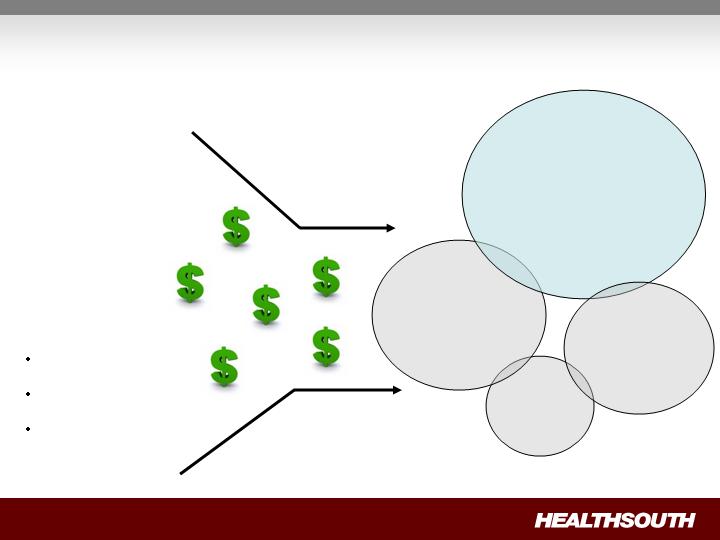

Disciplined Use of Cash

Non-Operating Cash

Tax refunds

Derivative proceeds

Digital Hospital

proceeds

De novo’s

Acquisitions/

Consolidations

Debt

Reduction

Bed

Expansions

Adjusted Free

Cash Flow(1)

(Major Focus)

(Opportunistic)

($15-20 million)

(3rd-party

financed)

(1) After maintenance CAPEX of ~ $35 million annually, which includes ~ $5-10 million for infrastructure enhancements

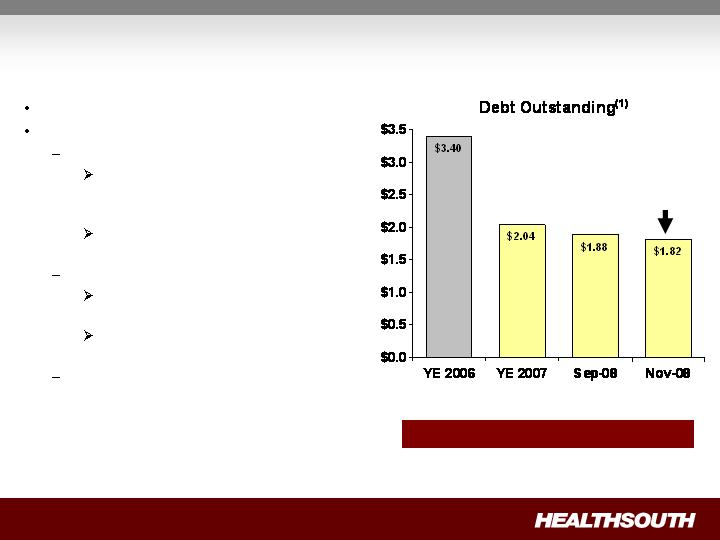

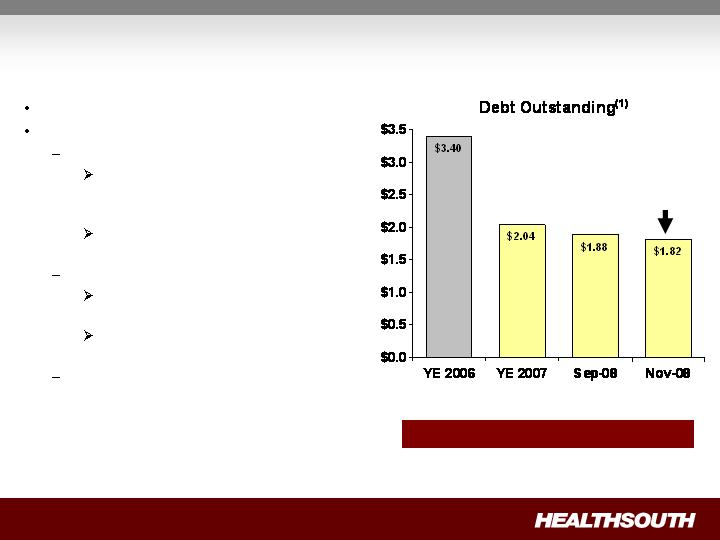

Debt Reduction

No near-term refinancing

Future debt reduction:

Additional income tax recoveries

$24 million federal tax refund

(+ interest) approved 12/30/08;

cash expected Q109(3)

Other recoveries being

pursued at state level

Derivative proceeds

UBS settled; cash expected

1H09

E&Y and Scrushy litigation on-

going

Excess cash from operations

$223.2M(2)

(1) A reconciliation can be found on slide 29

(2) Credit Agreement limits debt pay down on non–term loan balances. We have limited this to $50 million per year with the addition of a lifetime

basket of $100 million. We have the ability to buy back non-term loan debt with the discretionary cash available to the Company.

(3) Joint Committee on Taxation approved December 30, 2008 for 1995-1999 tax years

Debt to EBITDA 6.4X 6.3X 5.5X 5.5X

($ Billions)

Debt Reduction

Since 12/31/07

Short-Term Goal: 4.5X by YE 2010

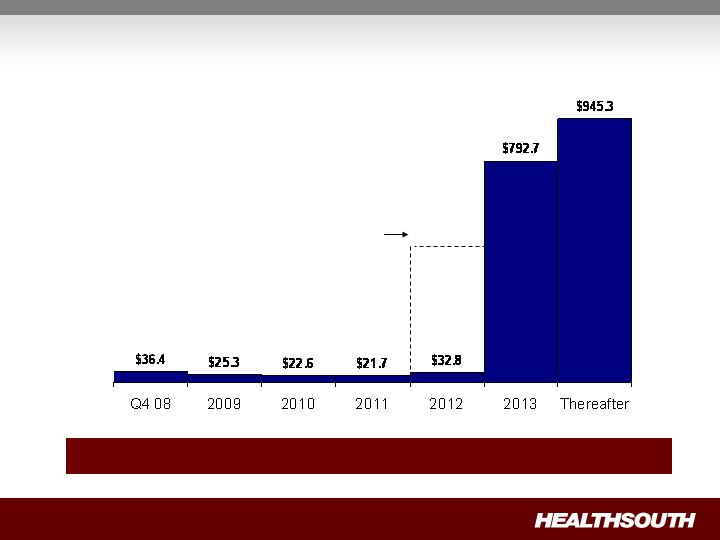

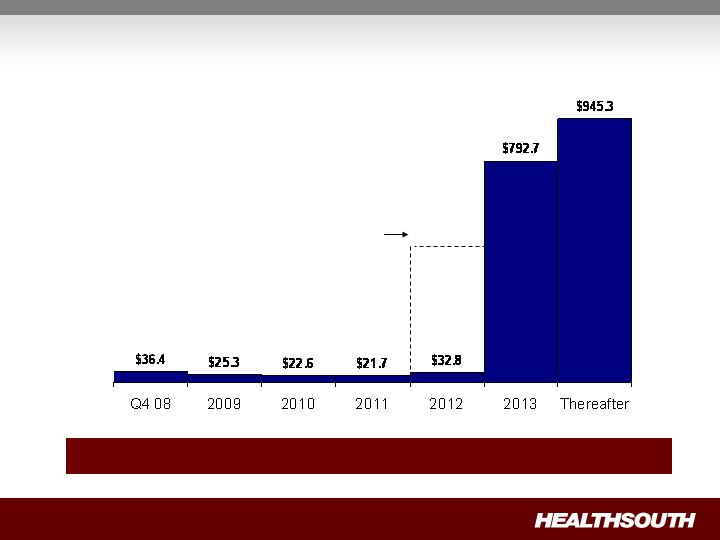

Debt Schedule

(Millions)

$ 40.0

Term loan facility - March 2013

785.7

Bonds Payable:

8.375% Senior Notes due 2011

0.3

7.625% Senior Notes due 2012

1.5

Floating Rate Senior Notes due 2014 (6 month Libor plus 600)

366.0

10.75% Senior Notes due 2016

494.3

12.8

Capital lease obligations

118.9

Total

1,819.5

$

Debt

Balances

Nov. 30, 2008

Notes payable to banks and others at interest rates from 7.9% to 12.9%

Advances under $400 million revolving credit facility, March 2012

Debt Maturities

(Millions)

Minimal Amortization and No Near-Term Financing Risk

$400.0

Undrawn revolver

goes away in 2012

Credit Ratings

S&P

Moody's

Corporate Credit Rating

B

B3

Outlook

Stable

Positive

Prices

Bank Debt

Jan 28, 2009

Term loan facility - March 2013

BB-

Ba3

$85-$87

Bonds

Floating Rate Senior Notes due 2014

CCC+

Caa1

$83-$84

10.75% Senior Notes due 2016

CCC+

Caa1

$98-$99

Disciplined Use of Cash

Non-Operating Cash

Tax refunds

Derivative proceeds

Digital Hospital

proceeds

De novo’s

Acquisitions/

Consolidations

Debt

Reduction

Bed

Expansions

Adjusted Free

Cash Flow(1)

(Major Focus)

(Opportunistic)

($15-20 million)

(3rd-party

financed)

(1) After maintenance CAPEX of ~ $35 million annually, which includes ~ $5-10 million for infrastructure enhancements

Organic Growth Enhanced Through Bed Expansions

Hospitals with greater than 85% occupancy are candidates for

bed expansion

We expect to add 65-75 beds by the end of 2009 and at least

another 44 beds in 2010

Average cost per bed:

With new construction = $100 – 250K

Internal renovation, only = $15 – 45K

(1) Includes Vineland, NJ and excludes Dallas, TX

(1)

Occupancy

Q4 2007

Q1 2008

Q2 2008

Q3 2008

High (85% or greater)

10

22

17

16

Medium (60% to 85%)

42

37

42

43

Low (Less than 60%)

41

34

34

34

Total

93

93

93

93

Number of HLS Hospitals

Disciplined Development

(2)

(1) Plan to work with a developer to obtain a lease arrangement

(2) CON is being appealed; operational date may change

154 additional beds in total, 34 of which became operational in Q308

Development priorities:

1.

Consolidations

2.

De novo (with third-party financing)

Location

Announced

Type of Investment

Installed Beds

Operational

Date

Vineland, NJ

Aug-08

Acquisition

34 Beds

Q3 2008

Arlington, TX

Aug-08

Consolidation

n/a

Q3 2008

Ocala, FL

Aug-08

De novo

(1)

40 Beds

3Q 2010

Loudoun County, VA

Aug-08

De novo

40 Beds

2Q 2010

Midland, TX

Sep-08

Consolidation

n/a

Q3 2008

Mesa, AZ

Oct-08

De novo

(1)

40 Beds

3Q 2009

Liquidity

(Millions)

(1) Letters of credit will be reduced by $33.6 million in connection with implementing the court order approving the final UBS settlement. We expect

the administrative steps to be completed in the first quarter of this year.

September 30,

2008

Cash

Available

24.9

$

Revolver

Total line

400.0

$

Less:

– Draws

(13.0)

– Letters of credit

(38.4)

(1)

Available

348.6

$

Total Liquidity

(available cash and revolver)

373.5

$

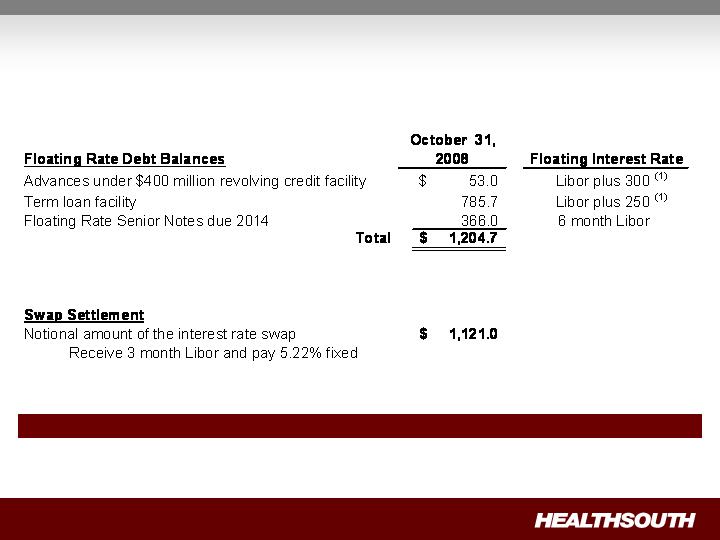

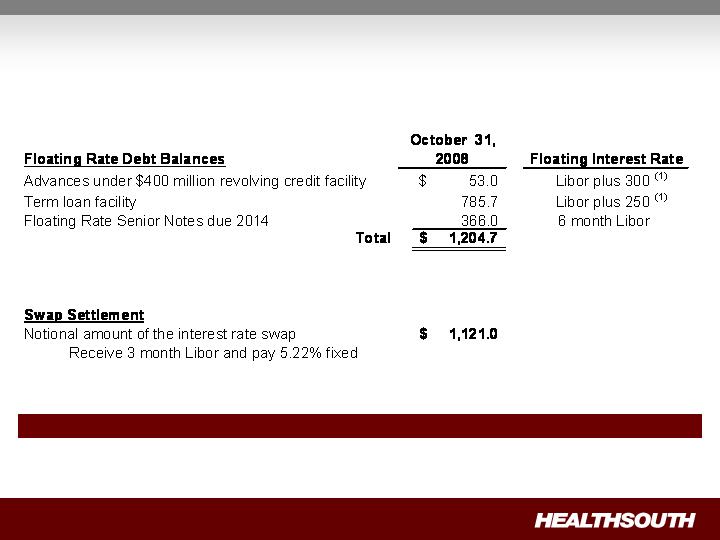

Interest Expense and Swap Settlements

(Millions)

As of September 30, 2008, we were in compliance with the covenants under our Credit Agreement.

(1) We have the flexibility to peg 1,2,3 or 6 month Libor, or prime

As Settled

Shareholders equity (paid-in-

capital) goes up

Outstanding shares go up

Cash effect “0”

Expected Settlement Date

1H 2009

Currently under appeal

Government, Class Action, and Related Settlements

Today

Under appeal

Shares are not issued

Change in fair value flows

through income statement

Share price goes up, liability

and expense go up

Share price goes down,

liability and expense go

down

Cash effect “0”

The class action Securities Litigation Settlement included

5.0 million shares of common stock and 8.2 million warrants

at a strike price of $41.40.

Convertible Perpetual Preferred Stock

400,000 shares 6.5% Series A preferred stock is convertible, at the

option of the holder

At initial conversion price of $30.50 per share

If converted represents 13.1 million shares

On or after July 20, 2011, we may cause conversion, if;

Closing price of our common stock exceeds 150% of the conversion

price ($45.75) for 20 of the last 30 consecutive trading days

Investment Considerations

Turnaround Complete: management focused on operations

and growth

Industry Leader in Attractive Industry

Strong Cash Flows: flexibility in the use of FCF

Deleveraging as Priority: reduce leverage to 4.5x or less by

YE 2010

Solid Organic Growth: TeamWorks initiative will help us meet

or exceed our EBITDA targets

Opportunistic, disciplined expansion

Focus: Delivering shareholder value

through strong EPS growth

Appendix and

Reconciliations

Debt Schedule

Debt to Adj. Consol. EBITDA on September 30, 2008 = 5.5X ; Target = 4.5X by YE 2010

(1) Credit Agreement limits debt pay down on non–term loan balances. We have limited this to $50 million per year with the addition of a lifetime

basket of $100 million. We have the ability to buy back non-term loan debt with the discretionary cash available to the Company.

(Millions)

2008

Debt

Reduction

March 2012

$ 40.0

$ 13.0

$ 75.0

$ 35.0

Term loan facility - March 2013

785.7

818.7

862.8

77.1

Bonds Payable:

7.000%

Senior Notes due 2008

-

-

5.0

5.0

10.750%

Senior Subordinated Notes due 2008

-

30.3

30.3

30.3

8.500%

Senior Notes due 2008

-

-

9.4

9.4

8.375%

Senior Notes due 2011

0.3

0.3

0.3

-

7.625%

Senior Notes due 2012

1.5

1.5

1.5

-

Floating Rate Senior Notes due 2014

366.0

366.0

375.0

9.0

(6 month Libor plus 600)

10.75%

Senior Notes due 2016

494.3

512.7

558.2

63.9

from 7.9% to 12.9%

12.8

12.9

17.0

4.2

Capital lease obligations

118.9

121.4

108.2

(10.7)

Total

1,819.5

$

1,876.8

$

2,042.7

$

223.2

$

Year-to-date debt reduction

(1)

223.2

$

165.9

$

November 30,

2008

Debt Balances

Notes payable to banks and others at interest rates

September 30,

2008

December 31,

2007

Advances under $400 million revolving credit facility,

9 Months 2008 Reconciliation of Net Income to Adjusted Income (Loss) from Continuing

Operations and Adjusted Consolidated EBITDA(1)(3) – (Notes on following page)

(In Millions, Except Per Share Data)

Per Share

(2)

Per Share

(2)

Net income

70.5

$

0.86

$

699.2

$

8.90

$

Income from discontinued operations

(8.6)

(0.11)

(473.7)

(6.03)

Income from continuing operations

61.9

0.76

225.5

2.87

Government, class action, and related settlements

(27.9)

(0.34)

(34.0)

(0.43)

Professional fees - accounting, tax, and legal

12.9

0.16

44.3

0.56

Loss on interest rate swap

16.1

0.20

6.8

0.09

Accelerated depreciation of corporate campus

10.0

0.12

-

-

Gain on sale of investment in Source Medical

-

-

(8.6)

(0.11)

Provision for income tax benefit

(21.7)

(0.27)

(288.2)

(3.67)

Estimated state tax expense

(3.9)

(0.05)

(3.9)

(0.05)

Adjusted income (loss) from continuing operations

(1)(3)

47.4

0.58

(58.1)

(0.74)

Adjustment to GAAP EPS for dilution

(2)

(0.08)

0.11

Adjusted income (loss) from continuing operations per

diluted share (2)(3)

$ 0.50

$ (0.63)

Estimated state tax expense

3.9

3.9

Interest expense and amortization of debt discounts and fees

131.3

177.9

Depreciation and amortization

55.8

56.9

238.4

180.6

Other adjustments per our Credit Agreement

Impairment charges

0.6

15.1

Net noncash loss on disposal of assets

0.8

2.2

Loss on early extinguishment of debt

5.8

19.9

Gain on sale of investment in Source Medical

-

8.6

Compensation expense under FASB Statement No. 123(R)

8.5

8.1

Sarbanes-Oxley related costs

-

0.3

Adjusted Consolidated EBITDA

(1)(3)(4)

254.1

$

234.8

$

Basic weighted average common shares outstanding

81.6

78.6

Diluted weighted average common shares

95.1

91.9

Nine Months Ended

September 30, 2008

Nine Months Ended

September 30, 2007

9 Months 2008 Reconciliation of Net Income to Adjusted Income (Loss) from

Continuing Operations and Adjusted Consolidated EBITDA – Notes

1) Adjusted income (loss) and Adjusted Consolidated EBITDA are non-GAAP financial measures.

Management and some members of the investment community utilize adjusted income (loss) from

continuing operations as a financial measure and Adjusted Consolidated EBITDA as a liquidity measure on

an ongoing basis. These measures are not recognized in accordance with GAAP and should not be viewed

as an alternative to GAAP measures of performance and liquidity. In evaluating these adjusted measures,

the reader should be aware that in the future HealthSouth may incur expenses similar to the adjustments

set forth above.

2) Per share amounts for the nine months ended September 30, 2008 and 2007 are based on basic

weighted average common shares outstanding for all amounts except adjusted income (loss) from

continuing operations per diluted share, which is based on diluted shares outstanding. The diluted share

counts for the nine months ended September 30, 2008 and 2007 contain 13.5 million and 13.3 million

shares, respectively, primarily related to the potential dilution of the convertible perpetual preferred

securities as described in Note 18, Earnings (Loss) per Common Share, in our 2007 Form 10-K. Per share

amounts do not include 5.0 million shares not yet issued under the securities litigation settlement. The

calculation of adjusted loss from continuing operations per diluted share ignores the antidilutive impact in

2007.

3) Adjusted diluted income (loss) per share and Adjusted Consolidated EBITDA are two components of our

guidance.

4) Our Credit Agreement allows certain items to be added to arrive at Adjusted Consolidated EBITDA that

are viewed as not being ongoing costs once the Company has completed its restructuring.

9 Months 2008 Reconciliation of Adjusted Consolidated EBITDA(1) to Net Cash Provided

by Operating Activities

2008 Full Year Guidance Notes

1) As previously reported, the Company’s earnings per share guidance does not

incorporate any assumptions related to actual amounts incurred in 2008 for: (1)

government, class action, and related settlement amounts, including the fair value

adjustments to the liability associated with the Company’s securities litigation settlement

that are required until the applicable common stock and warrants are issued and (2) any

gain or loss associated with the fair value adjustments to the Company’s interest rate

swap over the remaining term of this agreement. In addition, due to the income tax

benefits associated with the Company’s continued pursuit of its remaining income tax

refund claims, the Company’s earnings per share guidance does not include its provision

for income tax benefit, as such amounts are not reflective of the Company’s expected

income tax expense in future periods.

2) See supplemental information contained in exhibit 99.1 to the Current Report on Form

8-K filed on November 4, 2008 titled "Reconciliation of Net Income to Adjusted Income

(Loss) from Continuing Operations and Adjusted Consolidated EBITDA."