Fourth Quarter 2008 Earnings Call

Supplemental Slides

Exhibit 99.2

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and are

subject to various risks, uncertainties and other factors, including those set forth in our Form 10-Q for the

quarters ended March 31, 2008, June 30, 2008, and September 30, 2008, and Form 10-K for the year

ended December 31, 2007, and in other documents we previously filed with the SEC, as well as our Form

10-K for the year ended December 31, 2008, when filed, many of which are beyond our control, that may

cause actual results to differ materially from the views, beliefs and estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. A schedule is attached that reconciles the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United States.

Our Form 8-K, dated February 23, 2009, to which the following supplemental slides are attached as Exhibit

99.2, provides further explanation and disclosure regarding our use of non-GAAP financial measures and

should be read in conjunction with these supplemental slides.

Forward-Looking Statements

Table of Contents

2008 Goals vs. Results

................................

................................

................................

....................

4

Organic Growth

................................

................................

................................

...............................

5

Debt Reduction

................................

................................

................................

................................

6

Development Growth

................................

................................

................................

.......................

7

Revenues (Q4)

................................

................................

................................

................................

8

Expenses (Q4)

................................

................................

................................

................................

9

Adjusted Consolidated EBITDA

................................

................................

................................

.....

10

Adjusted Income (Loss) Per Share

................................

................................

................................

11

Free Cash Flow

................................

................................

................................

.............................

12

Liquidity

................................

................................

................................

................................

.........

13

UBS Settlement

................................

................................

................................

.............................

14

Year

-

End Summary

................................

................................

................................

.......................

15

2009 Guidance

................................

................................

................................

..............................

16

Appendix

................................

................................

................................

................................

.......

17

Revenues (Sequential)

................................

................................

................................

..................

18

Expenses (Sequential)

................................

................................

................................

..................

19

Revenues (Year End)

................................

................................

................................

....................

20

Expenses (Year End)

................................

................................

................................

....................

21

Operational and Labor Metrics

................................

................................

................................

......

22

Supplemental Information

................................

................................

................................

..............

23

Debt Schedule

................................

................................

................................

...............................

24

Debt Maturities and Swap

................................

................................

................................

.............

25

Non

-

Operat

ing Cash/Tax Position

................................

................................

................................

.

26

Outstanding Share Summary

................................

................................

................................

........

27

Reconciliation to Non

-

GAPP Financial Measures

................................

................................

....

28

-

31

Highlights: 2008 Goals vs. Results

Goal One – Organic Growth

Achieved 7.0% year-over-year discharge growth through the

implementation of the TeamWorks sales and marketing initiative

Goal Two – Delever the Balance Sheet

Reduced debt by $228 million and leverage from 6.3X to 5.3X

Equity issuance of 8.8 million shares for $150 million

Goal Three – Disciplined Opportunistic Growth

Acquired freestanding hospital in Vineland, New Jersey

Acquired and consolidated hospitals in Arlington and Midland, Texas

Adjusted Consolidated EBITDA(1) $341.8M vs. $321.3M in 2007

Adjusted EPS(1) $0.75 vs. ($0.64) in 2007

(1) For a reconciliation of Adjusted Consolidated EBITDA and Adjusted EPS, see slides 28 through 31.

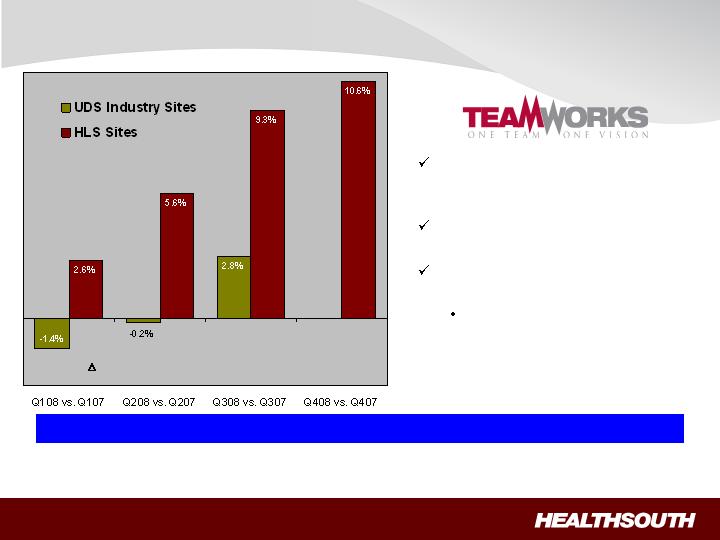

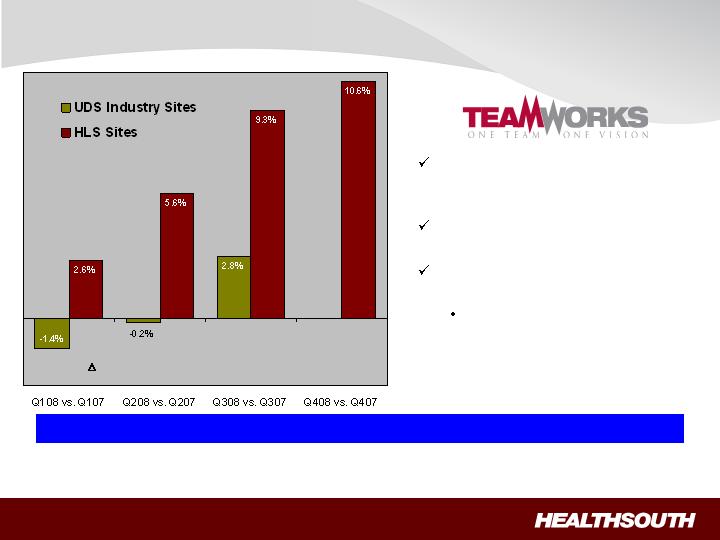

HealthSouth’s volume growth

continues to outpace competitors’

growth

Same store discharges were

+9.7% for HLS in Q408

Bed expansions will help facilitate

organic growth:

65 – 75 new beds in 2009;

another 44 in 2010

% Discharges of HLS vs. UDS Industry Sites(1)

(1) Data provided by UDSMR , a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry, including 88 HLS sites.

(2) Includes all 93 HLS inpatient rehab hospitals and six long-term acute care hospitals.

(3) Industry data is available on a quarter lag.

Highlights: Strong Organic Growth

Projected sustainable discharge growth: 4+% annual

(1)

(3)

(2)

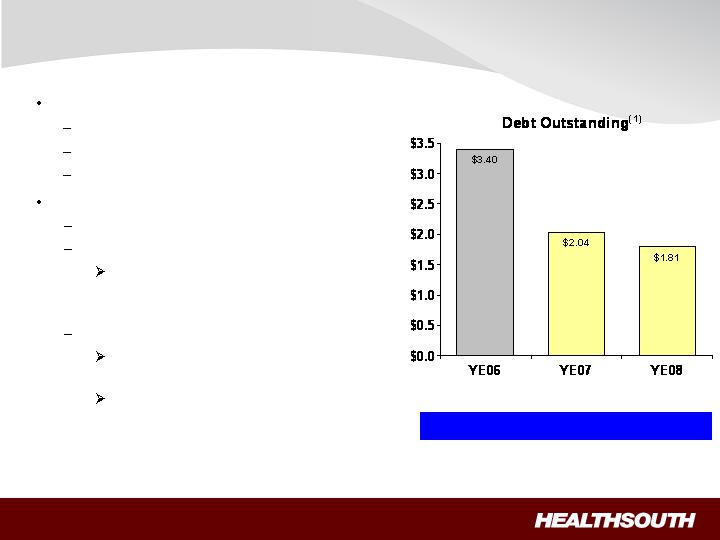

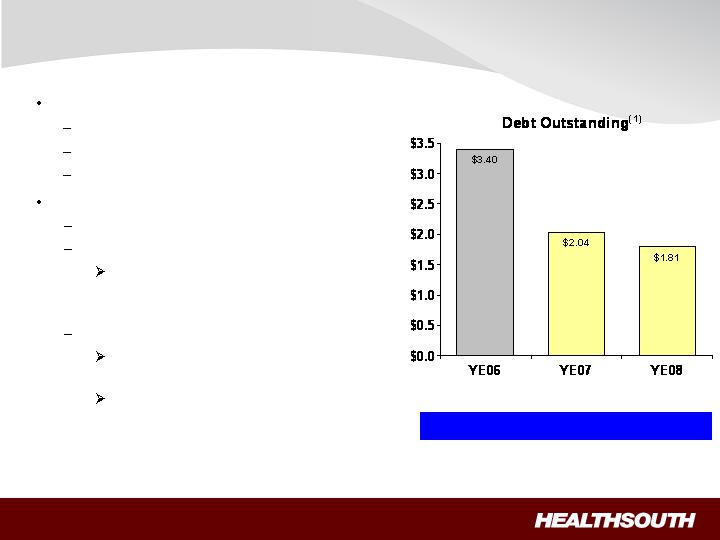

No near-term refinancing

Revolver = 2012

Term Loan = 2013

Bonds = 2014 & 2016

Future debt reduction:

Excess cash from operations

Additional income tax recoveries

$24 million federal income tax

refund (+ interest) received

February 2009

Derivative proceeds

UBS settled; ~ $60 million in

cash expected Q109

E&Y and Scrushy litigation

on-going

(1) Credit Agreement limits debt pay down on non–term loan balances. We have the right to buy back non-term loan debt with the discretionary

cash available to the Company.

Debt to EBITDA 6.3X 6.3X 5.3X

($ Billions)

Short-Term Goal: 4.5X by YE10

Highlight: Debt Reduction

Highlight: Development Growth

(2)

(1) Working with a third party to obtain lease arrangements.

(2) CON is being appealed; operational date may change.

154 additional beds in total, 34 added in third quarter 2008

Location

Announced

Type of Investment

Installed Beds

Operational

Date

Vineland, NJ

Aug-08

Acquisition of free

standing

34 Beds

Q308

Arlington, TX

Aug-08

Acquisition and

consolidation

n/a

Q308

Midland, TX

Sep-08

Acquisition and

consolidation

n/a

Q308

Mesa, AZ

Oct-08

De novo

(1)

40 Beds

Q309

Loudoun County, VA

Aug-08

De novo

40 Beds

Q210

Marion County, FL

Aug-08

De novo

(1)

40 Beds

Q310

Revenues (Q408 vs. Q407)

Inpatient revenue growth was driven by strong discharge volumes, offset by lower pricing

in Q408 due to Medicare pricing roll-back.

Volume growth was driven by the TeamWorks effort, the acquisition of a 34-bed hospital in

Vineland, NJ, and the acquisitions/consolidations of a 30-bed hospital unit in Arlington, TX

and a 38-bed hospital in Midland, TX.

“Same store” discharge growth was 9.7%, excluding our above-referenced Vineland, NJ

hospital.

Hospitals prepared for 65% threshold in Q407.

Net patient revenue/discharge was lower due to the roll-back in Medicare pricing on

April 1, 2008.

Outpatient revenue declined as a result of 11 fewer outpatient satellites year over year.

(Millions)

4th Qtr. 2008

4th Qtr. 2007

Change

Inpatient

418.4

$

388.4

$

7.7%

Outpatient and other

45.4

46.1

(1.5%)

Consolidated net operating

463.8

$

434.5

$

6.7%

(Actual Amounts)

Discharges

27,654

25,005

10.6%

Net patient revenue/discharge

15,130

$

15,533

$

(2.6%)

Expenses (Q408 vs. Q407)

Salaries and benefits increased quarter over quarter:

Increased labor costs in response to higher discharge volumes partially offset by productivity

improvements.

Range adjustments in select markets, contract labor, and the cost of recruitment and

orientation.

October 1, 2008 average merit increases of 3.0% (except senior management).

Minor adjustments to benefit plans November 15, 2008.

Hospital related expenses comparison affected by a reduction of self-insurance costs

in Q407 resulting from revised actuarial estimates.

Fewer non-comparable items in Q408.

G&A goal remains at 4.75% of net operating revenues.

(Millions, except percent)

Salaries and benefits

233.7

$

217.4

$

7.5

%

Percent of net operating revenues

50.4%

50.0%

40

bps

Hospital related expenses

113.2

$

102.8

$

10.1

%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.4%

23.7%

70

bps

General and administrative

23.5

$

23.6

$

(0.4)

%

(excludes 123(R) compensation expense)

Percent of net operating revenues

5.1%

5.4%

(30)

bps

4th Qtr. 2008

4th Qtr. 2007

Change

Adjusted Consolidated EBITDA(1)(2)

(Millions)

(1) Reconciliation to GAAP provided on slides 28 through 31.

(2) Q407 and Q108 included a market basket price increase that was rolled-back on April 1, 2008.

(3) Includes $8.6 million gain for Source Medical.

(3)

Q408 vs. Q407

Strong volume growth in Q408 helped offset

the absence of Medicare price increase

Q407 Medicare pricing: $7-8 million

benefit

2008 vs. 2007

Year-over-year improvement driven by:

increased volumes;

cost management; and

improved labor productivity.

4th Qtr.

2008

4th Qtr.

2007

87.8

$

86.4

$

Full-Year

2008

Full-Year

2007

341.8

$

321.3

$

Adjusted Income (Loss) per Share

(1) Reconciliation to GAAP provided on slides 28 through 31.

Year-over-year adjusted income from continuing operations per diluted share improved

by $1.39 per share. Major drivers were:

Lower interest expense

Lower early extinguishment of debt expenses

Lower G&A expense

Operational improvements

(Millions, except per share data)

4th Qtr.

2008

4th Qtr.

2007

Full-Year

2008

Full-Year

2007

Income (loss) from continuing operations

172.9

$

(27.3)

$

234.8

$

198.3

$

Adjusted income (loss) from continuing

operations

(1)

24.3

$

(0.7)

$

71.9

$

(58.5)

$

Adjusted income (loss) from continuing

operations per diluted share

(1)

0.24

$

(0.01)

$

0.75

$

(0.64)

$

Per Share

Per Share

Free Cash Flow

(1) Reconciliation to GAAP provided on slides 28 through 31.

(2) Includes capital expenditures for the hospital refresh program.

(Millions)

341.8

$

Cash interest expense

(158.5)

Change in working capital

(12.2)

Estimated state tax expense

(5.0)

Capital expenditures for maintenance

(2)

(37.3)

Net settlements on interest rate swap

(20.7)

Dividends paid on convertible perpetual preferred stock

(26.0)

Adjusted free cash flow

82.1

$

Adjusted Consolidated EBITDA

(1)

Year Ended

December 31, 2008

(1) In February 2009, draws under the revolver were reduced to zero.

(2) We expect the letters of credit will be reduced by approximately $33.6 million in connection with implementing the court order approving the

final UBS settlement in the first quarter of 2009.

Liquidity

(Millions)

December 31,

2008

Cash

Available

32.2

$

Revolver

Total line

400.0

$

Less:

– Draws

(40.0)

(1)

– Letters of credit

(52.7)

(2)

Available

307.3

$

Total Liquidity

(available cash and revolver)

339.5

$

UBS Settlement

(Announced October 27, 2008)

$100.0 million in cash (funded by UBS Securities and its insurance

carriers and held in escrow).

$30.7 million release of loan guarantee.

$21.3 million principal

$9.4 million accrued interest (included in interest expense)

Cash + principal = Gain on UBS Settlement.

$26.2 million fees and expenses owed to derivative plaintiffs’ attorneys

(included in professional fees – accounting, tax, and legal).

25% of net settlement proceeds to derivative plaintiffs (included in

government, class action, and related settlements expense).

~ $60 million of net cash proceeds to the Company.

Funds expected to be dispersed to applicable parties in Q109.

Summary 2008 vs. 2007

Volume Revenue EBITDA

+ 7.0% +6.0% +6.4%

Volume and revenue reflect strong organic growth.

Labor productivity (EPOB) helps offset increase in salaries and benefits

(SWB) per employee.

Employees per

Occupied Bed (EPOB)(1) SWB per FTE(1)

-2.7% 7.1%

(1) For full-time equivalents and EPOB table, see slide 22.

2009 Guidance

(1) Reconciliation to GAAP provided on slides 28 through 31.

(2) Adjusted income from continuing operations per diluted share.

Adjusted Consolidated EBITDA(1)

2008 Actual: $341.8 million

2009: Expected to be in the range of $342.0 million to $352.0 million

Adjusted Earnings per Share(1)(2)

2008 Actual: $0.75 per share

2009: Expected to be in the range of $0.85 to $0.90 per share

Appendix

Revenues (Sequential)

The increase in consolidated net operating revenues and volumes sequentially is

partially due to normal seasonality.

Outpatient and other revenue is up sequentially primarily as a result of seasonality.

Net patient revenue/discharge was lower as a result of a slight decline in acuity.

(Millions)

4th Qtr. 2008

3rd Qtr. 2008

Change

Inpatient

418.4

$

411.5

$

1.7%

Outpatient and other

45.4

44.7

1.6%

Consolidated net operating

463.8

$

456.2

$

1.7%

(Actual Amounts)

Discharges

27,654

26,827

3.1%

Net patient revenue/discharge

15,130

$

15,339

$

(1.4%)

Expenses (Sequential)

Adjustments were made to the benefit plans during Q408 and a 3.0% merit increase

was implemented October 1, 2008.

(Millions, except percent)

Salaries and benefits

233.7

$

236.5

$

(1.2)

%

Percent of net operating revenues

50.4%

51.8%

(140)

bps

Hospital related expenses

113.2

$

114.6

$

(1.2)

%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.4%

25.1%

(70)

bps

General and administrative

23.5

$

23.0

$

2.2

%

(excludes 123(R) compensation expense)

Percent of net operating revenues

5.1%

5.0%

10

bps

4th Qtr. 2008

3rd Qtr. 2008

Change

Revenues (Year End)

Inpatient revenue growth was driven by strong discharge volumes.

Volume growth was driven by the TeamWorks effort, the acquisition of a 34-bed hospital

in Vineland, NJ, and the acquisitions/consolidations of a 30-bed hospital unit in

Arlington, TX and a 38-bed hospital in Midland, TX.

“Same store” discharge growth was 6.1%, excluding our above-referenced Vineland, NJ

hospital.

Outpatient revenue declined as a result of 11 fewer outpatient satellites year over year.

(Millions)

2008

2007

Change

Inpatient

1,659.5

$

1,544.0

$

7.5%

Outpatient and other

182.9

193.5

(5.5%)

Consolidated net operating

1,842.4

$

1,737.5

$

6.0%

(Actual Amounts)

Discharges

107,780

100,738

7.0%

Net patient revenue/discharge

15,397

$

15,327

$

0.5%

Expenses (Year End)

Salaries and benefits were higher in 2008 driven by higher cost per employee and an

increase in the number of employees needed to manage the increase in discharge

volumes. The increase was offset by a 2.7% improvement in productivity.

Hospital related expenses were higher in 2008 mainly due to higher patient volumes,

but were essentially unchanged as a percent of net operating revenues.

(Millions, except percent)

Salaries and benefits

934.7

$

863.6

$

8.2

%

Percent of net operating revenues

50.7%

49.7%

100

bps

Hospital related expenses

454.8

$

430.1

$

5.7

%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.7%

24.8%

(10)

bps

General and administrative

93.8

$

117.3

$

(20.0)

%

(excludes 123(R) compensation expense)

Percent of net operating revenues

5.1%

6.8%

170

bps

Change

2008

2007

Operational and Labor Metrics

(1) Represents discharges from HealthSouth’s consolidated hospitals. As of December 31, 2008, the Company had 90 consolidated hospitals.

(2) Excludes 399 and 459 full-time equivalents for the three months ended December 31, 2008 and 2007, respectively, and 410 and 565 full-time

equivalents for the years ended December 31, 2008 and 2007, respectively, who are considered part of corporate overhead with their salaries

and benefits included in general and administrative expenses in the Company’s condensed consolidated statements of operations. Full-time

equivalents included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

(3) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is

determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

2008

2007

2008

2007

Net patient revenue-inpatient

418.4

$

388.4

$

1,659.5

$

1,544.0

$

Net patient revenue-outpatient and

other revenues

45.4

46.1

182.9

193.5

Net operating revenues

463.8

$

434.5

$

1,842.4

$

1,737.5

$

Discharges

(1)

27,654

25,005

107,780

100,738

Outpatient visits

292,081

306,828

1,228,233

1,319,198

Average length of stay

14.3 days

14.9 days

14.7 days

15.1 days

Occupancy %

65.7%

61.6%

66.3%

63.5%

# of licensed beds

6,543

6,573

6,543

6,573

Occupied beds

4,299

4,049

4,338

4,174

Full-time equivalents (FTEs)

(2)

15,550

15,247

15,580

15,406

Contract labor

119

151

170

175

Total FTE and contract labor

15,669

15,398

15,750

15,581

EPOB

(3)

3.64

3.80

3.63

3.73

(Actual Amounts)

(In Millions)

Year Ended

December 31,

Three Months Ended

December 31,

Supplemental Information

For the Year Ended December 31,

100.0%

100.0%

100.0%

Total

2.8%

2.5%

1.8%

Other income

0.4%

0.6%

0.7%

Patients

5.0%

6.3%

7.0%

Other third-party payors

18.5%

18.5%

19.0%

Managed care and other discount plans

2.6%

2.3%

2.1%

Workers' compensation

2.1%

2.0%

2.2%

Medicaid

68.6%

67.8%

67.2%

Medicare

2006

2007

2008

Payment Source

TeamWorks Growth Initiative Implementation and Discharge Growth

Cumulative # of

Hospitals with TeamWorks

Quarter-over-Quarter

Year-over-Year

Q108

44

2.6%

2.6%

Q208

76

5.6%

4.1%

Q308

92

9.3%

5.8%

Q408

93

10.6%

7.0%

% Increase in Discharges for All Hospitals

Debt Schedule

Debt to Adj. Consol. EBITDA on December 31, 2008 = 5.3X ; Target = 4.5X by YE 2010

(1) The Company used approximately $254 million of cash to reduce its total debt outstanding. Due to the addition of two capital leases, the

Company net total debt reduction was $228.3 million.

(2) Credit Agreement limits debt pay down on non–term loan balances. We have the ability to buy back non-term loan debt with the discretionary

cash available to the Company.

(Millions)

2008 Debt

Reduction

(1)(2)

March 2012

$ 40.0

$ 75.0

$ 35.0

Term loan facility - March 2013

783.6

862.8

79.2

Bonds Payable:

7.000%

Senior Notes due 2008

-

5.0

5.0

10.750%

Senior Subordinated Notes due 2008

-

30.3

30.3

8.500%

Senior Notes due 2008

-

9.4

9.4

8.375%

Senior Notes due 2011

0.3

0.3

-

7.625%

Senior Notes due 2012

1.5

1.5

-

Floating Rate Senior Notes due 2014

366.0

375.0

9.0

(6 month Libor plus 600)

10.75%

Senior Notes due 2016

494.3

558.2

63.9

from 7.9% to 12.9%

12.8

17.0

4.2

Capital lease obligations

115.9

108.2

(7.7)

Total

1,814.4

$

2,042.7

$

228.3

$

Year-to-date debt reduction

(1)(2)

228.3

$

December 31,

2008

Debt Balances

Notes payable to banks and others at interest rates

December 31,

2007

Advances under $400 million revolving credit facility,

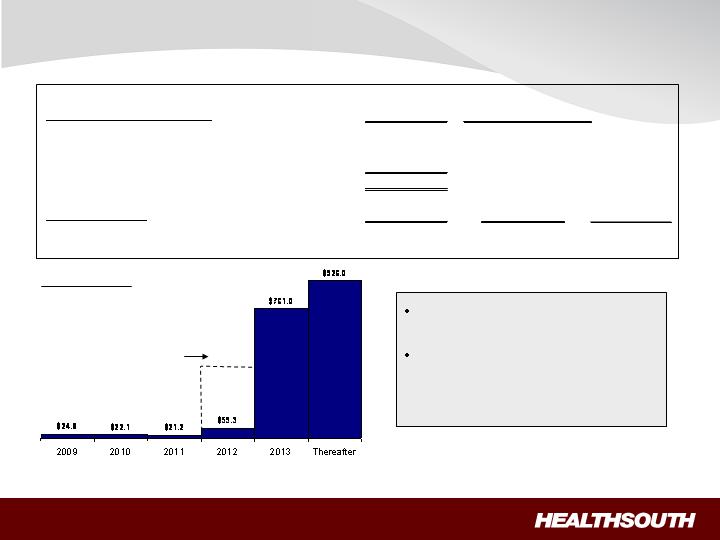

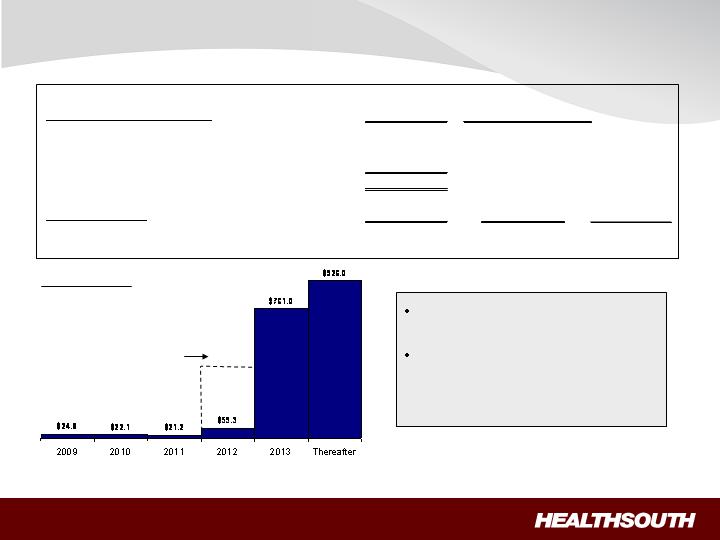

Debt Maturities and Swap

(Millions)

$400.0

Undrawn revolver

goes away in 2012

(1) We have the flexibility to peg 1,2,3 or 6 month Libor, or Prime.

(2) On December 31, 2008, a portion of the term loan was pegged to Prime.

Minimal amortization and no

near-term financing risk

As of December 31, 2008, we

were in compliance with the

covenants under our Credit

Agreement

Debt Maturities

December 31,

Floating Rate Debt Balances

2008

Advances under $400 million revolving credit facility

40.0

$

Libor plus 325

(1)

Term loan facility

783.6

Libor plus 250

(1)(2)

Floating Rate Senior Notes due 2014

366.0

6 month Libor +6%

Total

1,189.6

$

Swap Settlement

Dec. 31, 2008

March 2009

March 2011

Notional amount of the interest rate swap

1,121.2

$

1,056.0

$

-

$

Receive 3 month Libor and pay 5.22% fixed

Floating Interest Rate

Non-Operating Cash/Tax Position

Cash Refunds

$55.9 million receivable on balance sheet at

December 31, 2008.

$24 million tax refund + applicable interest

approved by Joint Committee on Taxation;

cash received in February 2009.

Future Cash Tax Payments

With over $2.5 billion in NOLs and tax

deductions, we do not expect to pay significant

federal income tax for the next 10-12 years.

Expect to pay about $5-7 million per year state

income tax.

Some exposure to Alternative Minimum Tax

(AMT).

GAAP Considerations

HealthSouth’s balance sheet currently reflects

a valuation allowance for the potential value

of NOLs and future deductions. The valuation

allowance is approximately $1.0 billion.

GAAP tax rate will net to small amount for

foreseeable future as there will be a reduction

in the valuation allowance when NOLs are

utilized.

NOL Usage

HealthSouth does not have an annual use

limitation (AUL) under section 382.

If we experienced a “change of ownership” as

defined by the Internal Revenue Service we

would be subject to an AUL. However, even

with a change of ownership we do not expect to

pay significant federal income tax for the next

10-12 years.

Outstanding Share Summary

(Millions)

4th Qtr.(4)

2008

4th Qtr.

2007

Year-End(4)

2008

Year-End

2007

Basic shares outstanding

(2)(3)

87.4

78.6

83.0

78.7

Diluted shares outstanding

(1)(2)(3)

100.7

91.9

96.4

92.0

Basic shares outstanding

(2)(3)

88.0

78.7

88.0

78.7

Diluted shares outstanding

(1)(2)(3)

101.3

92.0

101.4

92.0

Notes:

Average for the Period

End of Period

(1) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred

stock.

(2) Does not include warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In

connection with this transaction, we issued warrants to the lender to purchase two million shares of our common stock.

Each warrant has a term of ten years from the date of issuance and an exercise price of $32.50 per share. The warrants

were not assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented.

(3) Does not include approximately 5.0 million shares of common stock and warrants to purchase approximately 8.2 million

shares of common stock at a strike price of $41.40 to settle our class action securities litigation. This agreement received

final court approval on January 11, 2007. As of December 31, 2008, these shares of common stock and warrants have

not been issued and are not included in our basic or diluted common shares outstanding. We expect a ruling in the first

quarter 2009. If the judgment is affirmed, the distribution would occur in the first half of 2009.

(4) Completed an equity offering for 8.8 million shares on June 27, 2008.

Fourth Quarter Reconciliation of Net Income (Loss) to Adjusted Income (Loss) from

Continuing Operations and Adjusted Consolidated EBITDA (1)(3)(4)

Per Share

(2)

Net income (loss)

$

181.9

2.08

$

$

(45.9)

$

(0.58)

(Income) loss from discontinued operations

(9.0)

(0.10)

18.6

0.24

Income (loss) from continuing operations

172.9

1.98

(27.3)

(0.35)

Gain on UBS Settlement

(121.3)

(1.39)

-

-

Government, class action, and related settlements

(39.3)

(0.45)

31.2

0.40

Professional fees - accounting, tax, and legal

31.5

0.36

7.3

0.09

Loss on interest rate swap

39.6

0.45

23.6

0.30

Provision for income tax benefit

(48.4)

(0.55)

(34.2)

(0.44)

Interest associated with UBS Settlement

(9.4)

(0.11)

-

-

Estimated state tax expense

(1.3)

(0.01)

(1.3)

(0.02)

Adjusted income (loss) from continuing operations

(1)(3)

24.3

0.28

(0.7)

(0.01)

Adjustment to GAAP EPS for dilution

(2)

(0.04)

-

Adjusted income (loss) from continuing operations per

per diluted share

(2)(3)

$ 0.24

$

(0.01)

Estimated state tax expense

1.3

1.3

Interest expense and amortization of debt discounts and fees,

excluding interest associated with the UBS Settlement

37.8

51.9

Depreciation and amortization

18.0

19.4

81.4

71.9

Other adjustments per the Company's Credit Agreement:

Impairment charges related to investments

1.8

-

Net noncash loss on disposal of assets

1.4

3.6

Loss on early extinguishment of debt

0.1

8.3

Compensation expense under FASB Statement No. 123(R)

3.2

2.5

Other

(0.1)

0.1

Adjusted Consolidated EBITDA

(1)(3)(4)

$

87.8

86.4

$

Weighted average common shares outstanding:

Basic

87.4

78.6

Diluted

100.7

91.9

Per Share

(2)

(In Millions, Except Per Share Data)

Three Months Ended December 31,

2007

2008

Twelve Month Reconciliation of Net Income to Adjusted Income (Loss) from Continuing

Operations and Adjusted Consolidated EBITDA(1)(3)(4)

Per Share

(2)

Net income

$

252.4

3.04

$

$

653.4

$

8.30

Income from discontinued operations

(17.6)

(0.21)

(455.1)

(5.78)

Income from continuing operations

234.8

2.83

198.3

2.52

Gain on UBS Settlement

(121.3)

(1.46)

-

-

Government, class action, and related settlements

(67.2)

(0.81)

(2.8)

(0.04)

Professional fees - accounting, tax, and legal

44.4

0.53

51.6

0.66

Loss on interest rate swap

55.7

0.67

30.4

0.39

Accelerated depreciation of corporate campus

10.0

0.12

-

-

Gain on sale of investment in Source Medical

-

-

(8.6)

(0.11)

Interest associated with UBS Settlement

(9.4)

(0.11)

-

`

Provision for income tax benefit

(70.1)

(0.84)

(322.4)

(4.10)

Estimated state tax expense

(5.0)

(0.06)

(5.0)

(0.06)

Adjusted income (loss) from continuing operations

(1)(3)

71.9

0.87

(58.5)

(0.74)

Adjustment to GAAP EPS for dilution

(2)

(0.12)

0.10

Adjusted income (loss) from continuing operations per

diluted share

(2)(3)

$ 0.75

$

(0.64)

Estimated state tax expense

5.0

5.0

Interest expense and amortization of debt discounts and fees,

excluding interest associated with the UBS Settlement

169.1

229.8

Depreciation and amortization, excluding accelerated

depreciation of corporate campus

73.8

76.2

319.8

252.5

Other adjustments per the Company's Credit Agreement:

Impairment charges, including investments

2.4

15.1

Net noncash loss on disposal of assets

2.0

5.9

Loss on early extinguishment of debt

5.9

28.2

Gain on sale of investment in Source Medical

-

8.6

Compensation expense under FASB Statement No. 123(R)

11.7

10.6

Other

-

0.4

Adjusted Consolidated EBITDA

(1)(3)(4)

$

341.8

$

321.3

Weighted average common shares outstanding:

Basic

83.0

78.7

Diluted

96.4

92.0

(In Millions, Except Per Share Data)

2007

2008

Per Share

(2)

Year Ended December 31,

2008 Reconciliation of Adjusted Consolidated EBITDA(1) to Net Cash Provided by

Operating Activities

Year Ended

December 31, 2008

Adjusted Consolidated EBITDA

341.8

$

Compensation expense under FASB Statement No. 123(R)

(11.7)

Provision for doubtful accounts

27.8

Professional fees—accounting, tax, and legal

(44.4)

Interest expense and amortization of debt discounts and fees

(159.7)

Loss on sale of investments

1.4

Equity in net income of nonconsolidated affiliates

(10.6)

Minority interests in earnings of consolidated affiliates

29.8

Amortization of debt discounts and fees

6.5

Amortization of restricted stock

6.7

Distributions from consolidated affiliates

10.9

Stock-based compensation

5.0

Current portion of income tax benefit

73.8

Change in assets and liabilities

(49.1)

Change in government, class action, and related settlements

(7.4)

Other operating cash provided by discontinued operations

6.4

Net cash provided by operating activities

227.2

$

Reconciliation Notes

1.

Adjusted income (loss) from continuing operations and Adjusted Consolidated EBITDA are

non-GAAP financial measures. Management and some members of the investment

community utilize adjusted income (loss) from continuing operations as a financial measure

and Adjusted Consolidated EBITDA as a liquidity measure on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as an

alternative to GAAP measures of performance or liquidity. In evaluating these adjusted

measures, the reader should be aware that in the future HealthSouth may incur expenses

similar to the adjustments set forth above.

2.

Per share amounts for the three months and twelve months ended December 31, 2008 and

2007 are based on basic weighted average common shares outstanding for all amounts

except adjusted income (loss) from continuing operations per diluted share, which is based on

diluted weighted average shares outstanding. The difference in shares between the basic and

diluted shares outstanding is primarily related to our convertible perpetual preferred stock. Per

share amounts do not include 5.0 million shares not yet issued under the securities litigation

settlement. The calculation of adjusted loss from continuing operations per diluted share

ignores the antidilutive impact in 2007.

3.

Adjusted income (loss) from continuing operations per diluted share and Adjusted

Consolidated EBITDA are two components of our guidance.

4.

The Company’s Credit Agreement allows all unusual non-cash or non-recurring charges to be

added to arrive at Adjusted Consolidated EBITDA.