HealthSouth

Barclays Capital

Global Healthcare Conference

Miami, Florida

March 10, 2009

Exhibit 99.1

Note Regarding Forward-Looking Statements

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and are

subject to various risks, uncertainties and other factors, including those set forth in our Form 10-K for the

fiscal year ended December 31, 2008, and in other documents we previously filed with the SEC, many of

which are beyond our control, that may cause actual results to differ materially from the views, beliefs and

estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G under

the Securities Exchange Act of 1934. The Appendix at the end of this presentation includes reconciliations of

the non-GAAP financial measures found in the following presentation to the most directly comparable

financial measures calculated and presented in accordance with Generally Accepted Accounting Principles

in the United States. Our Form 8-K, dated March 9, 2009, to which the following presentation slides are

attached as Exhibit 99.1, provides further explanation and disclosure regarding our use of non-GAAP

financial measures and should be read in conjunction with these presentation slides.

Cautionary Statements

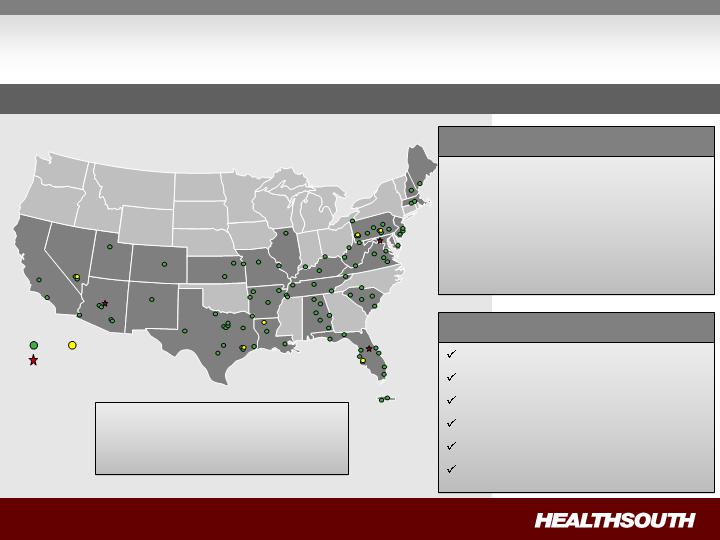

HealthSouth Today

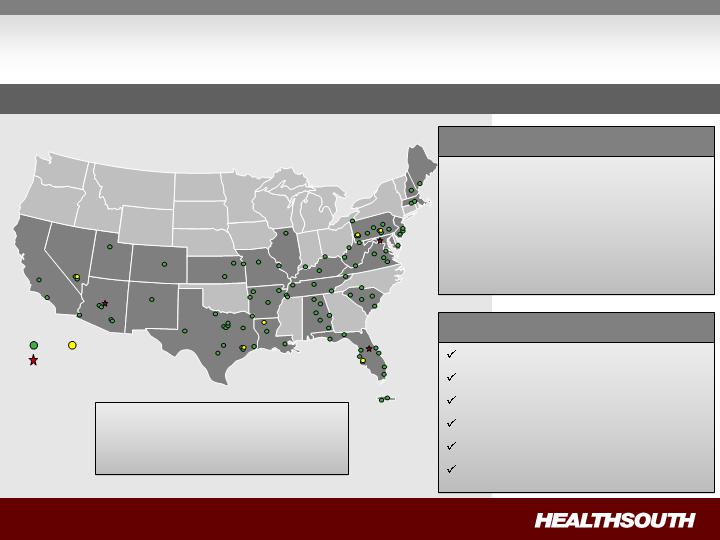

IRH

LTCH

93 Rehabilitation Hospitals and

Outpatient Departments

6 Long-Term Acute Care Hospitals

49 Outpatient Satellites

25 Hospital-Based Home

Health Agencies

Operational Components

Rehabilitation Nursing

Physical Therapy

Occupational Therapy

Speech-Language Therapy

Case Management

Specialized Technology

Major Services

Largest Provider of Inpatient Rehabilitative Healthcare Services in the U.S.

Development Sites

Employees: ~ 22,000

Corporate Office: Birmingham, AL

Exchange (Symbol): NYSE (HLS)

Longer term, we will pursue acquisitions of complementary,

post-acute services provided they are accretive to HealthSouth.

Target: 5-8% annual Adjusted Consolidated EBITDA growth

Margins will expand modestly

Target: 15-20% annual Adjusted EPS growth

Strategy:

To create shareholder value as the preeminent provider of

rehabilitative care in the U.S. by:

Creating a strong balance sheet through deleveraging;

Driving organic growth through operational excellence; and

Pursuing disciplined, opportunistic growth.

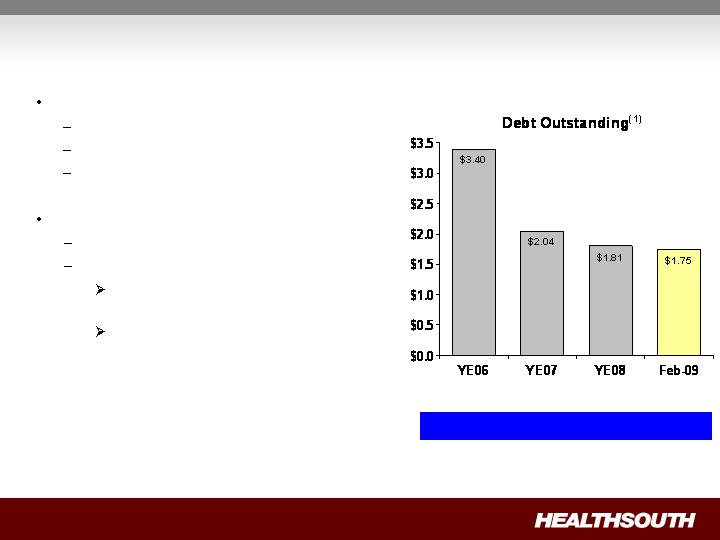

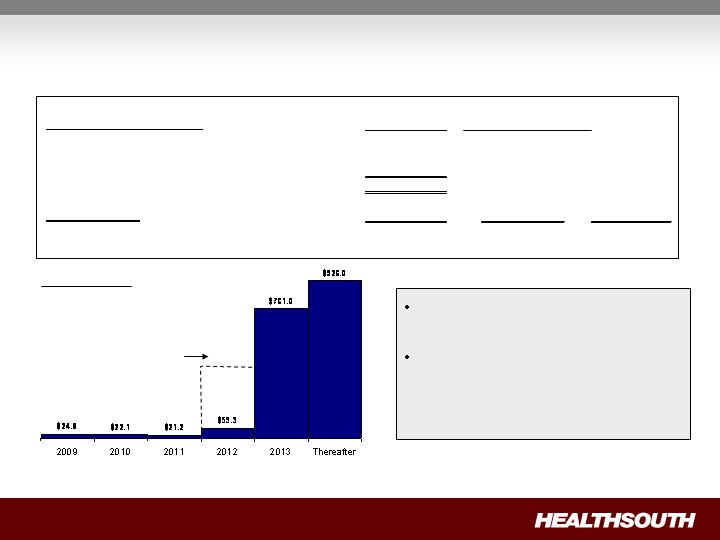

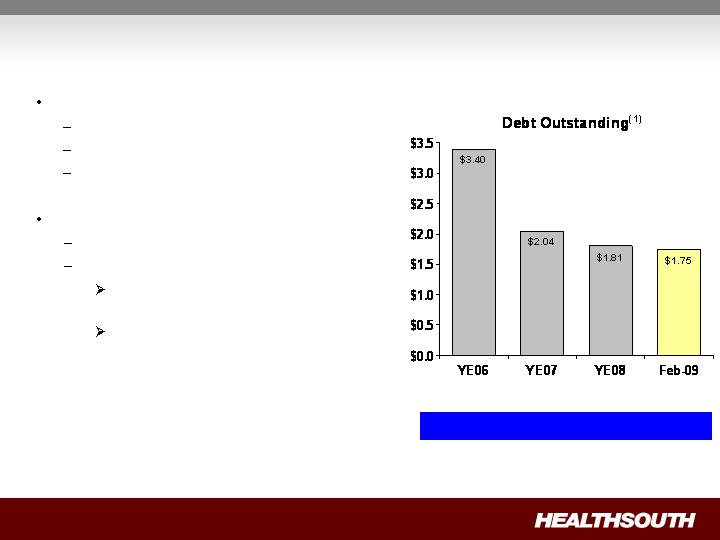

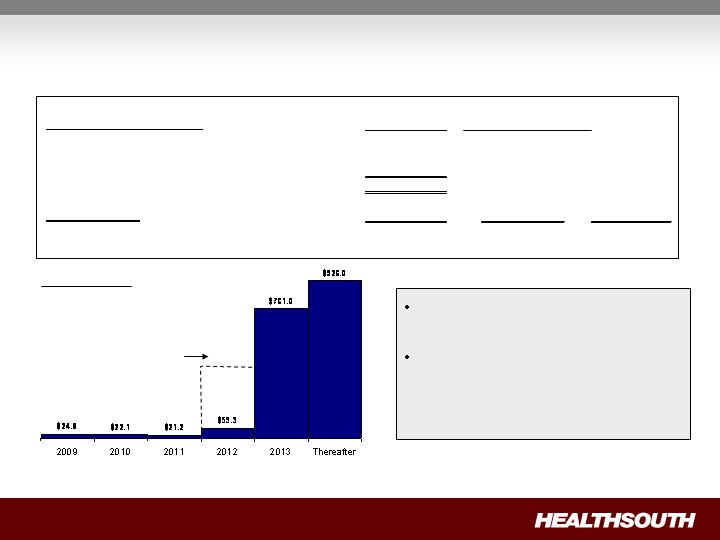

No near-term refinancing

Revolver = 2012

Term Loan = 2013

Bonds = 2014 & 2016

Future deleveraging:

Excess cash from operations

Derivative proceeds

UBS settlement; received ~ $60

million in cash

E&Y and Scrushy litigation

on-going

(1) Credit Agreement limits debt pay down on non–term loan balances. We have the right to buy back non-term loan debt with the discretionary cash

available to the Company.

(2) Based on 2008 Adjusted Consolidated EBITDA of $341.8 million; see related debt schedule on slide 31.

Debt to EBITDA 6.3X 6.3X 5.3X 5.1X(2)

($ Billions)

Short-Term Goal: 4.5X by YE10

Highlight: Debt Reduction

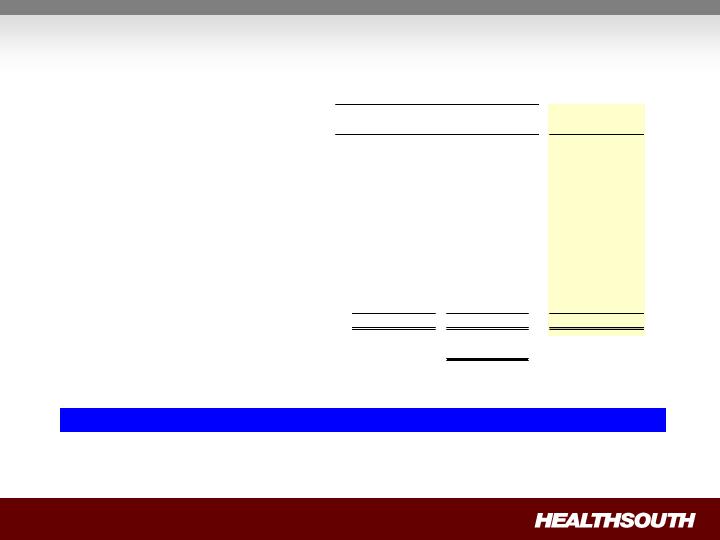

Highlight: Free Cash Flow

(1) Reconciliation to GAAP provided on slides 32 through 35.

(2) Includes capital expenditures for the hospital refresh program.

(Millions)

341.8

$

Cash interest expense

(158.5)

Change in working capital

(12.2)

Estimated state tax expense

(5.0)

Capital expenditures for maintenance

(2)

(37.3)

Net settlements on interest rate swap

(20.7)

Dividends paid on convertible perpetual preferred stock

(26.0)

Adjusted free cash flow

82.1

$

Adjusted Consolidated EBITDA

(1)

Year Ended

December 31, 2008

Highlight: Disciplined Use of Cash

Non-Operating Cash

Tax refunds

Derivative proceeds

Digital Hospital

proceeds

De novo’s

Acquisitions/

Consolidations

Debt

Reduction

Bed

Expansions

Adjusted Free

Cash Flow(1)

(Major Focus)

(Opportunistic)

($15-20 million)

(3rd-party

financed)

(1) After maintenance CAPEX of ~ $35 million annually, which includes ~ $5-10 million for infrastructure enhancements.

HealthSouth’s volume growth

continues to outpace

competitors’ growth

Same store discharges were

+9.7% for HLS in Q408

Bed expansions will help

facilitate organic growth:

65 – 75 new beds in 2009;

another 44 in 2010

% Discharges of HLS vs. UDS Industry Sites(1)

(1) Data provided by UDSMR, a data gathering and analysis organization for the rehabilitation industry; represents ~ 65-70% of industry, including 88 HLS sites.

(2) Includes all 93 HLS inpatient rehab hospitals and six long-term acute care hospitals.

Highlight: Strong Organic Growth

Projected sustainable discharge growth: 4+% annual

(1)

(2)

Organic Growth Enhanced Through Bed Expansions

Hospitals with greater than 85% occupancy are candidates for

bed expansion

We expect to add 65-75 beds by the end of 2009 and at least

another 44 beds in 2010

Average cost per bed:

With new construction = $100 – 250K

Internal renovation, only = $15 – 45K

Cash pay back in 2.5 to 3 years

Q408

Q407

Hospitals

14

10

Greater than 85% occupancy

Highlight: Development Growth

(2)

(1) Working with a third party to obtain lease arrangements.

(2) CON is being appealed; operational date may change.

154 additional beds in total, 34 added in third quarter 2008

Location

Announced

Type of Investment

Installed Beds

Operational

Date

Vineland, NJ

Aug-08

Acquisition of free

standing

34 Beds

Q308

Arlington, TX

Aug-08

Acquisition and

consolidation

n/a

Q308

Midland, TX

Sep-08

Acquisition and

consolidation

n/a

Q308

Mesa, AZ

Oct-08

De novo

(1)

40 Beds

Q309

Loudoun County, VA

Aug-08

De novo

40 Beds

Q210

Marion County, FL

Aug-08

De novo

(1)

40 Beds

Q310

Highlight: 2008 Goals vs. Results

Goal One – Organic Growth

Achieved 7.0% year-over-year discharge growth through the

implementation of the TeamWorks sales and marketing initiative

Goal Two – Delever the Balance Sheet

Reduced debt by $228 million and leverage from 6.3X to 5.3X

Equity issuance of 8.8 million shares for $150 million

Goal Three – Disciplined Opportunistic Growth

Acquired freestanding hospital in Vineland, New Jersey

Acquired and consolidated hospitals in Arlington and Midland, Texas

Adjusted Consolidated EBITDA(1) $341.8M vs. $321.3M in 2007

Adjusted EPS(1) $0.75 vs. ($0.64) in 2007

(1) For a reconciliation of Adjusted Consolidated EBITDA and Adjusted EPS, see slides 32 through 35.

Q109 Initial Observations

Volume:

Through February discharge growth in-line with expectations

Reminder: Q1 is typically a seasonally strong quarter; February 2008 had

one extra day.

Pricing:

No significant sequential change in pricing vs. Q408

Reminder: Quarter-over-quarter comparables will show decline due to last

year’s pricing roll-back.

Expenses:

Continued improvement in productivity and managing labor costs

Reminder: An average 3% merit increase went into effect on October 1,

2008 for non-management employees; benefits changes were effective

January 1, 2009.

Debt pay down:

~ $67 million in debt pay down through February month end

Reminder: Does not include the use of ~$60 million cash received from the

UBS settlement.

2009 Guidance

(1) Reconciliation to GAAP provided on slides 32 through 35.

(2) Adjusted income from continuing operations per diluted share.

Adjusted Consolidated EBITDA(1)

2008 Actual: $341.8 million

Adjusted for non-comparables $335 million

2009: Expected to be in the range of $342.0 million to $352.0

million

Adjusted Earnings per Share(1)(2)

2008 Actual: $0.75 per share

2009: Expected to be in the range of $0.85 to $0.90 per share

Political and Regulatory Landscape: “How the

sausage is made…”

(e.g. Recommend market

basket increases)

Healthcare

Policies &

Regulations

Health &

Human

Services

Congress / Legislative

Directive

President’s

Annual Budget

MedPAC(1)

(e.g. Congress directing

CMS to change 75%

threshold through

legislation)

(1) Independent agency that advises Congress on healthcare policy.

Background

Longstanding concept: Combine payments of acute care and post-acute

providers and pay “bundled” rate to acute care hospital

Most recently included in the December 2008 CBO report which listed 115

budget options (1)

Also included as a proposal in President George H.W. Bush's fiscal year

1992 budget

President's FY 2010 Budget Proposal/Rationale:

~ 18% of hospitalizations of Medicare beneficiaries come from

readmissions

By “bundling” acute and post-acute payments, acute care hospitals,

theoretically, will become more involved in determining appropriate post-

acute care, thereby reducing readmission rates

President's FY 2010 Budget Proposal/Timeline: Three year phase-in,

beginning FY 2013 and ending FY 2015

Details are sparse; Congress not bound by President's budget timeline

Observations on “Bundling”

(1) Source - Congressional Budget Office, http://www.cbo.gov/ftpdocs/99xx/doc9925/12-18-HealthOptions.pdf

Observations on “Bundling” (cont’d)

Comments:

Existing post-acute system is highly fragmented and burdened by

inefficient regulations

If bundling proposal eliminates these barriers, it could be a positive for

patients and HealthSouth

HLS could utilize its asset base more efficiently

Would be consistent with HealthSouth’s long-term strategy to

expand its post-acute footprint (LTCH, Home Health, SNF)

If bundling is adopted, safeguards would need to be put in place to

ensure:

Patients receive the post-acute care they require

Providers of post-acute care receive adequate reimbursement for

the services they provide

Emphasis is on quality of care and returning patients to their homes

Investment Considerations

Turnaround Complete: management focused on operations and

growth

Industry Leader in Attractive Industry

Strong Cash Flows: flexibility in the use of FCF

Deleveraging as Priority: reduce leverage to 4.5X or less by YE

2010

Solid Organic Growth: TeamWorks initiative will help us meet or

exceed our Adjusted Consolidated EBITDA targets

Opportunistic, disciplined expansion

Focus : Delivering shareholder value through

15% – 20% Adjusted EPS growth

Appendix and Reconciliations

Revenues (Q408 vs. Q407)

Inpatient revenue growth was driven by strong discharge volumes, offset by lower pricing

in Q408 due to Medicare pricing roll-back.

Volume growth was driven by the TeamWorks effort, the acquisition of a 34-bed hospital in

Vineland, NJ, and the acquisitions/consolidations of a 30-bed hospital unit in Arlington,

TX and a 38-bed hospital in Midland, TX.

“Same store” discharge growth was 9.7%, excluding our above-referenced Vineland, NJ

hospital.

Hospitals prepared for 65% threshold in Q407.

Net patient revenue/discharge was lower due to the roll-back in Medicare pricing on

April 1, 2008.

Outpatient revenue declined as a result of 11 fewer outpatient satellites year over year.

(Millions)

4th Qtr. 2008

4th Qtr. 2007

Change

Inpatient

418.4

$

388.4

$

7.7%

Outpatient and other

45.4

46.1

��

(1.5%)

Consolidated net operating

463.8

$

434.5

$

6.7%

(Actual Amounts)

Discharges

27,654

25,005

10.6%

Net patient revenue/discharge

15,130

$

15,533

$

(2.6%)

Expenses (Q408 vs. Q407)

Salaries and benefits increased quarter over quarter:

Increased labor costs in response to higher discharge volumes partially offset by productivity

improvements.

Range adjustments in select markets, contract labor, and the cost of recruitment and

orientation.

October 1, 2008 average merit increases of 3.0% (except senior management).

Minor adjustments to benefit plans November 15, 2008.

Hospital related expenses comparison affected by a reduction of self-insurance costs in

Q407 resulting from revised actuarial estimates.

Fewer non-comparable items in Q408.

G&A goal remains at 4.75% of net operating revenues.

(Millions, except percent)

Salaries and benefits

233.7

$

217.4

$

7.5

%

Percent of net operating revenues

50.4%

50.0%

40

bps

Hospital related expenses

113.2

$

102.8

$

10.1

%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.4%

23.7%

70

bps

General and administrative

23.5

$

23.6

$

(0.4)

%

(excludes 123(R) compensation expense)

Percent of net operating revenues

5.1%

5.4%

(30)

bps

4th Qtr. 2008

4th Qtr. 2007

Change

Revenues (Year End)

Inpatient revenue growth was driven by strong discharge volumes.

Volume growth was driven by the TeamWorks effort, the acquisition of a 34-bed hospital

in Vineland, NJ, and the acquisitions/consolidations of a 30-bed hospital unit in

Arlington, TX and a 38-bed hospital in Midland, TX.

“Same store” discharge growth was 6.1%, excluding our above-referenced Vineland, NJ

hospital.

Outpatient revenue declined as a result of 11 fewer outpatient satellites year over year.

(Millions)

2008

2007

Change

Inpatient

1,659.5

$

1,544.0

$

7.5%

Outpatient and other

182.9

193.5

(5.5%)

Consolidated net operating

1,842.4

$

1,737.5

$

6.0%

(Actual Amounts)

Discharges

107,780

100,738

7.0%

Net patient revenue/discharge

15,397

$

15,327

$

0.5%

Expenses (Year End)

Salaries and benefits were higher in 2008 driven by higher cost per employee and an

increase in the number of employees needed to manage the increase in discharge

volumes. The increase was offset by a 2.7% improvement in productivity.

Hospital related expenses were higher in 2008 mainly due to higher patient volumes,

but were essentially unchanged as a percent of net operating revenues.

(Millions, except percent)

Salaries and benefits

934.7

$

863.6

$

8.2

%

Percent of net operating revenues

50.7%

49.7%

100

bps

Hospital related expenses

454.8

$

430.1

$

5.7

%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.7%

24.8%

(10)

bps

General and administrative

93.8

$

117.3

$

(20.0)

%

(excludes 123(R) compensation expense)

Percent of net operating revenues

5.1%

6.8%

170

bps

Change

2008

2007

Adjusted Consolidated EBITDA(1)(2)

(Millions)

(1) Reconciliation to GAAP provided on slides 32 through 35.

(2) Q407 and Q108 included a market basket price increase that was rolled-back on April 1, 2008.

(3) Includes $8.6 million gain for Source Medical.

(3)

Q408 vs. Q407

Strong volume growth in Q408 helped

offset the absence of Medicare price

increase

Q407 Medicare pricing: $7-8 million benefit

2008 vs. 2007

Year-over-year improvement driven by:

increased volumes;

cost management; and

improved labor productivity.

4th Qtr.

2008

4th Qtr.

2007

87.8

$

86.4

$

Full-Year

2008

Full-Year

2007

341.8

$

321.3

$

Adjusted Income (Loss) per Share

(1) Reconciliation to GAAP provided on slides 32 through 35.

Year-over-year adjusted income from continuing operations per diluted share improved

by $1.39 per share. Major drivers were:

Lower interest expense

Lower early extinguishment of debt expenses

Lower G&A expense

Operational improvements

(Millions, except per share data)

4th Qtr.

2008

4th Qtr.

2007

Full-Year

2008

Full-Year

2007

Income (loss) from continuing operations

172.9

$

(27.3)

$

234.8

$

198.3

$

Adjusted income (loss) from continuing

operations

(1)

24.3

$

(0.7)

$

71.9

$

(58.5)

$

Adjusted income (loss) from continuing

operations per diluted share

(1)

0.24

$

(0.01)

$

0.75

$

(0.64)

$

Per Share

Per Share

Operational and Labor Metrics

(1) Represents discharges from HealthSouth’s consolidated hospitals. As of December 31, 2008, the Company had 90 consolidated hospitals.

(2) Excludes 399 and 459 full-time equivalents for the three months ended December 31, 2008 and 2007, respectively, and 410 and 565 full-time

equivalents for the years ended December 31, 2008 and 2007, respectively, who are considered part of corporate overhead with their salaries

and benefits included in general and administrative expenses in the Company’s condensed consolidated statements of operations. Full-time

equivalents included in the above table represent HealthSouth employees who participate in or support the operations of the Company’s

hospitals.

(3) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is

determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

2008

2007

2008

2007

Net patient revenue-inpatient

418.4

$

388.4

$

1,659.5

$

1,544.0

$

Net patient revenue-outpatient and

other revenues

45.4

46.1

182.9

193.5

Net operating revenues

463.8

$

434.5

$

1,842.4

$

1,737.5

$

Discharges

(1)

27,654

25,005

107,780

100,738

Outpatient visits

292,081

306,828

1,228,233

1,319,198

Average length of stay

14.3 days

14.9 days

14.7 days

15.1 days

Occupancy %

65.7%

61.6%

66.3%

63.5%

# of licensed beds

6,543

6,573

6,543

6,573

Occupied beds

4,299

4,049

4,338

4,174

Full-time equivalents (FTEs)

(2)

15,550

15,247

15,580

15,406

Contract labor

119

151

170

175

Total FTE and contract labor

15,669

15,398

15,750

15,581

EPOB

(3)

3.64

3.80

3.63

3.73

(Actual Amounts)

(In Millions)

Year Ended

December 31,

Three Months Ended

December 31,

Supplemental Information

For the Year Ended December 31,

100.0%

100.0%

100.0%

Total

2.8%

2.5%

1.8%

Other income

0.4%

0.6%

0.7%

Patients

5.0%

6.3%

7.0%

Other third-party payors

18.5%

18.5%

19.0%

Managed care and other discount plans

2.6%

2.3%

2.1%

Workers' compensation

2.1%

2.0%

2.2%

Medicaid

68.6%

67.8%

67.2%

Medicare

2006

2007

2008

Payment Source

TeamWorks Growth Initiative Implementation and Discharge Growth

Cumulative # of

Hospitals with TeamWorks

Quarter-over-Quarter

Year-over-Year

Q108

44

2.6%

2.6%

Q208

76

5.6%

4.1%

Q308

92

9.3%

5.8%

Q408

93

10.6%

7.0%

% Increase in Discharges for All Hospitals

(1) In February 2009, draws under the revolver were reduced to zero.

(2) Includes approximately $33.6 million for letters of credit released in Q109 as part of the UBS Settlement.

Liquidity

(Millions)

December 31,

2008

Cash

Available

32.2

$

Revolver

Total line

400.0

$

Less:

– Draws

(40.0)

(1)

– Letters of credit

(52.7)

(2)

Available

307.3

$

Total Liquidity

(available cash and revolver)

339.5

$

Debt Maturities and Swap

(Millions)

$400.0

Undrawn revolver

goes away in 2012

(1) We have the flexibility to peg 1,2,3 or 6 month Libor, or Prime.

(2) On December 31, 2008, a portion of the term loan was pegged to Prime.

Minimal amortization and no

near-term financing risk

As of December 31, 2008, we

were in compliance with the

covenants under our Credit

Agreement

Debt Maturities

December 31,

Floating Rate Debt Balances

2008

Advances under $400 million revolving credit facility

40.0

$

Libor plus 325

(1)

Term loan facility

783.6

Libor plus 250

(1)(2)

Floating Rate Senior Notes due 2014

366.0

6 month Libor +6%

Total

1,189.6

$

Swap Settlement

Dec. 31, 2008

March 2009

March 2011

Notional amount of the interest rate swap

1,121.2

$

1,056.0

$

-

$

Receive 3 month Libor and pay 5.22% fixed

Floating Interest Rate

Non-Operating Cash/Tax Position

Cash Refunds

$55.9 million receivable on balance sheet at

December 31, 2008.

$24 million tax refund + applicable interest

approved by Joint Committee on Taxation;

cash received in February 2009.

Future Cash Tax Payments

With over $2.5 billion in NOLs and tax

deductions, we do not expect to pay significant

federal income tax for the next 10-12 years.

Expect to pay about $5-7 million per year state

income tax.

Some exposure to Alternative Minimum Tax

(AMT).

GAAP Considerations

HealthSouth’s balance sheet currently reflects

a valuation allowance for the potential value

of NOLs and future deductions. The valuation

allowance is approximately $1.0 billion.

GAAP tax rate will net to small amount for

foreseeable future as there will be a reduction

in the valuation allowance when NOLs are

utilized.

NOL Usage

HealthSouth does not have an annual use

limitation (AUL) under section 382.

If we experienced a “change of ownership” as

defined by the Internal Revenue Service we

would be subject to an AUL. However, even

with a change of ownership we do not expect to

pay significant federal income tax for the next

10-12 years.

Outstanding Share Summary

(Millions)

4th Qtr.(4)

2008

4th Qtr.

2007

Year-End(4)

2008

Year-End

2007

Basic shares outstanding

(2)(3)

87.4

78.6

83.0

78.7

Diluted shares outstanding

(1)(2)(3)

100.7

91.9

96.4

92.0

Basic shares outstanding

(2)(3)

88.0

78.7

88.0

78.7

Diluted shares outstanding

(1)(2)(3)

101.3

92.0

101.4

92.0

Notes:

Average for the Period

End of Period

(1) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred

stock.

(2) Does not include warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In

connection with this transaction, we issued warrants to the lender to purchase two million shares of our common stock.

Each warrant has a term of ten years from the date of issuance and an exercise price of $32.50 per share. The warrants

were not assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented.

(3) Does not include approximately 5.0 million shares of common stock and warrants to purchase approximately 8.2 million

shares of common stock at a strike price of $41.40 to settle our class action securities litigation. This agreement received

final court approval on January 11, 2007. As of December 31, 2008, these shares of common stock and warrants have

not been issued and are not included in our basic or diluted common shares outstanding. We expect a ruling in the first

quarter 2009. If the judgment is affirmed, the distribution would occur in the first half of 2009.

(4) Completed an equity offering for 8.8 million shares on June 27, 2008.

Debt Schedule

Debt to Adj. Consol. EBITDA on February 28, 2008 = 5.1X (2) ; Target = 4.5X by YE 2010

(1) Credit Agreement limits debt pay down on non–term loan balances. We have the ability to buy back non-term loan debt with the discretionary cash

available to the Company.

(2) Based on 2008 Adjusted Consolidated EBITDA of $341.8 million.

(Millions)

2009 Debt

Reduction

(1)

March 2012

$ -

$ 40.0

$ (40.0)

Term loan facility - March 2013

759.1

783.6

(24.5)

Bonds Payable:

8.375%

Senior Notes due 2011

0.3

0.3

-

7.625%

Senior Notes due 2012

1.5

1.5

-

Floating Rate Senior Notes due 2014

366.0

366.0

-

(6 month Libor plus 600)

10.75%

Senior Notes due 2016

494.4

494.3

0.1

from 7.9% to 12.9%

12.6

12.8

(0.2)

Capital lease obligations

113.4

115.9

(2.5)

Total

1,747.3

$

1,814.4

$

(67.1)

$

Year-to-date debt reduction

(1)

67.1

$

Debt Balances

December 31,

2008

Notes payable to banks and others at interest rates

Advances under $400 million revolving credit facility,

February 28,

2009

Fourth Quarter Reconciliation of Net Income (Loss) to Adjusted Income (Loss) from

Continuing Operations and Adjusted Consolidated EBITDA (1)(3)(4)

Per Share

(2)

Net income (loss)

$

181.9

2.08

$

$

(45.9)

$

(0.58)

(Income) loss from discontinued operations

(9.0)

(0.10)

18.6

0.24

Income (loss) from continuing operations

172.9

1.98

(27.3)

(0.35)

Gain on UBS Settlement

(121.3)

(1.39)

-

-

Government, class action, and related settlements

(39.3)

(0.45)

31.2

0.40

Professional fees - accounting, tax, and legal

31.5

0.36

7.3

0.09

Loss on interest rate swap

39.6

0.45

23.6

0.30

Provision for income tax benefit

(48.4)

(0.55)

(34.2)

(0.44)

Interest associated with UBS Settlement

(9.4)

(0.11)

-

-

Estimated state tax expense

(1.3)

(0.01)

(1.3)

(0.02)

Adjusted income (loss) from continuing operations

(1)(3)

24.3

0.28

(0.7)

(0.01)

Adjustment to GAAP EPS for dilution

(2)

(0.04)

-

Adjusted income (loss) from continuing operations per

per diluted share

(2)(3)

$ 0.24

$

(0.01)

Estimated state tax expense

1.3

1.3

Interest expense and amortization of debt discounts and fees,

excluding interest associated with the UBS Settlement

37.8

51.9

Depreciation and amortization

18.0

19.4

81.4

71.9

Other adjustments per the Company's Credit Agreement:

Impairment charges related to investments

1.8

-

Net noncash loss on disposal of assets

1.4

3.6

Loss on early extinguishment of debt

0.1

8.3

Compensation expense under FASB Statement No. 123(R)

3.2

2.5

Other

(0.1)

0.1

Adjusted Consolidated EBITDA

(1)(3)(4)

$

87.8

86.4

$

Weighted average common shares outstanding:

Basic

87.4

78.6

Diluted

100.7

91.9

Per Share

(2)

(In Millions, Except Per Share Data)

Three Months Ended December 31,

2007

2008

Twelve Month Reconciliation of Net Income to Adjusted Income (Loss) from Continuing

Operations and Adjusted Consolidated EBITDA(1)(3)(4)

Per Share

(2)

Net income

$

252.4

3.04

$

$

653.4

$

8.30

Income from discontinued operations

(17.6)

(0.21)

(455.1)

(5.78)

Income from continuing operations

234.8

2.83

198.3

2.52

Gain on UBS Settlement

(121.3)

(1.46)

-

-

Government, class action, and related settlements

(67.2)

(0.81)

(2.8)

(0.04)

Professional fees - accounting, tax, and legal

44.4

0.53

51.6

0.66

Loss on interest rate swap

55.7

0.67

30.4

0.39

Accelerated depreciation of corporate campus

10.0

0.12

-

-

Gain on sale of investment in Source Medical

-

-

(8.6)

(0.11)

Interest associated with UBS Settlement

(9.4)

(0.11)

-

`

Provision for income tax benefit

(70.1)

(0.84)

(322.4)

(4.10)

Estimated state tax expense

(5.0)

(0.06)

(5.0)

(0.06)

Adjusted income (loss) from continuing operations

(1)(3)

71.9

0.87

(58.5)

(0.74)

Adjustment to GAAP EPS for dilution

(2)

(0.12)

0.10

Adjusted income (loss) from continuing operations per

diluted share

(2)(3)

$ 0.75

$

(0.64)

Estimated state tax expense

5.0

5.0

Interest expense and amortization of debt discounts and fees,

excluding interest associated with the UBS Settlement

169.1

229.8

Depreciation and amortization, excluding accelerated

depreciation of corporate campus

73.8

76.2

319.8

252.5

Other adjustments per the Company's Credit Agreement:

Impairment charges, including investments

2.4

15.1

Net noncash loss on disposal of assets

2.0

5.9

Loss on early extinguishment of debt

5.9

28.2

Gain on sale of investment in Source Medical

-

8.6

Compensation expense under FASB Statement No. 123(R)

11.7

10.6

Other

-

0.4

Adjusted Consolidated EBITDA

(1)(3)(4)

$

341.8

$

321.3

Weighted average common shares outstanding:

Basic

83.0

78.7

Diluted

96.4

92.0

(In Millions, Except Per Share Data)

2007

2008

Per Share

(2)

Year Ended December 31,

2008 Reconciliation of Adjusted Consolidated EBITDA(1) to Net Cash Provided by

Operating Activities

Year Ended

December 31, 2008

Adjusted Consolidated EBITDA

341.8

$

Compensation expense under FASB Statement No. 123(R)

(11.7)

Provision for doubtful accounts

27.8

Professional fees—accounting

,

tax

,

and legal

(44.4)

Interest expense and amortization of debt discounts and fees

(159.7)

Loss on sale of investments

1.4

Equity in net income of nonconsolidated affiliates

(10.6)

Minority interests in earnings of consolidated affiliates

29.8

Amortization of debt discounts and fees

6.5

Amortization of restricted stock

6.7

Distributions from consolidated affiliates

10.9

Stock-based compensation

5.0

Current portion of income tax benefit

73.8

Change in assets and liabilities

(49.1)

Change in government, class action, and related settlements

(7.4)

Other operating cash provided by discontinued operations

6.4

Net cash provided by operating activities

227.2

$

Reconciliation Notes

1.

Adjusted income (loss) from continuing operations and Adjusted Consolidated EBITDA are

non-GAAP financial measures. Management and some members of the investment

community utilize adjusted income (loss) from continuing operations as a financial measure

and Adjusted Consolidated EBITDA as a liquidity measure on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as an

alternative to GAAP measures of performance or liquidity. In evaluating these adjusted

measures, the reader should be aware that in the future HealthSouth may incur expenses

similar to the adjustments set forth above.

2.

Per share amounts for the three months and twelve months ended December 31, 2008 and

2007 are based on basic weighted average common shares outstanding for all amounts

except adjusted income (loss) from continuing operations per diluted share, which is based on

diluted weighted average shares outstanding. The difference in shares between the basic and

diluted shares outstanding is primarily related to our convertible perpetual preferred stock. Per

share amounts do not include 5.0 million shares not yet issued under the securities litigation

settlement. The calculation of adjusted loss from continuing operations per diluted share

ignores the antidilutive impact in 2007.

3.

Adjusted income (loss) from continuing operations per diluted share and Adjusted

Consolidated EBITDA are two components of our guidance.

4.

The Company’s Credit Agreement allows all unusual non-cash or non-recurring charges to be

added to arrive at Adjusted Consolidated EBITDA.