First Quarter 2009 Earnings Call

Supplemental Slides

Exhibit 99.2

The information contained in this presentation includes certain estimates, projections and other forward-

looking information that reflect our current views with respect to future events and financial performance.

These estimates, projections and other forward-looking information are based on assumptions that

HealthSouth believes, as of the date hereof, are reasonable. Inevitably, there will be differences between

such estimates and actual results, and those differences may be material.

There can be no assurance that any estimates, projections or forward-looking information will be realized.

All such estimates, projections and forward-looking information speak only as of the date hereof.

HealthSouth undertakes no duty to publicly update or revise the information contained herein.

You are cautioned not to place undue reliance on the estimates, projections and other forward-looking

information in this presentation as they are based on current expectations and general assumptions and

are subject to various risks, uncertainties and other factors, including those set forth in our Form 10-K for

the fiscal year ended December 31, 2008, the Form 10-Q for quarter ended March 31, 2009, when filed,

and in other documents we previously filed with the SEC, many of which are beyond our control, that may

cause actual results to differ materially from the views, beliefs and estimates expressed herein.

Note Regarding Presentation of Non-GAAP Financial Measures

The following presentation includes certain “non-GAAP financial measures” as defined in Regulation G

under the Securities Exchange Act of 1934. A schedule is attached that reconciles the non-GAAP financial

measures included in the following presentation to the most directly comparable financial measures

calculated and presented in accordance with Generally Accepted Accounting Principles in the United

States. Our Form 8-K, dated May 4, 2009, to which the following supplemental slides are attached as

Exhibit 99.2, provides further explanation and disclosure regarding our use of non-GAAP financial

measures and should be read in conjunction with these supplemental slides.

Forward-Looking Statements

Table of Contents

Highlights……………………………………………………………………………………………..

Revenues …………………………………………………………………………………………....

Expenses …………………………………………………………………………………………….

Adjusted Consolidated EBITDA …….……………………………….…………………………....

Adjusted Income per Share ……….……………………………………………………………....

Free Cash Flow……………………………………………………………………………………...

Debt Reduction…………………………………………………………………………..................

Liquidity……………………………………………………………………………………………….

2009 Guidance……………………………………………………………………………………....

Appendix……………………………………………………………………………………………..

Revenues (Sequential)……………………………………………………………………………..

Expenses (Sequential)……………………………………………………………………………...

Operational and Labor Metrics……………………………………………………………………..

Payment Sources………..…………………………………………………………………………..

Debt Maturities……………………………………………………………………………………….

Interest Rate Swaps……………………...………………………………………………………….

Debt Schedule………………………………………………………………………………………..

Non-Operating Cash/Tax Position..………………………………………………………………..

Outstanding Share Summary……………………………………………………………………....

US GAAP Reconciliations…………………………………………………………………………..

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23-26

Highlights: Q1 2009

Achieved 5.7% quarter-over-quarter discharge growth.

Same store discharge growth was 4.8%.

Revenue growth of 2.3%.

Driven by higher discharge volume which more than offset the Medicare price

roll-back and lower outpatient revenue.

Cost-effective, high-quality patient care.

Driven by effective management of hospital expenses and improved labor

productivity.

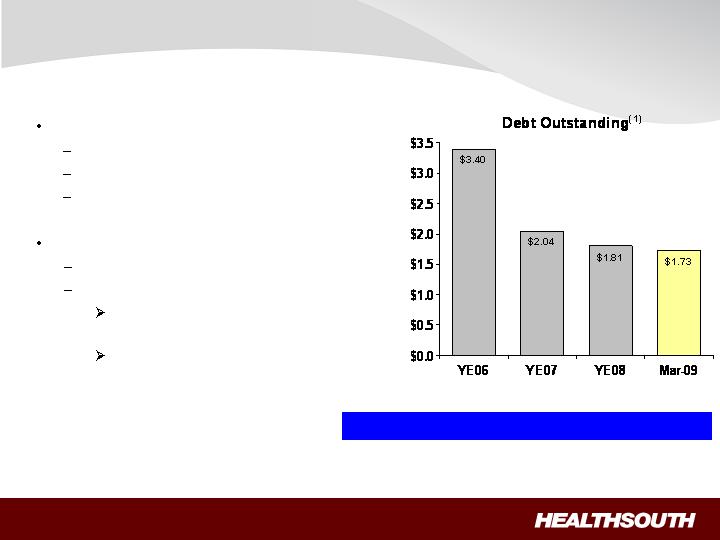

Reduced debt by $85.1 million since year end.

Leverage ratio reduced to 4.9x(1) from 5.3x at year end.

Received UBS Settlement net proceeds of approximately $60 million.

(1) Based on trailing four quarter Adjusted Consolidated EBITDA of $351.2 million; reconciliation to GAAP provided on slides 23 through 26.

Revenues (Q1 2009 vs. Q1 2008)

Inpatient revenue growth was driven by strong discharge volumes, offset by the Medicare price

roll-back.

Volume growth was driven by the sustained TeamWorks effort and disciplined development.

Same store discharge growth was 4.8%.

Net patient revenue / discharge was lower in Q109 due to the Medicare price roll-back, offset by

higher non-Medicare pricing.

Outpatient revenue declined as a result of 12 fewer outpatient satellites quarter over quarter.

Favorable/

(Unfavorable)

(Millions)

1st Qtr. 2009

1st Qtr. 2008

Change

Inpatient

433.1

$

419.1

$

3.3%

Outpatient and other

42.0

45.1

(6.9%)

Consolidated net operating

475.1

$

464.2

$

2.3%

(Actual Amounts)

Discharges

27,807

26,309

5.7%

Net patient revenue / discharge

15,575

$

15,930

$

(2.2%)

Expenses (Q1 2009 vs. Q1 2008)

Adjustments made to benefit plans are reflected in Q109 results.

Continued progress on labor productivity demonstrated by lower EPOB.

Reduced hospital related expenses as a result of lower costs for TeamWorks.

Lower general and administrative as a result of right sizing the corporate office.

Favorable/

(Unfavorable)

(Millions, except percent)

1st Qtr. 2009

1st Qtr. 2008

Change

Salaries and benefits

234.7

$

230.4

$

(1.9%)

Percent of net operating revenues

49.4%

49.6%

20 bps

EPOB (employee per occupied bed)

3.47

3.53

1.7%

Hospital related expenses

114.6

$

115.8

$

1.0%

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.1%

24.9%

80 bps

General and administrative

21.8

$

24.8

$

12.1%

(excludes 123(R) compensation)

Percent of net operating revenues

4.6%

5.3%

70 bps

Adjusted Consolidated EBITDA(1)

(Millions)

(1) Reconciliation to GAAP provided on slides 23 through 26.

Strong volume growth in Q109 helped offset the Medicare price roll-back.

Medicare market basket update: $7-8 million benefit in Q108.

Quarter-over-quarter improvement driven by:

Increased volumes

Lower G&A

Effective management of hospital related expenses

Improved labor productivity

1st Qtr.

1st Qtr.

2009

2008

$

%

98.7

$

89.2

$

9.5

$

10.7%

Change

Adjusted Income per Share

(1) Reconciliation to GAAP provided on slides 23 through 26.

Quarter-over-quarter adjusted income from continuing operations per diluted

share improved by $0.21 per share. Major drivers were:

Higher revenue driven by discharge growth

Lower interest expense

Lower G&A expense

Effective management of hospital related expenses

Improved labor productivity

1st Qtr.

1st Qtr.

(Millions, except per share data)

2009

2008

$

%

Income from continuing operations

attributable to HealthSouth

48.0

$

4.6

$

43.4

$

943.5%

Adjusted income from continuing

operations

(1)

39.8

$

17.0

$

22.8

$

134.1%

Adjusted income from continuing

operations per diluted share

(1)

0.39

$

0.18

$

0.21

$

116.7%

Per Share

Change

Free Cash Flow

(1)Includes capital expenditures for the hospital refresh program.

(Millions)

183.1

$

41.8

$

Incremental income tax expense

(0.3)

(1.4)

Capital expenditures for maintenance

(1)

(7.5)

(8.7)

Net settlements on interest rate swap

(8.5)

(0.2)

Dividends paid on convertible perpetual

preferred stock

(6.5)

(6.5)

Non-recurring items:

UBS Settlement proceeds,

less fees to derivative plaintiffs' attorneys

(73.8)

-

Income tax refund receivable

(47.8)

(3.8)

Adjusted free cash flow

38.7

$

21.2

$

Net cash provided by operating activities

2008

2009

Three Months Ended March 31,

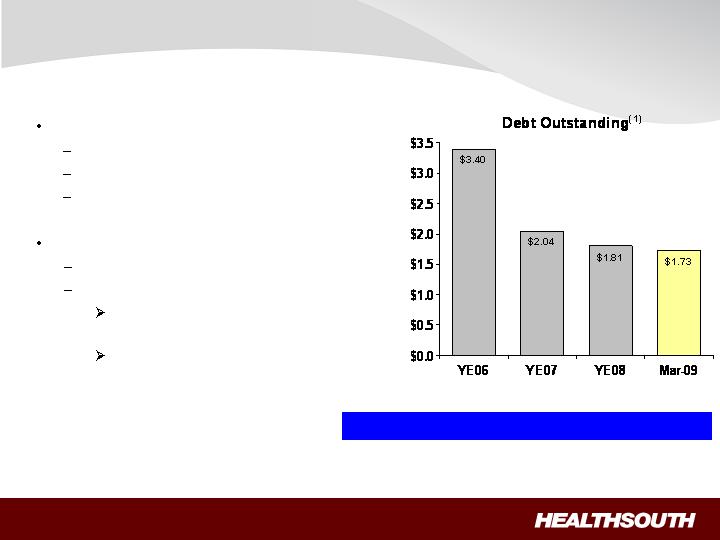

No near-term refinancing

Revolver = 2012

Term Loan = 2013

Bonds = 2014 & 2016

Future deleveraging:

Excess cash from operations

Derivative proceeds

UBS Settlement; net recovery

of ~ $60 million in cash

E&Y and Scrushy litigation

on-going

(1) Credit Agreement limits debt pay down on non–term loan balances. We have the right to buy back non-term loan debt with the discretionary

cash available to the Company.

(2) Based on four quarter trailing Adjusted Consolidated EBITDA of $351.2 million; see related debt schedule on slide 20, and reconciliation to

GAAP on slides 23 through 26.

Debt to EBITDA 6.3x 6.3x 5.3x 4.9x(2)

($ Billions)

Year-End 2012 Goal: 3.5x to 4.0x

Debt Reduction

Liquidity

(Millions)

March 31, 2009

December 31, 2008

Cash

Available

90.7

$

32.2

$

Revolver

Total line

400.0

$

400.0

$

Less:

– Draws

-

(40.0)

– Letters of credit

-

(52.7)

Available

400.0

$

307.3

$

Total Liquidity

(available cash and revolver)

490.7

$

339.5

$

2009 Guidance

(1) Reconciliation to GAAP provided on slides 23 through 26.

(2) Adjusted income from continuing operations per diluted share.

Adjusted Consolidated EBITDA(1)

2009 Range: $342.0 million to $352.0 million

Expect to be at the higher end of the range

Adjusted Earnings per Share(1)(2)

2009 Range: $0.85 to $0.90 per share

Expect to be at the higher end of the range

Key Drivers:

Sustainable discharge growth

Bed expansions

New hospitals

Cost-effective, high-quality patient care

Deleveraging

Appendix

Revenues (Sequential)

Inpatient revenue growth was driven by strong discharge growth and higher

revenue / discharge.

Favorable

(Unfavorable)

(Millions, except percent)

1st Qtr. 2009

4th Qtr. 2008

Change

Inpatient

433.1

$

418.4

$

3.5%

Outpatient and other

42.0

44.6

(5.8%)

Consolidated net operating

475.1

$

463.0

$

2.6%

(Actual Amounts)

Discharges

27,807

27,654

0.6%

Net patient revenue / discharge

15,575

$

15,130

$

2.9%

Expenses (Sequential)

Cost-effective, high-quality patient care.

Adjustments made to benefit plans are reflected in Q109 results.

Continued progress on labor productivity demonstrated by lower EPOB.

Favorable

(Unfavorable)

(Millions, except percent)

1st Qtr. 2009

4th Qtr. 2008

Change

Salaries and benefits

234.7

$

233.7

$

(0.4%)

Percent of net operating revenues

49.4%

50.5%

110 bps

EPOB (employee per occupied bed)

3.47

3.64

4.7%

Hospital related expenses

114.6

$

112.7

$

(1.7%)

(other operating, supplies, occupancy, bad debts)

Percent of net operating revenues

24.1%

24.3%

20 bps

General and administrative

21.8

$

23.5

$

7.2%

(excludes 123(R) compensation)

Percent of net operating revenues

4.6%

5.1%

50 bps

Operational and Labor Metrics

(1) Represents discharges from HealthSouth’s 90 consolidated hospitals.

(2) Excludes 395 and 444 full-time equivalents for the three months ended March 31, 2009 and 2008, respectively, who are considered part of

corporate overhead with their salaries and benefits included in general and administrative expenses in the Company’s condensed

consolidated statements of operations. Full-time equivalents included in the above table represent HealthSouth employees who participate in

or support the operations of the Company’s hospitals.

(3) Employees per occupied bed, or “EPOB,” is calculated by dividing the number of full-time equivalents, including an estimate of full-time

equivalents from the utilization of contract labor, by the number of occupied beds during each period. The number of occupied beds is

determined by multiplying the number of licensed beds by the Company’s occupancy percentage.

2009

2008

Net patient revenue-inpatient

433.1

$

419.1

$

Net patient revenue-outpatient and

other revenues

42.0

45.1

Net operating revenues

475.1

$

464.2

$

Discharges

(1)

27,807

26,309

Outpatient visits

285,101

306,145

Average length of stay

14.6 days

15.2 days

Occupancy %

69.4%

67.0%

# of licensed beds

6,523

6,565

Occupied beds

4,527

4,399

Full-time equivalents (FTEs)

(2)

15,566

15,319

Contract labor

144

202

Total FTE and contract labor

15,710

15,521

EPOB

(3)

3.47

3.53

Three Months Ended

March 31,

(In Millions)

(Actual Amounts)

Payment Sources

(1) Medicare Advantage revenues are included in “Managed care and other discount plans.”

2009

2008

Medicare

68.6%

68.2%

Medicaid

2.1%

2.3%

Workers' compensation

1.7%

2.2%

Managed care and other discount plans

(1)

22.2%

21.3%

Other third-party payors

3.2%

3.5%

Patients

0.8%

0.8%

Other income

1.4%

1.7%

Total

100.0%

100.0%

Three Months Ended March 31,

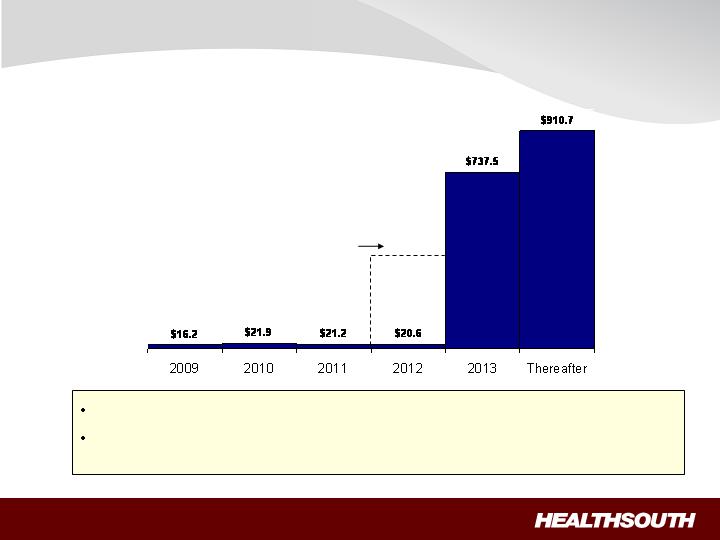

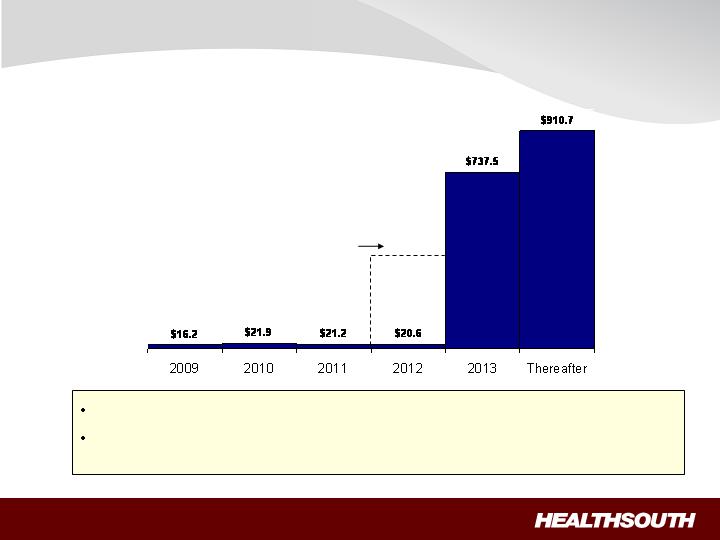

Debt Maturities

(Millions)

$400.0

Undrawn revolver

goes away in 2012

Minimal amortization and no near-term financing risk.

As of March 31, 2009, we were in compliance with the covenants under

our Credit Agreement.

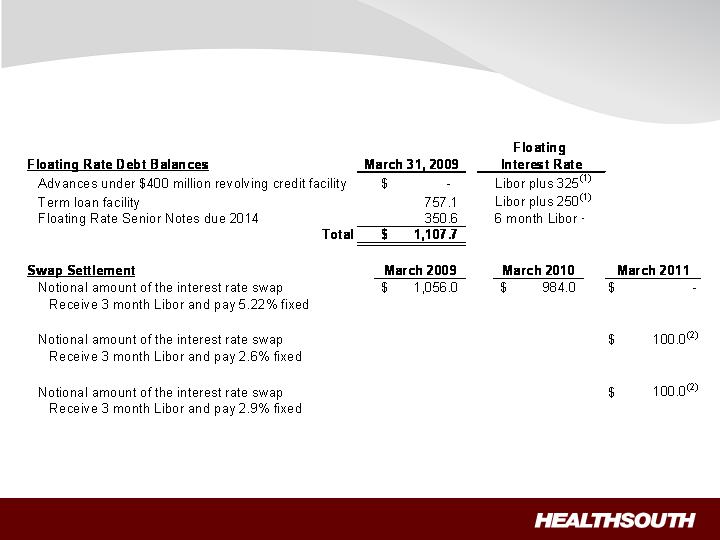

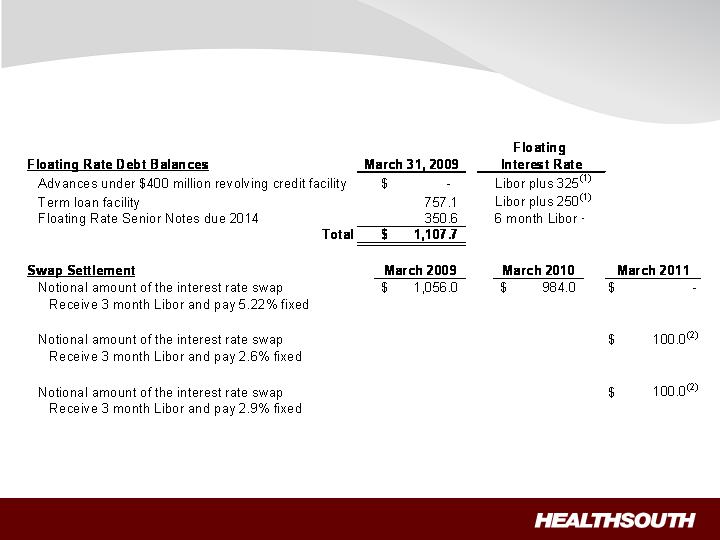

Interest Rate Swaps

(Millions)

(1) We have the flexibility to peg 1,2,3 or 6 month Libor, or Prime.

(2) Forward-starting interest rate swaps (designated as cash flow hedges).

Debt Schedule

(1) The Company had $90.7 million in cash and cash equivalents as of March 31, 2009.

(2) Credit Agreement limits debt pay down on non–term loan balances. We have the ability to buy back non-term loan debt with the discretionary

cash available to the Company.

(Millions)

Q109 Debt

Reduction

(1)(2)

March 2012

$ -

$ 40.0

$ (40.0)

Term loan facility - March 2013

757.1

783.6

(26.5)

Bonds Payable:

8.375%

Senior Notes due 2011

0.3

0.3

-

7.625%

Senior Notes due 2012

1.5

1.5

-

Floating Rate Senior Notes due 2014

350.6

366.0

(15.4)

(6 month Libor plus 600)

10.75%

Senior Notes due 2016

494.5

494.3

0.2

from 7.9% to 12.9%

12.6

12.8

(0.2)

Capital lease obligations

111.5

114.7

(3.2)

Total

1,728.1

$

1,813.2

$

(85.1)

$

Year-to-date debt reduction

(1)(2)

85.1

$

Debt Balances

December 31,

2008

Notes payable to banks and others at interest rates

Advances under $400 million revolving credit facility,

March 31,

2009

Non-Operating Cash/Tax Position

Cash Refunds

Federal tax recoveries virtually complete.

Approx. $42 million received in Q109.

State tax refunds in progress.

Approx. $6 million received in Q109.

Approx. $8 million net receivable on the

balance sheet March 31, 2009.

Future Cash Tax Payments

Expect to pay about $5-7 million per year of

income tax.

State income tax

Alternative Minimum Tax (AMT)

With over $2.5 billion in NOLs and tax

deductions, we do not expect to pay significant

federal income taxes for approximately the next

10-12 years.

At this time, we do not believe the use of

NOLs will be limited before they expire,

however, no assurances can be

provided.

HealthSouth is not currently subject to an

annual use limitation (AUL) under the Internal

Revenue Service section 382.

If we experienced a “change of ownership” as

defined by the Internal Revenue Service section

382, we would be subject to an AUL which is

equal to the value of the company at the time of

the “change of ownership” multiplied by the

long-term tax exempt rate.

GAAP Considerations

HealthSouth’s balance sheet currently reflects

a valuation allowance for the potential value

of NOLs and future deductions. The valuation

allowance is approximately $1.0 billion.

GAAP tax rate will net to small amount for

foreseeable future as there will be a reduction

in the valuation allowance when NOLs are

utilized.

Outstanding Share Summary

(Millions)

1st Qtr.(4)

2009

1st Qtr.

2008

Year-End(4)

2008

Year-End

2007

Basic shares outstanding

(2)(3)

87.5

78.9

83.0

78.7

Diluted shares outstanding

(1)(2)(3)

100.9

92.3

96.4

92.0

Basic shares outstanding

(2)(3)

88.3

79.1

88.0

78.7

Diluted shares outstanding

(1)(2)(3)

101.7

92.5

101.4

92.0

Notes:

Average for the Period

End of Period

(1) The difference between the basic and diluted shares outstanding is primarily related to our convertible perpetual preferred

stock.

(2) Does not include warrants issued in connection with a January 2004 loan repaid to Credit Suisse First Boston. In

connection with this transaction, we issued warrants to the lender to purchase two million shares of our common stock.

Each warrant has a term of ten years from the date of issuance and an exercise price of $32.50 per share. The warrants

were not assumed exercised for dilutive shares outstanding because they were antidilutive in the periods presented.

(3) Does not include approximately 5.0 million shares of common stock and warrants to purchase approximately 8.2 million

shares of common stock at a strike price of $41.40 to settle our class action securities litigation. This agreement received

final court approval on January 11, 2007. As of March 31, 2009, these shares of common stock and warrants have not

been issued and are not included in our basic or diluted common shares outstanding. We expect a ruling before the end

of third quarter. If the judgment is affirmed, the distribution would occur in 2009.

(4) Completed an equity offering for 8.8 million shares on June 27, 2008.

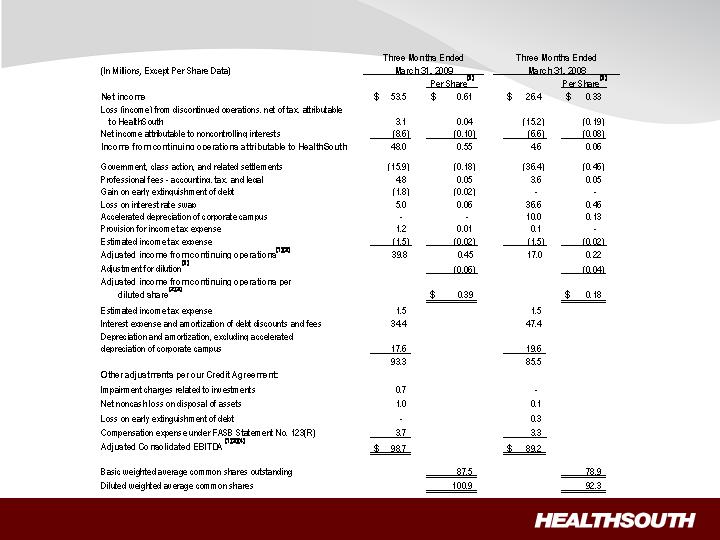

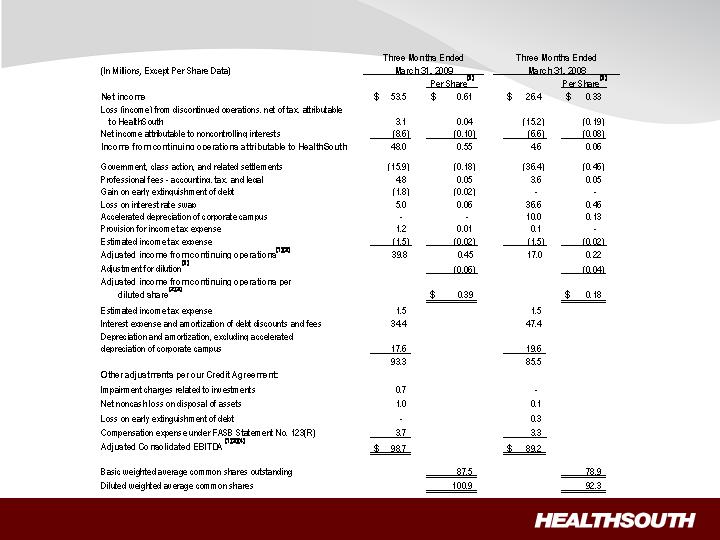

First Quarter Reconciliation of Net Income to Adjusted Income from Continuing

Operations and Adjusted Consolidated EBITDA (1)(3)

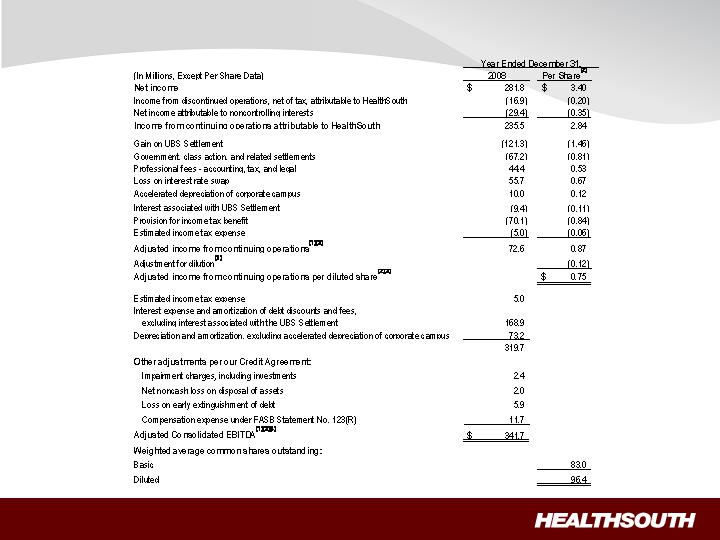

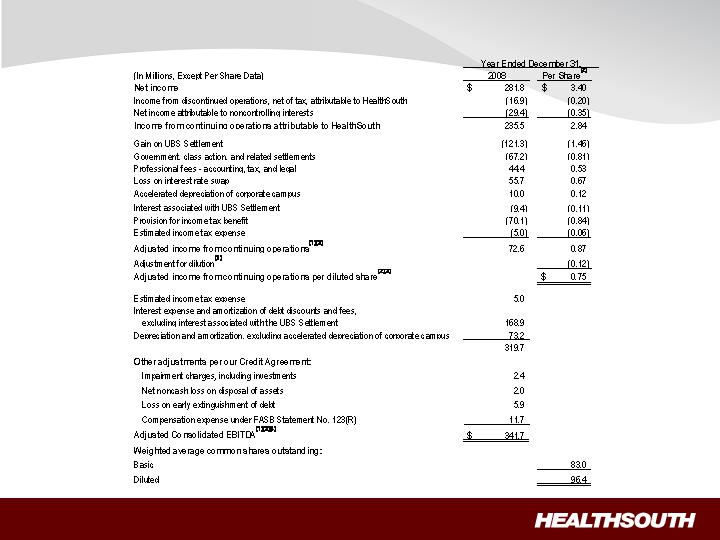

2008 Year-End Reconciliation of Net Income to Adjusted Income from

Continuing Operations and Adjusted Consolidated EBITDA(1)(3)

First Quarter Reconciliation of Adjusted Consolidated EBITDA(1) to Net Cash

Provided by Operating Activities

Reconciliation Notes

1.

Adjusted income from continuing operations and Adjusted Consolidated EBITDA are

non-GAAP financial measures. Management and some members of the investment

community utilize adjusted income from continuing operations as a financial measure

and Adjusted Consolidated EBITDA as a liquidity measure on an ongoing basis. These

measures are not recognized in accordance with GAAP and should not be viewed as an

alternative to GAAP measures of performance or liquidity. In evaluating these adjusted

measures, the reader should be aware that in the future HealthSouth may incur

expenses similar to the adjustments set forth above.

2.

Per share amounts for the three months ended March 31, 2009 and 2008 are based on

basic weighted average common shares outstanding for all amounts except adjusted

income from continuing operations per diluted share, which is based on diluted weighted

average shares outstanding. The difference in shares between the basic and diluted

shares outstanding is primarily related to our convertible perpetual preferred stock. Per

share amounts do not include 5.0 million shares not yet issued under the securities

litigation settlement.

3.

Adjusted income from continuing operations per diluted share and Adjusted

Consolidated EBITDA are two components of our guidance.

4.

The Company’s Credit Agreement allows certain other items to be added to arrive at

Adjusted Consolidated EBITDA, and there may be certain other deductions required.