LOAN AGREEMENT Among DLH Holdings Corp. (the “Company”), DLH Solutions, Inc. and Danya International, LLC (the “Subsidiary Borrowers” and together with the Company, the “Borrower”) and Fifth Third Bank as “Bank” Dated as of May 2, 2016

i TABLE OF CONTENTS Section Page 1. DEFINED TERMS ..............................................................................................................1 2. LOAN AMOUNT AND TERMS ......................................................................................13 2.1 Term Loan. .......................................................................................................................... 13 2.2 Repayment of Term Loan. .................................................................................................. 14 2.3 Revolving Line of Credit. ................................................................................................... 14 2.4 Availability Period. ............................................................................................................. 14 2.5 Letters of Credit. ................................................................................................................. 14 2.6 Borrowing Base................................................................................................................... 15 2.7 Interest Rate. ....................................................................................................................... 15 2.8 Optional Prepayment........................................................................................................... 15 2.9 Excess Cash Flow Recapture Payment ............................................................................... 15 2.10 Interest Calculation. ........................................................................................................ 16 2.11 Interest Limited. .............................................................................................................. 16 2.12 Increased Costs. .............................................................................................................. 16 2.13 Inability to Determine Rates. .......................................................................................... 17 2.14 Mitigation Obligations. ................................................................................................... 18 3. FEES AND EXPENSES ....................................................................................................18 3.1 Fees. .................................................................................................................................... 18 3.2 Expenses. ............................................................................................................................ 18 4. COLLATERAL .................................................................................................................19 4.1 Personal Property. ............................................................................................................... 19 5. DISBURSEMENTS, PAYMENTS AND COSTS ............................................................20 5.1 Disbursements and Payments. ............................................................................................. 20 5.2 Date of Application of Payments. ....................................................................................... 20 6. CONDITIONS ...................................................................................................................20 6.1 Loan Documents. ................................................................................................................ 20 6.2 Lien Searches. ..................................................................................................................... 20 6.3 Authorizations. .................................................................................................................... 20 6.4 Governing Documents. ....................................................................................................... 21 6.5 Collateral Assignments and Related Documents. ............................................................... 21 6.6 Perfection and Evidence of Priority. ................................................................................... 21 6.7 Payment of Fees. ................................................................................................................. 21 6.8 Legal Opinion. .................................................................................................................... 21 6.9 Know Your Customer. ........................................................................................................ 21 6.10 Ownership Interests in Subsidiary Borrowers. ................................................................ 21 6.11 Conditions to All Advances. ........................................................................................... 21 7. REPRESENTATIONS AND WARRANTIES..................................................................22 7.1 Formation. ........................................................................................................................... 22 7.2 Authorization. ..................................................................................................................... 22 7.3 Enforceable Agreement. ...................................................................................................... 23 7.4 No Conflicts. ....................................................................................................................... 23 7.5 Financial Information. ......................................................................................................... 23 7.6 Lawsuits. ............................................................................................................................. 23

ii 7.7 Collateral. ............................................................................................................................ 23 7.8 Use of Proceeds. .................................................................................................................. 23 7.9 Permits, Franchises. ............................................................................................................ 24 7.10 Other Obligations. ........................................................................................................... 24 7.11 Tax Matters. .................................................................................................................... 24 7.12 No Event of Default. ....................................................................................................... 24 7.13 Margin Regulations, Public Holding Company. ............................................................. 24 7.14 Subsidiaries, Equity Investments. ................................................................................... 24 7.15 Compliance with Laws. ................................................................................................... 25 7.16 OFAC. ............................................................................................................................. 25 7.17 No Material Adverse Change .......................................................................................... 25 7.18 Patriot Act and Corrupt Practices Act. ............................................................................ 25 8. COVENANTS ...................................................................................................................25 8.1 Financial Information. ......................................................................................................... 26 8.2 Fixed Charge Coverage Ratio. ............................................................................................ 27 8.3 Funded Indebtedness to EBITDA. ...................................................................................... 27 8.4 Other Indebtedness .............................................................................................................. 28 8.5 Other Liens. ......................................................................................................................... 28 8.6 Maintenance of Assets. ....................................................................................................... 28 8.7 Investments. ........................................................................................................................ 29 8.8 Loans. .................................................................................................................................. 30 8.9 Additional Negative Covenants. ......................................................................................... 30 8.10 Notices to Bank. .............................................................................................................. 30 8.11 Insurance. ........................................................................................................................ 31 8.12 Compliance with Laws. ................................................................................................... 31 8.13 Books and Records.......................................................................................................... 31 8.14 Field Audits. .................................................................................................................... 31 8.15 Perfection of Liens. ......................................................................................................... 32 8.16 ERISA Plans. .................................................................................................................. 32 8.17 Maintenance of Properties. ............................................................................................. 33 8.18 Assignment of Claims Act. ............................................................................................. 33 8.19 Bank as Principal Depository. ......................................................................................... 33 8.20 Collections Account ........................................................................................................ 33 8.21 Taxes and Assessments. .................................................................................................. 33 8.22 Conduct of Business........................................................................................................ 33 8.23 No Consumer Purpose. ................................................................................................... 34 9. DEFAULT AND REMEDIES ...........................................................................................34 9.1 Failure to Pay. ..................................................................................................................... 34 9.2 Other Bank Agreements. ..................................................................................................... 34 9.3 Cross-default. ...................................................................................................................... 35 9.4 False Information. ............................................................................................................... 35 9.5 Bankruptcy. ......................................................................................................................... 35 9.6 Receivers. ............................................................................................................................ 35 9.7 Judgments. .......................................................................................................................... 35 9.8 Corporate Existence. ........................................................................................................... 35 9.9 Default under Related Documents. ..................................................................................... 35 9.10 Security Interest. ............................................................................................................. 35 9.11 ERISA Plans. .................................................................................................................. 36 9.12 Breach of Borrowing Base. ............................................................................................. 36

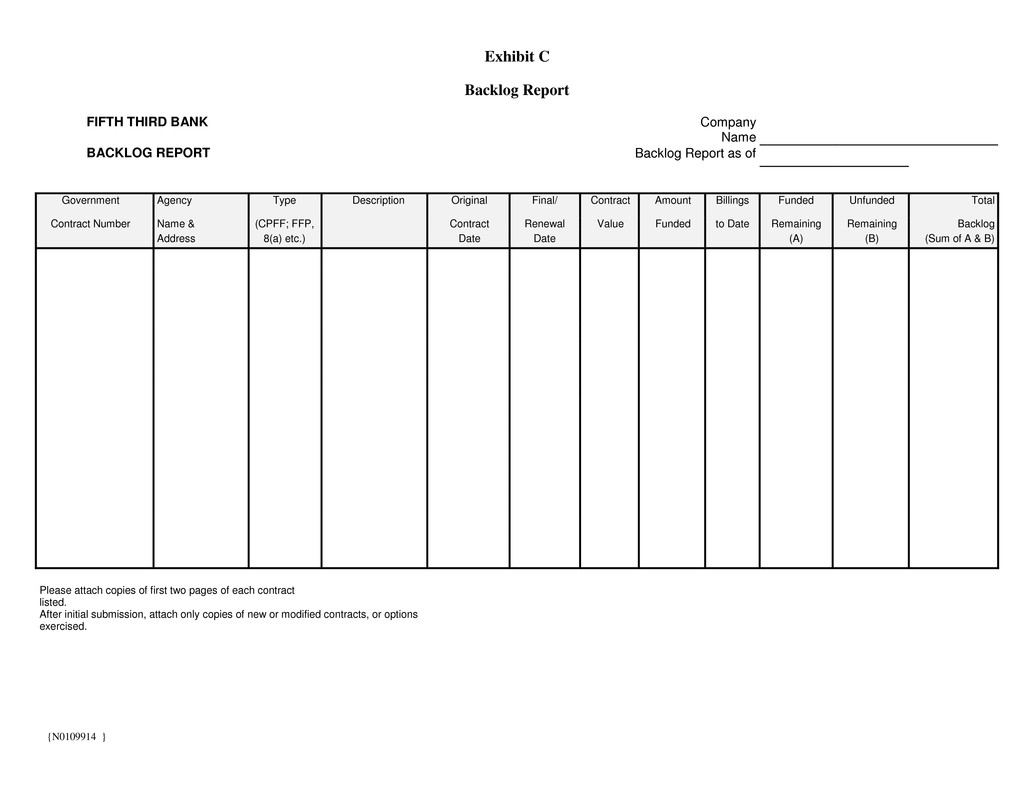

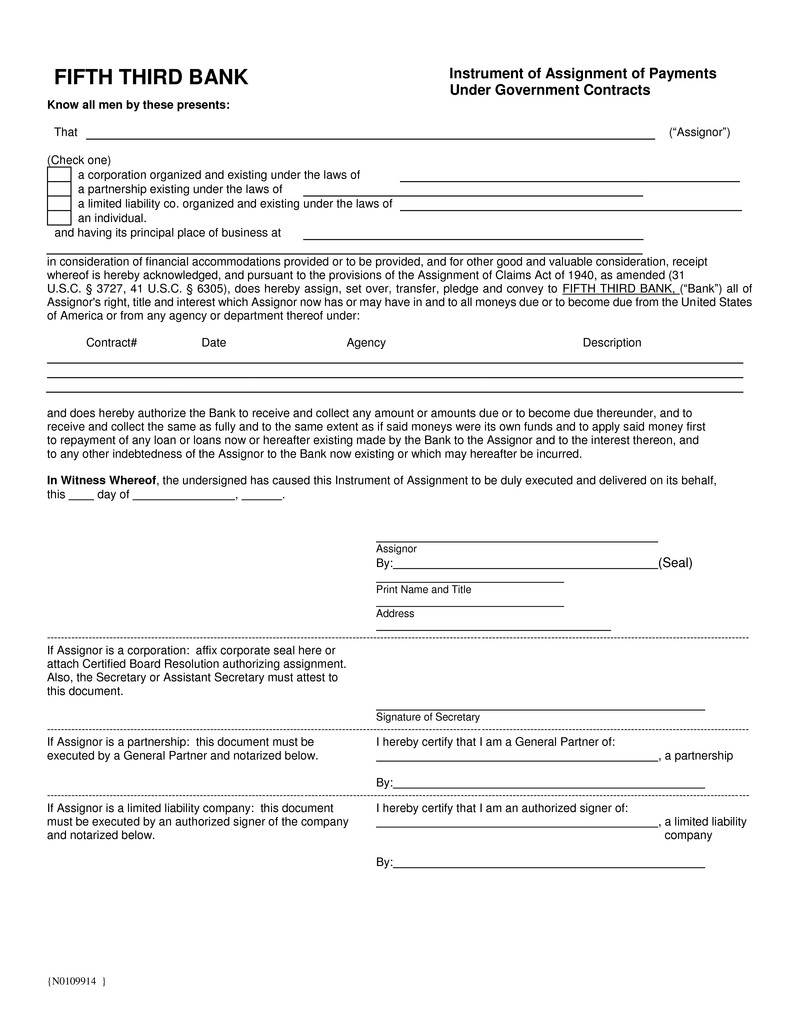

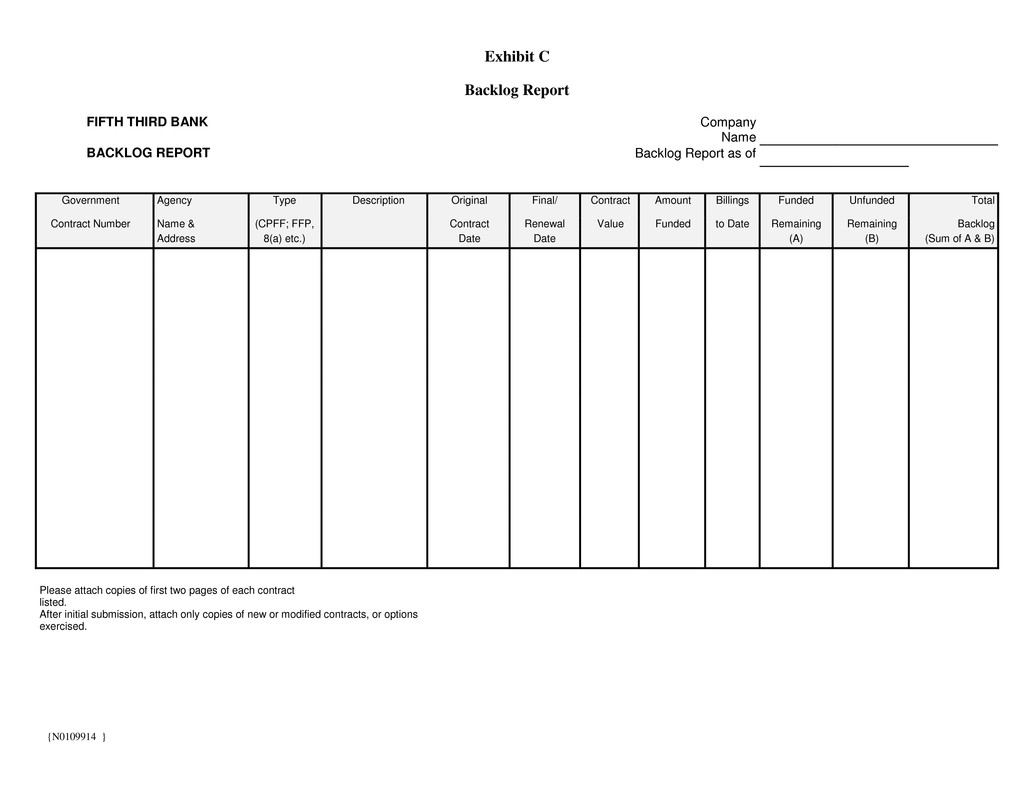

iii 9.13 Invalidity of Loan Documents ........................................................................................ 36 9.14 Change in Control ........................................................................................................... 36 9.15 Suspension or Debarment ............................................................................................... 36 10. ENFORCING THIS AGREEMENT; MISCELLANEOUS ..............................................37 10.1 GAAP. ............................................................................................................................. 37 10.2 Georgia Law. ................................................................................................................... 37 10.3 Successors and Assigns. .................................................................................................. 37 10.4 Right of Setoff. ................................................................................................................ 37 10.5 Severability; Waivers. ..................................................................................................... 37 10.6 Attorneys' Fees. ............................................................................................................... 37 10.7 One Agreement. .............................................................................................................. 38 10.8 Indemnification. .............................................................................................................. 38 10.9 Notices. ........................................................................................................................... 38 10.10 Further Assurances .......................................................................................................... 39 10.11 Headings. ........................................................................................................................ 39 10.12 Patriot Act Notice............................................................................................................ 39 10.13 Counterparts. ................................................................................................................... 39 Exhibit A: Borrowing Base Agreement Exhibit B: Permitted Liens Exhibit C: Backlog Report Exhibit D: Assignment of Claims Act Schedule 1 Adjusted EBITDA Schedule 7.13 Other Equity Investments Schedule 7.14: Subsidiaries Schedule 8.4: Existing Indebtedness Schedule 8.7: Existing Investments Schedule 8.8: Existing Extensions of Credit

LOAN AGREEMENT This Loan Agreement dated as of May 2, 2016 (this “Agreement”), is among Fifth Third Bank, an Ohio Banking Corporation (the “Bank”), and DLH Holdings Corp., a New Jersey corporation (the “Company”), DLH Solutions, Inc., a Georgia corporation, Danya International, LLC, a Maryland limited liability company (the “Subsidiary Borrowers” and together with the Company, the “Borrowers”), 1. DEFINED TERMS As used in this Agreement, the following terms shall have the meanings set forth below: “Acquisition” means any transaction, or any series of related transactions, consummated on or after the date of this Agreement, by which the Company or any of its Subsidiaries (i) acquires any going business or all or substantially all of the assets of any Person or division thereof, whether through purchase of assets, merger or otherwise or (ii) directly or indirectly acquires (in one transaction or as the most recent transaction in a series of transactions) at least a majority (in number of votes) of the voting stock of any Person. “Adjusted EBITDA” means EBITDA plus (i) cost synergies; (ii) non-cash stock option expense; (iii) executive compensation; (iv) contract renewal bonuses; (v) excess facility costs; (vi) severance expense; and (vii) normalized unallowable costs. For avoidance of any doubt, Adjusted EBITDA shall be computed consistent with Schedule 1 attached hereto which sets forth as an example a Summary Income Statement and EBITDA and Adjusted EBITDA Schedule for the last four fiscal quarters ended March 31, 2016. “Advance” means a borrowing hereunder (or conversion or continuation thereof) consisting of the aggregate amount of the several Loans made by the Bank (or converted or continued by the Bank on the same date of conversion or continuation). “Affiliate” means, with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. “Agreement” means this Loan Agreement as it may be amended, restated or modified from time to time. “Applicable Margin” means 3.00%. “Attributable Indebtedness” means, on any date, (a) in respect of any capital lease of any Person, the capitalized amount thereof that would appear on a balance sheet of such Person prepared as of such date in accordance with GAAP, and (b) in respect of any Synthetic Lease Obligation, the capitalized amount of the remaining lease payments under the relevant lease that would appear on a balance sheet of such Person prepared as of such date in accordance with GAAP if such lease were accounted for as a capital lease. “Available Letter of Credit Commitment” means the Letter of Credit Commitment minus an amount equal to the outstanding Letters of Credit issued hereunder.

{N0109914 } 2 6035818 “Borrower” is defined in the preamble hereto. “Borrowing Base Agreement” means that certain Borrowing Base Agreement between Borrower and Bank dated as of even date herewith. “Borrowing Base Certificate” means the certificate showing the availability of Advances required pursuant to the Borrowing Base Agreement. “Business Day” means any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the Laws of, or are in fact closed in, Cincinnati, Ohio and, if such day relates to any LIBOR Rate Increment, means any such day on which dealings in Dollar deposits are conducted by and between banks in the London interbank Eurodollar market. “Capital Expenditures” means expenditures to purchase real estate, equipment, or machinery. “Capital Stock” means (i) in the case of any corporation, all capital stock and any securities exchangeable for or convertible into capital stock and any warrants, rights or other options to purchase or otherwise acquire capital stock or such securities or any other form of equity securities, (ii) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of corporate stock, (iii) in the case of a partnership or limited liability company, partnership or membership interests (whether general or limited), and (iv) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person. “Change of Control” shall mean the occurrence, after the date hereof, of any of the following: (i) any person or group of persons (within the meaning of Section 13 or 14 of the Securities Exchange Act of 1934, as amended), other than any employee benefit plan or plans (within the meaning of Section 3(3) of ERISA), shall have acquired beneficial ownership (within the meaning of Rule 13d-3 promulgated by the Securities and Exchange Commission under said Act) of 35% or more in voting power of the outstanding Voting Stock of the Parent, or (ii) during any period of twelve (12) consecutive calendar months, individuals who were directors of the Parent on the first day of such period shall cease to constitute a majority of the board of directors of the Parent other than because of the replacement as a result of death or disability of one or more such directors; provided that for purposes of this definition, the aggregate beneficial ownership of the Voting Stock of the Parent as of the date hereof by Wynnefield Partners Small Cap Value, LP, Wynnefield Partners Small Cap Value, LP I, Wynnefield Small Cap Value Offshore Fund, Ltd. and any other affiliated entity controlled by Wynnefield Capital, Inc. shall not constitute a Change of Control. “Change in Law” means the occurrence, after the date of this Agreement, of any of the following: (a) the adoption or taking effect of any rule, regulation, treaty or other law, (b) any change in any rule, regulation, treaty or other law or in the administration, interpretation, implementation or application thereof by any Governmental Authority or (c) the making or issuance of any request, rule, guideline or directive (whether or not having the force of law) by any Governmental Authority; provided that, notwithstanding anything herein to the contrary, (i) the Dodd-Frank Wall Street Reform and Consumer Protection Act and all requests, rules,

{N0109914 } 3 6035818 guidelines or directives thereunder or issued in connection therewith and (ii) all requests, rules, guidelines or directives promulgated by the Bank for International Settlements, the Basel Committee on Banking Supervision (or any successor or similar authority) or the United States or foreign regulatory authorities, in each case pursuant to Basel III, and (iii) all requests, rules, guidelines or directives issued by a Governmental Authority in connection with the Bank’s submission or re-submission of a capital plan under 12 C.F.R. § 225.8 or a Governmental Authority’s assessment thereof shall in each case be deemed to be a “Change in Law”, regardless of the date enacted, adopted, implemented, promulgated or issued. “Closing Date” means May 2, 2016. “Code” means the Internal Revenue Code of 1986. “Collateral” shall mean any and all assets and rights and interests in or to property of Borrower, whether real or personal, tangible or intangible, in which a Lien is granted or purported to be granted pursuant to the Collateral Documents. “Collateral Documents” means all agreements, instruments and documents now or hereafter executed and delivered in connection with this Agreement pursuant to which Liens are granted or purported to be granted to Bank in Collateral securing all or part of the Obligations each in form and substance reasonably satisfactory to Bank, as each may be amended, restated or modified from time to time. “Collections Accounts” means that certain accounts numbered #7460952679 and #7460952828 maintained at Bank or such other account as Bank may designate as the Collections Account (which accounts may be subject springing deposit account control agreements at the Bank’s option). “Consolidated Entity” means at any date any Subsidiary, and any other entity the accounts of which would be combined or consolidated with those of the Borrower in its combined or consolidated financial statements if such statements were prepared as of such date. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have meanings correlative thereto. “Debtor Relief Laws” means the Bankruptcy Code of the United States, and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership, insolvency, reorganization, or similar debtor relief Laws of the United States or other applicable jurisdictions from time to time in effect and affecting the rights of creditors generally. ‘Default” means any event or condition that constitutes an Event of Default or that, with the giving of any notice, the passage of time, or both, would be an Event of Default. “Default Rate” means a rate of interest which is 200 basis points higher than the rate of interest otherwise provided under this Agreement.

{N0109914 } 4 6035818 “Dollar” and “$” mean lawful money of the United States. “EBITDA” means net income, less income or plus loss from discontinued operations and extraordinary items, plus income taxes, plus interest expense, plus depreciation, depletion, amortization, calculated in each case for Borrower and its Subsidiaries on a consolidated basis. For avoidance of any doubt, EBITDA shall be computed consistent with Schedule 1 attached hereto which sets forth as an example a Summary Income Statement and EBITDA and Adjusted EBITDA Schedule for the last four fiscal quarters ended March 31, 2016. “Equity Interest” means as to any Person all shares, options, warrants, general or limited partnership interests, membership interests or other equivalents (regardless of how designated) of or in a corporation, partnership, limited liability company or equivalent entity whether voting or nonvoting, including common stock, preferred stock or any other “equity security” (as such term is defined in Rule 3a11-1 of the General Rules and Regulations promulgated by the Securities and Exchange Commission under the Exchange Act). “Event of Default” has the meaning specified in Article 9. “Excluded Taxes” means, with respect to Bank and its successors and assigns, (a) taxes imposed on or measured by its gross or net income (however denominated), or business privilege, Capital Stock, or franchise taxes imposed on it (whether calculated on gross or net assets, gross or net income, capitalization or any combination of the foregoing), by any Governmental Authority, and (b) any branch profits taxes imposed by the United States or any similar tax imposed by any other jurisdiction in which Borrower is located. “Excess Cash Flow” with respect to any fiscal year equals EBITDA plus any change in Working Capital, less the sum of voluntary principal prepayments on the Term Loan and scheduled principal payments on funded debt (including amortization of the Term Loan but excluding prepayments of the Revolving Loan except to the extent such prepayment results in a permanent reduction in the Revolving Loan commitment), cash interest charges, cash tax payments and tax distributions, unfunded Capital Expenditures. “Fixed Charge Coverage Ratio” means the ratio of (a) Borrower’s Adjusted EBITDA plus rent and operating lease payments, less cash taxes paid, distributions, dividends and capital expenditures (other than Capital Expenditures financed with the proceeds of purchase money Indebtedness or Capital Leases to the extent permitted hereunder) and other extraordinary items for the twelve month period then ending to (b) the consolidated sum of (i) Borrower’s interest expense, and (ii) all principal payments with respect to Indebtedness that were paid or were due and payable by all Consolidated Entities during the period plus rent and operating lease expense incurred in the same such period. “Funded Debt” with respect to any Person, without duplication, (a) all Indebtedness for borrowed money and (b) all Indebtedness evidenced by notes, bonds, debentures or similar instruments, or upon which interest payments are customarily made, in each case, that by its terms matures more than one (1) year from, or is directly or indirectly renewable or extendible at such Person's option under a revolving credit or similar agreement obligating the lender or lenders to extend credit over a period of more than one (1) year from, the date of creation thereof, and

{N0109914 } 5 6035818 specifically including, without limitation, capitalized lease obligations, current maturities of long-term debt, revolving credit and short-term debt extendible beyond one (1) year at the option of the debtor, and also including, in the case of the Borrower, the Obligations and, without duplication, Guaranteed Obligations in respect of Funded Debt of other Persons. “Funded Indebtedness to Adjusted EBITDA” means the ratio of (a) indebtedness (i) in respect of money borrowed or (ii) evidenced by a note, debenture (excluding subordinated) or other like written obligation to pay money, or (iii) in respect of rent or hire of property under leases or lease arrangements which under generally accepted accounting principle are required to be capitalized, or (iv) in respect of obligations under conditional sales or other title retention agreements to (b) EBITDA. “GAAP” means generally accepted accounting principles in the United States set forth in the opinions and pronouncements of the Accounting Principles Board and the American Institute of Certified Public Accountants and statements and pronouncements of the Financial Accounting Standards Board or such other principles as may be approved by a significant segment of the accounting profession in the United States, that are applicable to the circumstances as of the date of determination, consistently applied. “Governmental Authority” means the government of the United States or any other nation, or of any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government (including any supra-national bodies such as the European Union or the European Central Bank). “Guarantee” means, as to any Person (a) any obligation, contingent or otherwise, of such Person guaranteeing or having the economic effect of guaranteeing any Indebtedness or other obligation payable or performable by another Person (the “primary obligor”) in any manner, whether directly or indirectly, and including any obligation of such Person, direct or indirect, (i) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation, (ii) to purchase or lease property, securities or services for the purpose of assuring the obligee in respect of such Indebtedness or other obligation of the payment or performance of such Indebtedness or other obligation, (iii) to maintain working capital, equity capital or any other financial statement condition or liquidity or level of income or cash flow of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation, or (iv) entered into for the purpose of assuring in any other manner the obligee in respect of such Indebtedness or other obligation of the payment or performance thereof or to protect such obligee against loss in respect thereof (in whole or in part), or (b) any Lien on any assets of such Person securing any Indebtedness or other obligation of any other Person, whether or not such Indebtedness or other obligation is assumed by such Person (or any right, contingent or otherwise, of any holder of such Indebtedness to obtain any such Lien). The amount of any Guarantee shall be deemed to be an amount equal to the stated or determinable amount of the related primary obligation, or portion thereof, in respect of which such Guarantee is made or, if not stated or determinable, the maximum reasonably anticipated liability in respect thereof as determined by the guaranteeing Person in good faith. The term “Guarantee” as a verb has a corresponding meaning.

{N0109914 } 6 6035818 “Guaranteed Obligations” means as to any Person, without duplication, any obligation of such Person guaranteeing, providing comfort or otherwise supporting any Indebtedness, lease, dividend, or other obligation (“primary obligation”) of any other Person (the “primary obligor”) in any manner, including any obligation or arrangement of such Person to (a) purchase or repurchase any such primary obligation, (b) advance or supply funds (i) for the purchase or payment of any such primary obligation or (ii) to maintain working capital or equity capital of the primary obligor or otherwise to maintain the net worth or solvency or any balance sheet condition of the primary obligor, (c) purchase property, securities or services primarily for the purpose of assuring the owner of any such primary obligation of the ability of the primary obligor to make payment of such primary obligation, (d) protect the beneficiary of such arrangement from loss (other than product warranties given in the ordinary course of business) or (e) indemnify the owner of such primary obligation against loss in respect thereof; provided that the term Guaranteed Obligations shall not include endorsements for collection or deposit in the ordinary course of business. The amount of any Guaranteed Obligations at any time shall be deemed to be an amount equal to the lesser at such time of (x) the stated or determinable amount of the primary obligation in respect of which such Guaranteed Obligations is incurred and (y) the maximum amount for which such Person may be liable pursuant to the terms of the instrument embodying such Guaranteed Obligations, or, if not stated or determinable, the maximum reasonably anticipated liability (assuming full performance) in respect thereof. “Guarantor” means any Person that executes a Guarantee of the Obligations. “Increment” shall mean any principal amount under the Loan bearing interest under the Libor Rate or any substitute rate. “Indebtedness” means (i) all items (except items of Capital Stock, of capital surplus, of general contingency reserves or of retained earnings, deferred income taxes, and amount attributable to minority interest if any) which in accordance with generally accepted accounting principles would be included in determining total liabilities on a consolidated basis (if Borrower should have a subsidiary) as shown on the liability side of a balance sheet as at the date as of which indebtedness is to be determined, (ii) all indebtedness secured by any mortgage, pledge, lien or conditional sale or other title retention agreement to which any property or asset owned or held is subject, whether or not the indebtedness secured thereby shall have been assumed (excluding non- capitalized leases which may amount to title retention agreements but including capitalized leases), and (iii) all indebtedness of others which Borrower or any Subsidiary has directly or indirectly guaranteed, endorse (otherwise than for collection or deposit in the ordinary course of business), discounted or sold with recourse or agreed (contingently or otherwise) to purchase or repurchase or otherwise acquire, or in sold with recourse or agreed (contingently or otherwise) to purchase or repurchase or otherwise acquire, or in respect of which Borrower or any Subsidiary has agreed to apply or advance funds (whether by way of loan, stock purchase, capital contribution or otherwise) or otherwise to become directly or indirectly liable. For all purposes hereof, the Indebtedness of any Person shall include the Indebtedness of any partnership or joint venture (other than a joint venture that is itself a corporation or limited liability company) in which such Person is a general partner or a joint venturer, unless such Indebtedness is expressly made non-recourse to such Person. The amount of any net obligation under any Swap Contract on any date shall be deemed to be the Swap Termination Value thereof

{N0109914 } 7 6035818 as of such date. The amount of any capital lease or Synthetic Lease Obligation as of any date shall be deemed to be the amount of Attributable Indebtedness in respect thereof as of such date. “Indemnified Taxes” means Taxes other than Excluded Taxes. “Interest Payment Date” means the 1st day of each month, beginning June 1, 2016, and provided further that, in addition to the foregoing, each of (x) the date upon which each of the Revolving Loan Commitment and the Term Loan Commitment have been terminated and the Loans have been paid in full and (y) the Term Loan Maturity Date and the Revolving Line of Credit Maturity Date, shall be deemed to be an “Interest Payment Date” with respect to any interest (including interest accruing at the Default Rate) that has then accrued under this Agreement. “Interest Period” means with respect to any LIBOR Rate Principal, the period commencing on the date such LIBOR Rate Principal is disbursed or on any subsequent Interest Rate Determination Date and ending on last day of each calendar month thereafter. “Interest Rate Determination Date” shall mean the date that the Loan is funded and the first day of each calendar month thereafter, beginning June 1, 2016. “Investment” means, as to any Person, any direct or indirect acquisition or investment by such Person, whether by means of (a) the purchase or other acquisition of Capital Stock or other securities of another Person, (b) a loan, advance or capital contribution to, Guarantee or assumption of Indebtedness of, or purchase or other acquisition of any other debt or equity participation or interest in, another Person, including any partnership or joint venture interest in such other Person and any arrangement pursuant to which the investor Guarantees Indebtedness of such other Person, or (c) the purchase or other acquisition (in one transaction or a series of transactions) of assets of another Person that constitute a business unit. For purposes of covenant compliance, the amount of any Investment shall be the amount actually invested, without adjustment for subsequent increases or decreases in the value of such Investment. “IRS” means the United States Internal Revenue Service. “Laws” means, collectively, all international, foreign, Federal, state and local statutes, treaties, rules, guidelines, regulations, ordinances, codes and administrative or judicial precedents or authorities, including the interpretation or administration thereof by any Governmental Authority charged with the enforcement, interpretation or administration thereof, and all applicable administrative orders, directed duties, requests, licenses, authorizations and permits of, and agreements with, any Governmental Authority, in each case whether or not having the force of law. “Lending Office” means, as to Bank, the office of Bank in Atlanta, Georgia. “Letter of Credit Commitment” shall mean the obligation of the Bank to issue Letters of Credit in an aggregate face amount not to exceed One Million Dollars ($1,000,000.00) outstanding at any time as a sublimit under the Revolving Line of Credit Commitment, as such obligations may be reduced from time to time pursuant to the terms hereof.

{N0109914 } 8 6035818 “Letter of Credit Obligations” shall mean, at any time, the sum of (a) an amount equal to the aggregate undrawn and unexpired amount of the then outstanding Letters of Credit (including the amount to which any such Letter of Credit can be reinstated pursuant to the terms hereof); and (b) an amount equal to the aggregate, but unreimbursed, drawings on any Letters of Credit. “Letter of Credit Reserve Account” shall mean any account maintained by the Bank, the proceeds of which shall be held by Bank as cash collateral for any Letter of Credit repayment obligations. “Letters of Credit” shall mean, collectively, standby Letters of Credit and commercial Letters of Credit issued by the Bank on behalf of the Borrower or its Subsidiaries from time to time in accordance with the terms hereof. “LIBOR Business Day” means a Business Day which is also a London Banking Day. “LIBOR Rate” is, as of any date of determination in accordance with this Agreement, the rate of interest fixed by ICE Benchmark Administration Limited (or any successor thereto, or replacement thereof, approved by Bank, each an “Alternate LIBOR Source”) at approximately 11:00 a.m., London, England time (or the relevant time established by ICE Benchmark Administration Limited, an Alternate LIBOR Source, or Bank, as applicable), two (2) Business Days prior to such date of determination, relating to quotations for the one month London InterBank Offered Rates on U.S. Dollar deposits, as displayed by Bloomberg LP (or any successor thereto, or replacement thereof, as approved by Bank, each an “Approved Bloomberg Successor”), or, if no longer displayed by Bloomberg LP (or any Approved Bloomberg Successor), such rate as shall be determined in good faith by Bank from such sources as it shall determine to be comparable to Bloomberg LP (or any Approved Bloomberg Successor), all as determined by Bank in accordance with this Note and Bank’s loan systems and procedures periodically in effect. Notwithstanding anything to the contrary contained herein, in no event shall the LIBOR Rate be less than 0% as of any date (the “LIBOR Rate Minimum”); provided that, at any time during which a Swap Contract with Bank is then in effect with respect to all or a portion of the Obligations, the LIBOR Rate Minimum, the Rounding Adjustment and the Adjustment Protocol (as defined below) shall all be disregarded and no longer of any force and effect with respect to such portion of the Obligations subject to such Swap Contract. Each determination by Bank of the LIBOR Rate shall be binding and conclusive in the absence of manifest error. The rate shall be adjusted on the first Interest Rate Determination Date and each subsequent Interest Rate Determination Date thereafter (the “Adjustment Protocol”). For purposes herein, the Libor Rate shall never be deemed to be below 0.00% regardless of the actual rate reported by the Bloomberg reporting service, or such similar service selected by the Bank. “LIBOR Rate Increment” means an Increment under the Loan that bears interest at a rate based on the LIBOR Rate. “LIBOR Rate Principal” means any portion of the Principal Debt which bears interest at an applicable LIBOR Rate at the time in question.

{N0109914 } 9 6035818 “Lien” means any mortgage, pledge, hypothecation, assignment, deposit arrangement, encumbrance, lien (statutory or other), charge, or preference, priority or other security interest or preferential arrangement in the nature of a security interest of any kind or nature whatsoever (including any conditional sale or other title retention agreement, any easement, right of way or other encumbrance on title to real property, and any financing lease having substantially the same economic effect as any of the foregoing). “Loan” means the Term Loan or the Revolving Line of Credit Loan, as the case may be, made by Bank to Borrower pursuant to Section 2 in an amount not to exceed the Term Loan Commitment and the Revolving Loan Commitment. Collectively the Term Loan and the Revolving Line of Credit Loan are referred to as the “Loans.” “Loan Documents” means this Agreement and each Collateral Document. “London Banking Day” means a day on which banks in London are open for business and dealing in offshore dollars. “Material Adverse Effect” means (a) a material adverse change in, or a material adverse effect upon, the operations, business, properties, liabilities (actual or contingent), condition (financial or otherwise) of Borrower and any Subsidiaries taken as a whole; (b) a material and sustained impairment of the ability of Borrower to perform its material obligations under any Loan Documents; or (c) a material adverse effect upon the legality, validity, binding effect or enforceability against Borrower of any material provisions of the Loan Documents. “Note” means collectively, the promissory notes evidencing the Term Loan and the Revolving Line of Credit Loan. “Obligations” means all advances to, and debts, liabilities, obligations, reimbursement obligation or indemnity of the Borrower on account of Letters of Credit, ACH, payment-cards, covenants and duties of Borrower to Bank, whether arising under any Loan Document or otherwise with respect to the Loan, any Swap Contract, or any other contract, agreement, instrument or other document, whether direct or indirect (including those acquired by assumption), absolute or contingent, due or to become due, now existing or hereafter arising and including interest and fees that accrue after the commencement by or against Borrower or any Affiliate thereof of any proceeding under any Debtor Relief Laws naming such Person as the debtor in such proceeding, regardless of whether such interest and fees are allowed claims in such proceeding. “Obligor” means for purposes of this Agreement any Guarantors. “Organization Documents” means, (a) with respect to any corporation, the certificate or articles of incorporation and the bylaws (or equivalent or comparable constitutive documents with respect to any non-U.S. jurisdiction); (b) with respect to any limited liability company, the certificate or articles of formation or organization and operating agreement; and (c) with respect to any partnership, joint venture, trust or other form of business entity, the partnership, joint venture or other applicable agreement of formation or organization and any agreement, instrument, filing or notice with respect thereto filed in connection with its formation or organization with the applicable Governmental Authority in the jurisdiction of its formation or organization and, if applicable, any certificate or articles of formation or organization of such entity.

{N0109914 } 10 6035818 “Other Taxes” means all present or future stamp, intangible or documentary taxes or any other excise or property taxes, charges or similar levies arising from any payment made hereunder or under any other Loan Document or from the execution, delivery or enforcement of, or otherwise with respect to, this Agreement or any other Loan Document. Other Taxes shall not include Excluded Taxes. “Permitted Liens” means (i) liens for taxes not yet due and payable; (ii) landlords’, carriers', warehousemen's, mechanics', materialmen's, repairmen's or other like liens arising in the ordinary course of business, payment for which is not more than thirty (30) days past due or which are being contested in good faith and by appropriate proceedings; (iii) pledges or deposits in connection with worker's compensation, unemployment insurance and other social security legislation; (iv) deposits to secure the performance of utilities, lease, statutory obligations and surety and appeal bonds, bids, tenders, contracts (other than contracts relating to Indebtedness) and other obligations of a like nature incurred in the ordinary course of business; (v) bankers' liens, rights of setoff and similar liens arising by statute or under customary terms regarding depository relationships on deposits held by financial institutions with whom either Borrower has a banker-customer relationship; (vi) typical restrictions imposed by licenses and leases of software (including location and transfer restrictions); (vii) judgment liens in respect of judgments that do not constitute an Event of Default; (viii) liens in favor of Bank, (ix) easements, rights of way, zoning restrictions, minor defects and irregularities of title and other charges or encumbrances with respect to real property, which in each case do not interfere in any material respect with the conduct of the Borrower’s or any Subsidiary’s business, (x) rights of setoff included in commercial contracts, (xi) other liens incidental to the conduct of the Borrower’s and its Subsidiaries’ business or the ownership of its property and assets which were not incurred in connection with the borrowing of money or obtaining of advances or credit, and which do not in the aggregate materially detract from the Bank’s rights to the Collateral or the value of the Borrower’s and its Subsidiaries’ property or assets; (xii) liens on assets purchased, leased or otherwise acquired, or reconditioned or improved, with Indebtedness, including capital lease obligations, and any renewals or extensions thereof, so long as the amount secured is not increased, and (xiii) those liens, if any, set forth and described on Exhibit B, and any renewals or extensions thereof, so long as the property covered by such liens is not expanded, and the amount secured is not increased. “Person” means any natural person, corporation, limited liability company, trust, joint venture, association, company, partnership, Governmental Authority or other entity. “Pledge Agreement” means a Pledge Agreement executed by the Company pledging in favor of Bank the Capital Stock in either a Subsidiary Borrower or any other Subsidiary. “Prime Rate” means the floating rate of interest established from time to time by Bank at its principal office as its “Prime Rate”, whether or not Bank shall at times lend to borrowers at lower rates of interest. “Principal Debt” means the aggregate unpaid principal balance on the Loans per the terms of this Agreement and related Loan Documents at the time in question. “Revolving Line of Credit Commitment” means $10,000,000.00.

{N0109914 } 11 6035818 “Revolving Line of Credit Loan” means the Loan provided for in Section 2.3. “Revolving Line of Credit Maturity Date” means May 1, 2018. “Subordination Agreement” means that certain Subordination Agreement dated of the date hereof among Bank, Company, Wynnefield Partners Small Cap Value, LP, Wynnefield Partners Small Cap Value, LP I and Wynnefield Small Cap Value Offshore Fund, Ltd. “Subordinated Liabilities” means liabilities subordinated to Borrower's obligations to Bank in a manner acceptable to Bank in its sole discretion. “Subsidiary” of a Person means a corporation, partnership, joint venture, limited liability company or other business entity of which a majority of the shares of securities or other interests having ordinary voting power for the election of directors or other governing body (other than securities or interests having such power only by reason of the happening of a contingency) are at the time beneficially owned, or the management of which is otherwise controlled, directly, or indirectly through one or more intermediaries, or both, by such Person. Unless otherwise specified, all references herein to a “Subsidiary” or to “Subsidiaries” shall refer to a Subsidiary or Subsidiaries of Borrower. “Swap Contract” means (a) any and all rate swap transactions, basis swaps, credit derivative transactions, forward rate transactions, commodity swaps, commodity options, forward commodity contracts, equity or equity index swaps or options, bond or bond price or bond index swaps or options or forward bond or forward bond price or forward bond index transactions, interest rate options, forward foreign exchange transactions, cap transactions, floor transactions, collar transactions, currency swap transactions, cross-currency rate swap transactions, currency options, spot contracts, or any other similar transactions or any combination of any of the foregoing (including any options to enter into any of the foregoing), whether or not any such transaction is governed by or subject to any master agreement, and (b) any and all transactions of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement (any such master agreement, together with any related schedules, a “Master Agreement”), including any such obligations or liabilities under any Master Agreement. “Swap Termination Value” means, in respect of any one or more Swap Contracts, after taking into account the effect of any legally enforceable netting agreement relating to such Swap Contracts, (a) for any date on or after the date such Swap Contracts have been closed out and termination value(s) determined in accordance therewith, such termination value(s), and (b) for any date prior to the date referenced in clause (a), the amount(s) determined as the mark-to-market value(s) for such Swap Contracts, as determined based upon one or more mid-market or other readily available quotations provided by any recognized dealer in such Swap Contracts (which may include a Bank or any Affiliate of the Bank). “Synthetic Lease Obligation” means the monetary obligation of a Person under (a) a so- called synthetic, off-balance sheet or tax retention lease, or (b) an agreement for the use or possession of property creating obligations that do not appear on the balance sheet of such Person

{N0109914 } 12 6035818 but which, upon the insolvency or bankruptcy of such Person, would be characterized as the indebtedness of such Person (without regard to accounting treatment). “Taxes” means all present or future taxes, levies, imposts, duties, deductions, withholdings, assessments, fees or other charges imposed by any Governmental Authority, including any interest, additions to tax or penalties applicable thereto. “Term Loan Commitment” means $25,000,000. “Term Loan” means the Loan provided for in Section 2.1. “Term Loan Maturity Date” shall mean May 1, 2021. “United States” and “U.S.” mean the United States of America. “Working Capital” means as of the date of the determination, current assets as of such date minus current liabilities as of such date calculated in accordance with GAAP. “Wynnefield Subordinated Notes” means Indebtedness in an amount not to exceed $2,500,000.00 owing by the Company to Wynnefield Partners Small Cap Value, LP, Wynnefield Partners Small Cap Value, LP I, Wynnefield Small Cap Value Offshore Fund, Ltd or any other affiliated fund controlled by Wynnefield Capital, Inc. 1.2 Other Interpretive Provisions. With reference to this Agreement and each other Loan Document, unless otherwise specified herein or in such other Loan Document (a) The definitions of terms herein shall apply equally to the singular and plural forms of the terms defined. Whenever the context may require, any pronoun shall include the corresponding masculine, feminine and neuter forms. The words “include,” “includes” and “including” shall be deemed to be followed by the phrase “without limitation.” The word “will” shall be construed to have the same meaning and effect as the word “shall.” Unless the context requires otherwise, (i) any definition of or reference to any agreement, instrument or other document (including any Organization Document) shall be construed as referring to such agreement, instrument or other document as from time to time amended, supplemented or otherwise modified (subject to any restrictions on such amendments, supplements or modifications set forth herein or in any other Loan Document), (ii) any reference herein to any Person shall be construed to include such Person's successors and assigns, (iii) the words “herein,” “hereof” and “hereunder,” and words of similar import when used in any Loan Document, shall be construed to refer to such Loan Document in its entirety and not to any particular provision thereof, (iv) all references in a Loan Document to Articles, Sections, Exhibits and Schedules shall be construed to refer to Articles and Sections of, and Exhibits and Schedules to, the Loan Document in which such references appear, (v) any reference to any law shall include all statutory and regulatory provisions consolidating, amending, replacing or interpreting such

{N0109914 } 13 6035818 law and any reference to any law or regulation shall, unless otherwise specified, refer to such law or regulation as amended, modified or supplemented from time to time, and (vi) the words “asset” and “property” shall be construed to have the same meaning and effect and to refer to any and all tangible and intangible assets and properties, including but not limited to cash, securities, accounts and contract rights. (b) In the computation of periods of time from a specified date to a later specified date, the word “from” means “from and including;” the words “to” and “until” each mean “to but excluding;” and the word “through” means “to and including.” (c) Section headings herein and in the other Loan Documents are included for convenience of reference only and shall not affect the interpretation of this Agreement or any other Loan Document. 1.3 Accounting Terms. (a) Generally. All accounting terms not specifically or completely defined herein shall be construed in conformity with, and all financial data (including financial ratios and other financial calculations) required to be submitted pursuant to this Agreement shall be prepared in conformity with, GAAP applied on a consistent basis, as in effect from time to time, applied in a manner consistent with that used in preparing the Borrower’s and its Consolidated Subsidiaries' audited financial statements, except as otherwise specifically prescribed herein. (b) Changes in GAAP. If at any time any change in GAAP would affect the computation of any financial ratio or requirement set forth in any Loan Document, and either Bank or Borrower shall request, Bank and Borrower shall negotiate in good faith to amend such ratio or requirement to preserve the original intent thereof in light of such change in GAAP; provided that, until so amended, (i) such ratio or requirement shall continue to be computed in accordance with GAAP prior to such change therein and (ii) Borrower shall provide Bank financial statements and other documents required under this Agreement or as reasonably requested hereunder setting forth a reconciliation between calculations of such ratio or requirement made before and after giving effect to such change in GAAP. 1.4 Rounding. Any financial ratios required to be maintained by Borrower pursuant to this Agreement shall be calculated by dividing the appropriate component by the other component, carrying the result to one place more than the number of places by which such ratio is expressed herein and rounding the result up or down to the nearest number (with a rounding-up if there is no nearest number). 1.5 Times of Day. Unless otherwise specified, all references herein to times of day shall be references to Eastern time (daylight or standard, as applicable). 2. LOAN AMOUNT AND TERMS 2.1 Term Loan.

{N0109914 } 14 6035818 (a) The Bank agrees to provide a term loan to the Borrower in the amount of the Term Loan Commitment. (b) The Term Loan is available in one disbursement from the Bank at closing. 2.2 Repayment of Term Loan. (a) The Borrower will pay all accrued and unpaid interest on the outstanding principal amount of the Term Loan on each Interest Payment Date until payment in full of any principal outstanding under the Term Loan at the then applicable rate per annum set forth in Section 2.7 hereof (plus any interest at the Default Rate if applicable). (b) The principal amount of the Term Loan shall be payable in fifty-nine (59) consecutive monthly installments of $312,500.00 payable on the first (1st) day of each month, beginning on June 1, 2016, and all remaining principal shall be payable on the Term Loan Maturity Date. 2.3 Revolving Line of Credit. (a) During the availability period described below, the Bank will provide a line of credit to the Borrower in the amount of the Revolving Line of Credit Commitment. (b) This is a revolving line of credit. The Borrower will pay interest on the outstanding principal amount of the Revolving Line of Credit Loan on each Interest Payment Date until the Revolving Line of Credit Loan has been repaid in its entirety, at the applicable rate per annum set forth in Section 2.6 hereof (plus any interest at the Default Rate if applicable). The Borrower agrees not to permit the principal balance outstanding to exceed the lesser of the Revolving Line of Credit Commitment or the amount allowed under the Borrowing Base Agreement. If the Borrower exceeds this limit, the Borrower will pay the excess to the Bank within one (1) Business Day following the Bank's demand. (c) The Borrower will repay in full any principal, interest or other charges outstanding under this facility no later than the Revolving Line of Credit Maturity Date. 2.4 Availability Period. The Revolving Line of Credit Loan is available between the date of this Agreement and the Revolving Line of Credit Maturity Date or such earlier date as the availability may terminate as provided for in this Agreement. 2.5 Letters of Credit. As part of the Revolving Line of Credit Loan, Bank agrees to issue Letters of Credit for the account of the Borrower in an aggregate amount not to exceed the Available Letter of Credit Commitment determined immediately prior to giving effect to the issuance thereof. Such aggregate amounts utilized hereunder shall at all times reduce the amount otherwise available for Advances under the Revolving Line of Credit Loan. All Letters of Credit shall be in form and substance reasonably

{N0109914 } 15 6035818 acceptable to Bank in its sole discretion and shall be subject to the terms and conditions of Bank's then current standard Application and Letter of Credit Agreement (the “Letter of Credit Application”). Borrower agrees to execute any further documentation in connection with any Letters of Credit as Bank may reasonably request. In the event a drawing is paid on a Letter of Credit, the Bank shall promptly notify Borrower thereof. 2.6 Borrowing Base. The Revolving Line of Credit Loan is subject to a borrowing base in accordance with the terms and conditions of a Borrowing Base Agreement executed by the Borrower in favor of the Bank as required under this Agreement and attached hereto as Exhibit A. The terms of the Borrowing Base (as defined in the Borrowing Base Agreement) include requirements to maintain collateral with an adequate loan value and grant to the Bank the right to issue a margin call in the event such requirements are not met. Further, any failure to meet the Borrowing Base requirements permits the Bank to refuse to make advances or other financial accommodations. The inability of the Borrower to bring the Line of Credit Loan into compliance with the Borrowing Base Agreement Failure may constitute an Event of Default under this Agreement. 2.7 Interest Rate. 1. Term Loan. The following interest rate shall be applicable for an Advance under the Term Loan: (i) LIBOR Rate plus the Applicable Margin. 2. Revolving Line of Credit Loan. The following interest rate shall be applicable to an Advance under the Revolving Line of Credit Loan: (i) LIBOR Rate plus the Applicable Margin. 2.8 Optional Prepayment. Upon three (3) Business Days' prior written notice to the Bank, the Borrower shall have the right to prepay in whole or in part the Term Loan and/or the then outstanding Revolving Line of Credit Loans, in each case without premium or penalty. No such prepayment shall eliminate or waive any fees or costs associated with the termination of any Swap Contract which Borrower may enter into with Bank or any other party. 2.9 Excess Cash Flow Recapture Payment Within fifteen (15) days’ receipt of the annual financial statement as required in Section 8.1(a) commencing with the year ending on September 30, 2017, the Borrower shall pay to Bank an amount (the “Cash Flow Recapture Payment”) equal to (a) 75% of the Excess Cash Flow of the Borrower for each year in which the Funded Indebtedness to Adjusted EBITDA Ratio is greater than or equal to 2.50:1.00, or (b) 50% of the Excess Cash Flow of the Borrower for each fiscal year in which the Funded Indebtedness to Adjusted EBITDA Ratio is less than 2.50:1.00 but

{N0109914 } 16 6035818 greater than or equal to 2.00:1.00. Borrower will provide a worksheet for Bank’s review and approval showing how the Cash Flow Recapture Payment is calculated prior to the time any such payment is made. Borrower may apply as an offset to any such Cash Flow Recapture Payment any voluntary prepayments of principal made by Borrower on the Term Loan for such fiscal year. The Cash Flow Recapture Payment shall be applied to the outstanding principal balance of the Term Loan until the Term Loan shall have been paid in full. The Cash Flow Recapture Payment is in addition to the monthly scheduled payments. 2.10 Interest Calculation. Except as otherwise stated in this Agreement, all interest and fees, if any, will be computed on the basis of a 360-day year and the actual number of days elapsed in the case of LIBOR Increments. Installments of principal which are not paid when due under this Agreement shall continue to bear interest until paid at the Default Rate. 2.11 Interest Limited. As used in this Agreement the term “interest” does not include any fees (including, but not limited to, any loan fee, periodic fee, unused commitment fee or waiver fee) or other charges imposed on the Borrower in connection with the Indebtedness evidenced by this Agreement, other than the interest described above. In no event shall the amount or rate of interest due and payable under this Agreement exceed the maximum amount or rate of interest allowed by applicable law and, in the event any such excess payment is made by the Borrower or received by the Bank, such excess sum shall be credited as a payment of principal (or if no principal shall remain outstanding, shall be refunded to the Borrower). It is the express intent hereof that the Borrower not pay and the Bank not receive, directly or indirectly, interest in excess of that which may be lawfully paid under applicable law including the usury laws in force in the State of Georgia. 2.12 Increased Costs. (a) Increased Costs Generally. If any Change in Law shall: (i) impose, modify or deem applicable any reserve, special deposit, compulsory loan, insurance charge or similar requirement against assets of, deposits with or for the account of, or credit extended or participated in by, Bank (except any reserve requirement reflected in the LIBOR Rate); (ii) subject Bank to any tax of any kind whatsoever with respect to this Agreement, or change the basis of taxation of payments to Bank in respect thereof (except for Indemnified Taxes or Other Taxes covered by Section 2.12 and the imposition of, or any change in the rate of, any Excluded Tax payable by Bank); or (iii) impose on Bank or the London interbank market any other condition, cost or expense affecting this Agreement or LIBOR Rate Increments; and the result of any of the foregoing shall be to increase the cost to Bank of making or maintaining any LIBOR Rate Increment, or to reduce the amount of any sum received or receivable by Bank hereunder (whether of principal, interest or any other amount) then,

{N0109914 } 17 6035818 upon request of Bank, Borrower will pay to such Bank, such additional amount or amounts as will compensate Bank for such additional costs incurred or reduction suffered. (b) Capital Requirements. If Bank determines that any Change in Law affecting Bank or the Lending Office or the Bank's holding company regarding capital requirements has or would have the effect of reducing the rate of return on Bank's capital or on the capital of Bank's holding company as a consequence of this Agreement to a level below that which Bank or Bank's holding company could have achieved but for such Change in Law (taking into consideration Bank's policies and the policies of Bank's holding company with respect to capital adequacy), then from time to time Borrower will pay to Bank, such additional amount or amounts as will compensate Bank or Bank's holding company for any such reduction suffered. (c) Certificates for Reimbursement. A certificate of Bank setting forth the amount or amounts necessary to compensate Bank or its holding company, as the case may be, as specified in subsection (a) or (b) of this Section and delivered to Borrower shall be conclusive absent manifest error. Borrower shall pay Bank the amount shown as due on any such certificate within 10 days after receipt thereof. (d) Delay in Requests. Failure or delay on the part of Bank to demand compensation pursuant to the foregoing provisions of this Section shall not constitute a waiver of Bank's right to demand such compensation, provided that Borrower shall not be required to compensate Bank pursuant to the foregoing provisions of this Section for any increased costs incurred or reductions suffered more than six months prior to the date that Bank notifies Borrower of the Change in Law giving rise to such increased costs or reductions and of Bank's intention to claim compensation therefor (except that, if the Change in Law giving rise to such increased costs or reductions is retroactive, then the six-month period referred to above shall be extended to include the period of retroactive effect thereof). 2.13 Inability to Determine Rates. If Bank, by written or telephonic notice, notifies Borrower that: (a) any change in any law, regulation or official directive, or in the interpretation thereof, by any governmental body charged with the administration thereof, has made it unlawful for Bank to fund or maintain its funding in Eurodollars of any portion of any advance subject to the LIBOR Rate or otherwise give effect to Bank’s obligations as contemplated hereby, or (b) (i) LIBOR deposits for periods of one month are not readily available in the London Interbank Offered Rate Market, (ii) by reason of circumstances affecting such market or other economic conditions, adequate and reasonable methods do not exist for ascertaining the rate of interest applicable to such deposits, or (iii) the LIBOR Rate as determined by Bank will not adequately and fairly reflect the cost to Bank of making or maintaining advances under this Note bearing interest with reference to the LIBOR Rate (including inaccurate or inadequate reflection of actual costs resulting from the calculation of rates by reporting sources), then, in any of such events: (A) Bank’s obligations in respect of the LIBOR Rate shall terminate forthwith, (B) the LIBOR Rate with respect to Bank shall forthwith cease to be in effect, (C)

{N0109914 } 18 6035818 Borrower’s right to utilize LIBOR Rate index pricing as set forth in this Note shall be terminated forthwith, and (D) amounts outstanding hereunder shall, on and after such date, bear interest at a rate per annum equal to: (1) the Prime Rate, or, if there is no such Prime Rate, then such other rate as may be substituted by Bank for such Prime Rate. Each determination by Bank of the Prime Rate shall be binding and conclusive in the absence of manifest error. In the event of a change in the Prime Rate, the interest rate accruing hereunder based upon the Prime Rate shall be changed immediately with such change to be based upon such new Prime Rate. 2.14 Mitigation Obligations. If Bank requests compensation under Section 2.11, or Borrower is required to pay any additional amount to Bank or any Governmental Authority for the account of Bank pursuant to Section 2.11, or if Bank gives a notice pursuant to Section 2.12(b), then Bank shall use reasonable efforts to designate a different Lending Office for funding or booking its Loans hereunder or to assign its rights and obligations hereunder to another of its offices, branches or affiliates, if, in the reasonable determination of Bank, such designation or assignment (i) would eliminate or reduce amounts payable under Article 2, in the future, and (ii) in each case, would not subject Bank to any unreimbursed cost or expense and would not otherwise be materially disadvantageous to Bank. Borrower hereby agrees to pay all reasonable costs and expenses incurred by Bank in connection with any such designation or assignment. 3. FEES AND EXPENSES 3.1 Fees. (a) Facility Fee. A facility fee equal to $350,000.00 shall be paid to the Bank on the Closing Date. (b) Unused Commitment Fee. Borrower agrees to pay a fee on any difference between the Revolving Loan Commitment and the amount of credit it actually uses, determined by the average of the daily amount of credit outstanding during the specified period. The fee will be calculated at 0.30% per year. The fee is payable monthly on the Interest Payment Date. 3.2 Expenses. The Borrower agrees to (a) reimburse and indemnify the Bank for any reasonable expenses it incurs (i) in the preparation of this Agreement and the Loan Documents and in connection with the continued administration of the Loan Documents including any amendments, modifications, consents and waivers, (ii) creating, perfecting and maintaining its Lien on the Collateral pursuant to the Loan Documents, including filing and recording fees and expenses, the costs of any bonds required to be posted in respect of future filing and recording fees and expenses, title investigations, environmental studies, appraisals and intangible taxes, and (iii) any matters contemplated by or arising out of the Loan Documents, including Bank's customary field audit

{N0109914 } 19 6035818 charges (but, provided that no Event of Default has occurred and is continuing, only twice per year) and the reasonable fees, expenses and disbursements of the Bank or any accountants or other experts retained by the Bank (including any affiliate of Bank as shall be engaged for such purpose) in connection with accounting and collateral audits or reviews of the Borrower and its affairs; and (b) to promptly pay all fees, costs and expenses (including attorneys' fees and expenses) incurred by Bank in connection with any action to enforce any Loan Document or to collect any payments due from Borrower. All fees, costs and expenses for which Borrower is responsible under this Section 3.2 shall be deemed part of the Obligations when incurred, and shall be payable within ten (10) days following demand by the Bank. 4. COLLATERAL 4.1 Personal Property. The property listed below now owned or owned in the future by the Borrower will secure the Borrower's obligations to the Bank under this Agreement. The Collateral is further defined in security or pledge agreements executed by the parties who own the Collateral. The Collateral shall secure all other present and future obligations of the Borrower to the Bank. All Collateral securing any other present or future obligations of the Borrower to the Bank shall also secure this Agreement. (a) Inventory. (b) Accounts, chattel paper, instruments, documents of title and letter of credit rights. (c) Equipment including vehicles, trailers and any equipment or goods for which certificates of title are issued. (d) All investment property and securities entitlements. (e) Deposit accounts. (f) Intangibles including all patents, patent rights, trademarks, and servicemarks (and goodwill appurtenant thereto) trademark rights, trade names, servicemark rights, trade name rights, copyrights, trade secret rights and all other intellectual property rights. (g) Commercial tort claims. (h) The Capital Stock of the Subsidiary Borrowers. All deposit accounts shall be treated as having been owned by one single entity for purposes of setoff, paying overdrafts or other charges or expenses incurred in any one deposit account.

{N0109914 } 20 6035818 5. DISBURSEMENTS, PAYMENTS AND COSTS 5.1 Disbursements and Payments. (a) Each payment by the Borrower will be made in U.S. Dollars and immediately available funds by direct debit to a deposit account as specified below or, for payments not required to be made by direct debit, by mail to the address shown on the Borrower's statement or at one of the Bank's banking centers in the United States. (b) Each disbursement by the Bank and each payment by the Borrower will be evidenced by records kept by the Bank. In addition, the Bank may, at its discretion, require the Borrower to sign one or more promissory notes to evidence the Term Loan and the Revolving Line of Credit Loan. 5.2 Date of Application of Payments. All payments and disbursements which would be due on a day which is not a Business Day will be due on the next Business Day. All payments received on a day which is not a Business Day will be applied to the credit on the next Business Day. 6. CONDITIONS Before the Bank is required to extend any credit to the Borrower under this Agreement, it must receive any documents and other items it may reasonably require, in form and content reasonably acceptable to the Bank, including any items specifically listed below. 6.1 Loan Documents. The Bank (or its counsel) shall have received from the Borrower (i) an original of this Agreement and all Loan Documents signed on behalf of such party or (ii) written evidence satisfactory to the Bank (which may include telecopy transmission of a signed signature page of this Agreement) that such party has signed a counterpart of this Agreement. 6.2 Lien Searches. Bank shall have received Uniform Commercial Code, tax and judgment lien search reports with respect to Borrower indicating that there are no prior Liens on any assets of Borrower other than Permitted Liens. 6.3 Authorizations. The Bank shall have received such documents and certificates as the Bank or its counsel may reasonably request relating to the organization, existence and good standing of the Borrower, the authorization of the Borrower to enter into this Agreement and any other legal matters relating to the Borrower or the Loan Documents, all in form and substance satisfactory to the Bank and its counsel.

{N0109914 } 21 6035818 6.4 Governing Documents. Such documents and certifications as Bank may reasonably require to evidence that the Borrower is duly organized or formed, and that the Borrower is validly existing, in good standing and qualified to engage in business in each jurisdiction where its ownership, lease or operation of properties or the conduct of its business requires such qualification, except to the extent that failure to do so could not reasonably be expected to have a Material Adverse Effect. 6.5 Collateral Assignments and Related Documents. Signed original assignments, pledges, financing statements or other documents as may be necessary for Bank to perfect its security interest in the Collateral. 6.6 Perfection and Evidence of Priority. Evidence that the security interests and liens in favor of the Bank are valid, enforceable, properly perfected in a manner acceptable to the Bank and prior to all others' rights and interests, except those the Bank consents to in writing or permitted under Section 8.7. 6.7 Payment of Fees. Payment of all fees and other amounts due and owing to the Bank, including without limitation payment of all accrued and unpaid expenses incurred by the Bank as required by Section 3.2. 6.8 Legal Opinion. A favorable written opinion from the Borrower's legal counsel, addressed to Bank, with respect to due execution, authority, enforceability of the Loan Documents, and such other matters as the Bank may require. The legal counsel and the terms of the opinion must be reasonably acceptable to the Bank. 6.9 Know Your Customer. The Bank shall have received all documentation and other information required by regulatory authorities under applicable “know your customer” and anti-money laundering rules and regulations, including the Patriot Act. 6.10 Ownership Interests in Subsidiary Borrowers. As of the date of this Agreement, Company owns all of the Capital Stock in the Subsidiary Borrowers issued and outstanding, all of which are owned by the Company free and clear of all encumbrances. The pledge, collateral assignment and delivery of the Capital Stock of the Subsidiary Borrowers pursuant to a Pledge Agreement create a valid first lien and first and senior security interest in the Capital Stock of the Subsidiary Borrowers, which lien and security interest are perfected. 6.11 Conditions to All Advances.