Grove Resource Solutions, Inc. Financial Statements and Independent Auditor's Report December 31, 2021 and 2020

Grove Resource Solutions, Inc. Index 1 Page Independent Auditor's Report 2 Financial Statements Balance Sheets 4 Statements of Income 5 Statements of Changes in Stockholders' Equity 6 Statements of Cash Flows 7 Notes to Financial Statements 8

2 Independent Auditor's Report To the Board of Directors and Management Grove Resource Solutions, Inc. Opinion We have audited the financial statements of Grove Resource Solutions, Inc. (the "Company"), which comprise the balance sheets as of December 31, 2021 and 2020, and the related statements of income, changes in stockholders' equity, and cash flows for the years then ended, and the related notes to the financial statements. In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of the Company as of December 31, 2021 and 2020, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Basis for Opinion We conducted our audits in accordance with auditing standards generally accepted in the United States of America ("GAAS"). Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Responsibilities of Management for the Financial Statements Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error. In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for one year after the date that the financial statements are issued. Auditor's Responsibilities for the Audit of the Financial Statements Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

3 In performing an audit in accordance with GAAS, we: • Exercise professional judgment and maintain professional skepticism throughout the audit. • Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. • Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control. Accordingly, no such opinion is expressed. • Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. • Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about the Company's ability to continue as a going concern for a reasonable period of time. We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit. Tysons, Virginia October 31, 2022

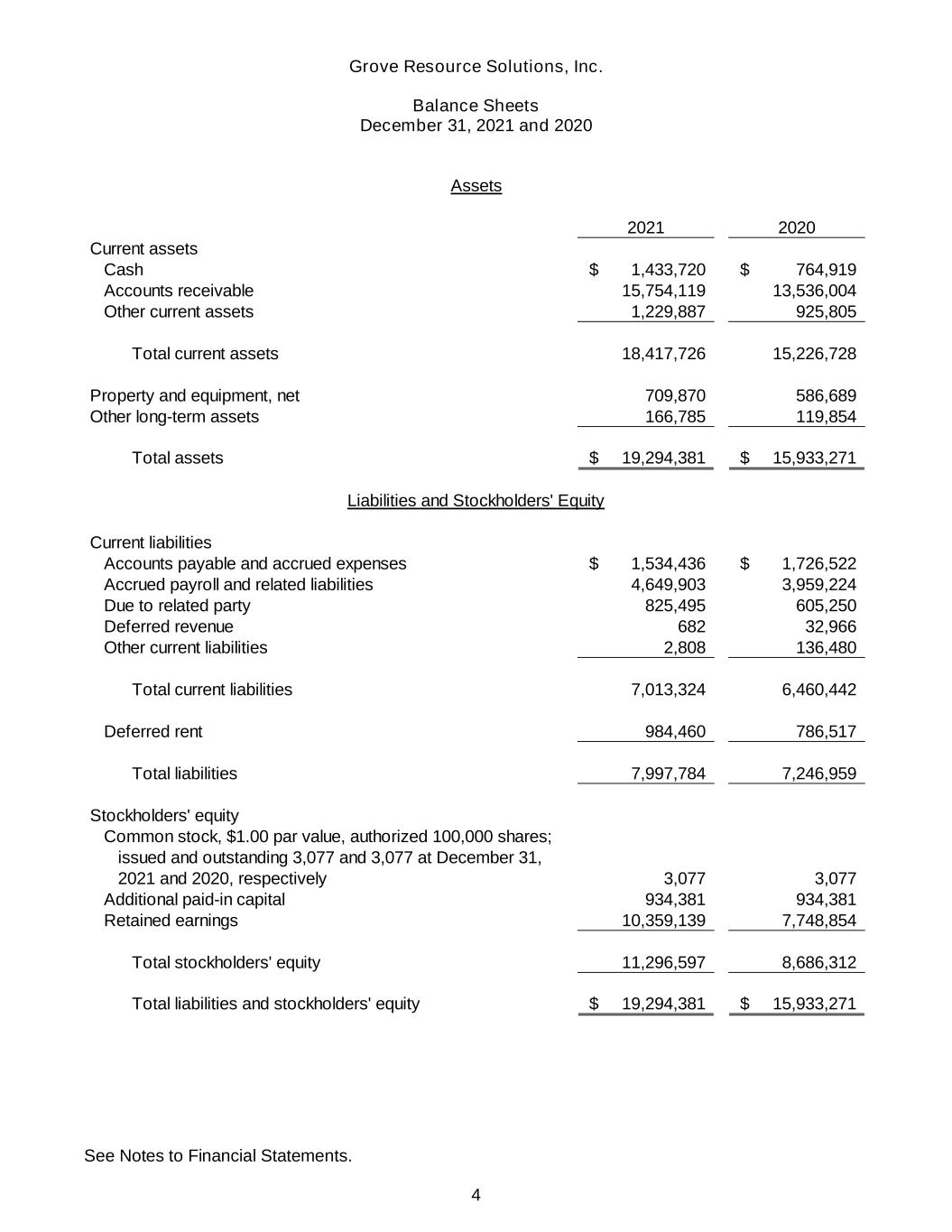

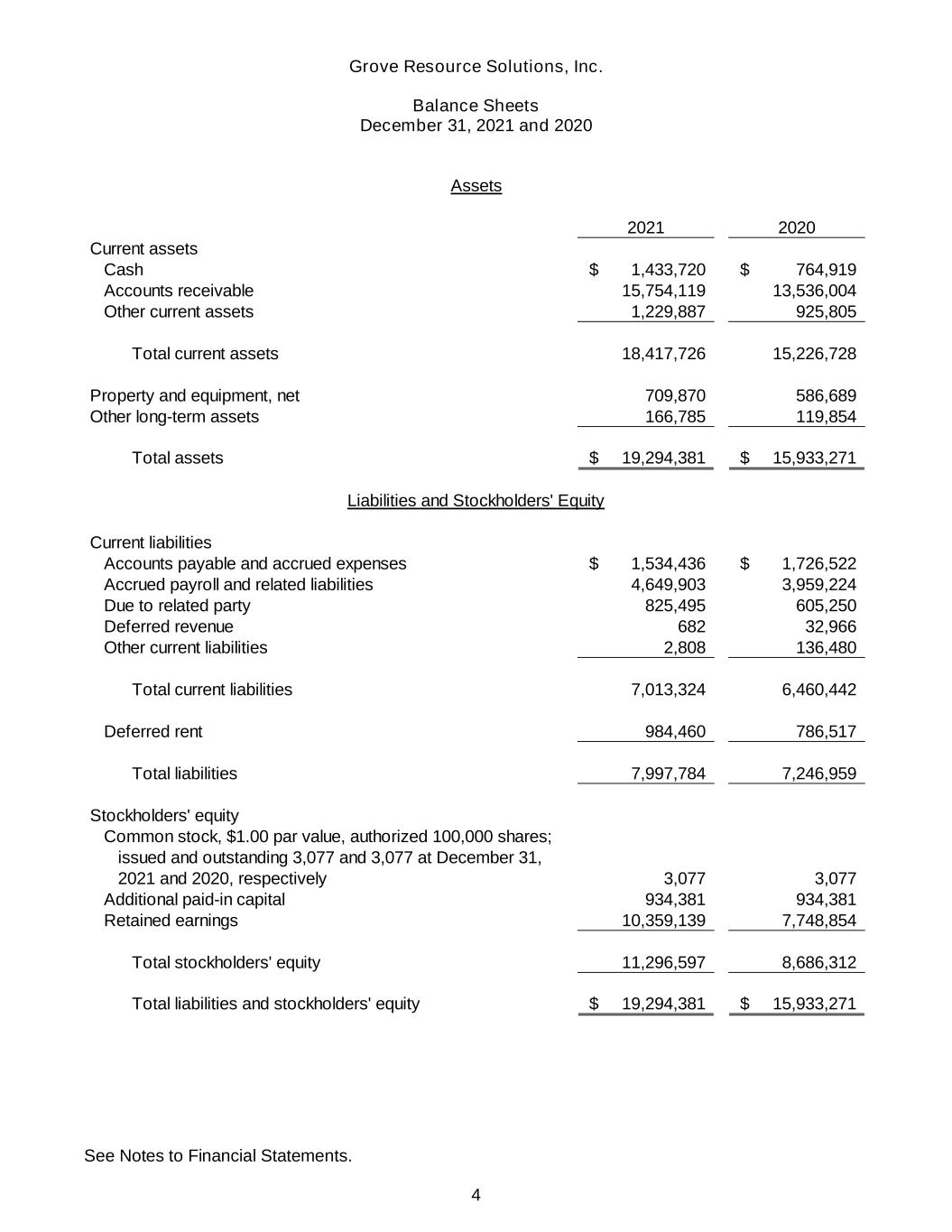

Grove Resource Solutions, Inc. Balance Sheets December 31, 2021 and 2020 See Notes to Financial Statements. 4 2021 2020 Current assets Cash 1,433,720$ 764,919$ Accounts receivable 15,754,119 13,536,004 Other current assets 1,229,887 925,805 Total current assets 18,417,726 15,226,728 Property and equipment, net 709,870 586,689 Other long-term assets 166,785 119,854 Total assets 19,294,381$ 15,933,271$ Current liabilities Accounts payable and accrued expenses 1,534,436$ 1,726,522$ Accrued payroll and related liabilities 4,649,903 3,959,224 Due to related party 825,495 605,250 Deferred revenue 682 32,966 Other current liabilities 2,808 136,480 Total current liabilities 7,013,324 6,460,442 Deferred rent 984,460 786,517 Total liabilities 7,997,784 7,246,959 Stockholders' equity Common stock, $1.00 par value, authorized 100,000 shares; issued and outstanding 3,077 and 3,077 at December 31, 2021 and 2020, respectively 3,077 3,077 Additional paid-in capital 934,381 934,381 Retained earnings 10,359,139 7,748,854 Total stockholders' equity 11,296,597 8,686,312 Total liabilities and stockholders' equity 19,294,381$ 15,933,271$ Liabilities and Stockholders' Equity Assets

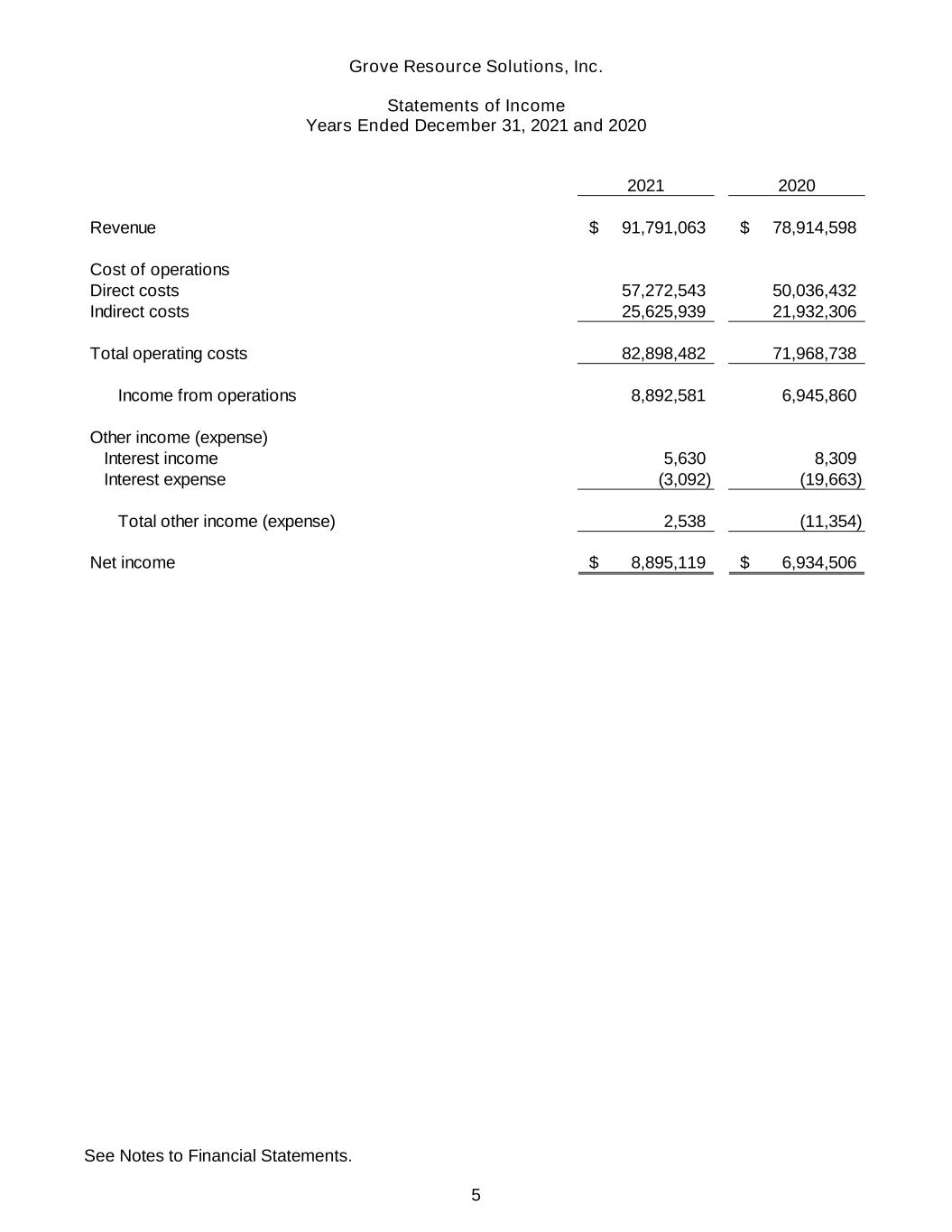

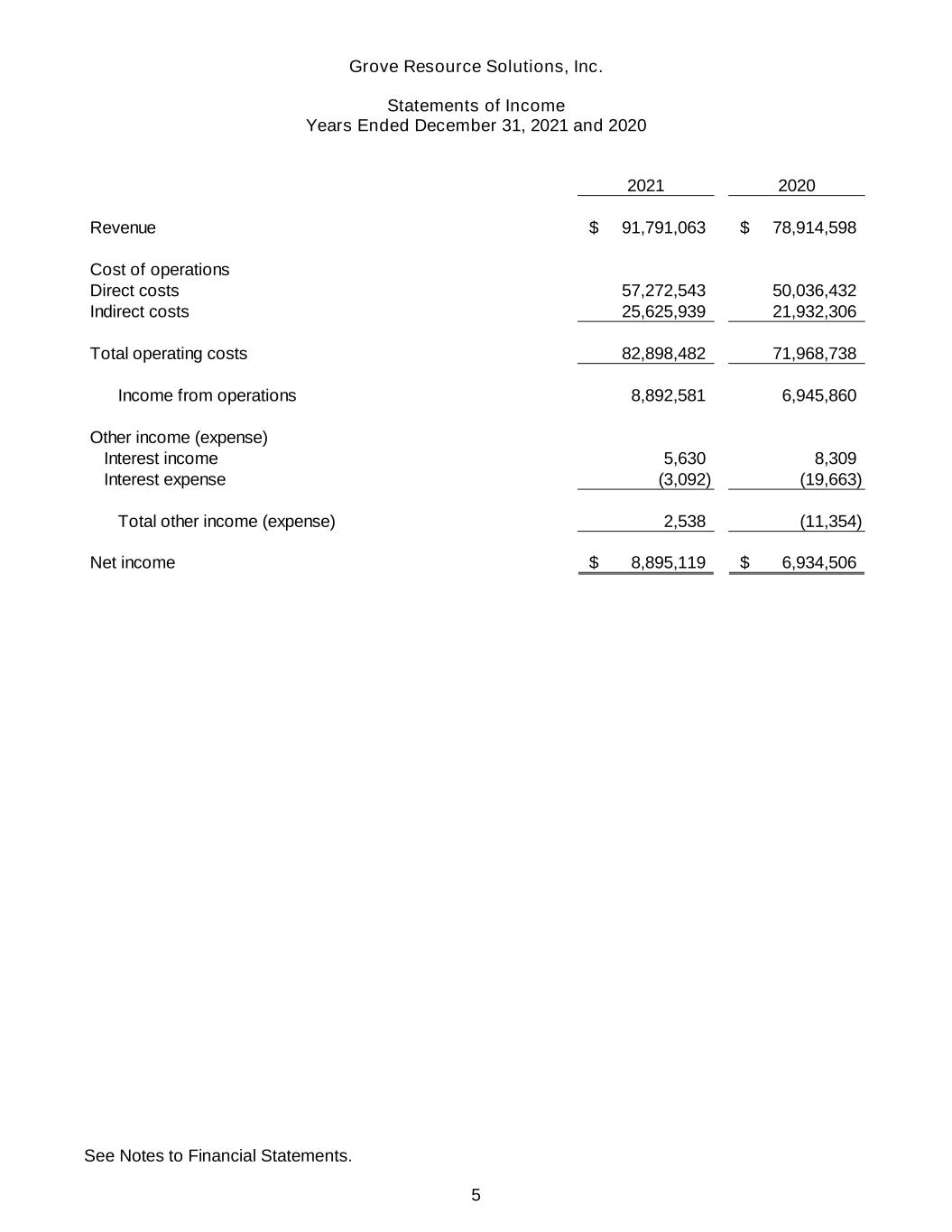

Grove Resource Solutions, Inc. Statements of Income Years Ended December 31, 2021 and 2020 See Notes to Financial Statements. 5 2021 2020 Revenue 91,791,063$ 78,914,598$ Cost of operations Direct costs 57,272,543 50,036,432 Indirect costs 25,625,939 21,932,306 Total operating costs 82,898,482 71,968,738 Income from operations 8,892,581 6,945,860 Other income (expense) Interest income 5,630 8,309 Interest expense (3,092) (19,663) Total other income (expense) 2,538 (11,354) Net income 8,895,119$ 6,934,506$

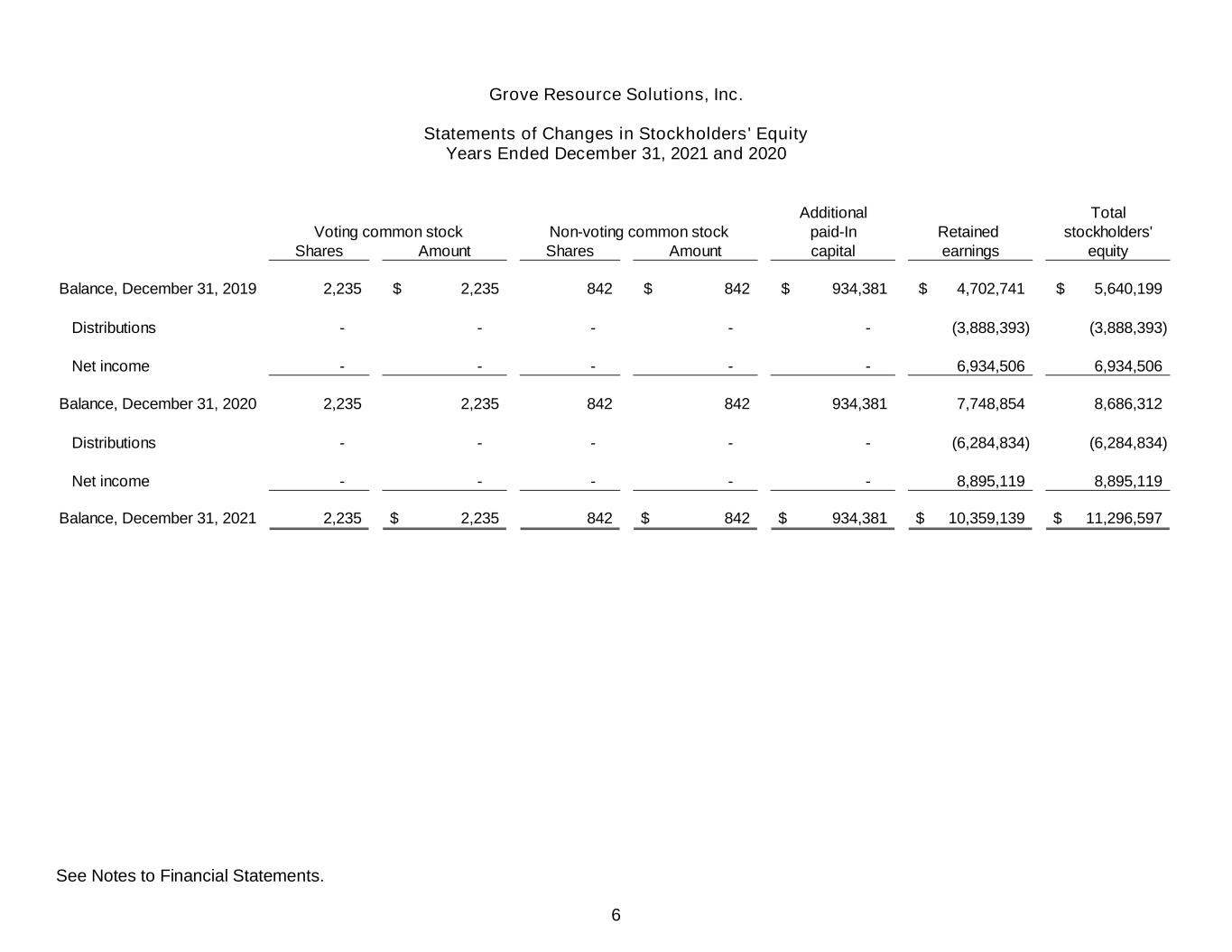

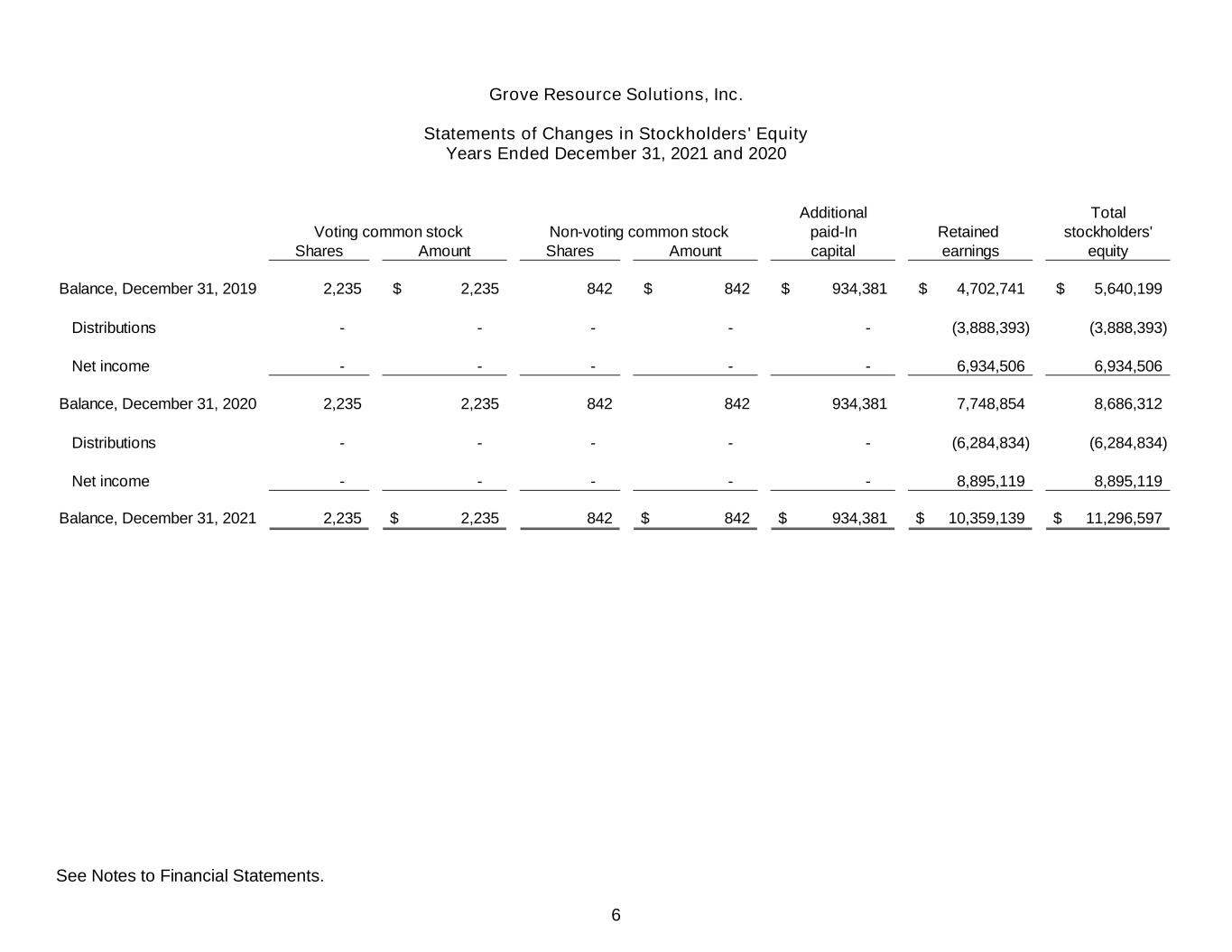

Grove Resource Solutions, Inc. Statements of Changes in Stockholders' Equity Years Ended December 31, 2021 and 2020 See Notes to Financial Statements. 6 Additional Total paid-In Retained stockholders' Shares Amount Shares Amount capital earnings equity Balance, December 31, 2019 2,235 2,235$ 842 842$ 934,381$ 4,702,741$ 5,640,199$ Distributions - - - - - (3,888,393) (3,888,393) Net income - - - - - 6,934,506 6,934,506 Balance, December 31, 2020 2,235 2,235 842 842 934,381 7,748,854 8,686,312 Distributions - - - - - (6,284,834) (6,284,834) Net income - - - - - 8,895,119 8,895,119 Balance, December 31, 2021 2,235 2,235$ 842 842$ 934,381$ 10,359,139$ 11,296,597$ Voting common stock Non-voting common stock

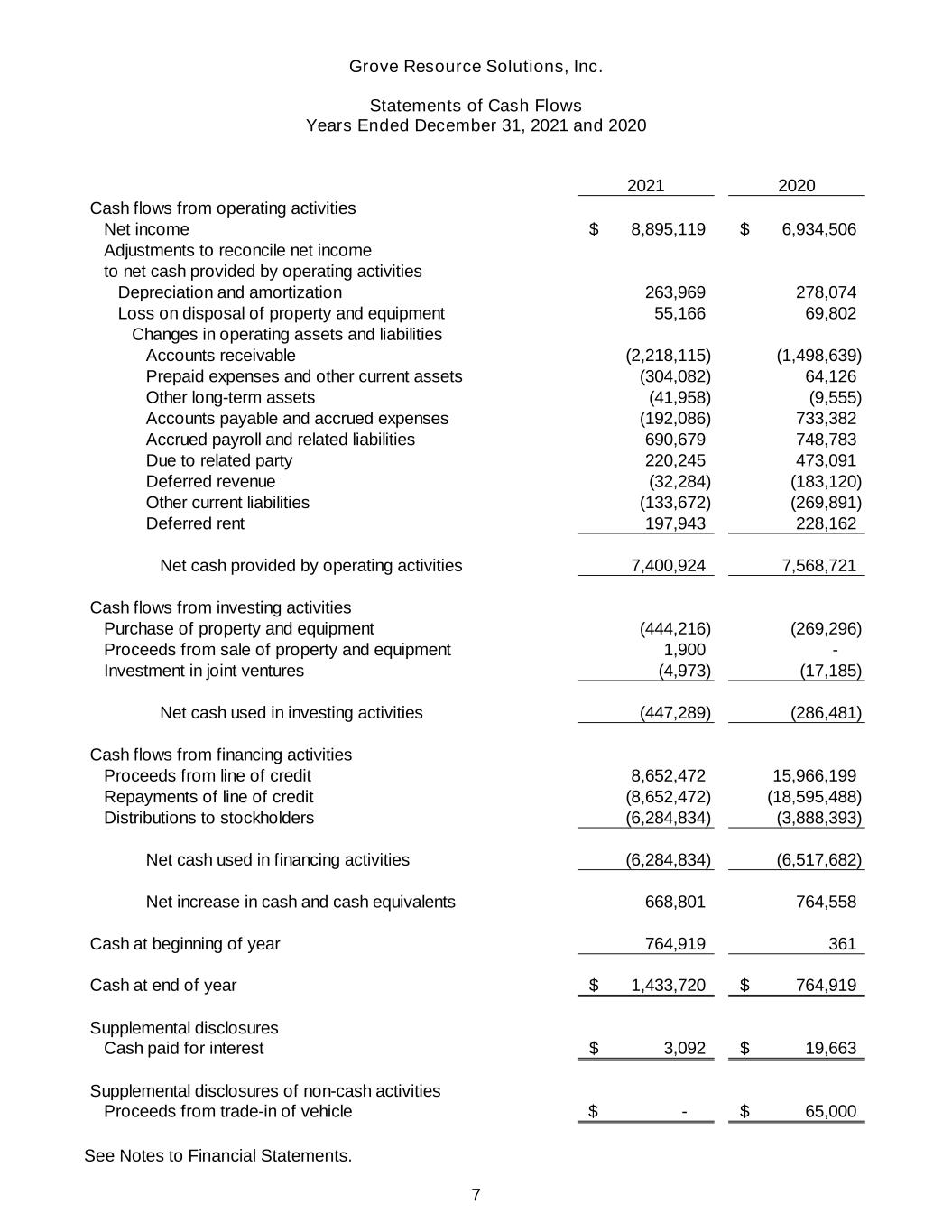

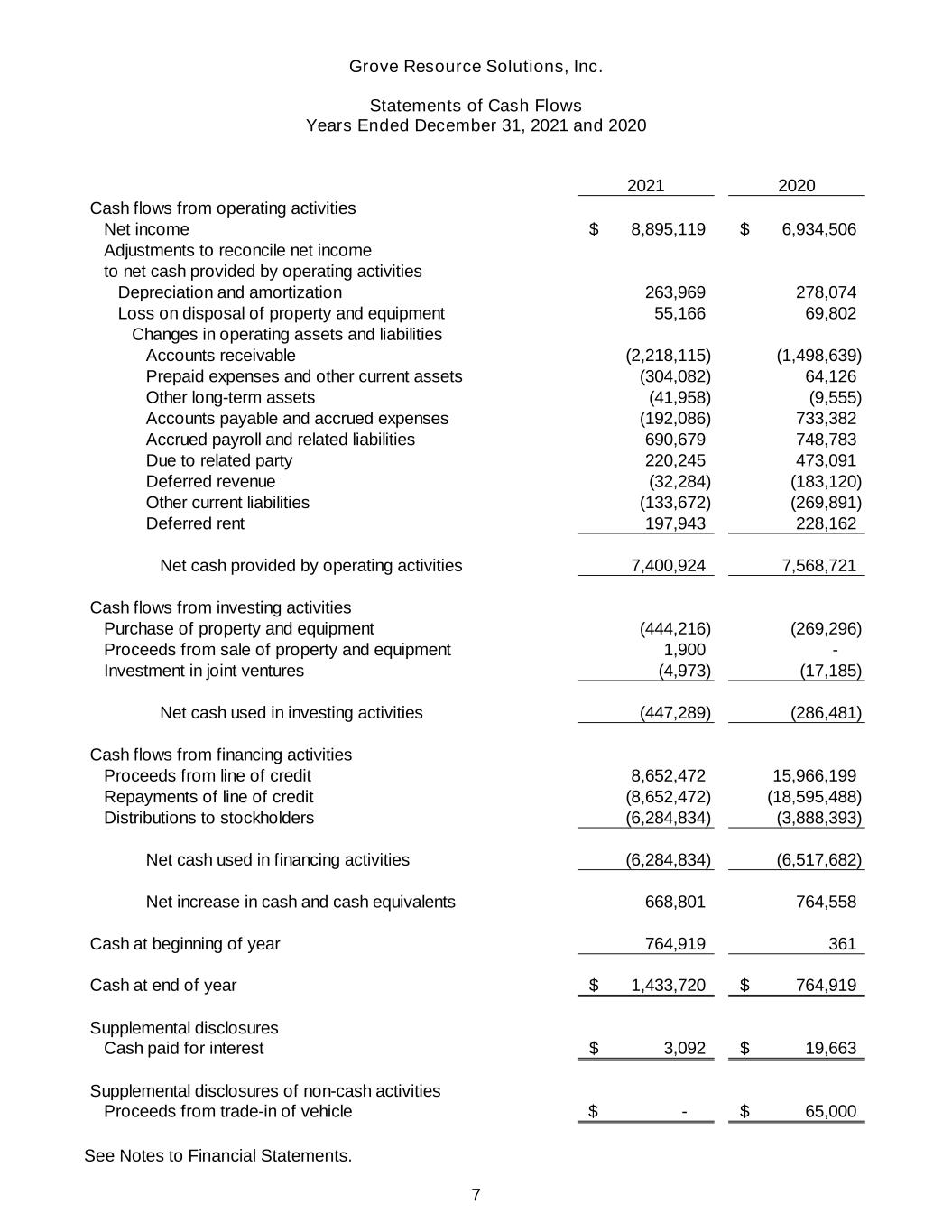

Grove Resource Solutions, Inc. Statements of Cash Flows Years Ended December 31, 2021 and 2020 See Notes to Financial Statements. 7 2021 2020 Cash flows from operating activities Net income 8,895,119$ 6,934,506$ Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 263,969 278,074 Loss on disposal of property and equipment 55,166 69,802 Changes in operating assets and liabilities Accounts receivable (2,218,115) (1,498,639) Prepaid expenses and other current assets (304,082) 64,126 Other long-term assets (41,958) (9,555) Accounts payable and accrued expenses (192,086) 733,382 Accrued payroll and related liabilities 690,679 748,783 Due to related party 220,245 473,091 Deferred revenue (32,284) (183,120) Other current liabilities (133,672) (269,891) Deferred rent 197,943 228,162 Net cash provided by operating activities 7,400,924 7,568,721 Cash flows from investing activities Purchase of property and equipment (444,216) (269,296) Proceeds from sale of property and equipment 1,900 - Investment in joint ventures (4,973) (17,185) Net cash used in investing activities (447,289) (286,481) Cash flows from financing activities Proceeds from line of credit 8,652,472 15,966,199 Repayments of line of credit (8,652,472) (18,595,488) Distributions to stockholders (6,284,834) (3,888,393) Net cash used in financing activities (6,284,834) (6,517,682) Net increase in cash and cash equivalents 668,801 764,558 Cash at beginning of year 764,919 361 Cash at end of year 1,433,720$ 764,919$ Supplemental disclosures Cash paid for interest 3,092$ 19,663$ Supplemental disclosures of non-cash activities Proceeds from trade-in of vehicle -$ 65,000$

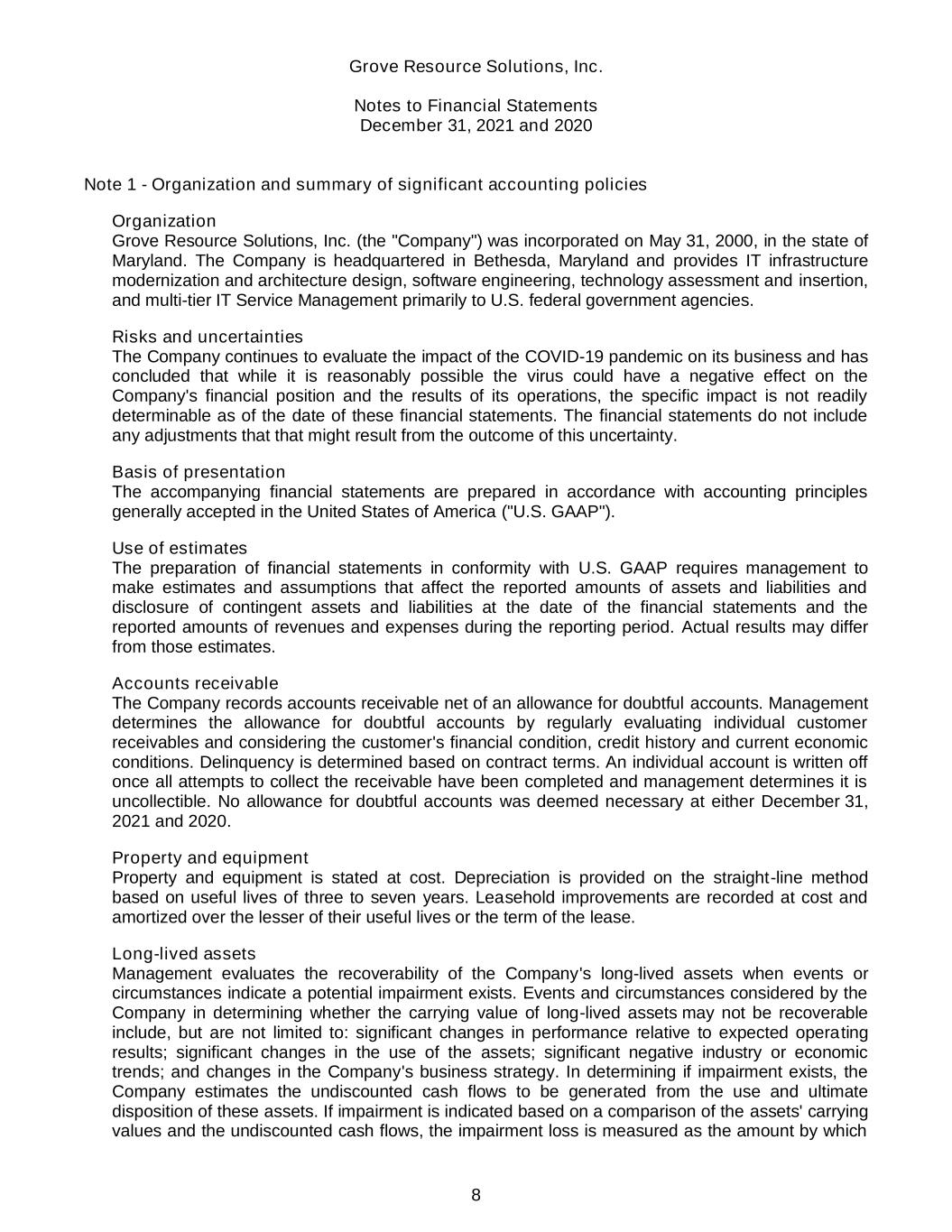

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 8 Note 1 - Organization and summary of significant accounting policies Organization Grove Resource Solutions, Inc. (the "Company") was incorporated on May 31, 2000, in the state of Maryland. The Company is headquartered in Bethesda, Maryland and provides IT infrastructure modernization and architecture design, software engineering, technology assessment and insertion, and multi-tier IT Service Management primarily to U.S. federal government agencies. Risks and uncertainties The Company continues to evaluate the impact of the COVID-19 pandemic on its business and has concluded that while it is reasonably possible the virus could have a negative effect on the Company's financial position and the results of its operations, the specific impact is not readily determinable as of the date of these financial statements. The financial statements do not include any adjustments that that might result from the outcome of this uncertainty. Basis of presentation The accompanying financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("U.S. GAAP"). Use of estimates The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates. Accounts receivable The Company records accounts receivable net of an allowance for doubtful accounts. Management determines the allowance for doubtful accounts by regularly evaluating individual customer receivables and considering the customer's financial condition, credit history and current economic conditions. Delinquency is determined based on contract terms. An individual account is written off once all attempts to collect the receivable have been completed and management determines it is uncollectible. No allowance for doubtful accounts was deemed necessary at either December 31, 2021 and 2020. Property and equipment Property and equipment is stated at cost. Depreciation is provided on the straight-line method based on useful lives of three to seven years. Leasehold improvements are recorded at cost and amortized over the lesser of their useful lives or the term of the lease. Long-lived assets Management evaluates the recoverability of the Company's long-lived assets when events or circumstances indicate a potential impairment exists. Events and circumstances considered by the Company in determining whether the carrying value of long-lived assets may not be recoverable include, but are not limited to: significant changes in performance relative to expected operating results; significant changes in the use of the assets; significant negative industry or economic trends; and changes in the Company's business strategy. In determining if impairment exists, the Company estimates the undiscounted cash flows to be generated from the use and ultimate disposition of these assets. If impairment is indicated based on a comparison of the assets' carrying values and the undiscounted cash flows, the impairment loss is measured as the amount by which

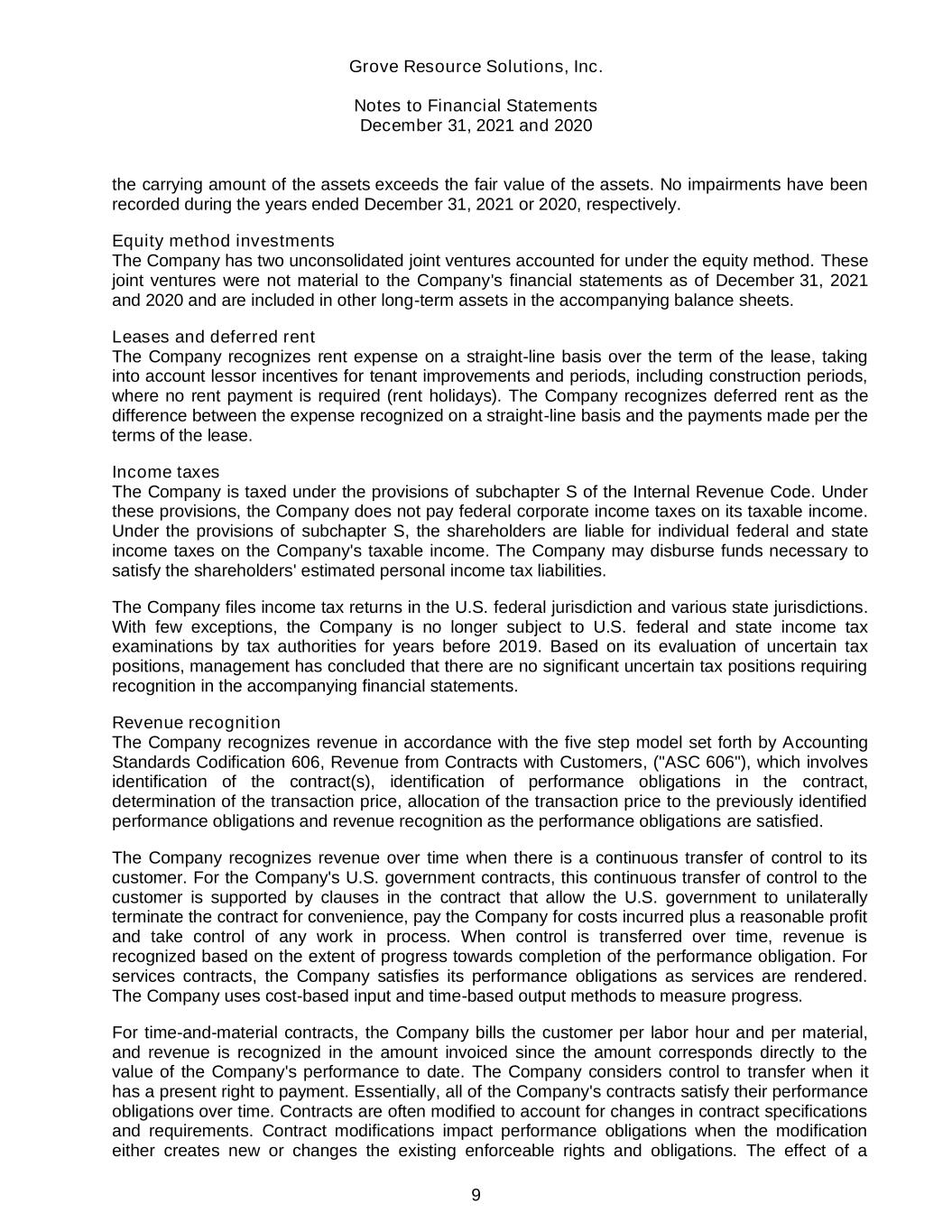

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 9 the carrying amount of the assets exceeds the fair value of the assets. No impairments have been recorded during the years ended December 31, 2021 or 2020, respectively. Equity method investments The Company has two unconsolidated joint ventures accounted for under the equity method. These joint ventures were not material to the Company's financial statements as of December 31, 2021 and 2020 and are included in other long-term assets in the accompanying balance sheets. Leases and deferred rent The Company recognizes rent expense on a straight-line basis over the term of the lease, taking into account lessor incentives for tenant improvements and periods, including construction periods, where no rent payment is required (rent holidays). The Company recognizes deferred rent as the difference between the expense recognized on a straight-line basis and the payments made per the terms of the lease. Income taxes The Company is taxed under the provisions of subchapter S of the Internal Revenue Code. Under these provisions, the Company does not pay federal corporate income taxes on its taxable income. Under the provisions of subchapter S, the shareholders are liable for individual federal and state income taxes on the Company's taxable income. The Company may disburse funds necessary to satisfy the shareholders' estimated personal income tax liabilities. The Company files income tax returns in the U.S. federal jurisdiction and various state jurisdictions. With few exceptions, the Company is no longer subject to U.S. federal and state income tax examinations by tax authorities for years before 2019. Based on its evaluation of uncertain tax positions, management has concluded that there are no significant uncertain tax positions requiring recognition in the accompanying financial statements. Revenue recognition The Company recognizes revenue in accordance with the five step model set forth by Accounting Standards Codification 606, Revenue from Contracts with Customers, ("ASC 606"), which involves identification of the contract(s), identification of performance obligations in the contract, determination of the transaction price, allocation of the transaction price to the previously identified performance obligations and revenue recognition as the performance obligations are satisfied. The Company recognizes revenue over time when there is a continuous transfer of control to its customer. For the Company's U.S. government contracts, this continuous transfer of control to the customer is supported by clauses in the contract that allow the U.S. government to unilaterally terminate the contract for convenience, pay the Company for costs incurred plus a reasonable profit and take control of any work in process. When control is transferred over time, revenue is recognized based on the extent of progress towards completion of the performance obligation. For services contracts, the Company satisfies its performance obligations as services are rendered. The Company uses cost-based input and time-based output methods to measure progress. For time-and-material contracts, the Company bills the customer per labor hour and per material, and revenue is recognized in the amount invoiced since the amount corresponds directly to the value of the Company's performance to date. The Company considers control to transfer when it has a present right to payment. Essentially, all of the Company's contracts satisfy their performance obligations over time. Contracts are often modified to account for changes in contract specifications and requirements. Contract modifications impact performance obligations when the modification either creates new or changes the existing enforceable rights and obligations. The effect of a

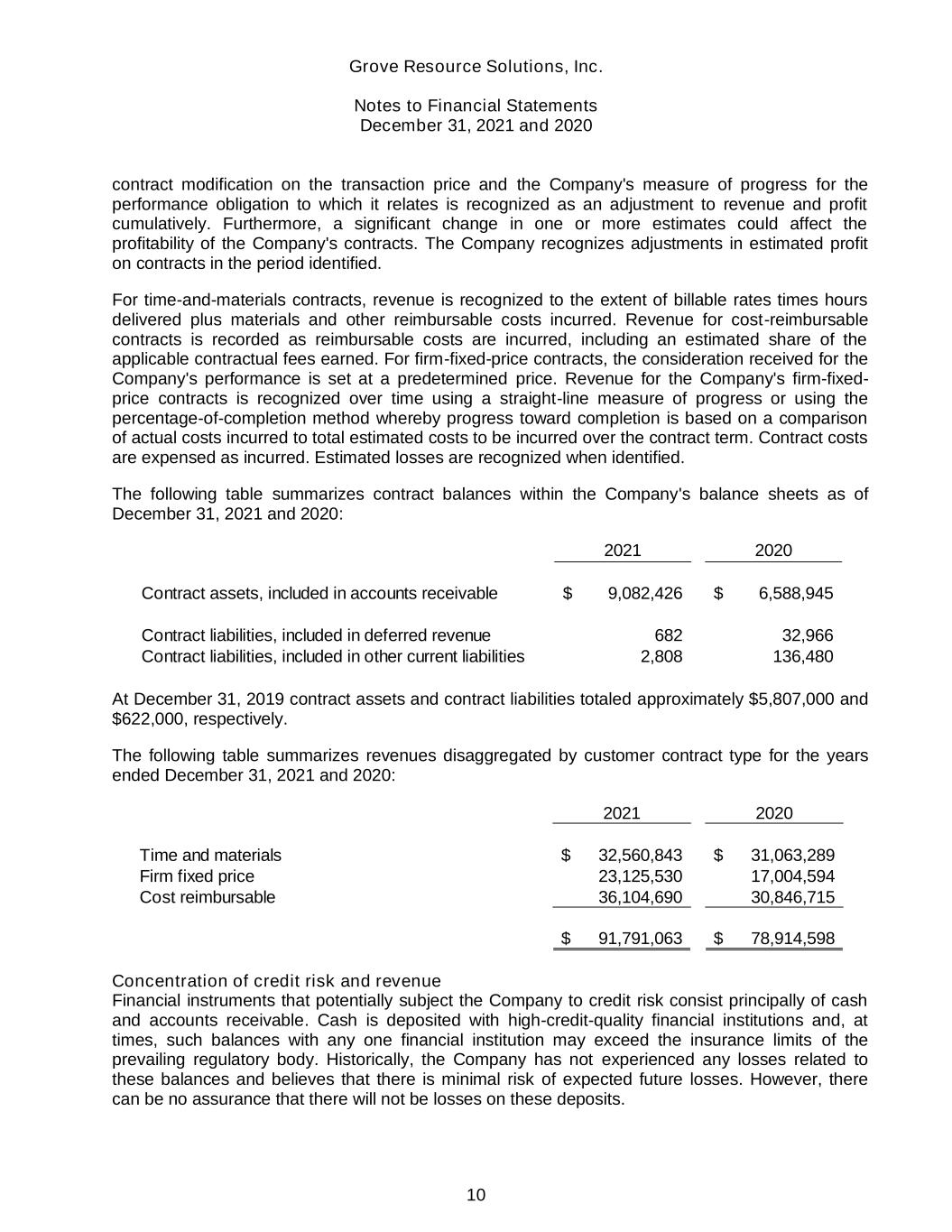

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 10 contract modification on the transaction price and the Company's measure of progress for the performance obligation to which it relates is recognized as an adjustment to revenue and profit cumulatively. Furthermore, a significant change in one or more estimates could affect the profitability of the Company's contracts. The Company recognizes adjustments in estimated profit on contracts in the period identified. For time-and-materials contracts, revenue is recognized to the extent of billable rates times hours delivered plus materials and other reimbursable costs incurred. Revenue for cost-reimbursable contracts is recorded as reimbursable costs are incurred, including an estimated share of the applicable contractual fees earned. For firm-fixed-price contracts, the consideration received for the Company's performance is set at a predetermined price. Revenue for the Company's firm-fixed- price contracts is recognized over time using a straight-line measure of progress or using the percentage-of-completion method whereby progress toward completion is based on a comparison of actual costs incurred to total estimated costs to be incurred over the contract term. Contract costs are expensed as incurred. Estimated losses are recognized when identified. The following table summarizes contract balances within the Company's balance sheets as of December 31, 2021 and 2020: 2021 2020 Contract assets, included in accounts receivable 9,082,426$ 6,588,945$ Contract liabilities, included in deferred revenue 682 32,966 Contract liabilities, included in other current liabilities 2,808 136,480 At December 31, 2019 contract assets and contract liabilities totaled approximately $5,807,000 and $622,000, respectively. The following table summarizes revenues disaggregated by customer contract type for the years ended December 31, 2021 and 2020: 2021 2020 Time and materials 32,560,843$ 31,063,289$ Firm fixed price 23,125,530 17,004,594 Cost reimbursable 36,104,690 30,846,715 91,791,063$ 78,914,598$ Concentration of credit risk and revenue Financial instruments that potentially subject the Company to credit risk consist principally of cash and accounts receivable. Cash is deposited with high-credit-quality financial institutions and, at times, such balances with any one financial institution may exceed the insurance limits of the prevailing regulatory body. Historically, the Company has not experienced any losses related to these balances and believes that there is minimal risk of expected future losses. However, there can be no assurance that there will not be losses on these deposits.

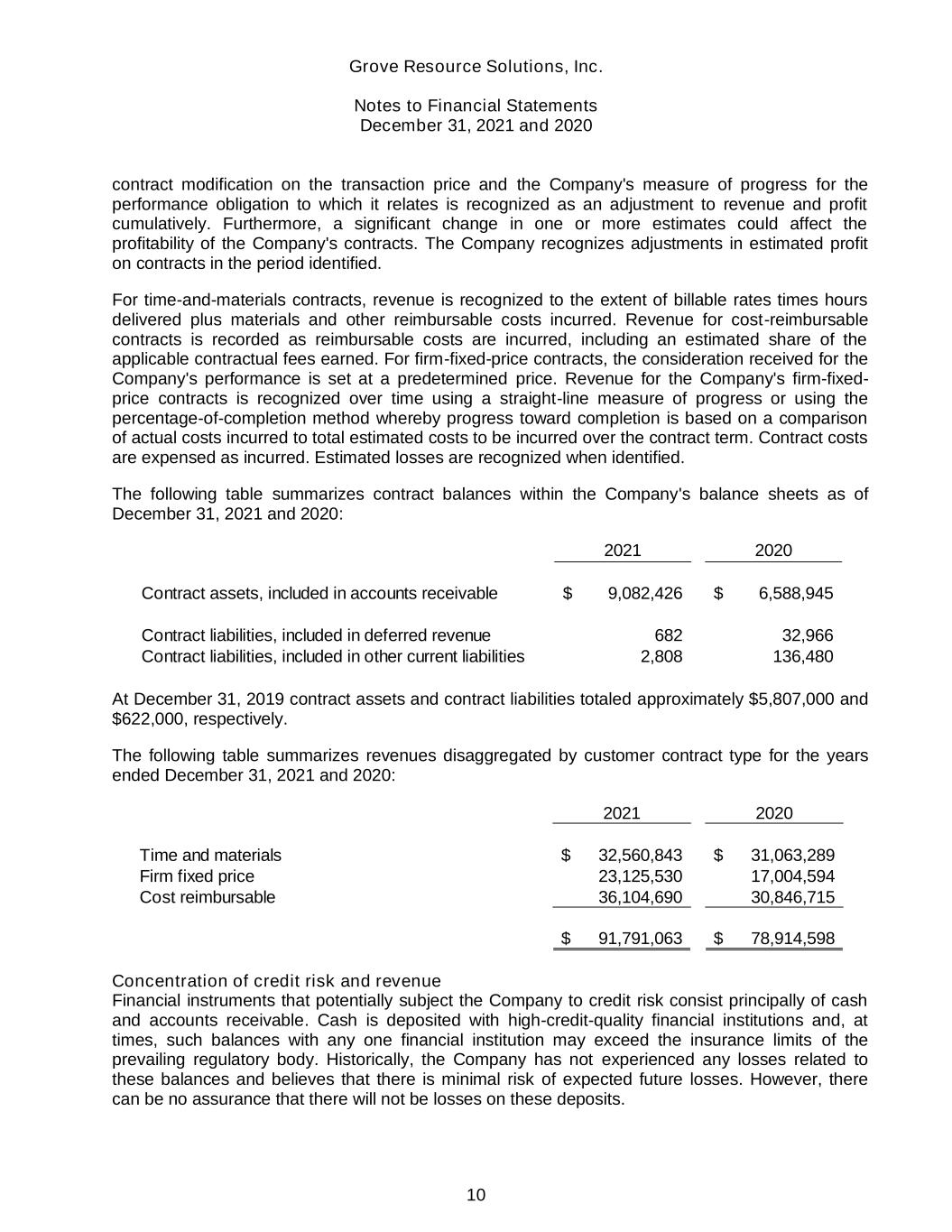

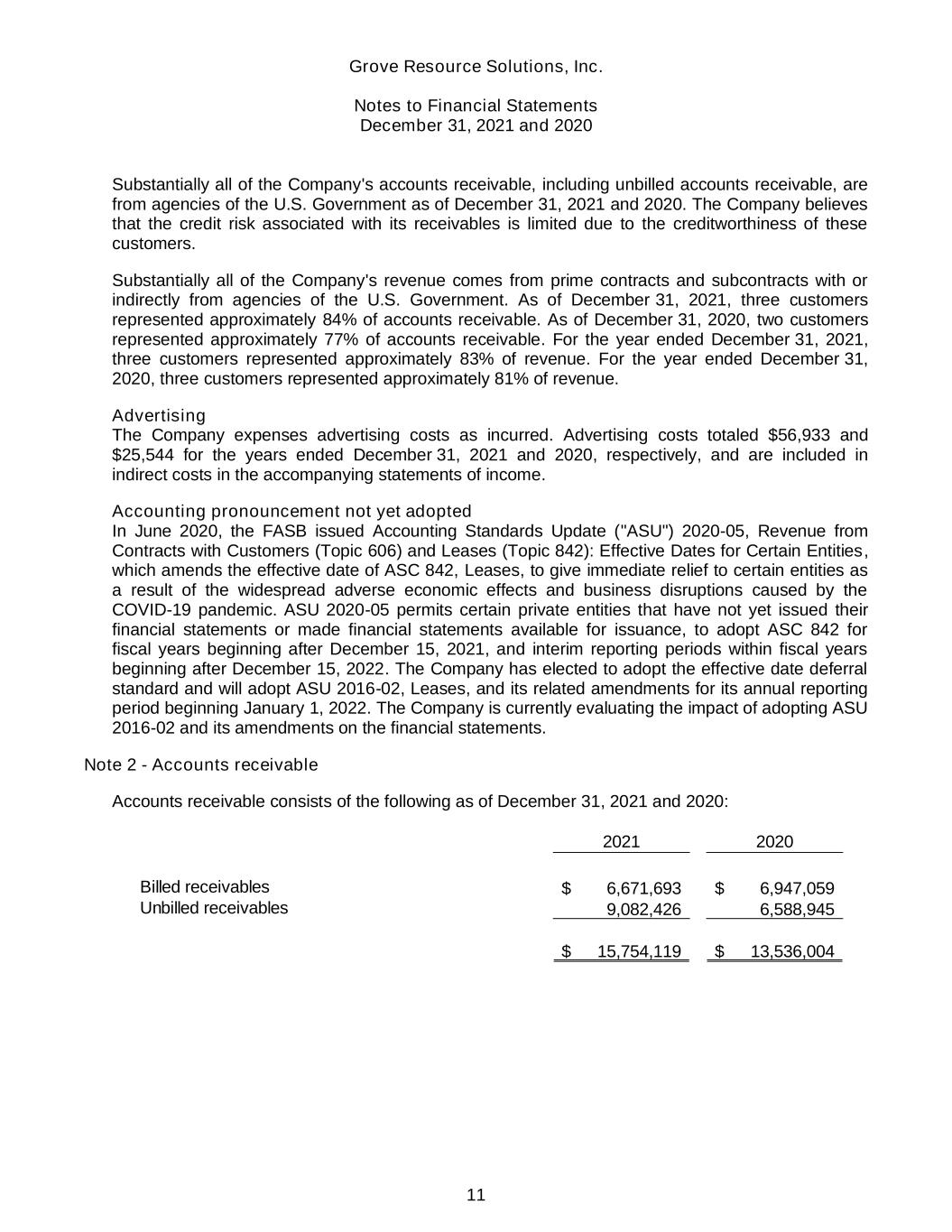

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 11 Substantially all of the Company's accounts receivable, including unbilled accounts receivable, are from agencies of the U.S. Government as of December 31, 2021 and 2020. The Company believes that the credit risk associated with its receivables is limited due to the creditworthiness of these customers. Substantially all of the Company's revenue comes from prime contracts and subcontracts with or indirectly from agencies of the U.S. Government. As of December 31, 2021, three customers represented approximately 84% of accounts receivable. As of December 31, 2020, two customers represented approximately 77% of accounts receivable. For the year ended December 31, 2021, three customers represented approximately 83% of revenue. For the year ended December 31, 2020, three customers represented approximately 81% of revenue. Advertising The Company expenses advertising costs as incurred. Advertising costs totaled $56,933 and $25,544 for the years ended December 31, 2021 and 2020, respectively, and are included in indirect costs in the accompanying statements of income. Accounting pronouncement not yet adopted In June 2020, the FASB issued Accounting Standards Update ("ASU") 2020-05, Revenue from Contracts with Customers (Topic 606) and Leases (Topic 842): Effective Dates for Certain Entities, which amends the effective date of ASC 842, Leases, to give immediate relief to certain entities as a result of the widespread adverse economic effects and business disruptions caused by the COVID-19 pandemic. ASU 2020-05 permits certain private entities that have not yet issued their financial statements or made financial statements available for issuance, to adopt ASC 842 for fiscal years beginning after December 15, 2021, and interim reporting periods within fiscal years beginning after December 15, 2022. The Company has elected to adopt the effective date deferral standard and will adopt ASU 2016-02, Leases, and its related amendments for its annual reporting period beginning January 1, 2022. The Company is currently evaluating the impact of adopting ASU 2016-02 and its amendments on the financial statements. Note 2 - Accounts receivable Accounts receivable consists of the following as of December 31, 2021 and 2020: 2021 2020 Billed receivables 6,671,693$ 6,947,059$ Unbilled receivables 9,082,426 6,588,945 15,754,119$ 13,536,004$

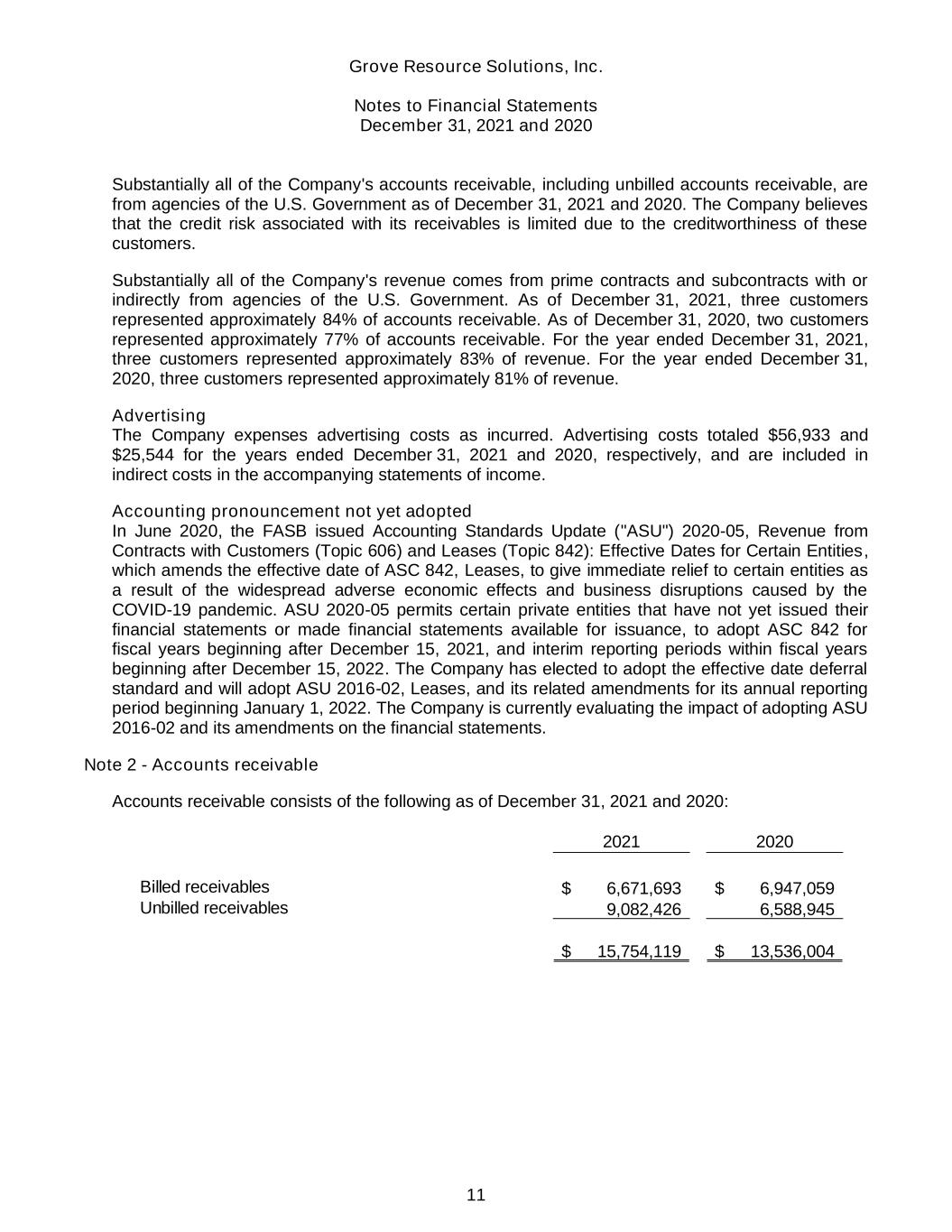

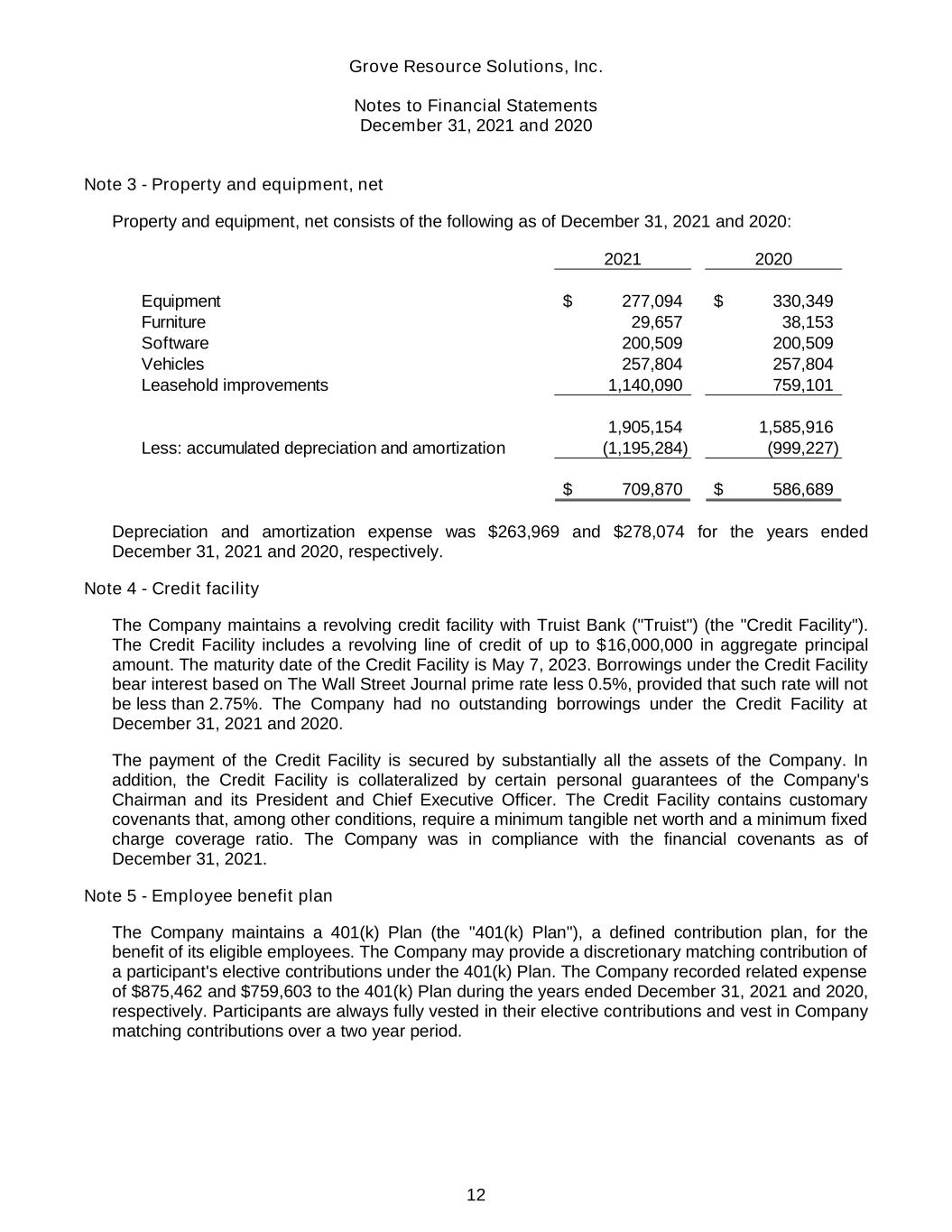

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 12 Note 3 - Property and equipment, net Property and equipment, net consists of the following as of December 31, 2021 and 2020: 2021 2020 Equipment 277,094$ 330,349$ Furniture 29,657 38,153 Software 200,509 200,509 Vehicles 257,804 257,804 Leasehold improvements 1,140,090 759,101 1,905,154 1,585,916 Less: accumulated depreciation and amortization (1,195,284) (999,227) 709,870$ 586,689$ Depreciation and amortization expense was $263,969 and $278,074 for the years ended December 31, 2021 and 2020, respectively. Note 4 - Credit facility The Company maintains a revolving credit facility with Truist Bank ("Truist") (the "Credit Facility"). The Credit Facility includes a revolving line of credit of up to $16,000,000 in aggregate principal amount. The maturity date of the Credit Facility is May 7, 2023. Borrowings under the Credit Facility bear interest based on The Wall Street Journal prime rate less 0.5%, provided that such rate will not be less than 2.75%. The Company had no outstanding borrowings under the Credit Facility at December 31, 2021 and 2020. The payment of the Credit Facility is secured by substantially all the assets of the Company. In addition, the Credit Facility is collateralized by certain personal guarantees of the Company's Chairman and its President and Chief Executive Officer. The Credit Facility contains customary covenants that, among other conditions, require a minimum tangible net worth and a minimum fixed charge coverage ratio. The Company was in compliance with the financial covenants as of December 31, 2021. Note 5 - Employee benefit plan The Company maintains a 401(k) Plan (the "401(k) Plan"), a defined contribution plan, for the benefit of its eligible employees. The Company may provide a discretionary matching contribution of a participant's elective contributions under the 401(k) Plan. The Company recorded related expense of $875,462 and $759,603 to the 401(k) Plan during the years ended December 31, 2021 and 2020, respectively. Participants are always fully vested in their elective contributions and vest in Company matching contributions over a two year period.

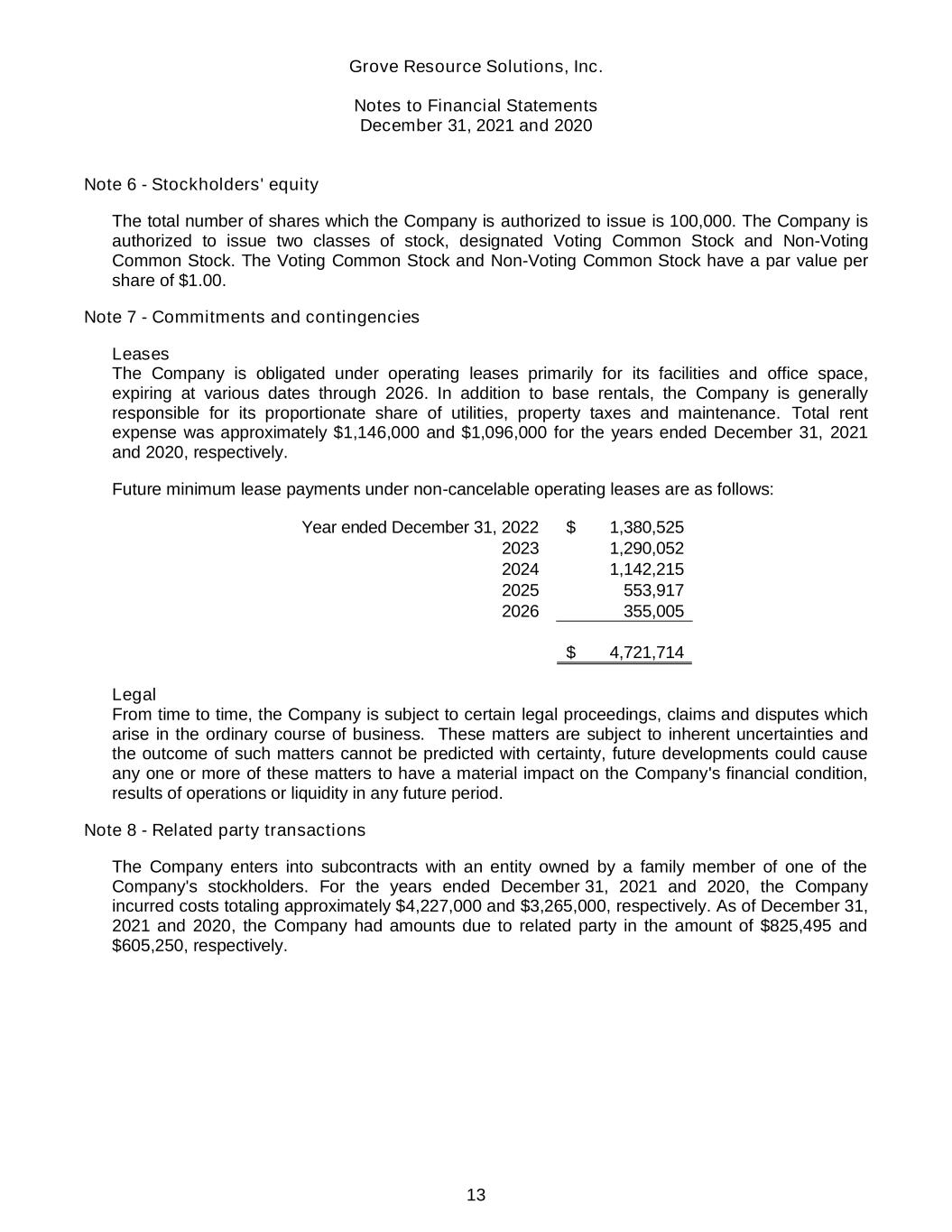

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 13 Note 6 - Stockholders' equity The total number of shares which the Company is authorized to issue is 100,000. The Company is authorized to issue two classes of stock, designated Voting Common Stock and Non-Voting Common Stock. The Voting Common Stock and Non-Voting Common Stock have a par value per share of $1.00. Note 7 - Commitments and contingencies Leases The Company is obligated under operating leases primarily for its facilities and office space, expiring at various dates through 2026. In addition to base rentals, the Company is generally responsible for its proportionate share of utilities, property taxes and maintenance. Total rent expense was approximately $1,146,000 and $1,096,000 for the years ended December 31, 2021 and 2020, respectively. Future minimum lease payments under non-cancelable operating leases are as follows: Year ended December 31, 2022 1,380,525$ 2023 1,290,052 2024 1,142,215 2025 553,917 2026 355,005 4,721,714$ Legal From time to time, the Company is subject to certain legal proceedings, claims and disputes which arise in the ordinary course of business. These matters are subject to inherent uncertainties and the outcome of such matters cannot be predicted with certainty, future developments could cause any one or more of these matters to have a material impact on the Company's financial condition, results of operations or liquidity in any future period. Note 8 - Related party transactions The Company enters into subcontracts with an entity owned by a family member of one of the Company's stockholders. For the years ended December 31, 2021 and 2020, the Company incurred costs totaling approximately $4,227,000 and $3,265,000, respectively. As of December 31, 2021 and 2020, the Company had amounts due to related party in the amount of $825,495 and $605,250, respectively.

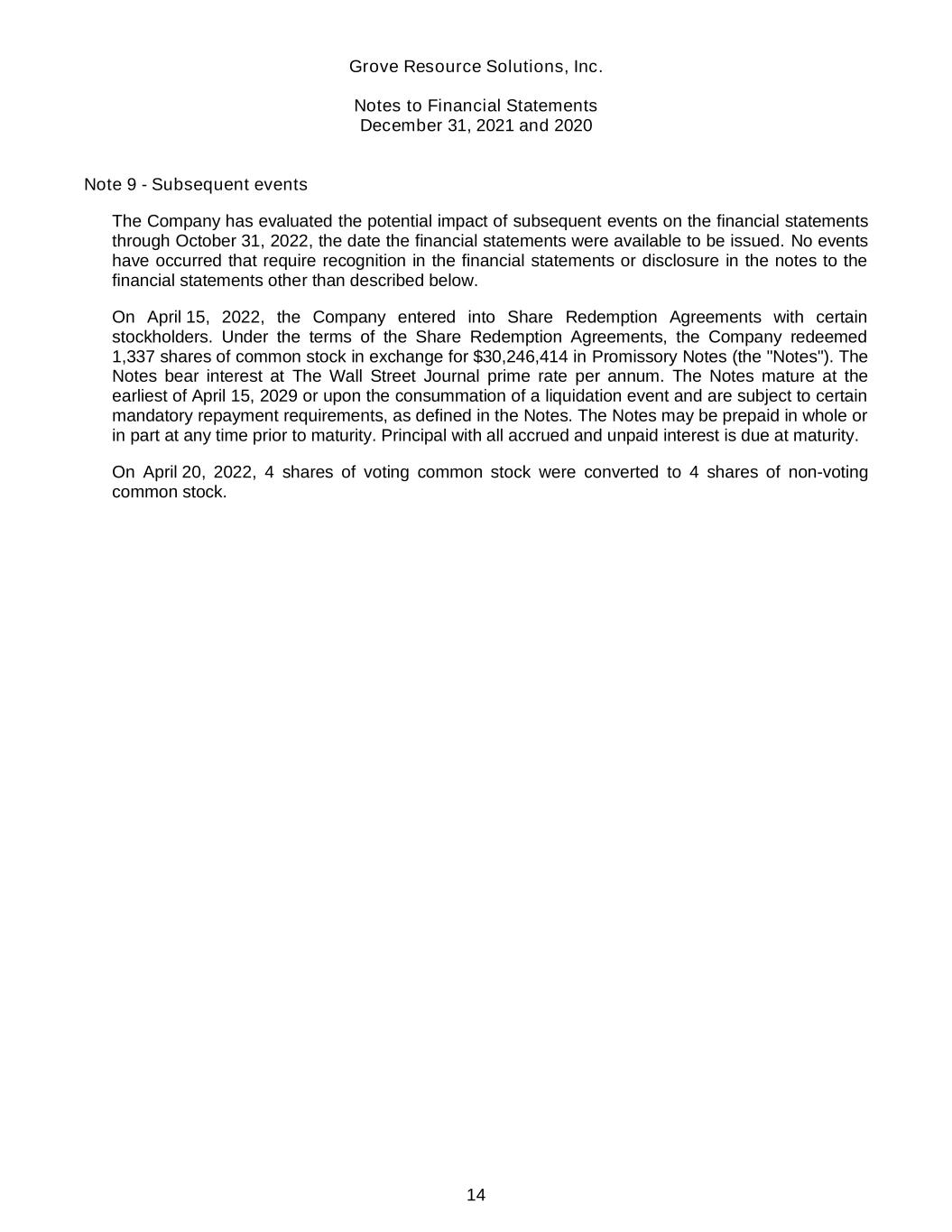

Grove Resource Solutions, Inc. Notes to Financial Statements December 31, 2021 and 2020 14 Note 9 - Subsequent events The Company has evaluated the potential impact of subsequent events on the financial statements through October 31, 2022, the date the financial statements were available to be issued. No events have occurred that require recognition in the financial statements or disclosure in the notes to the financial statements other than described below. On April 15, 2022, the Company entered into Share Redemption Agreements with certain stockholders. Under the terms of the Share Redemption Agreements, the Company redeemed 1,337 shares of common stock in exchange for $30,246,414 in Promissory Notes (the "Notes"). The Notes bear interest at The Wall Street Journal prime rate per annum. The Notes mature at the earliest of April 15, 2029 or upon the consummation of a liquidation event and are subject to certain mandatory repayment requirements, as defined in the Notes. The Notes may be prepaid in whole or in part at any time prior to maturity. Principal with all accrued and unpaid interest is due at maturity. On April 20, 2022, 4 shares of voting common stock were converted to 4 shares of non-voting common stock.