Revenues of $22.0 million for the Trailing Twelve Months ended June 30, 2006

Revenues of $22.0 million for the Trailing Twelve Months ended June 30, 2006

A Leading National Provider of Allied ?Travel’ Health Personnel and Permanent Placement

Focus on specialty areas that are critical for hospital—radiological techs, cardiovascular techs, ultrasound techs, radiation therapists, nuclear medicine techs, physicists, MRI techs, etc.

Currently have a database of over 12,000 allied healthcare personnel

Healthcare Personnel Are Typically Placed on 13-week Assignments

Hospitals pay for housing, car and travel

Travelers receive full benefits, e.g., healthcare, 401(k), etc.

Overview of

CONFIDENTIAL

Revenues of $12.4 million for the trailing twelve months ended June 30, 2006

Voted a “Top Ten” Nurse Travel Company by Highway Hypodermics in 2004

- -Provides RN’s, LPN’s, Med Surgical, Cardiac Cath, ER and OR Nurses

- -Currently has a database of over 5,000 nurses

- -Nurses are typically placed on 13-week assignments nationally

Additionally Provides Nurse Per Diem--daily & weekly shifts, in Memphis only

Assets Acquired November 2004

Overview of

Nursing Innovations

Nursing Innovations

CONFIDENTIAL

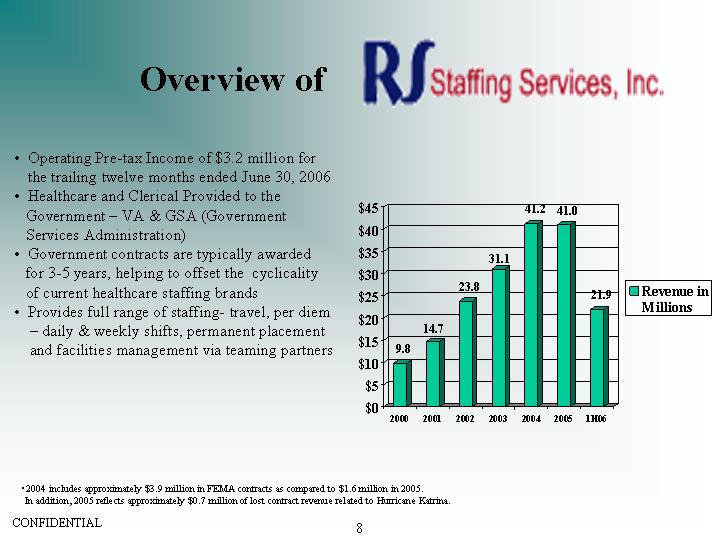

Overview of

CONFIDENTIAL

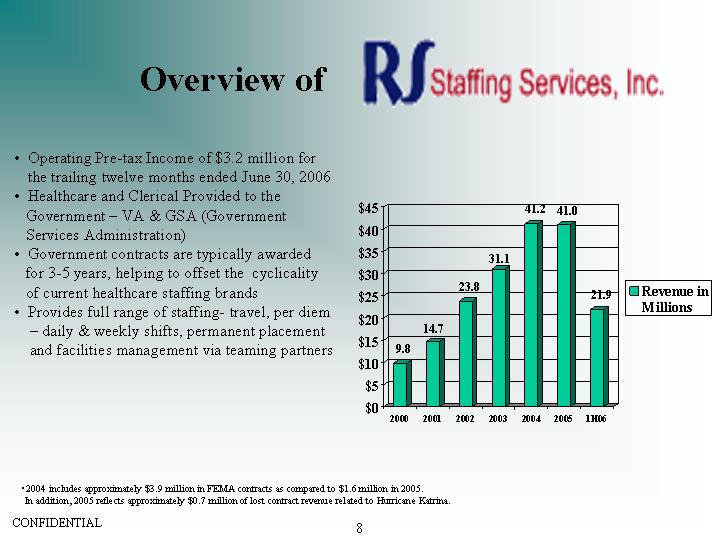

Operating Pre-tax Income of $3.2 million for the trailing twelve months ended June 30, 2006

Operating Pre-tax Income of $3.2 million for the trailing twelve months ended June 30, 2006

Healthcare and Clerical Provided to the

Government – VA & GSA (Government

Services Administration)

Government contracts are typically awarded

for 3-5 years, helping to offset the cyclicality

of current healthcare staffing brands

Provides full range of staffing- travel, per diem

– daily & weekly shifts, permanent placement

2004 includes approximately $3.9 million in FEMA contracts as compared to $1.6 million in 2005.

2004 includes approximately $3.9 million in FEMA contracts as compared to $1.6 million in 2005.

41.0

41.2

31.1

23.8

14.7

9.8

21.9

Company Turnaround 2003-2005: $29m Loss in Fiscal ’03 Improved To Consecutive Quarters Operating Breakeven In 2005

Built New & Experienced Leadership Team

Built New & Experienced Leadership Team

General Staffing and Healthcare Staffing Industry Experience

Public Company/Executive Management Experience

Sold PEO to Gevity in November 2003

PEO Was Low Margin, Capital Intensive Business

Provided Capital to Focus on Core Healthcare Staffing Business

Reduced Corporate Overhead Costs

Cut $3.5 million in Annualized Costs in FYE 2004

CONFIDENTIAL

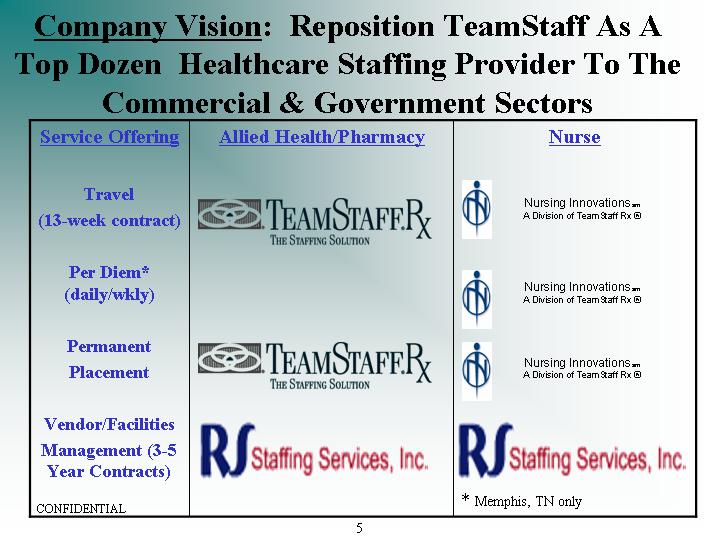

Company Acquisitions: Reposition TeamStaff As A Top Dozen Healthcare Staffing Provider To The Commercial & Government Sectors

Successful Equity Raise to Initiate Acquisitions

$4 Million “Pipe” Offering Completed November 2004

Made Two Acquisitions To Improve Company Scale & Market Position to the Healthcare Providers

Bought $14 Million Revenue Travel Nurse Company in November 2004

Bought $41 million Healthcare Provider to the Government

Provide Company with a Broader Product Offering for the Hospitals

Reduce cyclicality by entering Government segments with long term contracts

Sold DSi Payroll Processing Brand for $9 million June 2006

- - Use available cash to pay down debt and make additional acquisitions

CONFIDENTIAL

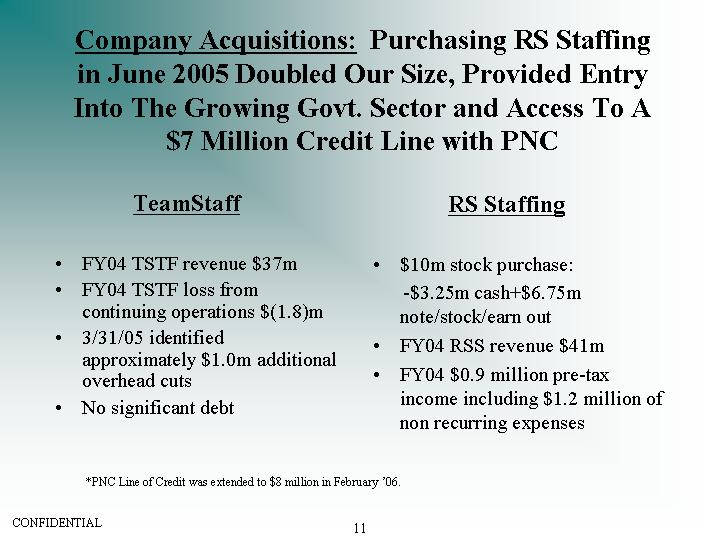

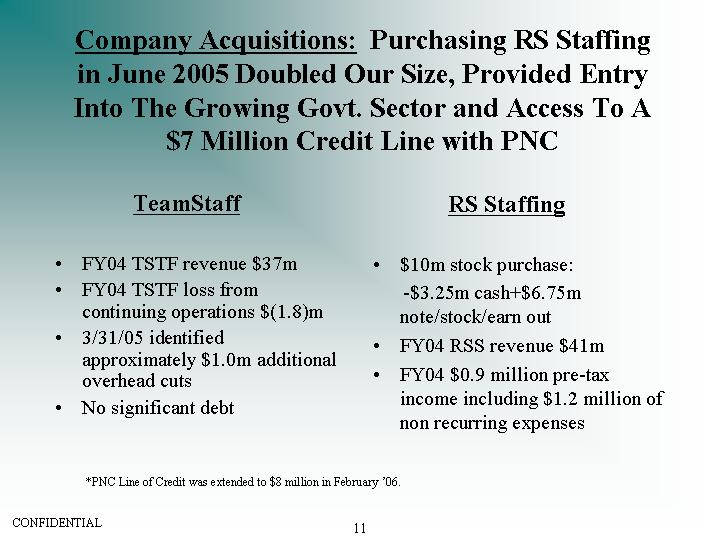

Company Acquisitions: Purchasing RS Staffing in June 2005 Doubled Our Size, Provided Entry Into The Growing Govt. Sector and Access To A $7 Million Credit Line with PNC

TeamStaff

TeamStaff

FY04 TSTF revenue $37m

FY04 TSTF loss from continuing operations $(1.8)m

3/31/05 identified approximately $1.0m additional overhead cuts

RS Staffing

$10m stock purchase:

- -$3.25m cash+$6.75m note/stock/earn out

FY04 RSS revenue $41m

FY04 $0.9 million pre-tax income including $1.2 million of non recurring expenses

CONFIDENTIAL

*PNC Line of Credit was extended to $8 million in February ’06.

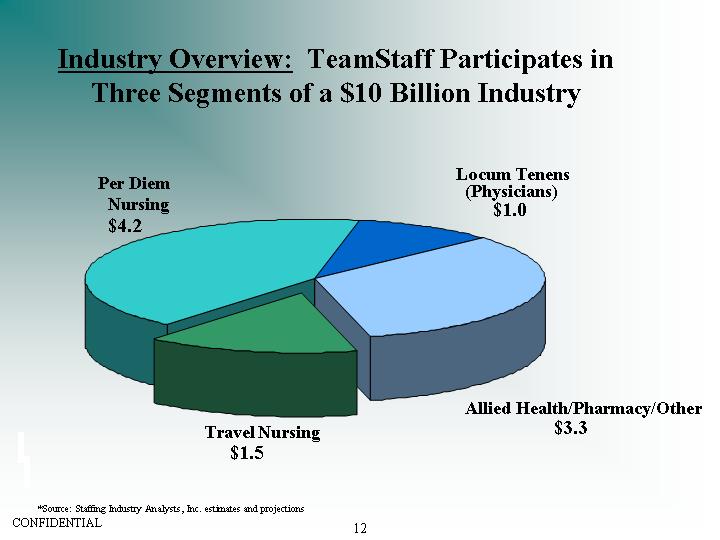

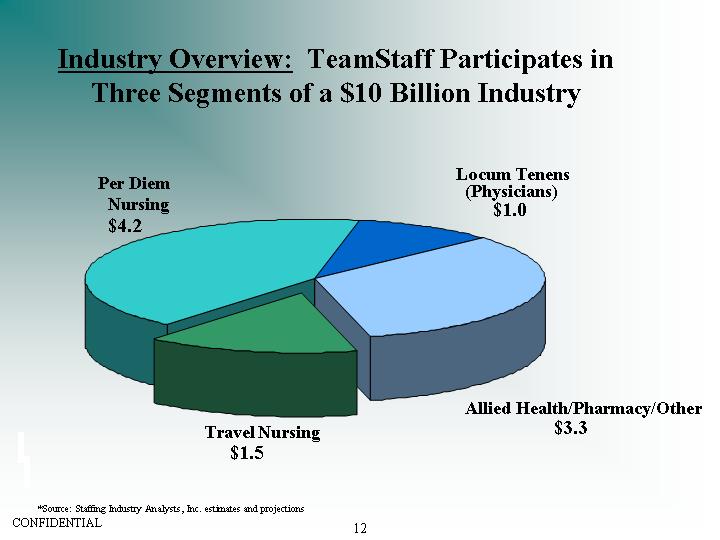

*Source: Staffing Industry Analysts, Inc. estimates and projections

Industry Overview: TeamStaff Participates in Three Segments of a $10 Billion Industry

CONFIDENTIAL

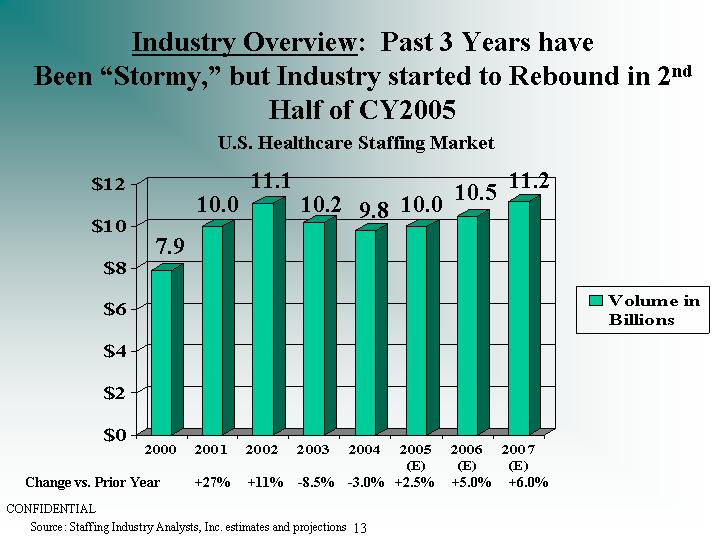

Source: Staffing Industry Analysts, Inc. estimates and projections

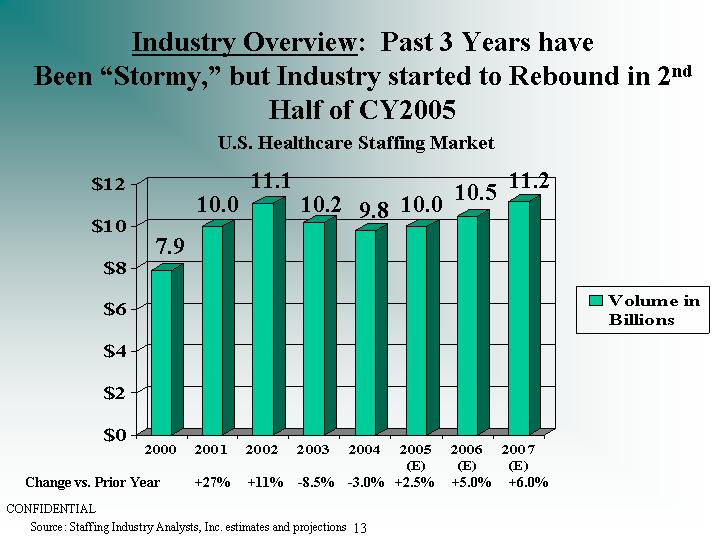

U.S. Healthcare Staffing Market

Industry Overview: Past 3 Years have<br/>Been “Stormy,” but Industry started to Rebound in 2nd Half of CY2005

CONFIDENTIAL

7.9

10.0

11.1

10.2

9.8

10.0

10.5

11.2

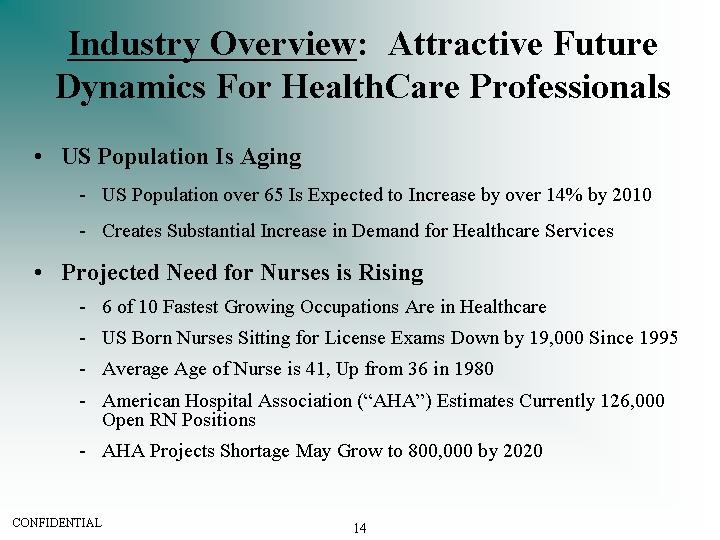

US Population Is Aging

US Population Is Aging

US Population over 65 Is Expected to Increase by over 14% by 2010

Creates Substantial Increase in Demand for Healthcare Services

Projected Need for Nurses is Rising

6 of 10 Fastest Growing Occupations Are in Healthcare

US Born Nurses Sitting for License Exams Down by 19,000 Since 1995

Average Age of Nurse is 41, Up from 36 in 1980

American Hospital Association (“AHA”) Estimates Currently 126,000 Open RN Positions

Industry Overview: Attractive Future Dynamics For HealthCare Professionals

CONFIDENTIAL

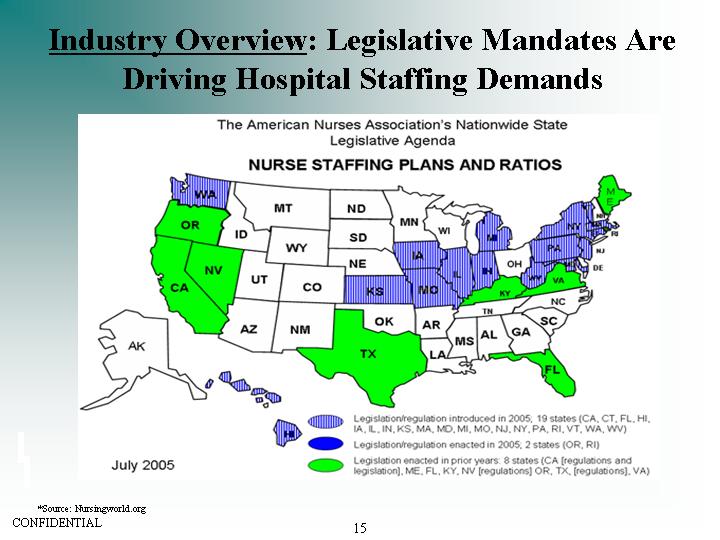

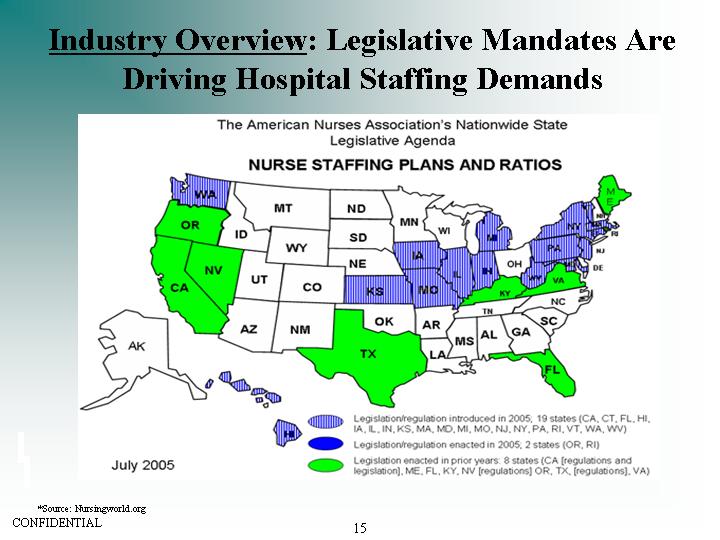

*Source: Nursingworld.org

CONFIDENTIAL

Industry Overview: Legislative Mandates Are Driving Hospital Staffing Demands

Industry Overview: Healthcare Staffing Industry Trends Are Repeating History From the Commercial Staffing Trends of the 1990’s

CONFIDENTIAL

Summary Of TeamStaff Opportunities

Long-Term Growth Dynamics of Healthcare

Long-Term Growth Dynamics of Healthcare

Staffing Industry Rebounding fully in 2006

Capability to make additional Acquisitions to Bolster Healthcare Offering & Scale

Large contract potential with Government Staffing

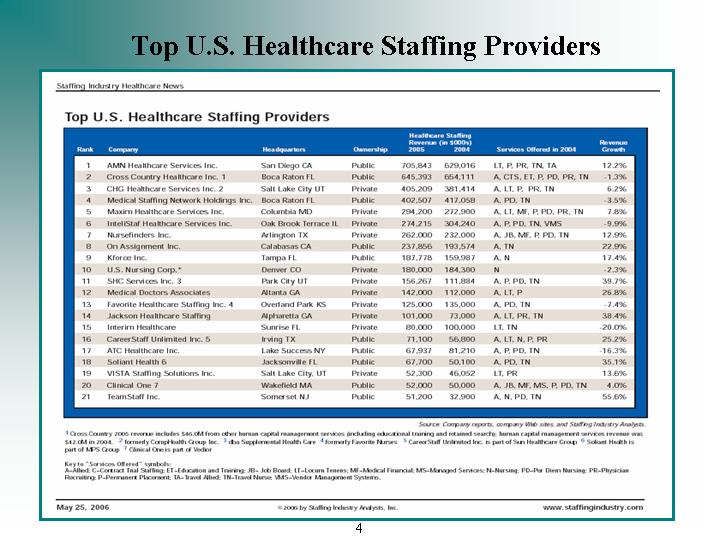

Strong Market Position as Top 20 Provider, As Well as Top Five Government & Travel Allied Provider

Experienced Staffing Industry Leadership Team

CONFIDENTIAL