Your Mission is Our Passion DLH Holdings Corp. Acquisition of Social & Scientific Systems July 2, 2019

Forward Looking Statement Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995: This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements relate to future events, such as DLH Holdings Corp’s (“DLH`s”) and Social and Scientific Systems’ (“SSS's”) future financial performance and the performance of the combined enterprise, including estimates of future revenues, operating income, earnings, and backlog. Any statements that are not statements of historical fact (including without limitation statements to the effect that DLH or its management "believes", "expects", "anticipates", "plans", "intends" and similar expressions) should be considered forward looking statements that involve risks and uncertainties which could cause actual events or actual results to differ materially from those indicated by the forward-looking statements. Those risks and uncertainties include, but are not limited to, the following: failure to achieve the anticipated benefits of the SSS acquisition (including anticipated future financial operating performance and results); diversion of management's attention from normal daily operations of the business and the challenges of managing larger and more widespread operations resulting from the acquisition; the inability to retain SSS employees and customers; contract awards in connection with re-competes for present business and/or competition for new business; the risks and uncertainties associated with client interest in and purchases of new services; changes in client budgetary priorities; government contract procurement (such as bid protest, small business set asides, loss of work due to organizational conflicts of interest, etc.) and termination risks; the ability to successfully integrate the operations of SSS and any future acquisitions; and other risks described in DLH's SEC filings. For a discussion of such risks and uncertainties which could cause actual results to differ from those contained in the forward-looking statements, see "Risk Factors" in DLH's periodic reports filed with the SEC, including DLH's Annual Report on Form 10-K for the fiscal year ended September 30, 2018, as well as interim quarterly filings thereafter.2 The forward-looking3 statements contained4 herein are made as of the date hereof. DLH does not assume any responsibility for updating forward-looking statements, except as may be required by law. 2

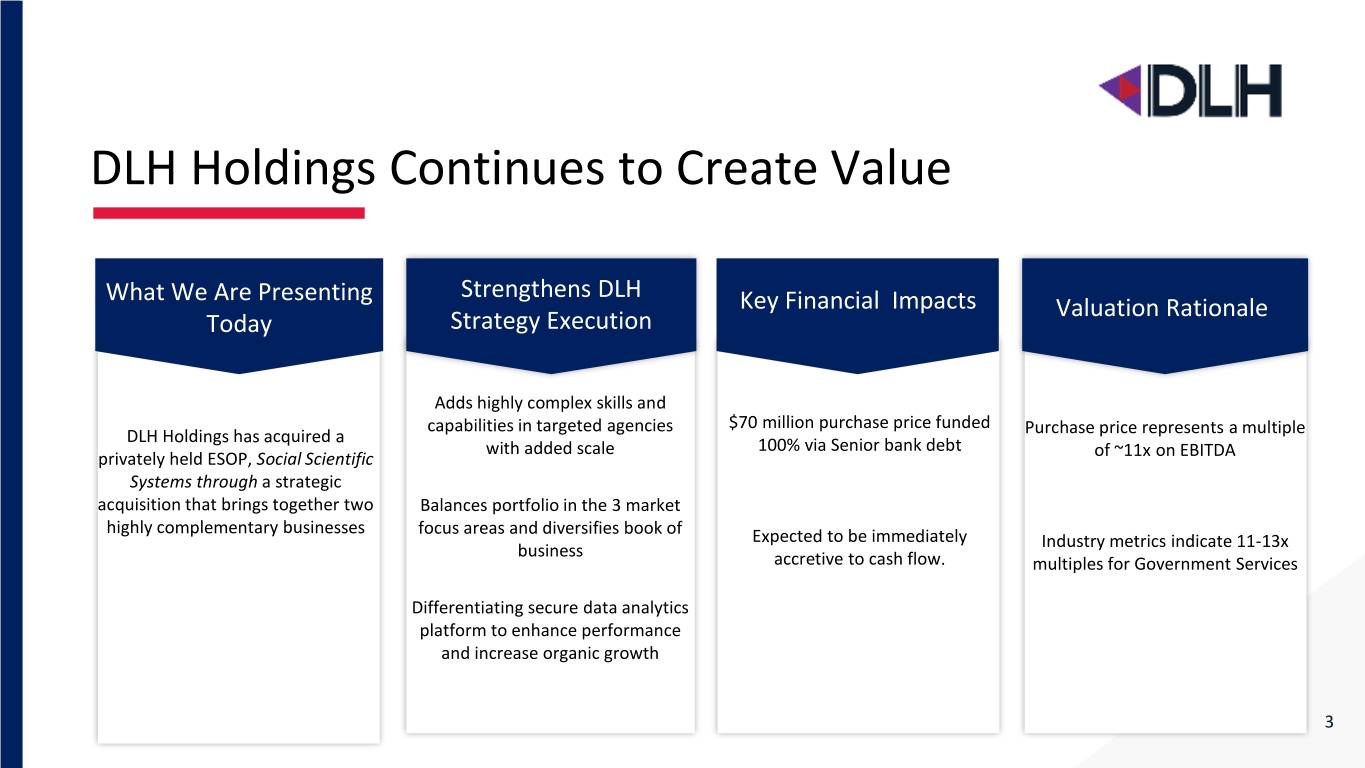

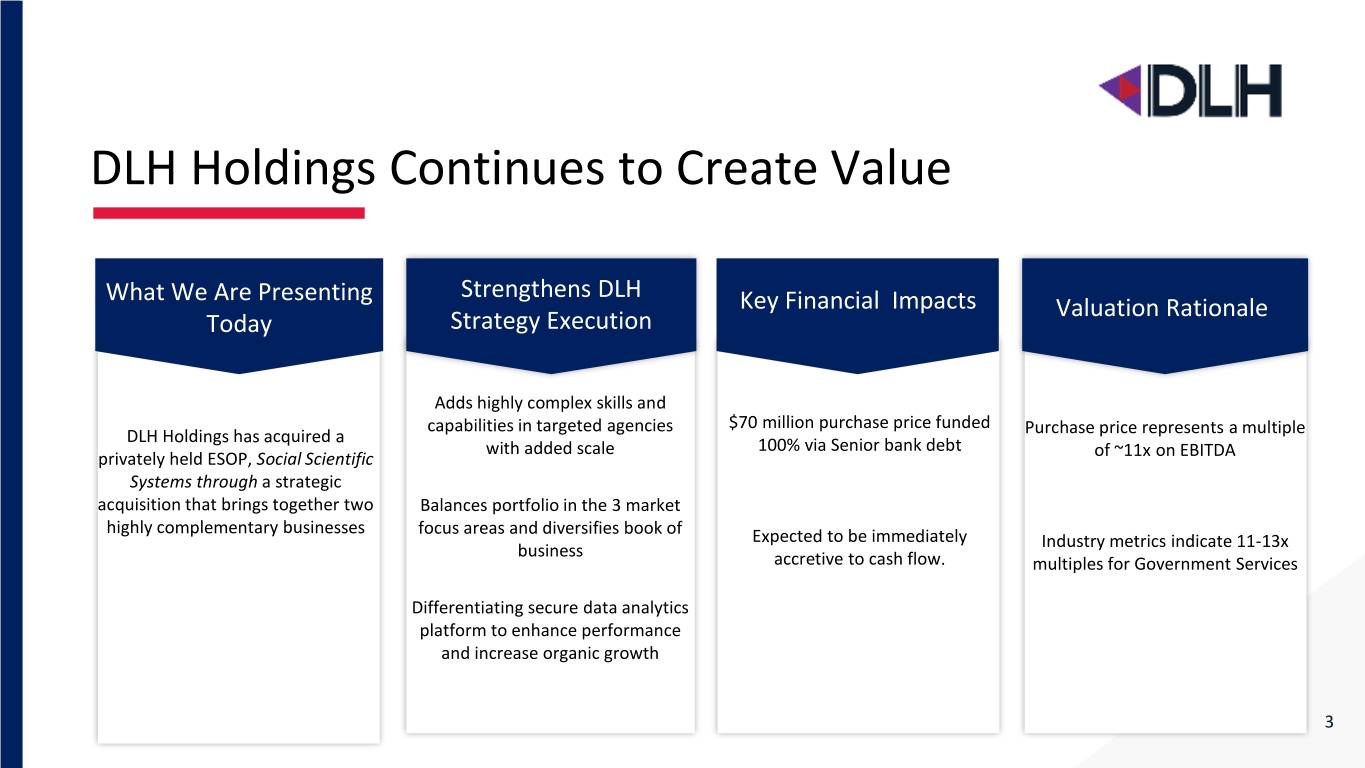

DLH Holdings Continues to Create Value What We Are Presenting Strengthens DLH Key Financial Impacts Valuation Rationale Today Strategy Execution Adds highly complex skills and capabilities in targeted agencies $70 million purchase price funded DLH Holdings has acquired a Purchase price represents a multiple with added scale 100% via Senior bank debt privately held ESOP, Social Scientific of ~11x on EBITDA Systems through a strategic acquisition that brings together two Balances portfolio in the 3 market highly complementary businesses focus areas and diversifies book of Expected to be immediately Industry metrics indicate 11-13x business accretive to cash flow. multiples for Government Services Differentiating secure data analytics platform to enhance performance and increase organic growth 3 4 3

Strategic Rationale Highly complementary businesses with common core capabilities for complex, nationally dispersed programs, operational synergies, and new business opportunities Accelerates long-term strategy of both entities; Public health & life sciences capabilities with a proven secure data analytics platform to go to market Reduces portfolio risk especially in view of Kingdomware (set-aside) impact on legacy VA revenue and profit delivery; adds > $300M unfunded contract backlog 2 3 4 Government contract consolidations (and IDIQ2 focus), coupled3 with industry mergers,4 place greater value on scale for small, mid-tier organic competitiveness 4

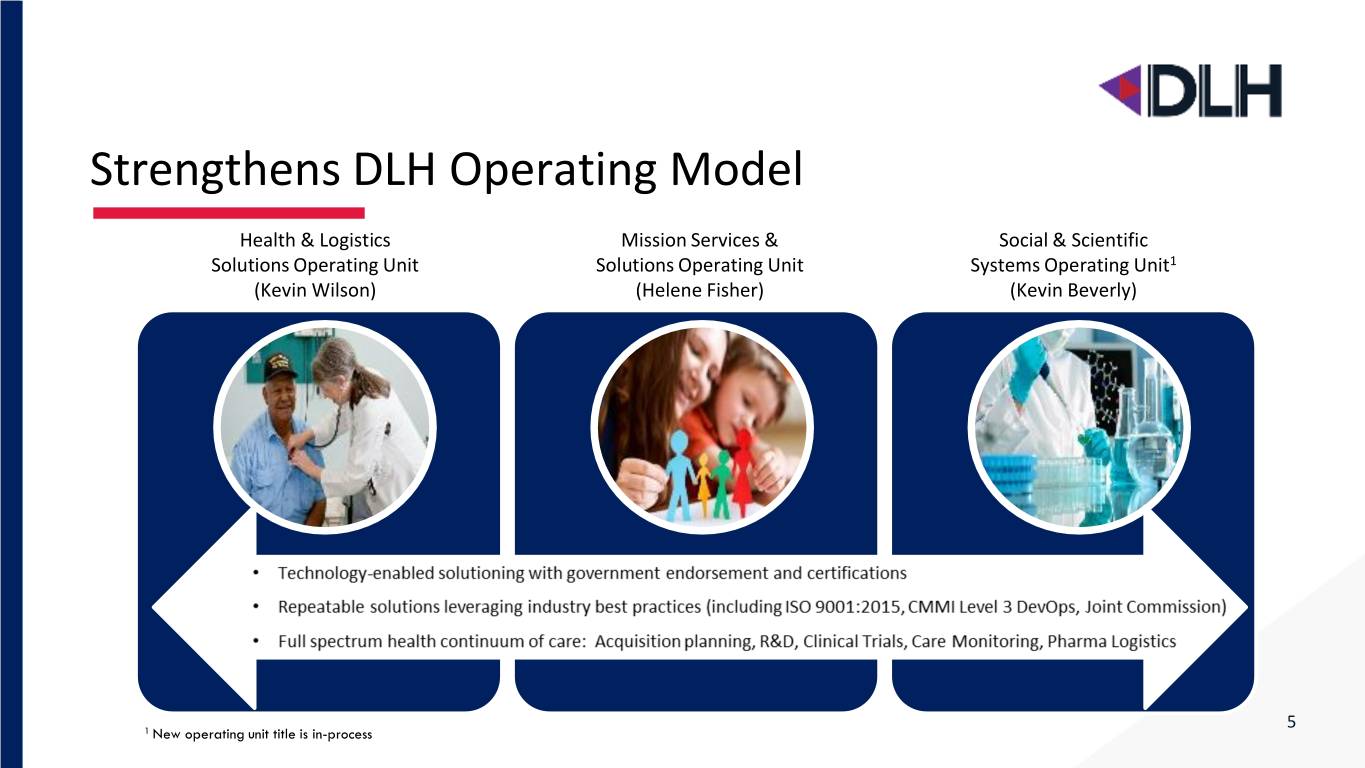

Strengthens DLH Operating Model Health & Logistics Mission Services & Social & Scientific Solutions Operating Unit Solutions Operating Unit Systems Operating Unit1 (Kevin Wilson) (Helene Fisher) (Kevin Beverly) 5 1 New operating unit title is in-process

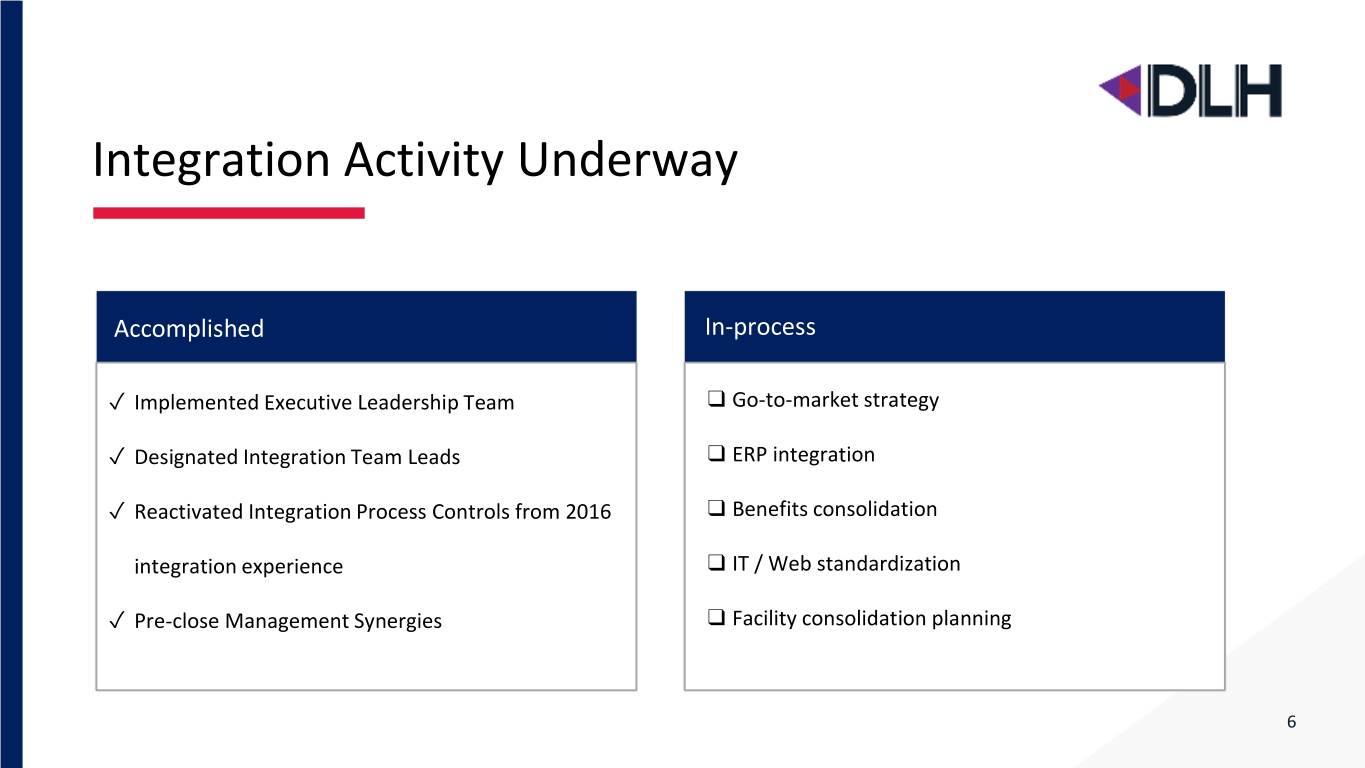

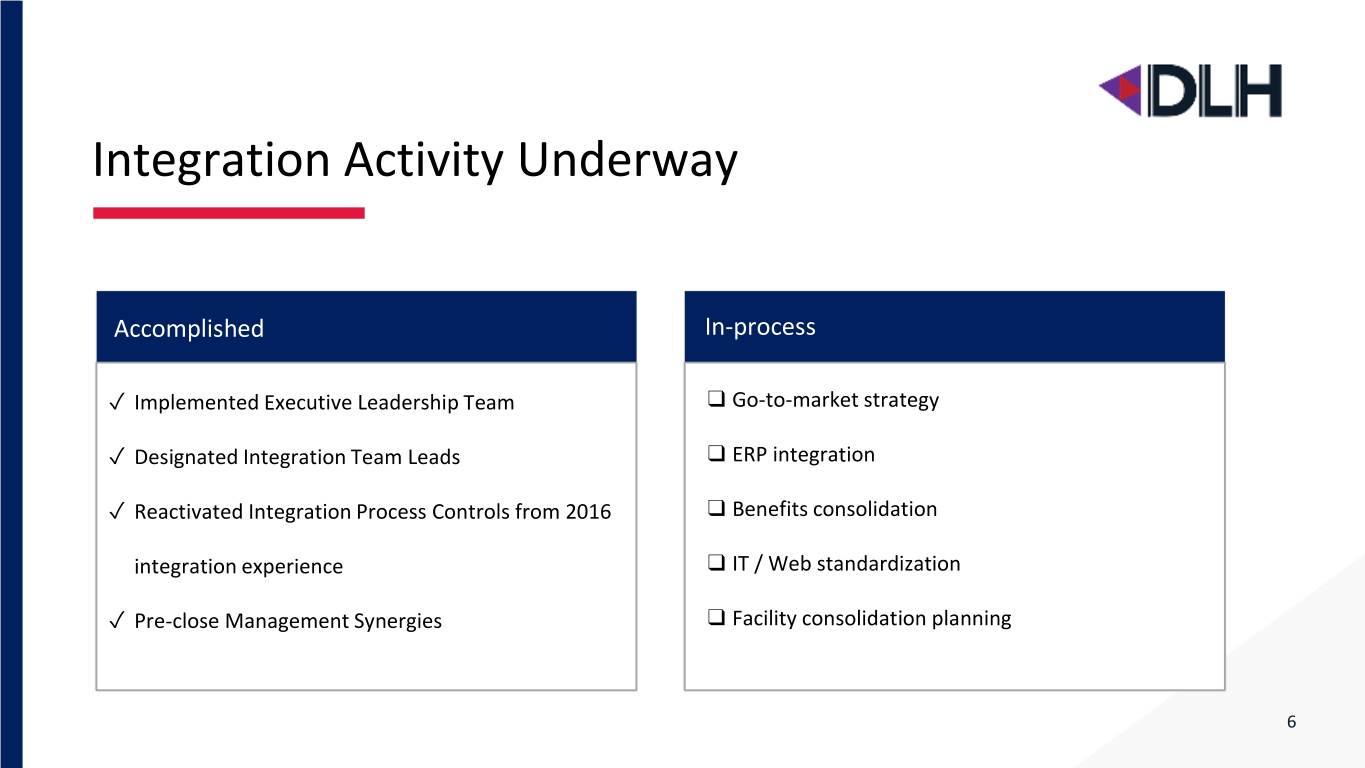

Integration Activity Underway Accomplished In-process ✓ Implemented Executive Leadership Team ❑ Go-to-market strategy ✓ Designated Integration Team Leads ❑ ERP integration ✓ Reactivated Integration Process Controls from 2016 ❑ Benefits consolidation integration experience ❑ IT / Web standardization ✓ Pre-close Management Synergies ❑ Facility consolidation planning 6

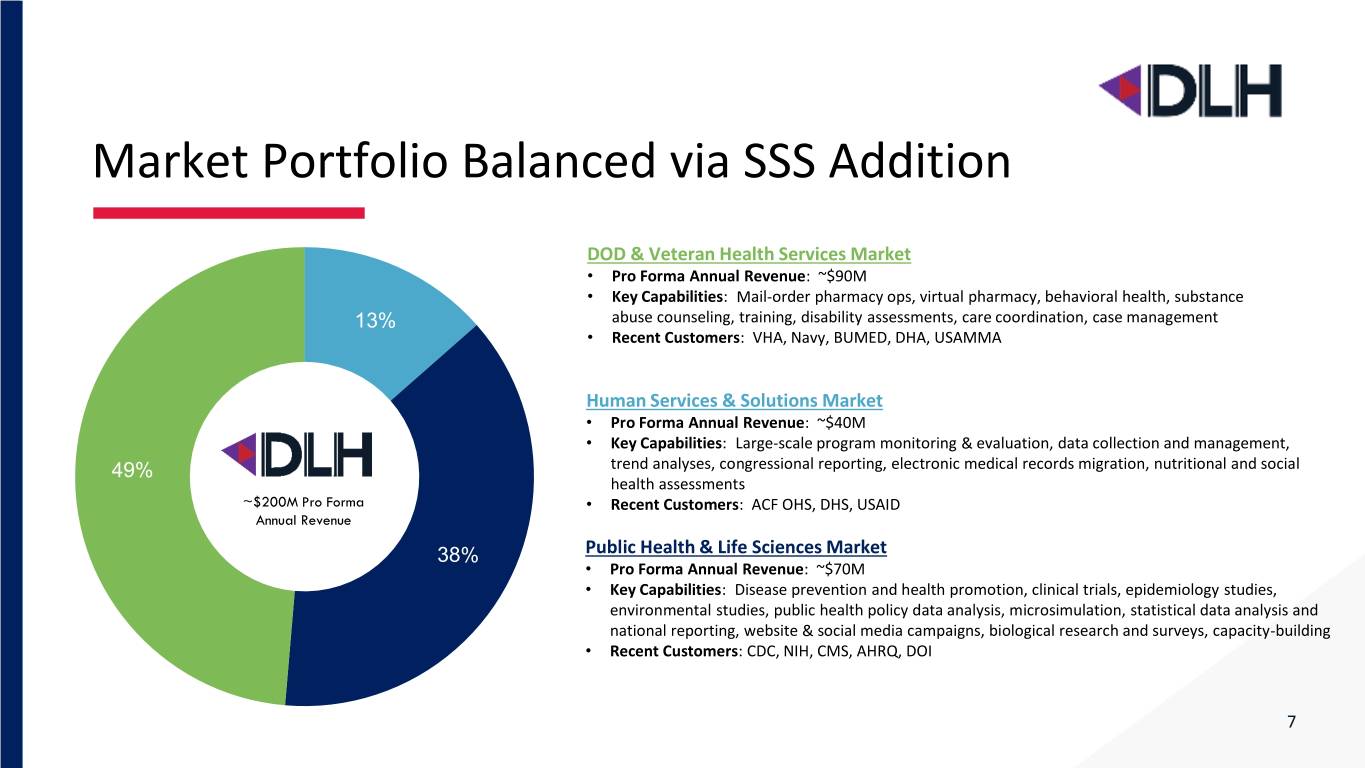

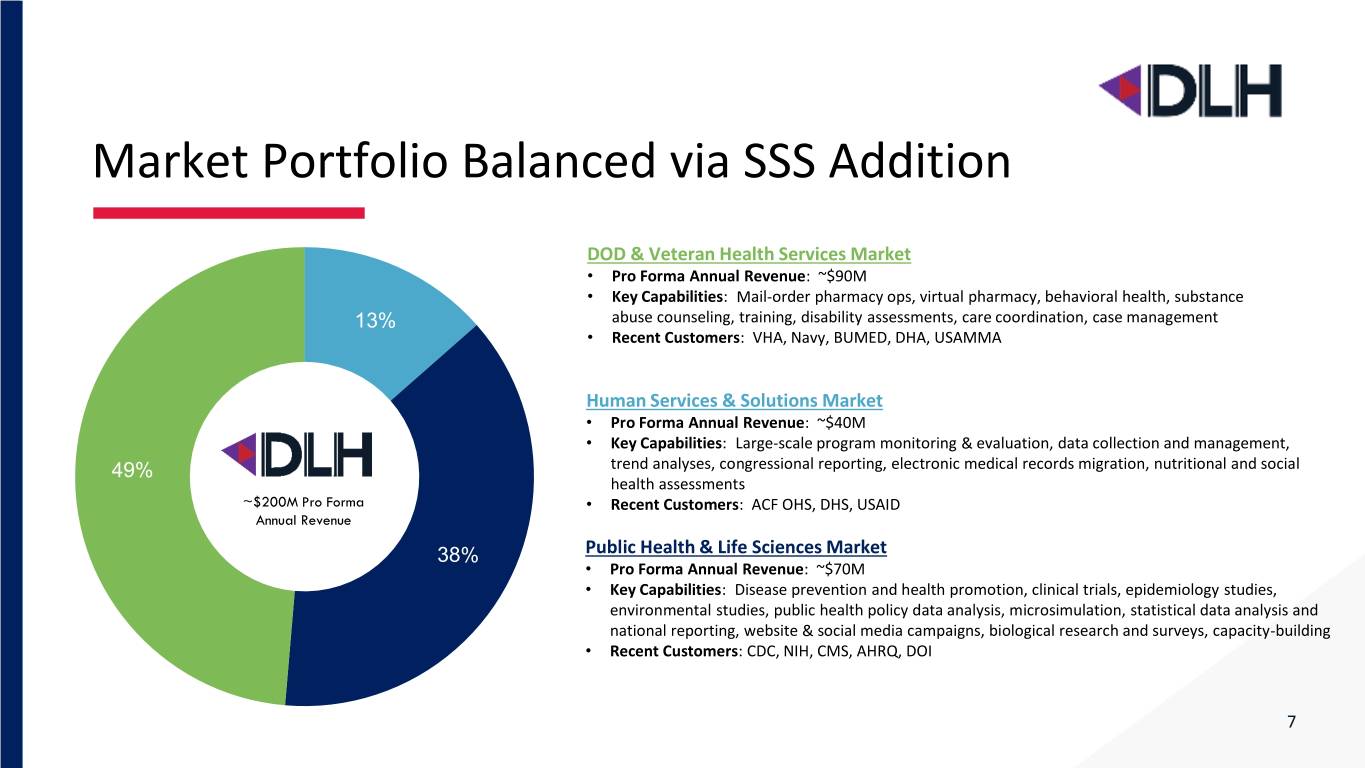

Market Portfolio Balanced via SSS Addition DOD & Veteran Health Services Market • Pro Forma Annual Revenue: ~$90M • Key Capabilities: Mail-order pharmacy ops, virtual pharmacy, behavioral health, substance 13% abuse counseling, training, disability assessments, care coordination, case management • Recent Customers: VHA, Navy, BUMED, DHA, USAMMA Human Services & Solutions Market • Pro Forma Annual Revenue: ~$40M • Key Capabilities: Large-scale program monitoring & evaluation, data collection and management, 49% trend analyses, congressional reporting, electronic medical records migration, nutritional and social health assessments ~$200M Pro Forma • Recent Customers: ACF OHS, DHS, USAID Annual Revenue 38% Public Health & Life Sciences Market • Pro Forma Annual Revenue: ~$70M • Key Capabilities: Disease prevention and health promotion, clinical trials, epidemiology studies, environmental studies, public health policy data analysis, microsimulation, statistical data analysis and national reporting, website & social media campaigns, biological research and surveys, capacity-building • Recent Customers: CDC, NIH, CMS, AHRQ, DOI 7

Portfolio Accelerates Targeted Market Growth Prospects Market Areas and Targeted Agencies Strategic Focus SSS Acquisition Impact DoD and Veterans Health Services DHA $303M addressable spend includes life sciences SSS 40 years experience with health research, clinical trials, clinical research across DHA directorates and joint VA and longitudinal studies across various population groups programs including longitudinal studies and medical coupled with legacy DLH medical systems biomedical simulation. VA increased focus on evidence-based research and development experience positions DLH well for policy decisions and data analytics. this competitive area. Human Services and Solutions Extensive opportunities for program monitoring and Direct development of systems program monitoring and evaluation and statistical assessment of effectiveness are capacity-building capability along with secure data analytics on the horizon for these agencies. Children's bureau, complements that currently performed for the Office of child welfare, and related organizations are looking for Head Start and offers innovative value propositions for these innovative technology-enabled approaches to improve agencies. DLH has applicable HRSA IDIQ contracts that can capacity and accountability for various programs. be leveraged for task order opportunities. Public Health and Life Sciences CDC $616M addressable spend includes various scientific Extensive epidemiology research and longitudinal public research projects and extensive survey study initiatives health studies offers prime caliber qualifications to leverage tied to emerging health threats. NIH continues to at CDC to complement existing DLH disease prevention and represent a large growth opportunity by merely health promotion studies, analyses, and communications increasing share within respective OPDIVs. SAMHSA projects. DLH has applicable CDC and SAMHSA IDIQ contracts research and analytics opportunities offer growth to leverage. opportunities. Independent pre-close due diligence identified new business opportunities that are expected to double current pipeline and increase win probability for signature contracts 8

Social & Scientific Systems Overview Clinical Research Services and Bioscience Epidemiology and Public Health Studies Program Evaluation and Policy Analysis Management and operational support for bioscience research Design and conduct epidemiologic studies examining associations Scientific evaluations, research, and analyses are used to develop programs and clinical trials expedite the availability of safe and between a range of environmental, occupational, and lifestyle successful policies that address pressing public health issues. effective therapeutics. exposures and their impacts. Health Data Management and Analysis Health IT and Cloud Services Data experts and software systems manage health data, provide Develop IT solutions, as a cloud service provider, for our clients to real-time analytical reporting, and deliver statistical programming manage and analyze their data in secure and efficient manner, for research. operating at CMMI-DEV Level 3. 9

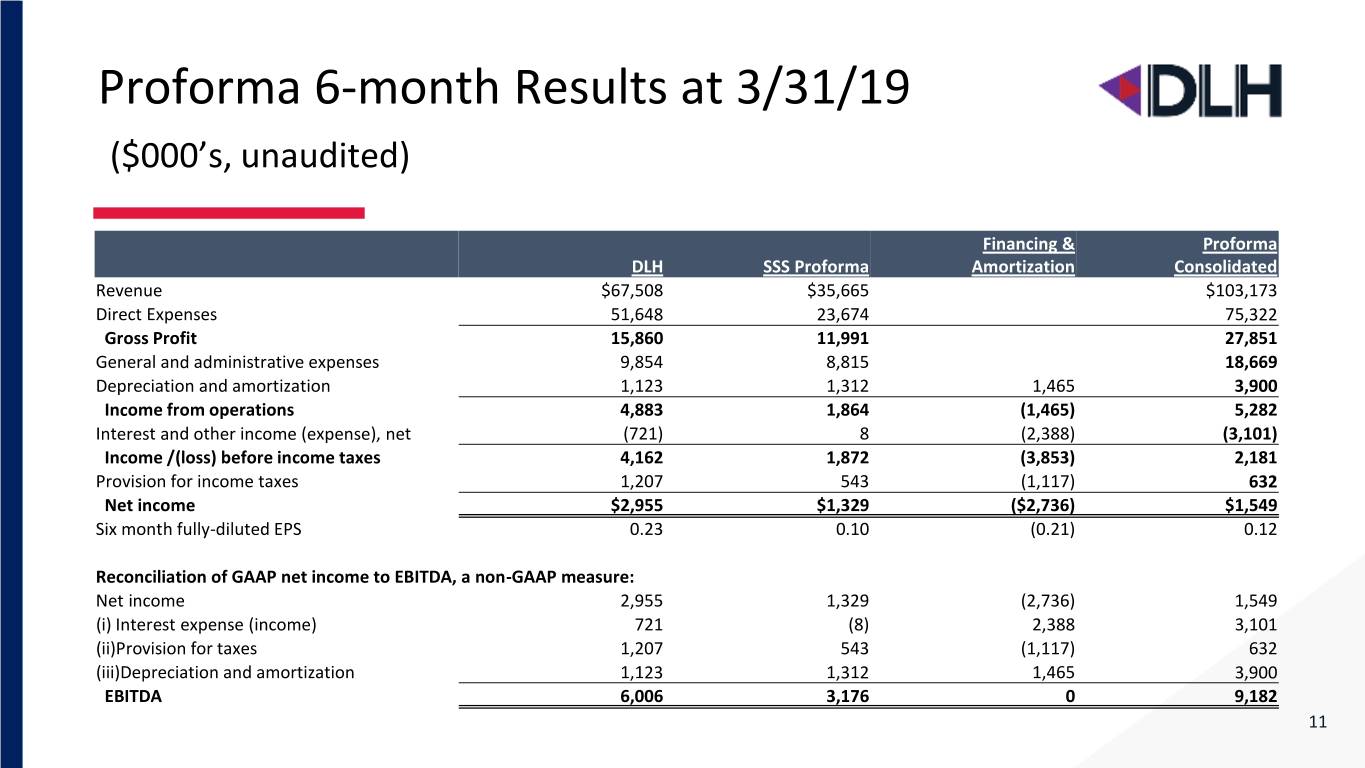

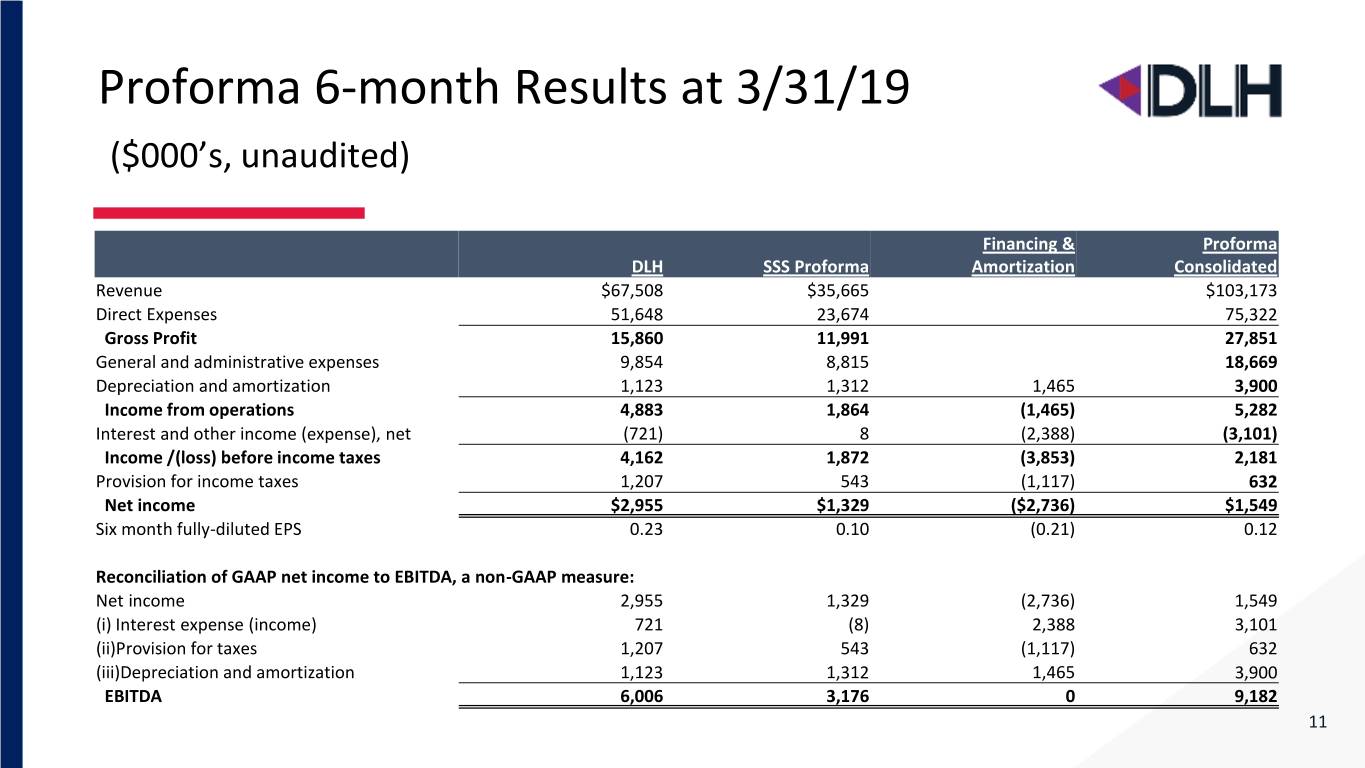

Proforma Considerations • DLH uses EBITDA as a supplemental non-GAAP measure of our performance. DLH defines EBITDA as net income excluding (i) interest expense, (ii) provision for or benefit from income taxes and (iii) depreciation and amortization. • Due to short-lived projects completed during the proforma period (six months ended 3/31/19), sustaining revenue of the enterprise is expected to be lower than in the proforma period. • DLH estimates that SSS will contribute approximately $65 million, on an annualized basis, to revenue of DLH going forward, with similar operating margins as during the proforma period. The following unaudited pro forma financial information combines the historical financial information of DLH and SSS and may not be indicative of the historical results that would have been achieved had the companies been combined 10 during the periods presented or of the future results that the combined companies will experience.

Proforma 6-month Results at 3/31/19 ($000’s, unaudited) Financing & Proforma DLH SSS Proforma Amortization Consolidated Revenue $67,508 $35,665 $103,173 Direct Expenses 51,648 23,674 75,322 Gross Profit 15,860 11,991 27,851 General and administrative expenses 9,854 8,815 18,669 Depreciation and amortization 1,123 1,312 1,465 3,900 Income from operations 4,883 1,864 (1,465) 5,282 Interest and other income (expense), net (721) 8 (2,388) (3,101) Income /(loss) before income taxes 4,162 1,872 (3,853) 2,181 Provision for income taxes 1,207 543 (1,117) 632 Net income $2,955 $1,329 ($2,736) $1,549 Six month fully-diluted EPS 0.23 0.10 (0.21) 0.12 Reconciliation of GAAP net income to EBITDA, a non-GAAP measure: Net income 2,955 1,329 (2,736) 1,549 (i) Interest expense (income) 721 (8) 2,388 3,101 (ii)Provision for taxes 1,207 543 (1,117) 632 (iii)Depreciation and amortization 1,123 1,312 1,465 3,900 EBITDA 6,006 3,176 0 9,182 11

Financial Benefits of the Acquisition • Highly visible revenue - Acquired company has approximately $346 million of total backlog, of which $40 million is funded - Due to research and studies nature of SSS work, contract durations tend to be longer than usual • Expected strong free cash flow and debt service - Free cash flow is further supported by tax-deductible purchase price and prior DLH tax shield - Capital requirements of the business are minimal • Substantial existing contract base - The acquired company’s contract portfolio supports 100% of its expected FY19 revenue and 95% of expected FY20 revenue • Significant potential for combined organic growth - Revenue growth is driven primarily by continued execution2 against recurring3 customer4 requirements, cross-selling opportunities (expanding offerings into each other’s respective markets), and unsaturated customer bases 12

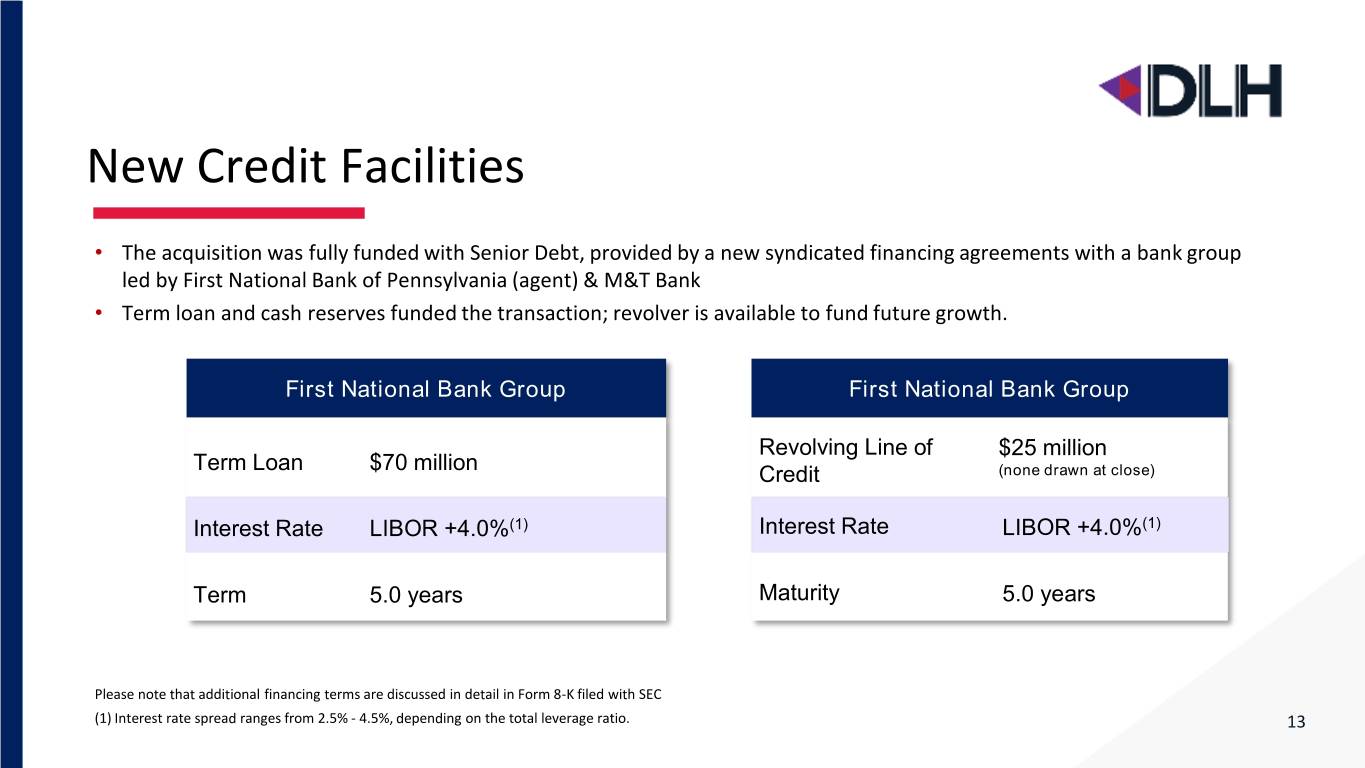

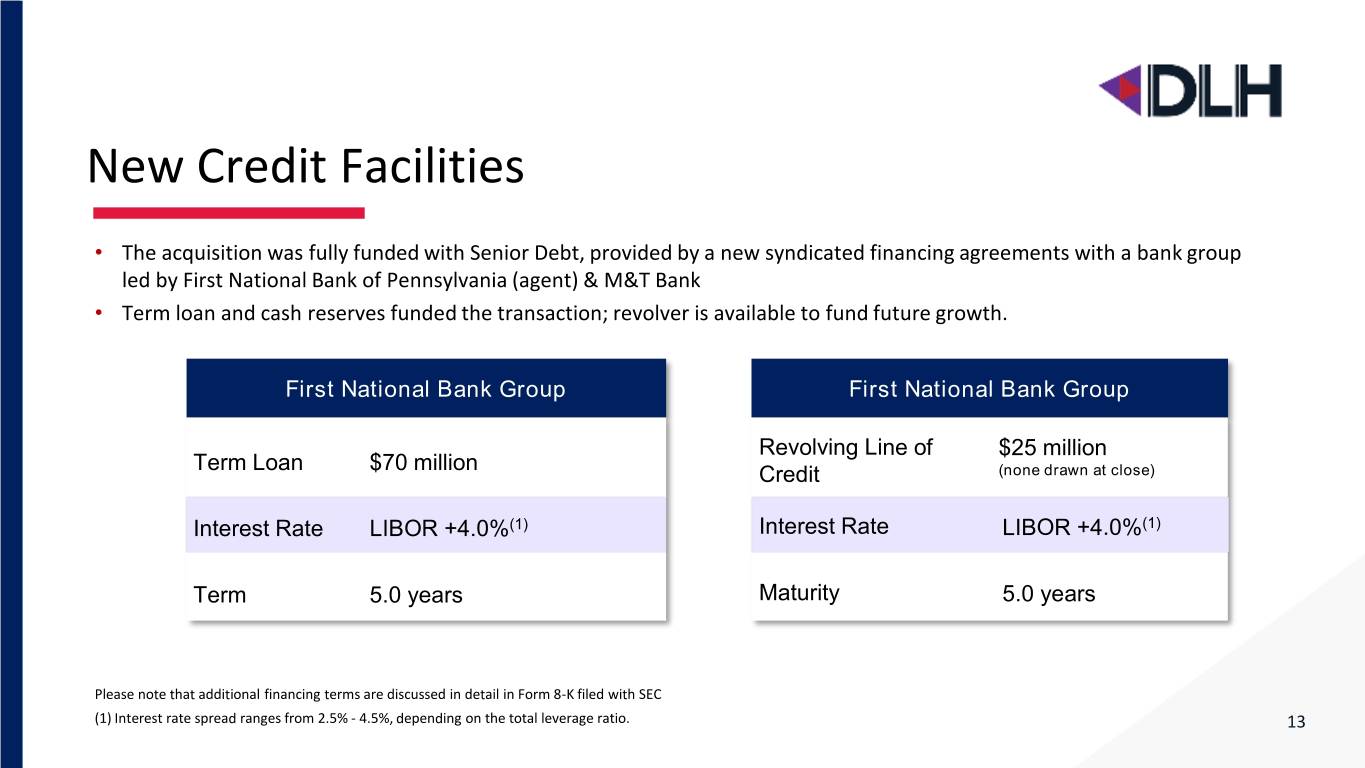

New Credit Facilities • The acquisition was fully funded with Senior Debt, provided by a new syndicated financing agreements with a bank group led by First National Bank of Pennsylvania (agent) & M&T Bank • Term loan and cash reserves funded the transaction; revolver is available to fund future growth. First National Bank Group First National Bank Group Revolving Line of $25 million Term Loan $70 million Credit (none drawn at close) Interest Rate LIBOR +4.0%(1) Interest Rate LIBOR +4.0%(1) Term 5.0 years Maturity 5.0 years Please note that additional financing terms are discussed in detail in Form 8-K filed with SEC (1) Interest rate spread ranges from 2.5% - 4.5%, depending on the total leverage ratio. 13

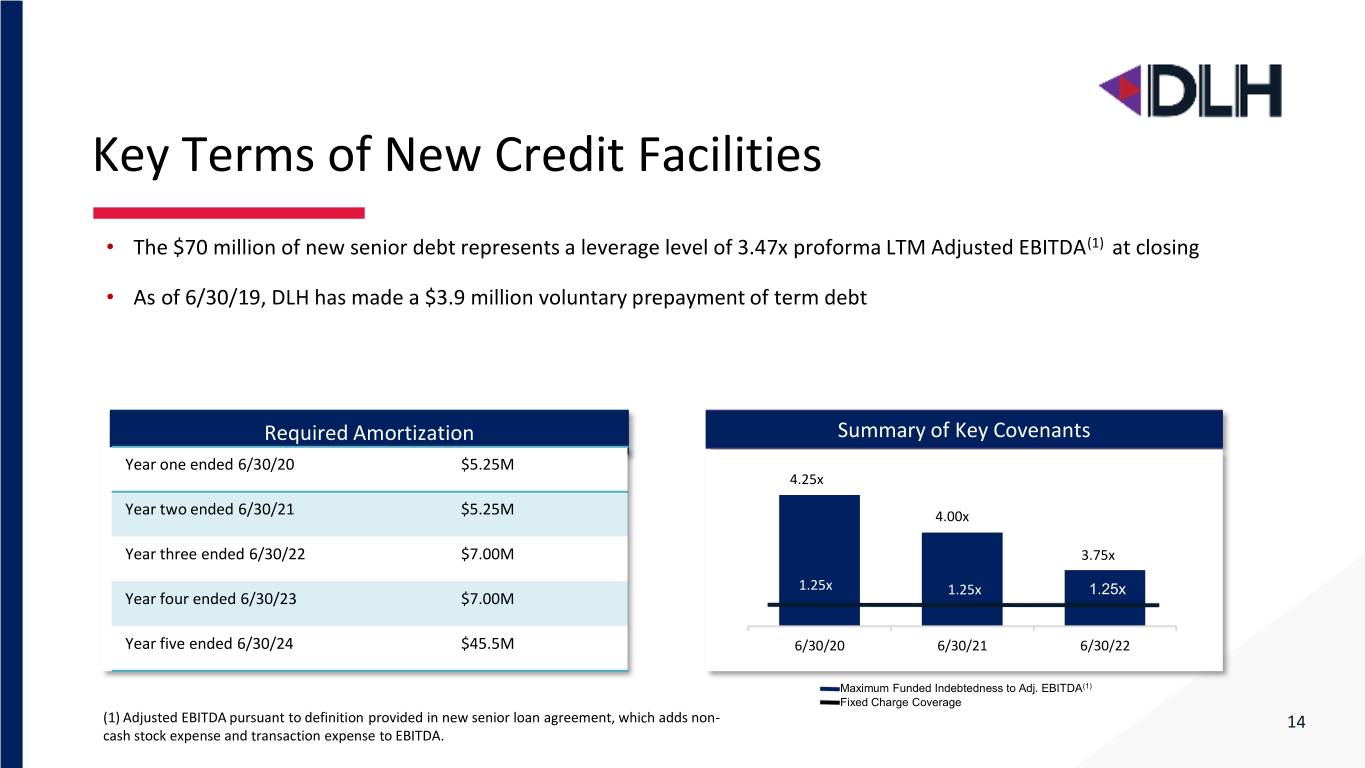

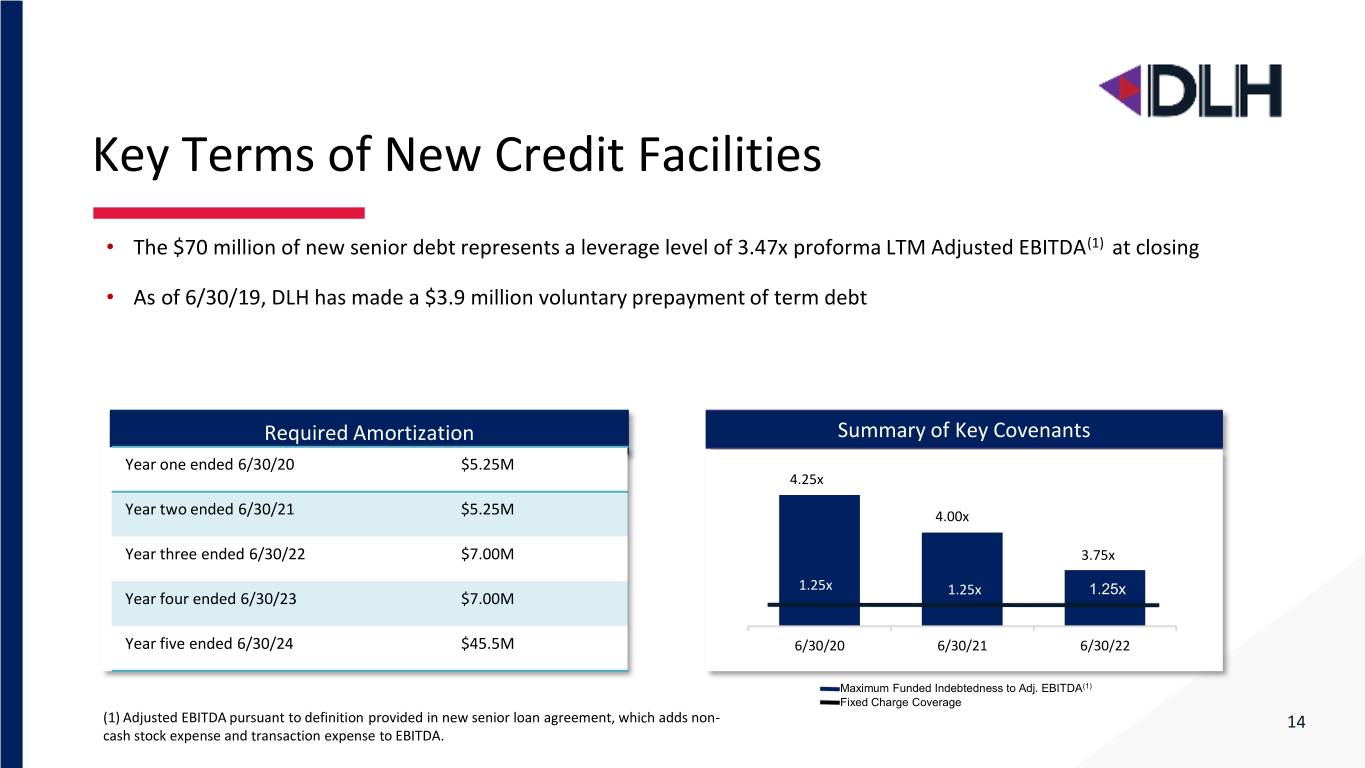

Key Terms of New Credit Facilities • The $70 million of new senior debt represents a leverage level of 3.47x proforma LTM Adjusted EBITDA(1) at closing • As of 6/30/19, DLH has made a $3.9 million voluntary prepayment of term debt Required Amortization Summary of Key Covenants Year one ended 6/30/20 $5.25M 4.25x Year two ended 6/30/21 $5.25M 4.00x Year three ended 6/30/22 v $7.00M v 3.75x 1.25x 1.25x 1.25x Year four ended 6/30/23 $7.00M Year five ended 6/30/24 $45.5M 6/30/20 6/30/21 6/30/22 Maximum Funded Indebtedness to Adj. EBITDA(1) Fixed Charge Coverage (1) Adjusted EBITDA pursuant to definition provided in new senior loan agreement, which adds non- 14 cash stock expense and transaction expense to EBITDA.

Your Mission is our Passion Q&A

Your Mission is our Passion