SOCIAL & SCIENTIFIC SYSTEMS, INC. UNAUDITED FINANCIAL STATEMENTS MARCH 31, 2019 AND 2018

Social & Scientific Systems, Inc. Page Balance Sheets 3 - 4 Statements of Income 5 Statements of Equity 6 Statements of Cash Flows 7 - 8 Notes to Financial Statements 9 - 21

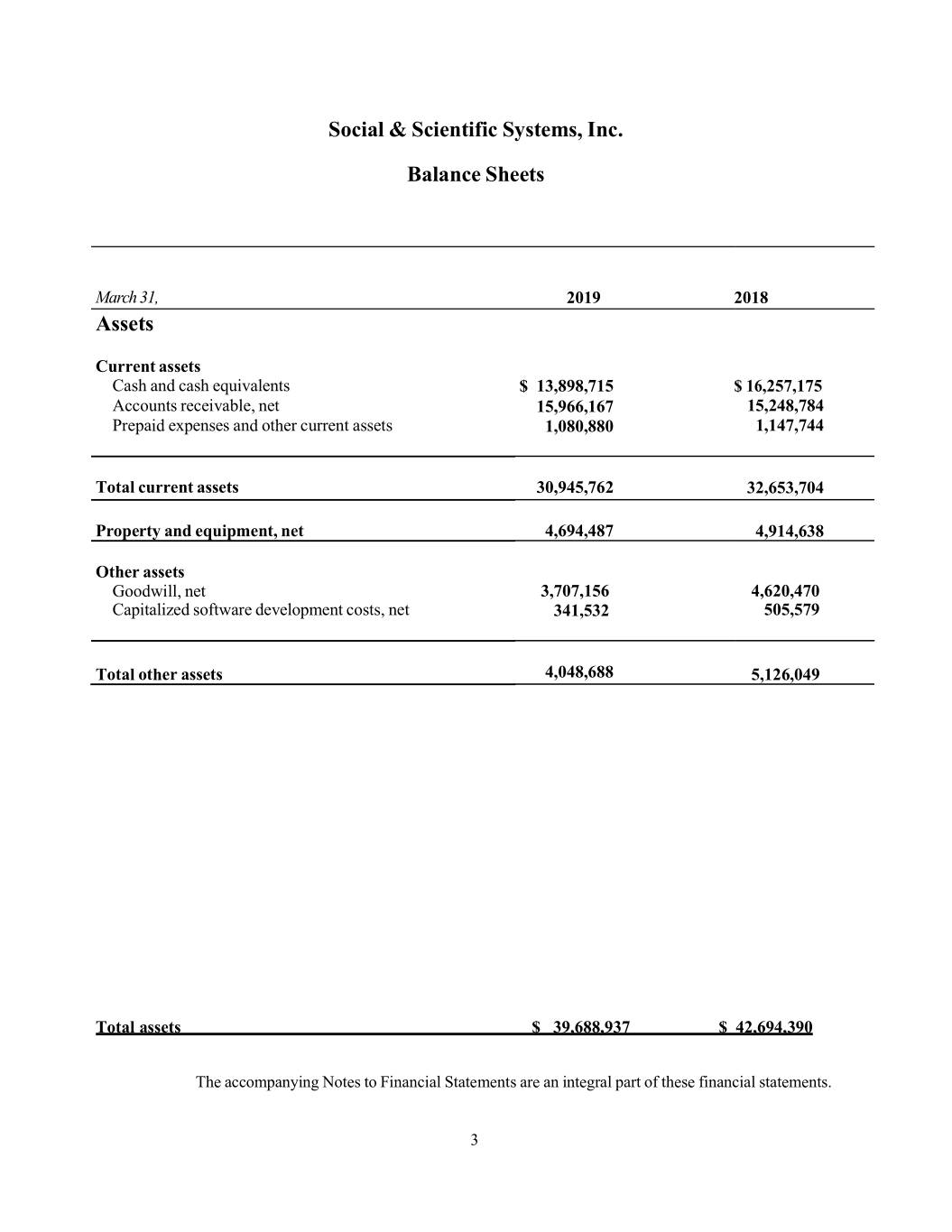

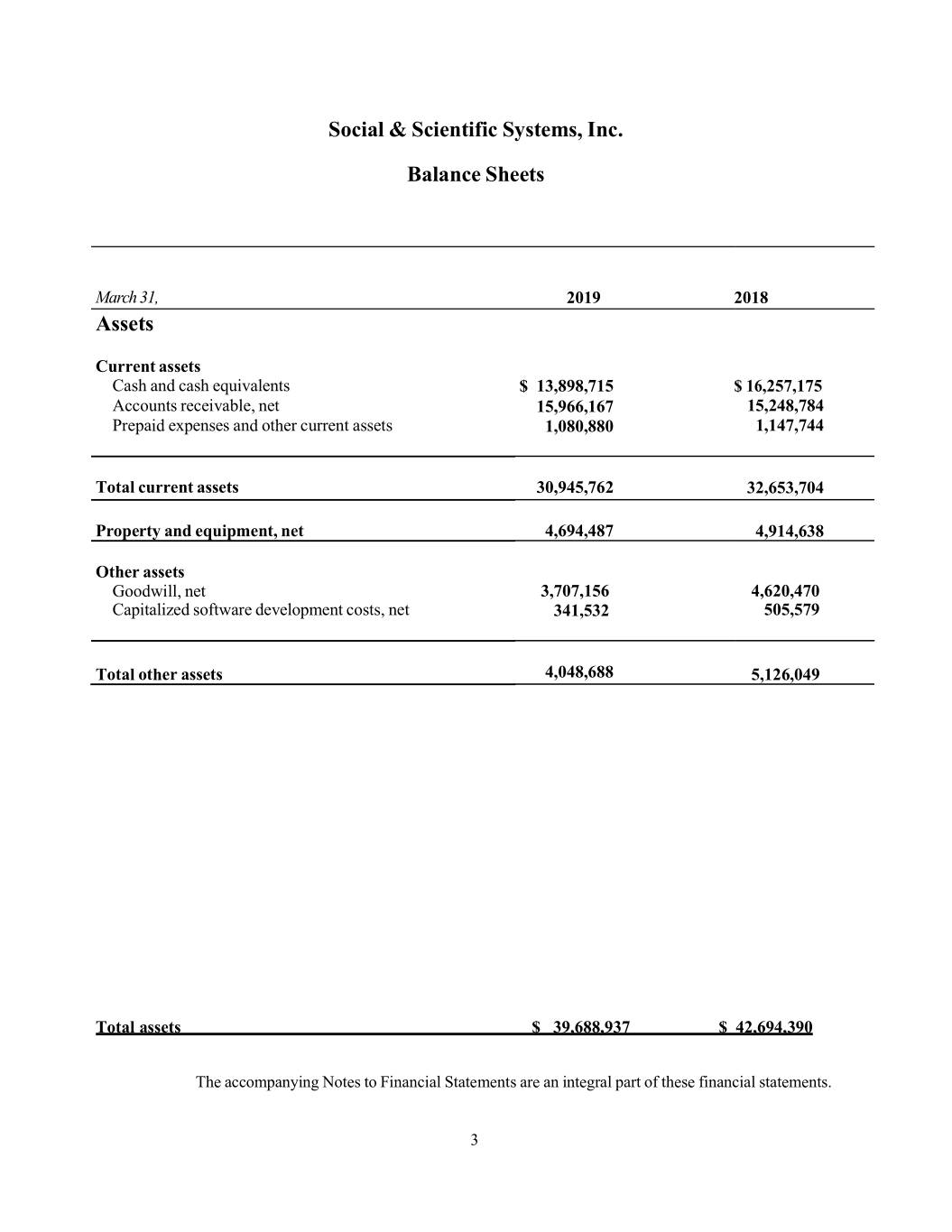

Social & Scientific Systems, Inc. Balance Sheets March 31, 2019 2018 Assets Current assets Cash and cash equivalents $ 13,898,715 $ 16,257,175 Accounts receivable, net 15,966,167 15,248,784 Prepaid expenses and other current assets 1,080,880 1,147,744 Total current assets 30,945,762 32,653,704 Property and equipment, net 4,694,487 4,914,638 Other assets Goodwill, net 3,707,156 4,620,470 Capitalized software development costs, net 341,532 505,579 Total other assets 4,048,688 5,126,049 Total assets $ 39,688,937 $ 42,694,390 The accompanying Notes to Financial Statements are an integral part of these financial statements. 3

Social & Scientific Systems, Inc. Balance Sheets March 31, 2019 2018 Liabilities and Shareholder's Equity Current liabilities Accounts payable and accrued expenses $ 1,477,961 $ 1,631,678 Accrued salaries and related liabilities 4,380,018 5,553,855 Deferred revenue 177,231 986,609 Overapplied indirect rate liability 589,070 543,336 Customer advances 408,619 435,860 Deferred rent 385,653 392,507 Total current liabilities 7,418,552 9,543,844 Long term Liabilities Other Liabilities 715,776 819,143 Deferred rent, net of current portion 2,227,863 2,586,344 Total long term liabilities 2,943,639 3,405,487 Total liabilities 10,362,192 12,949,331 Commitments and contingencies Shareholder's equity Common stock - $.0001 par value, 3,000,000 shares authorized, 85 85 850,000 shares issued and 360,262 and 381,805 outstanding Additional paid-in capital 1,995,421 1,995,421 Unallocated common stock held by ESOP (18,677,763) (19,526,752) Retained earnings 55,559,323 53,537,108 Treasury stock 489,738 and 468,195 shares (9,550,321) (6,260,803) Total shareholder's equity 29,326,745 29,745,059 Total liabilities and shareholder's equity $39,688,937 $42,694,390 The accompanying Notes to Financial Statements are an integral part of these financial statements. 4

Social & Scientific Systems, Inc. Statements of Income Periods Ended March 31, 2019 2018 Contract revenue Contract revenue - government $ 13,819,937 $ 14,311,311 Contract revenue - commercial 1,422,469 1,747,975 Federal grants 2,046,805 2,334,545 Total contract revenue 17,289,211 18,393,830 Direct costs Direct labor 5,319,926 6,159,948 Subcontractors 2,341,308 1,869,493 Other direct costs 1,828,903 2,006,877 Total direct costs 9,490,137 10,036,317 Gross margin on revenue 7,799,074 8,357,513 Indirect costs 7,721,130 7,743,368 Income from operations 77,943 614,145 Other income (expense) Foreign currency exchange loss (10,130) (14,068) Other income 1,000 Interest income 7,301 3,079 Interest expense (607) Total other expense (1,829) (11,597) Net income $ 76,114 $ 602,549 The accompanying Notes to Financial Statements are an integral part of these financial statements. 5

1,233,327 2,164,312 1,237,668 4,657,068 26,144,805 26,144,805 29,142,510 (2,897,031) (3,289,518) $29,250,631 $29,326,745 76,114 Stock Total Total Stock Treasury (3,363,772) (2,897,031) (6,260,803) ($9,550,321) ($9,550,321) (3,289,518) 865,301 . (20,392,053) (19,526,752) ($18,677,763) ($18,677,763) Unallocated Unallocated held held by ESOP Common Stock Common Stock 848,989 384,338 372,367 2,164,312 4,657,068 47,905,124 47,905,124 52,934,559 Retained Retained Earnings $55,559,323 $55,483,209 76,114 1,995,421 1,995,421 1,995,421 $1,995,421 $1,995,421 Additional paid-in capital paid-in Statements Equity of 85 85 85 $85 $85 Stock Social Social &Systems, Scientific Inc. Common The accompanyingThe Notes to Financial Statements are integral an part of these financial statements Balance, December 31, 2016 Balance, December 31, expense contribution ESOP of 18,781shares Purchase ofstock treasury Net income 2017 Balance 31, December sharesof 21,543 of stock Purchase treasury Contribution ESOP Expense Net income Balance, 2018 December 31, Net income 2019 Balance, March 31,

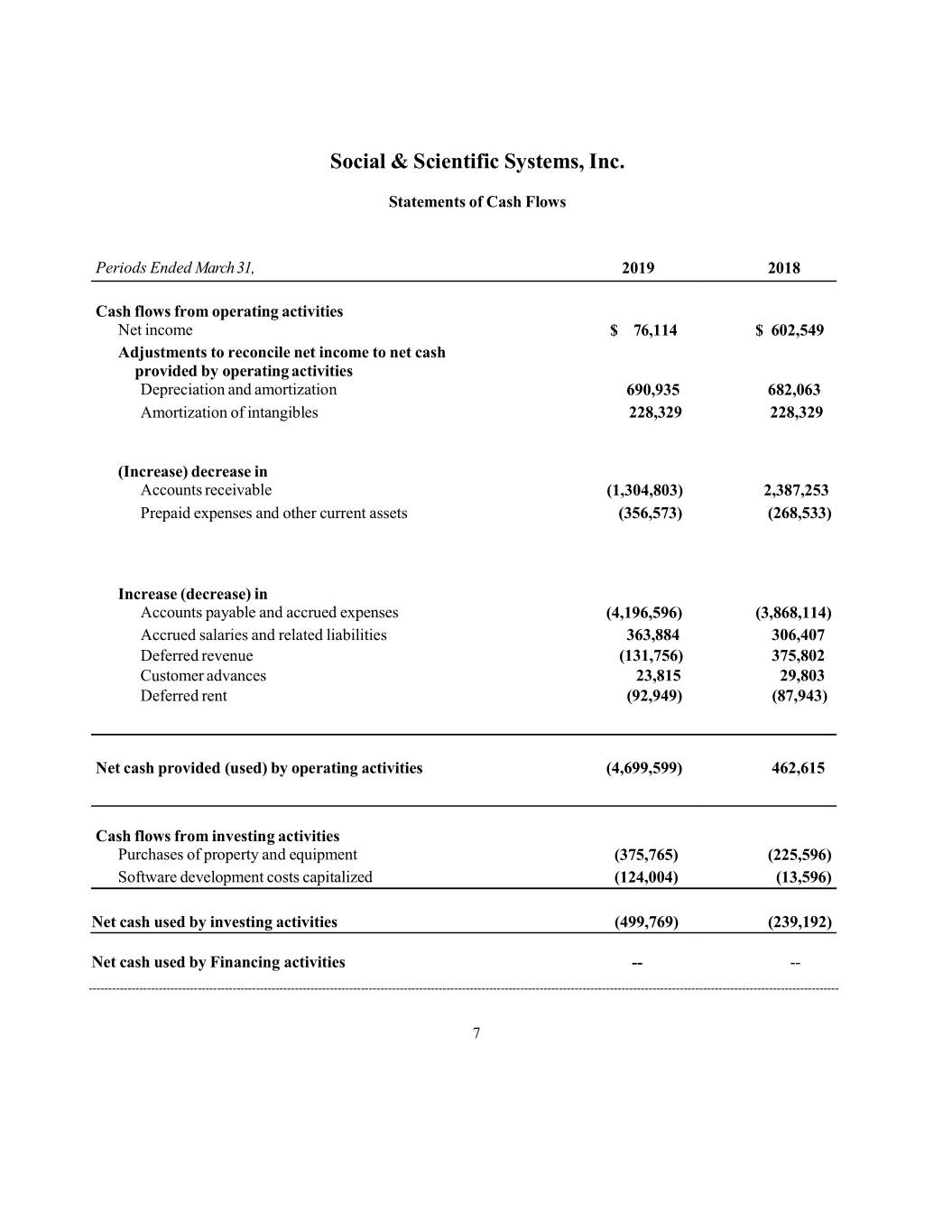

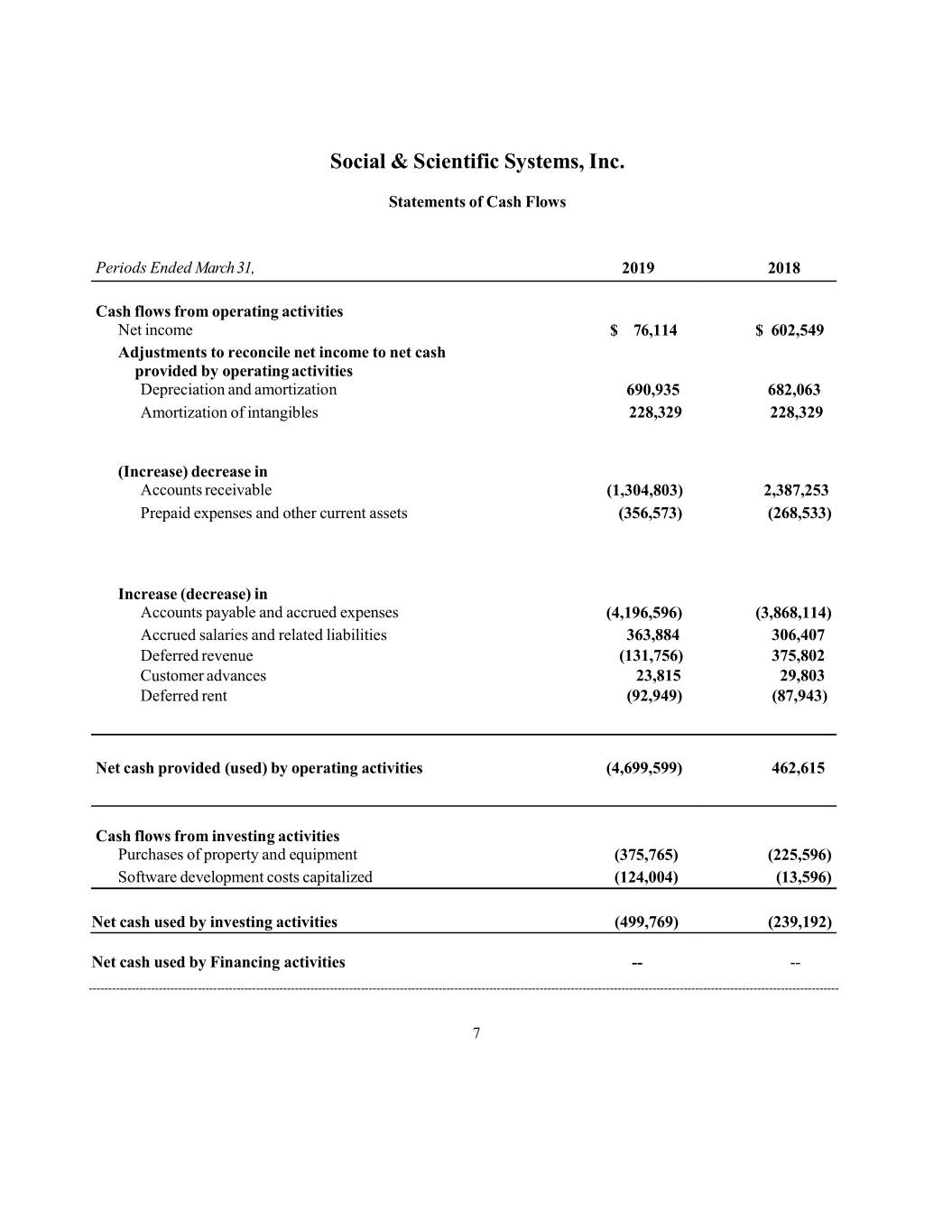

Social & Scientific Systems, Inc. Statements of Cash Flows Periods Ended March 31, 2019 2018 Cash flows from operating activities Net income $ 76,114 $ 602,549 Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization 690,935 682,063 Amortization of intangibles 228,329 228,329 (Increase) decrease in Accounts receivable (1,304,803) 2,387,253 Prepaid expenses and other current assets (356,573) (268,533) Increase (decrease) in Accounts payable and accrued expenses (4,196,596) (3,868,114) Accrued salaries and related liabilities 363,884 306,407 Deferred revenue (131,756) 375,802 Customer advances 23,815 29,803 Deferred rent (92,949) (87,943) Net cash provided (used) by operating activities (4,699,599) 462,615 Cash flows from investing activities Purchases of property and equipment (375,765) (225,596) Software development costs capitalized (124,004) (13,596) Net cash used by investing activities (499,769) (239,192) Net cash used by Financing activities -- -- ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------- 7

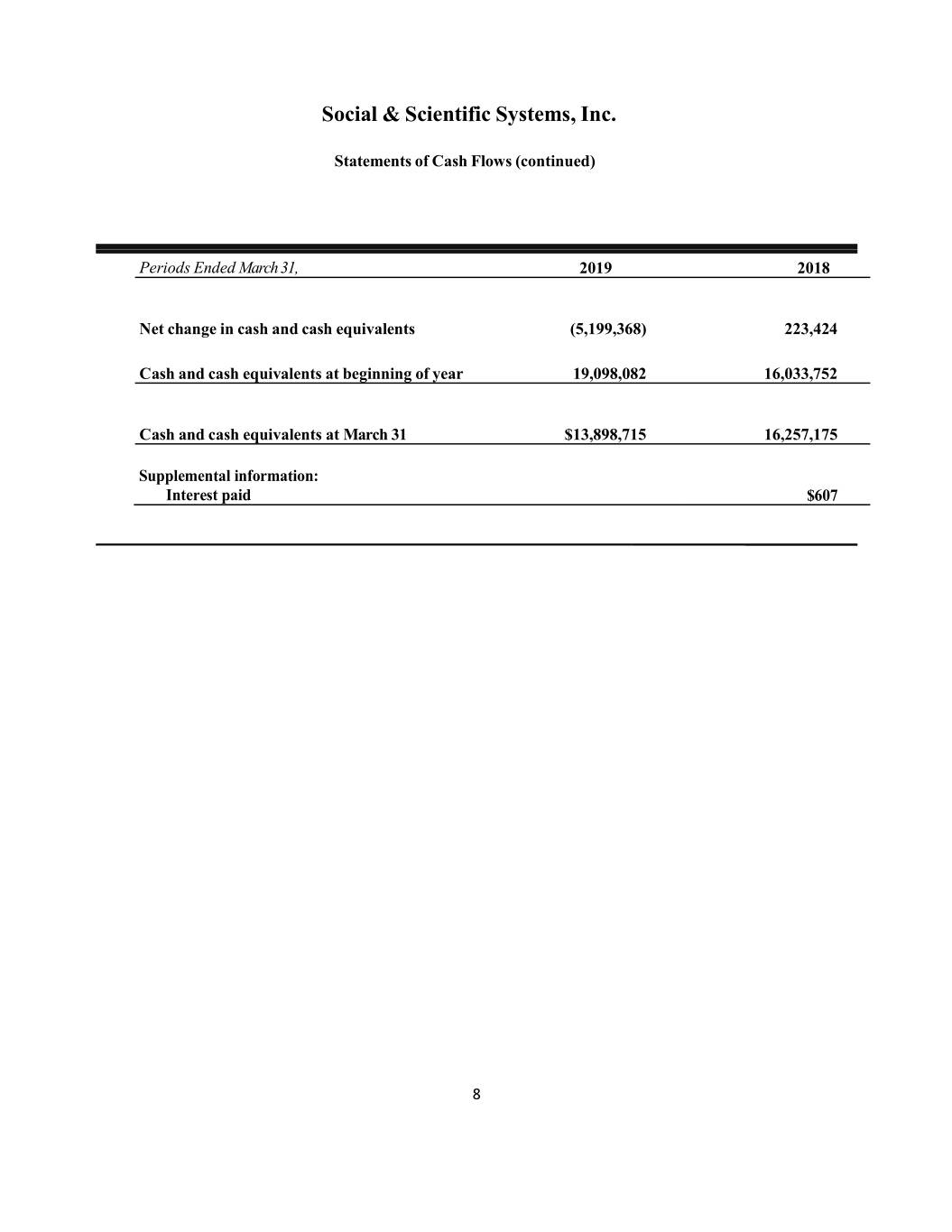

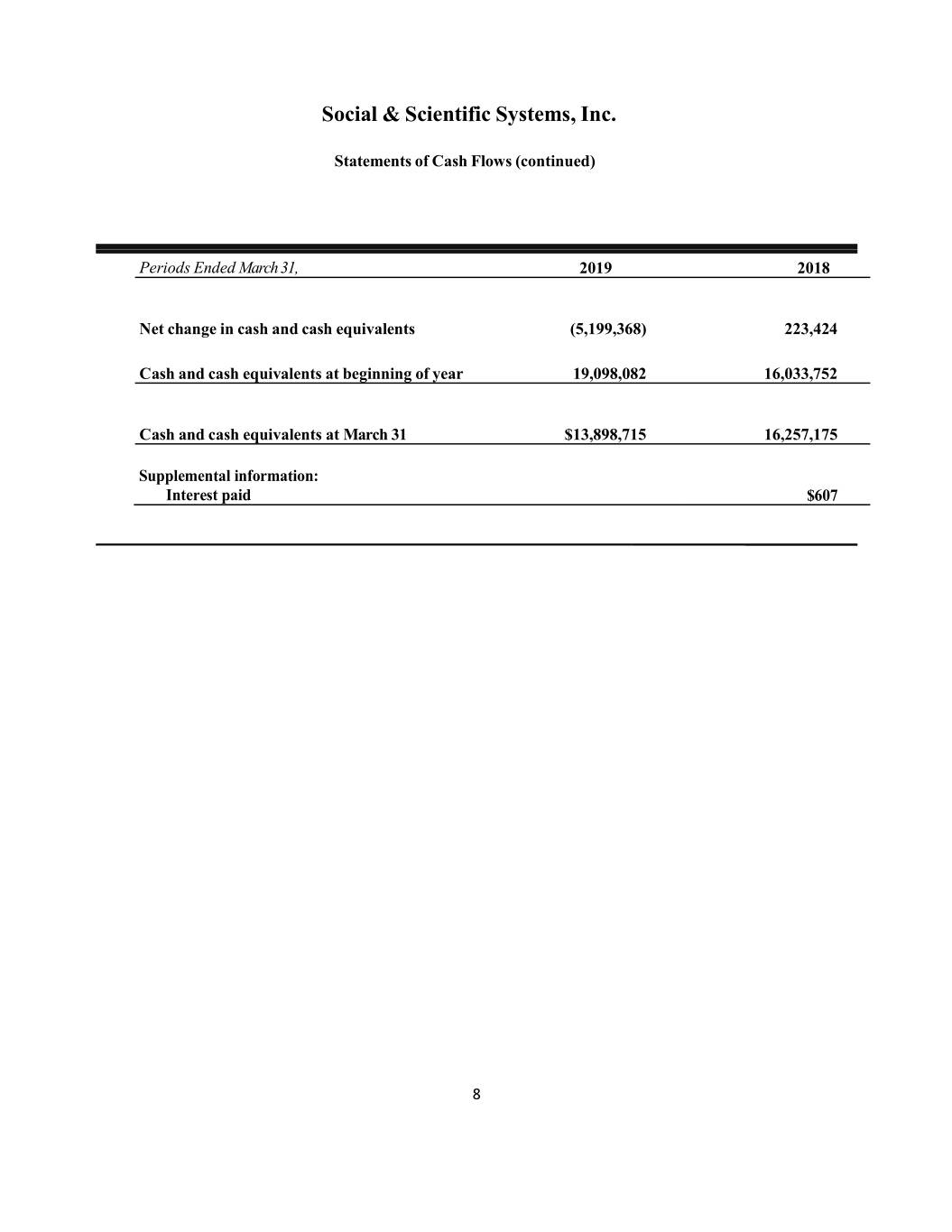

Social & Scientific Systems, Inc. Statements of Cash Flows (continued) Periods Ended March 31, 2019 2018 Net change in cash and cash equivalents (5,199,368) 223,424 Cash and cash equivalents at beginning of year 19,098,082 16,033,752 Cash and cash equivalents at March 31 $13,898,715 16,257,175 Supplemental information: Interest paid $607

1. Organization and significant accounting policies Organization: Social & Scientific Systems, Inc. ("Corporation") was incorporated under the laws of the State of Delaware on March 29, 1978 to provide professional services in support of public health research, primarily to federal government agencies in the Washington, D.C. metropolitan area. The core business groups coordinate multi-institutional clinical research programs, conduct health policy research and data analysis, and provide survey and epidemiology services. The Corporation is headquartered in Silver Spring, Maryland. Cash and cash equivalents: For purposes of financial statement presentation, the Corporation considers all highly liquid debt instruments with initial maturities of ninety days or less to be cash equivalents. The Corporation maintains cash balances which may exceed federally insured limits. As of March 31, 2019 and 2018, the Corporation had balances totaling $14,495,383 and $16,724,075, respectively, in a repurchase agreement sweep account. This account is included in the accompanying Balance Sheets net of outstanding checks in excess of bank balances at March 31, 2019 and 2018. Management does not believe that cash invested in excess of federally-insured limits pose a significant credit risk. Accounts receivable: The Corporation provides for an allowance for doubtful accounts based on management's best estimate of probable losses determined principally on the basis of historical experience and specific allowances for known troubled accounts, if needed. All accounts, or portions thereof that are deemed to be uncollectible or that require an excessive collection cost are written off to the allowance for doubtful accounts. Property and equipment: Property and equipment are recorded at the original cost and are being depreciated on a straight-line basis over estimated lives of three to fifteen years. Leasehold improvements are amortized over the life of the assets or the remaining period of the lease, whichever is shorter. Long-lived assets and impairment: The Corporation periodically evaluates the carrying value of long-lived assets, including, but not limited to, property and equipment and other assets, when events and circumstances warrant such a review. The carrying value of a long-lived asset is considered impaired when the anticipated undiscounted cash flows from such an asset are separately identifiable and are less than its carrying value. In that event, a loss is recognized to the extent that the carrying value exceeds the fair value of the long-lived asset. Fair value is determined primarily using the anticipated cash flows discounted at a rate commensurate with the risk involved. 9

1. Goodwill: Goodwill represents the excess of the purchase price of the net assets acquired over the fair value of those net assets. The Corporation accounts for goodwill subsequent to business combinations in accordance with Accounting Standards Update (ASU) 2014-02 Intangibles Goodwill and Other (Topic 350) Accounting for Goodwill, which allows entities who meet the definition of a private company to amortize goodwill on a straight-line basis over 10 years, or less than 10 years if the entity demonstrates that another useful life is more appropriate. Goodwill is tested for impairment when an event occurs or circumstances indicate the fair value of the entity may be below its carrying amount (a triggering event). The Corporation elected to test goodwill for impairment at the entity level, should triggering events occur. When a triggering event occurs, the entity has the option to first assess qualitative factors to determine if a quantitative impairment test is necessary. If the qualitative assessment indicates that impairment is more likely than not, a quantitative test will be performed to measure the excess of the carrying amount of the entity, including goodwill, over its fair value. The Corporation amortizes goodwill over a 10-year period and recognized amortization expense related to goodwill of $228,329 during the period ended March 31, 2019 and 2018, respectively. The Corporation did not identify any triggering events during the period ended March 31, 2019 and 2018, which would require goodwill to be evaluated for impairment. The changes in the carrying amount of goodwill year-to-date through the period ended March 31, 2019 and 2018 are as follows: 2019 2018 Balance as of January 1, $ 3,935,484 4,848,798 Amortization (228,329) (228,329) Balance as of March 31, $ 3,707,156 $ 4,620,470 Estimated future amortization expense for the years ending December 31, 2020 through December 31, 2022 is $913,314 per year and $282,228 during the year ending December 31, 2023.

1. Software development costs: The Corporation capitalizes certain software development costs for software which it plans to sell externally. Capitalization of software costs begins upon the establishment of technological feasibility. The establishment of technological feasibility and the ongoing assessment of recoverability of capitalized software development costs require considerable judgment by management with respect to certain external factors including, but not limited to, anticipated future gross revenue, estimated economic life, and changes in software and hardware technologies. Capitalized software costs are amortized over the economic life of the product using the greater of the straight-line method of amortization or based on the percentage of actual sales to expected total sales, commencing on the date of product release. When a software product is no longer sold, the costs and accumulated amortization are written off, and any loss is charged against operations. Year-To-Date through the period ended March 31, 2019 and 2018, capitalized software costs are presented net of accumulated amortization of $3,508,861 and $3,205,954, respectively. Year-To-Date through the period ended March 31, 2019 and 2018, amortization related to capitalized software development costs totaled $62,574 and $80,186, respectively, which is included in direct costs and indirect costs on the accompanying Statements of Income. Deferred rent: The Corporation recognizes the minimum non-contingent rents required under operating leases as rent expense on a straight-line basis over the life of the lease, with differences between amounts recognized as expense and the amounts actually paid recorded as deferred rent on the accompanying Balance Sheets. Stock appreciation rights expense: The Corporation measures compensation expense for its stock appreciation rights (SARS) plan in accordance with accounting principles generally accepted in the United States of America, which require that compensation expense be recorded in operations for all grants issued. The value of the stock grants is recognized over the requisite service period which is determined based on the intrinsic value of the stock as it appreciates. As the intrinsic value increases, the Corporation will record a liability based upon the intrinsic value at the time of the change. Contract Revenue: Revenue from cost-type contracts is recognized as costs are incurred on the basis of direct costs plus allowable indirect costs and an allocable portion of the fixed fee. Revenue from fixed-price type contracts is recognized under the percentage-of- completion method of accounting, with costs and estimated profits included in contract revenue as work is performed. If actual and estimated costs to complete a contract indicate a loss, provision is made currently for the loss anticipated on the contract. Revenue from time and material contracts is recognized as costs are incurred at amounts represented by the agreed-upon billing amounts. Revenue from government grants is recognized as costs are incurred in accordance with the terms of the grant.

1. Revenue recognized on contracts for which billings have not been presented to customers at year-end is included in the accounts receivable classification on the accompanying Balance Sheets. Revenue yet to be recognized on contracts for which cash payments have already been received is reflected in the accompanying Balance Sheets as deferred revenue. Foreign currency: Exchange adjustments resulting from transactions in foreign currency are generally recognized in operations. The cumulative translation adjustments are not material to the financial statements and therefore not disclosed. The Corporation has offices and conducts business in foreign countries which accounts for total contract revenues of $841,490 and $1,425,462 through March 31, 2019 and 2018, respectively. At March 31, 2019 and 2018, cash and cash equivalents denominated in both USD and Ugandan shillings (equivalent of $123,298 and $104,456 USD, respectively) are held in financial institutions in Uganda. Income taxes: The Corporation is 100% owned by an Employee Stock Ownership Plan (ESOP) (shareholder) and has elected to be treated as an S Corporation for federal income tax purposes whereby the tax attributes of the Corporation are passed through to and reported on the shareholder's tax return. Accordingly, there is no provision for federal or state income taxes included in the accompanying financial statements. The Corporation evaluates uncertainty in income tax positions taken or expected to be taken on a tax return based on a more-likely-than-not recognition standard. If that threshold is met, the tax position is then measured at the largest amount that is greater than 50% likely of being realized upon ultimate settlement and is recognized in the financial statements. If applicable, the Corporation records interest and penalties as a component of income tax expense. As of March 31, 2019 and 2018 there were no accruals for uncertain tax positions. Tax years from January 1, 2015 through the current year remain open for examination by federal and state tax authorities. Use of accounting estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Recently issued accounting pronouncements not yet adopted: In May 2014, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) No. 2014-09, Revenue from Contracts with Customers (Topic 606), which supersedes the existing accounting standards for revenue recognition. In August 2015, the FASB issued ASU No. 2015-14, Revenue from Contracts with Customers (Topic

1. 606): Deferral of the Effective Date, resulting in a one-year deferral of the effective date of ASU 2014-09, which will become effective for the Corporation on January 1, 2019. This ASU is based on the principle that revenue is recognized to depict the transfer of goods or services to customers at an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. The ASU also requires additional disclosure about the nature, amount, timing and uncertainty of revenue and cash flows arising from customer contracts, including significant judgments and changes in judgments, and assets recognized from costs incurred to obtain or fulfill a contract. Various updates have been issued to clarify the guidance in Topic 606. The new standard permits two methods of adoption: retrospectively to each prior reporting period presented (full retrospective method), or retrospectively with the cumulative effect of applying the guidance recognized at the date of initial application (the modified retrospective method). The Corporation is currently evaluating the potential effects on its financial statements as well as its accounting policies and procedures. Management believes the new revenue guidance does not materially affect the Corporation s financial results reported herein. In February 2016, the FASB issued ASU 2016-02, Leases (Topic 842), which supersedes the existing lease accounting standard and sets out principles for the recognition, measurement, presentation and disclosure of leases. Under the new guidance, a lessee will be required to recognize lease assets and lease liabilities for all leases with lease terms in excess of twelve months. The new standard requires lessees to apply a dual approach, classifying leases as either finance or operating leases based on the principle of whether or not the lease is effectively a financed purchase by the lessee. This classification will determine whether lease expense is recognized based on an effective interest method or on a straight line basis over the term of the lease. ASU 2016-02 becomes effective for the Corporation on January 1, 2020. The Corporation is in the process of evaluating the impact of this new guidance. Subsequent events: Management has evaluated subsequent events for disclosure in these financial statements through April 8, 2019.

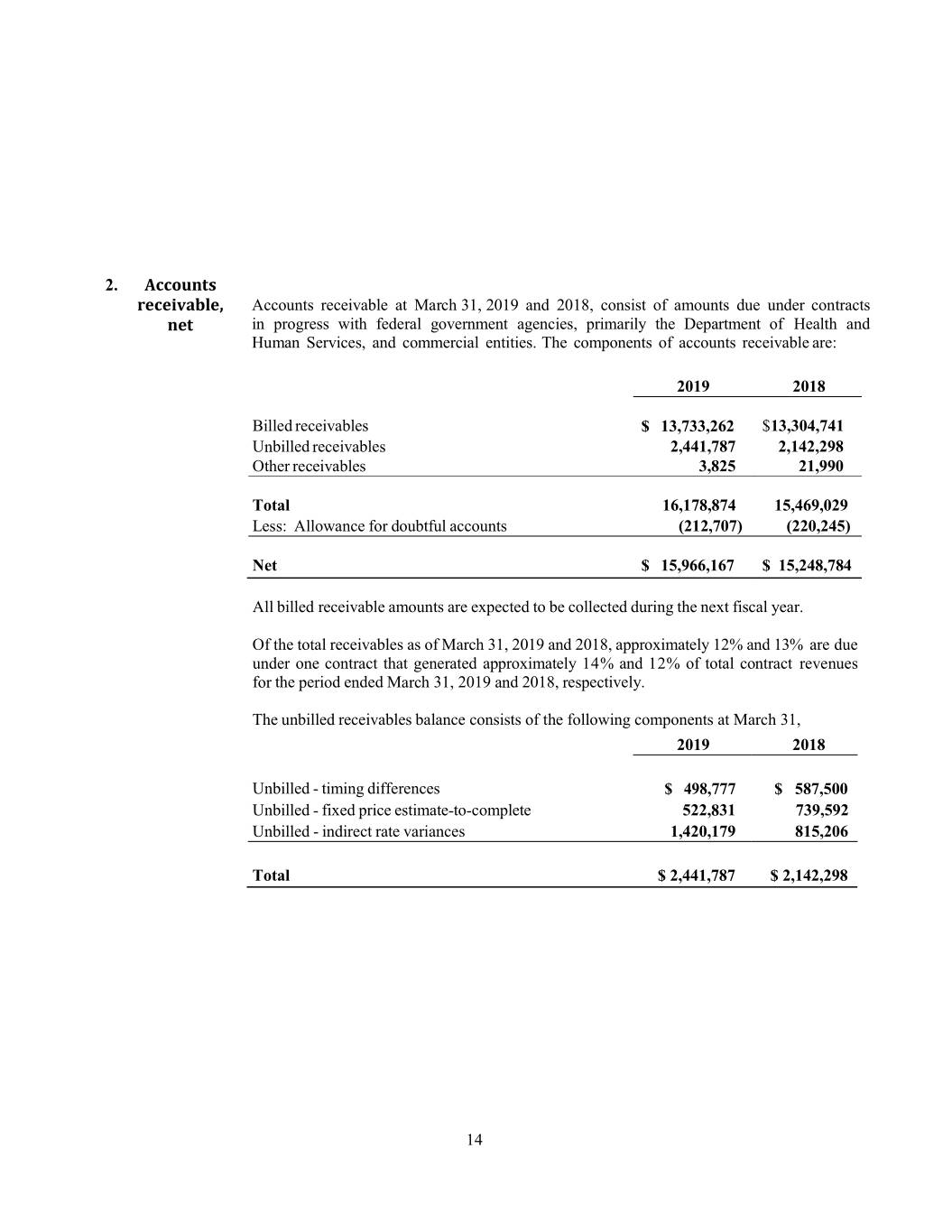

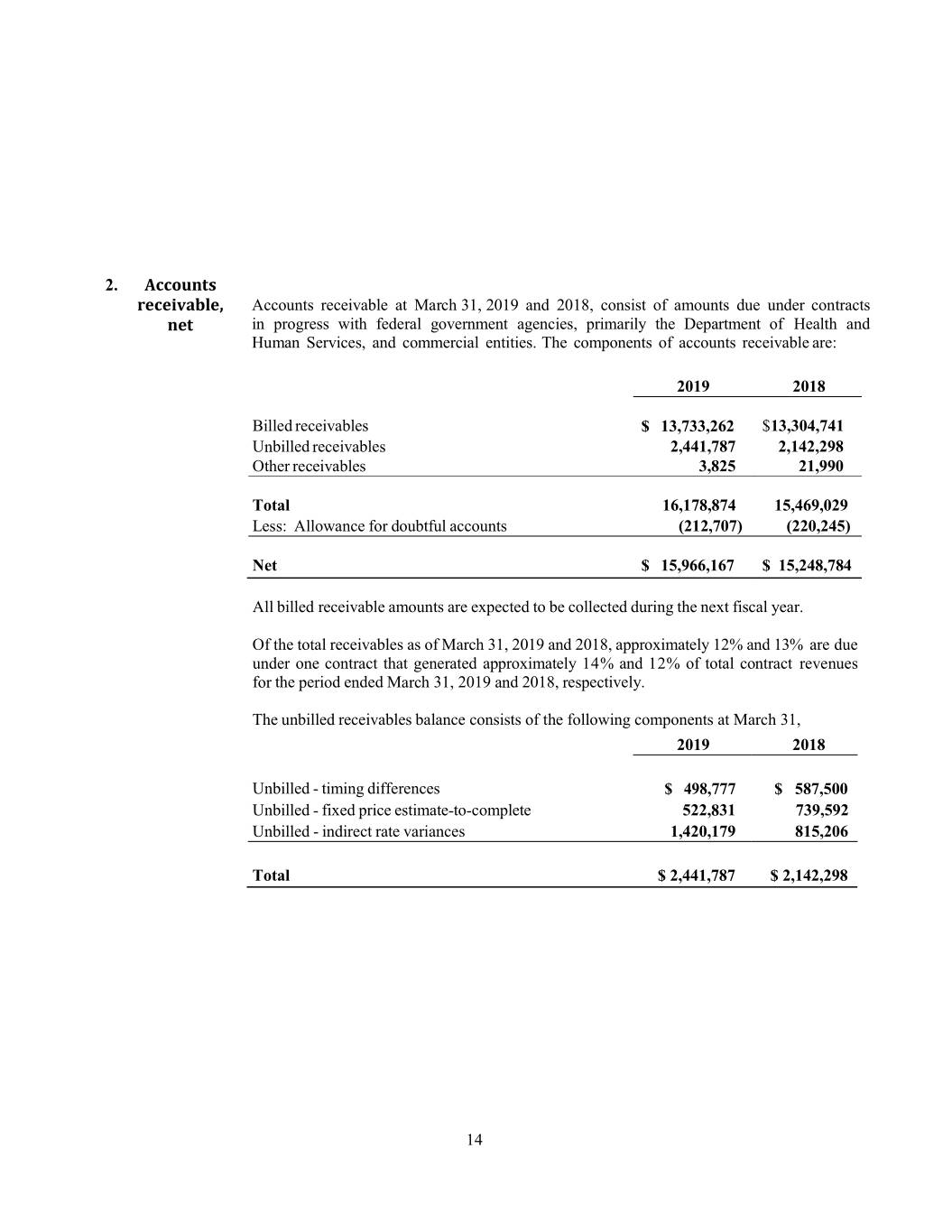

2. Accounts receivable at March 31, 2019 and 2018, consist of amounts due under contracts in progress with federal government agencies, primarily the Department of Health and Human Services, and commercial entities. The components of accounts receivable are: 2019 2018 Billed receivables $ 13,733,262 $13,304,741 Unbilled receivables 2,441,787 2,142,298 Other receivables 3,825 21,990 Total 16,178,874 15,469,029 Less: Allowance for doubtful accounts (212,707) (220,245) Net $ 15,966,167 $ 15,248,784 All billed receivable amounts are expected to be collected during the next fiscal year. Of the total receivables as of March 31, 2019 and 2018, approximately 12% and 13% are due under one contract that generated approximately 14% and 12% of total contract revenues for the period ended March 31, 2019 and 2018, respectively. The unbilled receivables balance consists of the following components at March 31, 2019 2018 Unbilled - timing differences $ 498,777 $ 587,500 Unbilled - fixed price estimate-to-complete 522,831 739,592 Unbilled - indirect rate variances 1,420,179 815,206 Total $ 2,441,787 $ 2,142,298 14

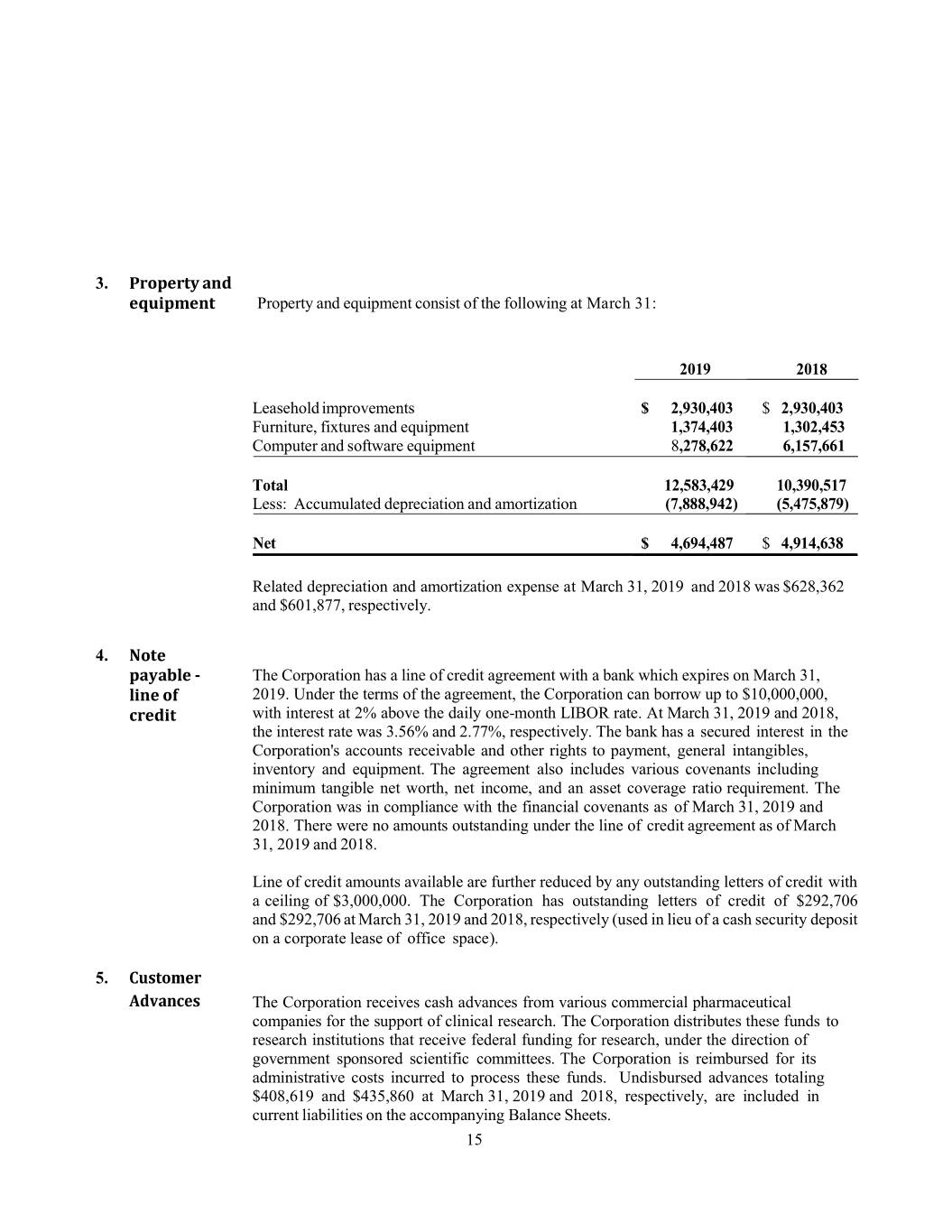

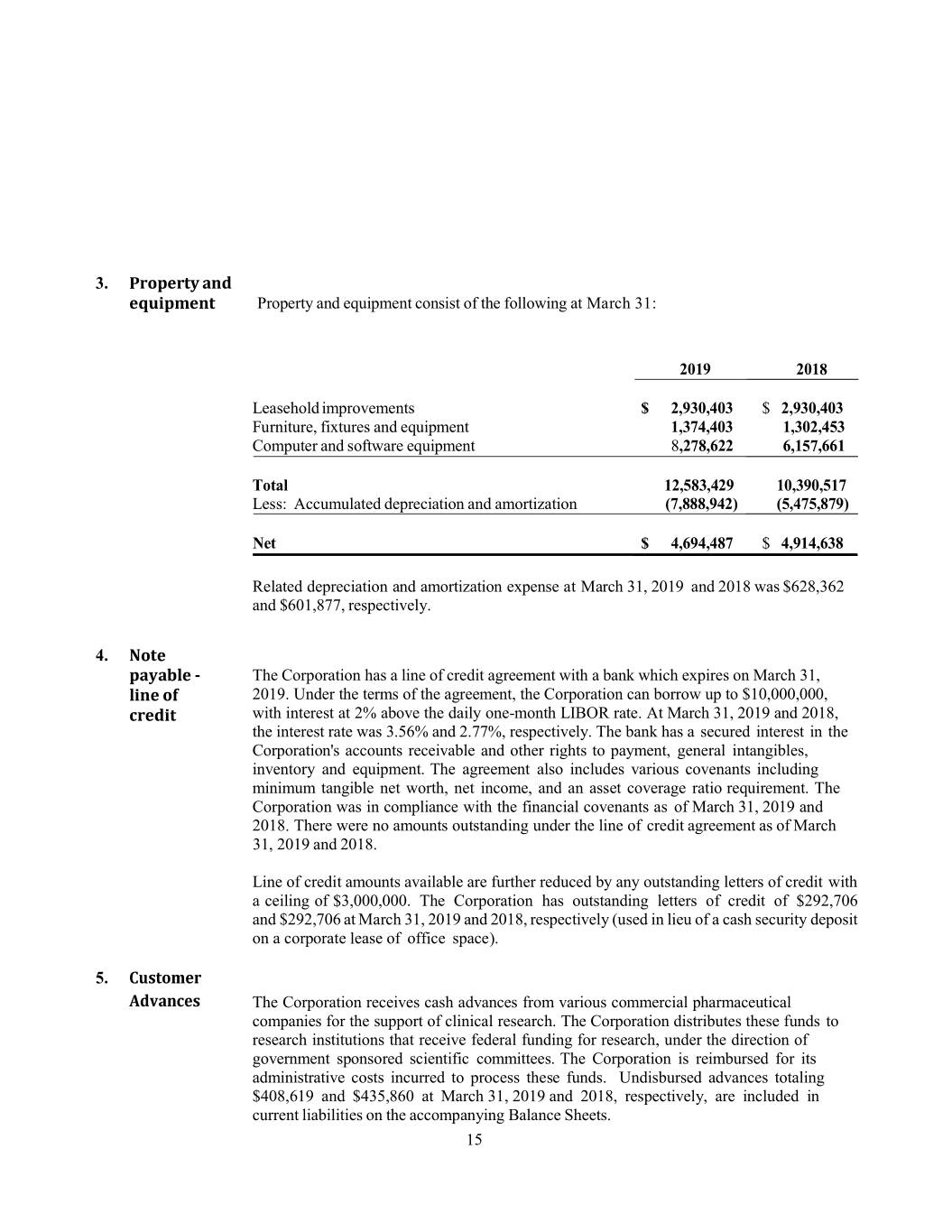

3. Property and equipment consist of the following at March 31: 2019 2018 Leasehold improvements $ 2,930,403 $ 2,930,403 Furniture, fixtures and equipment 1,374,403 1,302,453 Computer and software equipment 8,278,622 6,157,661 Total 12,583,429 10,390,517 Less: Accumulated depreciation and amortization (7,888,942) (5,475,879) Net $ 4,694,487 $ 4,914,638 Related depreciation and amortization expense at March 31, 2019 and 2018 was $628,362 and $601,877, respectively. 4. The Corporation has a line of credit agreement with a bank which expires on March 31, 2019. Under the terms of the agreement, the Corporation can borrow up to $10,000,000, with interest at 2% above the daily one-month LIBOR rate. At March 31, 2019 and 2018, the interest rate was 3.56% and 2.77%, respectively. The bank has a secured interest in the Corporation's accounts receivable and other rights to payment, general intangibles, inventory and equipment. The agreement also includes various covenants including minimum tangible net worth, net income, and an asset coverage ratio requirement. The Corporation was in compliance with the financial covenants as of March 31, 2019 and 2018. There were no amounts outstanding under the line of credit agreement as of March 31, 2019 and 2018. Line of credit amounts available are further reduced by any outstanding letters of credit with a ceiling of $3,000,000. The Corporation has outstanding letters of credit of $292,706 and $292,706 at March 31, 2019 and 2018, respectively (used in lieu of a cash security deposit on a corporate lease of office space). 5. The Corporation receives cash advances from various commercial pharmaceutical companies for the support of clinical research. The Corporation distributes these funds to research institutions that receive federal funding for research, under the direction of government sponsored scientific committees. The Corporation is reimbursed for its administrative costs incurred to process these funds. Undisbursed advances totaling $408,619 and $435,860 at March 31, 2019 and 2018, respectively, are included in current liabilities on the accompanying Balance Sheets. 15

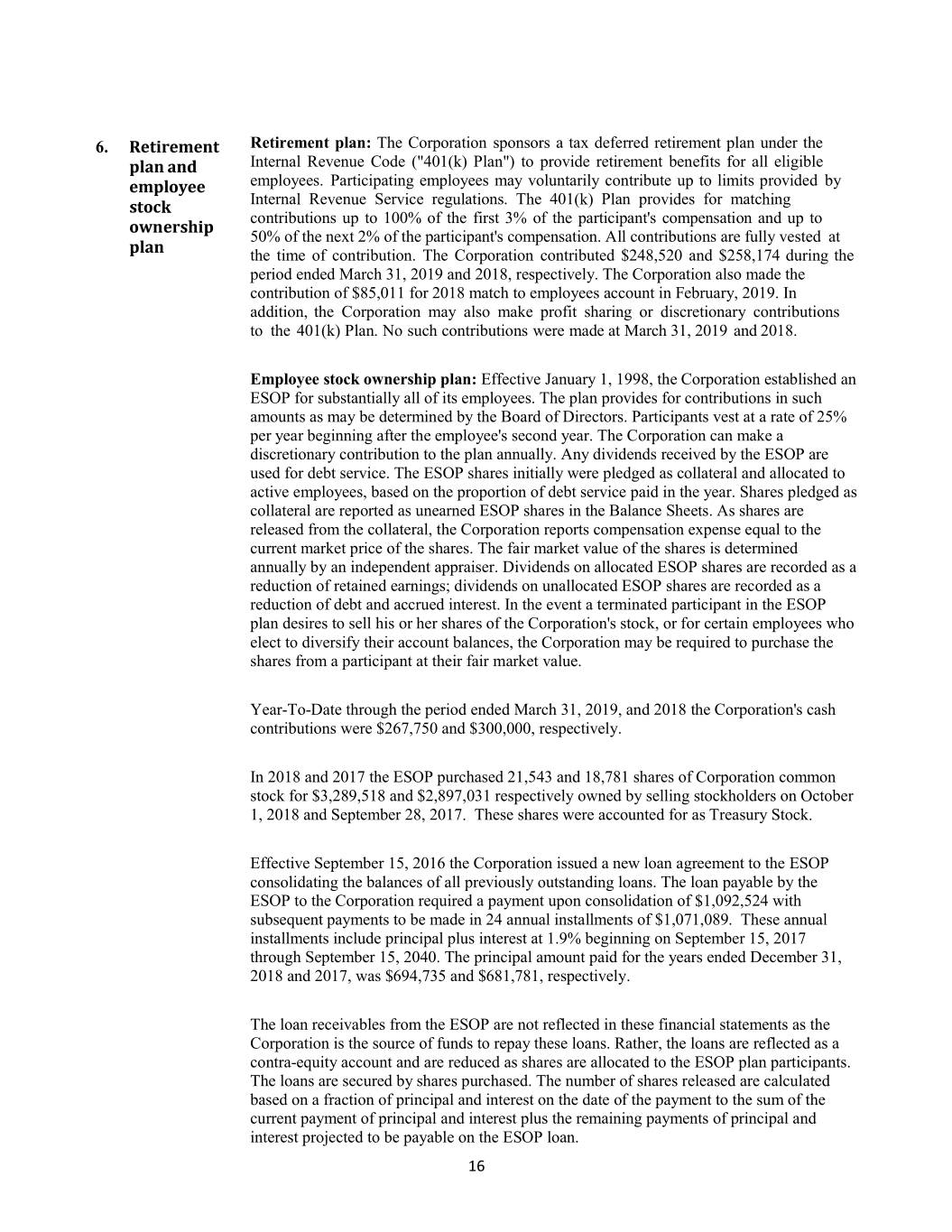

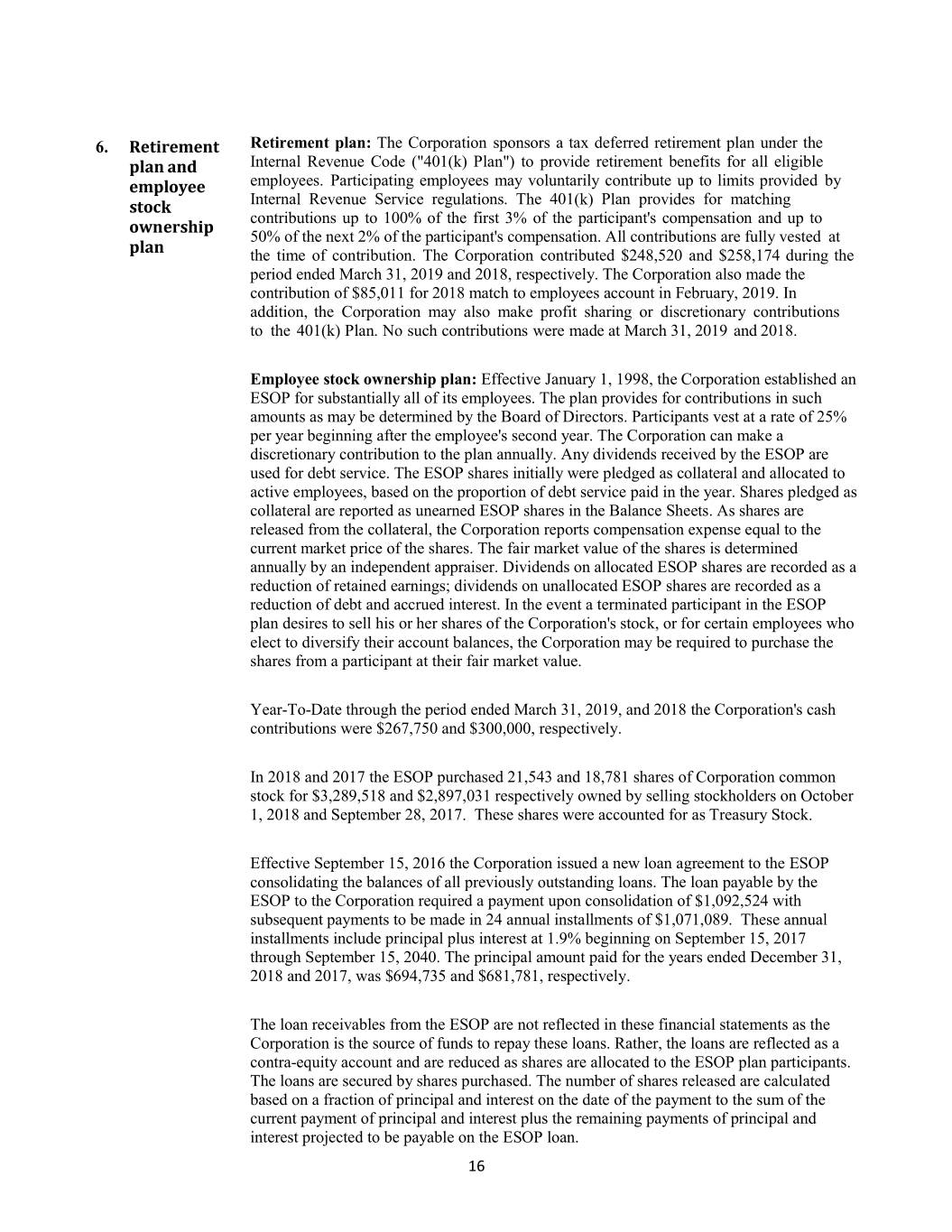

6. Retirement plan: The Corporation sponsors a tax deferred retirement plan under the Internal Revenue Code ("401(k) Plan") to provide retirement benefits for all eligible employees. Participating employees may voluntarily contribute up to limits provided by Internal Revenue Service regulations. The 401(k) Plan provides for matching contributions up to 100% of the first 3% of the participant's compensation and up to 50% of the next 2% of the participant's compensation. All contributions are fully vested at the time of contribution. The Corporation contributed $248,520 and $258,174 during the period ended March 31, 2019 and 2018, respectively. The Corporation also made the contribution of $85,011 for 2018 match to employees account in February, 2019. In addition, the Corporation may also make profit sharing or discretionary contributions to the 401(k) Plan. No such contributions were made at March 31, 2019 and 2018. Employee stock ownership plan: Effective January 1, 1998, the Corporation established an ESOP for substantially all of its employees. The plan provides for contributions in such amounts as may be determined by the Board of Directors. Participants vest at a rate of 25% per year beginning after the employee's second year. The Corporation can make a discretionary contribution to the plan annually. Any dividends received by the ESOP are used for debt service. The ESOP shares initially were pledged as collateral and allocated to active employees, based on the proportion of debt service paid in the year. Shares pledged as collateral are reported as unearned ESOP shares in the Balance Sheets. As shares are released from the collateral, the Corporation reports compensation expense equal to the current market price of the shares. The fair market value of the shares is determined annually by an independent appraiser. Dividends on allocated ESOP shares are recorded as a reduction of retained earnings; dividends on unallocated ESOP shares are recorded as a reduction of debt and accrued interest. In the event a terminated participant in the ESOP plan desires to sell his or her shares of the Corporation's stock, or for certain employees who elect to diversify their account balances, the Corporation may be required to purchase the shares from a participant at their fair market value. Year-To-Date through the period ended March 31, 2019, and 2018 the Corporation's cash contributions were $267,750 and $300,000, respectively. In 2018 and 2017 the ESOP purchased 21,543 and 18,781 shares of Corporation common stock for $3,289,518 and $2,897,031 respectively owned by selling stockholders on October 1, 2018 and September 28, 2017. These shares were accounted for as Treasury Stock. Effective September 15, 2016 the Corporation issued a new loan agreement to the ESOP consolidating the balances of all previously outstanding loans. The loan payable by the ESOP to the Corporation required a payment upon consolidation of $1,092,524 with subsequent payments to be made in 24 annual installments of $1,071,089. These annual installments include principal plus interest at 1.9% beginning on September 15, 2017 through September 15, 2040. The principal amount paid for the years ended December 31, 2018 and 2017, was $694,735 and $681,781, respectively. The loan receivables from the ESOP are not reflected in these financial statements as the Corporation is the source of funds to repay these loans. Rather, the loans are reflected as a contra-equity account and are reduced as shares are allocated to the ESOP plan participants. The loans are secured by shares purchased. The number of shares released are calculated based on a fraction of principal and interest on the date of the payment to the sum of the current payment of principal and interest plus the remaining payments of principal and interest projected to be payable on the ESOP loan.

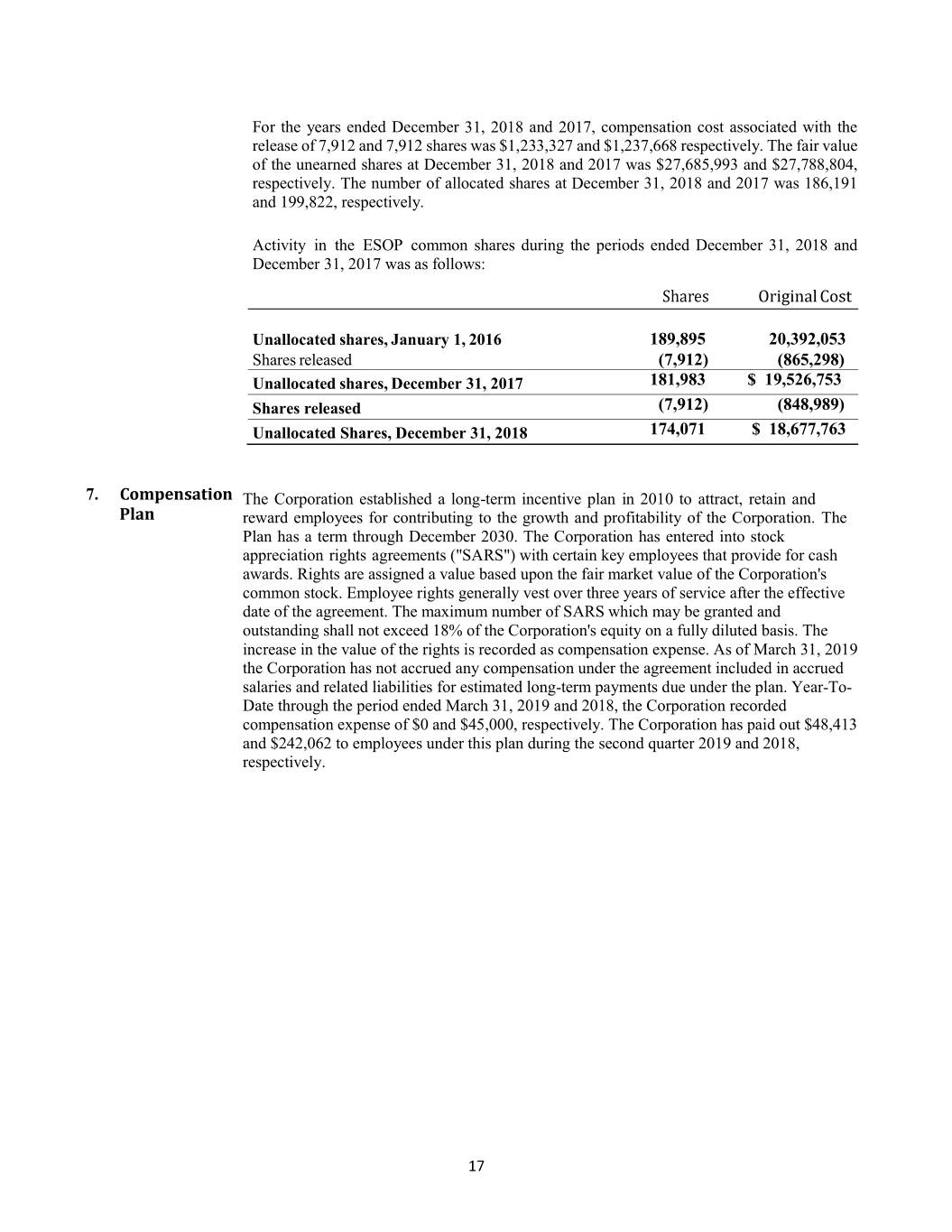

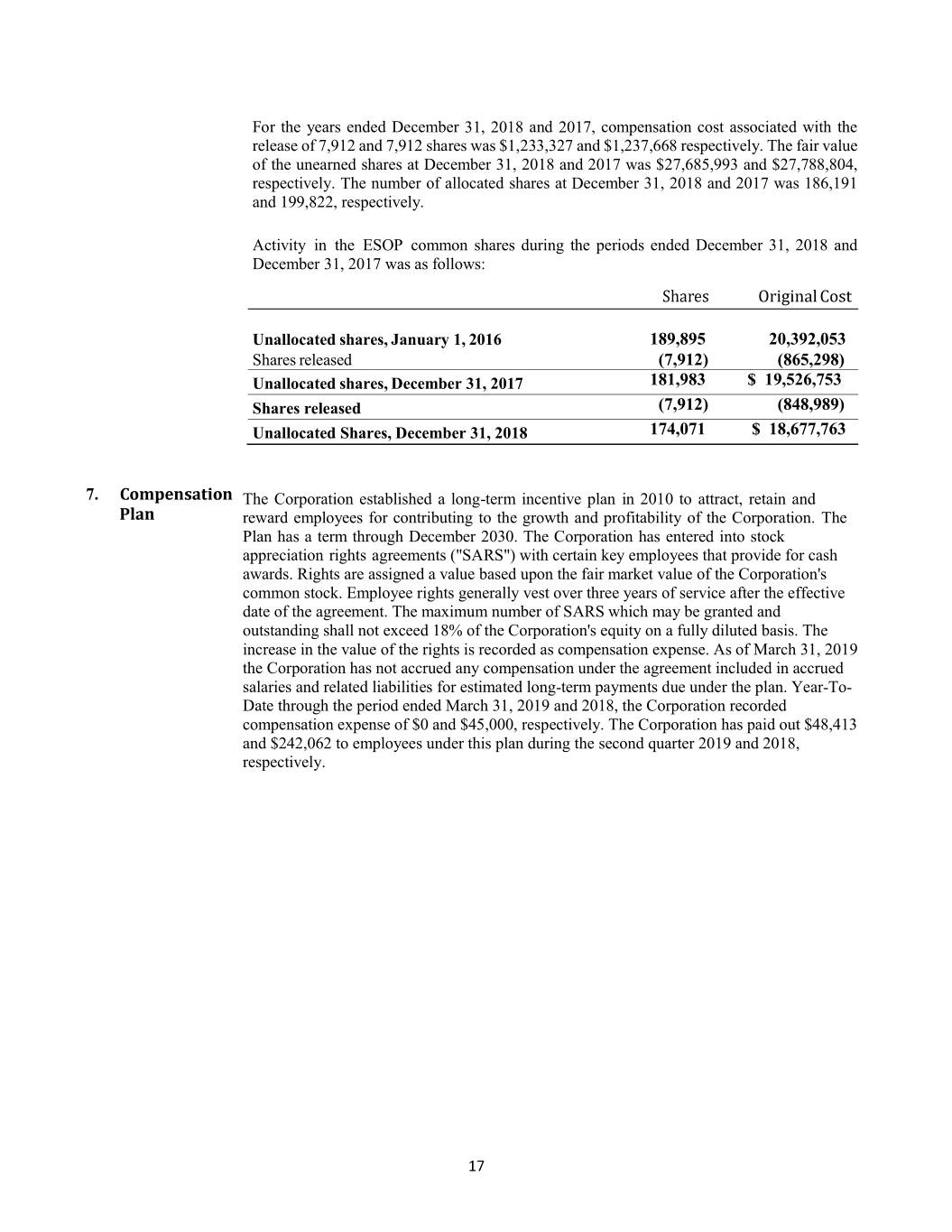

For the years ended December 31, 2018 and 2017, compensation cost associated with the release of 7,912 and 7,912 shares was $1,233,327 and $1,237,668 respectively. The fair value of the unearned shares at December 31, 2018 and 2017 was $27,685,993 and $27,788,804, respectively. The number of allocated shares at December 31, 2018 and 2017 was 186,191 and 199,822, respectively. Activity in the ESOP common shares during the periods ended December 31, 2018 and December 31, 2017 was as follows: Unallocated shares, January 1, 2016 189,895 20,392,053 Shares released (7,912) (865,298) Unallocated shares, December 31, 2017 181,983 $ 19,526,753 Shares released (7,912) (848,989) Unallocated Shares, December 31, 2018 174,071 $ 18,677,763 7. The Corporation established a long-term incentive plan in 2010 to attract, retain and reward employees for contributing to the growth and profitability of the Corporation. The Plan has a term through December 2030. The Corporation has entered into stock appreciation rights agreements ("SARS") with certain key employees that provide for cash awards. Rights are assigned a value based upon the fair market value of the Corporation's common stock. Employee rights generally vest over three years of service after the effective date of the agreement. The maximum number of SARS which may be granted and outstanding shall not exceed 18% of the Corporation's equity on a fully diluted basis. The increase in the value of the rights is recorded as compensation expense. As of March 31, 2019 the Corporation has not accrued any compensation under the agreement included in accrued salaries and related liabilities for estimated long-term payments due under the plan. Year-To- Date through the period ended March 31, 2019 and 2018, the Corporation recorded compensation expense of $0 and $45,000, respectively. The Corporation has paid out $48,413 and $242,062 to employees under this plan during the second quarter 2019 and 2018, respectively.

8. In 2014 the Corporation executed two separate agreements with Maryland and Montgomery County that provided the Corporation $1,000,000 in exchange for keeping its headquarters in its current location at the end of its lease. The first agreement was in the form of a Promissory . Payment of principal are deferred while the Corporation employs at least 300 full-time employees. The Corporation must repay a portion of the Loan and Grant should fewer than 300 employees be employed by the Corporation in Maryland as of each December 31 during the term of the Loan, net of any previous year repayments plus interest calculated at 3% per annum from the inception of the Loan and Grant. The loan was amended in the first quarter effective December 31, 2018. As amended, should the Corporation employ less than 150 employees, the Corporation shall be in default and the entire amount of the outstanding principal and interest of the Loan shall be immediately payable to Lender. If, as of June 30, 2023, there remains any outstanding Loan and Grant principal and the Corporation is not in default, Lender will forgive the balance of the Loan and the Corporation will recognize both the Loan and Grant as income. The Company has repaid approximately $324,537 under the two agreements, including $166,714 and $22,513 due at December 2018 and 2017, respectively, which is included under accounts payable and accrued expenses on the accompanying balance sheets. The outstanding principal balance on the Loan and Grant was $675,463 and $819,143 as of March 31, 2019 and 2018, respectively, and is included under other liabilities on the accompanying balance sheets.

9. The Corporation is obligated, as lessee, under non-cancelable operating leases for office space in Maryland, North Carolina, and Uganda. The following is a schedule by years of future minimum rental payments required under the operating leases that have an initial or remaining non-cancelable lease term in excess of one year as of March 31, 2019: Year Ending December 31 Total 2020 $3,731,406 2021 $3,855,772 2022 $3,984,387 2023 $3,028,352 2024 $873,427 Thereafter $1,818,536 Total $ 17,291,880 Total rent expense for office, vehicle, and equipment leases year-to-date through March 31, 2019 and 2018 was $762,557 and $791,593, respectively. 10. Provisional indirect cost rates: Billings under cost-based government contracts are calculated using provisional rates which permit recovery of indirect costs. These rates are subject to audit on an annual basis by the government agencies' cognizant audit agency. The cost audit will result in the negotiation and determination of the final indirect cost rates which the Corporation may use for the years audited. The final rates, if different from the provisional rates, may create a receivable or a liability. As of March 31, 2019, the Corporation had negotiated final settlements on indirect cost rates through March 31, 2014. The Corporation has negotiated provisional indirect rates for the years through June 30, 2019. The Corporation periodically reviews its cost estimates and experience rates, and adjustments, if needed, are made and reflected in the period in which the estimates are revised. In the opinion of management, redetermination of any cost-based contracts for the open years will not have any material effect on the Corporation's financial position or results of operations. Management has provided an accrual for over- applied provisional billings in the amount of $589,070 and $543,336 at March 31, 2019 and 2017, respectively. Total unbilled receivables for indirect cost rate variances is $1,420,179 at March 31, 2019 and includes $354,688 of unbilled variance recorded in 2019. All variances are subject to the gove

11. The Federal Government is implementing significant changes to government spending and other programs. The funding of U.S. government programs is subject to an annual Congressional budget authorization and appropriations process. The Corporation cannot predict the impact on existing, follow-on or replacement programs from potential changes in priorities due to changes in spending levels. 12. The current indirect rates as of March 31, 2019 are listed as below: Cost Actual 3/31/19 Provisional Overhead Cat I (HQ) 49.6% 44.0% Cat III (International offices) 16.6% 22.0% Cat IV (onsite) 14.4% 16.0% Cat V (NC) 24.4% 25.0% Cat VI (NC phone center) 14.7% 16.5% Fringe Benefits (FT) 40.3% 39.0% Fringe Benefits (PT) 27.2% 14.0% G&A 20.5% 14.0% Subcontract Administration 4.73% 2.50% 13. The following costs are unallowable costs and cannot be charged to our government contracts: 3/31/19 3/31/18 Unallowable Corporate Sponsorships and Contributions $9,815 $30,823 Unallowable Morale and Welfare 10,733 7,614 Unallowable Business Meals 2,111 469 Unallowable Professional Services 66,981 Accrued SAR Bonus 45,000 Goodwill Amortization 228,329 228,329 Bad Debt Expense 75,000 Unallowable Advertising 2,750 Other Unallowable Expenses 6,326 6,174 Unallowable Expenses subtotal, Excluding Interest $324,294 $396,158 Interest Expense 607 Total Unallowable Expenses $324,294 $396,765

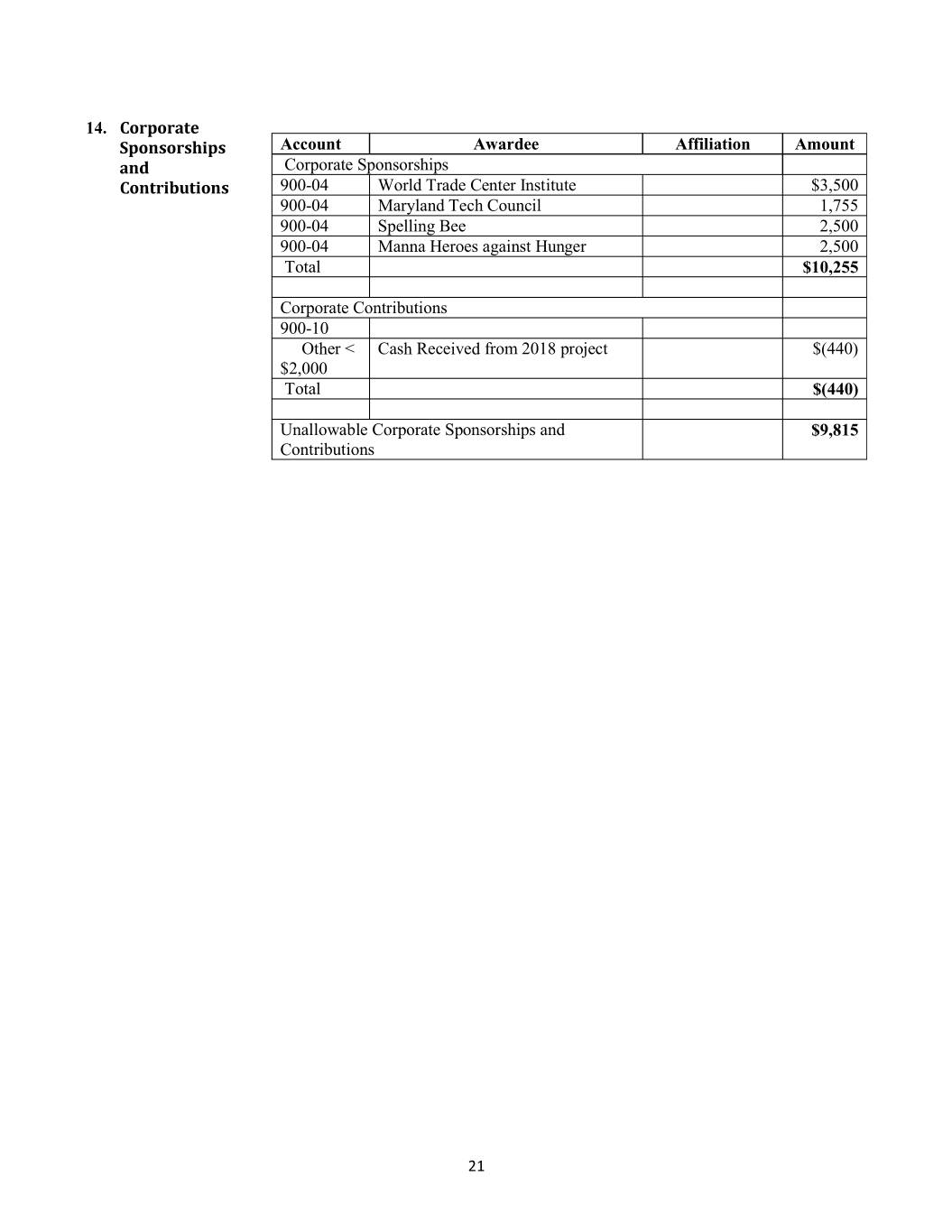

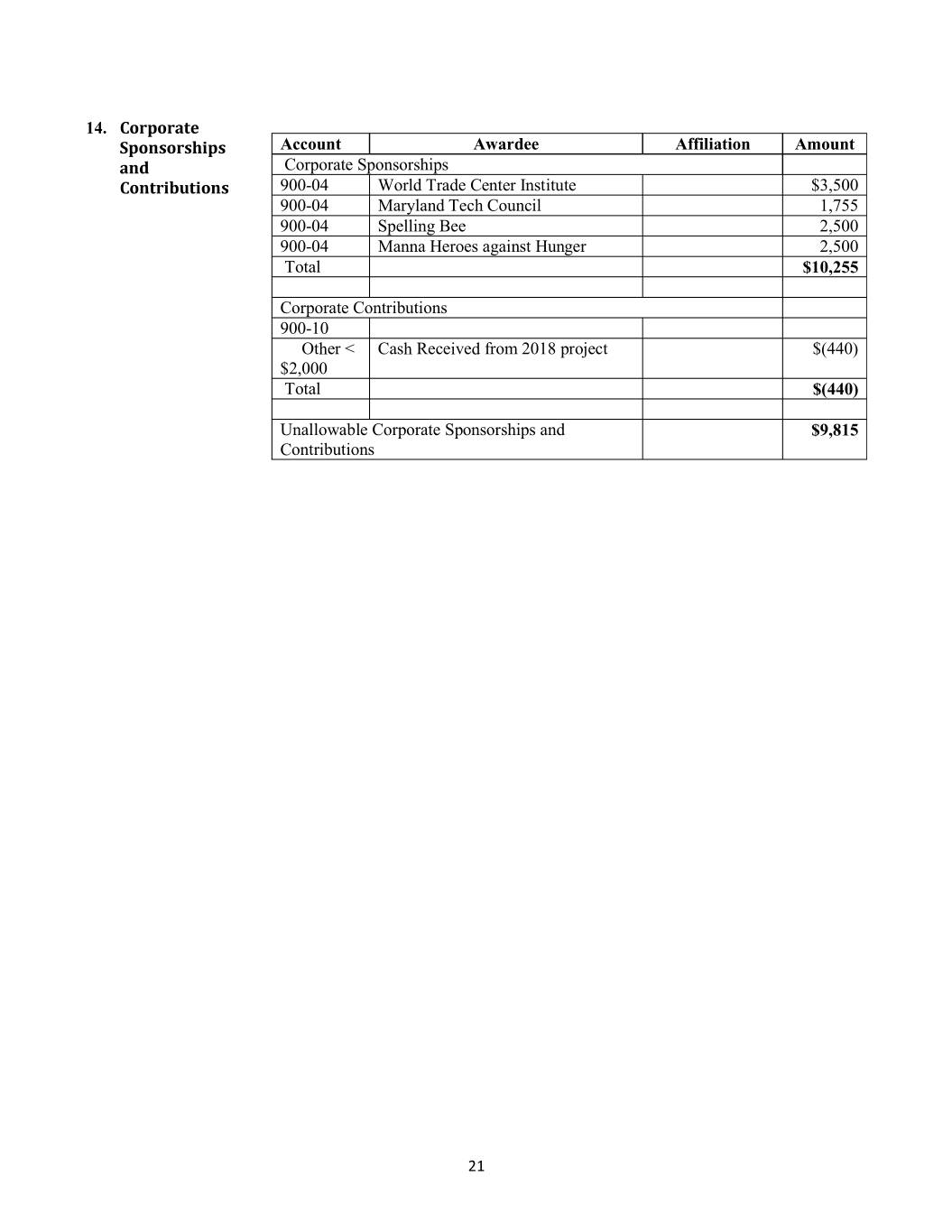

14. Account Awardee Affiliation Amount Corporate Sponsorships 900-04 World Trade Center Institute $3,500 900-04 Maryland Tech Council 1,755 900-04 Spelling Bee 2,500 900-04 Manna Heroes against Hunger 2,500 Total $10,255 Corporate Contributions 900-10 Other < Cash Received from 2018 project $(440) $2,000 Total $(440) Unallowable Corporate Sponsorships and $9,815 Contributions