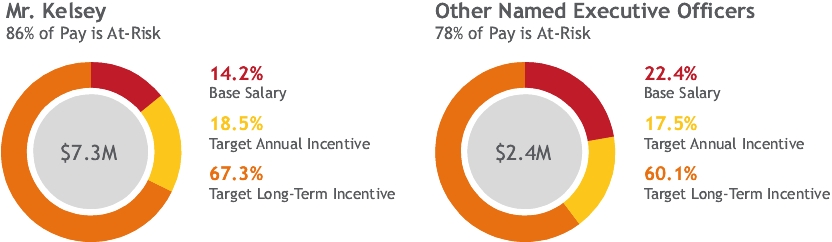

Mr. Kelsey would also receive accrued and vested benefits under the 401(k) Plan and the SERP, and payment for accrued but unused vacation, upon a termination of employment for any reason; those amounts are not included in “Potential Benefits Table” below. See “Nonqualified Deferred Compensation” above for further information.

If Mr. Kelsey is terminated by Plexus without cause or he resigns with good reason, his equity awards would be treated in accordance with the terms of the Incentive Plan and predecessor plans, with Mr. Kelsey being deemed a continuing employee for purposes of applying the vesting and exercisability provisions of any equity awards held by him on his separation date that were granted more than one year prior to such date; see “Treatment of Equity Awards” below for more information.

Under Mr. Kelsey’s Employment Agreement, the Company is protected from competition by Mr. Kelsey after the termination of his employment. Upon termination, Mr. Kelsey agrees to not interfere with the relationships between the active customers and suppliers, as well as employees, of the Company for two years, and to not compete with the Company over the same period. Further, Mr. Kelsey has agreed to related confidentiality requirements after the termination of his employment.

Pursuant to his change in control agreement, Mr. Kelsey is eligible to receive three times salary plus benefits in the event of a termination of his employment in connection with a change in control. If both the Employment Agreement and the change in control agreement apply to a particular termination, Mr. Kelsey will receive benefits under whichever agreement provides the higher amount of benefits in the aggregate. As discussed below, the Company’s change in control agreements with its executive officers, including Mr. Kelsey, do not contain excise tax gross-up provisions.

CHANGE IN CONTROL AGREEMENTS

Plexus has change in control agreements with its executive officers and certain other key employees. Under the terms of these agreements, if there is a change in control of Plexus, as defined in the agreement, the executive officers’ authorities, duties and responsibilities shall remain at least commensurate in all material respects with those prior to the change in control. Their compensation may not be reduced, their benefits must be commensurate with those of similarly situated executives of the acquiring firm and their location of employment must not be changed significantly as a result of the change in control.

Determination of Benefit Levels

In general, the change in control agreements with our executive officers provide that, upon termination in the event of a change in control, executive officers will receive compensation equaling three times annual base salary plus targeted bonus, and an amount equal to a continuation of health and retirement benefits for that period. Certain other key employees also have change in control agreements on substantially the same terms, although generally with multipliers of one or two times annual base salary plus targeted bonus. In determining which employees should have change in control agreements, the Committee utilizes its guidelines, which focus on position, responsibilities and compensation level in order to minimize subjectivity.

There are not any excise tax gross-up provisions in any of the change in control agreements. As discussed below, the change in control agreements with all participants allow for a reduction in payments under a “best net” approach, providing either the full amount of the total payment or an amount equal to the total payment reduced by an amount necessary to avoid adverse excise tax consequences to the executive officer.