Miller Energy Resources February 2013

Forward Looking Statement Certain statements in this press release and elsewhere by Miller Energy Resources¸ Inc. are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Miller Energy Resources, Inc. and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, the potential for Miller Energy to experience additional operating losses; high debt costs under its existing senior credit facility; potential limitations imposed by debt covenants under its senior credit facility on its growth and ability to meet business objectives; the need to enhance management, systems, accounting, controls and reporting performance; uncertainties related to deficiencies identified by the SEC in certain Forms 8-K filed in 2010 and the Form 10-K for 2011; litigation risks; its ability to perform under the terms of its oil and gas leases, and exploration licenses with the Alaska DNR, including meeting the funding or work commitments of those agreements; its ability to successfully acquire, integrate and exploit new productive assets in the future; its ability to recover proved undeveloped reserves and convert probable and possible reserves to proved reserves; risks associated with the hedging of commodity prices; its dependence on third party transportation facilities; concentration risk in the market for the oil we produce in Alaska; the impact of natural disasters on its Cook Inlet Basin operations; adverse effects of the national and global economic downturns on our profitability; the imprecise nature of its reserve estimates; drilling risks; fluctuating oil and gas prices and the impact on results from operations; the need to discover or acquire new reserves in the future to avoid declines in production; differences between the present value of cash flows from proved reserves and the market value of those reserves; the existence within the industry of risks that may be uninsurable; constraints on production and costs of compliance that may arise from current and future environmental, FERC and other statutes, rules and regulations at the state and federal level; the impact that future legislation could have on access to tax incentives currently enjoyed by Miller; that no dividends may be paid on its common stock for some time; cashless exercise provisions of outstanding warrants; market overhang related to restricted securities and outstanding options, and warrants; the impact of non-cash gains and losses from derivative accounting on future financial results; and risks to non-affiliate shareholders arising from the substantial ownership positions of affiliates. Additional information on these and other factors, which could affect Miller's operations or financial results, are included in Miller Energy Resources, Inc.'s reports on file with United States Securities and Exchange Commission including its Annual Report on Form 10-K, as amended, for the fiscal year ended April 30, 2012. Miller Energy Resources, Inc.'s actual results could differ materially from those anticipated in these forward- looking statements as a result of a variety of factors, including those discussed in its periodic reports that are filed with the Securities and Exchange Commission and available on its Web site (www.sec.gov). All forward-looking statements attributable to Miller Energy Resources or to persons acting on its behalf are expressly qualified in their entirety by these factors. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law.

*Management locked up from selling shares as long as Apollo credit line is outstanding 3 Company Snapshot Stock Ticker (NYSE) MILL Price (2/8/13) $3.98 Market Capitalization (2/8/13) $172.7 MM Shares Outstanding 43.4 MM Institutions Insider Ownership 25% 20* Analyst Coverage Brean Capital MLV Suntrust Proved Oil Reserves (P1) 9.03 MMBOE % of Proved Reserves / Oil 95% Company Operated % of Net Production 98% Lease & Exploratory Acres Alaska 753,466 Tennessee 49,260 ACRES Total Resources SEC Case Strip PV-10 $1.5 BILLION

Financing Highlights Over $40MM of Equity Raised Since December 2009, including $10MM of preferred in April 2012 which was redeemed on July 1, 2012. $100MM Five Year Senior Secured Credit Facility Provided by Apollo Inv. Corp. – 3rd largest private equity firm. $55MM Current Borrowing Base. Miller Listed on NYSE in April 2011. Hired KPMG as Auditors in February 2011.

5 Investment Summary Strong Balance Sheet 9.03mm BOE of Proven Reserves P1+P2+P3 PV-10 (SEC) of $1.543 Billion $295mm in shareholders equity (~ book value = $6.80/share) Advantages of state-of- the-art infrastructure Equipment and infrastructure in place to support significantly higher production volumes Able to maintain low operating costs + low incremental lifting costs $230MM+ appraised value and $500MM+ replacement value Value Driven Growth Strategy Strong Foundation in Place Built on Low Cost / High Value Acquisitions Efficient Low Cost Operators Advantages of Being in Alaska Favorable oil and natural gas prices Significant tax incentives for exploration and development Proven Management Scott Boruff, CEO: Led company through listing transition from OTC to NYSE. 25 years in senior level M&A, Corporate Finance, and Development. David Voyticky, President, Acting CFO: 15 years M&A, Corporate Finance, and other positions, spanning Goldman Sachs, JP Morgan, Houlihan Lokey. David Hall, CEO of Alaska Operations, Director: 20 years experience in operations, Formerly GM of Alaska Operations, Pacific Energy, and Production Foreman and Lead Operator, and ultimately Production Manager, Forest Oil Corp.

Operational Control Significant Infrastructure Miller Operates 98% of Net Production Control Equals Cost Savings Over $300MM of Assets to Support Alaskan Production Modern Infrastructure to Support Growth in Place and Paid For Modern Alaska Facilities with 50,000 BOD Processing Capacity 129 Sq. Miles Miles of 3D and 1,499 Miles of 2D Seismic Data in Alaska Fully Engineered Drill Ready Alaska Locations 600+ Wells in Tennessee with Full Infrastructure Favorable Exploration Significant Low Risk/High Return Projects Tax Incentives in Alaska for up to 65% of Exploration Costs Alaska is Pro Natural Gas and Oil The Miller Advantage Alaska Premium Gas Pricing Alaska has a Significant Natural Gas Shortage Natural Gas Sells in Alaska between $8 and $12 Mcf Substantial Upside We Believe There Are Vast Oil & Natural Gas Opportunities on Present Holdings Substantial Self Development and Joint Venture Opportunities

Reserves - Proved with Upside PUD 6.5 MMBOE PV-10 $364MM Total Reserves 53.6 MMBOE SEC Case: PV-10 $1.543 Billion Proved Reserves 9.043 MMBOE SEC CASE: PV-10 $446.7MM Large Drilling Inventory PDP 1.6 MMBOE PV-10 $59.22MM PDNP .943 MMBOE PV-10 $22.9MM PROBABLE (P2) 9.0 MMBOE PV-10 $387MM POSSIBLE (P3) 35.48 MMBOE PV-10 $710MM PROVED (P1) 8.4 MMBOE PV-10 $447MM Based on the RED April 2012 SEC Reserves at INO.com

Miller – Basins The Southern Appalachian Basin Cook Inlet, Alaska 90% 10%

Substantial Value In Untapped Mid-Stream Assets - Osprey Platform - Kustatan Production Facility - 40+ miles of pipelines - Grind & Inject Unit (2 disposal wells) - Power - Trans-Foreland Pipeline* Plenty of excess capacity to handle third-party contracts for power generation, fluid & gas processing, cuttings, and in 2014, transportation of crude. Value to stock price = ? * Proposed

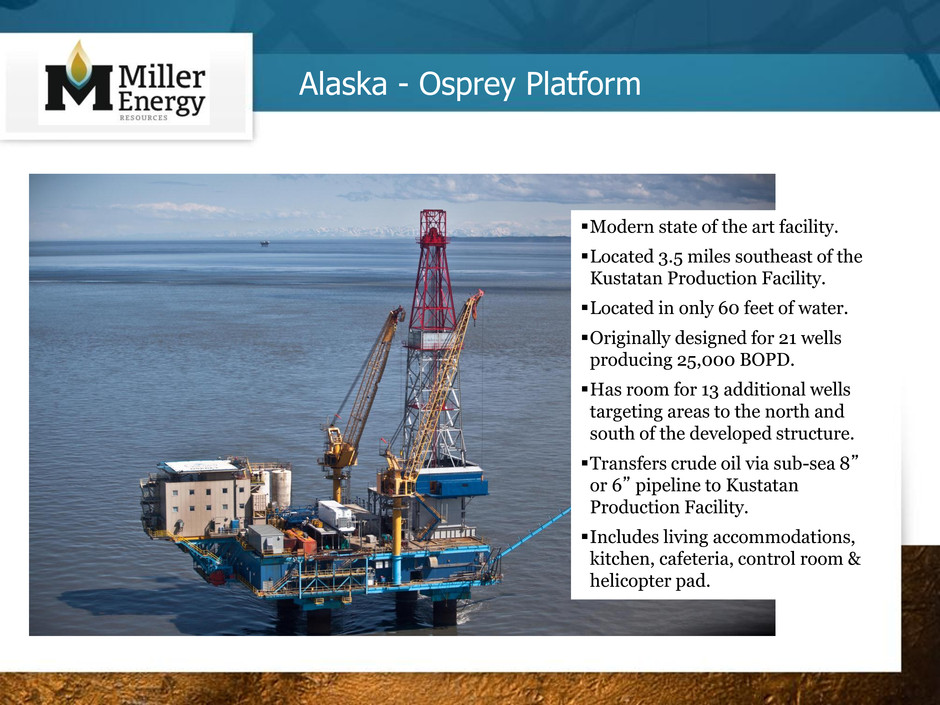

Alaska - Osprey Platform Modern state of the art facility. Located 3.5 miles southeast of the Kustatan Production Facility. Located in only 60 feet of water. Originally designed for 21 wells producing 25,000 BOPD. Has room for 13 additional wells targeting areas to the north and south of the developed structure. Transfers crude oil via sub-sea 8” or 6” pipeline to Kustatan Production Facility. Includes living accommodations, kitchen, cafeteria, control room & helicopter pad.

Alaska - Kustatan Production Facility Processes crude oil and natural gas from Osprey Platform. Onsite natural gas well brought online in 2010 to power the facility. Produces sales quality oil per Cook Inlet Pipeline specs. Provides electrical power for Osprey Platform and WMRU. Seven buildings contain equipment for pigging, crude heating, separation, water pumping, gas/oil handling, power generation and the control room. Tank farm contains 5 - 10,000 barrel tanks - 50,000 BBL total.

Five onsite wells producing over 1,000 BOED brought back into production in 2010. Originally developed for seven well sites. Has potential to target untapped gas sands, which overlay much of the surrounding structures. Includes living accommodations, kitchen & cafeteria. Has capacity to store 12,000 barrels of crude oil. Alaska - West McArthur River Unit

•Largest owner/operator of wells in Tennessee, over 49,000 acres. •Reworking existing stripper wells, Upgrade/replace lift systems, acid stimulation, etc. •Own & Operate drill Rigs and 100% of production - Over 45 years experience - Low operating costs •Exploit our Mississippi Lime oil - Similar formation and opportunity in Southern Kansas/Oklahoma •25+ horizontal drilling targets identified 2,000-3,000 foot horizontal, 10-30 stage fracs 3 weeks @ a cost of ~$1.1 million per well 1st horizontal east of Mississippi Waiting on EPA permits before beginning gas injection and production 13 Tennessee Development Strategy

2009 2010 2011 2012 1H 2013 Lease & Exploratory Acres 14,489 667,938 719,546 723,727 802,726 SEC Case Reserves $2.2MM $867MM $1.167B $1.54B $1.54B # 0f Wells 52 525 393 380 392 Revenues $1.6MM $5.8MM $23MM $35.4MM $19.1MM Production (BOE) 4,580 86,597 355,596 371,843 203,650 Adjusted EBITDA NMF NMF $1,454,735 $5,272,000 $5,619,000 April 30th Fiscal Year End * December 2009- Alaska Acquisition 14 Financial Summary

$100MM 5-Year Senior Secured Credit Facility by Apollo Investment - $55MM Current Borrowing Base with $45MM drawn $18MM Series C 10.75% Perpetual Preferred (listed under:MILL-PC) - $25/share face value - $10/share conversion price callable at $15/share 15 Strong Capital Position No common equity financing since March, 2010 EBITDA growing with increased production $45MM cap ex since inception Cash and cash equivalents (10/31/12) $4.3MM Available credit line from Apollo: $10MM Annualized EBITDA (1H FY 2013): $11.2MM

16 Recent Developments • Built, shipped and certified 2,000 HP offshore drilling rig in Alaska • Secured $100MM credit facility from Apollo • Acquired substantial acreage around existing positions • Successfully drilled first horizontal Mississippian Lime well with more wells planned; 9 out of 11 Alaskan reworks have been successful • Reduced transportation costs in Cook Inlet from $20/bbl to $5/bbl • Added accounting, legal and operations staff capable of supporting significantly higher production volumes • Upgraded to KPMG

Updates Since October 2012 Significant reduction in well bore concentration risk Since October 2012 six additional wells have been drilled We believe that 3 in Alaska and 2 in Tennessee will be productive wells Successful drilling activity has had positive impact on cash flow RU-4 has been producing at 1 million cubic feet per day, nearly enough to satisfy Alaskan operations fuel gas needs which was costing over $450,000 per month, expected payback on cost will take less than 3 months Expect completion of additional reworks expect to significantly increase cash flow during February Miller expects to have additional production from RU-7 and RU-3 in next two weeks Should add between 300 to 600 BOE/per day of production and increase monthly cash flow by up to $1 million or more Run rate EBITDA expected to increase to $2MM per month up from $500,000 per month in 2012 Success rate on reworks in Alaska now 9 out of 11 wells successfully reworked Upcoming drilling activities have potential to double free cash flow in next six months Tennessee horizontals now offer potential to drill lower cost shallow oil wells on fields previously thought depleted RU-2 and RU-5 are expected to be complete during summer with our expectations of 1000+ BOE per day

18 Upcoming Milestones – next 12 months • Drill and complete wells in Alaska – increasing production and reserves • RU-3 and RU-7 expected to be successful and productive in next two weeks • RU-2 and RU-5 expected within next 5 months • Accelerate horizontal drilling program in Tennessee • Start pipeline construction in Alaska • Receive $15MM to $20MM in tax rebates • Further pursue JV opportunities in Alaska