Miller Energy Resources Shareholder Meeting – April 2014

Forward Looking Statements Certain statements in this presentation and elsewhere by Miller Energy Resources¸ Inc. are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Miller Energy Resources, Inc. and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, the potential for Miller Energy to experience additional operating losses; high debt costs under its existing senior credit facility; potential limitations imposed by debt covenants under its senior credit facility on its growth and ability to meet business objectives; the need to enhance management, systems, accounting, controls and reporting performance; uncertainties related to the filing of its Form 10-K for 2011; litigation risks; its ability to perform under the terms of its oil and gas leases, and exploration licenses with the Alaska DNR, including meeting the funding or work commitments of those agreements; its ability to successfully acquire, integrate and exploit new productive assets in the future; its ability to recover proved undeveloped reserves and convert probable and possible reserves to proved reserves; risks associated with the hedging of commodity prices; its dependence on third party transportation facilities; concentration risk in the market for the oil we produce in Alaska; the impact of natural disasters on its Cook Inlet Basin operations; adverse effects of the national and global economic downturns on our profitability; the imprecise nature of its reserve estimates; drilling risks; fluctuating oil and gas prices and the impact on results from operations; the need to discover or acquire new reserves in the future to avoid declines in production; differences between the present value of cash flows from proved reserves and the market value of those reserves; the existence within the industry of risks that may be uninsurable; constraints on production and costs of compliance that may arise from current and future environmental, FERC and other statutes, rules and regulations at the state and federal level; the impact that future legislation could have on access to tax incentives currently enjoyed by Miller; that no dividends may be paid on its common stock for some time; cashless exercise provisions of outstanding warrants; market overhang related to restricted securities and outstanding options, and warrants; the impact of non-cash gains and losses from derivative accounting on future financial results; and risks to non-affiliate shareholders arising from the substantial ownership positions of affiliates. Additional information on these and other factors, which could affect Miller's operations or financial results, are included in Miller Energy Resources, Inc.'s reports on file with United States Securities and Exchange Commission including its Annual Report on Form 10-K, as amended, for the fiscal year ended April 30, 2013. Miller Energy Resources, Inc.'s actual results could differ materially from those anticipated in these forward- looking statements as a result of a variety of factors, including those discussed in its periodic reports that are filed with the Securities and Exchange Commission and available on its Web site (www.sec.gov). All forward-looking statements attributable to Miller Energy Resources or to persons acting on its behalf are expressly qualified in their entirety by these factors. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law. 1

Executive Overview We believe Fiscal 2015 finds us poised for continued value creation with all the necessary pieces in place – access to favorable financing, promising drilling targets, wellbore diversification, and a favorable Alaskan tax environment 2

Alaska Development Advantages Tax Incentives & Commodity Prices No severance tax on oil Oil contracts based on ANS pricing (premium to WTI, similar to Brent) Fixed contract with ENSTAR at $6.00/mcf Winter spot market at up to $22.00/mcf Prices negotiated directly with utilities and end users Alaska Cash Rebates 20% to 65% of development costs reimbursed by the state Proceeds generally received 4 to 6 months following application Not contingent on success Strong Incentives Exist for Development in Alaska Osprey Rig 35 Alaska Operations 3 Underexploited Basin with Significant Upside Multiple stacked-pay development targets Opportunities for lower risk sidetrack drilling

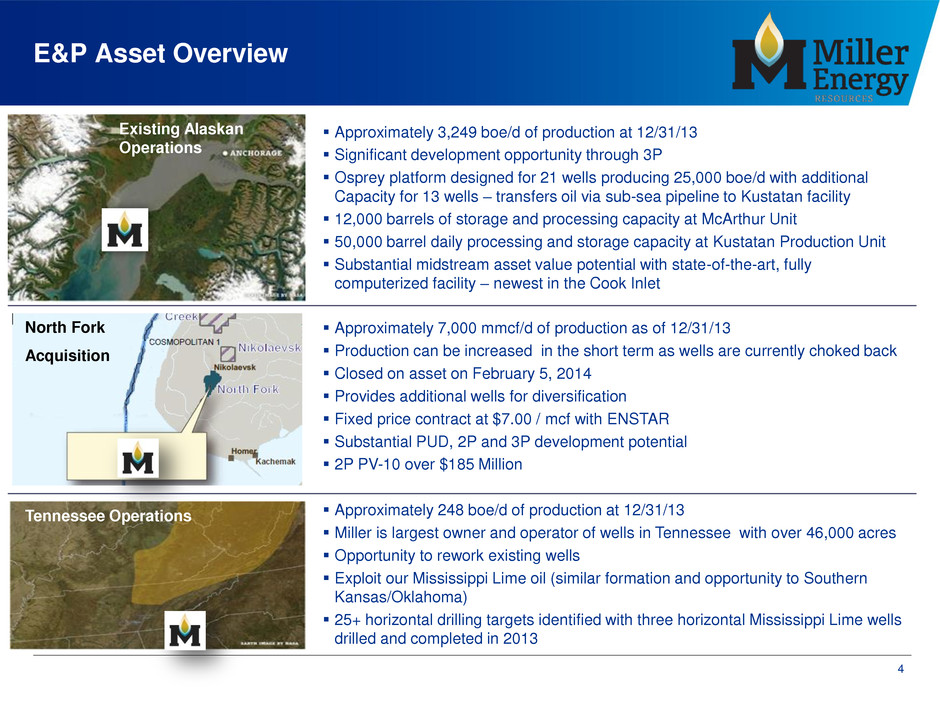

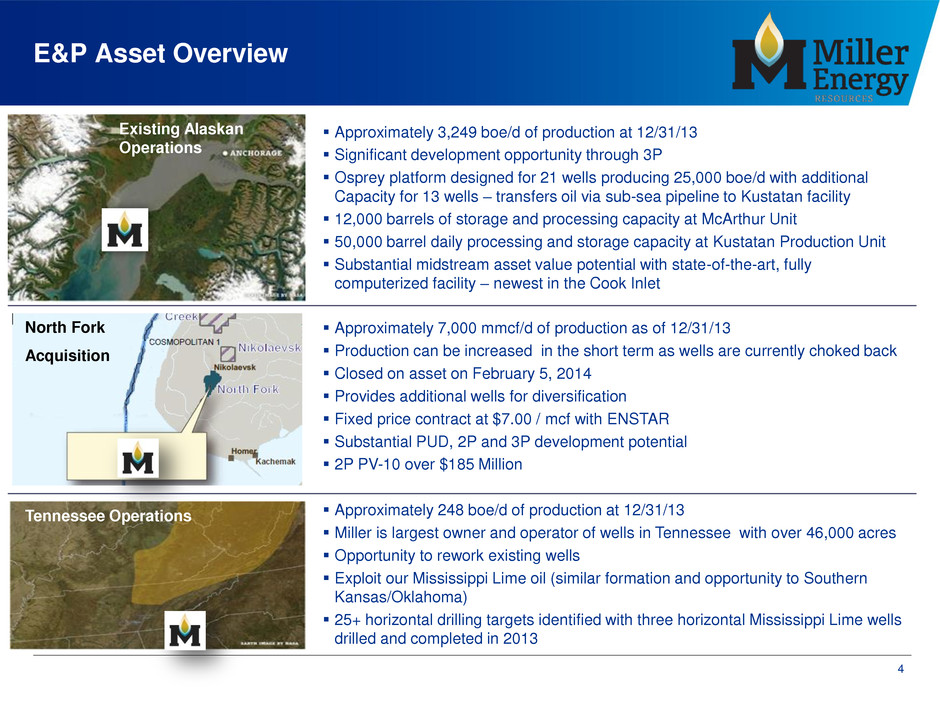

Existing Alaskan Operations Tennessee Operations Approximately 3,249 boe/d of production at 12/31/13 Significant development opportunity through 3P Osprey platform designed for 21 wells producing 25,000 boe/d with additional Capacity for 13 wells – transfers oil via sub-sea pipeline to Kustatan facility 12,000 barrels of storage and processing capacity at McArthur Unit 50,000 barrel daily processing and storage capacity at Kustatan Production Unit Substantial midstream asset value potential with state-of-the-art, fully computerized facility – newest in the Cook Inlet Approximately 248 boe/d of production at 12/31/13 Miller is largest owner and operator of wells in Tennessee with over 46,000 acres Opportunity to rework existing wells Exploit our Mississippi Lime oil (similar formation and opportunity to Southern Kansas/Oklahoma) 25+ horizontal drilling targets identified with three horizontal Mississippi Lime wells drilled and completed in 2013 Approximately 7,000 mmcf/d of production as of 12/31/13 Production can be increased in the short term as wells are currently choked back Closed on asset on February 5, 2014 Provides additional wells for diversification Fixed price contract at $7.00 / mcf with ENSTAR Substantial PUD, 2P and 3P development potential 2P PV-10 over $185 Million North Fork Acquisition E&P Asset Overview 4

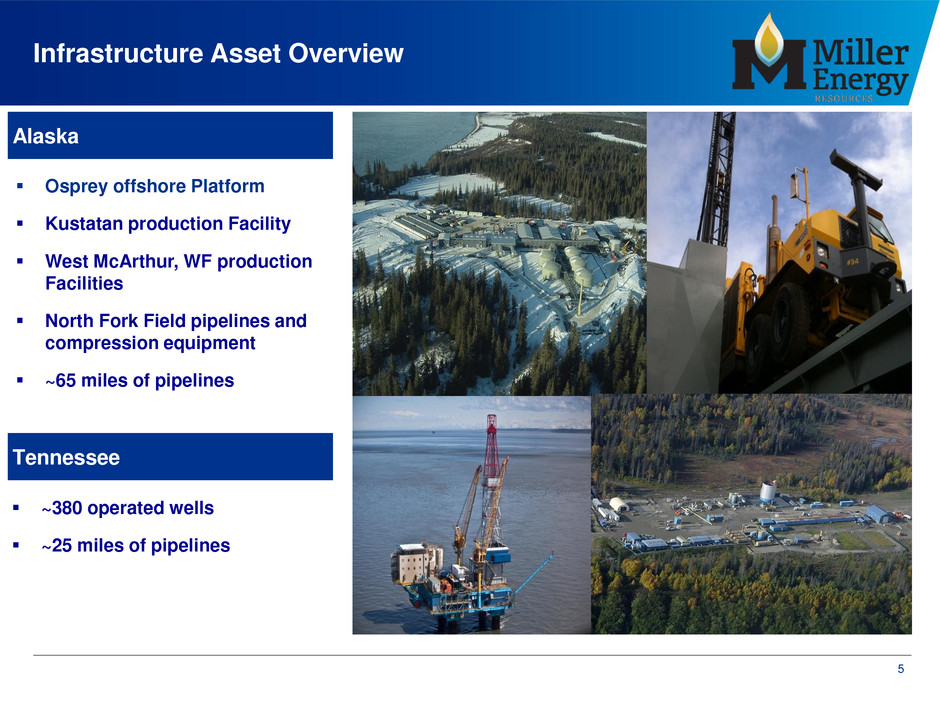

Infrastructure Asset Overview Osprey offshore Platform Kustatan production Facility West McArthur, WF production Facilities North Fork Field pipelines and compression equipment ~65 miles of pipelines Alaska ~380 operated wells ~25 miles of pipelines Tennessee 5

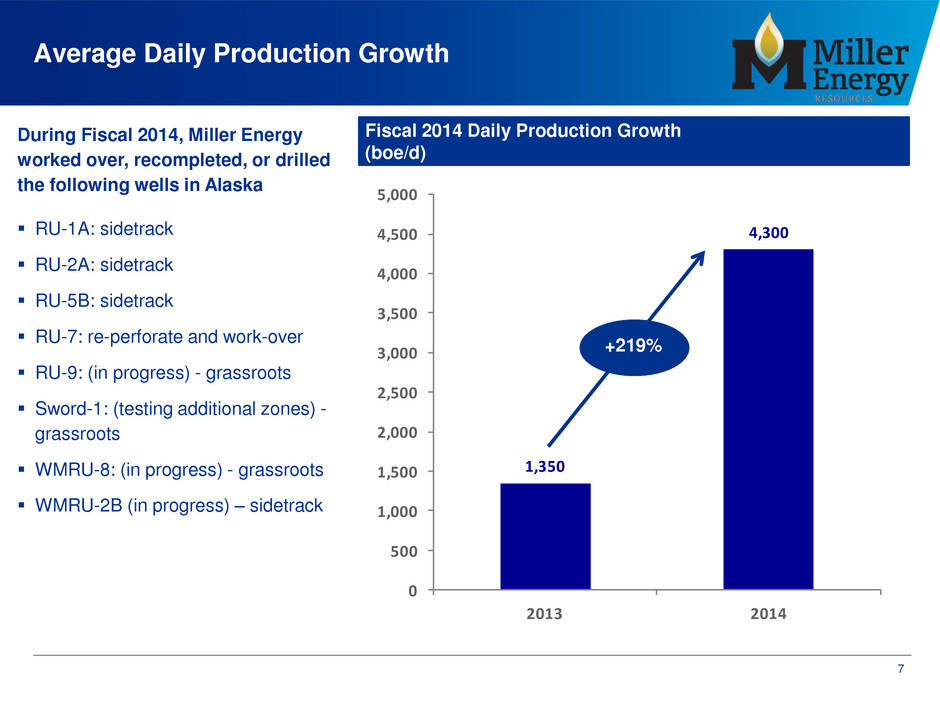

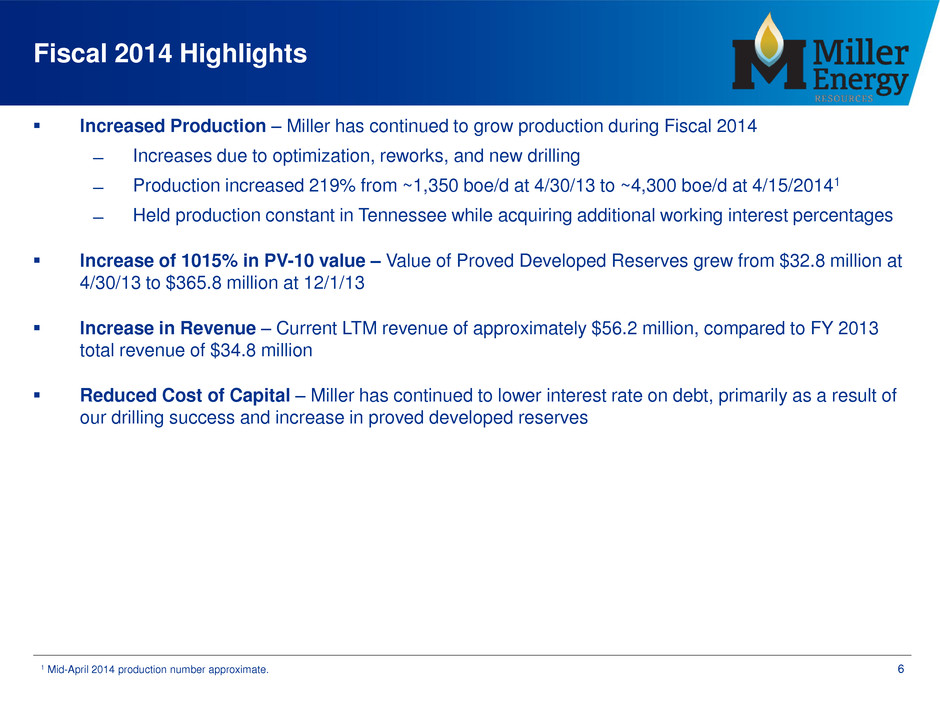

Fiscal 2014 Highlights Increased Production – Miller has continued to grow production during Fiscal 2014 ̶ Increases due to optimization, reworks, and new drilling ̶ Production increased 219% from ~1,350 boe/d at 4/30/13 to ~4,300 boe/d at 4/15/20141 ̶ Held production constant in Tennessee while acquiring additional working interest percentages Increase of 1015% in PV-10 value – Value of Proved Developed Reserves grew from $32.8 million at 4/30/13 to $365.8 million at 12/1/13 Increase in Revenue – Current LTM revenue of approximately $56.2 million, compared to FY 2013 total revenue of $34.8 million Reduced Cost of Capital – Miller has continued to lower interest rate on debt, primarily as a result of our drilling success and increase in proved developed reserves 6 1 Mid-April 2014 production number approximate.

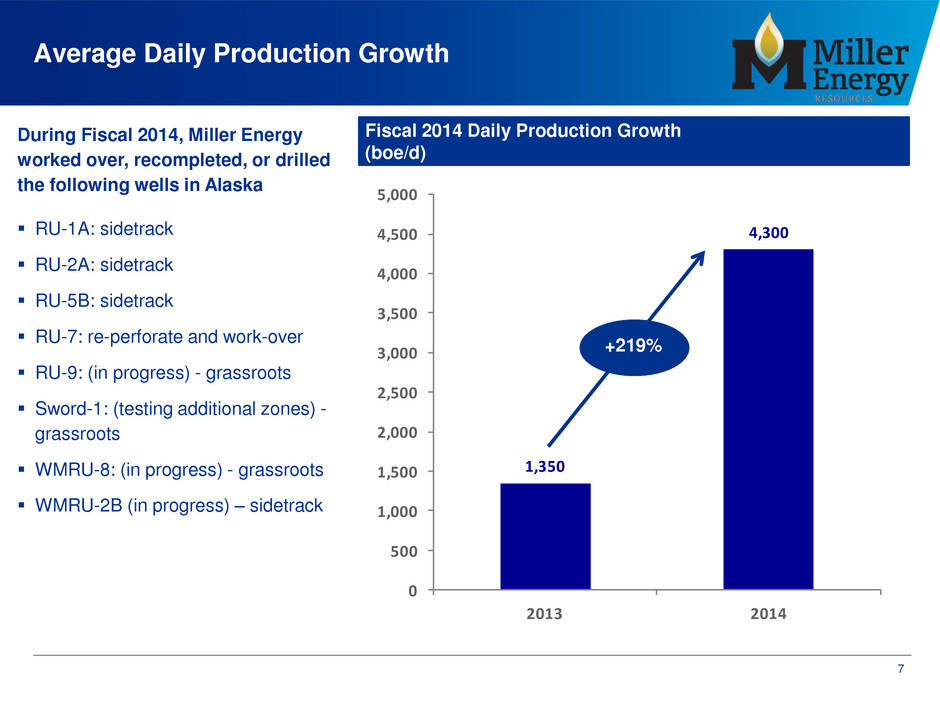

Average Daily Production Growth Fiscal 2014 Daily Production Growth (boe/d) During Fiscal 2014, Miller Energy worked over, recompleted, or drilled the following wells in Alaska RU-1A: sidetrack RU-2A: sidetrack RU-5B: sidetrack RU-7: re-perforate and work-over RU-9: (in progress) - grassroots Sword-1: (testing additional zones) - grassroots WMRU-8: (in progress) - grassroots WMRU-2B (in progress) – sidetrack 1,350 4,300 0 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 5,000 2013 2014 7 +219%

Growth in Proved Developed Reserves and Proved Developed PV-10 Proved Developed Reserves (mboe) Proved Developed Reserve PV-10 Value ($ millions) 8 1,613 8,384 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 4/30/2013 12/1/2013 $32.8 $365.8 $0.0 $50.0 $100.0 $150.0 $200.0 $250.0 $300.0 $350.0 $400.0 4/30/2013 12/1/2013 +420% +1015%

Decreasing Cost of Capital Current Financing $175MM 4-Year Second-Lien Secured Credit Facility by Apollo Investment Corp and Highbridge Principal Strategies at 11.75%, fully drawn at closing ̶ In process of establishing first lien position at lower rates than current second lien debt Series C 10.75% Perpetual Preferred (NYSE:MILL.C) ̶ $25/share face value ̶ $10/share conversion price, forced conversion at $15/share Series D 10.5% Perpetual Preferred (NYSE:MILL.D) ̶ $25/share face value ̶ Not convertible, except in the event of a change in control Past Financing $100MM 5-year Senior Secured Credit Facility by Apollo Investment Corp at 18% $100MM 2-year Senior Secured Credit Facility by Guggenheim Corporate Funding at 25% $2.5MM Series B Preferred Stock at 12% $10MM Series A Preferred Stock at 10% (fully redeemed) 9

Unlocking Adjacent Fault Block Value in Redoubt Field Worked-over two gas wells, became gas self sufficient, started gas sales 2013 Six target fault blocks Successfully developed two (2) fault blocks Four (4) fault blocks remain to be exploited by step out drilling Worked-over four oil wells (RU-1A, RU-2A, RU-5A, RU-7) Currently drilling new grass roots oil well (RU-9) Next target RU-12 (another grass roots oil well) Years of drilling ahead 10

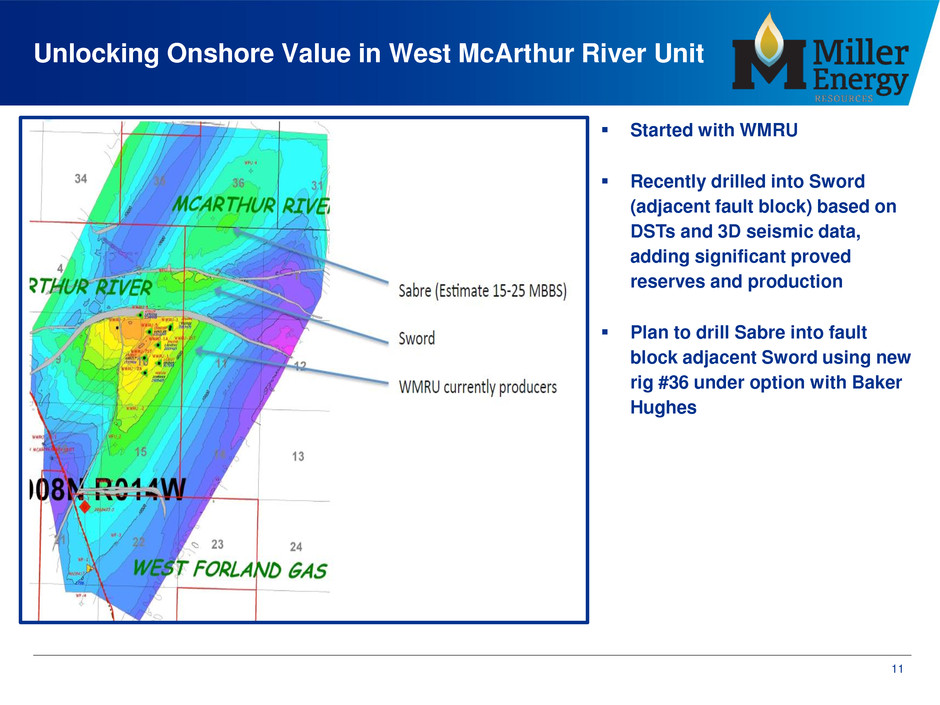

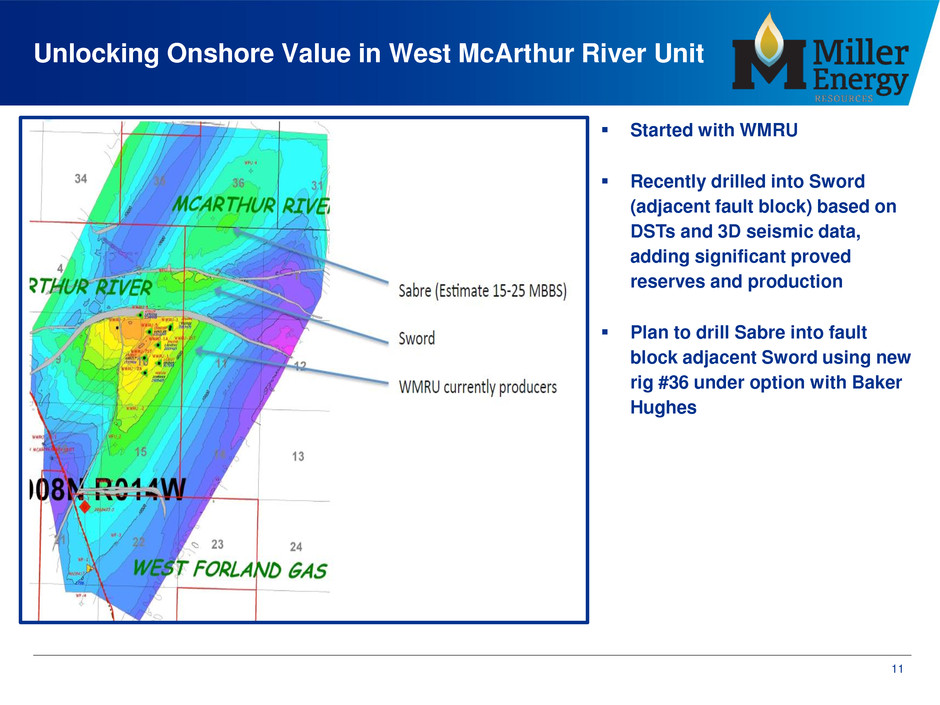

Unlocking Onshore Value in West McArthur River Unit Started with WMRU Recently drilled into Sword (adjacent fault block) based on DSTs and 3D seismic data, adding significant proved reserves and production Plan to drill Sabre into fault block adjacent Sword using new rig #36 under option with Baker Hughes 11

Alaska Onshore Activities Sword-1: Drill, tested, and completed well (883 BOED 1 of 3 zones), currently testing two other oil zones WMRU-8: Drilled & completing WMRU-2B: Currently drilling, (sidetracked WMRU-2A) Sabre: Design & engineering, permitting underway, entered into option for rig purchase North Fork Field: Design & engineering underway for two workovers and new grass roots wells 12

Upper Tyonek – Testing and producing oil, awaiting IP rate G-0 Zone – Testing and producing oil, awaiting IP rate Hemlock Zone – Current rate 600 bopd average Sword Log 13

North Fork Acquisition 100% working interest in $185 million of Proved and Probable PV-10 ̶ Probable SEC PV-10: $93.1 Million ̶ Total Proved SEC PV-10: $92.3 Million Includes six (6) natural gas wells, production and processing equipment and 15,464 acres Multi-year firm natural gas sales contract with ENSTAR (Alaska Utility) at $7.00/mcf Adding $20MM in annual revenue, with high operating margins Full field development of up to 24 additional wells, at a cost of approximately $8 million per well Onsite natural gas well brought online in 2010 to power the facility Miller Energy North Fork Acquisition (Closed February 2014) 14

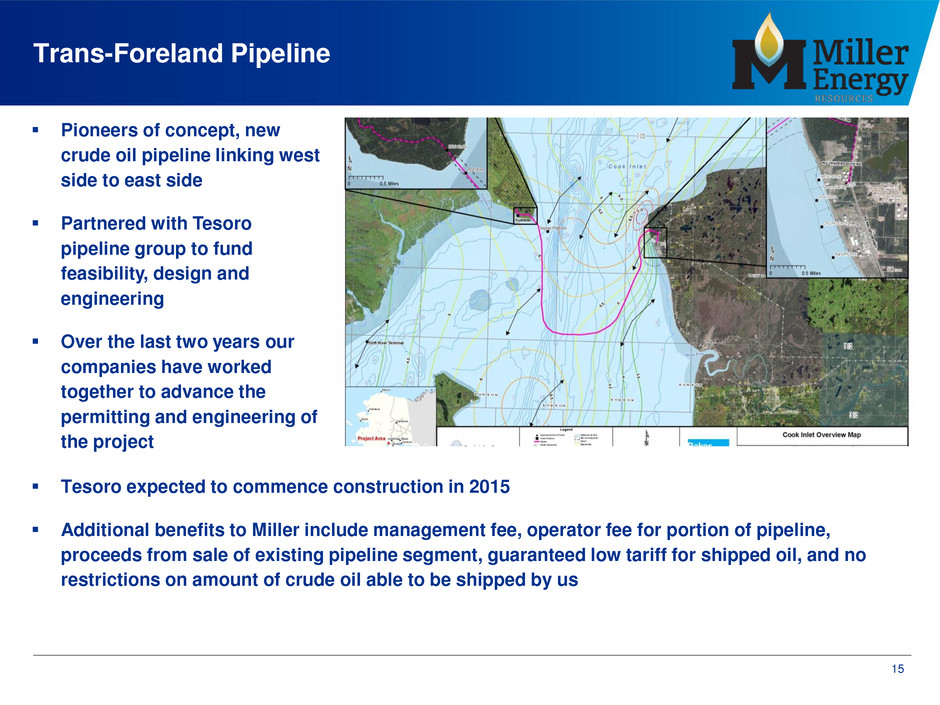

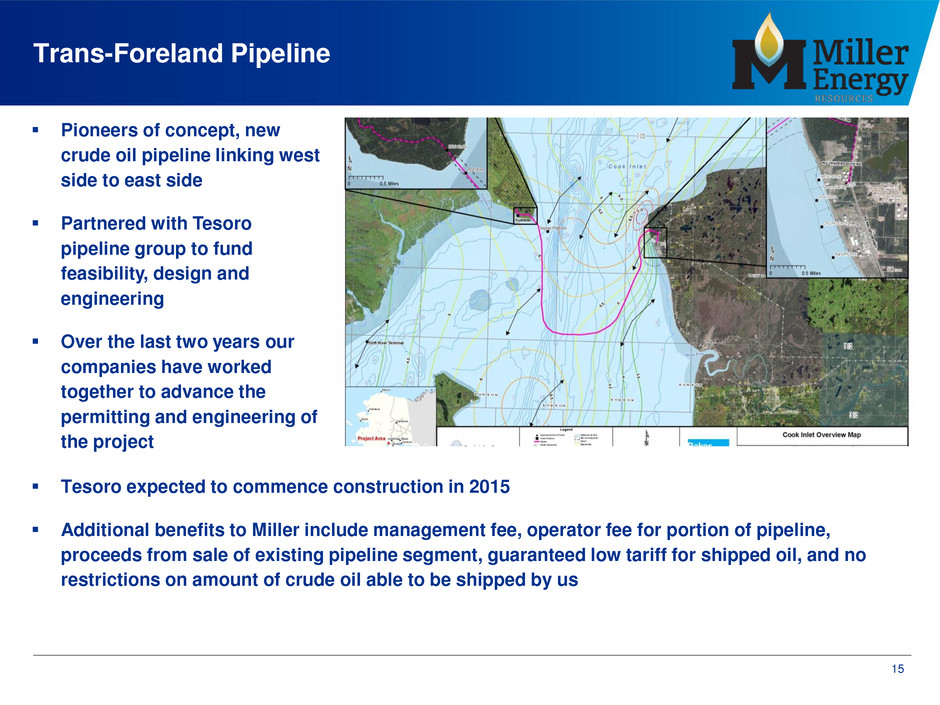

Trans-Foreland Pipeline Pioneers of concept, new crude oil pipeline linking west side to east side Partnered with Tesoro pipeline group to fund feasibility, design and engineering Over the last two years our companies have worked together to advance the permitting and engineering of the project Tesoro expected to commence construction in 2015 Additional benefits to Miller include management fee, operator fee for portion of pipeline, proceeds from sale of existing pipeline segment, guaranteed low tariff for shipped oil, and no restrictions on amount of crude oil able to be shipped by us 15

New Rig-36 Recent Land-base Rig Purchase Entered into option to purchase rig for $3.25MM, including deposit ~2400-HP, ~25,000’ drilling capabilities Planned rig improvements needed for Sabre prospect ie. high PSI mud system, pits, etc. Plan to drill Sabre from WMRU pad Up to 6 wells needed to develop Sabre prospect Forecasted rig payout in less than 12 months versus leasing rig 16

Tennessee Operations Control approximately 47,000 Gross Acres Operates ~ 190 Oil and 190 Gas wells On-going purchase of WI in wells to further production Re-working older wells to enhance production Drilled the first Horizontal well in the Mississippian Lime targeting oil in Tennessee To date have drilled three horizontal wells with plans to drill four more horizontal wells in fiscal year 2015 Received permit from EPA to inject gas for pressure maintenance in our first horizontal well (CPP-H-1 well); presently, working on maintaining a constant gas source for injection Acreage controls all formations to basement. Up to four potential deep formations for hydrocarbon development Potential JVs underway 17

Summary Increased shareholder value in FY 2014 by reworking, sidetracking and drilling new wells ̶ North Fork acquisition ̶ Refinanced debt at lower cost ̶ Continuing to add shareholder value with continued offshore and onshore development activity Planning for the Future – Miller continues to look ahead for growth opportunities while seeking to prudently manage the needs of our expanding company ̶ Trans-Foreland Pipeline ̶ Additional drilling rigs ̶ Appropriate staff increases – particularly in accounting and internal audit ̶ Strategic, “bolt on” acquisitions in Alaska ̶ Potential for future JVs ̶ Additional first lien debt at reduced interest rate 18

Appendix 19

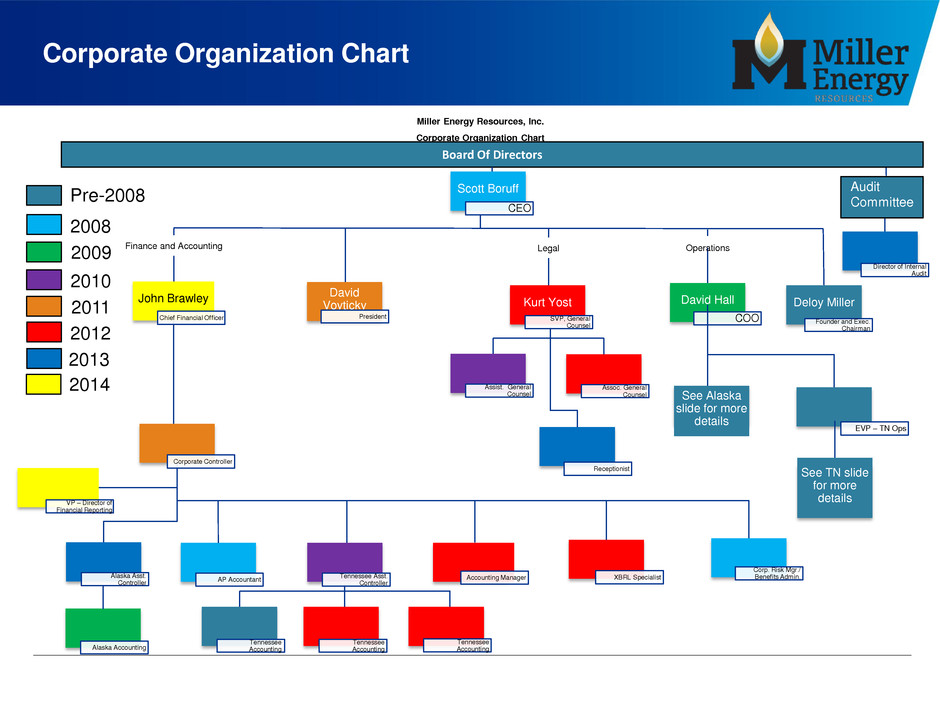

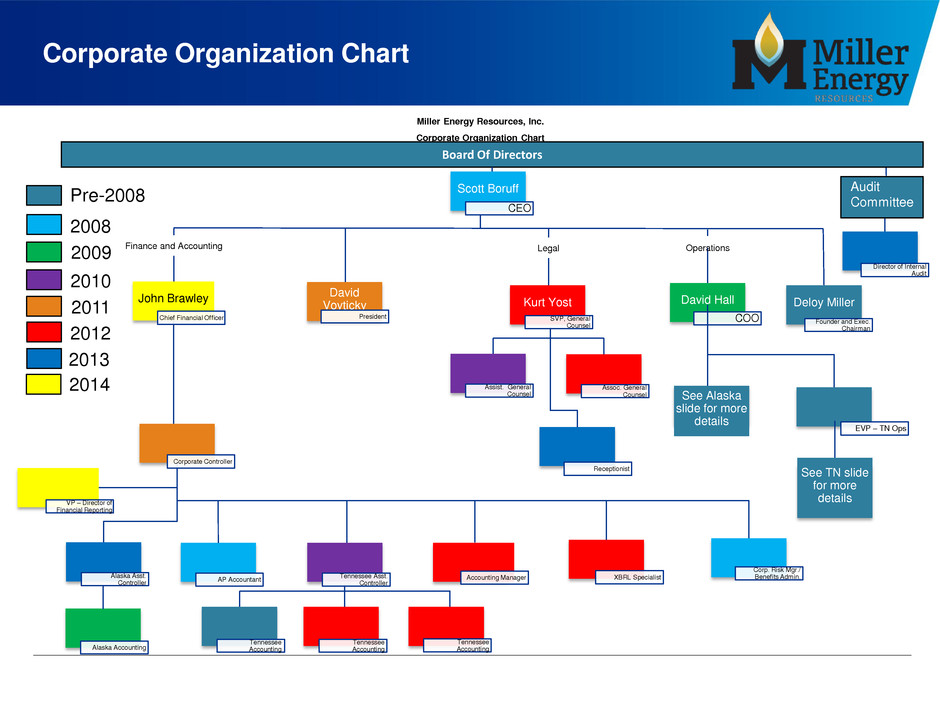

Miller Energy Resources, Inc. Corporate Organization Chart Board Of Directors Operations Legal Finance and Accounting Scott Boruff CEO Deloy Miller Founder and Exec. Chairman EVP – TN Ops David Hall COO Kurt Yost SVP, General Counsel Assist. General Counsel Assoc. General Counsel Corporate Controller Accounting Manager XBRL Specialist Corp. Risk Mgr./ Benefits Admin. Pre-2008 2008 2009 2010 2011 2012 2013 Alaska Asst. Controller AP Accountant Tennessee Accounting Tennessee Accounting Tennessee Accounting Alaska Accounting Tennessee Asst. Controller Receptionist 2014 John Brawley Chief Financial Officer VP – Director of Financial Reporting Audit Committee Director of Internal Audit See Alaska slide for more details See TN slide for more details David Voyticky President Corporate Organization Chart

2009 2010 2011 2012 Alaska Operations David Hall COO & CIE CEO Drilling Manager (Cont) Drilling Foremen Drilling Engineer Senior Land Man Jr. Land Man Exploration Manager Senior Geologist Resv. Eng. (cont) Geophysics (Cont) Petroleum Tech CPA, Tax spec.(Cont) Production Manager Production Foremen Production Eng. Accounting Tech CIE Pres., HSE Manager Compliance Adv. Admin/IT (Cont) AK, Controller 2013 Commercial Manager Senior Geologist . Corporate Controller 2014 Alaska Organization Chart

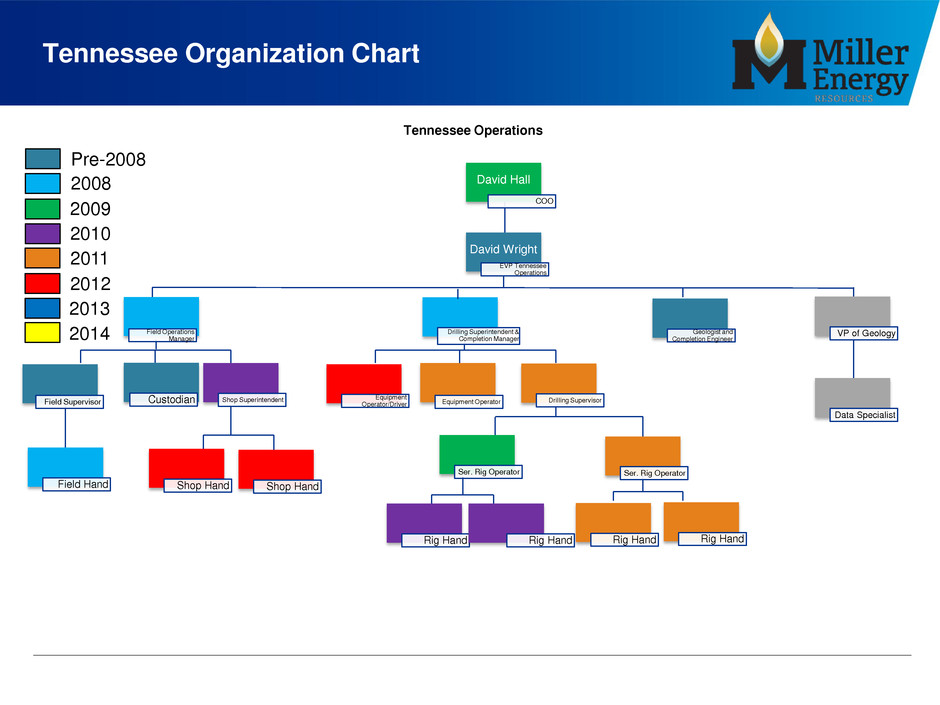

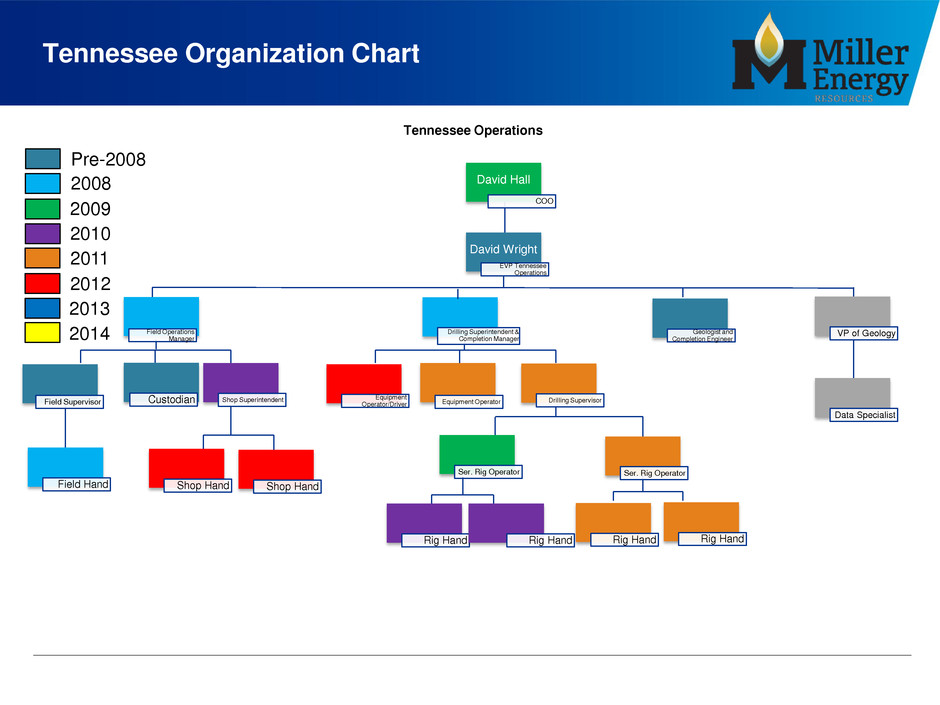

Pre-2008 2008 2009 2010 2011 2012 2013 Tennessee Operations David Wright EVP Tennessee Operations Shop Hand Rig Hand Rig Hand VP of Geology Data Specialist Geologist and Completion Engineer Drilling Superintendent & Completion Manager Equipment Operator/Driver Rig Hand Ser. Rig Operator Ser. Rig Operator Drilling Supervisor Equipment Operator Rig Hand Shop Hand Shop Superintendent Field Supervisor Field Hand Custodian Field Operations Manager David Hall COO 2014 Tennessee Organization Chart