NYSE: MILL

2 Forward Looking Statements Certain statements in this presentation and elsewhere by Miller Energy Resources¸ Inc. are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements involve the implied assessment that the resources described can be profitably produced in the future, based on certain estimates and assumptions. Forward-looking statements are based on current expectations, estimates and projections that involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated by Miller Energy Resources, Inc. and described in the forward-looking statements. These risks, uncertainties and other factors include, but are not limited to, the potential for Miller Energy to experience additional operating losses; high debt costs under its existing senior credit facility; potential limitations imposed by debt covenants under its senior credit facility on its growth and ability to meet business objectives; the need to enhance management, systems, accounting, controls and reporting performance; uncertainties related to the filing of its Form 10-K for 2011; litigation risks; its ability to perform under the terms of its oil and gas leases, and exploration licenses with the Alaska DNR, including meeting the funding or work commitments of those agreements; its ability to successfully acquire, integrate and exploit new productive assets in the future; its ability to recover proved undeveloped reserves and convert probable and possible reserves to proved reserves; risks associated with the hedging of commodity prices; its dependence on third party transportation facilities; concentration risk in the market for the oil we produce in Alaska; the impact of natural disasters on its Cook Inlet Basin operations; adverse effects of the national and global economic downturns on our profitability; the imprecise nature of its reserve estimates; drilling risks; fluctuating oil and gas prices and the impact on results from operations; the need to discover or acquire new reserves in the future to avoid declines in production; differences between the present value of cash flows from proved reserves and the market value of those reserves; the existence within the industry of risks that may be uninsurable; constraints on production and costs of compliance that may arise from current and future environmental, FERC and other statutes, rules and regulations at the state and federal level; the impact that future legislation could have on access to tax incentives currently enjoyed by Miller; that no dividends may be paid on its common stock for some time; cashless exercise provisions of outstanding warrants; market overhang related to restricted securities and outstanding options, and warrants; the impact of non-cash gains and losses from derivative accounting on future financial results; and risks to non-affiliate shareholders arising from the substantial ownership positions of affiliates. Additional information on these and other factors, which could affect Miller's operations or financial results, are included in Miller Energy Resources, Inc.'s reports on file with United States Securities and Exchange Commission including its Annual Report on Form 10-K, as amended, for the fiscal year ended April 30, 2013. Miller Energy Resources, Inc.'s actual results could differ materially from those anticipated in these forward- looking statements as a result of a variety of factors, including those discussed in its periodic reports that are filed with the Securities and Exchange Commission and available on its Web site (www.sec.gov). All forward-looking statements attributable to Miller Energy Resources or to persons acting on its behalf are expressly qualified in their entirety by these factors. Investors should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. We assume no obligation to update forward-looking statements should circumstances or management's estimates or opinions change unless otherwise required under securities law.

3 Executive Summary Company Highlights Alaska Assets Miller Resources, Inc. Highlights (1) Stock Ticker (NYSE) MILL Price (6/23/14) $5.51 Shares Outstanding (6/23/14) 45.24 million Market Capitalization (6/23/14) $249.3 million Total Capitalization $543.6 million Institutional Ownership 36% Insider Ownership 24% Ryder Scott Proved Developed Oil Reserves 8.4 MMBOE (2) $365.8 million (2) % Oil of Proved Developed Reserves 70% Company Operated % of Net Production 100% Lease and Exploratory Acres ~470,000 gross acres (1) As of 1/31/2014 unless otherwise noted (2) Source: Ryder Scott reserve reports dated December 1, 2013 (3) Close pending regulatory approval Savant Alaska Acquisition(3) 12,675 Net Acres North Fork Acquisition 15,464 Net Acres Existing Alaska Assets 409,122 Net Acres

4 Cook Inlet Region Pacific Assets Net production of 2,500 BOE/D (3,000 BOE/D gross) at April 30, 2014 Significant development opportunity through 3P The Osprey platform has capacity for 21 wells producing 25,000 BOE/D With eight wells currently in operation, Miller has capacity to add 13 new wells 12,000 BBLS of storage and processing capacity at the West McArthur River Unit 50,000 BBLS/D processing and storage capacity at Kustatan Production Facility Substantial midstream asset value and a state-of-the-art, fully computerized facility North Fork Assets Closed acquisition on February 5, 2014 Approximately 7.7 MMCF/D of net (9.8 MMCF/D gross) production as of April 30, 2014 Gas sales agreement with ENSTAR with an indexed contract price of $7.03 / MCF Production can be increased in the short term as wells are currently choked back 1P and 2P PV-10(1) of $92.3 million and $185.5 million, respectively Substantial PUD, 2P and 3P development potential Provides additional wells for diversification Savant Acquisition(2) Badami Plant and Facility Announced May 14, 2014 Acquisition adds approximately 600 BOE/D net (1,100 BOE/D gross) production Miller owns 67.5% working interest in Badami Unit and 100% working interest in nearby exploration leases Acquisition includes midstream assets located in the Alaska North Slope with a design capacity of 38,500 BOE/D and 25 miles of pipeline Miller estimates that the acquisition adds approximately $6 million of PDP PV-10 (based on internal assessments by Savant) with significant additional drilling opportunities Asset Overview 3-Mile Creek West Foreland Gas Field West McArthur River Unit Kustatan Production Facility Osprey Platform North Fork (1) Source: Ryder Scott reserve reports dated December 1, 2013 (2) Pursuant to regulatory approval

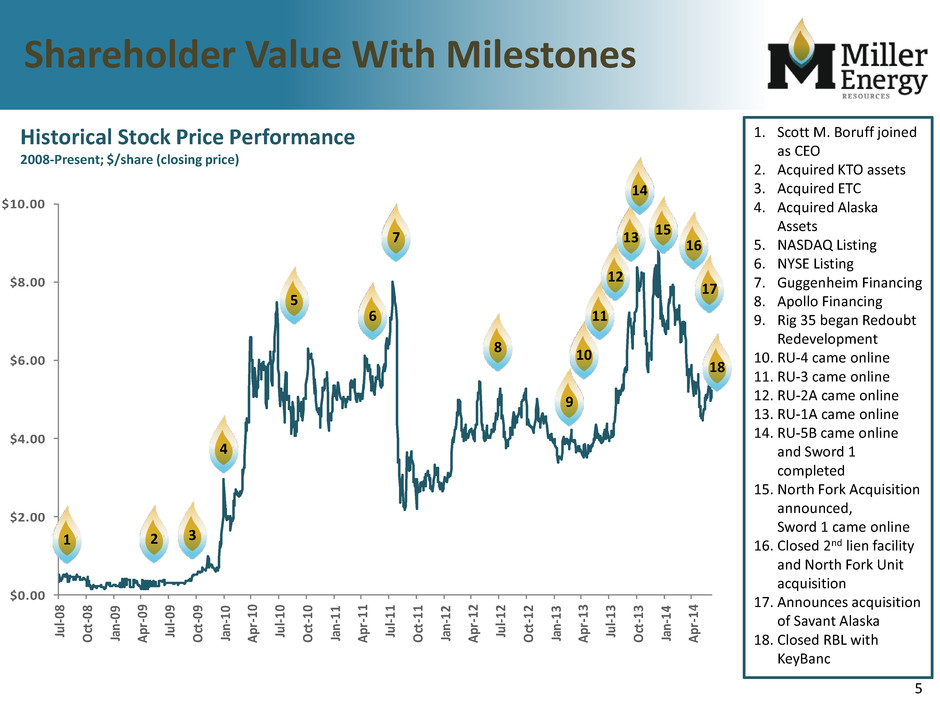

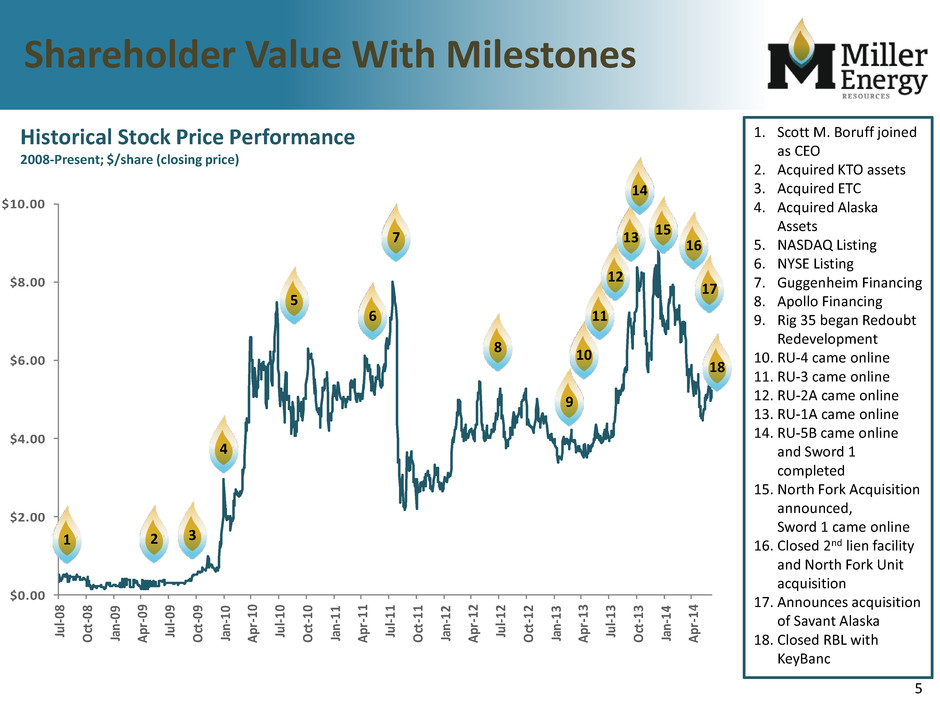

5 $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 Ju l-0 8 Oc t-0 8 Ja n- 09 Ap r-0 9 Ju l-0 9 Oc t-0 9 Ja n- 10 Ap r-1 0 Ju l-1 0 Oc t-1 0 Ja n- 11 Ap r-1 1 Ju l-1 1 Oc t-1 1 Ja n- 12 Ap r-1 2 Ju l-1 2 Oc t-1 2 Ja n- 13 Ap r-1 3 Ju l-1 3 Oc t-1 3 Ja n- 14 Ap r-1 4 Shareholder Value With Milestones 1. Scott M. Boruff joined as CEO 2. Acquired KTO assets 3. Acquired ETC 4. Acquired Alaska Assets 5. NASDAQ Listing 6. NYSE Listing 7. Guggenheim Financing 8. Apollo Financing 9. Rig 35 began Redoubt Redevelopment 10. RU-4 came online 11. RU-3 came online 12. RU-2A came online 13. RU-1A came online 14. RU-5B came online and Sword 1 completed 15. North Fork Acquisition announced, Sword 1 came online 16. Closed 2nd lien facility and North Fork Unit acquisition 17. Announces acquisition of Savant Alaska 18. Closed RBL with KeyBanc Historical Stock Price Performance 2008-Present; $/share (closing price) 2 1 3 4 5 6 7 8 9 10 13 14 11 12 15 16 17 18

6 Miller Energy Investment Strategy ACQUIRE OPTIMIZE EXPLORE Focus on Alaskan assets Looking for assets with significant upside Assets with significant infrastructure in place Build or acquire technical expertise Improve on past mistakes Apply new technologies and operational expertise Apply capital to underdeveloped plays Leverage infrastructure through increased production Minimize "exploration" risk Acquire additional "add-on" acreage Step-out drilling Bolt-on acquisitions

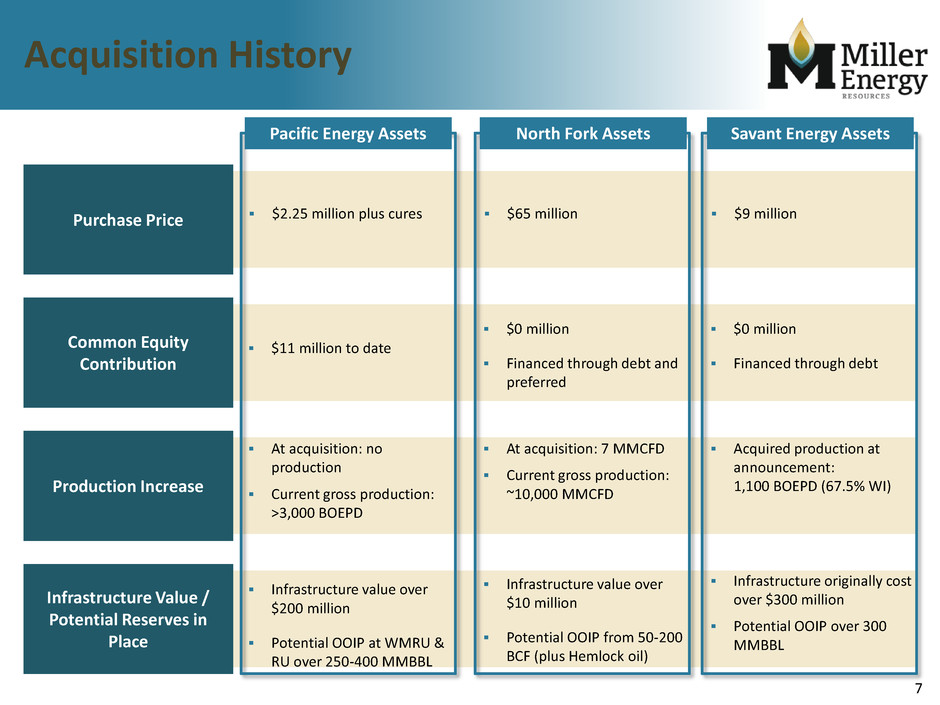

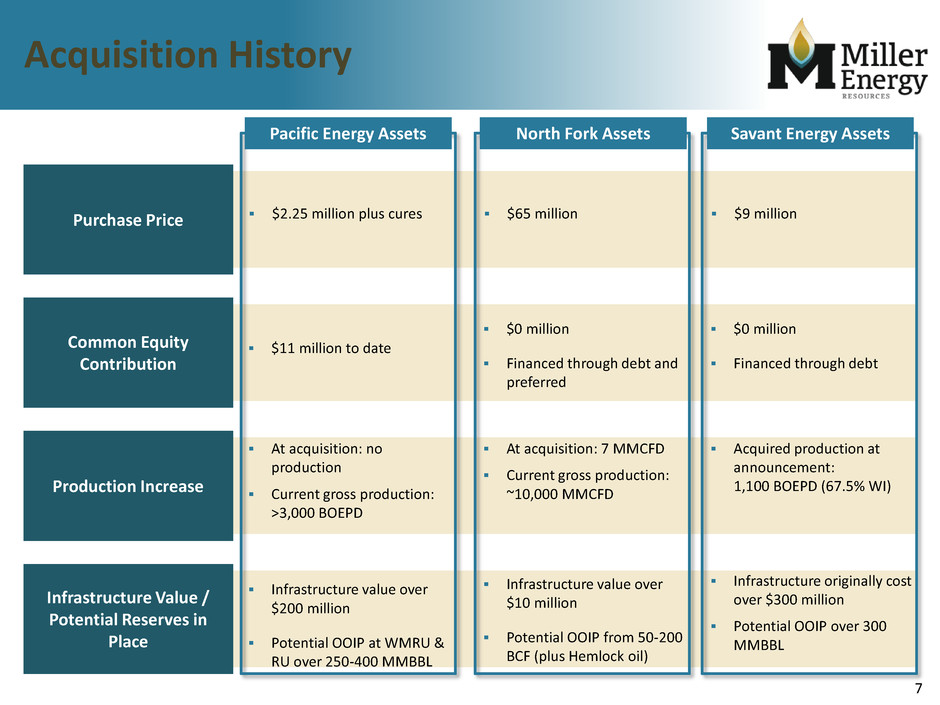

7 Acquisition History $2.25 million plus cures Pacific Energy Assets Savant Energy Assets North Fork Assets Purchase Price Common Equity Contribution Production Increase Infrastructure Value / Potential Reserves in Place $11 million to date At acquisition: no production Current gross production: >3,000 BOEPD Infrastructure value over $200 million Potential OOIP at WMRU & RU over 250-400 MMBBL $65 million $0 million Financed through debt and preferred At acquisition: 7 MMCFD Current gross production: ~10,000 MMCFD Infrastructure value over $10 million Potential OOIP from 50-200 BCF (plus Hemlock oil) $9 million $0 million Financed through debt Acquired production at announcement: 1,100 BOEPD (67.5% WI) Infrastructure originally cost over $300 million Potential OOIP over 300 MMBBL

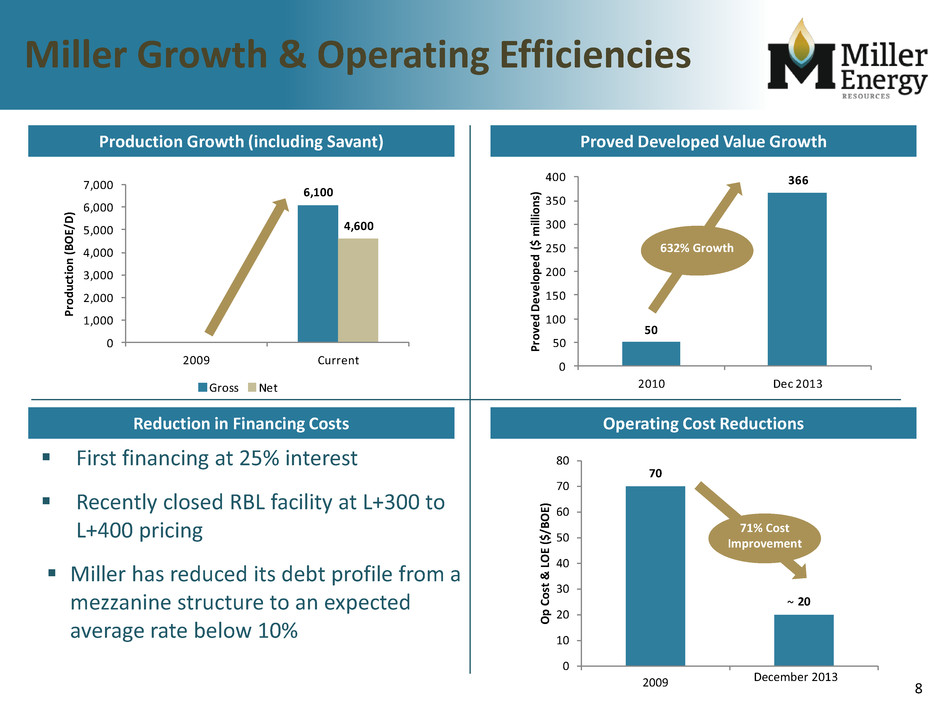

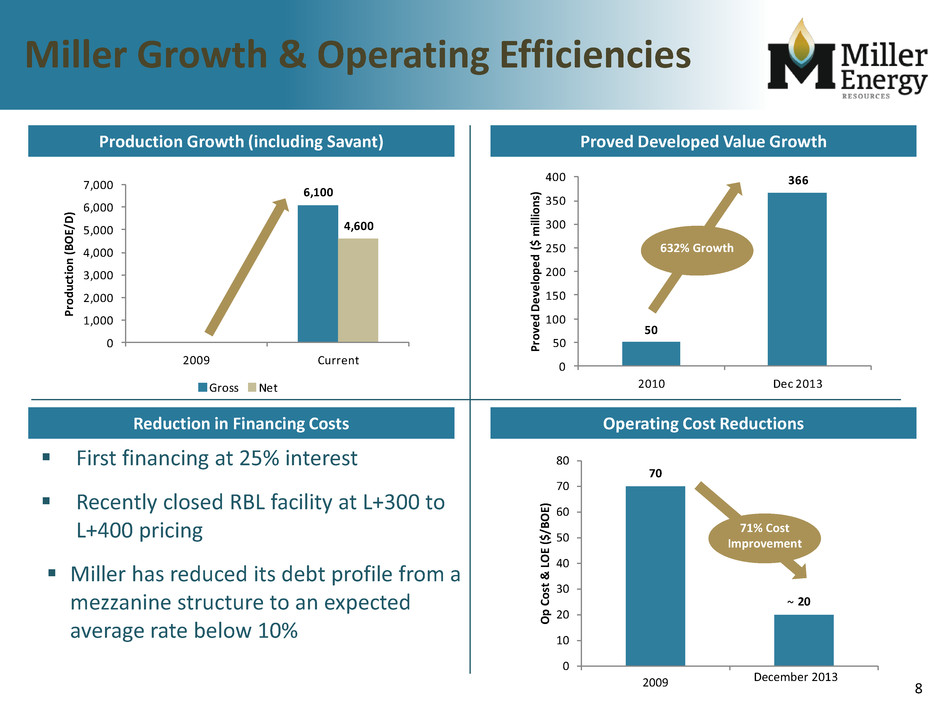

8 50 366 0 50 100 150 200 250 300 350 400 2010 Dec 2013 Pr ov ed De ve lop ed ($ m illi on s) 6,100 4,600 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 2009 Current Pr od uc tio n ( BO E/ D) Gross Net 70 20 0 10 20 30 40 50 6 70 80 2009 Op C ost & LO E ($ /B OE ) Miller Growth & Operating Efficiencies Production Growth (including Savant) Proved Developed Value Growth Operating Cost Reductions Reduction in Financing Costs First financing at 25% interest Recently closed RBL facility at L+300 to L+400 pricing Miller has reduced its debt profile from a mezzanine structure to an expected average rate below 10% 632% Growth 71% Cost Improvement December 2013 ~

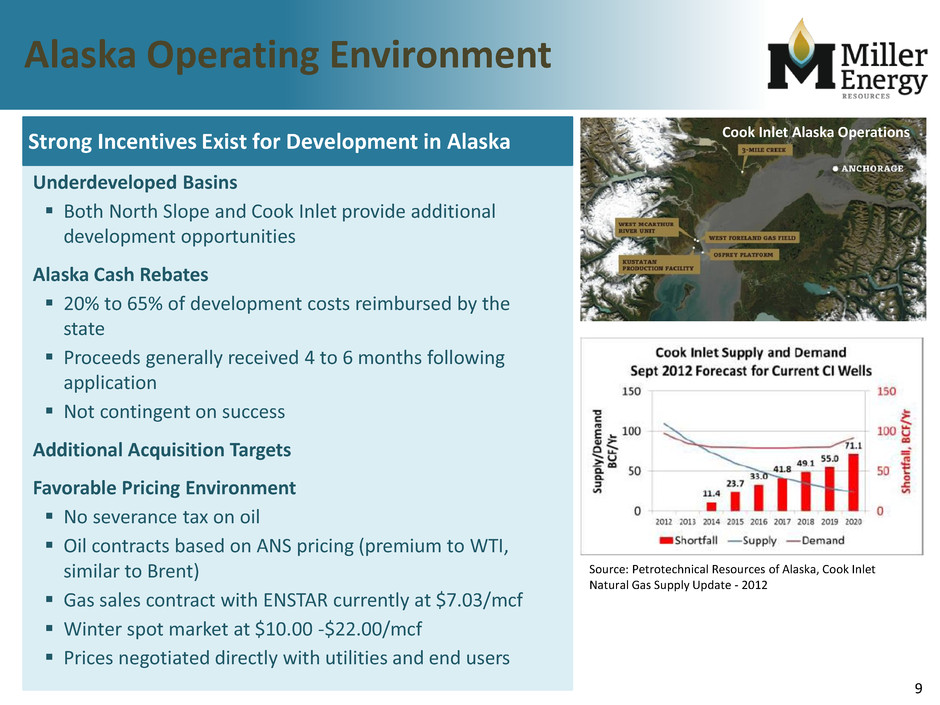

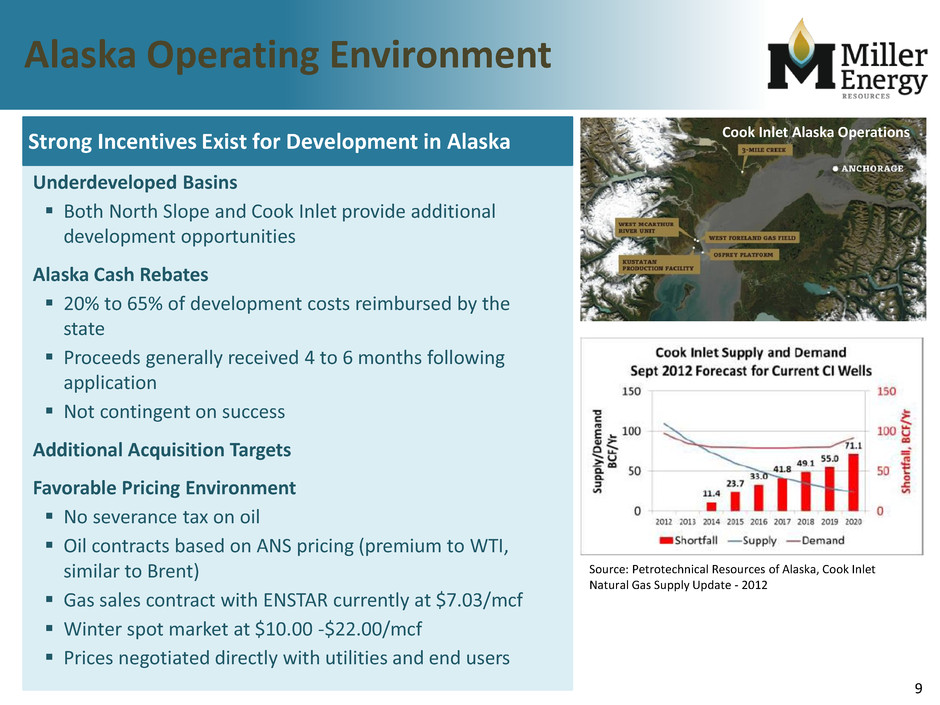

9 Alaska Operating Environment Underdeveloped Basins Both North Slope and Cook Inlet provide additional development opportunities Alaska Cash Rebates 20% to 65% of development costs reimbursed by the state Proceeds generally received 4 to 6 months following application Not contingent on success Additional Acquisition Targets Favorable Pricing Environment No severance tax on oil Oil contracts based on ANS pricing (premium to WTI, similar to Brent) Gas sales contract with ENSTAR currently at $7.03/mcf Winter spot market at $10.00 -$22.00/mcf Prices negotiated directly with utilities and end users Strong Incentives Exist for Development in Alaska Cook Inlet Alaska Operations Source: Petrotechnical Resources of Alaska, Cook Inlet Natural Gas Supply Update - 2012

10 Inflection Point for Miller Energy Resources Significant access to low cost capital Team has grown from six in 2009 to over 75 employees, excluding Savant, with all key functions in-house Vertically integrated - Own 3 drilling rigs, 1 under contract and looking to acquire additional rigs - Two production facilities with capacity for more than 80,000 BOED of additional production Estimated over $2 billion of drilling inventory and acquisition rich environment MILLER IS WELL POSITIONED FOR SIGNIFICANT RESERVE REVALUATION WITH APPLICATION OF ADDITIONAL CAPITAL

11 Redoubt Shoal Hemlock Structure Step out drilling commenced with RU-9 and we expect to have drilled into four new fault blocks by end of 2015 Positive DST tests in North & South Step Outs in 1960s RU-1 drilled in Central fault in 2001 – 1,089 IP & 10 mmbbls PUD RU-2 drilled in South fault 2002 – 1,954 IP & 40 mmbbls PUD Wells have initial production characteristics of other fields in Cook Inlet 100% working interest Highlights

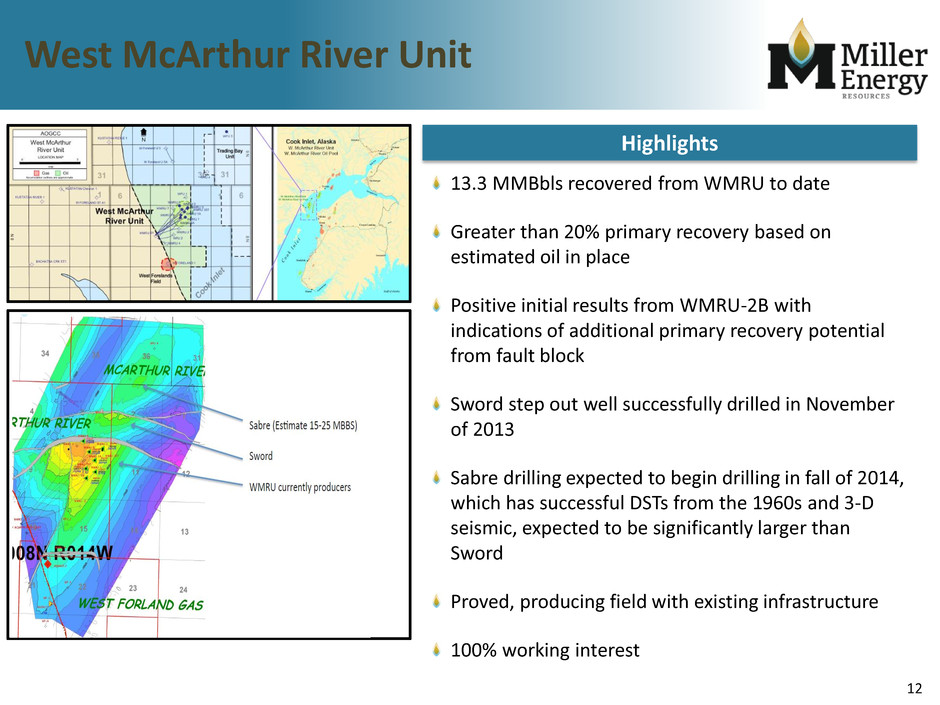

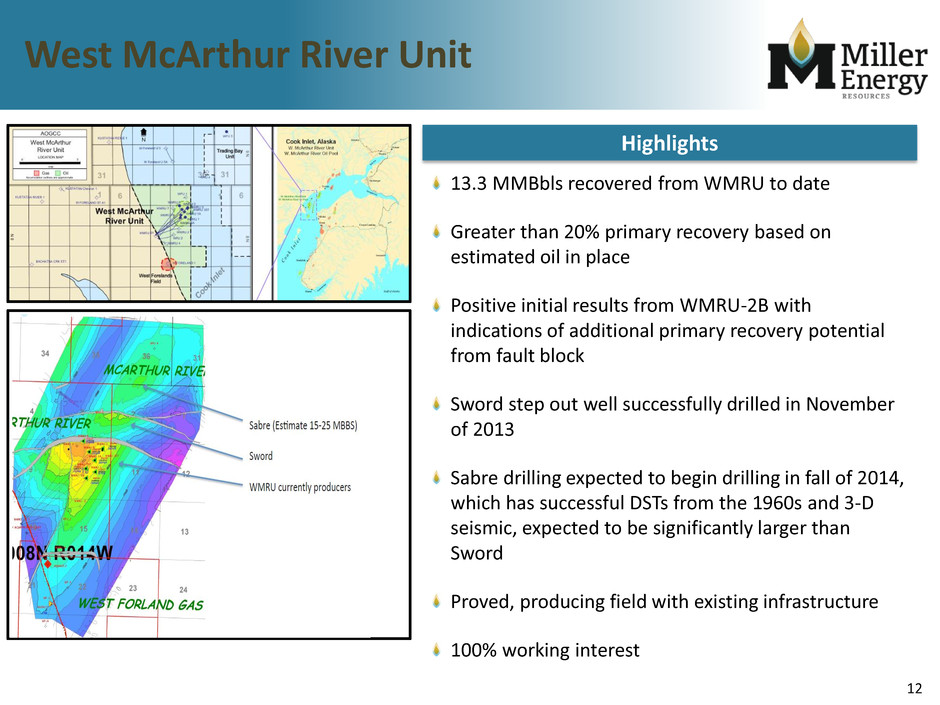

12 West McArthur River Unit 13.3 MMBbls recovered from WMRU to date Greater than 20% primary recovery based on estimated oil in place Positive initial results from WMRU-2B with indications of additional primary recovery potential from fault block Sword step out well successfully drilled in November of 2013 Sabre drilling expected to begin drilling in fall of 2014, which has successful DSTs from the 1960s and 3-D seismic, expected to be significantly larger than Sword Proved, producing field with existing infrastructure 100% working interest Highlights

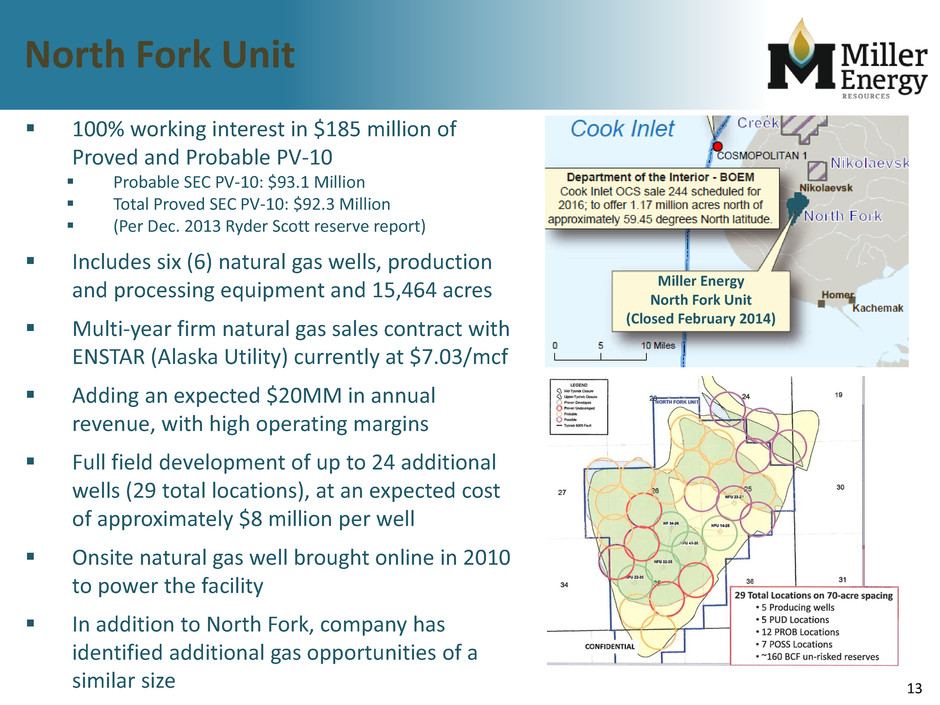

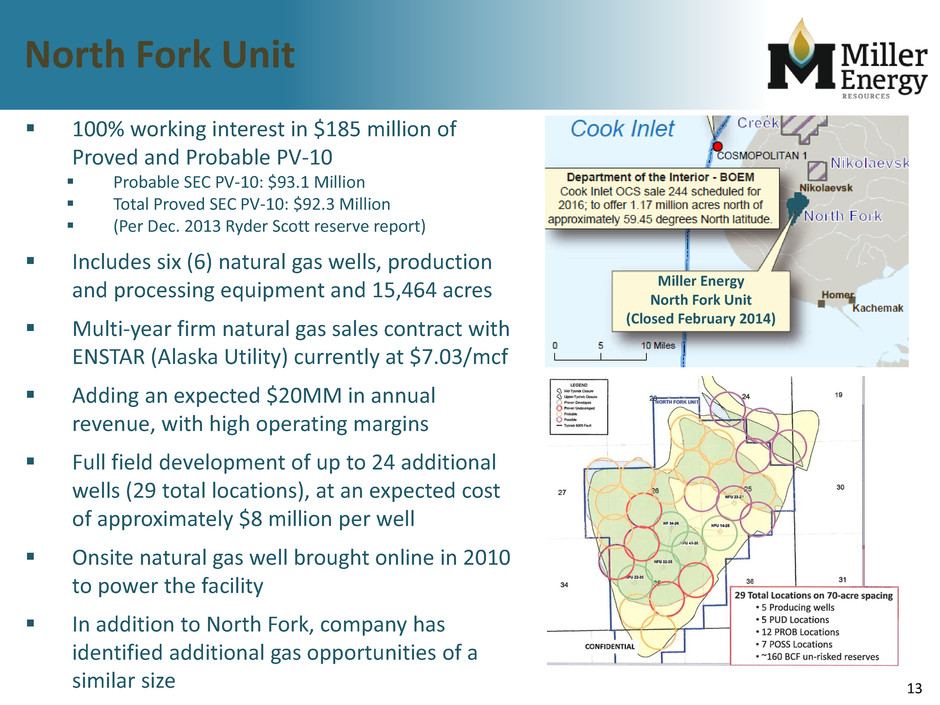

13 North Fork Unit 100% working interest in $185 million of Proved and Probable PV-10 Probable SEC PV-10: $93.1 Million Total Proved SEC PV-10: $92.3 Million (Per Dec. 2013 Ryder Scott reserve report) Includes six (6) natural gas wells, production and processing equipment and 15,464 acres Multi-year firm natural gas sales contract with ENSTAR (Alaska Utility) currently at $7.03/mcf Adding an expected $20MM in annual revenue, with high operating margins Full field development of up to 24 additional wells (29 total locations), at an expected cost of approximately $8 million per well Onsite natural gas well brought online in 2010 to power the facility In addition to North Fork, company has identified additional gas opportunities of a similar size Miller Energy North Fork Unit (Closed February 2014)

14 North Slope Acquisition - Savant Binding agreement to acquire Savant Alaska, LLC subject to due diligence and regulatory approval, for $9.0 MM Savant to become wholly-owned subsidiary of MILL MILL to own 67.5% working interest in the Badami Unit, with ASRC Exploration, LLC remaining as a 32.5% working interest partner Will obtain a 100% working interest in nearby exploration leases Assets would bring approx. 1,100 BOPD gross and 600 BOPD net of current production and ownership of midstream assets located in the Alaska North Slope with a design capacity of 38,500 BOPD and 25 miles of pipeline Initial field development cost of $300 MM Estimate the acquisition will add approximately $6 MM of PDP PV-10 with significant additional drilling opportunities Transaction is expected to close by November 2014, following regulatory approval with a May 1 effective date Badami Unit Production and Forecast Since November 2010 Restart

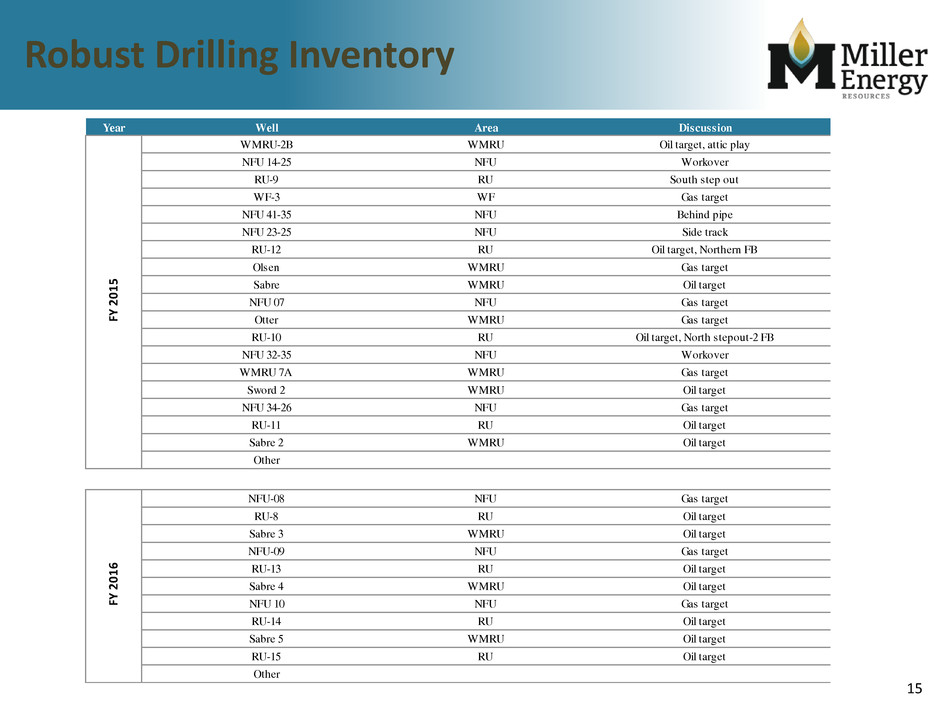

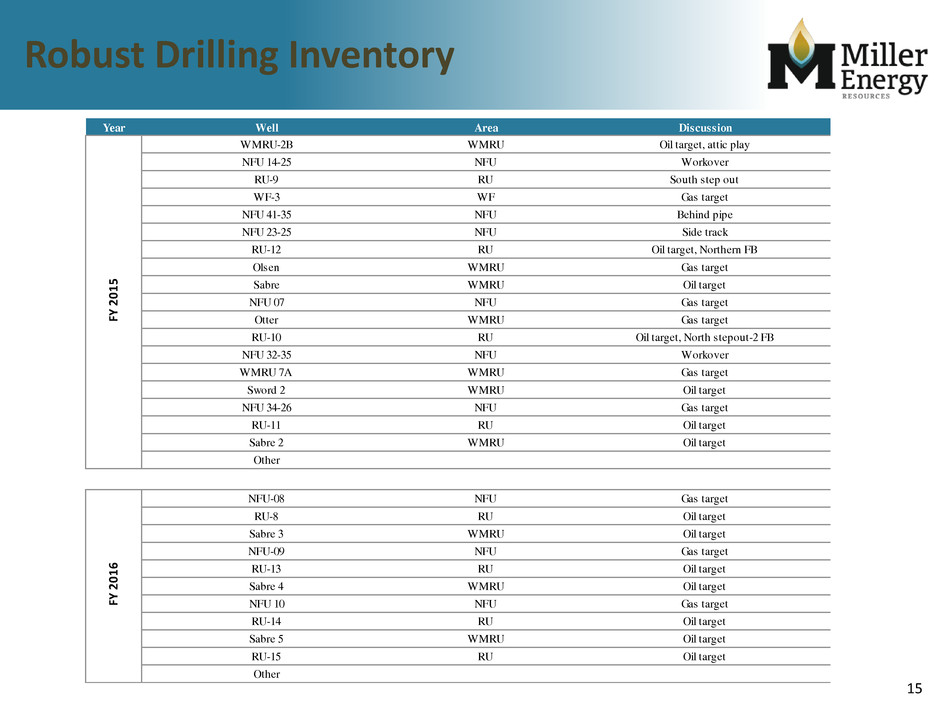

15 Robust Drilling Inventory Year Well Area Discussion WMRU-2B WMRU Oil target, attic play NFU 14-25 NFU Workover RU-9 RU South step out WF-3 WF Gas target NFU 41-35 NFU Behind pipe NFU 23-25 NFU Side track RU-12 RU Oil target, Northern FB Olsen WMRU Gas target Sabre WMRU Oil target NFU 07 NFU Gas target Otter WMRU Gas target RU-10 RU Oil target, North stepout-2 FB NFU 32-35 NFU Workover WMRU 7A WMRU Gas target Sword 2 WMRU Oil target NFU 34-26 NFU Gas target RU-11 RU Oil target Sabre 2 WMRU Oil target Other NFU-08 NFU Gas target RU-8 RU Oil target Sabre 3 WMRU Oil target NFU-09 NFU Gas target RU-13 RU Oil target Sabre 4 WMRU Oil target NFU 10 NFU Gas target RU-14 RU Oil target Sabre 5 WMRU Oil target RU-15 RU Oil target Other FY 2 01 5 FY 2 01 6

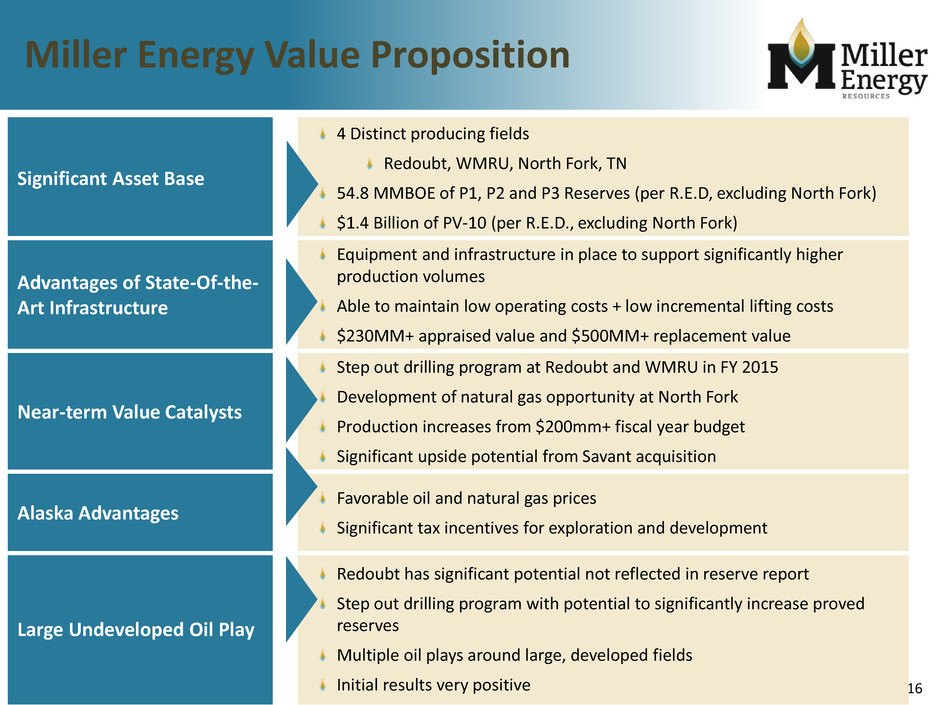

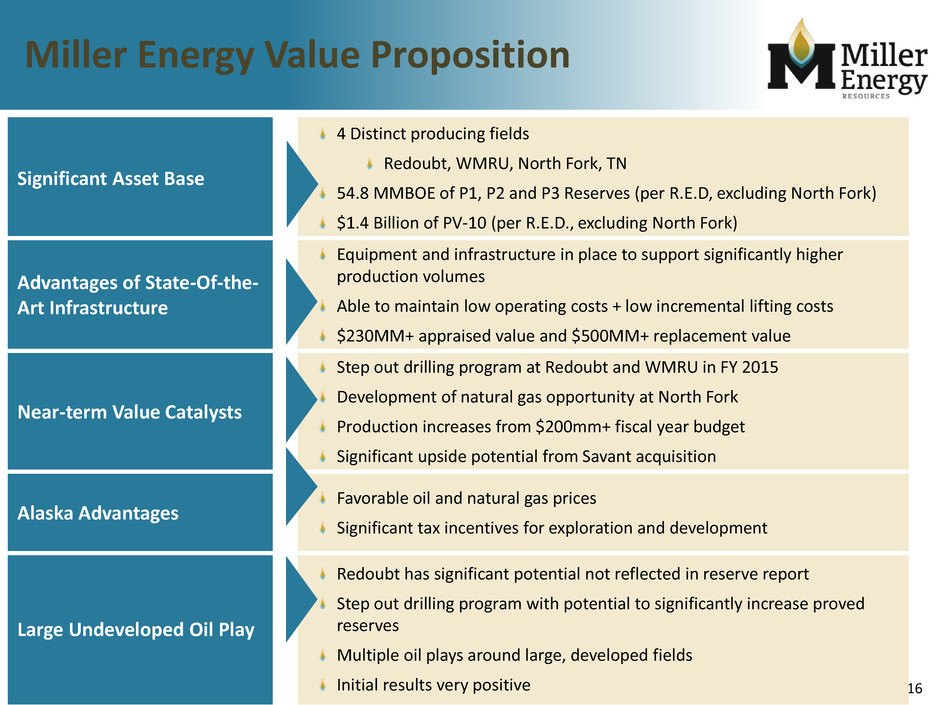

16 Miller Energy Value Proposition Significant Asset Base 4 Distinct producing fields Redoubt, WMRU, North Fork, TN 54.8 MMBOE of P1, P2 and P3 Reserves (per R.E.D, excluding North Fork) $1.4 Billion of PV-10 (per R.E.D., excluding North Fork) Advantages of State-Of-the- Art Infrastructure Equipment and infrastructure in place to support significantly higher production volumes Able to maintain low operating costs + low incremental lifting costs $230MM+ appraised value and $500MM+ replacement value Near-term Value Catalysts Step out drilling program at Redoubt and WMRU in FY 2015 Development of natural gas opportunity at North Fork Production increases from $200mm+ fiscal year budget Significant upside potential from Savant acquisition Alaska Advantages Favorable oil and natural gas prices Significant tax incentives for exploration and development Large Undeveloped Oil Play Redoubt has significant potential not reflected in reserve report Step out drilling program with potential to significantly increase proved reserves Multiple oil plays around large, developed fields Initial results very positive

Appendix Dynamic High Growth Leader

18 Management Biographies Deloy Miller - Mr. Miller, our founder, has been Chairman of the Board of Directors since December 1996, and was CEO from 1967 to August 2008, and COO from August 2008 to July 2013. Since then, Mr. Miller has been Executive Chairman of the Board of Directors. He is a seasoned gas and oil professional with more than 40 years of experience in the drilling and production business in the Appalachian basin. During his years as a drilling contractor, he acquired extensive geological knowledge of Tennessee and Kentucky and received training in the reading of well logs. Mr. Miller served two terms as president of the Tennessee Oil & Gas Association and in 1978 the organization named him the Tennessee Oil Man of the Year. He continues to serve on the board of that organization. In 2011, Mr. Miller was appointed to the Federal Reserve Bank of Atlanta's Energy Advisory Council for a two-year term. Scott M. Boruff - Mr. Boruff has served as a director and CEO since August 2008. Prior to joining our company, Mr. Boruff was a licensed investment banker. He served as a director from 2006 to 2007 of Cresta Capital Strategies, LLC, a New York investment banking firm that was responsible for closing transactions in the $150 to $200 M category. Mr. Boruff specialized in investment banking consulting services that included structuring of direct financings, recapitalizations, mergers and acquisitions, and strategic planning with an emphasis in the gas and oil field. As a commercial real estate broker for over 20 years, Mr. Boruff developed condominium projects, hotels, convention centers, golf courses, apartments and residential subdivisions. Mr. Boruff holds a Bachelor of Science in Business Administration from East Tennessee State University. David J. Voyticky - Mr. Voyticky has been our President since June 2011, was a member of our Board of Directors from April 2010 to April 2014, and was Acting CFO from September 2011 to February 2014. Mr. Voyticky has over 15 years of domestic and international mergers and acquisitions, restructuring and financing experience. From August 2005 to June 2011, Mr. Voyticky was an independent consultant to companies in the middle market on value maximization strategies, providing strategic and capital markets advice to high growth businesses. From December 2005 through June 2006, Mr. Voyticky was a partner in the $300 million re-launch of Chapman Capital L.L.C., an activist hedge fund focused on publicly traded middle market companies. He served on the Board of Directors of Best Energy Services, Inc. from January 2010 to February 2011. Mr. Voyticky received a J.D. and a M.B.A. degree from the University of Michigan and a Masters in International Policy and Economics from the Ford School at the University of Michigan. David M. Hall - Mr. Hall has served as our Chief Operating Officer since July 2013. He has been the Chief Executive Officer of our Cook Inlet Energy subsidiary since December 2009, and served on our Board of Directors from December 2009 to April 2014. Mr. Hall was the former Vice President and General Manager of Alaska Operations, Pacific Energy Resources Ltd. from January 2008 to December 2009. Before that time, from 2000 to 2008, he served as the Production Foreman and Lead Operator in Alaska for Forest Oil Corp, rising to Production Manager for all of Alaska operation for Forest Oil. John M. Brawley - Mr. Brawley was hired as our Chief Financial Officer in February 2014. He has significant experience in corporate finance, specializing in the energy industry. Mr. Brawley was previously a consultant for the Company, starting in November of 2013 and he managed the refinancing of our Apollo Credit Facility in February 2014. From 2010 to 2013 Mr. Brawley was a consultant with Guggenheim Partners, a diversified financial services firm with more than $190 billion of assets under management, where he managed their mezzanine energy portfolio as the co-head of the Houston office and provided energy expertise for Guggenheim's high yield and syndicated loan portfolios. Prior to Guggenheim Partners, Mr. Brawley worked directly for the CFO of ATP Oil & Gas as a consultant from 2007 to 2009, and was a financial analyst at Lehman Brothers in their energy investment banking practice in 2006. Mr. Brawley received a B.A. in Economics and Biological Sciences and an M.B.A., with a concentration in accounting and finance, from Rice University.

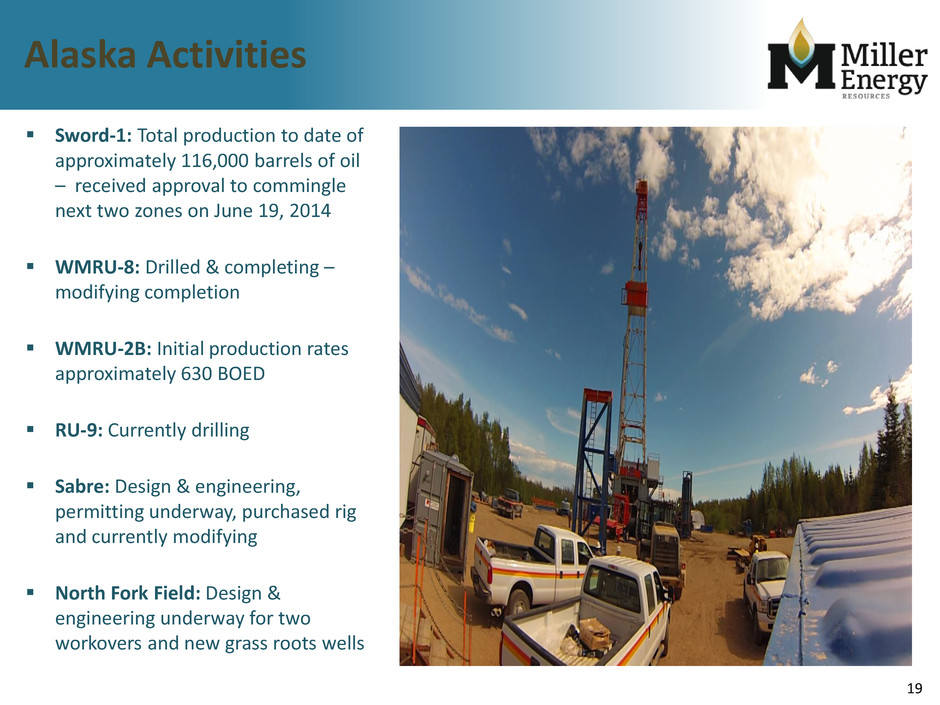

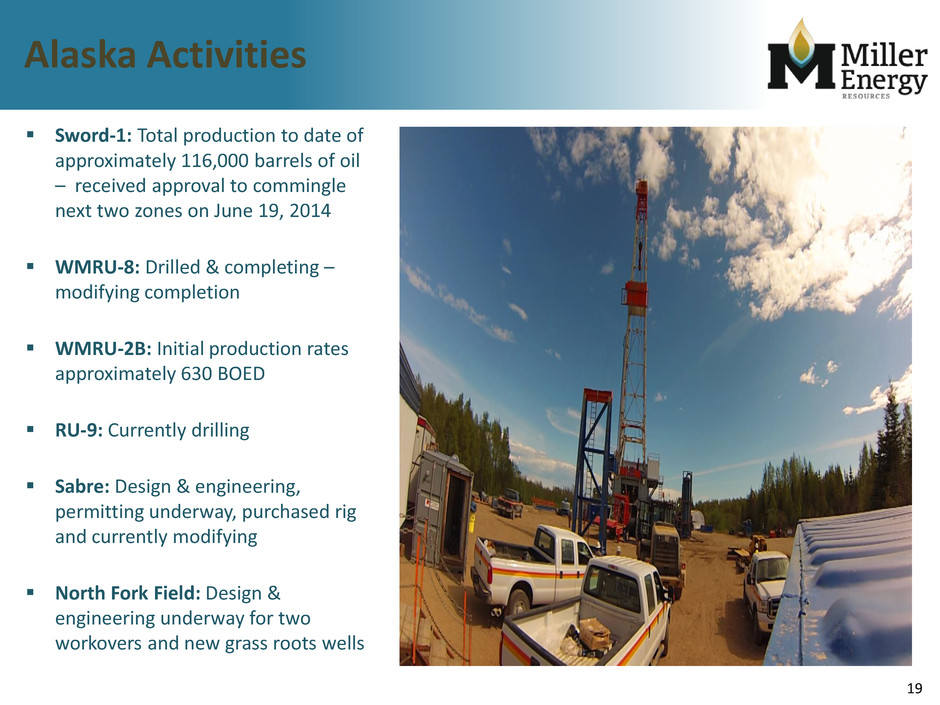

19 Alaska Activities Sword-1: Total production to date of approximately 116,000 barrels of oil – received approval to commingle next two zones on June 19, 2014 WMRU-8: Drilled & completing – modifying completion WMRU-2B: Initial production rates approximately 630 BOED RU-9: Currently drilling Sabre: Design & engineering, permitting underway, purchased rig and currently modifying North Fork Field: Design & engineering underway for two workovers and new grass roots wells

20 New Rig-36 Recent Land-based Rig Purchase Option Entered into option to purchase rig for $3.25MM, including deposit ~2400-HP, ~25,000’ drilling capabilities Planned rig improvements needed for Sabre prospect (high PSI mud system, pits, etc.) Plan to drill Sabre from WMRU pad Up to 6 wells needed to develop Sabre prospect Forecasted rig payout in less than 12 months versus leasing rig Financed with capital lease of up to $5 million ($3.25 million funded to date)

21 Pro Forma Capitalization $250 million facility $60 million initial borrowing base $20 million drawn at close Key credit facility terms include: L+300 to L+400 pricing Three (3) year maturity Undrawn commitment fee of 50bps to 75bps Led and arranged by KeyBanc Capital Markets Other Lenders include: CIT Finance LLC, Mutual of Omaha Bank, and OneWest Bank N.A. Revolving Credit Facility (in $000s) As of: 6/21/2014 Revolving Credit Facility ( L+300 - L+400 ) 20,000.0 Second Lien Term Loan ( 11.75% ) 175,000.0 Rig 36 Capital Lease 3,250.0 Series B Preferred Stock 2,575.0 Total Debt 200,825.0 Series C Preferred Stock 67,097.0 Series D Preferred Stock1 24,885.0 Common Equity 249,284.5 Total Capitalization (Ex-Cash) 542,091.5 (1) Net of $5,000 of Series D stock held in escrow

22 Decreasing Cost of Capital Current Financing $250MM RBL facility priced at L+300 – L+400 ̶ $60MM borrowing base available with $20MM drawn at close $175MM 4-Year Second-Lien Secured Credit Facility by Apollo Investment Corp and Highbridge Principal Strategies at 11.75%, fully drawn at closing Series C 10.75% Perpetual Preferred (NYSE:MILL.C) ̶ $25/share face value ̶ $10/share conversion price, forced conversion at $15/share Series D 10.5% Perpetual Preferred (NYSE:MILL.D) ̶ $25/share face value ̶ Not convertible, except in the event of a change in control Past Financing $100MM 5-year Senior Secured Credit Facility by Apollo Investment Corp at 18% $100MM 2-year Senior Secured Credit Facility by Guggenheim Corporate Funding at 25% $2.5MM Series B Preferred Stock at 12% $10MM Series A Preferred Stock at 10% (fully redeemed)

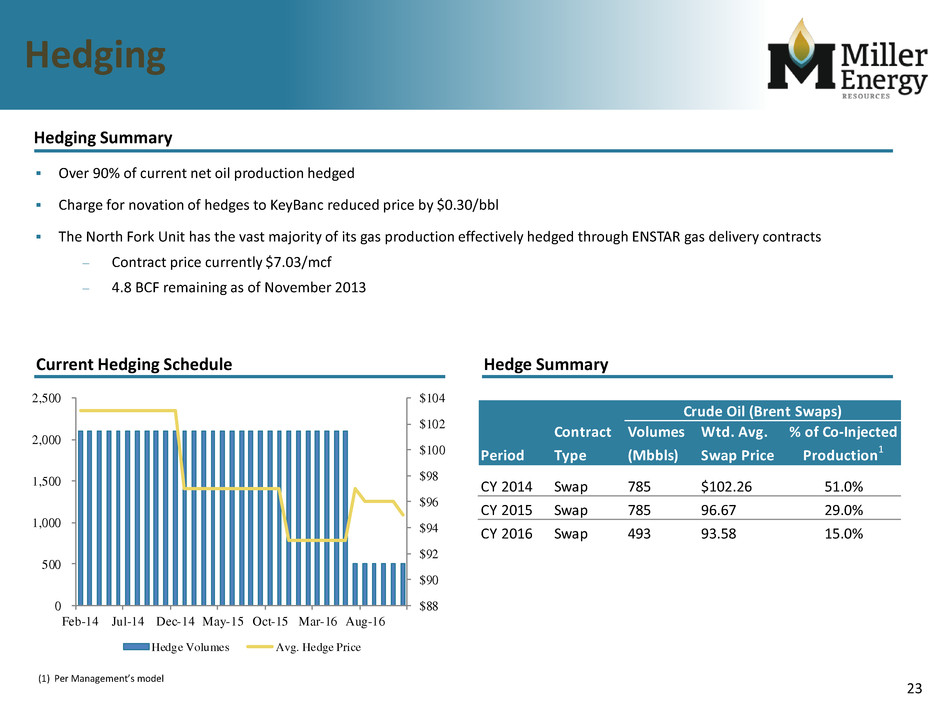

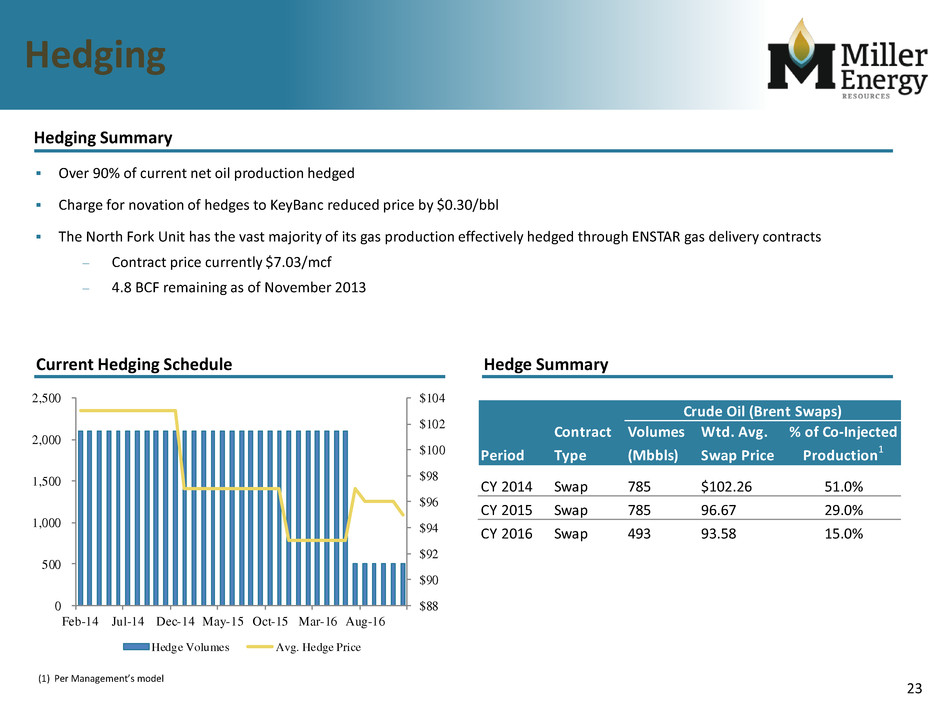

23 Hedging Hedging Summary Hedge Summary Over 90% of current net oil production hedged Charge for novation of hedges to KeyBanc reduced price by $0.30/bbl The North Fork Unit has the vast majority of its gas production effectively hedged through ENSTAR gas delivery contracts – Contract price currently $7.03/mcf – 4.8 BCF remaining as of November 2013 Current Hedging Schedule (1) Per Management’s model $88 $90 $92 $94 $96 $98 $100 $102 $104 0 500 1,000 1,500 2,000 2,500 Feb-14 Jul-14 Dec-14 May-15 Oct-15 Mar-16 Aug-16 Hedge Volumes Avg. Hedge Price Crude Oil (Brent Swaps) Contract Volumes Wtd. Avg. % of Co-Injected Period Type (Mbbls) Swap Price Production 1 CY 2014 Swap 785 $102.26 51.0% CY 2015 Swap 785 96.67 29.0% CY 2016 Swap 493 93.58 15.0%

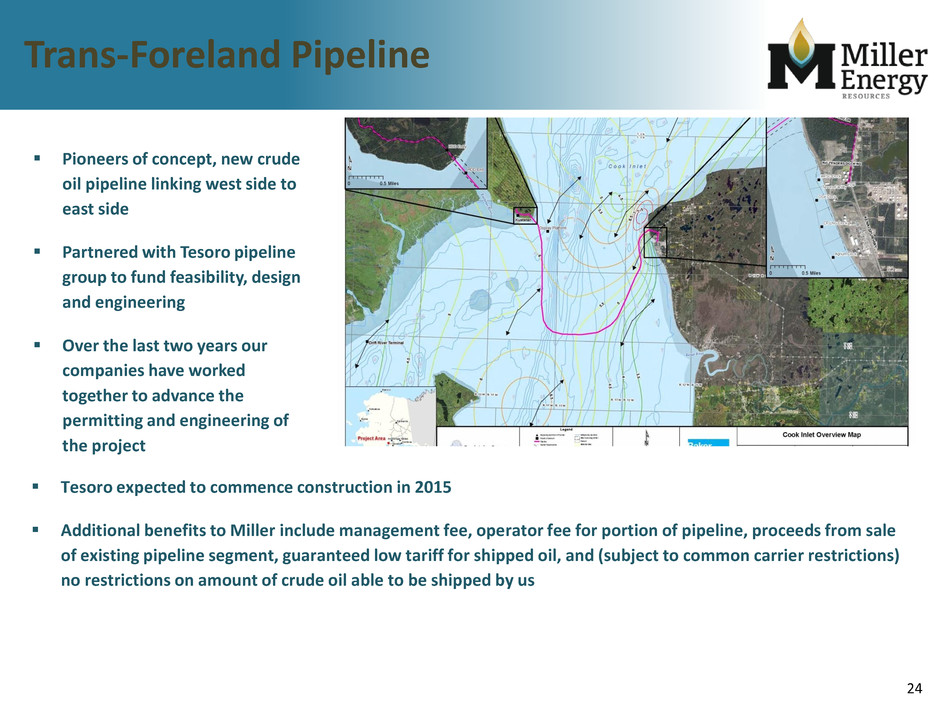

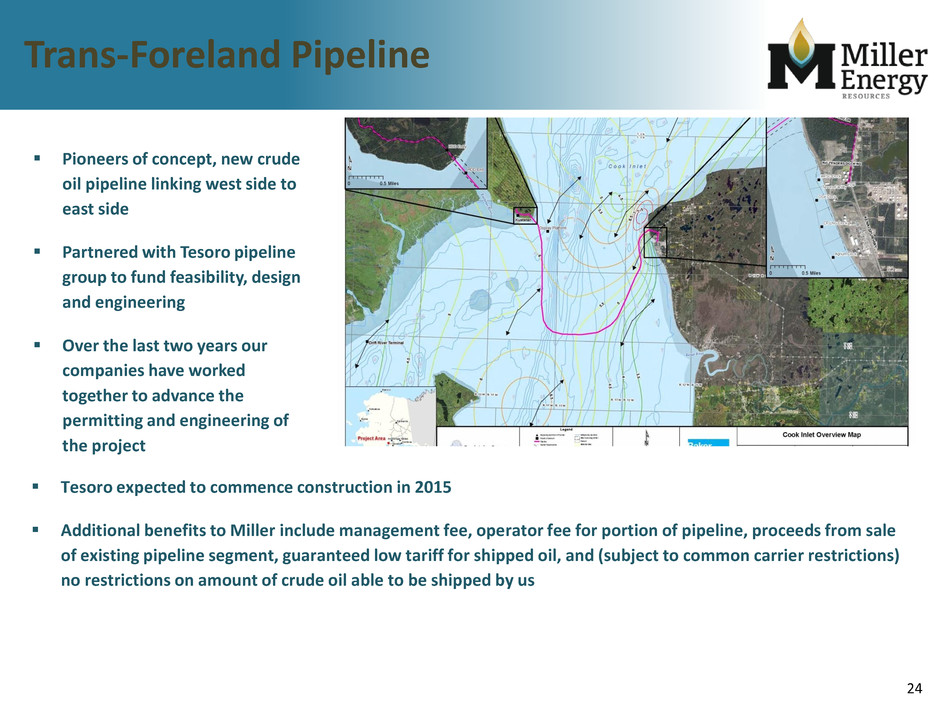

24 Trans-Foreland Pipeline Pioneers of concept, new crude oil pipeline linking west side to east side Partnered with Tesoro pipeline group to fund feasibility, design and engineering Over the last two years our companies have worked together to advance the permitting and engineering of the project Tesoro expected to commence construction in 2015 Additional benefits to Miller include management fee, operator fee for portion of pipeline, proceeds from sale of existing pipeline segment, guaranteed low tariff for shipped oil, and (subject to common carrier restrictions) no restrictions on amount of crude oil able to be shipped by us

25 Contact Information Miller Energy Resources, Inc. 9721 Cogdill Road, Suite 302 Knoxville, TN 37932-3425 Phone: 865-223-6575 info@millerenergyresources.com www.millerenergyresources.com Investor Relations MZ Group - North America Derek Gradwell SVP, Natural Resources Phone: 512-270-6990 dgradwell@mzgroup.us www.mzgroup.us