UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [X] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to Sec. 240.14a-12 |

LIBERTY ALL-STAR GROWTH FUND, INC.

(name of Registrant as Specified in its Charter)

ALPS FUND SERVICES, INC.

Attn: Tane Tyler

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: |

| 2) | Aggregate number of securities to which transaction applies: |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11(set forth the amount on which the filing fee is calculated and state how it was determined): |

| 4) | Proposed maximum aggregate value of transaction: |

| 5) | Total fee paid: |

| [ ] | Fee paid previously with preliminary materials. |

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| 1) | Amount Previously Paid: |

| 2) | Form, Schedule or Registration Statement No.: |

| 3) | Filing Party: |

| 4) | Date Filed: |

LIBERTY ALL-STAR® GROWTH FUND, INC.

Period Ending June 30, 2011 (Unaudited)

Fund Statistics | ||||||||

Net Asset Value (NAV) | $4.81 | |||||||

Market Price | $4.44 | |||||||

Discount | 7.7% | |||||||

| Quarter | Year-to-Date |

One Year | ||||||

Distributions |

$0.07 | $0.14 | $0.27 | |||||

Market Price Trading Range |

$4.22 to $4.68 | $4.20 to $4.68 | $3.25 to $4.68 | |||||

Discount Range |

4.9% to 8.3% | 4.9% to 8.3% | 4.9% to 11.0% | |||||

Performance | ||||||||

Shares Valued at NAV | 0.39% | 8.34% | 35.84% | |||||

Shares Valued at NAV with Dividends Reinvested | 0.58% | 8.69% | 36.40% | |||||

Shares Valued at Market Price with Dividends Reinvested | (2.12)% | 7.89% | 38.83% | |||||

NASDAQ Composite Index | (0.04)% | 5.00% | 32.73% | |||||

Russell 3000 Growth Index | 0.64% | 6.98% | 35.68% | |||||

S&P 500 Index | 0.10% | 6.02% | 30.69% | |||||

Lipper Multi-Cap Growth Mutual Fund Average* | (0.03)% | 6.32% | 35.37% | |||||

NAV Reinvested Percentile Rank | ||||||||

(1 = best; 100 = worst) | 39th | 19th | 46th | |||||

Number of Funds in Category | 500 | 492 | 463 | |||||

| * | Percentile rank calculated using the Fund’s NAV Reinvested return within the Lipper Multi-Cap Growth Open-end Mutual Fund Universe. |

Figures shown for the Fund and the Lipper Multi-Cap Growth Mutual Fund Average are total returns, which include dividends, after deducting fund expenses. Figures shown for the unmanaged NASDAQ Composite Index, the Russell 3000® Growth Index and the S&P 500 Index are total returns, including dividends. A description of the Lipper benchmark and the market indices can be found on page 34.

Past performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

The Fund is a closed-end fund and does not continuously offer shares. The Fund trades in the secondary market, investors wishing to buy or sell shares need to place orders through an intermediary or broker by using the Fund’s ticker symbol: ASG. The share price of a closed-end fund is based on the market’s value. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

Liberty All-Star® Growth Fund | President’s Letter |

Fellow Shareholders: | July 2011 |

Despite periodic bouts of investor worry and doubt, stocks managed to hold their own in the second quarter. As measured by the S&P 500 Index, stocks gained 0.10 percent in the quarter—essentially unchanged. While stocks did not gain ground in the quarter, neither did they give it up, and that may be considered a minor victory given that stocks declined for six straight weeks through May and mid-June, their longest losing streak since the market bottomed in March 2009. At one point in June (the 15th) the S&P 500 had declined 4.15 percent for the quarter, so by closing strong and crossing into positive territory the market gained momentum going into the third quarter.

The second quarter was dominated by a continuation of the “risk on, risk off” mentality as stocks and other asset classes responded to macro events that ranged from slowing domestic and global economic growth to sovereign debt problems in Southern Europe as well as deficit and debt ceiling challenges in the U.S. Sentiment turned quickly throughout the quarter based on geopolitical events and economic data in the U.S. and abroad. Other news was far more positive; corporate earnings generally continued to top estimates, the initial public offering market was active, as was merger and acquisition activity, and commodity prices backed away from near-record levels. The S&P 500 got off to a strong start in April by advancing 2.96 percent. But, it reversed direction and gave up 1.13 percent and 1.67 percent, respectively, in May and June. Only a strong finish in late June pushed the index back to the plus side.

While the technology-oriented NASDAQ Composite Index lagged the S&P 500 Index—returning -0.04 percent compared to +0.10 percent—growth stocks generally outperformed value stocks for the quarter. The Russell 3000® Growth Index gained 0.64 percent for the quarter compared to a decline of 0.68 percent for the Russell 3000® Value Index. While the Russell 3000® Growth Index gained a strong 3.37 percent in April, it was not immune to the broad-based selling that took place in May and June, as this index fell 1.16 percent and 1.50 percent, respectively, in those two months.

For the quarter, Liberty All-Star Growth Fund returned 0.39 percent with shares valued at net asset value (NAV) and 0.58 percent with shares valued at NAV with dividends reinvested, while it declined 2.12 percent with shares valued at market price (with dividends reinvested). The Fund’s NAV performance ranked it in the 39th percentile of its peer group, the Lipper Multi-Cap Growth Mutual Fund Average, which declined -0.03 percent for the quarter. The Fund’s reinvested NAV and market price returns both year-to-date and for the trailing one-year period ending June 30, 2011, exceed all the benchmarks shown on the inside front cover. The Fund ranks in the 19th and 46th percentiles for those respective periods within the Lipper Multi-Cap Growth peer group.

The discount at which Fund shares traded relative to their underlying NAV ranged from 4.9 percent to 8.3 percent over the quarter and ended the quarter at 7.7 percent, representing a continuation of the trend toward narrower discounts that the Fund experienced over the past 12 months, when the discount was as wide as 11.0 percent at one point. Also, although the Fund’s expense ratio has declined, it is still being negatively impacted by higher expenses associated with actions by dissident shareholders.

The third quarter got off to a fast start in its first few trading days before running into headwinds generated by Euro zone debt fears and concerns over the U.S. debt ceiling. These abrupt swings suggest that investors may see more of the heightened volatility that characterized the second quarter. Whatever markets bring, we are confident in the Fund’s structure and in the skills and dedication of the Fund’s three investment managers. In that regard, we invite you to read our

Semi-Annual Report (Unaudited) | June 30, 2011 | 1 |

| President’s Letter | Liberty All-Star® Growth Fund |

interview with the Fund’s small-cap growth manager, Matt Weatherbie of M.A. Weatherbie & Co., Inc., which we present in this quarterly report.

After the second quarter closed, ALPS Holdings, Inc., the parent company of your Fund’s manager, ALPS Advisors, Inc., announced that it had signed an agreement to be acquired by DST Systems, Inc. As a result, two proposals relating to your Fund’s advisory agreements will be submitted to Fund shareholders at a special shareholder meeting to be held on September 30. A proxy statement, which will be mailed separately, discusses these two proposals in detail. I ask for your support on these two proposals in order to provide continuity in the management and operation of your Fund. If you have not already done so, please review the proxy statement and cast your vote on each proposal.The Board of Directors recommends that you vote FOR each proposal.

We are gratified by the Fund’s continued strong performance. Over the past one, three and five year periods the Fund’s reinvested NAV and market price results exceed that of the S&P 500 Index, the Russell 3000® Growth Index and the Lipper Multi-Cap Growth Mutual Fund Average. We remain committed to a strong, high quality growth equity investment vehicle for our shareholders, and we thank you for your support and confidence in the Fund going forward.

Sincerely,

William R. Parmentier, Jr.

President and Chief Executive Officer

Liberty All-Star® Growth Fund, Inc.

The views expressed in the President’s letter and the Manager Interview reflect the views of the President and Manager as of July 2011 and may not reflect their views on the date this report is first published or anytime thereafter. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the Fund disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as an indication of trading intent.

2 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Table of Distributions & Rights Offerings |

| Rights Offerings | ||||||||

| Year | Per Share Distributions | Month Completed | Shares Needed to Purchase One Additional Share | Subscription Price | ||||

1997 | $1.24 | |||||||

1998 | 1.35 | July | 10 | $12.41 | ||||

1999 | 1.23 | |||||||

2000 | 1.34 | |||||||

2001 | 0.92 | September | 8 | 6.64 | ||||

2002 | 0.67 | |||||||

2003 | 0.58 | September | 8* | 5.72 | ||||

2004 | 0.63 | |||||||

2005 | 0.58 | |||||||

2006 | 0.59 | |||||||

2007 | 0.61 | |||||||

2008 | 0.47 | |||||||

2009** | 0.24 | |||||||

2010 | 0.25 | |||||||

2011 | ||||||||

1st Quarter | 0.07 | |||||||

2nd Quarter | 0.07 | |||||||

| * | The number of shares offered was increased by an additional 25% to cover a portion of the over-subscription requests. |

| ** | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

DISTRIBUTION POLICY

Liberty All-Star Growth Fund, Inc.’s current policy is to pay distributions on its shares totaling approximately 6 percent of its net asset value per year, payable in four quarterly installments of 1.5 percent of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. The fixed distributions are not related to the amount of the Fund’s net investment income or net realized capital gains or losses and may be taxed as ordinary income up to the amount of the Fund’s current and accumulated earnings and profits. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess.

Semi-Annual Report (Unaudited) | June 30, 2011 | 3 |

| Top 20 Holdings & Economic Sectors | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

| Top 20 Holdings* | Percent of Net Assets | |

Salesforce.com, Inc. | 2.27% | |

C.H. Robinson Worldwide, Inc. | 2.23 | |

Apple, Inc. | 1.96 | |

QUALCOMM, Inc. | 1.82 | |

Core Laboratories N.V. | 1.75 | |

Intuitive Surgical, Inc. | 1.75 | |

Green Mountain Coffee Roasters, Inc. | 1.70 | |

FMC Technologies, Inc. | 1.68 | |

IHS, Inc., Class A | 1.66 | |

Baidu, Inc. | 1.63 | |

ARM Holdings PLC | 1.59 | |

ACE Ltd. | 1.52 | |

Expeditors International of Washington, Inc. | 1.49 | |

Oceaneering International, Inc. | 1.48 | |

Rockwell Automation, Inc. | 1.45 | |

Rue21, Inc. | 1.45 | |

Google, Inc., Class A | 1.36 | |

American Tower Corp., Class A | 1.35 | |

LKQ Corp. | 1.26 | |

Signature Bank | 1.25 | |

| 32.65% | ||

| Economic Sectors* | Percent of Net Assets | |

Information Technology | 26.42% | |

Industrials | 16.23 | |

Health Care | 15.50 | |

Consumer Discretionary | 12.63 | |

Financials | 10.13 | |

Energy | 9.29 | |

Consumer Staples | 3.31 | |

Materials | 2.45 | |

Telecommunication Services | 1.35 | |

Utilities | 0.71 | |

Other Net Assets | 1.98 | |

| 100.00% | ||

| * | Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors in the future. |

4 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Major Stock Changes in the Quarter |

The following are the major ($500,000 or more) stock changes - both purchases and sales - that were made in the Fund’s portfolio during the second quarter of 2011.

| Security Name | Purchases (Sales) | Shares as of 6/30/11 | ||

Purchases | ||||

F5 Networks, Inc. | 5,400 | 9,200 | ||

Urban Outfitters, Inc. | 18,900 | 18,900 | ||

Sales | ||||

Alliance Data Systems Corp. | (10,100) | 0 | ||

Brigham Exploration Co. | (15,500) | 14,300 | ||

CVS Caremark Corp. | (23,100) | 0 | ||

E-Commerce China Dangdang, Inc. | (28,873) | 0 | ||

Janus Capital Group, Inc. | (76,400) | 0 | ||

Plains Exploration & Production Co. | (17,800) | 0 | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 5 |

Investment Managers/ Portfolio Characteristics | Liberty All-Star® Growth Fund |

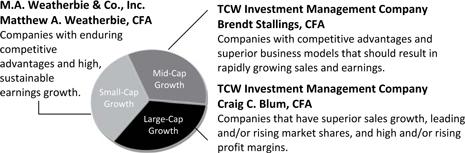

THE FUND’S THREE GROWTH INVESTMENT MANAGERS AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

MANAGERS’ DIFFERING INVESTMENT STRATEGIES ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 34 for a description of these indices.

PORTFOLIO CHARACTERISTICSAs of June 30, 2011 (Unaudited)

| Market Capitalization Spectrum | ||||||||||||||

| Small |  | Large | ||||||||||||

| RUSSELL GROWTH: | ||||||||||||||

| SMALLCAP INDEX | MIDCAP INDEX | LARGECAP INDEX | M.A. WEATHERBIE | TCW (MID-CAP) | TCW (LARGE-CAP) | TOTAL FUND | ||||||||

Number of Holdings | 1,161 | 469 | 591 | 60 | 56 | 31 | 129* | |||||||

Weighted Average Market Capitalization (billions) | $1.5 | $8.5 | $85.2 | $2.8 | $9.6 | $59.1 | $23.3 | |||||||

Average Five-Year Earnings Per Share Growth | 13% | 12% | 13% | 13% | 24% | 25% | 20% | |||||||

Dividend Yield | 0.6% | 0.9% | 1.4% | 0.3% | 0.4% | 0.6% | 0.4% | |||||||

Price/Earnings Ratio** | 23x | 22x | 18x | 25x | 33x | 26x | 27x | |||||||

Price/Book Value Ratio | 4.8x | 5.1x | 5.3x | 5.2x | 8.5x | 5.9x | 6.5x | |||||||

| * | Certain holdings are held by more than one manager. |

| ** | Excludes negative earnings. |

6 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Manager Interview |

| Matthew A. Weatherbie, CFA President and Founder M. A. Weatherbie & Co., Inc. |

USING BOTTOM-UP STOCK PICKING M. A. WEATHERBIE FINDS QUALITY SMALL-CAPS WITH ROBUST GROWTH PROSPECTS

M. A. Weatherbie & Co. manages the portion of the Liberty All-Star Growth Fund that is allocated to small-cap growth stocks. M. A. Weatherbie focuses on high quality companies that demonstrate superior earnings growth prospects, yet are reasonably priced relative to their intrinsic value. The firm seeks to provide superior returns relative to small capitalization growth indices over a full market cycle. Recently, we spoke with the firm’s President and founder, Matthew A. Weatherbie, CFA. The Fund’s Advisor, ALPS Advisors, Inc., moderated the interview.

Growth rates generated by the overall economy continue to disappoint. So, there’s a premium on companies and industries generating real growth. What industries and specific companies appear especially attractive for M. A. Weatherbie & Co. right now?

As bottom-up stock pickers, we do not focus on certain industries or concentrate on any specific sectors of the economy. But, in this slow growth economy there are certain types of companies that are especially attractive to us, and they are the ones that control their own destiny. An example is a consumer company like Ulta Salon, Cosmetics & Fragrance. This company operates cosmetics stores using a business model and formula that have proven to work, with the result that its growth is not dependent on the economy. The company’s competitive advantage is offering a full range of cosmetics, from lower price point products to the most popular mid-priced brands and even high priced brands that formerly were only available in department stores. Ulta Salon also operates salons within the stores, so in addition to a full line of products there is a service component to its strategy, and that combination makes it a very convenient, one-stop destination for consumers. Ulta Salon is driving incremental growth from opening additional highly profitable stores across the country.

Two additional examples of companies that should grow earnings in the current environment are IHS and Solera Holdings. IHS is an information services company with clients in four major areas: energy, product life cycle, environment and security. IHS provides industry data, technical documents, custom software applications and consulting services to clients in some 30 countries. Solera Holdings is a leading software and services provider to the automobile insurance claim processing industry. It is active in more than 50 countries on six continents. These companies are attractive due to the high fixed cost nature of their businesses, which serves as a barrier to entry. Their performance advantage comes from being able to sell and resell databases of critical industry information to a growing number of clients.

Semi-Annual Report (Unaudited) | June 30, 2011 | 7 |

| Manager Interview | Liberty All-Star® Growth Fund |

M. A. Weatherbie invests a portion of the portfolio in what it calls “Opportunity” growth stocks, or stocks where earnings have been temporarily depressed but whose prospects for a return to earnings growth in the future is good. It would seem that in the current environment it wouldn’t be hard to find stocks exhibiting such pricing distortions. What’s an example of one of these stocks?

A stock where we feel there’s a lot of upside ahead of it is Portfolio Recovery Associates. This company purchases charged-off receivable portfolios from banks, usually buying these portfolios for just a few cents on the dollar and then collecting 20 to 25 percent of the portfolio’s value over a few years. Portfolio Recovery Associates is a cyclical growth company whose stock is selling for only about 11 times earnings. Right now, its earnings are in a strong up-cycle because of actions the company took a few years ago when it purchased very attractively priced portfolios in the 2008 and 2009 financial crisis and recession. Now, even with modest improvement in the economy, more people are able to commit to a payment program so the company has seen better than expected collections on portfolios of that 2008/09 vintage.

Another name in the same category is Thor Industries, which is the largest assembler of recreational vehicles, especially towables. Again, this company is benefitting from a moderate increase in spending and cost savings associated with its leading position in the RV industry. As a result, it should see a good cyclical recovery in earnings as the consumer stabilizes and the financing situation improves.

How do small cap companies typically perform at this stage in the economic cycle? They often lead a recovery, and did so in 2009. In a slow growth economy which seems to be losing momentum, what are the general expectations for small caps? How does M. A. Weatherbie’s bottom-up investment process identify those small cap companies with the potential to outperform in a slowing economy?

The consensus, if you were to ask the average person who feels he or she knows something about the stock market, would likely be that smaller companies tend to be more economically sensitive and, therefore, in the early stages of an economic recovery they would tend to outperform. In fact, in 2009 in anticipation of an economic recovery that is what happened. Now, at this stage in the economic cycle, many would say that small-caps are fairly valued or even a little

overvalued, depending on which metrics you use. | ||||

My counter to that is that “small-cap” is a sort of generic term. What we at Weatherbie do is invest in high quality, smaller-cap growth companies whose business models and business prospects allow them to grow at a superior rate even in a sluggish economy. In fact, based on our own bottom-up earnings growth analysis, we are projecting a 20 percent earnings growth rate for our portfolio companies in 2011, 2012 and into 2013. These are our own bottom-up projections based on our detailed knowledge of these companies and do not depend on a certain growth rate in GDP. | In this slow growth economy there are certain types of companies that are especially attractive to us, and they are the ones that control their own destiny. | |||

8 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Manager Interview |

What is a new holding in the portion of the Liberty All-Star Growth Fund that you manage, and what was the rationale for purchasing it?

Normally we are sparing in our use of initial public offerings (IPOs) because we want to make sure that our portfolio | ||||

companies have robust business models. But, wedid buy a recent technology IPO called | ||||

| Based on our own bottom-up earnings growth analysis, we are projecting a 20 percent earnings growth rate for our portfolio companies in 2011, 2012 and into 2013 | Fusion-io. This is a data storage company that we think is extremely well positioned to grow in the next few years. The way that Fusion-io manages the explosive growth in stored information makes it attractive to social media companies like Facebook, Apple, Microsoft and others. Fusion-io offers a new storage memory platform that significantly improves the processing capabilities within a data center by moving critical data closer to the CPU where it is processed. Called data decentralization, this combination of hardware and software increases data center efficiency. There has been a tremendous demand for new storage solutions to deal with companies like Facebook and others that are in the vanguard of social media. The unique and differentiated solutions that Fusion-io offers | |||

enable the company to realize gross margins in the range of 55 percent. Right now, Fusion-io has about $150 million in annual revenues; but the total addressable market could be over $20 billion, so there is plenty of room for robust growth. Finally, we like the management, including the venture capital managers who took the company public. With IPOs it’s important to look at the quality of the venture capitalists backing the firm; in Fusion-io’s case, one of the prominent backers is a VC firm we have had great success with in the past. | ||||

Matt, thank you for the great insights.

Semi-Annual Report (Unaudited) | June 30, 2011 | 9 |

| Schedule of Investments | Liberty All-Star® Growth Fund | |

| June 30, 2011 (Unaudited) |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (98.02%) | ||||||||

CONSUMER DISCRETIONARY (12.63%) | ||||||||

Automobiles (0.47%) | ||||||||

Thor Industries, Inc. | 23,408 | $675,087 | ||||||

|

| |||||||

Distributors (1.26%) | ||||||||

LKQ Corp.(a) | 69,676 | 1,817,847 | ||||||

|

| |||||||

Diversified Consumer Services (1.40%) | ||||||||

Capella Education Co.(a) | 16,845 | 704,964 | ||||||

Global Education & Technology Group Ltd.(a)(b) | 46,213 | 249,550 | ||||||

Strayer Education, Inc. | 6,900 | 872,091 | ||||||

Xueda Education Group(a)(b) | 24,423 | 195,384 | ||||||

|

| |||||||

| 2,021,989 | ||||||||

|

| |||||||

Hotels, Restaurants & Leisure (1.21%) | ||||||||

BJ’s Restaurants, Inc.(a) | 14,705 | 769,954 | ||||||

Ctrip.com International Ltd.(a)(b) | 22,866 | 985,067 | ||||||

|

| |||||||

| 1,755,021 | ||||||||

|

| |||||||

Household Durables (0.61%) | ||||||||

Harman International Industries, Inc. | 19,304 | 879,683 | ||||||

|

| |||||||

Internet & Catalog Retail (2.26%) | ||||||||

Amazon.com, Inc.(a) | 8,240 | 1,684,998 | ||||||

Expedia, Inc. | 8,500 | 246,415 | ||||||

HomeAway, Inc.(a) | 300 | 11,610 | ||||||

priceline.com, Inc.(a) | 2,600 | 1,331,018 | ||||||

|

| |||||||

| 3,274,041 | ||||||||

|

| |||||||

Specialty Retail (3.27%) | ||||||||

CarMax, Inc.(a) | 28,500 | 942,495 | ||||||

Monro Muffler Brake, Inc. | 12,479 | 465,342 | ||||||

Rue21, Inc.(a) | 64,347 | 2,091,277 | ||||||

Ulta Salon, Cosmetics & Fragrance, Inc.(a) | 10,750 | 694,235 | ||||||

Urban Outfitters, Inc.(a) | 18,900 | 532,035 | ||||||

|

| |||||||

| 4,725,384 | ||||||||

|

| |||||||

Textiles, Apparel & Luxury Goods (2.15%) | ||||||||

Fossil, Inc.(a) | 10,400 | 1,224,288 | ||||||

Gildan Activewear, Inc. | 22,900 | 805,393 | ||||||

Under Armour, Inc., Class A(a) | 14,033 | 1,084,891 | ||||||

|

| |||||||

| 3,114,572 | ||||||||

|

| |||||||

CONSUMER STAPLES (3.31%) | ||||||||

Food & Staples Retailing (0.70%) | ||||||||

Costco Wholesale Corp. | 12,500 | 1,015,500 | ||||||

|

| |||||||

Food Products (2.61%) | ||||||||

Green Mountain Coffee Roasters, Inc.(a) | 27,600 | 2,463,576 | ||||||

See Notes to Schedule of Investments and Financial Statements. | ||

10 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Schedule of Investments |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (continued) | ||||||||

Food Products (continued) | ||||||||

Mead Johnson Nutrition Co. | 19,400 | $1,310,470 | ||||||

|

| |||||||

| 3,774,046 | ||||||||

|

| |||||||

ENERGY (9.29%) | ||||||||

Energy Equipment & Services (7.38%) | ||||||||

CARBO Ceramics, Inc. | 5,900 | 961,405 | ||||||

Core Laboratories N.V. | 22,711 | 2,533,185 | ||||||

Dril-Quip, Inc.(a) | 12,049 | 817,284 | ||||||

FMC Technologies, Inc.(a) | 54,300 | 2,432,097 | ||||||

Oceaneering International, Inc. | 53,000 | 2,146,500 | ||||||

Schlumberger Ltd. | 20,595 | 1,779,408 | ||||||

|

| |||||||

| 10,669,879 | ||||||||

|

| |||||||

Oil, Gas & Consumable Fuels (1.91%) | ||||||||

Brigham Exploration Co.(a) | 14,300 | 427,999 | ||||||

Occidental Petroleum Corp. | 15,800 | 1,643,832 | ||||||

Ultra Petroleum Corp.(a) | 15,300 | 700,740 | ||||||

|

| |||||||

| 2,772,571 | ||||||||

|

| |||||||

FINANCIALS (10.13%) | ||||||||

Capital Markets (3.23%) | ||||||||

Affiliated Managers Group, Inc.(a) | 12,883 | 1,306,980 | ||||||

The Charles Schwab Corp. | 57,000 | 937,650 | ||||||

Duff & Phelps Corp., Class A | 25,643 | 329,000 | ||||||

FXCM, Inc., Class A | 24,773 | 245,748 | ||||||

SEI Investments Co. | 39,200 | 882,392 | ||||||

T. Rowe Price Group, Inc. | 16,000 | 965,440 | ||||||

|

| |||||||

| 4,667,210 | ||||||||

|

| |||||||

Commercial Banks (1.25%) | ||||||||

Signature Bank(a) | 31,600 | 1,807,520 | ||||||

|

| |||||||

Consumer Finance (0.48%) | ||||||||

Green Dot Corp., Class A(a) | 20,700 | 703,386 | ||||||

|

| |||||||

Diversified Financial Services (2.23%) | ||||||||

MSCI, Inc., Class A(a) | 46,189 | 1,740,402 | ||||||

Portfolio Recovery Associates, Inc.(a) | 17,476 | 1,481,790 | ||||||

|

| |||||||

| 3,222,192 | ||||||||

|

| |||||||

Insurance (2.05%) | ||||||||

ACE Ltd. | 33,300 | 2,191,806 | ||||||

Greenlight Capital Re Ltd., Class A(a) | 29,248 | 768,930 | ||||||

|

| |||||||

| 2,960,736 | ||||||||

|

| |||||||

Real Estate Management & Development (0.89%) | ||||||||

FirstService Corp.(a) | 37,387 | 1,291,347 | ||||||

|

| |||||||

See Notes to Schedule of Investments and Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 11 |

Schedule of Investments | Liberty All-Star® Growth Fund | |

| June 30, 2011 (Unaudited) |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (continued) | ||||||||

HEALTH CARE (15.50%) | ||||||||

Biotechnology (3.51%) | ||||||||

BioMarin Pharmaceutical, Inc.(a) | 58,218 | $1,584,112 | ||||||

Dendreon Corp.(a) | 24,500 | 966,280 | ||||||

Human Genome Sciences, Inc.(a) | 39,588 | 971,489 | ||||||

Ironwood Pharmaceuticals, Inc.(a) | 19,500 | 306,540 | ||||||

Pharmasset, Inc.(a) | 2,100 | 235,620 | ||||||

Vertex Pharmaceuticals, Inc.(a) | 19,500 | 1,013,805 | ||||||

|

| |||||||

| 5,077,846 | ||||||||

|

| |||||||

Health Care Equipment & Supplies (4.50%) | ||||||||

Accuray, Inc.(a) | 40,464 | 324,117 | ||||||

Intuitive Surgical, Inc.(a) | 6,800 | 2,530,348 | ||||||

Masimo Corp. | 27,973 | 830,239 | ||||||

ResMed, Inc.(a) | 12,699 | 393,034 | ||||||

Varian Medical Systems, Inc.(a) | 22,600 | 1,582,452 | ||||||

Volcano Corp.(a) | 26,200 | 845,998 | ||||||

|

| |||||||

| 6,506,188 | ||||||||

|

| |||||||

Health Care Providers & Services (2.19%) | ||||||||

IPC The Hospitalist Co., Inc.(a) | 16,559 | 767,510 | ||||||

Lincare Holdings, Inc. | 24,990 | 731,457 | ||||||

PSS World Medical, Inc.(a) | 33,687 | 943,573 | ||||||

VCA Antech, Inc.(a) | 34,193 | 724,892 | ||||||

|

| |||||||

| 3,167,432 | ||||||||

|

| |||||||

Health Care Technology (1.86%) | ||||||||

athenahealth, Inc.(a) | 22,183 | 911,721 | ||||||

Cerner Corp.(a) | 29,100 | 1,778,301 | ||||||

|

| |||||||

| 2,690,022 | ||||||||

|

| |||||||

Life Sciences Tools & Services (1.04%) | ||||||||

Life Technologies Corp.(a) | 29,000 | 1,510,030 | ||||||

|

| |||||||

Pharmaceuticals (2.40%) | ||||||||

Allergan, Inc. | 18,600 | 1,548,450 | ||||||

Mylan, Inc.(a) | 38,200 | 942,394 | ||||||

Teva Pharmaceutical Industries Ltd.(b) | 20,210 | 974,526 | ||||||

|

| |||||||

| 3,465,370 | ||||||||

|

| |||||||

INDUSTRIALS (16.23%) | ||||||||

Aerospace & Defense (2.91%) | ||||||||

Aerovironment, Inc.(a) | 26,655 | 942,254 | ||||||

HEICO Corp. | 17,664 | 966,927 | ||||||

Precision Castparts Corp. | 8,100 | 1,333,665 | ||||||

TransDigm Group, Inc.(a) | 10,593 | 965,976 | ||||||

|

| |||||||

| 4,208,822 | ||||||||

|

| |||||||

See Notes to Schedule of Investments and Financial Statements. | ||

12 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Schedule of Investments |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (continued) | ||||||||

Air Freight & Logistics (3.72%) | ||||||||

C.H. Robinson Worldwide, Inc. | 40,850 | $3,220,614 | ||||||

Expeditors International of Washington, Inc. | 42,100 | 2,155,099 | ||||||

|

| |||||||

| 5,375,713 | ||||||||

|

| |||||||

Commercial Services & Supplies (1.64%) | ||||||||

American Reprographics Co.(a) | 45,920 | 324,654 | ||||||

Stericycle, Inc.(a) | 10,457 | 931,928 | ||||||

Waste Connections, Inc. | 35,080 | 1,113,089 | ||||||

|

| |||||||

| 2,369,671 | ||||||||

|

| |||||||

Electrical Equipment (1.98%) | ||||||||

II-VI, Inc.(a) | 29,672 | 759,603 | ||||||

Rockwell Automation, Inc. | 24,200 | 2,099,592 | ||||||

|

| |||||||

| 2,859,195 | ||||||||

|

| |||||||

Machinery (0.68%) | ||||||||

Graco, Inc. | 19,590 | 992,429 | ||||||

|

| |||||||

Professional Services (4.43%) | ||||||||

Huron Consulting Group, Inc.(a) | 27,950 | 844,370 | ||||||

ICF International, Inc.(a) | 15,501 | 393,415 | ||||||

IHS, Inc., Class A(a) | 28,819 | 2,404,081 | ||||||

Resources Connection, Inc. | 98,098 | 1,181,100 | ||||||

Robert Half International, Inc. | 34,900 | 943,347 | ||||||

Stantec, Inc.(a) | 22,172 | 643,653 | ||||||

|

| |||||||

| 6,409,966 | ||||||||

|

| |||||||

Road & Rail (0.87%) | ||||||||

Knight Transportation, Inc. | 23,321 | 396,224 | ||||||

Landstar System, Inc. | 18,523 | 860,949 | ||||||

|

| |||||||

| 1,257,173 | ||||||||

|

| |||||||

INFORMATION TECHNOLOGY (26.42%) | ||||||||

Communications Equipment (4.13%) | ||||||||

Aruba Networks, Inc.(a) | 37,700 | 1,114,035 | ||||||

F5 Networks, Inc.(a) | 9,200 | 1,014,300 | ||||||

InterDigital, Inc. | 8,751 | 357,478 | ||||||

Polycom, Inc.(a) | 13,253 | 852,168 | ||||||

QUALCOMM, Inc. | 46,365 | 2,633,069 | ||||||

|

| |||||||

| 5,971,050 | ||||||||

|

| |||||||

Computers & Peripherals (2.14%) | ||||||||

Apple, Inc.(a) | 8,460 | 2,839,768 | ||||||

Fusion-io, Inc.(a) | 8,313 | 250,138 | ||||||

|

| |||||||

| 3,089,906 | ||||||||

|

| |||||||

Electronic Equipment & Instruments (1.68%) | ||||||||

FARO Technologies, Inc.(a) | 20,331 | 890,498 | ||||||

FLIR Systems, Inc. | 18,439 | 621,579 | ||||||

See Notes to Schedule of Investments and Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 13 |

Schedule of Investments | Liberty All-Star® Growth Fund | |

| June 30, 2011 (Unaudited) |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (continued) | ||||||||

Electronic Equipment & Instruments (continued) | ||||||||

National Instruments Corp. | 22,853 | $678,505 | ||||||

Universal Display Corp.(a) | 6,800 | 238,612 | ||||||

|

| |||||||

| 2,429,194 | ||||||||

|

| |||||||

Internet Software & Services (5.05%) | ||||||||

Baidu, Inc.(a)(b) | 16,800 | 2,354,184 | ||||||

comScore, Inc.(a) | 12,048 | 312,043 | ||||||

Google, Inc., Class A(a) | 3,875 | 1,962,223 | ||||||

LinkedIn Corp., Class A(a) | 200 | 18,018 | ||||||

Monster Worldwide, Inc.(a) | 53,749 | 787,960 | ||||||

Qihoo 360 Technology Co. Ltd.(a)(b) | 1,100 | 21,351 | ||||||

VistaPrint Ltd.(a) | 15,480 | 740,718 | ||||||

Youku.com, Inc.(a)(b) | 32,464 | 1,115,138 | ||||||

|

| |||||||

| 7,311,635 | ||||||||

|

| |||||||

IT Services (3.13%) | ||||||||

Cognizant Technology Solutions Corp., Class A(a) | 20,100 | 1,474,134 | ||||||

FleetCor Technologies, Inc.(a) | 9,336 | 276,719 | ||||||

VeriFone Systems, Inc.(a) | 40,002 | 1,774,089 | ||||||

Visa, Inc., Class A | 11,915 | 1,003,958 | ||||||

|

| |||||||

| 4,528,900 | ||||||||

|

| |||||||

Semiconductors & Semiconductor Equipment (2.86%) | ||||||||

ARM Holdings PLC(b) | 80,700 | 2,294,301 | ||||||

Cavium, Inc.(a) | 21,188 | 923,585 | ||||||

Hittite Microwave Corp.(a) | 14,793 | 915,834 | ||||||

|

| |||||||

| 4,133,720 | ||||||||

|

| |||||||

Software (7.43%) | ||||||||

ANSYS, Inc.(a) | 15,648 | 855,476 | ||||||

Concur Technologies, Inc.(a) | 13,994 | 700,680 | ||||||

QLIK Technologies, Inc.(a) | 37,377 | 1,273,061 | ||||||

RealPage, Inc.(a) | 25,871 | 684,805 | ||||||

Salesforce.com, Inc.(a) | 22,000 | 3,277,560 | ||||||

Solera Holdings, Inc. | 24,440 | 1,445,870 | ||||||

SuccessFactors, Inc.(a) | 23,900 | 702,660 | ||||||

Ultimate Software Group, Inc.(a) | 6,353 | 345,794 | ||||||

VMware, Inc., Class A(a) | 14,660 | 1,469,372 | ||||||

|

| |||||||

| 10,755,278 | ||||||||

|

| |||||||

MATERIALS (2.45%) | ||||||||

Chemicals (1.71%) | ||||||||

CF Industries Holdings, Inc. | 6,100 | 864,187 | ||||||

Praxair, Inc. | 14,800 | 1,604,172 | ||||||

|

| |||||||

| 2,468,359 | ||||||||

|

| |||||||

Metals & Mining (0.74%) | ||||||||

Allegheny Technologies, Inc. | 7,600 | 482,372 | ||||||

See Notes to Schedule of Investments and Financial Statements. | ||

14 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Schedule of Investments |

| SHARES | MARKET VALUE | |||||||

COMMON STOCKS (continued) | ||||||||

Metals & Mining (continued) | ||||||||

Silver Wheaton Corp. | 17,900 | $590,700 | ||||||

|

| |||||||

| 1,073,072 | ||||||||

|

| |||||||

TELECOMMUNICATION SERVICES (1.35%) | ||||||||

Wireless Telecommunication Services (1.35%) | ||||||||

American Tower Corp., Class A(a) | 37,300 | 1,950,790 | ||||||

|

| |||||||

UTILITIES (0.71%) | ||||||||

Electric Utilities (0.71%) | ||||||||

ITC Holdings Corp. | 14,389 | 1,032,698 | ||||||

|

| |||||||

TOTAL COMMON STOCKS | 141,782,470 | |||||||

|

| |||||||

| PAR VALUE | ||||||||

SHORT TERM INVESTMENT (2.02%) | ||||||||

REPURCHASE AGREEMENT (2.02%) | ||||||||

Repurchase agreement with State Street Bank & Trust Co., dated 06/30/11, due 07/01/11 at 0.01%, collateralized by several Fannie Mae and Freddie Mac instruments with various maturity dates, market value of $2,981,016 (Repurchase proceeds of $2,918,001) | $2,918,000 | 2,918,000 | ||||||

|

| |||||||

TOTAL SHORT TERM INVESTMENT | 2,918,000 | |||||||

|

| |||||||

TOTAL INVESTMENTS (100.04%) | 144,700,470 | |||||||

LIABILITIES IN EXCESS OF OTHER ASSETS (-0.04%) |

| (62,706) | ||||||

|

| |||||||

NET ASSETS (100.00%) | $144,637,764 | |||||||

|

| |||||||

NET ASSET VALUE PER SHARE | $4.81 | |||||||

|

| |||||||

See Notes to Schedule of Investments and Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 15 |

Schedule of Investments | Liberty All-Star® Growth Fund | |

| June 30, 2011 (Unaudited) |

Notes to Schedule of Investments:

| (a) | Non-income producing security. |

| (b) | American Depositary Receipt. |

| (c) | Cost of investments for federal income tax purposes is $111,293,081. |

Gross unrealized appreciation and depreciation at June 30, 2011 based on cost of investments for federal income tax purposes is as follows:

Gross unrealized appreciation | $ | 38,211,545 | ||

Gross unrealized depreciation | (4,804,156 | ) | ||

Net unrealized appreciation | $ | 33,407,389 | ||

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by Fund management. This definition may not apply for purposes of this report, which may combine industry sub-classifications for reporting ease. Industries are shown as a percent of net assets. These industry classifications are unaudited.

See Notes to Financial Statements. | ||

16 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Statement of Assests and Liabilities |

ASSETS: | ||||

Investments at market value (Cost $110,877,194) | $144,700,470 | |||

Cash | 854 | |||

Receivable for investment securities sold | 430,567 | |||

Dividends and interest receivable | 46,028 | |||

Prepaid and other assets | 18,381 | |||

| ||||

Total Assets | 145,196,300 | |||

| ||||

LIABILITIES: | ||||

Payable for investments purchased | 369,066 | |||

Investment advisory fee payable | 91,663 | |||

Payable for administration, pricing and bookkeeping fees | 28,689 | |||

Accrued expenses | 69,118 | |||

| ||||

Total Liabilities | 558,536 | |||

| ||||

Net Assets | $144,637,764 | |||

| ||||

NET ASSETS REPRESENTED BY: | ||||

Paid-in capital | $113,600,217 | |||

Overdistributed net investment income | (5,094,192) | |||

Accumulated net realized gain on investments | 2,308,463 | |||

Net unrealized appreciation on investments | 33,823,276 | |||

| ||||

Net Assets | $144,637,764 | |||

| ||||

Shares of common stock outstanding (authorized 60,000,000 shares at $0.10 Par) | 30,080,350 | |||

| ||||

Net Asset Value Per Share | $4.81 | |||

| ||||

See Notes to Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 17 |

Statement of Operations | Liberty All-Star® Growth Fund |

For the Six Months Ended June 30, 2011 (Unaudited)

INVESTMENT INCOME: | ||||

Dividends (Net of foreign taxes withheld at source which amounted to $4,006) | $326,017 | |||

Interest | 170 | |||

| ||||

Total Investment Income | 326,187 | |||

| ||||

EXPENSES: | ||||

Investment advisory fee | 566,612 | |||

Administration fee | 141,653 | |||

Pricing and bookkeeping fees | 34,831 | |||

Audit fee | 13,996 | |||

Custodian fee | 24,910 | |||

Directors’ fees and expenses | 36,925 | |||

Insurance expense | 4,064 | |||

Legal fees | 245,354 | |||

NYSE fee | 14,088 | |||

Shareholder communication expenses | 33,353 | |||

Transfer agent fees | 27,377 | |||

Miscellaneous expenses | 3,759 | |||

| ||||

Total Expenses | 1,146,922 | |||

| ||||

Net Investment Loss | (820,735) | |||

| ||||

REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | ||||

Net realized gain on investment transactions | 4,716,433 | |||

Net unrealized appreciation on investments: | ||||

Beginning of year | 26,342,708 | |||

End of period | 33,823,276 | |||

| ||||

Net change in unrealized appreciation | 7,480,568 | |||

| ||||

Net Realized and Unrealized Gain on Investments | 12,197,001 | |||

| ||||

Net Increase in Net Assets from Operations | $11,376,266 | |||

| ||||

See Notes to Financial Statements. | ||

18 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Statements of Changes in Net Assets |

For the Six Months Ended June 30, 2011 (Unaudited) | For the Year Ended December 31, 2010 | |||||||

FROM OPERATIONS: | ||||||||

Net investment loss | $(820,735) | $(1,175,567) | ||||||

Net realized gain on investment transactions | 4,716,433 | 5,137,175 | ||||||

Net change in unrealized appreciation | 7,480,568 | 20,620,701 | ||||||

Net Increase in Net Assets From Operations | 11,376,266 | 24,582,309 | ||||||

DISTRIBUTIONS TO SHAREHOLDERS: | ||||||||

From net investment income | (4,211,249) | (5,615,921) | ||||||

Tax return of capital | – | (1,904,168) | ||||||

Total Distributions | (4,211,249) | (7,520,089) | ||||||

Net Increase in Net Assets | 7,165,017 | 17,062,220 | ||||||

NET ASSETS: | ||||||||

Beginning of period | 137,472,747 | 120,410,527 | ||||||

End of period (Includes overdistributed net investment income of | $144,637,764 | $137,472,747 | ||||||

See Notes to Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 19 |

Financial Highlights | Liberty All-Star® Growth Fund |

For the Six Months Ended June 30, 2011 (Unaudited) | ||||

Per Share Operating Performance: | ||||

Net asset value at beginning of period | $4.57 | |||

Income from investment operations: | ||||

Net investment loss(a) | (0.03) | |||

Net realized and unrealized gain/(loss) on investments | 0.41 | |||

Total from Investment Operations | 0.38 | |||

Less Distributions to Shareholders: | ||||

Net investment income | (0.14) | |||

Net realized gain on investments | – | |||

Tax return of capital | – | |||

Total Distributions | (0.14) | |||

Net asset value at end of period | $4.81 | |||

Market price at end of period | $4.44 | |||

Total Investment Return For Shareholders:(b) | ||||

Based on net asset value | 8.7% | (c) | ||

Based on market price | 7.9% | (c) | ||

Ratios and Supplemental Data: | ||||

Net assets at end of period (millions) | $145 | |||

Ratio of expenses to average net assets | 1.62% | (d) | ||

Ratio of net investment loss to average net assets | (1.16%) | (d) | ||

Portfolio turnover rate | 15% | (c) | ||

| (a) | Calculated using average shares outstanding during the period. |

| (b) | Calculated assuming all distributions are reinvested at actual reinvestment prices. The net asset value and market price returns will differ depending upon the level of any discount from or premium to net asset value at which the Fund’s shares traded during the period. Past performance is not a guarantee of future results. |

| (c) | Not annualized. |

| (d) | Annualized. |

| (e) | The benefits derived from custody credits and directed brokerage arrangements, if any had an impact of less than 0.01%. |

| See Notes to Financial Statements. | ||

20 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Financial Highlights |

For the Year Ended | For the Year Ended December 31, 2009 | For the Year Ended | For the Year Ended | For the Year Ended December 31, 2006 | ||||||||||||||

| $4.00 | $3.24 | $6.03 | $5.69 | $5.97 | ||||||||||||||

| (0.04) | (0.02) | (0.03) | (0.03) | (0.04) | ||||||||||||||

| 0.86 | 1.02 | (2.29) | 0.98 | 0.35 | ||||||||||||||

| 0.82 | 1.00 | (2.32) | 0.95 | 0.31 | ||||||||||||||

| (0.19) | – | – | – | – | ||||||||||||||

| – | – | (0.02) | (0.61) | (0.47) | ||||||||||||||

| (0.06) | (0.24) | (0.45) | – | (0.12) | ||||||||||||||

| (0.25) | (0.24) | (0.47) | (0.61) | (0.59) | ||||||||||||||

| $4.57 | $4.00 | $3.24 | $6.03 | $5.69 | ||||||||||||||

| $4.25 | $3.36 | $2.60 | $5.96 | $5.37 | ||||||||||||||

| 21.8% | 34.6% | (40.0%) | 17.9% | 6.4% | ||||||||||||||

| 34.8% | 40.8% | (51.3%) | 23.5% | 10.2% | ||||||||||||||

| $137 | $120 | $96 | $172 | $157 | ||||||||||||||

| 1.79% | 1.44% | 1.46% | 1.28% | (e) | 1.40% | (e) | ||||||||||||

| (0.95%) | (0.58%) | (0.74%) | (0.51%) | (e) | (0.73%) | (e) | ||||||||||||

| 80% | 135% | 97% | 60% | 52% | ||||||||||||||

See Notes to Financial Statements. | ||

Semi-Annual Report (Unaudited) | June 30, 2011 | 21 |

| Notes to Financial Statements | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

NOTE 1. ORGANIZATION

Liberty All-Star® Growth Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment Company Act of 1940 (the “Act”), as amended, as a diversified, closed-end management investment company.

Investment Goal

The Fund seeks long-term capital appreciation.

Fund Shares

The Fund may issue 60,000,000 shares of common stock at $0.10 par.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates. The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements.

Security Valuation

Equity securities including common stocks and exchange traded funds are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the National Association of Securities Dealers Automated Quotations (“NASDAQ”) exchange, which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the-counter markets.

Short-term debt obligations maturing in more than 60 days for which market quotations are readily available are valued at current market value. Short-term debt obligations maturing within 60 days are valued at amortized cost, which approximates market value.

Investments for which market quotations are not readily available are valued at fair value as determined in good faith under consistently applied procedures approved by and under the general supervision of the Fund’s Board of Directors.

Foreign Securities

The Fund invests in foreign securities including American Depositary Receipts, which may involve a number of risk factors and special considerations not present with investments in securities of U.S. corporations.

Security Transactions

Security transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Repurchase Agreements

The Fund may engage in repurchase agreement transactions with institutions that the Fund’s investment advisor has determined are creditworthy. The Fund, through its custodian, receives

22 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

delivery of underlying securities collateralizing a repurchase agreement. Collateral is at least equal, at all times, to the value of the repurchase obligation including interest. A repurchase agreement transaction involves certain risks in the event of default or insolvency of the counterparty. These risks include possible delays or restrictions upon a Fund’s ability to dispose of the underlying securities and a possible decline in the value of the underlying securities during the period while the Fund seeks to assert its rights.

Income Recognition

Interest income is recorded on the accrual basis. Corporate actions and dividend income are recorded on the ex-date.

Fair Value Measurements

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments. These inputs are categorized in the following hierarchy under applicable financial accounting standards:

Level 1 – | Unadjusted quoted prices in active markets for identical investments | |

Level 2 – | Other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) | |

Level 3 – | Significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) |

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2011:

| Valuation Inputs | ||||||||||||||||

Investments in Securities at Value* | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks | $ | 141,782,470 | $ | – | $ | – | $ | 141,782,470 | ||||||||

Short Term Investment | – | 2,918,000 | – | 2,918,000 | ||||||||||||

Total | $ | 141,782,470 | $ | 2,918,000 | $ | – | $ | 144,700,470 | ||||||||

*See Schedule of Investments for industry classifications

For the six months ended June 30, 2011, the Fund did not have any significant transfers between Level 1 and Level 2 securities. The Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value.

Semi-Annual Report (Unaudited) | June 30, 2011 | 23 |

| Notes to Financial Statements | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

Distributions to Shareholders

The Fund currently has a policy of paying distributions on its common shares totaling approximately 6% of its net asset value per year. The distributions are payable in four quarterly distributions of 1.5% of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Distributions to shareholders are recorded on ex-date.

NOTE 3. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess.

For the year ended December 31, 2010, permanent book and tax basis differences resulting primarily from excess distributions were identified and reclassified among the components of the Fund’s net assets as follows:

Accumulated Net Investment Income | Accumulated Net Realized Gain | Paid-In Capital | ||

$6,729,280 | $41,416 | ($6,770,696) |

Net investment income and net realized gains/(losses), as disclosed on the Statement of Operations, and net assets were not affected by this reclassification.

Included in the amount reclassified was a net operating loss offset to Paid-In Capital of $1,154,775.

Classification of Distributions to Shareholders

Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Funds. The amount and characteristics of the tax basis distributions and composition of distributable earnings / (accumulated losses) are finalized at fiscal year end; accordingly, tax basis balances have not been determined as of June 30, 2011.

The tax character of distributions paid during the year ended December 31, 2010 was as follows:

| 12/31/10 | ||||||

Distributions paid from: | ||||||

Ordinary income | $ | 5,615,921 | ||||

Tax return of capital | 1,904,168 | |||||

Total | $ | 7,520,089 | ||||

24 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

The following capital loss carryforwards are available to reduce taxable income arising from future net realized gains on investments, if any to the extent permitted by the Internal Revenue Code:

Year of Expiration | Capital Loss Carryforward | |

2017 | $1,769,353 |

The Fund used capital loss carry forwards of $5,615,921 to offset taxable capital gains during the period ended December 31, 2010.

Future realized gains offset by the loss carryforwards are not required to be distributed to shareholders. However, under the Fund’s distribution policy, such gains may be distributed to shareholders in the year the gains are realized. Any such gains distributed may be taxable to shareholders as ordinary income.

As of December 31, 2010, the components of distributable earnings on a tax basis were as follows:

Accumulated Capital Losses | Net Unrealized Appreciation | Other Cumulative Effect of Timing Differences | ||

($2,080,911) | $ 25,953,441 | 0 |

The differences between book-basis and tax-basis are primarily due to deferral of losses from wash sales.

Under current tax regulations, capital losses on securities transactions realized after October 31 may be deferred and treated as occurring on the first day of the following fiscal year.

As of December 31, 2010, for federal income tax purposes, the Fund elected to defer post-October losses of $311,558 to December 31, 2011.

Federal Income Tax Status

For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

Management has concluded that the Fund has taken no uncertain tax positions that require recognition in the financial statements. The Fund files income tax returns in the U.S. federal jurisdiction and Colorado. For the years ended December 31, 2007, December 31, 2008, December 31, 2009, and December 31, 2010 the Fund’s returns are still open to examination by the appropriate taxing authorities.

Semi-Annual Report (Unaudited) | June 30, 2011 | 25 |

| Notes to Financial Statements | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

NOTE 4. FEES AND COMPENSATION PAID TO AFFILIATES

Investment Advisory Fee

ALPS Advisors, Inc. (“AAI”) serves as the investment advisor to the Fund. AAI receives a monthly investment advisory fee based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |

First $300 million | 0.80% | |

Over $300 million | 0.72% |

AAI retains multiple Portfolio Managers to manage the Fund’s investments in various asset classes. AAI pays each Portfolio Manager a portfolio management fee based on the assets of the investment portfolio that they manage. The portfolio management fee is paid from the investment advisory fees collected by AAI and is based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |

First $300 million | 0.40% | |

Over $300 million | 0.36% |

Administration, Bookkeeping and Pricing Services Agreement

ALPS Fund Services, Inc. (“ALPS”) provides administrative and other services to the Fund for a monthly administration fee based on the Fund’s average daily net assets at the following annual rates:

Average Daily Net Assets | Annual Fee Rate | |

First $300 million | 0.20% | |

Over $300 million | 0.18% |

In addition, ALPS provides bookkeeping and pricing services to the Fund for an annual fee consisting of: (i) $38,000 paid monthly plus 0.015% on the average daily net assets for the month; and (ii) a multi-manager fee based on the number of portfolio managers; provided that during any 12-month period, the aggregate amount of (i) shall not exceed $140,000 (exclusive of out-of-pocket expenses and charges). The Fund also reimburses ALPS for out-of-pocket expenses and charges, including fees payable to third parties for pricing the Fund’s portfolio securities and direct internal costs incurred by ALPS in connection with providing fund accounting oversight and monitoring and certain other services.

Fees Paid to Officers

All officers of the Fund, including the Fund’s Chief Compliance Officer, are employees of AAI or its affiliates, and receive no compensation from the Fund. The Board of Directors has appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations.

NOTE 5. PORTFOLIO INFORMATION

Purchases and Sales of Securities

For the six months ended June 30, 2011, the cost of purchases and proceeds from sales of securities, excluding short-term obligations, were $20,752,149 and $25,632,283 , respectively.

26 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

NOTE 6. INDEMNIFICATION

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also, under the Fund’s organizational documents and by contract, the Directors and Officers of the Fund are indemnified against certain liabilities that may arise out of their duties to the Fund. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

NOTE 7. RESULTS OF ANNUAL MEETING OF SHAREHOLDERS

On June 30, 2011, the Annual Meeting of Shareholders of the Fund was held to elect two Directors. On April 1, 2011, the record date for the meeting, the Fund had outstanding 30,080,350 shares of common stock. The votes cast at the meeting were as follows:

Proposal to elect two Directors:

| For | Withheld | |||

John A. Benning | 22,363,442 | 3,898,538 | ||

Richard C. Rantzow | 22,385,817 | 3,876,163 |

NOTE 8. OTHER MATTERS

Maryland Statutes

By resolution of the Board of Directors, the Fund has opted into the Maryland Control Share Acquisition Act and the Maryland Business Combination Act. In general, the Maryland Control Share Acquisition Act provides that “control shares” of a Maryland corporation acquired in a control share acquisition may not be voted except to the extent approved by shareholders at a meeting by a vote of two-thirds of the votes entitled to be cast on the matter (excluding shares owned by the acquiror and by officers or directors who are employees of the corporation). “Control shares” are voting shares of stock which, if aggregated with all other shares of stock owned by the acquiror or in respect of which the acquiror is able to exercise or direct the exercise of voting power (except solely by virtue of a revocable proxy), would entitle the acquiror to exercise voting power in electing directors within certain statutorily defined ranges (one-tenth but less than one-third, one-third but less than a majority, and more than a majority of the voting power). In general, the Maryland Business Combination Act prohibits an interested shareholder (a shareholder that holds 10% or more of the voting power of the outstanding stock of the corporation) of a Maryland corporation from engaging in a business combination (generally defined to include a merger, consolidation, share exchange, sale of a substantial amount of assets, a transfer of the corporation’s securities and similar transactions to or with the interested shareholder or an entity affiliated with the interested shareholder) with the corporation for a period of five years after the most recent date on which the interested shareholder became an interested shareholder. At the time of adoption, March 19, 2009, the Board and the Fund were not aware, and currently are not aware, of any shareholder that held control shares or that was an interested shareholder under the statutes.

Semi-Annual Report (Unaudited) | June 30, 2011 | 27 |

| Notes to Financial Statements | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

9. SUBSEQUENT EVENT

The Funds have evaluated the need for disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no adjustments were required to the financial statements as of June 30, 2011.

On July 19, 2011, ALPS Holdings, Inc. (“ALPS”) and its various subsidiaries (including, ALPS Advisors, Inc., ALPS Fund Services, Inc. and ALPS Distributors, Inc.), entered into a merger agreement (“Transaction Agreement”) providing for the acquisition of ALPS by DST Systems, Inc. (“DST”). If the transaction contemplated by the Transaction Agreement (the “Transaction”) is completed, ALPS will become a wholly owned subsidiary of DST, a publicly traded company. Completion of the Transaction is subject to a number of conditions, including without limitation obtaining regulatory approval and the consent to the Transaction by a certain percentage of ALPS’ clients representing a specified percentage of the annualized revenue of ALPS and its subsidiaries. ALPS and DST currently expect to complete the Transaction in the fourth quarter of 2011.

28 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Re-Approval of the Investment Advisory Contracts |

BOARD CONSIDERATION OF THE RENEWAL OF THE FUND MANAGEMENT AND PORTFOLIO MANAGEMENT AGREEMENTS

The Investment Company Act of 1940 requires that the Board of Directors (“Board”) of the Liberty All-Star Growth Fund, Inc. (“Fund”), including all of the Directors who are not “interested persons” of the Fund (“Independent Directors”), annually review the Fund’s investment advisory agreements and consider whether or not to renew them for an additional year. At its meeting on June 30, 2011, the Board, including a majority of the Independent Directors, conducted such a review and approved the continuation of the Fund Management Agreement between the Fund and ALPS Advisors, Inc. (“AAI”) and the two separate Portfolio Management Agreements, among the Fund, AAI and the following independent investment management firms (each, a “Portfolio Manager”): M.A. Weatherbie & Co., Inc. (“Weatherbie”) and TCW Investment Management Company (“TCW”).

Prior to the Board action, the Independent Directors met to consider management’s recommendations with respect to the renewal of the Fund Management Agreement and the Portfolio Management Agreements (each, an “Agreement” and, collectively, the “Agreements”). In reaching its decision to renew each Agreement, the Board considered the overall fairness of the Agreement and whether the Agreement was in the best interest of the Fund. The Board further considered factors it deemed relevant with respect to the Fund, including (1) the nature, quality and extent of services provided to the Fund by AAI, its affiliates and each Portfolio Manager; (2) the performance of the Fund and the Portfolio Managers; (3) the level of the Fund’s management and portfolio management fees and expense ratios; (4) the costs of the services provided and profits realized by AAI and its affiliates from their relationship with the Fund; (5) the extent to which economies of scale would be realized as the Fund grows and whether fee levels will reflect economies of scale for the benefit of shareholders; (6) the “fall-out” benefits to AAI, each Portfolio Manager and their respective affiliates (i.e., any direct or indirect benefits to be derived by AAI, each Portfolio Manager and their respective affiliates from their relationships with the Fund); and (7) other general information about AAI and each Portfolio Manager. In considering each Agreement, the Board did not identify any single factor or information as all-important or controlling and each Director may have attributed different weight to each factor.

The Board considered these factors in the context of the Fund’s multi-manager methodology, which seeks to achieve more consistent and less volatile performance over the long term than if a single Portfolio Manager was employed. The Fund allocates its portfolio assets among Portfolio Managers recommended by AAI and approved by the Board, currently two for the Fund. The Board noted that each Portfolio Manager employs a different investment style and/or strategy, and from time to time AAI rebalances the Fund’s portfolio assets among the Portfolio Managers. The Board also noted AAI continuously analyzes and evaluates each Portfolio Manager’s investment performance and portfolio composition and, from time to time, recommends changes in the Portfolio Managers.

In connection with its deliberations, the Board took into account information furnished throughout the year at regular and special Board meetings, as well as information prepared specifically in connection with the annual renewal and approval process. Information furnished and discussed throughout the year included AAI’s analysis of the Fund’s investment performance and related financial information for the Fund, presentations given by the Fund’s Portfolio Managers, as well as periodic reports on legal,

Semi-Annual Report (Unaudited) | June 30, 2011 | 29 |

Re-Approval of the Investment Advisory Contracts | Liberty All-Star® Growth Fund |

June 30, 2011 (Unaudited)

compliance, brokerage commissions and execution and other services provided by AAI, the Portfolio Managers and their affiliates. Information furnished specifically in connection with the renewal process included, among other things, a report of the Fund’s investment performance over various time periods as compared to a peer universe and a market index and the Fund’s fees and expenses as compared to comparable groups of closed-end funds and open-end multi-managed funds based, in part, on information from Lipper, Inc. (“Lipper”), an independent organization, as well as additional materials prepared by AAI. The information provided by AAI generally included information reflecting the Fund’s management fees, expense ratios, investment performance and profitability, including AAI’s profitability with respect to the Fund.

As part of the process to consider the Agreements, legal counsel to the Independent Directors requested information from AAI and each Portfolio Manager. In response to these requests, the Independent Directors received reports from AAI and each Portfolio Manager that addressed specific factors designed to inform the Board’s consideration of each Agreement. Counsel also provided the Independent Directors and the Board with a memorandum discussing the legal standards applicable to their consideration of the Agreements. Based on its evaluation of all material factors, the Board unanimously concluded that the terms of each Agreement were reasonable and fair and that the renewal of each Agreement was in the best interests of the Fund and its shareholders. The following is a summary of the Board’s discussion and conclusions regarding these matters.

Nature, Extent and Quality of the Services Provided

The Board considered the nature, extent and quality of the portfolio manager selection, evaluation and monitoring services provided by AAI, and the portfolio management services provided by each Portfolio Manager, in light of the investment objective of the Fund. In connection with its review, the Board considered its long association with AAI and AAI’s relationships with the Portfolio Managers and their personnel and the Board’s familiarity with their culture to evaluate the services to be provided. In particular, the Board considered the AAI team’s long-term history of care and conscientiousness in the management of the Fund and the oversight of the Portfolio Managers. The Board also considered the nature, extent and quality of the administrative services provided to the Fund by ALPS Fund Services, Inc., an affiliate of AAI. The Board noted the steps that AAI has taken to encourage strong performance, including AAI’s willingness to recommend Portfolio Manager changes when necessary to address performance issues.

The Board also considered each Portfolio Manager’s demonstrated consistency in investment approach. The Board considered that TCW manages the large-cap and mid-cap growth and Weatherbie manages the small-cap growth portions of the Fund’s portfolio. The Board reviewed the background and experience of the personnel at AAI responsible for Portfolio Manager selection, evaluation and monitoring for the Fund and at the Portfolio Manager responsible for managing the Fund’s portfolio. The Board also considered the overall financial strength of AAI, effect on the Fund of any turnover in personnel at each Portfolio Manager, the insurance maintained by each Portfolio Manager and the compliance records of AAI and each Portfolio Manager.

The Board determined that the quality of the services provided by the senior advisory personnel employed by AAI and by the Portfolio Managers had been consistent with or superior to quality norms in the industry, and that AAI and the respective Portfolio Managers would continue to have sufficient

30 | www.all-starfunds.com |

Liberty All-Star® Growth Fund | Re-Approval of the Investment Advisory Contracts |

personnel, with the appropriate experience, to serve the Fund effectively. The Board also determined that the AAI and Portfolio Managers personnel who provide services to the Fund had appropriate education and experience to serve the Fund effectively and had demonstrated their continuing ability to attract and retain well-qualified personnel. In addition, the Board noted that the structure of AAI’s operations was sufficient to retain and properly motivate the Fund’s current senior advisory personnel. The Board concluded that the nature, extent and quality of the services provided by AAI and the Portfolio Managers were appropriate and consistent with the terms of the Agreements and that the Fund was likely to continue to benefit from services provided under the Agreements.

Investment Performance

The Board reviewed the long-term and short-term investment performance of the Fund over multiple periods, which generally included annual total returns both on an absolute basis and relative to an appropriate benchmark and/or Lipper peer universe. The Board reviewed the Fund’s performance based on both net asset value and market price and, in general, considered long-term performance to be more important in its evaluation than short-term performance. In addition, the Board reviewed the performance of other investment companies and accounts managed by the Portfolio Managers and the performance of the allocated portions of the Fund in the context of the Portfolio Managers’ different investment strategies and styles and the contribution of each Portfolio Manager to the Fund’s overall strategy and performance.