UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04537

Liberty All-Star Growth Fund, Inc.

(exact name of registrant as specified in charter)

1290 Broadway, Suite 1100, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1100

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2016 – June 30, 2016

Item 1. Reports to Stockholders.

Contents

| 1 | President’s Letter |

| 4 | Table of Distributions and Rights Offerings |

| 5 | Top 20 Holdings and Economic Sectors |

| 6 | Major Stock Changes in the Quarter |

| 7 | Investment Managers/Portfolio Characteristics |

| 8 | Manager Interview |

| 11 | Schedule of Investments |

| 17 | Statement of Assets and Liabilities |

| 18 | Statement of Operations |

| 19 | Statements of Changes in Net Assets |

| 20 | Financial Highlights |

| 22 | Notes to Financial Statements |

| 31 | Board Consideration of the New Portfolio Management Agreement |

| 34 | Description of Lipper Benchmark and Market Indices |

| Inside Back Cover: Fund Information |

A SINGLE INVESTMENT...

A DIVERSIFIED GROWTH PORTFOLIO

A single fund that offers:

| • | A diversified, multi-managed portfolio of small, mid- and large cap growth stocks |

| • | Exposure to many of the industries that make the U.S. economy one of the world’s most dynamic |

| • | Access to institutional quality investment managers |

| • | Objective and ongoing manager evaluation |

| • | Active portfolio rebalancing |

| • | A quarterly fixed distribution policy |

| • | Actively managed, exchange-traded closed-end fund listed on the New York Stock Exchange (ticker symbol: ASG) |

LIBERTY ALL-STAR® GROWTH FUND, INC.

Liberty All-Star® Growth Fund | President’s Letter |

(Unaudited)

| Fellow Shareholders: | July 2016 |

Although equity markets were volatile and driven by differing factors as the first half of 2016 progressed, the second quarter closed much as the first quarter did—with modest gains. To start the year, U.S. equities posted their worst 10-day opening-year decline in history, only to rebound beginning in mid-February and ultimately close the quarter with a 1.35 percent gain for the S&P 500® Index. The second quarter was calm by comparison until a poor jobs report for May rattled investors, only to be followed by the “Brexit” referendum in which voters in the U.K. said they favored leaving the European Union. Once again, however, a rally over the last few trading days of the quarter—the strongest weekly gains of the year to date—propelled U.S. stocks to a 2.46 percent gain, as measured by the S&P 500. The widely-followed Dow Jones Industrial Average (DJIA) gained 2.07 percent in the second quarter while the NASDAQ Composite Index returned -0.23 percent. For the full first half, the S&P 500 returned 3.84 percent, the DJIA returned 4.31 percent and the NASDAQ Composite returned -2.66 percent.

Growth stocks lagged their value counterparts in the second quarter, as they did in the first. Among key growth benchmarks, the broad market Russell 3000® Growth Index returned 0.80 percent for the quarter. Among market capitalization indices, the Russell 1000® Growth Index (large cap) returned 0.61 percent while the Russell Midcap® Growth Index returned 1.56 percent. Small cap stocks, as represented by the Russell 2000® Growth Index, returned 3.24 percent; this represented a sharp reversal for small cap growth stocks, which returned -4.68 percent in the first quarter.

For much of the second quarter, stocks ebbed and flowed, alternately helped and hurt by the mix of business, economic and political news. Investors were concerned by reports in mid-May that the cost of living in April climbed by the most in three years and that the rate of housing starts was strong and rising. Both raised the specter of action by the Federal Reserve to raise short-term interest rates. Reports of a surge in consumer spending in April—the biggest jump in six years—buoyed stocks as June opened. Additional good news came in the form of a gain in wages and salaries. Just days later, however, news that the U.S. added only 38,000 jobs in May—well below the 160,000 expected—depressed markets. But the data did have a positive side, as it put any increase in interest rates on hold. As June progressed, all eyes turned to the 23rd of the month—the day of the Brexit ballot. Stocks rallied in advance of the referendum on the belief that voters would choose the “stay” alternative. When the vote went the other way for the world’s fifth-largest economy, stocks retreated around the world for the next two trading days, only to be followed by a strong relief rally into the end of the quarter. It also helped that on June 28 the Department of Commerce raised first quarter real GDP to 1.1 percent from its original estimate of 0.5 percent.

Liberty All-Star® Growth Fund

Liberty All-Star® Growth Fund outperformed all key benchmarks during the second quarter, returning 4.41 percent with shares valued at net asset value (NAV) with dividends reinvested and 3.18 percent with shares valued at market price with dividends reinvested. The Lipper Multi-Cap Growth Mutual Fund Average returned 0.68 percent. The discount at which Fund shares traded relative to their NAV narrowed over the quarter, ranging from -9.8 percent to -12.0 percent.

Challenged in the first quarter by highly volatile markets—the factor that made the period difficult for active managers—for the full first half the Fund returned -2.88 percent with shares valued at NAV with dividends reinvested and -6.93 percent with shares valued at market price with dividends reinvested. The Lipper Multi-Cap Growth Mutual Fund Average returned -2.23 percent for the period.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 1 |

Liberty All-Star® Growth Fund | President’s Letter |

(Unaudited)

In keeping with policy, the Fund’s distribution for the second quarter was $0.09, up from $0.08 in the first quarter. The Fund's distribution policy has been in place since 1997 and is a major component of the Fund's total return. Since 1997, the Fund has paid distributions totaling $12.82 per share and we continue to emphasize that shareholders should include these distributions when determining the return on their investment in the Fund.

Turning to Fund news, in early June Congress Asset Management Company replaced TCW Investment Management Company as the Fund’s mid-cap growth manager. We invite shareholders to read the interview with Todd Solomon, CFA, Senior Vice President/Portfolio Manager for the firm’s mid-cap growth strategy, which may be found on page 8 in this report.

We are gratified by the Fund’s performance in the second quarter, especially after a challenging first quarter. We are confident in the Fund’s investment managers and the Fund’s underlying objectives and strategy, and, as always, appreciate and value your confidence in Liberty All-Star® Growth Fund.

| Sincerely, | |

| |

| |

| William R. Parmentier, Jr. | |

| President and Chief Executive Officer | |

Liberty All-Star® Growth Fund, Inc. | |

The views expressed in the President’s letter and the Manager Interview reflect the views of the President and Manager as of July 2016 and may not reflect their views on the date this report is first published or anytime thereafter. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the Fund disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as an indication of trading intent.

Liberty All-Star® Growth Fund | President’s Letter |

(Unaudited)

| Fund Statistics (Periods ended June 30, 2016) | |

| Net Asset Value (NAV) | $4.65 |

| Market Price | $4.09 |

| Discount | -12.0% |

| | Quarter | Year-to-Date |

| Distributions* | $0.09 | $0.17 |

| Market Price Trading Range | $3.90 to $4.26 | $3.45 to $4.54 |

| Premium/(Discount) Range | -9.8% to -12.0% | -7.8% to -12.7% |

| Performance (Periods ended June 30, 2016) | | |

| Shares Valued at NAV with Dividends Reinvested | 4.41% | -2.88% |

| Shares Valued at Market Price with Dividends Reinvested | 3.18% | -6.93% |

| Dow Jones Industrial Average | 2.07% | 4.31% |

| Lipper Multi-Cap Growth Mutual Fund Average | 0.68% | -2.23% |

| NASDAQ Composite Index | -0.23% | -2.66% |

| Russell Growth Benchmark | 1.68% | 0.54% |

S&P 500® Index | 2.46% | 3.84% |

| * | Sources of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Pursuant to Section 852 of the Internal Revenue Code, the taxability of these distributions will be reported on Form 1099-DIV for 2016. |

Performance returns for the Fund are total returns, which include dividends. Returns are net of management fees and other Fund expenses.

The returns shown for the Lipper Multi-Cap Growth Mutual Fund Average are based on open-end mutual funds’ total returns, which include dividends, and are net of fund expenses. Returns for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index, the Russell Growth Benchmark and the S&P 500®Index are total returns, including dividends. A description of the Lipper benchmark and the market indices can be found on page 34.

Past performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal.

Closed-end funds raise money in an initial public offering and shares are listed and traded on an exchange. Open-end mutual funds continuously issue and redeem shares at net asset value. Shares of closed-end funds frequently trade at a discount to net asset value. The price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore, the Fund cannot predict whether its shares will trade at, below or above net asset value.

Secondary market support provided to the Fund by ALPS Fund Services, Inc.’s affiliate ALPS Portfolio Solutions Distributor, Inc., a FINRA member.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 3 |

Liberty All-Star® Growth Fund | Table of Distributions & Rights Offerings |

(Unaudited)

| | | Rights Offerings |

| Year | Per Share Distributions | Month Completed | Shares Needed to Purchase One Additional Share | Subscription Price |

| 1997 | $1.24 | | | |

| 1998 | 1.35 | July | 10 | $12.41 |

| 1999 | 1.23 | | | |

| 2000 | 1.34 | | | |

| 2001 | 0.92 | September | 8 | 6.64 |

| 2002 | 0.67 | | | |

| 2003 | 0.58 | September | 81 | 5.72 |

| 2004 | 0.63 | | | |

| 2005 | 0.58 | | | |

| 2006 | 0.59 | | | |

| 2007 | 0.61 | | | |

| 2008 | 0.47 | | | |

20092 | 0.24 | | | |

| 2010 | 0.25 | | | |

| 2011 | 0.27 | | | |

| 2012 | 0.27 | | | |

| 2013 | 0.31 | | | |

| 2014 | 0.33 | | | |

20153 | 0.77 | | | |

| 2016 | | | | |

1st Quarter | 0.08 | | | |

2nd Quarter | 0.09 | | | |

| Total | $12.82 | | | |

| 1 | The number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription requests. |

| 2 | Effective with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

| 3 | Effective with the second quarter distribution, the annual distribution rate was changed from 6 percent to 8 percent. |

DISTRIBUTION POLICY

The current policy is to pay distributions on its shares totaling approximately 8 percent of its net asset value per year, payable in four quarterly installments of 2 percent of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Sources of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The actual amounts and sources of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations. If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s distributions) contained in shareholders’ 1099-DIV forms after the end of the year. If the Fund’s ordinary dividends and long-term capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute capital gains and pay income tax thereon to the extent of such excess.

Liberty All-Star® Growth Fund | Top 20 Holdings & Economic Sectors |

June 30, 2016 (Unaudited)

| Top 20 Holdings* | Percent of Net Assets |

| Signature Bank | 2.23% |

| Middleby Corp. | 1.93 |

| Wayfair, Inc., Class A | 1.77 |

| Core Laboratories NV | 1.69 |

| IPG Photonics Corp. | 1.58 |

| FirstService Corp. | 1.48 |

| Mondelez International, Inc., Class A | 1.47 |

| Visa, Inc., Class A | 1.45 |

| Cerner Corp. | 1.44 |

| Ecolab, Inc. | 1.43 |

| Lowe's Cos., Inc. | 1.41 |

| The Ultimate Software Group, Inc. | 1.38 |

| Red Hat, Inc. | 1.38 |

| The Priceline Group, Inc. | 1.33 |

| Apple, Inc. | 1.32 |

| Paylocity Holding Corp. | 1.31 |

| Equinix, Inc. | 1.27 |

| Colgate-Palmolive Co. | 1.24 |

| Automatic Data Processing, Inc. | 1.23 |

| NIKE, Inc., Class B | 1.22 |

| | 29.56% |

| Economic Sectors* | Percent of Net Assets |

| Information Technology | 25.37% |

| Consumer Discretionary | 18.27 |

| Industrials | 15.69 |

| Health Care | 14.49 |

| Financials | 12.62 |

| Consumer Staples | 5.50 |

| Energy | 3.15 |

| Materials | 2.21 |

| Telecommunication Services | 0.33 |

| Other Net Assets | 2.37 |

| | 100.00% |

| * | Because the Fund is actively managed, there can be no guarantee that the Fund will continue to hold securities of the indicated issuers and sectors in the future. |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 5 |

Liberty All-Star® Growth Fund | Major Stock Changes in the Quarter |

(Unaudited)

The following are the major ($600,000) stock changes - both purchases and sales - that were made in the Fund’s portfolio during the second quarter of 2016, excluding transactions from the manager replacement of TCW Investment Management Company with Congress Asset Management Company, LLP.

| | SHARES |

| Security Name | Purchases (Sales) | Held as of 6/30/16 |

| Purchases | | |

| Apple, Inc. | 16,694 | 16,694 |

| Bristol-Myers Squibb Co. | 13,473 | 13,473 |

| IPG Photonics Corp. | 18,231 | 23,861 |

| MACOM Technology Solutions Holdings, Inc. | 23,764 | 41,472 |

| Stamps.com, Inc. | 9,352 | 9,352 |

| VCA, Inc. | 15,000 | 15,000 |

| Sales | | |

| BofI Holding, Inc. | (34,046) | 50,801 |

| Diplomat Pharmacy, Inc. | (43,270) | 11,215 |

| ExamWorks Group, Inc. | (38,815) | 0 |

| LinkedIn Corp., Class A | (8,660) | 0 |

| Monsanto Co. | (13,000) | 0 |

| Paylocity Holding Corp. | (23,081) | 36,553 |

| Waste Connections, Inc. | (28,631) | 0 |

| West Pharmaceutical Services, Inc. | (12,050) | 0 |

Liberty All-Star® Growth Fund | Investment Managers/ Portfolio Characteristics |

(Unaudited)

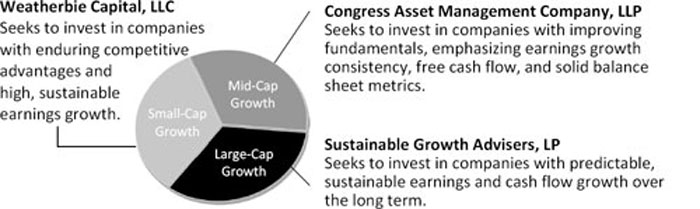

THE FUND’S THREE GROWTH INVESTMENT MANAGERS AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

ALPS Advisors, Inc., the investment advisor to the Fund, has the ultimate authority (subject to oversight by the Board of Directors) to oversee the investment managers and recommend their hiring, termination and replacement.

MANAGERS’ DIFFERING INVESTMENT STRATEGIES ARE REFLECTED IN PORTFOLIO CHARACTERISTICS

The portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 34 for a description of these indices.

PORTFOLIO CHARACTERISTICS As of June 30, 2016 (Unaudited)

| | | | | Market Capitalization Spectrum | |

| | | | | Small  Large | |

| | RUSSELL GROWTH | | | | |

| | SMALLCAP INDEX | MIDCAP INDEX | LARGECAP INDEX | WEATHERBIE | CONGRESS | SUSTAINABLE | TOTAL

FUND |

| Number of Holdings | 1,177 | 465 | 600 | 50 | 40 | 29 | 114* |

| Weighted Average Market Capitalization (billions) | $1.8 | $12.4 | $129.4 | $2.4 | $7.1 | $101.2 | $37.0 |

| Average Five-Year Earnings Per Share Growth | 9% | 11% | 10% | 24% | 17% | 10% | 16% |

| Average Five-Year Sales Per Share Growth | 11% | 10% | 11% | 18% | 10% | 13% | 13% |

| Price/Earnings Ratio** | 24x | 25x | 23x | 27x | 24x | 27x | 26x |

| Price/Book Value Ratio | 3.6x | 5.1x | 5.5x | 4.1x | 4.3x | 4.7x | 4.3x |

| * | Certain holdings are held by more than one manager. |

| ** | Excludes negative earnings. |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 7 |

Liberty All-Star® Growth Fund | Manager Interview |

(Unaudited)

| Todd Solomon, CFA Senior Vice President/Portfolio Manager

Congress Asset Management Company |

CONGRESS ASSET MANAGEMENT BELIEVES IN ITS STRATEGY AND PROCESS AND PRACTICES IT CONSISTENTLY THROUGH ALL MARKET ENVIRONMENTS

Congress Asset Management’s mid-cap growth strategy focuses on established, high-quality companies that are growing earnings and generating attractive levels of free cash flow. The firm also strives to construct portfolios with relatively low levels of volatility. We recently had the opportunity to talk with Todd Solomon, CFA, portfolio manager for the strategy. The Fund’s Investment Advisor, ALPS Advisors, Inc., conducted the interview.

As this is our first interview with Congress Asset Management, perhaps you can tell us about the firm: when it was founded, by whom, its size and, above all, the firm’s investment style and strategy. Also, what do you believe sets the firm apart, e.g., investment philosophy or process, culture, structure?

Congress Asset Management Company is an independent, management-owned, SEC-registered investment management firm founded January 1, 1985, by Alfred A. Lagan in Boston. The firm is led today by Dan Lagan, CEO and CIO, and we manage approximately $7.2 billion in assets.

At Congress, we utilize a bottom-up, growth style approach to stock selection with a focus on high quality companies. Our fundamental approach emphasizes growth of earnings and free cash flow. We also believe that a diversified portfolio consisting of established companies with the ability to consistently grow earnings over time will provide superior returns over a full market cycle.

The positive attributes of diversification are very important, especially in volatile markets. Accordingly, our portfolios consist of 35 to 45 individual holdings. The initial weighting in a position is usually 2.5 percent of the total equity portfolio and the maximum position size is 5 percent. Sector exposure is limited to 30 percent of the portfolio and industry exposure is limited to 15 percent.

What sets us apart from our competition is the consistent application of our process and philosophy, and the discipline we have to stick with it no matter what market conditions exist at any given time.

“What sets us apart from our competition is the consistent application of our process and philosophy, and the discipline we have to stick with it no matter what.”

Liberty All-Star® Growth Fund | Manager Interview |

(Unaudited)

Can you provide some insight into Congress’ investment process? And can you comment on your “growth at a reasonable risk” approach; growth at a reasonable price, or “GARP,” is a well-known approach, but not so much “GARR.”

Our primary goal is to construct “growth at reasonable risk” portfolios, which aim for growth in client assets while keeping an eye on preservation of capital. We want our clients to participate in rallying markets but are unwilling to put their assets at unwarranted levels of danger to do so. While we focus on low volatility, we do provide participation in up markets and cannot avoid risk entirely. If we identify an opportunity that, when added to the portfolio, may increase the level of risk uncomfortably, we can employ a “risk barbell” strategy in which we add a higher beta1 stock and pair it with a lower beta stock; pairing the two offsets some of the risk, which helps to keep the overall portfolio risk level in check. It is difficult to achieve balanced goals of risk and return, but it can be done by remaining focused, consistent and patient. Risk is just another investing variable that is almost impossible to time correctly.

“We believe that a diversified portfolio consisting of established companies with the ability to consistently grow earnings will provide superior returns.”

Put simply, our objective is to maximize returns over a full market cycle while controlling risk with a diversified portfolio of high quality growth stocks.

You conduct bottom-up fundamental research in the process of selecting companies for investment. How do you take macro factors into account, the most recent example being Brexit?

Macro factors are considered when identifying a company’s source of past success. We prefer companies that grow sales, earnings and free cash flow consistently through varied market environments to minimize the impact from macro factors. This focus may lead us to opportunities overlooked by growth managers. We do not invest in companies with upcoming binary events as the risk is too high; nor do we invest in companies that are “price takers,” as they have less means of managing through weakness. (Price takers are companies that accept pricing for its products and services that the market gives them, and thus tend to be more commoditized than differentiated.)

The most important aspect of analyzing macro factors for our portfolio is ensuring that large portions of the portfolio are not reliant on the same drivers.

Please tell us about two current holdings in the portion of the Liberty All-Star Growth Fund portfolio that you manage that exemplify Congress’ style and strategy.

Texas Roadhouse, Inc. (TXRH) founded in 1993, operates about 450 restaurants, mostly in the U.S., with a focus on steaks, ribs and other beef cuts served in a Western-oriented environment. Our first purchases of Texas Roadhouse were over three years ago. In a very competitive restaurant market, the company has prodded local franchisees to give their neighborhood the best customer experience and meal possible to drive traffic. While the company has faced increasing beef and labor costs, it has been very prudent in expanding seating within current locations and remaining focused on the value provided to diners. Management recently implemented a program to improve the layout of the restaurants’ bar area, so customers may see some changes, or have already seen changes, in Roadhouse locations. An interesting fact is that in March 2015, for the first time ever in the U.S., consumers spent more at restaurants and bars than at grocery stores.

| 1 | “Beta” is the measure of a stock’s volatility in comparison to an index or a benchmark. A high beta (greater than 1.0) represents a stock that is more volatile and a low beta (less than 1.0) represents a stock that is less volatile. |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 9 |

Liberty All-Star® Growth Fund | Manager Interview |

(Unaudited)

Another investment is a “behind the scenes” play whose name may not be familiar. This holding is Dorman Products, Inc. (DORM) a manufacturer of aftermarket auto parts. The company’s products are available at Carquest, AutoZone and O’Reilly, for example. Dorman should continue to be successful due to the rising age of cars in the U.S. and higher miles driven. Older cars need more frequent repairs and rising complexity makes these repairs more expensive. The company has also benefitted from the reduction in the number of new car dealers, as more drivers are taking their cars to independent repair shops—the so-called “do it for me” market—or are using the tried and true “do it yourself” method.

Many thanks, and welcome to the Fund.

Liberty All-Star® Growth Fund | Schedule of Investments |

| | June 30, 2016 (Unaudited) |

| | | SHARES | | | MARKET VALUE | |

| COMMON STOCKS (97.63%) | | | | | | |

| CONSUMER DISCRETIONARY (18.27%) | | | | | | |

| Auto Components (1.67%) | | | | | | |

Dorman Products, Inc.(a) | | | 22,792 | | | $ | 1,303,703 | |

Gentherm, Inc.(a) | | | 20,689 | | | | 708,598 | |

| | | | | | | | 2,012,301 | |

| Diversified Consumer Services (1.04%) | | | | | | | | |

2U, Inc.(a) | | | 16,060 | | | | 472,325 | |

Nord Anglia Education, Inc.(a)(b) | | | 36,802 | | | | 777,994 | |

| | | | | | | | 1,250,319 | |

| Hotels, Restaurants & Leisure (3.39%) | | | | | | | | |

Chipotle Mexican Grill, Inc.(a) | | | 3,008 | | | | 1,211,502 | |

Chuy's Holdings, Inc.(a) | | | 19,554 | | | | 676,764 | |

Planet Fitness, Inc., Class A(a)(b) | | | 23,952 | | | | 452,214 | |

| Starbucks Corp. | | | 14,610 | | | | 834,523 | |

| Texas Roadhouse, Inc. | | | 20,000 | | | | 912,000 | |

| | | | | | | | 4,087,003 | |

| Household Durables (0.81%) | | | | | | | | |

Helen of Troy Ltd.(a) | | | 9,500 | | | | 976,980 | |

| | | | | | | | | |

| Internet & Catalog Retail (4.27%) | | | | | | | | |

Amazon.com, Inc.(a) | | | 1,982 | | | | 1,418,359 | |

The Priceline Group, Inc.(a) | | | 1,283 | | | | 1,601,710 | |

Wayfair, Inc., Class A(a)(b) | | | 54,650 | | | | 2,131,350 | |

| | | | | | | | 5,151,419 | |

| Media (0.77%) | | | | | | | | |

| Scripps Networks Interactive, Inc., Class A | | | 15,000 | | | | 934,050 | |

| | | | | | | | | |

| Multiline Retail (0.57%) | | | | | | | | |

Ollie's Bargain Outlet Holdings, Inc.(a)(b) | | | 27,524 | | | | 685,072 | |

| | | | | | | | | |

| Specialty Retail (2.82%) | | | | | | | | |

| Foot Locker, Inc. | | | 17,500 | | | | 960,050 | |

Francesca's Holdings Corp.(a) | | | 66,460 | | | | 734,383 | |

| Lowe's Cos., Inc. | | | 21,540 | | | | 1,705,322 | |

| | | | | | | | 3,399,755 | |

| Textiles, Apparel & Luxury Goods (2.93%) | | | | | | | | |

| Carter's, Inc. | | | 9,500 | | | | 1,011,465 | |

G-III Apparel Group Ltd.(a) | | | 23,000 | | | | 1,051,560 | |

| NIKE, Inc., Class B | | | 26,657 | | | | 1,471,466 | |

| | | | | | | | 3,534,491 | |

| CONSUMER STAPLES (5.50%) | | | | | | | | |

| Food & Staples Retailing (1.12%) | | | | | | | | |

| Whole Foods Market, Inc. | | | 41,990 | | | | 1,344,520 | |

See Notes to Schedule of Investments and Financial Statements.

Semi-Annual Report (Unaudited) | June 30, 2016 | 11 |

Liberty All-Star® Growth Fund | Schedule of Investments |

| | June 30, 2016 (Unaudited) |

| | | SHARES | | | MARKET VALUE | |

| COMMON STOCKS (continued) | | | | | | |

| Food Products (2.29%) | | | | | | |

The Hain Celestial Group, Inc.(a) | | | 20,000 | | | $ | 995,000 | |

| Mondelez International, Inc., Class A | | | 38,816 | | | | 1,766,516 | |

| | | | | | | | 2,761,516 | |

| Household Products (2.09%) | | | | | | | | |

| Church & Dwight Co., Inc. | | | 10,000 | | | | 1,028,900 | |

| Colgate-Palmolive Co. | | | 20,390 | | | | 1,492,548 | |

| | | | | | | | 2,521,448 | |

| ENERGY (3.15%) | | | | | | | | |

| Energy Equipment & Services (3.15%) | | | | | | | | |

Core Laboratories NV(b) | | | 16,414 | | | | 2,033,531 | |

Natural Gas Services Group, Inc.(a) | | | 13,229 | | | | 302,944 | |

| Schlumberger Ltd. | | | 18,540 | | | | 1,466,143 | |

| | | | | | | | 3,802,618 | |

| FINANCIALS (12.62%) | | | | | | | | |

| Banks (0.43%) | | | | | | | | |

| Independent Bank Group, Inc. | | | 12,212 | | | | 524,017 | |

| | | | | | | | | |

| Capital Markets (2.27%) | | | | | | | | |

Financial Engines, Inc.(b) | | | 4,760 | | | | 123,141 | |

| Raymond James Financial, Inc. | | | 18,500 | | | | 912,050 | |

| State Street Corp. | | | 23,789 | | | | 1,282,703 | |

| Virtus Investment Partners, Inc. | | | 5,951 | | | | 423,592 | |

| | | | | | | | 2,741,486 | |

| Commercial Banks (2.23%) | | | | | | | | |

Signature Bank(a) | | | 21,570 | | | | 2,694,524 | |

| | | | | | | | | |

| Consumer Finance (1.45%) | | | | | | | | |

| Visa, Inc., Class A | | | 23,520 | | | | 1,744,478 | |

| | | | | | | | | |

| Diversified Financial Services (0.87%) | | | | | | | | |

| FactSet Research Systems, Inc. | | | 6,500 | | | | 1,049,230 | |

| | | | | | | | | |

| Insurance (0.99%) | | | | | | | | |

Greenlight Capital Re Ltd., Class A(a) | | | 34,427 | | | | 694,049 | |

| United Insurance Holdings Corp. | | | 30,277 | | | | 495,937 | |

| | | | | | | | 1,189,986 | |

| Real Estate Investment Trusts (2.15%) | | | | | | | | |

| Camden Property Trust | | | 12,000 | | | | 1,061,040 | |

| Equinix, Inc. | | | 3,961 | | | | 1,535,798 | |

| | | | | | | | 2,596,838 | |

| Real Estate Management & Development (1.48%) | | | | | | | | |

| FirstService Corp. | | | 38,813 | | | | 1,778,800 | |

See Notes to Schedule of Investments and Financial Statements.

Liberty All-Star® Growth Fund | Schedule of Investments |

| | June 30, 2016 (Unaudited) |

| | | SHARES | | | MARKET VALUE | |

| COMMON STOCKS (continued) | | | | | | |

| Thrifts & Mortgage Finance (0.75%) | | | | | | |

BofI Holding, Inc.(a)(b) | | | 50,801 | | | $ | 899,686 | |

| | | | | | | | | |

| HEALTH CARE (14.49%) | | | | | | | | |

| Biotechnology (4.03%) | | | | | | | | |

ACADIA Pharmaceuticals, Inc.(a)(b) | | | 22,343 | | | | 725,254 | |

| Amgen, Inc. | | | 9,410 | | | | 1,431,732 | |

Puma Biotechnology, Inc.(a)(b) | | | 17,322 | | | | 516,022 | |

Regeneron Pharmaceuticals, Inc.(a) | | | 3,419 | | | | 1,194,017 | |

Ultragenyx Pharmaceutical, Inc.(a) | | | 20,177 | | | | 986,857 | |

| | | | | | | | 4,853,882 | |

| Health Care Equipment & Supplies (2.62%) | | | | | | | | |

| The Cooper Cos., Inc. | | | 6,000 | | | | 1,029,420 | |

Insulet Corp.(a) | | | 34,969 | | | | 1,057,463 | |

| ResMed, Inc. | | | 17,000 | | | | 1,074,910 | |

| | | | | | | | 3,161,793 | |

| Health Care Providers & Services (2.33%) | | | | | | | | |

Diplomat Pharmacy, Inc.(a)(b) | | | 11,215 | | | | 392,525 | |

Henry Schein, Inc.(a) | | | 6,000 | | | | 1,060,800 | |

| U.S. Physical Therapy, Inc. | | | 5,587 | | | | 336,393 | |

VCA, Inc.(a) | | | 15,000 | | | | 1,014,150 | |

| | | | | | | | 2,803,868 | |

| Health Care Technology (1.90%) | | | | | | | | |

Cerner Corp.(a) | | | 29,553 | | | | 1,731,806 | |

Cotiviti Holdings, Inc.(a) | | | 22,797 | | | | 481,701 | |

Press Ganey Holdings, Inc.(a) | | | 1,947 | | | | 76,614 | |

| | | | | | | | 2,290,121 | |

| Life Sciences Tools & Services (2.47%) | | | | | | | | |

Cambrex Corp.(a) | | | 20,000 | | | | 1,034,600 | |

Mettler-Toledo International, Inc.(a) | | | 2,500 | | | | 912,300 | |

PAREXEL International Corp.(a) | | | 16,500 | | | | 1,037,520 | |

| | | | | | | | 2,984,420 | |

| Pharmaceuticals (1.14%) | | | | | | | | |

Aerie Pharmaceuticals, Inc.(a)(b) | | | 21,865 | | | | 384,824 | |

| Bristol-Myers Squibb Co. | | | 13,473 | | | | 990,939 | |

| | | | | | | | 1,375,763 | |

| INDUSTRIALS (15.69%) | | | | | | | | |

| Aerospace & Defense (1.73%) | | | | | | | | |

| B/E Aerospace, Inc. | | | 20,000 | | | | 923,500 | |

| HEICO Corp. | | | 17,420 | | | | 1,163,831 | |

| | | | | | | | 2,087,331 | |

| Air Freight & Logistics (0.40%) | | | | | | | | |

XPO Logistics, Inc.(a)(b) | | | 18,238 | | | | 478,930 | |

See Notes to Schedule of Investments and Financial Statements.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 13 |

Liberty All-Star® Growth Fund | Schedule of Investments |

| | June 30, 2016 (Unaudited) |

| | | SHARES | | | MARKET VALUE | |

| COMMON STOCKS (continued) | | | | | | |

| Building Products (1.62%) | | | | | | |

| Lennox International, Inc. | | | 7,000 | | | $ | 998,200 | |

| Masco Corp. | | | 31,000 | | | | 959,140 | |

| | | | | | | | 1,957,340 | |

| Commercial Services & Supplies (1.49%) | | | | | | | | |

The Advisory Board Co.(a) | | | 20,331 | | | | 719,514 | |

| Cintas Corp. | | | 11,000 | | | | 1,079,430 | |

| | | | | | | | 1,798,944 | |

| Electrical Equipment (0.82%) | | | | | | | | |

| Acuity Brands, Inc. | | | 4,000 | | | | 991,840 | |

| | | | | | | | | |

| Machinery (3.18%) | | | | | | | | |

Middleby Corp.(a) | | | 20,227 | | | | 2,331,162 | |

Proto Labs, Inc.(a)(b) | | | 8,232 | | | | 473,834 | |

| Snap-on, Inc. | | | 6,500 | | | | 1,025,830 | |

| | | | | | | | 3,830,826 | |

| Professional Services (4.42%) | | | | | | | | |

| Equifax, Inc. | | | 7,500 | | | | 963,000 | |

IHS, Inc., Class A(a) | | | 5,857 | | | | 677,128 | |

Paylocity Holding Corp.(a) | | | 36,553 | | | | 1,579,089 | |

| Robert Half International, Inc. | | | 24,000 | | | | 915,840 | |

WageWorks, Inc.(a) | | | 19,978 | | | | 1,194,884 | |

| | | | | | | | 5,329,941 | |

| Road & Rail (1.63%) | | | | | | | | |

| J.B. Hunt Transport Services, Inc. | | | 12,000 | | | | 971,160 | |

| Kansas City Southern | | | 8,549 | | | | 770,180 | |

| Landstar System, Inc. | | | 3,255 | | | | 223,488 | |

| | | | | | | | 1,964,828 | |

| Trading Companies & Distribution (0.40%) | | | | | | | | |

| H&E Equipment Services, Inc. | | | 17,120 | | | | 325,793 | |

SiteOne Landscape Supply, Inc.(a) | | | 4,535 | | | | 154,145 | |

| | | | | | | | 479,938 | |

| INFORMATION TECHNOLOGY (25.37%) | | | | | | | | |

| Communications Equipment (0.85%) | | | | | | | | |

F5 Networks, Inc.(a) | | | 9,000 | | | | 1,024,560 | |

| | | | | | | | | |

| Electronic Equipment & Instruments (2.41%) | | | | | | | | |

| Cognex Corp. | | | 23,000 | | | | 991,300 | |

IPG Photonics Corp.(a) | | | 23,861 | | | | 1,908,880 | |

| | | | | | | | 2,900,180 | |

| Internet Software & Services (4.33%) | | | | | | | | |

Alphabet, Inc., Class C(a) | | | 2,008 | | | | 1,389,736 | |

Facebook, Inc., Class A(a) | | | 6,860 | | | | 783,961 | |

GTT Communications, Inc.(a) | | | 62,098 | | | | 1,147,571 | |

See Notes to Schedule of Investments and Financial Statements.

Liberty All-Star® Growth Fund | Schedule of Investments |

| | June 30, 2016 (Unaudited) |

| | | SHARES | | | MARKET VALUE | |

| COMMON STOCKS (continued) | | | | | | |

| Internet Software & Services (continued) | | | | | | |

SPS Commerce, Inc.(a) | | | 17,928 | | | $ | 1,086,437 | |

Stamps.com, Inc.(a) | | | 9,352 | | | | 817,552 | |

| | | | | | | | 5,225,257 | |

| IT Services (4.93%) | | | | | | | | |

| Automatic Data Processing, Inc. | | | 16,205 | | | | 1,488,753 | |

EPAM Systems, Inc.(a) | | | 16,405 | | | | 1,055,006 | |

FleetCor Technologies, Inc.(a) | | | 9,838 | | | | 1,408,113 | |

Genpact Ltd.(a) | | | 37,000 | | | | 993,080 | |

| Jack Henry & Associates, Inc. | | | 11,500 | | | | 1,003,605 | |

| | | | | | | | 5,948,557 | |

| Semiconductors & Semiconductor Equipment (2.85%) | | | | | | | | |

ARM Holdings PLC(c) | | | 24,002 | | | | 1,092,331 | |

| Linear Technology Corp. | | | 21,000 | | | | 977,130 | |

MACOM Technology Solutions Holdings, Inc.(a) | | | 41,472 | | | | 1,367,746 | |

| | | | | | | | 3,437,207 | |

| Software (8.53%) | | | | | | | | |

Fleetmatics Group PLC(a) | | | 26,055 | | | | 1,128,963 | |

Globant SA(a)(b) | | | 22,773 | | | | 896,118 | |

Manhattan Associates, Inc.(a) | | | 15,000 | | | | 961,950 | |

RealPage, Inc.(a) | | | 37,392 | | | | 834,963 | |

Red Hat, Inc.(a) | | | 22,889 | | | | 1,661,742 | |

Salesforce.com, Inc.(a) | | | 14,842 | | | | 1,178,603 | |

SAP SE(b)(c) | | | 13,150 | | | | 986,513 | |

Synopsys, Inc.(a) | | | 18,000 | | | | 973,440 | |

The Ultimate Software Group, Inc.(a) | | | 7,911 | | | | 1,663,604 | |

| | | | | | | | 10,285,896 | |

| Technology Hardware Storage & Equipment (1.47%) | | | | | | | | |

| Apple, Inc. | | | 16,694 | | | | 1,595,947 | |

Stratasys Ltd.(a)(b) | | | 7,425 | | | | 169,958 | |

| | | | | | | | 1,765,905 | |

| MATERIALS (2.21%) | | | | | | | | |

| Chemicals (2.21%) | | | | | | | | |

| Ecolab, Inc. | | | 14,488 | | | | 1,718,277 | |

| International Flavors & Fragrances, Inc. | | | 7,500 | | | | 945,525 | |

| | | | | | | | 2,663,802 | |

| TELECOMMUNICATION SERVICES (0.33%) | | | | | | | | |

| Diversified Telecommunication (0.33%) | | | | | | | | |

inContact, Inc.(a) | | | 28,917 | | | | 400,500 | |

| | | | | | | | | |

TOTAL COMMON STOCKS (COST OF $102,671,426) | | | | | | | 117,722,166 | |

See Notes to Schedule of Investments and Financial Statements.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 15 |

Liberty All-Star® Growth Fund | Schedule of Investments |

June 30, 2016 (Unaudited)

| | | PAR VALUE/ SHARES | | | MARKET VALUE | |

| SHORT TERM INVESTMENTS (10.03%) | | | | | | |

| REPURCHASE AGREEMENT (2.50%) | | | | | | |

| Repurchase agreement with State Street Bank & Trust Co., dated 6/30/16, due 07/01/16 at 0.01%, collateralized by United States Treasury Bond, 2.125%, 09/30/21, market value of $3,084,805 and par value of $2,915,000. (Repurchase proceeds of $3,015,001). | | | | | | |

| (COST OF $3,015,000) | | $ | 3,015,000 | | | $ | 3,015,000 | |

| | | | | | | | | |

INVESTMENTS PURCHASED WITH COLLATERAL FROM SECURITIES LOANED (7.53%) | | | | | |

| State Street Navigator Securities Lending Prime Portfolio, 0.52% | | | | | | | | |

| (COST OF $9,082,841) | | | 9,082,841 | | | | 9,082,841 | |

| | | | | | | | | |

| TOTAL SHORT TERM INVESTMENTS | | | | | | | | |

| (COST OF $12,097,841) | | | | | | | 12,097,841 | |

| | | | | | | | | |

| TOTAL INVESTMENTS (107.66%) | | | | | | | | |

(COST OF $114,769,267)(d) | | | | | | $ | 129,820,007 | |

| | | | | | | | | |

| LIABILITIES IN EXCESS OF OTHER ASSETS (-7.66%) | | | | | | | (9,241,313 | ) |

| | | | | | | | | |

| NET ASSETS (100.00%) | | | | | | $ | 120,578,694 | |

| | | | | | | | | |

| NET ASSET VALUE PER SHARE | | | | | | | | |

| (25,955,945 SHARES OUTSTANDING) | | | | | | $ | 4.65 | |

Notes to Schedule of Investments:

(a) | Non-income producing security. |

(b) | Security, or a portion of the security position, is currently on loan. The total market value of securities on loan is $9,446,536. |

(c) | American Depositary Receipt. |

(d) | Cost of investments for federal income tax purposes is $115,971,682. |

Gross unrealized appreciation and depreciation at June 30, 2016 based on cost of investments for federal income tax purposes is as follows:

| Gross unrealized appreciation | | $ | 18,538,931 | |

| Gross unrealized depreciation | | | (4,690,606 | ) |

| Net unrealized appreciation | | $ | 13,848,325 | |

See Notes to Schedule of Investments and Financial Statements.

Liberty All-Star® Growth Fund | Statement of Assets and Liabilities |

June 30, 2016 (Unaudited)

| ASSETS: | | | |

| Investments at market value (Cost $114,769,267) | | $ | 129,820,007 | |

| Cash | | | 1,386 | |

| Receivable for investment securities sold | | | 2,512,568 | |

| Dividends and interest receivable | | | 84,479 | |

| Prepaid and other assets | | | 19,443 | |

TOTAL ASSETS | | | 132,437,883 | |

| | | | | |

| LIABILITIES: | | | | |

| Payable for investments purchased | | | 2,578,379 | |

| Investment advisory fee payable | | | 78,963 | |

| Payable for administration, pricing and bookkeeping fees | | | 29,894 | |

| Payable for collateral upon return of securities loaned | | | 9,082,841 | |

| Accrued expenses | | | 89,112 | |

TOTAL LIABILITIES | | | 11,859,189 | |

| NET ASSETS | | $ | 120,578,694 | |

| | | | | |

| NET ASSETS REPRESENTED BY: | | | | |

| Paid-in capital | | $ | 94,629,351 | |

| Distributions in excess of net investment income | | | (4,590,417 | ) |

| Accumulated net realized gain on investments | | | 15,489,020 | |

| Net unrealized appreciation on investments | | | 15,050,740 | |

| NET ASSETS | | $ | 120,578,694 | |

| | | | | |

| Shares of common stock outstanding (authorized 60,000,000 shares at $0.10 Par) | | | 25,955,945 | |

| NET ASSET VALUE PER SHARE | | $ | 4.65 | |

See Notes to Financial Statements.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 17 |

Liberty All-Star® Growth Fund | Statement of Operations |

For the Six Months Ended June 30, 2016 (Unaudited)

| INVESTMENT INCOME: | | | |

Dividends (Net of foreign taxes withheld at source which amounted to $6,440) | | $ | 376,506 | |

| Securities lending income | | | 177,831 | |

| Interest | | | 181 | |

TOTAL INVESTMENT INCOME | | | 554,518 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fee | | | 457,754 | |

| Administration fee | | | 114,439 | |

| Pricing and bookkeeping fees | | | 38,204 | |

| Audit fee | | | 13,997 | |

| Custodian fee | | | 18,821 | |

| Directors' fees and expenses | | | 30,645 | |

| Insurance expense | | | 3,324 | |

| Legal fees | | | 17,625 | |

| NYSE fee | | | 11,922 | |

| Shareholder communication expenses | | | 16,383 | |

| Transfer agent fees | | | 39,188 | |

| Miscellaneous expenses | | | 14,187 | |

TOTAL EXPENSES | | | 776,489 | |

NET INVESTMENT LOSS | | | (221,971 | ) |

| | | | | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain on investments | | | 10,089,981 | |

| Net change in unrealized depreciation on investments | | | (13,254,607 | ) |

NET REALIZED AND UNREALIZED LOSS ON INVESTMENTS | | | (3,164,626 | ) |

| NET DECREASE IN NET ASSETS RESULTING FROM OPERATIONS | | $ | (3,386,597 | ) |

See Notes to Financial Statements.

Liberty All-Star® Growth Fund | Statements of Changes in Net Assets |

| | | For the Six Months Ended June 30, 2016 (Unaudited) | | | For the Year Ended December 31, 2015 | |

| FROM OPERATIONS: | | | | | | |

| Net investment loss | | $ | (221,971 | ) | | $ | (621,454 | ) |

| Net realized gain on investments | | | 10,089,981 | | | | 9,700,847 | |

| Net change in unrealized depreciation on investments | | | (13,254,607 | ) | | | (7,111,152 | ) |

| Net Increase/(Decrease) in Net Assets From Operations | | | (3,386,597 | ) | | | 1,968,241 | |

| | | | | | | | | |

| DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | | | |

| From net investment income | | | (4,368,446 | ) | | | – | |

| From net realized gains on investments | | | – | | | | (18,951,117 | ) |

| Total Distributions | | | (4,368,446 | ) | | | (18,951,117 | ) |

| | | | | | | | | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Dividend reinvestments | | | 4,066,603 | | | | 3,524,229 | |

| Net Decrease in Net Assets | | | (3,688,440 | ) | | | (13,458,647 | ) |

| | | | | | | | | |

| NET ASSETS: | | | | | | | | |

| Beginning of period | | | 124,267,134 | | | | 137,725,781 | |

| End of period (Includes distributions in excess of net investment income of $(4,590,417) and $0, respectively) | | $ | 120,578,694 | | | $ | 124,267,134 | |

See Notes to Financial Statements.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 19 |

Liberty All-Star®Growth Fund

Financial Highlights

| PER SHARE OPERATING PERFORMANCE: |

Net asset value at beginning of period |

| INCOME FROM INVESTMENT OPERATIONS: |

Net investment loss(a) |

| Net realized and unrealized gain/(loss) on investments |

| Total from Investment Operations |

| |

| LESS DISTRIBUTIONS TO SHAREHOLDERS: |

| Net investment income |

| Net realized gain on investments |

| Tax return of capital |

| Total Distributions |

Change due to tender offer(b) |

| Net asset value at end of period |

| Market price at end of period |

| |

TOTAL INVESTMENT RETURN FOR SHAREHOLDERS:(c) |

| Based on net asset value |

| Based on market price |

| |

| RATIOS AND SUPPLEMENTAL DATA: |

| |

| Net assets at end of period (millions) |

| Ratio of expenses to average net assets after waiver/reimbursement |

| Ratio of expenses to average net assets before waiver/reimbursement |

| Ratio of net investment loss to average net assets |

| Portfolio turnover rate |

(a) | Calculated using average shares outstanding during the period. |

(b) | Effect of Fund's tender offer for shares at a price below net asset value, net of costs. |

(c) | Calculated assuming all distributions are reinvested at actual reinvestment prices. The net asset value and market price returns will differ depending upon the level of any discount from or premium to net asset value at which the Fund's shares traded during the period. Past performance is not a guarantee of future results. |

See Notes to Financial Statements.

Financial Highlights

For the Six Months Ended June 30, 2016 | | | For the Year Ended December 31, | |

| (Unaudited) | | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| | | | | | | | | | | | | | | | | |

| $ | 4.99 | | | $ | 5.69 | | | $ | 5.91 | | | $ | 4.54 | | | $ | 4.24 | | | $ | 4.57 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.01 | ) | | | (0.03 | ) | | | (0.04 | ) | | | (0.04 | ) | | | (0.03 | ) | | | (0.05 | ) |

| | (0.16 | ) | | | 0.10 | | | | 0.15 | | | | 1.72 | | | | 0.54 | | | | (0.01 | ) |

| | (0.17 | ) | | | 0.07 | | | | 0.11 | | | | 1.68 | | | | 0.51 | | | | (0.06 | ) |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (0.17 | ) | | | – | | | | – | | | | – | | | | – | | | | (0.07 | ) |

| | – | | | | (0.77 | ) | | | (0.33 | ) | | | (0.31 | ) | | | (0.22 | ) | | | (0.20 | ) |

| | – | | | | – | | | | – | | | | – | | | | (0.05 | ) | | | – | |

| | (0.17 | ) | | | (0.77 | ) | | | (0.33 | ) | | | (0.31 | ) | | | (0.27 | ) | | | (0.27 | ) |

| | – | | | | – | | | | – | | | | – | | | | 0.06 | | | | – | |

| $ | 4.65 | | | $ | 4.99 | | | $ | 5.69 | | | $ | 5.91 | | | $ | 4.54 | | | $ | 4.24 | |

| $ | 4.09 | | | $ | 4.58 | | | $ | 5.16 | | | $ | 5.62 | | | $ | 4.06 | | | $ | 3.81 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| | (2.9 | %)(d) | | | 3.9 | % | | | 2.4 | % | | | 39.0 | % | | | 14.3 | % | | | (1.0 | %) |

| | (6.9 | %)(d) | | | 5.1 | % | | | (2.3 | %) | | | 47.8 | % | | | 13.8 | % | | | (4.4 | %) |

| | | | | | | | | | | | | | | | | | | | | | | |

| $ | 121 | | | $ | 124 | | | $ | 138 | | | $ | 140 | | | $ | 104 | | | $ | 128 | |

| | N/ | A | | | N/ | A | | | N/ | A | | | N/ | A | | | 1.46 | % | | | N/ | A |

| | 1.36 | %(e) | | | 1.30 | % | | | 1.34 | % | | | 1.34 | % | | | 1.51 | % | | | 1.52 | % |

| | (0.39 | %)(e) | | | (0.45 | %) | | | (0.77 | %) | | | (0.73 | %) | | | (0.61 | %) | | | (1.04 | %) |

| | 66 | %(d) | | | 58 | % | | | 63 | % | | | 45 | % | | | 35 | % | | | 32 | % |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 21 |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

NOTE 1. ORGANIZATION

Liberty All-Star® Growth Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment Company Act of 1940 (the “Act”), as amended, as a diversified, closed-end management investment company.

Investment Goal

The Fund seeks long-term capital appreciation.

Fund Shares

The Fund may issue 60,000,000 shares of common stock at $0.10 par.

NOTE 2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. The Fund is considered an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board Accounting Standards Codification Topic 946.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America (“GAAP”) requires management to make estimates and assumptions that affect the reported amounts and disclosures in the financial statements. Actual results could differ from these estimates.

Security Valuation

Equity securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities listed on the NASDAQ Stock Market LLC (“NASDAQ”) , which are valued at the NASDAQ official closing price. Unlisted securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges or over-the- counter markets.

Cash collateral from securities lending activity is reinvested in the State Street Navigator Securities Lending Prime Portfolio, a registered investment company under the 1940 Act, which operates as a money market fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that investment company’s net asset value per share. Repurchase agreements are valued at cost, which approximates fair value.

The Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities, at fair value according to procedures adopted by the Fund's Board of Directors (the "Board"). When market quotations are not readily available, or in management’s judgment they do not accurately reflect fair value of a security, or an event occurs after the market close but before the Fund is priced that materially affects the value of a security, the securities will be valued by the Advisor, ALPS Advisors, Inc. (the "Advisor"), using fair valuation procedures established by the Board. Examples of potentially significant events that could materially impact the value of a security include, but are not limited to: single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations, acquisitions and buyouts; corporate announcements on earnings or product offerings; regulatory news; and litigation and multiple issuer events such as governmental actions; natural disasters or armed conflicts that affect a country or a region; or significant market fluctuations. Potential significant events are monitored by the Advisor, Sub-Advisers and/or the Valuation Committee through independent reviews of market indicators, general news sources and communications from the Fund’s custodian. As of June 30, 2016, the Fund held no securities that were fair valued.

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

Security Transactions

Security transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method for both financial statement and federal income tax purposes.

Income Recognition

Interest income is recorded on the accrual basis. Corporate actions and dividend income are recorded on the ex-date.

The Fund estimates components of distributions from real estate investment trusts (“REITs”). Distributions received in excess of income are recorded as a reduction of the cost of the related investments. Once the REIT reports annually the tax character of its distributions, the Fund revises its estimates. If the Fund no longer owns the applicable securities, any distributions received in excess of income are recorded as realized gains.

Repurchase Agreements

The Fund engages in repurchase agreement transactions with institutions that the Fund’s investment advisor has determined are creditworthy. The Fund, through its custodian, receives delivery of underlying securities collateralizing a repurchase agreement. Collateral is at least equal, at all times, to the value of the repurchase obligation including interest. A repurchase agreement transaction involves certain risks in the event of default or insolvency of the counterparty. These risks include possible delays or restrictions upon a Fund’s ability to dispose of the underlying securities and a possible decline in the value of the underlying securities during the period while the Fund seeks to assert its rights.

Repurchase agreements are entered into by the Fund under a Master Repurchase Agreement (“MRA”) which permits the Fund, under certain circumstances, including an event of default (such as bankruptcy or insolvency), to offset payables and/or receivables under the MRA with collateral held and/or posted to the counterparty and create one single net payment due or from the Fund.

At June 30, 2016, the open repurchase agreement with the counterparty State Street Bank & Trust Co., and subject to a MRA on a net payment basis, was as follows:

| | | | | | | | | | | | Gross Amounts Not Offset in the Statement of Financial Position | |

| Description | | Gross Amounts of Recognized Assets | | | Gross Amounts Offset in the Statement of Assets and Liabilities | | | Net Amounts Presented in the Statement of Assets and Liabilities | | | Financial Instruments Collateral Received | | | Cash Collateral Received | | | Net Amount | |

| Repurchase Agreement | | $ | 3,015,000 | | | $ | – | | | $ | 3,015,000 | | | $ | (3,015,000 | ) | | $ | – | | | $ | – | |

| Total | | $ | 3,015,000 | | | $ | – | | | $ | 3,015,000 | | | $ | (3,015,000 | ) | | $ | – | | | $ | – | |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 23 |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

Lending of Portfolio Securities

The Fund may lend its portfolio securities only to borrowers that are approved by the Fund’s securities lending agent, State Street Bank & Trust Co. (“SSB”). The Fund will limit such lending to not more than 20% of the value of its total assets. The borrower pledges and maintains with the Fund collateral consisting of cash (U.S. Dollar only), securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, or by irrevocable bank letters of credit issued by a person other than the Borrower or an affiliate of the Borrower. The initial collateral received by the Fund is required to have a value of no less than 102% of the market value of the loaned securities for securities traded on U.S. exchanges and a value of no less than 105% of the market value for all other securities. The collateral is maintained thereafter, at a market value equal to no less than 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the close of each business day and any additional required collateral is delivered to the Fund on the next business day. During the term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time period for settlement of securities transactions.

Any cash collateral received is reinvested in a money market fund managed by SSB as disclosed in the Fund’s Schedule of Investments and is reflected in the Statement of Assets and Liabilities as a payable for collateral upon return of securities loaned. Non-cash collateral, in the form of securities issued or guaranteed by the U.S. government or its agencies or instrumentalities, is not disclosed in the Fund’s Statements of Assets and Liabilities as it is held by the lending agent on behalf of the Fund and the Fund does not have the ability to re-hypothecate these securities. As of June 30, 2016, the market value of securities on loan was $9,446,536 and the total cash collateral and non-cash collateral received was $9,082,841 and $601,745, respectively. Income earned by the Fund from securities lending activity is disclosed in the Statement of Operations.

The risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by SSB. SSB’s indemnity allows for full replacement of securities lent wherein SSB will purchase the unreturned loaned securities on the open market by applying the proceeds of the collateral, or to the extent such proceeds are insufficient or the collateral is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense. However, the Fund could suffer a loss if the value of the investments purchased with cash collateral falls below the value of the cash collateral received.

The following table indicates the total amount of securities loaned by type, reconciled to gross liability payable upon return of the securities loaned by the Fund as of June 30, 2016:

| | | Remaining contractual maturity of the lending agreement | |

| | | | | | | | | | | | | | | | |

| Securities Lending Transactions | | Overnight & Continuous | | | Up to 30 days | | | 30-90 days | | | Greater than 90 days | | | Total | |

| Common Stocks | | $ | 9,446,536 | | | $ | – | | | $ | – | | | $ | – | | | $ | 9,446,536 | |

| Total Loans | | | | | | | | | | | | | | | | | | | 9,446,536 | |

| Gross amount of recognized liabilities for securities lending (collateral received) | | | $ | 9,082,841 | |

| Amounts due from counterparty | | | | | | | | | | | | | | | | | | $ | 363,695 | |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

Fair Value Measurements

The Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing the asset or liability that are developed based on the best information available.

Valuation techniques used to value the Fund's investments by major category are as follows:

Equity securities that are valued based on unadjusted quoted prices in active markets are categorized as Level 1 in the hierarchy. In the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Repurchase agreements are valued at cost, which approximates fair value, and are categorized as Level 2 in the hierarchy.

Various inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level 1 – | Unadjusted quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability to access at the measurement date; |

| Level 2 – | Quoted prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| Level 3 – | Significant unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where there is little or no market activity for the asset or liability at the measurement date. |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 25 |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

The following is a summary of the inputs used to value the Fund’s investments as of June 30, 2016:

| | | Valuation Inputs | | | | |

| Investments in Securities at Value* | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Common Stocks | | $ | 117,722,166 | | | $ | �� | | | $ | – | | | $ | 117,722,166 | |

| Short Term Investment | | | – | | | | 3,015,000 | | | | – | | | | 3,015,000 | |

| Investments Purchased with Collateral from Securities Loaned | | | 9,082,841 | | | | – | | | | – | | | | 9,082,841 | |

| Total | | $ | 126,805,007 | | | $ | 3,015,000 | | | $ | – | | | $ | 129,820,007 | |

| * | See Schedule of Investments for industry classifications. |

The Fund recognizes transfers between the levels as of the end of the period. For the six months ended June 30, 2016, the Fund did not have any transfers between Level 1 and Level 2 securities. The Fund did not have any securities which used significant unobservable inputs (Level 3) in determining fair value during the period.

Distributions to Shareholders

The Fund currently has a policy of paying distributions on its common shares totaling approximately 8% of its net asset value per year. The distributions are payable in four quarterly distributions of 2% of the Fund’s net asset value at the close of the New York Stock Exchange on the Friday prior to each quarterly declaration date. Distributions to shareholders are recorded on ex-date.

NOTE 3. FEDERAL TAX INFORMATION

The timing and character of income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP. Reclassifications are made to the Fund’s capital accounts for permanent tax differences to reflect income and gains available for distribution (or available capital loss carryforwards) under income tax regulations. If, for any calendar year, the total distributions made under the distribution policy exceed the Fund’s net investment income and net realized capital gains, the excess will generally be treated as a non-taxable return of capital, reducing the shareholder’s adjusted basis in his or her shares. If the Fund’s net investment income and net realized capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain and not distribute net realized capital gains and pay income tax thereon to the extent of such excess.

Classification of Distributions to Shareholders

Net investment income/(loss) and net realized gain/(loss) may differ for financial statement and tax purposes. The character of distributions made during the year from net investment income or net realized gains may differ from its ultimate characterization for federal income tax purposes. Also, due to the timing of dividend distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which the income or realized gain was recorded by the Fund. The amounts and characteristics of tax basis distributions and composition of distributable earnings/(accumulated losses) are finalized at fiscal year-end; accordingly, tax basis balances have not been determined as of June 30, 2016.

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

The tax character of distributions paid during the year ended December 31, 2015 were as follows:

| Distributions Paid From: | | 12/31/2015 | |

| Long-term capital gains | | $ | 18,951,117 | |

| Total | | $ | 18,951,117 | |

Future realized gains offset by the loss carryforwards are not required to be distributed to shareholders. However, under the Fund’s distribution policy, such gains may be distributed to shareholders in the year the gains are realized. Any such gains distributed may be taxable to shareholders as ordinary income.

The Fund elected to defer to the fiscal year ending December 31, 2016, capital losses recognized during the period from November 1, 2015 to December 31, 2015 in the amount of $636,116.

As of June 30, 2016, the costs of investments for federal income tax purposes and accumulated net unrealized appreciation/(depreciation) on investments were as follows:

| Cost of Investments | Gross unrealized Appreciation (excess of value over tax cost) | Gross unrealized Depreciation (excess of tax cost over value) | Net Unrealized Appreciation |

| $115,971,682 | $18,538,931 | $(4,690,606) | $13,848,325 |

The differences between book-basis and tax-basis are primarily due to deferral of losses from wash sales and the differing treatment of certain other investments.

Federal Income Tax Status

For federal income tax purposes, the Fund currently qualifies, and intends to remain qualified, as a regulated investment company under the provisions of Subchapter M of the Internal Revenue Code of 1986, as amended, by distributing substantially all of its investment company taxable net income including realized gain, not offset by capital loss carryforwards, if any, to its shareholders. Accordingly, no provision for federal income or excise taxes has been made.

As of and during the six months ended June 30, 2016, the Fund did not have a liability for any unrecognized tax benefits. The Fund files U.S. federal, state, and local tax returns as required. The Fund’s tax returns are subject to examination by the relevant tax authorities until expiration of the applicable statute of limitations which is generally three years after the filing of the tax return. Tax returns for open years have incorporated no uncertain tax positions that require a provision for income taxes.

NOTE 4. FEES AND COMPENSATION PAID TO AFFILIATES

Investment Advisory Fee

ALPS Advisors, Inc. (“AAI”) serves as the investment advisor to the Fund. AAI receives a monthly investment advisory fee based on the Fund’s average daily net assets at the following annual rates:

| Average Daily Net Assets | Annual Fee Rate |

| First $300 million | 0.80% |

| Over $300 million | 0.72% |

| Semi-Annual Report (Unaudited) | June 30, 2016 | 27 |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

Investment Advisory Fees for the six months ended June 30, 2016 are reported on the Statement of Operations.

AAI retains multiple Portfolio Managers to manage the Fund’s investments in various asset classes. AAI pays each Portfolio Manager a portfolio management fee based on the assets of the investment portfolio that they manage. The portfolio management fee is paid from the investment advisory fees collected by AAI and is based on the Fund’s average daily net assets at the following annual rates:

| Average Daily Net Assets | Annual Fee Rate |

| First $300 million | 0.40% |

| Over $300 million | 0.36% |

Administration, Bookkeeping and Pricing Services

ALPS Fund Services, Inc. (“ALPS”) serves as the administrator to the Fund and the Fund has agreed to pay expenses incurred in connection with this service. Pursuant to an Administrative, Bookkeeping and Pricing Services Agreement, ALPS provides operational services to the Fund including, but not limited to, fund accounting and fund administration and generally assists in the Fund’s operations. Officers of the Trust are employees of ALPS. The Fund’s administration fee is accrued on a daily basis and paid monthly. Administration, Pricing and Bookkeeping fees paid by the Fund for the six months ended June 30, 2016 are disclosed in the Statement of Operations.

The Fund also reimburses ALPS for out-of-pocket expenses and charges, including fees payable to third parties for pricing the Fund’s portfolio securities and direct internal costs incurred by ALPS in connection with providing fund accounting oversight and monitoring and certain other services.

Expense Limitation Agreement

Under the terms of the Expense Limitation Agreement between the Fund and AAI, AAI has agreed to waive certain fees they are entitled to receive from the Fund. Specifically, AAI has agreed to reimburse Fund expenses and/or waive a portion of the investment advisory and other fees that AAI is entitled to receive to the extent necessary that Total Annual Operating Expenses, after such expense reimbursement and/or fee waiver (excluding acquired fund fees and expenses, taxes, brokerage commissions and extraordinary expenses), do not exceed 1.45% of net assets. The Expense Limitation Agreement is effective through July 31, 2016. Pursuant to the Expense Limitation Agreement, the Fund may reimburse AAI for any fee waivers and expense reimbursements made by AAI, provided that any such reimbursements made by the Fund to AAI will not cause the Fund’s annual expense ratio to exceed the expense limitation rate. AAI is entitled to collect on or make a claim for waived fees at a maximum of three years from the date of the Expense Limitation Agreement. For the six months ended June 30, 2016 there was no fee waivers and/or reimbursements and AAI collected no previously waived fees.

Fees Paid to Officers

All officers of the Fund, including the Fund’s Chief Compliance Officer, are employees of AAI or its affiliates, and receive no compensation from the Fund. The Board of Directors has appointed a Chief Compliance Officer to the Fund in accordance with federal securities regulations.

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

NOTE 5. PORTFOLIO INFORMATION

Purchases and Sales of Securities

For the six months ended June 30, 2016, the cost of purchases and proceeds from sales of securities, excluding short-term obligations, were $77,282,023 and $87,345,839, respectively.

NOTE 6. CAPITAL TRANSACTIONS

During the six months ended June 30, 2016 and year ended December 31, 2015, distributions in the amounts of $4,066,603 and $3,524,229, respectively, were paid in newly issued shares valued at market value or net asset value, but not less than 95% of market value. Such distributions resulted in the issuance of 1,031,240 and 704,565 shares, respectively.

Under the Fund’s Automatic Dividend Reinvestment and Direct Purchase Plan (the “Plan”), shareholders automatically participate and have all their Fund dividends and distributions reinvested. Under the Plan, all dividends and distributions will be reinvested in additional shares of the Fund. Distributions declared payable in cash will be reinvested for the accounts of participants in the Plan in additional shares purchased by the Plan Agent on the open market at prevailing market prices, subject to certain limitations as described more fully in the Plan. Distributions declared payable in shares are paid to participants in the Plan entirely in newly issued full and fractional shares valued at the lower of market value or net asset value per share on the valuation date for the distribution (but not at a discount of more than 5 percent from market price). Dividends and distributions are subject to taxation, whether received in cash or in shares.

NOTE 7. INDEMNIFICATION

In the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims against the Fund. Also, under the Fund’s organizational documents and by contract, the Directors and Officers of the Fund are indemnified against certain liabilities that may arise out of their duties to the Fund. However, based on experience, the Fund expects the risk of loss due to these warranties and indemnities to be minimal.

NOTE 8. DIRECTORS’ FEES

As of June 30, 2016, there were six Directors, five of whom are not “interested persons” of the Fund within the meaning of that term under the 1940 Act (each, an “Independent Director”). The Independent Chairman of the Board receives a quarterly retainer of $8,250; the Independent Audit Chairman receives a quarterly retainer of $5,750; all other Independent Directors receive a quarterly retainer of $4,500. Each Independent Director also receives a meeting fee of $4,500 for attendance in person at a regular scheduled meeting or a special meeting; $4,500 for attendance by telephone at a regular meeting; $1,000 for attendance by telephone for a special meeting; and reimbursement for all reasonable out-of-pocket expenses relating to attendance at meetings. Directors’ fees are allocated between the Fund and the Liberty All-Star® Equity Fund. One-third of the Directors’ fees are equally shared and the remaining two-thirds are allocated based on each Fund’s proportionate share of total net assets. Directors’ fees and expenses accrued by the Fund for the six months ended June 30, 2016 are reported on the Statement of Operations.

| Semi-Annual Report (Unaudited) | June 30, 2016 | 29 |

Liberty All-Star® Growth Fund | Notes to Financial Statements |

June 30, 2016 (Unaudited)

NOTE 9. OTHER MATTERS

Maryland Statutes

By resolution of the Board of Directors, the Fund has opted into the Maryland Control Share Acquisition Act and the Maryland Business Combination Act. In general, the Maryland Control Share Acquisition Act provides that “control shares” of a Maryland corporation acquired in a control share acquisition may not be voted except to the extent approved by shareholders at a meeting by a vote of two-thirds of the votes entitled to be cast on the matter (excluding shares owned by the acquirer and by officers or directors who are employees of the corporation). “Control shares” are voting shares of stock which, if aggregated with all other shares of stock owned by the acquirer or in respect of which the acquirer is able to exercise or direct the exercise of voting power (except solely by virtue of a revocable proxy), would entitle the acquirer to exercise voting power in electing directors within certain statutorily defined ranges (one-tenth but less than one-third, one-third but less than a majority, and more than a majority of the voting power). In general, the Maryland Business Combination Act prohibits an interested shareholder (a shareholder that holds 10% or more of the voting power of the outstanding stock of the corporation) of a Maryland corporation from engaging in a business combination (generally defined to include a merger, consolidation, share exchange, sale of a substantial amount of assets, a transfer of the corporation’s securities and similar transactions to or with the interested shareholder or an entity affiliated with the interested shareholder) with the corporation for a period of five years after the most recent date on which the interested shareholder became an interested shareholder. At the time of adoption, March 19, 2009, the Board and the Fund were not aware of any shareholder that held control shares or that was an interested shareholder under the statutes.

Liberty All-Star® Growth Fund | Board Consideration of the

New Portfolio Management Agreement |

June 30, 2016 (Unaudited)

Board Consideration of the Initial Approval of the Portfolio Management Agreement with Congress Asset Management Company, LLP