UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A INFORMATION |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

CIMETRIX INCORPORATED |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | | |

CIMETRIX INCORPORATED

6979 South High Tech Drive

Salt Lake City, Utah 84047-3757

April 26, 2006

Dear Shareholder:

On behalf of the Board of Directors and management, we cordially invite you to attend the Annual Meeting of Shareholders for Cimetrix Incorporated, which will be held on Saturday, May 20, 2006, at 9:00 a.m. at the Company’s headquarters, located at 6979 South High Tech Drive, Salt Lake City, Utah.

At the meeting, your board is asking you to: (i) elect two directors for a three-year term; (ii) approve the combined amendment and restatement of the 1998 Incentive Stock Option Plan and the Director Stock Option Plan as the 2006 Long-Term Incentive Plan; (iii) ratify the appointment of Tanner LC as the Company’s independent registered public accountants; and (iv) transact such other business as may properly come before the meeting or any adjournment thereof. These proposals are more fully set forth in the accompanying proxy statement, which you are urged to read thoroughly. We will also report on the progress of the Company.

It is important that your shares are represented and voted at the Annual Meeting whether or not you plan to attend. Accordingly, you are requested to sign, date, and mail the enclosed proxy in the envelope provided at your earliest convenience.

| Very truly yours, |

| |

| |

| By: | /s/ Robert H. Reback |

| | Robert H. Reback |

| | President and Chief Executive Officer |

CIMETRIX INCORPORATED

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD MAY 20, 2006

To our Shareholders:

The Annual Meeting of the Shareholders of Cimetrix Incorporated, a Nevada corporation (the “Company”), will be held on Saturday, May 20, 2006, commencing at 9:00 a.m., in the Company’s headquarters located at 6979 South High Tech Drive, Salt Lake City, Utah, to consider and vote on the following matters described in this notice and the accompanying Proxy Statement:

1. To elect two directors to the Company’s Board of Directors for a three-year term.

2. To approve the combined amendment and restatement of the 1998 Incentive Stock Option Plan and the Director Stock Option Plan as the 2006 Long-Term Incentive Plan.

3. To ratify the appointment of Tanner LC as the Company’s independent registered public accountants.

4. To transact such other business as may properly come before the Annual Meeting or any adjournment thereof.

The Board of Directors has fixed the close of business on March 30, 2006, as the record date for determination of shareholders entitled to vote at the Annual Meeting or any adjournments thereof, and only record holders of common stock at the close of business on that day will be entitled to vote. At the record date, 31,927,432 shares of common stock were outstanding.

TO ASSURE YOUR REPRESENTATION AT THE ANNUAL MEETING, SHAREHOLDERS ARE URGED TO SIGN AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE POSTAGE-PREPAID ENVELOPE ENCLOSED FOR THAT PURPOSE. ANY SHAREHOLDER ATTENDING THE ANNUAL MEETING MAY VOTE IN PERSON EVEN IF HE OR SHE PREVIOUSLY RETURNED A PROXY. A PROXY MAY BE REVOKED BY WRITTEN REVOCATION FILED WITH THE SECRETARY OF THE COMPANY AT ANY TIME PRIOR TO THE ANNUAL MEETING.

| By Order of the Board of Directors, |

| |

| |

| By: | /s/ Brian L. Phillips |

April 26, 2006 | | Brian L. Phillips |

Salt Lake City, Utah | | Secretary and Treasurer |

CIMETRIX INCORPORATED

6979 South High Tech Drive

Salt Lake City, Utah 84047-3757

PROXY STATEMENT

INFORMATION CONCERNING SOLICITATION AND VOTING

This Proxy Statement is being mailed to shareholders on or about April 26, 2006 in connection with the solicitation of proxies by the Board of Directors of Cimetrix Incorporated, a Nevada corporation (the “Company” or “Cimetrix”). The proxies are for use at the 2006 Annual Meeting of the Shareholders of the Company, which will be held on Saturday, May 20, 2006, commencing at 9:00 a.m., at the Company’s headquarters, 6979 South High Tech Drive, Salt Lake City, Utah, and at any adjournment thereof (the “Annual Meeting”). The record date for the Annual Meeting is the close of business on March 30, 2006 (the “Record Date”). Only holders of record of the Company’s common stock on the Record Date are entitled to notice of the Annual Meeting and to vote at the Annual Meeting. The Company is making this proxy solicitation.

A proxy card is enclosed. Whether or not you plan to attend the Annual Meeting in person, please sign, date, and return the enclosed proxy card as promptly as possible in the postage-prepaid envelope provided, to ensure that your shares will be voted at the Annual Meeting. Any shareholder who returns a proxy has the power to revoke it by delivering to the Secretary of the Company, at the address set forth above, prior to the Annual Meeting an instrument revoking it or a duly executed proxy bearing a later date, or by attending the Annual Meeting and voting in person.

At the Record Date, there were 31,927,432 shares of the Company’s common stock outstanding, all of which are entitled to be voted at the meeting. No other voting securities of the Company were outstanding at the Record Date. The presence, either in person or by proxy, of persons entitled to vote a majority of the Company’s outstanding common stock is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and broker non-votes are counted for purposes of determining a quorum.

Holders of the common stock have one vote for each share on any matter that may be presented for consideration and action by the shareholders at the Annual Meeting. Generally, in order for action to be taken on any matter, the votes received in favor must exceed the votes against, except for the election of directors. There is no cumulative voting and directors are elected by a plurality vote. The two nominees for director receiving the highest number of votes at the Annual Meeting will be elected. The approval of the combined amendment and restatement of the 1998 Incentive Stock Option Plan and the Director Stock Option Plan as the 2006 Long-Term Incentive Plan and the ratification of Tanner LC as the Company’s independent registered public accountants must be approved by the affirmative vote of the holders of a majority of the votes cast at the Annual Meeting, in person or by proxy, with respect to each of the proposals.

The cost of preparing, assembling, printing and mailing this Proxy Statement and the accompanying form of proxy, and the cost of soliciting proxies relating to the Annual Meeting, will be borne by the Company. The Company may request banks and brokers to solicit their customers who beneficially own common stock listed of record in the names of nominees, and will reimburse such banks and brokers for their reasonable out-of-pocket expenses for such solicitations. The solicitation of proxies by mail may be supplemented by telephone, electronic and personal solicitation by officers, directors and regular employees of the Company, but no additional compensation will be paid for such efforts.

1

Shares of our common stock which are entitled to be voted at the Annual Meeting, and which are represented by properly executed proxies, will be voted in accordance with the instructions indicated on such proxies. If no instructions are indicated, such shares will be voted (i) FOR the election of Robert H. Reback and Scott C. Chandler as directors; (ii) FOR the approval of the Cimetrix Incorporated 2006 Long-Term Incentive Plan; (iii) FOR the ratification of the appointment by the Audit Committee of Tanner LC to be our independent registered public accountants for the year ending December 31, 2006; and (iv) in the discretion of the proxy holders as to any other matters which may properly come before the Annual Meeting and that we did not have notice of a reasonable time prior to mailing this Proxy Statement. We are not currently aware of any other matter that may be presented at the Annual Meeting.

ELECTION OF DIRECTORS

Proposal 1

Election to the Board of Directors

The Nominating Committee of the Board of Directors (“Nominating Committee”) has nominated Robert H. Reback, a director since 2002, and Scott C. Chandler, a director since 2003, for election to the Board of Directors, each for a three-year term. Messrs. Reback and Chandler have consented to being named in the Proxy Statement as nominees for election as directors and have agreed to serve as directors if elected.

Under the Company’s Articles of Incorporation and Bylaws, the directors are divided into three classes. The term of office of one class of directors expires in each year and their successors are elected for terms of three years and until their successors are elected and qualified. There is no cumulative voting for the election of directors. If Messrs. Reback or Chandler should for any reason become unavailable for election, the proxies may be voted for the election of a substitute nominee as the Board of Directors may propose. The accompanying form of proxy contains a discretionary grant of authority with respect to this matter.

Board of Directors

The Board of Directors of the Company is currently comprised of the following individuals:

Name | | Age | | Director

Since | | Expiration of

Current Term | | Expiration of

Term For

Which

Nominated | | Position With

The Company |

| | | | | | | | | | |

Robert H. Reback | | 46 | | 2002 | | 2006 | | 2009 | | President, Chief Executive Officer and Director |

C. Alan Weber | | 54 | | 2003 | | 2007 | | N/A | | Director |

Scott C. Chandler | | 44 | | 2003 | | 2006 | | 2009 | | Director |

Michael B. Thompson | | 53 | | 2004 | | 2008 | | N/A | | Director |

Biographical Information

There is no family relationship among the current directors and executive officers. There is no arrangement or understanding between any director and any other person pursuant to which the director

2

was or is to be selected as a director or nominee. The following sets forth brief biographical information for Messrs. Reback and Chandler, the director nominees, and our other directors.

Robert H. Reback President, Chief Executive Officer and Director has served as a director of the Company since July 2002, and was nominated by the Nominating Committee of the Board of Directors to be included in this year’s proxy statement as a director nominee. Mr.Reback joined Cimetrix as Vice President of Sales in January 1996, was promoted to Executive Vice President of Sales in January, 1997 and was promoted to President on June 25, 2001. Mr. Reback was the District Manager of Fanuc Robotics’ West Coast business unit from 1994 to 1995. From 1985 to 1993, he was Director of Sales/Account Executives for Thesis, Inc., a privately-owned supplier of factory automation software, and was previously a Senior Automation Engineer for Texas Instruments. Mr. Reback has a B.S. degree in Mechanical Engineering and a M.S. degree in Industrial Engineering from Purdue University. Mr. Reback currently serves on the board of directors of a privately-held company.

Scott C. Chandler has served as a director of the Company since May 2003, and was nominated by the Nominating Committee of the Board of Directors to be included in this year’s proxy statement as a director nominee. Since 2002 Mr. Chandler has been Managing Partner for Franklin Court Partners, LLC, a consulting firm designed to help companies develop business plans, raise initial funding, identify and complete mergers and acquisitions, secure additional rounds of financing and complete operational and financial restructuring. From 1998 to 2001, Mr. Chandler was Chief Financial Officer (1998-2000) and Senior Vice President for Global Business Development (2000-2001) for RHYTHMS NetConnections, a leading provider of broadband services utilizing digital subscriber line (DSL) technology. At RHYTHMS, Mr. Chandler was responsible for raising over $2 billion for the company and in 2001 led the financial restructuring of RHYTHMS which resulted in the sale of its assets to MCI. From 1996 to 1998, Mr. Chandler served as President and Chief Executive Officer of C-COR.net, a pioneer in the cable television industry. Under Mr. Chandler’s leadership, C-COR.net’s revenues increased to over $150 million, and it was named by Fortune magazine as one of the 100 fastest-growing public companies. Mr. Chandler earned an M.B.A. from the Wharton School of Business at the University of Pennsylvania, and a B.A from Whitworth College. Mr. Chandler currently serves as a member of the board of directors of several privately held companies.

C. Alan Weber has served as a director of the Company since May 2003. Mr. Weber is the President of Alan Weber and Associates, Inc., a consulting company specializing in semiconductor Advanced Process Control, eDiagnostics, and other related manufacturing systems technologies. Before founding his own company, he was the Vice President/General Manager of the KLA-Tencor Control Solutions Division, which was acquired from ObjectSpace, Inc. in March 2000. While at ObjectSpace, Mr. Weber was responsible for all aspects of the company’s semiconductor manufacturing system business. Before joining ObjectSpace in early 1997, Mr. Weber spent eight years at SEMATECH and was responsible for advanced manufacturing systems and related standards R&D. Prior to this, Mr. Weber spent 16 years at Texas Instruments, managing a variety of technology programs in the semiconductor CAD and industrial automation/control businesses. Mr. Weber has B.A. and M.E.E. degrees in Electrical Engineering from Rice University.

Michael B. Thompson has served as a director of the Company since May 2004. Since January 2006, Mr. Thompson has been the President of ScheduleQ, LLC, a new start-up company focused on solving workforce scheduling problems. From 2003 to 2006 Mr. Thompson served as President, Chief Executive Officer and director of Setpoint Companies, an industry leader in lean automation that fully designs, assembles, tests and delivers automated assembly and test equipment. Mr. Thompson continues to be integrally involved in Setpoint’s business development initiative as VP of Business Development while directly managing ScheduleQ, Setpoint Spectrometers, and Rocky Mountain Testing Solutions. From 1986 to 2003, Mr. Thompson was the Vice President of the Planning and Logistics Solutions Group of Brooks’ software division. Brooks Planning and Logistics Solutions Group’s primary market focus is to provide simulation, scheduling and material handling automation and software controls to the

3

semiconductor and related high technology industries. He was the President of AutoSimulations, Inc., which was acquired by Brooks in January of 2000. Mr. Thompson has been involved with automation, modeling and scheduling manufacturing systems for over 25 years. He holds B.S. and M.S. degrees from the Department of Engineering Sciences and Technology at Brigham Young University. Mr. Thompson has been a pioneer in the field of industrial scheduling and the application of simulation technology to industrial problems. He has authored over 50 papers and articles that have been published in technical magazines and professional journals.

The Board of Directors recommends that the shareholders vote “for” each of the two nominees to the board.

APPROVAL OF THE COMBINED AMENDMENT AND RESTATEMENT

OF THE 1998 INCENTIVE STOCK OPTION PLAN

AND THE DIRECTOR STOCK OPTION PLAN

AS THE 2006 LONG-TERM INCENTIVE PLAN

Proposal 2

At the Annual Meeting, the shareholders will be asked to approve the combined amendment and restatement of the Cimetrix Incorporated 1998 Incentive Stock Option Plan (the “Incentive Stock Option Plan”) and the Cimetrix Incorporated Director Stock Option Plan (the “Director Stock Option Plan”) as the Cimetrix 2006 Long-Term Incentive Plan.

The Incentive Stock Option Plan was originally adopted by the Board of Directors in 1998 and subsequently approved by the shareholders. As amended to date, a total of 5,000,000 shares of the Company’s common stock are authorized for awards under the Incentive Stock Option Plan. As of March 30, 2006, 65,625 shares had been issued upon exercise of options, 4,287,000 shares were subject to outstanding options and 647,375 shares remained available for the grant of future awards. The only type of equity award currently authorized under the Incentive Stock Option Plan is stock options.

The Director Stock Option Plan was originally adopted by the Board of Directors in 1999, and has been thereafter amended from time to time. The Director Stock Option Plan has not previously been approved by the shareholders. A total of 1,250,000 shares of the Company’s common stock are authorized for issuance under the Director Stock Option Plan, of which 1,213,000 shares are subject to outstanding options and 37,000 shares remain available for future grants. No options have been exercised under the Director Stock Option Plan.

On March 9, 2006, the Board of Directors approved the combined amendment and restatement of the Incentive Stock Option Plan and the Director Stock Option Plan as the 2006 Long Term Incentive Plan, subject to the approval of our shareholders. If approved by the shareholders, the 2006 Long Term Incentive Plan will supersede and replace the separate Incentive Stock Option Plan and the Director Stock Option Plan. Approval of the 2006 Long Term Incentive Plan will not increase the number of shares of the Company’s common stock authorized for issuance to employees and directors, but it will provide us with greater flexibility in structuring the terms of the equity incentives we use to attract, retain and motivate employees and directors. In addition to stock options, the 2006 Long Term Incentive Plan authorizes the grant of stock appreciation rights, restricted stock awards, and other stock unit and equity-based performance awards.

If the shareholders approve the proposal, the amended terms of the 2006 Long Term Incentive Plan will become effective on the day of the Annual Meeting. If the shareholders do not approve this proposal, the Incentive Stock Option Plan and the Director Stock Option Plan will remain in effect in accordance with their existing provisions. Notwithstanding the foregoing, any options or other awards

4

that were granted under the Incentive Stock Option Plan and the Director Stock Option Plan shall continue to be governed by, and shall remain subject to the provisions of, the applicable prior plan and the applicable option or award agreement as in effect prior to the effective date of the 2006 Long Term Incentive Plan.

We operate in a challenging and competitive marketplace where our success depends to a great extent on our ability to attract and retain employees of the highest caliber. The Board of Directors of the Company believes that the Company must offer a competitive equity plan if it is to successfully attract and retain the best possible candidates for positions of responsibility. The 2006 Long Term Incentive Plan will provide the Board’s Compensation Committee with a range of incentive tools and sufficient flexibility to permit it to make the most effective use of the shares our shareholders have previously authorized for incentive purposes.

Description of the 2006 Long Term Incentive Plan

The following description summarizes the principal features of the 2006 Long Term Incentive Plan, but is qualified in its entirety by reference to the full text of the 2006 Long Term Incentive Plan as set forth on Appendix A to this Proxy Statement.

Purpose. The purpose of the 2006 Long Term Incentive Plan is to assist the Company and its subsidiaries in attracting and retaining selected individuals to serve as directors, employees, consultants and advisors. The Board of Directors believes that such individuals will contribute to the Company’s success in achieving its long-term objectives, which will inure to the benefit of all shareholders of the Company, through the incentives inherent in the awards granted under the 2006 Long Term Incentive Plan.

Eligibility. All directors, employees, consultants and advisors of the Company and its subsidiaries are eligible to receive awards under the 2006 Long Term Incentive Plan.

Administration. The 2006 Long Term Incentive Plan will be administered by the Compensation Committee of the Board of Directors. The Compensation Committee has the authority to interpret and construe all provisions of the 2006 Long Term Incentive Plan and to make all decisions and determinations relating to the operation of the 2006 Long Term Incentive Plan, including the authority and discretion to: (i) select the individuals to receive stock option grants or other awards; (ii) determine the time or times when stock option grants or other awards will be granted and will vest; and (iii) establish the terms and conditions upon which awards may be exercised.

Duration. The 2006 Long Term Incentive Plan will be effective on the date it is approved by the shareholders of the Company and continue until the tenth anniversary of such approval date. If shareholder approval is not obtained, the 2006 Long Term Incentive Plan will be null and void.

Shares Subject to Plan. Upon shareholder approval, a maximum of 6,250,000 shares of Common Stock will be available for issuance under the 2006 Long Term Incentive Plan. This is the same as the combined amount already available under the Incentive Stock Option Plan and the Director Stock Option Plan. If an award under the 2006 Long Term Incentive Plan is forfeited or is settled in cash, the subject shares shall again be available for grant under the 2006 Long Term Incentive Plan. In the event the outstanding shares of Common Stock are increased, decreased, changed into, or exchanged for a different number or kind of shares or securities through reorganization, merger, recapitalization, reclassification, stock split, reverse stock split or similar transaction (a “Recapitalization”), the maximum number of shares available for issuance under the 2006 Long Term Incentive Plan will be proportionately adjusted.

5

Awards Under the 2006 Long Term Incentive Plan

The 2006 Long Term Incentive Plan provides for the following types of awards (“Awards”): (i) stock options; (ii) stock appreciation rights; (iii) restricted stock; (iv) restricted stock units; and (v) performance awards.

Stock Options. The Compensation Committee may from time to time award options to any participant. Stock options give the holder the right to purchase shares of Common Stock within a specified time at a specified price. Two types of stock options may be granted under the 2006 Long Term Incentive Plan: incentive stock options, or “ISOs,” which are subject to special tax treatment as described below, and non-statutory options, or “NSOs.” Eligibility for ISOs is limited to employees of the Company and its subsidiaries. The exercise price of an option cannot be less than the fair market value of a share of Common Stock at the time of grant. The expiration dates of options cannot be more than ten years after the date of the original grant. Prior to the issuance of shares upon the exercise of an option, no right to vote or receive dividends or any other rights as a shareholder will exist with respect to the underlying shares.

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights under the 2006 Long Term Incentive Plan. A stock appreciation right entitles the holder, upon exercise, to receive an amount in cash, shares of Common Stock, other property, or a combination thereof (as determined by the Compensation Committee), computed by reference to appreciation in the value of the Common Stock. The exercise price of a stock appreciation right cannot be less than the fair market value of a share of Common Stock at the time of grant. The expiration dates of stock appreciation rights cannot be more than ten years after the date of the original grant. Prior to the issuance of shares upon the exercise of a stock appreciation right, no right to vote or receive dividends or any other rights as a shareholder will exist with respect to the underlying shares.

Restricted Stock. The Compensation Committee may grant restricted shares of Common Stock to such persons, in such amounts, and subject to such terms and conditions (including the attainment of performance criteria) as the Compensation Committee shall determine in its discretion. Awards of restricted shares of Common Stock may be made in exchange for services or other lawful consideration. Generally, awards of restricted shares of Common Stock are subject to the requirement that the shares be forfeited to the Company unless specified conditions are met. Except for certain limited situations, grants of restricted shares of Common Stock will have a vesting period of not less than three years. Subject to these restrictions, conditions and forfeiture provisions, any recipient of an award of restricted stock will have all the rights of a shareholder of the Company, including the right to vote the shares, at the time of the grant of the award.

Restricted Stock Units. The Compensation Committee may grant units having a value equal to an identical number of shares of Common Stock to such persons, in such amounts, and subject to such terms and conditions (including the attainment of performance criteria) as the Compensation Committee shall determine in its discretion. If the requirements specified by the Compensation Committee are met, the grantee of such units will receive shares of Common Stock, cash, other property, or any combination thereof, equal to the fair market value of the corresponding number of shares of Common Stock.

Performance Awards. The Compensation Committee may also make awards of performance shares or performance units subject to the satisfaction of specified performance criteria. Performance awards may be paid in shares of Common Stock, cash, other property, or any combination thereof. The performance criteria governing performance awards may based upon one or any combination of the

6

following: net sales; revenue; revenue growth; operating income; pre- or after-tax income (before or after allocation of corporate overhead and bonus); net earnings; earnings per share; net income; division, group or corporate financial goals; return on equity; total shareholder return; return on assets or net assets; attainment of strategic and operational initiatives; appreciation in and/or maintenance of the price of the Common Stock or any other publicly-traded securities of the Company; market share; gross profits; earnings (including earnings before taxes, earnings before interest and taxes or earnings before interest, taxes, depreciation and amortization); economic value-added models; comparisons with various stock market indices; reductions in costs; cash flow (before or after dividends) cash flow per share (before or after dividends); return on capital (including return on total capital or return on invested capital; cash flow return on investment; improvement in or attainment of expense levels or working capital levels; cash margins; or revenue per employee.

Limitations on Grants

Subject to adjustment for a Recapitalization, no executive officer who is a 2006 Long Term Incentive Plan participant may be granted an award during any tax year with respect to more than 1,000,000 shares of common stock.

General Provisions

Unless authorized by the Compensation Committee in the agreement evidencing an Award granted under the 2006 Long Term Incentive Plan, Awards may not be transferred other than by will or the laws of descent and distribution, and may be exercised during the participant’s lifetime only by the participant or the participant’s guardian or legal representative. The Board of Directors may, from time to time, alter, amend, suspend or terminate the 2006 Long Term Incentive Plan. No grants may be made under the plan following the date of termination, although grants made prior to that date may remain outstanding following the termination of the 2006 Long Term Incentive Plan until their scheduled expiration date.

Certain Federal Income Tax Consequences

Tax Consequences to Participants

The following is a brief summary of certain of United States federal income tax consequences relating to awards under the 2006 Long Term Incentive Plan. This summary is not intended to be complete and does not describe state, local, foreign, or other tax consequences. The tax information summarized is not tax advice.

Nonqualified Stock Options (“NSOs”). In general, (i) no income will be recognized by an optionee at the time an NSO is granted; (ii) at the time of exercise of an NSO, ordinary income will be recognized by the optionee in an amount equal to the difference between the option price paid for the shares of Common Stock and the fair market value of the shares, if unrestricted, on the date of exercise; and (iii) at the time of sale of shares of Common Stock acquired pursuant to the exercise of an NSO, appreciation (or depreciation) in value of the shares after the date of exercise will be treated as either short-term or long-term capital gain (or loss) depending on how long the shares have been held.

Incentive Stock Options (“ISOs”). No income will be recognized by an optionee upon the grant of an ISO. In general, no income will be recognized upon the exercise of an ISO. However, the difference between the option price paid and the fair market value of the shares at exercise may constitute a preference item for the alternative minimum tax. If shares of Common Stock are issued to the optionee

7

pursuant to the exercise of an ISO, and if no disqualifying disposition of such shares is made by such optionee within two years after the date of the grant or within one year after the transfer of such shares to the optionee, then upon sale of such shares, any amount realized in excess of the option price will be taxed to the optionee as a long-term capital gain and any loss sustained will be a long-term capital loss.

If shares of Common Stock acquired upon the timely exercise of an ISO are disposed of prior to the expiration of either holding period described above, the optionee generally will recognize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of such shares at the time of exercise (or, if less, the amount realized on the disposition of such shares if a sale or exchange) over the option price paid for such shares. Any further gain (or loss) realized by the participant generally will be taxed as short-term or long-term capital gain (or loss) depending on the holding period.

Stock Appreciation Rights. No income will be recognized by a participant in connection with the grant of a stock appreciation right. When the stock appreciation right is exercised, the participant normally will be required to include as taxable ordinary income in the year of exercise an amount equal to the amount of cash received and the fair market value of any unrestricted shares of Common Stock or other property received on the exercise.

Restricted Stock. The recipient of restricted shares of Common Stock generally will not be subject to tax until the shares are no longer subject to forfeiture or restrictions on transfer for purposes of Section 83 of the Code (the “Restrictions”). At such time the recipient will be subject to tax at ordinary income rates on the fair market value of the restricted shares (reduced by any amount paid by the participant for such restricted shares). However, a recipient who so elects under Section 83(b) of the Code within 30 days of the date of transfer of the shares will have taxable ordinary income on the date of transfer of the shares equal to the excess of the fair market value of such shares (determined without regard to the Restrictions) over the purchase price, if any, of such restricted shares. Any appreciation (or depreciation) realized upon a later disposition of such shares will be treated as long-term or short-term capital gain (or loss) depending upon how long the shares have been held. If a Section 83(b) election has not been made, any dividends received with respect to restricted shares that are subject to the restrictions generally will be treated as compensation that is taxable as ordinary income to the participant.

Restricted Stock Units. Generally, no income will be recognized upon the award of restricted stock units. The recipient of a restricted stock unit award generally will be subject to tax at ordinary income rates on any cash received and the fair market value of any unrestricted shares of Common Stock or other property on the date that such amounts are transferred to the participant under the award (reduced by any amount paid by the participant for such restricted stock units).

Performance Awards. No income generally will be recognized upon the grant of a performance award. Upon payment in respect of a performance award, the recipient generally will be required to include as taxable ordinary income in the year of receipt an amount equal to the amount of cash received and the fair market value of any nonrestricted shares of Common Stock or other property received.

Tax Consequences to the Company

To the extent that a participant recognizes ordinary income in the circumstances described above, the Company or the subsidiary for which the participant performs services will be entitled to a corresponding deduction provided that, among other things, (i) the income meets the test of reasonableness, (ii) is an ordinary and necessary business expense, (iii) is not an “excess parachute payment” within the meaning of Section 280G of the Code, and (iv) is not disallowed by the $1 million limitation on certain executive compensation under Section 162(m) of the Code.

8

Value of Benefits

The Company is unable to determine the amount of benefits that may be received by participants under the 2006 Long Term Incentive Plan if adopted, as grants of awards are discretionary with the Compensation Committee.

Certain Interests of Directors

In considering the recommendation of the Board of Directors with respect to the 2006 Long Term Incentive Plan, shareholders should be aware that the members of the Board of Directors have certain interests, which may present them with conflicts of interest in connection with such proposal. As discussed above, directors are eligible to receive awards under the 2006 Long Term Incentive Plan. The Board of Directors recognizes that adoption of the 2006 Long Term Incentive Plan may benefit the Company’s directors and their successors, but believes that approval of the 2006 Long Term Incentive Plan will advance the Company’s interests and the interests of its shareholders by encouraging directors, employees, consultants and advisors to make significant contributions to the Company’s long-term success.

The Board of Directors believes that the 2006 Long Term Incentive Plan will serve a critical role in attracting and retaining the high caliber employees, directors and consultants essential to our success and in motivating these individuals to strive to meet our goals.

The Board of Directors believes the 2006 Long Term Incentive Plan is in the best interests of the Company, and therefore unanimously recommends that the shareholders vote “for” approval of the 2006 Long Term Incentive Plan.

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTANTS

Proposal 3

The Audit Committee has selected the firm of Tanner LC, certified public accountants, to serve as the Company’s independent registered public accountants for the fiscal year ending December 31, 2006. Tanner LC has audited the Company’s consolidated financial statements since the fiscal year ended December 31, 1997. Representatives from the firm are expected to be present at the Annual Meeting of Shareholders, where they will have an opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions.

The Board of Directors recommends that the shareholders vote “for” ratification of the appointment of Tanner LC as the Company’s independent registered public accountants for fiscal year 2006.

9

The following schedule presents the professional fees paid to Tanner LC, the Company’s independent registered public accountants, for the years ended December 31, 2005 and 2004.

| | 2005 | | 2004 | |

| | | | | |

Audit fees | | $ | 131,331 | | $ | 58,470 | |

Audit-related fees | | 200 | | 2,000 | |

Tax fees | | 6,670 | | 6,600 | |

Other fees | | — | | — | |

| | | | | |

Total | | $ | 138,201 | | $ | 67,340 | |

Audit fees consist of fees for the audit of the Company’s annual consolidated financial statements included in the Company’s report on Form 10-K, the review of the consolidated interim financial statements included in Forms 10-Q, and services in connection with the Company’s various statutory and regulatory filings.

Audit related fees relate to the review of proposed SEC filings, the review of a private placement memorandum, and the fees for EDGAR preparation and filing of regulatory filings.

Tax fees relate to the preparation of the Company’s federal and state income tax returns.

Our Audit Committee has determined that the above non-audit services provided to us by Tanner LC do not impair Tanner LC’s independence as the independent registered public accountants auditing our consolidated financial statements.

BOARD MEETINGS AND COMMITTEES

Board Meetings

The Company’s Board of Directors met six times during 2005. Each of the Company’s directors attended at least 75% of the meetings of the Board of Directors and of the meetings of each of the committees on which they served during 2005.

Board Committees

The Board of Directors currently has standing audit, compensation and nominating committees. No separate compensation is paid for committee attendance or assignments.

The Audit Committee currently consists of three independent directors, Scott C. Chandler, C. Alan Weber and Michael B. Thompson, and held three meetings during 2005. Each member of the audit committee is considered independent as defined by the New York Stock Exchange. The report of the Audit Committee is included below. The Board of Directors has determined that Scott Chandler, chairman of the Audit Committee, is an audit committee financial expert, as that term is defined under the Exchange Act.

The Compensation Committee currently consists of Scott C. Chandler, C. Alan Weber and Michael B. Thompson, and held two meetings during 2005. All members of the committee are

10

independent as defined by the New York Stock Exchange. The report of the Compensation Committee is included below.

The Nominating Committee held one meeting during 2005. The Nominating Committee currently consists of Scott C. Chandler, C. Alan Weber and Michael B. Thompson, who are considered independent as defined by the New York Stock Exchange. Functions of the Nominating Committee include identification of qualified individuals to serve as members of the Board of Directors, recommendation to the Board of Directors of a slate of nominees for election at each annual meeting of shareholders, recommendation to the Board of Directors concerning the appropriate size, function, needs and composition of the Board and its committees, and advising the Board of Directors on other corporate governance matters. The Nominating Committee will consider nominations from shareholders of individuals to serve as members of the Board of Directors to be elected at the Company’s annual meeting to be held in 2007 if such nominations are received by the Nominating Committee no later than January 1, 2007, and if the nominees meet the criteria set by the Nominating Committee for individuals to serve on the Board of Directors.

Audit Committee Report

The Audit Committee has met with management and discussed the Company’s internal controls, the quality of the Company’s financial reporting, and the results of the audit of the Company’s consolidated financial statements. In addition, the Audit Committee has met with the Company’s independent registered public accountants, Tanner LC, and discussed all matters required to be discussed by the independent registered public accountants with the Audit Committee under Statement on Auditing Standards No. 61 (communication with audit committees). The Audit Committee received and discussed with the independent registered public accountants their annual written report on their independence from the Company and its management, which is made under Independence Standards Board Standard No. 1 (independence discussions with audit committees), and considered whether the other non-audit services provided by the independent registered public accountants potentially impaired their independence and determined that it did not.

In performing these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which is responsible for the integrity of the Company’s internal controls and its financial statements and reports, and the Company’s independent registered public accountants, who are responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States), and for issuing a report on these consolidated financial statements.

Based upon the reviews and discussions described above, the Audit Committee recommended to the Board of Directors that the consolidated audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2005, for filing with the Securities and Exchange Commission. In addition, the Audit Committee selected Tanner LC as the independent registered public accountants for the Company for the year ending December 31, 2006.

Respectfully submitted,

Scott C. Chandler

C. Alan Weber

Michael B. Thompson

11

Compensation Committee Report

Decisions regarding executive compensation are made by the Company’s Compensation Committee. The Compensation Committee’s compensation philosophy for officers conforms to the Company’s compensation philosophy for all employees generally. The Company’s compensation is designed to:

• Provide compensation comparable to that offered by companies engaged in similar businesses, allowing the Company to successfully attract and retain the employees necessary to its long-term success.

• Provide compensation that rewards individual achievement and differentiates among employees based upon individual performance.

• Provide incentive compensation that varies according to both the Company’s success in achieving its performance goals and the employee’s contribution to that success; and

• Provide an appropriate linkage between employee compensation and the creation of shareholder value through awards that are tied to the Company’s financial performance and by facilitating employee stock ownership.

In furtherance of these goals, the Company’s officers’ compensation is comprised of salary, annual cash bonuses, long-term incentive compensation in the form of stock options and various fringe benefits, including medical benefits, a 401(k) savings plan, and a car allowance.

Annual Compensation

Base Salary

The Compensation Committee reviewed the salaries of all the officers of the Company for fiscal year 2005. Salary decisions concerning the officers were based upon a variety of considerations consistent with the compensation philosophy stated above. First, salaries were competitively set relative to both other companies in the software industry and other comparable companies. Second, the Compensation Committee considered each officer’s level of responsibility and individual performance, including an assessment of the person’s overall value to the Company. Third, internal equity among employees was factored into the decision. Finally, the Compensation Committee considered the Company’s financial performance and its ability to absorb any increases in salaries.

Annual Incentive Bonuses

Each officer is eligible to receive an annual cash bonus that is generally paid pursuant to an incentive compensation formula established at the beginning of a year in connection with the preparation of the Company’s operating budget for the year. In formulating decisions with respect to cash bonus awards, the Compensation Committee evaluates each officer’s role and responsibility in the Company and other factors that the Committee deems relevant to motivate each officer to achieve strategic performance goals.

Stock Options

The Company has a stock option plan (currently the 1998 Incentive Stock Option Plan) that is designed to align the interests of the shareholders and the Company’s officers in the enhancement of shareholder value. Stock options are granted under the plan by the Board of Directors, after approval of

12

the option grants by the Compensation Committee. Stock options are granted at an exercise price not lower than the fair market value of the Company’s common stock on the date of grant. In making decisions regarding the stock option plan, the Compensation Committee evaluates the Company’s overall financial performance for the year, the desirability of long-term service from an officer and the number of stock options held by other officers in the Company who have the same, more or less responsibility. To encourage long-term performance, the stock options granted under the plan generally vest ratably over a four-year period and expire five years after the date of grant.

As described in Proposal 2, the 1998 Incentive Stock Option Plan is proposed to be amended and included in the 2006 Long Term Incentive Plan. Approval of the 2006 Long Term Incentive Plan will not increase the number of shares of the Company’s common stock currently authorized for issuance to employees and directors under the 1998 Plan and the Director Stock Option Plan, but it will provide the Compensation Committee with greater flexibility in structuring the terms of the equity incentives we use to attract, retain and motivate employees and directors. In addition to stock options, the 2006 Long Term Incentive Plan authorizes the grant of stock appreciation rights, restricted stock awards, and other stock unit and equity-based performance awards. It is anticipated that the Compensation Committee will make use of this greater flexibility by granting awards to participants other than stock options.

Compensation of Chief Executive Officer

Since June 2001, Robert H. Reback has been the President and Chief Executive Officer of the Company. Compensation for Mr. Reback for fiscal year 2005 was based upon the compensation philosophy stated above. During 2005, Mr. Reback received a base annual salary amount of $175,000. Mr. Reback was also eligible to receive an annual cash bonus based upon the compensation philosophy regarding bonuses stated above. Mr. Reback received a bonus of $47,572 in fiscal year 2005.

Mr. Reback is eligible to participate in the Company’s long-term incentive programs. During fiscal year 2005, Mr. Reback was granted options to purchase 125,000 shares of common stock. During fiscal year 2004, Mr. Reback was granted options to purchase 150,000 shares of common stock. In fiscal year 2003, Mr. Reback received options to purchase 300,000 shares of the Company’s common stock. The total compensation for Mr. Reback for fiscal years 2005, 2004 and 2003 is disclosed in the “Summary Compensation Table” below, and consisted primarily of salary, bonus and stock options.

| Respectfully submitted, |

| |

| C. Alan Weber |

| Scott C. Chandler |

| Michael B. Thompson |

EXECUTIVE OFFICERS

The following table sets forth certain biographical information with respect to the executive officers of the Company:

Name | | Age | | Title |

| | | | |

Robert H. Reback | | 46 | | President and Chief Executive Officer |

David P. Faulkner | | 50 | | Executive Vice President of Sales and Marketing |

Michael D. Feaster | | 35 | | Executive Vice President of Research and Development |

Kourosh Vahdani | | 44 | | Vice President of Global Services |

Dennis P. Gauger | | 54 | | Chief Financial Officer |

13

Each officer serves at the discretion of the Board of Directors. There is no arrangement or understanding between any officer and any other person pursuant to which the officer was or is to be selected as an officer or nominee. There are no family relationships between any of the officers and/or between any of the officers and directors.

David P. Faulkner joined the Company in August 1996. Mr. Faulkner was previously employed as the Manager of PLC Marketing, Manager of Automotive Operations and District Sales Manager for GE Fanuc Automation, a global supplier of factory automation computer equipment specializing in programmable logic controllers, factory software and computer numerical controls from 1986 to 1996. Mr. Faulkner has a B.S. degree in Electrical Engineering and an MBA degree from Rensselaer Polytechnic Institute.

Michael D. Feaster joined Cimetrix as Director of Customer Services in April 1998, was promoted to Vice President of Software Development in December 1998 and was promoted to Executive Vice President of Research and Development in December 2004. From 1994 to 1998, Mr. Feaster was employed at Century Software, Inc., as the Vice President of Software Development. During that time, Century Software, Inc. was a global supplier of PC to UNIX connectivity software, specializing in internet access of Windows to legacy mission critical applications. From 1988 to 1994, he served as a software engineer contractor/subcontractor for such companies as Fidelity Investments, IAT, Inc., NASA, and Mexican Border Inspection Division. Mr. Feaster attended Southwest Missouri University from 1987 to 1990.

Kourosh Vahdani joined Cimetrix as Vice-President of Global Services in December 2004. Prior to joining Cimetrix, Mr. Vahdani was a Senior Consultant performing contract services for Xilinx, Inc. during 2004. From 1996 to 2003, he was Director of Western Operations for TRW, Inc. Manufacturing Solutions, with responsibility for the systems integration business serving semiconductor manufacturers worldwide. From 1987 to 1996, Mr. Vahdani worked for Advanced Micro Devices in a variety of engineering and management positions associated with factory automation. Mr. Vahdani has a B.S. degree in Computer Sciences from St. Edwards University in Austin, Texas.

Dennis P. Gauger joined Cimetrix as Chief Financial Officer in April 2004. Mr. Gauger is a licensed Certified Public Accountant in Utah and Nevada, and serves on a part-time, consulting basis. Over the past seven years, he has served several public and private companies in a variety of industries as a part-time, contract financial executive, corporate troubleshooter and consultant. Previously, Mr. Gauger worked for Deloitte & Touche LLP, an international accounting and consulting firm, for 22 years, including 9 years as an accounting and auditing partner, where he directed domestic and international firm interactions with senior executive management, audit committees, and boards of directors. He has a background in SEC accounting and reporting, mergers and acquisitions, technical accounting issues, financing and operations. Mr. Gauger holds a B.S. degree in Accounting from Brigham Young University. He is a member of the American Institute of Certified Public Accountants and the Utah Association of Certified Public Accountants.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Director Compensation

Beginning in June 2006 each external director will receive $750 for attending a board meeting in person and $350 for attending via telephone, plus reimbursement for expenses. Prior to June 2006 directors of the Company received no cash compensation, but were only reimbursed for expenses. Each director has been granted stock options to purchase shares of common stock at an exercise price per share equal to or in excess of 110% of the market price at the time of grant. Options vest immediately and

14

become exercisable at a pro rata amount each month during the year, such that 100% of the options become exercisable within one year after the date of grant. The following table summarizes the options held by each of the Company’s directors.

Name | | Exercise Price

$ 0.35 (1) | | Exercise

Price $ 0.36 (2) | | Exercise

Price $ 0.50 (3) | |

| | | | | | | |

Current Directors: | | | | | | | |

Scott C. Chandler | | 50,000 | | 50,000 | | 50,000 | |

C. Alan Weber | | 50,000 | | 50,000 | | 50,000 | |

Michael B. Thompson | | | | 50,000 | | 50,000 | |

(1) Messrs. Chandler and Weber were granted 50,000 options in August 2003 at an exercise price of $0.35 per share, expiring in August 2008.

(2) All options exercisable at $0.36 per share were granted in May 2004 and expire in May 2009.

(3) All options exercisable at $0.50 per share were granted in June 2005 and expire in June 2010.

15

EXECUTIVE OFFICERS

Executive Officer Compensation

The following table discloses compensation, for the three fiscal years ended December 31, 2005, 2004 and 2003, respectively, paid by the Company to the named executive officers whose annual compensation equals or exceeds $100,000 (collectively the “Named Executive Officers”).

| | | | | | | | | | Long-Term Compensation | |

| | | | | | | | | | | | | | Payouts | |

| | | | | | | | | | Awards | | Long-Term | | | |

| | | | | | | | | | Restricted | | Securities | | Incentive | | All | |

| | Annual Compensation | | Stock | | Underlying | | Plan | | Other | |

Name and Position | | Year | | Salary | | Bonus | | Other | | Awards | | Options | | Payouts | | Compensation | |

| | | | ($) | | ($) | | ($) | | ($) | | (#) | | ($) | | ($) | |

| | | | | | | | | | | | | | | | | |

Robert H. Reback | | 2005 | | 175,000 | | 47,572 | | — | | — | | 125,000 | | — | | 11,003 | (1) |

President and Chief | | 2004 | | 175,000 | | 30,000 | | — | | — | | 150,000 | | — | | 10,334 | (1) |

Executive Officer | | 2003 | | 154,327 | | 8,000 | | — | | — | | 300,000 | | — | | 10,334 | (1) |

| | | | | | | | | | | | | | | | | |

David P. Faulkner | | 2005 | | 150,000 | | 65,571 | | — | | — | | 100,000 | | — | | 10,003 | (2) |

Executive Vice President | | 2004 | | 150,000 | | 20,483 | | — | | — | | 100,000 | | — | | 9,918 | (2) |

of Sales and Marketing | | 2003 | | 150,000 | | 5,074 | | — | | — | | 250,000 | | — | | 10,054 | (2) |

| | | | | | | | | | | | | | | | | |

Michael D. Feaster | | 2005 | | 150,000 | | 39,501 | | — | | — | | 100,000 | | — | | 6,903 | (3) |

Executive Vice President | | 2004 | | 150,000 | | 20,000 | | — | | — | | 100,000 | | — | | 5,018 | (3) |

of Research and | | 2003 | | 133,333 | | 5,074 | | — | | — | | 250,000 | | — | | 6,012 | (3) |

Development | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Kourosh Vahdani | | 2005 | | 150,000 | | — | | | | — | | — | | — | | 6,903 | (4) |

Vice President | | 2004 | | 8,253 | | — | | | | — | | 250,000 | | — | | — | (4) |

of Global Services | | | | | | | | | | | | | | | | | |

(1) For the years 2005, 2004 and 2003, respectively, this amount includes matching contributions of $3,500, $2,916 and $2,720 to the Company’s 401(k) plan, payments of $903, $818 and $1,014 for term life insurance premiums, and $6,600 each year for an automobile allowance.

(2) For the years 2005, 2004 and 2003, respectively, this amount includes matching contributions of $2,500, $2,500 and $2,440 to the Company’s 401(k) plan, payments of $903, $818 and $1,014 for term life insurance premiums, and $6,600 each year for an automobile allowance.

(3) For the years 2005, 2004 and 2003, respectively, this amount includes matching contributions of $0, $0 and $852 to the Company’s 401(k) plan, payments of $903, $818 and $960 for term life insurance premiums, and $6,000, $4,200 and $4,200 for an automobile allowance.

(4) For 2005, this amount includes $903 for term life insurance premiums and $6,000 for an automobile allowance. Mr. Vahdani joined the Company in December 2004.

16

OPTION GRANTS IN LAST FISCAL YEAR

The following table sets forth certain information regarding the grant of stock options to the persons named in the Summary Compensation Table during the fiscal year ended December 31, 2005.

| | Individual Grants | | Potential Realizable

Value at Assumed

Annual Rate of | |

| | Number of | | Percent of | | | | | | Stock | |

| | Securities | | Total Options | | | | | | Price Appreciation | |

| | Underlying | | Granted to | | Exercise | | | | for | |

| | Options | | Employees in | | Price Per | | Expiration | | Option Term ($ ) (1) | |

Name | | Granted (#) | | Fiscal Year | | Share ($ ) | | Date | | 5% | | 10% | |

| | | | | | | | | | | | | |

Robert H. Reback | | 125,000 | | 23 | % | $ | 0.61 | | 3/14/2010 | | $ | 97,316 | | $ | 122,801 | |

David P. Faulkner | | 100,000 | | 18 | % | $ | 0.61 | | 3/14/2010 | | $ | 77,853 | | $ | 98,241 | |

Michael D. Feaster | | 100,000 | | 18 | % | $ | 0.61 | | 3/14/2010 | | $ | 77,853 | | $ | 98,241 | |

(1) Potential realizable value is based on the assumption that the common stock of the Company appreciates at the annual rate shown (compounded annually) from the date of grant until the expiration of the five year option term, using the market price on the date of the grant, which was $0.61, as the beginning value. The real value of the options depends on the actual appreciation of the value of the Company’s common stock. These numbers do not reflect the Company’s estimates of future stock price growth and no assurance exists that the price of the Company’s common stock will appreciate at the rates assumed in the table.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

| | Shares

Acquired

on

Exercise | | Value

Realized | | Number of Securities

Underlying Unexercised

Options at Fiscal

Year-End (#) | | Value of Unexercised

In-the-Money Options at

Fiscal Year-End ($ ) (1) | |

Name | | (#) | | ($ ) | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Robert H. Reback | | 0 | | 0 | | 837,500 | | 387,500 | | 0 | | 0 | |

David P. Faulkner | | 0 | | 0 | | 650,000 | | 300,000 | | 0 | | 0 | |

Michael D. Feaster | | 0 | | 0 | | 450,000 | | 300,000 | | 0 | | 0 | |

Kourosh Vahdani | | 0 | | 0 | | 62,500 | | 187,500 | | 0 | | 0 | |

(1) Closing market value per share of the Company’s common stock at December 31, 2005, of $0.34, minus the respective exercise prices of $0.35, $0.61, $1.00, or $3.00.

17

LONG-TERM INCENTIVE PLANS - AWARDS IN LAST FISCAL YEAR

The table titled “Long-Term Incentive Plans - Awards in Last Fiscal Year” has been omitted because there were no long-term incentive plan awards during the year ended December 31, 2005, to either the Company’s Executive Officers or Directors.

EMPLOYMENT AGREEMENTS

President and Chief Executive Officer

The Company has an employment agreement with Robert H. Reback, its President and Chief Executive Officer, that expires December 31, 2007. Under the terms of the agreement, Mr. Reback receives an annual salary of $175,000, subject to increases as the Board of Directors determines in its discretion. In addition, Mr. Reback is eligible to receive a cash bonus at the end of each fiscal year, upon the satisfaction of the performance objectives determined by the Board of Directors on an annual basis. Mr. Reback is also eligible to participate in the Company’s stock option and other compensation plans, with annual option awards determined by the Compensation Committee of the Board of Directors. In addition, the employment agreement provides that Mr. Reback cannot compete with the Company during the term of the agreement and for a period of two years thereafter.

For fiscal 2006, the agreement provides for Mr. Reback to receive options to acquire 325,000 shares of the Company’s common stock at an exercise price of $0.45 per share, the closing price as of the date of grant. The options vest annually in three equal amounts on December 31, 2006, 2007 and 2008. In addition, subject to approval of the 2006 Long-Term Incentive Plan by the shareholders, Mr. Reback will receive a restricted award of 325,000 shares that will vest with respect to the right to acquire 108,000 shares on December 31, 2006 and 2007, and with respect to the right to acquire 109,000 shares on December 31, 2008. If, prior to December 31, 2007, the price of the Company’s common stock closes above $0.80 per share for 30 consecutive trading days, 54,000 restricted shares that would have otherwise vested on December 31, 2007, will immediately vest. If, at any time prior to December 31, 2008, the Company’s common stock closes above $1.50 per share for 30 consecutive trading days, 55,000 restricted shares that would otherwise vest on December 31, 2008, will immediately vest.

The agreement further provides for severance pay equal to Mr. Reback’s annual salary then in effect, but not more than the salary left to be paid during the remainder of the agreement, if Mr. Reback is terminated without cause by the Company or resigns for “good reason” (as such terms are defined in the agreement) and, in such events, all of Mr. Reback’s options under the Company’s stock option plan become fully exercisable for their remaining term. If a change in control of the Company occurs, Mr. Reback is also entitled to accelerated vesting of his option and other awards under the Company’s compensation plans.

Other Executive Officers

The Compensation Committee of the Board of Directors is currently in the process of reviewing and amending the employment agreements of Mr. Faulkner, Feaster and Vahdani.

Dennis P. Gauger, Chief Financial Officer, serves the Company on a part-time, contract basis. The Company has an agreement with Mr. Gauger for a term ending April 16, 2007, which provides monthly compensation of $3,500. Additional services will be billed to the Company at a rate of $80 per

18

hour. Pursuant to such agreement, Mr. Gauger received options to acquire 35,000 shares of the Company’s common stock in 2005 at an exercise price of $0.46 per share and options to purchase 35,000 shares of the Company’s common stock with an exercise price of $0.35 per share in 2004. Mr. Gauger will receive a restrictive award of 20,000 shares in the event that the 2006 Long-Term Incentive Plan is approved by the shareholders. In the event that the 2006 Long-Term Incentive Plan is not approved by the shareholders, Mr. Gauger will receive an additional grant of options to acquire 40,000 shares at a price equal to the closing price of the common stock on the date of grant. All options and restricted stock awards granted to Mr. Gauger under the agreement vest at a rate of 25% every three months.

BOARD OF DIRECTORS INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee, consisting of Scott C. Chandler, C. Alan Weber, and Michael B. Thompson, each of whom is an independent director, reviewed and approved the compensation and fringe benefits for the Company’s officers. The Compensation Committee evaluates the performance of all officers and administers the Company’s compensation program for its officers on behalf of the Board of Directors. There are no relationships that are considered interlocks.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

There are no matters to report under this item for the year ended December 31, 2005.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors and greater than 10% shareholders to file reports of ownership and periodic changes in ownership of the Company’s common stock with the Securities and Exchange Commission. These reports are made on Forms 3, 4, and 5. Such persons are also required to furnish the Company with copies of all Section 16(a) reports they file.

Based solely on its review of the copies of Forms 3, 4, and 5 received with respect to fiscal year 2005, or written representations from certain reporting persons, the Company believes that all filing requirements applicable to its directors, officers and greater than 10% beneficial owners were complied with other than reports with respect to stock option grants to Dennis P. Gauger in May 2005. These reports were subsequently filed in April 2006.

19

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to beneficial ownership of the Company’s common stock (inclusive of options and warrants), as of March 31, 2006, for each beneficial owner of more than 5% of the Company’s common stock that is known to the Company:

Name and Address | | Number of Shares

of Common Stock | | Percent of

Ownership | |

| | | | | |

Tsunami Network Partners Corporation (1) | | 2,724,911 | | 8.53 | % |

Securities and Exchange Commission v. Paul A. Bilzerian, et al.,

Civil Action 89-1854 (SSH) Receivership Estate (2) (3) | | 2,108,821 | | 6.61 | % |

1994 Bilzerian Irrevocable Trust (2) (3) | | 1,648,500 | | 5.16 | % |

(1) The address for Tsunami Network Partners Corporation is c/o Tsunami Network Partners Corporation 3-6-1-Shin-Yokohama,Kouhoku-Ku, Yokohama-City, Kanagawa Japan 222-0033.

(2) Under the terms of the Final Judgment by Consent Against Terri L. Steffen, Overseas Holding Limited Partnership, Overseas Holding Co., Bicoastal Holding Co., The Paul A. Bilzerian and Terri L. Steffen 1994 Irrevocable Trust, Loving Spirit Foundation and Puma Foundation, Civil Action No. 89-1854 (RCL), dated January 16, 2002, Judge Royce C. Lamberth of the United States District Court for the District of Columbia ordered that such shares be subject to an irrevocable proxy in favor of the court appointed receiver who is Deborah R. Meshulan of the Washington, D.C. law firm of Piper Marbury Rudnick & Wolfe LLP until such shares are disposed of in an arms-length transaction. The legal name of the 1994 trust is “The Paul A. Bilzerian and Terri L. Steffen 1994 Irrevocable Trust for the benefit of Adam J. Bilzerian and Dan B. Bilzerian.”

(3) The address for the Receivership Estate is Piper Murbury Rudnick & Wolfe LLP, 1200 Nineteenth Street, N.W., Washington, D.C. 20036-2412. The address for the 1994 Bilzerian Irrevocable Trust is Park Tower, Suite 2630, 400 North Tampa Street, Tampa, Florida 33602.

20

SECURITY OWNERSHIP OF DIRECTORS AND MANAGEMENT

The following table sets forth information with respect to beneficial ownership of the Company’s common stock (inclusive of options and warrants), as of March 31, 2006, for each director and executive officer of the Company, and all executive officers and directors as a group:

Name, Title, and Address(1) | | Number of

Shares of

Common Stock | | Percent of

Ownership

(10) | |

Robert H. Reback, President, CEO and Director (2) | | 1,098,500 | | 3.34 | % |

C. Alan Weber, Director (3) | | 150,000 | | * | |

Scott C. Chandler Director (4) | | 150,000 | | * | |

Michael B. Thompson, Director (5) | | 100,000 | | * | |

David P. Faulkner, Exec. VP of Sales & Mktg. (6) | | 757,500 | | 2.32 | % |

Michael D. Feaster, Exec. VP of R&D (7) | | 537,500 | | 1.66 | % |

Dennis P. Gauger, Chief Financial Officer. (8) | | 52,500 | | * | |

Kourosh Vahdani, VP of Global Services(9) | | 62,500 | | * | |

Executive officers and directors as a group (8 persons) | | 2,908,500 | | 8.92 | % |

* Less than 1%.

(1) The addresses for Messrs. Reback, Weber, Chandler, Thompson, Faulker, Feaster, Gauger and Vahdani, are c/o Cimetrix Incorporated, 6979 South High Tech Drive, Salt Lake City, Utah 84047-3757.

(2) Includes 950,000 shares of common stock which Mr. Reback has the right to acquire within 60 days upon the exercise of stock options. Also includes 37,500 shares which Mr. Reback has the right to acquire within 60 days upon the exercise of warrants.

(3) Includes 150,000 shares of common stock which Mr. Weber has the right to acquire within 60 days upon the exercise of stock options.

(4) Includes 150,000 shares of common stock which Mr. Chandler has the right to acquire within 60 days upon the exercise of stock options.

(5) Includes 100,000 shares of common stock which Mr. Thompson has the right to acquire within 60 days upon the exercise of stock options.

(6) Includes 737,500 shares of common stock which Mr. Faulkner has the right to acquire within 60 days upon the exercise of stock options. Also includes 20,000 shares of common stock which Mr. Faulkner has the right to acquire within 60 days upon the exercise of warrants.

(7) Includes 537,500 shares of common stock which Mr. Feaster has the right to acquire within 60 days upon the exercise of stock options.

(8) Includes 52,500 shares of common stock which Mr. Gauger has the right to acquire within 60 days upon the exercise of stock options.

(9) Includes 62,500 shares of common stock which Mr. Vahdani has the right to acquire within 60 days upon the exercise of stock options.

(10) All applicable percentage ownership is based on 31,927,432 shares of common stock issued as of the Record Date, together with applicable options and warrants for the share owners. Shares of common stock subject to options currently exercisable or exercisable within 60 days after the Record Date, are deemed outstanding for computing the percentage ownership of the person holding the options, but are not deemed outstanding for computing the percentage of any other person.

21

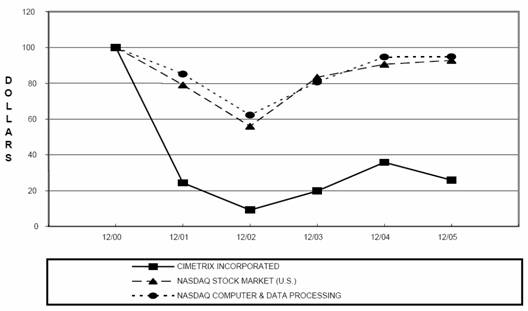

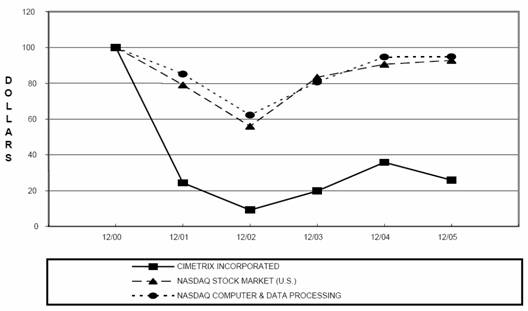

PERFORMANCE GRAPH

The following graph shows a comparison of the five-year cumulative total return for the Company’s common stock, the Nasdaq Stock Market (U.S.) Index, and the Nasdaq Computer and Data Processing Stocks Index, assuming an investment of $100 on December 31, 2000. The cumulative return of the Company was computed by dividing the difference between the price of the Company’s common stock at the end and the beginning of the measurement period (December 31, 2000 to December 31, 2005) by the price of the Company’s common stock at the beginning of the measurement period.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG CIMETRIX INCORPORATED, THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE NASDAQ COMPUTER & DATA PROCESSING INDEX

* $100 invested on 12/31/00 in stock or index-including reinvestment of dividends.

Fiscal year ending December 31.

ANNUAL REPORT

A copy of the Company’s Annual Report on Form 10-K for the year ended December 31, 2005 (including audited consolidated financial statements) accompanies this proxy statement. An additional copy will be furnished without charge to beneficial shareholders or shareholders of record upon request to Dennis P. Gauger, Chief Financial Officer, Cimetrix Incorporated, 6979 South High Tech Drive, Salt Lake City, Utah 84047-3757.

22

SHAREHOLDER PROPOSALS

Shareholders who wish to include proposals for action at the Company’s 2006 Annual Meeting of Shareholders in next year’s proxy statement must, in addition to other applicable requirements, cause their proposals to be received in writing by the Company at its address set forth on the first page of this Proxy Statement no later than January 1, 2007. Such proposals should be addressed to the Company’s Secretary at the Company’s address and may be included in next year’s proxy statement if they comply with certain rules and regulations promulgated by the Securities and Exchange Commission.

OTHER SECURITY HOLDER PROPOSALS FOR PRESENTATION AT THE 2007 ANNUAL MEETING

For any proposal that is not submitted for inclusion in the 2007 Proxy Statement but is instead sought to be presented directly at the 2007 Annual Meeting, SEC rules permit management to vote proxies in its discretion if the Company (1) receives notice of the proposal before the close of business on March 8, 2007, and advises share owners in the 2007 Proxy Statement about the nature of the matter and how management intends to vote on such matter; or (2) does not receive notice of the proposal prior to the close of business on March 8, 2007. Notices of intention to present proposals at the 2007 Annual Meeting should be addressed to the Company’s Secretary, at the Company’s address.

COMMUNICATIONS BETWEEN SHAREHOLDERS AND THE BOARD OF DIRECTORS

The Board of Directors of the Company has not adopted a formal procedure that shareholders must follow to send communications to it. The Board of Directors does receive communications from shareholders, from time to time, and addresses those communications as appropriate. Shareholders can send communication to the Board of Directors in one of the following ways:

• In writing, to Cimetrix Incorporated, 6979 South High Tech Drive, Salt Lake City, Utah 84047-3757, Attention Board of Directors

• By e-mail, at directors@cimetrix.com.

Matters relating to the Company’s consolidated financial statements, accounting practices or internal controls should be specifically addressed to the Chairman of the Audit Committee. As a matter of policy, a copy of all other written communications from shareholders will be provided to the Chairman of the Audit Committee.

The Board of Directors encourages attendance by our directors at the Annual Meeting of Shareholders. A total of four members of the Company’s Board of Directors attended our Annual Meeting held in 2005.

23

OTHER MATTERS

Management knows of no matters other than those listed in the attached Notice of the Annual Meeting, which are likely to be brought before the Annual Meeting. However, if any other matters should properly come before the Annual Meeting or any adjournment thereof, the persons named in the enclosed proxy will vote all proxies given to them in accordance with their best judgment of such matters.

| By Order of the Board of Directors, |

| |

| |

| By: | /s/ Brian L. Phillips |

April 26, 2006 | | Brian L. Phillips |

Salt Lake City, Utah | | Secretary and Treasurer |

24

Appendix A

CIMETRIX INCORPORATED

2006 LONG-TERM INCENTIVE PLAN

Combined Amendment and Restatement of 1998 Incentive Stock Option and Director Stock

Option Plans

Cimetrix, Incorporated, a Nevada corporation (the “Company”), hereby adopts the Cimetrix Incorporated 2006 Long-Term Incentive Plan (the “Plan”) as a combined amendment and restatement of the Cimetrix Incorporated 1998 Incentive Stock Option Plan and Cimetrix Incorporated Director Stock Option Plan (collectively the “Prior Plans”). On and after the Restatement Effective Date as defined below, this Plan shall supersede and replace the separate Prior Plans in their entirety and no further options or awards shall be granted under the Prior Plans. Notwithstanding the foregoing, any options or other awards that were granted under the Prior Plans and are outstanding immediately prior to the Restatement Effective Date shall continue to be governed by, and shall remain subject to the provisions of, the applicable Prior Plan and applicable option or award agreement as in effect prior to the Restatement Effective Date. This Plan does not amend or modify any option or award granted under the Prior Plans.

1. PURPOSE OF THE PLAN

The purpose of the Plan is to assist the Company and its Subsidiaries in attracting and retaining selected individuals to serve as directors, employees, consultants and/or advisors of the Company who are expected to contribute to the Company’s success and to achieve long-term objectives which will inure to the benefit of all shareholders of the Company through the additional incentives inherent in the Awards hereunder.

2. DEFINITIONS