UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrantx Filed by a Party other than the Registrant¨

Check the appropriate Box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission only (as permitted by rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to sec. 240.14a-12 |

BUTLER INTERNATIONAL

(Name of Registrant as Specified in Its Charter)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which the transaction applies: |

| | (2) | Aggregate number of securities to which the transaction applies: |

| | (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of the transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

BUTLER INTERNATIONAL, INC.

110 Summit Avenue

Montvale, New Jersey 07645

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held December 12, 2005

The Annual Meeting of Stockholders of BUTLER INTERNATIONAL, INC. (the “Company”) will be held at 601 N. Ft. Lauderdale Blvd., Ft. Lauderdale, FL 33304 on Monday, December 12, 2005 at 9:00 a.m. for the following purposes:

| 2. | To vote on a proposal to amend the Company’s 2003 Stock Incentive Plan (i) to allow for awards to employees and officers to be based on performance which may then be tax deductible notwithstanding the limitations of Section 162(m) of the Internal Revenue Code; (ii) to limit awards under the Company’s 2003 Stock Incentive Plan so that the Company may not issue awards for more than 1,200,000 shares of common stock to any single participant during any calendar year; and (iii) to allow for restricted common stock of the Company to be issued in lieu of salary or cash bonus payments otherwise payable to Company employees, in which event the restricted common stock will be valued at a discount to the then current market value of unrestricted shares of Company common stock. |

| 3. | To vote on a proposal to amend the Company’s 2002 Stock Incentive Plan (i) to allow for awards to employees and officers to be based on performance which may then be tax deductible notwithstanding the limitations of Section 162(m) of the Internal Revenue Code; and (ii) to allow for restricted common stock of the Company to be issued in lieu of salary or cash bonus payments otherwise payable to Company employees, in which event the restricted common stock will be valued at a discount to the then current market value of unrestricted shares of Company common stock. |

| 4. | To vote on a proposal to ratify the Amended Performance Bonus Plan. |

| 5. | To ratify the appointment of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2005. |

| 6. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

Only holders of record of the common stock and the 7% Series B cumulative convertible preferred stock at the close of business on September 26, 2005 are entitled to notice of, and to vote at, this meeting or any adjournment or adjournments thereof.

|

By Order of the Board of Directors, |

|

|

Warren F. Brecht |

Secretary |

Montvale, New Jersey

November 18, 2005

If you cannot personally attend the meeting, it is earnestly requested that you promptly indicate your vote on the issues included on the enclosed proxy and date, sign and mail it in the enclosed self-addressed envelope, which requires no postage if mailed in the United States. Doing so will save the Company the expense of further mailings. If you sign and return your proxy card without marking choices, it will be understood that you wish to have your shares voted in accordance with the recommendations of the Board of Directors.

BUTLER INTERNATIONAL, INC.

110 Summit Avenue

Montvale, New Jersey 07645

November 18, 2005

PROXY STATEMENT

The enclosed proxy is solicited by the Board of Directors of Butler International, Inc. (the “Company”), a Maryland corporation, in connection with the Annual Meeting of Stockholders to be held on December 12, 2005 at 9:00 a.m. Unless instructed to the contrary on the proxy, it is the intention of the persons named in the proxy to vote the proxiesFORthe election as a director of the nominee listed below for a term expiring in 2010,FORthe proposal to amend the Company’s 2003 Stock Incentive Plan (i) to allow for awards to employees and officers to be based on performance which may then be tax deductible under Section 162(m) of the Internal Revenue Code; (ii) to limit awards under the Company’s 2003 Stock Incentive Plan so that the Company may not issue awards for more than 1,200,000 shares of common stock to any single participant during any calendar year; and (iii) to allow for restricted common stock of the Company to be issued in lieu of salary or cash bonus payments otherwise payable to Company employees, in which event the restricted common stock will be valued at a discount to the then current market value of unrestricted shares of Company common stock;FORthe proposal to amend the Company’s 2002 Stock Incentive Plan (i) to allow for awards to employees and officers to be based on performance which may then be tax deductible under Section 162(m) of the Internal Revenue Code; and (ii) to allow for restricted common stock of the Company to be issued in lieu of salary or cash bonus payments otherwise payable to Company employees, in which event the restricted common stock will be valued at a discount to the then current market value of unrestricted shares of Company common stock;FORthe proposal to ratify the Amended Performance Bonus Plan; andFORthe ratification of the appointment of Grant Thornton LLP as independent public accountants. In the event that the nominee for director should become unavailable to serve, which management does not anticipate, the persons named in the proxy reserve full discretion to vote for any other person who may be nominated. Any stockholder of record giving a proxy may revoke the same by (i) submitting written notice to the Secretary of the Company at any time prior to the voting of such proxy, (ii) submitting a duly executed later-dated proxy, or (iii) voting in person at the Annual Meeting. This Proxy Statement and accompanying proxy are being mailed on or about November 18, 2005.

Each stockholder of the Company will be entitled to one vote for each share of common stock and each share of 7% Series B cumulative convertible preferred stock, standing in his or her name on the books of the Company at the close of business on September 26, 2005 (the “Record Date”). On that date, the Company had outstanding and entitled to vote 11,678,844 shares of common stock and 5,904,434 shares of 7% Series B cumulative convertible preferred stock.

CORPORATE GOVERNANCE MATTERS

Corporate Governance Philosophy

Corporate governance encompasses the internal policies and practices by which the Company is operated and controlled on behalf of its stockholders. A good system of corporate governance helps the Company maintain the confidence of investors and allows it to raise capital efficiently.

The Company has made various changes to its corporate governance practices in response to the Sarbanes-Oxley Act of 2002 and the changes to corporate governance rules of the Nasdaq. In some instances, the Company already had procedures in place that complied with the new stricter requirements. In other cases, changes have been necessary. Many of the changes required by the Sarbanes-Oxley Act are being phased in over time in compliance with the law. As a result, the Company’s response to these changes will be an ongoing process.

The business affairs of the Company are conducted under the direction of the Board of the Directors in accordance with the Maryland General Corporation Law as implemented by its articles of incorporation and bylaws. The role of the Board is to govern effectively the affairs of the Company for the benefit of its stockholders and, to the extent appropriate under Maryland law, other constituencies, which include its employees, customers and communities in which the Company does business. The Board strives to ensure the success and continuity of the Company’s business through the selection of a qualified management team. It is also responsible for ensuring that the activities of the Company are conducted in a responsible and ethical manner. The following principles, among others, govern the Company’s corporate governance practices:

| | • | | The Company’s President and Chief Executive Officer, Mr. Kopko, is the only director who is an employee of the Company; |

| | • | | A majority of the Company’s directors are independent as defined by Nasdaq’s independence standards; |

1

| | • | | Directors have access to members of the Company’s management team so that they can stay abreast of Company affairs; |

| | • | | The Board’s Nominations Committee, Audit Committee, Compensation Committee and Rule 4350(H) Committee are composed entirely of independent directors as defined by Nasdaq’s independence standards; |

| | • | | The Company’s Chief Executive Officer and Chief Financial Officer certify all quarterly and annual reports filed with the Securities and Exchange Commission (“SEC”); |

| | • | | Independent members of the Company’s Board of Directors meet at least twice annually at regularly scheduled executive sessions at which only they are present; |

| | • | | Annual and quarterly reports are accessible through a hyperlink on the Company’s website; and |

| | • | | The Company documents and regularly evaluates its established internal financial controls. |

Code Of Ethics

The Company has adopted a Code of Business Conduct and Ethics (“Code of Ethics”) as defined in Item 406 of Regulation S-K and as required by Nasdaq, which applies to all directors, officers and employees. The Code of Ethics, including future amendments, is available free of charge on the Company’s internet web site at www.butler.com under “Investors”. The Company will also post on its website any waivers under the Code of Ethics granted to any of its directors or executive officers. The Company will also provide a copy of its Code of Ethics, without charge, to any investor that requests it. Requests should be addressed in writing to: Corporate Secretary, Butler International, Inc., 110 Summit Avenue, Montvale, New Jersey 07645.

PROPOSAL 1: ELECTION OF DIRECTORS

Pursuant to the Company’s Articles of Incorporation and By-Laws, as amended, the Board of Directors currently consists of five classes of directors having staggered terms of five years each. One class of directors’ term expires at each Annual Meeting, with the term of the First-Class Director expiring at this year’s Annual Meeting.

The Board of Directors has reviewed the independence of each director under the listing standards of Nasdaq. Based upon its review, the Board has determined that, of the eight directors who will serve on the Board after the Annual Stockholders Meeting, Messrs. Comeau, LeCroy, Murray, Petrossi, Tyler and Uyematsu are “independent directors” as defined under the listing standards of the Nasdaq.

The election of directors require a plurality of the votes cast by holders of the shares of the Company’s common stock and the Company’s 7% Series B cumulative convertible preferred stock, voting together as a single class at a meeting with a quorum present. Brokers holding shares for beneficial owners must vote those shares according to the specific instructions they receive from the beneficial owners. If specific instructions are not received, brokers may generally vote these shares in their discretion. However, exchange rules preclude brokers from exercising their voting discretion on certain proposals. This results in what is known as a “broker non-vote”. Because Maryland corporate law requires a plurality of the votes cast for or against the proposal at this meeting to authorize action on this matter, shares withheld from voting on this matter and broker non-votes, which will not be counted “for” or “against” the proposal, will have no impact on the outcome of the election.

Unless instructed to the contrary on the proxy, the persons named in the proxy will vote “FOR” the election of Hugh G. McBreen, as First-Class Director to hold office for five years. The nominee is currently a member of the Board of Directors of the Company and has been a Director since 1986.

NOMINEE FOR FIRST-CLASS DIRECTOR—TERM EXPIRES IN 2010

HUGH G. MCBREEN

Mr. McBreen, age 50, is a partner of the law firm of McBreen & Kopko, Chicago, Illinois, and has been associated with that firm since September 1983. He is also the Secretary of Peter J. McBreen and Associates, Inc., a risk management and loss adjustment company. Mr. McBreen practices in the area of aviation law. He received an A.B. degree from Dartmouth College and a J.D. degree from Notre Dame Law School.

2

The Board of Directors unanimously recommends a vote FOR the election of Hugh G. McBreen as First-Class Director.

DIRECTORS CONTINUING IN OFFICE

| | |

| EDWARD M. KOPKO | | Director since 1985 - Term expires in 2008 |

Mr. Kopko, age 51, has been the President, Chief Executive Officer and the Chairman of the Board of Directors of the Company since its inception in November 1985. Mr. Kopko has also been the Chairman, President and Chief Executive Officer of Butler Service Group, Inc. since 1989, and the chairman of other Butler subsidiaries. In 2001, Mr. Kopko became the Chairman of the Board of Directors and Chief Executive Officer ofChief Executive Magazine. Mr. Kopko is a past President of the National Technical Services Association, the predominant trade association for the contract technical services industry. Mr. Kopko holds a B.A. degree in economics from the University of Connecticut, an M.A. degree in economics from Columbia University, and he undertook doctoral work in economics at Columbia.

| | |

| THOMAS F. COMEAU | | Director since 2001 - Term expires in 2006 |

Mr. Comeau, age 64, is the President of Swissport Fueling, Inc., the fueling division of Swissport, Inc., and has been President since 1995. Swissport is a wholly owned subsidiary of Ferrovial Group, headquartered in Madrid, Spain. Swissport does business at over 140 airports worldwide. Mr. Comeau has served as Chairman of the Board of the National Air Transportation Association and Chairman of the General Aviation Taskforce. He has been a Director of Butler Telecom, Inc. since 1998. Mr. Comeau holds a B.S. degree from Salem State College, Salem, Massachusetts.

| | |

| WALTER O. LECROY | | Director since 2003 - Term expires in 2006 |

Mr. LeCroy, age 70, currently serves as a director of LeCroy Corporation (NASDAQ: LCRY), the Company he founded in 1963. Using its core competency of wave shape analysis, defined as the capture and analysis of complex electronic signals, his company develops, manufactures, sells and licenses signal acquisition and analysis products. Its principal product line consists of a family of high-performance digital oscilloscopes used primarily by electrical design engineers in various markets, including communications test, data storage and power measurement. Mr. LeCroy holds a B.A. degree in physics from Columbia College.

| | |

| FRANK H. MURRAY | | Director since 2004 - Term expires in 2009 |

Mr. Murray, age 52, is the Founder, President and Director of InterTech Media, LLC, a software company that provides software to media companies throughout the United States and the Caribbean, since 1999. Concurrently, he is the Founder, President and Director of EMS Companies, LLC, a publishing and software company. From 1996 to 1999, he was Chairman and Chief Executive Officer of Goodman Manufacturing Company, one of the largest private companies in the United States. Previously, he held leadership positions in merger and acquisition services with The Beacon Group, Merrill Lynch & Co. and Dillon Read & Co. Mr. Murray received an A.B. degree in mathematics and economics from Ohio Wesleyan University, Delaware, OH and a M.B.A. degree from Harvard Business School, Boston, MA. He is a Trustee of The Mead School, Stamford, CT.

| | |

| LOUIS F. PETROSSI | | Director since 2003 - Term��expires in 2008 |

Mr. Petrossi, age 65, has a varied business career mixing years in the financial services industry with Fortune 500 companies. Mr. Petrossi currently and since 2004 has been the President of Chadwicke, Inc. of Saratoga, CA, a comprehensive financial planning business. Prior to his career in financial services, Mr. Petrossi worked in marketing for Johnson & Johnson and Pitney Bowes. Mr. Petrossi holds B.A. and M.A. degrees from the University of Hartford.

| | |

| WESLEY B. TYLER | | Director since 2004 - Term expires in 2009 |

Mr. Tyler, age 46, is the Founder and Principal of Old Oak Partners, LLC, a small business consulting and investment organization, since May 1999. He is also the President and Director of North American Commercial Parts & Service, Inc., a holding company of regional businesses that provide parts and repair services for commercial food equipment, since July 2003. He is also a Director and Principal of Westport Resources Investment Services, Inc., a registered broker-dealer with the SEC and National Association of Securities Dealers, and of Westport Resources Management, Inc., a registered investment advisor, since December 2002. From 1991 to May 1999, Mr. Tyler was president of GCS Service, Inc., the largest independent servicer of commercial food equipment and in 1998 he directed the sale of GCS to Ecolab, Inc. (ECL: NYSE), a Fortune 500 company. Mr. Tyler is registered as an Investment Advisor Representative through Flat Rock Three, LLC. Mr. Tyler attended Manhattanville College, Purchase, NY and the University of Bridgeport, Bridgeport, CT. He serves as a Trustee of Greens Farms Academy, Westport, CT.

3

| | |

| RONALD UYEMATSU | | Director since 2004 - Term expires in 2007 |

Mr. Uyematsu, age 45, was associated with BMA Securities, a securities broker-dealer, from August 2004 to June 2005. Mr. Uyematsu also has been a consultant for TMC Entertainment and its predecessor, Total Media Group, Inc., worldwide production and distribution companies, since April 2002. From July 1998 to April 2002, Mr. Uyematsu held the position of Vice President at VMR Capital Markets, U.S., a registered broker-dealer. Mr. Uyematsu attended Boston College and the University of California, Irvine.

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors met eight times during 2004. Each member of the Board attended at least 75% of the aggregate of the meetings of the Board and of the Committees on which he serves and held during the period for which he was a Board or Committee member, respectively. It is the policy of the Company that all directors of the Board should attend each annual stockholders’ meeting. Last year, all directors attended the Company’s 2004 Annual Meeting.

The Board of Directors has four standing committees: Nominations Committee, Audit Committee, Compensation Committee, and Rule 4350(H) Committee.

Nominations Committee

The Nominations Committee of the Board of Directors consists solely of independent directors as determined under the current listing standards of the Nasdaq. The Nominations Committee was established in March 2004 and met one time in 2004. Its members are Messrs. Petrossi and LeCroy with Mr. Petrossi serving as Chair. The Nominations Committee identifies individuals believed to be qualified to become Board members, consistent with criteria approved by the Board, and to select or recommend to the Board the nominees to stand for election as directors at the Annual Meeting of Stockholders or, if applicable, at a special meeting of stockholders. In the case of a vacancy in the office of a director, including a vacancy created by an increase in the size of the Board, the Nominations Committee will recommend to the Board an individual to fill such vacancy either through appointment by the Board or through election by stockholders. In selecting or recommending candidates, the Nominations Committee will take into consideration the criteria approved by the Board and other such factors, as it deems appropriate. The Nominations Committee will also consider candidates recommended by the Company’s qualified stockholders and candidates proposed by management. The Nominations Committee will review all candidates in the same manner regardless of the source of the recommendation. The Nominations Committee also identifies Board members qualified to fill vacancies on any committee of the Board (other than the Nominations Committee) and recommends that the Board appoint the identified member or members to the respective committee. A copy of the charter of the Nominations Committee is available on the Company’s website.

Audit Committee

The Company has a standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Messrs. Comeau, LeCroy and Petrossi are members of the Audit Committee. The Company’s Board of Directors determined that all members of the Company’s Audit Committee are independent under the current listing standards of the Nasdaq. Mr. Comeau serves as Chair of the Audit Committee. The Audit Committee provides assistance to the Board in fulfilling its oversight responsibility, including: (i) internal and external financial reporting, (ii) risks and controls related to financial reporting, and (iii) the internal and external audit process. The Audit Committee is also responsible for recommending to the Board the selection of the Company’s independent registered public accounting firm.

The Company’s Board of Directors has determined that, due to Mr. LeCroy’s past and current affiliation with LeCroy Corporation, along with his other academic and business credentials, Mr. LeCroy has the prerequisite experience and applicable background to meet Nasdaq standards requiring financial sophistication of at least one member of the Audit Committee. The Company’s Board of Directors has also determined that neither Mr. LeCroy nor any other member of the Audit Committee is an audit committee financial expert as defined by applicable SEC regulations. The Company may choose to recruit a director who satisfies the current requirements for an audit committee financial expert; however, the Company has not yet identified an individual satisfying those criteria as well as other criteria that the Company believes are important for an individual to make a meaningful contribution to the deliberations of the Board of Directors as a whole. There can be no assurance when, or if, the Company will identify such an individual in the foreseeable future.

The Audit Committee acts under a written charter first adopted and approved by the Board in 2000 and amended in 2004. The amended Audit Committee Charter is available on the Company’s website.

The Committee met four times in 2004. The independent auditors were present in person or telephonically at all meetings.

4

Compensation Committee

The Compensation Committee of the Board of Directors consists solely of independent directors as determined under the current listing standards of the Nasdaq. The members of the Compensation Committee are Messrs. Comeau, LeCroy and Uyematsu with Mr. Comeau serving as Chair. Immediately following this Annual Meeting of Stockholders, Mr. Uyematsu will serve as Chair of the Compensation Committee, with Messrs. Comeau and LeCroy remaining as the other members of the Compensation Committee.

The Compensation Committee determines, or recommends to the Board for determination, the compensation of the Company’s Chief Executive Officer (“CEO”) and all other executive officers of the Company. With respect to the CEO, the Compensation Committee reviews and approves corporate goals and objectives relevant to the CEO’s discretionary compensation components, evaluates the CEO’s performance in light of those goals and objectives, and determines, or recommends to the Board for determination, such compensation. The Compensation Committee determines all issues of interpretation under employment agreements with executive officers. The Compensation Committee also makes recommendations to the Board with respect to the Company’s incentive compensation plans and equity-based plans, oversees the activities of the individuals and committees responsible for administering these plans, and discharges any responsibilities imposed on the Compensation Committee by these plans. The Compensation Committee, in conjunction with management, oversees regulatory compliance with respect to compensation matters, and will begin including structuring compensation programs to preserve tax deductibility and, as required, establishing performance goals and certifying that performance goals have been attained for purposes of Section 162(m) of the Internal Revenue Code.

The Compensation Committee met three times during 2004. A copy of the charter of the Compensation Committee is available on the Company’s website.

Rule 4350(H) Committee

The Rule 4350(H) Committee of the Board of Directors consists solely of independent directors as determined under the current listing standards of the Nasdaq. The members of the Rule 4350(H) Committee are Messrs. Uyematsu and Comeau with Mr. Uyematsu serving as Chair. The purpose of the Rule 4350(H) Committee is, pursuant to Nasdaq Rule 4350(H), to review all related party transactions for potential conflict of interest situations on an ongoing basis, including transactions with management, certain business relationships, and indebtedness of management, among others. The 4350(H) Committee was established in March 2004 and its responsibilities were previously part of the Audit Committee. The Committee met one time in 2004. A copy of the charter of the Rule 4350(H) Committee is available on the Company’s website.

Communications With The Board Of Directors

Any stockholder who desires to contact the Company’s Board of Directors or specific members of our Board of Directors may do so by writing to: Stockholder Communications, Butler International, Inc., 110 Summit Avenue, Montvale, New Jersey, 07645.

DIRECTORS COMPENSATION

Of the Company’s current directors, only Mr. Kopko is a salaried employee of the Company. All other directors receive separate compensation for Board services. That compensation is currently comprised of:

| | |

| |

| Retainer: | | $5,000 per quarter |

| |

| Attendance Fees: | | $1,000 for each board meeting $850 for each board committee meeting |

| |

| Stock Options: | | 18,000 shares annually |

5

As part of a review of board compensation paid to peer group companies, compensation for board services will change immediately following the 2005 annual meeting of stockholders, as follows:

| | |

Retainer: (board members) | | $5,000 per quarter (same) |

| |

Retainer: (Audit Committee Chairman) | | $4,500 per quarter (new) |

| |

Retainer: (Compensation Committee Chairman) | | $2,000 per quarter (new) |

| |

Attendance Fees: | | $ 1,000 for each in-person board meeting (same) $800 for each telephonic board meeting (new) $850 for each in-person committee meeting (same) $700 for each telephonic committee meeting (new) |

| |

Stock Options: | | 18,000 shares annually (same) |

The directors will also be permitted to elect to receive awards of immediately vested common stock of the Company, subject to securities law restrictions (restricted stock awards) in lieu of all or part of their cash retainer and attendance fees. In order to account for the non-transferability of the restricted stock, the Company will discount the value of the restricted stock by 33 1/3% of the then current market value of unrestricted shares of Butler common stock. As a result, the number of restricted shares to be awarded shall equal the amount of foregone cash compensation divided by two-thirds of the then current market value of unrestricted shares of Butler common stock.

The Company reimburses all directors for travel and other necessary business expenses incurred in the performance of their services for the Company and extends coverage to them under the Company’s medical, dental, life, accidental death and dismemberment, and directors’ and officers’ indemnity insurance policies.

The cash compensation paid to each non-employee director in 2004 was as follows: Mr. Comeau - $35,350; Mr. Robert Hussey - $18,000; Mr. Frederick Kopko, Jr. - $14,000; Mr. LeCroy - $32,800; Mr. McBreen - $33,650; Mr. Murray - $12,000; Mr. Nikhil Nagaswami - $28,500; Mr. Petrossi - $27,700; Mr. Tyler $12,000; and Mr. Uyematsu - $18,850.

EXECUTIVE OFFICERS OF THE COMPANY

The executive officers of the Company are listed below. The executive officers of the Company or its subsidiaries are appointed by the respective Board of Directors and hold office for one-year terms or until their respective successors have been duly elected. There are no family relationships among any of the Company’s executive officers and directors.

Edward M. Kopko is the Chairman of the Board of Directors and Chief Executive Officer. (See “Directors”.)

James Beckley, age 52, has been Senior Vice President - Technical Services and Project Engineering since April 2004. Mr. Beckley had been Division Vice President - Butler International, Inc. (Technical Group) since January 1999. Mr. Beckley joined Butler in December of 1990 as the Vice President for the Northwest territory (San Jose and Seattle) of the former CTS division. Mr. Beckley has held a wide variety of positions with Butler that included management responsibility for all sales, recruiting, and administration for the CTS division west of the Mississippi. He later became Vice President of BI Sales West, and eventually Vice President for all of BI Sales. Mr. Beckley received a BA degree in Public Administration from California State University, Chico.

Ivan Estes, age 62, has been Senior Vice President - Telecommunication Services since October 2002. Mr. Estes joined the Company in December of 1990 as Regional Sales Manager after a 25-year career with GTE. In 1993, he was promoted to Vice President, West Division and in 1996, he was promoted to Vice President and given general manager responsibility for telecommunications services. He was promoted to Senior Vice President in 1998. Mr. Estes graduated from Texas A&M University with a BBA degree in Management.

6

Craig S. Tireman, age 47, was Vice President - Finance and Controller since 2000. Mr. Tireman has a BS in Accounting from Ramapo College of New Jersey. Mr. Tireman resigned from the Company on April 28, 2005.

Thomas J. Considine, Jr., age 51, joined the Company on April 11, 2005 as Senior Vice President and Chief Financial Officer. From November 2000 to April 2005, Mr. Considine was employed by Technitrol, a New York Stock Exchange company and a multi-national producer of electronic components and electrical contact parts. Mr. Considine joined Technictrol as Treasurer in November 2000, served as its Vice President beginning May 2002, and served as Secretary beginning July 2004. Prior to Technitrol, from April 1998 until November 2000, Mr. Considine was the Treasurer of Vlasic Foods, a packaged food company. Mr. Considine holds an M.B.A. in Finance from University of Pennsylvania, Wharton Business School, a Master’s degree from Duke University, and a Bachelor of Science from Rutgers University.

PRINCIPAL STOCKHOLDERS

The following table presents information as of the Record Date regarding the beneficial ownership of the Company’s common stock and Series B 7% cumulative convertible preferred stock by: (i) all persons known by the Company to be the beneficial owners of more than 5% of the common stock and/or preferred stock of the Company; (ii) each director and nominee; (iii) each executive officer named in the Summary Compensation Table on page 11; and (iv) all directors and executive officers as a group. Under the rules of the Securities and Exchange Commission, “beneficial ownership” includes shares for which the individual, directly or indirectly, has or shares voting or investment power, whether or not the shares are held for the individual’s benefit. Unless otherwise stated, all shares are held directly with sole voting and investment power. The business address of the named stockholders is the address of the Company, except as otherwise noted. Except as disclosed in the chart below, the Company knows of no other person or group owning 5% or more of any class of the Company’s voting securities.

PRINCIPAL STOCKHOLDERS

| | | | | | | | | | | | | | | | | |

| | | Common Stock1

| | | Series B Preferred Stock2

| | | Total Equivalent

Voting Rights3

| |

Name

| | Number of

Shares

Beneficially

Owned

| | | Percent of

Class

| | | Number of

Shares

Beneficially

Owned

| | | Percent of

Class

| | | Number of

Shares

| | Percent of

Total

| |

Edward M. Kopko | | 2,243,542 | 4 | | 18.3 | % | | 1,228,992 | | | 20.8 | % | | 3,472,534 | | 19.7 | % |

Hugh G. McBreen | | 355,371 | 5 | | 3.0 | % | | 1,277,299 | 6 | | 21.9 | % | | 1,632,670 | | 9.2 | % |

Wesley B. Tyler | | 168,600 | 7 | | 1.4 | % | | — | | | — | | | 168,600 | | | * |

Walter O. LeCroy | | 133,950 | 8 | | 1.1 | % | | — | | | — | | | 133,950 | | | * |

Thomas F. Comeau | | 127,747 | 9 | | 1.1 | % | | — | | | — | | | 127,747 | | | * |

Frank H. Murray | | 48,300 | 10 | | | * | | — | | | — | | | 48,300 | | | * |

Louis F. Petrossi | | 36,000 | 11 | | | * | | — | | | — | | | 36,000 | | | * |

Ronald Uyematsu | | 18,000 | 12 | | | * | | — | | | — | | | 18,000 | | | * |

James Beckley | | 137,200 | 13 | | 1.2 | % | | — | | | — | | | 137,200 | | | * |

Ivan Estes | | 93,558 | 14 | | | * | | — | | | — | | | 93,558 | | | * |

Craig Tireman | | 47,608 | 15 | | | * | | — | | | — | | | 47,608 | | | * |

Frederick H. Kopko, Jr. | | 398,953 | 16 | | 3.3 | % | | 1,319,907 | 17 | | 22.7 | % | | 1,718,860 | | 9.7 | % |

David M. Knott | | 996,600 | 18 | | 8.5 | % | | — | | | — | | | 996,600 | | 5.7 | % |

Bruce S. Kovner/Caxton Associates, L.L.C. | | 609,716 | 19 | | 5.2 | % | | — | | | — | | | 609,716 | | 3.5 | % |

All directors and executive officers as a group (12 persons) | | 3,420,526 | 20 | | 26.6 | % | | 2,506,291 | | | 42.4 | % | | 5,926,817 | | 31.6 | % |

| 1 | Assumes as to each person or entity the exercise of his or its options and warrants. |

7

| 2 | Series B Preferred Stock consists of 5,904,434 outstanding shares, has one vote per share, and is convertible into shares of Common Stock at a rate of 0.285 per share of Series B Preferred Stock. |

| 3 | Assumes no conversion of Series B Preferred Stock. |

| 4 | Includes 1,173,400 shares of restricted stock, of which 66,666 shares are vested, 33,334 will become vested on October 15, 2006 and 1,073,400 shares will become vested on October 24, 2006. The restricted stock is subject to forfeiture or acceleration of vesting upon certain events. Also, includes 578,767 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 5 | Includes 5,437 shares beneficially owned by Mr. McBreen’s children (as to which Mr. McBreen disclaims beneficial ownership), and 141,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. The business address of Mr. McBreen is 20 North Wacker Drive, Suite 2520, Chicago, IL 60606. |

| 6 | Includes 2,982 shares owned by Mr. McBreen’s wife (as to which Mr. McBreen disclaims beneficial ownership). |

| 7 | Includes 18,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. Also, includes 150,000 shares held through Old Oak Partners, LLC. Mr. Tyler is a managing member of Old Oak Partners, LLC. |

| 8 | Includes 36,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 9 | Includes 84,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 10 | Includes 18,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 11 | Consists of 36,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 12 | Consists of 18,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 13 | Includes 93,500 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 14 | Includes 78,500 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

| 15 | Includes 47,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. Mr. Tireman was previously the Vice President – Finance and Controller of the Company. He resigned from Butler on April 28, 2005. |

| 16 | Includes 108,000 shares that may be purchased upon exercise of options granted under Butler stock option plans. The business address of Mr. Kopko is 20 North Wacker Drive, Suite 2520, Chicago, IL 60606. |

| 17 | Includes 8,464 shares owned by Mr. Kopko’s wife (as to which Mr. Kopko disclaims beneficial ownership). |

| 18 | Based on publicly available information reported on June 7, 2004, Mr. Knott may be deemed to own beneficially 996,600 shares of the Company’s Common Stock. Mr. Knott individually has the sole power to vote and to dispose of 539,000 shares of the Company’s Common Stock held in the Knott Partners, L.P.’s account and, as managing member of Knott Partners Management, LLC, of 74,500 shares held in the account of the 3(c)(7) Fund. As President of Dorset Management Corporation (“Dorset”), Mr. Knott (i) has the sole power to vote and dispose of 9,300 shares of Common Stock held in two client’s accounts and (ii) shares with each of Dorset’s other clients the power to vote and dispose of that part of the 364,500 shares held in each such client’s respective accounts. The business address of Mr. Knott is 485 Underhill Boulevard, Syosset, NY 11791. |

| 19 | Based on publicly available information reported on February 3, 2005, Mr. Kovner and Caxton Associates, L.L.C. (“Caxton”) may be deemed to own beneficially 609,716 shares of the Company’s Common Stock. Mr. Kovner is the Chairman of Caxton and the sole shareholder of Caxton Corporation, the manager and majority owner of Caxton. Caxton is the trading advisor to GDK, Inc. (“GDK”) and Caxton International Limited (“CI”) and as such, has voting and dispositive power with respect to investments of Caxton, CI and GDK. CI owns 534,293 shares of the Company’s Common Stock and GDK owns 75,423 shares of the Company’s Common Stock. The business address of GDK is c/o Prime Management Limited, Mechanics Building, 12 Church Street, Hamilton HM11, Bermuda. |

| 20 | Includes 1,163,767 shares that may be purchased upon exercise of options granted under Butler stock option plans. |

8

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee is comprised entirely of independent directors and is advised by an independent consultant retained by the Company. No employee of the Company serves on the Compensation Committee. The Company employs Mr. Comeau’s son in a non-executive officer position. Mr. Comeau’s son’s compensation exceeds $60,000 annually.

REPORT OF THE COMPENSATION COMMITTEE

ON ANNUAL COMPENSATION OF EXECUTIVE OFFICERS

The Company’s executive compensation programs are intended to attract and retain qualified executive and non-executive officers and to motivate them to achieve goals that will lead to increased stockholder value. A portion of most executives’ compensation is dependent upon the Company’s profitability and appreciation in the market price of the Company’s common stock. Achievement of certain other corporate goals and individual performance objectives also impact executive compensation.

The main components of executive compensation are: base salary, annual incentive cash bonus, and longer-term equity-based incentive compensation. The Compensation Committee periodically reviews independent surveys, peer group compensation, compensation trends, and competitive factors in making judgments on the appropriate compensation package for each executive employee. In certain cases, the Company has hired executive talent from outside, and both base pay and other compensation elements have been determined with the guidance of the executive search firm used for that purpose. The Compensation Committee’s decisions also acknowledge that Butler’s Retirement Program is very modest compared with many other companies, with the Company’s Defined Benefit Plan frozen since 1996.

The “Industry Report on Top Management Compensation – 2004/2005”, published by Watson Wyatt Data Services (“WWDS”), was a primary source for reviewing the compensation of executive and non-executive officers for 2004. WWDS is the compensation survey service that the Employers Association of New Jersey uses. In addition, in late 2004, the Compensation Committee engaged a Watson Wyatt compensation consultant to review the total direct compensation (salary plus cash bonus plus the value of long-term incentive compensation) of its CEO, Edward M. Kopko, and its other named executive officers, and to make recommendations on their compensation structure going forward.

In its review of the WWDS survey data, the Committee determined that Mr. Kopko’s salary was above the 50th percentile, or median, for CEOs of “All Non-Manufacturing Companies” in Butler’s sales range, and that his total cash compensation, including a guaranteed bonus component, was significantly above the median. Mr. Kopko’s long-term incentive compensation, however, was significantly below the median. As a result, his total direct compensation was around the median.

Using a tailored peer group, the compensation consultant concluded that Mr. Kopko’s guaranteed pay was above the market median for total direct compensation; therefore, the consultant recommended no upward adjustment to Mr. Kopko’s salary or guaranteed bonus. He also noted that Mr. Kopko had a beneficial ownership level that was above the 75th percentile of the peer group, and recommended no additional equity grants.

With guidance from the consultant, the Committee concluded that Mr. Kopko was fully compensated and that no additional guaranteed compensation was warranted at this time. The Committee also concluded that no additional stock grants were advisable in light of Mr. Kopko’s already significant ownership position in the Company. The Committee did note that Mr. Kopko’s salary was scheduled to increase effective April 1, 2005, in accordance with his employment agreement, after four years of no increases and one salary decrease. The Committee is currently considering modifying his prior restricted stock awards to make the vesting conditioned upon satisfaction of performance goals. The Committee’s intent is to make his vesting schedule more restrictive, more stringent, and more dependent on performance.

In evaluating Mr. Kopko’s compensation against the Company’s performance, the Committee acknowledges that Butler compared unfavorably with its peer group on most financial measures over the three-year period 2001-2003. The Committee noted, however, that such measures as EBITDA, cash flow, net income, and stock price all improved significantly in 2004, and that Mr. Kopko deserves recognition for the Company’s turnaround. Among the accomplishments, Butler returned to profitability for the first time since 2000, with sales up 20% to $251 million. Butler’s stock price more than tripled. Gross margins increased while SG&A expenses decreased. The Company embarked on a three-pronged strategic course, and client satisfaction reached its highest level ever.

Using the WWDS survey data for the other named executive officers and non-executive officers, their combined base salaries were below the median for comparable positions, and slightly below the median for total cash compensation. Collectively, their long-term incentive compensation was significantly below the median and, therefore, their total direct compensation was below the median.

9

The compensation consultant also reported that, for the other named executive officers as a group, base salaries, total cash compensation, long-term incentive compensation, and total direct compensation were all below the median of the tailored peer group. The consultant recommended additional structure around the annual bonus program based on setting target bonus levels at the 50th percentile.

Executive Employment Agreements:On December 12, 2002, the Board of Directors and the Executive Compensation Committee approved the terms of a second amended and restated employment agreement (the “Employment Agreement”) with Mr. Kopko. The terms of Mr. Kopko’s Employment Agreement are set forth below under “Employment Agreements”.

Thomas J. Considine, Jr., the Company’s Senior Vice President – Finance and Chief Financial Officer, entered into an employment agreement effective April 2005, as authorized by the Committee. James Beckley, the Company’s Senior Vice President - Technical Services and Project Engineering, entered into an employment agreement effective July 2001, as authorized by the Committee. Ivan Estes, the Company’s Senior Vice President - Telecommunication Services, entered into an employment agreement effective July 2001, as authorized by the Committee. The terms of these employment agreements are set forth below under “Employment Agreements”.

Base Salary:Using WWDS survey information, the Committee looked at the base salary and total cash compensation for each officer position compared with companies of similar size and complexity as determined by sales range. Except for certain equity adjustments or a significant increase in responsibilities, annual salary increases have generally been limited to cost of living adjustments. In general, however, no salary increases were given during 2002 or 2003 to executive and non-executive officers. In fact, the officer group had taken a 10% pay cut in late 2002, and these pay cuts were not restored until April 2004.

Annual Incentive Cash Bonus:Each executive officer and certain non-executive officers are eligible to participate in an annual cash bonus plan. A contractual agreement is reached early in the year, with each such officer to be given the opportunity to earn a cash bonus generally based in part on the achievement of profitability and in part on the accomplishment of several key individual, department, or business unit objectives that are believed to be vital to the Company’s success. The financial objectives are generally based on operating income of the Company as a whole, or of a business unit, division or region — rather than on target thresholds. The mix between financial and non-financial objectives depends upon the nature of each executive’s responsibilities. An officer with bottom line responsibility typically has a greater portion of incentive bonus tied to the operating profit of his or her group. However, all executive officers and non-executive officers have some portion of their bonus dependent upon the successful completion of non-financial objectives such as specific projects for their group and/or individually. The bonuses awarded in 2004 to the officers (other than the CEO) reflect the mix of corporate, department and individual performance achieved. The Committee intends to explore Watson Wyatt’s recommendation for additional structure around the bonus program.

Longer-Term Equity-Based Incentive Compensation:The Company has longer-term, equity-based plans whose purpose is to promote the interests of the Company and its stockholders by encouraging greater management ownership of the Company’s common stock. Such plans provide an incentive for the creation of stockholder value over the long term, since the full benefit of the compensation package cannot be realized unless an appreciation in the price of the Company’s common stock occurs. Additionally, these plans strengthen the Company’s ability to attract and retain experienced and knowledgeable employees over a longer period and to furnish additional incentives to those employees upon whose judgment, initiative and efforts the Company largely depends.

The plans currently in use are the 2002 Stock Incentive Plan and the 2003 Stock Incentive Plan, which replaced the 1992 Incentive Stock Option Plan, the 1992 Non-Qualified Stock Option Plan, the 1992 Stock Bonus Plan and the 1990 Employee Stock Purchase Plan.

The Committee believes it is important that the CEO and other senior officers have a significant number of stock options whose value can provide a powerful incentive to driving the Company’s bottom line and stock performance. Stock option awards are based on an officer’s level of responsibilities and expected contribution, rather than following the achievement of certain targets. In 2004, a total of 307,500 incentive stock options were awarded to five officers, including 300,000 incentive stock options to the Named Executive Officers. In addition, the CEO received 100,000 shares of restricted stock.

The Committee believes that, in general, the executive compensation policies and programs serve the interests of the stockholders and will continue to seek ways to make them better. Such compensation is intended to be a function of the Company’s increase in profits and share price value over a longer-term perspective. At the same time, the Committee plans to review the ways in which the Company provides incentives to its executives, particularly stock-based compensation, and will continue to seek ways to make them better.

10

Under the 2003 Stock Incentive Plan and the 2002 Stock Incentive Plan, executive officers and, with the consent of the compensation committee, other employees of Butler are also permitted to elect to receive immediately vested shares of Butler common stock, subject to securities laws restrictions (restricted stock awards), in lieu of cash compensation or bonus. In order to account for the non-transferability of any restricted stock grant hereunder, the Committee will discount the value of the restricted shares by 33 1/3% from the market price of unrestricted shares of common stock, so that the number of restricted shares to be awarded shall equal the amount of any foregone cash compensation divided by two-thirds of the then current market value of unrestricted shares of Butler common stock.

Internal Revenue Code Section 162(m):Internal Revenue Code Section 162(m) generally limits the tax deduction to $1 million for compensation paid to the CEO and each of the four other most highly compensated executive officers of Butler. Qualifying performance-based compensation is not subject to the deduction limitation if certain requirements are met. The Compensation Committee’s policy with respect to Section 162(m) is to make every reasonable effort to ensure that compensation is deductible to the extent permitted while simultaneously providing the Company’s executives with appropriate rewards for their performance. Towards this end, the Company’s 2002 Stock Incentive Plan and its 2003 Stock Incentive Plan, upon stockholder approval of proposal nos. 2 and 3, will be structured such that awards may qualify as performance-based compensation that is not subject to the deductibility limitation imposed by Section 162(m). Consequently, the Board of Directors is seeking stockholder approval of (i) amendments to the Company’s 2003 Stock Incentive Plan and its 2002 Stock Incentive Plan to allow for restricted stock awards based on performance which may then be tax deductible notwithstanding the limitations of Section 162(m) and (ii) the ratification of the Amended Performance Bonus Plan, which would provide that certain payments made to the Company’s Chief Executive Officer that are directly tied to the attainment of the Company’s business performance may qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code.

COMPENSATION COMMITTEE

Thomas F. Comeau, Chair

Walter O. LeCroy

Ronald Uyematsu

The following table summarizes cash and non-cash compensation for each of the last three fiscal years awarded to, earned by or paid to the Company’s Chief Executive Officer and the other three executives officers who were serving as executive officers as of December 31, 2004 (collectively, the “Named Executive Officers”). In 2004, the Company had only four executive officers.

SUMMARY COMPENSATION TABLE

| | | | | | | | | | | | | | | | | | | | | |

| | | | | Annual Compensation

| | | Long-Term Compensation

| | |

Name and

Principal Position

| | Year

| | Salary

($)

| | Bonus

($)

| | Other Annual

Compensation1

($)

| | | Restricted

Stock Awards

($)

| | | Securities

Underlying

Options2 (#)

| | All Other

Compensation3

($)

|

Edward M. Kopko | | 2004 | | $ | 426,727 | | $ | 562,673 | | $ | 606,758 | 4 | | $ | 185,000 | 5 | | 250,000 | | $ | 67,268 |

President and | | 2003 | | | 425,844 | | | 31,336 | | | 308,160 | 6 | | | 1,137,804 | 7 | | — | | | 67,220 |

CEO | | 2002 | | | 449,950 | | | 229,382 | | | 540,632 | 8 | | | — | | | 62,667 | | | 77,423 |

| | | | | | | |

James Beckley | | 2004 | | | 140,635 | | | 114,542 | | | — | | | | — | | | 15,000 | | | 1,085 |

Sr. VP - | | 2003 | | | 127,800 | | | 69,125 | | | — | | | | — | | | — | | | 1,085 |

Technical Services | | 2002 | | | 137,631 | | | 66,523 | | | — | | | | — | | | 40,000 | | | 6,425 |

| | | | | | | |

Ivan Estes | | 2004 | | | 168,365 | | | 97,500 | | | — | | | | — | | | 10,000 | | | 606 |

Sr. VP | | 2003 | | | 153,000 | | | 40,000 | | | — | | | | — | | | — | | | 606 |

Telecommunication Services | | 2002 | | | 164,769 | | | 35,000 | | | — | | | | — | | | 40,000 | | | 7,091 |

| | | | | | | |

Craig S. Tireman | | 2004 | | | 134,733 | | | 30,000 | | | — | | | | — | | | 25,000 | | | 1,108 |

VP - Finance and | | 2003 | | | 103,740 | | | 25,935 | | | — | | | | — | | | — | | | 1,108 |

Controller | | 2002 | | | 107,520 | | | 27,300 | | | — | | | | — | | | 20,000 | | | 5,406 |

| 1 | Excludes perquisites and other personal benefits that, in the aggregate, do not exceed the lesser of $50,000 or 10% of the Named Executives Officer’s salary and bonus for any year |

| 2 | No options were repriced during the last fiscal year or at any time since the Company’s inception. |

11

| 3 | For the Named Executives Officers, this column includes the following payments by the Company in the years indicated: |

| | | | | | | | | | | |

Name

| | Year

| | 401 (k) Company Match

| | Term Life Insurance Payments

| | Disability and Whole Life Insurance Premiums

|

Edward M. Kopko | | 2004 | | | — | | $ | 276 | | $ | 66,992 |

| | | 2003 | | | — | | | 228 | | | 66,992 |

| | | 2002 | | $ | 10,000 | | | 431 | | | 66,992 |

| | | | |

James Beckley | | 2004 | | | — | | | 1,085 | | | — |

| | | 2003 | | | — | | | 1,085 | | | — |

| | | 2002 | | | 5,352 | | | 1,073 | | | — |

| | | | |

Ivan Estes | | 2004 | | | — | | | 606 | | | — |

| | | 2003 | | | — | | | 606 | | | — |

| | | 2002 | | | 6,702 | | | 389 | | | — |

| | | | |

Craig S. Tireman | | 2004 | | | — | | | 1,108 | | | — |

| | | 2003 | | | — | | | 1,108 | | | — |

| | | 2002 | | | 4,305 | | | 1,101 | | | — |

| 4 | Consists of imputed interest on loans to buy common stock of the Company in the amount of $133,233, tax gross-up on imputed interest, insurance payments and accrued vacation payments in the amounts of $110,874, $55,748 and $281,689, respectively. |

| 5 | The Company granted 100,000 shares of restricted stock to Mr. Kopko under the 2003 Stock Incentive Plan, of which 66,666 shares are vested, and of which 33,334 will become vested on October 15, 2006, subject to forfeiture or acceleration of vesting upon certain events. The market value of the restricted shares at December 31, 2004 was $533,000. |

| 6 | Consists of imputed interest on loans to buy common stock of the Company in the amount of $133,233 and tax gross-up on imputed interest and insurance payments in the amounts of $101,748 and $51,159, respectively. |

| 7 | During 2003, Mr. Kopko elected to receive shares of the Company’s restricted stock in lieu of $510,000 bonus payments owed him in cash for the nine-month period ended September 30, 2003. The Company granted 1,073,400 shares of restricted stock to him under the 2003 Stock Incentive Plan. The stock is restricted for three years, subject to forfeiture or acceleration of vesting upon certain events. The market value of the restricted shares at December 31, 2004 was $5,721,222. |

| 8 | Consists of imputed interest on loans to buy common stock of the Company in the amount of $133,233 and tax gross-up on imputed interest, insurance payments, 2001 bonus payments and stock awards in the amounts of $117,678, $59,169, $183,537 and $24,995, respectively. |

Employment Contracts and Termination of Employment and Change-in-Control Arrangement

On December 4, 2002, as the result of the Sarbanes-Oxley Act of 2002 and management salary reductions, the Board of Directors and the Executive Compensation Committee approved the terms of a second amended and restated employment agreement (collectively, the “Employment Agreement”) with Mr. Kopko. Under the Employment Agreement, Mr. Kopko has agreed to serve as President, Chairman of the Board and Chief Executive Officer of the Company, and in a similar capacity for the Company’s subsidiaries, for a term commencing on January 1, 1991 and terminating three years after a notice of termination is given by either the Company or Mr.��Kopko, subject to earlier termination in accordance with the terms of the Employment Agreement.

The Employment Agreement provides for base compensation and annual raises of not less than five percent of the prior year’s salary. The employment agreement, however, further provides that (i) during the year 2002, Mr. Kopko’s salary reflected a ten percent reduction effective September 2002: (ii) Mr. Kopko would not receive the automatic five percent salary increase for the year 2002; (iii) Mr. Kopko would not receive the automatic five percent increase for the year 2003 and (iv) Mr. Kopko would not receive the automatic five percent increase for the year 2004. Mr. Kopko will also receive payment of a performance bonus (referred to in the Employment Agreement as an annual cash bonus) in an amount equal to

12

five percent of the Company’s operating income of $3 million or less, plus three percent of operating income above $3 million, but not less than $150,000 per quarter. The Employment Agreement also provides for an incentive bonus based on the successful completion of management objectives and other factors. In no event is the total annual bonus to exceed four times Mr. Kopko’s base salary.

“Operating Income” is defined in the Employment Agreement as net income of the Company’s principal operating subsidiary before adjustments for Federal and State income taxes and taxes imposed at the federal/national level by foreign countries (based upon income), and excluding extraordinary items. “Operating income” is also defined to exclude such items as corporate expense allocation from the Company and certain goodwill amortization, and to include items such as general and administrative expense and related working capital interest income and expense.

The Employment Agreement further provides that prior to the end of the first three calendar quarters of each year, the Company shall pay to Mr. Kopko an amount equal to the sum of the following: (i) eighty percent of the Company’s estimate of Mr. Kopko’s performance bonus for said quarter based on the operating income of the Company, as reported to the Board of Directors for the quarter; and (ii) eighty percent of the Company’s incentive bonus for said quarter, based on satisfactory progress toward completion of the management objectives. The remaining payment will be made within ninety days of the end of the fiscal year.

The previous employment agreement entered into between the Company and Mr. Kopko contained a performance-based bonus plan for Mr. Kopko (the “Performance Bonus Plan”) which is intended to comply with the provisions of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). Section 162(m) generally authorizes the tax deduction of compensation in excess of $1,000,000 per taxable year payable to a chief executive officer (and certain other officers) only where such compensation is based on performance, satisfies certain other requirements, and is approved by the stockholders. The Company’s stockholders approved the Performance Bonus Plan at the Company’s 1999 Annual Meeting. The Performance Bonus Plan was amended by the terms of the Employment Agreement, as set forth above (the “Amended Performance Bonus Plan”). If the Amended Performance Bonus Plan is ratified by the affirmative vote of the holders of at least a majority of the shares of Common and Preferred Stock present and entitled to vote at the meeting, and certain other requirements set forth in Section 162(m) of the Code are satisfied, certain performance bonus payments to Mr. Kopko pursuant to the Amended Performance Bonus Plan may qualify for deduction under Section 162(m) of the Code. If the Amended Performance Bonus Plan is not ratified by the stockholders, Mr. Kopko has agreed to forego payment of all amounts due him thereunder and such amounts will not be paid even if the performance goals are achieved.

Mr. Kopko is also entitled to benefits, including stock options and payment of taxes on his behalf based on imputed income. If the Company breaches its duty under the Employment Agreement, if Mr. Kopko determines in good faith that his status with the Company has been reduced, or if, after a change in control of the Company, Mr. Kopko determines in good faith that the financial prospects of the Company have significantly declined, Mr. Kopko may terminate his employment and receive all salary and bonus owed to him at that time, pro rated, plus three times the highest annual salary and bonus paid to him in the three years immediately preceding the termination.

The Company and General Electric Capital Corporation (“GECC”) on March 28, 2003, entered into a third amendment and waiver of its credit facility dated September 28, 2001 (the “GE Third Amendment”), whereby, among other things, certain scheduled amortization payments were waived and certain covenants were modified. Additionally, the GE Third Amendment provides that certain compensation payments to senior executive officers may only be paid in the form of non-cash consideration. During 2003, the CEO elected to receive shares of the Company’s restricted stock in lieu of $510,000 bonus payments owed him in cash for the nine-month period ended September 30, 2003. The Company granted 1,073,400 shares of restricted stock to him under the 2003 Stock Incentive Plan. The stock is restricted for three years, subject to forfeiture or acceleration of vesting upon certain events.

In April 2005, the Company entered into a three-year employment agreement with Thomas J. Considine, Jr. at an annual salary of $235,000. Mr. Considine’s employment agreement is terminable by either party with four months prior notice. Mr. Considine received an immediate bonus of $75,000 at the commencement date of his contract. In addition, Mr. Considine is eligible for bonuses of up to $100,000 ($50,000 is guaranteed for 2005), based on the achievement of mutually agreed upon goals and objectives (as defined) and other factors. The employment agreement provides that if Mr. Considine’s employment is terminated other than for cause, he will be entitled to up to one year’s base salary or a lesser amount based on his remaining contract term. The agreement provides that Mr. Considine will not compete with the Company for a period of one year after termination of employment.

In July 2001, the Company entered into an employment agreement with James Beckley. Mr. Beckley’s employment agreement is terminable by either party with four months prior notice. Mr. Beckley is eligible for bonuses of up to 50% of his base salary, based on the Company obtaining specified management objectives (as defined) and other factors. The employment agreement provides that if Mr. Beckley’s employment is terminated other than for cause, he will be entitled to four months salary. The agreement provides that Mr. Beckley will not compete with the Company for a period of one year after termination of employment.

13

In July 2001, the Company entered into an employment agreement with Ivan Estes. Mr. Estes’ employment agreement is terminable by either party with four months prior notice. Mr. Estes is eligible for bonuses of up to 50% of his base salary, based on the Company obtaining specified management objectives (as defined) and other factors. The employment agreement provides that if Mr. Estes’ employment is terminated other than for cause, he will be entitled to four months salary. The agreement provides that Mr. Estes will not compete with the Company for a period of one year after termination of employment.

Stock Options Grants in Fiscal Year 2004

This table shows stock options grants during 2004 to the Named Executive Officers. No stock appreciation rights have been granted to the Named Executive Officers.

OPTIONS GRANTED IN 2004

| | | | | | | | | | | | | | |

Name of Individual

| | Number of Securities Underlying Options Granted

| | | Percent of Total Options Granted to Employees in Fiscal Year

| | | Exercise Price

| | Expiration Date1

| | Grant Date

Present Value2

|

Edward M. Kopko | | 250,000 | 3 | | 57.7 | % | | $ | 1.85 | | October 14, 2014 | | $ | 270,907 |

James Beckley | | 15,000 | 4 | | 3.5 | % | | | 1.50 | | February 9, 2014 | | | 13,176 |

Ivan Estes | | 10,000 | 5 | | 2.3 | % | | | 1.50 | | February 9, 2014 | | | 8,784 |

Craig S. Tireman | | 25,000 | 6 | | 5.8 | % | | | 2.28 | | May 25, 2014 | | | 33,624 |

| 1 | These options could expire earlier in certain situations such as an individual’s termination of employment with the Company. |

| 2 | The estimated fair value of stock options is measured at the grant date using the Black-Scholes option pricing model based on the following assumptions: expected stock price volatility of 83.8% based on the average monthly closing price of the Company’s common stock for 2004; expected term to exercise of approximately 5.93 years; and interest t-rates equal to the U.S. Treasury Note rates at the date of grant (4.08% for options granted on February 9, 2004, 4.72% for options granted on May 25, 2004, 4.13% for options granted on October 14, 2004 ). The actual value, if any, an individual may realize will depend on the excess of the stock price over the exercise price on the date the option is exercised. Consequently, there is no assurance the value realized will be at or near the value estimated above. |

| 3 | Consists of options granted under the 2002 Stock Incentive Plan on October 14, 2004, of which 83,333 are exercisable on each of April 14, 2005 and 2006 and 83,334 are exercisable on April 14, 2007. |

| 4 | Consists of options granted under the 2002 Stock Incentive Plan on February 9, 2004, of which 5,000 are exercisable on each of February 9, 2005, 2006 and 2007. |

| 5 | Consists of options granted under the 2002 Stock Incentive Plan on February 9, 2004, of which 3,333 are exercisable on each of February 9, 2005 and 2006 and 3,334 are exercisable on February 9, 2007. |

| 6 | Consists of options granted under the 2002 Stock Incentive Plan on May 25, 2004, of which 8,333 are exercisable on each of May 25, 2005 and 2006 and 8,334 are exercisable on May 25, 2007. |

14

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

No options were exercised by the Named Executives Officers in fiscal year 2004. This table shows information regarding the number and value of options held at year-end by the Named Executives Officers.

2004 YEAR-END OPTION VALUES

| | | | | | | | | |

Name of Individual

| | Shares Acquired

On Exercise

| | Value

Realized

| | Number of Securities

Underlying

Unexercised Options

at 2004 Year-End

Exercisable/

Unexercisable

| | Value of Unexercised

In-the-Money

Options

at 2004 Year-End

Exercisable/

Unexercisable

|

Edward M. Kopko | | 0 | | $ | 0 | | 307,8781/270,889 | | $349,837/5937,054 |

James Beckley | | 0 | | $ | 0 | | 40,1662/28,334 | | $85,598/$100,252 |

Ivan Estes | | 0 | | $ | 0 | | 45,1663/23,334 | | $85,598/$81,102 |

Craig S. Tireman | | 0 | | $ | 0 | | 15,3344/31,666 | | $42,802 / $97,648 |

| 1 | Consists of: (1) currently exercisable non-qualified stock options to purchase 26,100 shares, granted in 1986 and 1987 at an option price of $6.68 per share; (2) currently exercisable options to purchase 90,000 shares under the 1992 Incentive Stock Option Plan, granted on August 2, 1993, at an exercise price of $2.93 per share; (3) currently exercisable options to purchase 150,000 shares under the 1992 Non-Qualified Plan, granted on December 1, 1999, at an exercise price of $8.00 per share; (4) options to purchase 62,667 shares under the 1992 Incentive Stock Option Plan granted on March 1, 2002, at the exercise price of $2.12 per share, of which 20,889 became exercisable on each of March 1, 2003 and 2004 and 20,889 will become exercisable on March 1, 2005; and (5) options to purchase 250,000 shares under the 2002 Stock Incentive Plan granted of October 14, 2004, at the exercise price of $1.85 per share, of which 83,333 are exercisable on each of April 14, 2005 and 2006 and 83,334 are exercisable on April 14, 2007. |

| 2 | Consists of: (1) currently exercisable incentive stock options to purchase 3,000 shares, granted in December 1996 at an exercise price of $6.42 per share; (2) currently exercisable incentive stock options to purchase 3,375 shares granted in December 1997 at an exercise price of $ 11.25 per share; (3) currently exercisable incentive stock options to purchase 3,375 shares granted in April 1999 at an exercise price of $13.00 per share; (4) currently exercisable incentive stock options to purchase 3,750 shares granted in February 2000 at an exercise price of $9.69 per share; (5) options to purchase 40,000 shares under the 1992 Incentive Stock Option Plan granted on March 1, 2002, at the exercise price of $2.12 per share, of which 13,333 became exercisable on each March 1, 2003 and 2004 and 13,334 will become exercisable on March 1, 2005; and (6) options to purchase 15,000 shares under the 2002 Stock Incentive Plan granted on February 9, 2004 at $1.50 per share, of which 5,000 are exercisable on each of February 9, 2005, 2006 and 2007. |

| 3 | Consists of: (1) currently exercisable incentive stock options to purchase 4,500 shares, granted in December 1996 at an exercise price of $6.42 per share; (2) currently exercisable incentive stock options to purchase 4,500 shares granted in December 1997 at an exercise price of $11.25 per share; (3) currently exercisable incentive stock options to purchase 4,500 shares granted in April 1999 at an exercise price of $13.00 per share; (4) currently exercisable incentive stock options to purchase 5,000 shares granted in February 2000 at an exercise price of $9.69 per share; (5) options to purchase 40,000 shares under the 1992 Incentive Stock Option Plan granted on March 1, 2002, at the exercise price of $2.12 per share, of which 13,333 became exercisable on each March 1, 2003 and 2004 and 13,334 will become exercisable on March 1, 2005; and (6) options to purchase 10,000 shares under the 2002 Stock Incentive Plan granted on February 9, 2004 at $1.50 per share, of which 3,333 are exercisable on each of February 9, 2005 and 2006 and 3,334 are exercisable on February 9, 2007. |

| 4 | Consists of: (1) currently exercisable incentive stock options to purchase 2,000 shares, granted on May 11, 2000 at an exercise price of $8.00 per share; (2) options to purchase 20,000 shares under the 1992 Incentive Stock Option Plan granted on March 1, 2002, at the exercise price of $2.12 per share, of which 6,667 became exercisable on each March 1, 2003 and 2004 and 6,666 will become exercisable on each of March 1, 2005; and (3) options to purchase. 25,000 shares, granted under the 2002 Stock Incentive Plan on May 25, 2004, of which 8,333 are exercisable on each of May 25, 2005 and 2006 and 8,334 are exercisable on May 25, 2007 |

15

RETIREMENT PLANS

Staff employees of the Company, including the executive officers referred to in the Summary Compensation Table, are entitled to participate in the Butler Service Group, Inc. Defined Benefit Plan (the “Plan”), which is a non-contributory, defined benefit retirement plan. The Defined Benefit Plan was frozen as of December 31, 1996. Retirement benefits are computed on the basis of a specified percentage of the average monthly base compensation (during any 60 consecutive months of an employee’s final 120 months of employment which results in the highest average) multiplied by the employee’s years of credited service. The Plan provides for several optional forms of benefit payment including a straight life annuity, a 50% joint and survivor annuity, a period certain annuity, and a lump sum. Retirement benefits are in addition to benefits payable from Social Security. Normal retirement age is 65, although benefits may begin as early as age 55 with ten years of service. A pension benefit is vested after five years of service.

As of December 31, 1996, the Named Executive Officers had the following years of credited service for retirement compensation purposes: Mr. Kopko—11, Mr. Beckley—6, Mr. Estes—6, and Mr. Tireman—14. The following table shows the estimated annual retirement benefits payable assuming that retirement occurs at age 65.

PENSION PLAN TABLE

| | | | | | | | | | | | |

Average Annual Earnings for the Highest Consecutive 60 Months of the Last 120 Months Prior to 1/1/97

| | Years of Service

|

| | 10

| | 15

| | 20

| | 25

|

$100,000 | | $ | 11,532 | | $ | 17,298 | | $ | 23,064 | | $ | 28,830 |

$150,000* | | $ | 17,532 | | $ | 26,298 | | $ | 35,064 | | $ | 43,830 |

| * | Salary limited by terms of Plan and the law to $160,000 as of January 1, 1997. For Mr. Kopko, the compensation used for service prior to 1994 is $235,840. |

The above pensions are offset by pension equivalents from two other plans: (1) The Company sponsored Employee Stock Ownership Plan (“ESOP”); and (2) Pensions purchased from Nationwide Insurance Company due to termination of predecessor plan. The ESOP has approximately 39,000 shares of the Company’s stock. The shares of stock were allocated to employees over seven years beginning in 1987 and ending in 1993.

The Company established a 401(k) savings plan (“401(k) Plan”) for all employees. The 401(k) Plan is designed to provide an incentive for employees of the Company, including the Named Executive Officers, to save regularly through payroll deductions. The Company may make matching contributions or other additional discretionary contributions to the 401(k) Plan in amounts determined by the Employee Benefits Administrative Committee. As of September 1, 2002, the Company suspended its matching program. On January 1, 2005, the matching program was reinstated.

The Company also maintains a supplemental executive retirement plan (“SERP”) for certain key employees, including the Named Executive Officers. The SERP allows participants to defer, on a pre-tax basis, a portion of their salary and bonus and accumulate tax-deferred earnings, plus investment earnings on the deferred balances, as a retirement fund. Participants do not receive a Company match on any of these deferrals. All employee deferrals vest immediately.

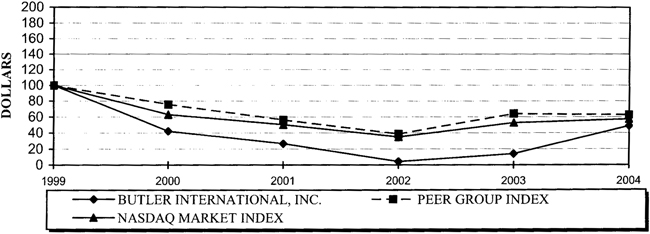

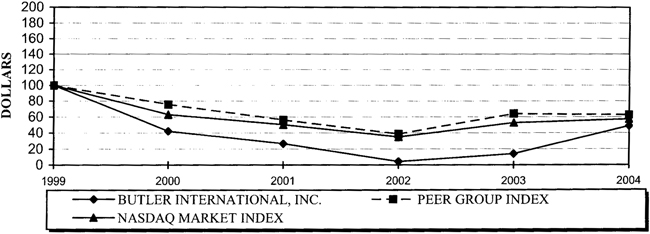

PERFORMANCE GRAPH

The following graph compares the cumulative total return on the Company’s common stock for the last five years with the cumulative total return of the NASDAQ Market Index and a self-constructed peer group of companies. The peer group companies are CDI Corporation, Comforce Corporation, Computer Horizons Corporation, Dycom Industries, Inc., Keane, Inc., Kelly Services, Inc., Mastec, Inc., Quanta Services, Inc., RCM Technologies, Inc., and SOS Staffing Services, Inc. The results are based on an assumed $100 invested on December 31, 1999 and the reinvestment of dividends.

16

COMPARE 5-YEAR CUMULATIVE TOTAL RETURN

AMONG BUTLER INTERNATIONAL, INC.,

NASDAQ MARKET INDEX AND PEER GROUP INDEX

ASSUMES $100 INVESTED ON DECEMBER 31, 1999

ASSUMES DIVIDEND REINVESTED THROUGH

FISCAL YEAR ENDING DECEMBER 31, 2004