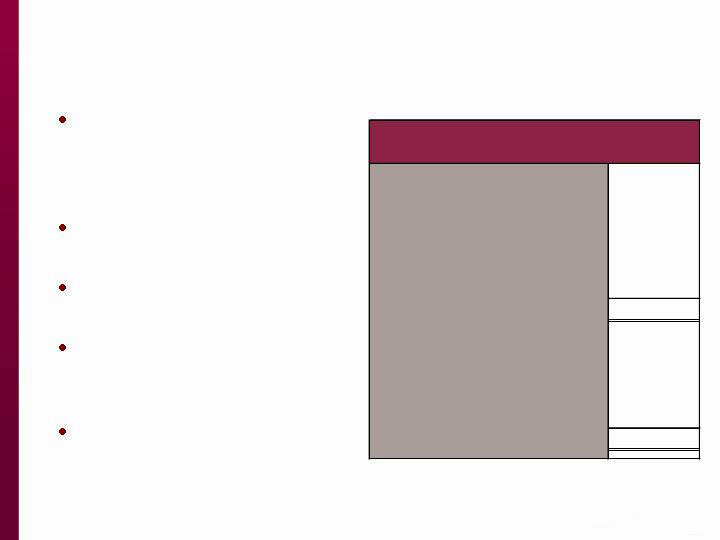

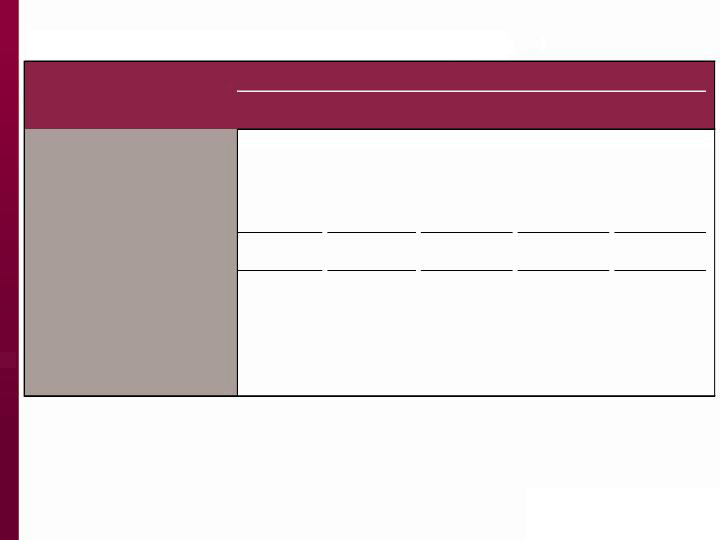

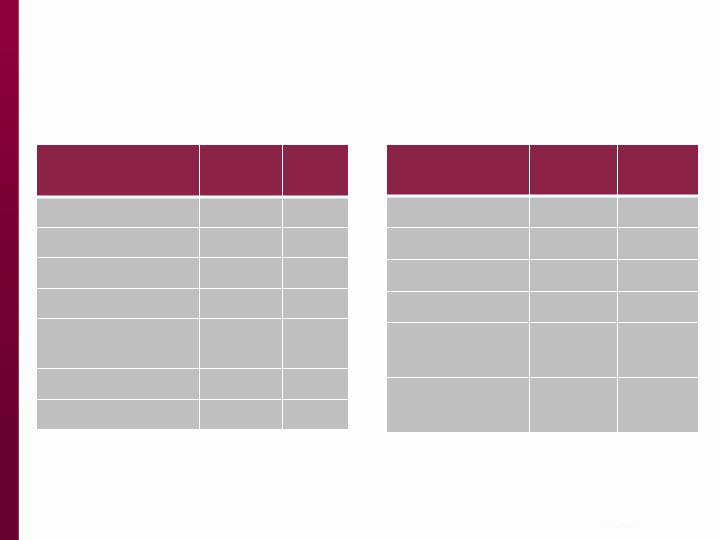

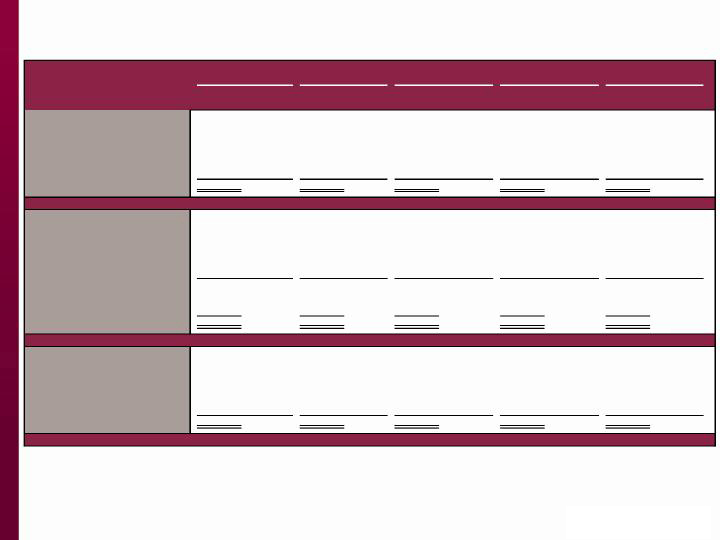

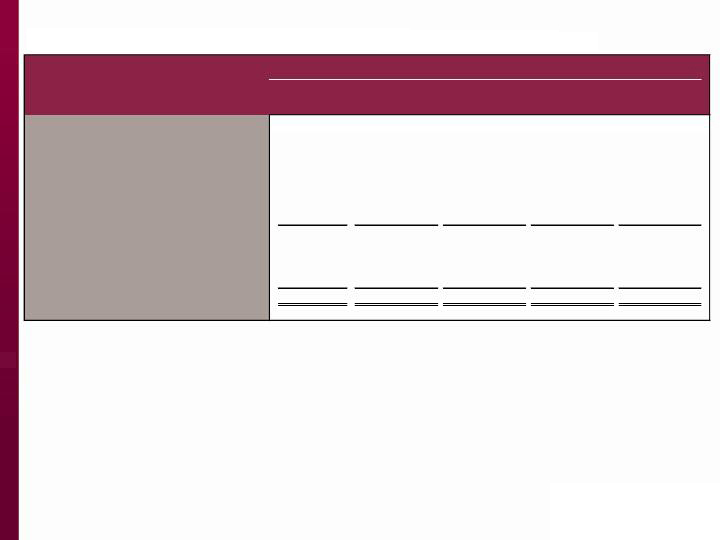

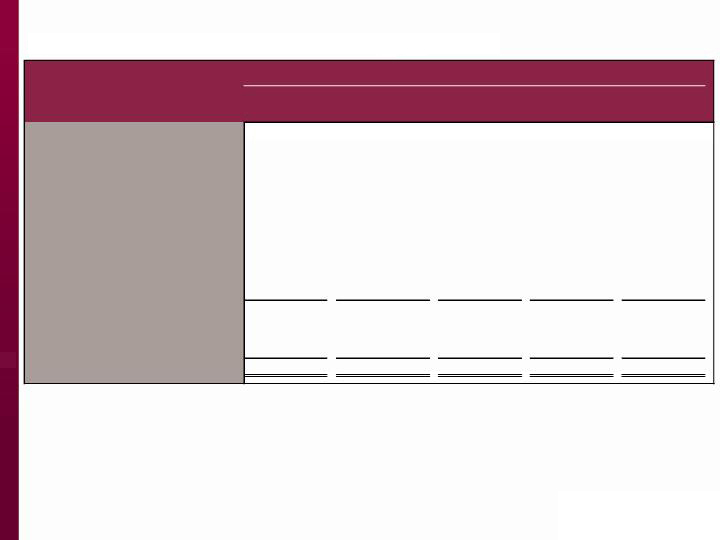

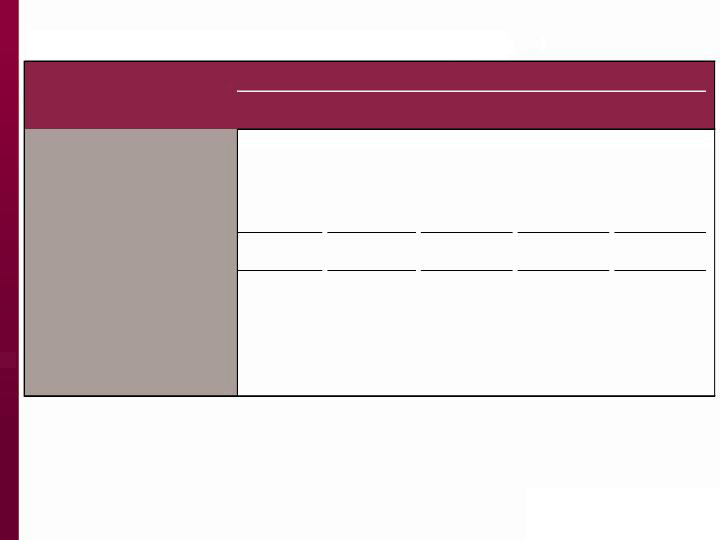

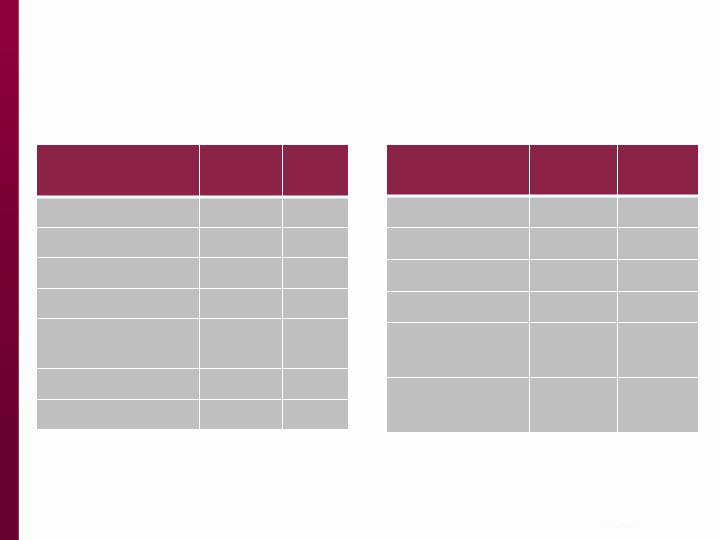

Management Team

Name

Position

Age

Years of

Financial

Services

Experience

Relevant

Experience

R. Wayne Hall

President and Chief Executive Officer

62

36

EVP / CRO at Provident Bank

Blaise B. Bettendorf

Executive Vice President - Chief Financial Officer

49

28

SVP / CFO at Carolina Commerce Bank,

and Summit National Bank; Previously

Audit Manager with PricewaterhouseCoopers

J. Dale Hall

Executive Vice President - Chief Banking Officer

64

42

SVP / Commercial Market Executive

at Bank of America

Joseph W. Amy

Executive Vice President - Chief Credit Officer

62

38

Credit positions at Mellon and U.S. Bank

Richard A. Arthur

Executive Vice President - Retail Banking

40

16

SVP at Bank of America

Susan A. Bagwell

Executive Vice President - Human Resources

48

27

VP Human Resources at First Federal

Robert L. Davis

Executive Vice President - Corporate Counsel

59

30

Managing Director and General Counsel at

Provident Bankshares Corporation/Provident

Bank

John N. Golding

Executive Vice President - Commercial Banking

44

22

SVP at Wachovia/Wells Fargo

Kellee S. McGahey

Executive Vice President - Marketing

33

2

Assistant Director at College of

Charleston/Lowcountry Graduate Center

Eartha C. Morris

Executive Vice President - Support Services

55

34

EVP / COO at Congressional Bank

EVP / Head of Bank Operations at PNC Bank

(formerly Riggs National Bank)

Daniel S. Vroon

Executive Vice President - Wealth Management

44

15

SVP Bank of America

First Financial Holdings, Inc.

6

Strategic Initiatives Accomplished

During the Prior Twelve Months

• Sold insurance agencies in 2011 and generated non-dilutive tangible equity

• Completed the bulk sale of nonperforming and select performing assets

– Significantly reduced the level of problem loans

– Active management has maintained improved credit metrics

• Acquired Plantation Federal through an FDIC-assisted transaction

– Expanded coastal presence and entered Greenville, SC market

• Completed acquisition of 5 branches in the Hilton Head market

– Consolidated 3 into existing locations and added 2 new financial centers

• Repositioned the balance sheet to enhance future net interest income,

noninterest income and net interest margin

• Developed new sales process, retail deposit product set, and

complementary products to drive organic growth of core deposits and

revenue enhancements

• Consolidated five existing branches, excluding acquisition activities, to

improve profitability

First Financial Holdings, Inc.

7

Strategic Acquisition

Plantation Federal Bank

• FDIC-assisted transaction

— Purchased substantially all assets and assumed deposits and certain

other liabilities of Plantation Federal Bank on April 27, 2012

— Loss-share coverage on commercial loans and OREO

— 80% FDIC coverage on losses up to $55 million and 60% coverage

over $65 million

• Locations include Grand Strand coastal market and Upstate SC

— Initial entry into the demographically attractive Greenville market,

providing geographic diversification

— Expanded existing market share in Myrtle Beach and Pawleys Island

• Financially attractive

— Immediately accretive to EPS and tangible book value

— No external capital needed to complete transaction

— Considerable opportunity for operating efficiencies

First Financial Holdings, Inc.

8

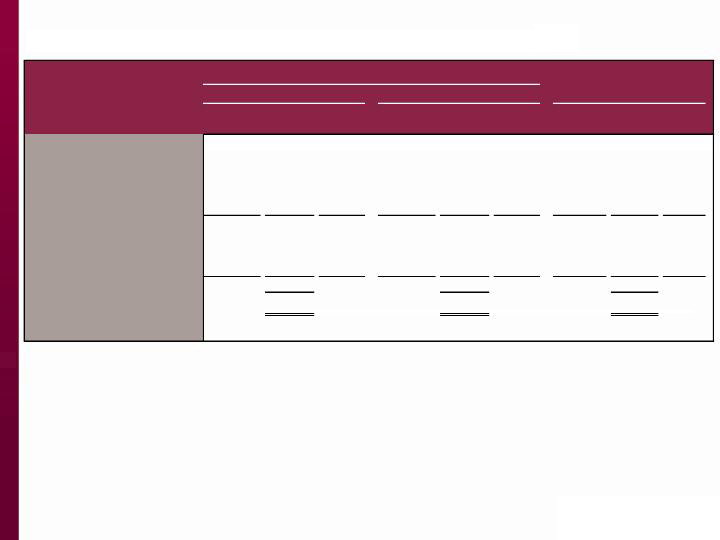

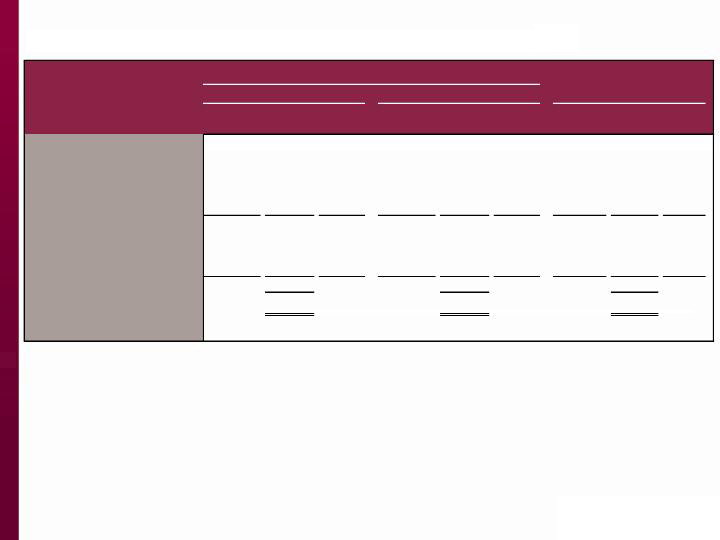

Transaction Overview

Plantation Federal Bank

Financial Highlights as of April 27, 2012

($ in thousands)

Total assets $ 421,016

Loans 278,651

Residential 21.2%

Commercial 62.8%

Consumer 16.0%

FDIC indemnification asset, net 34,300

Other real estate owned 10,736

Core deposit intangible, net 1,710

Deposits 419,929

Transaction accounts 14.4%

Savings & money market 30.3%

Time deposits 55.3%

Deferred tax liability 5,583

Liability for FDIC indemnification

“claw-back” 3,520

Gain on acquisition, net of taxes 9,024

Asset discount bid 46,000

• Purchase accounting resulted in a fair value

adjustment on loans of 14.7% and on OREO

of 57.5%

• Loans accounted for under ASC 310-30

(Loans Acquired with Deteriorated Credit

Quality) represent 50.2% of acquired loans

• Loans covered by loss share are

approximately 60%; covered OREO are

approximately 90%

• Purchase accounting accretion of discounts

contributed to NIM increase

• Exercised option to acquire Plantation’s

Pawleys Island location (to close in Q3);

consolidate remaining acquired branches on

the coast in Q3 for no net increase in

financial centers; added 3 locations in

Greenville

First Financial Holdings, Inc.

9

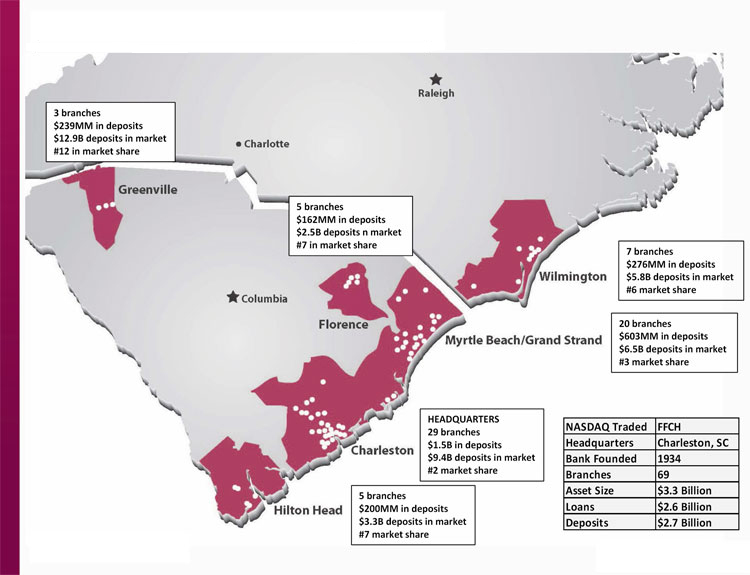

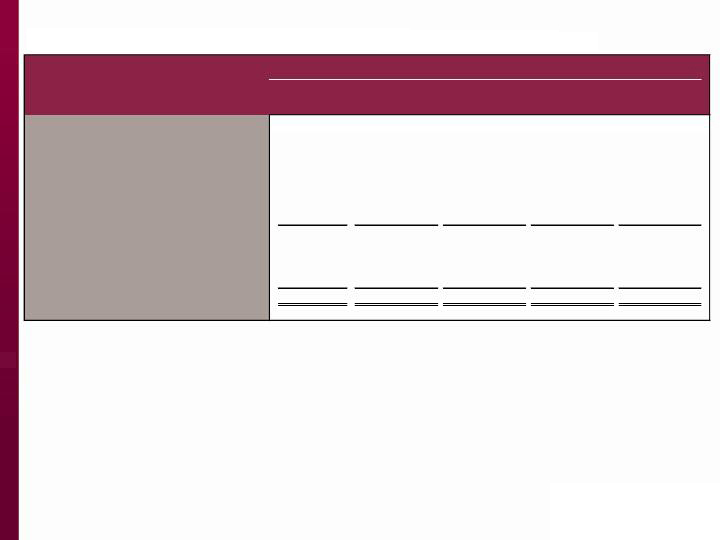

Market Share Analysis

Plantation Federal Bank

Plantation Federal Bank Overview:

Founded in 1986 in Pawleys Island, SC

Leading market share in Pawleys Island

Established First Savers Bank in Greenville, SC as separate de novo

charter in 1996

Combined Plantation and First Savers charters in 2008

Attractive deposit mix with solid core deposits in excess of 40%

Market

# of New

Branches

Total

Deposits

(000s)

Deposit

Market

Share (%)

Market

Share Rank

Myrtle Beach/Grand Strand, SC1

0

$603,305

9.32%

3

Greenville, SC

3

238,923

1.85%

12

1 Includes Georgetown and Horry Counties

Source - SNL Financial; FDIC deposit data as of June 30, 2011

First Financial Holdings, Inc.

10

Strategic Expansion

Liberty Savings Bank Branches

Acquired five branches from

Liberty Savings Bank, FSB in the

Hilton Head market on

April 20, 2012

Moved to 7th from 12th in market

share and doubled deposit base

Consolidated 3 locations and

added 2 new financial centers

Attractive deposit mix with solid

core deposits in excess of 75%

and 0.39% cost of funds

Loans acquired were all

performing and in-market

($ in thousands)

Assets acquired:

Total loans

Residential

6,179

$

Commercial

2,852

Consumer

13,166

Intangibles

5,239

27,436

$

Liabilities assumed:

Total deposits

Transaction accounts

59,800

$

Savings & money market

25,106

Time deposits

28,010

112,916

$

Transaction Summary as of April 20, 2012

First Financial Holdings, Inc.

11

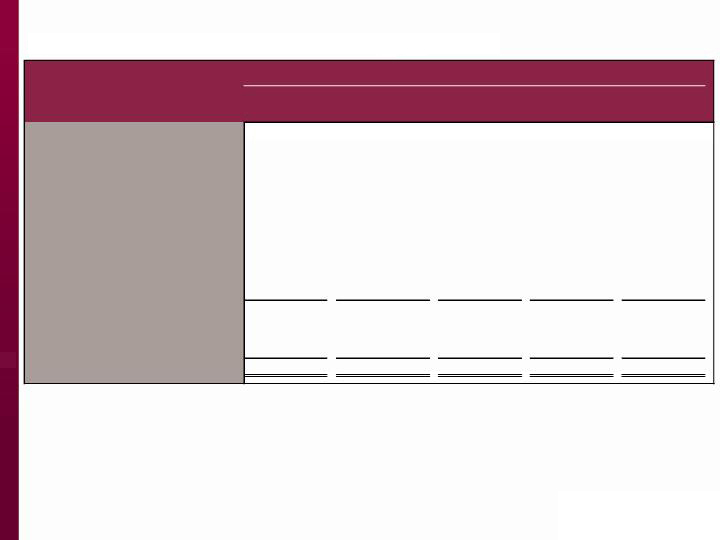

Balance Sheet Repositioning

Transaction considered economically accretive as breakeven point anticipated to be less

than 2 years

Securities with low book yield relative to duration/extension risk selected

Deleveraging the balance sheet created capital to support acquisition activities

($ in thousands)

Average

Rate/Yield

Balance Sheet

Impact

Equity

Impact

Anticipated

Ongoing

Annual

Income

Impact

Mortgage-backed securitites sold

1.79%

($203,628)

$2,197

($3,641)

FHLB advances terminated/Deleverage

3.15%

125,000

(5,287)

3,932

Net cash to reinvest after deleverage

(78,628)

(3,090)

291

Reinvestments1

Bank-owned life insurance2

5.00%

50,000

---

2,500

Other investment securities

2.00%

30,000

---

600

Net reduction in total assets

($123,628)

Annualized income impact, net of taxes

$2,103

2 Tax-equivalent yield estimate; earnings included in noninterest income.

1 Based on committed BOLI investments, partially funded in June 2012, with the balance to be completed in July 2012.

Other investments anticipated to be purchased in July 2012.

First Financial Holdings, Inc.

12

Profitability enhancements

Continue to expand mortgage correspondent and retail lending

channels

Continue to develop specialty financing channels

Expand Wealth Management presence and territory for broker-

dealer and 401k administration division

Enhance operating efficiencies through process improvement

initiatives

Position the franchise for the future

Fully integrate acquisitions and achieve efficiencies

Launch the brand in the new Greenville market

Consider financially and strategically attractive non-dilutive growth

opportunities

Strategic Priorities

First Financial Holdings, Inc.

13

FINANCIAL REVIEW

First Financial Holdings, Inc.

14

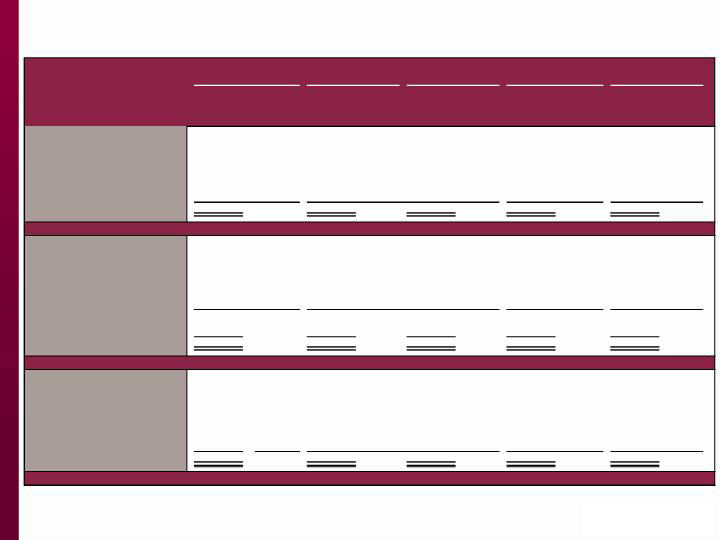

Operating Results Highlights

June 30,

September 30,

December 31,

March 31,

June 30,

2011

2011

2011

2012

2012

Core operating income1

$ 252

$ 2,596

$ 2,866

$ 3,850

$ 6,650

Net (loss) income

(43,001)

1,077

15,572

1,739

12,584

Net interest income

29,416

29,064

28,899

28,252

31,713

Provision for loan losses

77,803

8,940

7,445

6,745

4,697

Noninterest income

11,422

14,238

32,770

13,182

32,530

Noninterest expense

28,600

29,588

28,886

28,709

39,250

(Loss) income from continuing

operations

(40,277)

2,881

15,572

1,739

12,584

Loss from discontinued

operations (net of income taxes)2

(2,724)

(1,804)

---

---

---

EPS - continuing operations

(2.50)

0.12

0.88

0.05

0.70

EPS - common

(2.66)

0.01

0.88

0.05

0.70

Pretax preprovision earnings

12,238

13,714

32,783

12,725

24,993

Net interest margin

3.83%

3.87%

3.91%

3.84%

4.08%

($ in thousands)

For the Quarter Ended

1 Excludes the after-tax effect of: June 30, 2011 provision for loan losses for loan held for sale reclassification $40.1 million and goodwill impairment

$0.4 million; September 30, 2011 provision for loan losses for loan reclassification $0.9 million and gain on loans held for sale $(1.2) million;

December 31, 2011 gain on loans held for sale $(12.7) million; March 31, 2012 State DTA writeoff $2.1 million; and June 30, 2012 gain on

acquisition $(9.0) million, gain on securities sales $(2.2) million and FHLB prepayment penalty $5.3 million

2 Sale of First Southeast Insurance was completed on June 1, 2011 and the sale of Kimbrell was completed on September 30, 2011

First Financial Holdings, Inc.

15

Net Interest Margin Analysis

($ in thousands)

Average

Balance

Interest

Average

Rate

Average

Balance

Interest

Average

Rate

Average

Balance

Interest

Basis

Points

Earning assets:

Interest-bearing deposits

$ 8,484

$ 1

0.05%

$ 10,191

$ 19

0.75%

$ 1,707

$ 18

70

Investment securities1

490,356

3,867

3.31

443,181

3,538

3.40

(47,175)

(329)

9

Loans2

2,420,000

32,476

5.39

2,619,409

35,643

5.46

199,409

3,167

7

FDIC indemnification asset

48,774

15

0.12

69,816

143

0.82

21,042

128

70

Total earning assets

2,967,614

36,359

4.94

3,142,597

39,343

5.05

174,983

2,984

11

Interest-bearing liabilities:

Deposits

1,946,317

3,951

0.82

2,254,290

3,981

0.71

307,973

30

(11)

Borrowings

609,665

4,156

2.73

428,505

3,649

3.43

(181,160)

(507)

70

Total interest-bearing liabilities

2,555,982

8,107

1.28

2,682,795

7,630

1.14

126,813

(477)

(14)

Net interest income

$28,252

$31,713

$ 3,461

Net interest margin

3.84%

4.08%

24

2

Average loans include loans held for sale and nonaccrual loans. Loan fees, which are not material for any of the periods, have been included in loan interest income for the rate calculation.

For the Quarter Ended

March 31, 2012

June 30, 2012

Change in

1

Interest income used in the average rate calculation includes the tax equivalent adjustment of $182 thousand and $226 thousand for the quarter ended March 31, 2012 and June 30, 2012,

respectively, calculated based on a federal tax rate of 35%.

First Financial Holdings, Inc.

16

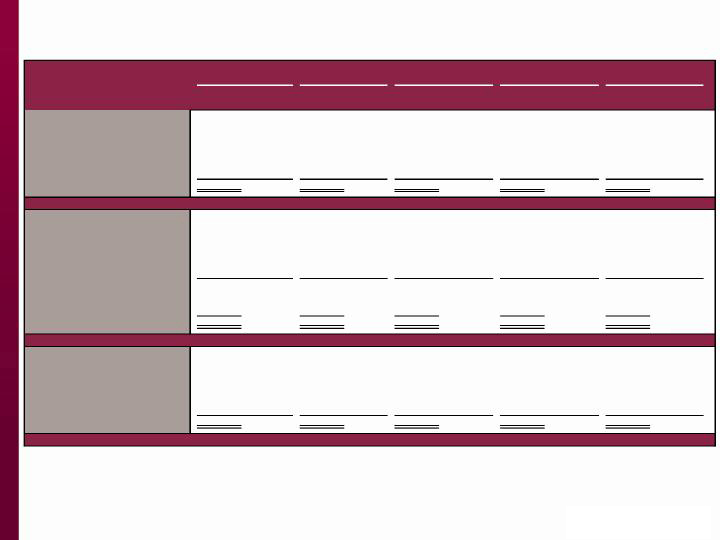

Noninterest Income

June 30,

September 30,

December 31,

March 31,

June 30,

2011

2011

2011

2012

2012

Service charges and fees on deposit accounts

6,982

$

7,196

$

7,099

$

7,302

$

7,558

$

Mortgage and other loan income

2,051

2,743

2,681

3,435

4,372

Trust and plan administration

1,116

1,333

1,192

1,081

1,078

Brokerage fees

657

588

532

664

875

Other

670

647

650

769

699

Other-than-temporary-impairment

(54)

(169)

(180)

(69)

(145)

Total core noninterest income

11,422

12,338

11,974

13,182

14,437

Gain on acquisition

---

---

---

---

14,550

Gain on sale of securities

---

---

---

---

3,543

Gain on sold loan pool, net

---

1,900

20,796

---

---

Total noninterest income

11,422

$

14,238

$

32,770

$

13,182

$

32,530

$

($ in thousands)

For the Quarter Ended

First Financial Holdings, Inc.

17

Noninterest Expense

June 30,

September 30,

December 31,

March 31,

June 30,

2011

2011

2011

2012

2012

Salaries and employee benefits

15,373

$

14,672

$

14,511

$

15,142

$

15,212

$

Occupancy costs

2,116

2,188

2,144

2,267

2,933

Furniture and equipment

1,769

1,725

1,870

1,809

1,893

Other real estate owned expenses, net

800

3,115

1,541

530

134

FDIC insurance and regulatory fees

850

576

830

986

761

Professional services

1,094

1,521

1,019

1,431

1,816

Advertising and marketing

810

868

792

656

972

Other loan expense

1,099

990

1,043

1,351

1,283

Intangible asset amortization

82

79

90

90

368

Other expense

3,976

3,854

5,046

4,447

5,353

Total core noninterest expense

27,969

$

29,588

$

28,886

$

28,709

$

30,725

$

FHLB prepayment penalty

---

---

---

---

8,525

Goodwill impairment

630

---

---

---

---

Total noninterest expense

28,599

$

29,588

$

28,886

$

28,709

$

39,250

$

($ in thousands)

For the Quarter ended

First Financial Holdings, Inc.

18

Balance Sheet Summary

June 30,

September 30,

December 31,

March 31,

June 30,

2011

2011

2011

2012

2012

Total assets

$ 3,221,544

$ 3,206,310

$ 3,146,964

$ 3,145,538

$ 3,304,174

Investment securities

478,570

469,561

457,730

500,331

293,400

Performing loans

2,329,502

2,312,375

2,337,747

2,305,666

2,582,546

Nonperforming loans

42,567

42,905

47,710

49,901

49,937

Loans

2,372,069

2,355,280

2,385,457

2,355,567

2,632,483

Allowance for loan losses

55,491

54,333

53,524

50,776

48,799

Net loans

2,316,578

2,300,947

2,331,933

2,304,791

2,583,684

Deposits

2,315,745

2,302,857

2,239,138

2,264,489

2,703,202

Borrowings

604,704

605,204

608,204

580,204

280,204

Shareholders’ Equity

266,564

268,506

277,178

278,043

287,264

Loan/deposit ratio

102.43%

102.28%

106.53%

104.02%

97.38%

($ in thousands)

As of

First Financial Holdings, Inc.

19

Capital Position

June 30,

September 30,

December 31,

March 31,

June 30,

2011

2011

2011

2012

2012

First Financial (FFCH)

Equity to assets

8.27%

8.37%

8.81%

8.84%

8.69%

6.08

6.27

6.67

6.70

6.47

$ 12.20

$ 12.31

$ 12.84

$ 12.89

$ 13.45

11.83

12.16

12.69

12.75

12.91

0.05

0.05

0.05

0.05

0.05

Common shares outstanding, end of period (000s)

16,527

16,527

16,527

16,527

16,527

Tier 1 leverage capital ratio2

10.22%

9.79%

Tier 1 risk-based capital ratio2

14.81

13.89

Total risk-based capital ratio2

16.08

15.16

First Federal (FFB)3

Tier 1 leverage capital ratio

7.48%

8.26%

8.92%

9.00%

9.06%

Tier 1 risk-based capital ratio

10.07

11.26

12.35

13.05

12.86

Total risk-based capital ratio

11.33

12.53

13.61

14.32

14.13

of Condition and Income (the “Call” Report). Prior period ratios are reported based on superseded regulatory requirements previously issued by the Office of Thrift Supervision.

3 Capital ratios for the quarter ended March 31, 2012 for First Federal Bank are based on reporting requirements for financial institutions filing FFIEC 041, FDIC Consolidated Reports

1 Non-GAAP

2 The quarter ended March 31, 2012 was the first period First Financial was required to file bank holding company ratios with the Federal Reserve Bank

As of

Book value per common share

Tangible common book value per share1

Dividends paid per common share, authorized

Tangible common equity to tangible assets1

First Financial Holdings, Inc.

20

Investment Portfolio

42% fixed/ 58% variable

Average portfolio yield: 4.89%

Modified duration: 3.0 years

Private label/CMO: mostly 2003-2005 vintages

All but 3 securities are in super senior or senior tranches (3 are in mezzanine)

Bank trust preferred CDOs: <$1 million individually; all are in mezzanine tranche

($ in thousands)

Amortized

Cost

Estimated

Fair Value

Amortized

Cost

Estimated

Fair Value

Securities available for sale

Obligations of the U.S. Government agencies

and corporations

$ 1,860

$ 1,887

$ 1,490

$ 1,516

State and municipal obligations

450

466

450

481

Collateralized debt obligations

7,385

3,354

6,697

3,541

Mortgage-backed securities

89,756

93,465

41,627

43,602

Collateralized mortgage obligations

313,029

314,540

192,592

188,377

Other securities

5,318

5,255

5,959

6,542

Total securities available for sale

417,798

$

418,967

$

248,815

$

244,059

$

Securities held to maturity

State and municipal obligations

$ 21,070

$ 22,972

$ 19,513

$ 22,022

Certificates of deposit

907

907

501

501

Total securities held to maturity

$ 21,977

$ 23,879

$ 20,014

$ 22,523

As of

June 30, 2012

June 30, 2011

First Financial Holdings, Inc.

21

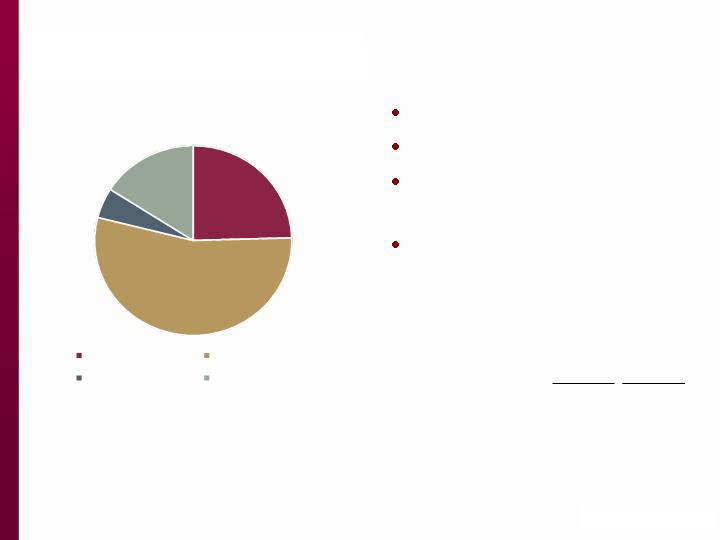

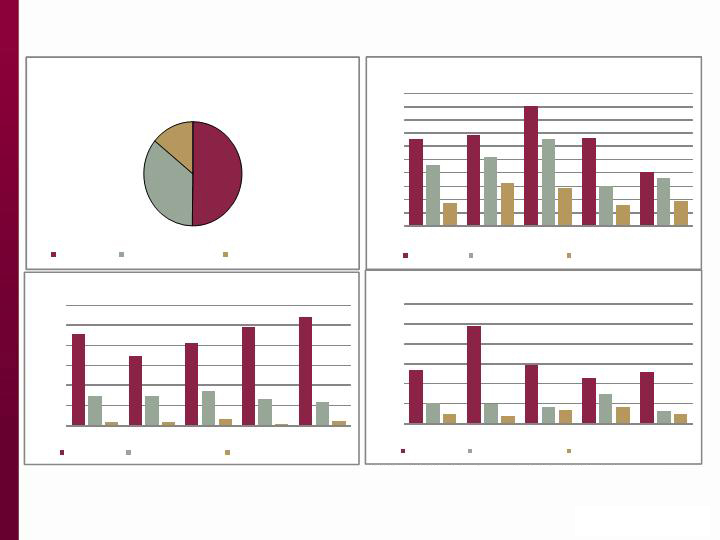

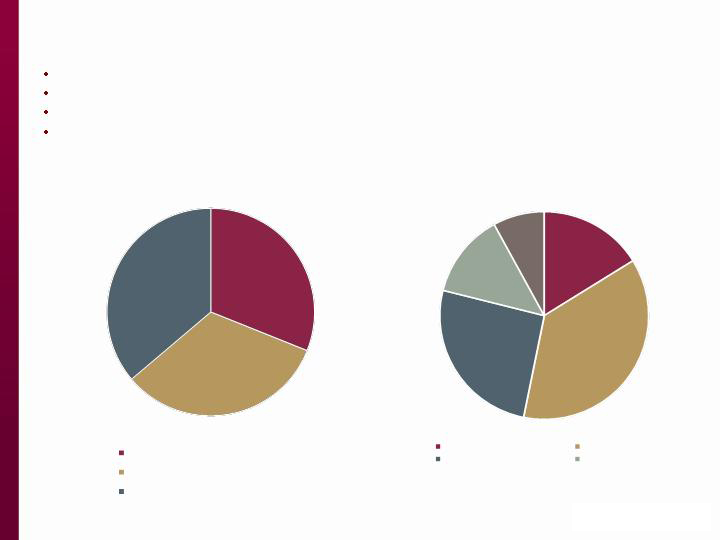

Loan Composition

June 30, 2012

39%

3%

4%

21%

3%

15%

11%

4%

Residential 1-4 family

Residential construction and land

Commercial business

Commercial real estate

Commercial construction and land

Home equity

Manufactured housing

Marine and other consumer

($ in thousands)

Balance

Avg

Yield

1

Balance

Avg

Yield

1

Residential loans

Residential 1-4 family

895,650

$

1,023,800

$

Residential construction

19,603

19,601

Residential land

42,763

56,073

Total residential loans

958,016

4.30%

1,099,474

3.98%

Commercial loans

Commercial business

80,566

107,804

Commercial real estate

482,315

555,588

Commercial construction

16,037

17,201

Commercial land

70,562

78,011

Total commercial loans

649,480

5.35%

758,604

6.53%

Consumer loans

Home equity

379,122

388,534

Manufactured housing

274,192

276,607

Marine

57,406

59,643

Other consumer

53,853

49,621

Total consumer loans

764,573

6.88%

774,405

6.95%

Total loans

2,372,069

$

5.40%

2,632,483

$

5.59%

Covered loans2

162,287

$

264,986

$

1 Portfolio yield is for the month presented

2 Covered loans as of June 30, 2011 were acquired in the Cape Fear Bank FDIC-assisted transaction and

June 30, 2012 also includes those acquired from Plantation Federal Bank. Both are subject to a loss

share agreement.

June 30, 2011

June 30, 2012

First Financial Holdings, Inc.

22

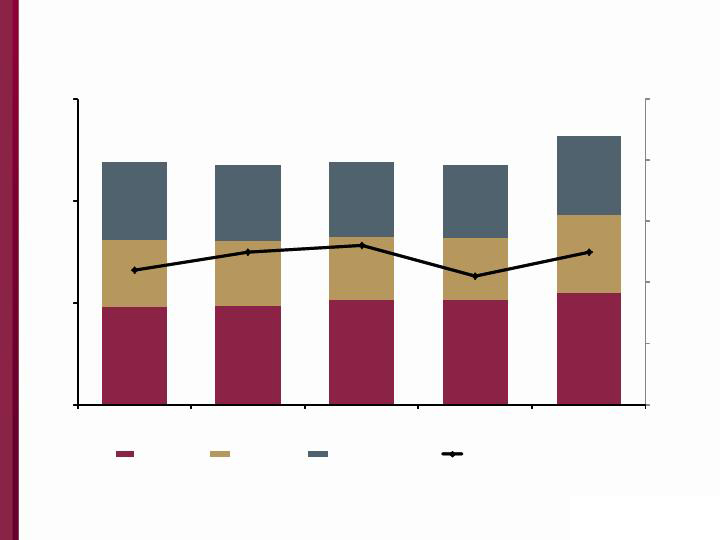

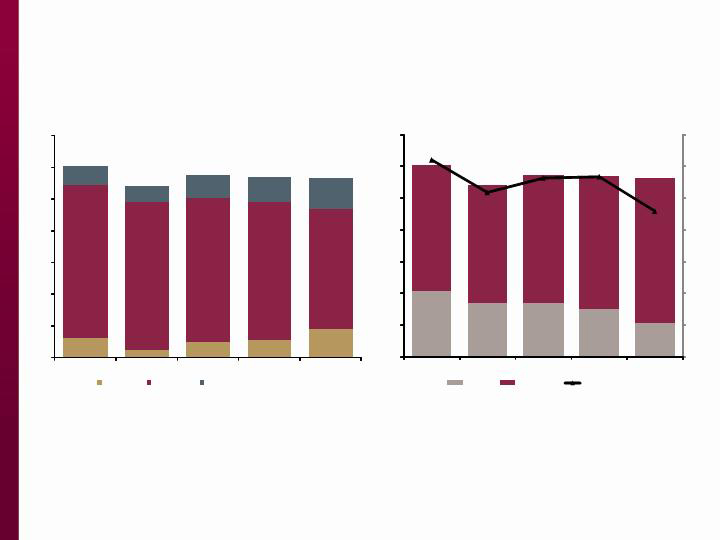

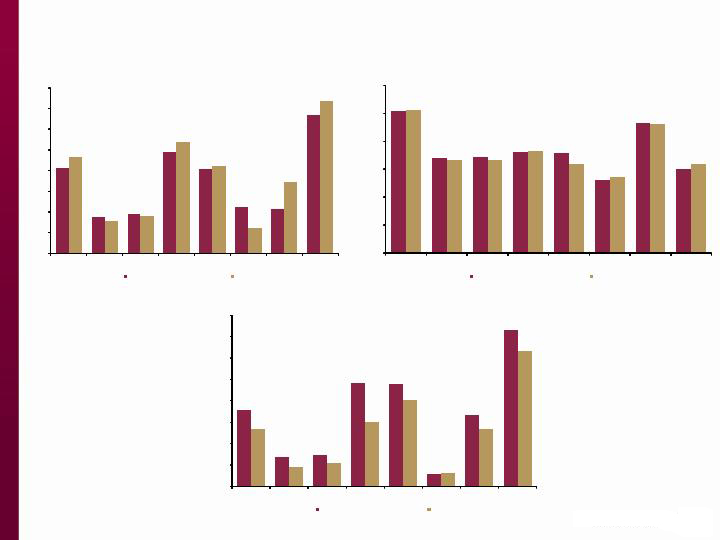

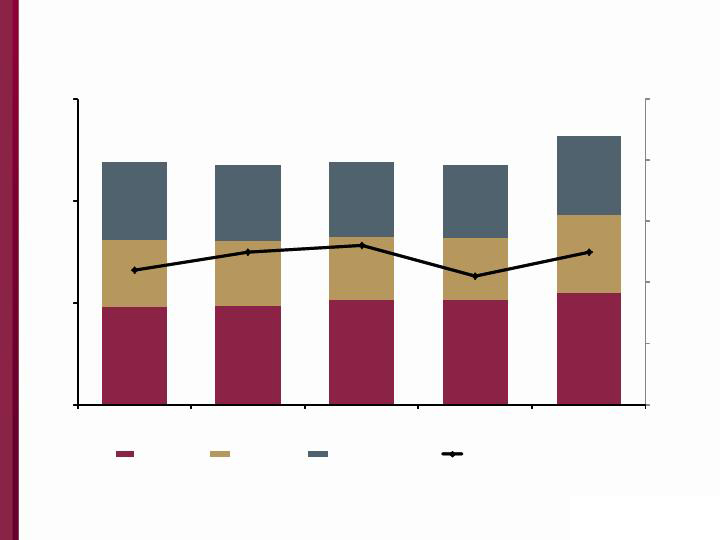

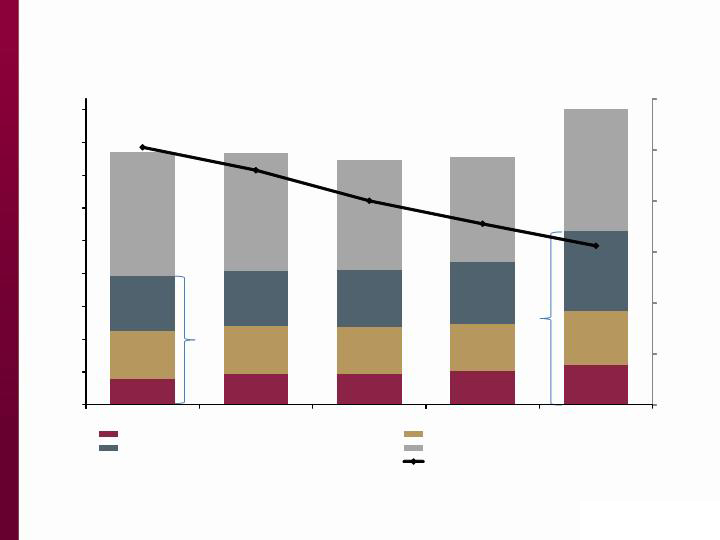

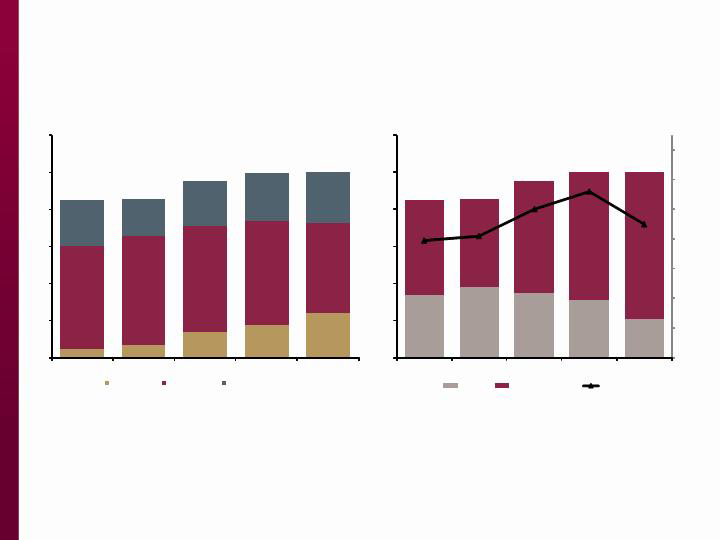

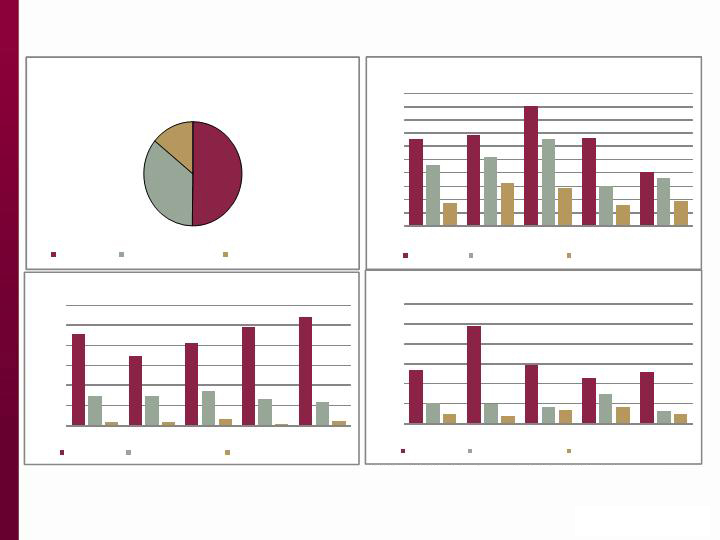

Loan Trends

$958

$967

$1,032

$1,029

$1,099

$649

$635

$618

$607

$759

$765

$753

$735

$720

$774

$2,372

$2,355

$2,385

$2,356

$2,632

5.44%

5.50%

5.52%

5.42%

5.50%

5.00%

5.20%

5.40%

5.60%

5.80%

6.00%

$0

$1,000

$2,000

$3,000

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

($ in millions)

Residential

Commercial

Consumer

Weighted Average Yield for Quarter

First Financial Holdings, Inc.

23

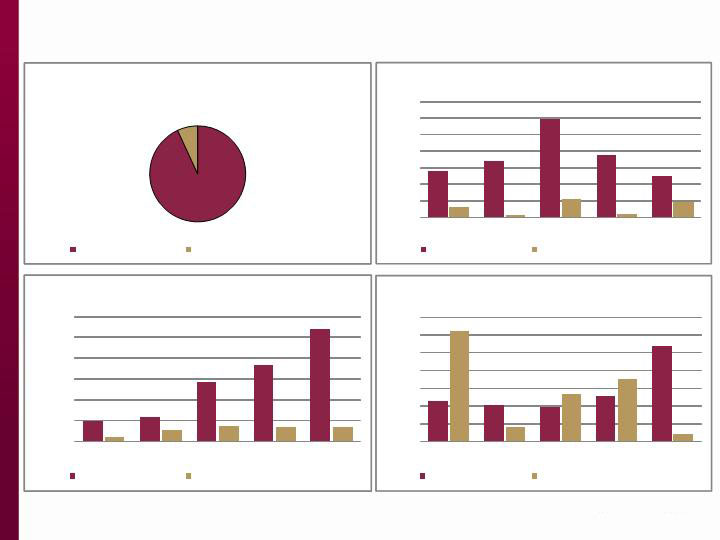

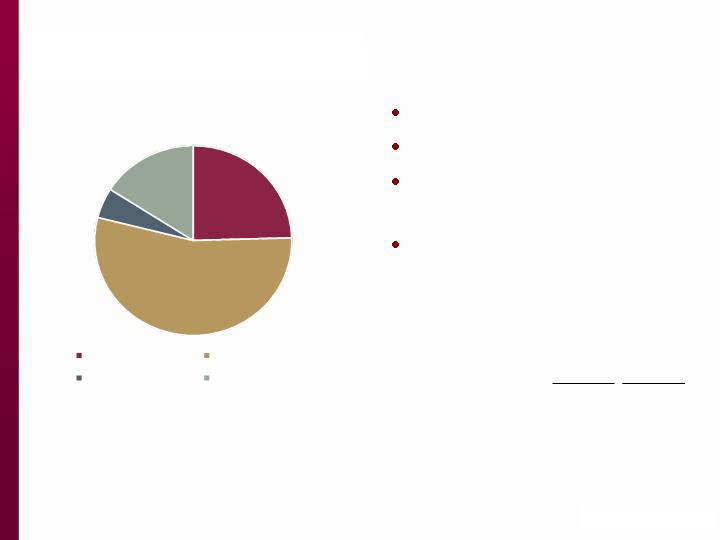

Deposit Mix

June 30, 2012

13%

19%

9%

18%

17%

10%

8%

2%

4%

Noninterest-bearing

Interest-bearing

Savings

Money market

Retail CDs < $100,000

Retail CDs > $100,000

Retail time deposits - IRAs

CDARs

Brokered CDs

($ in thousands)

Balance

Avg

Yield

1

Balance

Avg

Yield

1

Noninterest-bearing

$

234,478

---

$

359,552

---

Interest-bearing

437,179

0.33

%

502,530

0.14

%

Savings

189,283

0.27

252,380

0.16

Money market

316,953

0.47

479,049

0.45

Total core deposits

1,177,893

0.28

1,593,511

0.20

Retail CDs < $100,000

383,076

465,742

Retail CDs> $100,000

309,379

260,535

Retail time deposits - IRAs

161,747

207,968

Total retail time deposits

854,202

934,245

CDARs

94,809

67,850

Brokered CDs

188,841

107,596

Total wholesale time deposits

283,650

175,446

Total time deposits

1,137,852

1.71

1,109,691

1.12

Total deposits

$

2,315,745

0.99

%

$

2,703,202

0.58

%

1

Deposit yield is for the month presented

June 30, 2012

June 30, 2011

First Financial Holdings, Inc.

24

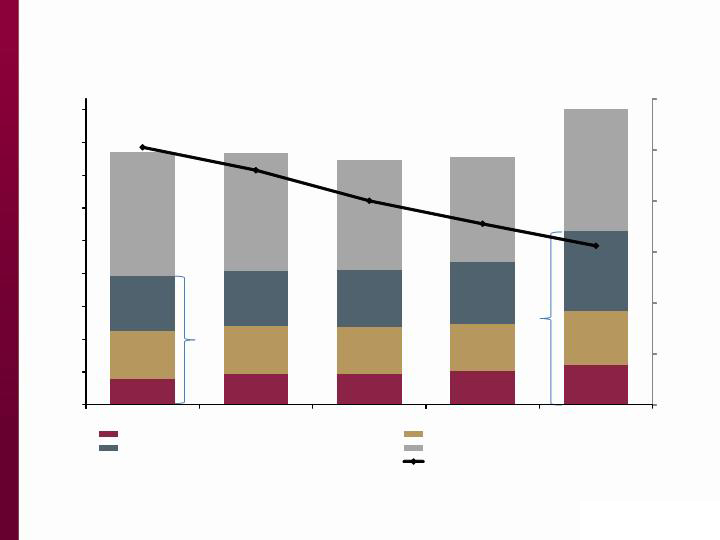

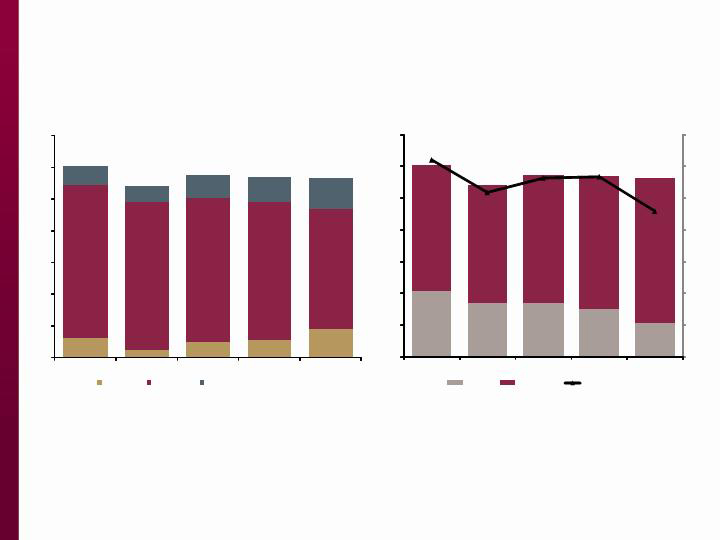

Deposit Trends

$235

$279

$280

$308

$360

$437

$441

$430

$435

$502

$506

$505

$522

$563

$731

$1,138

$1,078

$1,007

$958

$1,110

$2,316

$2,303

$2,239

$2,264

$2,703

1.01%

0.92%

0.80%

0.71%

0.62%

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

1.20%

$0

$300

$600

$900

$1,200

$1,500

$1,800

$2,100

$2,400

$2,700

Jun-11

Sep 11

Dec 11

Mar-12

Jun-12

($ in millions)

Non-interest Bearing

Interest Bearing

Savings and Money Market

CDs

Weighted Average Cost of Deposits For the Quarter

Core =

$1,178

Core =

$1,593

First Financial Holdings, Inc.

25

Liquidity Sources

June 30, 2012

Stable core deposit base

Multiple funding sources

Consistent cash flows from

securities portfolio

Capacity to obtain

additional Brokered and

Jumbo CDs

$191

$423

$40

$124

Primary Source Availability

FRB

FHLB

Fed Funds

Unpledged Securities

Total Available =

$778

million

Key Liquidity Ratios:

6/30/2011

6/30/2012

Funding Availability/Assets

22.49%

23.59%

Total Deposits/Total Funding

81.03%

92.10%

Brokered Deposits/Total Funding

9.64%

5.93%

Unpledged Securities/Total Assets

6.66%

3.87%

First Financial Holdings, Inc.

26

Credit Quality

First Financial Holdings, Inc.

27

Credit Trends

($ in millions)

June 30,

2011

September 30,

2011

December 31,

2011

March 31,

2012

June 30,

2012

Credit Metrics

Total nonperforming assets (“NPA”)

70.4

$

1

67.2

$

1

68.2

$

71.7

$

78.1

$

NPAs/assets

2.18%

1

2.10%

1

2.17%

2.28%

2.36%

Net charge-offs (“NCO”)

12.4

2

7.9

2

8.3

9.5

6.7

NCOs/average loans

1.96%

2

1.33%

2

1.39%

1.60%

1.04%

Allowance for loan losses/total loans

2.34%

2.31%

2.24%

2.16%

1.85%

3

Classified assets/FFB tier 1 capital +

allowance for loan losses (“ALL”)

50.58%

41.76%

40.53%

40.83%

40.45%

Classified assets/FFCH tier 1 capital + ALL4

41.57%

36.77%

36.12%

36.56%

37.78%

Credit Metrics Excluding Covered Assets

Total nonperforming assets

46.2

$

39.5

$

43.1

$

44.7

$

47.8

$

NPAs/assets

1.43%

1.23%

1.37%

1.42%

1.45%

ALL/Nonperforming loans

216.35%

5

227.09%

5

177.35%

148.22%

123.30%

Classified assets/FFB tier 1 capital + ALL

34.21%

28.29%

28.21%

28.51%

28.72%

Classified assets/FFCH tier 1 capital + ALL4

28.12%

24.91%

25.15%

25.53%

26.83%

3

Includes $295mm of acquired loans carried at fair value with no current allowance, excluding the acquired loans the allowance percentage is 2.09%

As of and for the Quarter ended

4

FFCH began reporting regulatory capital information at March 31, 2011. All prior periods are pro forma calculations.

5

Excludes nonperforming loans held for sale of $42.7 million and $39.4 million at June 30, 2011 and September 30, 2011, respectively.

1

Excludes nonperforming assets held for sale of $42.7 million and $41.3 million at June 30, 2011 and September 30, 2011, respectively.

2

Excludes charge-offs of $95.0 million and $2.2 million from loans reclassified to held for sale for the quarters ending June 30, 2011 and September 30, 2011, respectively.

First Financial Holdings, Inc.

28

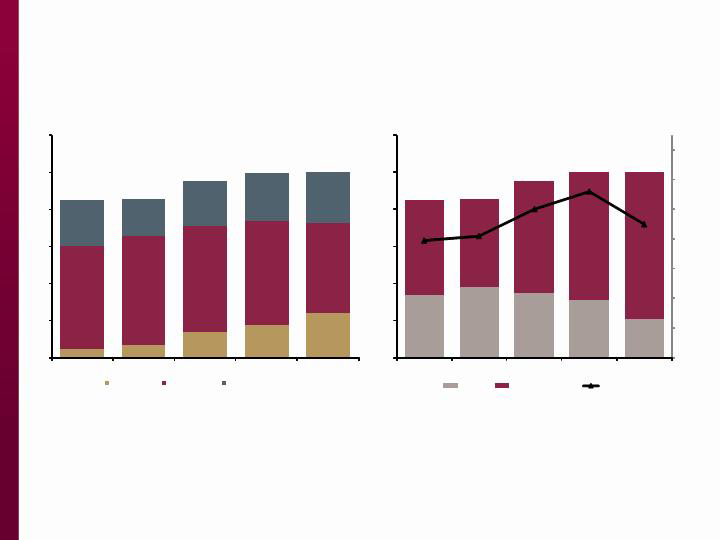

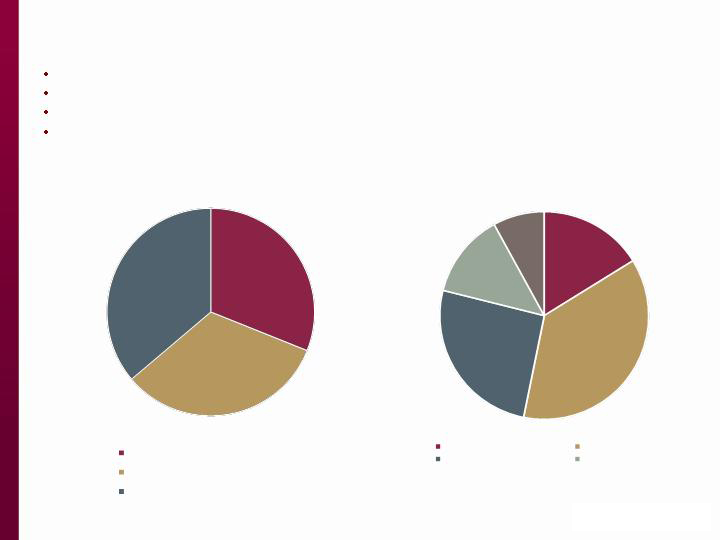

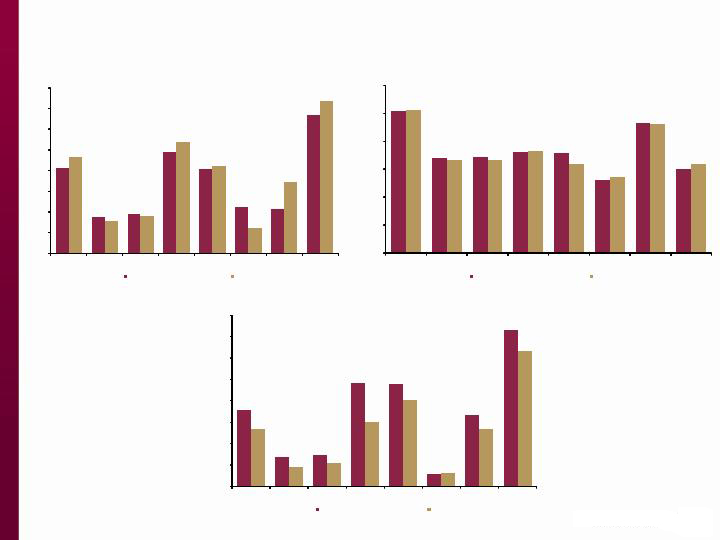

Classified Loans

$12.0

$5.0

$10.0

$11.0

$18.0

$97.0

$93.0

$91.0

$87.0

$76.0

$12.0

$10.0

$14.0

$16.0

$19.0

$121.0

$108.0

$115.0

$114.0

$113.0

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Residential

Commercial

Consumer

$41.0

$34.0

$34.0

$30.0

$21.0

$80.0

$74.0

$81.0

$84.0

$92.0

$121.0

$108.0

$115.0

$114.0

$113.0

5.10%

4.59%

4.82%

4.84%

4.29%

2.00%

2.50%

3.00%

3.50%

4.00%

4.50%

5.00%

5.50%

$0.0

$20.0

$40.0

$60.0

$80.0

$100.0

$120.0

$140.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Covered

Noncovered

% of Loans

First Financial Holdings, Inc.

29

Delinquent Loans

$1.7

$1.8

$3.5

$2.0

$1.7

$5.9

$5.4

$5.6

$7.0

$4.6

$6.4

$7.6

$9.2

$5.6

$4.8

$14.1

$14.8

$18.4

$14.6

$11.1

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Residential

Commercial

Consumer

$3.0

$2.7

$2.3

$3.1

$2.9

$11.1

$12.1

$16.1

$11.5

$8.1

$14.1

$14.8

$18.4

$14.6

$11.1

0.59%

0.63%

0.77%

0.62%

0.42%

0.00%

0.10%

0.20%

0.30%

0.40%

0.50%

0.60%

0.70%

0.80%

0.90%

$0.0

$2.0

$4.0

$6.0

$8.0

$10.0

$12.0

$14.0

$16.0

$18.0

$20.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Covered

Noncovered

% of Loans

First Financial Holdings, Inc.

30

Nonperforming Loans

Note:

Nonperforming loans include loans past due 90+ days still accruing interest and restructured loans still accruing interest.

Nonperforming loans held for sale of $43 million and $39 million were excluded from the graph, for the quarters ended

June 30, 2011 and September 30, 2011 respectively.

$2.4

$3.5

$7.2

$8.8

$12.2

$27.7

$29.3

$28.3

$28.1

$24.2

$12.4

$10.1

$12.2

$13.0

$13.6

$42.6

$42.9

$47.7

$49.9

$49.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Residential

Commercial

Consumer

$16.9

$19.0

$17.5

$15.6

$10.4

$25.6

$23.9

$30.2

$34.3

$39.6

$42.6

$42.9

$47.7

$49.9

$49.9

1.79%

1.82%

2.00%

2.12%

1.90%

1.00%

1.20%

1.40%

1.60%

1.80%

2.00%

2.20%

2.40%

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Covered

Noncovered

% of Loans

First Financial Holdings, Inc.

31

Other Repossessed Assets

Note: Other reposessed assets excludes $1.9 million of non-covered other

real estate owned that was included in assets held for bulk sale at

September 30, 2011.

$10.6

$8.1

$7.8

$7.1

$5.7

$7.2

$7.8

$5.4

$4.6

$6.5

$8.8

$7.1

$5.8

$8.0

$14.3

$1.1

$1.3

$1.5

$2.1

$1.7

$27.8

$24.3

$20.5

$21.8

$28.2

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Residential

Commercial

Land

Other

$7.3

$8.7

$7.6

$11.4

$20.0

$20.5

$15.6

$12.9

$10.5

$8.2

$27.8

$24.3

$20.5

$21.8

$28.2

$0.0

$5.0

$10.0

$15.0

$20.0

$25.0

$30.0

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

$ in millions

Covered

Noncovered

First Financial Holdings, Inc.

32

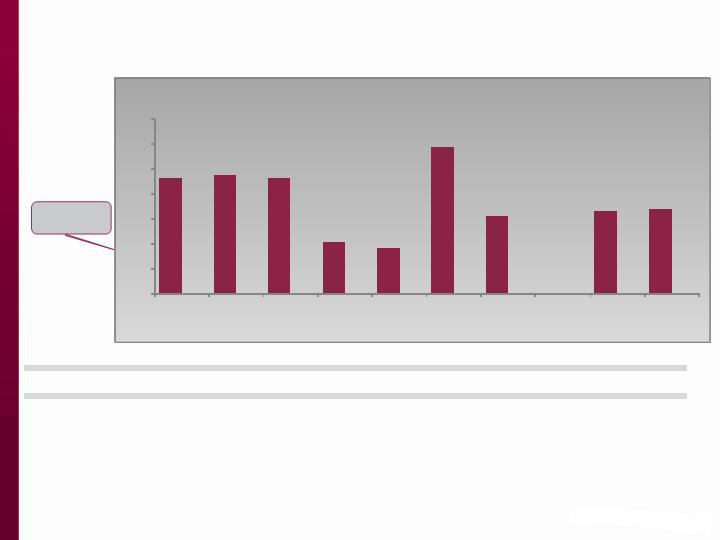

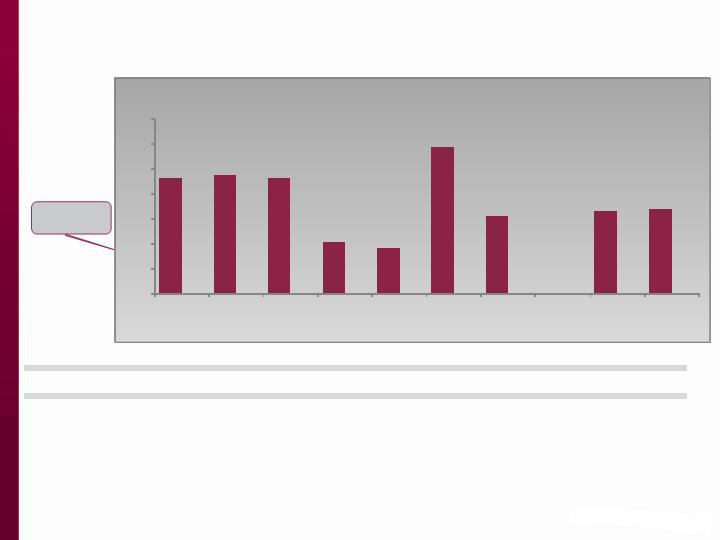

Net Charge-offs and Provision

Provision $

Net Charge-offs $

(in millions)

Jun-12

Mar-12

Dec-11

Sep-11

Jun-11

$20.0

$18.0

$16.0

$14.0

$12.0

$10.0

$8.0

$6.0

$4.0

$2.0

$-

$4.7

$6.7

$7.4

$7.5

$12.1

$6.7

$9.5

$8.3

$7.9

$12.4

Note: Excludes charge-offs of $95.0 million and $2.2 million and provision of $65.7 million and $1.4 million from loans

reclassified as held for sale for the quarters ending June 30, 2011 and September 30, 2011, respectively.

First Financial Holdings, Inc.

33

Continued core earnings enhancement opportunities

Actively manage interest rate risk and net interest margin

Diversified income sources and initiatives for additional revenue enhancement

Ongoing evaluations of business processes and cost control for operating efficiency gains

Well-positioned balance sheet

Actively manage the balance sheet to maximize returns

Solid capital position

Actively managing problem assets yielded positive results and sound credit quality

Increased core deposit base and ample sources of liquidity

Experienced senior management team

Diverse backgrounds include national, regional and community banks

Demographically attractive banking markets

Economic development initiatives in existing markets

Carolinas markets considered highly attractive locations for new businesses and growth

opportunities

Investment Opportunity

First Financial Holdings, Inc.

34

APPENDIX

First Financial Holdings, Inc.

35

3.62%

US Average

Highly Attractive Markets

Population

676,751

368,176

275,035

60,440

207,064

189,493

645,404

4,682,632

9,658,876

Projected Population Growth

8.58%

9.01%

9.22%

2.88%

3.14%

10.41%

6.15%

6.04%

6.57%

Median Household Income (HHI)

$44,910

$40,649

$40,390

$38,486

$36,246

$51,129

$44,251

$41,607

$42,941

Projected Median HHI Growth

10.12%

11.73%

10.81%

4.67%

5.65%

9.96%

8.33%

8.43%

8.99%

Unemployment Rates 12/31/11*

7.70%

10.90%

12.00%

10.40%

10.40%

7.80%

7.60%

9.50%

10.20%

Unemployment Rates 05/31/12*

7.90%

9.60%

9.90%

9.50%

10.00%

8.30%

8.00%

9.30%

9.40%

* Not seasonally adjusted

Data Source:

SNL Financial as of June 30, 2011

9.28%

9.54%

9.28%

4.12%

3.65%

11.71%

6.25%

6.57%

6.78%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

Charleston

MSA

Wilmington

MSA

Myrtle Beach

MSA

Georgetown

MSA

Florence

MSA

Hilton Head/

Beaufort

MSA

Greenville

MSA

SC

NC

2011-2016 Projected Household Growth Rate

First Financial Holdings, Inc.

36

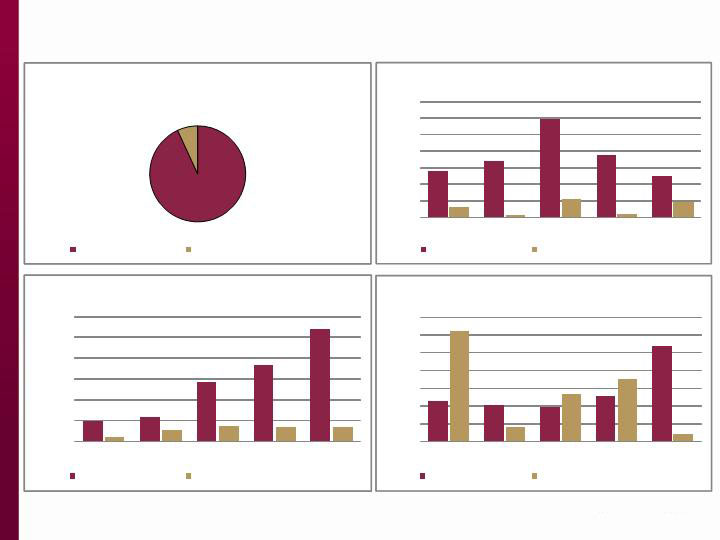

Real Estate Metrics

0

100

200

300

400

500

600

700

800

Charleston

Dorchester

Berkeley

Wilmington

Horry

Florence

Beaufort

Greenville

June 2011

June 2012

Number of Closed Sales

(Number of Homes Sold)

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

Charleston

Dorchester

Berkeley

Wilmington

Horry

Florence

Beaufort

Greenville

June 2011

June 2012

Median Sales Price

(in $)

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Charleston

Dorchester

Berkeley

Wilmington

Horry

Florence

Beaufort

Greenville

June 2011

June 2012

Inventory for Sale

(Housing Units)

First Financial Holdings, Inc.

37

Aerospace/Aviation

Boeing plant completed and Dreamliner production in process

First 787 rolled off the assembly line in April 2012

Four airplanes completed, awaiting delivery

Anticipate 3,800 direct jobs; opportunity to double with suppliers

In excess of $66 million in investment and over 700 jobs in the aerospace-related sector

announced for SC in 2011

TIGHITCO, an industry leader in the design, fabrication and repair of engineered

components and integrated systems for aerospace, locating a new $30 million

manufacturing facility in Charleston, creating 350 jobs in 2012

Alternative Energy

Clemson University Restoration Institute (CURI), created a 97-acre campus in Charleston

for experts and researchers in design, planning and construction to advance global

restoration methods and technologies

World’s largest, and one of only three, wind turbine drivetrain test facility; fully

operational by end of 2012, offering simultaneous testing of 7.5 and 15 megawatt power

train components

Potential for 20,000 jobs statewide with manufacturing contract

Economic Updates

Charleston Market Targeted Industries

First Financial Holdings, Inc.

38

Biomedical

Medical University of SC, nationally recognized research center and teaching hospital,

awards 800+ degrees each year, employs more than 11,000, and annually contributes over

$2.3 billion to the local economy

In excess of $243 million in research funding granted in 2011

MUSC opening drug discovery and bioengineering research buildings in next year

Bioscience activity in area includes 35 pharmaceutical and medical device manufacturers

and more than 50 research laboratories and development companies

Advanced Security and IT

Nearly every U.S. Department of Defense and Department of Homeland Security agency

engaged in next-generation security systems and monitoring technology are housed in the

region with more than 18,000 ex-military and government employees in the area

Hundreds of defense contractors are located in Charleston, including SAIC, SRC and BAE,

with an estimated $8 billion in contracts completed since 2000

Space & Naval Warfare Systems Center Atlantic (SPAWAR) will soon open a new

consolidated engineering laboratory to focus on IT innovations

Economic Updates

Charleston Market Targeted Industries

First Financial Holdings, Inc.

39

SC Port Authority - Charleston

Eighth largest U.S. container port by cargo value

Over $62.4 billion in goods move through the port annually

Deepest harbor and shipping channels in the South Atlantic

Regularly hosts post-Panamax vessels at high tide

Approval for study to deepen harbor 3 – 5 feet to accommodate larger ships at any tide

State has set aside funds allocated for harbor deepening; anticipate completion by 2019

Offers global connections to 150 countries

Fiscal 2011 year ended with container volume up 8.3%

Incremental 1.4 million twenty-foot equivalent units “TEU”

Breakbulk pier tonnage increased 21.5% during the first six months of fiscal 2012

New three-berth, 280-acre container terminal scheduled to open in 2013

Other Market Updates

Continental Tires building a Sumter, SC plant starting in mid-2012, total investment

expected to be $500 million and will bring 1,700 new jobs by 2020

2012 PGA Championship to be held at Kiawah Island will make a projected economic

impact of $193 million to SC

PeopleMatter, a human resource technology firm locating in downtown Charleston, will

invest $18.8 million and create 265 new jobs during the next 5 years

Economic Updates

First Financial Holdings, Inc.

40

Upstate Market Developments

SC Ports Authority approved development of in-land port in Greer, which will convert all-

truck container moves to multimodal moves via both truck and rail; anticipated capital

investment in excess of $23 million

BMW plans additional investments of nearly $900 million and 300 new jobs in 2012

Clemson University trustees approved the addition of a $6.5 million research and

education center in conjunction with Clemson University/Greenwood Genetic Center

Greenville-based Michelin North America to hire 500 people and invest $750 million in

Anderson and Lexington counties to meet growing demand for the massive tires used on

earth-moving equipment

JTEKT Automotive South Carolina Inc. to invest $102 million and add 80 jobs to its location

in Piedmont, SC during 2012

Amazon plans to open a one million square foot distribution center by fall 2012 in

Spartanburg, creating 390 jobs

Economic Updates

First Financial Holdings, Inc.

41

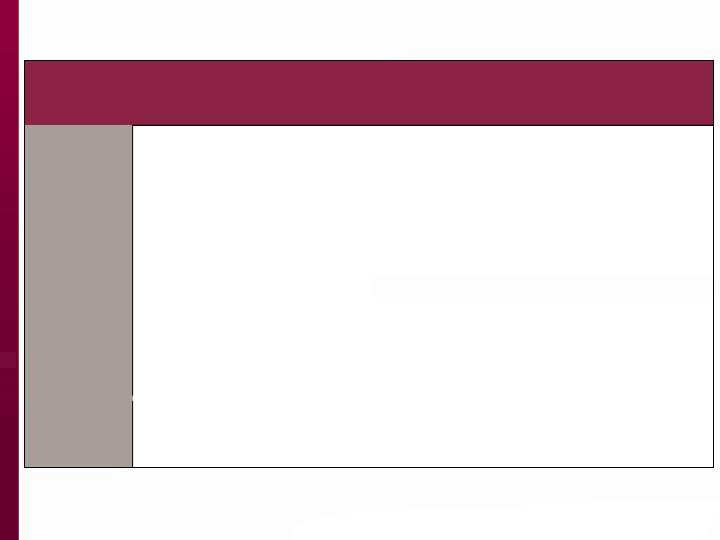

Residential Mortgage Loans

$-

$200

$400

$600

$800

$1,000

$1,200

$1,400

Jun-11*

Sep-11

Dec-11

Mar-12

Jun-12

Net Charge-Offs

Residential 1-4 family

Residential construction and land

($ in thousands)

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

Jun-11

Sept-11

Dec-11

Mar-12

Jun-12

Nonperforming Loans

Residential 1-4 family

Residential construction and land

($ in thousands)

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Delinquent Loans

Residential 1-4 family

Residential construction and land

($ in thousands)

93%

7%

Residential Mortgage Loan Portfolio

As of June 30, 2012

Residential 1-4 family

Residential construction and land

* Excludes $15 million from loans reclassified as held for sale.

First Financial Holdings, Inc.

42

$22,685

Residential Mortgage Credit Quality Trends

June 30, 2011

September 30, 2011

December 31, 2011

March 31, 2012

June 30, 2012

(dollars in thousands)

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

Delinquent Loans1

Residential 1-4 family

1,404

$

0.16%

1,722

$

0.19%

2,986

$

0.31%

1,889

$

0.19%

1,244

$

0.12%

Residential land

325

0.76

65

0.16

561

1.35

123

0.30

475

0.85

Total delinquent residential loans

1,729

$

0.18%

1,787

$

0.18%

3,547

$

0.34%

2,012

$

0.20%

1,719

$

0.16%

Nonperforming Loans

Residential 1-4 family

1,242

$

0.14%

1,595

$

0.18%

4,977

$

0.51%

6,649

$

0.68%

10,460

$

1.02%

Residential land

451

1.05

1,140

2.80

1,448

3.48

1,398

3.43

1,423

2.54

Total residential nonaccruing loans

1,693

0.18%

2,735

0.28%

6,425

0.62%

8,047

0.78%

11,883

1.08%

Restructured loans still accruing

733

734

734

734

330

Total nonperforming residential loans

2,426

$

3,469

$

7,159

$

8,781

$

12,213

$

Net Charge-Offs

Residential 1-4 family

461

$

2

0.21%

414

$

0.18%

391

$

0.16%

507

$

0.21%

1,070

$

0.42%

Residential land

1,237

2

11.57

165

1.58

532

5.31

701

6.75

78

0.59

Total residential net charge-offs

1,698

$

0.72%

579

$

0.24%

923

$

0.37%

1,208

$

0.47%

1,148

$

0.42%

1 Includes loans past due 30-89 days.

2 Excludes $11,716 and $2,862 from loans reclassified as held for sale

As of and for the Quarter ended

First Financial Holdings, Inc.

43

Analysis of Portfolio Loans

As of June 2012

% of

Portfolio

Avg

Yld

30-year Fixed Rate

13%

5.23%

30-year Jumbos

6%

5.14%

15-year Fixed Rate

23%

3.83%

Hybrid ARMs

9%

4.86%

Adjustable Rate

Mortgages 1

47%

3.25%

Other

2%

7.04%

100%

3.97%

Retail

CLD2

Source

47%

53%

Avg. FICO

756

768

Avg. LTV

70%

69%

Fixed rate locks

74%

99%

Purchase

percentage

38%

28%

Refinance

percentage

62%

72%

Residential Mortgage Loan Details

Origination Profile

As of June 2012

2 - Correspondent Lending Division

1 - Generally up to 30 year terms and annual rate adjustment after being

fixed for a period of 3, 5, 7 or 10 years in accordance with a designated

index. Either a 1%, 2% or 5% cap on the rate adjustment after the initial

repricing period, a 1% or 2% annual cap and a 4%, 5% or 6% life cap.

First Financial Holdings, Inc.

44

Commercial Loans

* Excludes $78 million from loans reclassified as held for sale

14%

73%

13%

Commercial Loan Portfolio

As of June 30, 2012

Commercial business

Commercial real estate

Commercial construction and land

Note:

39% of Legacy CRE consists of owner occupied property

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Delinquent Loans

Commercial business

Commercial real estate

Commercial construction and land

($ in thousands)

$-

$5,000

$10,000

$15,000

$20,000

$25,000

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Nonperforming Loans

Commercial business

Commercial real estate

Commercial construction and land

($ in thousands)

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

Jun - 11*

Sep-11

Dec-11

Mar-12

Jun-12

Net Charge-Offs

Commercial business

Commercial real estate

Commercial construction and land

($ in thousands)

First Financial Holdings, Inc.

45

$22,685

Commercial Credit Quality Trends

June 30, 2011

(dollars in thousands)

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

Delinquent Loans1

Commercial business

2,387

$

2.96%

868

$

1.07%

908

$

1.08%

1,677

$

1.90%

903

$

0.84%

Commercial real estate

2,703

0.56

3,394

0.72

3,514

0.77

3,065

0.69

3,014

0.54

Commercial construction

---

---

595

3.95

---

---

---

---

---

---

Commercial land

821

1.16

537

0.80

1,185

1.94

2,271

4.15

675

0.87

Total commercial delinquent loans

5,911

$

0.91%

5,394

$

0.85%

5,607

$

0.91%

7,013

$

1.16%

4,592

$

0.61%

Nonperforming Loans

Commercial business

3,664

$

4.55%

4,322

$

5.34%

3,665

$

4.37%

1,931

$

2.19%

1,198

$

1.11%

Commercial real estate

16,396

3.40

18,400

3.90

17,160

3.76

18,474

4.13

15,918

2.87

Commercial construction

1,451

9.05

266

1.77

573

3.48

261

1.60

261

1.52

Commercial land

5,411

7.67

6,310

9.36

5,232

8.54

5,240

9.56

4,577

5.87

Total commercial nonaccrual loans

26,922

4.15%

29,298

4.62%

26,630

4.31%

25,906

4.27%

21,954

2.89%

Restructured loans still accruing

802

---

1,677

2,229

2,215

Total commercial nonperforming

27,724

$

29,298

$

28,307

$

28,135

$

24,169

$

Net Charge-Offs

Commercial business

982

$

2

4.88%

136

$

0.69%

640

$

3.22%

825

$

3.60%

334

$

1.34%

Commercial real estate

2,233

2

1.85

433

0.36

1,417

1.22

1,462

1.30

715

0.54

Commercial construction

56

2

1.40

635

16.12

(3)

(0.07)

(2)

(0.05)

(2)

(0.05)

Commercial land

3,251

2

18.43

2,052

12.15

804

4.94

1,439

9.87

723

4.00

Total net commercial charge-offs

6,522

$

4.02%

3,256

$

2.04%

2,858

$

1.83%

3,724

$

2.41%

1,770

$

0.99%

1

Includes loans past due 30-89 days.

2

Excludes $5,844 in Commercial business, $38,789 in Commercial real estate, $3,011 in Commercial construction and $30,744 in Commercial Land reclassified as loans held for sale

December 31, 2011

September 30, 2011

June 30, 2012

As of and for the Quarter ended

March 31, 2012

First Financial Holdings, Inc.

46

Consumer Loans

50%

36%

14%

Consumer Loan Portfolio

As of June 30, 2012

Home equity

Manufactured housing

Marine and other consumer

$-

$500

$1,000

$1,500

$2,000

$2,500

$3,000

$3,500

$4,000

$4,500

$5,000

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Delinquent Loans

Home equity

Manufactured housing

Marine and other consumer

($ in thousands)

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

Jun-11

Sep-11

Dec-11

Mar-12

Jun-12

Nonperforming Loans

Home equity

Manufactured housing

Marine and other consumer

($

in thousands)

$-

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

Jun-11*

Sep-11

Dec-11

Mar-12

Jun-12

Net Charge - Offs

Home equity

Manufactured housing

Marine and other consumer

($ in thousands)

* Excludes $2 million from loans reclassified as held for sale

First Financial Holdings, Inc.

47

$22,685

Consumer Credit Quality Trends

June 30, 2011

September 30, 2011

(dollars in thousands)

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

$

% of

Portfolio

Delinquent Loans1

Home equity

3,266

0.86%

3,408

0.92%

4,525

1.27%

3,315

0.95%

2,017

0.52%

Manufactured housing

2,298

0.84

2,600

0.94

3,267

1.19

1,502

0.54

1,835

0.66

Marine

264

0.46

980

1.77

597

1.14

358

0.71

300

0.50

Other consumer

589

1.09

629

1.19

831

1.66

445

0.97

626

1.26

Total delinquent loans

6,417

$

0.84%

7,617

$

1.01%

9,220

$

1.25%

5,620

$

0.78%

4,778

$

0.62%

Nonperforming Loans

Home equity

9,165

2.42%

6,871

1.86%

8,192

2.29%

9,779

2.81%

10,636

2

2.74%

Manufactured housing

2,953

1.08

2,922

1.06

3,461

1.26

2,648

0.96

2,197

0.79

Marine

94

0.16

47

0.09

246

0.47

63

0.12

29

0.05

Other consumer

129

0.24

127

0.24

224

0.45

131

0.29

306

0.62

Total consumer nonaccrual loans

12,341

1.61%

9,967

1.32%

12,123

1.65%

12,621

1.75%

13,168

1.70%

Loans 90+ days still accruing

76

171

121

51

75

Restructured loans still accruing

---

---

---

314

313

Total consumer nonperforming loans

12,417

$

10,138

$

12,244

$

12,986

$

13,556

$

Net Charge-Offs

Home equity

2,686

$

3

2.83%

4,910

$

5.28%

2,955

$

3.26%

2,264

$

2.57%

2,580

$

2.71%

Manufactured housing

1,049

1.54

978

1.42

845

1.23

1,467

2.13

666

0.97

Marine

44

0.30

158

1.12

142

1.05

361

2.83

82

0.60

Other consumer

446

3.28

217

1.61

531

4.09

469

3.90

428

3.48

Total consumer net charge-offs

4,225

$

2.21%

6,263

$

3.31%

4,473

$

2.41%

4,561

$

2.51%

3,756

$

1.98%

1

Includes loans past due 30-89 days.

2

Of the $10,636 of nonperforming home equity loans, $4,597 are in first position, $2,615 are in second position where First Federal holds the first and $3,424 are in second position

where another bank holds the first

3

Excludes $2,039 from loans reclassified as held for sale

December 31, 2011

June 30, 2012

As of and for the Quarter ended

March 31, 2012

First Financial Holdings, Inc.

48

Annual review of collateral values and quarterly reviews of credit score

95% of lines are interest only

22% of lines are fully drawn as of June 30, 2012

20% of lines are frozen as result of reviews which identified material changes in financial

circumstances

Home Equity Composition

31%

33%

36%

1st Position

2nd Position to First Federal 1st Position

2nd Position to Third party 1st Position

16%

37%

26%

13%

8%

800 + beacon

750 -799 beacon

700 - 749 beacon

660 -699 beacon

Based on portfolio review conducted as of December 31, 2011

First Financial Holdings, Inc.

49

Non-GAAP Reconciliation

(dollars in thousands, except per share data)

June 30,

2011

September 30,

2011

December 31,

2011

March 31,

2012

June 30,

2012

Tangible assets and tangible common equity

Total assets

3,221,544

$

3,206,310

$

3,146,964

$

3,145,538

$

3,304,174

$

Goodwill1

(3,250)

---

---

---

---

Other intangible assets, net1

(2,776)

(2,491)

(2,401)

(2,310)

(8,931)

Tangible assets (non-GAAP)

3,215,518

$

3,203,819

$

3,144,563

$

3,143,228

$

3,295,243

$

Total shareholders’ equity

266,564

$

268,506

$

277,178

$

278,043

$

287,264

$

Preferred stock

(65,000)

(65,000)

(65,000)

(65,000)

(65,000)

Goodwill1

(3,250)

---

---

---

---

Other intangible assets, net1

(2,776)

(2,491)

(2,401)

(2,310)

(8,931)

Tangible common equity (non-GAAP)

195,538

$

201,015

$

209,777

$

210,733

$

213,333

$

Shares outstanding, end of period (000s)

16,527

16,527

16,527

16,527

16,527

Tangible common equity to tangible assets

6.08%

6.27%

6.67%

6.70%

6.47%

Tangible common book value per share

11.83

$

12.16

$

12.69

$

12.75

$

12.91

$

Pre-tax pre-provision earnings from

continuing operations

(Loss) income before income taxes

(65,565)

$

4,774

$

25,338

$

5,980

$

20,296

$

Provision for loan losses

77,803

8,940

7,445

6,745

4,697

Pre-tax pre-provision earnings (non-GAAP)

12,238

$

13,714

$

32,783

$

12,725

$

24,993

$

1

Represents amounts for continuing operations and for discontinued operations.

As of and For the Quarter Ended

First Financial Holdings, Inc.

50

First Financial Holdings, Inc.

Nasdaq: FFCH

www.firstfinancialholdings.com

R. Wayne Hall

Blaise B. Bettendorf

President & CEO

EVP & Chief Financial Officer

whall@firstfederal.com

bbettendorf@firstfederal.com

843.529.5907

843.529.5456