First Financial Holdings, Inc . Nasdaq: FFCH March 31, 2013

2 Statements in this presentation that are not statements of historical fact, including without limitation, statements that include terms such as “believes,” “expects,” “anticipates,” “estimates,” “forecasts,” “intends,” “plans,” “targets,” “potentially,” “probably,” “projects,” “outlook,” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” or “could” constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . These forward - looking statements regarding future financial and operating results, plans, objectives, expectations and intentions involve risks and uncertainties, many of which are beyond First Financial’s control or are subject to change . No forward - looking statement is a guarantee of future performance and actual results could differ materially from those anticipated by the forward - looking statements . Factors that could cause or contribute to such differences include risks and uncertainties detailed from time to time in First Financial’s other filings with the SEC, such as the risk factors listed in “Item 1 A . Risk Factors,” of First Financial’s 2012 Annual Report on Form 10 - K and subsequent Forms 10 - Q . Other factors not currently anticipated may also materially and adversely affect First Financial’s results of operations, cash flows, and financial condition . There can be no assurance that future results will meet expectations . While First Financial believes that the forward - looking statements in this presentation are reasonable, the reader should not place undue reliance on any forward - looking statement . In addition, these statements speak only as of the date made . First Financial does not undertake, and expressly disclaims any obligation to update or alter any statements, whether as a result of new information, future events or otherwise, except as required by applicable law . Forward - looking Statements

3 Overview

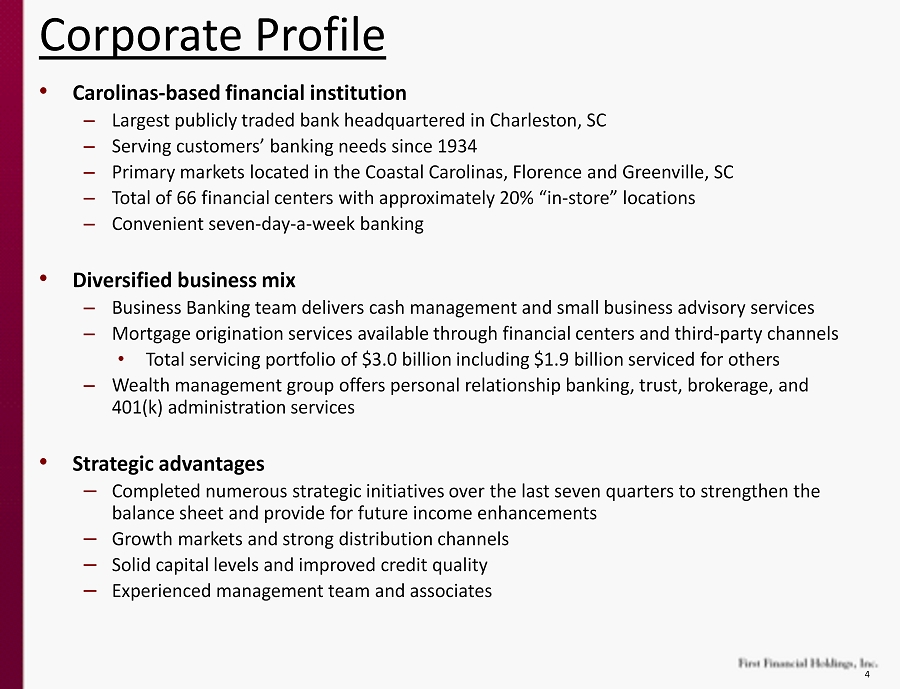

4 • Carolinas - based financial institution – Largest publicly traded bank headquartered in Charleston, SC – Serving customers’ banking needs since 1934 – Primary markets located in the Coastal Carolinas, Florence and Greenville, SC – Total of 66 financial centers with approximately 20% “in - store” locations – Convenient seven - day - a - week banking • Diversified business mix – Business Banking team delivers cash management and small business advisory services – Mortgage origination services available through financial centers and third - party channels • Total servicing portfolio of $3.0 billion including $1.9 billion serviced for others – Wealth management group offers personal relationship banking, trust, brokerage, and 401(k) administration services • Strategic advantages – Completed numerous strategic initiatives over the last seven quarters to strengthen the balance sheet and provide for future income enhancements – Growth markets and strong distribution channels – Solid capital levels and improved credit quality – Experienced management team and associates Corporate Profile

5 7 branches $237MM in deposits $5.9B deposits in market #9 market share 5 branches $162MM in deposits $2.6B deposits in market #7 in market share 5 branches $204MM in deposits $3.4B deposits in market #7 market share HEADQUARTERS 30 branches $1.4B in deposits $9.6B deposits in market #2 market share 16 branches $530MM in deposits $6.4B deposits in market #5 market share Note: FDIC deposit data as of June 30, 2012 Data Source: SNL Financial First Financial Footprint 3 branches $199MM in deposits $11.2B deposits in market #14 in market share NASDAQ Traded FFCH Headquarters Charleston, SC Bank Founded 1934 Branches 66 Asset Size $3.2 Billion Loans $2.5 Billion Deposits $2.6 Billion

6 FINANCIAL REVIEW

7 Operating Results Highlights March 31, June 30, September 30, December 31, March 31, 2012 2012 2012 2012 2013 Core operating income 1 $ 3,894 $ 6,742 $ 6,543 $ 7,421 $ 5,432 Net income 1,739 12,584 6,667 7,823 5,253 Net interest income 28,252 31,713 33,197 35,089 33,138 Provision for loan losses 6,745 4,697 4,533 4,161 5,972 Noninterest income 13,182 32,530 14,548 16,173 15,837 Noninterest expense 28,709 39,250 33,029 35,357 35,120 Earnings per share 0.05 0.70 0.34 0.41 0.26 Pretax preprovision earnings 12,725 24,993 14,716 15,905 13,855 Net interest margin 3.84% 4.08% 4.35% 4.69% 4.51% Net interest margin, adjusted (Non-GAAP) 2 3.84 4.08 4.29 4.15 3.99 ($ in thousands) For the Quarter Ended 1 Excludes the following pretx amounts and two DTAs: OTTI loss of $69 thousand and state NOL DTA writeoff of $2.1 million in March 2012; gain on acquisition of $14.6 million, gain on sale of securities of $3.5 million, OTTI loss of $145 thousand and FHLB prepayment penalty of $8.5 million in June 2012; gain on sale of securities of $334 thousand and OTTI loss of $145 thousand in September 2012; loss on acquisition of $661 thousand, OTTI loss of $144 thousand and state NOL DTA write-up of $931 thousand in December 2012; and OTTI loss of $268 thousand in March 2013. 2 Net interest margin, adjusted for the quarters ended March 31, 2013, December 31 and September 30, 2012 excludes the effect of $3.8 million, $4.0 million and $472 thousand incremental accretion on Cape Fear Bank loans, respectively.

8 Net Interest Margin Analysis ($ in thousands) Average Balance Interest Average Rate Average Balance Interest Average Rate Average Balance Interest Basis Points Earning assets: Interest-bearing deposits $ 62,441 $ 29 0.19% $ 32,711 $ 13 0.17% $ 29,730 $ 16 2 Investment securities 1 316,426 2,225 3.02 283,929 2,519 3.78 32,497 (294) (76) Loans 2 2,481,410 32,764 5.33 2,545,956 34,387 5.38 (64,546) (1,623) (5) Loans held for sale 47,156 380 3.22 56,856 492 3.46 (9,700) (112) (24) FDIC indemnification asset 70,794 82 0.47 75,530 90 0.47 (4,736) (8) --- Total earning assets 2,978,227 35,480 4.83 2,994,982 37,501 5.01 (16,755) (2,021) (18) Interest-bearing liabilities: Deposits 2,180,741 3,172 0.59 2,205,336 3,388 0.61 (24,595) (216) (2) Borrowings 280,229 3,019 4.37 282,122 3,072 4.33 (1,893) (53) 4 Total interest-bearing liabilities $ 2,460,970 6,191 1.02 $ 2,487,458 6,460 1.03 $ (26,488) (269) (1) Net interest income 29,289 31,041 (1,752) Net interest margin, adjusted 3.99 4.15 (16) Effect of incremental Cape Fear accretion 3,849 0.52 4,048 0.54 (199) (2) Net interest margin $ 33,138 4.51% $ 35,089 4.69% $ (1,951) (18) For the Quarter Ended March 31, 2013 December 31, 2012 Change in 1 Interest income used in the average rate calculation includes the tax equivalent adjustments of $158 thousand and $168 thousand for the quarters ended March 31, 2013 and December 31, 2012, respectively, calculated based on a federal tax rate of 35%. 2 Average loans include nonaccrual loans. Loan fees, which are not material for any of the periods, have been included in loan interest income for the rate calculation. Loan yields for March 2013 and December 2012 exclude the impact of $3.8 million and $4.0 million incremental accretion on Cape Fear Bank loans, respectively.

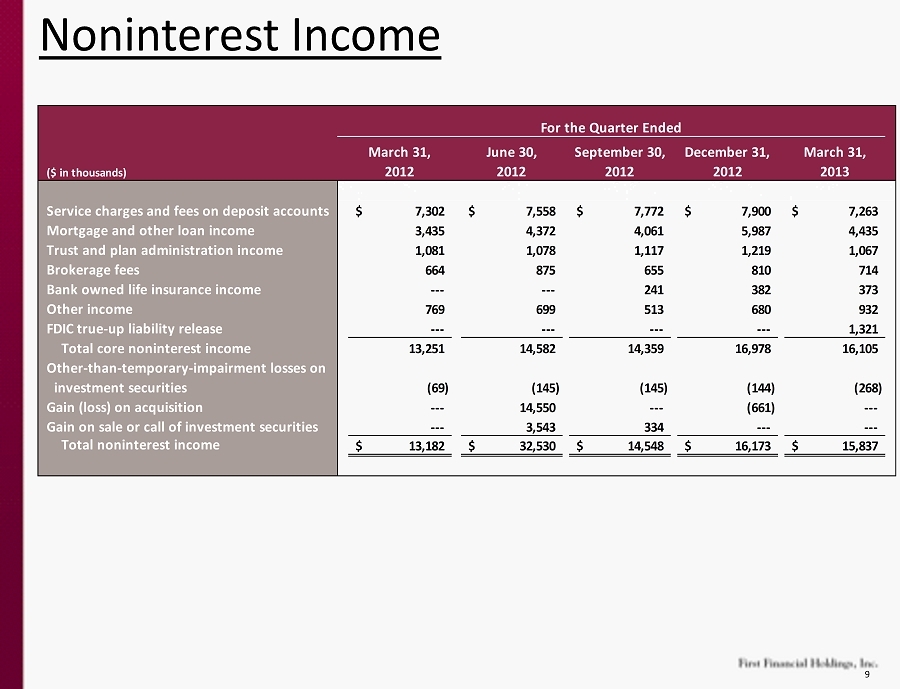

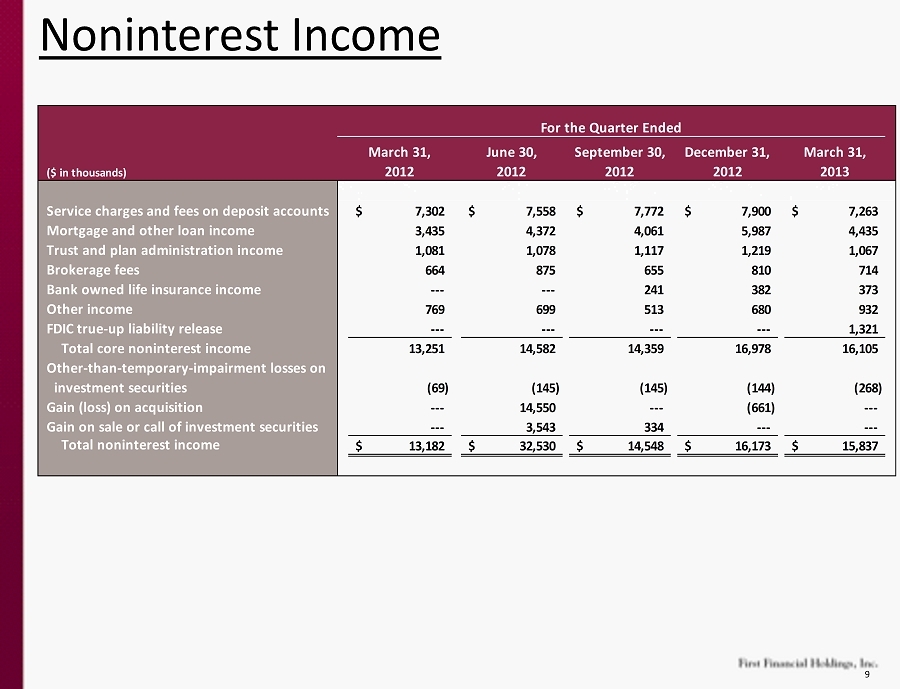

9 Noninterest Income March 31, June 30, September 30, December 31, March 31, 2012 2012 2012 2012 2013 Service charges and fees on deposit accounts 7,302$ 7,558$ 7,772$ 7,900$ 7,263$ Mortgage and other loan income 3,435 4,372 4,061 5,987 4,435 Trust and plan administration income 1,081 1,078 1,117 1,219 1,067 Brokerage fees 664 875 655 810 714 Bank owned life insurance income --- --- 241 382 373 Other income 769 699 513 680 932 FDIC true-up liability release --- --- --- --- 1,321 Total core noninterest income 13,251 14,582 14,359 16,978 16,105 Other-than-temporary-impairment losses on investment securities (69) (145) (145) (144) (268) Gain (loss) on acquisition --- 14,550 --- (661) --- Gain on sale or call of investment securities --- 3,543 334 --- --- Total noninterest income 13,182$ 32,530$ 14,548$ 16,173$ 15,837$ ($ in thousands) For the Quarter Ended

10 Noninterest Expense March 31, June 30, September 30, December 31, March 31, 2012 2012 2012 2012 2013 Salaries and employee benefits 15,142$ 15,212$ 15,621$ 16,020$ 16,335$ Occupancy costs 2,267 2,933 2,333 2,214 2,214 Furniture and equipment 1,809 1,893 2,132 2,033 2,068 Other real estate owned, net 530 134 1,030 18 924 FDIC insurance and regulatory fees 994 761 693 646 531 Professional services 1,465 1,875 1,980 1,838 2,070 Advertising and marketing 652 966 964 714 866 Other loan expense 1,351 1,283 1,620 2,283 1,372 Intangible amortization 90 368 512 512 512 FDIC indemnification asset impairment --- --- 563 3,423 3,806 Other expense 4,409 5,300 5,581 5,656 4,422 Total core noninterest expense 28,709$ 30,725$ 33,029$ 35,357$ 35,120$ FHLB prepayment termination charge --- 8,525 --- --- --- Total noninterest expense 28,709$ 39,250$ 33,029$ 35,357$ 35,120$ ($ in thousands) For the Quarter ended

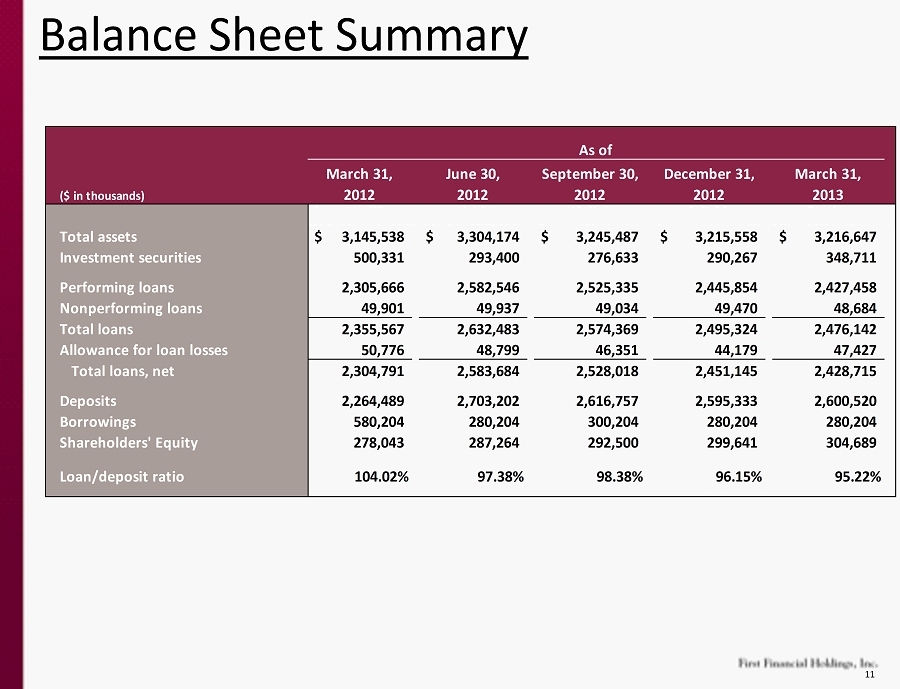

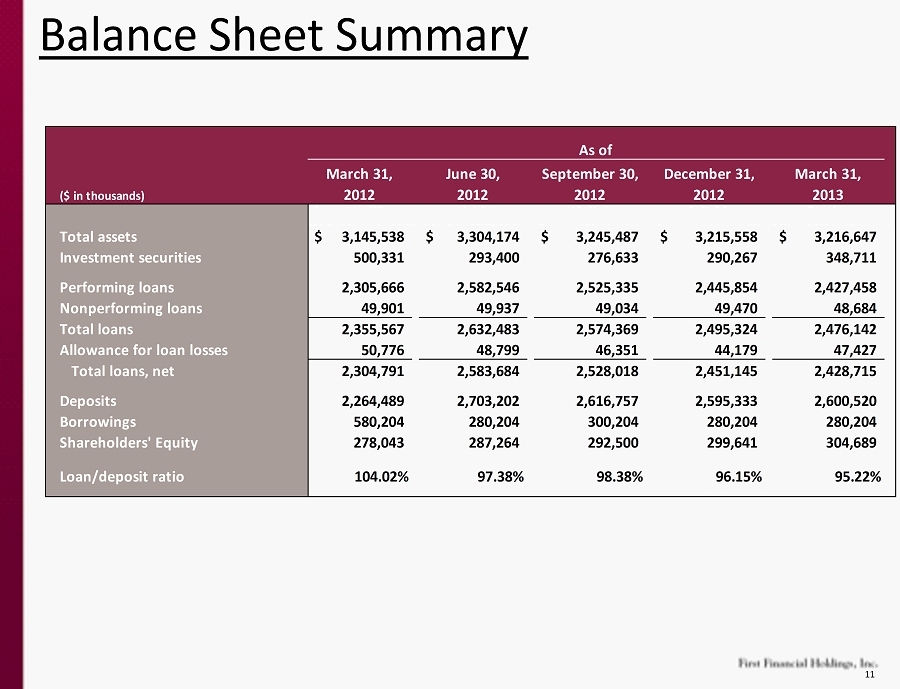

11 Balance Sheet Summary March 31, June 30, September 30, December 31, March 31, 2012 2012 2012 2012 2013 Total assets $ 3,145,538 $ 3,304,174 $ 3,245,487 $ 3,215,558 $ 3,216,647 Investment securities 500,331 293,400 276,633 290,267 348,711 Performing loans 2,305,666 2,582,546 2,525,335 2,445,854 2,427,458 Nonperforming loans 49,901 49,937 49,034 49,470 48,684 Total loans 2,355,567 2,632,483 2,574,369 2,495,324 2,476,142 Allowance for loan losses 50,776 48,799 46,351 44,179 47,427 Total loans, net 2,304,791 2,583,684 2,528,018 2,451,145 2,428,715 Deposits 2,264,489 2,703,202 2,616,757 2,595,333 2,600,520 Borrowings 580,204 280,204 300,204 280,204 280,204 Shareholders’ Equity 278,043 287,264 292,500 299,641 304,689 Loan/deposit ratio 104.02% 97.38% 98.38% 96.15% 95.22% ($ in thousands) As of

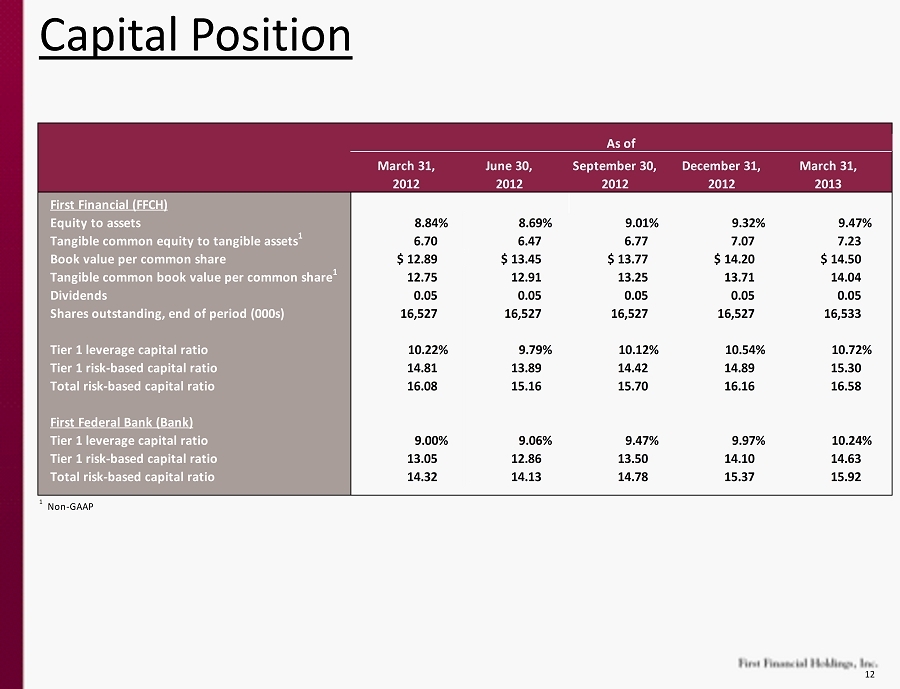

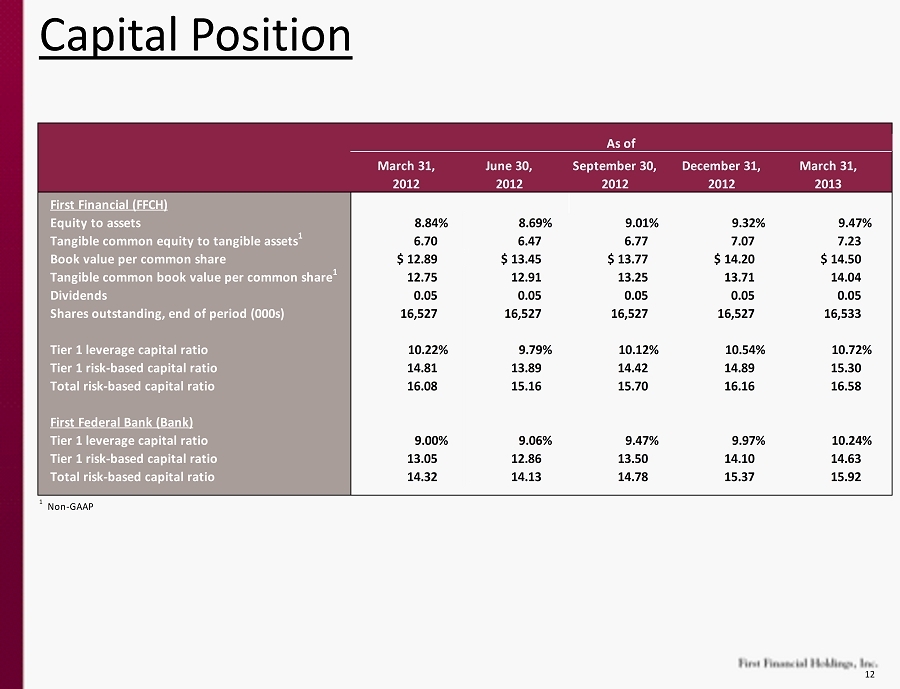

12 Capital Position March 31, June 30, September 30, December 31, March 31, 2012 2012 2012 2012 2013 First Financial (FFCH) Equity to assets 8.84% 8.69% 9.01% 9.32% 9.47% 6.70 6.47 6.77 7.07 7.23 $ 12.89 $ 13.45 $ 13.77 $ 14.20 $ 14.50 12.75 12.91 13.25 13.71 14.04 0.05 0.05 0.05 0.05 0.05 Shares outstanding, end of period (000s) 16,527 16,527 16,527 16,527 16,533 Tier 1 leverage capital ratio 10.22% 9.79% 10.12% 10.54% 10.72% Tier 1 risk-based capital ratio 14.81 13.89 14.42 14.89 15.30 Total risk-based capital ratio 16.08 15.16 15.70 16.16 16.58 First Federal Bank (Bank) Tier 1 leverage capital ratio 9.00% 9.06% 9.47% 9.97% 10.24% Tier 1 risk-based capital ratio 13.05 12.86 13.50 14.10 14.63 Total risk-based capital ratio 14.32 14.13 14.78 15.37 15.92 1 Non-GAAP As of Book value per common share Tangible common book value per common share 1 Dividends Tangible common equity to tangible assets 1

13 Investment Portfolio • 61% fixed / 39% variable • Average portfolio yield: 3.02% • Modified duration: 3.9 years • Private label / CMO: mostly 2003 - 2005 vintages • All but 3 securities are in super senior or senior tranches (3 are in mezzanine) • Bank trust preferred CDOs: <$1 million individually in estimated fair value; all are in mezzanine tranche ($ in thousands) Amortized Cost Estimated Fair Value Amortized Cost Estimated Fair Value Securities available for sale Obligations of US Government agencies and corporations $ 1,227 $ 1,244 $ 1,260 $ 1,278 State and municipal obligations 13,378 13,263 13,460 13,483 Collateralized debt obligations 6,106 3,504 6,191 3,332 Mortgage-backed securities 143,543 145,308 72,527 74,304 Collateralized mortgage obligations 145,159 144,507 157,534 154,883 Other securities 5,656 6,771 5,609 6,518 Total securities available for sale $ 315,069 $ 314,597 $ 256,581 $ 253,798 Securities held to maturity State and municipal obligations $ 14,369 $ 16,442 $ 15,055 $ 17,367 Certificates of deposit 500 500 500 500 Total securities held to maturity $ 14,869 $ 16,942 $ 15,555 $ 17,867 As of December 31, 2012March 31, 2013

14 Loan Composition March 31, 2013 39% 3% 5% 19% 3% 15% 11% 5% Residential 1-4 family Residential construction and land Commercial business Commercial real estate Commercial construction and land Home equity Manufactured housing Marine, yacht and other consumer Avg Avg Balance Yield 1 Balance Yield 1 Residential loans Residential 1-4 family 963,053$ 3.76% 956,355$ 3.74% Residential construction and land 74,806 6.08 75,178 8.06 Total residential loans 1,037,859 3.92 1,031,533 4.04 Commercial loans Commercial business 130,169 7.09 118,379 7.48 Commercial real estate 467,890 4.53 491,567 6.28 Commercial construction and land 65,674 10.90 71,173 4.66 Total commercial loans 663,733 5.64 681,119 6.31 Consumer loans Home equity 373,108 5.85 384,664 5.25 Manufactured housing 282,114 8.61 280,100 8.52 Marine 48,989 7.34 49,251 7.46 Yacht 30,339 4.46 26,485 4.58 Other consumer 40,000 8.25 42,172 7.00 Total consumer loans 774,550 7.02 782,672 6.18 Total portfolio loans 2,476,142$ 5.35% 2,495,324$ 5.32% Covered loans 2 201,186$ 216,689$ Loans held for sale 33,752 3.46% 55,201 3.48% 1 Yields for March 2013 and December 2012 exclude the impact of $1.2 million and $3.6 million incremental accretion on Cape Fear Bank loans, respectively. March 31, 2013 December 31, 2012 2 Covered loans, which are included in total loans above, include those acquired from Cape Fear Bank and Plantation Federal Bank. Both are subject to loss share agreements with the FDIC.

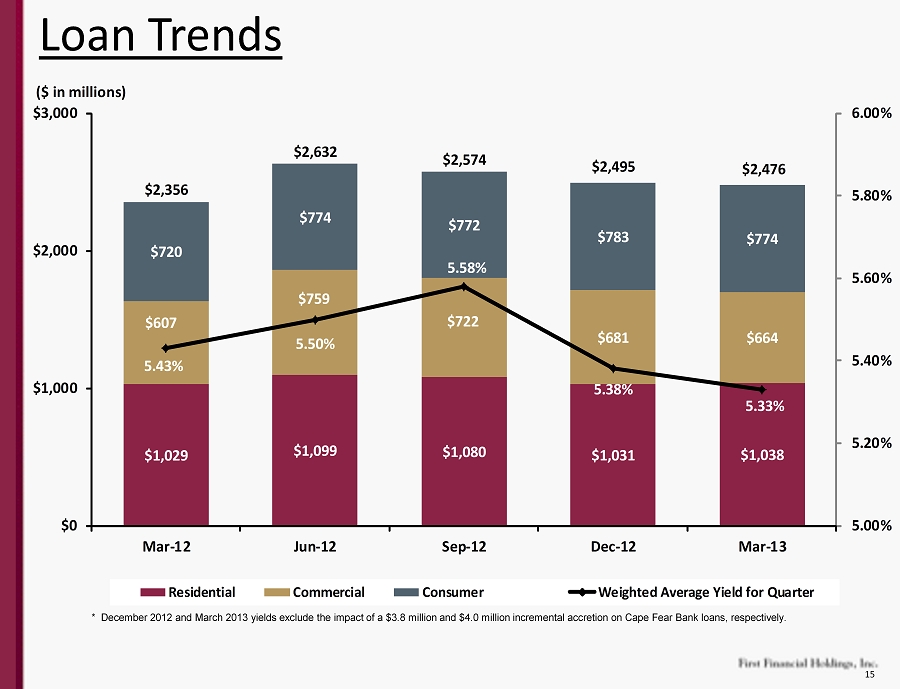

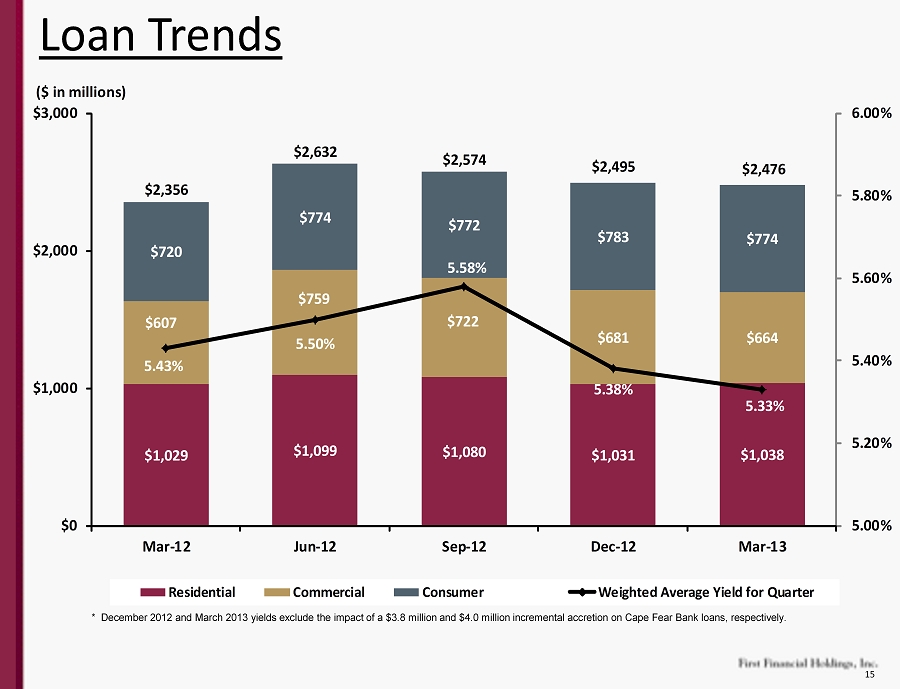

15 Loan Trends * December 2012 and March 2013 yields exclude the impact of a $3.8 million and $4.0 million incremental accretion on Cape Fear Bank loans, respectively. $1,029 $1,099 $1,080 $1,031 $1,038 $607 $759 $722 $681 $664 $720 $774 $772 $783 $774 $2,356 $2,632 $2,574 $2,495 $2,476 5.43% 5.50% 5.58% 5.38% 5.33% 5.00% 5.20% 5.40% 5.60% 5.80% 6.00% $0 $1,000 $2,000 $3,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Residential Commercial Consumer Weighted Average Yield for Quarter

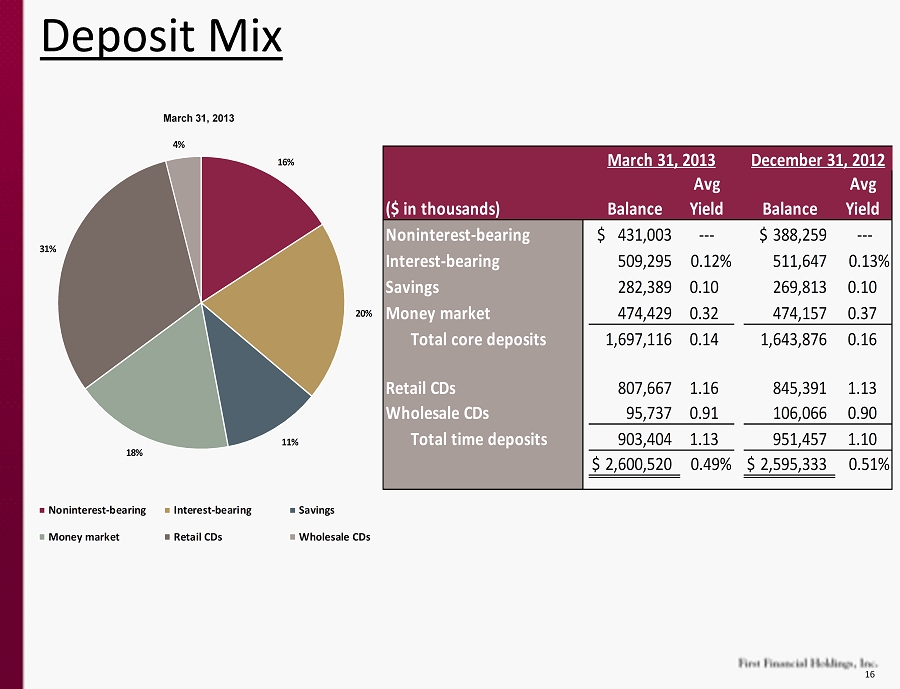

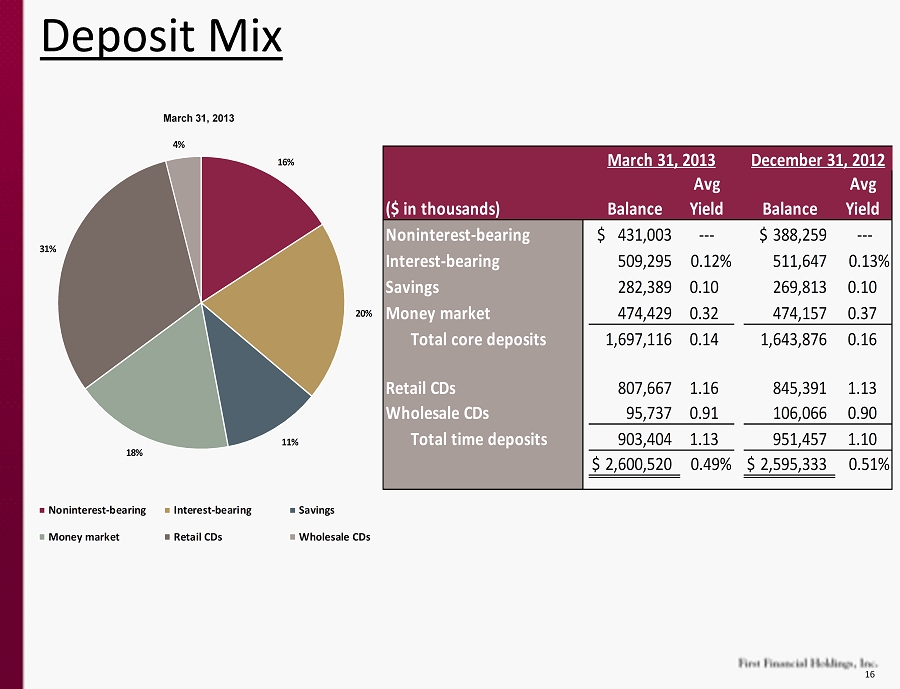

16 Deposit Mix 16% 20% 11% 18% 31% 4% Noninterest-bearing Interest-bearing Savings Money market Retail CDs Wholesale CDs March 31, 2013 ($ in thousands) Balance Avg Yield Balance Avg Yield Noninterest-bearing 431,003$ --- $388,259 --- Interest-bearing 509,295 0.12% 511,647 0.13% Savings 282,389 0.10 269,813 0.10 Money market 474,429 0.32 474,157 0.37 Total core deposits 1,697,116 0.14 1,643,876 0.16 Retail CDs 807,667 1.16 845,391 1.13 Wholesale CDs 95,737 0.91 106,066 0.90 Total time deposits 903,404 1.13 951,457 1.10 $2,600,520 0.49% $2,595,333 0.51% March 31, 2013 December 31, 2012

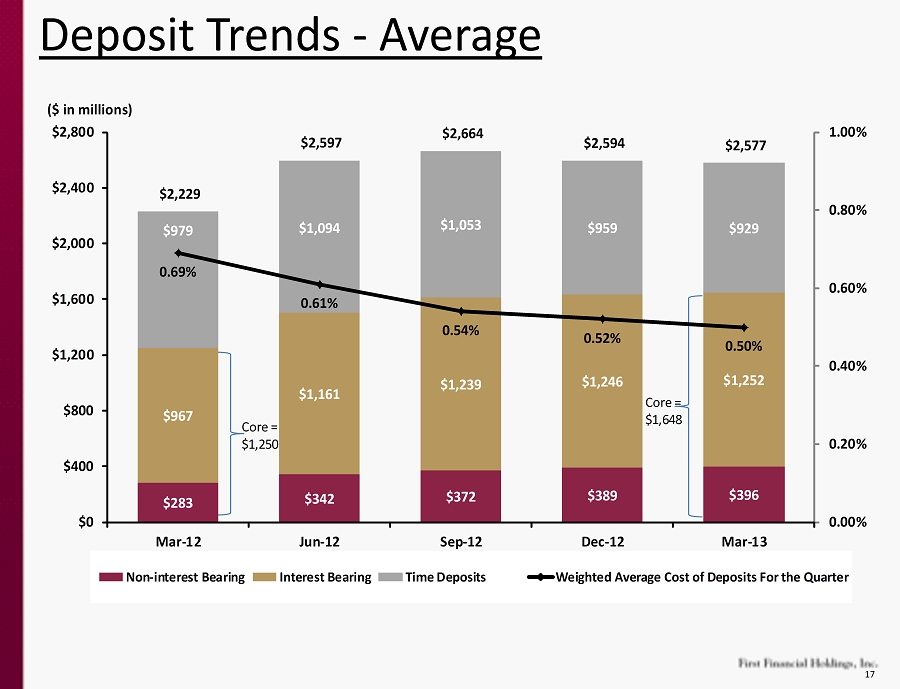

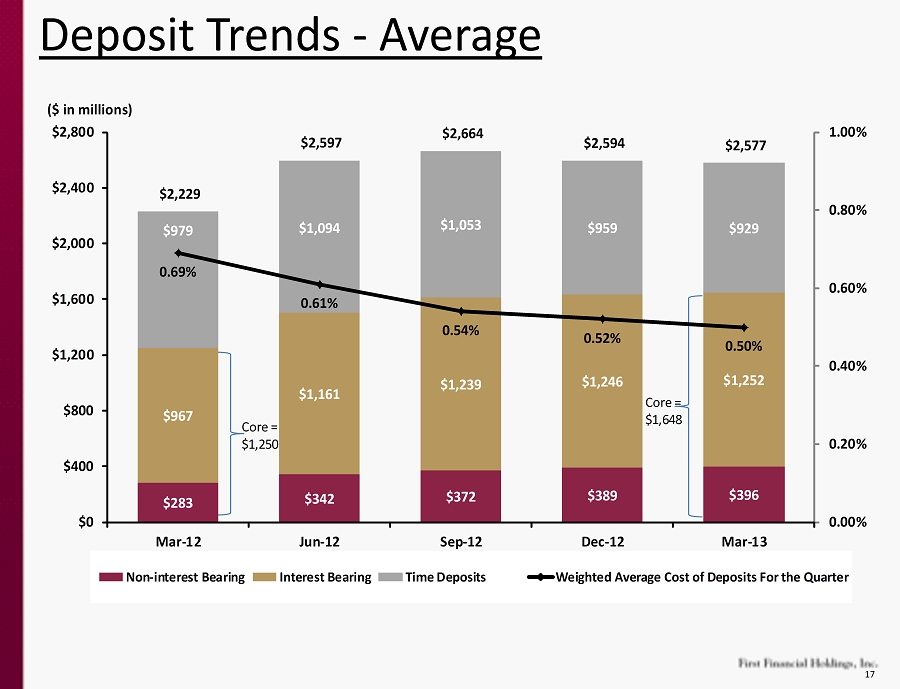

17 Deposit Trends - Average $283 $342 $372 $389 $396 $967 $1,161 $1,239 $1,246 $1,252 $979 $1,094 $1,053 $959 $929 $2,229 $2,597 $2,664 $2,594 $2,577 0.69% 0.61% 0.54% 0.52% 0.50% 0.00% 0.20% 0.40% 0.60% 0.80% 1.00% $0 $400 $800 $1,200 $1,600 $2,000 $2,400 $2,800 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Non-interest Bearing Interest Bearing Time Deposits Weighted Average Cost of Deposits For the Quarter Core = $1,250 Core = $1,648

18 Credit Quality

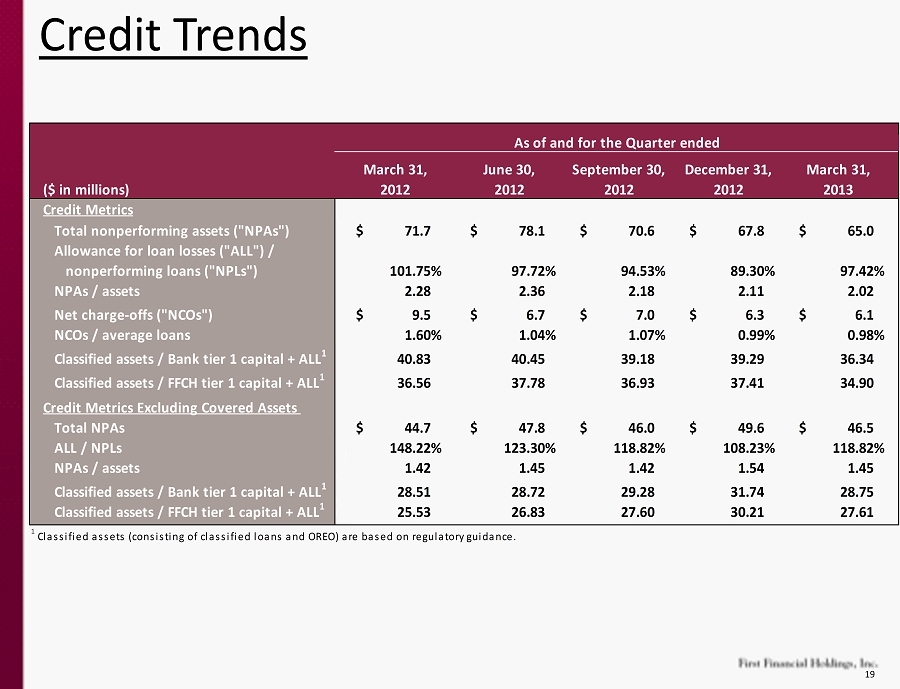

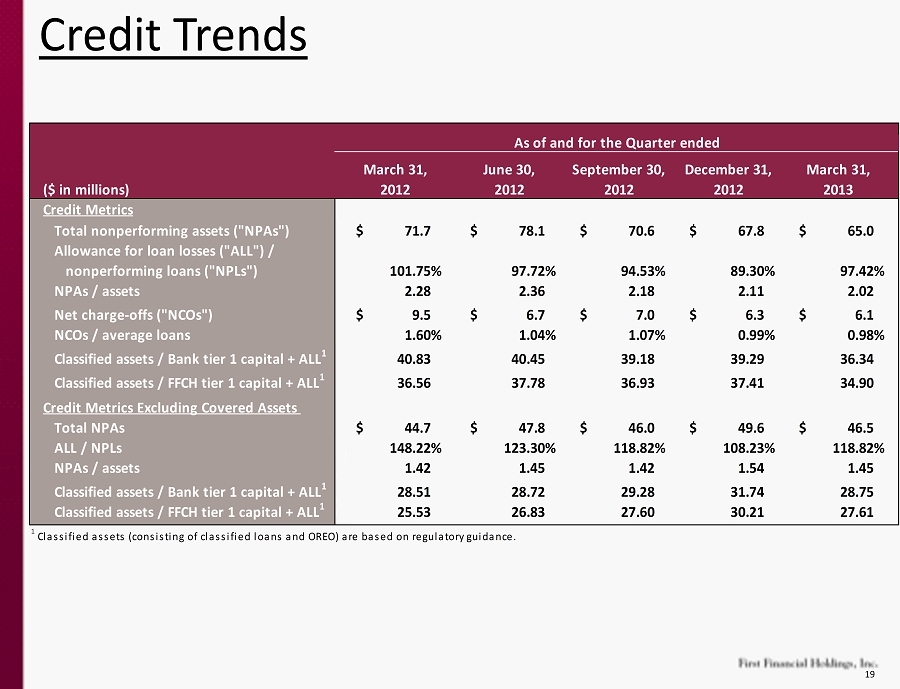

19 Credit Trends ($ in millions) March 31, 2012 June 30, 2012 September 30, 2012 December 31, 2012 March 31, 2013 Credit Metrics Total nonperforming assets (“NPAs”) 71.7 $ 78.1 $ 70.6 $ 67.8 $ 65.0 $ Allowance for loan losses (“ALL”) / nonperforming loans (“NPLs”) 101.75% 97.72% 94.53% 89.30% 97.42% NPAs / assets 2.28 2.36 2.18 2.11 2.02 Net charge-offs (“NCOs”) 9.5 $ 6.7 $ 7.0 $ 6.3 $ 6.1 $ NCOs / average loans 1.60% 1.04% 1.07% 0.99% 0.98% Classified assets / Bank tier 1 capital + ALL 1 40.83 40.45 39.18 39.29 36.34 Classified assets / FFCH tier 1 capital + ALL 1 36.56 37.78 36.93 37.41 34.90 Credit Metrics Excluding Covered Assets Total NPAs 44.7 $ 47.8 $ 46.0 $ 49.6 $ 46.5 $ ALL / NPLs 148.22% 123.30% 118.82% 108.23% 118.82% NPAs / assets 1.42 1.45 1.42 1.54 1.45 Classified assets / Bank tier 1 capital + ALL 1 28.51 28.72 29.28 31.74 28.75 Classified assets / FFCH tier 1 capital + ALL 1 25.53 26.83 27.60 30.21 27.61 1 Classified assets (consisting of classified loans and OREO) are based on regulatory guidance. As of and for the Quarter ended

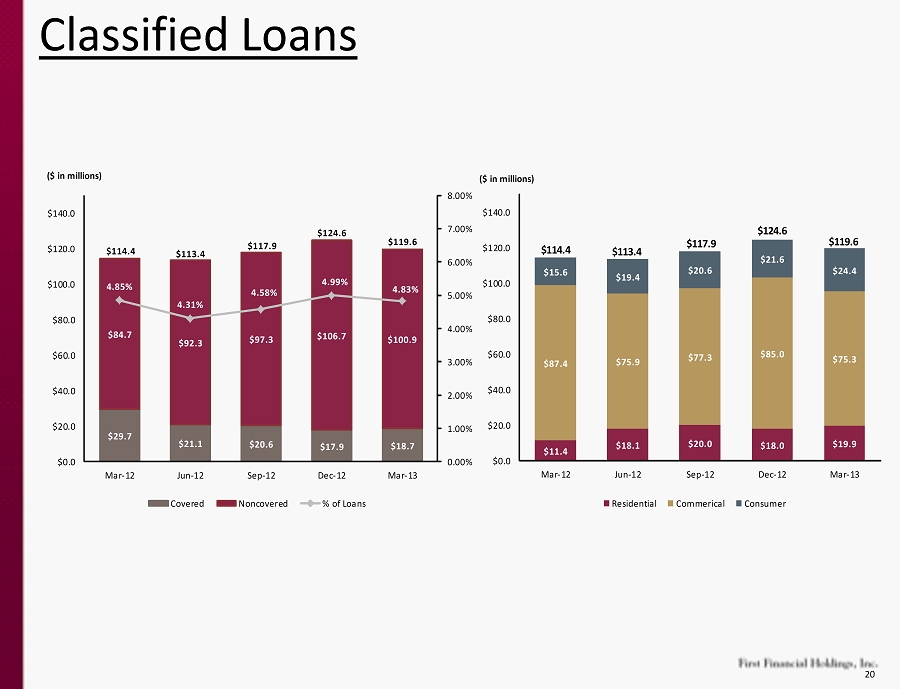

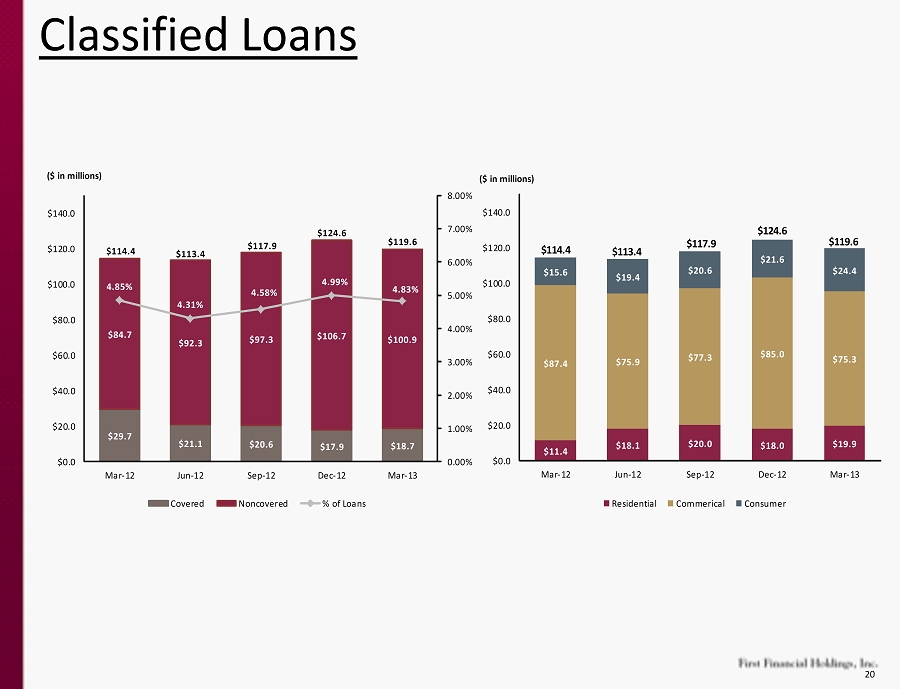

20 Classified Loans $29.7 $21.1 $20.6 $17.9 $18.7 $84.7 $92.3 $97.3 $106.7 $100.9 $114.4 $113.4 $117.9 $124.6 $119.6 4.85% 4.31% 4.58% 4.99% 4.83% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Covered Noncovered % of Loans $11.4 $18.1 $20.0 $18.0 $19.9 $87.4 $75.9 $77.3 $85.0 $75.3 $15.6 $19.4 $20.6 $21.6 $24.4 $114.4 $113.4 $117.9 $124.6 $119.6 $0.0 $20.0 $40.0 $60.0 $80.0 $100.0 $120.0 $140.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Residential Commerical Consumer

21 Delinquent Loans $3.1 $2.9 $1.4 $1.7 $3.3 $11.5 $8.2 $10.1 $15.4 $10.4 $14.6 $11.1 $11.5 $17.1 $13.7 0.62% 0.42% 0.45% 0.68% 0.55% 0.00% 0.50% 1.00% 1.50% $0.0 $5.0 $10.0 $15.0 $20.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Covered Noncovered % of Loans $2.0 $1.7 $2.5 $2.9 $2.4 $7.0 $4.6 $3.3 $5.9 $7.0 $5.6 $4.8 $5.7 $8.3 $4.3 $14.6 $11.1 $11.5 $17.1 $13.7 $0.0 $5.0 $10.0 $15.0 $20.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Residential Commerical Consumer

22 $143 $131 7 Nonperforming Loans $15.6 $10.4 $10.0 $8.7 $8.8 $34.3 $39.5 $39.0 $40.8 $39.9 $49.9 $49.9 $49.0 $49.5 $48.7 2.12% 1.90% 1.90% 1.98% 1.97% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% $0.0 $20.0 $40.0 $60.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Covered Noncovered % of Loans $8.8 $12.2 $12.8 $8.2 $8.6 $28.1 $24.2 $23.2 $27.1 $27.0 $13.0 $13.5 $13.0 $14.2 $13.1 $49.9 $49.9 $49.0 $49.5 $48.7 $0.0 $20.0 $40.0 $60.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 ($ in millions) Residential Commercial Consumer

23 $143 $128 $123 $131 7 Other Repossessed Assets $11.4 $20.0 $14.6 $9.6 $9.7 $10.4 $8.2 $7.0 $8.7 $6.6 $21.8 $28.2 $21.6 $18.3 $16.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Covered Non-Covered (in millions) $7.1 $5.7 $5.0 $4.7 $4.1 $4.6 $6.5 $4.7 $5.6 $5.2 $8.0 $14.2 $10.3 $6.3 $5.4 $2.1 $1.8 $1.6 $1.7 $1.6 $21.8 $28.2 $21.6 $18.3 $16.3 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 (in millions) Residential Commercial Land Other

24 Net Charge - offs and Provision $9.5 $6.7 $7.0 $6.3 $6.1 $6.7 $4.7 $4.5 $4.2 $6.0 2.16% 1.85% 1.80% 1.77% 1.92% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% $0.0 $2.0 $4.0 $6.0 $8.0 $10.0 Mar-12 June-12 Sep-12 Dec-12 Mar-13 ($ in millions) Net Charge-offs Provision for Loan Losses ALL% of Loans

25 APPENDIX

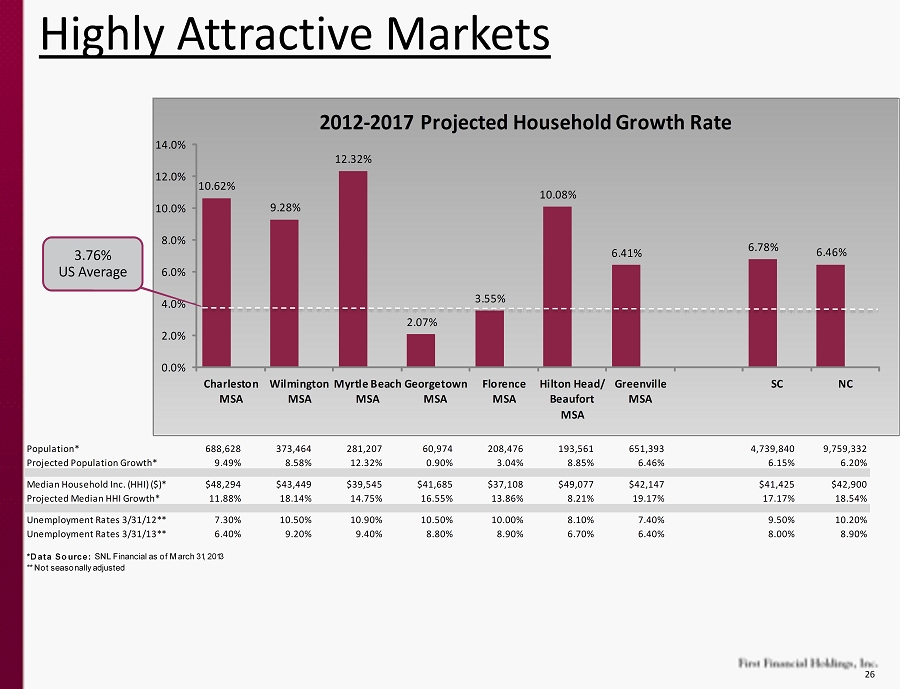

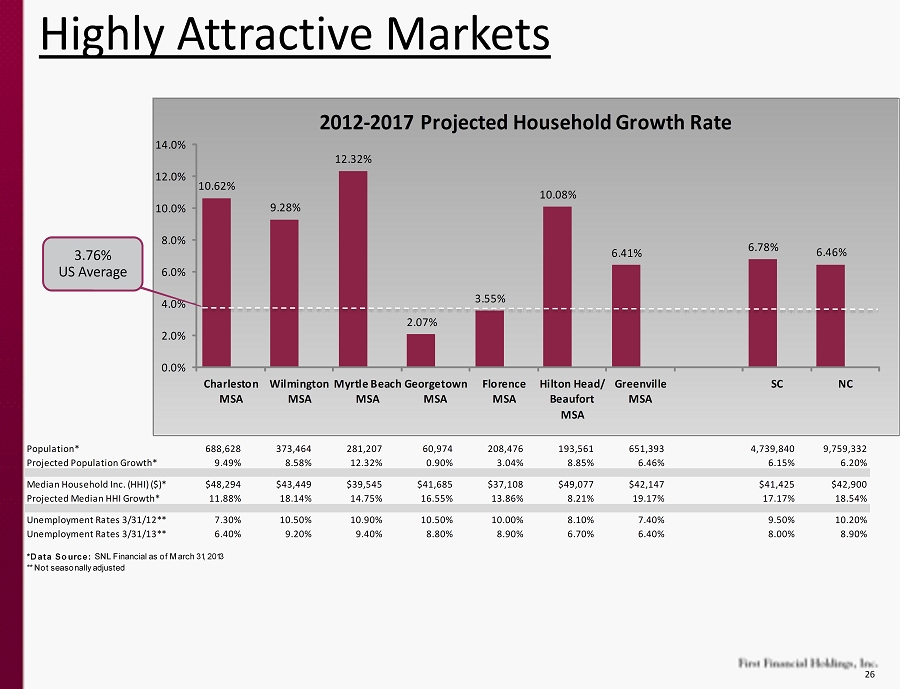

26 Population* 688,628 373,464 281,207 60,974 208,476 193,561 651,393 4,739,840 9,759,332 Projected Population Growth* 9.49% 8.58% 12.32% 0.90% 3.04% 8.85% 6.46% 6.15% 6.20% Median Household Inc. (HHI) ($)* $48,294 $43,449 $39,545 $41,685 $37,108 $49,077 $42,147 $41,425 $42,900 Projected Median HHI Growth* 11.88% 18.14% 14.75% 16.55% 13.86% 8.21% 19.17% 17.17% 18.54% Unemployment Rates 3/31/12** 7.30% 10.50% 10.90% 10.50% 10.00% 8.10% 7.40% 9.50% 10.20% Unemployment Rates 3/31/13** 6.40% 9.20% 9.40% 8.80% 8.90% 6.70% 6.40% 8.00% 8.90% *Data Source: SNL Financial as of March 31, 2013 ** Not seasonally adjusted 10.62% 9.28% 12.32% 2.07% 3.55% 10.08% 6.41% 6.78% 6.46% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% Charleston MSA Wilmington MSA Myrtle Beach MSA Georgetown MSA Florence MSA Hilton Head/ Beaufort MSA Greenville MSA SC NC 2012 - 2017 Projected Household Growth Rate 3.76% US Average Highly Attractive Markets

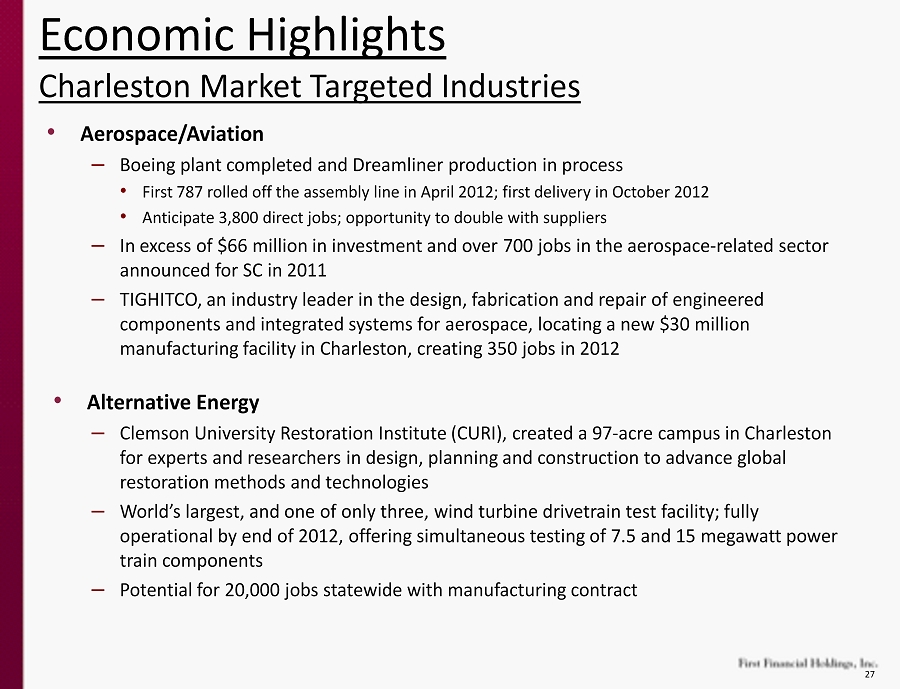

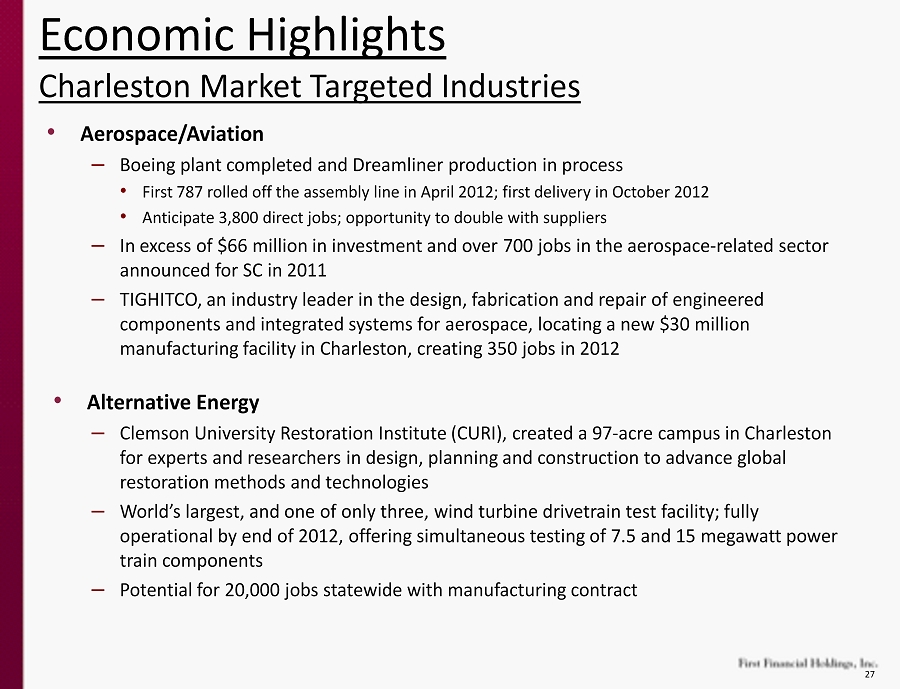

27 • Aerospace/Aviation – Boeing plant completed and Dreamliner production in process • First 787 rolled off the assembly line in April 2012; first delivery in October 2012 • Anticipate 3,800 direct jobs; opportunity to double with suppliers – In excess of $66 million in investment and over 700 jobs in the aerospace - related sector announced for SC in 2011 – TIGHITCO, an industry leader in the design, fabrication and repair of engineered components and integrated systems for aerospace, locating a new $30 million manufacturing facility in Charleston, creating 350 jobs in 2012 • Alternative Energy – Clemson University Restoration Institute (CURI), created a 97 - acre campus in Charleston for experts and researchers in design, planning and construction to advance global restoration methods and technologies – World’s largest, and one of only three, wind turbine drivetrain test facility; fully operational by end of 2012, offering simultaneous testing of 7.5 and 15 megawatt power train components – Potential for 20,000 jobs statewide with manufacturing contract Economic Highlights Charleston Market Targeted Industries

28 • Biomedical – Medical University of SC, the region’s largest biomedical employer and nationally recognized research center and teaching hospital , employs more than 11,000 and conducts more than $243 million in research annually – Two research centers: the Drug Discovery Building and Bioengineering Building opened October 2011 on the MUSC campus – SCRA/MUSC Innovation Center is a state - of - the - art research facility and business incubator with lab spaces designed to support medical and bioscience research – Bioscience activity in area includes 35 pharmaceutical and medical device manufacturers and more than 50 research laboratories and development companies • Advanced Security and IT – The Charleston region is home to more than 18,000 ex - military and government employees, many with high - level security clearances, engaged in next - generation security systems and monitoring technology, including SPAWAR Atlantic – Hundreds of defense contractors are located in Charleston , including SAIC, SRC and BAE, with an estimated $8 billion in contracts completed since 2000 – Charleston is one of the fastest growing mid - size metro areas for software industries: • Top 10 fastest - growing software development regions and mid - size metro for computer - related occupations • Fourth highest per capita concentration in U.S. for computer research scientists and seventh for computer hardware engineers Economic Highlights Charleston Market Targeted Industries

29 • SC Port Authority - Charleston – Eighth largest U.S. container port by cargo value • Over $62.4 billion in goods move through the port annually – Deepest harbor and shipping channels in the South Atlantic • Regularly hosts post - Panamax vessels at high tide • 3 – 5 feet harbor deepening anticipated completion by 2019 – Container business up 3.5% in the fiscal year ended June 30, 2012, with 1.4 million 20 - foot equivalent units (TEUs) handled last fiscal year. – Fastest - growing top 10 U.S. container port; container volume grew 7.4% from January to June 2012 and up 12% year - over - year for Q1 of fiscal 2013. – New three - berth, 280 - acre container terminal scheduled to open in 2013 – Development of in - land port in Greer, SC approved; will convert all - truck container moves to multimodal moves via both truck and rail; anticipated capital investment up to $ 25mm • Other Market Updates – Continental Tires building a Sumter, SC plant started in mid - 2012, total investment expected to be $500 million and will bring 1,700 new jobs by 2020 – 2012 PGA Championship held at Kiawah Island in August 2012 with an estimated economic impact of $193 million to SC – PeopleMatter, a human resource technology firm locating in downtown Charleston, will invest $18.8 million and create 265 new jobs during the next 5 years Economic Highlights

30 • Upstate Market Developments – BMW plans additional investments of nearly $ 900 million and 300 new jobs – Clemson University trustees approved $ 6 . 5 million research and education center in conjunction with Clemson University/Greenwood Genetic Center – Greenville - based Michelin North America to hire 500 people and invest $ 750 million in Anderson and Lexington counties to meet growing demand for massive tires used on earth - moving equipment – JTEKT Automotive South Carolina Inc . to invest $ 102 million and add 80 jobs to its location in Piedmont, SC – Amazon opened a one million square foot distribution center in fall 2012 in Spartanburg, creating 390 jobs Economic Highlights

31 Residential Mortgage Loans 93% 7% Residential Mortgage Loan Portfolio As of March 31, 2013 Residential 1-4 family Residential construction and land $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Delinquent Loans Residential 1-4 family Residential construction and land ($ in thousands) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Nonperforming Loans Residential 1-4 family Residential construction and land ($ in thousands) $(500) $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Net Charge - Offs Residential 1-4 family Residential construction and land ($ in thousands )

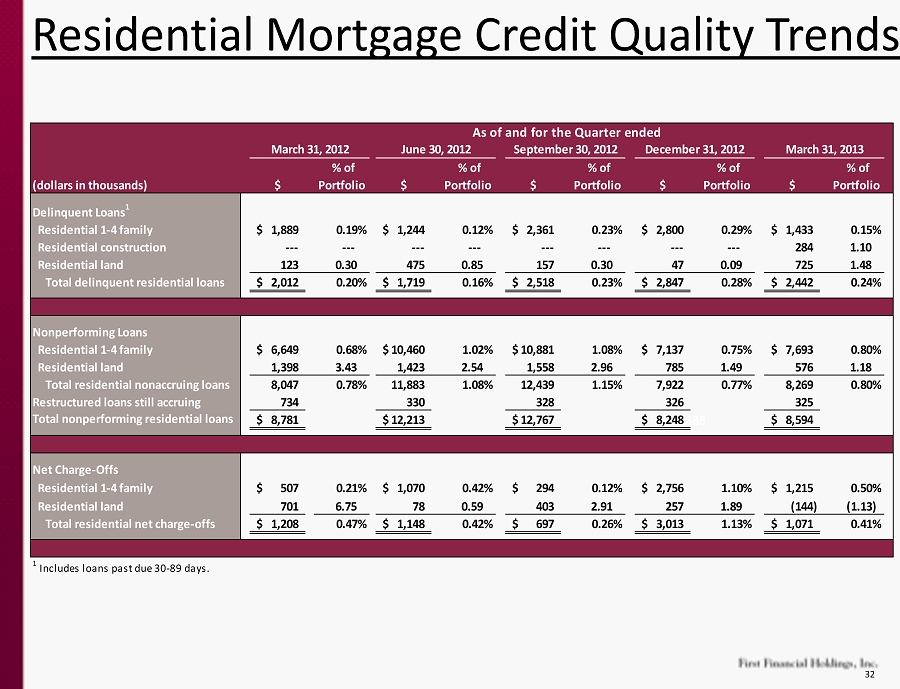

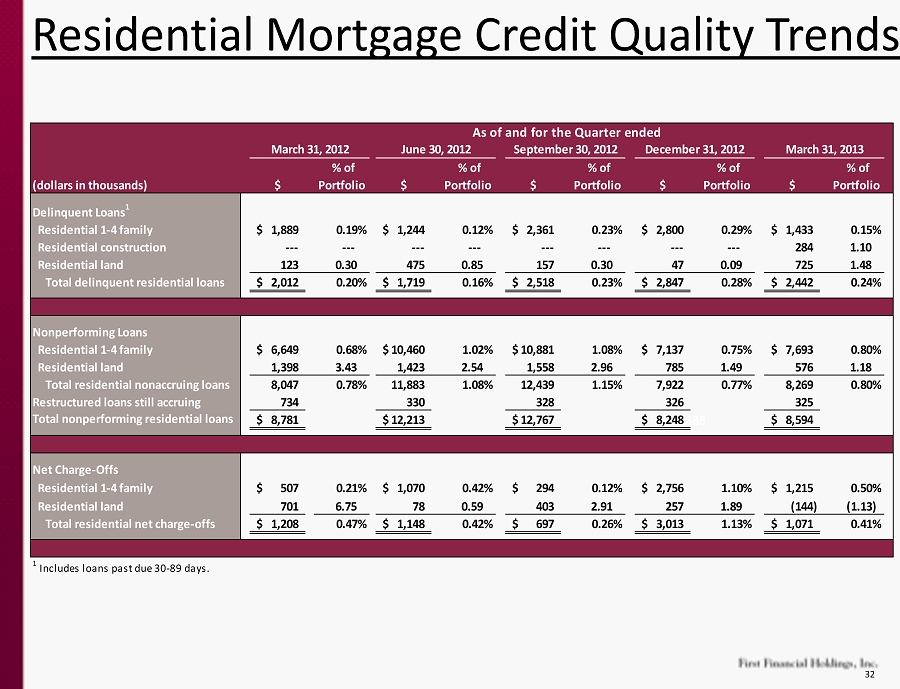

32 $22,685 Residential Mortgage Credit Quality Trends (dollars in thousands) $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio Delinquent Loans 1 Residential 1-4 family 1,889$ 0.19% 1,244$ 0.12% 2,361$ 0.23% 2,800$ 0.29% 1,433$ 0.15% Residential construction --- --- --- --- --- --- --- --- 284 1.10 Residential land 123 0.30 475 0.85 157 0.30 47 0.09 725 1.48 Total delinquent residential loans 2,012$ 0.20% 1,719$ 0.16% 2,518$ 0.23% 2,847$ 0.28% 2,442$ 0.24% Nonperforming Loans Residential 1-4 family 6,649$ 0.68% 10,460$ 1.02% 10,881$ 1.08% 7,137$ 0.75% 7,693$ 0.80% Residential land 1,398 3.43 1,423 2.54 1,558 2.96 785 1.49 576 1.18 Total residential nonaccruing loans 8,047 0.78% 11,883 1.08% 12,439 1.15% 7,922 0.77% 8,269 0.80% Restructured loans still accruing 734 330 328 326 325 Total nonperforming residential loans 8,781$ 12,213$ 12,767$ 8,248$ 8,594$ Net Charge-Offs Residential 1-4 family 507$ 0.21% 1,070$ 0.42% 294$ 0.12% 2,756$ 1.10% 1,215$ 0.50% Residential land 701 6.75 78 0.59 403 2.91 257 1.89 (144) (1.13) Total residential net charge-offs 1,208$ 0.47% 1,148$ 0.42% 697$ 0.26% 3,013$ 1.13% 1,071$ 0.41% 1 Includes loans past due 30-89 days. As of and for the Quarter ended September 30, 2012 December 31, 2012 March 31, 2013June 30, 2012March 31, 2012

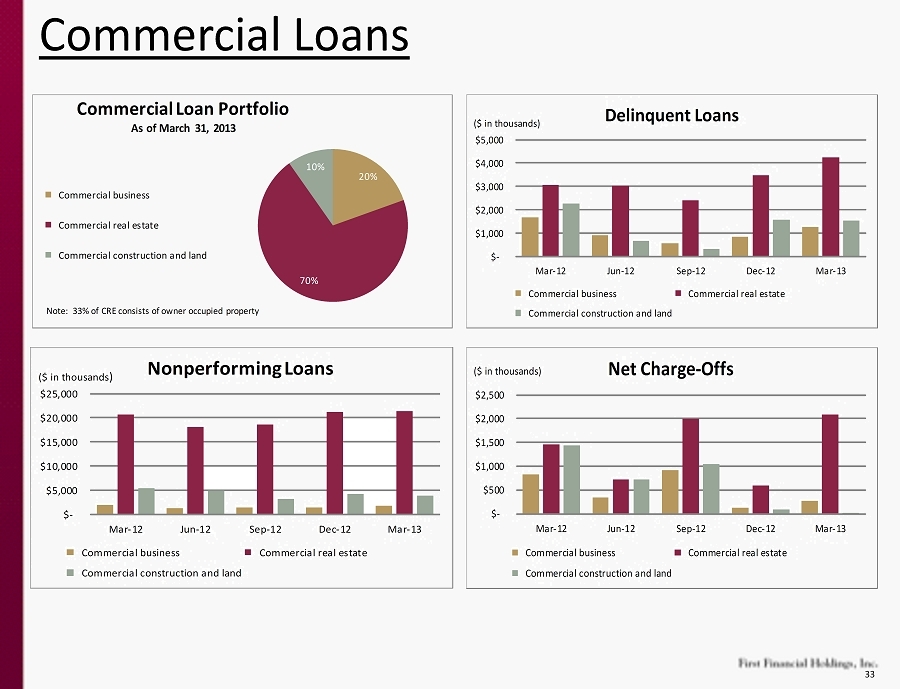

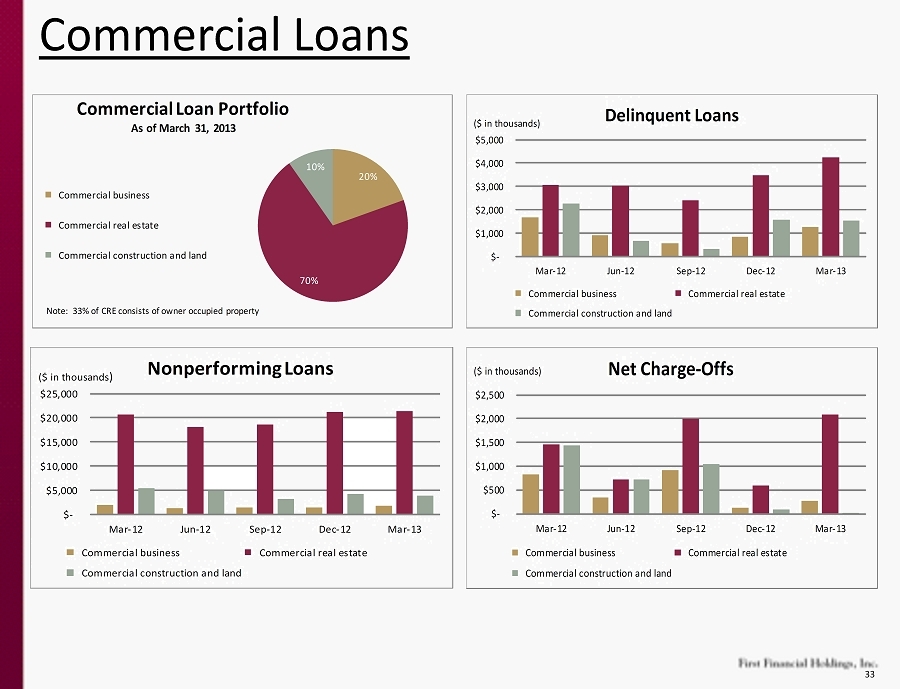

33 Commercial Loans 20% 70% 10% Commercial Loan Portfolio As of March 31, 2013 Commercial business Commercial real estate Commercial construction and land Note: 33% of CRE consists of owner occupied property $- $1,000 $2,000 $3,000 $4,000 $5,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Delinquent Loans Commercial business Commercial real estate Commercial construction and land ($ in thousands) $- $5,000 $10,000 $15,000 $20,000 $25,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Nonperforming Loans Commercial business Commercial real estate Commercial construction and land ($ in thousands ) $- $500 $1,000 $1,500 $2,000 $2,500 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Net Charge - Offs Commercial business Commercial real estate Commercial construction and land ($ in thousands)

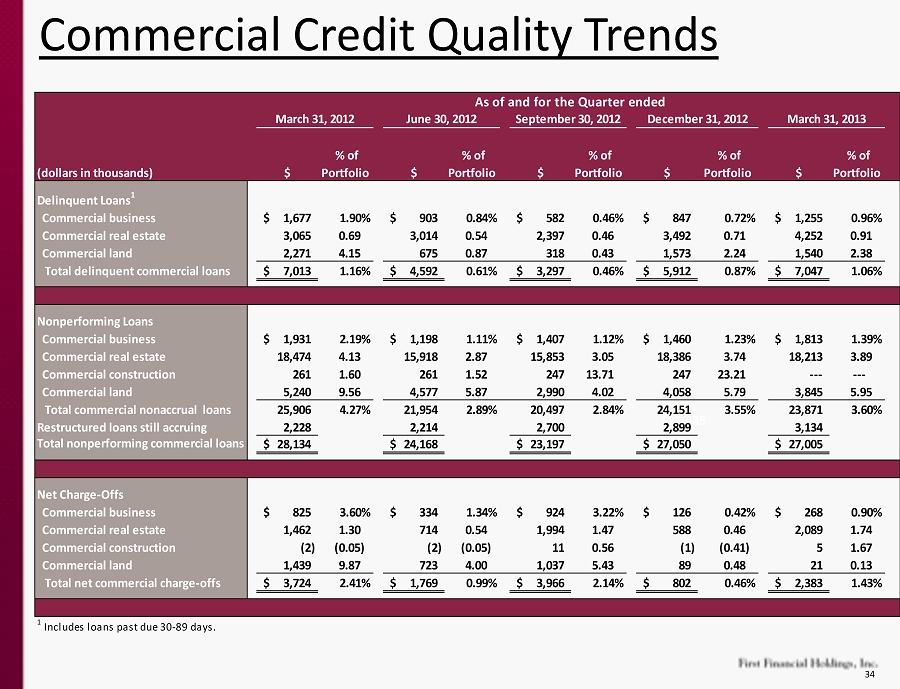

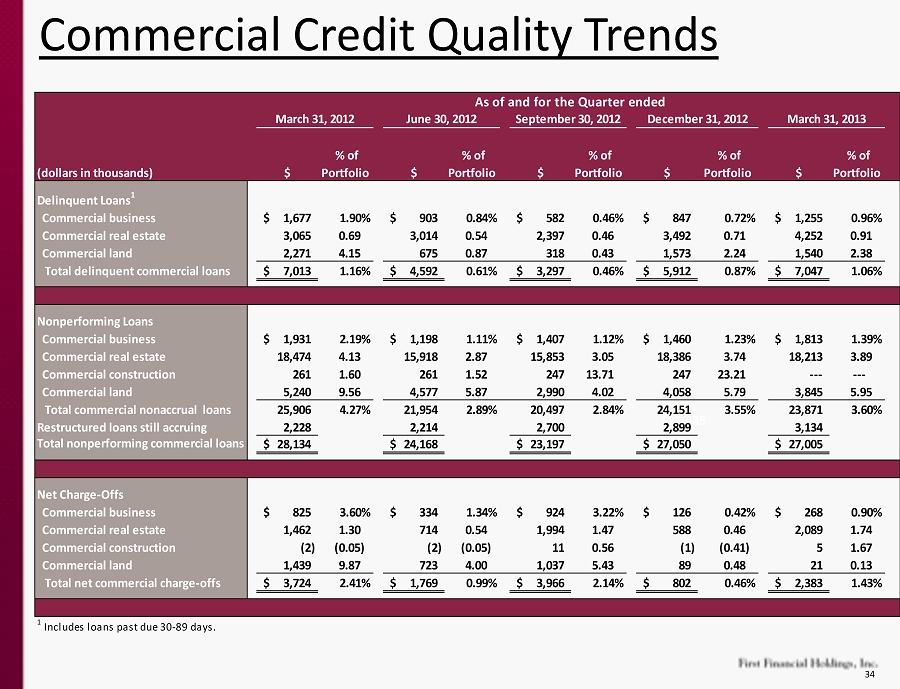

34 $22,685 Commercial Credit Quality Trends (dollars in thousands) $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio Delinquent Loans 1 Commercial business 1,677$ 1.90% 903$ 0.84% 582$ 0.46% 847$ 0.72% 1,255$ 0.96% Commercial real estate 3,065 0.69 3,014 0.54 2,397 0.46 3,492 0.71 4,252 0.91 Commercial land 2,271 4.15 675 0.87 318 0.43 1,573 2.24 1,540 2.38 Total delinquent commercial loans 7,013$ 1.16% 4,592$ 0.61% 3,297$ 0.46% 5,912$ 0.87% 7,047$ 1.06% Nonperforming Loans Commercial business 1,931$ 2.19% 1,198$ 1.11% 1,407$ 1.12% 1,460$ 1.23% 1,813$ 1.39% Commercial real estate 18,474 4.13 15,918 2.87 15,853 3.05 18,386 3.74 18,213 3.89 Commercial construction 261 1.60 261 1.52 247 13.71 247 23.21 --- --- Commercial land 5,240 9.56 4,577 5.87 2,990 4.02 4,058 5.79 3,845 5.95 Total commercial nonaccrual loans 25,906 4.27% 21,954 2.89% 20,497 2.84% 24,151 3.55% 23,871 3.60% Restructured loans still accruing 2,228 2,214 2,700 2,899 3,134 Total nonperforming commercial loans 28,134$ 24,168$ 23,197$ 27,050$ 27,005$ Net Charge-Offs Commercial business 825$ 3.60% 334$ 1.34% 924$ 3.22% 126$ 0.42% 268$ 0.90% Commercial real estate 1,462 1.30 714 0.54 1,994 1.47 588 0.46 2,089 1.74 Commercial construction (2) (0.05) (2) (0.05) 11 0.56 (1) (0.41) 5 1.67 Commercial land 1,439 9.87 723 4.00 1,037 5.43 89 0.48 21 0.13 Total net commercial charge-offs 3,724$ 2.41% 1,769$ 0.99% 3,966$ 2.14% 802$ 0.46% 2,383$ 1.43% 1 Includes loans past due 30-89 days. September 30, 2012June 30, 2012 March 31, 2013 As of and for the Quarter ended December 31, 2012March 31, 2012

35 Consumer Loans 48% 37% 15% Consumer Loan Portfolio As of March 31, 2013 Home equity Manufactured housing Marine and other consumer $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 $4,500 $5,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Delinquent Loans Home equity Manufactured housing Marine and other consumer ($ in thousands) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Nonperforming Loans Home equity Manufactured housing Marine and other consumer ($ in thousands) $- $500 $1,000 $1,500 $2,000 $2,500 $3,000 Mar-12 Jun-12 Sep-12 Dec-12 Mar-13 Net Charge - Offs Home equity Manufactured housing Marine and other consumer ($ in thousands)

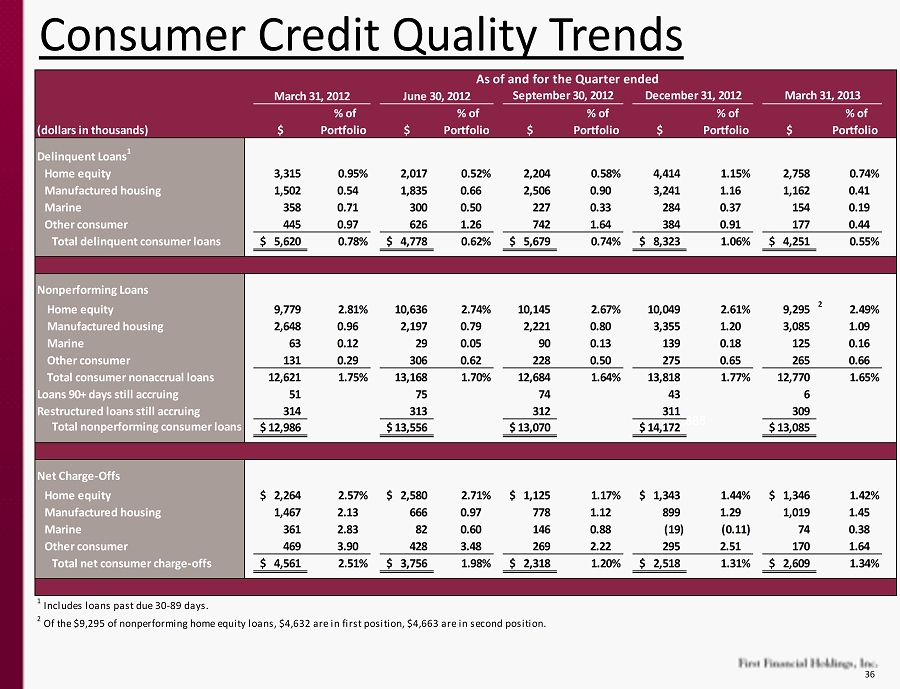

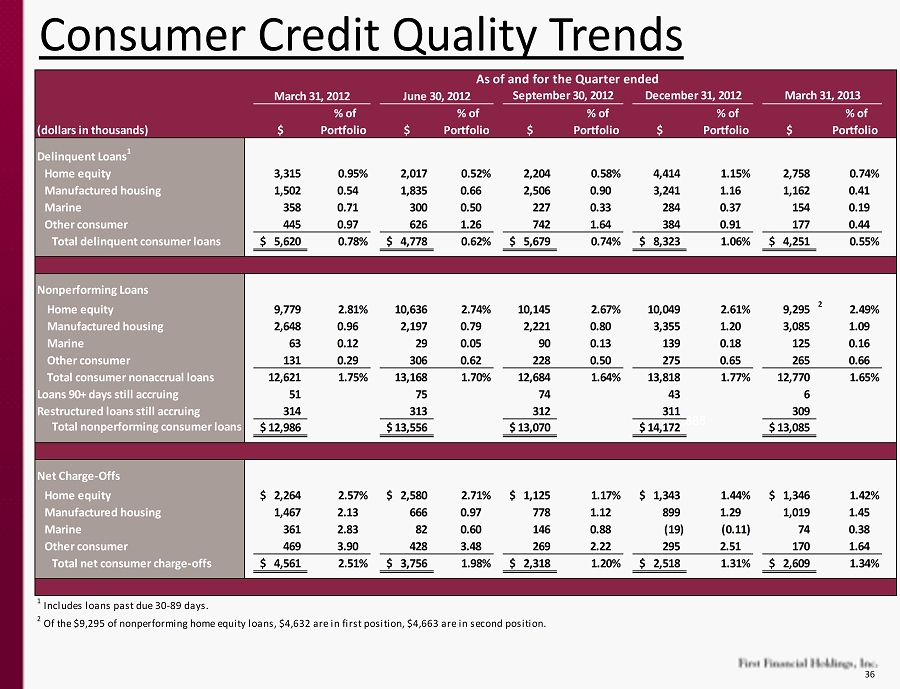

36 $22,685 Consumer Credit Quality Trends March 31, 2012 June 30, 2012 (dollars in thousands) $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio $ % of Portfolio Delinquent Loans 1 Home equity 3,315 0.95% 2,017 0.52% 2,204 0.58% 4,414 1.15% 2,758 0.74% Manufactured housing 1,502 0.54 1,835 0.66 2,506 0.90 3,241 1.16 1,162 0.41 Marine 358 0.71 300 0.50 227 0.33 284 0.37 154 0.19 Other consumer 445 0.97 626 1.26 742 1.64 384 0.91 177 0.44 Total delinquent consumer loans 5,620$ 0.78% 4,778$ 0.62% 5,679$ 0.74% 8,323$ 1.06% 4,251$ 0.55% Nonperforming Loans Home equity 9,779 2.81% 10,636 2.74% 10,145 2.67% 10,049 2.61% 9,295 2 2.49% Manufactured housing 2,648 0.96 2,197 0.79 2,221 0.80 3,355 1.20 3,085 1.09 Marine 63 0.12 29 0.05 90 0.13 139 0.18 125 0.16 Other consumer 131 0.29 306 0.62 228 0.50 275 0.65 265 0.66 Total consumer nonaccrual loans 12,621 1.75% 13,168 1.70% 12,684 1.64% 13,818 1.77% 12,770 1.65% Loans 90+ days still accruing 51 75 74 43 6 Restructured loans still accruing 314 313 312 311 309 Total nonperforming consumer loans 12,986$ 13,556$ 13,070$ 14,172$ 13,085$ Net Charge-Offs Home equity 2,264$ 2.57% 2,580$ 2.71% 1,125$ 1.17% 1,343$ 1.44% 1,346$ 1.42% Manufactured housing 1,467 2.13 666 0.97 778 1.12 899 1.29 1,019 1.45 Marine 361 2.83 82 0.60 146 0.88 (19) (0.11) 74 0.38 Other consumer 469 3.90 428 3.48 269 2.22 295 2.51 170 1.64 Total net consumer charge-offs 4,561$ 2.51% 3,756$ 1.98% 2,318$ 1.20% 2,518$ 1.31% 2,609$ 1.34% 1 Includes loans past due 30-89 days. 2 Of the $9,295 of nonperforming home equity loans, $4,632 are in first position, $4,663 are in second position. September 30, 2012 March 31, 2013 As of and for the Quarter ended December 31, 2012

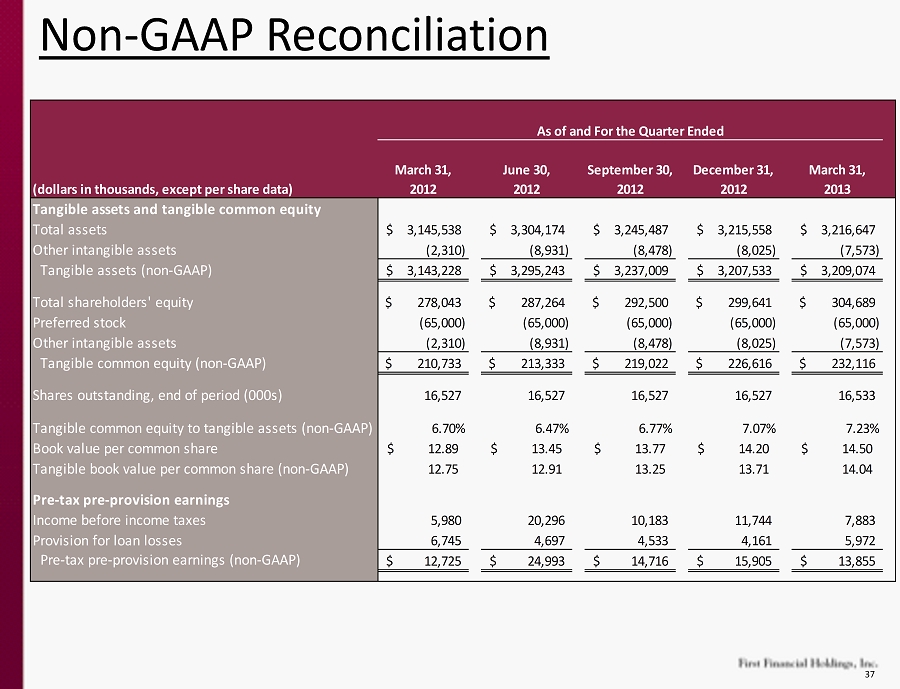

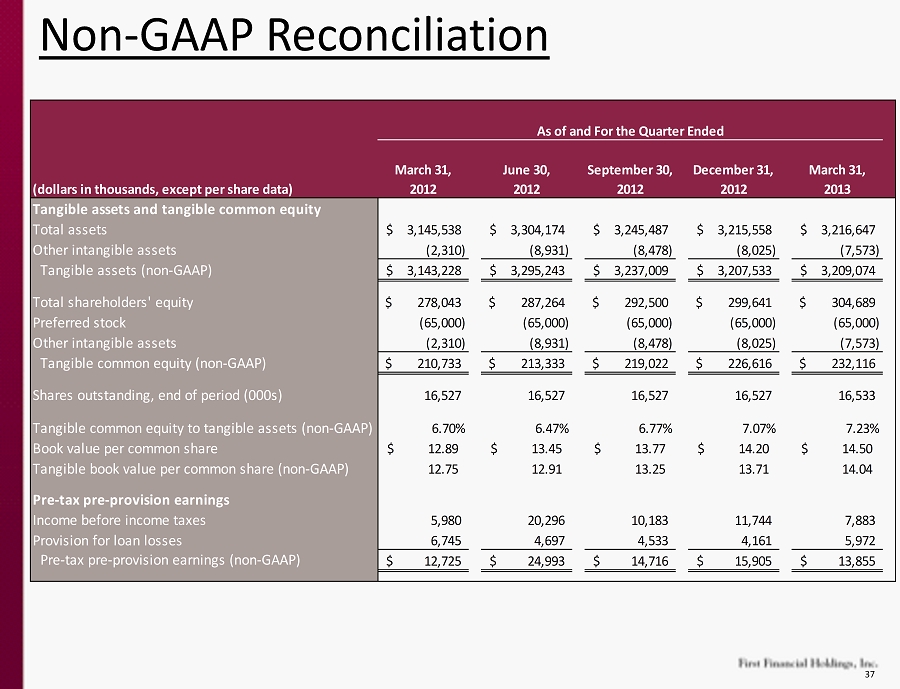

37 Non - GAAP Reconciliation (dollars in thousands, except per share data) March 31, 2012 June 30, 2012 September 30, 2012 December 31, 2012 March 31, 2013 Tangible assets and tangible common equity Total assets 3,145,538$ 3,304,174$ 3,245,487$ 3,215,558$ 3,216,647$ Other intangible assets (2,310) (8,931) (8,478) (8,025) (7,573) Tangible assets (non-GAAP) 3,143,228$ 3,295,243$ 3,237,009$ 3,207,533$ 3,209,074$ Total shareholders’ equity 278,043$ 287,264$ 292,500$ 299,641$ 304,689$ Preferred stock (65,000) (65,000) (65,000) (65,000) (65,000) Other intangible assets (2,310) (8,931) (8,478) (8,025) (7,573) Tangible common equity (non-GAAP) 210,733$ 213,333$ 219,022$ 226,616$ 232,116$ Shares outstanding, end of period (000s) 16,527 16,527 16,527 16,527 16,533 Tangible common equity to tangible assets (non-GAAP) 6.70% 6.47% 6.77% 7.07% 7.23% Book value per common share 12.89 $ 13.45 $ 13.77 $ 14.20 $ 14.50 $ Tangible book value per common share (non-GAAP) 12.75 12.91 13.25 13.71 14.04 Pre-tax pre-provision earnings Income before income taxes 5,980 20,296 10,183 11,744 7,883 Provision for loan losses 6,745 4,697 4,533 4,161 5,972 Pre-tax pre-provision earnings (non-GAAP) 12,725$ 24,993$ 14,716$ 15,905$ 13,855$ As of and For the Quarter Ended

First Financial Holdings, Inc . Nasdaq: FFCH www.firstfinancialholdings.com R. Wayne Hall Blaise B. Bettendorf President & CEO EVP & Chief Financial Officer whall@firstfederal.com bbettendorf@firstfederal.com 843.529.5907 843.529.5456