Forward-looking Statements

The Private Securities Litigation Report Act of 1995 provides a "safe harbor" for certain forward-looking statements. This presentation contains forward-looking

statements with respect to the Company’s financial condition, results of operations, plans, objectives, future performance or business. These forward-looking statements

are subject to certain risks and uncertainties, including those identified below, which could cause future results to differ materially from historical results or those

anticipated. The words "believe," "expect," "anticipate," "intend," "estimate," "goals," "would," "could," "should" and other expressions which indicate future events and

trends identify forward-looking statements. We caution readers not to place undue reliance on these forward-looking statements, which is based only on information

actually known to the Company, speak only as of their dates, and if no date is provided, then such statements speak only as of today.

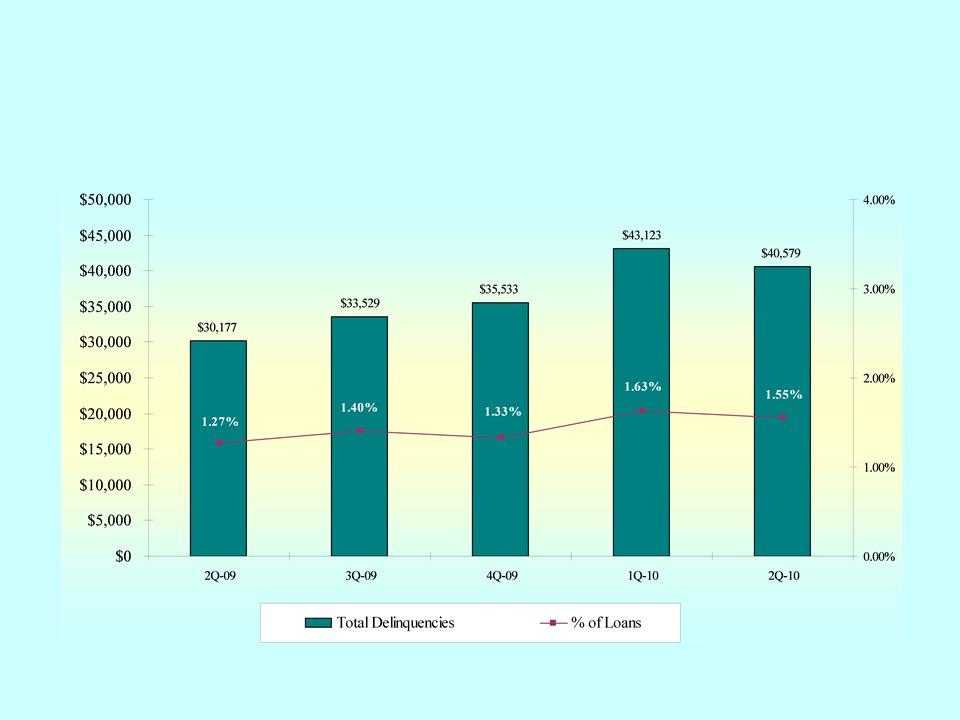

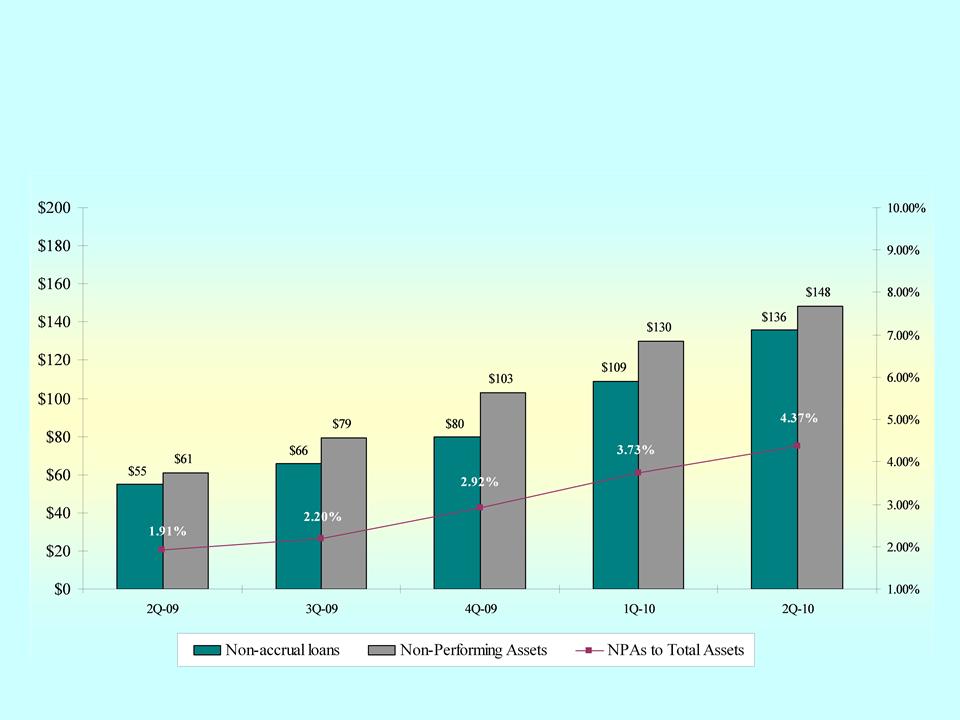

There are a number important factors that could cause future results to differ materially from historical results or those anticipated, including, but not limited to: the credit

risks of lending activities, including changes in the level and trend of loan delinquencies and write-offs and changes in our allowance for loan losses and provision for

loan losses that may be impacted by deterioration in the housing and commercial real estate markets; changes in general economic conditions, either nationally or in our

market areas; changes in the levels of general interest rates, and the relative differences between short and long term interest rates, deposit interest rates, our net interest

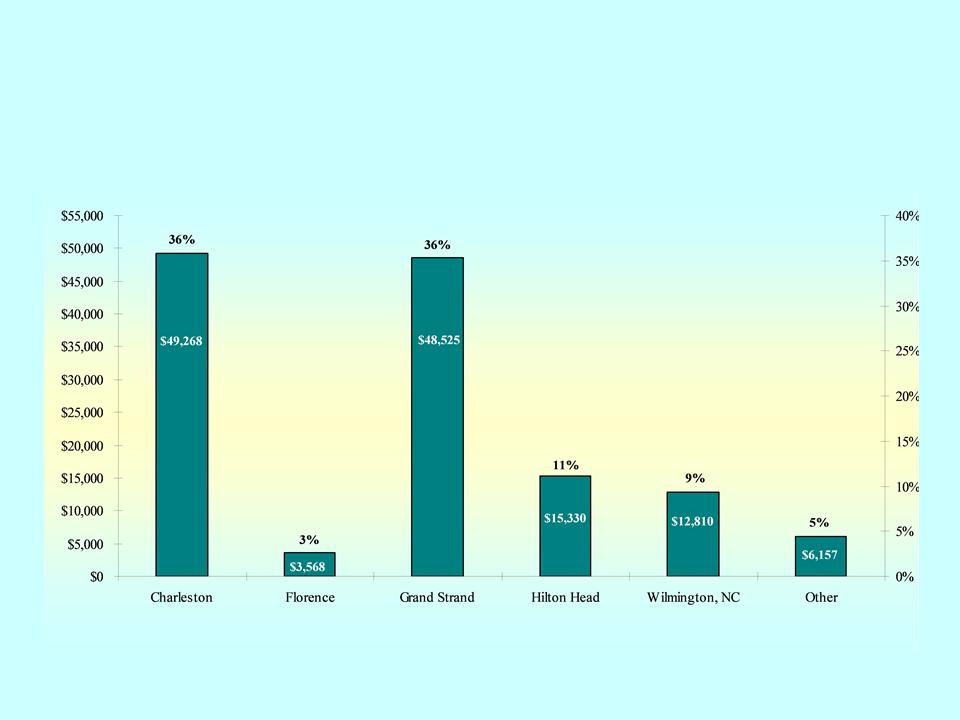

margin and funding sources; fluctuations in the demand for loans, the number of unsold homes, land and other properties and fluctuations in real estate values in our

market areas; the accuracy of the results of our internal stress test and the assumptions we used to derive such results; results of examinations of us by the Office of Thrift

Supervision or the Federal Deposit Insurance Corporation or other regulatory authorities, including the possibility that any such regulatory authority may, among other

things, require us to increase our reserve for loan losses, write-down assets, change our regulatory capital position or affect our ability to borrow funds or maintain or

increase deposits, which could adversely affect our liquidity and earnings; legislative or regulatory changes that adversely affect our business including changes in

regulatory policies and principles, or the interpretation of regulatory capital or other rules; further increases in premiums for deposit insurance; our ability to control

operating costs and expenses; the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant

declines in valuation; difficulties in reducing risk associated with the loans on our balance sheet; staffing fluctuations in response to product demand or the

implementation of corporate strategies that affect our workforce and potential associated charges; computer systems on which we depend could fail or experience a

security breach; our ability to retain key members of our senior management team; costs and effects of litigation, including settlements and judgments; our ability to

implement our branch expansion strategy; our ability to successfully integrate any assets, liabilities, customers, systems, and management personnel we have acquired or

may in the future acquire into our operations and our ability to realize related revenue synergies and cost savings within expected time frames and any goodwill charges

related thereto; changes in premiums or claims that adversely affect our insurance segment; increased competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the availability of resources to address changes in laws, rules, or regulations or to respond to regulatory actions; our

ability to pay dividends on our common stock; adverse changes in the securities markets; inability of key third-party providers to perform their obligations to us; changes

in accounting policies and practices, as may be adopted by the financial institution regulatory agencies or the Financial Accounting Standards Board, including additional

guidance and interpretation on accounting issues and details of the implementation of new accounting methods; other economic, competitive, governmental, regulatory,

and technological factors affecting our operations, pricing, products and services; future legislative changes in the TARP Capital Purchase Program and other risks

described elsewhere in the Company’s reports filed with the Securities and Exchange Commission, including the 2009 Annual Report on Form 10-K for the fiscal year

ended September 30, 2009, the Company’s quarterly reports on Form 10-Q, other documents and the prospectus supplement filed with the SEC on September 21, 2009.