UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant [ ] Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ x ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material pursuant to §240.14a-12

| FIRST FINANCIAL HOLDINGS, INC. |

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ x] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | 1. | Title of each class of securities to which transaction applies: |

| | | N/A |

| | 2. | Aggregate number of securities to which transaction applies: |

| | | N/A |

| | 3. | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | N/A |

| | 4. | Proposed maximum aggregate value of transaction: |

| | | N/A |

[ ] Fee paid previously with preliminary materials: ____________________________________

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | 1. | Amount Previously Paid: |

| | | N/A |

| | 2. | Form, Schedule or Registration Statement No.: |

| | | N/A |

First Financial Holdings, Inc.

2440 Mall Drive

Charleston, South Carolina 29406

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on January 26, 2012

Dear Fellow Shareholder:

We cordially invite you to attend the 2012 Annual Meeting of Shareholders of First Financial Holdings, Inc., the holding company for First Federal Savings and Loan Association of Charleston. At the meeting, we will report on our performance in 2011 and answer your questions. We hope that you can attend the meeting and look forward to seeing you there.

This letter serves as your official notice that we will hold the meeting on January 26, 2012, at our office located at 2440 Mall Drive, Charleston, South Carolina at 5:30 p.m., Eastern Time for the following purposes:

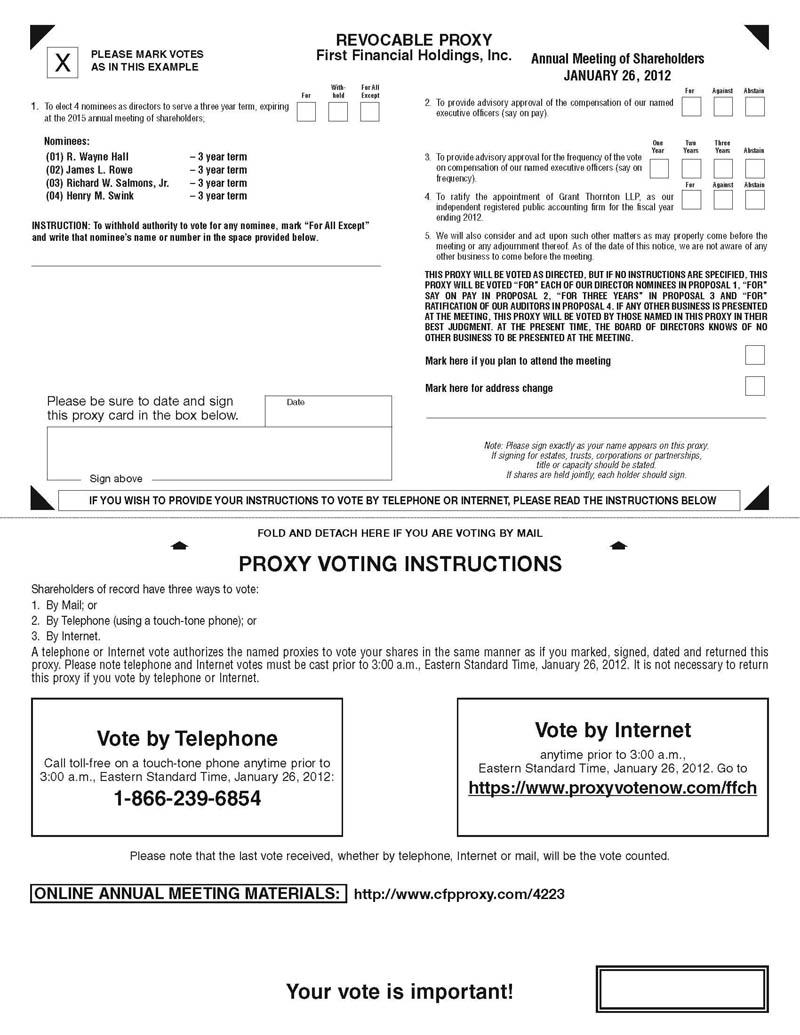

| 1. | Elect Directors. To elect four nominees as directors to serve a three-year term, expiring at the 2015 annual meeting of shareholders; |

| 2. | Advisory (Non-binding) Vote on Executive Compensation. To obtain a non-binding resolution approving the compensation of the Company's Named Executive Officers as determined by the Compensation/Benefits Committee and the Board of Directors ("Say-on-Pay"); |

| 3. | Advisory (Non-binding) Vote on Frequency of Voting on Say-on-Pay Proposals. To approve a non-binding resolution to determine whether shareholders should vote on Say-on-Pay proposals every one, two, or three years ("Say-on-Frequency"); |

| 4. | Ratify Independent Accountants. To ratify the selection of Grant Thornton LLP as the Company's independent registered public accounting firm for fiscal year 2012; |

| 5. | Other Business. To transact any other business that may properly come before the meeting or any adjournment of the Annual Meeting. |

Shareholders owning our common stock as of the close of business on November 30, 2011 are entitled to attend and vote at the meeting. A complete list of these shareholders will be available at the Company's headquarters in Charleston, South Carolina prior to the meeting. If you need assistance in completing your proxy, please call the Company at (843) 529-5933. If your shares are held in "street name," you will need to obtain a proxy form from the institution that holds your shares in order to vote at the Annual Meeting. If you are a record shareholder, attend the Annual Meeting and desire to revoke your proxy or vote in person, you may do so. In any event, a proxy may be revoked by a record holder at any time before it is exercised.

Please use this opportunity to take part in the affairs of your Company by voting on the business to come before the Annual Meeting. Even if you plan to attend the Annual Meeting, we encourage you to vote as soon as possible through the Internet, by telephone or by signing, dating and mailing your proxy card in the envelope enclosed. Internet voting permits you to vote at your convenience, 24 hours a day, seven days a week. Detailed voting instructions are included on your proxy card.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE "FOR" APPROVAL OF ALL THE PROPOSALS PRESENTED.

| | | By Order of the Board of Directors | |

| | |  | |

| Charleston, South Carolina | | R. Wayne Hall | |

| December 30, 2011 | | President and Chief Executive Officer | |

TABLE OF CONTENTS

| VOTING INFORMATION | 1 |

| PROPOSAL NO. 1 ELECTION OF DIRECTORS | 3 |

| PROPOSAL NO. 2 ADVISORY, NON-BINDING VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS | 5 |

| PROPOSAL NO. 3 ADVISORY, NON-BINDING VOTE ON FREQUENCY OF APPROVAL OF THE COMPENSATION OF NAMED EXECUTIVE OFFICERS | 6 |

| PROPOSAL NO. 4 RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 7 |

| CORPORATE GOVERNANCE | 8 |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 14 |

| EXECUTIVE OFFICERS | 15 |

| EXECUTIVE COMPENSATION AND OTHER INFORMATION | 19 |

| Compensation Discussion and Analysis | 19 |

| Summary Compensation Table | 29 |

| Outstanding Equity Awards at Fiscal Year-End | 31 |

| Option Exercises and Stock Vested | 31 |

| Pension Benefits | 31 |

| Nonqualified Deferred Compensation | 31 |

| Terms of the Change in Control Severance Agreements | 31 |

| OTHER INFORMATION RELATING TO DIRECTORS AND EXECUTIVE OFFICERS | 33 |

| AUDIT FEES | 35 |

| SUBMISSION OF BUSINESS PROPOSALS AND SHAREHOLDER NOMINATIONS | 35 |

| SHAREHOLDER COMMUNICATIONS | 36 |

| FORWARD LOOKING STATEMENTS | 36 |

| WHERE YOU CAN FIND MORE INFORMATION | 36 |

First Financial Holdings, Inc.

2440 Mall Drive

Charleston, South Carolina 29406

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

To be Held on January 26, 2012

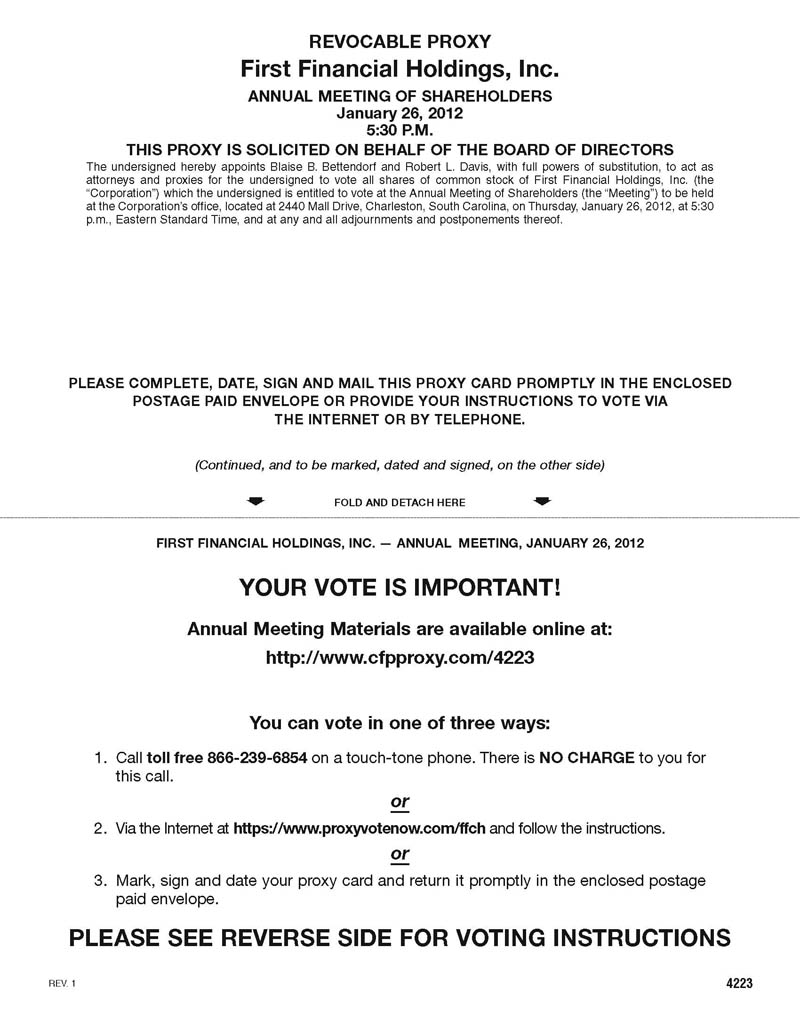

This proxy statement is furnished to shareholders of First Financial Holdings, Inc., a Delaware corporation (together with its subsidiaries, "First Financial" or the "Company"), the holding company for First Federal Savings and Loan Association of Charleston ("First Federal" or the "Bank"), in connection with the solicitation of proxies by the Company's Board of Directors for use at the Annual Meeting of Shareholders to be held at the Company's principal executive office located at 2440 Mall Drive, Charleston, South Carolina at 5:30 p.m., on January 26, 2012, or any adjournment thereof (the "Annual Meeting"), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders.

VOTING INFORMATION

Only holders of the Company's common stock are entitled to vote at the Annual Meeting. Each share of common stock entitles the holder thereof to one vote on each matter to come before the Annual Meeting. At the close of business on November 30, 2011 (the "Record Date"), the Company had issued and outstanding 16,526,752 shares of common stock entitled to vote, which were held by approximately 5,802 persons, which includes record holders and individual participants in security position listings. Only shareholders of record at the close of business on the Record Date are entitled to receive notice of and to vote on matters that come before the Annual Meeting. Notwithstanding the Record Date specified above, the Company's stock transfer books will not be closed and shares of the common stock may be transferred subsequent to the Record Date. However, all votes must be cast in the names of holders of record on the Record Date. Detailed voting instructions are included on your proxy card.

The presence in person or by proxy of the holders of a majority of the outstanding shares of common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. If a share is represented for any purpose at the Annual Meeting by the presence of the registered owner or a person holding a valid proxy for the registered owner, it is deemed to be present for the purposes of establishing a quorum. Therefore, valid proxies which are marked "Abstain" or "Withheld" or as to which no vote is marked, including proxies submitted by brokers who are record owners of shares but lack the power to vote such shares (so-called "broker non-votes"), will be included in determining the number of shares present or represented at the Annual Meeting. If a quorum is not present or represented at the meeting, the shareholders entitled to vote, whether present in person or represented by proxy, have the power to adjourn the meeting from time to time until a quorum is present or represented. If any such adjournment is for a period of less than 30 days, no notice, other than an announcement at the meeting, will be given of the adjournment. If the adjournment is for 30 days or more, notice of the adjourned meeting will be given in accordance with the Bylaws. Directors, officers and regular employees of the Company may solicit proxies for the reconvened meeting in person or by mail, telephone or other means. At any such reconvened meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally noticed. Once a quorum has been established, it will not be disrupted by the departure of shares prior to the adjournment of the meeting.

Provided a quorum is established at the Annual Meeting, Directors will be elected by a plurality of the votes cast at the Annual Meeting. Shareholders of the Company do not have cumulative voting rights.

All other matters to be considered and acted upon at the Annual Meeting, including the proposal to ratify the appointment of Grant Thornton LLP as the Company's independent registered public accounting firm, require that the number of shares of common stock voted in favor of the matter exceed the number of shares of common stock voted against the matter, provided a quorum has been established. Abstentions, broker non-votes and the failure to return a signed proxy will have no effect on the outcome of such matters.

Any record shareholder returning the accompanying proxy may revoke such proxy at any time prior to its exercise (a) by giving written notice to the Company of such revocation, (b) by voting in person at the meeting, (c) by voting again over the Internet or by telephone prior to 3:00 a.m. Eastern time on January 26, 2012, or (d) by executing and delivering to the Company a later dated proxy.

Attendance at the Annual Meeting will not in itself constitute revocation of a proxy. Any written notice or proxy revoking a proxy should be sent to First Financial Holdings, Inc., 2440 Mall Drive, Charleston, South Carolina 29406, Attention: Robert L. Davis, Executive Vice President, Corporate Counsel and Corporate Secretary. Written notice of revocation or delivery of a later dated proxy will be effective upon receipt thereof by the Company.

If the shareholder votes using one of the methods described on the proxy card, the shareholder will be designating Robert L. Davis and Blaise B. Bettendorf as proxies to vote the shares as instructed. In each case where the shareholder appropriately specified how the proxy is to be voted, it will be voted in accordance with those specifications. In any case where the shareholder has not specified how an executed and furnished proxy is to be voted, it will be voted "FOR" the proposals as recommended by the Board of Directors. As to any other matter of business that may be brought before the Annual Meeting, a vote may be cast pursuant to the accompanying proxy in accordance with the best judgment of the persons voting the same. However, our Board of Directors does not know of any such other business.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count in the election of Director nominees, for the approval of the Say-on-Pay proposal, and in the Say-on-Frequency proposal. In the past, if you held your shares in street name and you did not indicate how you wanted your shares voted in the election of Directors or on executive compensation matters, your bank or broker was allowed to vote those shares on your behalf in the election of Directors and on executive compensation matters as they deemed appropriate. Changes in regulations were made to take away the ability of your bank or broker to vote your uninstructed shares in the election of Directors and on executive compensation matters on a discretionary basis. Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote in the election of Directors, on the Say-on-Pay proposal, or in the Say-on-Frequency proposal, no votes will be cast on your behalf.

The Company will pay the costs of solicitation of proxies, including any charges and expenses of brokerage firms and others for forwarding solicitation material to the beneficial owners of the Company's shares. In addition, solicitation of proxies may be made in person or by mail, telephone or other means by Directors, Officers and regular employees of the Company. The Company may also request banking institutions, brokerage firms, custodians, nominees and fiduciaries to forward solicitation materials to beneficial owners of common stock of the Company held of record by such persons and the Company will reimburse the reasonable forwarding expenses. This proxy statement was first mailed to shareholders on or about December 30, 2011.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE SHAREHOLDER MEETING TO BE HELD ON JANUARY 26, 2012

The Company's Proxy, Proxy Statement (providing important shareholder information for the Annual Meeting), and 2011 Annual Report to Shareholders (which includes its 2011 Annual Report on Form 10-K) accompany this Notice. The Proxy Statement and 2011 Annual Report to Shareholders are available at http://www.firstfinancialholdings.com.

ELECTION OF DIRECTORS

The Company's Board of Directors currently consists of ten members. The Board is divided into three classes with terms of three years, with approximately one-third of the Directors elected each year. The Board of Directors' nominees for election this year will serve for a three-year term or until their respective successors have been elected and qualified.

Our Director nominees are:

R. Wayne Hall

James L. Rowe

Richard W. Salmons, Jr.

Henry M. Swink

The Directors will be elected by a plurality of the votes cast at the meeting. This means that the nominees receiving the highest number of votes will be elected. Set forth below is certain information about the nominees and the Directors continuing in office, including business experience for the past five years.

The Board of Directors unanimously recommends a vote FOR these nominees.

R. WAYNE HALL, 61, is President and Chief Executive Officer of First Financial and of First Federal. He has served as a Director of First Financial since 2011 and of First Federal since 2009. Mr. Hall was initially employed by First Federal and First Financial on December 1, 2006 as Executive Vice President, Financial Management. He subsequently served as the Principal Financial and Accounting Officer and Chief Financial Officer of the Company and as First Federal’s Chief Operating Officer. He is a certified public accountant. Mr. Hall has over 34 years of audit and financial institutions experience, having served in several senior financial positions, including Executive Vice President and Chief Risk Officer of Provident Bank, Baltimore, Maryland.

JAMES L. ROWE, 68, has served as a Director of First Financial since 2001. From 2001 until its sale during 2011, he served as President of First Southeast Insurance Services, Inc. and Kinghorn Insurance Services, Inc., each subsidiaries of First Financial.

RICHARD W. SALMONS, JR., 52, has served as a Director of First Federal since 2001. Mr. Salmons is the President and Chief Executive Officer of Salmons Dredging Corporation, a marine construction company which also provides commercial diving and marine services in the southeastern United States.

HENRY M. SWINK, 66, is President of McCall Farms, Inc., a food processing company that manufactures and markets canned fruits and vegetables throughout the Southeast. Mr. Swink has served as a Director of First Financial since 2002 and First Federal since 2010. From 1996 until 2002, he served as a Director of Peoples Federal Savings and Loan Association, an institution acquired by First Financial and later merged into First Federal.

Directors With Terms Ending in 2013

PAULA HARPER BETHEA, 56, has served as a Director of First Financial and First Federal since 1996 and has served as Chairman since 2010. She was one of nine South Carolinians chosen in 2001 to establish the South Carolina Education Lottery and serves as its executive director.

PAUL G. CAMPBELL, JR., 65, has served as a Director of First Financial and First Federal since 1991. Mr. Campbell is the retired President of the Southeast Region for Alcoa Primary Metals and continues to work for Alcoa as a consultant. In 2007, he was elected to the South Carolina Senate and re-elected in November 2008 to represent District 44 in Berkeley County.

RONNIE M. GIVENS, 69, has served as a Director of First Financial since 2004 and First Federal since 2010. Mr. Givens is a Certified Public Accountant with approximately 40 years of professional experience. He is a director of Dixon Hughes Goodman LLP, a certified public accounting and business advisory firm.

Directors With Terms Ending in 2014

THOMAS J. JOHNSON, 61, is currently Vice Chairman and has served as a Director of First Financial since 1998 and of First Federal since 2002. He is President, Chief Executive Officer and Owner of F & J Associates, a company that owns and operates automobile dealerships in the southeastern United States and the U.S. Virgin Islands.

D. KENT SHARPLES, 68, has served as a Director of First Financial since 1992 and of First Federal since 2009. He previously served as a Director of Peoples Federal Savings and Loan Association, an institution acquired by First Financial and later merged into First Federal. He has served as the President of CEO Business Alliance in Daytona Beach, Florida since February 2011. Dr. Sharples is the past President of Daytona State College, Daytona Beach, Florida.

B. ED SHELLEY, JR., 59, has served as a Director of First Financial since 2011 and First Federal since 2002. He is engaged in the private practice of medicine, specializing in radiology. Dr. Shelley is involved in several businesses outside of the practice of radiology, including real estate development and pharmaceutical and software sales.

HUGH L. WILLCOX, JR., 65, has served as a Director of First Financial since 2010 and First Federal since 2002. Mr. Willcox is a Senior Partner in the law firm of Willcox, Buyck, and Williams, PA, of Florence and Surfside Beach, South Carolina.

Family Relationships. There are no family relationships among any of the Directors of the Company.

PROPOSAL NO. 2

ADVISORY, NON-BINDING VOTE ON COMPENSATION OF NAMED EXECUTIVE OFFICERS

As a participant in the U.S. Treasury's Capital Purchase Program (the "CPP"), we must submit a non-binding shareholder vote to approve the compensation of the Company's Named Executive Officers. In addition, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act") enables our shareholders to vote to approve, on a non-binding basis, the compensation of the Company's Named Executive Officers. Accordingly, we are asking you to approve the compensation of the Company's Named Executive Officers as described under "Executive Compensation and Other Information – Compensation Discussion and Analysis" and the tabular disclosure regarding Named Executive Officer compensation (together with the accompanying narrative disclosure) in this proxy statement.

The Company seeks to align the interests of our Named Executive Officers with the interests of our shareholders. Therefore, our compensation programs are designed to reward our Named Executive Officers for the achievement of strategic and operational goals and the achievement of increased shareholder value, while at the same time avoid encouraging of unnecessary or excessive risk-taking. The Compensation/Benefits Committee of the Board periodically engages an external compensation consultant to provide an independent and objective review of the Company's compensation program for executive management and to offer recommendations on this compensation program. The most recent review was conducted in late calendar-year 2010 by Pearl Meyer & Partners, LLC. We believe that our compensation policies and procedures are competitive and focused on performance and are strongly aligned with the long-term interest of our shareholders.

The proposal described below, commonly known as a "Say-on-Pay" proposal, gives you the opportunity to express your views regarding the compensation of the Named Executive Officers by voting to approve or not approve such compensation as described in this proxy statement. This vote is advisory and will not be binding upon the Company, the Board or the Compensation/Benefits Committee. However, the Company, the Board and the Compensation/Benefits Committee will take into account the outcome of the vote when considering future executive compensation arrangements. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our Named Executive Officers, as described in this proxy statement in accordance with the compensation disclosure rules of the Securities and Exchange Commission (the "SEC").

The Board asks our shareholders to vote in favor of the following resolution at the Annual Meeting:

"RESOLVED, that the compensation paid to the Company's Named Executive Officers, as disclosed in the Company's Proxy Statement for the 2012 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and any related material disclosed in the proxy statement, is hereby APPROVED."

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" THE APPROVAL OF THE RESOLUTION RELATED TO THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS.

PROPOSAL NO. 3

ADVISORY, NON-BINDING VOTE ON FREQUENCY OF APPROVAL OF THE COMPENSATION OF NAMED EXECUTIVE OFFICERS

The Dodd-Frank Act requires that the Company provide shareholders with the opportunity to vote, on a non-binding advisory basis, for their preference as to how frequently the Company should consult an advisory Say-on-Pay vote. Shareholders may indicate whether they would prefer that the Company conduct future Say-on-Pay votes every year, every two years or every three years. Shareholders also may abstain from casting a vote on this proposal.

The Board of Directors has determined that a Say-on-Pay vote that occurs once every three years is the most appropriate alternative for the Company and therefore the Board recommends that you vote in favor of conducting a Say-on-Pay vote every three years. The Board believes that a Say-on-Pay vote occurring every three years will provide our shareholders with sufficient time to evaluate the effectiveness of the Company's overall compensation philosophy, policies and practices in the context of our long-term business results for the corresponding period, while avoiding an over-emphasis on short-term variations in compensation and business results. A Say-on-Pay vote occurring every three years will also permit shareholders to observe and evaluate the effect of any changes to our executive compensation policies and practices that have occurred since the last advisory vote on executive compensation.

This vote is advisory, which means that is not binding on the Company, the Board of Directors and the Compensation/Benefits Committee. The Company recognizes that the shareholders may have different views as to the best approach and looks forward to hearing from the shareholders as to their preferences on the frequency of the Say-on-Pay vote. The Board of Directors and Compensation/Benefits Committee will carefully review the outcome of the frequency vote; however, when considering the frequency of future Say-on-Pay votes, the Board of Directors may decide that it is in the Company's and the shareholders' long-term best interest to hold a Say-on-Pay vote more or less frequently than the frequency receiving the most votes cast by our shareholders.

The proxy card provides shareholders with the opportunity to choose among four options (holding the Say-on-Pay vote every year, every two years, every three years or abstain from voting). Shareholders are not being asked to approve or disapprove the recommendation of the Board of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT YOU VOTE "FOR" THE OPTION OF ONCE EVERY THREE YEARS AS THE PREFERRED FREQUENCY FOR SAY-ON-PAY VOTES. PROPOSAL NO. 4

RATIFICATION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed Grant Thornton LLP to be the Company’s independent registered public accounting firm for the 2012 fiscal year, subject to ratification by shareholders. A representative of Grant Thornton LLP is expected to be present at the annual meeting to respond to appropriate questions from shareholders and will have the opportunity to make a statement should he or she desire to do so.

If the ratification of the appointment of the independent registered public accounting firm is not approved by shareholders at the annual meeting, the Audit Committee will consider other independent registered public accounting firms.

THE BOARD OF DIRECTORS RECOMMENDS THAT SHAREHOLDERS VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

OTHER MATTERS

The Board of Directors knows of no other business to be presented at the Annual Meeting. If matters other than those described herein should properly come before the meeting, the persons named in the enclosed form of proxy intend to vote at such meeting in accordance with their best judgment on such matters. If you specify a different choice on your proxy, your shares will be voted in accordance with your directions.

CORPORATE GOVERNANCE

Overview of the Board of Directors

During the fiscal year of 2011, the Board of Directors of the Company held 28 meetings. All Directors attended at least 75% of the aggregate of (a) the total number of meetings of the Board of Directors held during the period for which he or she served as a Director, and (b) the total number of meetings held by all committees of the Board of Directors of the Company on which he or she served.

There is no formal policy regarding attendance at annual shareholder meetings; however, such attendance is strongly encouraged. Last year, all of our Directors attended the 2011 Annual Shareholders Meeting, with the exception of one individual. We cover or reimburse the Directors for all reasonable out-of-pocket expenses associated with attendance at annual meetings.

First Financial has adopted a Code of Business Conduct and Ethics that is designed to ensure that the Company’s Directors and employees meet the highest standards of ethical conduct. The Code of Business Conduct and Ethics, which applies to all employees and Directors, addresses conflicts of interest, the treatment of confidential information, general employee conduct and compliance with applicable laws, rules and regulations. In addition, the Code of Business Conduct and Ethics is designed to deter wrongdoing and promote honest and ethical conduct, the avoidance of conflicts of interest, full and accurate disclosure and compliance with all applicable laws, rules and regulations. The Code of Business Conduct and Ethics is available on the Company's corporate website located at www.firstfinancialholdings.com. The Company may post amendments or waivers of the provisions of the Code of Business Conduct and Ethics, if any, made with respect to any of our Executive Officers on that website. Please note, however, that the information contained on the website is not incorporated by reference in, or considered to be a part of, this proxy statement.

Qualifications of the Board of Directors

The following table identifies the experience, qualifications, attributes and skills that led to the selection of the members of the Board of Directors of First Financial.

| DIRECTORS | CEO or President of Public Company | CEO or President | Director of Other Public Compan- ies or Large Enterpri- ses | CPA or Finan- cial Expert | Attor- ney | Audit Commit- tee Experi- ence | Comp/ Benefits Commit- tee Experi- ence | Strong Com- munity Presence/ Involve- ment | Banking Expertise or Prior Bank Board Experi- ence | Insur- ance Exper- tise | Know- ledge of Local Real Estate Markets |

| Paula Harper Bethea | | √ | √ | | | √ | √ | √ | √ | | √ |

| Paul G. Campbell | | √ | √ | | | √ | √ | √ | √ | | √ |

| Ronnie M. Givens | | | | √ | | √ | √ | √ | √ | | √ |

| R. Wayne Hall | √ | √ | | √ | | | | √ | √ | | |

| Thomas J. Johnson | | √ | | | | √ | √ | √ | √ | | √ |

| James L. Rowe | | √ | √ | | | | | √ | | √ | √ |

| D. Kent Sharples | | √ | | | | √ | √ | √ | √ | | |

| B. Ed Shelley, Jr. | | | | | | √ | √ | √ | √ | | √ |

| Henry M. Swink | | √ | | | | √ | √ | √ | √ | | √ |

| Hugh L. Willcox, Jr. | | | | | √ | √ | √ | √ | √ | √ | √ |

The Corporate Governance/Nominating Committee and the Board believe that each Director brings to the Board his or her own unique background and particular expertise. This provides the Board with the necessary and appropriate mix of skills, characteristics and attributes that enable the Board to work together in a professional and collegial atmosphere and that is required for the Board to fulfill its oversight responsibility to our shareholders.

Board Leadership Structure and Role in Risk Oversight

We are focused on the Company's corporate governance practices and value independent Board oversight as an essential component of strong corporate performance to enhance shareholder value. Our commitment to independent oversight is demonstrated by the fact that all of our Directors, except R. Wayne Hall, our CEO, and James L. Rowe, who was President of First Southeast Insurance Services, Inc., a former wholly-owned subsidiary of the Company that was sold in June 2011, are independent under the listing requirements of the NASDAQ Stock Market. In addition, all current members of our Board of Directors' Audit, Compensation/Benefits, and Corporate Governance/Nominating Committees are independent under the listing requirements of the NASDAQ Stock Market. In determining the independence of its Directors, the Board considered transactions, relationships and arrangements between the Company and its Directors, including those not otherwise required to be disclosed in this proxy statement under the heading “Transactions with Related Persons,” and including loans or lines of credit that First Federal has directly or indirectly made to each of its Directors. Upon review and as a result of a payment of $2,600 to Mr. Willcox's law firm related to certain real estate transactions that occurred during 2011, we have determined that Mr. Willcox is no longer eligible for Audit Committee service under NASDAQ standards and he has, therefore, resigned from the Audit Committee effective December 8, 2011.

The Board fulfills its risk oversight function primarily through its key committees, which report to the full Board and are currently comprised solely of independent Directors. In addition, the full Board periodically receives reports and information about our risk management program directly from management. Each of the Board's committees is responsible for oversight of specific risks.

The Corporate Governance/Nominating Committee is responsible for periodically reviewing the Board's role in risk oversight of the Company, the manner in which this oversight function is administered, the Board's leadership structure, given the Company's characteristics or circumstances at the time and providing recommendations to the Board of Directors.

Our Board of Directors believes that it is preferable for one of our independent Directors to serve as Chairman of the Board. The person our Board selected as Chairman, Paula Harper Bethea, has been one of our Directors since 1996. We believe it is the CEO's responsibility to manage the Company and the Chairman's responsibility to lead the Board. As Directors continue to have more oversight responsibility than ever before, we believe it is beneficial to have an independent Chairman whose sole job with respect to the Company is leading the Board. In making its decision to have an independent chairman, the Board of Directors considered the time that Mr. Hall is required to devote as CEO in the current economic environment. By having another Director serve as Chairman of the Board of Directors, Mr. Hall is able to focus his energy on managing the Company. We believe this structure provides strong leadership for the Board, while also positioning the CEO as the leader of the Company in the eyes of our customers, employees and other stakeholders.

The Audit Committee oversees our major financial risk exposures and the steps management has taken to monitor and control such exposures, including our risk assessment and risk management policies. The Audit Committee also oversees our internal audit function, which has been outsourced to a third-party service provider.

The Compensation/Benefits Committee meets at least semiannually to discuss and evaluate employee compensation plans (1) in light of any risks posed to First Financial by these plans and (2) to ensure that these plans do not encourage the manipulation of First Financial’s reported earnings to enhance employee compensation. For further discussion on the foregoing, please refer to the Compensation Discussion and Analysis section, below.

Each of the committees is also responsible for overseeing reputational risk related to its specific responsibilities. To provide appropriate oversight of risk without unnecessary duplication, the committee chairs communicate as they deem advisable regarding risk issues. To foster additional cross-committee communication, Directors are usually members of more than one committee.

Each year, the full Board and the Audit, Compensation/Benefits, and Corporate Governance/Nominating Committees evaluate their own effectiveness. The Board views self-evaluation as an ongoing process designed to achieve high levels of Board and committee performance. The evaluation covers preparation, knowledge and expertise, attendance and commitment, shareholder alignment, judgment and skills, and participation and contribution to collective decision-making. The Board continues to review and work for improvement where opportunities are identified.

Directors receive ongoing continuing education through educational sessions at meetings and receive information about ongoing developments relevant to First Financial and our industry. The Board also encourages Directors to participate in continuing education programs and reimburses Directors for the expenses of such participation.

Corporate Governance Principles

The Board of Directors has adopted a set of corporate governance principles to govern certain activities, including: the duties and responsibilities of Directors; the composition, responsibilities and operation of the Board of Directors; the establishment and operation of Board committees; succession planning; convening executive sessions of independent Directors; the Board of Directors’ interaction with management and third parties; and the evaluation of the performance of the Board of Directors.

Committees of the Board of Directors

The following table identifies our standing committees and their members as of September 30, 2011. Each of our standing committees operates under a written charter that is approved by the Board of Directors. Each committee reviews and reassesses the adequacy of its charter at least annually. The charters of all three committees are available in the Governance Documents portion of the Corporate Overview section of our Web site (www.firstfinancialholdings.com).

| Director | | Audit Committee | | Compensation/Benefits Committee | | Corporate Governance/ Nominating Committee |

| | | | | | | |

Paula Harper Bethea | | | | X | | X* |

Paul G. Campbell, Jr. | | X | | X | | X |

Ronnie M. Givens | | X* | | | | X |

R. Wayne Hall. | | | | | | |

Thomas J. Johnson | | | | | | X |

James L. Rowe | | | | | | |

D. Kent Sharples | | X | | X* | | |

B. Ed Shelley, Jr. | | | | | | X |

Henry M. Swink | | X | | X | | |

Hugh L. Willcox, Jr. | | X | | X | | |

Number of Meetings in Fiscal 2011 | | 9 | | 4 | | 2 |

__________________

* Denotes Chairperson

Audit Committee

The Audit Committee is responsible for providing oversight of the Company’s financial reporting process, systems of internal accounting and financial controls, internal audit function, annual independent audit and the compliance and ethics programs established by management and the Board. The Audit Committee selects the independent registered public accounting firm and meets with them to discuss the results of the annual audit and any related matters. The Board of Directors has determined that Mr. Givens, who currently serves as the chair of the Audit Committee, is an “audit committee financial expert.” Mr. Givens is independent under the listing standards of the NASDAQ Stock Market.

Compensation/Benefits Committee

The Compensation/Benefits Committee is responsible for all matters regarding the Company’s and the Bank’s employee compensation and benefit programs. The Compensation/Benefits Committee has two primary responsibilities: (1) assisting the Board of Directors in determining the compensation of the Company's CEO and Executive Officers; and (2) establishing compensation policies that will attract and retain qualified personnel through an overall level of compensation that is comparable to, and competitive with, others in the industry and, in particular, peer financial institutions.

For the fiscal year 2011, the Compensation/Benefits Committee engaged Pearl Meyer to perform a competitive review of executive compensation for the Company. Pearl Meyer evaluated the competitiveness of the compensation to the Company's Executive Officers and made recommendations for managing executive compensation in the fiscal year 2011.

Corporate Governance/Nominating Committee

The Corporate Governance/Nominating Committee takes a leadership role in shaping governance policies and practices, including recommending to the Board of Directors the corporate governance policies and guidelines applicable to First Financial and monitoring compliance with these policies and guidelines.

The Corporate Governance/Nominating Committee is responsible for identifying individuals qualified to become Board members and to recommend to the Board the individuals for nomination as members of the Board. The Committee and the Board expect to create a Board that will demonstrate objectivity and the highest degree of integrity on an individual and collective basis. The Committee’s evaluation of Director candidates includes an assessment of issues and factors regarding an individual’s education, business experience, accounting and financial expertise, age, reputation, civic and community relationships. The Committee also takes into consideration the Board’s retirement policy, the ability of Directors to devote adequate time to Board and Committee matters and the need for a substantial majority of the Board to consist of independent Directors. When considering current Board members for nomination for re-election, the Committee also considers prior Board contributions and performance, as well as meeting attendance records.

In identifying and evaluating potential nominees for Director, the Corporate Governance/Nominating Committee considers individuals from various disciplines and diverse backgrounds. Although we have no formal policy regarding diversity, the Board believes that diversity, including diversity in background, skills, experience, expertise, viewpoints, gender, race and culture, is an important component of a robust Board of Directors. The Corporate Governance/Nominating Committee assesses the mix of skills and industries currently represented on the Board, whether any vacancies on the Board are expected due to retirement or otherwise, the skills represented by retiring Directors and additional skills highlighted during the Board evaluation process that could improve the overall quality and ability of the Board to carry out its function. The Corporate Governance/Nominating Committee or a subcommittee may interview potential candidates to further assess their ability to serve as a Director, as well as the qualifications possessed by the candidates. The Corporate Governance/Nominating Committee will evaluate the prospective nominee to determine whether such person possesses the following important attributes and qualifications as established by the Committee:

| · | the highest personal and professional ethics, integrity and values and a commitment to representing the long-term interests of shareholders; |

| · | an inquisitive and objective perspective, practical wisdom, mature judgment and the ability to exercise informed judgment in the performance of his or her duties; |

| · | commitment of sufficient time and attention to discharge his or her obligations; |

| · | a distinguished record of leadership and success in his or her area of activity; |

| · | a strong educational background; and |

| · | strong community ties in our markets that can assist in business development efforts. |

The Corporate Governance/Nominating Committee will also consider such other relevant factors as it deems appropriate. After completing this evaluation, the Committee will make a recommendation to the Board of the persons who should be nominated and the Board will then determine the nominees.

The Corporate Governance/Nominating Committee seeks the input of the other members of the Board in identifying and attracting Director candidates who are consistent with the criteria outlined above. In addition, the Committee may use the service of consultants or a search firm, although it has not done so in the past. The Committee will consider recommendations by First Financial’s shareholders of qualified Director candidates for possible nomination by the Board. Based on preliminary assessment of a candidate’s qualifications, the Corporate Governance/Nominating Committee may conduct interviews with the candidate and request additional information from the candidate. The Committee uses the same process for evaluating all nominees, including those recommended by shareholders. The Committee did not receive any shareholder nominations this year.

Director Compensation

The following table sets forth information regarding the compensation earned by or awarded to each Director who served on our Board of Directors during the fiscal year ended September 30, 2011, with the exception of A. Thomas Hood, who retired from the Board of Directors of First Financial and First Federal effective March 1, 2011, and R. Wayne Hall. The compensation of Messrs. Hood and Hall is reflected below under “Executive Compensation.”

Name | Fees Earned or Paid in Cash ($)1 | All Other Compensation ($)2 | Total ($) |

| Paula Harper Bethea | 33,675 | 1,950 | 35,625 |

| Paul G. Campbell, Jr. | 25,933 | — | 25,933 |

| Ronnie M. Givens | 29,683 | — | 29,683 |

| Thomas J. Johnson | 29,892 | — | 29,892 |

| James L. Rowe | 7,492 | 600 | 8,092 |

| D. Kent Sharples | 30,025 | 1,650 | 31,675 |

| B. Ed Shelley, Jr. | 22,492 | 1,650 | 24,142 |

| Henry M. Swink | 27,158 | 1,800 | 28,958 |

| Hugh L. Willcox, Jr. | 28,725 | 1,800 | 30,525 |

| 1 | Please see the description of Directors' fees below. |

| 2 | Consists of payments to travel to Board of Director meetings. |

Non-employee members of First Financial’s Board who also serve on First Federal’s Board receive monthly fees of $1,900, except the Chairman and Vice Chairman of the Board, who receive monthly fees of $2,400 and $2,150, respectively. Non-employee members who serve on the Board of either First Financial or First Federal receive monthly fees of $1,667. First Financial’s Audit Committee members each receive an additional annual fee of $2,000 and the Audit Committee Chairman receives an additional annual fee of $6,000. Directors also receive $1,250 per day for attending all day joint meetings (with First Financial’s management) for strategic planning purposes. These meetings are generally scheduled to occur twice each year. The Chairman of First Financial’s Compensation/Benefits Committee receives an annual fee of $3,000 and members of this Committee receive an annual fee of $1,000. Non-employee Directors who serve on First Financial’s non-banking subsidiary boards were paid $200 to $500 on a quarterly basis. Each Director is also entitled to reimbursement for his or her reasonable out-of-pocket expenses incurred in connection with travel to and from, and attendance at, meetings of the Board of Directors or its committees and related activities, including Director education courses and materials.

In fiscal 2008, the Company adopted the 2007 Equity Incentive Plan. No equity incentive awards or options were given to Directors in fiscal 2011. Directors were eligible to defer their cash payments in fiscal 2011; however, no First Financial Director elected to do so.

The 2005 Performance Equity Plan for Non-Employee Directors was approved by shareholders at the 2005 annual meeting of shareholders. Under this plan, the Boards of Directors of First Financial and First Federal specified performance targets for First Financial and First Federal, as appropriate, and the percentage of total Board fees eligible for conversion to shares of First Financial common stock upon the attainment of the performance targets. Performance targets (return on equity) for fiscal years 2010 and 2011 were not achieved and thus no shares were or will be distributed to Directors in February 2011 or 2012 under this plan.

Report of the Audit Committee

The Company’s management is responsible for the Company’s internal controls and financial reporting process. The independent registered public accounting firm is responsible for performing an independent audit of the Company’s consolidated financial statements and issuing an opinion on the conformity of those financial statements with generally accepted accounting principles. The Audit Committee oversees the Company’s internal controls and financial reporting on behalf of the Board of Directors. Each current member of the Audit Committee satisfies the independence and financial literacy requirements for serving on the Audit Committee and at least one member has accounting or related financial management expertise, all as required by the NASDAQ Stock Market.

In fulfilling its oversight responsibilities, the Audit Committee has met and held discussions with management and the independent registered public accounting firm. Management represented to the Audit Committee that the Company’s consolidated financial statements were prepared in accordance with generally accepted accounting principles and the Audit Committee has reviewed and discussed the consolidated financial statements with management and the independent registered public accounting firm. The Audit Committee discussed with the independent registered public accounting firm matters required to be discussed pursuant to U.S. Auditing Standards No. 380 (The Auditor’s Communication With Those Charged With Governance), including the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of the disclosures in the financial statements.

In addition, the Audit Committee has received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board and has discussed with the independent registered public accounting firm the auditors’ independence from the Company and its management. In concluding that the auditors are independent, the Audit Committee considered, among other factors, whether the non-audit services provided by the auditors were compatible with its independence.

The Audit Committee discussed with the Company’s independent registered public accounting firm the overall scope and plans for its audit. The Audit Committee meets with the independent registered public accounting firm, with and without management present, to discuss the results of its examination, its evaluation of the Company’s internal controls and the overall quality of the Company’s financial reporting.

In performing all of these functions, the Audit Committee acts only in an oversight capacity. In its oversight role, the Audit Committee relies on the work and assurances of the Company’s management, which has the primary responsibility for financial statements and reports, and of the independent registered public accounting firm which, in its report, expresses an opinion on the conformity of the Company’s financial statements to generally accepted accounting principles. The Audit Committee’s oversight does not provide it with an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or policies or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions with management and the independent registered public accounting firm do not assure that the Company’s financial statements are presented in accordance with generally accepted accounting principles, that the audit of the Company’s consolidated financial statements has been carried out in accordance with the standards of the Public Company Accounting Oversight Board or that the Company’s independent registered public accounting firm is, in fact, “independent.”

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended September 30, 2011 for filing with the Securities and Exchange Commission. The Audit Committee and the Board of Directors also have approved, subject to shareholder ratification, the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for fiscal 2012.

Audit Committee of the Board of Directors

of First Financial Holdings, Inc.

| | Ronnie M. Givens (Chairman) |

| | Paul G. Campbell, Jr. |

| | D. Kent Sharples |

| | Henry M. Swink |

| | Hugh L. Willcox, Jr. |

SECURITY OWNERSHIP OF CERTAIN

BENEFICIAL OWNERS AND MANAGEMENT

The following table shows the persons known to First Financial to be the beneficial owners of more than 5% of the Company’s outstanding common stock as of November 30, 2011.

| Name and Address | | Number of Shares Owned | | Percent of Common Stock Outstanding |

| | | | | |

Wellington Management Co. LLP 280 Congress Street Boston, Massachusetts 02210 | | 1,509,182(1) | | 9.13%(2) |

______________________

| (1) | Based on information contained in a Form 13F filed with the U.S. Securities and Exchange Commission on November 14, 2011. |

| (2) | The percentage of total beneficial ownership are based on 16,526,752 shares of common stock outstanding on November 30, 2011. |

The following table shows how much common stock of the Company is owned by the Directors and Named Executive Officers, and all Directors and Executive Officers as a group, as of November 30, 2011. The mailing address for each beneficial owner is care of First Financial Holdings, Inc., 2440 Mall Drive, Charleston South Carolina, 29406.

| Name | | Common Stock (1) | | Options Exercisable Within 60 Days (2) | | Total | | Percent of Shares Outstanding (3) |

| Directors | | | | | | | | |

Paula Harper Bethea | | 24,797 | | 1,000 | | 25,797 | | 0.16% |

Paul G. Campbell, Jr. | | 22,048 | | 7,227 | | 29,275 | | 0.18% |

Ronnie M. Givens | | 25,029 | | 3,217 | | 28,246 | | 0.17% |

R. Wayne Hall. | | 17,319 | | 11,000 | | 28,319 | | 0.17% |

Thomas J. Johnson | | 42,495 | | 1,000 | | 43,495 | | 0.26% |

James L. Rowe | | 16,384 | | 11,985 | | 28,369 | | 0.17% |

D. Kent Sharples | | 35,962 | | 5,580 | | 41,542 | | 0.25% |

B. Ed Shelley, Jr. | | 14,207 | | 5,304 | | 19,511 | | 0.12% |

Henry M. Swink | | 26,260 | | 7,179 | | 33,439 | | 0.20% |

Hugh L. Willcox, Jr. | | 21,996 | | 7,805 | | 29,801 | | 0.18% |

| | | | | | | | | |

Named Executive Officers Who Are Not Also Directors | | | | | | | | |

Blaise B. Bettendorf | | 2,630 | | 0 | | 2,630 | | 0.02% |

Richard A. Arthur | | 0 | | 0 | | 0 | | — |

Robert L. Davis | | 0 | | 0 | | 0 | | — |

J. Dale Hall | | 2,000 | | 0 | | 2,000 | | 0.01% |

All Directors and Executive Officers as a group (14 persons) | | 251,127 | | 61,297 | | 312,424 | | 1.89% |

| (1) | Includes shares for which the named person has sole voting and investment power, has shared voting and investment power, or holds in an IRA or other retirement plan program, unless otherwise indicated in these footnotes. |

| (2) | Includes shares that may be acquired within the next 60 days as of November 30, 2011 by exercising vested stock options but does not include any unvested stock options. |

| (3) | For each individual, this percentage is determined by assuming the named person exercises all options which he or she has the right to acquire within 60 days, but that no other persons exercise any options or warrants. For the directors and executive officers as a group, this percentage is determined by assuming that each director and executive officer exercises all options which he or she has the right to acquire within 60 days, but that no other persons exercise any options. The percentages of total beneficial ownership are based on 16,526,752 shares of common stock outstanding on November 30, 2011. |

EXECUTIVE OFFICERS

The following information is provided for those officers currently designated as Executive Officers by our Board of Directors. Ages presented are as of September 30, 2011.

BLAISE B. BETTENDORF, 48, is Executive Vice President and Chief Financial Officer of First Financial and First Federal. She began her employment with the Company and the Bank in January 2010 and served as Executive Vice President, Chief Accounting Officer until her promotion to CFO in May 2010. Prior to her employment with the Company and the Bank she served as Senior Vice President and Chief Financial Officer at Carolina Commerce Bank in Gastonia, North Carolina from August 2008 until its sale in October 2009, and she served as Senior Vice President and Chief Financial Officer for Colony Signature Bank in Charlotte, North Carolina from August 2007 to August 2008. Ms. Bettendorf was a de novo bank consultant in Charlotte, North Carolina from October 2005 to July 2007.

ROBERT L. DAVIS, 58, is Executive Vice President and Corporate Counsel of First Financial and First Federal. He began his employment with the Company and the Bank in July 2010. Prior to joining the Company and First Federal, Mr. Davis was Managing Director and General Counsel of Provident Bankshares Corporation and Provident Bank in Baltimore, Maryland from 1991 through 2009.

JOSEPH W. AMY, 61, is Executive Vice President and Chief Credit Officer of First Financial and First Federal. He began his employment with the Company and the Bank in September 2009. Prior to joining First Financial, Mr. Amy had 35 years of financial institution experience having started his career in 1974 at Mellon Bank, N.A. and going on to serve in senior positions in a number of regional and community banks before joining the Company.

MARK R. ADELSON, 57, is Senior Vice President and Treasurer of First Federal. He began his employment with the Bank in 1986 and served as a Senior Vice President of Investments until 2007.

RICHARD A. ARTHUR, 39, is Executive Vice President, Retail Banking, of First Federal. He began his employment with the Bank in January 2010. Prior to his employment with the Bank, he served as Senior Vice President with Bank of America from 2001 to 2009 where he oversaw sales, service and operations for 11 consumer markets and 335 branches in the Southeast.

SUSAN A. BAGWELL, 48, is Executive Vice President, Human Resources, of First Financial and First Federal. She began her employment with the Bank in 1985 as a Human Resources Associate.

JOHN N. GOLDING, 44, is Executive Vice President, Commercial Banking, of First Federal. He began his employment with the Bank in March 2010. Prior to his employment with the Bank, he served as Senior Vice President with Wachovia/Wells Fargo with responsibility as a Regional Commercial Banking Relationship Manager from 1990 to 2010.

J. DALE HALL, 63, is Executive Vice President and Chief Banking Officer of First Financial and First Federal. He began his employment with the Company and the Bank in Charleston, South Carolina in June 2009, having previously worked in the North Carolina region as an Executive Vice President. Prior to his employment with the Company and the Bank, he was employed with Bank of America for 38 years where he led specialized sales teams in Commercial Middle Market, Government and Non-Profit Healthcare.

MICHAEL NEAL HELMUS, 45, is Senior Vice President and Chief Risk Officer of First Financial and First Federal. He began his employment with the Company and the Bank in 2011. He has 15 years of financial institution experience, including serving as Audit Manager for U.S. Bancorp from 2009 to 2011. He served as Director of Internal Control and Risk Management for Provident Bank in Baltimore, Maryland from 2006 to 2009.

KELLEE S. MCGAHEY, 32, is Senior Vice President, Marketing, of First Federal. She began her employment with the Bank in September 2010. She has 10 years of multi-dimensional marketing experience specifically Public Relations, Brand Development, Advertising, Event Organization and Interactive Media.

EARTHA C. MORRIS, 54, is Executive Vice President, Support Services, of First Federal. She began her employment with the Bank in March 2010. Prior to her employment with the Company and the Bank, she served as Executive Vice President and Chief Operating Officer at Congressional Bank in Bethesda, Maryland from 2007 to 2010. She served as Senior Vice President and Risk Manager for Provident Bank, in Baltimore, Maryland from 2004 to 2007.

SANDRA LEE PETROWSKI, 42, is Senior Vice President and Controller of First Financial and First Federal. She began her employment with the Company and the Bank in August 2010. Prior to her employment with the Company and the Bank, she had 24 years of financial institution experience having started her career in 1986 at Citizens Republic Bancorp in Flint, Michigan.

DANIEL S. VROON, 43, is Executive Vice President, Wealth Management of First Federal. He began his employment with the Bank in April 2009 as Senior Vice President in the same capacity. Prior to his employment with the Bank, he served as Senior Vice President Market Manager (South Carolina) for Premier Banking and Investments channel (part of the Global Wealth and Investment Management Division) at Bank of America from 2007 to 2009. Mr. Vroon also served as Senior Vice President Client/Relationship Manager for Bank of America in Charleston, South Carolina from 2004 to 2007.

DOROTHY B. WRIGHT, 50, became the Senior Vice President and Chief Compliance Officer of First Financial and First Federal in July 2011. Ms. Wright previously served as our Corporate Secretary from 2002 to 2011.

Report of the Compensation/Benefits Committee

The following Report of the Compensation/Benefits Committee should not be deemed filed or incorporated by reference into any other document, including the Company's filings under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates this Report into any such filing by reference.

The Compensation/Benefits Committee has reviewed and discussed the following Compensation Discussion and Analysis with management and its advisors and, based on such review and discussions, the Compensation/Benefits Committee recommended to the Board of Directors that the Compensation Discussion and Analysis be included in this Proxy Statement.

The Compensation/Benefits Committee certifies that it has reviewed with the Company's Senior Risk Officer the Senior Executive Officers' incentive compensation arrangements and has made reasonable efforts to ensure that any such arrangements do not encourage the Senior Executive Officers to take unnecessary and excessive risks that threaten the value of the Company. In addition, the Compensation/Benefits Committee has reviewed with the Company's Senior Risk Officer all compensation plans for all levels of employees, has made reasonable efforts to ensure that such arrangements do not encourage any employee to take unnecessary or excessive risks that threaten the value of the Company and has made reasonable efforts to eliminate all features that would encourage the manipulation of reported earnings of First Financial to enhance the compensation of any employee.

All Senior Executive Officer compensation plans are measured by specific performance targets, reviewed and approved or disapproved by the Compensation/Benefits Committee of the Board of Directors. As a result of the current economic environment, the Compensation/Benefits Committee did not consider any specific performance targets for fiscal 2011 and no payments were made to the Named Executive Officers in fiscal 2011 under the Company's incentive compensation plans.

In addition, the Company has in place agreements that contain a payback provision which requires the Named Executive Officer to return to First Financial any bonus amounts if it is subsequently discovered that the bonus payment was calculated as a result of misstated financial information. This payback provision is effective for a period of two years beyond the payment date of the bonus.

First Financial has implemented the following controls over the awarding of bonuses to Named Executive Officers:

| · | The Compensation/Benefits Committee reviews the Named Executive Officer compensation plans at least twice a year with the Company's Senior Risk Officer to ensure that the plans do not encourage the Named Executive Officers to take unnecessary and excessive risks that could threaten the value of First Financial. In addition, the Committee endeavors to identify and eliminate any risk detrimental to First Financial. |

| · | All other employee compensation plans are reviewed and approved or disapproved by executive management on an annual basis and presented to the Compensation/Benefits Committee for its review and approval or disapproval. The Committee attempts to identify and eliminate any risk that is detrimental to First Financial or that could potentially cause intentional manipulation of earnings to First Financial. |

| · | Any employee who knowingly receives bonus compensation based on incorrect or manipulated performance targets will be terminated immediately. |

During fiscal year 2011, the assessment of the Company's Senior Risk Officer with the Compensation/Benefits Committee occurred on May 26, 2011 and covered all compensation plans, including the Senior Executive Officer compensation plans. The Compensation/Benefits Committee adopted the approach recommended by the Senior Risk Officer and focused its review on incentive based compensation plans and the controls around these plans and the administration of them.

The Compensation/Benefits Committee believes that the Company’s overall compensation practices for Senior Executive Officers limit the ability of Executive Officers to benefit from taking unnecessary or excessive risks. In addition, the Compensation/Benefits Committee believes that there are controls around incentive plans for all employees, as described below, that effectively discourage unnecessary and excessive risk taking.

Risk Policy Framework

The Company’s adherence to the risk tolerances is ensured by the Company’s system of internal controls and validated by independent groups, including Internal Audit, Risk Management, Credit Risk Management and, to some extent, the external auditors. All material business plans are reviewed for excessive risks. Incentive compensation plans and performance goals are tied to the risk-assessed business plans.

In addition, there are controls around employee incentive plans (including the Senior Executive Officer plans) that effectively discourage and limit unnecessary and excessive risks. All employee incentive plans allow for management discretion (or Compensation/Benefits Committee discretion in the case of the Senior Executive Officer plans) to reduce or eliminate any award. Every incentive plan is documented using a standard template and is reviewed annually by a design team that consists of representatives from the business segment, Finance, Human Resources, Risk Management and any other group deemed to be appropriate, with final approval by the appropriate Executive Officer. As further described below, the Compensation/Benefits Committee reviews and approves all Senior Executive Officer plans, award opportunities and performance goals.

Senior Executive Officer Compensation Plans

The Senior Executive Officer compensation plans are currently operating within the constraints of the TARP limits, which include extensive restrictions on bonus or other incentive payments to executives. The Compensation/Benefits Committee believes, however, that the Company’s standard compensation programs for executives do not encourage unnecessary and excessive risk even before application of the TARP limits. Annual incentive awards and long-term incentive awards are closely linked to the Company’s financial performance compared with the Company’s strategic plans for each plan year or plan cycle. The opportunity to earn annual incentive awards in cash and long-term awards in a combination of cash and stock provides a mix of variable compensation that integrates the Company’s short-term and long-term goals and helps to attract and retain Executive Officers. Due to the impact of TARP, annual cash incentive awards for the Senior Executive Officers under the Management Performance Compensation Plan have been severely limited or prohibited. Equity awards under the 2007 Equity Incentive Plan are also restricted.

Employee Compensation Plans

In addition to the incentive plans in which the Senior Executive Officers participate, the Company has multiple incentive plans which reward measurable performance across the Company’s major business segments. The Compensation/Benefits Committee believes that the features of these incentive compensation plans, alone or combined with the systems of controls in place, do not encourage unnecessary or excessive risk and do not encourage the manipulation of reported earnings to enhance the compensation of any employee. In particular, there is a multi-level approval process before any amounts are paid out under any of these incentive plans. In addition, persons having compliance, risk, credit quality, quality assurance and finance roles are not compensated on the same results as the business teams they support. Instead, their incentives are tied to corporate goals under the Management Performance Compensation Plan. The Company has integrated a recoupment policy into every incentive compensation pursuant to which the Company can withhold or recoup all or a portion of any incentive payment if it is determined that an unnecessary or excessive risk was taken that, had it not, would have resulted in a smaller or no payout. The Company has had a recoupment policy for Senior Executive Officer incentive plans in effect since 2009.

Further, in light of the significant level of oversight and controls surrounding incentive plans and the significant amounts that would be required to impact the Company’s reported earnings, the Compensation/Benefits Committee believes that the incentive plans for employees, including Senior Executive Officers, do not contain any features that would encourage the manipulation of reported earnings to enhance the compensation of any employee.

THE COMPENSATION/BENEFITS COMMITTEE

D. Kent Sharples, Chairman

Paula Harper Bethea

Paul G. Campbell, Jr.

Henry M. Swink

Hugh L. Willcox, Jr.

EXECUTIVE COMPENSATION AND OTHER INFORMATION

Compensation Discussion and Analysis

The following Compensation Discussion and Analysis may contain statements regarding future individual and Company performance targets or goals. We have disclosed these targets or goals in the limited context of the Company's compensation programs, and, therefore, you should not take these statements to be statements of management's expectations or estimates of results or other guidance. We specifically caution investors not to apply such statements to other contexts.

This Compensation Discussion and Analysis is intended to assist you in understanding the Company's compensation programs. This section presents and explains the philosophy underlying our compensation strategy and fundamental elements of compensation paid to our CEO, CFO and other individuals included in the Summary Compensation Table (collectively, the "Named Executive Officers") for fiscal 2011. This Compensation Discussion and Analysis addresses the following:

| · | Overview of the Company's performance and executive compensation for fiscal 2011; |

| · | Current restrictions on the Company's executive compensation; |

| · | Compensation philosophy and the objectives of our compensation programs; |

| · | What our compensation programs are designed to reward; |

| · | Process for determining Executive Officer compensation, including: |

· the role and responsibility of the Compensation/Benefits Committee;

· the role of the CEO and other Named Executive Officers;

· the role of compensation consultants;

· benchmarking and other market analyses; and

| · | Elements of compensation provided to our Executive Officers, including a discussion of; |

· the purpose of each element of compensation;

· why we elect to pay each element of compensation;

· how we determine the levels or payout opportunities for each element; and

· decisions on final payments for each element and how these align with performance; and

| · | Other compensation and benefit policies affecting our Executive Officers, including the impact of compensation plans on Company risks. |

Overview of the Company's Performance and Executive Compensation for Fiscal 2011

For the fiscal year ended September 30, 2011, the Company recorded a net loss of $41.2 million compared with a net loss of $36.8 million for the fiscal year ended September 30, 2010. Although the Company has faced challenges due to the global recession and its effect on the banking industry and, specifically, the regional real estate market of our market areas, we believe that we have made great strides in the execution of our strategic plan to position the Company for enhanced performance in the coming years. In fiscal 2011, the Company took the following steps in implementing our strategic plan:

| · | On October 27, 2011, the Company sold selected performing loans and classified assets with an aggregate contractual principal balance of $197.9 million. The sale is expected to result in a pretax gain of approximately $20 million, which will be realized during the quarter ended December 31, 2011. As a result of the sale, the Company has removed a considerable amount of risk and uncertainty from the balance sheet. Considering the effect of this transaction, nonperforming assets at September 30, 2011 would have been reduced by $41.3 million. |

| · | On June 1, 2011, the Company sold its insurance agency subsidiary, First Southeast Insurance Services, Inc., and on September 30, 2011, the Company sold its managing general insurance agency subsidiary, Kimbrell Insurance Group, Inc. The sale of the Company's insurance business allows the Company to concentrate its resources on building and enhancing our core banking franchise. |

Certain of the Company's financial results as of September 30, 2011 show the Company's efforts to reposition the Company to focus on core operating earnings:

| · | Our net interest margin remained strong for the last quarter of fiscal 2011 at 3.87%, an increase of four basis points over the prior quarter ended June 30, 2011. |

| · | Our core deposits grew over the last three quarters of 2011 to $1.2 billion at September 30, 2011, which represented an increase of 4.0% over June 30, 2011. |

| · | Our provision for loan losses for the quarter ended September 30, 2011 totaled $8.9 million, which is a decrease of $68.9 million from the prior quarter, as a result of reclassifying $65.7 million of nonperforming and performing loans to loans held for sale. |

| · | Net charge-offs totaled $10.1 million for the quarter ended September 30, 2011, which is a decrease in net charge-offs of $97.4 million from the prior quarter as a result of recording the loans transferred to held for sale to estimated fair value. |

The Company continues to focus on conserving capital as part of its strategic plan and seeks to provide a balanced pay program and, as a result, the following steps were taken in fiscal 2011 with respect to the Company's executive compensation:

| · | Other than in the case of Mr. R. Wayne Hall, who received a modest promotional increase in his base salary, the Named Executive Officers only received minimal increases of three percent in their base salary; |

| · | None of the Named Executive Officers received annual bonuses, and awards under the Management Performance Incentive Compensation Plan were suspended; |

| · | No long-term equity awards were granted under the Company's 2007 Equity Incentive Plan to Named Executive Officers; |

| · | No contributions were made to the employees' 401(k) savings plan or under the Company's Profit Sharing Plan; and |

| · | Only minimal perquisites were provided to the Named Executive Officers, which included auto allowances, life insurance premiums and relocation expenses for fiscal 2011. |

| | Current Restrictions on the Company's Executive Compensation |

In December 2008, First Financial completed the sale and issuance of 65,000 shares of Fixed Rate Cumulative Perpetual Preferred Stock, Series A to the U.S. Treasury pursuant to the Troubled Asset Relief Program ("TARP"). Participation in the Treasury's Capital Purchase Program ("CPP") required that compensation of the Company's five Senior Executive Officers be limited in certain ways, as described below.

The rules also encourage companies to pay salary in the form of stock that must be held for a long period of time and may not be entirely converted to cash until TARP funds are repaid. This is intended to align executives' incentives with those of shareholders and taxpayers and effectively ensure that executives experience a "clawback" effect if positive results prove illusory and the stock drops in value.

To ensure compliance with the CPP restrictions, the Company entered into written agreements with each of its Senior Executive Officers amending each of the executive compensation programs in which they participate. Amendments to the Company's executive compensation programs will continue to remain in effect for so long as the U.S. Treasury holds debt or equity securities issued by the Company under the CPP.

The following requirements currently apply to all CPP participants. “Senior Executive Officers” (“SEOs”) are defined as the top five most highly compensated executives of a public company whose compensation is required to be disclosed pursuant to SEC regulations. The SEOs of the Company are likely to be the same individuals as those comprising the Named Executive Officers presented in this Proxy Statement. The requirements related to executive compensation are as follows:

| | • | Limits on Incentive Compensation — The scope of limits on incentive compensation vary based upon the amount of funds received under the CPP. Since the Company received over $25,000,000 but less than $250,000,000 in funds, the following limits apply only to the five most highly compensated employees of the Company (the SEOs): |

| |

| | • | CPP participants are prohibited from paying or accruing any bonus, retention award or incentive compensation for the covered employee. This prohibition does not apply to any bonus payments required to be paid pursuant to a written employment agreement executed on or before February 11, 2009. |