UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| x | QUARTERLY REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

| For the quarterly period ended March 31, 2010 |

| |

| o | TRANSITION REPORT UNDER SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| |

For the transition period from _____ to _____ |

Commission file number 001-34378

CHINA NORTH EAST PETROLEUM

HOLDINGS LIMITED

(Exact name of small business issuer as specified in its charter)

| | Nevada | | 87-0638750 | |

| | (State of other jurisdiction of incorporation or organization) | | (IRS Employer identification No.) | |

445 Park Avenue, New York, New York 10022

(Address of principal executive offices)

(212) 307-3568

(Registrant's telephone number, including area code)

Indicated by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark whether the registrant is a large accelerate filer, an accelerate filer, a non-accelerated filer, or a smaller reporting company. See the definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | o | Accelerated filer | o | |

| | Non-accelerated filer | o | Smaller reporting company | x | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Number of shares of common stock outstanding as of August 30, 2010: 29,504,860

| INDEX | | | |

| | | Page No. | |

| PART I FINANCIAL INFORMATION | | | |

| | | | |

| Item 1. | Financial Statements | | | 2 | |

| | | | | | |

| | Condensed Consolidated Balance Sheets – March 31, 2010 (Unaudited) and December 31, 2009 (Audited) | | | 2 | |

| | | | | | |

| | Condensed Consolidated Statements of Operations and Comprehensive Income (Loss) - three months ended March 31, 2010 and 2009 (Unaudited) | | | 3 | |

| | | | | | |

| | Condensed Consolidated Statements of Cash Flows – three months ended March 31, 2010 and 2009 (Unaudited) | | | 4 | |

| | | | | | |

| | Notes to Condensed Consolidated Financial Statements as of March 31, 2010 (Unaudited) | | | 5 | |

| | | | | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition And Results of Operations | | | 22 | |

| | | | | | |

| Item 3. | Quantitative and Qualitative Disclosure About Market Risk | | | 31 | |

| | | | | | |

| Item 4T. | Controls and Procedures | | | 32 | |

| | | | | |

| PART II OTHER INFORMATION | | | | |

| | | | | |

| Item 1. | Legal Proceedings | | | 34 | |

| | | | | | |

| Item 1A. | Risk Factors | | | 34 | |

| | | | | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | | | 34 | |

| | | | | | |

| Item 3. | Defaults Upon Senior Securities | | | 34 | |

| | | | | | |

| Item 4. | (Removed and Reserved) | | | 34 | |

| | | | | | |

| Item 5. | Other Information | | | 35 | |

| | | | | | |

| Item 6. | Exhibits | | | 35 | |

| | | | | | |

| SIGNATURES | | | 36 | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

On one or more occasions, we may make forward-looking statements in this Quarterly Report on Form 10-Q regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events. Words or phrases such as “anticipates,” “may,” “will,” “should,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “targets,” “will likely result,” “will continue” or similar expressions identify forward-looking statements. These forward-looking statements are only our predictions and involve numerous assumptions, risks and uncertainties, including, but not limited to, those listed below and those business risks and factors described else where in this report and our other Securities and Exchange Commission (“SEC”) filings.

Forward-looking statements involve risks and uncertainties which could cause actual results or outcomes to differ materially from those expressed. We caution that while we make such statements in good faith and believe such statements are based on reasonable assumptions, including without limitation, management’s examination of historical operating trends, data contained in records and other data available from third parties, we cannot assure you that our projections will be achieved. Factors that may cause such differences include but are not limited to:

| | ● | Our expectation of continued growth in the demand for our oil; |

| | ● | Our expectation that we will have adequate liquidity from cash flows from operations; |

| | ● | A variety of market, operational, geologic, permitting, labor and weather related factors; and |

| | ● | The other risks and uncertainties which are described below under “RISK FACTORS,” including, but not limited to, the following: |

| | | ♦ Unanticipated conditions may cause profitability to fluctuate; and |

| | | ♦ Decreases in purchases of oil by our customer will adversely affect our revenues. |

We have attempted to identify, in context, certain of the factors that we believe may cause actual future experience and results to differ materially from our current expectation regarding the relevant matter or subject area. In addition to the items specifically discussed above, our business and results of operations are subject to the uncertainties described under the caption “Risk Factors” which is a part of the disclosure included in Item 2 of this Report entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

From time to time, oral or written forward-looking statements are also included in our reports on Forms 10-K, 10-Q and 8-K, Proxy Statements on Schedule 14A, press releases, analyst and investor conference calls, and other communications released to the public. Although we believe that at the time made, the expectations reflected in all of these forward-looking statements are and will be reasonable, any or all of the forward-looking statements in this quarterly report on Form 10-Q, our reports on Forms 10-K and 8-K, our Proxy Statements on Schedule 14A and any other public statements that are made by us may prove to be incorrect. This may occur as a result of inaccurate assumptions or as a consequence of known or unknown risks and uncertainties. Many factors discussed in this Quarterly Report on Form 10-Q, certain of which are beyon d our control, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this Quarterly Report on Form 10-Q or other public communications that we might make as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements.

We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. However, your attention is directed to any further disclosures made on related subjects in our subsequent annual and periodic reports filed with the SEC on Forms 10-K, 10-Q and 8-K and Proxy Statements on Schedule 14A.

Unless the context requires otherwise, references to “we,” “us,” “our,” the “Company” and “NEP” refer specifically to China North East Petroleum Holdings Limited and its subsidiaries.

PART I FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES ("NEP") | |

| Condensed Consolidated Balance Sheets | |

| | | | | | | | |

| | | | As of | |

| | | | March 31, | | | December 31, | |

| | | | 2010 | | | 2009 | |

| | | | (Unaudited) | | | (Audited) | |

| | | | | | | | |

| ASSETS | |

| CURRENT ASSETS | | | | | | |

| | Cash and cash equivalents | | $ | 34,198,945 | | | $ | 28,693,132 | |

| | Accounts receivable, net | | | 22,073,272 | | | | 16,231,369 | |

| | Prepaid expenses and other current assets | | | 1,829,993 | | | | 678,349 | |

| | Total Current Assets | | | 58,102,210 | | | | 45,602,850 | |

| | | | | | | | | | |

| PROPERTY AND EQUIPMENT | | | | | | | | |

| | Oil properties, net | | | 43,759,402 | | | | 45,777,428 | |

| | Fixed assets, net | | | 16,041,303 | | | | 16,466,117 | |

| | Oil properties under construction | | | 79,798 | | | | 69,395 | |

| | Total Property and Equipment | | | 59,880,503 | | | | 62,312,940 | |

| | | | | | | | | | |

| LAND USE RIGHTS, NET | | | 619,633 | | | | 630,387 | |

| GOODWILL | | | | 1,645,589 | | | | 1,645,589 | |

| DEFERRED TAX ASSETS | | | 7,681,900 | | | | 7,538,868 | |

| | | | | | | | | | |

| TOTAL ASSETS | | $ | 127,929,835 | | | $ | 117,730,634 | |

| | | | | | | | | | |

| | | | | | | | | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| | Accounts payable | | $ | 11,844,034 | | | $ | 13,373,640 | |

| | Current portion of secured debenture | | | - | | | | 5,625,000 | |

| | Other payables and accrued expenses | | | 1,177,244 | | | | 1,165,494 | |

| | Due to a related party | | | 14,628 | | | | 14,626 | |

| | Due to a related company | | | 27,793 | | | | 144,796 | |

| | Income tax and other taxes payable | | | 8,185,780 | | | | 4,930,202 | |

| | Due to a stockholder | | | 2,495,725 | | | | 89,269 | |

| | Total Current Liabilities | | | 23,745,204 | | | | 25,343,027 | |

| | | | | | | | | | |

| LONG-TERM LIABILITIES | | | | | | | | |

| | Secured debenture | | | - | | | | 4,875,000 | |

| | Warrants | | | 28,687,343 | | | | 39,528,261 | |

| | Total Long-term Liabilities | | | 28,687,343 | | | | 44,403,261 | |

| | | | | | | | | | |

| TOTAL LIABILITIES | | | 52,432,547 | | | | 69,746,288 | |

| | | | | | | | | | |

| COMMITMENTS AND CONTINGENCIES | | | - | | | | - | |

| | | | | | | | | | |

| EQUITY | | | | | | | | | |

| | NEP Stockholders' Equity | | | | | | | | |

| | Common stock ($0.001 par value, 150,000,000 shares authorized, | | | | | |

| | 29,474,995 shares issued and outstanding as of | | | | | |

| | March 31, 2010; 27,935,818 shares issued and | | | | | |

| | outstanding as of December 31, 2009) | | | 29,475 | | | | 27,936 | |

| | Additional paid-in capital | | | 46,918,624 | | | | 42,582,142 | |

| | Retained earnings (deficits) | | | | | | | | |

| | Unappropriated | | | 13,749,438 | | | | (7,995,947 | ) |

| | Appropriated | | | 2,524,055 | | | | 2,524,055 | |

| | Accumulated other comprehensive income | | | 2,176,728 | | | | 3,181,452 | |

| | Total NEP Stockholders' Equity | | | 65,398,320 | | | | 40,319,638 | |

| | Noncontrolling interests | | | 10,098,968 | | | | 7,664,708 | |

| TOTAL EQUITY | | | 75,497,288 | | | | 47,984,346 | |

| | | | | | | | | | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | | $ | 127,929,835 | | | $ | 117,730,634 | |

The accompanying notes are an integral part of these condensed consolidated financial statements

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES ("NEP") | |

| Consolidated Statements of Operations and Comprehensive Income (Loss) | |

| (Unaudited) | |

| | | | For the three months ended March 31, | |

| | | | 2010 | | | 2009 | |

| | | | | | | (Restated) | |

| | | | | | | | |

| REVENUE | | | | | | | |

| Sales of crude oil | | $ | 16,646,495 | | | $ | 8,899,223 | |

| Drilling revenue | | | 12,281,798 | | | | - | |

| | Total Revenue | | | 28,928,293 | | | | 8,899,223 | |

| | | | | | | | | | |

| COST OF REVENUE | | | | | | | | |

| Production costs | | | 1,219,243 | | | | 514,400 | |

| Drilling costs | | | 4,511,289 | | | | - | |

| Depreciation, depletion and amortization of oil properties | | | 1,611,105 | | | | 3,079,630 | |

| Depreciation of drilling equipment | | | 477,439 | | | | - | |

| Amortization of land use rights | | | 10,856 | | | | 2,979 | |

| Government oil surcharge | | | 2,494,718 | | | | 37,792 | |

| | Total Cost of Revenue | | | 10,324,650 | | | | 3,634,801 | |

| | | | | | | | | | |

| GROSS PROFIT | | | 18,603,643 | | | | 5,264,422 | |

| | | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Selling, general and administrative expenses | | | 1,525,026 | | | | 678,875 | |

| Professional fees | | | 75,056 | | | | 98,756 | |

| Consulting fees | | | - | | | | (2,594 | ) |

| Depreciation of fixed assets | | | 95,380 | | | | 68,815 | |

| Impairment of oil properties | | | - | | | | 13,825,567 | |

| | Total Operating Expenses | | | 1,695,462 | | | | 14,669,419 | |

| | | | | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | | | 16,908,181 | | | | (9,404,997 | ) |

| | | | | | | | | | |

| OTHER INCOME (EXPENSE) | | | | | | | | |

| Other expense | | | (37,972 | ) | | | (793 | ) |

| Interest expense | | | (23,572 | ) | | | (280,000 | ) |

| Amortization of deferred financing costs | | | - | | | | (144,507 | ) |

| Amortization of discount on debenture | | | - | | | | (670,492 | ) |

| Imputed interest expense | | | - | | | | (12,248 | ) |

| Interest income | | | 23,162 | | | | 15,096 | |

| Change in fair value of warrants | | | 10,840,918 | | | | 653,705 | |

| Loss on extinguishment of debt | | | - | | | | (8,260,630 | ) |

| | Total Other Income (Expense), net | | | 10,802,536 | | | | (8,699,869 | ) |

| | | | | | | | | | |

| NET INCOME (LOSS) BEFORE INCOME TAXES | | | 27,710,717 | | | | (18,104,866 | ) |

| Income tax expense | | | (4,600,070 | ) | | | - | |

| NET INCOME (LOSS) | | | 23,110,647 | | | | (18,104,866 | ) |

| | | | | | | | | | |

| Less: net loss (income) attributable to noncontrolling interests | | | (1,365,262 | ) | | | 873,368 | |

| NET INCOME (LOSS) ATTRIBUTABLE TO NEP COMMON STOCKHOLDERS | | | 21,745,385 | | | | (17,231,498 | ) |

| | | | | | | | | | |

| OTHER COMPREHENSIVE INCOME | | | | | | | | |

| Total other comprehensive income | | | 64,274 | | | | 62,024 | |

| Less: foreign currency translation gain attributable to noncontrolling interests | | | (1,068,998 | ) | | | (6,203 | ) |

| Foreign currency translation (loss) gain attributable to NEP common stockholders | | | (1,004,724 | ) | | | 55,821 | |

| | | | | | | | | | |

| COMPREHENSIVE INCOME (LOSS) | | $ | 20,740,661 | | | $ | (17,175,677 | ) |

| | | | | | | | | | |

| Net income (loss) per share | | | | | | | | |

| - basic | | | $ | 0.75 | | | $ | (0.83 | ) |

| - diluted | | | $ | 0.69 | | | $ | (0.83 | ) |

| | | | | | | | | | |

| Weighted average number of shares outstanding during the period | | | | | | | | |

| - basic | | | | 28,870,641 | | | | 20,784,080 | |

| - diluted | | | | 31,302,781 | | | | 20,784,080 | |

The accompanying notes are an integral part of these condensed consolidated financial statements

| CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED AND SUBSIDIARIES | |

| Condensed Consolidated Statements of Cash Flows | |

| (Unaudited) | |

| | | | | | | |

| | | For the three months ended March 31, | |

| | | 2010 | | | 2009 | |

| | | | | | (Restated) | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | |

| Net income (loss) | | $ | 23,110,647 | | | $ | (18,104,866 | ) |

| Adjusted to reconcile net income (loss) to cash provided by | | | | | | | | |

| operating activities: | | | | | | | | |

| Depreciation, depletion and amortization of oil properties | | | 1,611,105 | | | | 3,079,630 | |

| Depreciation of drilling equipment | | | 477,439 | | | | - | |

| Depreciation of fixed assets | | | 95,380 | | | | 68,816 | |

| Amortization of land use rights | | | 10,856 | | | | 2,979 | |

| Amortization of deferred financing costs | | | - | | | | 144,507 | |

| Amortization of discount on debenture | | | - | | | | 670,492 | |

| Amortization of stock option compensation | | | 218,280 | | | | 279,868 | |

| Loss on extinguisment expense of debt | | | - | | | | 8,260,630 | |

| Change in fair value of warrants | | | (10,840,918 | ) | | | (653,705 | ) |

| Impairment of oil properties | | | - | | | | 13,825,567 | |

| Warrants issued for services | | | - | | | | 26,740 | |

| Stock-based compensation for employee services | | | 808,000 | | | | 202,500 | |

| Imputed interest expenses | | | - | | | | 12,248 | |

| Changes in operating assets and liabilities | | | | | | | | |

| (Increase) decrease in: | | | | | | | | |

| Accounts receivable | | | (5,841,903 | ) | | | 161,201 | |

| Prepaid expenses and other current assets | | | (1,151,644 | ) | | | 33,677 | |

| Value added tax recoverable | | | - | | | | 311,240 | |

| Deferred tax assets | | | (143,032 | ) | | | (1,597,043 | ) |

| Increase (decrease) in: | | | | | | | | |

| Accounts payable | | | (1,529,606 | ) | | | 377,501 | |

| Other payables and accrued expenses | | | 11,750 | | | | 269,427 | |

| Income tax and other taxes payable | | | 3,255,578 | | | | (1,585,778 | ) |

| Net cash provided by operating activities | | | 10,091,932 | | | | 5,785,631 | |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchase of oil properties | | | (703 | ) | | | (13,880 | ) |

| Purchase of fixed assets | | | (42,533 | ) | | | (157,769 | ) |

| Additions to oil properties under construction | | | (10,403 | ) | | | - | |

| Net cash used in investing activities | | | (53,639 | ) | | | (171,649 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Repayment of secured debenture | | | (10,500,000 | ) | | | (150,000 | ) |

| Proceeds from exercise of stock warrants and options | | | 3,311,741 | | | | - | |

| Increase in amount due to a stockholder | | | 2,406,456 | | | | 964,424 | |

| Increase in amount due to a related party | | | - | | | | (51,654 | ) |

| Increase in amount due to a related company | | | (117,003 | ) | | | - | |

| Net cash (used in) provided by financing activities | | | (4,898,806 | ) | | | 762,770 | |

| | | | | | | | | |

| EFFECT OF EXCHANGE RATE ON CASH | | | 366,326 | | | | (6,837 | ) |

| | | | | | | | | |

| NET INCREASE IN CASH AND CASH EQUIVALENTS | | | 5,505,813 | | | | 6,369,915 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | | | 28,693,132 | | | | 13,239,213 | |

| | | | | | | | | |

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | | $ | 34,198,945 | | | $ | 19,609,128 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: | | | | | | | | |

| Cash paid during the period for: | | | | | | | | |

| Income tax expense | | $ | 5,310,620 | | | $ | 2,482,717 | |

| | | | | | | | | |

| Interest expense | | $ | - | | | $ | - | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURE OF NON-CASH INVESTING AND FINANCING ACTIVITIES: | | | | | |

On March 29, 2010, 400,000 share of common stocks valued at $3,232,000 were issued to the key management of Tiancheng, of which the Company recognized $808,000 as staff compensation expenses included in selling, general and administrative expenses for the three months ended March 31, 2010. | |

The accompanying notes are an integral part of these condensed consolidated financial statements

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 1 RESTATEMENT OF PREVIOUSLY REPORTED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

On February 23, 2010, China North East Petroleum Holdings Limited (the “Company”) determined that the Company’s financial statements as of March 31, 2009 and for the three months then ended should no longer be relied upon and should be restated as a result of certain non-cash errors contained therein regarding the accounting for: (i) warrants issued in conjunction with a secured debenture on February 28, 2008, which warrants should have been classified according to Accounting Standards Codification (“ASC”) 815-40 (formerly Emerging Issues Task Force (“EITF”) 00-19) as liability instruments rather than equity instruments; (ii) the change in the fair value of those warrants from the date of issuance through the end of the reporting period; (iii) effective interest expense arising from amorti zation of the discount to the carrying value of the secured debenture; (iv) the recording of warrants issued to investment consultants in connection with the issuance of the secured debenture as deferred financing costs instead of consulting fees; (v) the rate of amortization of deferred financing costs associated with the issuance of that secured debenture; (vi) compensation issued to employees in the form of stock; (vii) depreciation, depletion and amortization of oil properties; (viii) ceiling test reduction of the net carrying value of oil properties; (ix) income tax expense; (x) noncontrolling interests; and (xi) restructuring of the secured debenture on March 5, 2009, treated as an extinguishment of debt.

As a result, the accompanying unaudited condensed consolidated statements of operations and comprehensive loss and cash flows for the three months ended March 31, 2009 have been restated from the amounts previously reported. The information in the data table below represents only those statement of operations and comprehensive income (loss), and statement of cash flows line items affected by the restatement.

STATEMENT OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS) INFORMATION

| | | Three months ended March 31, 2009 | |

| | | As previously reported | | | Adjustments | | | As restated | |

| Cost of Sales: | | | | | | | | | |

| Depreciation, depletion and amortization of oil properties | | $ | 2,624,254 | | | $ | 455,376 | | | $ | 3,079,630 | |

| Operating Expenses: | | | | | | | | | | | | |

| Selling, general and administrative expenses | | | 572,583 | | | | 106,292 | | | | 678,875 | |

| Professional fees | | | 72,016 | | | | 26,740 | | | | 98,756 | |

| Consulting fees | | | 57,680 | | | | (60,274 | ) | | | (2,594 | ) |

| Impairment of oil properties | | | - | | | | 13,825,567 | | | | 13,825,567 | |

| Other Income (Expense): | | | | | | | | | | | | |

| Amortization of deferred financing costs | | | (74,139 | ) | | | (70,368 | ) | | | (144,507 | ) |

| Amortization of discount on debenture | | | (492,703 | ) | | | (177,789 | ) | | | (670,492 | ) |

| Change in fair value of warrants | | | - | | | | 653,705 | | | | 653,705 | |

| Loss on extinguishment of debt | | | - | | | | (8,260,630 | ) | | | (8,260,630 | ) |

| Income tax expense | | | (1,419,819 | ) | | | 1,419,819 | | | | - | |

| Net income (loss) | | | 2,684,098 | | | | (20,788,964 | ) | | | (18,104,866 | ) |

| Noncontrolling interest | | | (412,745 | ) | | | 1,286,113 | | | | 873,368 | |

| Net income (loss) attributable to NEP common stockholders | | | 2,271,353 | | | | (19,502,851 | ) | | | (17,231,498 | ) |

| Foreign currency translation gain | | | 71,045 | | | | (15,224 | ) | | | 55,821 | |

| Comprehensive income (loss) | | | 2,342,398 | | | | (19,518,075 | ) | | | (17,175,677 | ) |

| Net income (loss) per share -- Basic | | | 0.11 | | | | (0.94 | ) | | | (0.83 | ) |

| Net income (loss) per share -- Diluted | | | 0.11 | | | | (0.94 | ) | | | (0.83 | ) |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 1 RESTATEMENT OF PREVIOUSLY REPORTED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Continued)

STATEMENT OF CASH FLOWS INFORMATION

| | | Three months ended March 31, 2009 | |

| | | As previously reported | | | Adjustments | | | As restated | |

| Net income (loss) | | $ | 2,271,353 | | | $ | (20,376,219 | ) | | $ | (18,104,866 | ) |

| Adjustments to reconcile net income (loss) to cash provided by operating activities: | | | | | | | | | | | | |

| Depreciation, depletion and amortization of oil properties | | | 2,624,254 | | | | 455,376 | | | | 3,079,630 | |

| Amortization of deferred financing costs | | | 74,139 | | | | 70,368 | | | | 144,507 | |

| Amortization of discount on debenture | | | 492,703 | | | | 177,789 | | | | 670,492 | |

| Amortization of stock option compensation | | | 173,576 | | | | 106,292 | | | | 279,868 | |

| Change in fair value of warrants | | | - | | | | (653,705 | ) | | | (653,705 | ) |

| Impairment of oil properties | | | - | | | | 13,825,567 | | | | 13,825,567 | |

| Loss on extinguishment of debt | | | - | | | | 8,260,630 | | | | 8,260,630 | |

| Warrants issued for services | | | 48,680 | | | | (21,940 | ) | | | 26,740 | |

| Noncontrolling interests | | | 412,745 | | | | (412,745 | ) | | | - | |

| Other payables and accrued liabilities | | | 281,021 | | | | (11,594 | ) | | | 269,427 | |

| Deferred tax assets | | | (172,139 | ) | | | (1,424,904 | ) | | | (1,597,043 | ) |

| Net cash provided by operating activities | | | 5,790,716 | | | | (5,085 | ) | | | 5,785,631 | |

| Effect of exchange rate on cash | | | (11,922 | ) | | | 5,085 | | | | (6,837 | ) |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 2 BASIS OF PRESENTATION

The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America for interim financial information and pursuant to the rules and regulations of the Securities and Exchange Commission. Accordingly, they do not include all of the information and footnotes required by generally accepted accounting principles for complete financial statements.

In the opinion of management, the unaudited condensed consolidated financial statements contain all adjustments consisting only of normal recurring accruals considered necessary to present fairly the Company's financial position at March 31, 2010, the results of operations for the three months ended March 31, 2010 and 2009 and cash flows for the three months ended March 31, 2010 and 2009. The results for the three months ended March 31, 2010 are not necessarily indicative of the results to be expected for the entire fiscal year ending December 31, 2010.

These financial statements should be read in conjunction with the Company's annual report on Form 10-K for the fiscal year ended December 31, 2009.

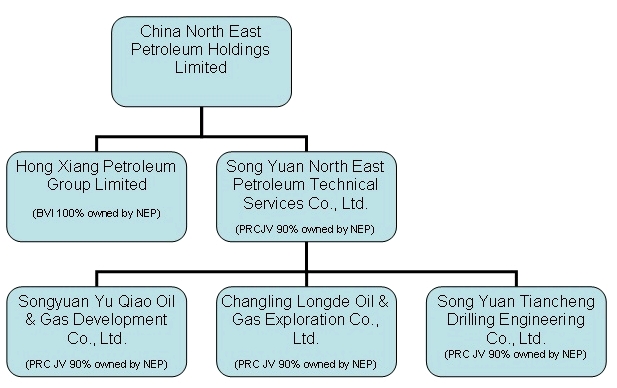

NOTE 3 ORGANIZATION

China North East Petroleum Holdings Limited (“North East Petroleum”) was incorporated in Nevada on August 20, 1999 under the name of Draco Holding Corporation (“Draco”).

Hong Xiang Petroleum Group Limited ("Hong Xiang Petroleum Group") was incorporated in the British Virgin Islands (“BVI”) on August 28, 2003 as an investment holding company.

Song Yuan City Hong Xiang Petroleum Technical Services Co., Ltd. (“Hong Xiang Technical”) was incorporated in the People’s Republic of China (“PRC”) on December 5, 2003 to provide technical advisory services to oil and gas exploration companies in the PRC.

During 2004, Hong Xiang Petroleum Group acquired a 100% ownership of Hong Xiang Technical.

During 2004, Hong Xiang Technical acquired a 100% interest in Song Yuan City Yu Qiao Qianan Hong Xiang Oil and Gas Development Co., Ltd. (“Hong Xiang Oil Development”) which is engaged in the exploration and production of crude oil in the Jilin Oil Region, of the PRC. In December 2002, Hong Xiang Oil Development entered into an oil lease agreement with Song Yuan City Yu Qiao Oil and Gas Development Limited Corporation (“Yu Qiao”) to develop the proven reserves in the Qian’an Oil Field Zone 112 (Qian’an 112) in Jilin Oil Region for 20 years.

During 2004, Draco executed a Plan of Exchange to acquire 100% of Hong Xiang Petroleum Group.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 3 ORGANIZATION (Continued)

On July 26, 2006, the Company entered into a Joint Venture Agreement (the “JV Agreement”) with a principal stockholder and a related party, hereafter referred to as the “Related Parties,” to acquire oil properties for the exploration of crude oil in the PRC. Pursuant to the JV Agreement, the Company and the Related Parties are obligated to contribute $1 million and $121,000, respectively, to the registered capital of Song Yuan North East Petroleum Technical Service Co., Ltd. (“Song Yuan Technical”), and the Company and the Related Parties will each share 90% and 10% respectively of the equity and profit interests of Song Yuan Technical.

On June 1, 2005, Song Yuan Technical acquired from third parties 100% equity interest of LongDe Oil & Gas Development Co. Ltd. (“LongDe”) at a consideration of $120,773 in cash. LongDe is engaged in the exploration and production of crude oil in the Jilin Oil Region of the PRC.

On January 26, 2007, Song Yuan Technical acquired 100% of the equity interest of Yu Qiao for 10,000,000 shares of the Company’s common stock having a fair value of $3,100,000. Yu Qiao is engaged in the exploration and production of crude oil in Jilin Province, PRC and operates 3 oilfields with a total exploration area of 39.2 square kilometers. Pursuant to a 20-year exclusive Cooperative Exploration Contract (the “Oil Lease”) which was entered into on May 28, 2002 with PetroChina Group, a corporation organized and existing under the laws of PRC (“PetroChina”), the Company has the right to explore, develop and extract oil at Qian’an 112, Da 34 and Gu 31 area.

After the acquisition of Yu Qiao, the oil lease agreement between Yu Qiao and Hong Xiang Oil Development was rescinded and Hong Xiang Technical and Hong Xiang Oil Development were dissolved in March 2007.

On September 25, 2009, Song Yuan Technical acquired from third parties 100% of the equity interest of Song Yuan Tiancheng Drilling Engineering Co., Ltd. (“Tiancheng”) at a consideration of $13,000,000 in cash. Tiancheng provides contract land drilling services to customers for exploration and production of crude oil in the PRC.

North East Petroleum, Hong Xiang Petroleum Group, Song Yuan Technical, LongDe, Yu Qiao and Tiancheng are hereinafter referred to as (the “Company”).

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation

The accompanying unaudited condensed consolidated financial statements as of March 31, 2010 include the unaudited financial statements of North East Petroleum and its wholly owned subsidiary, Hong Xiang Petroleum Group and 90% owned subsidiaries, Song Yuan Technical, LongDe, Yu Qiao and Tiancheng. The noncontrolling interests represent the minority shareholders’ 10% share of the results of Song Yuan Technical, LongDe, Yu Qiao and Tiancheng.

The accompanying unaudited condensed consolidated financial statements as of March 31, 2009 include the unaudited financial statements of North East Petroleum and its wholly owned subsidiary, Hong Xiang Petroleum Group and 90% owned subsidiaries, Song Yuan Technical, LongDe and Yu Qiao. The noncontrolling interests represent the minority shareholders’ 10% share of the results of Song Yuan Technical, LongDe and Yu Qiao.

All significant inter-company accounts and transactions have been eliminated in consolidation.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates include the value of the Company’s oil reserve quantities which are the basis for the calculation of the depletion, depreciation and amortization of oil properties and impairments of oil properties, and estimates of the fair value of warrants. Actual results could differ from those estimates.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Foreign currency translation and other comprehensive income

The reporting currency of the Company is the US dollar. The functional currency of Song Yuan Technical, LongDe, Yu Qiao and Tiancheng is the Chinese Renminbi (“RMB”).

For the subsidiaries whose functional currencies are other than the US dollar, all assets and liabilities accounts were translated at the exchange rate on the balance sheet date; stockholder's equity is translated at the historical rates and items in the statement of operations and statement of cash flows are translated at the average rate for the year. Translation adjustments resulting from this process are included in accumulated other comprehensive income in the statement of stockholders’ equity. The resulting translation gains and losses that arise from exchange rate fluctuations on transactions denominated in a currency other than the functional currency are included in the results of operations as incurred. Accumulated other comprehensive income in the condensed consolidated balance sheets amounted to $2,176,728 and $3,181, 452 as of March 31, 2010 and December 31, 2009, respectively. The balance sheet amounts with the exception of equity at March 31, 2010 were translated at 6.8361 RMB to $1.00 USD. The average translation rates applied to income statement amounts for the three months ended March 31, 2010 and 2009 was 6.8409 RMB to $1.00 USD and 6.84659 RMB to $1.00 USD, respectively.

Cash and concentration of risk

The Company considers all highly liquid investments with original maturities of three months or less at the time of purchase to be cash equivalents, for statement of cash flows purposes. Cash includes cash on hand and demand deposits in accounts maintained with state owned banks within the PRC and with banks in the United States.

The Company’s cash equivalents are exposed to concentration of credit risk. The Company maintains balances at financial institutions which, from time to time, may exceed Federal Deposit Insurance Corporation insured limits for the banks located in the United States. Balances at financial institutions or state owned banks within the PRC are not covered by insurance. As of March 31, 2010 and December 31, 2009, the Company had deposits in excess of federally insured limits totaling $94,839 and $9,307,837, respectively. The Company has not experienced any losses in such accounts and believes it is not exposed to any significant risks on its cash in bank accounts.

Substantially all of the Company's operations are carried out in the PRC. Accordingly, the Company's business, financial condition and results of operations may be influenced by the political, economic and legal environments in that country, and by the general state of that country’s economy. The Company's operations in the PRC are subject to specific considerations and significant risks not typically associated with companies in the United States. These include risks associated with, among others, the political, economic and legal environments and foreign currency exchange. The Company's results may be adversely affected by changes in governmental policies with respect to laws and regulations, anti-inflationary measures, currency conversion and remittance abroad, and rates and methods of taxation, among other things.

Revenue Recognition

Our oil production business records revenues from the sales of oil on a net basis when delivery to the customer (PetroChina) has occurred and title has transferred. This occurs when oil has been delivered to a PetroChina depot.

Pursuant to the Oil Lease entered into in 2002 and 2003 with PetroChina, each with twenty year terms, the Company is entitled to 80% of the Company’s oil production for the first ten years and 60% of the Company’s oil production for the remaining ten years . The Company receives payment for the net physical volume of oil delivered (either 80% or 60% by volume, depending upon the lease terms that are current at that point in time). The Company only records revenue for the production that the Company is entitled to.

Our oilfield drilling business (Tiancheng) records revenues from the sales of services that are generally sold based upon purchase orders or contracts with the customer that include fixed or determinable prices and that do not include right of return or other similar provisions or other significant post-delivery obligations. Revenue for services is recognized as the services are rendered and when collectibility is reasonably assured. Rates for services are typically priced on a per day, per meter, per man hour or similar basis. In certain situations, revenue is generated from transactions that may include multiple services under one contract or agreement. Revenue from these arrangements is recognized as each service is delivered based on their relative fair value.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Major customers

Our oil production business has only one customer – PetroChina’s Jilin Refinery branch, located in Song Yuan City, Jilin Province, PRC. Pursuant to our lease agreements with PetroChina we are unable to sell our oil production to any other customer.

Our oilfield drilling business has one primary customer (PetroChina) but also serves other independent oil production companies located in Jilin and Heilongjiang provinces in the PRC.

Accounts receivables and allowance for doubtful accounts

Our oil production business bills PetroChina on a monthly basis, at month-end, for the oil that we delivered to PetroChina during that month. We receive payment from PetroChina approximately 10 to 20 days following the end of each month. We receive payment in full for the prior month, less a holdback in the first and second months of each calendar quarter for the amount of oil surcharge tax (if any) due to the PRC government for the respective month’s oil sales. These oil surcharge tax holdbacks are paid to the Company with the normal monthly payment in the third month of each quarter, and therefore are to be received by us shortly before we are responsible for remitting the quarterly oil surcharge tax to the PRC government. Therefore, the amount we show as accounts receivable at the end of each r eporting period will include the amounts due to us for sales in the prior month, as well as amounts of oil surcharge due from the two preceding months equal to the amount of oil surcharge tax payable by us. We do not recognize any allowance for doubtful accounts, as PetroChina has always paid our invoices on a correct, consistent and timely basis.

Our oilfield drilling business bills customers according to the terms of each service contract. These contracts generally require downpayments of 30% of the drilling contract sum at the initiation of drilling services and payments of the remaining 70% of the drilling contract sum in twelve monthly installments following the completion of the drilling services.

Long-lived assets

The Company evaluates at least annually, more often when circumstances require, the carrying value of long-lived assets to be held and used. Impairment losses to be recorded on long-lived assets used in operations when indicators of impairment are present and the undiscounted cash flows estimated to be generated by those assets are less than the assets' carrying amounts. In that event, a loss is recognized based on the amount by which the carrying amount exceeds the fair market value of the long-lived assets. The impairment of oil properties for the three months ended March 31, 2010 and 2009 was $0 and $13,825,567, respectively.

Financial instruments

The Company analyzes all financial instruments with features of both liabilities and equity under ASC 480-10 (formerly Statement of Financial Accounting Standards (“SFAS”) No. 150, “Accounting for Certain Financial Instruments with Characteristics of Both Liabilities and Equity”), ASC 815-10 (formerly SFAS No. 133, “Accounting for Derivative Instruments and Hedging Activities”) and ASC 815-40 (formerly EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially Settled in, a Company’s Own Stock”). The warrants issued in conjunction with the issuance of the secured debenture in February 2008 are treated as liability instruments and will be marked to fair value as of each reporting date. Additionally, the Company analyzes registration rights agr eements associated with any equity instruments issued to determine if penalties triggered for late filing should be accrued under ASC 825-20 (formerly FSP EITF 00-19-2, “Accounting for Registration Payment Arrangements”) (See Note 8, Registration Payment Arrangment Below).

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Fair value of financial instruments

On January 1, 2008, the Company adopted ASC 820-10 (formerly SFAS No. 157, “Fair Value Measurements”), which defines fair value, establishes a three-level valuation hierarchy for disclosures of fair value measurement and enhances disclosures requirements for fair value measures. The three levels are defined as follow:

| | · | Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| | · | Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the assets or liability, either directly or indirectly, for substantially the full term of the financial instruments. |

| | · | Level 3 inputs to the valuation methodology are unobservable and significant to the fair value. |

The financial assets and liabilities are classified based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of the fair value of assets and liabilities and their placement within the fair value hierarchy levels.

Assets and liabilities measured at fair value on a recurring basis as of March 31, 2010 are summarized as follows (unaudited):

| | | Fair value measurement using inputs | |

| | | Level 1 | | | Level 2 | | | Level 3 | |

| | | | | | | | | | |

| Liabilities: | | | | | | | | | |

| Derivative instruments − Warrants | | $ | - | | | $ | - | | | $ | 28,687,343 | |

| Total | | $ | - | | | $ | - | | | $ | 28,687,343 | |

The Company determines the fair value of the warrants using a Black-Scholes option model using inputs that are derived from observable and unobservable data and are therefore considered Level 3 in the fair value hierarchy.

The carrying values of cash and cash equivalents, trade receivables and payables, and short-term bank loans and debts approximate their fair values due to the short maturities of these instruments.

Stock-Based Compensation

The Company follows ASC 718 (formerly SFAS No. 123R, “Share-Based Payments”). This Statement requires a company to measure the cost of services provided by employees in exchange for an award of equity instruments to be based on the grant-date fair value of the award. That cost will be recognized over the period during which services are received. Stock compensation for stock granted to non-employees has been determined in accordance with ASC 718 and ASC 505-50 (formerly EITF No. 96-18, "Accounting for Equity Instruments that are issued to Other than Employees for Acquiring, or in Conjunction with Selling Goods or Services"), as the fair value of the consideration received or the fair value of equity instruments issued, whichever is more reliably measured.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Property and equipment, net

The Company uses the full cost method of accounting for oil properties. As the Company currently maintains oil operations in only one country (the PRC), the Company has only one cost center. All costs incurred in the acquisition, exploration, and development of properties (including costs of surrendered and abandoned leaseholds, delay lease rentals, dry holes and overhead related to exploration and development activities) and the fair value of estimated future costs of site restoration, dismantlement, and abandonment activities are capitalized.

Investments in unproved properties, including capitalized interest costs, are not depleted pending determination of the existence of proved reserves. Unproved reserves are assessed periodically to ascertain whether impairment has occurred. Unproved properties whose costs are individually significant are assessed individually by considering the primary lease terms of the properties, the holding periods of the properties, and geographic and geologic data obtained relating to the properties. Where it is not practicable to assess individually the amount of impairment of properties for which costs are not individually significant, such properties are grouped for purposes of assessing impairment. The amount of impairment assessed is added to the costs to be amortized, or is reported as a period exp ense, as appropriate. As of March 31, 2010, the Company did not have any investment in unproved oil properties.

Under the full cost method of accounting, a ceiling test is performed each quarter. The full cost ceiling test is an impairment test to determine a limit, or ceiling, on the book value of oil properties. That limit is basically the after tax present value of the future net cash flows from proved crude oil reserves, excluding future cash outflows associated with settling asset retirement obligations that have been accrued on the balance sheet; using an average price over the prior 12-month period held flat for the life of production plus the lower of cost or fair market value of unproved properties. For the three months ended March 31, 2009 we used prices in effect on March 31, the end of period. If net capitalized costs of crude oil properties exceed the ceiling limit, we must charge the amount of the excess to earnings as an expense reflected in additional accumulated depreciation, depletion and amortization. This is called a “ceiling limitation write-down.” The Company recognized impairment loss of oil properties for the three months ended March 31, 2009 of $13,825,567. The Company d id not recognize any impairment loss for the three months ended March 31, 2010.

Depletion of proved oil properties is computed on the unit-of-production method, whereby capitalized costs, as adjusted for future development costs and asset retirement obligations, net of salvage, are amortized over the total estimated proved reserves. Furniture and fixtures, leasehold improvements, computer hardware and software, and other equipment are depreciated on the straight-line method, based upon estimated useful lives of the assets ranging from three to fifteen years.

Asset Retirement Obligations

ASC 410-20 (formerly SFAS No. 143, “Accounting for Asset Retirement Obligations”) requires entities to record the fair value of a liability for an asset retirement obligation in the period in which it is incurred with a corresponding increase in the carrying amount of the related long-lived asset. Subsequent to initial measurement, the asset retirement liability is required to be accreted each period to its present value. Capitalized costs are depleted as a component of the full cost pool using the unit-of-production method. Pursuant to our lease agreements with PetroChina, which terminate in 2022 and 2023, we do not recognize any asset retirement obligations, because at the end of the lease term we are obligated to hand over to PetroChina all of the physical assets we have erected on the le ased properties, including all wells, facilities and equipment.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Income (loss) per share

The Company reports income (loss) per share in accordance with the provisions of ASC 260-10 (formerly SFAS No. 128, "Earnings Per Share”). ASC 260-10 requires presentation of basic and diluted income (loss) per share in conjunction with the disclosure of the methodology used in computing such income (loss) per share. Basic income (loss) per share excludes dilution and is computed by dividing income (loss) available to common stockholders by the weighted average common shares outstanding during the period. Diluted income (loss) per share takes into account the potential dilution that could occur if securities or other contracts to issue common stock were exercised and converted into common stock using the treasury method.

Income taxes

Income taxes are accounted for under the asset and liability method in accordance with ASC 740-10 (formerly SFAS No. 109, “Accounting for Income Taxes”). Deferred tax assets and liabilities are recognized for future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases and operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the enacted tax rates expected to apply to taxable income in the years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. The Company pro vides valuation allowances against the net deferred tax asset for amounts that are not considered more likely than not to be realized.

The Company adopted ASC 740-10 (formerly FASB Interpretation 48, “Accounting for Uncertainty in Income Taxes” (“FIN 48”)), on January 1, 2007. A tax position is recognized as a benefit only if it is “more likely than not” that the tax position would be sustained in a tax examination, with a tax examination being presumed to occur. The amount recognized is the largest amount of tax benefit that is greater than 50% likely of being realized on examination. For tax positions not meeting the “more likely than not” test, no tax benefit is recorded. The adoption had no effect on the Company’s financial statements.

Deferred tax is accounted for using the balance sheet liability method in respect of temporary differences arising from differences between the carrying amount of assets and liabilities in the financial statements and the corresponding tax basis used in the computation of assessable tax profit. In principle, deferred tax liabilities are recognized for all taxable temporary differences, and deferred tax assets are recognized to the extent that it is probably that taxable profit will be available against which deductible temporary differences can be utilized. Deferred tax is calculated at the tax rates that are expected to apply to the period when the asset is realized or the liability is settled. Deferred tax is charged or credited to profit or loss, except when it related to items credited or charged directly to equity, in which case t he deferred tax is also dealt with in equity. Deferred tax assets and liabilities are offset when they relate to income taxes levied by the same taxation authority and the Company intends to settle its current tax assets and liabilities on a net basis. As of March 31, 2010 and December 31, 2009, the Company’s deferred tax assets amounted to $7,681,900 and $7,538,868, respectively.

Value Added Tax

Sales revenue represents the invoiced value of oil, net of a value-added tax (“VAT”). All of the Company’s oil that is sold in the PRC is subject to a Chinese value-added tax at a rate of 17% of the gross sales price. This VAT may be offset by VAT paid by the Company on investment and operating costs associated with oil production. The Company records its net VAT Payable or VAT Recoverable balance in the financial statements. As of March 31, 2010 the Company had a net VAT Payable liability balance of $810,726, compared with a net VAT Payable liability balance of $123,190 as of December 31, 2009.

Business Segment

The Company operates in two segments: oil production and oilfield services (well drilling). Segment disclosure is presented in Note 13 "Segments".

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Recently issued accounting pronouncements

In January 2010, the FASB issued ASU 2000-03 Extract Activities- Oil and Gas Reserve Estimation and Disclosures. This ASU amends the “Extractive Industries- Oil and Gas” topic of the Codification to align the Oil and Gas reserve estimation and disclosure requirements in this Topic with the SEC Release No. 33-8995, “Modification of Oil and Gas Reporting Requirements (Final Rule)”. The amendments are effective for annual reporting periods ending on or after December 31, 2009, and the adoption of these provisions on December 31, 2009 did not have a material impact on our consolidated financial statements.

In January 2010, FASB issued ASU 2010-06 – Improving Disclosures about Fair Value Measurements (“ASU 2010-6”). ASU 2010-6 provides amendments to Subtopic 820-10 that requires separate disclosure of significant transfers in and out of Level 1 and Level 2 fair value measurements and the presentation of separate information regarding purchases, sales, issuances, and settlements for Level 3 fair value measurements. Additionally, ASU 2010-6 provides amendments to Subtopic 820-10 that clarifies existing disclosures about the level of disaggregation and inputs and valuation techniques. ASU 2010-6 is effective for financial statements issued for interim and annual periods ending after December 15, 2010. The Company does not expect the adoption of ASU 2010-6 to have a material impact on its consolidated results of operations or financial position.

In January 2010, FASB issued ASU 2010-02 Accounting and Reporting for Decreases in Ownership of a Subsidiary a Scope Clarification (“ASU 2010-2”). ASU 2010-2 addresses implementation issues related to the changes in ownership provisions in the Consolidation-Overall Subtopic (Subtopic 810-10) of the FASB Accounting Standards Codification, originally issued as FASB Statement No.160, Noncontrolling Interests in Consolidated Financial Statements. Subtopic 810-10 establishes the accounting and reporting guidance for noncontrolling interests and changes in ownership interests of a subsidiary. An entity is required to deconsolidate a subsidiary when the entity ceases to have a co ntrolling financial interest in the subsidiary. Upon deconsolidation of a subsidiary, an entity recognizes a gain or loss on the transaction and measures any retained investment in the subsidiary at fair value. The gain or loss includes any gain or loss associated with the difference between the fair value of the retained investment in the subsidiary and its carrying amount at the date the subsidiary is deconsolidated. In contrast, an entity is required to account for a decrease in ownership interest of a subsidiary that does not result in a change of control of the subsidiary as an equity transaction. ASU 2010-2 is effective for the Company starting January 3, 2010. The Company does not expect the adoption of ASU 2010-2 to have a material impact on the Company’s consolidated results of operations or financial position.

In February 2010, FASB issued ASU 2010-09 Subsequent Events (Topic 855) Amendments to Certain Recognition and Disclosure Requirements (“ASU 2010-9”). ASU 2010-9 amends disclosure requirements within Subtopic 855-10. An entity that is an SEC filer is not required to disclose the date through which subsequent events have been evaluated. This change alleviates potential conflicts between Subtopic 855-10 and the SEC’s requirements. ASU 2010-9 is effective for interim and annual periods ending after June 15, 2010. The Company does not expect the adoption of ASU 2010-9 to have a material impact on its consolidated results of operations or financial positio n.

In March 2010, FASB issued ASU 2010-11 Scope Exception Related to Embedded Credit Derivatives (“ASU 2010-11”). ASU 2010-11 clarifies the type of embedded credit derivative that is exempt from embedded derivative bifurcation requirements. Only one form of embedded credit derivative qualifies for the exemption-one that is related only to the subordination of one financial instrument to another. As a result, entities that have contracts containing an embedded credit derivative feature in a form other than such subordination may need to separately account for the embedded credit derivative feature. The amendments in this Update are effective for each reporting entity at the beginning of its first fiscal quarter beginning after June 15, 2010. Early adoption is permitted at the beginning of each entity’s first fiscal quarter beginning after issuance of this Update. The Management is currently evaluating the potential impact of ASU 2010-11 on our financial statements.

In April 2010, FASB issued ASU 2010-13 Effect of Denominating the Exercise Price of a Share-Based Payment Award in the Currency of the Market in Which the Underlying Equity Security Trades. (“ASU 2010-13”) addresses the classification of a share-based payment award with an exercise price denominated in the currency of a market in which the underlying equity security trades. Topic 718 is amended to clarify that a share-based payment award with an exercise price denominated in the currency of a market in which a substantial portion of the entity’s equity securities trades shall not be considered to contain a market, performance, or service condition. Therefore, such an award is not to be classified as a liability if it otherwise qualifies as equity classification. The amendments in this Update should be effective for fiscal years, and inte rim periods within those fiscal years, beginning on or after December 15, 2010.The guidance should be applied by recording a cumulative-effect adjustment to the opening balance of retained earnings for all outstanding awards as of the beginning of the fiscal year in which the amendments are initially applied. Management is currently evaluating the potential impact of ASU 2010-13 on our financial statements.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 4 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Reclassifications

Certain prior period amounts have been reclassified to conform to the current period presentation. These reclassifications have no effect on net income or cash flows.

NOTE 5 SECURED DEBENTURE

The following is a summary of secured debenture at March 31, 2010 and December 31, 2009:

| | | March 31, | | | December 31, | |

| | | | | | | |

| Secured Debenture at 8% interest | | | | | | |

| per annum, secured by 66% of the Company's equity interest | | | | | | |

| in Song Yuan Technical and certain properties of the Company | | | | | | |

| and 6,732,000 shares of common stock of the Company | | | | | | |

| owned by a stockholder, due on February 28, 2012 | | $ | - | | | $ | 10,500,000 | |

| | | | | | | | | |

| Less: current maturities | | | - | | | | (5,625,000 | ) |

| Long-term portion | | $ | - | | | $ | 4,875,000 | |

On February 28, 2008, the Company entered into a Securities Purchase Agreement (the "Purchase Agreement") with Lotusbox Investments Limited (the "Investor"). Pursuant to the Purchase Agreement, the Company agreed to issue to the Investor an 8% Secured Debenture due 2012 (the "Debenture") in the aggregate principal amount of $15,000,000, and agreed to issue to the Investor five-year warrants exercisable for up to (i) 1,200,000 shares of the Company's common stock at an initial exercise price equal to $0.01 per share ("Class A Warrants"), (ii) 1,500,000 shares of the Company's common stock at an initial exercise price equal to $3.20 per share ("Class B Warrants") and (iii) 2,100,000 shares of the Company's common stock at an initial exercise price equal to $3.45 per share ("Class C Warrants"), with all warrant exerc ise prices being subject to certain adjustments. The Class B Warrants are subject to certain call rights by the Company. As additional security provided to the Investor, the Company also granted the Investor the right to purchase up to 24% of the registered capital of Song Yuan Technical at fair market value which right shall only become enforceable immediately on the date following the occurrence of an event of a payment default. Pursuant to Section 2(e) of the Series B and C Common Stock Purchase Warrant issued on February 28, 2008 (the “B Warrants” and “C Warrants”) for the purchase of 3,600,000 shares of common stock of Company, the exercise price of the B Warrants and C Warrants have been reset to $2.35 per share.

The Company accounts for these warrants as liability instruments in accordance with paragraph 8 of EITF 00-19, “Accounting for Derivative Financial Instruments Indexed to, and Potentially settled in, a Company’s Own Stock.” (now ASC 815-40). Upon issuance, the warrants were recorded at fair value of $10,268,321, which was recognized as a discount to the carrying value of the debenture. The initial carrying value of the debenture, net of discount, was $4,731,679.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 5 SECURED DEBENTURE (Continued)

On March 5, 2009, the Company and the Investor entered into Agreement No.1 to 8% Secured Debenture (the "Amendment" or the “restructuring”) which amended the Debenture issued to the Investor on February 28, 2008 for the principal amount of $15,000,000. Pursuant to the Amendment, the Investor agreed to extend the Company's requirement to effect a listing of its common stock on either the NYSE Alternext US LLC or NASDAQ until August 30, 2010, and the Company issued four-year warrants to the Investor to purchase up to (i) 250,000 shares of common stock at an exercise price of $2 per share and (ii) 250,000 shares of common stock at an exercise price of $2.35 per share. Also pursuant to the Amendment, the parties have agreed to amend the monthly principal repayment schedule of the Debenture. The Company treated this r estructuring as an extinguishment of debt, as the net present value of cash flows projected to be paid by the Company to the Investor as a result of this Amendment exceed the net present value of cash flows projected to be paid by the Company to the Investor pursuant to the previously existing repayment schedule by greater than 10%. Therefore, the Company has accounted for this Amendment as an extinguishment and reissue of debt. Accordingly, the Company has recognized a loss on extinguishment of debt, effective March 5, 2009, of $8,260,630, which comprised the remaining unamortized discount on the secured debenture prior to the Amendment date, plus the unamortized deferred financing fees on the secured debenture prior to the Amendment date, plus the fair value of the warrants issued to the Investor in conjunction with the Amendment.

As the restructuring is presumed to have the effect of reflecting fair market terms and conditions for the Amended secured debenture, the carrying value of the debenture is the remaining principal balance of the debenture and no discount is recognized. Changes in the fair value of the warrants will continue to be recognized as gain or loss in the period incurred.

In conjunction with the amendment of the terms of the secured debenture, the Company is obligated to file a registration statement registering the resale of shares of the Company’s common stock issuable upon exercise of the Warrants on or before March 5, 2010 (the “Filing Date”). If this registration statement has not been declared effective by the Filing Date, on the 180th day following the Filing Date and each sixth month anniversary thereafter until the registration statement is declared effective, the Company must execute and deliver to the Investor new warrants to purchase up to a total of 62,500 on the same terms as the Warrants. During 2009, the Company repaid a total of $3,750,000 of the principal amount outstanding on the secured debenture, which reduced the principal balance on the debenture to $1 0,500,000 as of December 31, 2009. On January 13, 2010, the Company repaid the entire remaining balance of the debenture in the amount of $10,500,000. As of March 31, 2010, there was no debenture outstanding.

Interest expense on the secured debenture for the three months ended March 31, 2010 and 2009 was $23,572 and $280,000 respectively.

Discount amortized on the secured debenture for the three months ended March 31, 2010 and 2009 was $0 and $670,492, respectively.

NOTE 6 NET INCOME (LOSS) PER SHARE

The following is a reconciliation of the numerators and denominators used in computing basic and diluted net income (loss) per share (in thousands, except per share amounts):

| | | Three months ended March 31, | |

| | | 2010 | | | 2009 | |

| | | (Unaudited) | | | (Unaudited) | |

| | | | | | (Restated) | |

| Numerator: | | | | | | |

| Net income (loss) attributable to NEP common stockholders | | | | | | |

| used in computing basis net income (loss) per share | | $ | 21,745 | | | $ | (17,231 | ) |

| Net income (loss) attributable to NEP common stockholders | | | | | | | | |

| used in computing diluted net income (loss) per share | | $ | | | | $ | (17,231 | ) |

| | | | | | | | | |

| Denominator: | | | | | | | | |

| Shares used in the computation of basic net income (loss) per share | | | | | | | | |

| (weighted average common stock outstanding) | | | 28,871 | | | | 20,784 | |

| Dilutive potential common stock: | | | | | | | | |

| Options and warrants | | | 2,432 | | | | - | |

| Shares used in the computation of diluted net income (loss) per share | | | 31,303 | | | | 20,784 | |

| Basic net income (loss) per share | | $ | 0.75 | | | $ | (0.83 | ) |

| Diluted net income (loss) per share | | $ | 0.69 | | | $ | (0.83 | ) |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

For the three months ended March 31, 2010, 100,000 options and 4,039,899 warrants were included in the calculation under treasury stock method as they were dilutive.

For the three months ended March 31, 2009, options and warrants to purchase shares of common stock were not included in the calculation because the effect is anti-dilutive.

NOTE 7 COMMITMENTS AND CONTINGENCIES

The full time employees of LongDe, Yu Qiao and Tiancheng are entitled to employee benefits including medical care, welfare subsidies, unemployment insurance and pension benefits through a Chinese government mandated multi-employer defined contribution plan. The Company is required to accrue for those benefits based on certain percentages of the employees’ salaries and make contributions to the plans out of the amounts accrued for medical and pension benefits. The Chinese government is responsible for the medical benefits and the pension liability to be paid to these employees.

The Company leases office spaces from a stockholder, land and office spaces from third parties under three operating leases which expire on September 20, 2023, June 30, 2015 and January 20, 2011 at annual rentals of $183, $19,017 and $20,160, respectively.

As of March 31, 2010, the Company has outstanding commitments with respect to the above operating leases, which are due as follows:

| 2010 | | $ | 39,360 | |

| 2011 | | | 3,448 | |

| 2012 | | | 183 | |

| Thereafter | | | 1,782 | |

| | | $ | 44,773 | |

As of March 31, 2010, the Company had capital commitment totaling $1,440,000 with a contractor to complete the drilling of 6 oil wells.

The Company was recently involved in six purported legal actions, three of which are securities class actions and three of which are shareholder derivative actions, in the U.S. District Court for the Southern District of New York against the Company and certain officers and directors. The three class actions assert claims under the federal securities laws and the three derivative actions assert common law claims based on breach of duty. See Note 14. “Subsequent events”.

NOTE 8 REGISTRATION PAYMENT ARRANGEMENTS

In conjunction with the March 5, 2009 modification of the Company’s secured debenture issued on February 28, 2008 (see Note 5, Secured Debenture, above) and the original issuance of the secured debenture, the Company entered into two Registration Rights Agreements which cover stock to be issued underlying warrants associated with both the modification and the issuance of the secured debenture. These Registration Rights Agreements provide for financial penalties in certain circumstances, including (i) if the registration statement covering the shares of common stock underlying the Original Warrants is not declared effective within 180 days of the date of the Registration Rights Agreement or (ii) after effectiveness, the registration statement ceases to remain continuously effective for more than 10 consecutiv e calendar days or more than 30 calendar days in any 30 calendar day period. The financial penalty equals to 1% of the aggregate purchase price paid for the Original Warrants subject to the registration rights up to a maximum of 10% of the principal amount of the debenture.

The Company analyzes these registration rights agreements to determine if penalties triggered for late filing should be accrued under ASC 825-20 (formerly FSP EITF 00-19-2, “Accounting for Registration Payment Arrangements”). The Company evaluates the potential likelihood of incurring these financial penalties, and the magnitude of the associated costs, on a probabilistic basis, as required under ASC 825-20. For the period ended March 31, 2010, the Company estimates that no financial penalties are likely to be incurred as a result of any of its registration obligations, and therefore no expense has been accrued for anticipated future registration payments.

NOTE 9 STOCK-BASED COMPENSATION

During 2009, the Company granted to its employees 60,000 stock options qualified under the Company’s 2006 Stock Option/Stock Issuance Plan (the “2006 Plan”) to purchase Common Stock. As of March 31, 2010, stock options granted under the 2006 Plan to purchase 470,000 shares of its Common Stock (the “Options”) at an exercise price from $2.94 to $4.50 per share were outstanding. 25% of the 160,000 stock options shall vest upon grant and 25% shall vest every three months thereafter, and these stock options granted shall expire ten years after the grant date if unexercised at that time. 50% of the 310,000 stock options shall vest upon grant and 50% shall vest on the first anniversary of the grant date.

The 2006 Plan authorizes the issuance of up to 2,500,000 common stock equivalents (stock options, restricted stock, stock grants). As of March 31, 2010, the Company had 300,000 remaining share equivalents available for grant under the 2006 Plan. The Company settles employee stock option exercises with newly issued common shares.

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

The fair value of stock options granted was estimated at the date of grant using the Black-Scholes option-pricing model with the following assumptions:

| Expected | Expected | Dividend | Risk Free | Grant Date |

| Life | Volatility | Yield | Interest Rate | Fair Value |

| 5 years | 292% - 316% | 0% | 2.43% - 3.42% | $2.94 to $4.50 |

| - | Dividend Yield: The expected dividend yield is zero. The Company has not paid a dividend and does not anticipate paying dividends in the foreseeable future. |

| - | Risk Free Rate: Risk-free interest rate of 2.43% to 3.42% was used. The risk-free interest rate was based on U.S. Treasury yields with a remaining term that corresponded to the expected term of the option calculated on the grant date. |

| - | Expected Life: Because the Company has no historical share option exercise experience to estimate future exercise patterns, the expected life was determined using the simplified method as these awards meet the definition of "plain-vanilla.”. |

Stock compensation expense is recognized based on awards expected to vest. There was no estimated forfeiture as the Company has a short history of issuing options. ASC 718-10 (formerly FAS No. 123R) requires forfeiture to be estimated at the time of grant and revised in subsequent periods, if necessary, if actual forfeitures differ from those estimates.

On January 28, 2010, 250,000 shares of stock options previously granted to one of the management members were exercised at $4.50 per share, with an aggregate fair value of $1,125,000 paid to the Company.

On March 29, 2010, 400,000 shares of common stock of the Company with fair a value of approximately $3,232,000 were granted to the key management team of Tiancheng, of which the Company recognized $808,000 as staff compensation expenses included in selling, general and administrative expenses for the three months ended March 31, 2010.

As of March 31, 2010, the total compensation cost related to stock options not yet recognized was $2,656,618 and will be recognized over the next three years.

The following is a summary of the stock options activity:

| | | Number of Options Outstanding | | | Weighted- Average Exercise Price | |

| Balance, December 31, 2009 | | | | | | $ | 4.18 | |

| Granted | | | - | | | | - | |

| Forfeited | | | - | | | | - | |

| Exercised | | | (250,000 | ) | | | 4.50 | |

| Balance, March 31, 2010 | | | 100,000 | | | $ | 3.38 | |

The following is a summary of the status of options outstanding at March 31, 2010:

| Exercise Price | | Outstanding Options Number | | Average Remaining Contractual Life | | Average Exercise Price | | Exercisable Options Number | | Weighted Average Exercise Price |

| $4.05 | | 40,000 | | 8.15 years | | $4.05 | | 40,000 | | $4.05 |

| $2.94 | | 60,000 | | 9.15 years | | $2.94 | | 60,000 | | $2.94 |

CHINA NORTH EAST PETROLEUM HOLDINGS LIMITED

AND SUBSIDIARIES

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS AS OF MARCH 31, 2010

(UNAUDITED)

NOTE 10 STOCKHOLDERS’ EQUITY

The Company’s outstanding warrants as of March 31, 2010 is as follows:

| | | Date of issue | | Exercise price | | Outstanding Warrants |

| | | | | | | |

| Warrant 1 | | February 28, 2008 | | $2.35 | | 2,100,000 |

| Warrant 2 | | March 5, 2009 | | $2.00 | | 250,000 |

| Warrant 3 | | March 5, 2009 | | $2.35 | | 250,000 |

| Warrant 4 | | April 29, 2009 | | $2.65 | | 50,000 |

| Warrant 5 | | September 15, 2009 | | $6.00 | | 778,261 |

| Warrant 6 | | September 10, 2009 | | $6.00 | | 160,000 |

| Warrant 7 | | December 11, 2009 | | $8.10 | | 58,910 |

| Warrant 8 | | December 17, 2009 | | $8.10 | | 392,728 |

| | | | | | | 4,039,899 |

The Company treats these warrants as liabilities under ASC 815-40 and accordingly records the warrants at fair value with changes in fair values recorded in profit or loss until such time as the warrants are exercised or expire. The fair values were $39,528,261 at December 31, 2009, and $28,687,343 at March 31, 2010. For the three months ended March 31, 2010 and 2009, the Company recorded gain of $10,840,918 and $653,705 in changes in the fair value of the warrants in earnings.