Filed Pursuant to Rule 424(b)(3)

Registration No. 333-136243

EMPIRE ENERGY CORPORATION INTERNATIONAL

68,327,129

Shares of Common Stock

Par Value $0.001 Per Share

This prospectus relates to the offering by the selling stockholders of Empire Energy Corporation International of up to 68,327,129 shares of our Class A common stock, par value $0.001 per share, including shares issuable to persons holding warrants, a convertible debenture and Series A Convertible Preferred Stock and warrants of Pacific Rim Foods Ltd. We are registering the offer and sale of the common stock, to satisfy registration rights we have granted to the selling stockholders.

We will not receive any proceeds from the sale of common stock. We will receive proceeds from the exercise price of certain warrants and options if they are exercised by the holders. We intend to use any proceeds received from the selling stockholders’ exercise of the warrants for working capital and general corporate purposes.

The selling stockholders have advised us that they will sell the shares of common stock from time to time in the open market, on the OTC Bulletin Board, in privately negotiated transactions or a combination of these methods, at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or otherwise as described under the section of this prospectus titled “Plan of Distribution.”

Our common stock is traded on the OTC Bulletin Board under the symbol “EEGC.” On August 1, 2006 the closing price of the common stock was $0.14 per share.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. We have not authorized anyone to provide you with different information.

Investing in these securities involves significant risks. See “Risk Factors” beginning on page 3.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is September 29, 2006

The information contained in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by Empire Energy Corporation International with the Securities and Exchange Commission. The selling stockholders may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

TABLE OF CONTENTS

i

SUMMARY

The following summary highlights selected information contained in this prospectus. This summary does not contain all the information you should consider before investing in the securities. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements, and the notes to the financial statements.

For purposes of this prospectus, unless otherwise indicated or the context otherwise requires, all references herein to “Empire,” “we,” “us,” and “our,” refer to Empire Energy Corporation International, a Nevada corporation.

Our Company

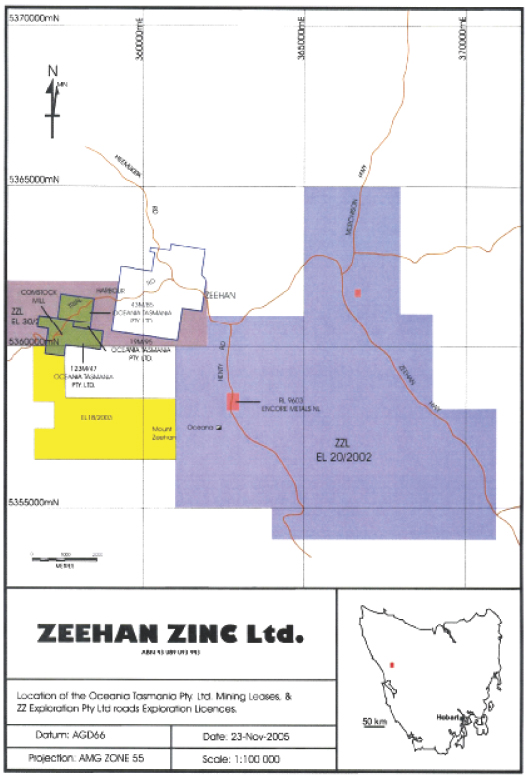

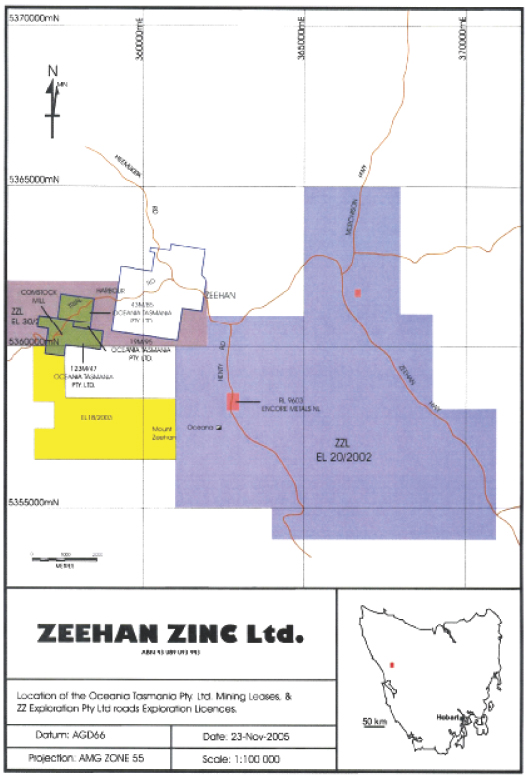

Empire is a reporting company under the Securities Exchange Act of 1934 whose common stock trades on the OTC Bulletin Board under ticker symbol EEGC. The Company is headquartered in Lenexa, Kansas (Kansas City area). Empire is principally a development stage oil and gas exploration company, devoting substantially all of its efforts to exploration and development of sub-surface hydrocarbons (oil and gas) in commercial quantities in Tasmania and raising funds to finance these operations. The company has acquired and currently holds through a wholly owned subsidiary, 13.2% of Zeehan Zinc Ltd. Zeehan Zinc is a zinc, lead and silver company with several mining leases, mining lease applications and exploration licenses near Zeehan, Western Tasmania. Empire has also acquired 51% of Pacific Rim Foods which has interests in the shelf food industry in China. The Company has also obtained the use of a novel technology (the Nanokey Ball Mill), sourced from China and developed in Melbourne, Australia, that potentially enables very efficient and cheap processing of ores and other raw materials.

Empire was incorporated on November 10, 1983 in the state of Utah under the name Medivest, Inc. On May 17, 1999, the stockholders of Medivest approved a change of name from Medivest Inc. to Empire Energy Corporation and Empire commenced commercial activity in the oil and gas industry. In July 2002, Empire entered into an agreement to acquire Great South Land Minerals, Ltd., an oil and gas exploration company in Tasmania, Australia, which it completed on April 15, 2005 by issuing 62,426,782 shares of Class A common stock. To facilitate the merger with Great South Land, Empire:

| | • | | sold all of its assets in exchange for the purchasers’ assumption of Empire’s liabilities; |

| | • | | changed it name from Empire Energy Corporation to Empire Energy Corporation International; |

| | • | | reincorporated in the state of Nevada; |

| | • | | increased the authorized shares of common stock to 300,000,000; and |

| | • | | effected a 1 for 10 reverse stock split. |

On August 31, 2005, the Company agreed to exchange 37,500,000 shares of its Class A Common Stock for shares of the privately held British Virgin Islands company Cyber Finance Group Limited whose sole asset was 37.5% of the then-issued and outstanding shares of Zeehan Zinc. The mechanics of the exchange were completed on November 14, 2005. Mr. Malcolm Bendall, a director, former president and chief executive officer and substantial shareholder of Empire, is also a director of and a substantial shareholder of Zeehan Zinc.

At present, the Company’s principal assets are the mineral leases and exploration licenses held indirectly through its wholly-owned subsidiary Great South Land and the interest it holds in Zeehan Zinc.

This prospectus

We have undertaken several transactions the result of which has been the issuance of shares that have restrictions on their transferability. In order to provide those investors with liquidity for their shares, we are filing

1

with the SEC this prospectus as part of a registration statement to register those securities. We are also registering the resale of shares of Class A common stock to be issued to persons who exercise Class A or Class B warrants. We will not receive any proceeds from any sales of these shares but may receive the exercise price from warrant holders electing to exercise their warrants to acquire common stock at a set price. Any funds we receive upon exercise of warrants would be used for general corporate purposes.

THE OFFERING

Common stock currently outstanding | 195,958,389 shares |

Common stock offered by the selling stockholders | 68,327,129 shares |

Common stock outstanding after the offering(1) | 219,224,486 shares |

Use of proceeds | We will not receive any proceeds from the sale of common stock offered by this prospectus except proceeds from the exercise of options or warrants, if any. |

OTC Bulletin Board symbol | EEGC |

| (1) | Assumes the full exercise of all warrants and options as well as the conversion of the full principal of the convertible debenture. |

2

RISK FACTORS

You should carefully consider the following risk factors, together with the information contained in this prospectus, any reports we file with the SEC and the documents referred to herein. You should also be aware that the risks described below may not be the only risks relevant to your determination. Instead, these are the risks that we believe most material to your decision.

Risks related to our oil and gas business

We may not be able to meet our substantial capital requirements.

Our business is capital intensive. We must invest a significant amount in development and exploration activities. We are currently making and will continue to make substantial capital expenditures to find, develop and produce natural gas and oil reserves. If our capital resources diminish as a result of operating difficulties, we may not be able to meet the exploration expenditure requirements of our petroleum license – thus voiding the license. The license is our single most important asset and its loss would result in a substantial decrease in our ability to eventually become a profit-generating company.

We may not be able to obtain debt or equity financing to meet our capital requirements. Even if we acquire sufficient financing to meet the license expenditure requirements, we may not be able to obtain the capital necessary to undertake or complete future drilling programs or acquisition opportunities unless we raise additional funds through debt or equity financings. Moreover, our future cash flow from operations may not be sufficient for continued exploration, development or acquisition activities, and we may not be able to obtain the necessary funds from other sources.

We anticipate future losses and negative cash flow.

Great South Land has experienced negative cash flow since its inception. Since the merger, we have continued Great South Land’s operations in Tasmania in the same fashion that Great South Land did. We are strictly in the exploration phase and have no proven petroleum reserves. We will continue to incur significant expenses over the next several years with our operations, including further seismic studies and exploratory drilling. Based on the exploration results to date, we anticipate that the cost per commercial well, if further results justify attempts at commercial drilling, would be no less than $1.5 million each and an additional $2,500,000 to complete an exploratory well to make it a producing well.

Drilling partners may require participation interests which could decrease future profitability.

The pace of exploration and the level of operations will be determined by the amount of funding made available to us. If funding is limited, exploration could continue under agreements that provide drilling partners with a participation interest in a particular property we own. Under this type of arrangement, a drilling partner would invest in specific property and receive a negotiated interest in that property. This could reduce the potential profitability of the remaining interest in the property and reduce our ability to control and manage the property.

The success of our business depends upon our ability to find, develop and acquire oil and gas reserves.

Based on our previous testing of the area, we expect to find certain reserves of gas and oil that can be profitably exploited within our licensed area SEL 13/98 and the area encompassed within our application SEL 3/2006. There is, however, no guarantee that we will find reserves that we can economically produce. Future drilling activities will subject us to many risks, including the risk that we will not find commercially productive reservoirs. Drilling for oil and natural gas can be unprofitable, not only as a result of dry holes, but from productive wells that do not produce sufficient oil to return a profit. Also, title problems, weather conditions,

3

governmental requirements and shortages or delays in the delivery of equipment and services can delay our drilling operations or result in their cancellation. The cost of drilling, completing and operating wells is often uncertain, and not all wells produce oil and gas. As a result, we may not recover all or any portion of our investment. Moreover, if natural gas and oil prices decline, the amount of natural gas and oil we can economically produce may be reduced, which may result in a material decline in our revenues and our reserves if we are ever able to establish reserves.

Estimates of oil and natural gas reserves that we make may be inaccurate.

The process of estimating oil and gas reserves is complex, and will require us to use significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each property. As a result, our reserve estimates, if any, will be inherently imprecise. If actual production results vary substantially from our reserve estimates or oil and gas prices drop, this could result in the impairment of our oil and natural gas interests.

Drilling new wells could result in new liabilities, which could endanger our interests in our properties and assets.

There are risks associated with the drilling of oil and natural gas wells, including encountering unexpected formations or pressures, premature declines of reservoirs, blow-outs, craterings, sour gas releases, fires and spills. The occurrence of any of these events could significantly increase our costs and cause substantial losses, impairing our future operating results. We may become subject to liability for pollution, blow-outs or other hazards. We will obtain insurance with respect to these hazards, but such insurance has limitations on liability that may not be sufficient to cover the full extent of such liabilities. The payment of such liabilities could reduce the funds available to us or could, in an extreme case, result in a total loss of our properties and assets. Moreover, we may not be able to maintain adequate insurance in the future at rates that are considered reasonable.

Abandonment expenses are difficult to estimate and may be substantial; unplanned costs could divert resources from other projects.

We may become responsible for costs associated with abandoning and reclaiming wells, facilities and pipelines which we use for production of oil and gas reserves. We have not yet determined whether we will establish a cash reserve account for these potential costs in respect of any of our current properties or facilities, or if we will satisfy such costs of abandonment from the proceeds of production in accordance with the practice generally employed in onshore oilfield operations. If abandonment is required before economic depletion of our properties or if our estimates of the costs of abandonment exceed the value of the reserves remaining at any particular time to cover such abandonment costs, we may have to draw on funds from other sources to satisfy such costs. The use of other funds to satisfy such abandonment costs could impair our ability to focus capital investment in other areas of our business.

Increases in our operating expenses will impact our operating results and financial condition.

Exploration, development, production, marketing (including distribution costs) and regulatory compliance costs (including taxes) will substantially impact the net revenues we derive from the oil and gas that we produce. While we believe we have access to a pipeline to deliver production to mainland Australia, there can be no guarantee this will remain the case and we could be forced to rely on more expensive cargo shipping to market our production. These costs are subject to fluctuations and variation in different locales in which we will operate, and we may not be able to predict or control these costs. If these costs exceed our expectations, this may adversely affect our results of operations. In addition, we may not be able to earn net revenue at our predicted levels, which may impact our ability to satisfy our obligations.

4

Penalties we may incur could impair our business.

Failure to comply with government regulations could subject us to civil and criminal penalties, could require us to forfeit property rights, and may affect the value of our assets. We may also be required to take corrective actions, such as installing additional equipment or taking other actions, each of which could require us to make substantial capital expenditures. We could also be required to indemnify our employees in connection with any expenses or liabilities that they may incur individually in connection with regulatory action against them. As a result, our future business prospects could deteriorate due to regulatory constraints, and our profitability could be impaired by our obligation to provide such indemnification to our employees.

A decline in natural gas and oil prices will adversely affect our financial results.

As a concern proposing to generate income from the exploitation of possible Tasmanian hydrocarbon reserves, any revenues we generate from those future operations would be highly dependent on the price of, and demand for, natural gas and oil. Even relatively modest changes in oil and natural gas prices may significantly change those revenues, our results of operations and our cash flows. Historically, the markets for natural gas and oil have been volatile and this volatility is likely to continue in the future. Prices for natural gas and oil may fluctuate widely in response to relatively minor changes in the supply of and demand for natural gas and oil, market uncertainty and a variety of additional factors that are beyond our control, such as:

| | • | | the price of foreign imports; |

| | • | | overall domestic and global economic conditions; |

| | • | | political and economic conditions or hostilities in oil producing regions, including the Middle East and South America; |

| | • | | the ability of the members of the Organization of Petroleum Exporting Countries to agree to and maintain oil price and production controls; |

| | • | | domestic and foreign governmental regulations; |

| | • | | development of alternate technologies; and |

| | • | | the price and availability of alternative fuels. |

Competitive industry conditions may adversely affect our results of operations.

As a prospective independent natural gas and oil producer, we face strong competition in all aspects of our business. Many of our competitors are large, well-established companies that have substantially larger operating staffs and greater capital resources than we do. These companies may be able to pay more for productive natural gas and oil properties and exploratory prospects and to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial and human resources permit. Additionally, our larger competitors may find it easier to line up less expensive drilling arrangements than we can due to prior working arrangements. This could result in a competitive disadvantage in our cost of production.

We may incur substantial costs to comply with environmental and other governmental regulations.

Our exploration and production operations are regulated extensively. We have made and will continue to make all necessary expenditures, both financial and managerial, to comply with the requirements of environmental and governmental regulations. Increasingly strict environmental laws, regulations and enforcement policies and claims for damages to property, employees, other persons and the environment resulting from our operations could result in substantial costs and liabilities in the future.

5

Foreign currency exchange rate fluctuations may negatively affect our financial results.

We expect to sell our oil and natural gas production under agreements that will be denominated in the currency of the importing purchaser. Many of the operational and other expenses we incur will be paid in Australian dollars. As a result, fluctuations in the currencies of the importing purchaser against the Australian dollar could result in unanticipated and material fluctuations in our financial results. Local operations may require funding that exceeds operating cash flow and there may be restrictions on expatriating proceeds and/or adverse tax consequences associated with such funding.

Business Risks

We inadvertently violated Australian securities laws, possibly exposing us to civil and/or criminal liability.

When we initially acquired our stake in Zeehan Zinc Limited, as described in“Management’s Plan of Operation – Overview” below, we indirectly acquired what is termed a “relevant interest” under Section 606(1) of the Australian Corporations Act. On January 11, 2006, we received a notice from the Australian Securities & Investments Commission, notifying us that our acquisition violated Section 606(1) of the Corporations Act by acquiring in excess of 20% of the voting power of an unlisted company with more than 50 shareholders, without having an available exception. ASIC further notified us that remedies include:

| | • | | Referral to the Takeovers Panel – The panel is the main forum for resolving matters arising under Chapters 6-6C of the Corporations Act, including takeover disputes. ASIC may make an application for a declaration of unacceptable circumstances under Section 657A of the Corporations Act and the panel may in turn, make any order that it thinks appropriate, including an order to protect the rights or interests of any person affected by the unacceptable circumstances. |

| | • | | Civil remedies – ASIC may apply under Section 1325A of the Corporations Act for an order of the court which may require that a person dispose of their securities or be restrained from exercising voting rights. |

| | • | | Criminal sanctions – The penalty for a contravention of Section 606 of the Corporations Act is a fine, imprisonment or both. |

While we are cooperating with the Australian Securities and Investments Commission, it is unclear how they intend to proceed and what, if any, remedy they may recommend.

We may not be able to effectively manage our growth, which may harm our profitability.

Our strategy presumes business expansion. If we fail to effectively manage our growth, our financial results could be adversely affected. Growth may place a strain on our management systems and resources. We must continue to refine and expand our business development capabilities, our systems and processes and our access to financing sources. As we grow, we must continue to hire, train, supervise and manage new employees. We cannot assure you that we will be able to:

| | • | | expand our systems effectively or efficiently or in a timely manner; |

| | • | | allocate our human resources optimally; |

| | • | | identify and hire qualified employees or retain valued employees; or |

| | • | | incorporate effectively the components of any business that we may acquire in our effort to achieve growth. |

If we are unable to manage our growth, our operations and our financial results could be adversely affected which could diminish our chance of becoming profitable.

6

Our business may suffer if we do not attract and retain talented personnel.

Our success will depend in large measure on the abilities, expertise, judgment, discretion integrity and good faith of our management and other personnel in conducting our business. We have a small management team consisting of Malcolm R. Bendall, our President, Chief Executive Officer, and Chief Financial Officer, and John C. Garrison, our Secretary. The loss of either of these individuals or our staff in Tasmania or our inability to attract suitably qualified staff could materially adversely impact our business.

Our management team does not have extensive experience in public company matters, which could impair our ability to comply with legal and regulatory requirements.

Our management team has had limited U.S. public company management experience or responsibilities, which could impair our ability to comply with legal and regulatory requirements, such as the Sarbanes-Oxley Act of 2002 and applicable federal securities laws including filing on a timely basis required reports and other required information. Our management may not be able to implement and affect programs and policies in an effective and timely manner that adequately respond to increased legal or regulatory compliance and reporting requirements imposed by such laws and regulations. Our failure to comply with such laws and regulations could lead to the imposition of fines and penalties and further result in the deterioration of our business.

Integration of newly acquired businesses may increase costs and pull management attention away from our core business.

Our principal business is the exploration and extraction of petroleum and natural gas resources in our license areas in Tasmania. We have recently acquired a sizable interest in a lead, silver and zinc mining company in the area as well as a company owning interests in certain Chinese shelf food operations. There is a risk that the attention required to develop these other businesses may prevent us from pursuing every opportunity to develop our oil and gas program in the most efficient manner.

Market Risks

Our investment in Zeehan Zinc could require us to register under the Investment Company Act.

The Investment Company Act of 1940 regulates mutual funds and other collective investment funds defined as “investment companies” under the statute. One of the definitions includes any company 40% of more of whose assets are made up of securities of issuers in which the Company owns less than 50% of the voting securities. On September 7, 2005 we agreed to acquire, and on November 6, 2005 we closed the purchase of, Cyber Finance Group, Ltd., whose sole asset is a minority stake in Zeehan Zinc. We currently believe the present value of this investment represents less than 40% of our total assets as calculated in compliance with SEC rules under the Investment Company Act. If in the future the value of the Zeehan Zinc investment plus any other holdings of investment securities we may have at that time exceeds 40% of our total assets, calculated as required by the Act, we could be required to register as an investment company under the Act. We believe registration under and compliance with the Investment Company Act would prevent the ongoing effective operation of the Company.

The trading price of our common stock may be volatile.

Our common stock trades on the OTC Bulletin Board. The OTC Bulletin Board is not an exchange. Trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on an exchange or NASDAQ. You may have difficulty reselling any of the shares that you purchase from the selling shareholders. We are not certain that a more active trading market in our common stock will develop, or if such a market develops, that it will be sustained. Sales of a significant number of shares of our common stock in the public market could result in a decline in the market price of our common stock, particularly in light of the illiquidity and low trading volume in our common stock.

7

This situation has been exacerbated by the fact that the company has been involuntarily registered on the Berlin Stock Exchange which makes the company shares susceptible to sale by parties not in physical possession of stock (naked shorts). These transactions can have both short and long term effects on the company share price and can introduce extreme, random and irrational volatility into the marketplace. Attempts by Empire to remove the listing to date have failed.

The trading price of our common stock may not reflect its value.

The trading price of our common stock has, from time to time, fluctuated widely and in the future may be subject to similar fluctuations. The trading price may be affected by a number of factors including the risk factors set forth herein, as well as our operating results, financial condition, general conditions in the oil and gas exploration and development industry, market demand for our common stock, various other events or factors both in and out of our control. In addition, the sale of our common stock into the public market upon the effectiveness of this registration statement could put downward pressure on the trading price of our common stock. In recent years, broad stock market indices, in general, and smaller capitalization companies, in particular, have experienced substantial price fluctuations. In a volatile market, we may experience wide fluctuations in the market price of our common stock. These fluctuations may have a negative effect on the market price of our common stock.

We do not expect to pay dividends in the foreseeable future.

We do not intend to declare dividends for the foreseeable future, as we anticipate that we will reinvest any future earnings in the development and growth of our business. Therefore, investors will not receive any funds unless they sell their common stock, and stockholders may be unable to sell their shares on favorable terms or at all. Investors cannot be assured that they will receive a positive return on investment or that they will not lose the entire amount of their investment in our common stock.

Applicable SEC rules governing the trading of “penny stocks” limit the liquidity of our common stock, which may affect the trading price of our common stock.

Our common stock currently trades on the OTC Bulletin Board. Since our common stock continues to trade well below $5.00 per share, our common stock is considered a “penny stock” and is subject to SEC rules and regulations that impose limitations upon the manner in which our shares can be publicly traded. These regulations require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the associated risks. Under these regulations, certain brokers who recommend such securities to persons other than established customers or certain accredited investors must make a special written suitability determination for the purchaser and receive the written purchaser’s agreement to a transaction prior to purchase. These regulations have the effect of limiting the trading activity of our common stock and reducing the liquidity of an investment in our common stock.

8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”). This prospectus includes statements regarding our plans, goals, strategies, intent, beliefs or current expectations. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished. These forward looking statements can be identified by the use of terms and phrases such as “believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect,” and the like, and/or future-tense or conditional constructions “may,” “could,” “should,” etc. Items contemplating or making assumptions about, actual or potential future sales, market size, collaborations, and trends or operating results also constitute such forward-looking statements.

Although forward-looking statements in this report reflect the good faith judgment of our management, forward-looking statements are inherently subject to known and unknown risks, business, economic and other risks and uncertainties that may cause actual results to be materially different from those discussed in these forward-looking statements. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this report. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this report, other than as may be required by applicable law or regulation. Readers are urged to carefully review and consider the various disclosures made by us in our reports filed with the Securities and Exchange Commission which attempt to advise interested parties of the risks and factors that may affect our business, financial condition, results of operation and cash flows. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected.We will have little likelihood of long-term success unless we are able to continue to raise capital from the sale of our securities until, if ever, we generate positive cash flow from operations.

USE OF PROCEEDS

This prospectus relates to the resale of certain shares of our Class A common stock that may be offered and sold from time to time by the selling stockholders. This prospectus also relates to shares of our Class A common stock to be issued to persons who exercise warrants. We will not receive any proceeds from the sale of shares of common stock in this offering. However, we will receive proceeds from the exercise of any warrants or options and we will use any such proceeds for general working capital purposes.

DETERMINATION OF OFFERING PRICE

The selling stockholders will determine at what price they may sell the offered shares, and such sales may be made at prevailing market prices, or at privately negotiated prices.

MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the Over-the-Counter Bulletin Board under the symbol “EEGC”.

As of June 30, 2006, we had 195,958,389 shares of our Class A common stock outstanding held by approximately 1,378 shareholders of record and 102,314 shares of our Class B common stock outstanding, held by approximately 471 shareholders of record. Some of the 195,958,389 shares were issued in transactions exempt from registration and are being registered with this prospectus.

9

The following table sets forth the range of high and low closing bid quotations for our common stock since our common stock was listed on the Over-the-Counter Bulletin Board. The quotations represent inter-dealer prices without retail markup, markdown or commission, and may not necessarily represent actual transactions.

| | | | | | |

Period Ended | | High | | Low |

March 31, 2004 | | $ | 1.40 | | $ | 0.80 |

June 30, 2004 | | $ | 1.45 | | $ | 0.85 |

September 30, 2004 | | $ | 0.99 | | $ | 0.42 |

December 31, 2004 | | $ | 0.63 | | $ | 0.21 |

March 31, 2005 | | $ | 0.82 | | $ | 0.25 |

June 30, 2005 | | $ | 0.56 | | $ | 0.22 |

September 30, 2005 | | $ | 0.20 | | $ | 0.12 |

December 31, 2005 | | $ | 0.20 | | $ | 0.11 |

March 31, 2006 | | $ | 0.18 | | $ | 0.11 |

June 30, 2006 | | $ | 0.30 | | $ | 0.14 |

At August 1, 2006, the bid price of the Company’s Class A common stock was $0.14.

The Company has not paid any dividends on its common stock and the board of directors presently intends to continue a policy of retaining earnings, if any, for use in the Company’s operations and to finance expansion of its business. The declaration and payment of dividends in the future, of which there can be no assurance, will be determined by the board of directors in light of conditions then existing, including earnings, financial condition, capital requirements and other factors. There are no restrictions that currently materially limit the Company’s ability to pay dividends or which the Company reasonably believes are likely to limit materially the future payment of dividends on common stock.

The Securities and Exchange Commission has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, deliver a standardized risk disclosure document prepared by the Commission, which: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker’s or dealer’s duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of Securities’ laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form as the Commission shall require by rule or regulation. The broker-dealer also must provide to the customer, prior to effecting any transaction in a penny stock, (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) monthly account statements showing the market value of each penny stock held in the customer’s account. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitably statement.

These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our stock if it becomes subject to these penny stock rules. Therefore, if our common stock becomes subject to the penny stock rules, stockholders may have difficulty selling those securities.

10

MANAGEMENT’S PLAN OF OPERATION

Overview

We are a development stage oil and gas exploration company, devoting substantially all of our efforts to raising funding to support our exploration and development of sub-surface hydrocarbons in commercial quantities in Tasmania, Australia. We presently possess 13.2% of the outstanding shares of Zeehan Zinc Limited, a zinc, lead and silver mining company located near our license area in Tasmania. We have also recently acquired a 51% interest in Pacific Rim Foods Ltd., a Mauritius-based entity with interests in the Chinese shelf foods industry. In May 2006, we acquired Expedia International Limited, a company incorporated in the British Virgin Islands that has entered into a joint venture with Batego Limited, a Hong Kong corporation, for the development and exploitation of certain intellectual property held by Batego.

Our principal business is the exploration for petroleum/natural gas in Tasmania, Australia through our wholly-owned subsidiary and operating company, Great South Land Minerals Ltd, which we acquired pursuant to a share exchange finalized in April of 2005. Great South Land operates pursuant to a license issued by the Tasmanian Minister for Infrastructure, Energy and Resources which license is subject to minimum expenditures over its term and is, at the Minister’s discretion, subject to forfeiture for failure to complete the necessary infrastructure expenditures. We are currently in the midst of completing an 1,150 kilometer line of 2D seismic over the license premises at an expense of approximately AUD $6 million which we believe will satisfy our current required expenditures. While this 2D seismic work was to be completed in 2005, as a result of the unavailability of required seismic equipment, the project commenced during the second quarter of 2006 and is expected to be completed prior to the end of the first quarter of 2007. We have received sufficient results for us to apply with the regulator for permission to commence exploratory drilling at five sites within the licensed area prior to the end of 2006, beginning with Lachish #1 which has already received approval. Each well is expected to cost approximately $1.5 million and, if in our judgment, we discover adequate producible reserves of oil and gas, we will need to expend an additional $2.5 million to complete each well. As a result of this expense, it is likely that we will enter into a joint venture type of arrangement with a driller/operator in accordance with normal industry practice.

We acquired our interest in Cyber Finance Group Limited, a privately-held Hong Kong entity, in an exchange offer whereby we issued 37.5 million shares of our common stock, representing 33% of our then issued and outstanding common stock, in exchange for all outstanding ownership interests of Cyber. At the time of Empire’s acquisition of Cyber, that company held approximately 12,745,407 ordinary shares (37.5%) in Zeehan Zinc, an unlisted Australian registered company with a total issued share capital of approximately 33,986,863 ordinary shares at the date of the transaction. Since the date of transaction, Zeehan Zinc has issued additional ordinary shares and Cyber has reduced its holding to 7,445,407 ordinary shares, decreasing Cyber’s relative shareholding to 13.2% of the total issued and outstanding Zeehan Zinc shares. Empire reduced Cyber’s shareholding in Zeehan Zinc pursuant to an agreement with Batego to enter into the development of new technology relating to innovative mining treatment methods, as described below.

We see the application of new technologies to the Zeehan mine as an important initiative in the push for a reduction in mining costs and possibly as a significant driver for increased revenue by potentially being able to extract all the metals from the mining stream with no waste and without the attendant costs of waste disposal. Expedia International, a fully-owned subsidiary company of Empire has therefore been created to hold the world marketing rights for innovative and novel technologies that Batego Limited, an independent company with whom Empire has negotiated exclusivity arrangements, has developed. We have, through Expedia International, secured a license for the exclusive world marketing rights of the intellectual property of Batego, (excluding some minor third party rights), in exchange for the transfer of 15,000,000 shares of our Class A common stock, and 5,000,000 ordinary shares of Zeehan Zinc from Cyber to Batego. Third party rights include exclusive rights for exploitation of the nanokey ball mill in the gold mining industry globally and a non-exclusive license to use the nanokey ball mill to manufacture polymers from the non-ore remainder at mines.

One of the projects to facilitate cost reductions at the Zeehan mine is the full implementation of the nanokey ball mill technology which we believe will enhance cost-effective crushing of ores and will facilitate extraction

11

of metals without the usual and associated environmental discharges associated with customary production practices. The nanokey ball mill utilizes kinetic energy, electricity and ultrasonics to process a wide range of granular materials down to sub-micron-sized particles and facilitates mass/chemical reactions requiring high pressures and temperatures. The mill accomplishes this through a combination of ultrasonic energy, rapid energy dissipation, and applied voltages of selected frequency and waveform, resulting in what we expect to be a substantial reduction in capital requirements and operating crushing costs for granular material compared with that of conventional mechanical ball and rod mills. We believe that if we are successful in using the nanokey ball mill technology at Zeehan Zinc, that we will be able to sell this licensed technology throughout the mining industry and create a second profit center for Empire.

Expedia International is currently planning to introduce the nanokey ball mill into Zeehan Zinc to improve the cost-effectiveness of that operation, with the terms of use well-defined in the agreement between Batego and Expedia International and financial risk limited to the initial development investment. Expedia International is also actively pursuing wider applications with trials planned or currently under testing to determine the applicability of the science to other industrial applications. Tests are currently underway to verify the results from Zeehan Zinc ores in an experimental pilot plant, and commissioning of a commercial unit is anticipated in the first quarter of 2007.

On March 21, 2006, pursuant to a subscription agreement with RAB Special Situations (Master) Fund Limited, a British investment fund, we issued 17,100,000 shares of our Class A Common Stock, together with warrants entitling the holder to acquire an additional 8,550,000 shares, in exchange for $1,881,000, which we are using for general corporate purposes. The warrants are exercisable at a price of $0.13 over an exercise period of three years. We covenanted in the subscription agreement to register the issued shares as well as the shares underlying the warrants. On the same date, we sold $1.5 million of our 6% convertible debenture and a Class B Warrant offering up to 5 million shares exercisable at $.15 per share for 3 years. The convertible debenture matures on March 14, 2008, pays interest in arrears semi-annually, is convertible at the holder’s discretion and has an initial conversion price of $0.18 per share. RAB Special Situations also purchase this offering. RAB Special Situations (Master) Fund Limited represented itself as a non U.S. person. Libertas Capital, a U.K. investment banking firm, acted as our financial adviser in exchange for 4,065,000 shares of our Class A common stock (equal to 10% of the RAB shares issuable) as their fees for those services. We relied on Regulation S as the exemption from registration as the offering was conducted entirely overseas and the investor is a non-U.S. person. The convertible debenture and both of the warrants have restrictions on transferability in compliance with U.S. securities laws.

Our twelve-month plan of operation

We currently have four wholly-owned subsidiaries, Great South Land, Cyber, Bob Owen & Co., and Expedia International and own 51% of Pacific Rim Foods, Ltd. Great South Land undertakes all of our Tasmanian operations. Cyber holds a 13.2% stake in Zeehan Zinc Ltd. Although we have a letter of intent with the board of directors of Zeehan Zinc to acquire the balance of the Company, as discussed in detail above, we now expect the Zeehan Zinc acquisition not to be commercially feasible. Bob Owen & Co. is not actively conducting business. Expedia International is a company incorporated under the laws of the British Virgin Islands and was acquired to act as our joint venture counter-party with Batego Limited in developing and exploiting intellectual property owned by Batego. Pacific Rim Foods, Ltd. has interests in the Chinese shelf stable foods industry.

Great South Land’s principal asset presently is its tenement in Tasmania, SEL 13/98. The terms of the Great South Land lease SEL 13/98 set by Mineral Resources Tasmania, the local authority under the Department of Industry, Energy and Resources of Tasmania, require the Company to expend no less than AUD $17,200,000 on exploration and development in scheduled increments over five years. As discussed more fully below, we have recently received proceeds from a financing of $3.4 million that funded the initial AUD $2 million prepayment made to Terrex Seismic and we are currently negotiating to acquire further funding to cover the balance of the

12

survey costs. This investment complies with the majority of our expenditure obligations for the second quarter of 2006, but our expenditures are still less than those required under the terms of the license. We have successfully completed 150km of 2D Seismic that has defined the Southern portion of the Bellevue Dome and discovered a new structure which we have named the Thunderbolt Anticline. We believe these structures are over 1000 sq km in area and have the potential to contain substantial oil and gas reserves.

During the first quarter of 2006, we raised in private offerings approximately $3.4 million by issuing shares of common stock, Class A and Class B warrants and a convertible debenture in the amount of $1.5 million. Proceeds were used to repay a short-term promissory note in the amount of $1 million without interest, make a substantial deposit on the seismic surveys to be performed by Terrex in SEL 13/98, purchase certain inventory for our Pacific Rim Foods subsidiary, extend a loan to Zeehan Zinc and for other general corporate purposes. We will need approximately an additional AUD $4.5 million for Terrex to complete the seismic survey, which will be payable early in the third quarter of this year. Once Terrex completes the survey, it is our intent to commence drilling our first exploratory well at Lachish No. 1, assuming the seismic survey confirms our geologic information. The Company intends on calling on M&R Associates (Primeline) to engage in a joint venture with respect to two locations that they have chosen to drill on within their joint venture area, and have also commenced negotiations with certain contacts based in China for additional exploration joint venture partners which joint ventures we believe may be consummated before the end of the third quarter. We expect the seismic survey to continue through the first quarter of 2007 and our drilling campaign will trail the Stage 1 seismic, which has now been completed. We hope to drill five additional pre-collar holes during the third quarter of 2006, if we have sufficient funds to do so.

With respect to our Pacific Rim Foods Ltd. subsidiary, we acquired our 51% interest in this entity in consideration of issuing 9,000,000 shares of our common stock to Pacific Rim Foods Ltd. Pacific Rim is controlled by Mr. Tad Ballantyne, a director of Empire, who has been principally engaged in the food processing industry for a substantial part of his career. Mr. Ballantyne has substantial contacts in China and has negotiated on behalf of Pacific Rim (1) the acquisition of the brand name “Jimei,” subject to certain terms and conditions of a Transfer Agreement; (2) the purchase of canned inventory, subject to Inventory Purchase Agreements; (3) a contract to acquire a 49% interest in Jilin Jimei Foods Ltd. with its canning facilities located in Jilin Province, subject only to Pacific Rim approval of a balance sheet audit which is to be received by the end of June 2007; and (4) a two-year lease of a canning facility and of agricultural acreage in Liaoning Province. These activities were completed using the $300,000 advance from Empire Energy made to Pacific Rim in March 2006 and proceeds from sales of Pacific Rim convertible preferred stock.

During the third and fourth quarters of 2006, Pacific Rim expects to (1) acquire majority control of Jilin Jimei Foods Ltd.; (2) make additional inventory purchase agreement advances to complete 2006 inventory production; (3) identify additional potential facility acquisition targets consistent with Pacific Rim’s goal capacity of eight facilities and commence initial acquisition discussions with identified targets; and (4) consider a listing on the AIM Market in London. To accomplish these goals, Pacific Rim will need to raise approximately $1,000,000 through either debt or equity raises of which $470,000 was raised in an offering of convertible preferred shares and about $300,000 from a second offering of convertible preferred shares. Conversion of these preferred shares or exercise of attached warrants will be fulfilled from Empire Energy shares issued to and held in escrow by Pacific Rim. As a result of Pacific Rim’s early success at raising working capital, we do not believe Pacific Rim Foods needs any additional funds from Empire Energy prior to becoming fully operational.

Zeehan Zinc has entered into a letter of understanding with Libertas Capital, a London-based investment banking firm, to assist it in financing the opening of the mining operations and infrastructure necessary to commence operations on these tenements. Libertas Capital has also agreed to consider floating up to 40% of Zeehan Zinc on the London Exchange Alternative Investment Market. During the balance of this year Zeehan Zinc expects to raise and expend approximately $25 million for infrastructure, completing the gravity plant, upgrading the crushing mill, building access roads, completing environmental planning and design for the access roads, and the design and planning of a tailings dam and test pits as well as increasing staff by approximately

13

thirty. The majority of these funds are expected to come from the capital-raising efforts being negotiated by Libertas Capital. Zeehan Zinc believes it has also concluded negotiations with RAB Special Situations (Master) Fund Ltd. in August 2006 to obtain funds necessary to purchase the bonds required by its mining licenses. During the third quarter of 2006, we expect to be able to finish the gravity plant and mill upgrade, to complete planning for the installation of a floatation plant and finish our exploratory drilling program and gravity surveys necessary pursuant to our lease obligations to the Department of Industry, Energy and Resources of Tasmania.

We intend in the first quarter of 2007 to set up a nanokey ball mill which will be used to liquefy the ore extracted from the mines which is a more environmentally friendly method of separating valuable metals from ore and also permits the manufacture of building materials from the residual materials. During the first quarter 2007, we intend on setting up the initial trial of the nanokey ball mill. During that same quarter, we expect Zeehan Zinc to commence mining operations through open pit mine developments. At the present time, management of Zeehan Zinc believes that it should be able to commence production of ore concentrates for shipment to a smelter in the second quarter of 2007, although, Zeehan Zinc does not expect to generate revenue until the second quarter of 2007.

During the second quarter of 2006, a subsidiary of Empire, Expedia International, entered into a joint venture agreement whereby it will have a substantial operating role in developing and exploiting an exclusive license held by the joint venture for the nanokey ball mill technology. While this technology is currently being developed for use on Zeehan Zinc properties, management believes it has several other significant markets which we plan to develop commencing in approximately the last quarter of 2006. These technologies include the building materials discussed above, as well as production of ink products.

Liquidity and future capital requirements

On June 30, 2006, the Company had $368,060 in cash, $271,444 in prepayments of exploration costs, $160,709 in receivables and $3,623,587 in current liabilities. The liabilities include approximately $500,000 in convertible debentures and the remainder substantially in trade payables and accrued expenses. Net cash used in operating activities for the six months ended June 30, 2006 was $2,372,425 compared to $328,923 for the six months ended June 30, 2005. Cash used in investing activities during the six months ended June 30, 2006 was $1,130,702 loaned to Zeehan or invested in China. No cash was used in investing activities for the six months ended June 30, 2005. Net cash provided by financing activities was $1,500,000 from sale of convertible debentures and $1,881,000 from sale of common stock and $460,000 from the sale of preferred stock in our subsidiary during the six months ended June 30, 2006. Net cash of $259,429 was provided by financing activities during the three months ended June 30, 2005. Additional financing will be needed to develop the license property and pursue the company’s business plan.

Results of operations

Since the inception of our current business plan following our merger with Great South Land in 2005, our operations have consisted primarily of various start-up activities relating to our current business, including seeking institutional investors, locating joint venture partners, engaging firms to conduct seismic surveys in order to comply with leasehold conditions, incurring strategic investments and developing our long term business strategies.

During the six months ended June 30, 2006, the combined Company generated no revenue. The combined Company generated a loss of $5,676,225 by incurring general & administrative expenses of $2,207,119, primarily legal, accounting, auditing and consulting expenses required to maintain the corporate existence and incurred $1,567,142 to pursue the Great South Land exploration activities and Zeehan Zinc development activities. During the quarter ended June 30, 2005, the Company (then Great South Land alone) also generated no revenue. The Company generated a loss of $990,365 primarily by incurring $814,572 from general and administrative expenses while pursuing the merger of Great South Land and Empire.

14

Critical accounting policies

The preparation of financial statements in conformity with Generally Accepted Accounting Principles in the United States requires management to use judgment in making estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of contingent assets and liabilities and the reported amounts of revenue and expenses. The following accounting policies are based on, among other things, judgments and assumptions made by management that include inherent risks and uncertainties. Management’s estimates are based on the relevant information available at the end of each period.

Principles of Consolidation: The consolidated financial statements include the accounts of Empire (the “Parent” entity) and its wholly owned or controlled subsidiaries. All significant inter-company balances and transactions have been eliminated on consolidation.

Equity Investment: In November 2005, Empire acquired a British Virgin Islands Company, Cyber Finance Group Limited in exchange for 37.5 million shares of newly issued Empire common stock. The sole asset of Cyber at that time was an investment of 12,745,407 shares of common stock in Zeehan Zinc, then representing approximately 37.5% of the total outstanding shares of Zeehan Zinc. This investment was accounted for using the equity method. Under this method the investment is recorded at cost on a single line on the balance sheet when the investment is made and the Company records its proportional share of the results of operations on a single line on the statement of operations.

Going Concern and Liquidity: Empire is in the development stage, devoting substantially all of its efforts to exploration and raising financing. Empire has substantially funded its operations with proceeds from the issuance of common stock. In the course of its exploration activities, Empire has sustained operating losses and expects such losses to continue for the foreseeable future. Empire will finance its operations primarily through cash and cash equivalents on hand, future financing from the issuance of debt or equity instruments and generation of revenues once commercial operations get underway. However, the Company has yet to generate any significant revenues and has no assurance of future revenues. To management’s knowledge, no company has yet successfully developed sub-surface hydrocarbons in commercial quantities in Tasmania. Even if development efforts are successful, substantial time may pass before revenues are realized.

Revenue Recognition: Interest revenue is recognized as it accrues, taking into account the effective yield on the financial asset. Other revenue is recognized when persuasive evidence of an arrangement exists, delivery has occurred, the sales price is fixed or determinable and collectibility is probable. Generally, these criteria are met at the time product is delivered.

Capitalization of Oil and Gas Expenditures: Acquisitions costs for proved and unproved properties are capitalized when incurred. Costs of unproved properties are transferred to proved properties when proved reserves are found. Exploration costs, including geological and geophysical costs and costs of carrying and retaining unproved properties, are charged against income as incurred. Exploratory drilling costs are capitalized initially; however, if it is determined that an exploratory well does not contain proved reserves, the capitalized costs are charged to expense, as dry hole costs, at that time. Development costs are capitalized. Costs incurred to operate and maintain wells and equipment and to lift oil and gas to the surface are generally expensed.

Receivables: The collectibility of receivables is assessed and an allowance is made for any doubtful accounts. Receivables at December 31, 2005 have been reduced by an allowance of $29,204 compared to $Nil the previous year.

Use of Estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

15

Foreign Currency Translation: The functional currency of Great South Land is the Australian dollar. Financial statements for Great South Land are translated into United States dollars at year end exchange rates as to assets and liabilities and weighted average exchange rates as to revenues and expenses. Capital accounts are translated at their historical exchange rates when capital transactions occurred.

Off balance sheet arrangements

Empire has no off-balance sheet arrangements.

16

DESCRIPTION OF BUSINESS

Our principal business is the exploration for petroleum/natural gas in Tasmania, Australia via our wholly-owned subsidiary Great South Land Minerals Limited. Empire in its present form began in April 2005, when it acquired via reverse merger the Tasmanian company Great South Land, then a publicly held Australian company. Prior to the acquisition, we had divested ourselves of all assets and most liabilities and had been seeking opportunities in the oil and gas sector which our board felt were best met by the merger with Great South Land.

We are still in the exploration stages and have not yet produced any natural resources or revenues. As an exploration company without proven reserves, we cannot guarantee we ever will earn revenues or pay dividends. A description of our leaseholds where we have exclusive rights to explore for gas, oil and helium is set out in the section “Description of Properties” below. At present we are primarily fund-raising to continue the exploration of our leasehold tenement and have diversified our business slightly to facilitate financing opportunities.

We have recently expanded our business activities to include an interest in Zeehan Zinc Limited, a base metal and precious metal mining concern located near the Tasmanian oil operations. We indirectly acquired 37.5% of the then issued and outstanding shares in November 2005. Zeehan Zinc has since issued equity in consideration for cancellation of outstanding debt, and Cyber has sold some shares on the market and has transferred part of its holding in Zeehan Zinc to Batego, pursuant to an agreement to exploit technology of Batego relevant to the mining industry, which issue and transfer have combined to dilute our indirect share ownership in Zeehan Zinc to 13.2%. We have a letter of intent to acquire all outstanding shares of Zeehan Zinc by offering shares of our Class A common stock as consideration, but subsequent market events, namely the substantial increase in the value of the Zeehan Zinc shares, and the capital fund-raising needs of Zeehan Zinc have made such an offer commercially non-viable. Due to the effect on transaction viability caused by intervening events, we view the letter of intent as having expired.

We have a controlling interest (51%) in Pacific Rim Foods Limited and a wholly-owned subsidiary Expedia International Limited but, although management sees each as important in the future, neither is presently material to our business.

To date, Great South Land has not yet produced any revenues. Great South Land is in the exploratory stages, although we believe the license area shows the potential for economically exploitable reserves. In the last three years, Zeehan Zinc has not generated any revenues, however, Zeehan Zinc expects to commence generating revenue in the first quarter of 2007.

Background

Empire

Empire is headquartered in Lenexa, Kansas (Kansas City area). Empire was incorporated in November of 1983 in the state of Utah. We are a reporting company under the Securities Exchange Act of 1934 whose common shares trade on the OTC bulletin board under ticker symbol EEGC.

Empire was incorporated in November of 1983 in the state of Utah under the name Medivest, Inc. Medivest engaged in various business enterprises and eventually filed for protection under the bankruptcy laws. Medivest emerged from bankruptcy and had its corporate charter reinstated in 1995 but remained inactive until 1999 when Peterson & Sons Holding Company acquired control by purchasing a majority of the then outstanding shares of Medivest from the majority shareholder and the shareholders of Medivest approved a change of name from Medivest Inc. to Empire Energy Corporation and Empire commenced commercial activity in the oil and gas industry. Empire raised $500,000 in 1999 by way of the sale of convertible debentures which debentures have since been converted at $1.00 per share.

In November 2000, Empire acquired a working interest in a natural gas field in Texas. On 29 June 2001, Empire acquired Commonwealth Energy Corporation, a Canadian company primarily engaged in the acquisition

17

and exploration of petroleum and natural gas properties in the United States. Commonwealth Energy Corporation had two wholly owned subsidiaries, Blue Mountain Resources Inc. and Commonwealth Energy (USA) Inc. with production and/or prospects located in the states of Oklahoma, Texas and Wyoming.

During 2001 and 2002, Empire experienced liquidity problems related to the Commonwealth merger cost being more than expected and the cost associated with the unsuccessful attempt to establish economic production from the Bedsole No. 1 well in Leon County Texas. As a result, during 2002, Empire sold its interest in the Bedsole Unit, the Parker County, Texas properties and the Tennessee production to partially pay liabilities. Empire sold the Coleman County, Texas properties in 2003. In preparation for the acquisition of Great South Land, the interest in a prior project was transferred to shareholders of Empire in 2004. The two subsidiaries were sold in March 2004 along with all remaining assets of Empire in exchange for assumption of all liabilities of the corporation.

To assist in the financing of Great South Land and its acquisition, on July 2, 2004, Empire merged with Bob Owen & Company, Inc., a Kansas corporation. As a result of the merger, Bob Owen & Co. became a wholly-owned subsidiary of Empire, all outstanding shares of Bob Owen & Co., capital stock held by its sole stockholder were converted into 100,000 shares of Empire common stock and Empire assumed primary obligation under a Convertible Debenture Purchase Agreement dated as of July 2, 2004 by and between Bob Owen & Co., and HEM Mutual Assurance LLC, an accredited investor located in Minneapolis, Minnesota, pursuant to which Bob Owen & Co., sold and issued convertible debentures to HEM (now converted) in an aggregate principal amount of $500,000. Those debentures converted into a total of 6,925,000 shares of Empire common stock from July 2004 until February 2006 when the last debentures converted.

In April 2005, we concluded an exchange offer for all of the issued and outstanding shares of Great South Land. We acquired 100% control of Great South Land in July of that year in exchange for 62,426,782 shares of our common stock.

On August 17, 2005, the Company’s shareholders approved a resolution increasing the authorized shares of common stock from 100 million to 300 million shares.

Great South Land

In 1984, Conga Oil Proprietary Limited, a predecessor company of Great South Land, was formed to carry out a limited stratigraphic exploration program on a 50 square kilometer license, EL 10/84 encompassing wells drilled in 1916 and 1929. In 1988, EL10/84 was incorporated into a new permit EL 1/88, covering an area of 3,500 square kilometers.

In 1989, Condor Oil Investments Unit Trust No 1 was established to provide tax effective investment opportunities to certain investors and to acquire the assets, exploration licenses and permits held by Conga Oil. In 1992 Condor Oil took over responsibility for exploration and during this period up to and including 1994 produced several consultants’ reports. In 1994, Condor Oil commenced the first three stratigraphic wells, Shittim #1, Jericho #1, and Gilgal #1 on North Bruny Island. These stratigraphic wells produced shows of hydrocarbon gas and helium.

During 1995 Great South Land Minerals Proprietary Limited was incorporated. The Company was formed to acquire the assets and licenses of Condor Oil. Two further licenses were added to the portfolio and the Company increased its exploration activities. Over the period 1995 to 1998 the Company undertook further collaborative studies and appointed independent consultants to undertake various reviews.

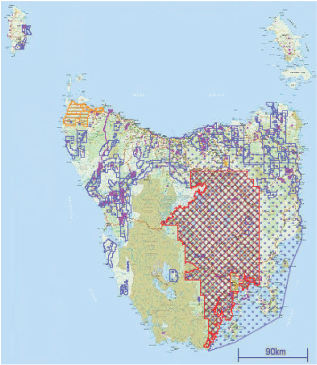

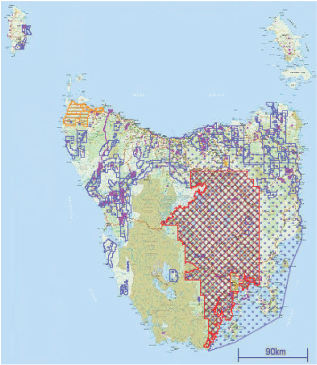

In March 1998 Great South Land Minerals Proprietary Limited changed from a private to a public company, Great South Land, by way of a Special Resolution approved by shareholders. In 1999, Great South Land acquired rights to the largest onshore petroleum license in Australia, Special Exploration License SEL 13/98. SEL 13/98

18

initially comprised 30,356 square kilometers and covered the whole Tasmania Basin. This license was created in June 1999 by incorporating areas covered by permits EL l/88, EL 9/95 and EL 21/95 into a special exploration license covering all of the accessible area of the Tasmania Basin.

In 2001, the Australian Federal Government, through the Australian Research Grants Scheme awarded the University of Tasmania and Great South Land a AUD $417,000 Research and Development grant to study the petroleum systems in Tasmania. This grant is enabling a team of university and Great South Land geoscientists to develop a computer model for the geological, tectonic and fluid flow evolution of central Tasmania for the last 500 million years. The grant was supported by an AUD $268,000 payment from Great South Land above the AUD $417,000 grant from the government, making the total spent on research AUD $685,000.

In 2000, Great South Land undertook the first major regional seismic survey to be carried out onshore Tasmania, completing in 2001. It is the director’s understanding that the 660 kilometer line survey, coupled with prior studies established that large geological structures, with the potential to be petroleum traps, exist south of Launceston and under the Central Highlands.

Early in 2002, Great South Land signed an Exploration Agreement with OME Resources Australia Pty Limited by which OME would earn a joint venture interest of 15% in SEL 13/98 by conducting drilling and related work. This commitment by OME was intended to satisfy the minimum work requirements for SEL 13/98 until June 2003.

However, a dispute subsequently arose between Great South Land and OME as to whether OME had complied with certain of its obligations under the exploration agreement. The parties were able to settle their differences and recorded their agreed position in a settlement agreement dated August 8, 2003. One of the terms of that settlement agreement was to the effect that Great South Land and OME would jointly approach the Tasmanian Minister for Infrastructure Energy and Resources for his consent to vary the terms of SEL 13/98 held by Great South Land in accordance with the variance agreed between OME and Great South Land. The effect of that variance was that Great South Land would surrender the right to explore for coal bed methane over the area of SEL 13/98 to OME.

The varied SEL 13/98 was signed by the Minister on October 28, 2004. OME and Great South Land entered into a further agreement on September 14, 2004 confirming that there are no outstanding claims or disputes between the parties and that the exploration agreement is terminated and of no further effect.

Great South Land and its predecessor companies have researched the potential for oil and gas discovery and have shown the Tasmania Basin as being similar in geological terms to major oil producing regions such as Oman and the Cooper Basin. Tests by these companies have also demonstrated, and five independent consulting petroleum geologists have confirmed, that the Tasmania Basin is prospective for oil, hydrocarbon gases and helium.

Operations

As of the date of this prospectus, Empire has two administrative employees. Contracted management and professional services were rendered by John Garrison (Director) and Malcolm Bendall (Principal/CEO) during the period.

Great South Land employed seven full-time administration staff and the contracted management services of Dr. Clive Burrett (Geologist/Director) and Mr. Malcolm Bendall (Chairman).

For the purposes of disclosure within this report, Zeehan Zinc through its subsidiary operation, Oceania Tasmania Pty Ltd, employed seven persons including a senior full-time Geologist. The contracted management services were provided by Mr. David Tanner (ex-Director) and Dr. Clive Burrett (Geologist/Director). Exploration and development activities commission industry specialized in contracted services by the companies from time to time.

19

Australian law and regulation of our industries

Great South Land & Zeehan Zinc operations are under the operational jurisdiction of Mineral Resources Tasmania, a state government body assigned to govern mining and resource development within the State of Tasmania, Australia. Various pieces of legislation govern administration of natural resources businesses such as Great South Land and Zeehan Zinc, including The Mineral Resources Development Act, 1995, which provides for the development of mineral resources consistent with sound economic and environmental land use under Australian law.

Environmental controls are imposed within the provisions of the Environmental Management and Pollution Control Act 1994 which has as its fundamental basis the prevention, reduction and remediation of environmental harm, including environmental nuisance and its adverse effect on the environment. Permits are issued in accordance with Land Use Planning and Approvals Act 1993 in respect of proposed use or development affecting the leased land.

Each of Great South Land and Zeehan Zinc uses bonds to ensure that sites are adequately rehabilitated so that there are no remaining environmental or safety hazards requiring remediation in the event of failure of the respective company to carry out site remediation obligations and is consistent with other Australian jurisdictions. Zeehan Zinc has supplied the below bonds or bank guarantees in respect of the following mining or exploration activities:

| | • | | Road maintenance bond $10,000 AUD |

| | • | | Environmental bond for rehabilitation (Comstock Mine) $255,000 AUD. Subject to review of mining operations. |

| | • | | Environmental bond for rehabilitation (Oceana Mine) $9,600 AUD. Subject to review of mining operations. |

| | • | | Performance bond, $5000 AUD for EL 18/2003, EL 20/2002 & EL 30/2002 |

| | • | | Private landowner bonds, $2000 AUD |

Great South Land has a guarantee and bond in the amount of $75,000 AUD.

Our strategy

The exploration objective of Great South Land is to discover commercial quantities of oil and gas on onshore Tasmania. Great South Land’s current exploration strategy is based on an extensive seismic and drilling program involving the acquisition of at least 2,000 line kilometers of seismic data, and is designed to

| | • | | determine the extent of the two petroleum systems that have been outlined within the SEL 13/98 leaseholder; |

| | • | | define potential petroleum targets; and |

| | • | | test potential targets through a drilling program. |

On the basis of research carried out mainly in the last five years, two petroleum systems have been identified on onshore Tasmania: an Ordovician Early Devonian Larapintine System within the Wurawina Supergroup below the Tasmania Basin and a Permo-Triassic Gondwana System within the Parmeener Supergroup of the Tasmania Basin.

The mainly oil prone Gondwona Petroleum System is considered more prospective than the mainly gas prone Larapintine Petroleum System. Maturation of the Gondwona Petroleum System increases towards the south of the basin, being undermature in the north to possibly overmature for oil in the south, whereas reservoir quality increases towards to north. Faulting is much more intense in the southern half than in the northern half of the basin, thereby reducing trap size and increasing the risk of seal breaching. Additionally, the centre of the basin has not been uplifted to the extent of areas in the Central Highlands and in the south. Great South Land

20

therefore proposes an exploration program that concentrates seismic exploration in the central parts of the Tasmania Basin and also explores the potential of the Larapintine Petroleum System under the Central Highlands.