CONFIDENTIAL DRAFT

Special Committee Discussion Materials

March 24, 2004

William Blair & Company

Important Information DRAFT

Confidential Material Presented to the Special Committee of the Board of Directors of Johnson Outdoors, Inc.

The following pages contain material that was provided to the Special Committee of the Board of Directors (the “Special Committee”) of Johnson Outdoors Inc. (the “Company”) and is for discussion purposes only. The accompanying material was compiled or prepared on a confidential basis for use by the Special Committee and not with a view toward public disclosure. This material is preliminary in nature and contains assumptions and methodologies which may be subject to change.

Table of Contents DRAFT

I. Executive Summary

II. Situation Overview

III. Valuation Methodologies

A. Comparable Public Companies Analysis

B. Comparable M&A Transactions Analysis

C. M&A Premiums Paid Analysis

D. Discounted Cash Flow Analysis

E. Leveraged Buyout Analysis

Appendix

A. Valuation Matrix

B. Comparable Public Companies Model

DRAFT

Executive Summary

Executive Summary

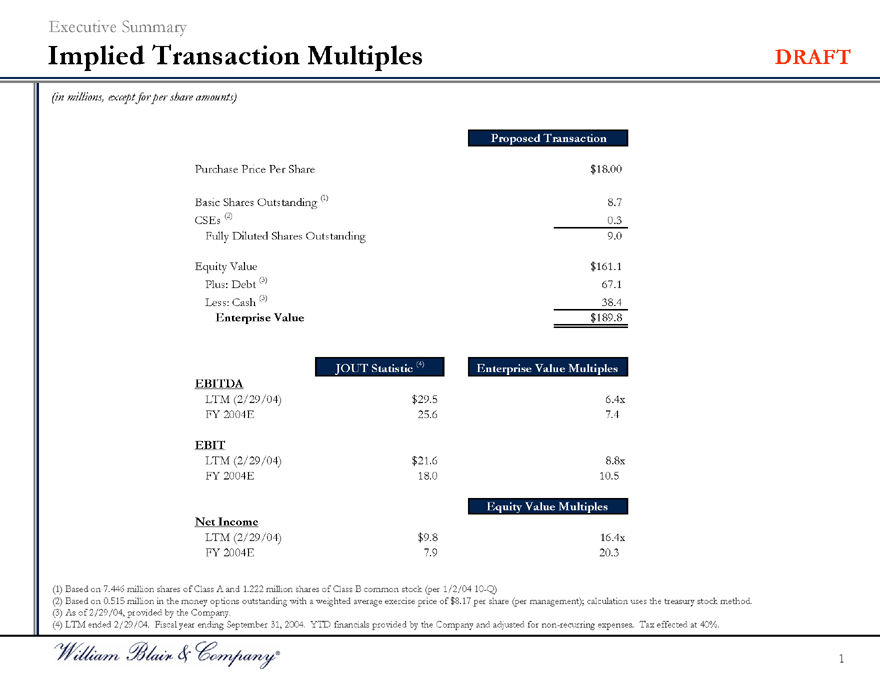

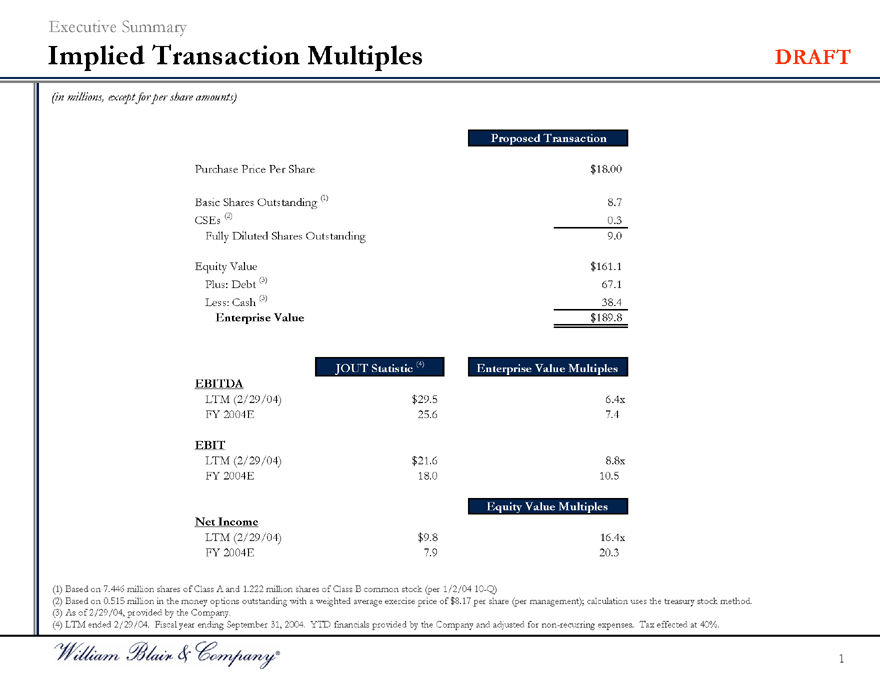

Implied Transaction Multiples DRAFT

(in millions, except for per share amounts)

Proposed Transaction

Purchase Price Per Share $18.00

Basic Shares Outstanding (1) 8.7

CSEs (2) 0.3

Fully Diluted Shares Outstanding 9.0

Equity Value $161.1

Plus: Debt (3) 67.1

Less: Cash (3) 38.4

Enterprise Value $189.8

JOUT Statistic (4) Enterprise Value Multiples

EBITDA

LTM (2/29/04) $29.5 6.4x

FY 2004E 25.6 7.4

EBIT

LTM (2/29/04) $21.6 8.8x

FY 2004E 18.0 10.5

Equity Value Multiples

Net Income

LTM (2/29/04) $9.8 16.4x

FY 2004E 7.9 20.3

(1) Based on 7.446 million shares of Class A and 1.222 million shares of Class B common stock (per 1/2/04 10-Q)

(2) Based on 0.515 million in the money options outstanding with a weighted average exercise price of $8.17 per share (per management); calculation uses the treasury stock method.

(3) As of 2/29/04, provided by the Company.

(4) LTM ended 2/29/04. Fiscal year ending September 31, 2004. YTD financials provided by the Company and adjusted for non-recurring expenses. Tax effected at 40%.

1

DRAFT

Situation Overview

Situation Overview

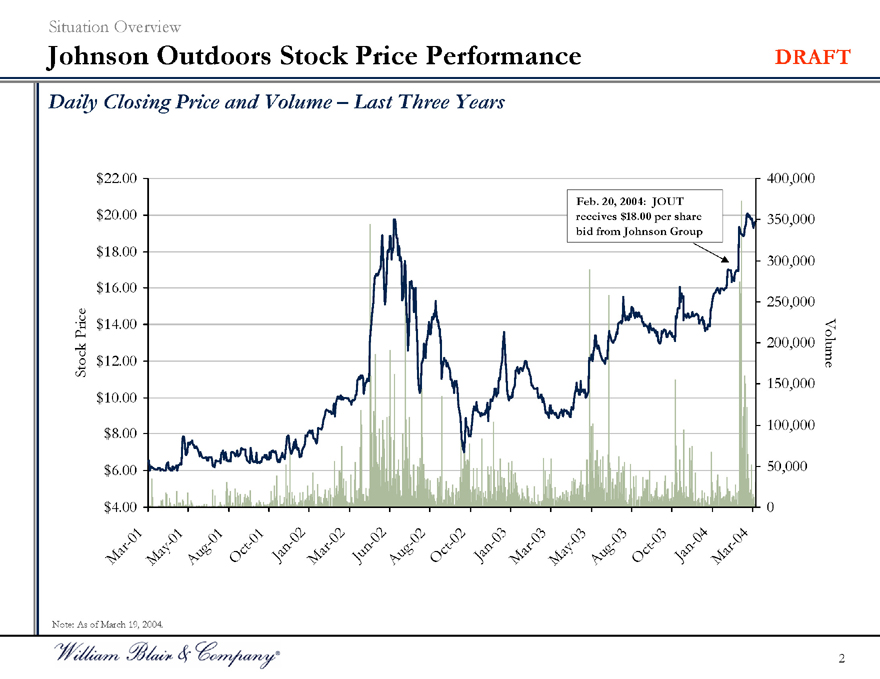

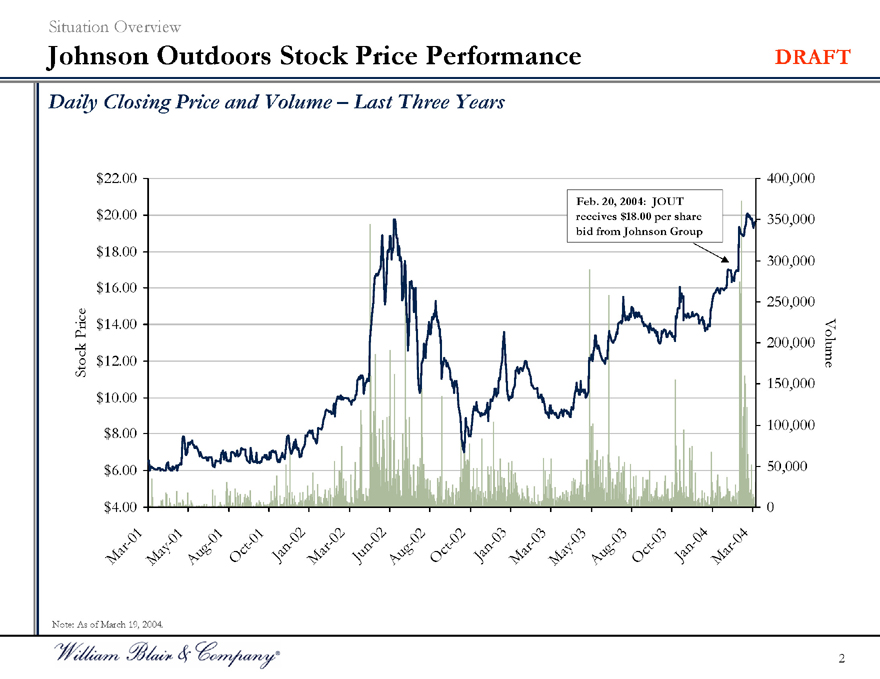

Johnson Outdoors Stock Price Performance DRAFT

Daily Closing Price and Volume – Last Three Years

Stock Price $22.00 $20.00 $18.00 $16.00 $14.00 $12.00 $10.00 $8.00 $6.00 $4.00

Mar-01 Ma y-01 Aug-01 Oct-01 Jan-02 Mar-02 Jun-02 Aug-02 Oct-02 Jan-03 Ma r-03 Ma y-03 Aug-03 Oct-03 Jan-04 Mar-04

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,0000

Volume

Feb. 20, 2004: JOUT receives $18.00 per share bid from Johnson Group

Note: As of March 19, 2004.

2

Situation Overview

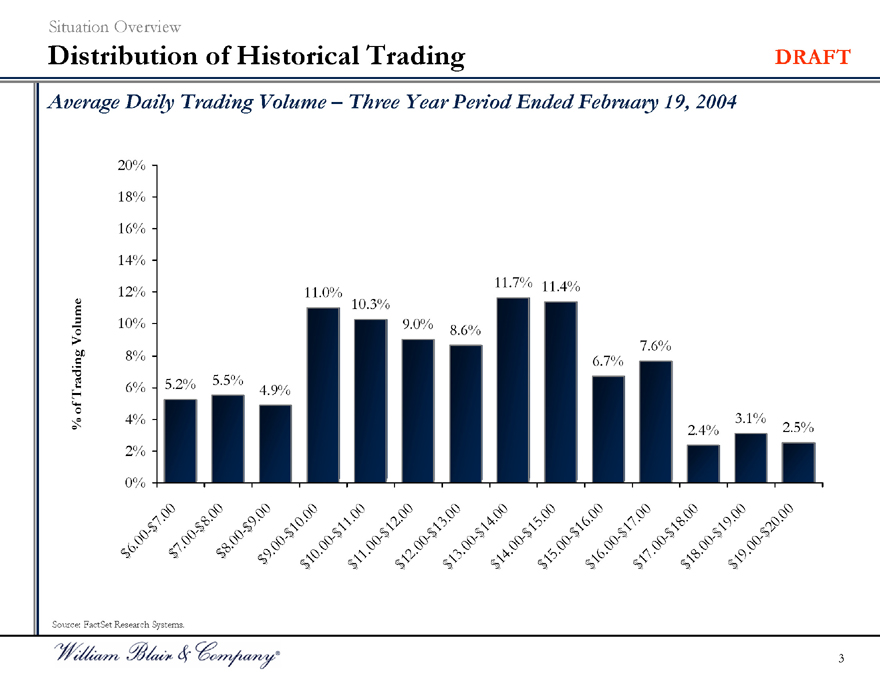

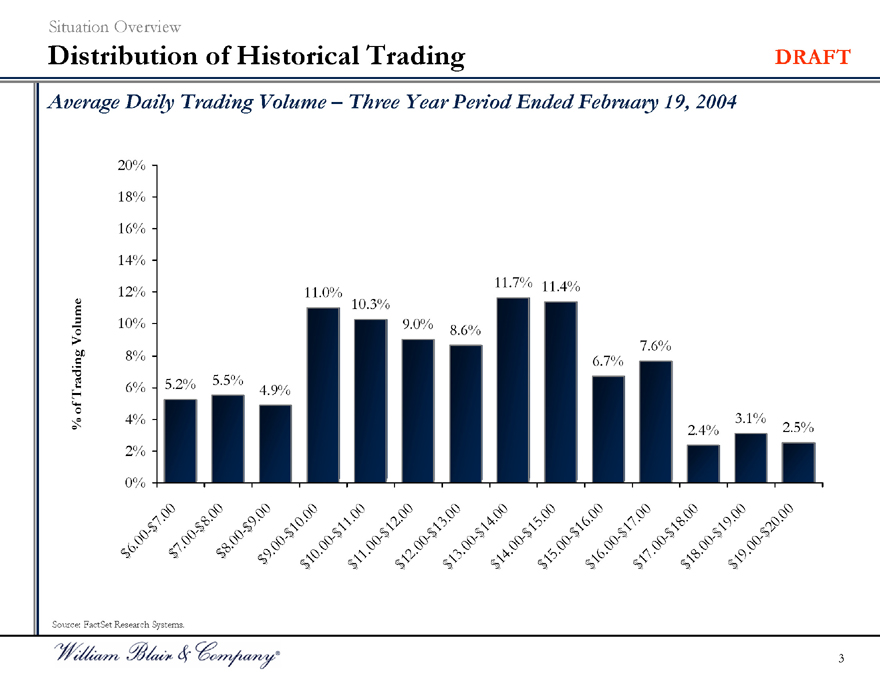

Distribution of Historical Trading DRAFT

Average Daily Trading Volume – Three Year Period Ended February 19, 2004

% of Trading Volume

20% 18% 16% 14% 12% 10% 8% 6% 4% 2% 0%

11.7% 11.4% 11.0% 10.3% 9.0% 8.6%

7.6% 6.7% 5.2% 5.5% 4.9%

3.1% 2.4% 2.5%

$6.00—$7.00

$7.00—$8.00

$8.00—$9.00

$9.00—$10.00

$10.00—$11.00

$11.00—$12.00

$12.00—$13.00

$13.00—$14.00

$14.00—$15.00

$15.00—$16.00

$16.00—$17.00

$17.00—$18.00

$18.00—$19.00

$19.00—$20.00

Source: FactSet Research Systems.

3

Situation Overview

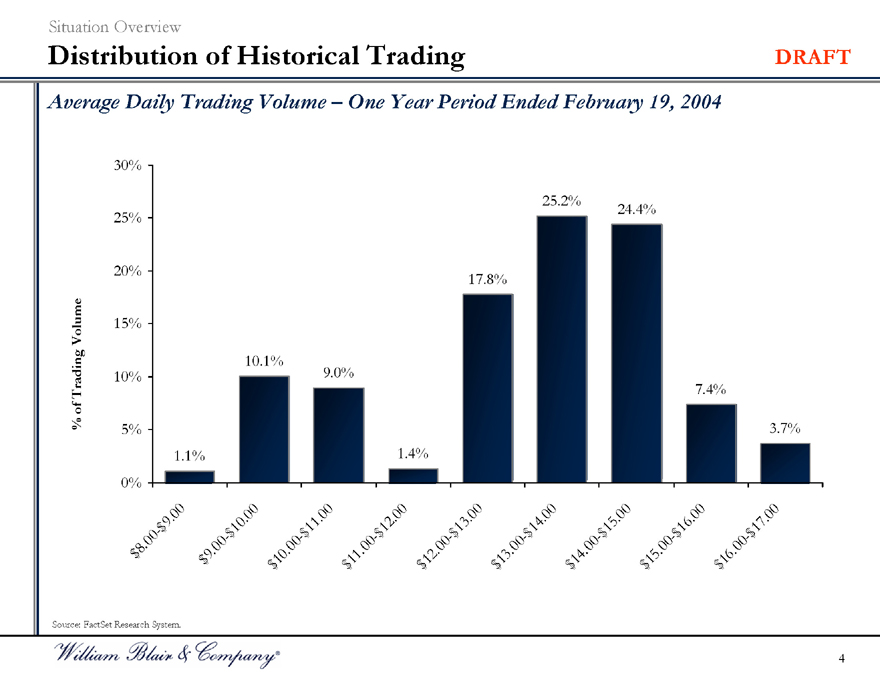

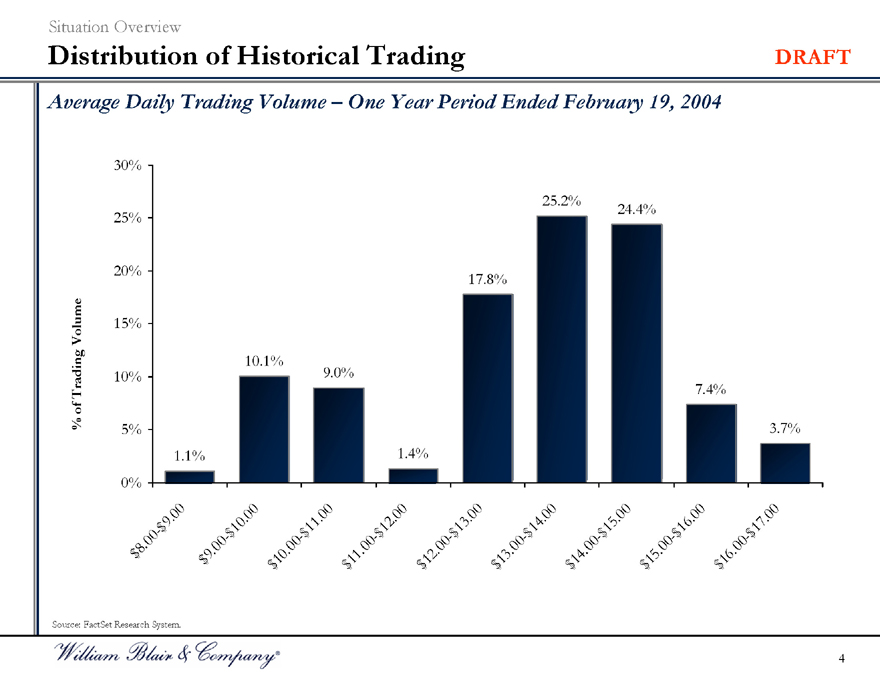

Distribution of Historical Trading DRAFT

Average Daily Trading Volume – One Year Period Ended February 19, 2004

% of Trading Volume

30% 25% 20% 15% 10% 5% 0%

25.2%

24.4%

17.8%

10.1%

9.0%

7.4%

3.7% 1.1% 1.4%

$8.00—$9.00

$9.00—$10.00

$10.00—$11.00

$11.00—$12.00

$12.00—$13.00

$13.00—$14.00

$14.00—$15.00

$15.00—$16.00

$16.00—$17.00

Source: FactSet Research System.

4

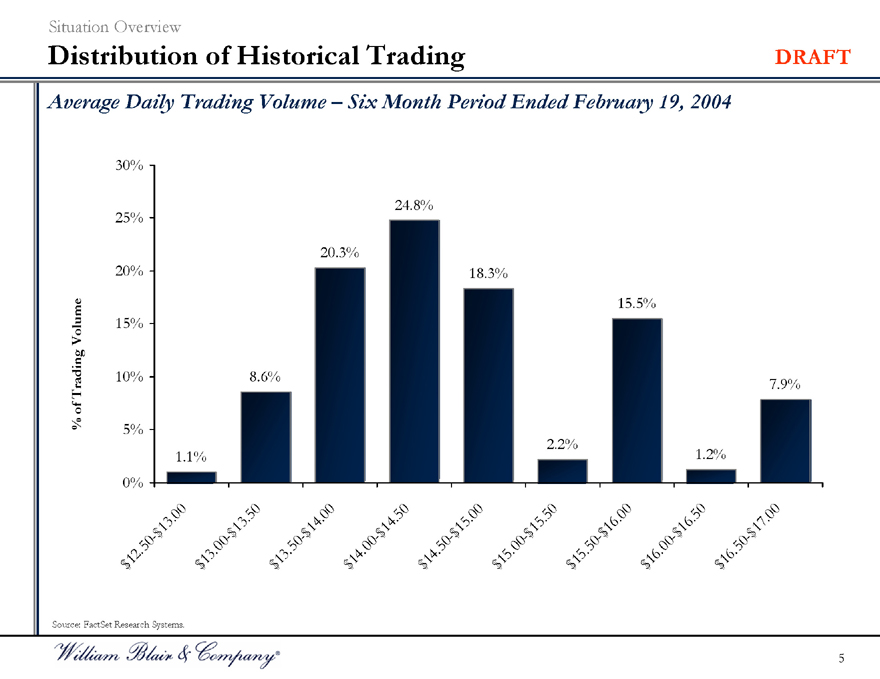

Situation Overview

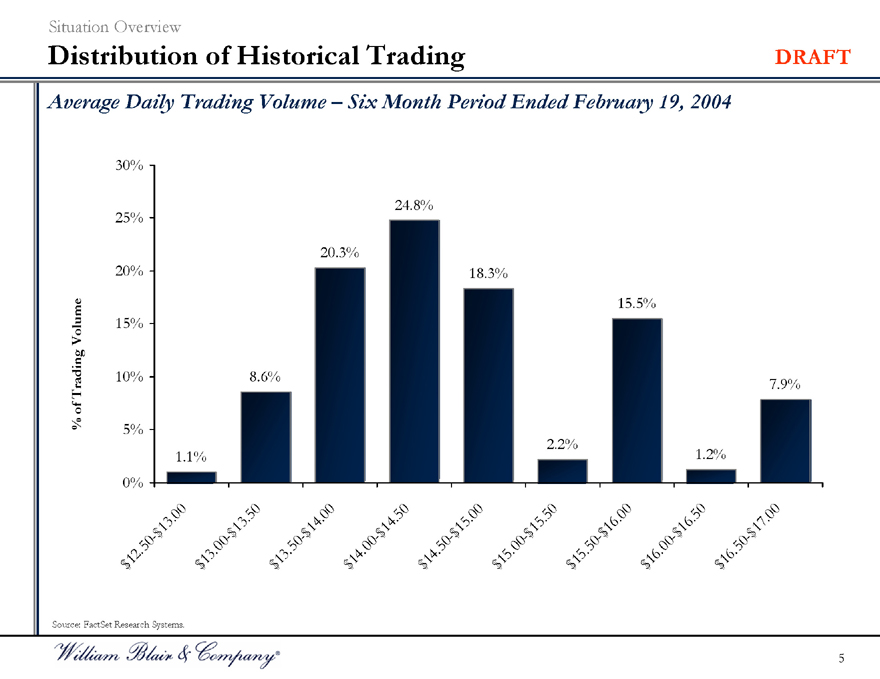

Distribution of Historical Trading DRAFT

Average Daily Trading Volume – Six Month Period Ended February 19, 2004

% of Trading Volume

30% 25% 20% 15% 10% 5% 0%

$12.50—$13.00

$13.00—$13.50

$13.50- $14.00

$14.00- $14.50

$14.50- $15.00

$15.00- $15.50

$15.50- $16.00

$16.00- $16.50

$16.50—$17.00

24.8%

20.3%

18.3%

15.5%

8.6%

7.9%

2.2%

1.1% 1.2%

Source: FactSet Research Systems.

5

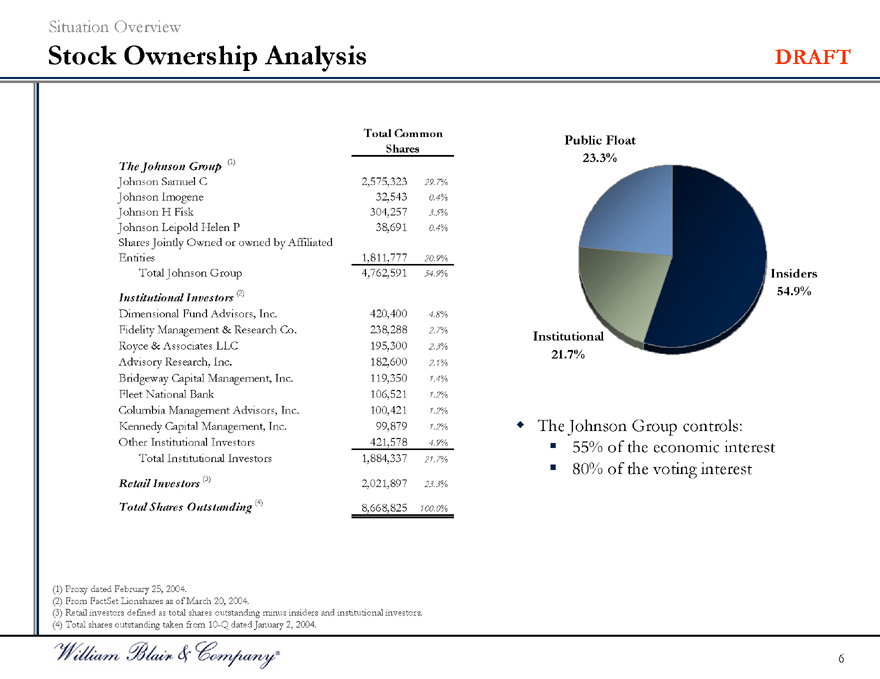

Situation Overview

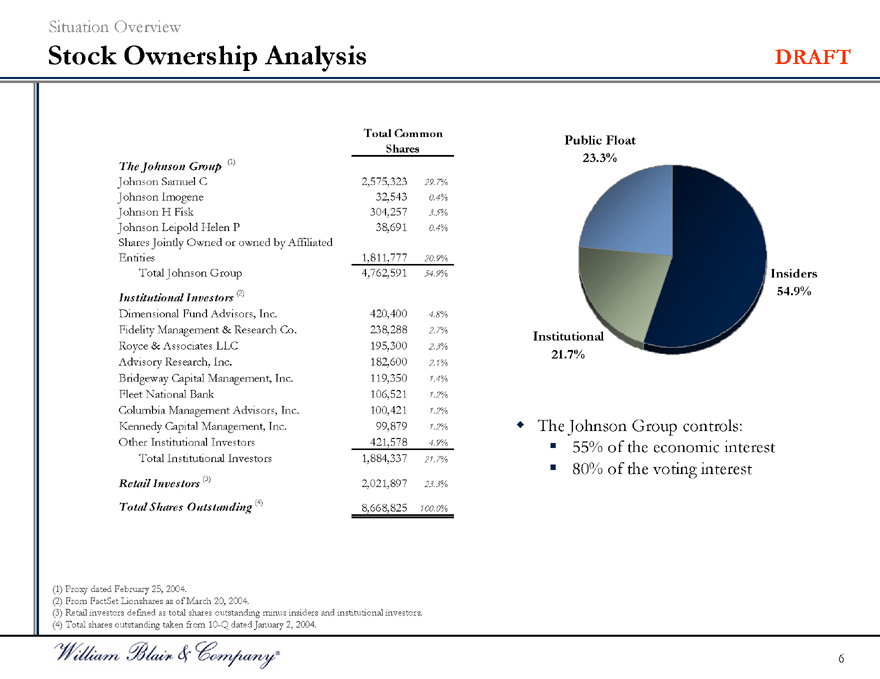

Stock Ownership Analysis DRAFT

Total Common Shares

The Johnson Group (1)

Johnson Samuel C 2,575,323 29.7%

Johnson Imogene 32,543 0.4%

Johnson H Fisk 304,257 3.5%

Johnson Leipold Helen P 38,691 0.4%

Shares Jointly Owned or owned by Affiliated

Entities 1,811,777 20.9%

Total Johnson Group 4,762,591 54.9%

Institutional Investors(2)

Dimensional Fund Advisors, Inc. 420,400 4.8%

Fidelity Management & Research Co. 238,288 2.7%

Royce & Associates LLC 195,300 2.3%

Advisory Research, Inc. 182,600 2.1%

Bridgeway Capital Management, Inc. 119,350 1.4%

Fleet National Bank 106,521 1.2%

Columbia Management Advisors, Inc. 100,421 1.2%

Kennedy Capital Management, Inc. 99,879 1.2%

Other Institutional Investors 421,578 4.9%

Total Institutional Investors 1,884,337 21.7%

Retail Investors(3) 2,021,897 23.3%

Total Shares Outstanding (4) 8,668,825 100.0%

Public Float 23.3%

Institutional 21.7%

Insiders 54.9%

The Johnson Group controls:

55% of the economic interest

80% of the voting interest

(1) Proxy dated February 25, 2004.

(2) From FactSet Lionshares as of March 20, 2004.

(3) Retail investors defined as total shares outstanding minus insiders and institutional investors. (4) Total shares outstanding taken from 10-Q dated January 2, 2004.

6

Valuation Methodologies

DRAFT

Valuation Methodologies

Valuation Methodologies DRAFT

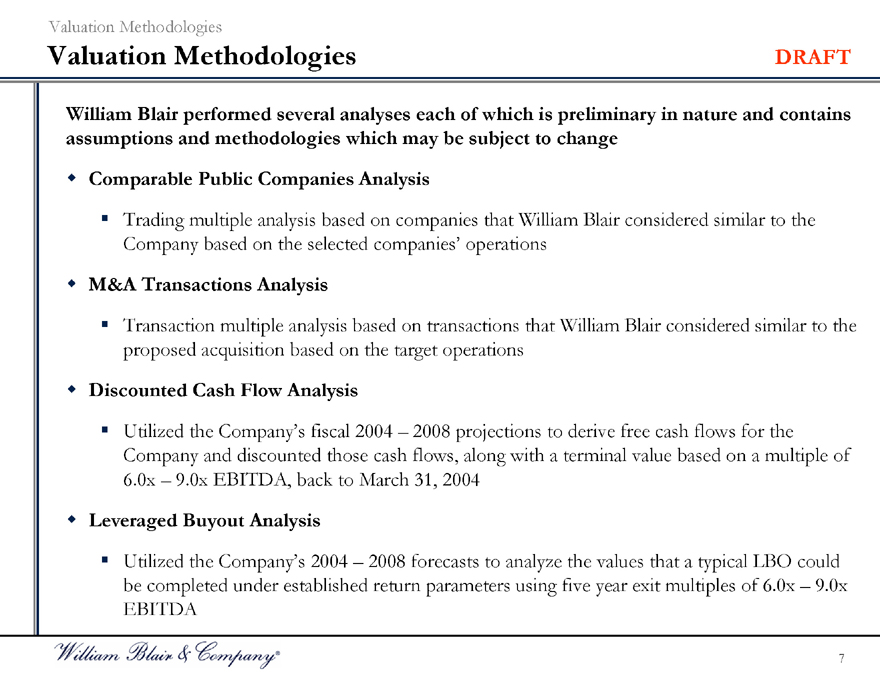

William Blair performed several analyses each of which is preliminary in nature and contains assumptions and methodologies which may be subject to change

Comparable Public Companies Analysis

Trading multiple analysis based on companies that William Blair considered similar to the Company based on the selected companies’ operations

M&A Transactions Analysis

Transaction multiple analysis based on transactions that William Blair considered similar to the proposed acquisition based on the target operations

Discounted Cash Flow Analysis

Utilized the Company’s fiscal 2004 – 2008 projections to derive free cash flows for the Company and discounted those cash flows, along with a terminal value based on a multiple of 6.0x – 9.0x EBITDA, back to March 31, 2004

Leveraged Buyout Analysis

Utilized the Company’s 2004 – 2008 forecasts to analyze the values that a typical LBO could be completed under established return parameters using five year exit multiples of 6.0x – 9.0x EBITDA

7

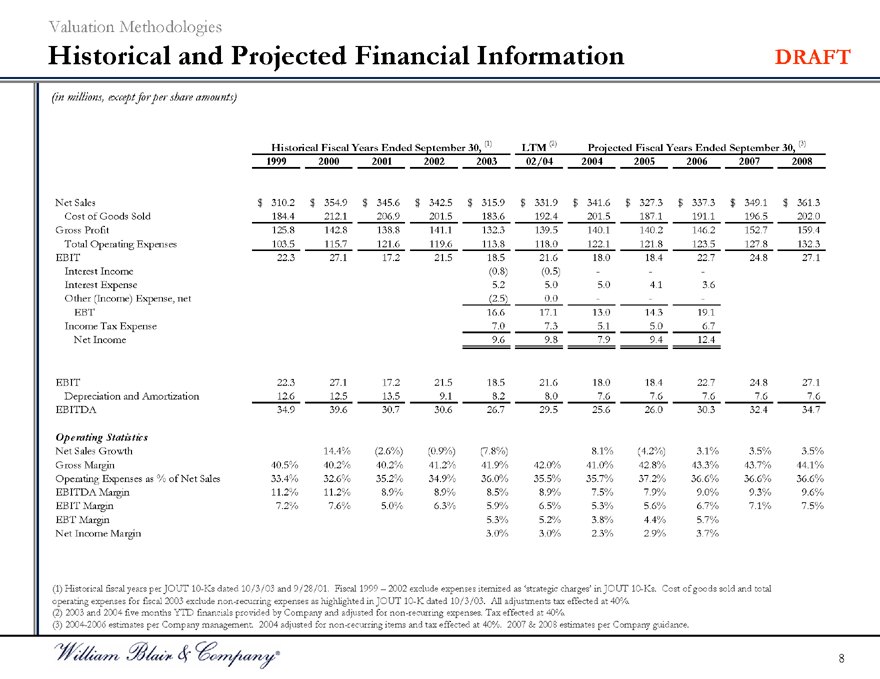

Valuation Methodologies

Historical and Projected Financial Information DRAFT

(in millions, except for per share amounts)

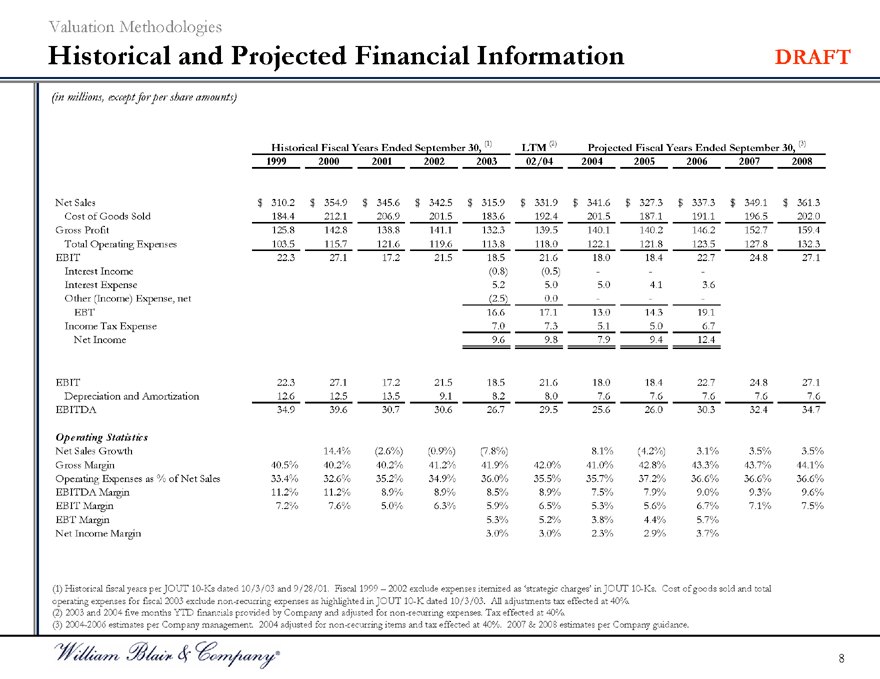

Historical Fiscal Years Ended September 30, (1) LTM (2) Projected Fiscal Years Ended September 30, (3)

1999 2000 2001 2002 2003 02/04 2004 2005 2006 2007 2008

Net Sales $310.2 $354.9 $345.6 $342.5 $315.9 $331.9 $341.6 $327.3 $337.3 $349.1 $361.3

Cost of Goods Sold 184.4 212.1 206.9 201.5 183.6 192.4 201.5 187.1 191.1 196.5 202.0

Gross Profit 125.8 142.8 138.8 141.1 132.3 139.5 140.1 140.2 146.2 152.7 159.4

Total Operating Expenses 103.5 115.7 121.6 119.6 113.8 118.0 122.1 121.8 123.5 127.8 132.3

EBIT 22.3 27.1 17.2 21.5 18.5 21.6 18.0 18.4 22.7 24.8 27.1

Interest Income (0.8) (0.5) - - -

Interest Expense 5.2 5.0 5.0 4.1 3.6

Other (Income) Expense, net (2.5) 0.0 - - -

EBT 16.6 17.1 13.0 14.3 19.1

Income Tax Expense 7.0 7.3 5.1 5.0 6.7

Net Income 9.6 9.8 7.9 9.4 12.4

EBIT 22.3 27.1 17.2 21.5 18.5 21.6 18.0 18.4 22.7 24.8 27.1

Depreciation and Amortization 12.6 12.5 13.5 9.1 8.2 8.0 7.6 7.6 7.6 7.6 7.6

EBITDA 34.9 39.6 30.7 30.6 26.7 29.5 25.6 26.0 30.3 32.4 34.7

Operating Statistics

Net Sales Growth 14.4% (2.6%) (0.9%) (7.8%) 8.1% (4.2%) 3.1% 3.5% 3.5%

Gross Margin 40.5% 40.2% 40.2% 41.2% 41.9% 42.0% 41.0% 42.8% 43.3% 43.7% 44.1%

Operating Expenses as% of Net Sales 33.4% 32.6% 35.2% 34.9% 36.0% 35.5% 35.7% 37.2% 36.6% 36.6% 36.6%

EBITDA Margin 11.2% 11.2% 8.9% 8.9% 8.5% 8.9% 7.5% 7.9% 9.0% 9.3% 9.6%

EBIT Margin 7.2% 7.6% 5.0% 6.3% 5.9% 6.5% 5.3% 5.6% 6.7% 7.1% 7.5%

EBT Margin 5.3% 5.2% 3.8% 4.4% 5.7%

Net Income Margin 3.0% 3.0% 2.3% 2.9% 3.7%

(1) Historical fiscal years per JOUT 10-Ks dated 10/3/03 and 9/28/01. Fiscal 1999 – 2002 exclude expenses itemized as ‘strategic charges’ in JOUT 10-Ks. Cost of goods sold and total operating expenses for fiscal 2003 exclude non-recurring expenses as highlighted in JOUT 10-K dated 10/3/03. All adjustments tax effected at 40%.

(2) 2003 and 2004 five months YTD financials provided by Company and adjusted for non-recurring expenses. Tax effected at 40%.

(3) 2004-2006 estimates per Company management. 2004 adjusted for non-recurring items and tax effected at 40%. 2007 & 2008 estimates per Company guidance.

8

Valuation Methodologies

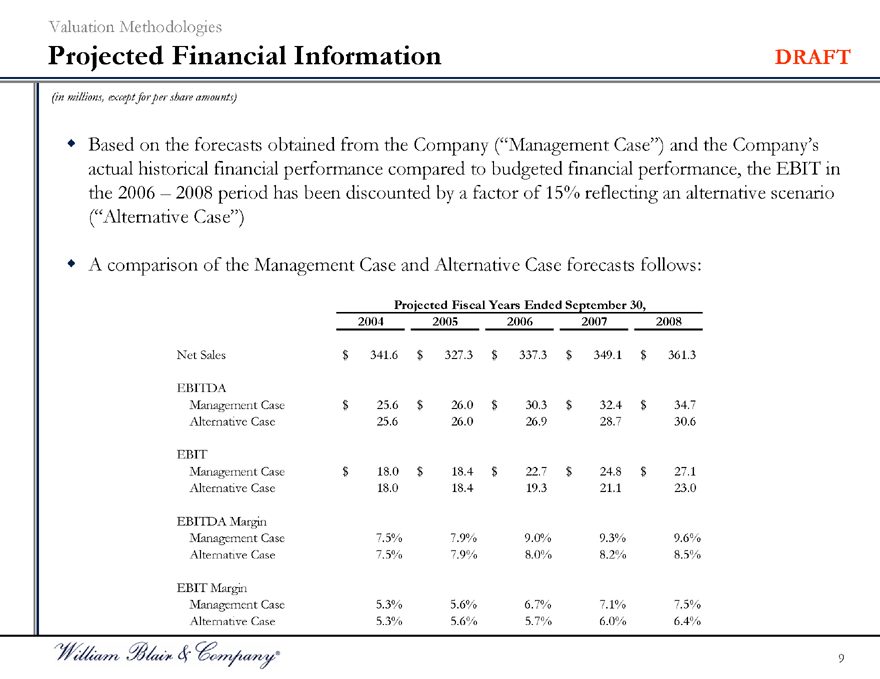

Projected Financial Information DRAFT

(in millions, except for per share amounts)

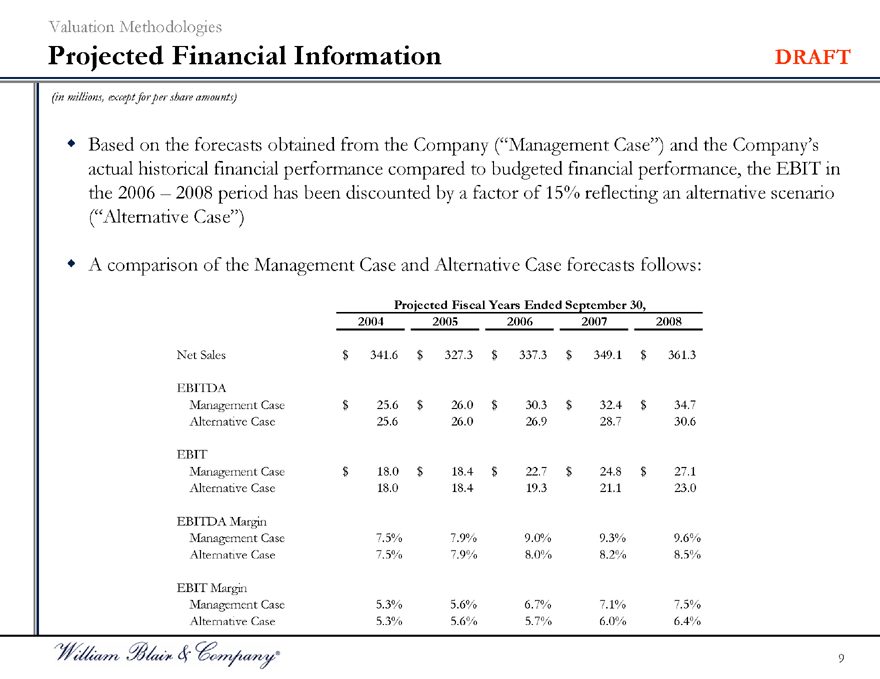

Based on the forecasts obtained from the Company (“Management Case”) and the Company’s actual historical financial performance compared to budgeted financial performance, the EBIT in the 2006 – 2008 period has been discounted by a factor of 15% reflecting an alternative scenario (“Alternative Case”)

A comparison of the Management Case and Alternative Case forecasts follows:

Projected Fiscal Years Ended September 30,

2004 2005 2006 2007 2008

Net Sales $341.6 $327.3 $337.3 $349.1 $361.3

EBITDA

Management Case $25.6 $26.0 $30.3 $32.4 $34.7

Alternative Case 25.6 26.0 26.9 28.7 30.6

EBIT

Management Case $18.0 $18.4 $22.7 $24.8 $27.1

Alternative Case 18.0 18.4 19.3 21.1 23.0

EBITDA Margin

Management Case 7.5% 7.9% 9.0% 9.3% 9.6%

Alternative Case 7.5% 7.9% 8.0% 8.2% 8.5%

EBIT Margin

Management Case 5.3% 5.6% 6.7% 7.1% 7.5%

Alternative Case 5.3% 5.6% 5.7% 6.0% 6.4%

9

Comparable Public Companies Analysis

DRAFT

Comparable Public Companies Analysis

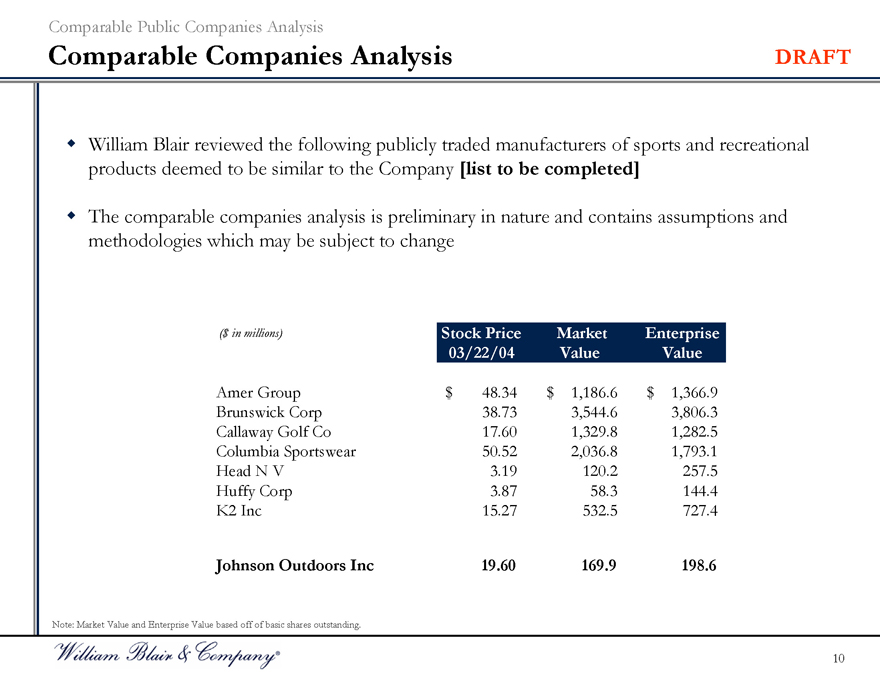

Comparable Companies Analysis DRAFT

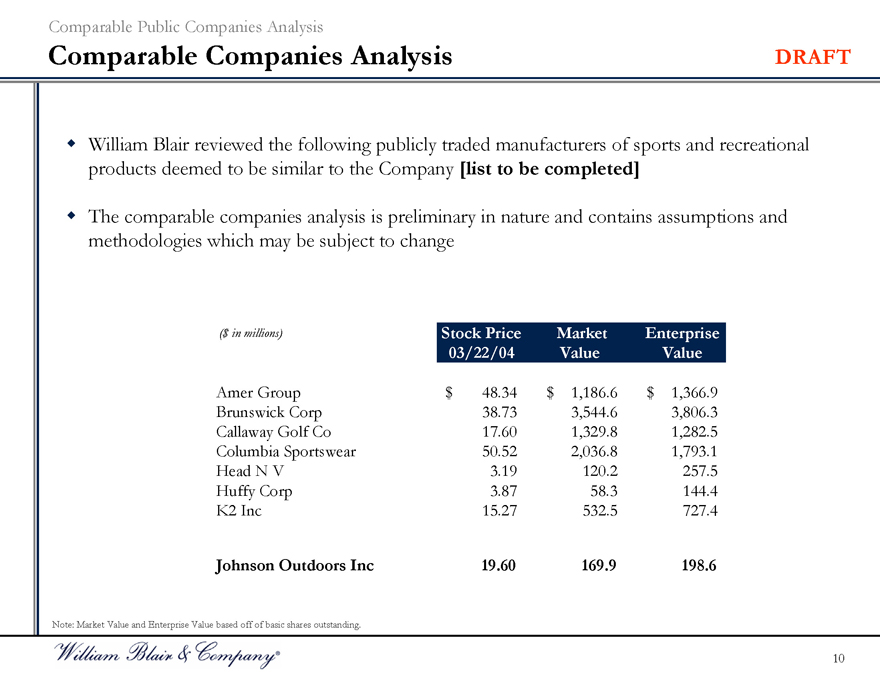

William Blair reviewed the following publicly traded manufacturers of sports and recreational products deemed to be similar to the Company [list to be completed]

The comparable companies analysis is preliminary in nature and contains assumptions and methodologies which may be subject to change

($in millions) Stock Price Market Enterprise

03/22/04 Value Value

Amer Group $48.34 $1,186.6 $1,366.9

Brunswick Corp 38.73 3,544.6 3,806.3

Callaway Golf Co 17.60 1,329.8 1,282.5

Columbia Sportswear 50.52 2,036.8 1,793.1

Head N V 3.19 120.2 257.5

Huffy Corp 3.87 58.3 144.4

K2 Inc 15.27 532.5 727.4

Johnson Outdoors Inc 19.60 169.9 198.6

Note: Market Value and Enterprise Value based off of basic shares outstanding.

10

Comparable Public Companies Analysis

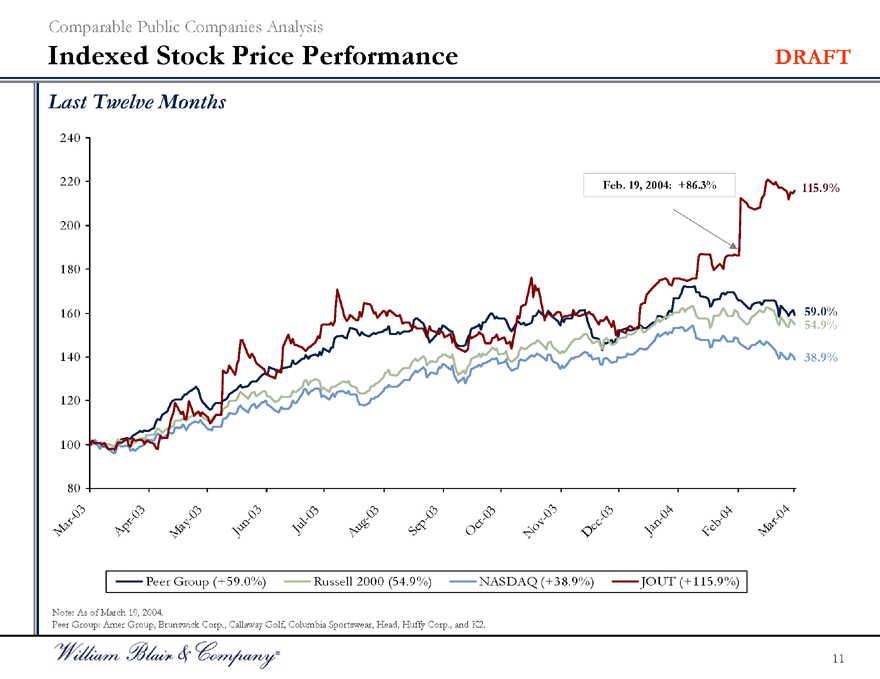

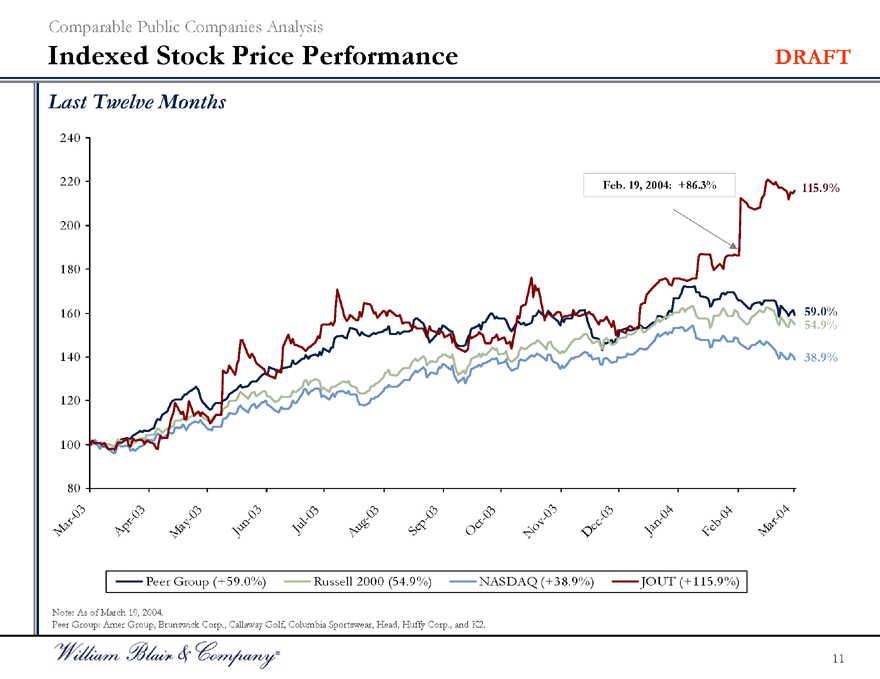

Indexed Stock Price Performance DRAFT

Last Twelve Months

240 220 200 180 160 140 120 100 80

Feb. 19, 2004: +86.3%

115.9%

59% 54.9

38.9%

Mar-03

Apr-03

May-03

Jun–03

Jul-03

Aug-03

Sep-03

Oct–03

Nov-03

Dec-03

Jan-04

Feb-04

Mar-04

Peer Group (+59.0%)

Russell 2000 (54.9%)

NASDAQ (+38.9%)

JOUT (+115.9%)

Note: As of March 19, 2004.

Peer Group: Amer Group, Brunswick Corp., Callaway Golf, Columbia Sportswear, Head, Huffy Corp., and K2.

11

Comparable Public Companies Analysis

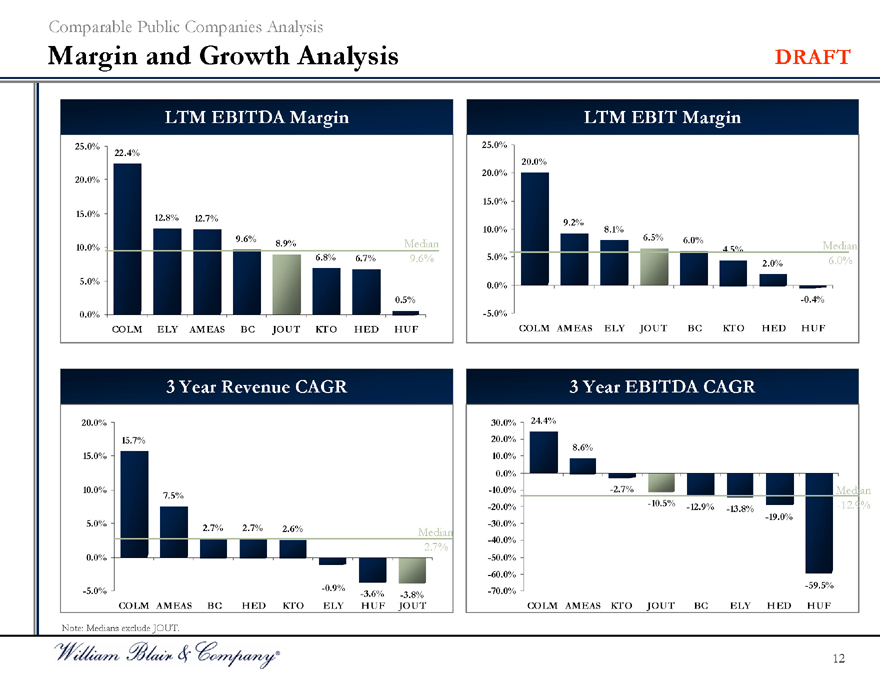

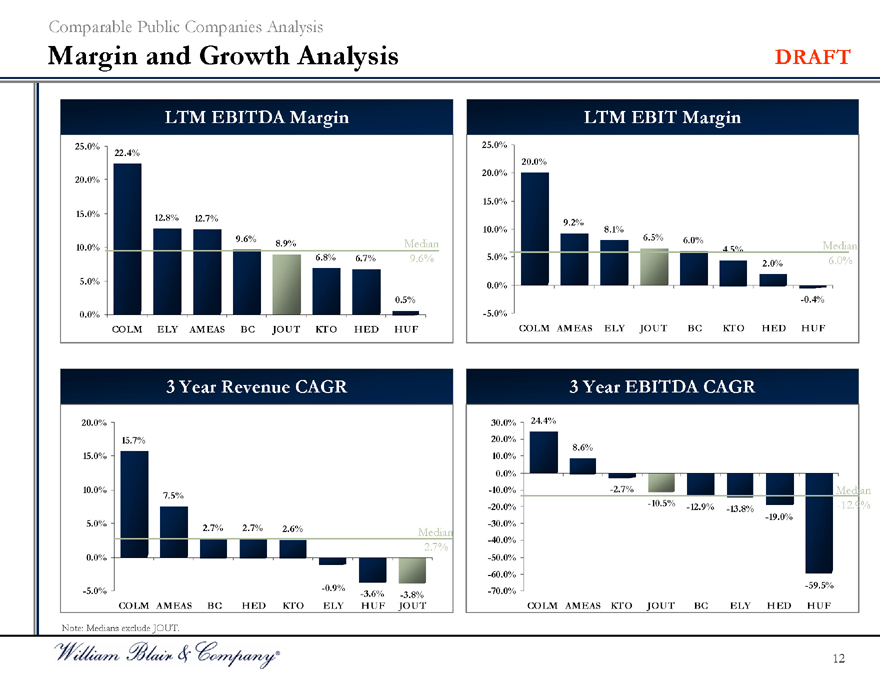

Margin and Growth Analysis DRAFT

LTM EBITDA Margin

25.0% 20.0% 15.0% 10.0% 5.0% 0.0%

22.4% 12.8% 12.7%

9.6%

8.9%

6.8% 6.7% Median 9.6%

0.5%

COLM ELY AMEAS BC JOUT KTO HED HUF

LTM EBIT Margin

25.0% 20.0% 15.0% 10.0% 5.0% 0.0% -5.0%

20.0% 9.2% 8.1% 6.5% 6.0% 4.5% 2.0% Median 6.0%

-0.4%

COLM AMEAS ELY JOUT BC KTO HED HUF

3 Year Revenue CAGR 20.0% 15.0% 10.0% 5.0% 0.0% -5.0% 15.7% 7.5% 2.7% 2.7% 2.6% Median 2.7% - -0.9% -3.6% -3.8% COLM AMEAS BC HED KTO ELY HUF JOUT

3 Year EBITDA CAGR

30.0%

20.0%

10.0%

0.0%

-10.0%

-20.0%

-30.0%

-40.0%

-50.0%

-60.0%

-70.0%

24.4% 8.6% -2.7% -10.5% -12.9% Median -12.9% -13.8% -19.0% -59.5%

COLM AMEAS KTO JOUT BC ELY HED HUF

Note: Medians exclude JOUT.

12

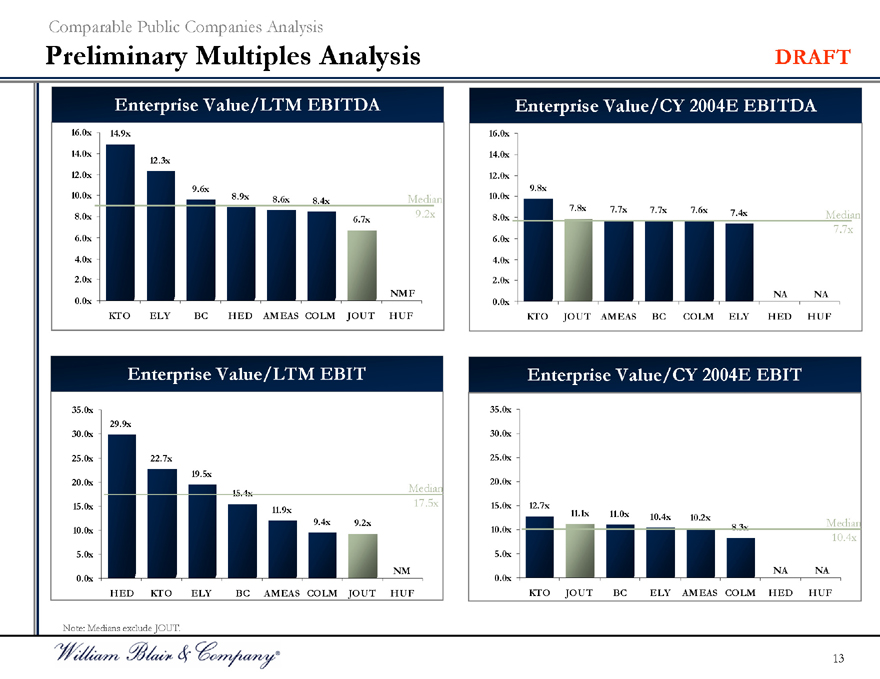

Comparable Public Companies Analysis

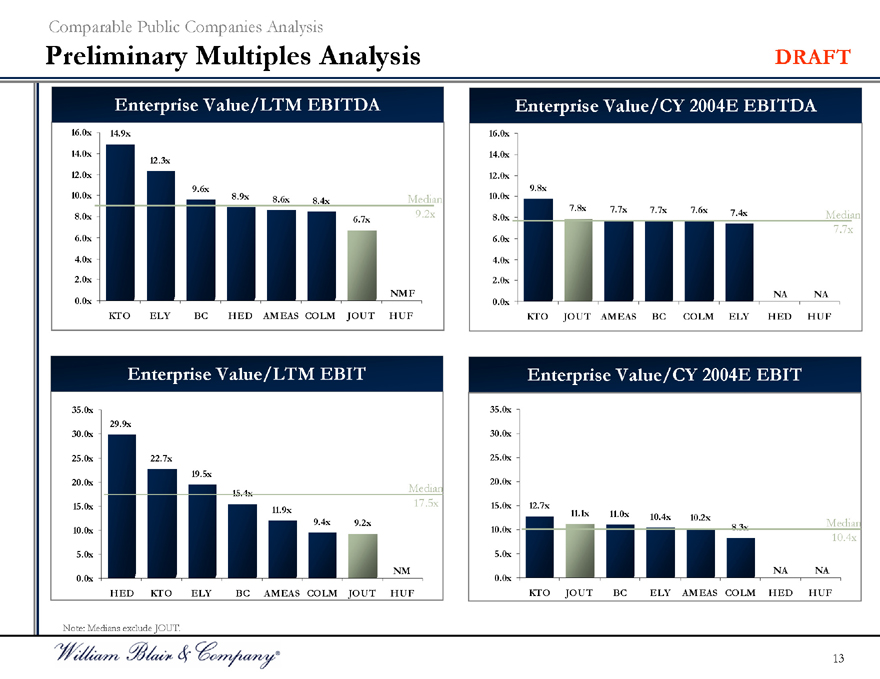

Preliminary Multiples Analysis DRAFT

Enterprise Value/LTM EBITDA

16.0x

14.0x

12.0x

10.0x

8.0x

6.0x

4.0x

2.0x

0.0x

14.9x

12.3x

9.6x

8.9x 8.6x Median 8.4x

9.2x

6.7x

NMF

KTO ELY BC HED AMEAS COLM JOUT HUF

Enterprise Value/CY 2004E EBITDA

16.0x

14.0x

12.0x

10.0x

8.0x

6.0x

4.0x

2.0x

0.0x

9.8x

7.8x 7.7x 7.7x 7.6x

7.4x

Median 7.7x

NA NA

KTO JOUT AMEAS BC COLM ELY HED HUF

Enterprise Value/LTM EBIT

35.0x 30.0x 25.0x 20.0x 15.0x 10.0x 5.0x 0.0x

29.9x

22.7x

19.5x

15.4x

Median 17.5x

11.9x

9.4x 9.2x

NM

HED KTO ELY BC AMEAS COLM JOUT HUF

Enterprise Value/CY 2004E EBIT

35.0x 30.0x 25.0x 20.0x 15.0x 10.0x 5.0x 0.0x

12.7x

11.1x 11.0x 10.4x

10.2x

8.3x

Median 10.4x

NA NA

KTO JOUT BC ELY AMEAS COLM HED HUF

Note: Medians exclude JOUT.

13

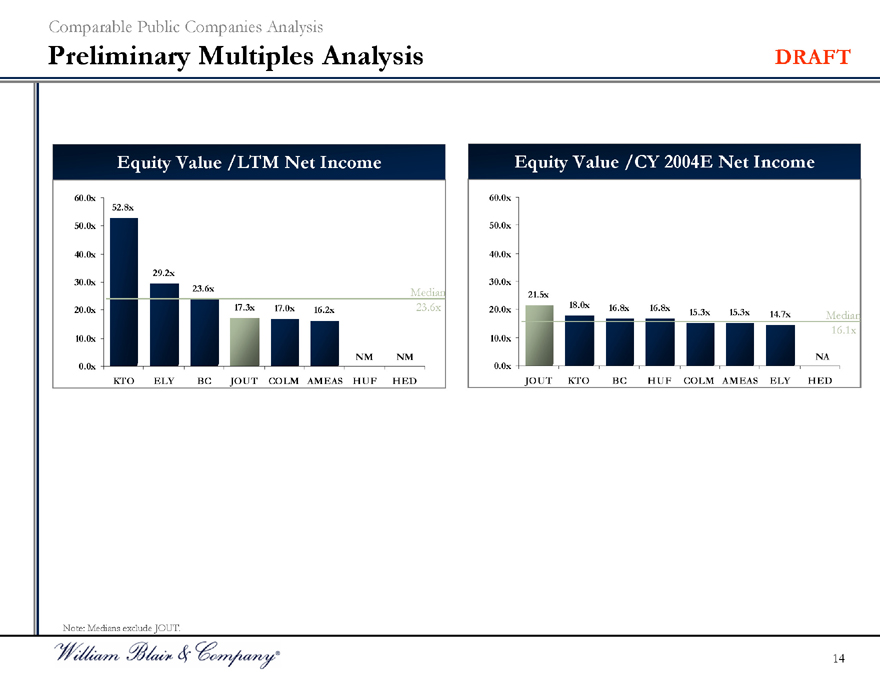

Comparable Public Companies Analysis

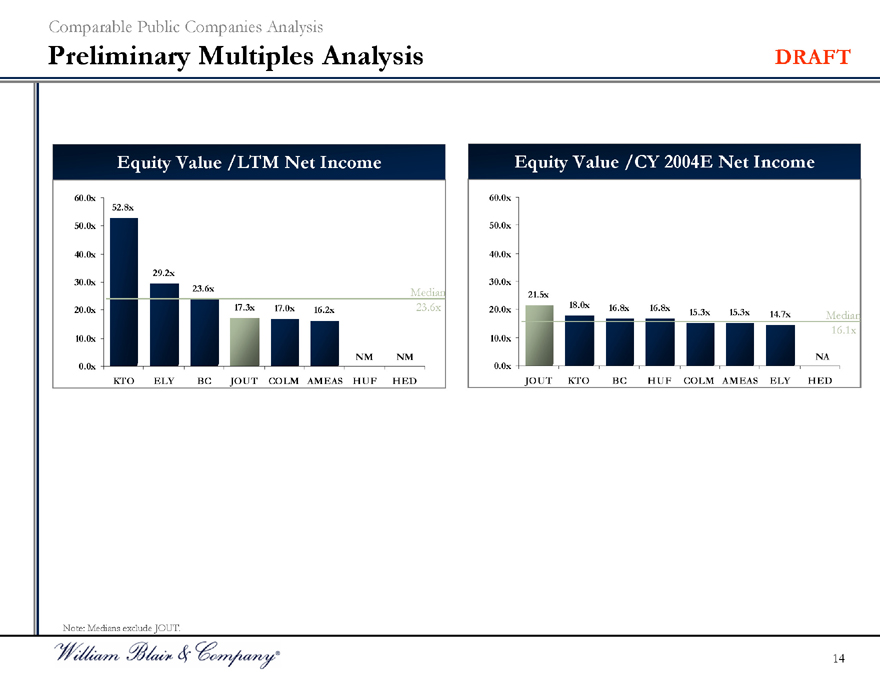

Preliminary Multiples Analysis DRAFT

Equity Value /LTM Net Income

60.0x 50.0x 40.0x 30.0x 20.0x 10.0x 0.0x

52.8x

29.2x

23.6x

17.3x 17.0x 16.2x Median 23.6x

NM NM

KTO ELY BC JOUT COLM AMEAS HUF HED

Equity Value /CY 2004E Net Income

60.0x 50.0x 40.0x 30.0x 20.0x 10.0x 0.0x

21.5x

18.0x 16.8x 16.8x

15.3x 15.3x 14.7x Median 16.1x

NA

JOUT KTO BC HUF COLM AMEAS ELY HED

Note: Medians exclude JOUT.

14

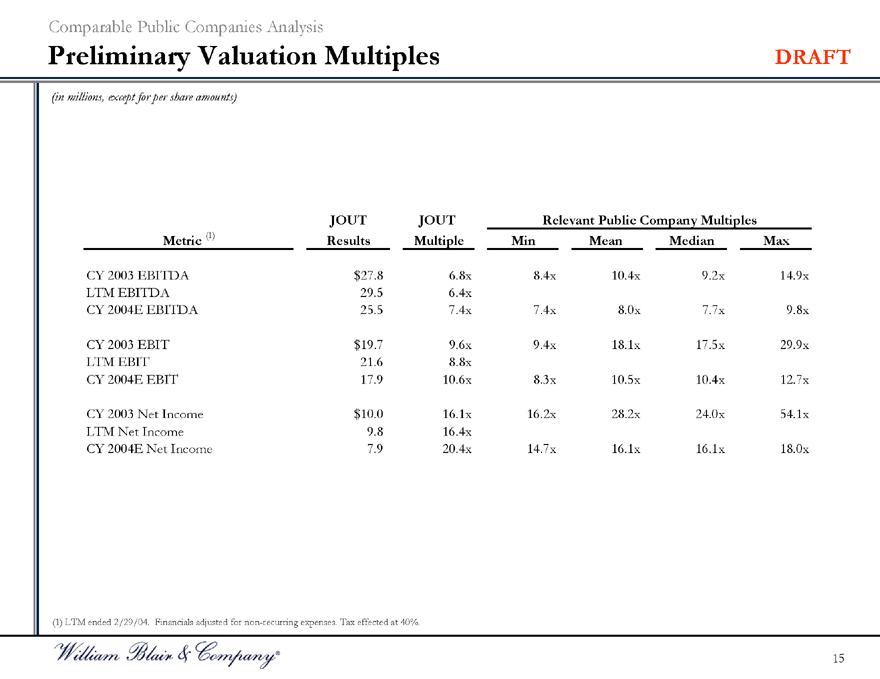

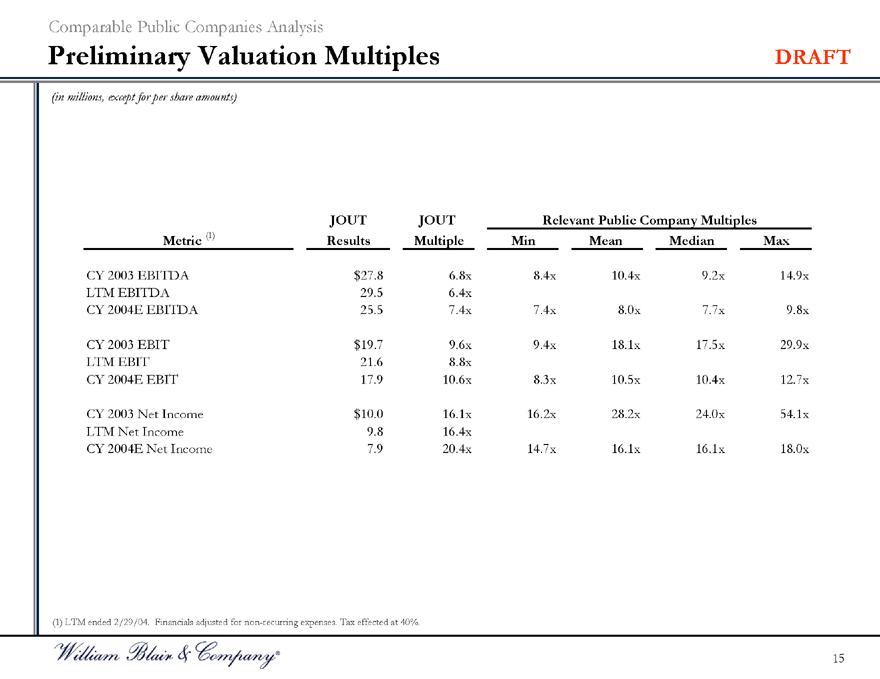

Comparable Public Companies Analysis

Preliminary Valuation Multiples DRAFT

(in millions, except for per share amounts)

JOUT JOUT Relevant Public Company Multiples

Metric (1) Results Multiple Min Mean Median Max

CY 2003 EBITDA $27.8 6.8x 8.4x 10.4x 9.2x 14.9x

LTM EBITDA 29.5 6.4x

CY 2004E EBITDA 25.5 7.4x 7.4x 8.0x 7.7x 9.8x

CY 2003 EBIT $19.7 9.6x 9.4x 18.1x 17.5x 29.9x

LTM EBIT 21.6 8.8x

CY 2004E EBIT 17.9 10.6x 8.3x 10.5x 10.4x 12.7x

CY 2003 Net Income $10.0 16.1x 16.2x 28.2x 24.0x 54.1x

LTM Net Income 9.8 16.4x

CY 2004E Net Income 7.9 20.4x 14.7x 16.1x 16.1x 18.0x

(1) LTM ended 2/29/04. Financials adjusted for non-recurring expenses. Tax effected at 40%.

15

DRAFT

Comparable M&A Transactions Analysis

\

Comparable M&A Transactions Analysis

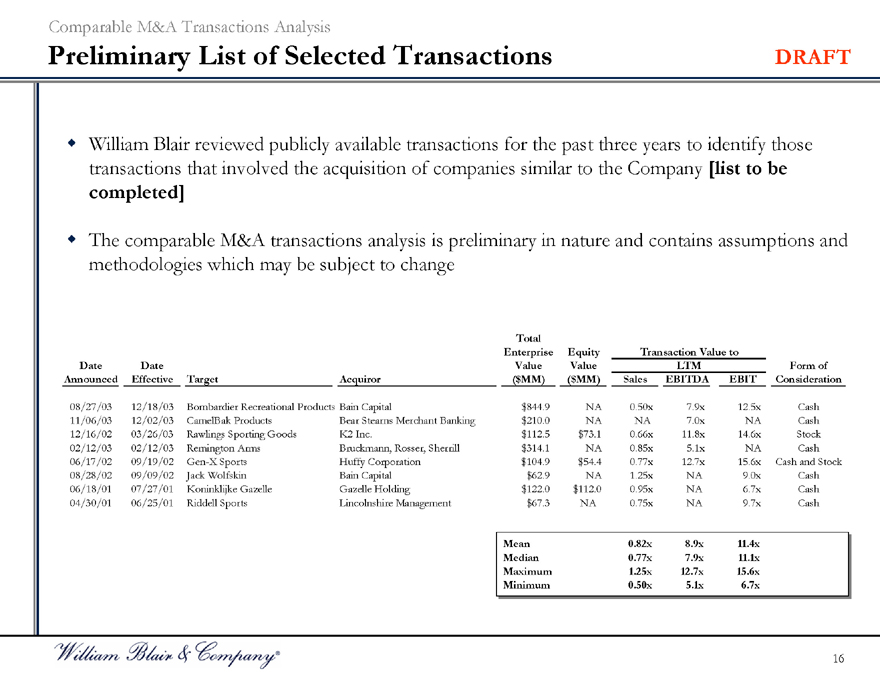

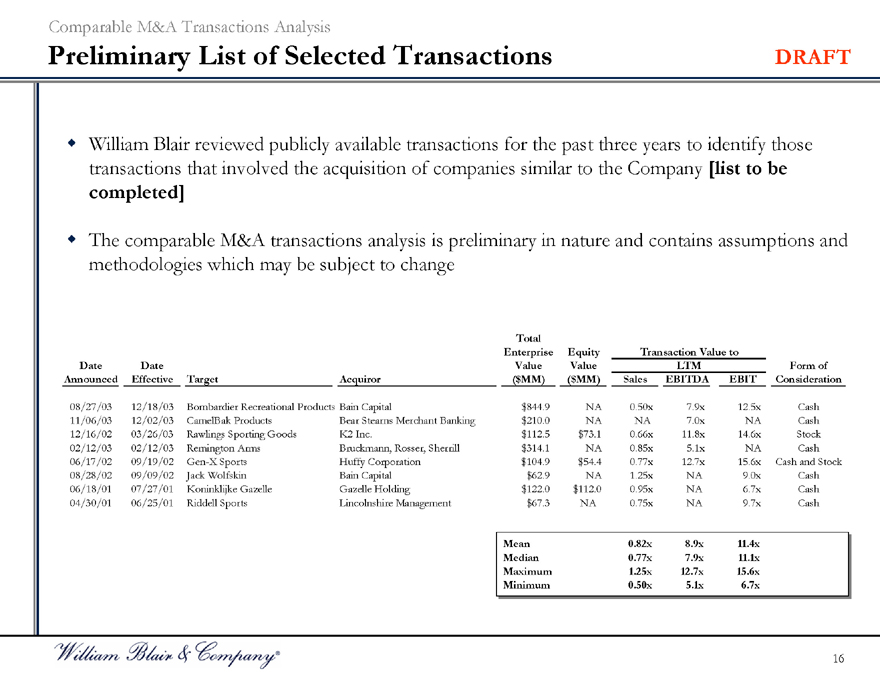

Preliminary List of Selected Transactions DRAFT

William Blair reviewed publicly available transactions for the past three years to identify those transactions that involved the acquisition of companies similar to the Company [list to be completed]

The comparable M&A transactions analysis is preliminary in nature and contains assumptions and methodologies which may be subject to change

Total

Enterprise Equity Transaction Value to

Date Date Value Value LTM Form of

Announced Effective Target Acquiror ($MM) ($MM) Sales EBITDA EBIT Consideration

08/27/03 12/18/03 Bombardier Recreational Products Bain Capital $844.9 NA 0.50x 7.9x 12.5x Cash

11/06/03 12/02/03 CamelBak Products Bear Stearns Merchant Banking $210.0 NA NA 7.0x NA Cash

12/16/02 03/26/03 Rawlings Sporting Goods K2 Inc. $112.5 $73.1 0.66x 11.8x 14.6x Stock

02/12/03 02/12/03 Remington Arms Bruckmann, Rosser, Sherrill $314.1 NA 0.85x 5.1x NA Cash

06/17/02 09/19/02 Gen-X Sports Huffy Corporation $104.9 $54.4 0.77x 12.7x 15.6x Cash and Stock

08/28/02 09/09/02 Jack Wolfskin Bain Capital $62.9 NA 1.25x NA 9.0x Cash

06/18/01 07/27/01 Koninklijke Gazelle Gazelle Holding $122.0 $112.0 0.95x NA 6.7x Cash

04/30/01 06/25/01 Riddell Sports Lincolnshire Management $67.3 NA 0.75x NA 9.7x Cash

Mean 0.82x 8.9x 11.4x

Median 0.77x 7.9x 11.1x

Maximum 1.25x 12.7x 15.6x

Minimum 0.50x 5.1x 6.7x

16

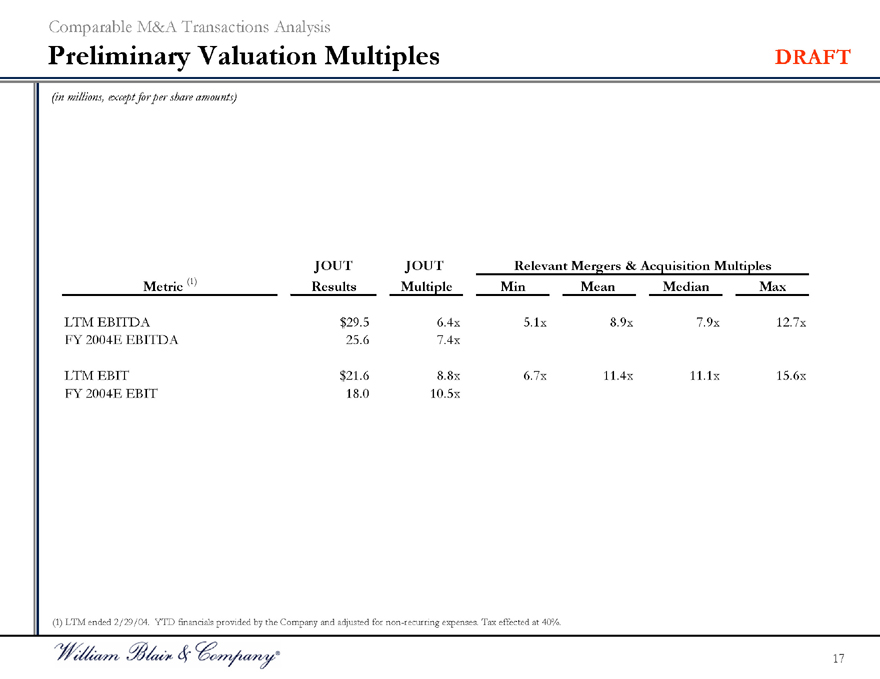

Comparable M&A Transactions Analysis

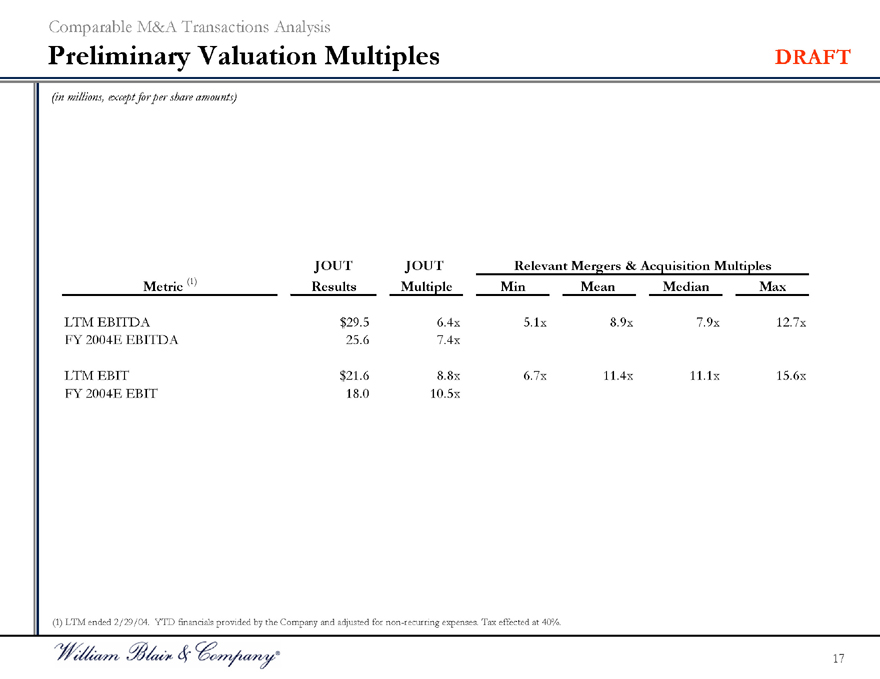

Preliminary Valuation Multiples DRAFT

(in millions, except for per share amounts)

JOUT JOUT Relevant Mergers & Acquisition Multiples Metric (1) Results Multiple Min Mean Median Max

LTM EBITDA $29.5 6.4x 5.1x 8.9x 7.9x 12.7x FY 2004E EBITDA 25.6 7.4x

LTM EBIT $21.6 8.8x 6.7x 11.4x 11.1x 15.6x FY 2004E EBIT 18.0 10.5x

(1) LTM ended 2/29/04. YTD financials provided by the Company and adjusted for non-recurring expenses. Tax effected at 40%.

17

DRAFT

M&A Premiums Paid Analysis

M&a Premiums Paid Analysis

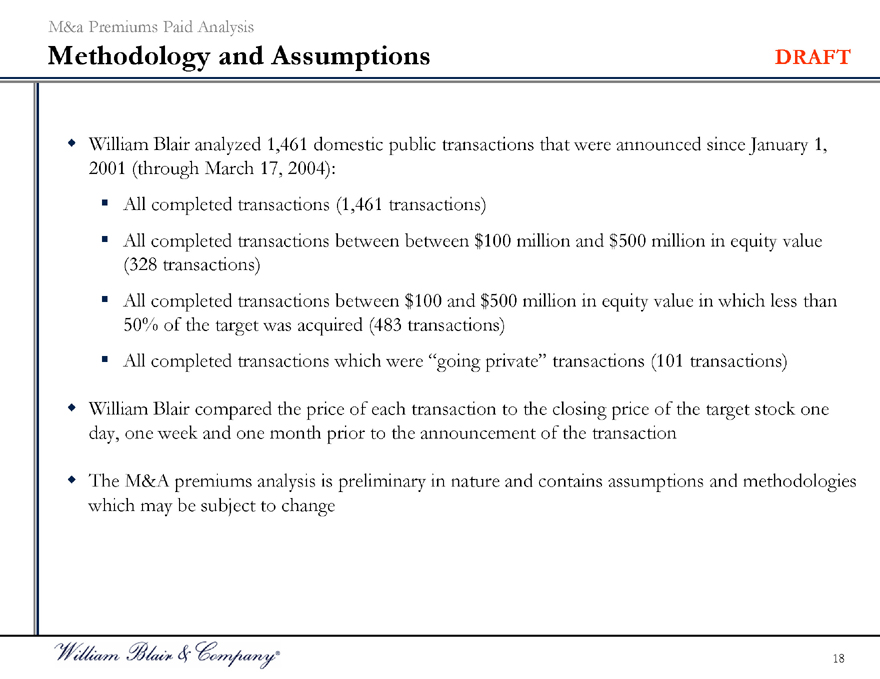

Methodology and Assumptions DRAFT

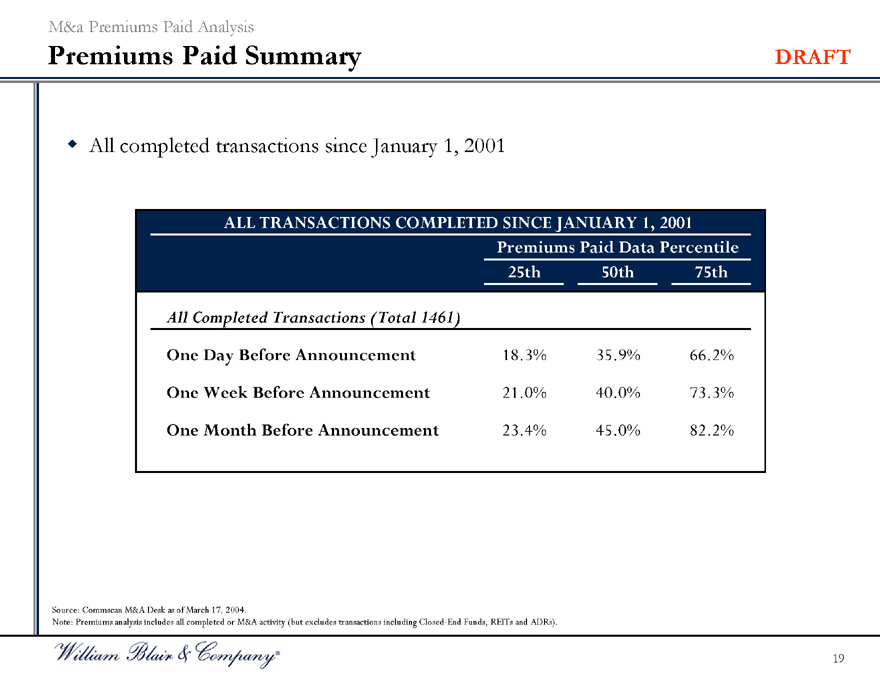

William Blair analyzed 1,461 domestic public transactions that were announced since January 1, 2001 (through March 17, 2004):

All completed transactions (1,461 transactions)

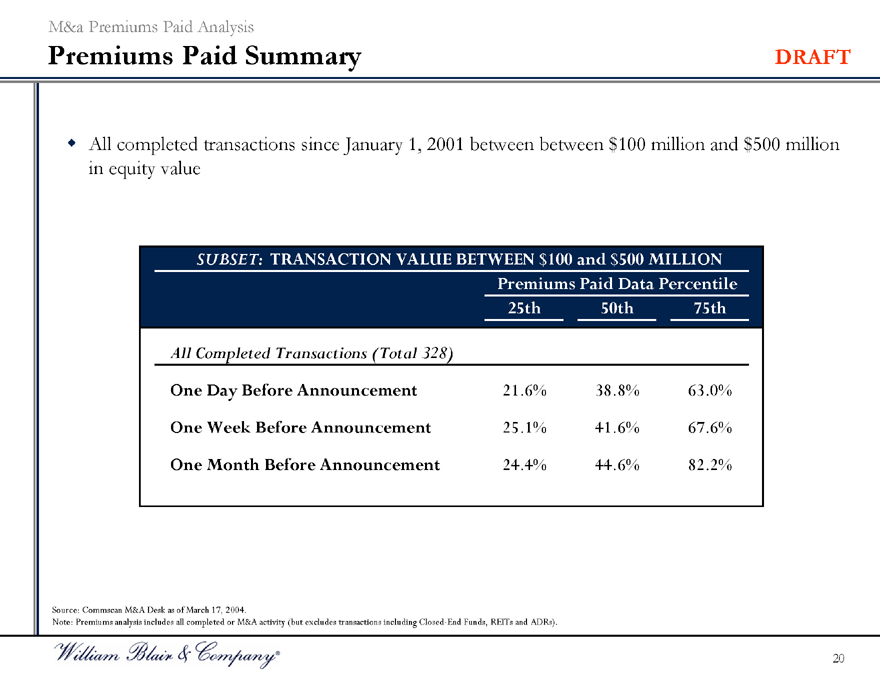

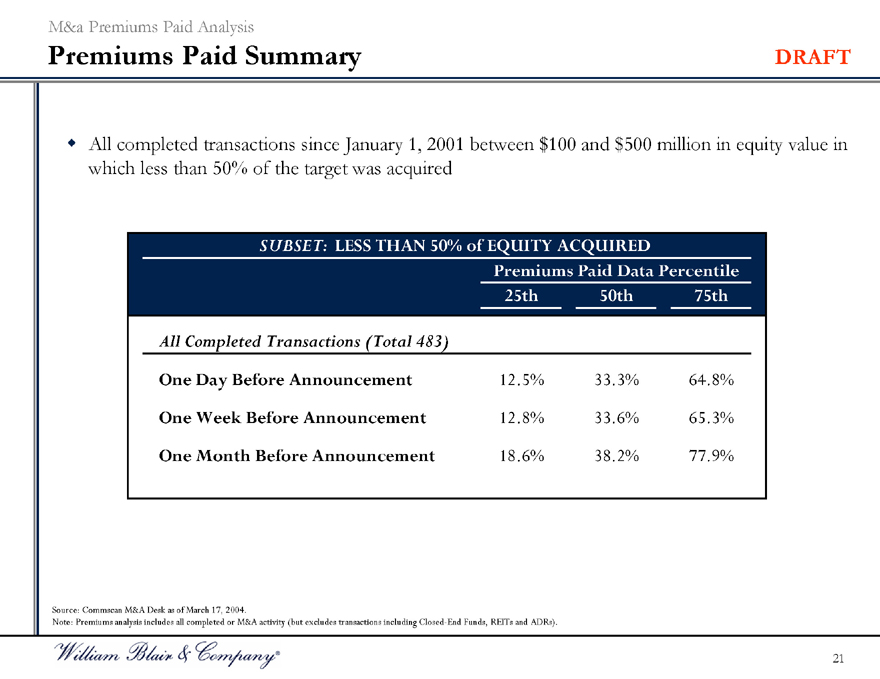

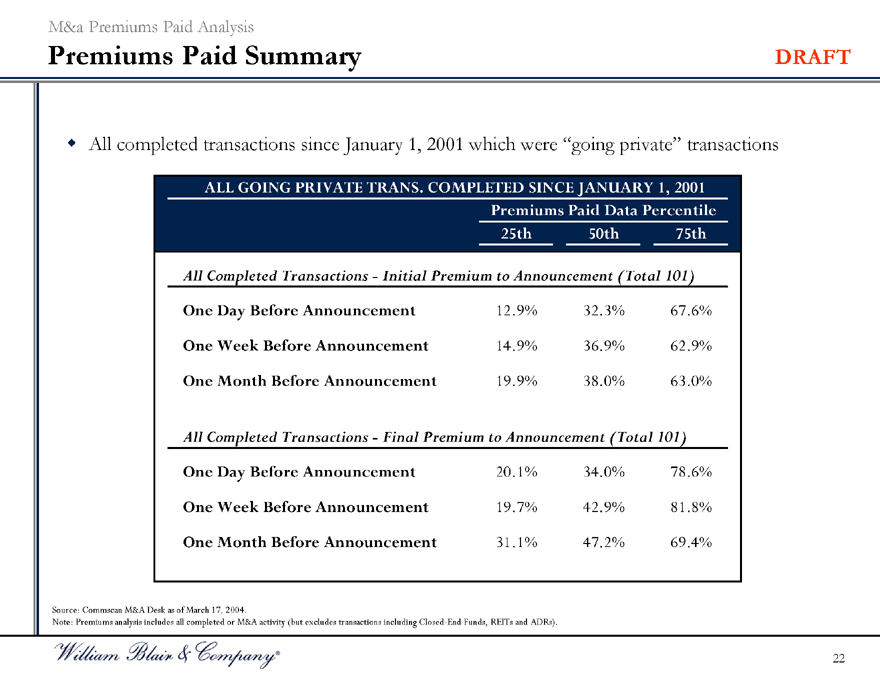

All completed transactions between between $100 million and $500 million in equity value (328 transactions) All completed transactions between $100 and $500 million in equity value in which less than 50% of the target was acquired (483 transactions) All completed transactions which were “going private” transactions (101 transactions)

William Blair compared the price of each transaction to the closing price of the target stock one day, one week and one month prior to the announcement of the transaction

The M&A premiums analysis is preliminary in nature and contains assumptions and methodologies which may be subject to change

18

M&a Premiums Paid Analysis

Premiums Paid Summary DRAFT

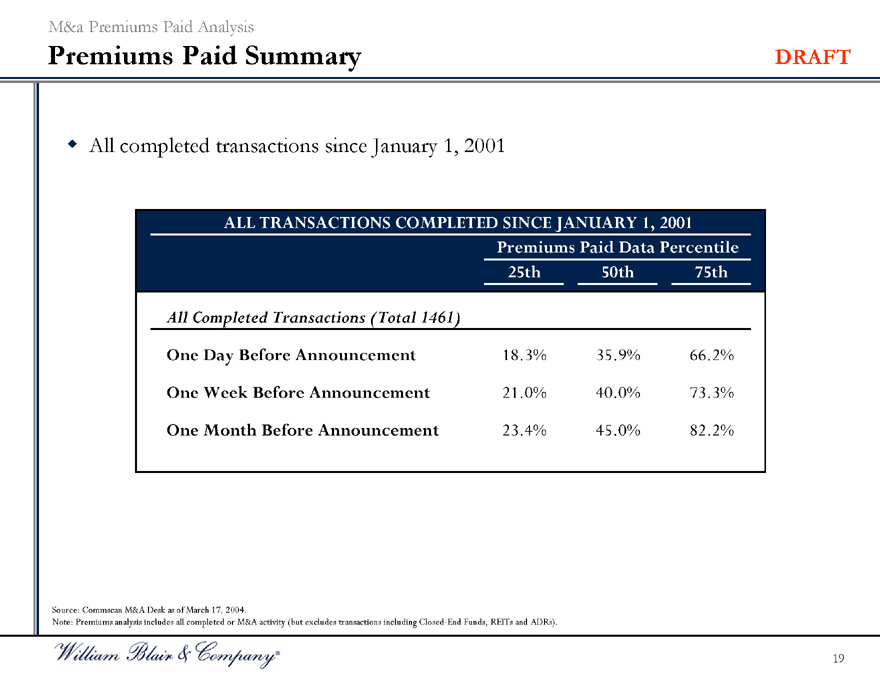

All completed transactions since January 1, 2001

ALL TRANSACTIONS COMPLETED SINCE JANUARY 1, 2001

Premiums Paid Data Percentile

25th 50th 75th

All Completed Transactions (Total 1461)

One Day Before Announcement 18.3% 35.9% 66.2%

One Week Before Announcement 21.0% 40.0% 73.3%

One Month Before Announcement 23.4% 45.0% 82.2%

Source: Commscan M&A Desk as of March 17, 2004.

Note: Premiums analysis includes all completed or M&A activity (but excludes transactions including Closed-End Funds, REITs and ADRs).

19

M&a Premiums Paid Analysis

Premiums Paid Summary DRAFT

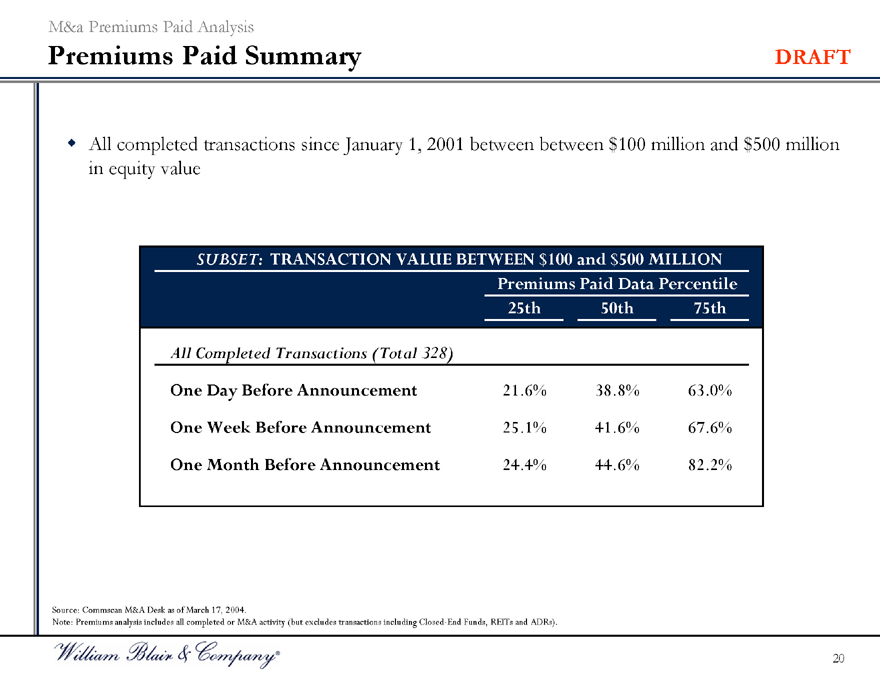

All completed transactions since January 1, 2001 between between $100 million and $500 million in equity value

SUBSET: TRANSACTION VALUE BETWEEN $100 and $500 MILLION

Premiums Paid Data Percentile

25th 50th 75th

All Completed Transactions (Total 328)

One Day Before Announcement 21.6% 38.8% 63.0%

One Week Before Announcement 25.1% 41.6% 67.6%

One Month Before Announcement 24.4% 44.6% 82.2%

Source: Commscan M&A Desk as of March 17, 2004.

Note: Premiums analysis includes all completed or M&A activity (but excludes transactions including Closed-End Funds, REITs and ADRs).

20

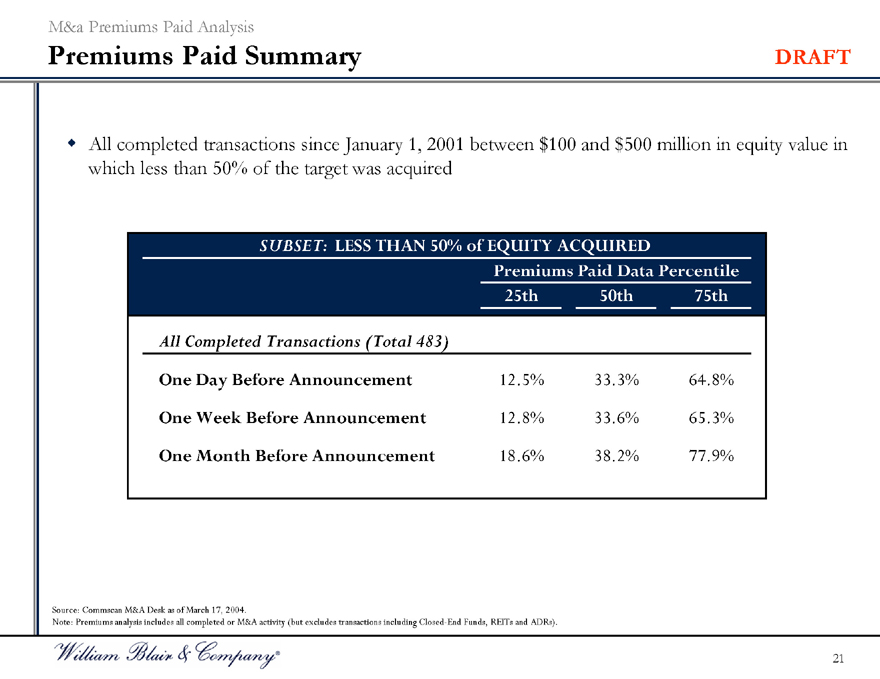

M&a Premiums Paid Analysis

Premiums Paid Summary DRAFT

All completed transactions since January 1, 2001 between $100 and $500 million in equity value in which less than 50% of the target was acquired

SUBSET: LESS THAN 50% of EQUITY ACQUIRED

Premiums Paid Data Percentile

25th 50th 75th

All Completed Transactions (Total 483)

One Day Before Announcement 12.5% 33.3% 64.8%

One Week Before Announcement 12.8% 33.6% 65.3%

One Month Before Announcement 18.6% 38.2% 77.9%

Source: Commscan M&A Desk as of March 17, 2004.

Note: Premiums analysis includes all completed or M&A activity (but excludes transactions including Closed-End Funds, REITs and ADRs).

21

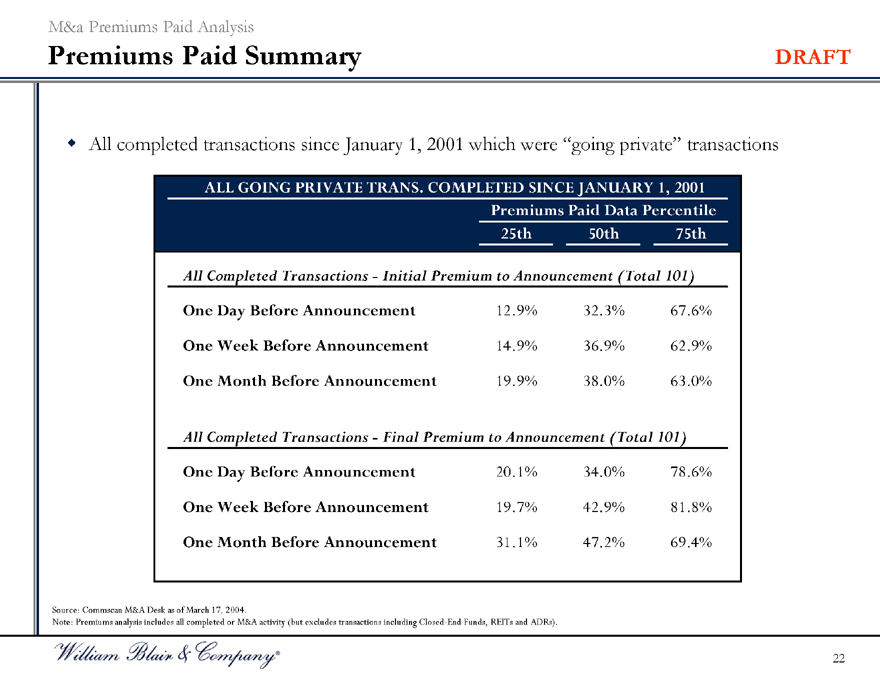

M&a Premiums Paid Analysis

Premiums Paid Summary DRAFT

All completed transactions since January 1, 2001 which were “going private” transactions

ALL GOING PRIVATE TRANS. COMPLETED SINCE JANUARY 1, 2001

Premiums Paid Data Percentile

25th 50th 75th

All Completed Transactions - Initial Premium to Announcement (Total 101)

One Day Before Announcement 12.9% 32.3% 67.6%

One Week Before Announcement 14.9% 36.9% 62.9%

One Month Before Announcement 19.9% 38.0% 63.0%

All Completed Transactions - Final Premium to Announcement (Total 101)

One Day Before Announcement 20.1% 34.0% 78.6%

One Week Before Announcement 19.7% 42.9% 81.8%

One Month Before Announcement 31.1% 47.2% 69.4%

Source: Commscan M&A Desk as of March 17, 2004.

Note: Premiums analysis includes all completed or M&A activity (but excludes transactions including Closed-End Funds, REITs and ADRs).

22

DRAFT

Discounted Cash Flow Analysis

Discounted Cash Flow Analysis

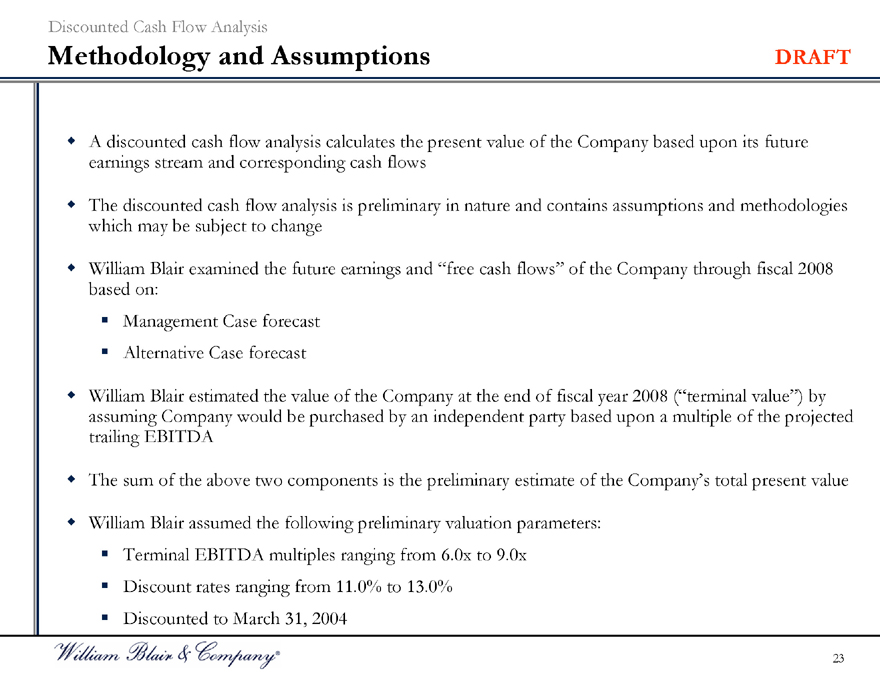

Methodology and Assumptions DRAFT

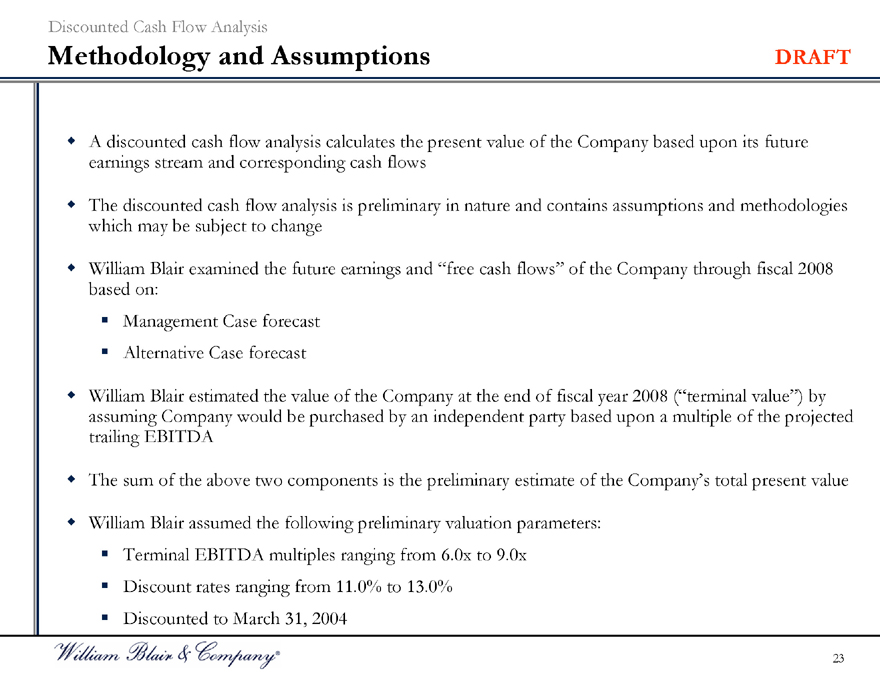

A discounted cash flow analysis calculates the present value of the Company based upon its future earnings stream and corresponding cash flows

The discounted cash flow analysis is preliminary in nature and contains assumptions and methodologies which may be subject to change

William Blair examined the future earnings and “free cash flows” of the Company through fiscal 2008 based on:

Management Case forecast Alternative Case forecast

William Blair estimated the value of the Company at the end of fiscal year 2008 (“terminal value”) by assuming Company would be purchased by an independent party based upon a multiple of the projected trailing EBITDA

The sum of the above two components is the preliminary estimate of the Company’s total present value

William Blair assumed the following preliminary valuation parameters:

Terminal EBITDA multiples ranging from 6.0x to 9.0x Discount rates ranging from 11.0% to 13.0% Discounted to March 31, 2004

23

Discounted Cash Flow Analysis

Discounted Cash Flow Analysis – Management Case DRAFT

(in millions, except for per share amounts)

Present Value of Enterprise Value

Discount Rate Terminal EBITDA Multiple

6.0x 7.5x 9.0x

11.0% $168.8 $201.3 $233.8

11.5% 165.8 197.6 229.5

12.0% 162.7 194.0 225.2

12.5% 159.8 190.4 221.0

13.0% 156.9 186.9 216.9

Present Value of Per Share Equity Value

Discount Rate Terminal EBITDA Multiple

6.0x 7.5x 9.0x

11.0% $15.66 $19.29 $22.92

11.5% 15.31 18.87 22.43

12.0% 14.98 18.47 21.95

12.5% 14.65 18.07 21.49

13.0% 14.33 17.68 21.03

24

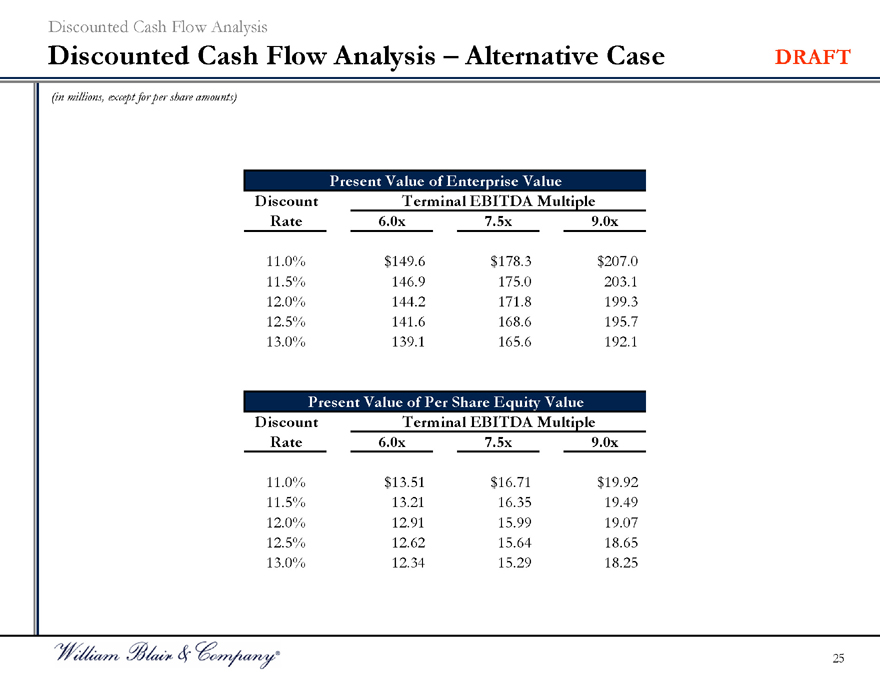

Discounted Cash Flow Analysis

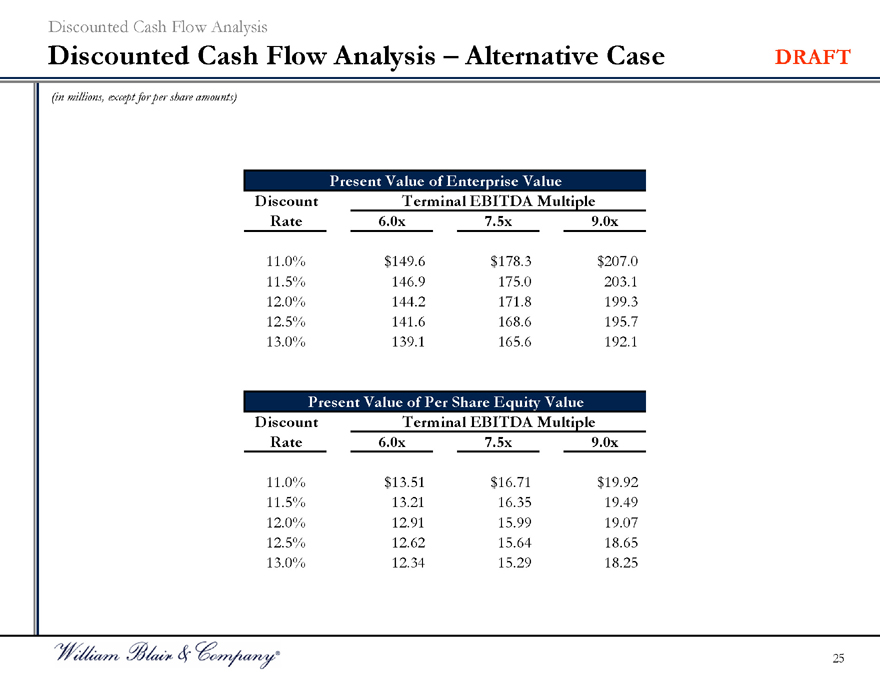

Discounted Cash Flow Analysis – Alternative Case DRAFT

(in millions, except for per share amounts)

Present Value of Enterprise Value

Discount Rate Terminal EBITDA Multiple

6.0x 7.5x 9.0x

11.0% $149.6 $178.3 $207.0

11.5% 146.9 175.0 203.1

12.0% 144.2 171.8 199.3

12.5% 141.6 168.6 195.7

13.0% 139.1 165.6 192.1

Present Value of Per Share Equity Value

Discount Rate Terminal EBITDA Multiple

6.0x 7.5x 9.0x

11.0% $13.51 $16.71 $19.92

11.5% 13.21 16.35 19.49

12.0% 12.91 15.99 19.07

12.5% 12.62 15.64 18.65

13.0% 12.34 15.29 18.25

25

DRAFT

Leveraged Buyout Analysis

Leveraged Buyout Analysis

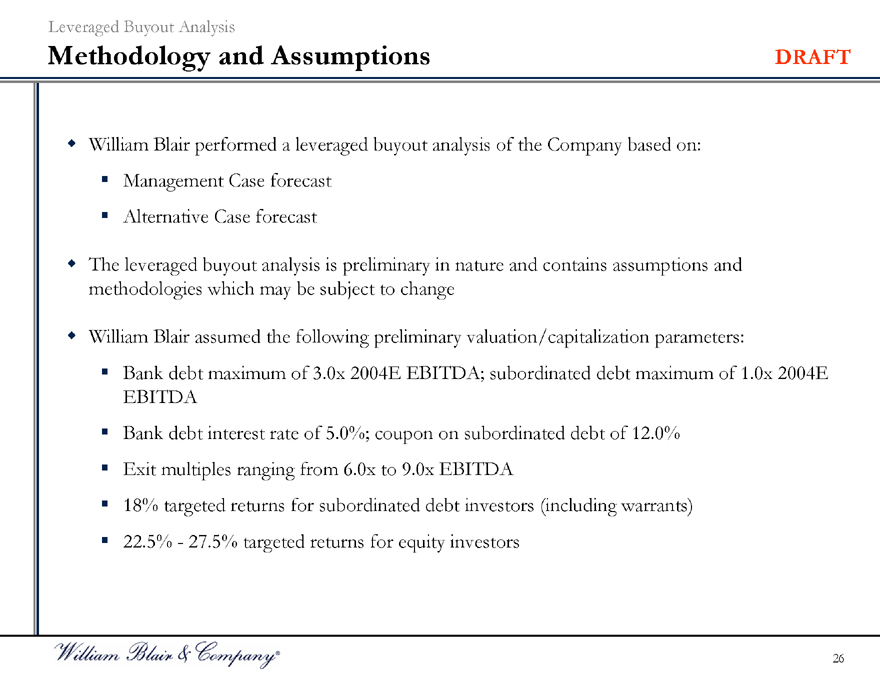

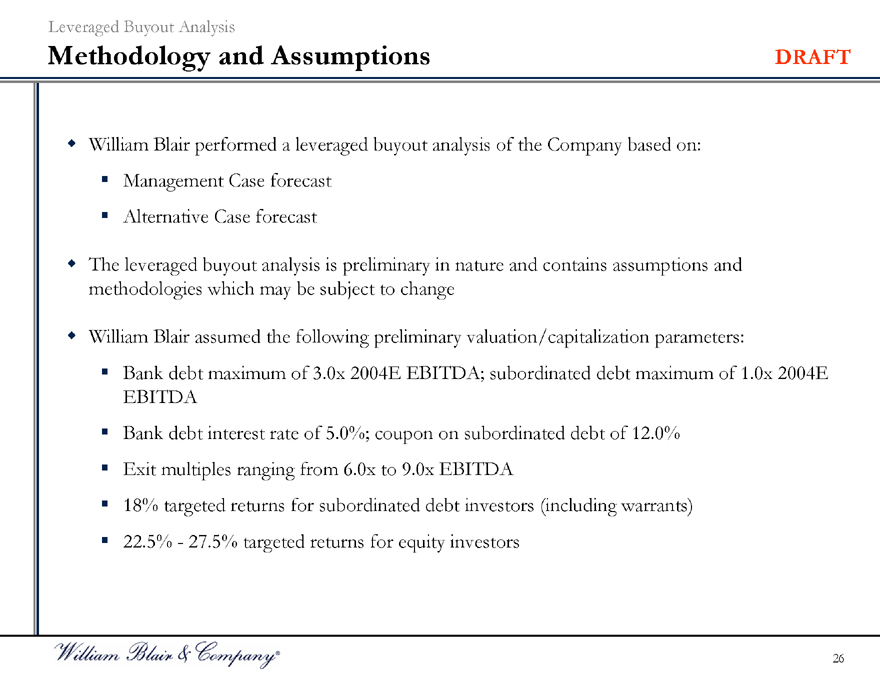

Methodology and Assumptions DRAFT

William Blair performed a leveraged buyout analysis of the Company based on:

Management Case forecast

Alternative Case forecast

The leveraged buyout analysis is preliminary in nature and contains assumptions and methodologies which may be subject to change

William Blair assumed the following preliminary valuation/capitalization parameters:

Bank debt maximum of 3.0x 2004E EBITDA; subordinated debt maximum of 1.0x 2004E EBITDA

Bank debt interest rate of 5.0%; coupon on subordinated debt of 12.0%

Exit multiples ranging from 6.0x to 9.0x EBITDA

18% targeted returns for subordinated debt investors (including warrants)

22.5%—27.5% targeted returns for equity investors

26

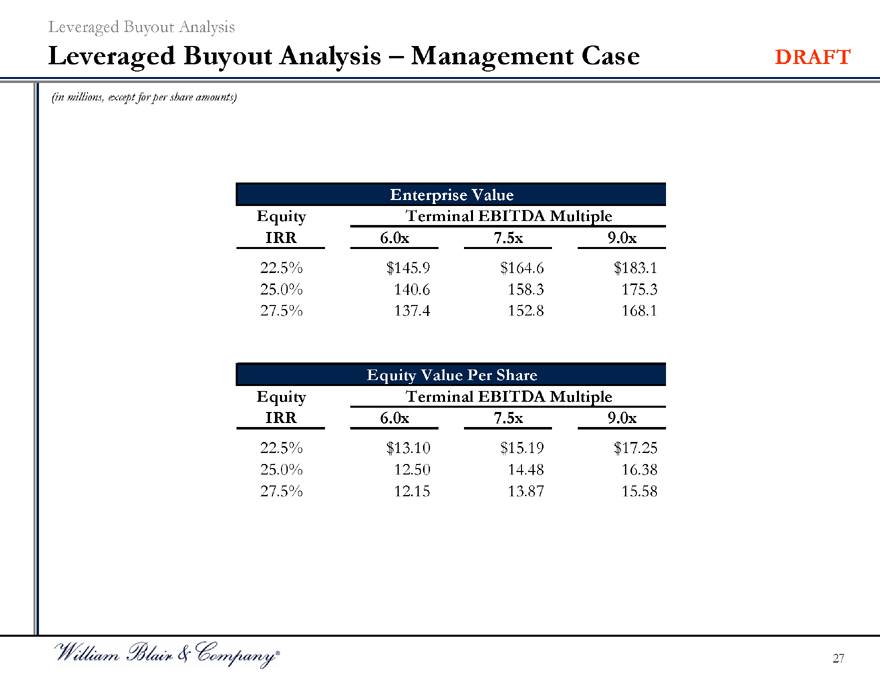

Leveraged Buyout Analysis

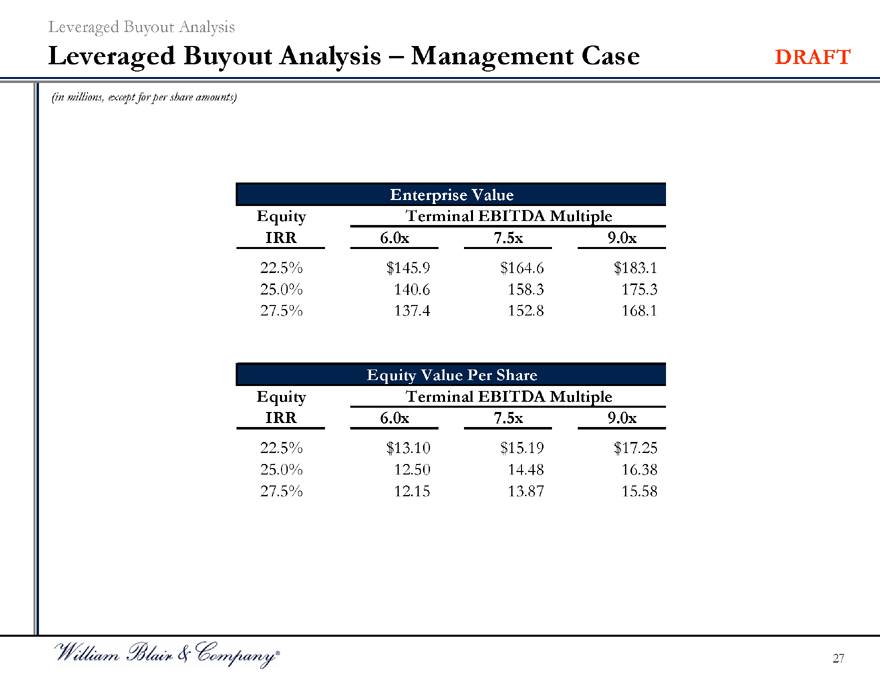

Leveraged Buyout Analysis – Management Case DRAFT

(in millions, except for per share amounts)

Enterprise Value

Equity IRR Terminal EBITDA Multiple

6.0x 7.5x 9.0x

22.5% $145.9 $164.6 $183.1

25.0% 140.6 158.3 175.3

27.5% 137.4 152.8 168.1

Equity Value Per Share

Equity IRR Terminal EBITDA Multiple

6.0x 7.5x 9.0x

22.5% $13.10 $15.19 $17.25

25.0% 12.50 14.48 16.38

27.5% 12.15 13.87 15.58

27

Leveraged Buyout Analysis

Leveraged Buyout Analysis – Alternative Case DRAFT

(in millions, except for per share amounts)

[Alternative Case Forthcoming]

28

DRAFT

Valuation Matrix

Valuation Matrix

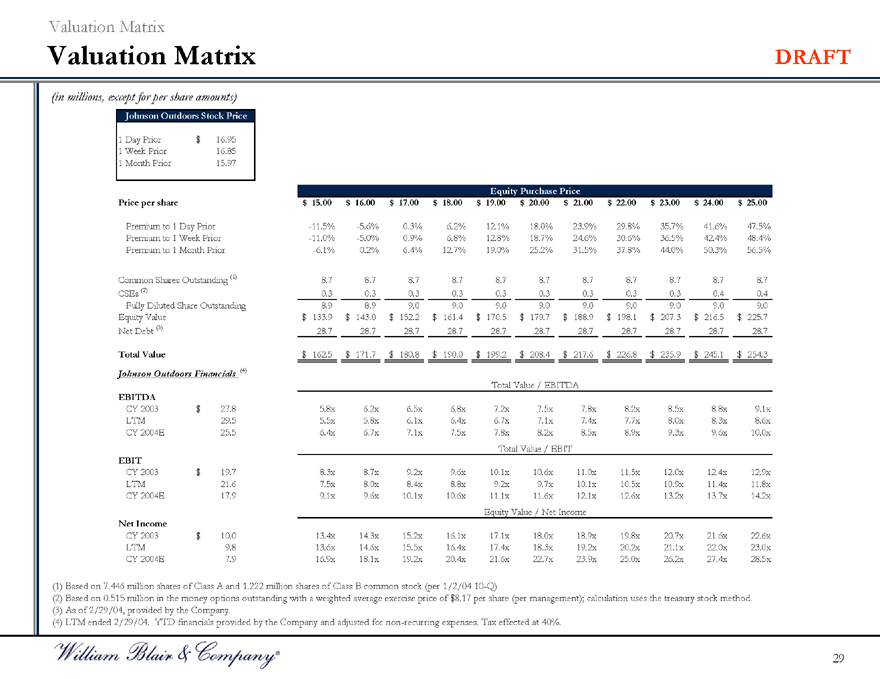

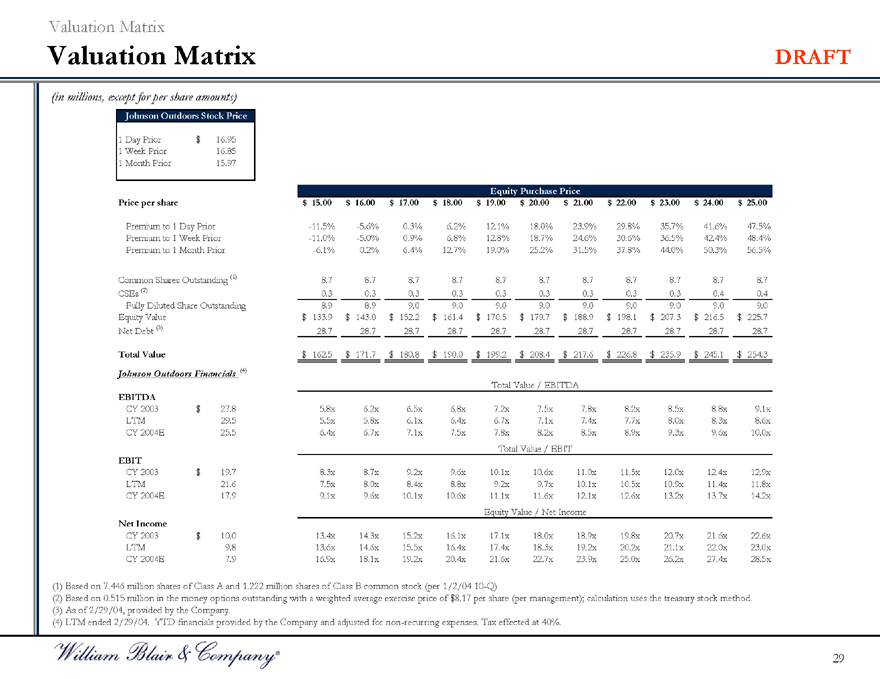

Valuation Matrix DRAFT

(in millions, except for per share amounts)

Johnson Outdoors Stock Price

1 Day Prior $16.95

1 Week Prior 16.85

1 Month Prior 15.97

Equity Purchase Price

Price per share $15.00 $16.00 $17.00 $18.00 $19.00 $20.00 $21.00 $22.00 $23.00 $24.00 $25.00

Premium to 1 Day Prior -11.5% -5.6% 0.3% 6.2% 12.1% 18.0% 23.9% 29.8% 35.7% 41.6% 47.5%

Premium to 1 Week Prior -11.0% -5.0% 0.9% 6.8% 12.8% 18.7% 24.6% 30.6% 36.5% 42.4% 48.4%

Premium to 1 Month Prior -6.1% 0.2% 6.4% 12.7% 19.0% 25.2% 31.5% 37.8% 44.0% 50.3% 56.5%

Common Shares Outstanding (1) 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7 8.7

CSEs (2) 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.3 0.4 0.4

Fully Diluted Share Outstanding 8.9 8.9 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0 9.0

Equity Value $133.9 $143.0 $152.2 $161.4 $170.5 $179.7 $188.9 $198.1 $207.3 $216.5 $225.7

Net Debt (3) 28.7 28.7 28.7 28.7 28.7 28.7 28.7 28.7 28.7 28.7 28.7

Total Value $162.5 $171.7 $180.8 $190.0 $199.2 $208.4 $217.6 $226.8 $235.9 $245.1 $254.3

Johnson Outdoors Financials (4)

Total Value / EBITDA

EBITDA

CY 2003 $27.8 5.8x 6.2x 6.5x 6.8x 7.2x 7.5x 7.8x 8.2x 8.5x 8.8x 9.1x

LTM 29.5 5.5x 5.8x 6.1x 6.4x 6.7x 7.1x 7.4x 7.7x 8.0x 8.3x 8.6x

CY 2004E 25.5 6.4x 6.7x 7.1x 7.5x 7.8x 8.2x 8.5x 8.9x 9.3x 9.6x 10.0x

Total Value / EBIT

EBIT

CY 2003 $19.7 8.3x 8.7x 9.2x 9.6x 10.1x 10.6x 11.0x 11.5x 12.0x 12.4x 12.9x

LTM 21.6 7.5x 8.0x 8.4x 8.8x 9.2x 9.7x 10.1x 10.5x 10.9x 11.4x 11.8x

CY 2004E 17.9 9.1x 9.6x 10.1x 10.6x 11.1x 11.6x 12.1x 12.6x 13.2x 13.7x 14.2x

Equity Value / Net Income

Net Income

CY 2003 $10.0 13.4x 14.3x 15.2x 16.1x 17.1x 18.0x 18.9x 19.8x 20.7x 21.6x 22.6x

LTM 9.8 13.6x 14.6x 15.5x 16.4x 17.4x 18.3x 19.2x 20.2x 21.1x 22.0x 23.0x

CY 2004E 7.9 16.9x 18.1x 19.2x 20.4x 21.6x 22.7x 23.9x 25.0x 26.2x 27.4x 28.5x

(1) Based on 7.446 million shares of Class A and 1.222 million shares of Class B common stock (per 1/2/04 10-Q)

(2) Based on 0.515 million in the money options outstanding with a weighted average exercise price of $8.17 per share (per management); calculation uses the treasury stock method. (3) As of 2/29/04, provided by the Company.

(4) LTM ended 2/29/04. YTD financials provided by the Company and adjusted for non-recurring expenses. Tax effected at 40%.

29

DRAFT

Comparable Public Companies Model

Comparable Public Companies Model

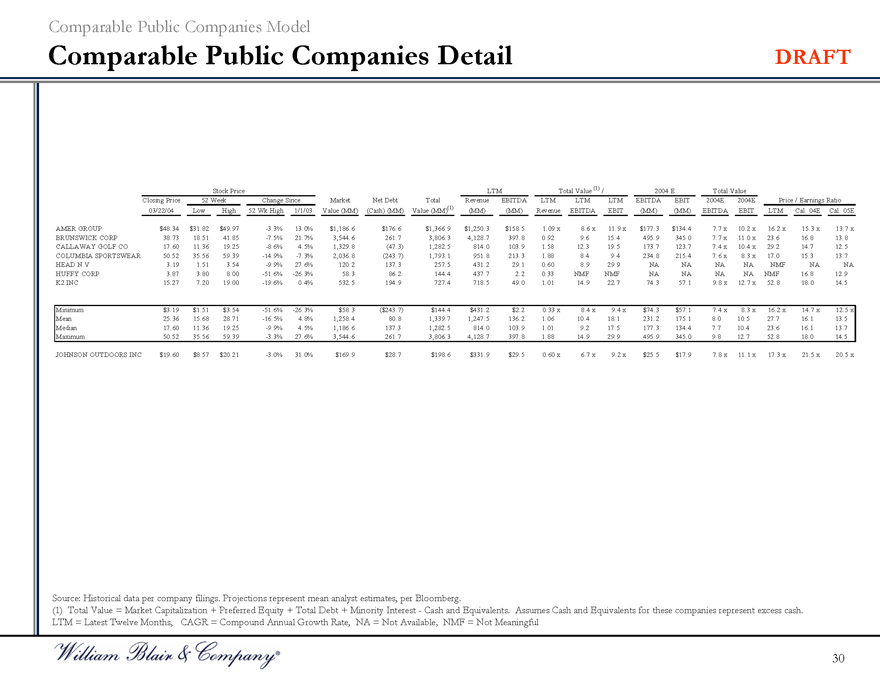

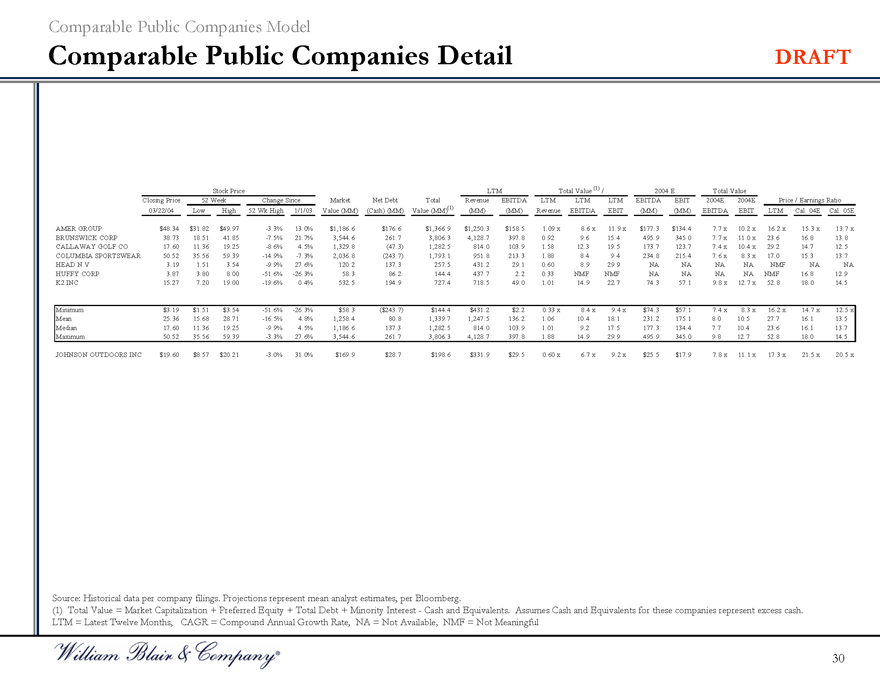

Comparable Public Companies Detail DRAFT

Stock Price LTM Total Value (1) / 2004 E Total Value

Closing Price 52 Week Change Since Market Net Debt Total Revenue EBITDA LTM LTM LTM EBITDA EBIT 2004E 2004E Price / Earnings Ratio

03/22/04 Low High 52 Wk High 1/1/03 Value (MM) (Cash) (MM) Value (MM)(1) (MM) (MM) Revenue EBITDA EBIT (MM) (MM) EBITDA EBIT LTM Cal. 04E Cal. 05E

AMER GROUP $48.34 $31.82 $49.97 -3.3% 13.0% $1,186.6 $176.6 $1,366.9 $1,250.3 $158.5 1.09 x 8.6 x 11.9 x $177.3 $134.4 7.7 x 10.2 x 16.2 x 15.3 x 13.7 x

BRUNSWICK CORP 38.73 18.51 41.85 -7.5% 21.7% 3,544.6 261.7 3,806.3 4,128.7 397.8 0.92 9.6 15.4 495.9 345.0 7.7 x 11.0 x 23.6 16.8 13.8

CALLAWAY GOLF CO 17.60 11.36 19.25 -8.6% 4.5% 1,329.8 (47.3) 1,282.5 814.0 103.9 1.58 12.3 19.5 173.7 123.7 7.4 x 10.4 x 29.2 14.7 12.5

COLUMBIA SPORTSWEAR 50.52 35.56 59.39 -14.9% -7.3% 2,036.8 (243.7) 1,793.1 951.8 213.3 1.88 8.4 9.4 234.8 215.4 7.6 x 8.3 x 17.0 15.3 13.7

HEAD N V 3.19 1.51 3.54 -9.9% 27.6% 120.2 137.3 257.5 431.2 29.1 0.60 8.9 29.9 NA NA NA NA NMF NA NA

HUFFY CORP 3.87 3.80 8.00 -51.6% -26.3% 58.3 86.2 144.4 437.7 2.2 0.33 NMF NMF NA NA NA NA NMF 16.8 12.9

K2 INC 15.27 7.20 19.00 -19.6% 0.4% 532.5 194.9 727.4 718.5 49.0 1.01 14.9 22.7 74.3 57.1 9.8 x 12.7 x 52.8 18.0 14.5

Minimum $3.19 $1.51 $3.54 -51.6% -26.3% $58.3 ($243.7) $144.4 $431.2 $2.2 0.33 x 8.4 x 9.4 x $74.3 $57.1 7.4 x 8.3 x 16.2 x 14.7 x 12.5 x

Mean 25.36 15.68 28.71 -16.5% 4.8% 1,258.4 80.8 1,339.7 1,247.5 136.2 1.06 10.4 18.1 231.2 175.1 8.0 10.5 27.7 16.1 13.5

Median 17.60 11.36 19.25 -9.9% 4.5% 1,186.6 137.3 1,282.5 814.0 103.9 1.01 9.2 17.5 177.3 134.4 7.7 10.4 23.6 16.1 13.7

Maximum 50.52 35.56 59.39 -3.3% 27.6% 3,544.6 261.7 3,806.3 4,128.7 397.8 1.88 14.9 29.9 495.9 345.0 9.8 12.7 52.8 18.0 14.5

JOHNSON OUTDOORS INC $19.60 $8.57 $20.21 -3.0% 31.0% $169.9 $28.7 $198.6 $331.9 $29.5 0.60 x 6.7 x 9.2 x $25.5 $17.9 7.8 x 11.1 x 17.3 x 21.5 x 20.5 x

Source: Historical data per company filings. Projections represent mean analyst estimates, per Bloomberg.

(1) Total Value = Market Capitalization + Preferred Equity + Total Debt + Minority Interest—Cash and Equivalents. Assumes Cash and Equivalents for these companies represent excess cash. LTM = Latest Twelve Months, CAGR = Compound Annual Growth Rate, NA = Not Available, NMF = Not Meaningful

30

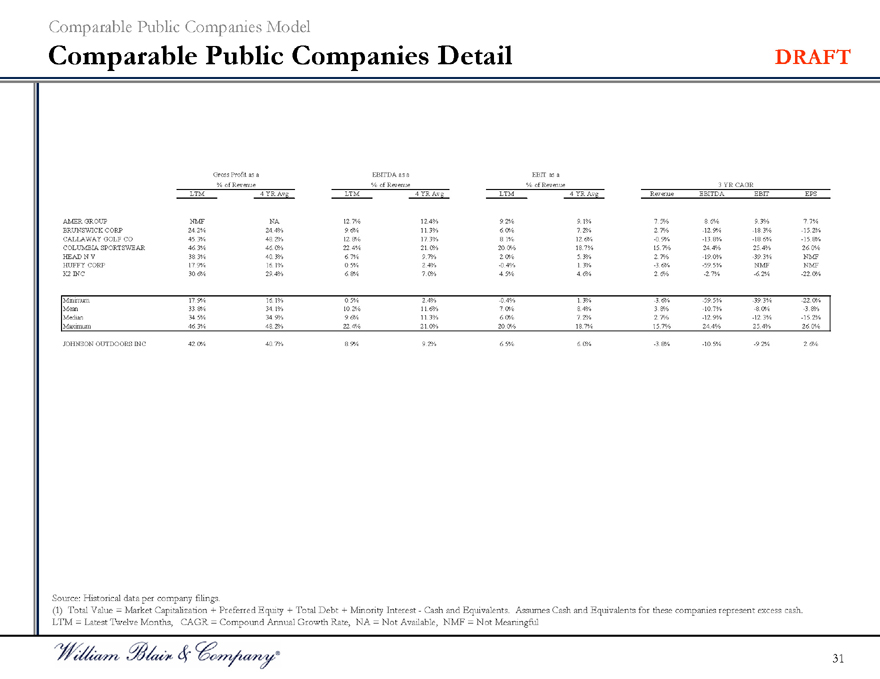

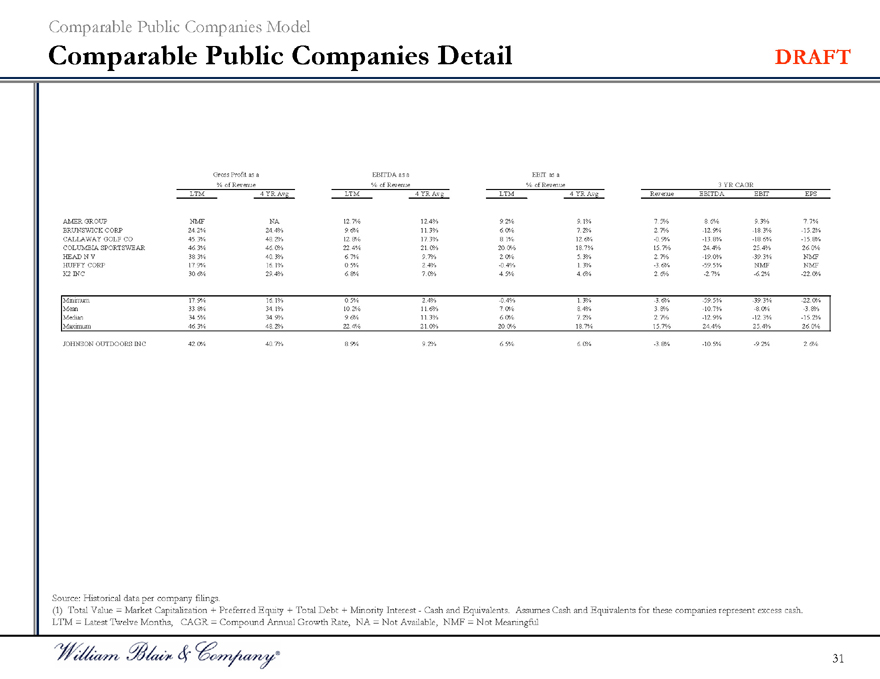

Comparable Public Companies Model

Comparable Public Companies Detail DRAFT

Gross Profit as a EBITDA as a EBIT as a

% of Revenue % of Revenue % of Revenue 3 YR CAGR

LTM 4 YR Avg LTM 4 YR Avg LTM 4 YR Avg Revenue EBITDA EBIT EPS

AMER GROUP NMF NA 12.7% 12.4% 9.2% 9.1% 7.5% 8.6% 9.3% 7.7%

BRUNSWICK CORP 24.2% 24.4% 9.6% 11.3% 6.0% 7.2% 2.7% -12.9% -18.3% -15.2%

CALLAWAY GOLF CO 45.3% 48.2% 12.8% 17.3% 8.1% 12.6% -0.9% -13.8% -18.6% -15.8%

COLUMBIA SPORTSWEAR 46.3% 46.0% 22.4% 21.0% 20.0% 18.7% 15.7% 24.4% 25.4% 26.0%

HEAD N V 38.3% 40.3% 6.7% 9.7% 2.0% 5.3% 2.7% -19.0% -39.3% NMF

HUFFY CORP 17.9% 16.1% 0.5% 2.4% -0.4% 1.3% -3.6% -59.5% NMF NMF

K2 INC 30.6% 29.4% 6.8% 7.0% 4.5% 4.6% 2.6% -2.7% -6.2% -22.0%

Minimum 17.9% 16.1% 0.5% 2.4% -0.4% 1.3% -3.6% -59.5% -39.3% -22.0%

Mean 33.8% 34.1% 10.2% 11.6% 7.0% 8.4% 3.8% -10.7% -8.0% -3.8%

Median 34.5% 34.9% 9.6% 11.3% 6.0% 7.2% 2.7% -12.9% -12.3% -15.2%

Maximum 46.3% 48.2% 22.4% 21.0% 20.0% 18.7% 15.7% 24.4% 25.4% 26.0%

JOHNSON OUTDOORS INC 42.0% 40.7% 8.9% 9.2% 6.5% 6.0% -3.8% -10.5% -9.2% 2.6%

Source: Historical data per company filings.

(1) Total Value = Market Capitalization + Preferred Equity + Total Debt + Minority Interest—Cash and Equivalents. Assumes Cash and Equivalents for these companies represent excess cash. LTM = Latest Twelve Months, CAGR = Compound Annual Growth Rate, NA = Not Available, NMF = Not Meaningful

31