UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-4570

Name of Registrant: Vanguard New York Tax-Free Funds

Address of Registrant: | P.O. Box 2600 |

| Valley Forge, PA 19482 |

|

|

Name and address of agent for service: | Heidi Stam, Esquire |

| P.O. Box 876 |

| Valley Forge, PA 19482 |

|

|

|

|

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2006–November 30, 2007

Item 1: Reports to Shareholders |

|

|

> | For the fiscal year ended November 30, 2007, Vanguard New York Tax-Exempt Money Market Fund returned 3.6%, exceeding the average return of its peers. |

> | Both the Investor and Admiral Shares of Vanguard New York Long-Term Tax-Exempt Fund returned 1.6%, which lagged the fund’s benchmark index but outperformed the peer-group average. |

> | After rising for three years, interest rates began to decline in midsummer as investors became more concerned about the larger impact of subprime lending woes. The Federal Reserve Board stepped in during, and after, the period, lowering interest rate targets to address concerns about liquidity and a slowing economy. |

Contents |

|

|

|

Your Fund’s Total Returns | 1 |

Chairman’s Letter | 2 |

Advisor’s Report | 8 |

New York Tax-Exempt Money Market Fund | 11 |

New York Long-Term Tax-Exempt Fund | 30 |

About Your Fund’s Expenses | 53 |

Glossary | 55 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the cover of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Total Returns

Fiscal Year Ended November 30, 2007 |

|

|

| Ticker | Total |

| Symbol | Returns |

Vanguard New York Tax-Exempt Money Market Fund | VYFXX | 3.6% |

SEC 7-Day Annualized Yield: 3.48% |

|

|

Taxable-Equivalent Yield: 5.75%1 |

|

|

Average New York Tax-Exempt Money Market Fund2 |

| 3.1 |

|

|

|

Vanguard New York Long-Term Tax-Exempt Fund |

|

|

Investor Shares | VNYTX | 1.6% |

SEC 30-Day Annualized Yield: 3.96% |

|

|

Taxable-Equivalent Yield: 6.54%1 |

|

|

Admiral™ Shares3 | VNYUX | 1.6 |

SEC 30-Day Annualized Yield: 4.03% |

|

|

Taxable-Equivalent Yield: 6.66%1 |

|

|

Lehman 10 Year Municipal Bond Index |

| 3.5 |

Average New York Municipal Debt Fund2 |

| 1.1 |

Your Fund’s Performance at a Glance |

|

|

|

|

November 30, 2006–November 30, 2007 |

|

|

|

|

|

|

| Distributions Per Share | |

| Starting | Ending | Income | Capital |

| Share Price | Share Price | Dividends | Gains |

Vanguard New York Tax-Exempt Fund |

|

|

|

|

Money Market | $1.00 | $1.00 | $0.035 | $0.000 |

Long-Term |

|

|

|

|

Investor Shares | 11.44 | 11.09 | 0.486 | 0.035 |

Admiral Shares | 11.44 | 11.09 | 0.494 | 0.035 |

1 This calculation, which assumes a typical itemized tax return, is based on the maximum federal income tax rate of 35% and the maximum state of New York income tax rate. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

2 Derived from data provided by Lipper Inc.

3 A lower-cost class of shares available to many longtime shareholders and to those with significant investments in the fund.

1

Chairman’s Letter

Dear Shareholder,

The past fiscal year was a tale of two markets. For most of this period, concerns about inflation drove interest rates higher (and bond prices lower), especially at the longer end of the maturity spectrum. Beginning in midsummer, however, as the subprime mortgage crisis reverberated through the markets, investors bid up ultra-safe U.S. Treasury securities, driving their yields lower. These interest rate dynamics were less pronounced in the tax-exempt bond market, and on balance, municipal securities lagged their Treasury counterparts. As municipal bond prices declined, their tax-exempt yields increased to exceptionally attractive levels relative to taxable bond yields.

In this environment, Vanguard New York Tax-Exempt Money Market Fund outperformed the New York Long-Term Tax-Exempt Fund and returned 3.6% for the 12 months ended November 30. The Money Market Fund’s yield at year-end was 3.48%, a taxable-equivalent yield of 5.75% for investors in the highest income tax bracket. The fund maintained a net asset value of $1 per share, as is expected but not guaranteed.

Both the Investor and Admiral Shares of Vanguard New York Long-Term Tax-Exempt Fund returned 1.6% for the fiscal year, as interest income more than offset a modest decline in share prices. As of November 30, the Investor Shares’ yield was 3.96% (up from 3.69% a year ago).

2

For investors in the highest income tax bracket, the taxable-equivalent yield was 6.54%. Yields were slightly higher for Admiral Shares.

Please note: Although the New York Tax-Exempt Money Market Fund’s income distributions are expected to be exempt from federal and New York state income taxes, a portion of these distributions may be subject to the alternative minimum tax.

Federal Reserve rate cuts depressed short-term yields

Ongoing turmoil in the subprime lending market engendered a “flight to quality” that drove prices of U.S. Treasury bonds sharply higher, and as the bonds’ prices rose, their yields fell. Declines in Treasury yields were steepest at the short end of the maturity spectrum.

The declines were prompted largely by the actions of the Federal Reserve Board, which cut its target for the federal funds rate on two separate occasions. (On December 11, 2007, after the end of the fiscal period, the central bank again lowered the target for short-term interest rates by 0.25 percentage point, to 4.25%. The yield of the 3-month Treasury bill, which started the fiscal year at 5.02%, had dropped nearly 2 percentage points, to 3.15%, by the end of the period.

The broad taxable bond market returned 6.0% for the fiscal 12 months. Returns from tax-exempt municipal bonds were lower, at 2.7%.

Market Barometer |

|

|

|

| Average Annual Total Returns | ||

| Periods Ended November 30, 2007 | ||

| One Year | Three Years | Five Years |

Bonds |

|

|

|

Lehman U.S. Aggregate Bond Index (Broad taxable market) | 6.0% | 4.8% | 4.8% |

Lehman Municipal Bond Index | 2.7 | 4.2 | 4.7 |

Citigroup 3-Month Treasury Bill Index | 4.9 | 4.1 | 2.9 |

|

|

|

|

Stocks |

|

|

|

Russell 1000 Index (Large-caps) | 7.8% | 10.6% | 12.3% |

Russell 2000 Index (Small-caps) | –1.2 | 7.9 | 14.9 |

Dow Jones Wilshire 5000 Index (Entire market) | 7.6 | 10.7 | 12.9 |

MSCI All Country World Index ex USA (International) | 22.5 | 22.7 | 24.1 |

|

|

|

|

CPI |

|

|

|

Consumer Price Index | 4.3% | 3.2% | 3.0% |

3

A volatile stock market produced solid gains

Although the U.S. economy began to slow toward the end of the fiscal year, stocks produced solid returns for the 12 months. These gains came despite a recession in housing and intensified problems among subprime mortgage-loan lenders—problems that first erupted in midsummer and continued to rattle the financial markets for the remainder of the period. In November, the stock market was quite volatile, as crude oil prices hovered near historic highs while the U.S. dollar continued to lose ground against other major currencies.

The broad U.S. stock market returned 7.6% for the year. Returns from large-capitalization stocks far outpaced those of small-cap issues, and growth stocks outperformed their value-oriented counterparts.

International stocks continued to outpace domestic issues. Emerging-markets stocks did particularly well, followed by stocks in Europe and the Pacific regions—excluding Japan, where returns were slight. The dollar’s ongoing weakness further enhanced international markets’ gains for U.S.-based investors.

Portfolios skillfully navigated choppy waters

During the second half of fiscal-year 2007, U.S. Treasury securities outperformed almost all other fixed income investments, from below-investment-grade bonds to AAA tax-exempt securities. Investors seeking refuge in virtually risk-free securities drove

Expense Ratios1 |

|

|

|

Your fund compared with its peer group |

|

|

|

|

|

|

|

| Investor | Admiral | Peer |

New York Tax-Exempt Fund | Shares | Shares | Group |

Money Market | 0.10% | — | 0.61% |

Long-Term | 0.15 | 0.08% | 1.10 |

1 Fund expense ratios reflect the 12 months ended November 30, 2007. Peer groups are: for the New York Tax-Exempt Money Market Fund, the Average New York Tax-Exempt Money Market Fund; and for the New York Long-Term Tax-Exempt Fund, the Average New York Municipal Debt Fund. Peer-group expense ratios are derived from data provided by Lipper Inc. and capture information through year-end 2006.

4

Treasury yields lower and prices higher. The relative performance of muni bonds was also held in check by a significant increase in supply. Nationwide, total tax-exempt issuance increased almost 25% for the 12 months ended November 30 and is on track to reach a calendar-year record. In New York, muni-bond issuance increased more than 22% over the prior fiscal year.

Compared with Treasury bonds, interest rate movements among tax-exempt bonds were more subdued, though still significant. For most of the year, tax-exempt money market rates remained at or near their highest level since 2000. As rates fell, in advance of the Federal Reserve’s September and October rate cuts, the yield of the New York Tax-Exempt Money Market Fund also trended downward, ending the fiscal period essentially unchanged from a year ago. For the 12 months through November 30, the fund returned 3.6%, besting the average return of its peers. The fund benefited from very low operating costs and a focus by the advisor—Vanguard Fixed Income Group—on the market’s highest-quality securities.

The midsummer reversal in interest rates helped the New York Long-Term Tax-Exempt Fund finish the fiscal year on a positive note. Rising rates in the first half put pressure on the fund’s portfolio, resulting in a negative total return. Later in the year, however, falling interest rates (or, put differently, rising prices) combined with interest income to help the fund deliver a 1.6% return for both Investor and Admiral Shares for the full 12 months. Although

Total Returns |

|

|

Ten Years Ended November 30, 2007 |

|

|

|

| Average |

|

| Annual Return |

|

| Average |

| Vanguard | Competing |

New York Tax-Exempt Fund | Fund | Fund1 |

Money Market | 2.5% | 2.1% |

Long-Term Investor Shares | 5.2 | 4.3 |

The figures shown represent past performance, which is not a guarantee of future results. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost.

1 Peer groups are: for the New York Tax-Exempt Money Market Fund, the Average New York Tax-Exempt Money Market Fund; and for the New York Long-Term Tax-Exempt Fund, the Average New York Insured Municipal Debt Fund through March 31, 2002, and the Average New York Municipal Debt Fund thereafter. Peer-group returns are derived from data provided by Lipper Inc.

5

the fund trailed its benchmark index, its return was higher than the average result for competing New York municipal bond funds. Compared with the index, your fund’s slightly longer duration—a measure of interest rate sensitivity—acted as a headwind to performance; interest rates of longer-term bonds ended the year higher, despite falling from their midyear peaks, which put pressure on longer-maturity bond prices.

Low expenses help sustain the funds’ long-term performance

Over time, Vanguard’s emphasis on high-quality securities, prudent portfolio management, and low costs has helped to produce impressive results relative to competing tax-exempt portfolios.

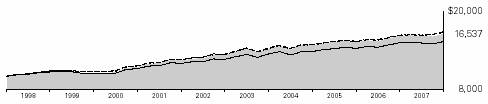

For the ten years ended November 30, the New York Tax-Exempt Money Market Fund earned an average annual return of 2.5%, outperforming its peers. The fund marked its tenth anniversary in September and continued to deliver superior tax-exempt returns while providing liquidity and preserving principal. Low costs are especially critical in the money market arena, where generally low short-term yields and the limited variety of securities constrain a fund’s ability to offset the deleterious impact of high costs.

The New York Long-Term Tax-Exempt Fund earned an average annual return of 5.2% over the ten years ended November 30, transforming a hypothetical initial investment of $10,000 made ten years ago into $16,537. By comparison, the average return for competing funds would have produced a total of $15,297. The New York Long-Term Tax-Exempt Fund benefits from Vanguard’s low costs, which enable our portfolio managers to focus their efforts on identifying high-quality securities from hundreds of diverse municipal issuers.

Income and quality are anchors for diversified portfolios

Over the past year, both equity and fixed income markets have experienced increased volatility. Because market cycles are hard to predict with accuracy, Vanguard always encourages shareholders to invest with a long-term view, to diversify within and across asset classes, and to pay attention to costs.

Fixed income investments have an important role to play in a balanced, diversified portfolio. A fixed income allocation can moderate the volatility of an all-stock portfolio while generating a steady stream of income. For investors in higher tax brackets, municipal bonds can be an especially attractive option.

6

Along with an experienced portfolio management team, your fund’s advisor, Vanguard Fixed Income Group, has a large and experienced credit analysis group that independently evaluates high-quality municipal securities issued by a broad cross section of New York state and local governments as well as regional authorities. And, by keeping expenses low, the advisor helps investors keep more of the funds’ returns. Both the New York Tax-Exempt Money Market Fund and the New York Long-Term Tax-Exempt Fund can play important roles in helping you build a diversified portfolio to achieve your financial goals.

Thank you for entrusting your assets to Vanguard.

Sincerely,

John J. Brennan

Chairman and Chief Executive Officer

December 13, 2007

7

Advisor’s Report

For the fiscal year ended November 30, 2007, Vanguard New York Tax-Exempt Money Market Fund returned 3.6%, exceeding the average return of its peers. Both the Investor and Admiral Shares of Vanguard New York Long-Term Tax-Exempt Fund returned 1.6%, lagging the fund’s benchmark index but outperforming the peer-group average.

The investment environment

Over the past year, the U.S. economy expanded slightly below its potential long-run growth rate. The Commerce Department’s estimate of growth in real gross domestic product (GDP) for the 12 months ended September 30, 2007, was 2.8%. Robust GDP growth in the July–September quarter was fueled by surging global demand for U.S. exports (made more attractive by a relatively weak dollar) and an expanding service sector. Consumer spending, adjusted for inflation, grew at a 2.9% pace for the 12 months ended November 30, thanks to rising incomes and a fairly tight labor market. Consensus expectations point to a moderation in real GDP growth going forward as the housing recession continues and the attendant “credit crunch” increases financing costs.

The rate of consumer inflation accelerated toward the end of 2007 as food and energy prices rose. For the 12 months ended November 30, the Consumer Price Index (CPI) increased 4.3%. Expectations for core CPI inflation (excluding food and

Yields of Municipal Securities |

|

|

(AAA-Rated General-Obligation Issues) |

|

|

| November 30, | November 30, |

Maturity | 2006 | 2007 |

2 years | 3.45% | 3.18% |

5 years | 3.43 | 3.26 |

10 years | 3.56 | 3.62 |

30 years | 3.91 | 4.32 |

Yields of U.S. Treasury Securities |

|

|

| November 30, | November 30, |

Maturity | 2006 | 2007 |

2 years | 4.61% | 3.00% |

5 years | 4.45 | 3.39 |

10 years | 4.46 | 3.94 |

30 years | 4.56 | 4.38 |

Source: Vanguard.

8

energy prices) are for a modest and gradual deceleration toward or even below 2% in coming months.

Following its 50-basis-point reduction in the federal funds target rate in September, the Federal Reserve Board again lowered its target, by 25 basis points, to 4.5% on October 31. On December 11, after the end of the fiscal year, the Fed reduced the target rate by another 25 basis points, to 4.25%. In its statement at that time, the Fed commented that “economic growth is slowing, reflecting the intensification of the housing correction and some softening in business and consumer spending,” although recent actions “should help promote moderate growth over time.” Many financial market participants expect further reductions in the federal funds rate in 2008, given expectations for slower growth, stable core inflation rates, and ongoing concerns about credit availability.

Impact of subprime lending woes

Over the 12 months ended November 30, municipal bonds underperformed U.S. Treasuries across the yield curve. This reflected a global “flight to quality” that produced a rally in Treasuries as the subprime lending crisis continued to unnerve the credit markets. The relative underperformance of municipal bonds was exacerbated by credit concerns surrounding some of the municipal insurance companies that backstop many AAA-rated municipal bonds. The net effect of these forces was to cheapen high-quality tax-exempt bonds to extraordinarily attractive levels on an after-tax basis.

For fiscal-year 2007, total tax-exempt issuance increased 24.6% to $451.9 billion. At the end of the period, municipal market issuance appeared headed toward a calendar-year record. In New York State, total tax-exempt issuance increased 22.3%, similar to the nationwide trend.

Management of the funds

Yields rose in the New York Tax-Exempt Money Market Fund during the first half of the fiscal year, then fell in the second half, finishing the period mostly unchanged. The fund outperformed the average return of its peer group by 0.50 percentage point, benefiting from our emphasis on the market’s highest-quality securities and the fund’s low expenses. The New York Long-Term Tax-Exempt Fund’s performance reflected these same characteristics, outpacing the peer-group average. On an absolute basis, however, the fund’s 1.6% return was modest, as rising interest rates for longer-term bonds put pressure on the portfolio’s holdings.

About half of all outstanding municipal debt is guaranteed by various insurance companies. Recent news about some of these companies has brought into question the durability of AAA ratings, given the insurers’ exposure to guaranteed residential mortgage-backed securities. It is important to remember that the decision to invest in insured bonds and money market instruments depends first and foremost on the quality of the underlying tax-exempt issuer.

9

As a matter of course, Vanguard always looks carefully beneath the surface, to an evaluation of the underlying credit as the key factor in the purchase of a tax-exempt instrument. Our large and experienced municipal credit group conducts a focused and diligent examination of all holdings, and we believe our shareholders can continue to rely on the rigorous review and oversight process that is consistent with our funds’ objectives.

We expect that our funds’ combination of low costs, prudent management, and bias toward high-quality issues will continue to produce more-than-competitive returns.

Kathryn T. Allen, Principal

John M. Carbone, Principal

Vanguard Fixed Income Group

December 18, 2007

10

New York Tax-Exempt Money Market Fund

Fund Profile

As of November 30, 2007

Financial Attributes |

|

|

|

Yield | 3.5% |

Average Weighted Maturity | 27 days |

Average Quality1 | MIG-1 |

Expense Ratio | 0.10% |

Distribution by Credit Quality2 (% of portfolio) |

|

|

|

MIG-1/A-1+/SP-1+/F-1+ | 88.4% |

P-1/A-1/SP-1/F-1 | 10.2 |

AAA/AA | 1.0 |

A | 0.4 |

1 Moody’s Investors Service.

2 Ratings: Moody’s Investors Service, Standard & Poor’s, Fitch. See page 54 for a glossary of investment terms.

11

New York Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at www.vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The annualized yield shown reflects the current earnings of the fund more closely than do the average annual returns.

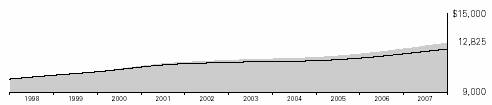

Cumulative Performance: November 30, 1997–November 30, 2007

Initial Investment of $10,000

| Average Annual Total Returns | Final Value | ||

| Periods Ended November 30, 2007 | of a $10,000 | ||

| One Year | Five Years | Ten Years | Investment |

New York Tax-Exempt Money Market Fund1 | 3.60% | 2.19% | 2.52% | $12,825 |

Average New York Tax-Exempt |

|

|

|

|

Money Market Fund2 | 3.11 | 1.74 | 2.09 | 12,299 |

1 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000.

2 Returns for the Average New York Tax-Exempt Money Market Fund are derived from data provided by Lipper Inc.

12

New York Tax-Exempt Money Market Fund

Fiscal-Year Total Returns (%): November 30, 1997–November 30, 2007 | ||

|

| Average |

|

| Fund1 |

Fiscal | Total | Total |

Year | Return | Return |

1998 | 3.3% | 2.9% |

1999 | 3.0 | 2.6 |

2000 | 3.9 | 3.4 |

2001 | 2.8 | 2.4 |

2002 | 1.3 | 0.9 |

2003 | 0.9 | 0.5 |

2004 | 1.0 | 0.6 |

2005 | 2.2 | 1.7 |

2006 | 3.3 | 2.8 |

2007 | 3.6 | 3.1 |

SEC 7-Day Annualized Yield (11/30/2007): 3.48% |

|

|

Average Annual Total Returns: Periods Ended September 30, 2007

This table presents average annual total returns through the latest calendar quarter—rather than through the end of the fiscal period. Securities and Exchange Commission rules require that we provide this information.

| Inception Date | One Year | Five Years | Ten Years |

New York Tax-Exempt Money Market Fund2 | 9/3/1997 | 3.61% | 2.12% | 2.52% |

1 Returns for the Average New York Tax-Exempt Money Market Fund are derived from data provided by Lipper Inc.

2 Total returns do not include the account service fee that may be applicable to certain accounts with balances below $10,000. Note: See Financial Highlights table on page 28 for dividend information.

13

New York Tax-Exempt Money Market Fund

Financial Statements

Statement of Net Assets

As of November 30, 2007

The fund provides a complete list of its holdings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at www.sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

Municipal Bonds (99.4%) |

|

|

|

|

| |

| Albany NY IDA Fac. Rev. |

|

|

|

|

|

| (Albany Medical Center) VRDO | 3.600% | 12/7/07 | LOC | 3,000 | 3,000 |

| Albany NY IDA Fac. Rev. |

|

|

|

|

|

| (Holland Suites Project) VRDO | 3.610% | 12/7/07 | LOC | 6,390 | 6,390 |

| Allegany County NY IDA |

|

|

|

|

|

| (Atlantic Richfield Project) VRDO | 3.660% | 12/3/07 |

| 4,700 | 4,700 |

1 | Battery Park City NY Auth. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 5,215 | 5,215 |

| Clifton Park NY IDA Multifamily Housing Rev. |

|

|

|

|

|

| (Coburg Village Project) VRDO | 3.590% | 12/7/07 | LOC | 5,400 | 5,400 |

| Cold Spring Harbor NY Central School Dist. TAN | 4.250% | 6/30/08 |

| 2,250 | 2,258 |

1 | East Rochester NY Housing Auth. Rev. TOB VRDO | 3.740% | 12/7/07 |

| 11,665 | 11,665 |

1 | Erie County NY IDA School Fac. Rev. TOB VRDO | 3.650% | 12/7/07 | (4) | 3,825 | 3,825 |

1 | Erie County NY IDA School Fac. Rev. TOB VRDO | 3.650% | 12/7/07 | (4) | 9,205 | 9,205 |

| Erie County NY Water Auth. Rev. VRDO | 3.510% | 12/7/07 | (2) | 11,400 | 11,400 |

| Great Neck NY UFSD TAN | 4.000% | 6/26/08 |

| 15,000 | 15,046 |

1 | GS Pool Trust TOB VRDO | 3.680% | 12/7/07 |

| 10,868 | 10,868 |

| Half Hollow Hills NY Central School Dist. |

|

|

|

|

|

| Huntington & Babylon TAN | 4.250% | 6/30/08 |

| 24,000 | 24,077 |

| Harrison NY BAN | 4.250% | 6/20/08 |

| 7,000 | 7,022 |

1 | Haverstraw-Stony Point NY Central |

|

|

|

|

|

| School Dist. GO TOB VRDO | 3.630% | 12/7/07 | (4) | 12,100 | 12,100 |

1 | Hudson Yards Infrastructure Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.680% | 12/7/07 | (3) | 28,500 | 28,500 |

1 | Hudson Yards Infrastructure Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.680% | 12/7/07 | (1) | 16,065 | 16,065 |

| Jericho NY UFSD TAN | 4.250% | 6/20/08 |

| 3,750 | 3,761 |

1 | Liberty NY Dev. Corp. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 6,565 | 6,565 |

1 | Liberty NY Dev. Corp. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 7,745 | 7,745 |

1 | Liberty NY Dev. Corp. Rev. TOB VRDO | 3.660% | 12/7/07 |

| 25,215 | 25,215 |

| Long Island NY Power Auth. Electric System Rev. | 5.125% | 4/1/08 | (1)(Prere.) | 14,255 | 14,460 |

| Long Island NY Power Auth. Electric System Rev. | 5.125% | 4/1/08 | (1)(Prere.) | 10,940 | 11,098 |

| Long Island NY Power Auth. Electric System Rev. | 5.000% | 6/1/08 | (4)(Prere.) | 13,000 | 13,213 |

| Long Island NY Power Auth. Electric System Rev. | 5.125% | 6/1/08 | (4)(Prere.) | 18,000 | 18,306 |

| Long Island NY Power Auth. Electric System Rev. | 5.125% | 6/1/08 | (4)(Prere.) | 38,755 | 39,416 |

| Long Island NY Power Auth. Electric System Rev. | 5.250% | 6/1/08 | (1)(Prere.) | 28,630 | 29,133 |

| Long Island NY Power Auth. Electric System Rev. CP | 3.400% | 12/20/07 | LOC | 59,200 | 59,200 |

1 | Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. TOB VRDO | 3.650% | 12/7/07 | (1) | 15,000 | 15,000 |

1 | Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. TOB VRDO | 3.650% | 12/7/07 | (10) | 69,300 | 69,300 |

14

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. TOB VRDO | 3.710% | 12/7/07 | (2)(4) | 14,000 | 14,000 |

| Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. VRDO | 3.540% | 12/3/07 | LOC | 3,500 | 3,500 |

| Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. VRDO | 3.520% | 12/7/07 | (4) | 4,100 | 4,100 |

| Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. VRDO | 3.540% | 12/7/07 | (1) | 10,000 | 10,000 |

| Long Island NY Power Auth. |

|

|

|

|

|

| Electric System Rev. VRDO | 3.570% | 12/7/07 | (4) | 49,610 | 49,610 |

| Massapequa NY UFSD TAN | 4.250% | 6/26/08 |

| 3,000 | 3,010 |

| Metro. New York Transp. Auth. Rev. (Commuter Fac.) | 6.000% | 7/1/08 | (3)(Prere.) | 9,000 | 9,142 |

1 | Metro. New York Transp. Auth. Rev. |

|

|

|

|

|

| (Dedicated Petroleum Tax) TOB VRDO | 3.690% | 12/7/07 | (4) | 7,500 | 7,500 |

1 | Metro. New York Transp. Auth. Rev. |

|

|

|

|

|

| (Dedicated Petroleum Tax) TOB VRDO | 3.700% | 12/7/07 | (1) | 11,385 | 11,385 |

| Metro. New York Transp. Auth. Rev. (Transit Rev.) CP | 3.550% | 12/6/07 | LOC | 25,000 | 25,000 |

| Metro. New York Transp. Auth. Rev. (Transit Rev.) CP | 3.500% | 12/13/07 | LOC | 30,000 | 30,000 |

| Metro. New York Transp. Auth. Rev. |

|

|

|

|

|

| (Transit Rev.) VRDO | 3.580% | 12/3/07 | LOC | 21,075 | 21,075 |

| Metro. New York Transp. Auth. Rev. |

|

|

|

|

|

| (Transit Rev.) VRDO | 3.530% | 12/7/07 | LOC | 23,160 | 23,160 |

1 | Metro. New York Transp. Auth. Rev. TOB VRDO | 3.650% | 12/7/07 | (1) | 6,615 | 6,615 |

1 | Metro. New York Transp. Auth. Rev. TOB VRDO | 3.690% | 12/7/07 | (3) | 14,265 | 14,265 |

1 | Metro. New York Transp. Auth. Rev. TOB VRDO | 3.690% | 12/7/07 | (3) | 19,715 | 19,715 |

1 | Metro. New York Transp. Auth. Rev. TOB VRDO | 3.690% | 12/7/07 | (2) | 4,980 | 4,980 |

| Metro. New York Transp. Auth. Rev. VRDO | 3.550% | 12/7/07 | (4) | 3,500 | 3,500 |

| Metro. New York Transp. Auth. Rev. VRDO | 3.550% | 12/7/07 | (10) | 54,800 | 54,800 |

| Metro. New York Transp. Auth. Rev. VRDO | 3.570% | 12/7/07 | LOC | 30,600 | 30,600 |

| Metro. New York Transp. Auth. Transit Fac. CP | 3.380% | 3/6/08 | LOC | 25,000 | 25,000 |

| Monroe County NY IDA |

|

|

|

|

|

| (Monroe Community College) VRDO | 3.560% | 12/7/07 | LOC | 4,000 | 4,000 |

| Muni. Assistance Corp. for New York City NY | 5.000% | 7/1/08 |

| 10,000 | 10,097 |

| Nassau County NY GO BAN | 3.625% | 2/15/08 |

| 40,000 | 40,000 |

| Nassau County NY RAN | 4.250% | 5/30/08 |

| 65,000 | 65,182 |

| Nassau Health Care Corp. NY VRDO | 3.510% | 12/7/07 | (4) | 10,000 | 10,000 |

| Nassau Health Care Corp. NY VRDO | 3.550% | 12/7/07 | (4) | 13,605 | 13,605 |

| New York City NY Capital Resources |

|

|

|

|

|

| (Enhanced Assistance PG) VRDO | 3.540% | 12/7/07 | LOC | 8,700 | 8,700 |

| New York City NY Cultural Resources Rev. |

|

|

|

|

|

| (Pierpont Morgan Library) VRDO | 3.530% | 12/7/07 | LOC | 6,000 | 6,000 |

| New York City NY Cultural Resources Rev. |

|

|

|

|

|

| (Solomon R. Guggenheim Foundation) VRDO | 3.540% | 12/7/07 | LOC | 14,207 | 14,207 |

1 | New York City NY GO TOB PUT | 3.500% | 1/24/08 | (3) | 9,670 | 9,670 |

1 | New York City NY GO TOB VRDO | 3.630% | 12/7/07 | (2) | 7,715 | 7,715 |

1 | New York City NY GO TOB VRDO | 3.630% | 12/7/07 | (2) | 24,810 | 24,810 |

1 | New York City NY GO TOB VRDO | 3.660% | 12/7/07 | (4) | 6,144 | 6,144 |

1 | New York City NY GO TOB VRDO | 3.670% | 12/7/07 | (4) | 8,405 | 8,405 |

1 | New York City NY GO TOB VRDO | 3.670% | 12/7/07 |

| 50,000 | 50,000 |

1 | New York City NY GO TOB VRDO | 3.690% | 12/7/07 | (2) | 4,565 | 4,565 |

1 | New York City NY GO TOB VRDO | 3.820% | 12/7/07 | (1) | 5,840 | 5,840 |

| New York City NY GO VRDO | 3.500% | 12/3/07 | (4) | 9,250 | 9,250 |

| New York City NY GO VRDO | 3.500% | 12/3/07 | LOC | 6,900 | 6,900 |

| New York City NY GO VRDO | 3.500% | 12/3/07 | LOC | 3,100 | 3,100 |

| New York City NY GO VRDO | 3.560% | 12/3/07 | (1) | 1,000 | 1,000 |

| New York City NY GO VRDO | 3.540% | 12/7/07 | (2) | 13,525 | 13,525 |

15

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

| New York City NY GO VRDO | 3.540% | 12/7/07 | LOC | 23,000 | 23,000 |

| New York City NY GO VRDO | 3.550% | 12/7/07 | LOC | 5,695 | 5,695 |

| New York City NY GO VRDO | 3.550% | 12/7/07 | LOC | 18,475 | 18,475 |

| New York City NY Housing Dev. Corp. |

|

|

|

|

|

| Multi-Family Rev. (First Avenue) VRDO | 3.660% | 12/7/07 |

| 24,205 | 24,205 |

1 | New York City NY Housing Dev. Corp. |

|

|

|

|

|

| Multi-Family Rev. TOB VRDO | 3.690% | 12/7/07 |

| 12,505 | 12,505 |

1 | New York City NY Housing Dev. Corp. |

|

|

|

|

|

| Multi-Family Rev. TOB VRDO | 3.690% | 12/7/07 |

| 12,515 | 12,515 |

| New York City NY Housing Dev. Corp. |

|

|

|

|

|

| Multi-Family Rev. VRDO | 3.640% | 12/7/07 |

| 45,800 | 45,800 |

1 | New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Capital Funding Program) TOB VRDO | 3.700% | 12/7/07 | (3) | 8,755 | 8,755 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing– |

|

|

|

|

|

| 155 West 21st Street) VRDO | 3.680% | 12/7/07 |

| 11,400 | 11,400 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing– |

|

|

|

|

|

| 201 Pearl Street) VRDO | 3.620% | 12/7/07 | LOC | 21,300 | 21,300 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing– |

|

|

|

|

|

| 90 West Street) VRDO | 3.620% | 12/7/07 |

| 25,000 | 25,000 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing– |

|

|

|

|

|

| Atlantic Court) VRDO | 3.640% | 12/7/07 |

| 53,100 | 53,100 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing–Ocean Gate) VRDO | 3.580% | 12/7/07 |

| 32,530 | 32,530 |

| New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| (Multi-Family Rent Housing– |

|

|

|

|

|

| One Columbus Place) VRDO | 3.640% | 12/7/07 | LOC | 32,000 | 32,000 |

1 | New York City NY Housing Dev. Corp. Rev. TOB PUT | 3.750% | 3/6/08 | (3) | 12,745 | 12,745 |

1 | New York City NY Housing Dev. Corp. Rev. |

|

|

|

|

|

| TOB VRDO | 3.820% | 12/7/07 | (3) | 5,130 | 5,130 |

| New York City NY Housing Dev. Corp. Rev. VRDO | 3.660% | 12/7/07 |

| 22,200 | 22,200 |

| New York City NY IDA (Civic Fac. Rev.) VRDO | 3.570% | 12/7/07 | (10) | 10,235 | 10,235 |

| New York City NY IDA (Civil Liberties Union) VRDO | 3.530% | 12/3/07 | LOC | 8,700 | 8,700 |

| New York City NY IDA (NY Congregational |

|

|

|

|

|

| Nursing Center Project) VRDO | 3.570% | 12/7/07 | LOC | 4,900 | 4,900 |

| New York City NY IDA Special Fac. Rev. |

|

|

|

|

|

| (Korean Air Lines) VRDO | 3.590% | 12/7/07 | LOC | 16,100 | 16,100 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System CP | 3.680% | 12/13/07 |

| 10,000 | 10,000 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System CP | 3.550% | 1/17/08 |

| 25,000 | 25,000 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.630% | 12/7/07 |

| 38,125 | 38,125 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.630% | 12/7/07 |

| 10,000 | 10,000 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.650% | 12/7/07 | (2) | 4,935 | 4,935 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.650% | 12/7/07 |

| 9,055 | 9,055 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.650% | 12/7/07 |

| 4,800 | 4,800 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.650% | 12/7/07 |

| 17,325 | 17,325 |

16

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.650% | 12/7/07 |

| 4,500 | 4,500 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.660% | 12/7/07 | (4) | 20,015 | 20,015 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.660% | 12/7/07 |

| 9,356 | 9,356 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.660% | 12/7/07 | (1) | 4,500 | 4,500 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.660% | 12/7/07 |

| 5,625 | 5,625 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.690% | 12/7/07 | (2) | 22,170 | 22,170 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.700% | 12/7/07 |

| 5,000 | 5,000 |

1 | New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. TOB VRDO | 3.700% | 12/7/07 | (1) | 12,685 | 12,685 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.500% | 12/3/07 |

| 2,980 | 2,980 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.500% | 12/3/07 |

| 5,900 | 5,900 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.500% | 12/3/07 |

| 5,200 | 5,200 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.520% | 12/3/07 |

| 35,100 | 35,100 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.520% | 12/3/07 |

| 6,200 | 6,200 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.530% | 12/3/07 |

| 14,955 | 14,955 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.530% | 12/3/07 |

| 13,750 | 13,750 |

| New York City NY Muni. Water Finance Auth. |

|

|

|

|

|

| Water & Sewer System Rev. VRDO | 3.530% | 12/3/07 |

| 11,700 | 11,700 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.630% | 12/7/07 | (1) | 14,775 | 14,775 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.630% | 12/7/07 | (1) | 2,250 | 2,250 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.630% | 12/7/07 | (1) | 2,570 | 2,570 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.630% | 12/7/07 | (1) | 6,585 | 6,585 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.630% | 12/7/07 | (2) | 6,400 | 6,400 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.650% | 12/7/07 | (1) | 5,675 | 5,675 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.650% | 12/7/07 | (1) | 4,805 | 4,805 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.650% | 12/7/07 | (2) | 14,850 | 14,850 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.660% | 12/7/07 | (2) | 9,400 | 9,400 |

1 | New York City NY Sales Tax Asset |

|

|

|

|

|

| Receivable Corp. TOB VRDO | 3.700% | 12/7/07 | (2) | 6,515 | 6,515 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Building Aid Rev. TOB PUT | 3.760% | 6/5/08 | (3) | 10,000 | 10,000 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. Future Tax TOB VRDO | 3.710% | 12/7/07 | (2)(4) | 18,915 | 18,915 |

17

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.630% | 12/7/07 |

| 15,415 | 15,415 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.630% | 12/7/07 | (3) | 6,070 | 6,070 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.630% | 12/7/07 | (3) | 6,725 | 6,725 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.660% | 12/7/07 |

| 20,895 | 20,895 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.690% | 12/7/07 | (3) | 6,080 | 6,080 |

1 | New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.690% | 12/7/07 | (3) | 7,600 | 7,600 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.500% | 12/3/07 |

| 17,715 | 17,715 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.540% | 12/3/07 |

| 3,860 | 3,860 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.540% | 12/3/07 |

| 5,700 | 5,700 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.550% | 12/3/07 |

| 13,600 | 13,600 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.570% | 12/3/07 |

| 6,000 | 6,000 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.570% | 12/3/07 |

| 14,200 | 14,200 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.550% | 12/7/07 |

| 8,465 | 8,465 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.570% | 12/7/07 |

| 44,195 | 44,195 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.600% | 12/7/07 |

| 12,900 | 12,900 |

| New York City NY Transitional Finance Auth. |

|

|

|

|

|

| Rev. VRDO | 3.600% | 12/7/07 |

| 13,670 | 13,670 |

1 | New York Convention Center Dev. Corp. |

|

|

|

|

|

| Rev. TOB VRDO | 3.650% | 12/7/07 | (2) | 15,500 | 15,500 |

1 | New York Metro. Transp. Auth. |

|

|

|

|

|

| Rev. TOB VRDO | 3.690% | 12/7/07 | (3) | 14,290 | 14,290 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Catholic Health) VRDO | 3.570% | 12/7/07 | LOC | 8,280 | 8,280 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Catholic Health) VRDO | 3.570% | 12/7/07 | LOC | 27,495 | 27,495 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (City Univ.) TOB VRDO | 3.670% | 12/7/07 | (4) | 7,220 | 7,220 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Columbia Univ.) CP | 3.510% | 12/12/07 |

| 26,670 | 26,670 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Columbia Univ.) CP | 3.360% | 3/5/08 |

| 12,800 | 12,800 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Cornell Univ.) CP | 3.460% | 12/10/07 |

| 33,725 | 33,725 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Cornell Univ.) CP | 3.350% | 1/9/08 |

| 5,400 | 5,400 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Cornell Univ.) VRDO | 3.530% | 12/7/07 |

| 26,330 | 26,330 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Dept. of Health) TOB VRDO | 3.630% | 12/7/07 | (3) | 2,605 | 2,605 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Memorial Sloan Kettering) TOB VRDO | 3.630% | 12/7/07 | (1) | 7,085 | 7,085 |

18

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) TOB VRDO | 3.650% | 12/7/07 | (1) | 9,225 | 9,225 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.530% | 12/7/07 | (4) | 53,255 | 53,255 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.530% | 12/7/07 | (4) | 9,405 | 9,405 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.530% | 12/7/07 | (4) | 15,500 | 15,500 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.530% | 12/7/07 | (2) | 2,500 | 2,500 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.530% | 12/7/07 | (1) | 21,200 | 21,200 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.550% | 12/7/07 |

| 71,500 | 71,500 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Mental Health Services) VRDO | 3.570% | 12/7/07 | (4) | 11,870 | 11,870 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (New York Public Library) VRDO | 3.540% | 12/7/07 | (1) | 9,900 | 9,900 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (New York Public Library) VRDO | 3.540% | 12/7/07 | (1) | 35,940 | 35,940 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (New York Univ.) TOB VRDO | 3.660% | 12/7/07 | (1) | 6,700 | 6,700 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.640% | 12/7/07 |

| 11,950 | 11,950 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.650% | 12/7/07 |

| 4,305 | 4,305 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.670% | 12/7/07 | (2) | 5,835 | 5,835 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.670% | 12/7/07 | (2) | 17,725 | 17,725 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.700% | 12/7/07 |

| 28,385 | 28,385 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.700% | 12/7/07 |

| 40,340 | 40,340 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.820% | 12/7/07 | (1) | 5,485 | 5,485 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Rockefeller Univ.) VRDO | 3.570% | 12/7/07 |

| 24,400 | 24,400 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (St. John’s Univ.) | 5.250% | 7/1/08 | (1)(Prere.) | 15,170 | 15,450 |

| New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Univ. System) | 5.250% | 1/1/08 | (1)(Prere.) | 14,500 | 14,809 |

1 | New York State Dormitory Auth. Rev. |

|

|

|

|

|

| (Vassar College) TOB VRDO | 3.650% | 12/7/07 |

| 5,315 | 5,315 |

| New York State Dormitory Auth. Rev. Non State |

|

|

|

|

|

| Supported Debt (Barnard College) VRDO | 3.700% | 12/7/07 | (3) | 10,580 | 10,580 |

1 | New York State Dormitory Auth. Rev. TOB PUT | 3.780% | 2/27/08 | (3) | 5,480 | 5,480 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.630% | 12/7/07 |

| 4,015 | 4,015 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (1) | 23,250 | 23,250 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (3) | 7,280 | 7,280 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (3) | 9,475 | 9,475 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (4) | 5,540 | 5,540 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.640% | 12/7/07 |

| 28,625 | 28,625 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 52,305 | 52,305 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.650% | 12/7/07 | (1) | 10,000 | 10,000 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 25,000 | 25,000 |

19

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.650% | 12/7/07 |

| 19,235 | 19,235 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.660% | 12/7/07 |

| 15,200 | 15,200 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.660% | 12/7/07 | (2) | 3,583 | 3,583 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.670% | 12/7/07 | (2) | 16,765 | 16,765 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.700% | 12/7/07 | (3) | 19,085 | 19,085 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.700% | 12/7/07 | (1) | 11,175 | 11,175 |

1 | New York State Dormitory Auth. Rev. TOB VRDO | 3.710% | 12/7/07 |

| 18,380 | 18,380 |

| New York State Energy Research & Dev. Auth. |

|

|

|

|

|

| (Con Edison) VRDO | 3.520% | 12/7/07 | LOC | 15,000 | 15,000 |

| New York State Energy Research & Dev. Auth. |

|

|

|

|

|

| (Con Edison) VRDO | 3.530% | 12/7/07 | LOC | 13,700 | 13,700 |

| New York State Energy Research & Dev. Auth. |

|

|

|

|

|

| (Con Edison) VRDO | 3.570% | 12/7/07 | LOC | 15,000 | 15,000 |

1 | New York State Environmental Fac. Corp. |

|

|

|

|

|

| PCR TOB VRDO | 3.650% | 12/7/07 | (4) | 25,400 | 25,400 |

| New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) | 5.000% | 6/15/08 |

| 9,415 | 9,490 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 9,990 | 9,990 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 2,560 | 2,560 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 26,485 | 26,485 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 11,290 | 11,290 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 15,445 | 15,445 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.630% | 12/7/07 |

| 8,065 | 8,065 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.650% | 12/7/07 |

| 2,640 | 2,640 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.650% | 12/7/07 |

| 6,370 | 6,370 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.650% | 12/7/07 |

| 9,720 | 9,720 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.660% | 12/7/07 |

| 19,595 | 19,595 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.670% | 12/7/07 |

| 5,380 | 5,380 |

1 | New York State Environmental Fac. Corp. Rev. |

|

|

|

|

|

| (Clean Water & Drinking Revolving Funds) |

|

|

|

|

|

| TOB VRDO | 3.710% | 12/7/07 |

| 16,500 | 16,500 |

| New York State Environmental Fac. Corp. |

|

|

|

|

|

| Solid Waste Disposal Rev. |

|

|

|

|

|

| (General Electric Co.) VRDO | 3.430% | 12/3/07 |

| 16,100 | 16,100 |

20

New York Tax-Exempt Money Market Fund

|

|

|

| Face | Market |

|

|

| Maturity | Amount | Value• |

|

| Coupon | Date | ($000) | ($000) |

| New York State Environmental Fac. Corp. Solid |

|

|

|

|

| Waste Disposal Rev. (General Electric Co.) VRDO | 3.510% | 12/3/07 | 26,700 | 26,700 |

| New York State Environmental Fac. Corp. Solid |

|

|

|

|

| Waste Disposal Rev. (General Electric Co.) VRDO | 3.510% | 12/3/07 | 25,900 | 25,900 |

| New York State GO PUT | 3.700% | 12/4/07 LOC | 26,500 | 26,500 |

| New York State Housing Finance Agency Rev. |

|

|

|

|

| (Chelsea Apartments) VRDO | 3.670% | 12/7/07 | 66,170 | 66,170 |

| New York State Housing Finance Agency Rev. |

|

|

|

|

| (Clinton Green North) VRDO | 3.580% | 12/7/07 LOC | 40,000 | 40,000 |

1 | New York State Housing Finance Agency Rev. |

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.820% | 12/7/07 (3) | 7,855 | 7,855 |

| New York State Housing Finance Agency Rev. |

|

|

|

|

| (Residential) VRDO | 3.680% | 12/7/07 (2) | 6,500 | 6,500 |

| New York State Housing Finance Agency Rev. |

|

|

|

|

| (Saville Housing) VRDO | 3.640% | 12/7/07 LOC | 55,000 | 55,000 |

| New York State Housing Finance Agency Rev. |

|

|

|

|

| (West 23rd Street) VRDO | 3.590% | 12/7/07 LOC | 42,400 | 42,400 |

| New York State Housing Finance Agency Rev. VRDO | 3.530% | 12/7/07 LOC | 20,400 | 20,400 |

| New York State Housing Finance Agency Rev. VRDO | 3.540% | 12/7/07 | 4,500 | 4,500 |

| New York State Housing Finance Agency Rev. VRDO | 3.580% | 12/7/07 LOC | 31,000 | 31,000 |

| New York State Housing Finance Agency Rev. VRDO | 3.590% | 12/7/07 LOC | 50,000 | 50,000 |

| New York State Housing Finance Agency Rev. VRDO | 3.620% | 12/7/07 | 22,000 | 22,000 |

| New York State Housing Finance Agency Rev. VRDO | 3.650% | 12/7/07 LOC | 22,300 | 22,300 |

| New York State Housing Finance Agency Rev. VRDO | 3.680% | 12/7/07 | 50,000 | 50,000 |

| New York State Housing Finance Agency Service |

|

|

|

|

| Contract Rev. VRDO | 3.550% | 12/7/07 LOC | 24,500 | 24,500 |

| New York State Housing Finance Agency Service |

|

|

|

|

| Contract Rev. VRDO | 3.580% | 12/7/07 LOC | 25,000 | 25,000 |

| New York State Housing Finance Agency Service |

|

|

|

|

| Contract Rev. VRDO | 3.590% | 12/7/07 | 26,700 | 26,700 |

| New York State Housing Finance Agency Service |

|

|

|

|

| Contract Rev. VRDO | 3.590% | 12/7/07 LOC | 9,000 | 9,000 |

| New York State Local Govt. Assistance Corp. VRDO | 3.500% | 12/7/07 (4) | 10,450 | 10,450 |

| New York State Local Govt. Assistance Corp. VRDO | 3.500% | 12/7/07 (3) | 34,000 | 34,000 |

| New York State Local Govt. Assistance Corp. VRDO | 3.520% | 12/7/07 LOC | 33,875 | 33,875 |

| New York State Local Govt. Assistance Corp. VRDO | 3.540% | 12/7/07 LOC | 6,300 | 6,300 |

| New York State Local Govt. Assistance Corp. VRDO | 3.550% | 12/7/07 LOC | 20,000 | 20,000 |

| New York State Local Govt. Assistance Corp. VRDO | 3.550% | 12/7/07 LOC | 53,975 | 53,975 |

1 | New York State Mortgage Agency Rev. TOB VRDO | 3.700% | 12/7/07 | 24,315 | 24,315 |

| New York State Mortgage Agency Rev. VRDO | 3.550% | 12/3/07 | 19,000 | 19,000 |

| New York State Mortgage Agency Rev. VRDO | 3.580% | 12/7/07 | 28,200 | 28,200 |

| New York State Power Auth. Rev. CP | 3.480% | 1/8/08 | 44,200 | 44,200 |

| New York State Power Auth. Rev. CP | 3.470% | 1/14/08 | 15,000 | 15,000 |

| New York State Power Auth. Rev. CP | 3.360% | 1/25/08 | 12,925 | 12,925 |

| New York State Power Auth. Rev. PUT | 3.640% | 3/3/08 | 32,000 | 32,000 |

| New York State Thruway Auth. Rev. |

|

|

|

|

| (Highway & Bridge Trust Fund) | 5.000% | 4/1/08 (1)(ETM) | 6,000 | 6,026 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.600% | 12/7/07 (2) | 7,995 | 7,995 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.630% | 12/7/07 (2) | 7,500 | 7,500 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.630% | 12/7/07 (2) | 4,685 | 4,685 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.650% | 12/7/07 | 5,245 | 5,245 |

21

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.660% | 12/7/07 | (2) | 9,270 | 9,270 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.660% | 12/7/07 | (2) | 8,700 | 8,700 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.670% | 12/7/07 | (1) | 8,365 | 8,365 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.700% | 12/7/07 | (2) | 10,365 | 10,365 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.700% | 12/7/07 | (2) | 11,480 | 11,480 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.700% | 12/7/07 |

| 15,110 | 15,110 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.700% | 12/7/07 |

| 42,590 | 42,590 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Highway & Bridge Trust Fund) TOB VRDO | 3.820% | 12/7/07 | (1) | 5,950 | 5,950 |

1 | New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Personal Income Tax) TOB VRDO | 3.650% | 12/7/07 | (2) | 5,205 | 5,205 |

| New York State Thruway Auth. Rev. |

|

|

|

|

|

| (Service Contract) | 5.000% | 3/15/08 |

| 23,100 | 23,190 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.620% | 12/7/07 | (3) | 8,900 | 8,900 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (4) | 4,445 | 4,445 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (2) | 31,990 | 31,990 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.630% | 12/7/07 | (2) | 8,065 | 8,065 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.680% | 12/7/07 | (3) | 25,885 | 25,885 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.690% | 12/7/07 | (1)(3)(4) | 40,495 | 40,495 |

1 | New York State Thruway Auth. Rev. TOB VRDO | 3.700% | 12/7/07 |

| 10,415 | 10,415 |

1 | New York State Urban Dev. Corp. Rev. |

|

|

|

|

|

| (Correctional Fac.) TOB VRDO | 3.630% | 12/7/07 | (3) | 5,140 | 5,140 |

1 | New York State Urban Dev. Corp. Rev. |

|

|

|

|

|

| (Correctional Fac.) TOB VRDO | 3.630% | 12/7/07 | (3) | 4,920 | 4,920 |

1 | New York State Urban Dev. Corp. Rev. TOB VRDO | 3.630% | 12/7/07 | (4) | 6,660 | 6,660 |

1 | New York State Urban Dev. Corp. Rev. TOB VRDO | 3.670% | 12/7/07 | (4) | 13,890 | 13,890 |

1 | New York State Urban Dev. Corp. Rev. TOB VRDO | 3.820% | 12/7/07 | (2) | 5,295 | 5,295 |

1 | New York State Urban Dev. Corp. TOB VRDO | 3.660% | 12/7/07 | (Prere.) | 12,155 | 12,155 |

| Niagara County NY IDA Civic Fac. |

|

|

|

|

|

| Var-Student Housing Rev. VRDO | 3.560% | 12/7/07 | LOC | 5,000 | 5,000 |

| Oneida County NY IDA Rev. |

|

|

|

|

|

| (Hamilton College) VRDO | 3.570% | 12/7/07 | (1) | 24,480 | 24,480 |

| Onondaga County NY IDA Civic Fac. Rev. VRDO | 3.580% | 12/7/07 | LOC | 11,280 | 11,280 |

1 | Orange County NY TOB VRDO | 3.630% | 12/7/07 |

| 1,175 | 1,175 |

| Orangetown NY BAN | 4.000% | 3/28/08 |

| 14,100 | 14,119 |

| Oyster Bay NY BAN | 4.000% | 3/14/08 |

| 18,875 | 18,899 |

| Oyster Bay NY BAN | 4.000% | 9/19/08 |

| 42,000 | 42,182 |

1 | Port Auth. of New York & New Jersey Rev. TOB PUT | 3.830% | 2/13/08 | (4) | 3,990 | 3,990 |

1 | Port Auth. of New York & New Jersey Rev. TOB PUT | 3.780% | 3/6/08 | (4) | 9,975 | 9,975 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.620% | 12/7/07 | (4) | 6,300 | 6,300 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.630% | 12/7/07 | (4) | 6,300 | 6,300 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.630% | 12/7/07 |

| 10,000 | 10,000 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.640% | 12/7/07 | (3) | 4,160 | 4,160 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.640% | 12/7/07 | (3) | 2,740 | 2,740 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.640% | 12/7/07 | (1) | 6,140 | 6,140 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.660% | 12/7/07 | (4) | 10,000 | 10,000 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.730% | 12/7/07 | (3) | 2,585 | 2,585 |

1 | Port Auth. of New York & New Jersey Rev. TOB VRDO | 3.820% | 12/7/07 | (10) | 5,215 | 5,215 |

22

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market |

|

|

| Maturity |

| Amount | Value• |

|

| Coupon | Date |

| ($000) | ($000) |

| Port Auth. of New York & New Jersey Special |

|

|

|

|

|

| Obligation Rev. (Versatile Structure) VRDO | 3.510% | 12/3/07 |

| 7,400 | 7,400 |

| Port Auth. of New York & New Jersey Special |

|

|

|

|

|

| Obligation Rev. (Versatile Structure) VRDO | 3.530% | 12/3/07 |

| 6,950 | 6,950 |

| Riverhead NY IDA Rev. (Central Suffolk Hosp.) VRDO | 3.570% | 12/7/07 | LOC | 7,000 | 7,000 |

| Riverhead NY IDA Rev. (Central Suffolk Hosp.) VRDO | 3.570% | 12/7/07 | LOC | 5,000 | 5,000 |

| Rockland County NY BAN | 4.000% | 3/20/08 |

| 65,000 | 65,086 |

| Southampton Town NY BAN | 4.000% | 4/3/08 |

| 7,300 | 7,311 |

| Suffolk County NY Water Auth. Rev. VRDO | 3.500% | 12/7/07 |

| 45,000 | 45,000 |

| Syosset NY Central School Dist. TAN | 4.250% | 6/27/08 |

| 15,000 | 15,049 |

1 | Tobacco Settlement Financing Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.600% | 12/7/07 | (3) | 14,300 | 14,300 |

1 | Tobacco Settlement Financing Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.640% | 12/7/07 | (2) | 10,310 | 10,310 |

1 | Tobacco Settlement Financing Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.640% | 12/7/07 | (2) | 11,355 | 11,355 |

1 | Tobacco Settlement Financing Corp. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.820% | 12/7/07 | (2) | 4,995 | 4,995 |

| Tompkins County NY IDA Civic Fac. |

|

|

|

|

|

| (Cornell Univ.) VRDO | 3.530% | 12/7/07 |

| 15,700 | 15,700 |

| Tompkins County NY IDA Civic Fac. |

|

|

|

|

|

| (Cornell Univ.) VRDO | 3.530% | 12/7/07 |

| 8,390 | 8,390 |

| Tompkins County NY IDA Civic Fac. |

|

|

|

|

|

| (Ithaca College) VRDO | 3.620% | 12/7/07 | (10) | 26,510 | 26,510 |

| Tompkins County NY IDA Civic Fac. |

|

|

|

|

|

| (Ithaca College) VRDO | 3.620% | 12/7/07 | (10) | 35,290 | 35,290 |

1 | Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.630% | 12/7/07 |

| 6,830 | 6,830 |

1 | Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.650% | 12/7/07 |

| 9,260 | 9,260 |

1 | Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.660% | 12/7/07 | (1) | 7,200 | 7,200 |

1 | Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. TOB VRDO | 3.660% | 12/7/07 | (1) | 1,995 | 1,995 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.530% | 12/7/07 |

| 9,700 | 9,700 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.530% | 12/7/07 |

| 5,200 | 5,200 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.540% | 12/7/07 |

| 65,275 | 65,275 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.540% | 12/7/07 |

| 90,800 | 90,800 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.550% | 12/7/07 |

| 48,820 | 48,820 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.550% | 12/7/07 | (4) | 14,700 | 14,700 |

| Triborough Bridge & Tunnel Auth. |

|

|

|

|

|

| New York Rev. VRDO | 3.580% | 12/7/07 |

| 14,480 | 14,480 |

| Watervliet NY Housing Auth. Rev. |

|

|

|

|

|

| (Beltrone Senior Living) VRDO | 3.590% | 12/7/07 | LOC | 14,000 | 14,000 |

| West Islip NY UFSD TAN | 4.000% | 6/27/08 |

| 16,000 | 16,054 |

| White Plains NY City School Dist. BAN | 4.000% | 12/18/07 |

| 15,000 | 15,002 |

23

New York Tax-Exempt Money Market Fund

|

|

|

|

| Face | Market | |

|

|

| Maturity |

| Amount | Value• | |

|

| Coupon | Date |

| ($000) | ($000) | |

Outside New York |

|

|

|

|

| ||

1 | Puerto Rico Highway & Transp. Auth. Rev. TOB VRDO | 3.650% | 12/7/07 | (4) | 5,680 | 5,680 | |

1 | Puerto Rico Highway & Transp. Auth. Rev. TOB VRDO | 3.660% | 12/7/07 | (11)(12) | 10,000 | 10,000 | |

| Puerto Rico Highway & Transp. Auth. Rev. VRDO | 3.500% | 12/7/07 | (2) | 11,700 | 11,700 | |

1 | Puerto Rico Infrastructure Financing Auth. |

|

|

|

|

| |

| Special Tax Rev. TOB VRDO | 3.670% | 12/7/07 | (2) | 10,855 | 10,855 | |

1 | Puerto Rico Sales Tax Financing Corp. Rev. |

|

|

|

|

| |

| TOB VRDO | 3.670% | 12/7/07 | (2) | 8,975 | 8,975 | |

Total Municipal Bonds (Cost $5,419,221) |

|

|

|

| 5,419,221 | ||

Other Assets and Liabilities (0.6%) |

|

|

|

|

| ||

Other Assets—Note B |

|

|

|

| 59,564 | ||

Liabilities |

|

|

|

| (27,895) | ||

|

|

|

|

|

| 31,669 | |

Net Assets (100%) |

|

|

|

|

| ||

Applicable to 5,450,777,816 outstanding $.001 par value shares of |

|

|

|

| |||

beneficial interest (unlimited authorization) |

|

|

|

| 5,450,890 | ||

Net Asset Value Per Share |

|

|

|

| $1.00 | ||

At November 30, 2007, net assets consisted of: |

|

|

| Amount | Per |

| ($000) | Share |

Paid-in Capital | 5,450,906 | $1.00 |

Undistributed Net Investment Income | — | — |

Accumulated Net Realized Losses | (16) | — |

Unrealized Appreciation | — | — |

Net Assets | 5,450,890 | $1.00 |

• | See Note A in Notes to Financial Statements. |

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At November 30, 2007, the aggregate value of these securities was $1,941,161,000, representing 35.6% of net assets.

For a key to abbreviations and other references, see page 25.

24

New York Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security. |

BAN—Bond Anticipation Note. |

COP—Certificate of Participation. |

CP—Commercial Paper. |

FR—Floating Rate. |

GAN—Grant Anticipation Note. |

GO—General Obligation Bond. |

IDA—Industrial Development Authority Bond. |

IDR—Industrial Development Revenue Bond. |

PCR—Pollution Control Revenue Bond. |

PUT—Put Option Obligation. |

RAN—Revenue Anticipation Note. |

TAN—Tax Anticipation Note. |

TOB—Tender Option Bond. |

TRAN—Tax Revenue Anticipation Note. |

UFSD—Union Free School District. |

USD—United School District. |

VRDO—Variable Rate Demand Obligation. |

(ETM)—Escrowed to Maturity. |

(Prere.)—Prerefunded. |

Scheduled principal and interest payments are guaranteed by: |

(1) MBIA (Municipal Bond Insurance Association). |

(2) AMBAC (Ambac Assurance Corporation). |

(3) FGIC (Financial Guaranty Insurance Company). |

(4) FSA (Financial Security Assurance). |

(5) BIGI (Bond Investors Guaranty Insurance). |

(6) Connie Lee Inc. |

(7) FHA (Federal Housing Authority). |

(8) CapMAC (Capital Markets Assurance Corporation). |

(9) American Capital Access Financial Guaranty Corporation. |

(10) XL Capital Assurance Inc. |

(11) CIFG (CDC IXIS Financial Guaranty). |

(12) Assured Guaranty Corp. |

The insurance does not guarantee the market value of the municipal bonds. |

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

25

New York Tax-Exempt Money Market Fund

Statement of Operations

| Year Ended |

| November 30, 2007 |

| ($000) |

Investment Income |

|

Income |

|

Interest | 180,679 |