| Schedule 14A Information |

| Proxy Statement Pursuant to Section 14(a) |

| of the Securities Exchange Act of 1934 |

| Filed by the Registrant[X] |

| Filed by a Party other than the Registrant[ ] |

| Check the appropriate box: |

| [ ] Preliminary Proxy Statement |

| [ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| [ ] Definitive Proxy Statement |

| [X] Definitive Additional Materials |

| [ ] Soliciting Material under Rule 14a-12 |

| Vanguard Admiral Funds |

| Vanguard Bond Index Funds |

| Vanguard CMT Funds |

| Vanguard California Tax-Free Funds |

| Vanguard Charlotte Funds |

| Vanguard Chester Funds |

| Vanguard Convertible Securities Fund |

| Vanguard Explorer Fund |

| Vanguard Fenway Funds |

| Vanguard Fixed Income Securities Funds |

| Vanguard Horizon Funds |

| Vanguard Index Funds |

| Vanguard Institutional Index Funds |

| Vanguard International Equity Index Funds |

| Vanguard Malvern Funds |

| Vanguard Massachusetts Tax-Exempt Funds |

| Vanguard Money Market Reserves |

| Vanguard Montgomery Funds |

| Vanguard Morgan Growth Fund |

| Vanguard Municipal Bond Funds |

| Vanguard New Jersey Tax-Free Funds |

| Vanguard New York Tax-Free Funds |

| Vanguard Ohio Tax-Free Funds |

| Vanguard Pennsylvania Tax-Free Funds |

| Vanguard Quantitative Funds |

| Vanguard Scottsdale Funds |

| Vanguard Specialized Funds |

| Vanguard STAR Funds |

| Vanguard Tax-Managed Funds |

| Vanguard Trustees’ Equity Fund |

| Vanguard Valley Forge Funds |

| Vanguard Variable Insurance Funds |

| Vanguard Wellesley Income Fund |

| Vanguard Wellington Fund |

| Vanguard Whitehall Funds |

| Vanguard Windsor Funds |

| Vanguard World Funds |

| (Name of Registrant as Specified in its Declaration of Trust) |

| (Name of Person(s) Filing Proxy Statement if other than the Registrant) |

| Payment of Filing Fee (Check the appropriate box): |

| [ X ]No fee required. |

| [ ]Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act |

| Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was |

| determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total Fee Paid: |

| [ ]Fee paid previously with preliminary materials. |

| [ ]Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and |

| identify the filing for which the offsetting fee was paid previously. Identify the previous filing |

| by registration statement number, or the form or schedule and the date of its filing. |

| (1) Amount previously paid: |

| (2) Form, schedule or registration statement no.: |

| (3) Filing party; |

| (4) Date filed: |

A Message from Vanguard’s CEO: Your Vote, Your Vanguard

The deadline is fast approaching to vote your fund’s proxy. If you’ve cast your vote, a sincere thanks. If not, I encourage you to do so before November 15.

As a client-owner, your vote is your voice on how Vanguard operates and manages its funds, and you have this opportunity to:

Elect your representatives—the funds’ trustees

The most important reason we’re asking you to vote is to elect fund trustees. The trustees oversee each U.S.-based mutual fund and ensure that it is managed in your best interests.

We have a highly capable, experienced slate of nominees, including two new independent trustee candidates, Deanna Mulligan and Sarah Bloom Raskin. With the election of the new members, nearly half our board will be gender- or ethnically diverse. The research on the positive impact of diversity in the boardroom is conclusive—a diverse board is good business.

Simplify the advisor retention process

Two proposals relate to manager oversight. The independent board, in exercising its fiduciary duty to appoint the best investment advisor to manage your assets, is asking for your approval to hire external advisors and Vanguard subsidiaries without holding future shareholder votes.

As it stands today, more than 50 Vanguard funds have the flexibility to make external advisor changes without shareholder approval. We are simply proposing to extend this flexibility to all funds to retain external advisors or subsidiaries of Vanguard. We have a strong roster of external advisors in place, as well as highly skilled and competent Vanguard portfolio managers in the United Kingdom and Australia. We see considerable merit in having the flexibility across all funds to choose the optimal advisor—whether internal or external—to manage your funds. The benefits include access to an exceptionally broad range of investment expertise, greater diversity of management approaches, and the opportunity to lower fund management costs.

We need your approval; otherwise, we’d be required to hold a shareholder vote each time we want to make this type of change, which is both costly and time-consuming.

Enable Vanguard to change the objective of a widely held fund

We are also seeking to change the investment objective (and benchmark) for Vanguard REIT Index Fund and the REIT Index Portfolio of the Vanguard Variable Insurance Fund. This would bring the funds into alignment with the index methodology governing our ten other sector index funds. The proposed MSCI index that would be each fund’s new target benchmark includes real estate management and development companies in addition to real estate investment trusts, thus offering broader diversification and exposure to the real estate market than the fund’s current benchmark.

You can find detailed descriptions of all the proposals on Vanguard.com. Our overarching objective is to ensure that we can manage the funds in an efficient and effective manner, which will enable us to continue to lower the cost of investing, deliver superior investment returns, and provide a better overall investing experience at Vanguard.

We hope you’ll make it a priority to vote, as we want avoid additional costs and delay in soliciting sufficient votes should we not obtain a quorum.

Thank you for voting and thank you for investing with Vanguard.

All investing is subject to risk, including possible loss of principal

Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

For more information about Vanguard funds or Vanguard ETFs, visit vanguard.com or call xxx-xxx-xxxx to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.

[Vanguard.com interview with Jon Cleborne]

Vanguard’s head of portfolio review discusses proxy, new funds

Since its inception in 1975, Vanguard has served as a manager of investment managers—in the beginning, it was responsible for 11 active funds managed by a single advisory firm, Wellington Management Company. Today, Vanguard oversees more than 350 funds around the world, which are advised both by in-house equity and fixed income teams and by a distinguished roster of 29 external asset managers.

Vanguard’s Portfolio Review Department, led by Jon Cleborne, is at the heart of the company’s fund oversight and governance process. Mr. Cleborne recently discussed several of the fund-related proposals onVanguard’s proxy, the recent launch of two new global balanced funds, and the continued growth of Vanguard’s exchange-traded fund (ETF) lineup.

One of the proposals on the proxy, if approved, would give Vanguard the ability to hire a subsidiary to manage its funds. Can you explain?

Vanguard invests considerable energy and resources to ensure that our funds are in the hands of the best investment teams. Right now, the Vanguard investment professionals at our headquarters in Malvern, Pennsylvania, are essentially the only ones permitted to serve as investment advisor to a large number of our funds. Why wouldn’t we want one of our portfolio managers in London—who works for one of our subsidiaries—to bring his or her expertise and experience to a fund with significant European exposure? We’ve built out our investment management teams and technology in order to manage money on a global basis. We believe there may be instances where we can generate better results for our clients by making portfolio decisions a bit closer to home markets.

Similarly, Vanguard is seeking approval to have third parties manage its funds. Same reasoning?

Yes. Many of our funds were granted the ability to retain third-party managers without prior shareholder approval in a 1993 proxy vote. We are simply standardizing this policy across all funds—index and active. It gives us the option to hire another advisor to diversify a fund management team. For example, we added Vanguard Fixed Income Group to the advisory team ofVanguard Long-Term Investment-Grade Fundin 2013 to complement Wellington Management. As it stands now, we do not have the ability to add Wellington Management or another external advisor to, for example,Vanguard Short-Term Investment-Grade Fund, if we deemed it to be in the best interest of clients.

With shareholder approval of these two proposals, all Vanguard funds could operate under “manager of managers” structures that are common in the mutual fund industry. We are not asking for anything unique, as other leading firms have this ability across their lineups.

Are these proposals designed to save costs?

Yes, in the sense that a proxy is not an inexpensive proposition, and obtaining shareholder approval for even periodic advisor changes would result in onerous and unnecessary costs. There is also potential opportunity cost in not having the right team in place to manage a fund.

But doesn’t it seem inconceivable that you’d want to replace Vanguard as an advisor to one or more of your index funds?

If we found a manager to run an index fund cheaper and better, potentially, yes, we could make that change. In reality, the main consideration at play here is business continuity. We invest considerable energy and resources in contingency planning, ensuring we have the people, processes, and systems in place to manage our clients’ assets through any contingency—natural or man-made disaster, the loss of key personnel, or a technology or infrastructure issue. While it’s not pleasant to think about, should something catastrophic happen to Vanguard’s headquarters, we’d want the funds’ boards of trustees to have the option of naming a new investment advisor without a shareholder vote. We want to leave nothing to chance in executing our responsibility in managing other people’s money.

How do you select advisors?

We have a rigorous process in place to evaluate advisors andthe Portfolio Review groupthat I have the privilege to lead has a long, successful track record of manager oversight. We get down deep in the weeds, examining people, process, philosophy, portfolio, and performance. It is a high bar to manage money for Vanguard. And we cast the net far and wide when looking for advisor talent, considering everyone from large asset managers to small boutique firms around the world to run mandates for us.

Why is Vanguard pursuing a change in the benchmark for the REIT Index Fund?

To clarify, we are seeking approval to change the investment objective for theREIT Index Fundas well as the REIT Index Portfolio of the Variable Insurance Fund, which would then result in a change in the benchmark. It is really about alignment. This change would align the funds with the updated Global Industry Classification Standard methodology, an industry-recognized approach to classifying global market sectors. Vanguard’s ten other sector index funds currently seek to track MSCI benchmarks under this methodology.

An added benefit is broader diversification. The proposed benchmark is the MSCI US Investable Market Real Estate 25/50 Index, which includes real estate management and development companies in addition to real estate investment trusts, thereby offering broader exposure to the real estate market. The current benchmark offers exposure only to publicly traded equity REITs.

Tell us about the new global balanced fund offerings.

We are pleased to add to our already robust balanced-fund lineup. Our newGlobal Wellington™andGlobal Wellesley® IncomeFunds provide broad diversification among global stocks and bonds in a single portfolio. In essence, they represent Vanguard investment philosophy—balance, diversification, discipline, low cost, and a long-term approach.

Why did Vanguard select Wellington Management?

Vanguard’s relationship with Wellington dates back to our founding. Wellington manages more than $350 billion on behalf of Vanguard clients, including some of our oldest and largest active funds, such as theWellington™,Windsor™, andWellesley® IncomeFunds. In short, we chose Wellington Management for its deep international expertise and proven track record managing balanced portfolios. The firm manages $1 trillion worldwide with offices serving more than 65 countries, and we’ve tapped some of the same experienced investment professionals who’ve built a great record with Wellington and Wellesley Income Funds.

What’s on the horizon for new ETFs?

Over the past few years, we’ve really accelerated the pace of ETF launches abroad. Since 2015, we have launched nearly 30 ETFs in Canada, Australia, Hong Kong, and Europe. In the United States, where the ETF industry is more mature, our aim is to complement our current roster of 70 ETFs.

One example is Vanguard Total Corporate Bond ETF (VTC). Wefiled a registration statementfor the fund in August and expect it will launch in the next few weeks. The fund will solidify Vanguard’s position as the low-cost leader in the corporate bond ETF space. VTC will also be Vanguard’s first ETF-of-ETFs, investing in our three current corporate bond ETFs.

Our product development philosophy is based on offering low-cost, high-quality products that are sound, enduring, long-term, and meet our clients’ needs. This is just one reason why Vanguard has grown its lineup to an incredible $11 billion in assets on average per ETF.

What about active ETFs?

Vanguard also recently received the regulatory relief necessary to offer active ETFs in the United States. While this is new in the United States, we already offer actively managed ETFs in international markets. In December 2015, Vanguard launched four factor ETFs in Europe and, in June 2016, four factor ETFs were brought to market in Canada.

While it’s too early to discuss specific plans at this point, we’re excited to have the flexibility to offer actively managed investment strategies in an ETF product.

All investing is subject to risk, including possible loss of principal

Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

For more information about Vanguard funds or Vanguard ETFs, visit vanguard.com or call xxx-xxx-xxxx to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.

“Your Vote, Your Vanguard”

Vanguard.com video script

Bill McNabb

October 30, 2017

A Message from Vanguard’s CEO: Your Vote, Your Vanguard

The deadline is fast approaching to vote your fund’s proxy. If you’ve cast your

vote, a sincere thanks. If not, I encourage you to do so before November 15th.

As a client-owner, your vote is your voice on how Vanguard operates and manages

its funds. Please use this opportunity to:

[TEXT DISPLAYS ONSCREEN:Elect your representatives – the funds’

trustees][READ BY BILL AS …] “Elect your representatives”

This is the most important reason we’re asking you to vote. The trustees oversee

each U.S.-based mutual fund and ensure that it is managed in your best interests.

We have a highly capable, experienced slate of nominees, including two new, independent trustee candidates—Deanna Mulligan and Sarah Bloom Raskin. With the election of the new members, nearly half our board will be gender- or ethnically diverse.

And the research is conclusive – a diverse board is good for business.

[DISPLAY TEXT OF NEXT THEME: “Simplify the advisor retention

process”]

1

Two proposals relate to manager oversight. The independent board has a fiduciary duty to appoint the best investment advisor to manage your assets. To fulfill that duty, the board seeks your approval to let Vanguard hire external advisors and Vanguard subsidiaries. As it stands today, more than 50 Vanguard funds have the flexibility to make external advisor changes without shareholder approval. We are simply proposing to extend this flexibility to all funds to retain external advisors or subsidiaries of Vanguard.

The advantages of being able to choose the optimal advisor – be it internal or

external – to manage your funds are many. It would provide:

- More access to a broad range of investment expertise.

- Greater diversity of management approaches.

- And quite importantly, the opportunity to lower fund management costs.

We need your approval; otherwise, we’d be required to hold a shareholder vote each time we wanted to make this type of change. That would be both very costly and time consuming.

[DISPLAY TEXT OF NEXT THEME: “Enable Vanguard to change the

objective of a widely held fund”]

2

We’re also seeking to change the investment objective and benchmark for Vanguard REIT Index Fund and the REIT Index Portfolio of the Vanguard Variable Insurance Fund. This would make each fund’s index methodology consistent with our other ten sector index funds. That means greater efficiency.

We’re proposing an MSCI index as each fund’s target benchmark. This benchmark

would offer broader diversification and exposure to the real estate market.

You can find detailed descriptions ofallthe proposals on Vanguard.com.

Our overarching objective it to ensure we manage the funds efficiently and effectively. In turn, we can continue to lower the cost of investing, deliver superior investment returns, and provide a better overall investing experience—for you.

Help your funds avoid the additional costs and delay of insufficient votes—please

vote today.

Thanks for giving this your attention, and thank you for investing with Vanguard.

All investing is subject to risk, including possible loss of principal

Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

Visitvanguard.comto obtain a fund prospectus, or, if available, a summary prospectus, which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.

3

Vanguard Executive Voicemail Script

Vanguard Executive Voicemail: Beneficial Shareholders

Hello. This is Bill McNabb, Chairman and CEO of The Vanguard Group. I’m calling to connect with you as a fellow Vanguard fund shareholder and to request your vote in the Vanguard funds’ Proxy campaign. Not too long ago, we sent you proxy materials requesting your vote on important matters regarding your Vanguard fund investments. By voting today, you’ll help us reach the required shareholder participation threshold. You’ll also be helping to keep your fund expenses low. The reason for that is if we have to re-solicit in order to reach a voting quorum, it will significantly add to the costs of your funds.

So if you have your proxy materials, simply vote on-line or by phone using the instructions on your proxy ballot. If you don’t have your materials, vote by calling our proxy agent, Computershare, toll free at 1-866-650-3709. Again, that’s 1-866-650-3709.

Thanks for entrusting your investments to Vanguard and for your participation in the Vanguard funds’ Proxy campaign.

Vanguard Executive Voicemail: Registered Shareholders

Hello. This is Bill McNabb, Chairman and CEO of The Vanguard Group. I’m calling to connect with you as a fellow Vanguard fund shareholder and to request your vote in the Vanguard funds’ Proxy campaign. Not too long ago, we sent you proxy materials requesting your vote on important matters regarding your Vanguard fund investments. By voting today, you’ll help us reach the required shareholder participation threshold. You’ll also be helping to keep your fund expenses low. The reason for that is if we have to re-solicit in order to reach a voting quorum, it will significantly add to the costs of your funds.

So if you have your proxy materials, simply vote on-line or by phone using the instructions on your proxy ballot. If you don’t have your materials, vote by calling our proxy agent, Computershare, toll free at 1-866-650-3710. Again, that’s 1-866-650-3710.

Thanks for entrusting your investments to Vanguard and for your participation in the Vanguard funds’ Proxy campaign.

Watch: Vanguard CEO reminds shareholders to vote as proxy campaign nears finish line

October 31, 2017

In a new video, Vanguard CEO Bill McNabb is reminding Vanguard fund shareholders of the importance of voting as the end of the current three-month proxy campaign approaches. Vanguard hopes to avoid the extra cost of having to solicit sufficient votes to reach the required quorum.

Vanguard is asking shareholders to elect the trustees of its U.S.-domiciled funds and to approve several policy changes across its U.S.-domiciled fund lineup. Voting by proxy is scheduled to end by November 15, 2017, when a shareholder meeting will be held in Scottsdale, Arizona.

Details on the proposals and voting methods are available at Vanguard’s proxy resource center,www.xxxxxxxxxxxxxxxxx.com.

Notes:

- All investing is subject to risk, including the possible loss of money you invest.

Vanguard CEO reminds shareholders to vote their proxy

In a new video, Vanguard CEO Bill McNabb is reminding Vanguard fund shareholders of the importance of voting as the end of the current three-month proxy campaign approaches. Vanguard hopes to avoid the extra cost of having to solicit sufficient votes to reach the required quorum.

Vanguard is asking shareholders to elect the trustees of its U.S.-domiciled funds and to approve several policy changes across its U.S.-domiciled fund lineup. Voting by proxy is scheduled to end by November 15, 2017, when a shareholder meeting will be held in Scottsdale, Arizona.

Read transcript

Read more about thefund proposals.

Visit the voting website tovote now.

Details on the proposals and voting methods are available at Vanguard’sproxy resource center.

Notes:

- All investing is subject to risk, including the possible loss of the money you invest.

[Search description and LinkedIn posting]

Voting by November 15 gives Vanguard fund shareholders a voice in who oversees their funds and how the funds are managed, Chairman and CEO Bill McNabb says in a 3-minute video.

[Long description]

In this 3-minute video, Vanguard Chairman and CEO Bill McNabb urges shareholders of all U.S.-based funds to vote by the November 15 deadline, so they can have a say on the composition of each fund’s board of trustees and how the funds are managed.

[Keywords (50 to 300 characters, including spaces)]

Vanguard proxy, proxy, fund trustees, election, Vanguard CEO, Bill McNabb, Vanguard shareholders, fund policies, investment, vote, shareholder, proposal, board

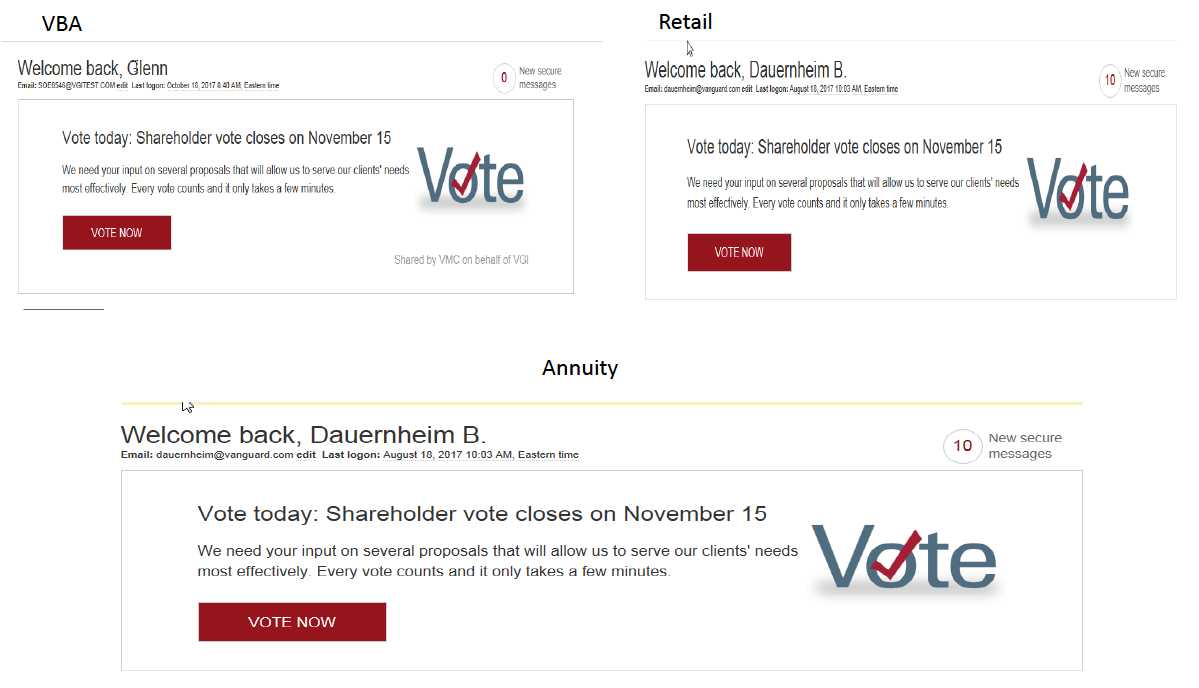

Subject: Deadline is near for your plan’s proxy vote

I’m writing to remind you of theNovember 15deadline to vote in Vanguard’s 2017 proxy campaign, which includes an important proposal affecting Vanguard® Institutional Index Fund and Vanguard Institutional Total Stock Market Index Fund.

Your vote matters—especially because your plan has one or both of these funds in its plan lineup. The Vanguard board recommends a vote in favor of the proposal.

Proposal in brief:This management proposal asks shareholders to approve a new investment advisory, administrative, and distribution arrangement for the Institutional Index Fund and the Institutional Total Stock Market Index Fund by adopting the Vanguard Funds’ Service Agreement.

Key changes, if approved:The adoption of the Service Agreement would result in lower expense ratios for Institutional class shares of both funds and a reduction in the minimum initial investments for three of the funds’ four share classes, as shown in the table below.

| Institutional Index Fund | ||||

| Expense ratio | Minimum initial investment | |||

| Share class | Current | Proposed | Current | Proposed |

| Institutional | 0.04% | 0.035% | $5 million | $5 million |

| Institutional Plus | 0.02% | 0.02% | $200 million | $100 million |

| Institutional Total Stock Market Index Fund | ||||

| Expense ratio | Minimum initial investment | |||

| Share class | Current | Proposed | Current | Proposed |

| Institutional | 0.04% | 0.035% | $100 million | $5 million |

| Institutional Plus | 0.02% | 0.02% | $200 million | $100 million |

Your vote is your voice

In this final stage of our 2017 proxy campaign, I encourage you to listen to a video message from Vanguard Chairman and CEO Bill McNabb highlighting the vital role shareholders play in how Vanguard operates and manages the funds:http://institutional.vanguard.com/VideoBillProxyRequest

I’d also like to call your attention to an interview with Jon Cleborne, our head of portfolio review, regarding several fund-related proposals:http://institutional.vanguard.com/cleborne

Shareholders may vote online, by phone, by mail, or in person. Voting ends with a shareholder meeting scheduled for Wednesday, November 15, 2017, in Scottsdale, Arizona.

Vote now:

http://www.proxy-direct.com/vanguard

View the proxy booklet and additional proxy-related information:http://about.vanguard.com/proxy/

Thanks in advance for your consideration and your vote. If you have any questions or would like more information, please don't hesitate to contact me.

**For more information about Vanguard funds, visit institutional.vanguard.com or call 800-523-1036 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.**

All investing is subject to risk, including the possible loss of the money you invest.

For institutional use only. Not for distribution to retail investors.

© 2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. | Privacy statement:http://www.vanguard.com/instlprivacystmt

455 Devon Park Drive | Wayne, PA 19087-1815 | institutional.vanguard.com

Subject: Proxy deadline is near on Vanguard REIT portfolios

I’m writing to remind you of theNovember 15deadline to vote in Vanguard’s 2017 shareholder proxy campaign. Two important proposals seek to change:

- The investment objective of Vanguard® REIT Index Fund and Vanguard Variable Insurance FundREIT Index Portfolio.

- The diversification status of Vanguard REIT Index Fund.

Your vote matters—especially since your plan lineup contains one or both of these funds. The Vanguard board recommends a vote in favor of both proposals.

INVESTMENT OBJECTIVE CHANGE PROPOSAL

Proposal in brief:This management proposal asks shareholders to approve a change in the investment objective for the REIT Index Fund and the REIT Index Portfolio of the Variable Insurance Fund. The change would broaden the mandate to include real estate management and development companies.

Key changes, if approved:Each fund would undergo a corresponding change to its investment objective, benchmark index, and name, as shown in the table below.

| Current | Proposed | |

| Investment | The fund seeks to provide a high level | The fund seeks to provide a high level |

| objective | of income and moderate long-term | of income and moderate long-term |

| capital appreciation by tracking the | capital appreciation by tracking the | |

| performance of a benchmark index that | performance of a benchmark index that | |

| measures the performance of publicly | measures the performance of publicly | |

| traded equity REITs. | traded equity REITsand other real | |

| estate-related investments. | ||

| Benchmark | MSCI US REIT Index | MSCI US Investable Market Real |

| Estate 25/50 Index | ||

| Fund names | Vanguard REIT Index Fund | VanguardReal EstateIndex Fund |

| Vanguard Variable Insurance Fund | Vanguard Variable Insurance Fund | |

| REIT Index Portfolio | Real EstateIndex Portfolio |

Shareholders will not be asked to vote on the name change or the benchmark change of the funds; however, changing the benchmark will necessitate a change to the names of the funds.

DIVERSIFICATION CHANGE PROPOSAL

Proposal in brief:This management proposal asks shareholders to approve a change in the diversification status of the REIT Index Fund from diversified to nondiversified, as defined by the Investment Company Act of 1940 (the 1940 Act).

Your vote is your voice

In this final stage of our 2017 proxy campaign, I encourage you to listen to a video message from Vanguard Chairman and CEO Bill McNabb highlighting the vital role shareholders play in how Vanguard operates and manages the funds:http://institutional.vanguard.com/VideoBillProxyRequest

I’d also like to call your attention to an interview with Jon Cleborne, our head of portfolio review, regarding several fund-related proposals: http://institutional.vanguard.com/VideoBillProxyRequesthttp://institutional.vanguard.com/cleborne

Shareholders may vote online, by phone, by mail, or in person. Voting ends with a shareholder meeting scheduled for Wednesday, November 15, 2017, in Scottsdale, Arizona.

Vote now:

http://www.proxy-direct.com/vanguard

View the proxy booklet and additional proxy-related information:http://about.vanguard.com/proxy/

Thanks in advance for your consideration and your vote. If you have any questions or would like more information, please don't hesitate to contact me.

**For more information about Vanguard funds, visit institutional.vanguard.com or call 800-523-1036 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.**

All investing is subject to risk, including the possible loss of the money you invest. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility.

The Global Industry Classification Standard ("GICS") was developed by and is the exclusive property and a service mark of MSCI Inc. ("MSCI") and Standard and Poor's, a division of McGraw-Hill Companies, Inc. ("S&P") and is licensed for use by Vanguard. Neither MSCI, S&P nor any third party involved in making or compiling the GICS or any GICS classification makes any express or implied warranties or representations with respect to such standard or classification (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability, or fitness for a particular purpose with respect to any such standard or classification. Without limiting any of the foregoing, in no event shall MSCI, S&P, any of its affiliates, or any third party involved in making or compiling the GICS or any GICS classification have any liability for any direct, indirect, special, punitive, consequential, or any other damages (including lost profits) even if notified of the possibility of such damages.

The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. The preliminary proxy statement the Vanguard funds filed with the SEC contains a more detailed description of the limited relationship MSCI has with The Vanguard Group, Inc. and any related funds.

For institutional use only. Not for distribution to retail investors.

© 2017 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. | Privacy statement:http://www.vanguard.com/instlprivacystmt

455 Devon Park Drive | Wayne, PA 19087-1815 | institutional.vanguard.com

Proxy 2017 campaign countdown tile

2017 proxy voting campaign

X days left to vote

McNabb article

• Your vote is your voice. Bill McNabb reminds shareholders of the important proxy proposals up for vote:

• Time's running out. Cast you proxy ballot today! Learn why your vote is your voice:

Cleborne article

• Vanguard executive offers insights into proxy fund proposals:

• A Q&A with Jon Cleborne on 2017 proxy proposals and fund initiatives:

• A behind-the-scenes look into 2017 proxy proposals and fund initiatives:

[Search description and LinkedIn text (75 to 150 characters, including spaces)]

Vanguard’s 2017 proxy campaign seeks in part to enhance the firm’s ability to pursue the best investment talent, says Head of Portfolio Review Jon Cleborne.

[Long description (100 to 270 characters, including spaces)]

Proxy proposals, benchmark changes, advisor selection, and new fund and ETF offerings are among the topics Vanguard Head of Portfolio Review Jon Cleborne addresses in an interview.

[Keywords (50 to 300 characters, including spaces)]

proxy, vote, vanguard, cleborne, etf, exchange-traded, active, advisor, selection, investment, global, wellington, windsor, wellesley, income, balanced, international, stock, bond, growth, diversification, corporate, investment grade, portfolio, review, reit, long-term