UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04571

Name of Registrant: Vanguard Pennsylvania Tax-Free Funds

| |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| |

| Name and address of agent for service: | Heidi Stam, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: November 30

Date of reporting period: December 1, 2015 – May 31, 2016

Item 1: Reports to Shareholders

Semiannual Report | May 31, 2016

Vanguard Pennsylvania Tax-Exempt Funds

Vanguard Pennsylvania Tax-Exempt Money Market Fund

Vanguard Pennsylvania Long-Term Tax-Exempt Fund

Vanguard’s Principles for Investing Success

We want to give you the best chance of investment success. These principles, grounded in Vanguard’s research and experience, can put you on the right path.

Goals. Create clear, appropriate investment goals.

Balance. Develop a suitable asset allocation using broadly diversified funds. Cost. Minimize cost.

Discipline. Maintain perspective and long-term discipline.

A single theme unites these principles: Focus on the things you can control.

We believe there is no wiser course for any investor.

| |

| Contents | |

| Your Fund’s Total Returns. | 1 |

| Chairman’s Letter. | 2 |

| Advisor’s Report. | 8 |

| Pennsylvania Tax-Exempt Money Market Fund. | 12 |

| Pennsylvania Long-Term Tax-Exempt Fund. | 27 |

| About Your Fund’s Expenses. | 65 |

| Trustees Approve Advisory Arrangements. | 67 |

| Glossary. | 68 |

Please note: The opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

See the Glossary for definitions of investment terms used in this report.

About the cover: Pictured is a sailing block on the Brilliant, a 1932 schooner docked in Mystic, Connecticut. A type of pulley, the sailing block helps coordinate the setting of the sails. At Vanguard, the intricate coordination of technology and people allows us to help millions of clients around the world reach their financial goals.

Your Fund’s Total Returns

| | | | | | |

| Six Months Ended May 31, 2016 | | | | | |

| | | Taxable- | | | |

| | SEC | Equivalent | Income | Capital | Total |

| | Yield | Yield | Returns | Returns | Returns |

| Vanguard Pennsylvania Tax-Exempt Money Market | | | | | |

| Fund | 0.24% | 0.44% | 0.04% | 0.00% | 0.04% |

| Other States Tax-Exempt Money Market Funds | | | | | |

| Average | | | | | 0.01 |

| Other States Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. | |

| Vanguard Pennsylvania Long-Term Tax-Exempt Fund | | | | | |

| Investor Shares | 1.88% | 3.43% | 1.80% | 2.22% | 4.02% |

| Admiral™ Shares | 1.95 | 3.55 | 1.84 | 2.22 | 4.06 |

| Barclays PA Municipal Bond Index | | | | | 3.54 |

| Pennsylvania Municipal Debt Funds Average | | | | | 3.24 |

Pennsylvania Municipal Debt Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company.

7-day SEC yield for the Pennsylvania Tax-Exempt Money Market Fund; 30-day SEC yield for the Pennsylvania Long-Term Tax-Exempt Fund.

The calculation of taxable-equivalent yield assumes a typical itemized tax return and is based on the maximum federal tax rate of 43.4% and the maximum income tax rate for the state. Local taxes were not considered. Please see the prospectus for a detailed explanation of the calculation.

Admiral Shares carry lower expenses and are available to investors who meet certain account-balance requirements.

| | | | | |

| Your Fund’s Performance at a Glance | | | | |

| November 30, 2015, Through May 31, 2016 | | | | |

| | | | Distributions Per Share |

| | Starting | Ending | Income | Capital |

| | Share Price | Share Price | Dividends | Gains |

| Vanguard Pennsylvania Tax-Exempt Money Market | | | | |

| Fund | $1.00 | $1.00 | $0.000 | $0.000 |

| Vanguard Pennsylvania Long-Term Tax-Exempt Fund | | | | |

| Investor Shares | $11.67 | $11.89 | $0.241 | $0.038 |

| Admiral Shares | 11.67 | 11.89 | 0.247 | 0.038 |

1

Chairman’s Letter

Dear Shareholder,

Sustained demand helped the broad U.S. municipal bond market return well over 3% for the six months ended May 31, 2016, outpacing the broad taxable market.

For the six months, Vanguard Pennsylvania Long-Term Tax-Exempt Fund returned 4.02% for Investor Shares and 4.06% for Admiral Shares. These results exceeded the 3.54% return of the benchmark, the Barclays Pennsylvania Municipal Bond Index, and the 3.24% return of competing Pennsylvania tax-exempt funds. They also surpassed the 3.42% return for the broad muni bond market, as measured by the Barclays Municipal Bond Index.

Price appreciation and interest income made solid contributions to the results. For both Investor and Admiral Shares, the capital return was 2.22%. Return from income was 1.80% for Investor Shares and 1.84% for Admiral Shares.

The fund’s 30-day SEC yield for Investor Shares fell to 1.88% as of May 31 from 2.40% six months earlier. (Bond yields and prices move in opposite directions.)

Yields for tax-exempt money market instruments, however, moved higher. Vanguard Pennsylvania Tax-Exempt Money Market Fund’s 7-day SEC yield rose to 0.24% by the end of the period, a level not seen since 2009. Much lower yields early on, though, put the six-month return for the fund at 0.04%. The average return for its peers was 0.01%.

Please note that the funds are permitted to invest in securities whose income is subject to the alternative minimum tax (AMT). As of May 31, however, only the Money Market Fund owned securities that would generate income distributions subject to the AMT.

Before moving on to the markets, I wanted to give you a brief update on money market reforms. As we’ve mentioned before, the Securities and Exchange Commission has adopted reforms for money market funds, and key aspects of the new rules will come into effect in October 2016. Their impact on the Money Market Fund, to be designated a retail fund, will be minimal. The fund will continue to seek to maintain a stable share price of $1.

Bonds enjoyed a strong ride after some early weakness

The broad U.S. taxable bond market returned 3.12% for the half year. After dipping in December, bonds climbed. The yield of the 10-year U.S. Treasury note closed at 1.85% at the end of May, down from 2.22% six months earlier.

The period began with the Federal Reserve’s long-anticipated but small increase in short-term interest rates. Through the succeeding months, mixed signals from Fed officials—as well as from economic data—created uncertainty about when the next increase might occur.

| | | | |

| Market Barometer | | | |

| | | | Total Returns |

| | | Periods Ended May 31, 2016 |

| | Six | One | Five Years |

| | Months | Year | (Annualized) |

| Bonds | | | |

| Barclays U.S. Aggregate Bond Index (Broad taxable | | | |

| market) | 3.12% | 2.99% | 3.33% |

| Barclays Municipal Bond Index (Broad tax-exempt market) | 3.42 | 5.87 | 5.07 |

| Citigroup Three-Month U.S. Treasury Bill Index | 0.10 | 0.12 | 0.05 |

| |

| Stocks | | | |

| Russell 1000 Index (Large-caps) | 1.64% | 0.78% | 11.44% |

| Russell 2000 Index (Small-caps) | -2.86 | -5.97 | 7.86 |

| Russell 3000 Index (Broad U.S. market) | 1.29 | 0.22 | 11.15 |

| FTSE All-World ex US Index (International) | -1.14 | -10.87 | 0.52 |

| |

| CPI | | | |

| Consumer Price Index | 1.22% | 1.02% | 1.23% |

3

Money market funds and savings accounts produced limited returns as the Fed’s target rate of 0.25%–0.5% remained historically low, despite the quarter-percentage-point rise in December.

International bond markets (as measured by the Barclays Global Aggregate Index ex USD) returned 9.17%. In a reversal from the trend of recent years, foreign currencies strengthened against the dollar, boosting international bonds. Even without this currency benefit, international bond returns were solidly positive.

In a tale of two halves, stocks fell and then rose

U.S. stocks advanced about 1% for the six months. Equities retreated over the period’s first half before rebounding, as a sharp recovery in oil prices seemed to alleviate fears of a global economic slowdown.

International stocks fared worse than their U.S. counterparts, returning about –1%. Emerging-market stocks rose a bit, while stocks from the developed markets of Europe and the Pacific region declined. European stocks lagged amid investor anxiety in the lead-up to the United Kingdom’s June vote on whether to remain in the European Union.

Longer-dated bonds boosted performance

Even with the Fed raising its target for overnight interest rates toward the close of 2015—the first hike in almost a decade—yields for all but the very

| | | | |

| Expense Ratios | | | |

| Your Fund Compared With Its Peer Group | | | |

| | Investor | Admiral | Peer Group |

| | Shares | Shares | Average |

| Pennsylvania Tax-Exempt Money Market | | | |

| Fund | 0.16% | — | 0.11% |

| Pennsylvania Long-Term Tax-Exempt Fund | 0.20 | 0.12% | 1.03 |

The fund expense ratios shown are from the prospectus dated March 29, 2016, and represent estimated costs for the current fiscal year. For the six months ended May 31, 2016, the funds’ annualized expense ratios were: for the Pennsylvania Tax-Exempt Money Market Fund, 0.09%; and for the Pennsylvania Long-Term Tax-Exempt Fund, 0.20% for Investor Shares and 0.12% for Admiral Shares. The six-month expense ratio for the Pennsylvania Tax-Exempt Money Market Fund reflects a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the fund’s annualized six-month expense ratio was 0.16%. Peer-group expense ratios are derived from data provided by Lipper, a Thomson Reuters Company, and capture information through year-end 2015.

Peer groups: For the Pennsylvania Tax-Exempt Money Market Fund, Other States Tax-Exempt Money Market Funds; for the Pennsylvania Long-Term Tax-Exempt Fund, Pennsylvania Municipal Debt Funds. In most, if not all, cases, the expense ratios for funds in the peer groups are based on net operating expenses after reimbursement and/or fee waivers by fund sponsors. In contrast, the Vanguard money market funds’ expense ratios in the table above do not reflect expense reductions.

4

shortest-dated munis moved lower. Demand for these securities was fueled in part by concerns about the fragile state of global growth. Other contributing factors included the subdued outlook for inflation (with oil prices volatile but still low) and, toward the end of the period, the Fed’s dampening of expectations for further rate hikes. And with many central banks abroad pursuing further monetary easing,

|

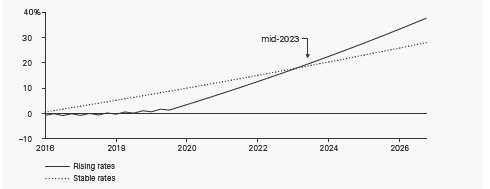

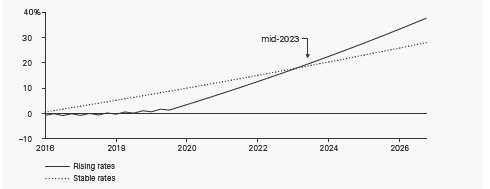

| The potential upside of rising rates |

| |

| Bond fund investors may wonder about the effect of rising interest rates on bond prices— |

| even though the Federal Reserve has raised rates more slowly than anticipated. |

| |

| Initially, as interest rates go up, the market value of bonds in a portfolio will decline, bringing |

| their yields closer to those of newer issues. However, the opportunity to reinvest cash flow |

| into higher-yielding bonds over time can benefit investors who can wait. |

| |

| Consider a hypothetical example of an intermediate-term investment-grade taxable bond fund |

| yielding 2.25%. Assume rates rise by a quarter of a percentage point every January and July |

| from 2016 through 2019, ending at 4.25%. Although the cumulative total return would decline |

| initially, by mid-2023, it would be higher than if rates hadn’t changed. The bond math would be |

| similar for municipal bonds. Of course, the pace and magnitude of rate increases would affect |

| the time until breakeven. |

| |

| The silver lining of higher yields |

| Cumulative rate of return |

| Notes: This hypothetical example shows the impact on a generic, taxable intermediate-term bond fund if the Federal Reserve raised |

| short-term interest rates by a quarter of a percentage point every January and July from 2016 through 2019. Intermediate-term rates |

| are assumed to rise by the same amount. The bond fund has a duration of 5.5 years. (Duration is a measure of the sensitivity of |

| bond—and bond mutual fund—prices to interest rate movements.) |

| Source: Vanguard. |

5

the yields on offer from U.S. bonds, including munis, continued to attract international buyers.

On the supply side, issuance across the nation was down compared with the comparable period a year earlier. Although state coffers continued to benefit from rising tax revenues, municipal issuers didn’t have much appetite for initiating new capital projects. In Pennsylvania, supply declined from a year ago but was slightly higher than in 2014 and 2013. In line with the national trend, most of this supply involved the refunding of outstanding debt rather than new capital. Demand, meanwhile, was up for hospital, university, water, and sewer debt, but down for general obligation issues.

The Pennsylvania Long-Term Tax-Exempt Fund benefited from the expertise and skill of its advisor, Vanguard Fixed Income Group. A higher allocation to maturities of ten years or more and to A-rated and BBB-rated securities boosted relative returns.

Vanguard Fixed Income Group also added value by favoring some of the best-performing sectors of the muni market. Hospital and university revenue bonds, for example, offset some of the weakness resulting from the fund’s lower-than-benchmark exposure to transportation revenue bonds.

For more information about the advisor’s approach and the fund’s positioning during the period, please see the Advisor’s Report that follows this letter.

Consider rebalancing to manage your risk

Let’s say you’ve taken the time to carefully create an appropriate asset allocation for your investment portfolio. Your efforts have produced a diversified mix of stock, bond, and money market funds tailored to your goals, time horizon, and risk tolerance.

But what should you do when your portfolio drifts from its original asset allocation as the financial markets rise or fall? Consider rebalancing to bring it back to the proper mix.

Just one year of outsized returns can throw your allocation out of whack. Take 2013 as an example. That year, the broad stock market (as measured by the Russell 3000 Index) returned 33.55%, and the broad taxable bond market (as measured by the Barclays U.S. Aggregate Bond Index) returned –2.02%. A hypothetical portfolio that tracked the broad domestic market indexes and started the year with 60% stocks and 40% bonds would have ended with a more aggressive mix of 67% stocks and 33% bonds.

Rebalancing to bring your portfolio back to its original targets would require you to shift assets away from areas that have

6

been performing well toward those that have been falling behind. That isn’t easy or intuitive, but it’s a way to minimize risk and to stick with your investment plan through different types of markets. (You can read more about our approach in Best Practices for Portfolio Rebalancing at vanguard.com/research.)

It’s not necessary to check your portfolio every day or every month, much less rebalance it that frequently. It may be more appropriate to monitor it annually or semiannually and rebalance when your allocation swings 5 percentage points or more from its target.

It’s important, of course, to be aware of the tax implications. You’ll want to consult with your tax advisor, but generally speaking, it may be a good idea to make any asset changes within a tax-advantaged retirement account or to direct new cash flows into the underweighted asset class.

However you go about it, keeping your asset allocation from drifting too far off target can help you stay on track with the investment plan you’ve crafted to meet your financial goals.

As always, thank you for investing with Vanguard.

Sincerely,

F. William McNabb III

Chairman and Chief Executive Officer

June 13, 2016

Advisor’s Report

For the six months ended May 31, 2016, Vanguard Pennsylvania Long-Term Tax-Exempt Fund returned 4.02% for Investor Shares and 4.06% for Admiral Shares. The fund outpaced its benchmark, the Barclays Pennsylvania Municipal Bond Index, which returned 3.54%, and the 3.24% average return of its peers. Vanguard Pennsylvania Tax-Exempt Money Market Fund returned 0.04%, compared with the 0.01% average return of its peers.

The investment environment

The period began with market expectations firmly set that the Federal Reserve would start raising interest rates in December. The Fed did raise the federal funds target range by a quarter percentage point, to 0.25%–0.5%, citing considerable improvement in labor market conditions

and reasonable confidence that inflation would rise over the medium term to the Fed’s 2% objective. Future rate hikes were expected to be gradual, and the Fed reaffirmed its data-dependent stance.

A global growth scare and steep declines in commodity prices early in 2016, however, went against expectations and triggered a large risk-off move in global financial markets. The Fed began to sound less eager to raise rates as it looked at how deteriorating economic conditions abroad might impede the United States from reaching the central bank’s employment and inflation targets. Market expectations adjusted down from four rate hikes in 2016 to two.

| | | |

| Yields of Tax-Exempt Municipal Securities | | |

| (AAA-Rated General-Obligation Issues) | | |

| | November 30, | May 31, |

| Maturity | 2015 | 2016 |

| 2 years | 0.72% | 0.72% |

| 5 years | 1.26 | 1.09 |

| 10 years | 2.02 | 1.66 |

| 30 years | 2.96 | 2.45 |

| Source: Vanguard. | | |

8

The U.S. economy showed signs of slowing, with GDP expanding by 1.4% in the fourth quarter of 2015, followed by only 0.8% in the first quarter of 2016. The strong dollar, combined with weaker global economic and financial conditions overall, is believed to be behind the slowdown; we expect growth to return to about 2% over the coming year.

Although employment gains were strong early in the six-month period, payrolls slumped in May, in part because of a strike by communications workers; that put the average monthly gain for the period at about 170,000. The unemployment rate sank to 4.7% by the end of May, reflecting job gains but also contraction in the labor force. Core inflation ticked up, from 2.1% in December to 2.2% in May, and headline inflation (including food and energy prices, which tend to be volatile) rose from 0.7% in December to 1.0% in May.

Pennsylvania’s economy has been growing at a slower pace than that of the United States as a whole, according to a gauge of current economic conditions published monthly by the Federal Reserve Bank of Philadelphia. From November 2015 to April 2016, the bank’s index for Pennsylvania rose by less than 1%, while at the national level, the index rose about 1%. From its low point in 2009 through April 2016, the bank’s index for Pennsylvania climbed about 19%, compared with about 21% for the U.S. index. (Each state’s index incorporates data on nonfarm payroll employment, the jobless rate, average hours worked in manufacturing, and inflation-adjusted wage and salary payments.)

In March, the Pennsylvania fiscal year 2016 budget was finally passed after a nine-month impasse. Absent compromise in Harrisburg, another stalemate is likely for fiscal year 2017. Pennsylvania remains burdened by a structural budget deficit in excess of $2 billion, a lack of reserves, mounting unfunded pension liabilities, and underfunded school districts.

Moody’s (Aa3), Standard & Poor’s (AA–), and Fitch (AA–) affirmed the commonwealth’s credit ratings, all of which had been downgraded since the summer of 2014. The agencies cited structural budget imbalance and increasing pension liabilities as factors, while also noting that Pennsylvania still benefits from a moderate overall debt structure, a diversifying economic base, and conservative financial planning and management on the part of the state government.

Going forward, Pennsylvania’s credit rating depends largely on the outcome of the 2017 budget negotiations, and we continue to characterize the trend as “developing.”

Management of the funds

We remained focused on driving value through strategic allocation positioning and security selection. Because municipal yields have fallen and bonds with the longest maturities have had the biggest yield drops (and the biggest subsequent

9

price increases), the Long-Term Fund has benefited from its overweighting of bonds with maturities beyond 10 years.

In terms of quality, being overweight in A-rated and BBB-rated bonds helped as investors continued to reach for yield. From a sector standpoint, greater allocation to hospital and university bonds lifted returns. As the state continued to struggle with passing a budget and addressing pension and budgetary concerns, having less exposure to general obligation bonds also served the Long-Term Fund well.

These strengths offset some weakness that arose from being underweight in the transportation sector. In order to maintain appropriate diversification, we had less exposure to bonds from the Pennsylvania Turnpike Commission, a very large issuer.

We continued to overweight premium callable bonds, which outperformed. They will remain a core strategy for us, as they would provide some protection to the funds if rates were to rise sharply. Tactical duration adjustments to take advantage of shorter-term technical conditions added value as well.

We collaborate closely with Vanguard’s experienced team of credit analysts, who perform an objective, thorough, and independent analysis of the overall creditworthiness of these bonds, and of every issuer whose bonds we own or are considering buying. The muni market is large, fragmented, and often inefficient, so our deep credit analysis bench strength is crucial as we identify bonds that appear mispriced in the marketplace.

A look ahead

Interest rates are likely to remain range- bound for some time, with the U.S. growth pace setting a floor on how low they can go and weakness in the global economy capping how high they can rise.

The Fed left rates unchanged at its May meeting and seems on track to continue tightening at a much slower pace than in previous cycles. That slower pace and possibly a lower terminal short-term interest rate would most likely keep municipal rates below what we’ve seen over the past ten to 15 years.

We are starting the second half of the fiscal year neutral on duration and yield-curve positioning but will make tactical adjustments as seasonal opportunities arise.

Higher-yielding segments of the muni market are expected to continue to produce modestly positive excess returns, with credit fundamentals improving and investors continuing to reach for yield.

Municipal defaults are likely to remain isolated events. That said, we will try to build an even greater bias in our portfolios toward liquid, favorably structured securities from issuers with solid credit fundamentals; this should provide some downside cushion if economic growth slackens.

With future Fed hikes remaining dependent on economic data, rate volatility is likely to stay elevated, and short periods of market dislocation are to be expected. The funds’

10

liquidity should position us to take advantage of any buying opportunities that arise from such dislocation.

On the money market front, as previously reported, we plan to designate the Pennsylvania Tax-Exempt Money Market Fund as a retail fund, along with all our national and state-specific tax-exempt money market funds—giving investors continued access to these stable-value offerings.

As always, our experienced team of portfolio managers, traders, and credit analysts will seek to add value to the portfolios through security selection by identifying bonds that are mispriced by the market.

Christopher W. Alwine, CFA, Principal,

Head of Municipal Group

James M. D’Arcy, CFA, Portfolio Manager

Justin A. Schwartz, CFA, Portfolio Manager,

Head of Municipal Money Market Funds

Vanguard Fixed Income Group

June 17, 2016

Pennsylvania Tax-Exempt Money Market Fund

Fund Profile

As of May 31, 2016

| |

| Financial Attributes | |

| Ticker Symbol | VPTXX |

| Expense Ratio1 | 0.16% |

| 7-Day SEC Yield | 0.24% |

| Average Weighted | |

| Maturity | 15 days |

| |

| Distribution by Credit Quality (% of portfolio) |

| First Tier | 100.0% |

A First Tier security is one that is eligible for money market funds and has been rated in the highest short-term rating category for debt obligations by nationally recognized statistical rating organizations. Credit-quality ratings are obtained from Moody's, Fitch, and S&P. For securities rated by all three agencies, where two of them are in agreement and assign the highest rating category, the highest rating applies. If a security is only rated by two agencies, and their ratings are in different categories, the lower of the ratings applies. An unrated security is First Tier if it represents quality comparable to that of a rated security, as determined in accordance with SEC Rule 2a-7. For more information about these ratings, see the Glossary entry for Credit Quality.

1 The expense ratio shown is from the prospectus dated March 29, 2016, and represents estimated costs for the current fiscal year. For the six months ended May 31, 2016, the annualized expense ratio was 0.09%, reflecting a temporary reduction in operating expenses (described in Note B of the Notes to Financial Statements). Before this reduction, the annualized expense ratio was 0.16%.

12

Pennsylvania Tax-Exempt Money Market Fund

Performance Summary

Investment returns will fluctuate. All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) The returns shown do not reflect taxes that a shareholder would pay on fund distributions. An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money by investing in the fund. The fund’s 7-day SEC yield reflects its current earnings more closely than do the average annual returns.

| | | |

| Fiscal-Year Total Returns (%): November 30, 2005, Through May 31, 2016 | |

| | | Spliced PA |

| | | Tax-Exempt |

| | | Money Mkt |

| | | Funds Avg. |

| Fiscal Year | Total Returns | Total Returns |

| 2006 | 3.31% | 2.85% |

| 2007 | 3.64 | 3.14 |

| 2008 | 2.42 | 1.93 |

| 2009 | 0.50 | 0.22 |

| 2010 | 0.12 | 0.00 |

| 2011 | 0.06 | 0.00 |

| 2012 | 0.03 | 0.01 |

| 2013 | 0.01 | 0.00 |

| 2014 | 0.01 | 0.00 |

| 2015 | 0.01 | 0.01 |

| 2016 | 0.04 | 0.01 |

| 7-day SEC yield (5/31/2016): 0.24% | | |

| For a benchmark description, see the Glossary. | | |

| Spliced Pennsylvania Tax-Exempt Money Market Funds Average: Derived from data provided by Lipper, a Thomson Reuters Company. |

| Note: For 2016, performance data reflect the six months ended May 31, 2016. | |

Average Annual Total Returns: Periods Ended March 31, 2016

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | |

| | Inception | One | Five | Ten |

| | Date | Year | Years | Years |

| Pennsylvania Tax-Exempt Money | | | | |

| Market Fund | 6/13/1988 | 0.01% | 0.02% | 0.90% |

See Financial Highlights for dividend information.

13

Pennsylvania Tax-Exempt Money Market Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2016

The fund reports a complete list of its holdings in various monthly and quarterly regulatory filings. The fund publishes its holdings on a monthly basis at vanguard.com and files them with the Securities and Exchange Commission on Form N-MFP. The fund’s Form N-MFP filings become public 60 days after the relevant month-end, and may be viewed at sec.gov or via a link on the “Portfolio Holdings” page on vanguard.com. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the SEC on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (99.4%) | | | | |

| Pennsylvania (99.4%) | | | | |

| Allegheny County PA GO VRDO | 0.400% | 6/7/16 LOC | 3,500 | 3,500 |

| Allegheny County PA GO VRDO | 0.400% | 6/7/16 LOC | 3,455 | 3,455 |

| Allegheny County PA Higher Education Building | | | | |

| Authority University Revenue (Carnegie Mellon | | | | |

| University) VRDO | 0.360% | 6/1/16 | 84,520 | 84,520 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (Concordia Lutheran) VRDO | 0.380% | 6/7/16 LOC | 31,250 | 31,250 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (Jefferson Regional | | | | |

| Medical Center) VRDO | 0.410% | 6/7/16 LOC | 22,000 | 22,000 |

| 1 Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) TOB VRDO | 0.410% | 6/1/16 LOC | 12,000 | 12,000 |

| 1 Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) TOB VRDO | 0.410% | 6/7/16 LOC | 11,300 | 11,300 |

| Allegheny County PA Industrial Development | | | | |

| Authority Revenue (Western Pennsylvania | | | | |

| School for Blind Children) VRDO | 0.400% | 6/7/16 | 10,000 | 10,000 |

| Beaver County PA Industrial Development | | | | |

| Authority Pollution Control Revenue (FirstEnergy | | | | |

| Generation Project) VRDO | 0.380% | 6/1/16 LOC | 35,925 | 35,925 |

| Bucks County PA GO | 2.000% | 6/1/16 | 2,125 | 2,125 |

| Bucks County PA Industrial Development | | | | |

| Authority Hospital Revenue (Grand View | | | | |

| Hospital) VRDO | 0.370% | 6/7/16 LOC | 20,100 | 20,100 |

| Bucks County PA Industrial Development | | | | |

| Authority Hospital Revenue (Grand View | | | | |

| Hospital) VRDO | 0.400% | 6/7/16 LOC | 1,265 | 1,265 |

| Butler County PA General Authority Revenue | | | | |

| (Erie School District Project) VRDO | 0.410% | 6/7/16 LOC | 12,340 | 12,340 |

| Butler County PA General Authority Revenue | | | | |

| (North Allegheny School District Project) VRDO | 0.400% | 6/7/16 | 8,825 | 8,825 |

| Butler County PA Hospital Authority Revenue | | | | |

| (Concordia Lutheran Obligated Group) VRDO | 0.380% | 6/7/16 LOC | 1,600 | 1,600 |

14

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Central Bradford PA Progress Authority Revenue | | | | |

| (Robert Packer Hospital) TOB VRDO | 0.410% | 6/7/16 LOC | 27,965 | 27,965 |

| Chambersburg PA Authority Revenue (Wilson | | | | |

| College Project) VRDO | 0.430% | 6/7/16 LOC | 6,700 | 6,700 |

| 1 Chester County PA Industrial Development | | | | |

| Authority Water Facilities Revenue (Aqua | | | | |

| Pennsylvania Inc. Project) TOB VRDO | 0.430% | 6/7/16 (13) | 15,935 | 15,935 |

| Delaware County PA Authority Hospital Revenue | | | | |

| (Crozer-Chester Medical Center Obligated | | | | |

| Group) VRDO | 0.470% | 6/7/16 LOC | 2,115 | 2,115 |

| Delaware County PA Authority Revenue | | | | |

| (Haverford College) VRDO | 0.390% | 6/7/16 | 29,845 | 29,845 |

| Delaware County PA GO | 2.000% | 10/1/16 | 1,510 | 1,518 |

| Delaware County PA Industrial Development | | | | |

| Authority Airport Facilities Revenue (United | | | | |

| Parcel Service Inc.) VRDO | 0.370% | 6/1/16 | 40,800 | 40,800 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue (Scott Paper | | | | |

| Co.) VRDO | 0.430% | 6/7/16 | 8,500 | 8,500 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue (Scott Paper | | | | |

| Co.) VRDO | 0.430% | 6/7/16 | 12,000 | 12,000 |

| Delaware County PA Industrial Development | | | | |

| Authority Solid Waste Revenue (Scott Paper | | | | |

| Co.) VRDO | 0.430% | 6/7/16 | 13,490 | 13,490 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.370% | 6/7/16 LOC | 12,710 | 12,710 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.390% | 6/7/16 LOC | 3,100 | 3,100 |

| Delaware River Port Authority Pennsylvania & | | | | |

| New Jersey Revenue VRDO | 0.390% | 6/7/16 LOC | 24,425 | 24,425 |

| East Stroudsburg PA Area School District | 7.750% | 9/1/16 (Prere.) | 2,580 | 2,626 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 36,110 | 36,110 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 2,200 | 2,200 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 1,200 | 1,200 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 15,200 | 15,200 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 7,700 | 7,700 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 8,700 | 8,700 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 6,700 | 6,700 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 15,000 | 15,000 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 10,000 | 10,000 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 4,900 | 4,900 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 11,700 | 11,700 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 1,200 | 1,200 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 7,100 | 7,100 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 500 | 500 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 8,000 | 8,000 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 17,900 | 17,900 |

| Emmaus PA General Authority Revenue VRDO | 0.400% | 6/7/16 LOC | 6,000 | 6,000 |

| 1 Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) TOB VRDO | 0.430% | 6/7/16 | 5,000 | 5,000 |

| 1 Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) TOB VRDO | 0.430% | 6/7/16 | 5,230 | 5,230 |

15

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) TOB VRDO | 0.430% | 6/7/16 | 2,785 | 2,785 |

| Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) VRDO | 0.330% | 6/1/16 | 47,600 | 47,600 |

| Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) VRDO | 0.330% | 6/1/16 | 1,000 | 1,000 |

| Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) VRDO | 0.330% | 6/1/16 | 1,900 | 1,900 |

| Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) VRDO | 0.330% | 6/1/16 | 23,300 | 23,300 |

| Geisinger Authority Health System Pennsylvania | | | | |

| Revenue (Geisinger Health System) VRDO | 0.330% | 6/1/16 | 1,000 | 1,000 |

| Haverford Township PA School District GO VRDO | 0.410% | 6/7/16 LOC | 5,000 | 5,000 |

| Lancaster County PA Hospital Authority Health | | | | |

| Center Revenue (Masonic Homes Project) | | | | |

| VRDO | 0.350% | 6/1/16 LOC | 17,570 | 17,570 |

| 1 Lancaster County PA Hospital Authority Health | | | | |

| System Revenue (Lancaster General Hospital | | | | |

| Project) TOB VRDO | 0.430% | 6/7/16 | 3,410 | 3,410 |

| 1 Lancaster County PA Hospital Authority Revenue | | | | |

| (University of Pennsylvania Health System) | | | | |

| TOB VRDO | 0.430% | 6/7/16 | 3,750 | 3,750 |

| Lower Merion PA School District GO VRDO | 0.390% | 6/7/16 LOC | 24,915 | 24,915 |

| Lower Merion PA School District GO VRDO | 0.390% | 6/7/16 LOC | 11,000 | 11,000 |

| Montgomery County PA GO VRDO | 0.360% | 6/1/16 | 11,660 | 11,660 |

| Montgomery County PA Industrial Development | | | | |

| Authority Revenue (Friends’ Central School | | | | |

| Project) VRDO | 0.370% | 6/7/16 LOC | 2,515 | 2,515 |

| Montgomery County PA Redevelopment | | | | |

| Authority Revenue (Forge Gate Apartments | | | | |

| Project) VRDO | 0.420% | 6/7/16 | 4,990 | 4,990 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lafayette | | | | |

| College) VRDO | 0.400% | 6/7/16 | 22,290 | 22,290 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lafayette | | | | |

| College) VRDO | 0.410% | 6/7/16 | 11,000 | 11,000 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lafayette | | | | |

| College) VRDO | 0.410% | 6/7/16 | 9,990 | 9,990 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lehigh | | | | |

| University) VRDO | 0.380% | 6/7/16 | 15,515 | 15,515 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lehigh | | | | |

| University) VRDO | 0.380% | 6/7/16 | 9,895 | 9,895 |

| Northampton County PA General Purpose | | | | |

| Authority University Revenue (Lehigh | | | | |

| University) VRDO | 0.380% | 6/7/16 | 10,445 | 10,445 |

| Northeastern Pennsylvania Hospital & | | | | |

| Educational Authority Revenue (Commonwealth | | | | |

| Medical College Project) VRDO | 0.400% | 6/7/16 LOC | 4,835 | 4,835 |

| Nuveen Pennsylvania Investment Quality | | | | |

| Municipal Fund VRDP VRDO | 0.520% | 6/7/16 LOC | 50,500 | 50,500 |

16

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| 1 Nuveen Pennsylvania Investment Quality | | | | |

| Municipal Fund VRDP VRDO | 0.520% | 6/7/16 LOC | 39,000 | 39,000 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Exempt Facilities Revenue (York | | | | |

| Water Co. Project) VRDO | 0.450% | 6/7/16 LOC | 12,000 | 12,000 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Unemployment Compensation | | | | |

| Revenue | 4.000% | 7/1/16 | 2,160 | 2,167 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Unemployment Compensation | | | | |

| Revenue | 5.000% | 7/1/16 | 24,315 | 24,410 |

| Pennsylvania Economic Development Financing | | | | |

| Authority Unemployment Compensation | | | | |

| Revenue | 4.000% | 1/1/17 | 5,500 | 5,615 |

| 1 Pennsylvania Economic Development Financing | | | | |

| Authority Water Facilities Revenue (Aqua | | | | |

| Pennsylvania Inc. Project) TOB VRDO | 0.420% | 6/7/16 (13) | 9,900 | 9,900 |

| Pennsylvania GO | 5.000% | 6/15/16 | 17,375 | 17,406 |

| Pennsylvania GO | 5.000% | 7/1/16 | 4,040 | 4,056 |

| Pennsylvania GO | 5.000% | 3/1/17 | 16,540 | 17,076 |

| Pennsylvania GO | 5.000% | 3/15/17 | 1,330 | 1,375 |

| 1 Pennsylvania GO TOB VRDO | 0.400% | 6/7/16 | 10,400 | 10,400 |

| 1 Pennsylvania GO TOB VRDO | 0.430% | 6/7/16 | 19,325 | 19,325 |

| 1 Pennsylvania GO TOB VRDO | 0.440% | 6/7/16 | 5,000 | 5,000 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Drexel University) VRDO | 0.350% | 6/1/16 LOC | 3,550 | 3,550 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Drexel University) VRDO | 0.370% | 6/7/16 LOC | 24,570 | 24,570 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Drexel University) VRDO | 0.400% | 6/7/16 LOC | 8,245 | 8,245 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Gwynedd Mercy | | | | |

| College) VRDO | 0.370% | 6/7/16 LOC | 15,750 | 15,750 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Higher Education System) | 5.000% | 6/15/16 | 8,085 | 8,099 |

| 1 Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Presbyterian Medical | | | | |

| Center) TOB VRDO | 0.430% | 6/7/16 | 7,200 | 7,200 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (Susquehanna University) | | | | |

| VRDO | 0.420% | 6/7/16 LOC | 4,100 | 4,100 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (University of Pennsylvania | | | | |

| Health System) | 3.000% | 8/15/16 | 4,725 | 4,751 |

| Pennsylvania Higher Educational Facilities | | | | |

| Authority Revenue (University of Pennsylvania | | | | |

| Health System) VRDO | 0.380% | 6/7/16 | 68,495 | 68,495 |

| 1 Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue TOB VRDO | 0.450% | 6/7/16 | 2,300 | 2,300 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.430% | 6/7/16 | 5,000 | 5,000 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.440% | 6/7/16 | 11,450 | 11,450 |

17

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.440% | 6/7/16 | 27,270 | 27,270 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.440% | 6/7/16 | 21,515 | 21,515 |

| Pennsylvania Housing Finance Agency Single | | | | |

| Family Mortgage Revenue VRDO | 0.440% | 6/7/16 | 15,750 | 15,750 |

| 1 Pennsylvania Intergovernmental Cooperation | | | | |

| Authority Special Tax Revenue (Philadelphia | | | | |

| Funding Program) TOB VRDO | 0.430% | 6/7/16 | 5,055 | 5,055 |

| Pennsylvania State University Revenue PUT | 0.290% | 6/1/16 | 29,500 | 29,500 |

| 1 Pennsylvania State University Revenue | | | | |

| TOB VRDO | 0.430% | 6/7/16 | 6,100 | 6,100 |

| 1 Pennsylvania Turnpike Commission Oil Franchise | | | | |

| Tax Revenue TOB VRDO | 0.430% | 6/7/16 | 10,500 | 10,500 |

| Pennsylvania Turnpike Commission Revenue | 5.000% | 6/1/16 (Prere.) | 7,695 | 7,695 |

| Pennsylvania Turnpike Commission Revenue | 5.000% | 6/1/16 (Prere.) | 1,900 | 1,900 |

| Pennsylvania Turnpike Commission Revenue | 5.250% | 7/15/16 | 1,625 | 1,634 |

| Philadelphia Airport CP | 0.600% | 8/10/16 LOC | 3,000 | 3,000 |

| Philadelphia Authority for Industrial Development | | | | |

| Revenue (Gift of Life Donor Program) VRDO | 0.370% | 6/7/16 LOC | 10,325 | 10,325 |

| Philadelphia PA Airport Revenue VRDO | 0.410% | 6/7/16 LOC | 19,190 | 19,190 |

| Philadelphia PA Airport Revenue VRDO | 0.420% | 6/7/16 LOC | 16,500 | 16,500 |

| 1 Philadelphia PA Authority for Industrial | | | | |

| Development Revenue (Children’s Hospital of | | | | |

| Philadelphia Project) TOB VRDO | 0.430% | 6/7/16 | 3,750 | 3,750 |

| 1 Philadelphia PA Authority for Industrial | | | | |

| Development Revenue (Children’s Hospital of | | | | |

| Philadelphia Project) TOB VRDO | 0.430% | 6/7/16 | 7,500 | 7,500 |

| Philadelphia PA Authority for Industrial | | | | |

| Development Revenue (Inglis House Project) | | | | |

| VRDO | 0.400% | 6/7/16 | 21,000 | 21,000 |

| Philadelphia PA Authority for Industrial | | | | |

| Development Revenue (New Courtland Elder | | | | |

| Services Project) VRDO | 0.410% | 6/7/16 LOC | 7,090 | 7,090 |

| Philadelphia PA Authority for Industrial | | | | |

| Development Revenue (Temple University) | 5.000% | 4/1/17 | 5,910 | 6,118 |

| Philadelphia PA Gas Works Revenue VRDO | 0.370% | 6/7/16 LOC | 10,530 | 10,530 |

| Philadelphia PA Gas Works Revenue VRDO | 0.400% | 6/7/16 LOC | 6,350 | 6,350 |

| Philadelphia PA Gas Works Revenue VRDO | 0.400% | 6/7/16 LOC | 25,600 | 25,600 |

| Philadelphia PA GO | 7.125% | 7/15/16 (Prere.) | 10,405 | 10,490 |

| 1 Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) TOB VRDO | 0.430% | 6/7/16 | 4,765 | 4,765 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.350% | 6/1/16 | 43,900 | 43,900 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.350% | 6/1/16 | 3,000 | 3,000 |

| Philadelphia PA Hospitals & Higher Education | | | | |

| Facilities Authority Hospital Revenue (Children’s | | | | |

| Hospital of Philadelphia Project) VRDO | 0.350% | 6/1/16 | 3,500 | 3,500 |

| Philadelphia PA Industrial Development Authority | | | | |

| Lease Revenue VRDO | 0.370% | 6/7/16 LOC | 7,050 | 7,050 |

18

| | | | |

| Pennsylvania Tax-Exempt Money Market Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Philadelphia PA TRAN | 2.000% | 6/30/16 | 25,000 | 25,034 |

| Philadelphia PA Water & Waste Water Revenue | | | | |

| VRDO | 0.390% | 6/7/16 LOC | 41,990 | 41,990 |

| Pittsburgh PA GO | 5.250% | 9/1/16 (Prere.) | 1,405 | 1,422 |

| Pittsburgh PA Water & Sewer Authority Revenue | | | | |

| VRDO | 0.390% | 6/7/16 LOC | 50,750 | 50,750 |

| Pittsburgh PA Water & Sewer Authority Revenue | | | | |

| VRDO | 0.400% | 6/7/16 LOC | 6,100 | 6,100 |

| Ridley PA School District GO VRDO | 0.410% | 6/7/16 LOC | 8,505 | 8,505 |

| 1 Southcentral Pennsylvania General Authority | | | | |

| Revenue (WellSpan Health Obligated Group) | | | | |

| TOB VRDO | 0.440% | 6/7/16 | 6,670 | 6,670 |

| 1 Southcentral Pennsylvania General Authority | | | | |

| Revenue (WellSpan Health Obligated Group) | | | | |

| TOB VRDO | 0.440% | 6/7/16 | 3,000 | 3,000 |

| 1 Southcentral Pennsylvania General Authority | | | | |

| Revenue (WellSpan Health Obligated Group) | | | | |

| TOB VRDO | 0.440% | 6/7/16 | 10,000 | 10,000 |

| St. Mary Hospital Authority Pennsylvania Health | | | | |

| System Revenue (Catholic Health Initiatives) | | | | |

| VRDO | 0.360% | 6/7/16 | 17,050 | 17,050 |

| State Public School Building Authority | | | | |

| Pennsylvania School Revenue (North Allegheny | | | | |

| School District Project) VRDO | 0.400% | 6/7/16 | 18,110 | 18,110 |

| Union County PA Higher Educational Facilities | | | | |

| Financing Authority University Revenue | | | | |

| (Bucknell University) VRDO | 0.420% | 6/7/16 | 2,985 | 2,985 |

| University of Pittsburgh of the Commonwealth | | | | |

| System of Higher Education Pennsylvania | | | | |

| (University Capital Project) RAN | 2.000% | 8/2/16 | 35,000 | 35,100 |

| University of Pittsburgh PA Revenue CP | 0.110% | 6/1/16 | 7,500 | 7,500 |

| University of Pittsburgh PA Revenue CP | 0.110% | 6/1/16 | 7,500 | 7,500 |

| University of Pittsburgh PA Revenue CP | 0.130% | 6/1/16 | 19,000 | 19,000 |

| University of Pittsburgh PA Revenue CP | 0.590% | 7/5/16 | 20,000 | 20,000 |

| University of Pittsburgh PA Revenue CP | 0.600% | 7/6/16 | 20,000 | 20,000 |

| University of Pittsburgh PA Revenue CP | 0.500% | 8/1/16 | 10,000 | 10,000 |

| University of Pittsburgh PA Revenue CP | 0.500% | 8/1/16 | 20,000 | 20,000 |

| University of Pittsburgh PA Revenue CP | 0.500% | 8/2/16 | 13,821 | 13,821 |

| University of Pittsburgh PA Revenue CP | 0.500% | 8/16/16 | 3,750 | 3,750 |

| University of Pittsburgh PA Revenue CP | 0.500% | 8/16/16 | 5,000 | 5,000 |

| York County PA GO | 4.000% | 12/1/16 | 1,750 | 1,780 |

| York County PA Industrial Development | | | | |

| Authority Revenue (Crescent Industries Inc. | | | | |

| Project) VRDO | 0.470% | 6/7/16 LOC | 1,110 | 1,110 |

| Total Tax-Exempt Municipal Bonds (Cost $1,953,133) | | | 1,953,133 |

19

| |

| Pennsylvania Tax-Exempt Money Market Fund | |

| |

| |

| |

| |

| | Amount |

| | ($000) |

| Other Assets and Liabilities (0.6%) | |

| Other Assets | |

| Investment in Vanguard | 164 |

| Receivables for Investment Securities Sold | 4,745 |

| Receivables for Accrued Income | 3,747 |

| Receivables for Capital Shares Issued | 5,430 |

| Other Assets | 6,257 |

| Total Other Assets | 20,343 |

| Liabilities | |

| Payables for Capital Shares Redeemed | (4,390) |

| Payables for Distributions | (9) |

| Payables to Vanguard | (3,737) |

| Total Liabilities | (8,136) |

| Net Assets (100%) | |

| Applicable to 1,965,230,549 outstanding $.001 par value shares of | |

| beneficial interest (unlimited authorization) | 1,965,340 |

| Net Asset Value Per Share | $1.00 |

| |

| |

| At May 31, 2016, net assets consisted of: | |

| | Amount |

| | ($000) |

| Paid-in Capital | 1,965,325 |

| Undistributed Net Investment Income | — |

| Accumulated Net Realized Gains | 15 |

| Net Assets | 1,965,340 |

• See Note A in Notes to Financial Statements.

1 Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified institutional buyers. At May 31, 2016, the aggregate value of these securities was $237,840,000, representing 12.1% of net assets.

A key to abbreviations and other references follows the Statement of Net Assets.

See accompanying Notes, which are an integral part of the Financial Statements.

20

Pennsylvania Tax-Exempt Money Market Fund

Key to Abbreviations

ARS—Auction Rate Security.

BAN—Bond Anticipation Note.

COP—Certificate of Participation.

CP—Commercial Paper.

FR—Floating Rate.

GAN—Grant Anticipation Note.

GO—General Obligation Bond.

PILOT—Payments in Lieu of Taxes.

PUT—Put Option Obligation.

RAN—Revenue Anticipation Note.

TAN—Tax Anticipation Note.

TOB—Tender Option Bond.

TRAN—Tax Revenue Anticipation Note.

VRDO—Variable Rate Demand Obligation.

VRDP—Variable Rate Demand Preferred.

(ETM)—Escrowed to Maturity.

(Prere.)—Prerefunded.

Scheduled principal and interest payments are guaranteed by:

(1) MBIA (Municipal Bond Investors Assurance).

(2) AMBAC (Ambac Assurance Corporation).

(3) FGIC (Financial Guaranty Insurance Company).

(4) AGM (Assured Guaranty Municipal Corporation).

(5) BIGI (Bond Investors Guaranty Insurance).

(6) Connie Lee Inc.

(7) FHA (Federal Housing Authority).

(8) CapMAC (Capital Markets Assurance Corporation).

(9) American Capital Access Financial Guaranty Corporation.

(10) XL Capital Assurance Inc.

(11) CIFG (CDC IXIS Financial Guaranty).

(12) AGC (Assured Guaranty Corporation).

(13) BHAC (Berkshire Hathaway Assurance Corporation).

(14) NPFG (National Public Finance Guarantee Corporation).

(15) BAM (Build America Mutual Assurance Company).

(16) MAC (Municipal Assurance Corporation).

(17) RAA (Radian Asset Assurance Inc.).

The insurance does not guarantee the market value of the municipal bonds.

LOC—Scheduled principal and interest payments are guaranteed by bank letter of credit.

21

Pennsylvania Tax-Exempt Money Market Fund

Statement of Operations

| |

| | Six Months Ended |

| | May 31, 2016 |

| | ($000) |

| Investment Income | |

| Income | |

| Interest | 1,818 |

| Total Income | 1,818 |

| Expenses | |

| The Vanguard Group—Note B | |

| Investment Advisory Services | 220 |

| Management and Administrative | 1,100 |

| Marketing and Distribution | 286 |

| Custodian Fees | 12 |

| Shareholders’ Reports | 4 |

| Trustees’ Fees and Expenses | 1 |

| Total Expenses | 1,623 |

| Expense Reduction—Note B | (662) |

| Net Expenses | 961 |

| Net Investment Income | 857 |

| Realized Net Gain (Loss) on Investment Securities Sold | 15 |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 872 |

See accompanying Notes, which are an integral part of the Financial Statements.

22

Pennsylvania Tax-Exempt Money Market Fund

Statement of Changes in Net Assets

| | |

| | Six Months Ended | Year Ended |

| | May 31, | November 30, |

| | 2016 | 2015 |

| | ($000) | ($000) |

| Increase (Decrease) in Net Assets | | |

| Operations | | |

| Net Investment Income | 857 | 216 |

| Realized Net Gain (Loss) | 15 | (13) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | 872 | 203 |

| Distributions | | |

| Net Investment Income | (857) | (216) |

| Realized Capital Gain | — | — |

| Total Distributions | (857) | (216) |

| Capital Share Transactions (at $1.00 per share) | | |

| Issued | 665,922 | 1,368,356 |

| Issued in Lieu of Cash Distributions | 822 | 210 |

| Redeemed | (760,715) | (1,534,235) |

| Net Increase (Decrease) from Capital Share Transactions | (93,971) | (165,669) |

| Total Increase (Decrease) | (93,956) | (165,682) |

| Net Assets | | |

| Beginning of Period | 2,059,296 | 2,224,978 |

| End of Period1 | 1,965,340 | 2,059,296 |

| 1 Net Assets—End of Period includes undistributed (overdistributed) net investment income of $0 and $0. | |

See accompanying Notes, which are an integral part of the Financial Statements.

23

Pennsylvania Tax-Exempt Money Market Fund

Financial Highlights

| | | | | | |

| Six Months | | | | | |

| | Ended | | | | | |

| For a Share Outstanding | May 31, | | | Year Ended November 30, |

| Throughout Each Period | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 |

| Net Asset Value, Beginning of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Investment Operations | | | | | | |

| Net Investment Income | .0004 | .0001 | .0001 | .0001 | .0003 | .001 |

| Net Realized and Unrealized Gain (Loss) | | | | | | |

| on Investments | — | — | — | — | — | — |

| Total from Investment Operations | .0004 | .0001 | .0001 | .0001 | .0003 | .001 |

| Distributions | | | | | | |

| Dividends from Net Investment Income | (.0004) | (.0001) | (.0001) | (.0001) | (.0003) | (.001) |

| Distributions from Realized Capital Gains | — | — | — | — | — | — |

| Total Distributions | (.0004) | (.0001) | (.0001) | (.0001) | (.0003) | (.001) |

| Net Asset Value, End of Period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| |

| Total Return1 | 0.04% | 0.01% | 0.01% | 0.01% | 0.03% | 0.06% |

| |

| Ratios/Supplemental Data | | | | | | |

| Net Assets, End of Period (Millions) | $1,965 | $2,059 | $2,225 | $2,455 | $2,474 | $2,649 |

| Ratio of Expenses to | | | | | | |

| Average Net Assets | 0.09%2 | 0.05%2 | 0.06%2 | 0.10%2 | 0.15%2 | 0.16%2 |

| Ratio of Net Investment Income to | | | | | | |

| Average Net Assets | 0.08% | 0.01% | 0.01% | 0.01% | 0.03% | 0.06% |

| The expense ratio and net investment income ratio for the current period have been annualized. | | | |

1 Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

2 The ratio of total expenses to average net assets before an expense reduction was 0.16% for 2016, 0.16% for 2015, 0.16% for 2014, 0.16% for 2013, 0.16% for 2012, and 0.17% for 2011. See Note B in Notes to Financial Statements. |

|

|

|

See accompanying Notes, which are an integral part of the Financial Statements.

24

Pennsylvania Tax-Exempt Money Market Fund

Notes to Financial Statements

Vanguard Pennsylvania Tax-Exempt Money Market Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in debt instruments of municipal issuers whose ability to meet their obligations may be affected by economic and political developments in the state.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its financial statements.

1. Security Valuation: Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Securities are valued at amortized cost, which approximates market value.

2. Federal Income Taxes: The fund intends to continue to qualify as a regulated investment company and distribute all of its income. Management has analyzed the fund’s tax positions taken for all open federal income tax years (November 30, 2012–2015), and for the period ended May 31, 2016, and has concluded that no provision for federal income tax is required in the fund’s financial statements.

3. Distributions: Distributions from net investment income are declared daily and paid on the first business day of the following month.

4. Credit Facility: The fund and certain other funds managed by The Vanguard Group (“Vanguard”) participate in a $3.1 billion committed credit facility provided by a syndicate of lenders pursuant to a credit agreement that may be renewed annually; each fund is individually liable for its borrowings, if any, under the credit facility. Borrowings may be utilized for temporary and emergency purposes, and are subject to the fund’s regulatory and contractual borrowing restrictions. The participating funds are charged administrative fees and an annual commitment fee of 0.10% of the undrawn amount of the facility; these fees are allocated to the funds based on a method approved by the fund’s board of trustees and included in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under this facility bear interest at a rate based upon the higher of the one-month London Interbank Offered Rate, federal funds effective rate, or overnight bank funding rate plus an agreed-upon spread.

The fund had no borrowings outstanding at May 31, 2016, or at any time during the period then ended.

5. Other: Interest income is accrued daily. Premiums and discounts on debt securities purchased are amortized and accreted, respectively, to interest income over the lives of the respective securities. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment securities are those of the specific securities sold.

B. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund investment advisory, corporate management, administrative, marketing, and distribution services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the board of trustees. Vanguard does not require reimbursement in the current period for certain costs of operations (such as deferred compensation/benefits and risk/insurance costs); the fund’s liability for these costs of operations is included in Payables to Vanguard on the Statement of Net Assets.

Upon the request of Vanguard, the fund may invest up to 0.40% of its net assets as capital in Vanguard. At May 31, 2016, the fund had contributed to Vanguard capital in the amount of $164,000, representing 0.01% of the fund’s net assets and 0.07% of Vanguard’s capitalization. The fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

25

Pennsylvania Tax-Exempt Money Market Fund

Vanguard and the board of trustees have agreed to temporarily limit certain net operating expenses in excess of the fund’s daily yield in order to maintain a zero or positive yield for the fund. Vanguard and the board of trustees may terminate the temporary expense limitation at any time. For the period ended May 31, 2016, Vanguard’s expenses were reduced by $662,000 (an effective annual rate of 0.03% of the fund’s average net assets); the fund is not obligated to repay this amount to Vanguard.

C. Various inputs may be used to determine the value of the fund’s investments. These inputs are summarized in three broad levels for financial statement purposes. The inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments).

At May 31, 2016, 100% of the market value of the fund’s investments was determined based on Level 2 inputs.

D. Management has determined that no material events or transactions occurred subsequent to May 31, 2016, that would require recognition or disclosure in these financial statements.

26

Pennsylvania Long-Term Tax-Exempt Fund

Fund Profile

As of May 31, 2016

| | | |

| Share-Class Characteristics | |

| | Investor | Admiral |

| | Shares | Shares |

| Ticker Symbol | VPAIX | VPALX |

| Expense Ratio1 | 0.20% | 0.12% |

| 30-Day SEC Yield | 1.88% | 1.95% |

| | | | |

| Financial Attributes | | |

| |

| |

| | | Barclays | |

| | | PA | Barclays |

| | | Muni | Municipal |

| | | Bond | Bond |

| | Fund | Index | Index |

| |

| Number of Bonds | 696 | 1,588 | 48,863 |

| |

| Yield to Maturity | | | |

| (before expenses) | 2.1% | 2.0% | 1.8% |

| |

| Average Coupon | 4.7% | 4.8% | 4.8% |

| |

| Average Duration | 5.7 years | 5.8 years | 5.8 years |

| |

| Average Stated | | | |

| Maturity | 15.6 years | 13.3 years | 13.0 years |

| |

| Short-Term | | | |

| Reserves | 5.1% | — | — |

| | | |

| Volatility Measures | | |

| | Barclays PA | Barclays |

| | Muni Bond | Municipal |

| | Index | Bond Index |

| R-Squared | 0.99 | 0.98 |

| Beta | 1.17 | 1.12 |

| These measures show the degree and timing of the fund’s fluctuations compared with the indexes over 36 months. |

|

| | |

| Distribution by Stated Maturity | |

| (% of portfolio) | |

| Under 1 Year | 6.3% |

| 1 - 3 Years | 6.6 |

| 3 - 5 Years | 3.1 |

| 5 - 10 Years | 8.7 |

| 10 - 20 Years | 41.6 |

| 20 - 30 Years | 32.8 |

| Over 30 Years | 0.9 |

| | |

| Distribution by Credit Quality (% of portfolio) |

| AAA | 0.8% |

| AA | 48.1 |

| A | 38.7 |

| BBB | 8.4 |

| BB | 1.6 |

| Not Rated | 2.4 |

Credit-quality ratings are obtained from Moody's and S&P, and the higher rating for each issue is shown. "Not Rated" is used to classify securities for which a rating is not available. Not rated securities include a fund's investment in Vanguard Market Liquidity Fund or Vanguard Municipal Cash Management Fund, each of which invests in high-quality money market instruments and may serve as a cash management vehicle for the Vanguard funds, trusts, and accounts. For more information about these ratings, see the Glossary entry for Credit Quality.

1 The expense ratios shown are from the prospectus dated March 29, 2016, and represent estimated costs for the current fiscal year. For the six months ended May 31, 2016, the annualized expense ratios were 0.20% for Investor Shares and 0.12% for Admiral Shares.

27

Pennsylvania Long-Term Tax-Exempt Fund

Investment Focus

28

Pennsylvania Long-Term Tax-Exempt Fund

Performance Summary

All of the returns in this report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Fiscal-Year Total Returns (%): November 30, 2005, Through May 31, 2016

| | | | |

| | | | | Barclays PA |

| | | | | Muni Bond |

| | | | Investor Shares | Index |

| Fiscal Year | Income Returns | Capital Returns | Total Returns | Total Returns |

| 2006 | 4.72% | 1.58% | 6.30% | 5.77% |

| 2007 | 4.50 | -2.20 | 2.30 | 3.40 |

| 2008 | 4.19 | -8.67 | -4.48 | -1.82 |

| 2009 | 4.67 | 7.65 | 12.32 | 13.08 |

| 2010 | 4.10 | 0.18 | 4.28 | 4.31 |

| 2011 | 4.16 | 1.91 | 6.07 | 6.47 |

| 2012 | 3.91 | 6.52 | 10.43 | 10.26 |

| 2013 | 3.50 | -7.46 | -3.96 | -2.90 |

| 2014 | 4.01 | 5.89 | 9.90 | 8.32 |

| 2015 | 3.67 | 0.03 | 3.70 | 3.35 |

| 2016 | 1.80 | 2.22 | 4.02 | 3.54 |

| Note: For 2016, performance data reflect the six months ended May 31, 2016. | | |

Average Annual Total Returns: Periods Ended March 31, 2016

This table presents returns through the latest calendar quarter—rather than through the end of the fiscal period.

Securities and Exchange Commission rules require that we provide this information.

| | | | | | |

| | | | | | | Ten Years |

| | Inception Date | One Year | Five Years | Income | Capital | Total |

| Investor Shares | 4/7/1986 | 4.45% | 5.98% | 4.12% | 0.60% | 4.72% |

| Admiral Shares | 5/14/2001 | 4.53 | 6.07 | 4.20 | 0.60 | 4.80 |

See Financial Highlights for dividend and capital gains information.

29

Pennsylvania Long-Term Tax-Exempt Fund

Financial Statements (unaudited)

Statement of Net Assets

As of May 31, 2016

The fund reports a complete list of its holdings in regulatory filings four times in each fiscal year, at the quarter-ends. For the second and fourth fiscal quarters, the lists appear in the fund’s semiannual and annual reports to shareholders. For the first and third fiscal quarters, the fund files the lists with the Securities and Exchange Commission on Form N-Q. Shareholders can look up the fund’s Forms N-Q on the SEC’s website at sec.gov. Forms N-Q may also be reviewed and copied at the SEC’s Public Reference Room (see the back cover of this report for further information).

| | | | |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Tax-Exempt Municipal Bonds (99.5%) | | | | |

| Pennsylvania (99.2%) | | | | |

| Allegheny County PA GO | 5.000% | 11/1/27 | 2,575 | 2,987 |

| Allegheny County PA GO | 5.000% | 11/1/29 | 4,000 | 4,480 |

| Allegheny County PA GO | 5.000% | 12/1/30 | 1,365 | 1,629 |

| Allegheny County PA GO | 5.250% | 12/1/32 | 1,000 | 1,214 |

| Allegheny County PA GO | 5.250% | 12/1/33 | 1,000 | 1,211 |

| Allegheny County PA GO | 5.000% | 12/1/34 | 3,600 | 4,234 |

| Allegheny County PA GO | 5.000% | 12/1/34 | 1,695 | 2,001 |

| Allegheny County PA GO | 5.000% | 12/1/37 | 10,000 | 11,760 |

| Allegheny County PA GO | 5.000% | 12/1/37 (4) | 10,000 | 11,787 |

| Allegheny County PA GO VRDO | 0.400% | 6/7/16 LOC | 14,000 | 14,000 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Carnegie Mellon University) VRDO | 0.360% | 6/1/16 | 8,800 | 8,800 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Chatham University) | 5.000% | 9/1/30 | 2,545 | 2,887 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.250% | 3/1/21 (Prere.) | 4,005 | 4,744 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/21 (Prere.) | 1,700 | 2,033 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/21 (Prere.) | 1,940 | 2,320 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.500% | 3/1/21 (Prere.) | 770 | 921 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.000% | 3/1/28 | 1,950 | 2,400 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.000% | 3/1/29 | 1,500 | 1,839 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 4.000% | 3/1/30 | 2,375 | 2,646 |

30

| | | | |

| Pennsylvania Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.000% | 3/1/30 | 1,180 | 1,405 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 4.000% | 3/1/31 | 1,550 | 1,716 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 4.000% | 3/1/33 | 2,045 | 2,249 |

| Allegheny County PA Higher Education | | | | |

| Building Authority University Revenue | | | | |

| (Duquesne University) | 5.000% | 3/1/33 | 1,375 | 1,569 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) | 5.375% | 8/15/29 | 4,020 | 4,526 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) | 1.247% | 2/1/37 | 3,000 | 2,763 |

| Allegheny County PA Hospital Development | | | | |

| Authority Revenue (University of Pittsburgh | | | | |

| Medical Center) | 5.625% | 8/15/39 | 10,835 | 12,218 |

| Allegheny County PA Port Authority Revenue | 5.750% | 3/1/29 | 7,500 | 8,924 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.500% | 12/1/16 (ETM) | 11,295 | 11,535 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 6/1/26 (4) | 4,925 | 5,708 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/27 (15) | 5,300 | 6,578 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 6/1/30 (4) | 3,500 | 4,028 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/30 (15) | 3,400 | 4,160 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/32 (14) | 12,000 | 12,473 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/35 | 6,000 | 7,127 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/40 | 4,250 | 4,979 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.250% | 12/1/41 (15) | 3,500 | 4,128 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.250% | 12/1/44 (15) | 6,210 | 7,306 |

| Allegheny County PA Sanitary Authority | | | | |

| Sewer Revenue | 5.000% | 12/1/45 | 4,620 | 5,358 |

| Allentown PA Neighborhood Improvement | | | | |

| Zone Development Authority Tax Revenue | 5.000% | 5/1/26 | 400 | 449 |

| Allentown PA Neighborhood Improvement | | | | |

| Zone Development Authority Tax Revenue | 5.000% | 5/1/29 | 250 | 277 |

| Allentown PA Neighborhood Improvement | | | | |

| Zone Development Authority Tax Revenue | 5.000% | 5/1/35 | 11,530 | 12,511 |

| Allentown PA Neighborhood Improvement | | | | |

| Zone Development Authority Tax Revenue | 5.000% | 5/1/42 | 11,120 | 11,979 |

| Beaver County PA Hospital Authority Revenue | | | | |

| (Heritage Valley Health System Inc.) | 5.000% | 5/15/20 | 2,205 | 2,514 |

31

| | | | |

| Pennsylvania Long-Term Tax-Exempt Fund | | | | |

| |

| |

| |

| | | | Face | Market |

| | | Maturity | Amount | Value• |

| | Coupon | Date | ($000) | ($000) |

| Beaver County PA Hospital Authority Revenue | | | | |

| (Heritage Valley Health System Inc.) | 5.000% | 5/15/22 | 1,240 | 1,451 |

| Beaver County PA Hospital Authority Revenue | | | | |

| (Heritage Valley Health System Inc.) | 5.000% | 5/15/25 | 1,620 | 1,867 |

| Beaver County PA Hospital Authority Revenue | | | | |

| (Heritage Valley Health System Inc.) | 5.000% | 5/15/28 | 2,000 | 2,275 |

| Bensalem Township PA School District GO | 5.250% | 6/15/17 (Prere.) | 3,700 | 3,875 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | 5.500% | 11/1/31 | 3,500 | 3,979 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | 5.750% | 11/1/39 | 4,615 | 5,261 |

| Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | 5.000% | 11/1/40 | 6,935 | 7,761 |

| 1 Berks County PA Municipal Authority Revenue | | | | |

| (Reading Hospital & Medical Center Project) | | | | |

| TOB VRDO | 0.440% | 6/7/16 | 9,750 | 9,750 |

| 2 Bethel Park PA School District GO | 5.000% | 8/1/26 | 650 | 824 |

| 2 Bethel Park PA School District GO | 5.000% | 8/1/27 | 1,300 | 1,631 |

| 2 Bethel Park PA School District GO | 5.000% | 8/1/28 | 2,745 | 3,416 |

| 2 Bethel Park PA School District GO | 5.000% | 8/1/29 | 2,500 | 3,096 |

| 2 Bethel Park PA School District GO | 4.000% | 8/1/31 | 2,500 | 2,807 |

| Blair County PA Hospital Authority Hospital | | | | |

| Revenue (Altoona Hospital Project) | 5.500% | 7/1/16 (2) | 1,760 | 1,764 |

| Bristol Township PA School District GO | 5.250% | 6/1/37 | 5,000 | 5,826 |

| Bucks County PA Water & Sewer Authority | | | | |

| Water System Revenue | 5.000% | 12/1/29 (4) | 2,000 | 2,325 |

| Bucks County PA Water & Sewer Authority | | | | |

| Water System Revenue | 5.000% | 12/1/33 (4) | 2,000 | 2,286 |

| Bucks County PA Water & Sewer Authority | | | | |

| Water System Revenue | 5.000% | 12/1/37 (4) | 3,500 | 4,000 |