- PEG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Public Service Enterprise (PEG) 8-KRegulation FD Disclosure

Filed: 29 May 08, 12:00am

Exhibit 99

Public Service Enterprise Group

Deutsche Bank

May 29, 2008

2008 Energy and Utilities Conference

Miami Beach, FL

Forward-Looking Statement

Readers are cautioned that statements contained in this presentation about our and our subsidiaries' future performance, including

future revenues, earnings, strategies, prospects and all other statements that are not purely historical, are forward-looking statements

for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Although we believe that our

expectations are based on reasonable assumptions, we can give no assurance they will be achieved. The results or events predicted in

these statements may differ materially from actual results or events. Factors which could cause results or events to differ from current

expectations include, but are not limited to:

•

Adverse changes in energy industry, policies and regulation, including market rules that may adversely affect our operating results.

•

Any inability of our energy transmission and distribution businesses to obtain adequate and timely rate relief and/or regulatory approvals

from federal and/or state regulators.

•

Changes in federal and/or state environmental regulations that could increase our costs or limit operations of our generating units.

•

Changes in nuclear regulation and/or developments in the nuclear power industry generally, that could limit operations of our nuclear

generating units.

•

Actions or activities at one of our nuclear units that might adversely affect our ability to continue to operate that unit or other units at

the same site.

•

Any inability to balance our energy obligations, available supply and trading risks.

•

Any deterioration in our credit quality.

•

Any inability to realize anticipated tax benefits or retain tax credits.

•

Increases in the cost of or interruption in the supply of fuel and other commodities necessary to the operation of our generating units.

•

Delays or cost escalations in our construction and development activities.

•

Adverse capital market performance of our decommissioning and defined benefit plan trust funds.

•

Changes in technology and/or increased customer conservation.

For further information, please refer to our Annual Report on Form 10-K, including Item 1A. Risk Factors, and subsequent reports on

Form 10-Q and Form 8-K filed with the Securities and Exchange Commission. These documents address in further detail our

business, industry issues and other factors that could cause actual results to differ materially from those indicated in this presentation.

In addition, any forward-looking statements included herein represent our estimates only as of today and should not be relied upon as

representing our estimates as of any subsequent date. While we may elect to update forward-looking statements from time to time,

we specifically disclaim any obligation to do so, even if our estimates change, unless otherwise required by applicable securities laws.

2

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Net Income reported

in accordance with accounting principles generally accepted in the United

States (GAAP). Operating Earnings is a non-GAAP financial measure that

differs from Net Income because it excludes the impact of the sale of

certain non-core domestic and international assets and costs stemming

from the terminated merger agreement with Exelon Corporation. PSEG

presents Operating Earnings because management believes that it is

appropriate for investors to consider results excluding these items in

addition to the results reported in accordance with GAAP. PSEG believes

that the non-GAAP financial measure of Operating Earnings provides a

consistent and comparable measure of performance of its businesses to

help shareholders understand performance trends. This information is not

intended to be viewed as an alternative to GAAP information. The last

slide in this presentation includes a list of items excluded from Net Income

to reconcile to Operating Earnings, with a reference to that slide included

on each of the slides where the non-GAAP information appears. These

slides are intended to be reviewed in conjunction with the oral

presentation to which they relate.

3

PSEG Power

Dan Cregg

Vice President – Finance, PSEG Power

PSEG Power represents the largest subsidiary within a diverse

platform…

Major electric generation

Stable electric and gas

Redeployment of capital

company with 13,300

distribution and

through the sale of

MW of base-load,

transmission company

international assets.

intermediate and load

rated top quartile for

Focused on managing

following capability

reliability providing

lease portfolio and

operating in attractive

service in mature

potential investment in

markets in the Northeast

service territory in New

renewables.

with operating control of

Jersey.

additional 2,000 MW of

capacity in Texas.

2007 Operating

Earnings:

$949M*

$376M*

$115M*

2008 Guidance:

$1,040M - $1,140M

$350M – $370M

5

* See page 30 for Items excluded from Net Income to reconcile to Operating Earnings

$45M – $60M

… providing earnings stability, multiple growth opportunities and

substantial cash flow.

Major influences on our business environment remain …

Infrastructure

Climate Change

Capacity Needs

Requirements

• Capital investment in

• PSEG Power’s base-

• Significant new

coal fleet to meet

load nuclear assets

well situated in carbon

constrained

environment

transmission capital

environmental

program to improve

requirements

reliability

maintains critical

infrastructure and

expands capability

• PSE&G pursuing

investments in energy

• Potential to leverage

efficiency and

existing brownfield

renewables

sites; potential for

new nuclear

… and PSEG’s assets are well positioned to meet the needs of

6

customers and shareholders in a challenging environment.

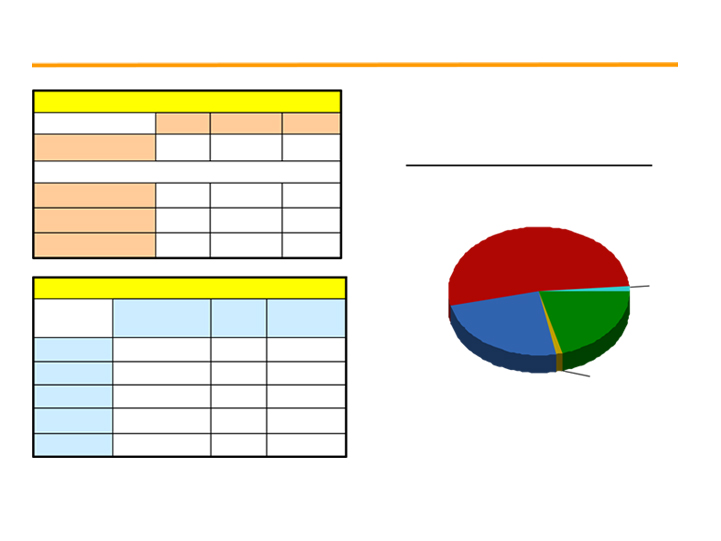

Right set of assets, right markets at the right time …

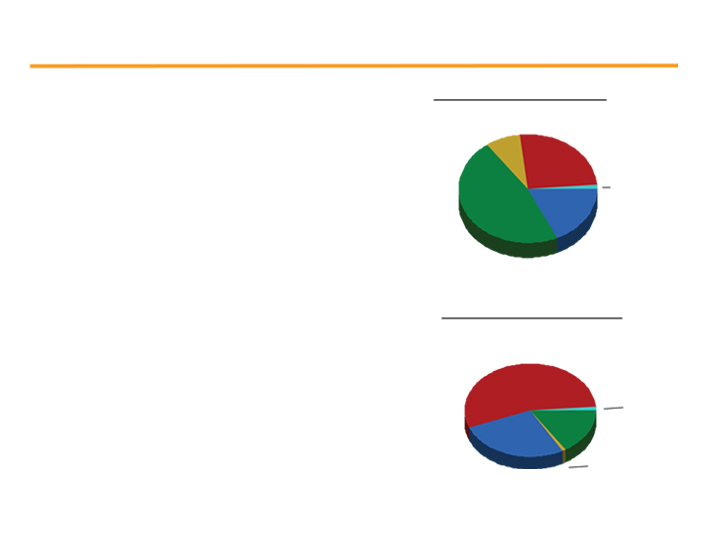

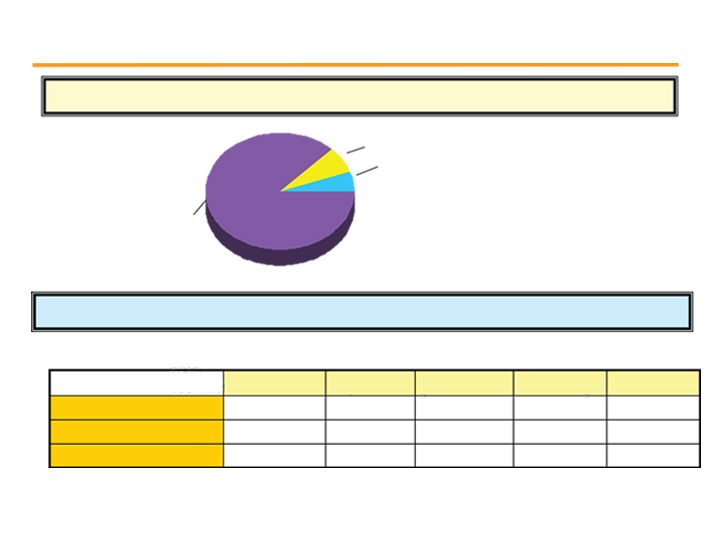

Fuel Diversity – 2007

• Low-cost portfolio

Total MW: 13,300*

• Strong cash generator

Oil

Nuclear

8%

• Regional focus in competitive,

26%

Pumped

liquid markets

Storage

18%

1%

47%

• Assets favorably located

Coal

Gas

– Many units east of PJM constraints

Energy Produced - 2007

– Near customers/load centers

Total GWh: 53,200*

• 80% of Fossil capacity has dual

Nuclear

fuel capabilities

54%

Pumped

•

Integrated generation and portfolio

Storage

1%

19%

management optimizes asset-

25%

Gas

based revenues

Oil 1%

Coal

… we continue to like the assets we have and their location.

7

* Excludes 2,000MW of combined cycle generation in Texas under PSEG Power’s operating control.

– Southern NEPOOL/ Connecticut

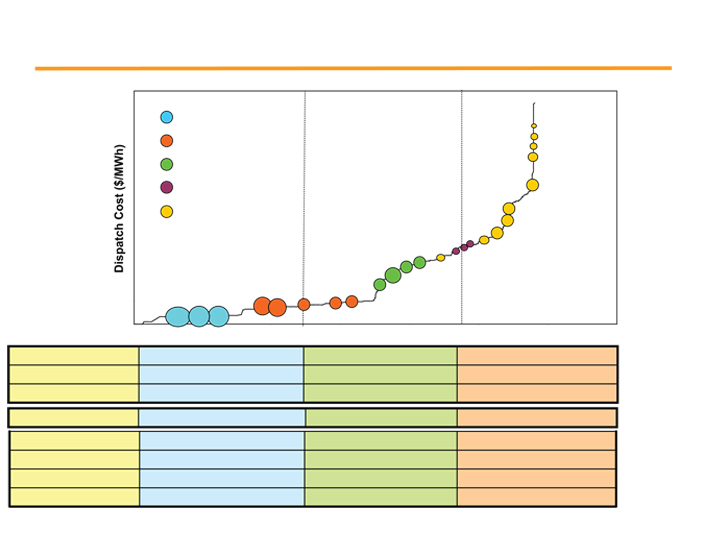

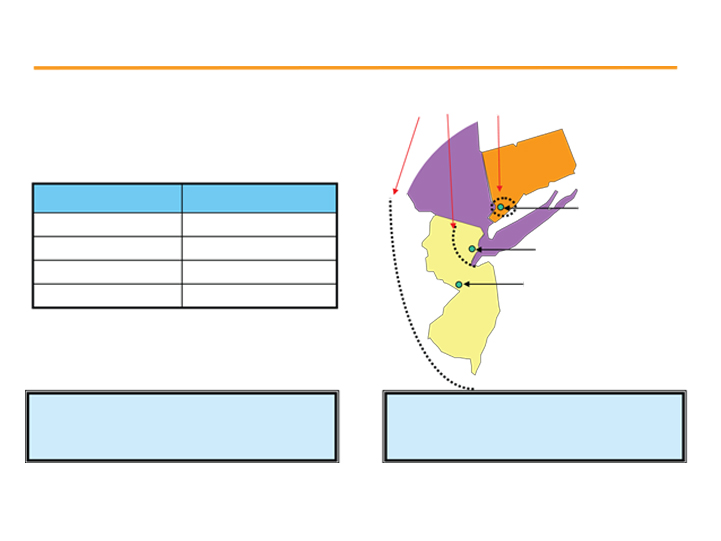

Power’s assets along the dispatch curve …

Nuclear

National Park

Coal

Sewaren 6

Mercer 3

Kearny 10-11

Combined Cycle

Burlington 8-9-11

Steam

GT Peaking

Edison 1-2-3

Essex 10-11-12

New

Haven

Linden 5-8 / Essex 9

Bergen 1

Burlington 12 / Kearny 12

Linden 1,2

Keystone

Yards

Sewaren 1-4

Conemaugh

Creek

Hudson 1

Peach

BEC

Bottom

Bridgeport

Hudson 2

Hope

Bergen 2

Creek

Salem

Mercer1, 2

Illustrative

Baseload units

Load following units

Peaking units

Energy Revenue

X

X

X

Capacity Revenue

X

X

X

Ancillary Revenue

X

X

Dual Fuel

X

X

Nuclear CF

90% to 92%

Coal CF

85% to 90%

50% to 70%

Combined Cycle CF

30% to 50%

Peaking CF

2% to 10%

8

… position the company to serve full requirement load contracts.

Our five unit nuclear fleet …

Hope Creek

• Operated by PSEG Nuclear

Salem Units 1 and 2

• PSEG Ownership: 100%

• Operated by PSEG Nuclear

• Technology:

Boiling Water Reactor

• Ownership: PSEG - 57%,

Exelon – 43%

Peach Bottom Units 2 and 3

• Total Capacity: 1,061MW

• Technology:

Pressurized Water Reactor

• Operated by Exelon

• Owned Capacity: 1,061MW*

• License Expiration: 2026

• Total Capacity: 2,304MW

• PSEG Ownership: 50%

*125MW uprate expected for 2008 summer run

• Owned Capacity: 1,323MW*

• Technology:

Boiling Water Reactor

• License Expiration: 2016 and

2020

• Total Capacity: 2,224MW

• Owned Capacity: 1,112MW

*15MW uprate expected for 2008 summer run

• License Expiration: 2033

and 2034

… is a critical element of Power’s success.

9

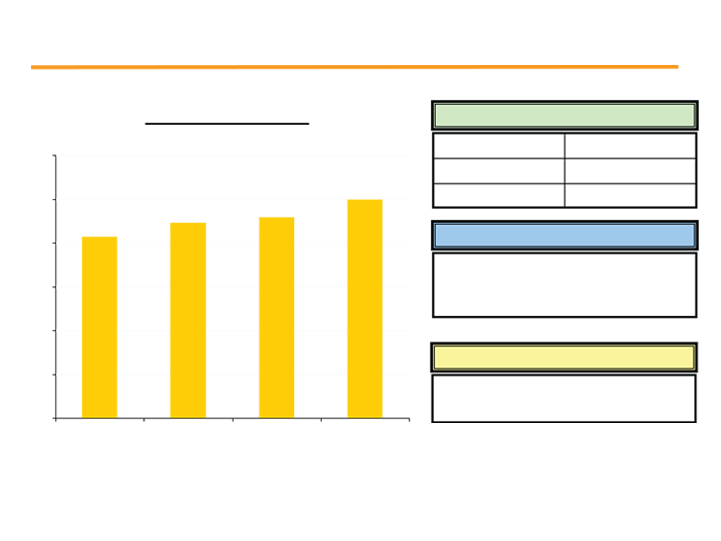

We have delivered strong nuclear performance …

Total Nuclear Output

O&M Total Incurred Cost

(000 GWh)

($ millions)

$589

$567

$564

$554

$542

29.2

28.5

28.8

27.4

24.8

2004

2005

2006

2007

2008 Target

2004

2005

2006

2007

10

Note: Values represent Salem/Hope Creek/Peach Bottom, PSEG Share

2008 Target

… while reducing cost of operations.

We have some major 2008 initiatives …

Hope Creek Uprate

Salem Steam Generator Outage

• NRC approved Hope Creek’s

• Unit 2 outage concluded

extended power uprate

within 58 days – on time

license amendment in May

• 15 MW uprate (PS share)

2008

expected for 2008 summer

• 125 MW uprate expected for

run

2008 summer run

INPO Assessments

Hope Creek

Salem

Corporate

… that will drive value for years to come.

11

Fossil operations contribute to earnings …

Total Fossil Output

A Diverse 9,800 MW Fleet (MW)

(GWh)

Coal

2,350

30,000

Combined Cycle

3,150

25,000

Steam / Peaking

4,300

Right Assets – Right Location

20,000

• Fuel diversity

15,000

• Technical diversity

`

• Near load centers

10,000

Operation of 2,000 MW Texas Portfolio

5,000

• Shared best practices

• Leverage scale

0

2004

2005

2006

2007

… through a low-cost portfolio in which the majority of the output is

from coal facilities.

12

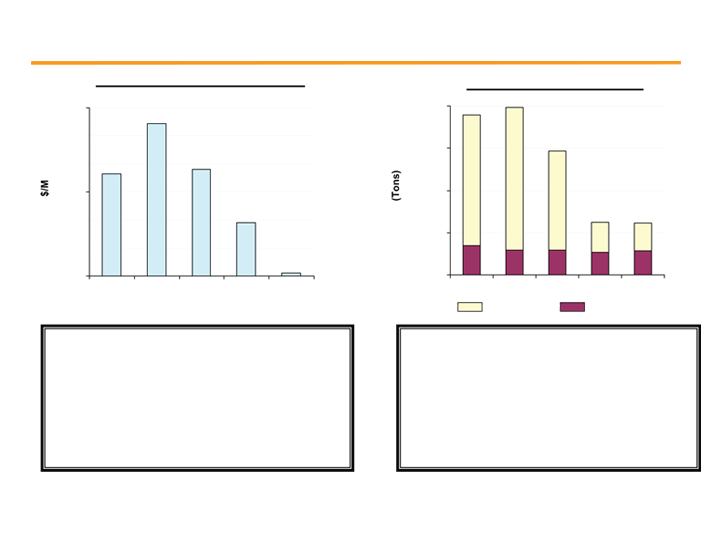

Fossil’s capital spending on pollution control equipment

declines over time …

Coal Environmental Capital

Coal Emissions Output

$600

80,000

60,000

$300

40,000

20,000

$0

0

2007

2008

2009

2010

2011

2007

2008

2009

2010

2011

Coal – SO2

Coal – NOx

• Fossil spending on BET reaches a peak of over

• Aggregate emissions will decline nearly 70%

$500 million in 2008

after installation of the pollution control

equipment

• Fossil’s coal fleet will be well positioned in

2010, with a dramatic reduction in capital

• The installation will allow for fuel flexibility in

spending on pollution control equipment

future years

… and the coal fleet’s profile results in lower emissions and

13

higher output.

Power’s eastern coal plants are in the right areas …

System Interface

Coal Units

Capacity (MW)

Bridgeport Harbor 3

Hudson 2

558

Mercer 1&2

648

Hudson 2

Bridgeport

372

Mercer 1&2

Total

1,578

Power’s New Jersey coal units are

Power is also making considerable

mid-merit, with capacity factors

investments beyond the pollution

averaging 50% to 60%.

control facilities for its coal assets.

… and after capital investments, anticipate increased capacity factors.

14

Markets remain attractive …

Energy markets have seen rising prices

Fuel costs have risen

Reserve margins have tightened

Capacity pricing mechanisms have been implemented in Power’s

key markets

Five RPM auctions implemented in PJM

Power’s hedging strategy enables strong and stable cash flows

Increasingly visible and stable margin

BGS results in line with markets, including load serving value

Gas asset optimization and other products round out a strong

portfolio

2007 delivered strong results

… in response to rising fuel costs and the need for new capacity.

15

First FCM auction implemented in NE

Other recontracting to drive value

Through the new capacity constructs, and repricing at

market prices …

Power’s capacity is located in three Northeast markets.

NE

NY

Total Capacity 13,300MW*

(~ 1,000 - 1,500 MW under RMR)

PJM

* Excludes 2,000MW of combined cycle generation in Texas under PSEG Power’s operating control.

The RPM Auction to date has provided strong price signals in PJM.

Delivery Year ($MW/Day)

2007 / 2008

2008 / 2009

2009 / 2010

2010 / 2011

2011 / 2012

Zones

Eastern MAAC*

$197.67

$148.80

$191.32

$174.29

$110.00

MAAC

---

---

$191.32 (a)

$174.29

$110.00

Rest of Pool

$40.80

$111.92

$102.04

$174.29

$110.00

* Majority of Power’s assets

(a) – includes APS

16

… Power expects to maintain strong margins.

Power’s fleet diversity and location ...

Market Perspective – BGS Auction Results

Increase in Full Requirements Component Due to:

Increased Congestion (East/West Basis)

Full Requirements

Increase in Capacity Markets/RPM

$111.50

$102.51

• Ancillary services

Volatility in Market Increases Risk Premium

$98.88

• Capacity

• Congestion

~ $43

• Load shape

~ $32

~ $41

$65.41

• RECs

• Transmission

$55.59

$55.05

• Risk premium

~ $21

~ $18

~ $21

$58-$60

$68 - $71

$44 - $46

$67 - $70

$33 - $34

Round the Clock

PJM West

Forward Energy

Price

2003

2004

2005

2006

2007

2008

… has enabled successful participation in each BGS auction and

17

cushioned customer impacts.

Note: BGS prices reflect PSE&G Zone

$36 - $37

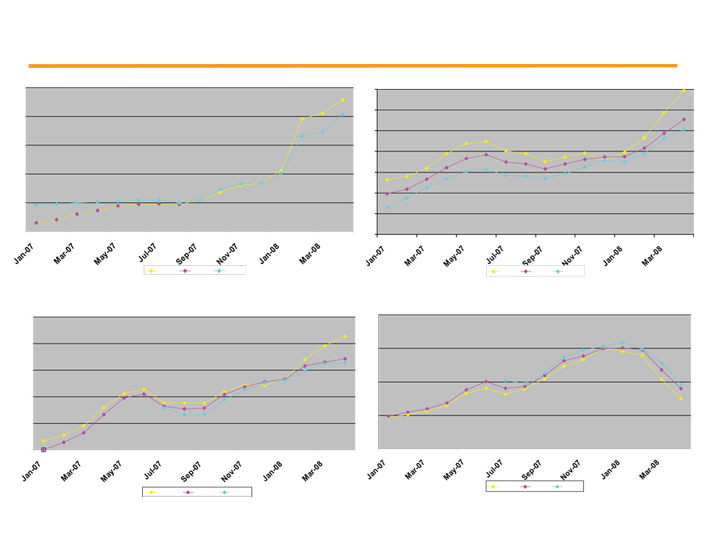

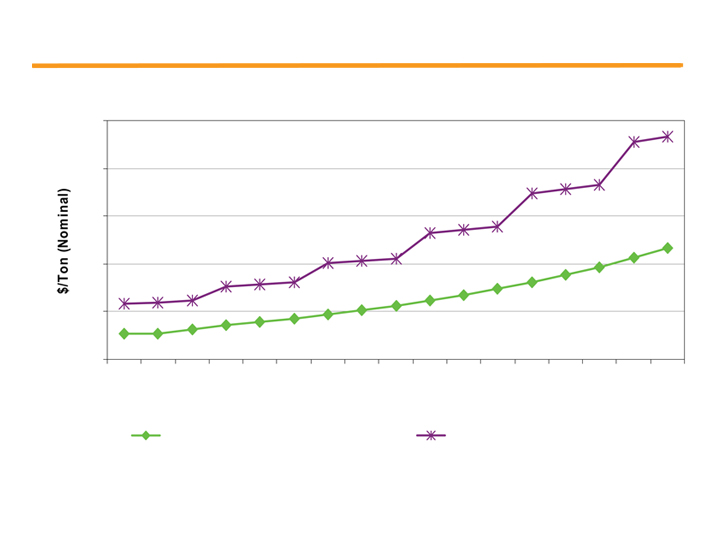

Rising coal and natural gas prices have driven LMPs ...

Central Appalachian Coal ($/Ton)

Natural Gas Henry Hub ($/MMbtu)

$90

$10.0

$9.5

$80

$9.0

$70

$8.5

$60

$8.0

$7.5

$50

$7.0

$40

$6.5

2009

2010

2011

2009

2010

2011

On Peak Heat Rate Expansion (MMbtu/MWh)

Electric PJM Western Hub RTC Price ($/MWh)

$80

10.5

$75

10.0

$70

9.5

$65

9.0

$60

$55

8.5

2009

2010

2011

2009

2010

2011

18

… and this trend may continue.

Note: Forward prices as of 4/28/08

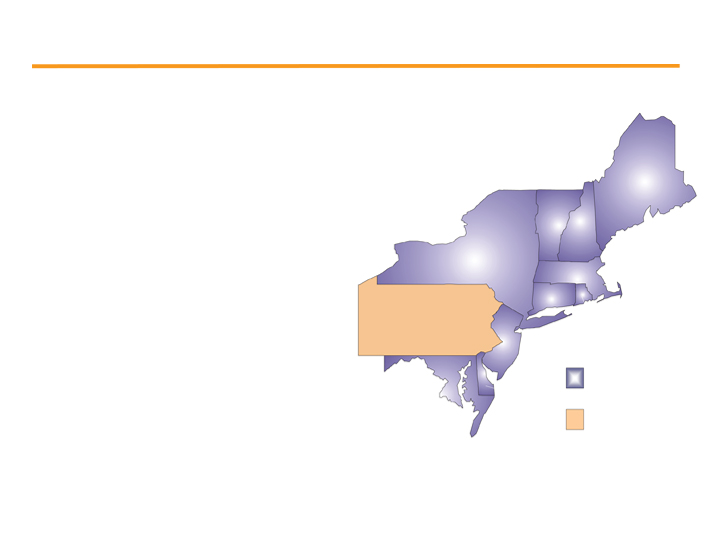

The Regional Greenhouse Gas Initiative (RGGI) …

• Cooperative effort by Northeast states to

design a regional cap-and-trade program to

reduce carbon dioxide (CO2 ) emissions

– Full participants – CT, MA, MD, ME, NH, VT,

NY, NJ, RI, and DE

RGGI

States

ME

– Observers – PA, DC, and Eastern Canadian

Provinces and New Brunswick

VT

NH

•

Timeline

NY

– April 2003 process proposed by Governor Pataki

MA

– 2003 – 2006 – Stakeholder process

CT

PA

RI

– December 20, 2005 Final 7 state MOU

NJ

– March 23, 2006 – Draft Model Rule

– August 15, 2006 – Final Model Rule & amended

MOU

MD

Participating States

DE

– 2007-2008 – State level adoption

Observer States

– First RGGI allowance auction September 2008

– January 1, 2009 – Implementation

… is a potential influence on market prices.

19

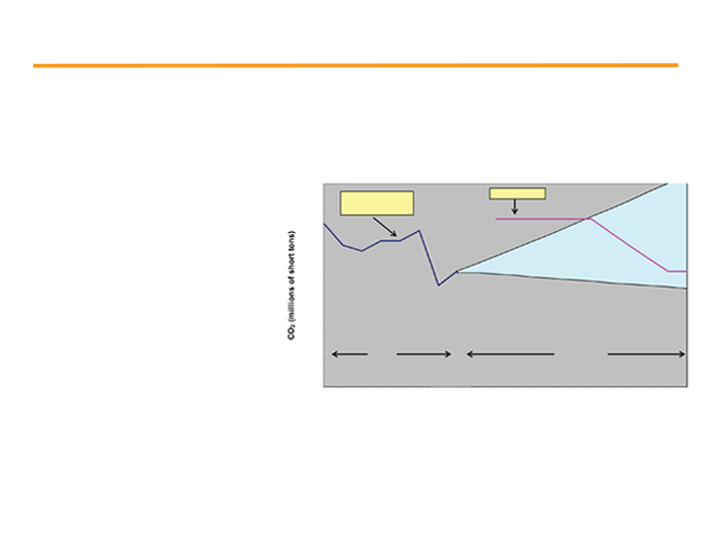

The RGGI cap shows headroom …

• Affected Sources

– Fossil fired electric generating units

CO2 Emissions vs. RGGI Cap

with a capacity of 25 megawatts

(Actuals through 2007)

(MW) and larger

200

RGGI Cap

Actual &

Forecast CO2

190

– Three-year compliance periods

180

with the first running from 2009-

2011

170

– Stabilization of CO2 emissions at

160

recent levels through 2015 (~188

million tons per year)

150

– Achieve a 10% reduction of CO2

Actual

Projected

140

emissions below recent levels by

2019

130

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

– This translates into ~13% reduction

below 1990 levels or ~35%

reduction from BAU levels by 2020

20

… when viewed in comparison to historical emissions.

• Targets and Timing

RGGI’s CO2 pricing projections …

$10

$8

$0

2009

2011

2013

2015

2017

2019

2021

2023

2025

RGGI - ICF Base

RGGI - ICF Base (Rev. Oct-06)

… reflect moderate prices, based on the headroom in the cap.

21

$2

$4

$6

Power’s open EBITDA is approximately $2.6 - $2.8 billion …

$3.0

EBITDA

Assumption

Sensitivity

Impact

$2.5

Capacity

~ $60 - $65/KW-yr

(~ $165 - $178/MW-day)

$10/KW-yr

~ $120M

Energy

$1/MWh

~ $40M

~ $69 - 73/MWh

(PJM-West)

$2.0

Fuel

Gas ~$8.50 to $9.00/MB

Coal ~ $2.85 to $3.15/MB

O&M

~ $1.0 - 1.05B

$1.5

2008 Forecasted EBITDA $2.05B - $2.25B

$1.0

… which will vary depending upon market drivers.

22

* Open EBITDA reflects unhedged results of Power at market prices shown above

PSEG Power’s capital program

2007

2008

2009

2010

2011

2006 10-K

$584

$626

$516

$527

$198

($ millions)

2007 10-K

$562

$890

$675

$620

$430

($ millions)

Program focused on meeting environmental commitments,

capital associated with new capacity ($500M*) and exploring

the opportunity for new nuclear. All initiatives focused on

improving the fleet’s reliability and performance.

23

* Forecast capital spending associated with new peaking could be lower than amount indicated.

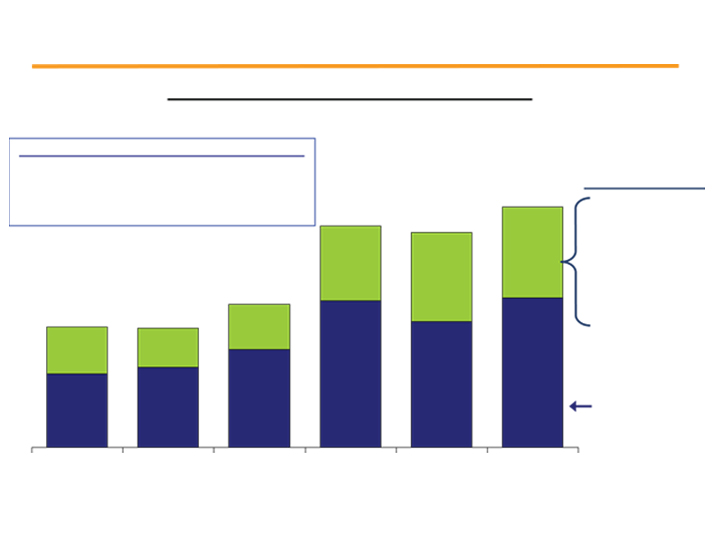

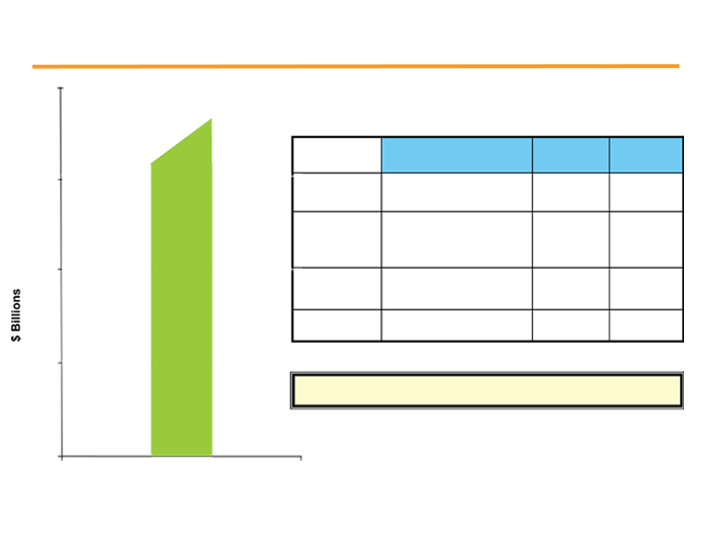

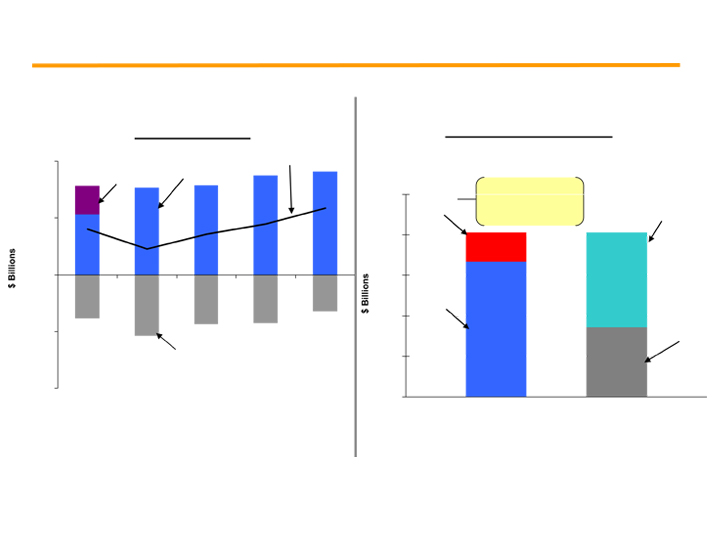

At Power, strong cash generation and declining

capital expenditures …

Power Cash Flow

Power Sources and Uses

(2008 – 2011 Forecast)

Net Cash

Flow

$2.0

Asset

Sales

Cash

from Ops

Incremental debt

$10.0

Net

capacity while

Dividends

Financing

maintaining target

to Parent

$1.0

credit measures

$8.0

$0.0

$6.0

Cash from

Ops

$4.0

($1.0)

Investments

Declining Investments

$2.0

($2.0)

$0.0

2007

2008

2009

2010

2011

Sources

Uses

… should result in substantial discretionary cash available to

24

PSEG for additional growth and/or share repurchases.

Public Service Enterprise Group

APPENDIX

The implementation of carbon legislation will address

the critical issue of global warming …

By Fuel Type

Coal

CTs

CC

Carbon tons/MWh

1.0

0.6

0.4

PSEG Power Generation by Fuel

Price ($/MWh)

2007 Total GWh: 53,200*

@$10/ton

$10.0

$6.0

$4.0

Nuclear

@$20/ton

$20.0

$12.0

$8.0

@$30/ton

$30.0

$18.0

$12.0

54%

Dispatch curve implication @ $20/ton**

Pumped

Storage

On margin

$/MWh

Impact

19%

1%

(Illustrative)

25%

($/MWh)

Gas

Coal

50%

$20.0

$10.0

Coal

CTs

10%

$12.0

$1.2

Oil 1%

Gas CC

40%

$8.0

$3.2

Nuclear

0%

$0.0

$0.0

Total

100%

$14.4

… and will put additional upward pressure on energy prices.

27

* Excludes 2,000MW of combined cycle generation in Texas under PSEG Power’s operating control.

** For illustration purposes – potential impact of CO2 on power prices with current dispatch – not an indication of net effect on income.

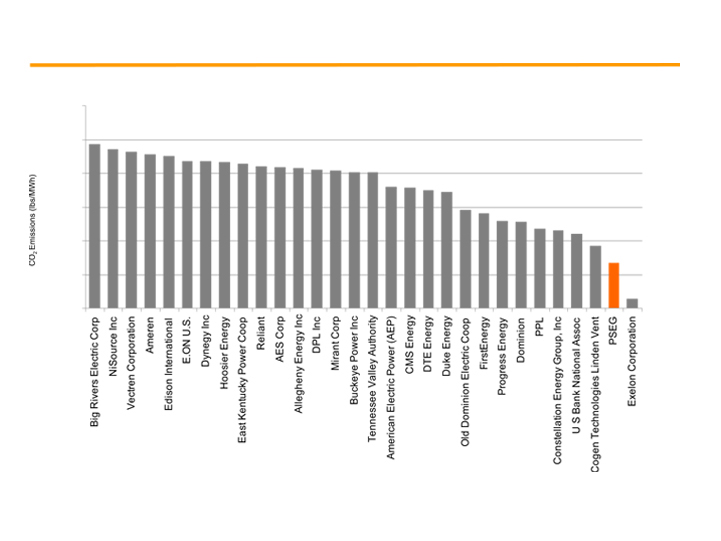

Power’s fleet has a low carbon profile …

2006 CO2 Emissions Rate Ranking

3,000

(Companies in PJM States)

2,500

2,000

1,500

1,000

500

0

* Source: Energy Information Administration (2006)

… which is well positioned for virtually any form of carbon restrictions.

28

The separation between coal and gas pricing …

Allowance Price Needed to

Dispatch Gas over Coal

• Fuel switching is an expensive

option

$120.00

$100.00

• At current fuel and allowance

$23.25

$80.00

prices, switching from coal to

CO2 Adder

$52.62

combined-cycle natural gas

$60.00

NOx & SO2

Fuel Cost

may require an allowance price

$40.00

of about $50/ton

$20.00

– Politically infeasible in the near

term

$-

Coal

CC NG

… may require significant carbon prices to alter dispatch.

29

Items Excluded from Net Income to Reconcile to Operating Earnings

($ millions )

(EPS)

Years Ended Dec. 31,

Years Ended Dec. 31,

2007

2006

2007

2006

Merger related Costs:

PSE&G

$

-

$

(1)

$

-

Enterprise

-

(7)

(0.02)

Total Merger related Costs

$

-

$

(8)

$

-

$

(0.02)

Impact of Asset Sales:

Loss on Sale of RGE

-

(178)

$

-

$

(0.35)

Chilquinta & Luz Del Sur

(23)

-

(0.05)

-

Write down of Turboven

(7)

-

(0.01)

-

Premium on bond redemption

(28)

(7)

(0.06)

(0.02)

Total Impact of Asset Sales

$

(58)

$

(185)

$

(0.12)

$

(0.37)

Discontinued Operations:

Power - Lawrenceburg

$

(8)

$

(239)

$

(0.02)

$

(0.47)

Holdings:

SAESA

(33)

57

(0.06)

0.11

Electroandes

57

16

0.11

0.03

Elcho and Skawina

-

226

-

0.45

Total Holdings

$

24

$

299

$

0.05

$

0.59

Total Discontinued Operations

$

16

$

60

$

0.03

$

0.12

Please see Slide 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income.

30