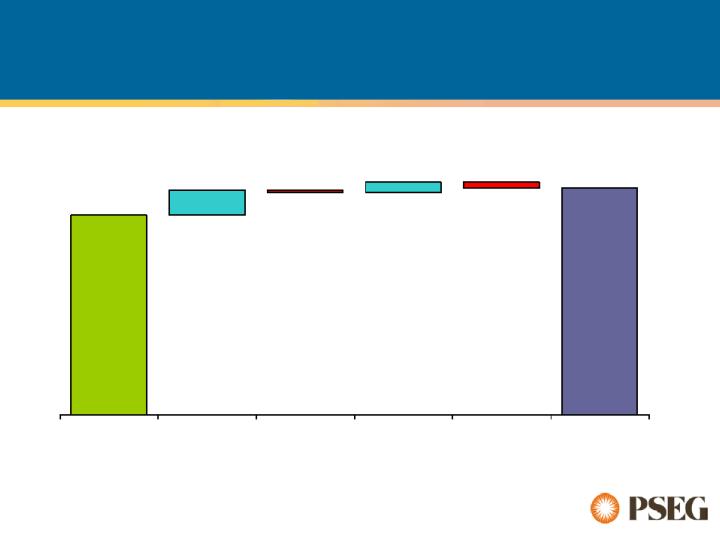

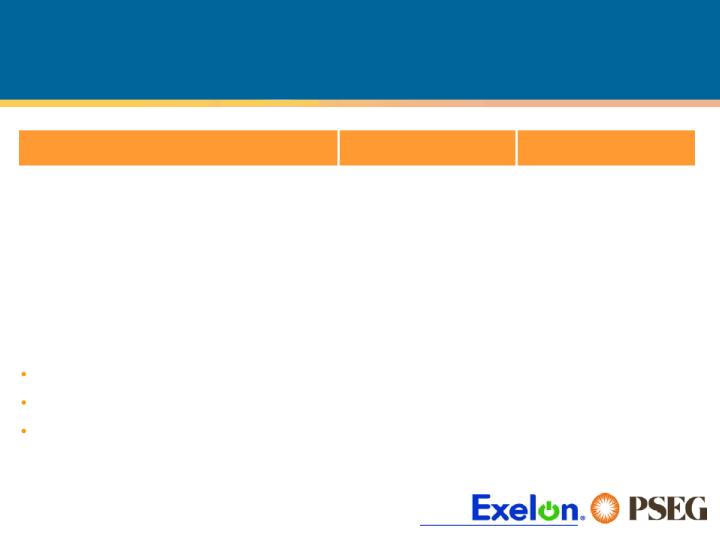

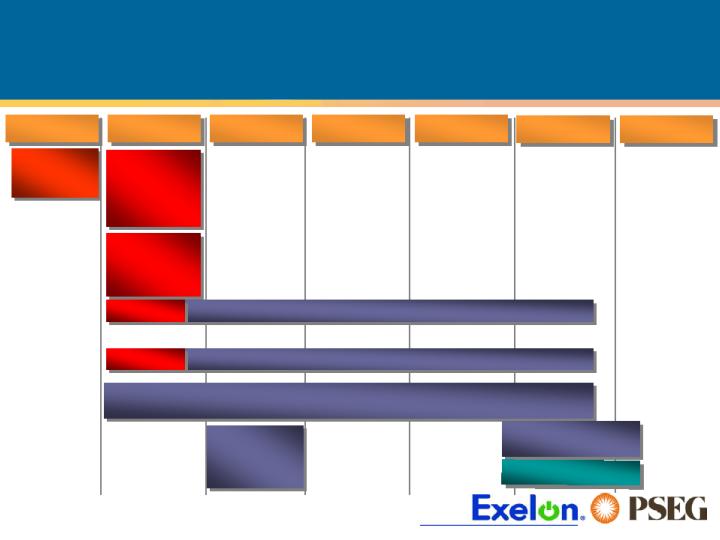

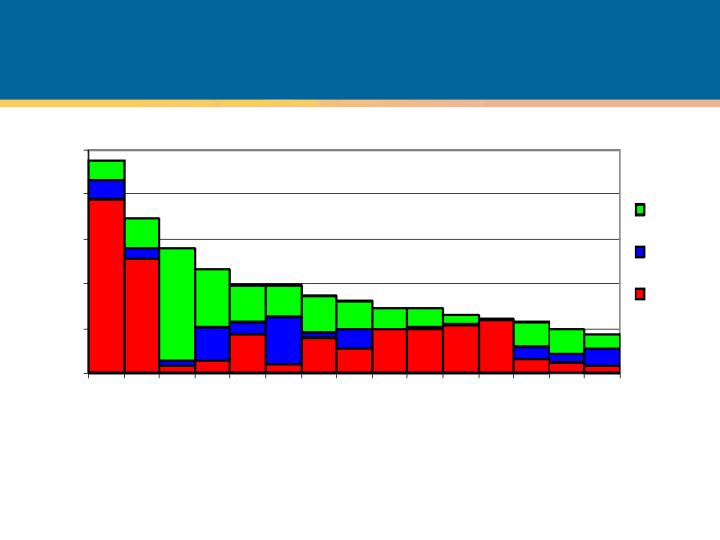

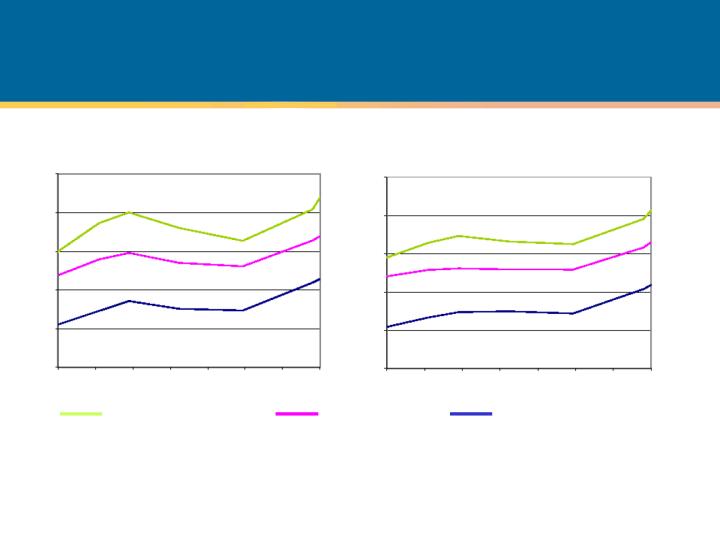

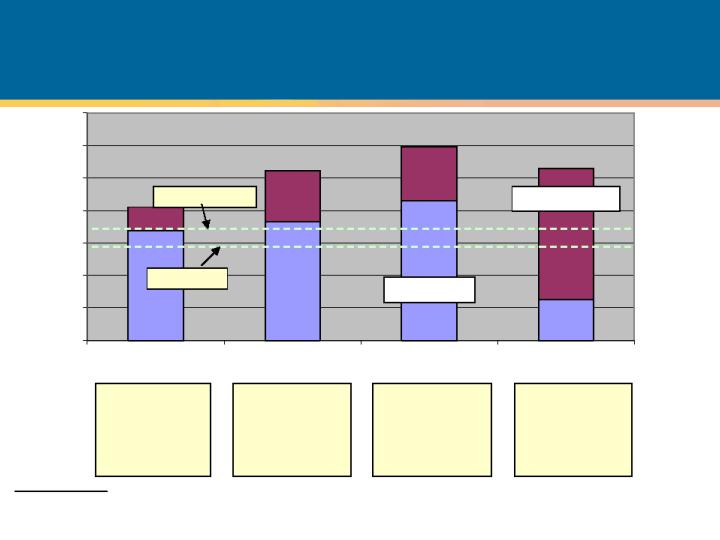

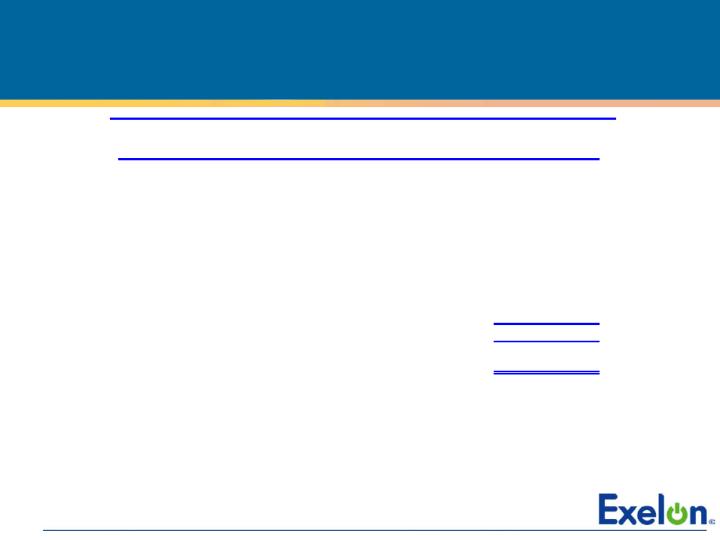

GAAP EPS Reconciliation 2003-2004

39

$1.38

2003 GAAP Reported EPS

Boston Generating impairment

Charges associated with investment in Sithe Energies, Inc.

Severance

Cumulative effect of adopting SFAS No. 143

Property tax accrual reductions

Enterprises’ Services goodwill impairment

Enterprises’ impairments due to anticipated sale

March 3 ComEd Settlement Agreement

2003 Adjusted (non-GAAP) Operating EPS

2004 GAAP Reported EPS

Charges associated with debt repurchases

Investments in synthetic fuel-producing facilities

Severance

Cumulative effect of adopting FIN No. 46-R

Settlement associated with the storage of spent nuclear fuel

Boston Generating 2004 impact

Charges associated with investment in Sithe Energies, Inc.

Costs related to proposed merger with PSEG

2004 Adjusted (non-GAAP) Operating EPS

0.87

0.27

0.24

(0.17)

(0.07)

0.03

0.03

0.03

$2.61

$2.78

0.12

(0.10)

0.07

(0.05)

(0.04)

(0.03)

0.02

0.01

$2.78

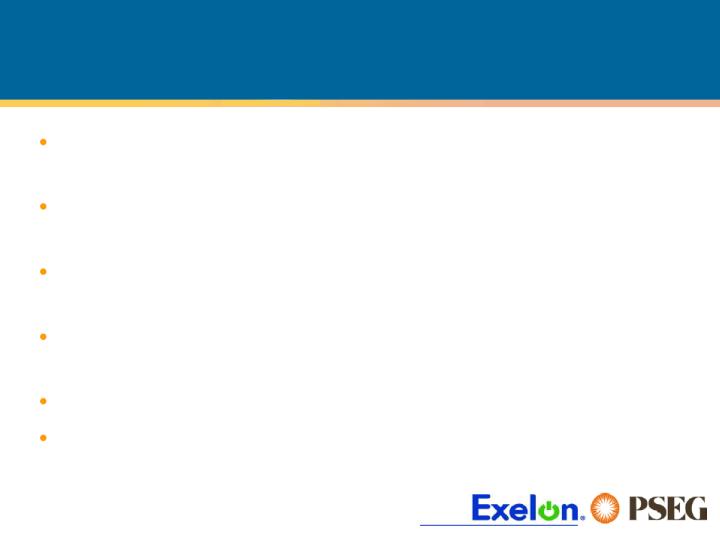

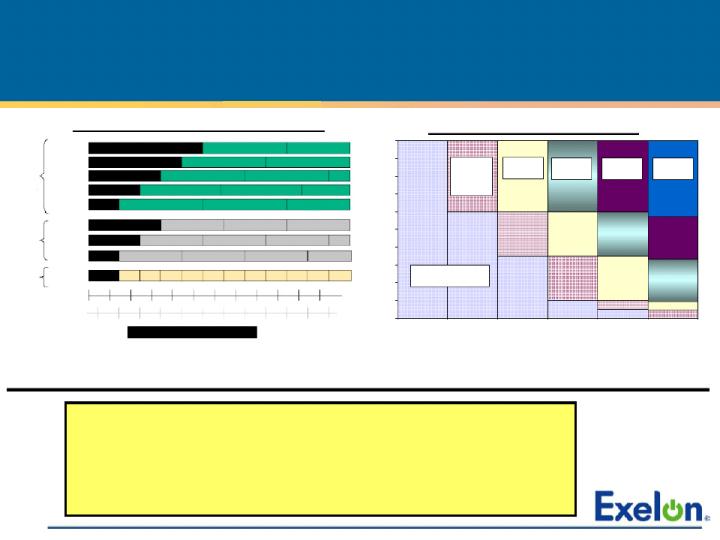

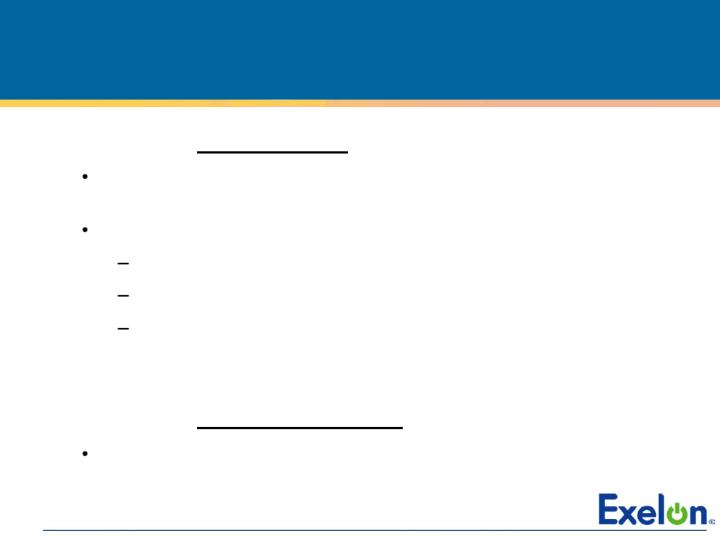

Total Increase in Cash and Cash Equivalents

to Free Cash Flow Reconciliation ($ in millions)

GAAP Increase in Cash and Cash Equivalents

Adjustments for Goal:

Discretionary Debt Activity:

- Change in Short-Term Debt

- Net Long-Term Debt Retirements(1)

- Other Financing Activities

Cash from Long-Term Incentive Plan(2)

Other Discretionary Adjustments(3)

Total Adjustments

Free Cash Flow

Includes net long-term debt issuances and payment on the acquisition note to Sithe Energies, Inc.

and excludes ComEd Transitional Funding Trust and PECO Energy Transition Trust Retirements.

Net of treasury shares purchased.

Includes the incremental increase in dividend payments over 2003, exclusion of Sithe cash,

severance payments, call premiums associated with the redemption of debt as a result of

the accelerated liability management plan, and the tax effect of discretionary items.

$ 35

(164)

1,424

(34)

(158)

283

1,351

$ 1,386

Full Year 2004 Cash Reconciliation

40

(1)

(2)

(3)

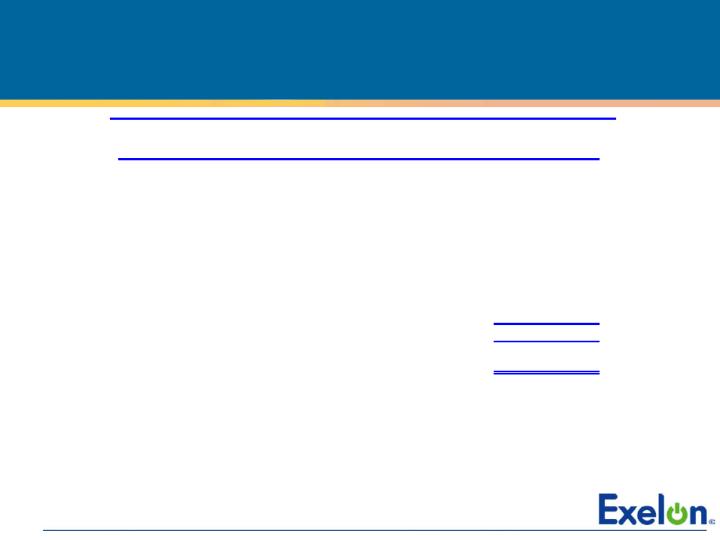

Cash Flow Definitions

We define free cash flow as:

Cash from operations (which includes pension contributions

Cash used in investing activities, less

Transition debt maturities

Common stock dividend payments at 2003 rates

Other routine activities (e.g., severance payments, tax

effect of discretionary items, etc.)

and the benefit of synthetic fuel investments), less

We define available cash flow as:

Cash from operations less capital expenditures, less common

stock dividend payments, less securitized debt retired

41