Public Service Enterprise Group

41st EEI Financial Conference

November 7, 2006

Forward-Looking Statements

This presentation includes forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors

that could cause actual results of Public Service Enterprise Group Incorporated (PSEG), Public

Service Electric and Gas Company, PSEG Power LLC, and PSEG Energy Holdings L.L.C.

(collectively, the PSEG Companies) to differ materially from these forward-looking statements

include those discussed herein as well as those discussed in (1) the PSEG Companies’ 2005

Annual Report on Form 10-K, and 2006 Quarterly Reports on Form 10-Q in (a) Forward Looking

Statements (b) Risk Factors, and (c) Management’s Discussion and Analysis of Financial

Condition and Results of Operations and (2) other factors discussed in filings with the SEC by the

PSEG Companies. Readers are cautioned not to place undue reliance on these forward-looking

statements, which apply only as of the date of this presentation. None of the PSEG Companies

undertakes any obligation to publicly release any revision to its forward-looking statements to

reflect events or circumstances after the date of this presentation.

1

Agenda

PSEG Overview

Ralph Izzo

PSE&G Update

PSEG Power Update

Tom O’Flynn

Energy Holdings Update

PSEG Update

2

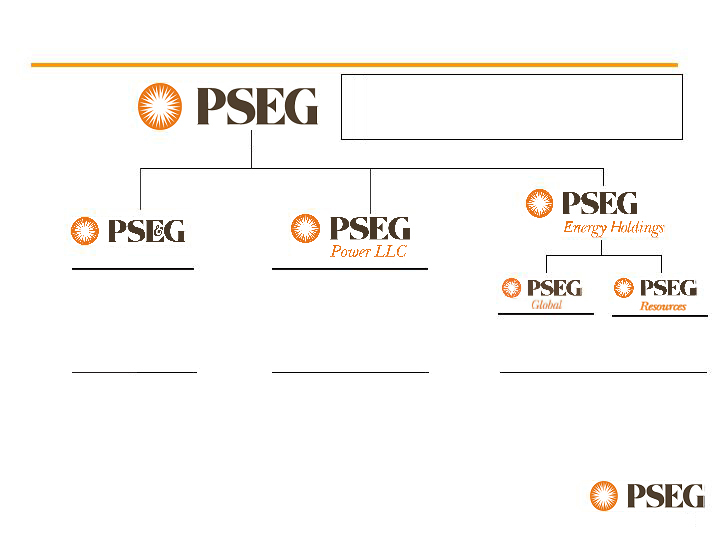

PSEG Overview

Ralph Izzo

President and Chief Operating Officer

PSEG Overview

Electric Customers: 2.1M

Gas Customers: 1.7M

Nuclear Capacity: 3,494 MW

Total Capacity: 14,636 MW

Traditional T&D

Leveraged

Leases

2006E Operating Earnings(1)(2): $875M - $950M

2006 EPS Guidance(1)(2): $3.45 - $3.75

Assets (as of 9/30/06): $28.7B

Domestic/Int’l

Energy

Regional

Wholesale Energy

(1)

Includes the parent impact of $(60-70)M

(2)

Income from Continuing Operations, excluding merger-related costs and

excludes gains/losses from asset sales

(3) Income from Continuing Operations, excluding merger-related costs of $3M for

PSE&G and $12M for PSEG Power

2005 Results: $347M(3) $418M(3) $196M

2006 Range: $250M - $270M(2) $500M - $550M(2) $185M - $205M(2)

4

Operations

PSE&G consistently demonstrates top reliability performance

Significant improvement in nuclear operations

Regulatory

PSE&G settlement demonstrates return to constructive environment

Environmental – nearing NJ coal solution

Energy Markets

Power benefiting from higher prices and lower risk through forward hedges

Utility customers insulated through staggered BGS

Financial

Strong earnings growth in 2007 and 2008

Improving credit measures

Reduced international exposure

As a standalone company, we have made steady

progress across a variety of areas.

Our objective is to build on these results to make

a strong company even stronger.

5

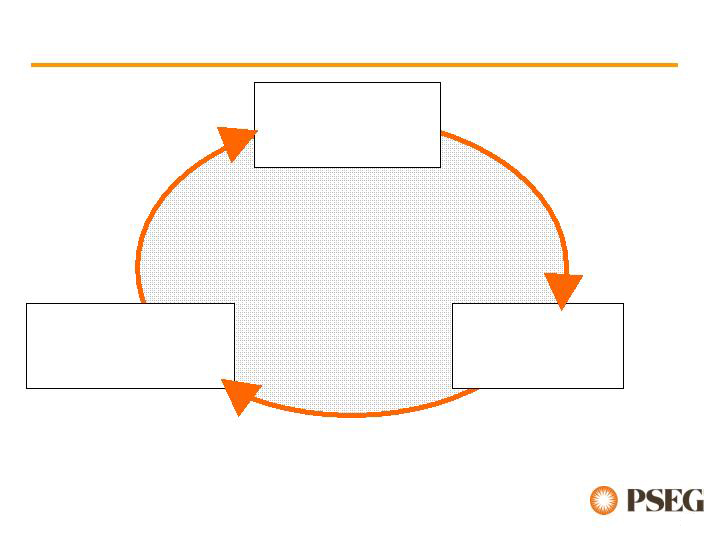

Financial

Strength

We will focus on the basics of operational

excellence...

…to produce financial strength that will be

deployed through disciplined investment.

Operational

Excellence

Disciplined

Investment

6

Solidify improvements in nuclear and fossil operations

Extended Nuclear Operations Services Agreement

Considering long term alternatives for Nuclear Operations

Implement fair and timely rate relief

Awaiting final BPU approval of electric distribution financial

review and gas distribution rate case

Targeted Restaffing

Preserve cost savings

Selectively rethink the organization

Recruit new and diverse talent

In the near-term, sustaining operational excellence

requires addressing top priorities…

…which will serve as the basis for continually

increasing our financial strength.

7

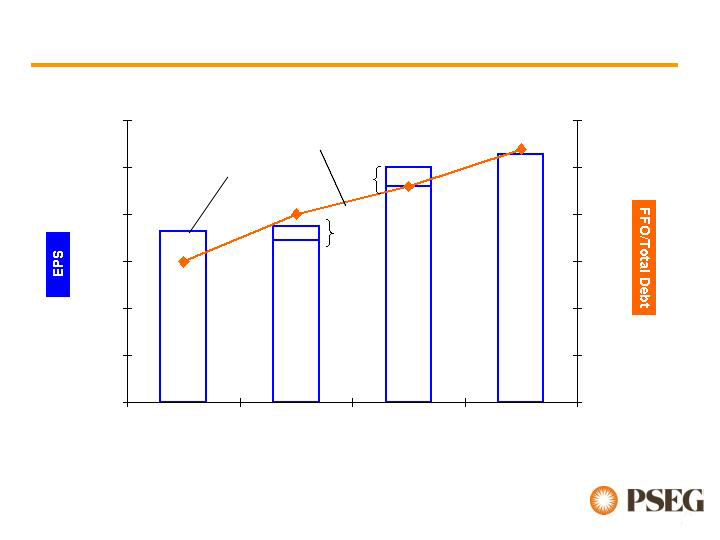

Strong earnings and cash flows will be used to

further delever the balance sheet.

Improving our credit profile will enable us to

maximize growth opportunities.

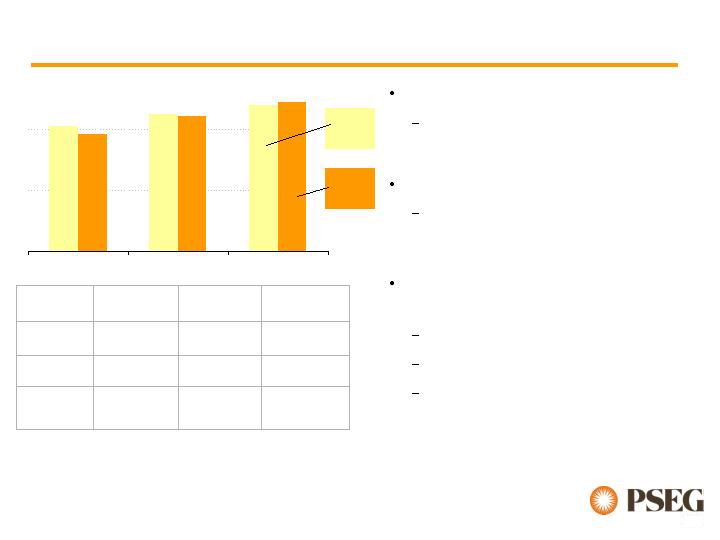

$0.00

$1.00

$2.00

$3.00

$4.00

$5.00

$6.00

2005 Actual

2006 Guidance

2007 Guidance

2008 Est.

0%

5%

10%

15%

20%

25%

30%

Excess

of 10%

Growth

FFO/

Total Debt

EPS

*

*

* Guidance range.

8

…and decide how to grow the generation and

delivery businesses.

From a position of financial strength, we will make

disciplined investments…

Near-term:

Capitalize on opportunities for rate base growth

Optimize our existing generation portfolio

Environmental improvements at NJ coal stations

Take a hard look at the pace of monetizing international assets

Longer-term:

Flexibility to pursue growth in core businesses and regions

Leverage strength in attractive markets

Consider a range of strategic alternatives

9

By positioning ourselves as industry thought

leaders…

Environmental leadership

Engage in policy debate

Pledged support to develop Energy Master Plan in New Jersey

Workforce development

Partner with higher education institutions

Recruit new and diverse talent

Technology adapters

Evaluate use of technology to improve customer service and work

management systems

Capture opportunities for revenue growth and cost savings

…we can create shareholder value over the

long-term.

10

PSE&G

PSE&G Overview

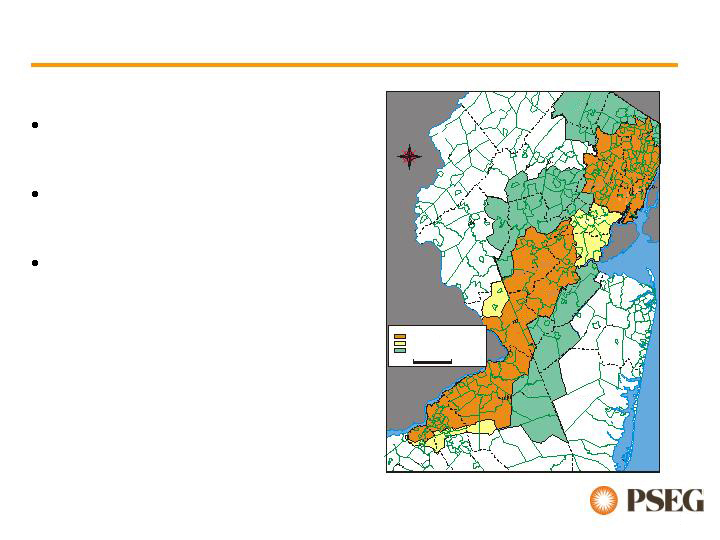

0

1 2 3 4 5 6 7 8 9

10 ml

Sussex Co.

Passaic Co.

Warren Co.

Bergen Co.

Morris Co.

Essex Co.

Hudson Co.

Hunterdon Co.

Union Co.

STATEN

ISLAND

Somerset Co.

Middlesex Co.

Mercer Co.

Monmouth Co.

Burlington Co.

Ocean Co.

Gloucester Co.

Camden Co.

COMBINED ELECTRIC & GAS TERRITORIES

ELECTRIC TERRITORY

GAS TERRITORY

KEY:

N

E

W

S

2.1 M electric customers

1.7 M gas customers

2,600 sq miles in service

territory

12

PSE&G is recognized as a top performing utility…

…providing a foundation for satisfied customers

and a constructive regulatory environment

80

75

70

65

60

Worse

Better

0.80

0.75

0.70

0.65

0.60

Worse

Better

96

97

98

99

100

Worse

Better

CAIDI (Duration of Outages) - Minutes

SAIFI (Frequency of Outages) - % of Customers

Gas Leak Response (Less than 1 hour) - % Response

PSE&G

PSE&G

Benchmark

1st Quartile

Benchmark

1st Quartile

PSE&G

Benchmark

1st Quartile

13

Fair outcomes on both cases will help ensure…

Settlement agreement with BPU staff, Public Advocate, and other parties

Gas Base Rate case provides for $79M of gas margin

$40M increase in rates

$39M decrease in non-cash expenses

Electric Distribution financial review provides $47M of additional revenues

Base rates remain effective until November 2009

New Jersey regulatory climate providing a fair return to investors

Opportunity to earn a ROE of 10%

…our continued ability to provide safe, reliable

service to customers and fair returns to shareholders.

14

Looking forward PSE&G…

Continues to invest in its assets for the future

Distribution System Reinforcements

Transmission Investments

Customer Service

Is committed to meeting customer needs and

expectations

Maintains constructive regulatory relations regarding

traditional utility matters

15

PSEG Power

Tom O’Flynn

PSEG Chief Financial Officer

PSEG Power Overview

Diverse asset mix mitigates risk and provides strong

returns

15,000 MW of nuclear, coal, gas, oil and hydro facilities

Low-cost portfolio

Strong cash generator

Regional focus with demonstrated BGS success

Assets favorably located

Many units east of PJM constraint

Southern NEPOOL/Connecticut constraint

Near customers/load centers

Integrated generation and portfolio management

optimizes asset-based revenues

17

Capacity Factors

82%

90%

96%

77%

89%

98%

2004

2005

2006 YTD

*Uprate of 127MW scheduled for Fall 2007

Strong operational performance

Capacity factors: YTD ~96%

Summer ~100%

Outage management

Site records achieved, including most

recent 21 day refueling outage at

Salem 2

Continuing the Nuclear Operating

Services Agreement for two years

Moving into a transition phase

Option to extend for additional year

Reviewing a number of long-term

alternatives

Exelon

Operated

PSEG

Operated

(NOSA)

PSEG

Operated

(NOSA)

Operations

Jointly Owned

Jointly Owned

PSEG Owned

Ownership

1,112MW

1,323MW

1,059MW*

PSEG MW

Owned

Peach Bottom

2 & 3

Salem

1 & 2

Hope Creek*

Total

Fleet

Strong results under the Nuclear Operating Services

Agreement with Exelon continue…

…while we consider longer-term alternatives.

NJ

Fleet

18

Strong Fossil Operations round out a diverse portfolio…

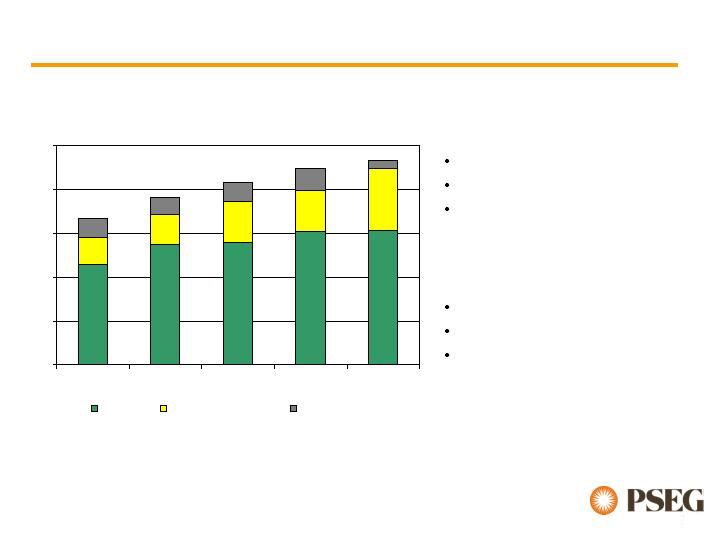

0

5,000

10,000

15,000

20,000

25,000

2002

2003

2004

2005

2006 Est.

Coal

Combined Cycle

Peaking & Other

Total Fossil Output (Gwh)

A Diverse 11,000 MW Fleet

2,400 MW coal

4,300 MW combined cycle

4,500 MW peaking and other

Strong Performance

Continued growth in output

Improved fleet performance

Constructive progress on an

environmental resolution

regarding Hudson

…in which over 80% of fleet output is from low

cost coal and nuclear facilities

19

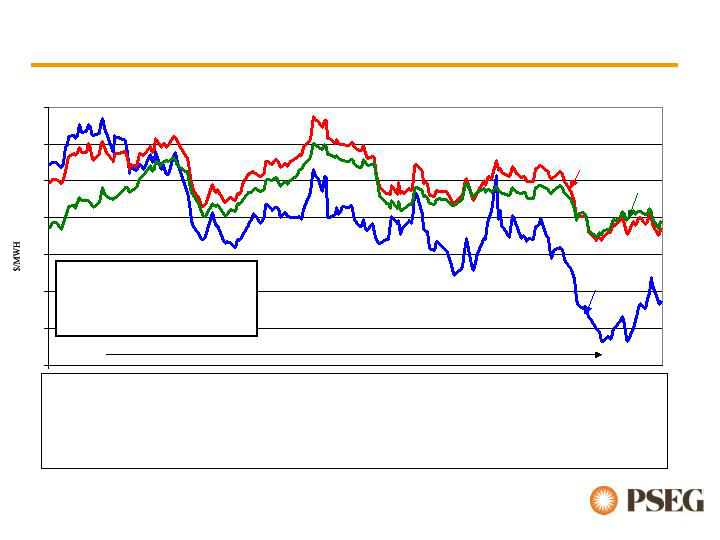

Calendar Forward Prices - PJM West RTC

40

45

50

55

60

65

70

75

Strong electric prices support growth in margins…

…as Power secures a stable revenue stream

through a strategy of forward hedging

Average PJM West RTC Price

2005 = $60/mwh

2004 = $42/mwh

2003 = $38/mwh

2006

2008

2007

Nov ‘05

Nov ‘06

10-40%

65-80%

85-95%

>95%

Percent of coal and nuclear energy output hedged

$0.65-$0.95

$0.20-$0.35

$0.10-$0.15

Est’d impact of $10/mwh PJM West RTC price change*

* - Assuming normal market dynamics

2009

2008

2007

2006

20

Strengthening of capacity market design…

New England

Forward Capacity Market (FCM)

scheduled to begin 12/1/06

Transition period prices have been

established

12/1/06 – 5/31/08 $36.60/kw-yr

6/1/08 – 5/31/09 $45.00/kw-yr

6/1/09 – 5/31/10 $49.20/kw-yr

First auction scheduled in 2008 for

2010 delivery

PJM

FERC Order 4/20/06

Locational pricing

Settlement filed with FERC 9/29/06

Anticipated implementation 6/1/07

PJM simulations show pricing from

$20/kw-yr to mid $30’s/kw-yr

…provides appropriate market signals, and enhances

margin for Power’s 15,000MW fleet.

Total Generating Capacity

PSEG Power

PJM

NY

NE

21

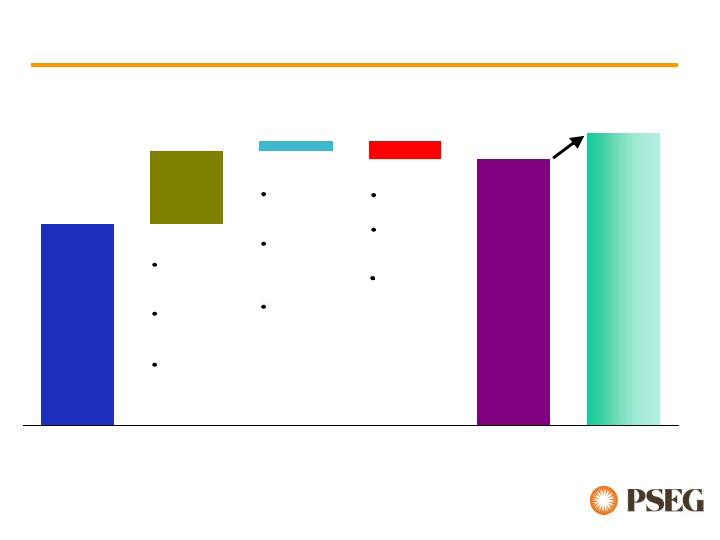

The year over year improvements…

Energy

Capacity

Other

…drive growth in PSEG’s 2007 earnings

guidance.

2007E

Gross Margin

2006E

Gross

Margin

Key Drivers

BGS Pricing

UI Recontracting

Other Recontracting

Capacity Markets

$400M - $500M

$100M - $150M

$2.5B-

$2.0B-

$1.5B-

$1.0B-

$0.5B-

$0M - $50M

22

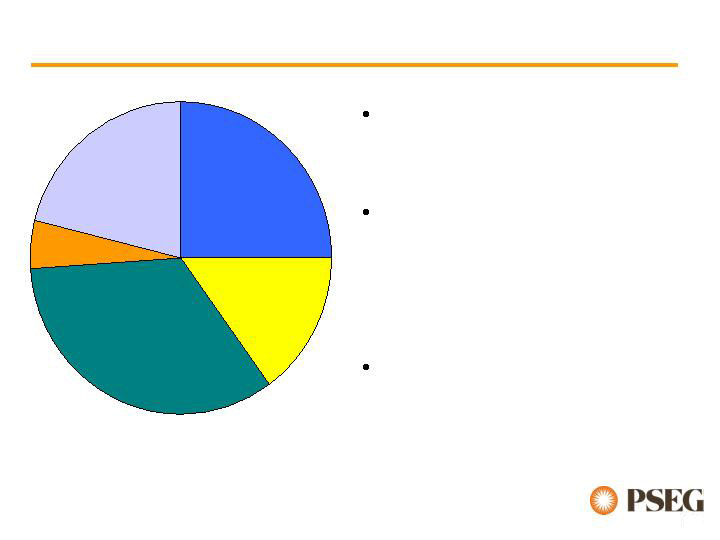

PSEG Energy Holdings

Energy Holdings Overview

PSEG

Resources

Latin American

Distribution

Texas Merchant

Generation

(2,000 MW)

International

Generation

Other fully contracted

US Generation

Projected 2007 Earnings

Contribution

Global’s risk profile

substantially improved

Vast majority of earnings

from U.S. generation and

Latin American

distribution

Strong earnings

contribution from Texas

24

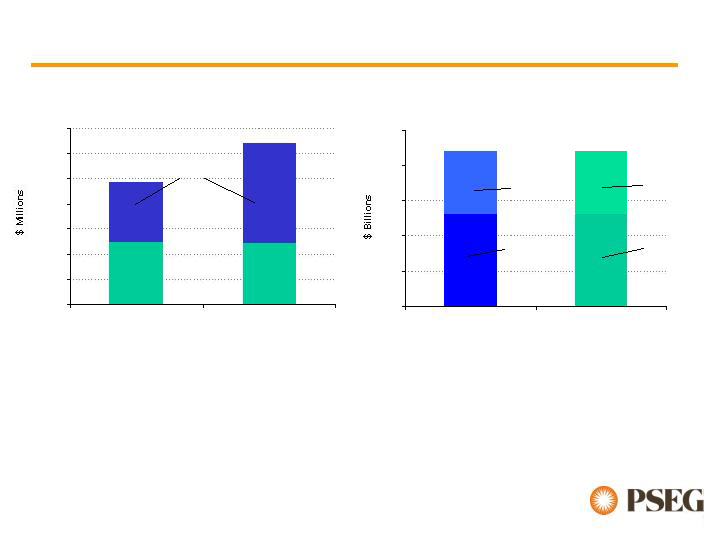

Holdings has provided meaningful earnings and

cash flow…

* For investments accounted for under the equity method of accounting, includes Global’s share of net earnings, including

Interest Expense and Income Tax Expense. Excludes loss on sale of RGE of $263M in 2006 and Global G&A – Unallocated.

…which has supported debt reduction and return

of capital to PSEG

EBIT* For the Nine Months Ended September

$0

$50

$100

$150

$200

$250

$300

$350

2005

2006

North

America

Sources & Uses of Cash from 2004 - 2006 (YTD)

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

Sources

Uses

Asset

Sales

Cash Ops/

Cash on

Hand

Reduced

Debt

Return

Capital/

Dividends

Global providing meaningful

domestic earnings

Significant decapitalization

totaling $2.2B from 2004 -

2006 (YTD)

25

Looking Forward Energy Holdings…

Optimize Texas assets

Take a hard look at the pace of monetizing international

assets

Maintain financial and operational stability of existing

assets

26

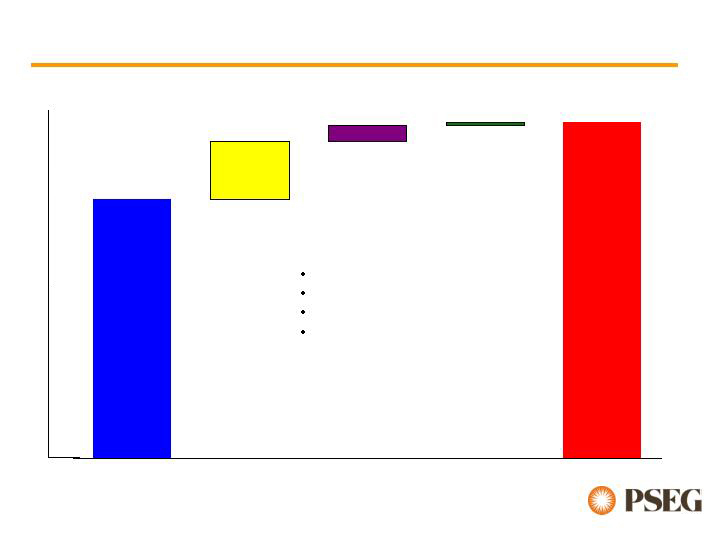

PSEG

PSEG 2007 Earnings Outlook & Drivers

2006 Guidance

Power

PSE&G

Holdings

2007 Guidance

2008

$3.45 - $3.75

$4.60 - $5.00

Excess

of 10%

Growth

Forward

Hedging

Re-contracting

- PJM/NE

Capacity

Market Design

Gas Rate

Case

Electric

Financial

Review

Weather

Texas

2006 RGE

Sale

New

Accounting

Standard

28

Public Service Enterprise Group

29