- PEG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Public Service Enterprise (PEG) 8-KRegulation FD Disclosure

Filed: 6 Sep 06, 12:00am

| Lehman Brothers 2006 CEO Energy/Power Conference New York City September 6, 2006 Exelon Corporation Public Service Enterprise Group |

| Forward-Looking Statements This presentation includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, that are subject to risks and uncertainties. The factors that could cause actual results of Exelon Corporation (Exelon), Commonwealth Edison Company, PECO Energy Company, and Exelon Generation Company LLC (collectively, the Exelon Companies) to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (a) the Exelon Companies' 2005 Annual Report on Form 10-K-ITEM 1A. Risk Factors, (b) the Exelon Companies' 2005 Annual Report on Form 10-K-ITEM 8. Financial Statements and Supplementary Data: Exelon-Note 20, ComEd-Note 17, PECO-Note 15 and Generation-Note 17, and (c) other factors discussed in filings with the SEC by the Exelon Companies. The factors that could cause actual results of Public Service Enterprise Group Incorporated (PSEG), Public Service Electric and Gas Company, PSEG Power LLC, and PSEG Energy Holdings L.L.C. (collectively, the PSEG Companies) to differ materially from these forward-looking statements include those discussed herein as well as those discussed in (1) the PSEG Companies' 2005 Annual Report on Form 10-K, and 2006 Quarterly Reports on Form 10-Q in (a) Forward Looking Statements (b) Risk Factors, and (c) Management's Discussion and Analysis of Financial Condition and Results of Operations and (2) other factors discussed in filings with the SEC by the PSEG Companies. A discussion of risks associated with the proposed merger of Exelon and PSEG is included in the joint proxy statement/prospectus that Exelon filed with the SEC pursuant to Rule 424(b)(3) on June 3, 2005 (Registration No. 333-122704). Readers are cautioned not to place undue reliance on these forward-looking statements, which apply only as of the date of this presentation. None of the Exelon Companies or the PSEG Companies undertakes any obligation to publicly release any revision to its forward-looking statements to reflect events or circumstances after the date of this presentation. |

| Agenda Tom O'Flynn Executive VP and CFO Public Service Enterprise Group John Young Executive VP, Finance and Markets, and CFO Exelon Corporation PSEG Update Exelon Update Merger Update |

| PSEG Update |

| PSEG Overview Electric Customers: 2.1M Gas Customers: 1.7M Nuclear Capacity: 3,494 MW Total Capacity: 14,636 MW Traditional T&D Leveraged Leases 2006E Operating Earnings(1)(2): $875M - $950M 2006 EPS Guidance(1)(2): $3.45 - $3.75 Assets (as of 12/31/05): $ 29.8B Domestic/Int'l Energy Regional Wholesale Energy Includes the parent impact of $(60-70)M Income from Continuing Operations, excluding merger-related costs (3) Income from Continuing Operations, excluding merger-related costs of $3M for PSE&G and $12M for PSEG Power 2005 Results: $347M(3) $418M(3) $196M 2006 Range: $250M - $270M(2) $500M - $550M(2) $185M - $205M |

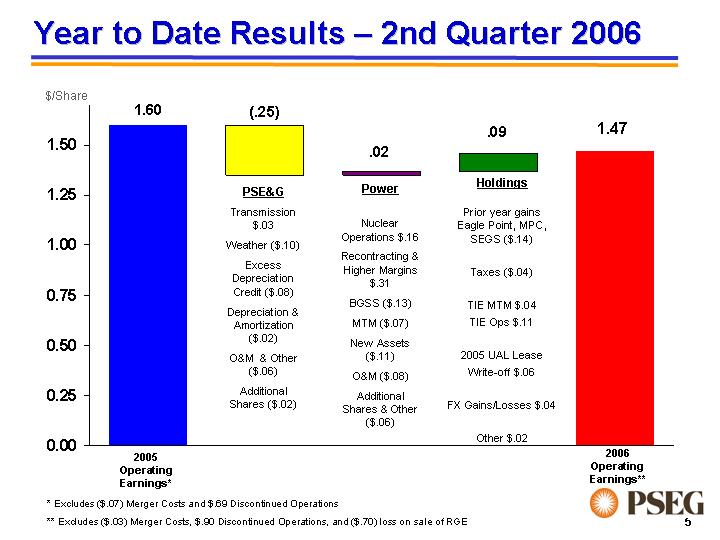

| 2005 2006 1.35 1.35 1.37 activity 1.6 1.47 negative activity 0.25 0.02 0.09 Power Nuclear Operations $.16 Recontracting & Higher Margins $.31 BGSS ($.13) MTM ($.07) Depreciation on New Assets ($.11) O&M ($.08) Additional Shares & Other ($.06) $/Share Holdings Prior year gains Eagle Point, MPC, SEGS ($.14) Taxes ($.04) Texas Ops $.15, including MTM of $.04 2005 United Lease Write-off $.06 FX Gains/Losses $.04 Other $.02 PSE&G Transmission $.03 Weather ($.10) Excess Depreciation Credit ($.08) Depreciation & Amortization ($.02) O&M & Other ($.06) Additional Shares ($.02) Year to Date Results - 2nd Quarter 2006 2006 Operating Earnings** 2005 Operating Earnings* * Excludes ($.07) Merger Costs and $.69 Discontinued Operations ** Excludes ($.03) Merger Costs, $.90 Discontinued Operations, and ($.70) loss on sale of RGE 1.47 ($.14) |

| PSEG Power Overview Nuclear Nuclear Operating Services Agreement 2005 - record output 2006 - year to date output exceeds 2005 at each unit Fossil Increased output over 2005 Improved performance Margin Growth 2006 - energy recontracting improvements 2007 and beyond - energy recontracting and capacity market improvements |

| NYMEX Natural Gas PJM West RTC Henry Hub $/MBTU PJM West RTC $/Mwh PJM Pricing Environment Electricity and Natural Gas Forward Price Movements 2003 - 2007 |

| BGS Auction Results Transmission Ancillary services Load shape Congestion Risk premium Capacity RTC Forward Energy Cost RTC = round the clock Full Requirements 2003 Auction 2004 Auction 2005 Auction 2006 Auction East 34 37 45.14 67.7 West 21.59 18.05 20.77 34.51 $33 - $34 $36 - $37 $55.59 (34 Month NJ Avg.) $55.05 (36 Month NJ Avg.) $65.91 (36 Month NJ Avg.) $44 - $46 ~ $21 ~ $18 ~ $21 $102.21 (36 Month NJ Avg.) $67 - $70 ~ $32 Increase in Full Requirements Component Due to: Increased Congestion (East/West Basis) Anticipated Increase in Capacity Markets/RPM Higher Volatility in Market Increases Risk Premium |

| > 95% 85 - 95% 65 - 80% 2006 2007 2008 % Hedged Significant Forward Hedging of Nuclear and Coal |

| PSE&G / Holdings Overview PSE&G Providing safe, reliable, low-cost service Merger issues & rate relief requirements Manageable infrastructure improvements Energy Holdings Significant monetization / debt pay downs Stability in international operations Strong performance in Texas |

| 2005 Actual Markets Operations New Assets Leases Other 2006 Guidance 2007 2008 West 890 890 1049 1010 966 914 0 0 0 Seminole 159 48 87 33 17 918 1000 1100 NDT 35 Weather Driven by Power Recontracting at Higher Commodity Prices $3.45 $3.65* PSEG Stand-Alone 2006 Earnings Guidance More than 10% Growth Each Year 244M Avg. Shares 253M Avg. Shares NDT Normal Weather * Excludes 14 cents per share of merger costs that are included in Income from Continuing Operations ** Excluding merger costs that are included in Income from Continuing Operations NDT = nuclear decommissioning trust $3.75** to |

| Merger Update |

| Merger Update - NJ Negotiations NJ BPU approval is the final regulatory action needed to complete the merger Series of discussions conducted with parties in NJ to arrive at "best offer" proposal Exelon and PSEG Boards will reassess and make final decision once NJ requirements are known Exelon announced an approximate $55M pre-tax write-off of capitalized merger costs in 3Q06 due to management's determination that probability of merger completion is no longer "more likely than not" |

| Lehman Brothers 2006 CEO Energy/Power Conference New York City September 6, 2006 |