- PEG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Public Service Enterprise (PEG) 8-KRegulation FD Disclosure

Filed: 29 Jun 10, 12:00am

PSEG Public Service Enterprise Group California Investor Meetings June 29 - 30, 2010 Exhibit 99 |

2 Forward-Looking Statement Readers are cautioned that statements contained in this presentation about our and our subsidiaries' future performance, including future revenues, earnings, strategies, prospects and all other statements that are not purely historical, are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Although we believe that our expectations are based on reasonable assumptions, we can give no assurance they will be achieved. The results or events predicted in these statements may differ materially from actual results or events. Factors which could cause results or events to differ from current expectations include, but are not limited to: • Adverse changes in energy industry law, policies and regulation, including market structures and rules and reliability standards. • Any inability of our transmission and distribution businesses to obtain adequate and timely rate relief and regulatory approvals from federal and state regulators. • Changes in federal and state environmental regulations that could increase our costs or limit operations of our generating units. • Changes in nuclear regulation and/or developments in the nuclear power industry generally that could limit operations of our nuclear generating units. • Actions or activities at one of our nuclear units located on a multi-unit site that might adversely affect our ability to continue to operate that unit or other units located at the same site. • Any inability to balance our energy obligations, available supply and trading risks. • Any deterioration in our credit quality. • Availability of capital and credit at commercially reasonable terms and conditions and our ability to meet cash needs. • Any inability to realize anticipated tax benefits or retain tax credits. • Changes in the cost of, or interruption in the supply of, fuel and other commodities necessary to the operation of our generating units. • Delays or unforeseen cost escalations in our construction and development activities. • Increase in competition in energy markets in which we compete. • Adverse performance of our decommissioning and defined benefit plan trust fund investments, and changes in discount rates and funding requirements. • Changes in technology and increased customer conservation. For further information, please refer to our Annual Report on Form 10-K, including Item 1A. Risk Factors, and subsequent reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission. These documents address in further detail our business, industry issues and other factors that could cause actual results to differ materially from those indicated in this presentation. In addition, any forward-looking statements included herein represent our estimates only as of today and should not be relied upon as representing our estimates as of any subsequent date. While we may elect to update forward-looking statements from time to time, we specifically disclaim any obligation to do so, even if our internal estimates change, unless otherwise required by applicable securities laws. |

3 GAAP Disclaimer PSEG presents Operating Earnings in addition to its Net Income reported in accordance with accounting principles generally accepted in the United States (GAAP). Operating Earnings is a non-GAAP financial measure that differs from Net Income because it excludes the impact of mark-to-market activity, Nuclear Decommissioning Trust Fund related activity, the sale of certain non-core domestic and international assets and material impairments and lease-transaction-related charges. PSEG presents Operating Earnings because management believes that it is appropriate for investors to consider results excluding these items in addition to the results reported in accordance with GAAP. PSEG believes that the non-GAAP financial measure of Operating Earnings provides a consistent and comparable measure of performance of its businesses to help shareholders understand performance trends. This information is not intended to be viewed as an alternative to GAAP information. The last two slides in this presentation include a list of items excluded from Net Income to reconcile to Operating Earnings, with a reference to that slide included on each of the slides where the non-GAAP information appears. |

PSEG – Defining the Future Ralph Izzo Chairman, President and Chief Executive Officer Caroline Dorsa Executive Vice President and Chief Financial Officer Kathleen A. Lally Vice President, Investor Relations |

5 PSEG: the right mix for the opportunities of today and tomorrow Electric & Gas Delivery and Transmission Regional Wholesale Energy Renewable Investments PSE&G positioned to meet NJ’s energy policy and economic growth objectives with $5.3 billion investment program. PSEG Power’s low-cost baseload nuclear and coal fleet is geographically well positioned and environmentally responsible. PSEG Energy Holdings positioned to pursue attractive renewable generation opportunities: • Solar • Offshore wind • Compressed Air Energy Storage (CAES) |

6 A successful track record… … provides the confidence to capitalize on the opportunities of tomorrow. PSEG Power resumed independent control of nuclear fleet, produced record levels of generation and achieved top quartile performance; fossil fleet retrofitted to meet more stringent environmental requirements. PSE&G consistently recognized for reliability; investment programs expanded to meet NJ’s goals for economic growth and clean energy. Business focus improved; balance sheet strengthened; Holdings’ financial risk lessened with sale of international investments, termination of offshore leases Operational and financial focus has allowed PSEG to meet/exceed earnings objectives in each of the past three years. History of returning cash to shareholders through common dividend. 2007 2008 2009 |

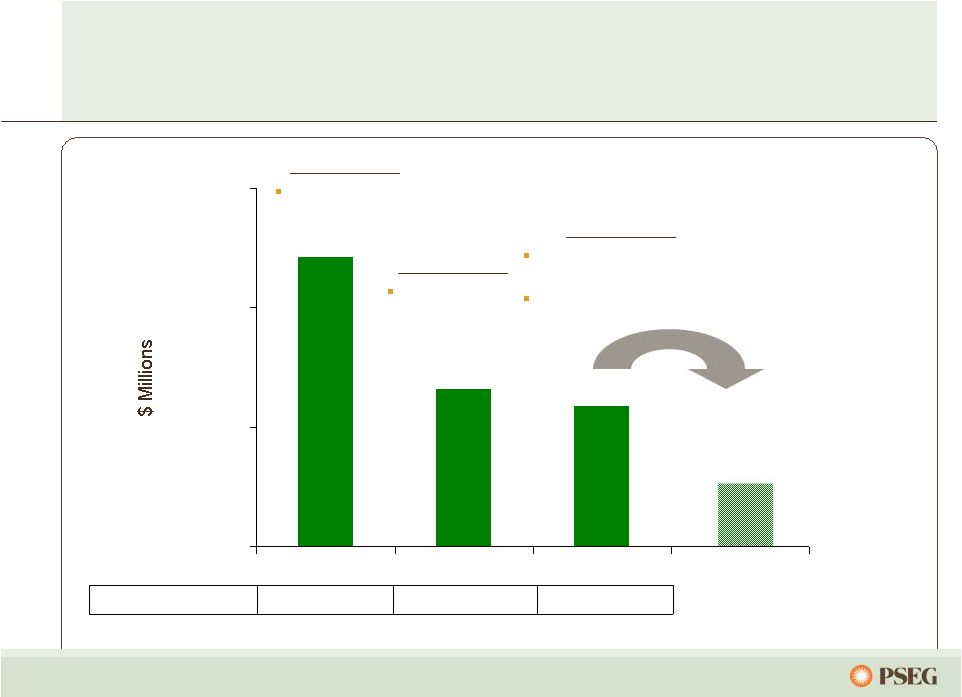

7 Earnings growth achieved… … through higher pricing, increased production and lower costs. $2.68 $3.03 $3.12 2007 Operating Earnings* 2008 Operating Earnings* 2009 Operating Earnings* * See page 71 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

8 Investment programs, hedge profile and cost control support 2010 outlook $3.12 $3.00 - $3.25 2009 Operating Earnings* 2010 Guidance * See page 71 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

Tomorrow’s energy market will reward… …an operationally efficient, environmentally responsible, integrated generation, transmission and distribution business. Higher margins driven by environmentally responsible & operationally flexible energy supply Superior operations = customer satisfaction + higher value Business driven by the need to address environmental issues and stable pricing Infrastructure investment to support reliability + improve performance 9 |

10 A $7.7 billion investment program over 2010 – 2012… … supports long-term growth. |

11 PSEG is advantaged… … with a strong balance sheet and cash flow to pursue an investment program that seizes the opportunities of tomorrow. Right Assets, Right Markets Operational Flexibility Environmental Infrastructure Improvements 2010 Integrated business model with assets located close to load centers Dispatch flexibility of operating assets and trading capability supports margins in full-requirements markets Environmentally responsible; pursuing investments in renewables; nuclear uprates Investments to improve reliability and functionality of grid |

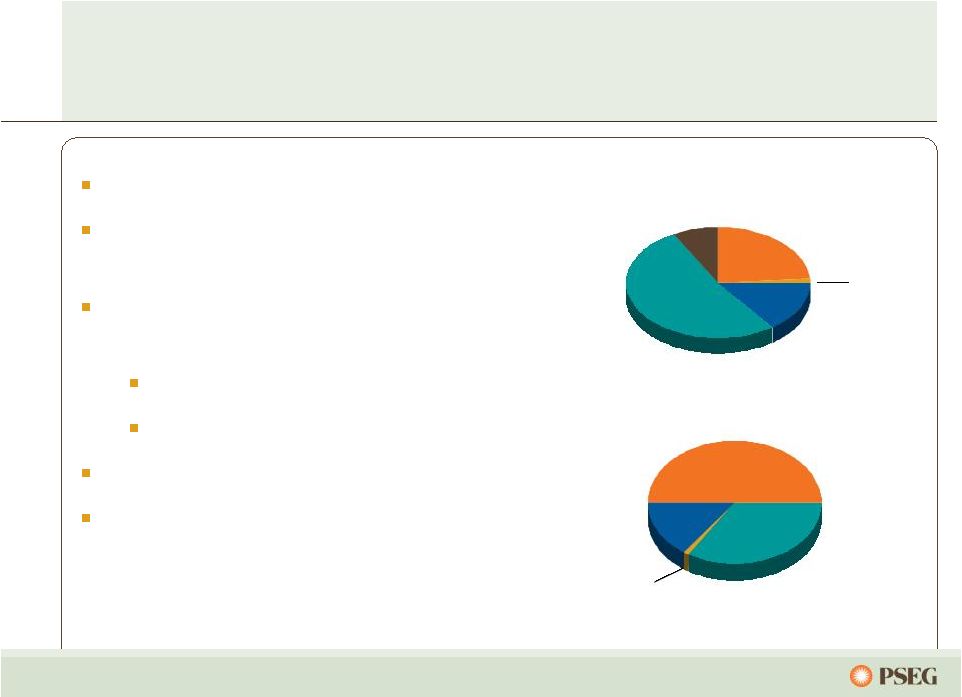

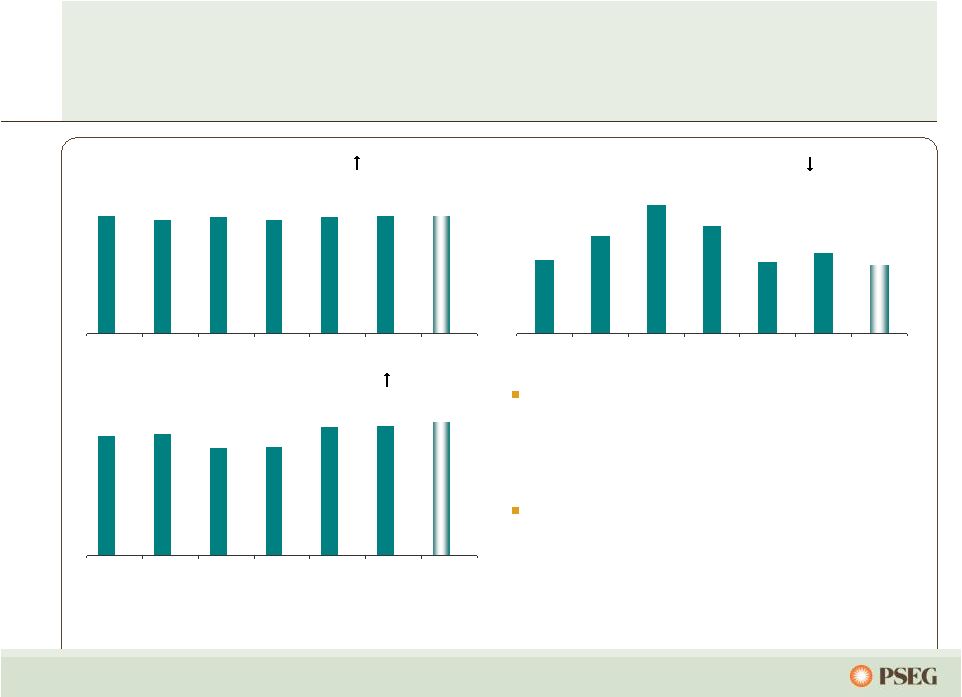

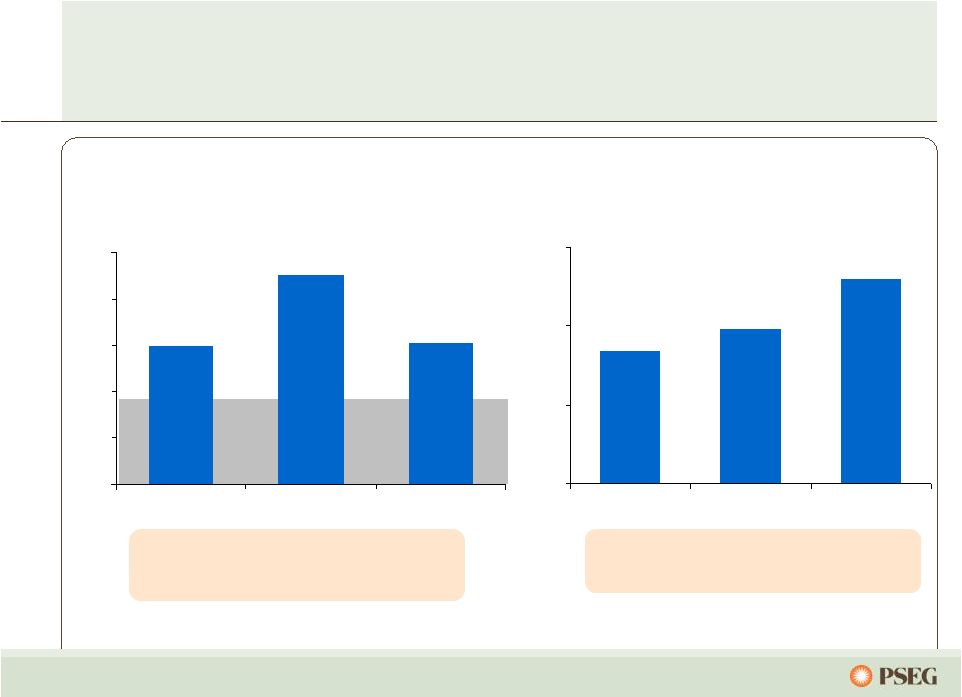

12 PSEG has provided investors with a better than average return… … and we are positioned to deliver value over the long-term. 5 year* 10 year* 3 year* *For the period ended December 31, 2009. -10 -5 0 5 10 15 20 PSEG S&P 500 Electrics Dow Jones Utility Average 0 20 40 60 PSEG S&P 500 Electrics Dow Jones Utility Average 0 50 100 150 200 PSEG S&P 500 Electrics Dow Jones Utility Average |

13 *Indicated annual dividend rate Seventh consecutive annual dividend increase is part of a 103-year history of paying common dividends… 43% 70% 44% Payout Ratio 42 – 46% 43% 66% 63% Dividends per Share … and we remain comfortably within our targeted 40-50% payout range. $1.10 $1.12 $1.14 $1.17 $1.29 $1.33 $1.37* 2004 2005 2006 2007 2008 2009 2010 |

14 PSEG is responding to investors’ questions PSE&G’s capital programs have nominal impact on rates Stable supply costs provide room for regulatory support of capital programs What is the impact on customer from capital programs? Strong PSEG cash flow and approved PSE&G capital structure support financing requirements Do you need equity? Downside risk limited by recent auction results which incorporated lower market energy prices Physical assets provide optionality What is the impact of migration? Modest payout ratio and strong balance sheet provide support – 7 consecutive annual increase Is dividend secure? Multi-year hedging through participation in full-requirements auctions Asset balance dampens relative fuel price volatility Capacity markets provide stability What’s the impact of commodity volatility? Environmentally advantaged Federal and State Policy initiatives support capital plans How is PSEG affected by policy changes? PSEG Position Investors’ Questions th |

PSEG Power – Review and Outlook |

16 PSEG Power – Right assets in the right markets… Portfolio approach to hedging over multi-year timeframe to derive market premiums Investment program supported by strong cash flow and credit metrics Low-cost, environmentally responsible, operationally flexible supply located in premium markets Focus on operational excellence to maximize asset value … with dispatch flexibility supporting returns in volatile markets. |

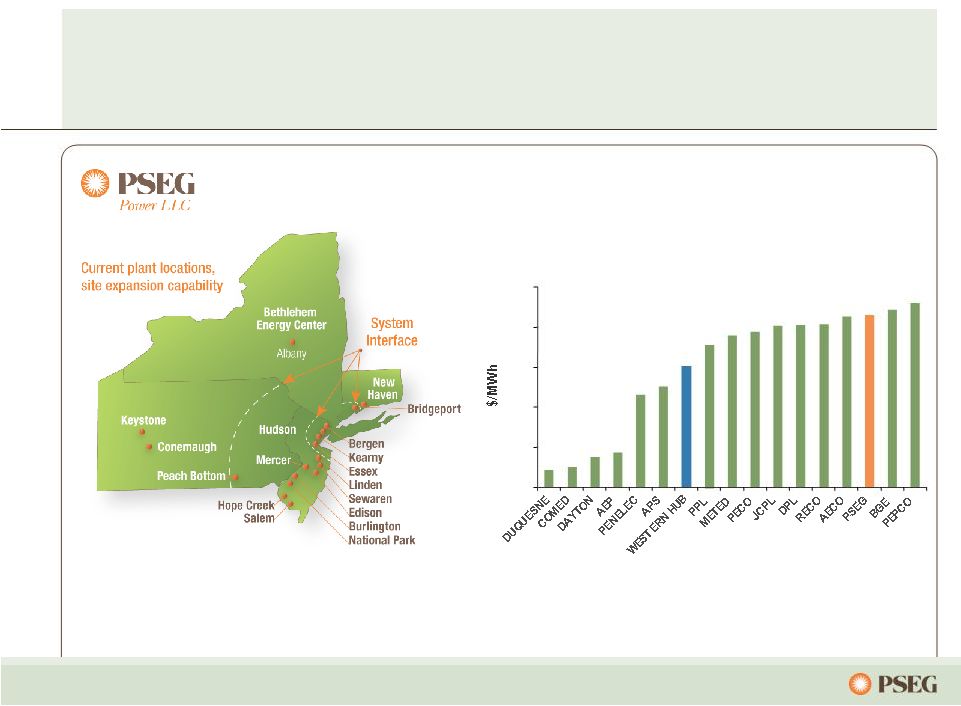

17 Low-cost portfolio Regional focus in competitive, liquid markets Assets favorably located near customers/load centers Many units east of PJM constraints Southern NEPOOL/ Connecticut Texas assets – low cost combined cycle Market knowledge and experience to maximize the value of our assets … with low cost plants, in good locations, within solid markets. Power’s assets drive value in a dynamic environment… 15% 52% 8% Fuel Diversity Coal Gas Oil Nuclear Pumped Storage 1% Energy Produced (Twelve months ended December 31, 2009) Total GWh: 59,808 51% 15% 34% Pumped Storage & Oil <1% Nuclear Coal Gas Total MW: 15,548 24% 8% |

18 Power’s Northeast assets are located in attractive markets near load centers … ... and the fleet has expanded to include 2,000MW in Texas. |

19 … while maintaining optionality under a variety of conditions. Power’s PJM assets along the dispatch curve reduce the risk of serving full requirement load contracts… X X Ancillary Revenue X X X X Capacity Revenue X X Energy Revenue X X Dual Fuel Salem Nuclear Coal Combined Cycle Steam Peaking Peaking units Baseload units Load following units Illustrative Hope Creek Keystone Conemaugh Hudson 2 Linden 1,2 Burlington 8-9-11 Edison 1-2-3 Essex 10-11-12 Bergen 1 Sewaren 1-4 Hudson 1 Mercer1, 2 Bergen 2 Sewaren 6 Mercer 3 Kearny 10-11 Linden 5-8 / Essex 9 Burlington 12 / Kearny 12 Peach Bottom Yards Creek National Park Salem 3 Bergen 3 |

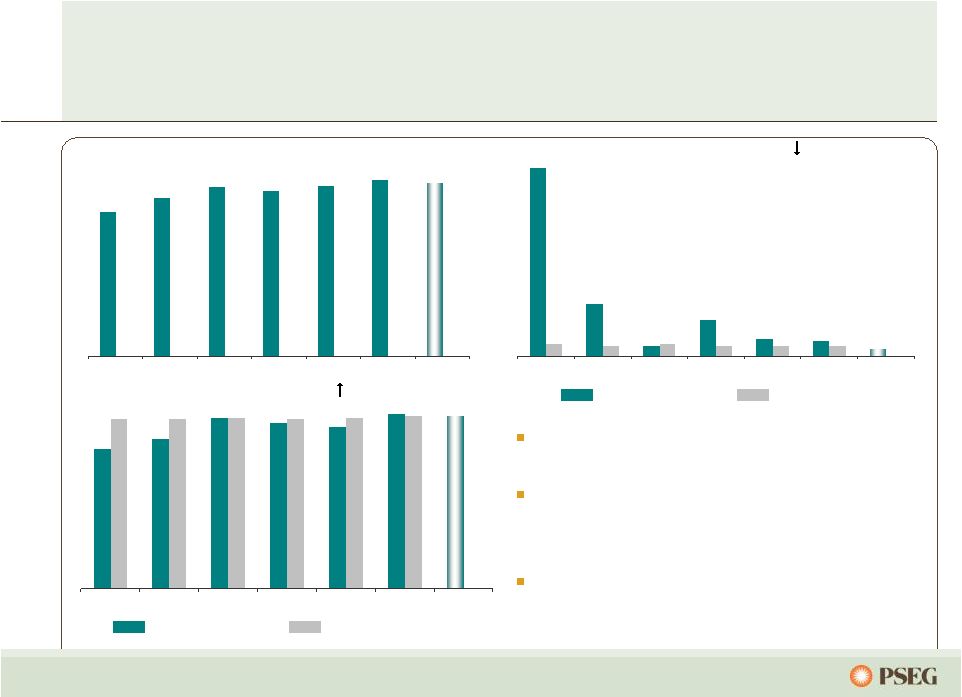

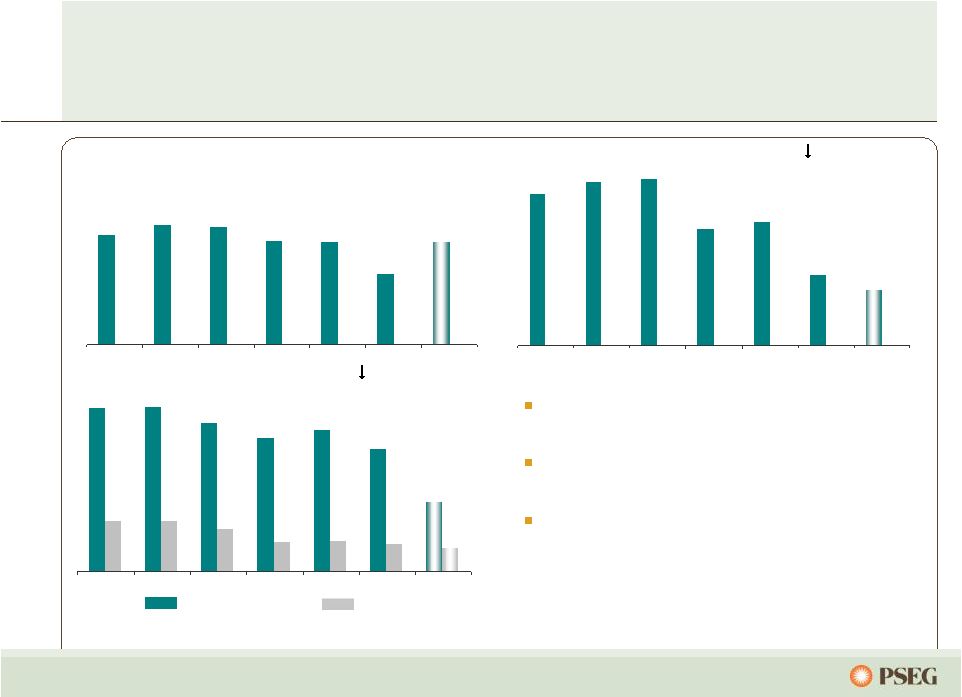

20 Our nuclear performance has improved… 11.1 3.1 0.6 2.1 1.0 0.9 0.4 0.7 0.6 0.7 0.6 0.6 0.6 2004 2005 2006 2007 2008 2009 2010 Target 25 27 29 28 29 30 30 2004 2005 2006 2007 2008 2009 2010 Target 79.0 85.0 97.0 94.0 91.7 99.0 98.0 96 96 97 96 97 98 2004 2005 2006 2007 2008 2009 2010 Target Salem station set a new generation record. Highest combined Salem and Hope Creek Nuclear site output in Power’s history Top quartile INPO Index … as we maintain our drive for excellence. Nuclear Generation Output* (000’s GWh) Forced Loss Rate ( ) (%) INPO Index ( ) NJ Units 1 Quartile NJ Units 1 Quartile * Total PS share nuclear generation st st |

21 SO 2 … and back-end technology investments will prepare us for the future. Power’s coal fleet has shown improvement… 14 15 15 13 13 9 13 2004 2005 2006 2007 2008 2009 2010 Target 10.3 11.1 11.3 7.9 8.4 4.8 3.8 2004 2005 2006 2007 2008 2009 2010 Target Market conditions reduced output in 2009 Operational results greatly improved Environmental footprint improved Output (000’s GWh) Forced Outage Rate ( ) (% EFORD) SO 2 and NOx Rates ( ) (lb/mmbtu) NOx 1.11 1.12 1.01 0.91 0.96 0.83 0.47 0.34 0.34 0.29 0.20 0.21 0.19 0.16 2004 2005 2006 2007 2008 2009 2010 Target |

22 Power’s combined cycle fleet is creating value… 5 4 8 10 20 20 18 2004 2005 2006 2007 2008* 2009* 2010 Target* 3.4 7 3.4 2.5 1.8 1.5 0.8 2004 2005 2006 2007 2008* 2009* 2010 Target* 8079 7847 7928 7768 7587 7507 7452 2004 2005 2006 2007 2008* 2009* 2010 Target* Output (000’s GWh) Forced Outage Rate ( ) (% EFORD) Period Heat Rate ( ) (mmbtu/KWh) Highest output ever in 2009 Approaching top quartile forced outage rate Benefiting from heat rate improvement program … benefiting from operating enhancements and market dynamics. * Includes Texas |

23 Our peaking fleet rounds out a diverse generation portfolio… 13 17 23 19 13 14 12 2004 2005 2006 2007 2008 2009 2010 Target 85 86 76 77 91 92 94 2004 2005 2006 2007 2008 2009 2010 Target Peaking start success provides opportunities in ancillary and real time markets Peaking adds flexibility in serving load and managing needs of a diverse market environment … and provides ability to follow load during periods of high demand. % Start Success ( ) Forced Outage Rate ( ) (% EFORD) Equivalent Availability ( ) (%) 99.7 96.5 98.6 97.0 98.9 99.3 99.7 2004 2005 2006 2007 2008 2009 2010 Target |

24 Stringent environmental challenges are on the horizon, with potentially broad industry impacts… High High Regional High High Industry Impact Emission restrictions net favorable to Power Carbon Controls on coal units done or under way Power’s relative position very strong NOx, SO 2 , Hg (CAIR) Peaking fleet replacement strategy Upwind states anticipated to increase NOx stringency Ozone air quality standards (HEDD) EPA required to perform cost-benefit analysis Issue widely shared across industry Potential capital spend exposure Once-through cooling water (316(b)) Power uses dry fly ash systems Ash has been tested as non-hazardous Coal ash regulation Power’s Positioning Issue …but Power’s clean fleet is very competitively positioned for success. |

25 Source: EPA, EIA (2006 and 2007) and PSEG Projection Power’s coal assets will have completed many environmental upgrades by 2010… …resulting in dramatically lower emissions. PSEG Projected NOX Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Conemaugh Hudson Bridgeport Mercer Keystone NOx Keystone Bridgeport Conemaugh Hudson Mercer SO 2 PSEG Projected SO2 Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Keystone Conemaugh Bridgeport Mercer Mercury PSEG Projected HG Emission Rate for 2011 versus 2008 400 U.S. Coal Plants Hudson 0 2 4 6 8 10 12 14 0 10 20 30 40 50 60 0 50 100 150 200 250 |

26 Power remains a leading provider in an excellent market… Pricing in 2009 was impacted by low economic demand, cool summer weather, and low gas prices Power’s hedging strategy enabled strong results 2010 forwards imply continued market challenges, but entities with the right assets in the right locations are best positioned Power will continue to utilize a hedging strategy that incorporates full requirement load contracts and other contracting to secure pricing over a 2-3 year forward horizon BGS continues to be the foundation of our hedging strategy Balanced generation portfolio in ideal position to serve BGS Three year nature of BGS provides pricing stability for customers and providers … and has a fleet ideally positioned to serve customers. |

27 Full Requirements Component Increase in Capacity Markets/RPM Growing Renewable Energy Requirements Component for Market Risk Through Power’s participation in each of the BGS auctions… Market Perspective – BGS Auction Results … we have developed an expertise in serving full-requirements contracts. 2003 2004 2005 2006 2007 2008 2009 2010 3 Year Average Round the Clock PJM West Forward Energy Price $55.59 Capacity Load shape Transmission Congestion Ancillary services Risk premium Green $33 - $34 $36 - $37 $44 - $46 $67 - $70 $58 - $60 $68 - $71 $56 - $58 $48 - $50 ~ $21 $55.05 ~ $18 $65.41 ~ $21 $102.51 ~ $32 $98.88 ~ $41 $111.50 ~ $43 $103.72 ~ $47 $95.77 ~ $47 Note: BGS prices reflect PSE&G Zone |

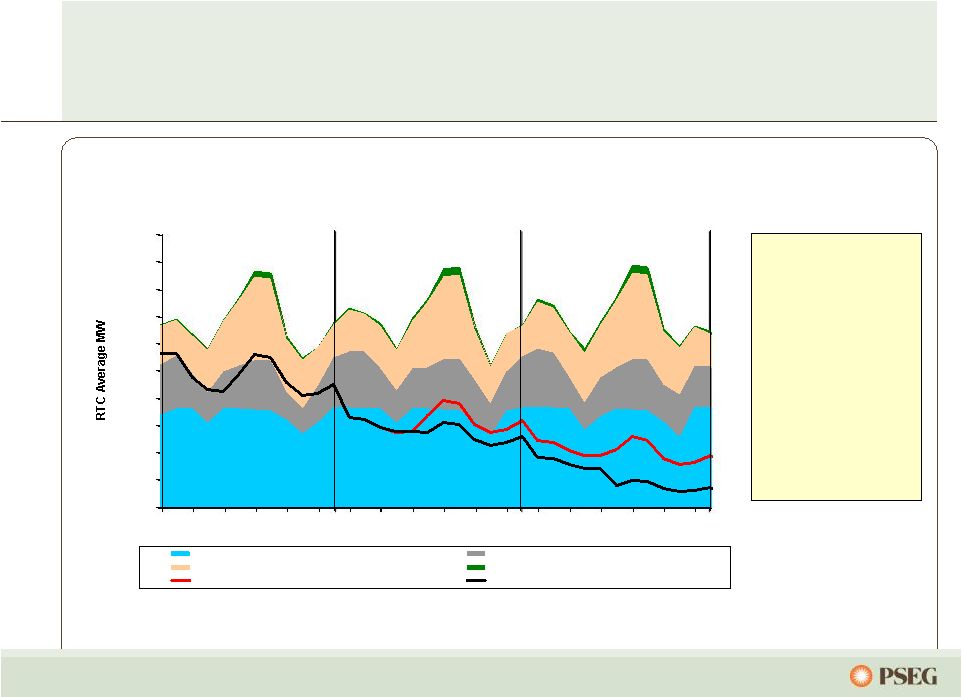

28 The result of Power’s hedging strategy is a portfolio of contracted output… … which dampens the impact of market volatility on earnings in the near term. Power’s anticipated nuclear and coal output is contracted over the next few years: 2010: 90-95% 2011: 50-60% 2012: 15-30% Nuclear / Pumped Storage Coal Combined Cycle (CC) Steam and Peakers Existing BGS, Other Load Contracts, Hedges + Future BGS Existing BGS, Other Load Contracts, and Hedges Total Fleet RTC Average 2010 2011 2012 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 |

29 Power’s coal hedging reflects supply matched with sales… … while maintaining flexibility on supply post BET installation. 0% 20% 40% 60% 80% 100% 2010 2011 2012 $0 $10 $20 $30 $40 $50 Contracted Coal Mid $20’s To High $20’s Mid $20’s To High $20’s Mid $40’s To Low $40’s Mid $40’s To Low $40’s High $40’s To Mid $40’s Indicative Pricing ($/MWh) Prices lower, moderating Northern Appalachian Conemaugh Prices lower, moderating Northern Appalachian Keystone More limited segment of coal market Metallurgical CAPP/NAPP Mercer Flexibility after BET in 2010 Adaro (2010) CAPP/NAPP (2011+) Hudson Higher price, lower BTU, enviro coal Adaro Bridgeport Harbor Comments Coal Type Station % Hedged (left scale) $/MWh (right scale) * *Reflects Keystone and Conemaugh contracts |

30 $0 $5 $10 2010 2011 2012 Anticipated Nuclear Fuel Cost Power has hedged its nuclear fuel needs through 2012… … with increased costs over that time horizon. Hedged |

$40 $45 $50 $55 $60 $65 Power’s assets are well positioned near load centers… … which resulted in a 9% growth in PJM gross margin from 2008 to 2009. Historical 5-year Average PJM Energy Price (Around the Clock) Note: excludes Dominion (less than 5 years of history) 31 |

32 … with sites in the eastern part of PJM. Reliability Pricing Model – locational value of Power’s generating fleet recognized… With nearly 1/3 of its capacity in PS North and nearly 2/3 of its capacity in MAAC and EMAAC, Power’s assets in congested locations received higher pricing in the 2013/2014 RPM Auction. • Locational value of Power’s fleet recognized • Bid for 90MW of new capacity accepted for 2013/2014 auction; in-service June 2013 • On schedule to complete 178MW of previously cleared peaking capacity by June 2012 $27.73 $16.46 $110.00 $174.29 $102.04 Rest of Pool $245.00 $185.00 PSEG North Zone $245.00 PSEG $133.37 $139.73 2012 / 2013 $226.15 $245.00 2013/2014 $110.00 $174.29 $191.32 MAAC $110.00 $174.29 $191.32 Eastern MAAC 2011 / 2012 2010 / 2011 2009 / 2010 $/MW-day PJM Zones PJM Capacity Available to Receive Auction Pricing 0 2,000 4,000 6,000 8,000 10,000 12,000 09/10 10/11 11/12 12/13 13/14 |

33 0% 25% 50% 75% 100% 2010 2011 2012 $0 $10 $20 $30 $40 $50 $60 $70 $80 $90 0% 25% 50% 75% 100% 2010 2011 2012 $0 $50 $100 $150 Power’s hedging program provides near- term stability from market volatility… … while remaining open to long-term market forces. Estimated EPS impact of $10/MWh PJM West around the clock price change* (~$2/mmbtu gas change) Contracted Capacity Price (right scale) * As of March 31, 2010 Assuming normal market commodity correlation and demand ** Excludes Texas – No capacity market Power has contracted for a considerable percentage of its future output over the next two years at attractive prices. The pricing for most of Power’s capacity has been fixed through May 2014, with the completion of auctions in PJM and NE. % sold (left scale) $0.30 - $0.60 $0.10 - $0.30 $0.05 - $0.10 Contracted Energy Price (right scale) % sold (left scale) ** * |

PSE&G – Review and Outlook |

35 PSE&G is positioned for growth… …through investments in infrastructure, renewables and energy efficiency. Leader in reliability; focused on maintaining position by improving customer responsiveness and efficiency Economically meeting mandates for reliability, service quality and access to renewables Largest provider of electric and gas distribution services and transmission in NJ. Creating renewable and energy efficiency solutions for NJ customers Focused on regulatory mechanisms that provide reasonable and current recovery of and return on capital |

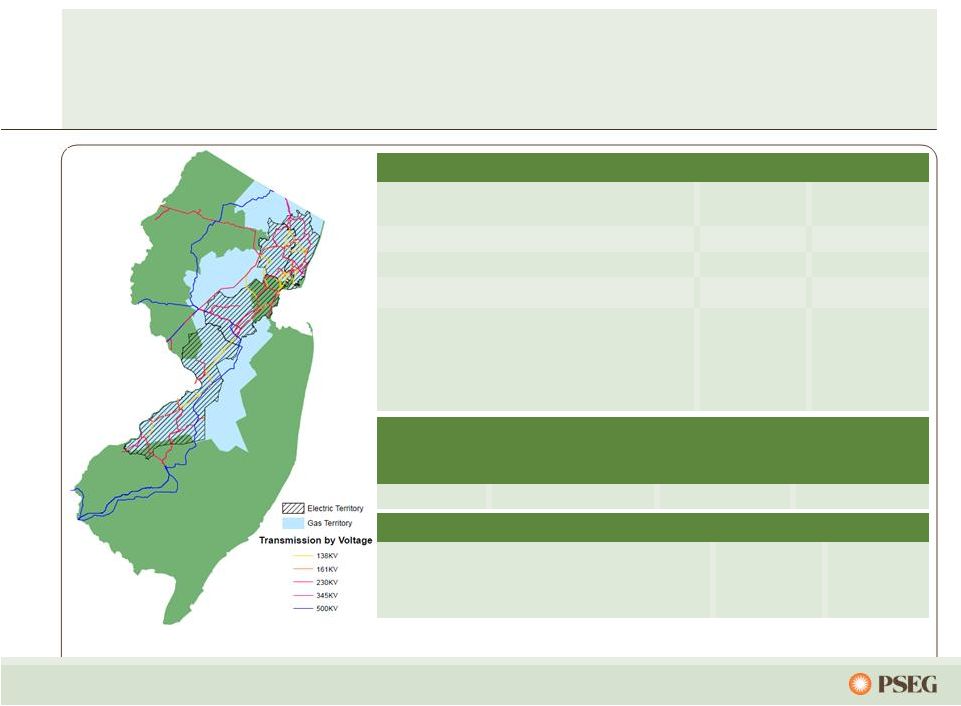

PSE&G is the largest utility in New Jersey providing electric, gas and transmission services,… …and delivering renewable and energy efficiency solutions for customers. * Actual ** Weather normalized = estimated annual growth per year over forecast period *** Lifetime GWh + Lifetime Dtherms converted to GWh 60% 31% Residential 36% 58% Commercial 0.4%** 0.4% - 1.3%** Projected Annual Load Growth (2009 – 2012) Sales Mix 3,500 M Therms 41,961 GWh Electric Sales and Gas Sold and Transported (0.4%)* (0.6%)* Historical Annual Load Growth (2005 - 2009) 4% 11% Industrial 1.7 Million 3.2% Gas 2.1 Million 3.0% Customers Growth (2004 – 2009) Electric 0.5%* Historical Annual Peak Load Growth 2005-2009 1,442 Network Circuit Miles Key Statistics Transmission 2.1%** Projected PJM Peak Load Growth 2009-2012 13,512 GWh 230 GWh Energy Efficiency Initiative (lifetime equivalent)*** 80 MW 1 MW Solar 4 All 11.6 MW 2009 Renewables and Energy Efficiency Solar Loan 81 MW Total 36 |

37 …which creates superior value to customers. PSE&G provides the highest reliability at below average cost... SAIDI VS O&M $- $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 $9.00 $10.00 0 50 100 150 200 250 300 350 System Average Interruption Duration Index (SAIDI) PSE&G |

38 Our 2010 – 2012 capital plan calls for investing $ 5.3 billion… 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2009 2010 2011 2012 NJ Infrastructure Stimulus Solar Energy Efficiency Transmission Core Investment …with contemporaneous recovery mechanisms approved for $3.6 billion. |

39 Branchburg Branchburg Roseland Roseland Hopatcong Hopatcong Hudson Hudson Transmission investment recovery… Future Transmission project spending will be influenced by PJM evaluation, potentially adding $1.5B in additional projects over 2010 – 2015. Various $300 14 69kV Reliability projects thru 2012 Various $200 20 Approved RTEP projects thru 2012 125 bps 2013 $1,100 Branchburg-Roseland-Hudson 125 bps 2012 $750 Susquehanna-Roseland Incentive In-Service Spending ($ Millions) …is supported by formula rate treatment and CWIP in rate base*. * Approval of CWIP for 500kV backbone projects. Transmission Projects Future Projects |

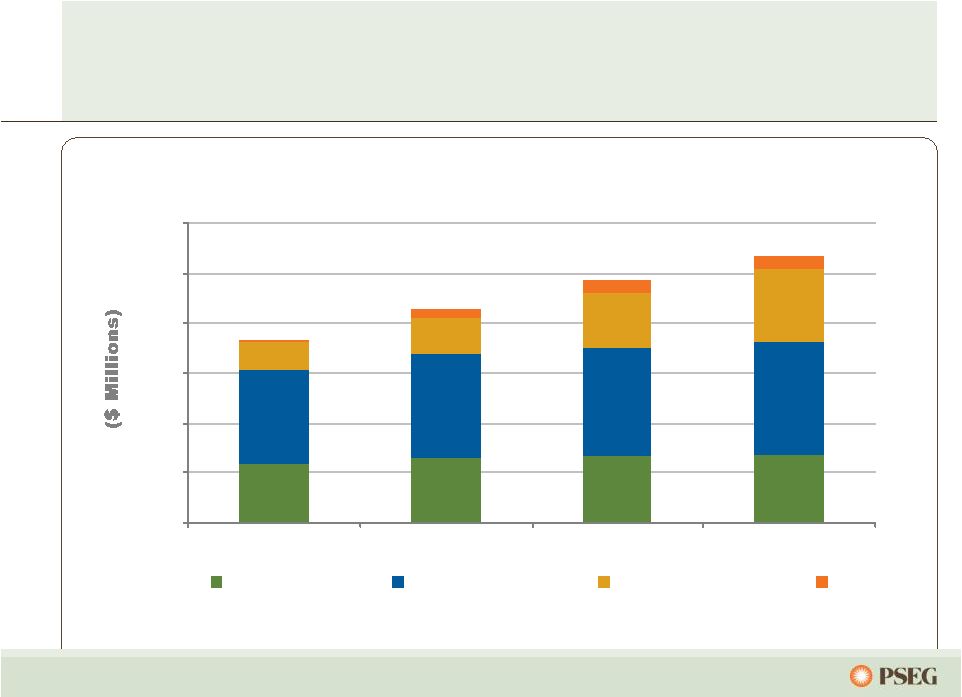

40 PSE&G’s investment program provides opportunity for 14% annualized growth in rate base PSE&G Rate Base 0 2,000 4,000 6,000 8,000 10,000 12,000 2009 2010 2011 2012 Gas Distribution Electric Distribution Electric Transmission EMP * * *projected rate base |

41 New Jersey Electric & Gas Rate Agreement -- A Balancing of Interests 51.2% Equity Ratio 11.25% Return on Equity $6.2B $2.3B $3.89B Rate Base $222.5M $74.0M $148.5M Increase Total Gas Electric 51.2% Equity Ratio 10.3% Return on Equity $6.0B $2.27B $3.75B Rate Base $100.0M $26.5M $73.5M Increase Total Gas Electric Request Agreement … in a difficult economic environment. |

42 PSE&G Rate Agreement Terms Rate Agreement approved by NJ Board of Public Utilities (BPU) on June 7, 2010. • The agreement, an increase in electric revenue of $73.5 million and gas revenue of $26.5 million, is based on a 10.3% return on equity and a 51.2% equity ratio on a $6.0 billion rate base. • The agreement provides for a gas weather normalization clause. • The agreement does not provide for trackers on pension costs and capital expenditures. • The agreement requires PSE&G to return $122 million of Market Transition Charges to customers over a 2-year period. • Agreement supports a review by the BPU of policy on consolidated tax accounting and recovery of Societal Benefits Charge. |

43 Regulatory Reform Working in New Jersey to build political and regulatory support for “Utility of the Future”... …to create shareholder and customer value. Transmission Backbone Projects Smart Grid/PHEV Infrastructure T&D Infrastructure Replacement Renewables Development Energy Efficiency Development |

PSEG Energy Holdings – Review and Outlook |

PSEG Energy Holdings Simplifying the business and creating sustainable growth opportunities. Streamlined business and reduced financial risk Maximizing the value of the remaining portfolio Transaction structures and partnerships mitigate financial risk Capitalizing on renewable opportunities 45 |

46 PSEG Energy Holdings… PSEG Global International assets sold* Texas generating assets (2 – 1,000MW CCGTs) transferred to PSEG Power Small remaining investment in domestic traditional generation joint venture assets PSEG Resources Tax exposure reduced by $740 million through fourteen LILO/SILO lease terminations, including Nuon termination in January 2010 Maximizing value and minimizing risk for traditional leases and real estate Long-term debt reduced by $1 billion over 2008 and 2009 Redemption of $642 million of Energy Holdings recourse debt $368 million eliminated through bond exchange $127 million of debt remaining … has streamlined its businesses and reduced its risk. * Nominal investment in Venezuela remaining |

PSEG Energy Holdings is focused on renewable energy opportunities Complementing PSEG portfolio by increasing earnings base with structured, low risk investments Disciplined evaluation of favorable markets for renewables Transaction structure and partnerships designed to mitigate risk Expand geographic and regulatory diversity Attractive and predictable returns Pursuing renewable strategy through three primary vehicles Solar Source LLC Energy Storage and Power LLC Garden State Offshore Energy LLC 47 |

Long-term off-take agreements with creditworthy counterparties Capitalizing on existing renewable markets Leveraging partnerships and alliances A 2MW solar facility developed and installed in 2009 An additional 27MW in construction for completion in 2010 20-30 year Power Purchase Agreements for energy, capacity and green attributes Low risk Engineering, Procurement & Construction contracts Projects that leverage the Investment Tax Credit ~$114M total investment to date … in the emergent solar industry. PSEG Solar Source is building a portfolio to take advantage of attractive opportunities… 48 |

PSEG – Financial Review and Outlook |

50 PSEG… …is focused on providing above average risk-adjusted returns. Top quartile performance in operations with year- over-year improvements and cost management. Maintain balance between risk and return through prudent balance sheet management Met/exceeded earnings and financial objectives Securing premium value in transparent, competitive markets; implementing mechanisms supporting cost recovery in reasonable timeframe |

51 $3.12* We have met or exceeded our earnings objectives … … and expect 2010 earnings to remain strong. Holdings PSE&G Power Parent Earnings per Share by Subsidiary $2.68* *See page 71 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings $3.00 - $3.25 $2.80 - $3.05 $2.30 - $2.50 Guidance Range $3.03* $(0.12) $0.14 $0.74 $1.92 $0.02 $(0.05) $0.09 $0.07 $0.63 $0.71 $2.38 $2.30 2007 2008 2009 |

52 Earnings were strong in 2009… …benefiting from pricing, cost control and risk mitigation. $3.12 $3.03 2008* PSE&G Power Holdings / Enterprise 2009* ($0.08) $0.08 $0.09 Interest 0.03 Debt Exchange Premium Eliminated in Consolidation 0.04 Recontracting and Lower Fuel Expense 0.04 BGSS and Wholesale Power Trading 0.01 O&M 0.02 Interest 0.03 Depreciation and Other (0.02) Margin – Gas, Electric, Transmission and Appliance Service 0.04 Weather (0.01) O&M (0.06) Depreciation (0.03) Taxes (0.03) Interest 0.01 2009 Lease Sales 0.13 Lease Income (0.04) Effective Tax Rate and Other (0.03) Debt Exchange Premium Eliminated in Consolidation (0.04) Holdings: Enterprise: *See page 71 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings |

53 $0.84 0.01 (0.01) (0.01) (0.10) $0.95 0.00 0.25 0.50 0.75 1.00 PSEG EPS Reconciliation – Q1 2010 versus Q1 2009 Q1 2010 operating earnings* Q1 2009 operating earnings* Interest Higher volume offset by lower prices (0.05) BGSS and trading (0.04) O&M (0.02) Increase in effective tax rate related to new healthcare legislation (0.02) Depreciation, interest and other 0.03 PSEG Power Weather (0.02) O&M (0.02) Electric margin 0.01 Transmission margin 0.01 Other 0.01 PSE&G PSEG Energy Holdings Enterprise Lower project earnings and lower gains on lease sales * See page 72 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

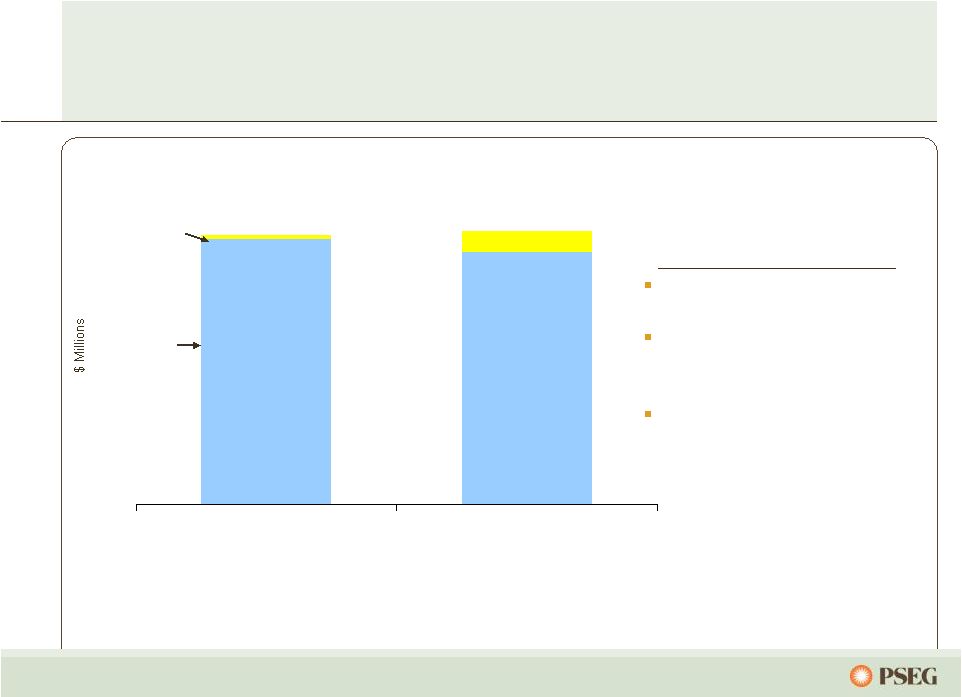

54 $2,091 $1,993 $163 $30 2008 2009 Sustainability Plan Non-pension O&M Expense (1) Pension Expense Manage Staffing Levels Control General and Administrative Expenses Capture Productivity Gains (1) Excludes O&M related to PSE&G clauses We have successfully managed our O&M … … through benchmarking efforts and operational excellence. $2,121M $2,156M |

55 Cash Exposure Net of $320M of IRS Deposits 12/31/08 12/31/09 1/31/10 4 5 17 # of LILO/SILO Leases 2009 Activities Terminated 12 LILO / SILO leases 2010 Activities Terminated 1 lease in January Pursue additional lease termination opportunities 2008 Activities Terminated 1 LILO / SILO lease Exposure to our potential lease tax liability… …was reduced with aggressive asset management. $660 ~$1,200 ~$270 ~$590 $- $500 $1,000 $1,500 |

56 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 2009 2010 2011 2012 PSEG Consolidated O&M (1) C.A.G.R. (’09 –’12) = 0.7% (1) Excludes O&M related to PSE&G clauses Aggressive employee management of our O&M, including 2010 wage freeze … …and improving pension expense, will result in modest O&M growth. * * * *estimated |

57 2009 Operating Earnings* 2010 Guidance Rigorous cost controls, hedging strategy and improved utility capital recovery… …help mitigate the risk of weak prices in 2010. $3.12 $3.00 - $3.25 PSE&G: Network Transmission Service (NTS) revenue increase for 2010 from 2009 ~ $0.03 EPS 2009 earned ROE = 8.3% 1% change in Distribution earned ROE in 2010 ~ $0.07 EPS 1% change in load in 2010 ~ $0.02 EPS PSEG Power: Revenue/Margin Nuclear output fully contracted Dark Spread change of $5/MWh at market – impact of $0.03-$0.07/share Spark Spread change of $5/MWh at market – impact of $0.08-$0.12/share Operations 1% change in nuclear capacity factor – impact of $0.01-$0.03/share O&M 1% change – impact of ~$0.01/share Drivers *See page 71 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings |

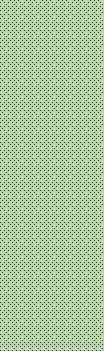

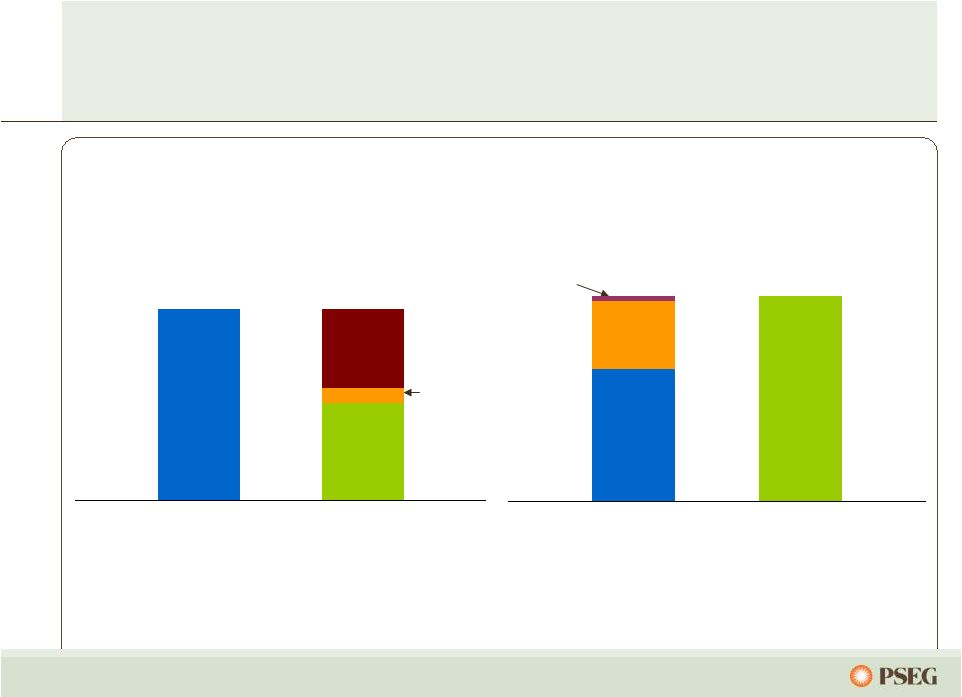

58 PSEG is shifting emphasis to growth investments… …to meet the requirements of the evolving energy markets. Maintenance / Regulatory Investments $2.5B Growth Investments $5.2B Capital Spending by Category Total 2010-2012 Capital: $7.7 Billion |

59 $0 $1,000 $2,000 $3,000 $4,000 $5,000 Sources Uses In 2009, we had substantial cash generation … PSEG Consolidated 2009 Sources and Uses Power Cash from Ops Shareholder Dividend Gross Lease Proceeds PSE&G Investment …which was applied toward improving our financial profile. Debt Redemptions Lease Termination Taxes & IRS Deposit Debt Issuances PSE&G Cash from Ops(1) Power Investment (1) PSE&G Cash from Operations adjusts for securitization principal repayments of ~ $190M Regulated investment Eliminated Parent Long-term debt and minimized Holdings’ debt Reduced Tax Risk |

60 Target = 51.2% • 2009 FFO to Debt remained strong comfortably above minimum threshold level • Decline from 2008 expected due to Power debt exchange which reduced Holdings refinancing risk 25% 30% 35% 40% 45% 50% 2007 2008 2009 PSEG Power Funds from Operations / Total Debt PSE&G Regulatory Equity Ratio Key credit measures support our planned investment program Our balance sheet also provides a platform for future growth. 40% 45% 50% 55% 2007 2008 2009 |

61 Sources Uses PSEG Power’s internally generated cash flow enables Power… … to strengthen its long term balance sheet; support the shareholder dividend; and, allows PSE&G to retain earnings for growth. Sources Uses Cash from Ops Net Debt Redemption Investment Dividends to Parent for payment to shareholders Power 2009–2012 Sources and Uses Cash from Ops* Net Debt Issuance Intercompany Capital Contribution Investment PSE&G �� 2009-2012 Sources and Uses * Cash from Operations adjusts for securitization principal repayments ~ $0.8B |

62 With our current facilities, PSEG/Power expects to have approximately $2.5 billion of credit capacity through 2012 ... Non-PSE&G Credit Capacity ...and we will continue to ensure adequate liquidity. Power facility reduced by $75M in 12/2011 PSEG facility reduced by $47M in 12/2011 $0.0 $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 2010 2011 2012 Power Syndicated Facility - 1.60B ¹ Expires 12/2012 Power 2-Year Facility - 0.35B Expires 7/2011 PSEG Syndicated Facility - 1.00B ² Expires 12/2012 1 2 |

63 PSEG value proposition PSEG provides investors with a balanced portfolio of assets within a shifting landscape for energy. PSEG’s focus on operational excellence and O&M control will yield benefits now, and over the long-term. PSEG’s capital commitments are focused on improving reliability and service quality at attractive risk-adjusted returns. PSEG’s strong balance sheet and cash flow support a capital program that will benefit shareholders through ongoing support of dividends and opportunity for future growth. |

64 PSEG is advantaged… … with a strong balance sheet and cash flow to pursue an investment program that seizes the opportunities of tomorrow. Right Assets, Right Markets Operational Flexibility Environmental Infrastructure Improvements Integrated business model with assets located close to load centers Dispatch flexibility of operating assets and trading capability supports margins in full-requirements markets Environmentally responsible; pursuing investments in renewables; nuclear uprates Investments to improve reliability and functionality of grid 2010 |

Appendix |

66 Q1 Operating Earnings by Subsidiary $ 482 (4) 11 123 $ 352 2009 $ 425 3 7 117 $ 298 2010 Operating Earnings Earnings per Share -- 0.01 Enterprise $ 0.95 $ 0.84 Operating Earnings* 0.02 0.01 PSEG Energy Holdings 0.24 0.23 PSE&G $ 0.69 $ 0.59 PSEG Power 2009 2010 $ millions (except EPS) Quarter ended March 31 * See page 72 for Items excluded from Income from Continuing Operations to reconcile to Operating Earnings. |

67 PSEG Power – Gross Margin Performance $0 $25 $50 $75 2010 2009 $63 $55 Quarter ended March 31 Power’s gross margin affected by lower pricing and customer migration which offset 7% increase in production. Combined cycle gas units maintained strong contribution to operations. No change versus year ago; higher prices offset decline in generation. $18 Texas Regional Performance $12 $27 $748 Q1 Gross Margin ($M) Q1 Performance Region Increase in generation supported margin. New York Contribution to margin hurt by lower prices. New England Q1 contribution to gross margin ($M) declined 5.0% versus year ago; decline in price and migration offset increase in production. PJM PSEG Power Gross Margin ($/MWh)* * Excludes Texas Increase in generation was predominantly from combined cycle and coal with continued strong nuclear. |

68 Projects to NY Neptune HVDC project (685 MW) Sayreville to Long Island Linden VFT project (330 MW) Linden to Staten Island Bergen O66 project (670 MW*) Bergen to ConEd's West 49th St Bergen U2-100 project (800 MW**) connecting Bergen to NY Projects to NJ PSE&G’s evaluation of the proposed backbone Transmission projects: Susquehanna - Roseland Branchburg- Roseland-Hudson*** As a result NJ will need new generation, DSM or additional transmission imports. Total Import Capability ~ 2,000 MW Total Export Capability ~ 2,500 MW 2010-2020 NJ Summer Peak Growth Rate = 1.6% Sources: Imports: PSE&G Estimates; Exports: PJM 2009 RTEP; Load Growth: PJM 2010 Load Forecast Report NJ’s load is expected to grow 3,450MW by 2020, with net imports decreasing ~500MW. * Project has firm contract for 320MW ** Project in queue – no firm contracts ***PJM has specified a June 2013 in-service date for this project, though PJM has publicly indicated that the in-service date may be delayed and that alternatives to the project are being considered. |

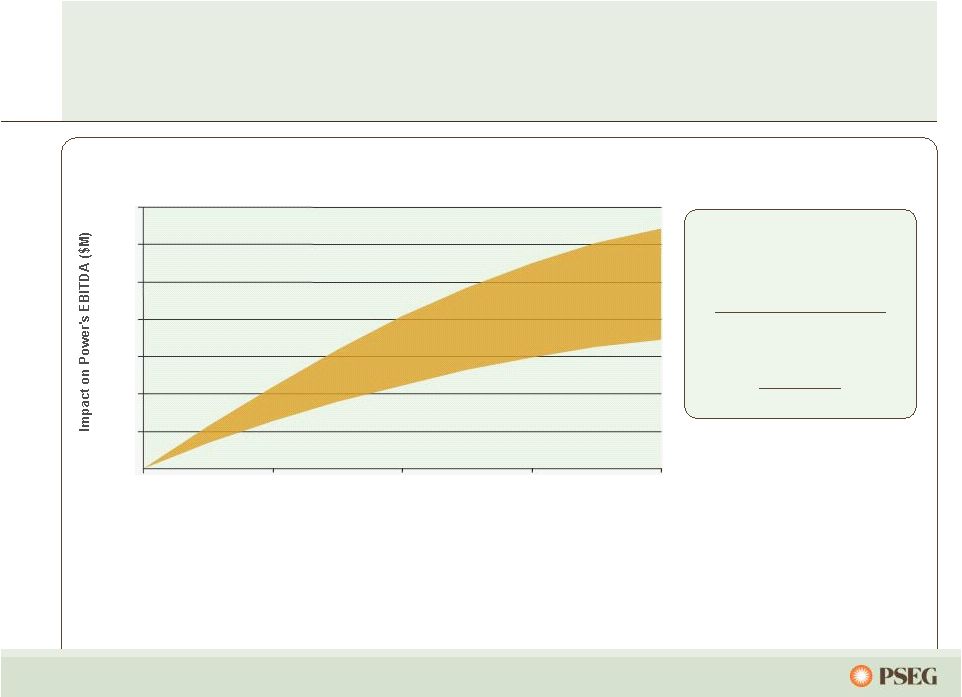

69 $0 $100 $200 $300 $400 $500 $600 $700 $0 $10 $20 $30 $40 CO 2 Price ($/ton) While the prospects for a cap and trade program may be delayed… …Power remains well positioned to capture value if implemented. CO 2 $/Ton Impact on PJM Prices and Power’s EBITDA The impact on electric prices moderates at higher CO 2 prices as: • the fleet dispatch changes, and • the CO 2 intensity of the grid goes down. Illustration at $20 CO 2 : (2008 Data) 62 TWh x ~ $11 to $14/MWh ~ $680 – $870 M revenue 23M tons x $20/ton ~ $460 M expense |

70 Debt Maturity Profile as of May 2010 Note: Excludes securitized debt. 0 100 200 300 400 500 600 700 800 900 1,000 1,100 ENTERPRISE 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 HOLDINGS (Non-Recourse) 22 3 4 3 1 1 7 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 HOLDINGS (Recourse) 0 127 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 POWER 0 605 666 300 250 300 303 0 0 0 420 0 0 0 0 0 0 19 0 0 0 525 0 0 0 0 0 40 0 0 0 0 45 PSE&G excl. Securitization 0 0 300 725 250 300 171 0 400 0 9 134 0 0 0 23 0 0 0 0 0 0 150 0 0 250 250 365 0 250 300 0 0 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 2036 2037 2038 2039 2040 2041 2042 2010 Financing Activity • PSE&G maturity of $300M in March 2010 • PSE&G issued $300M due 2040 • PSE&G issued $300M due 2015 • Power remarketed $44M of tax-exempt bonds due 2042 • Power called $48M due 2013 and $161M due 2014 • Power issued $300M due 2013 • Power issued $250M due 2020 • Power exchanged $195M due 2011 for $156M due 2020 plus cash of $52M |

71 Items Excluded from Income from Continuing Operations to Reconcile to Operating Earnings Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income. Pro-forma Adjustments, net of tax 2009 2008 2007 2006 2005 Earnings Impact ($ Millions) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 9 $ (71) $ 12 $ 11 40 Gain (Loss) on Mark-to-Market (MTM) (25) 16 10 28 (9) Lease Transaction Reserves - (490) - - - Net Reversal of Lease Transaction Reserves 29 - - - - Asset Sales and Impairments - (13) (32) (178) - Premium on Bond Redemption - (1) (28) (7) (6) Merger-related Costs - - - (8) (32) Total Pro-forma adjustments 13 $ (559) $ (38) $ (154) $ (7) $ Fully Diluted Average Shares Outstanding (in Millions) 507 508 509 505 489 Per Share Impact (Diluted) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 0.02 $ (0.14) $ 0.02 $ 0.02 $ 0.08 $ Gain (Loss) on Mark-to-Market (MTM) (0.05) 0.03 0.02 0.06 (0.02) Lease Transaction Reserves - (0.96) - - - Net Reversal of Lease Transaction Reserves 0.05 - - - - Asset Impairments - (0.03) (0.06) (0.35) - Premium on Bond Redemption - - (0.06) (0.01) (0.01) Merger-related Costs - - - (0.02) (0.07) Total Pro-forma adjustments 0.02 $ (1.10) $ (0.08) $ (0.30) $ (0.02) $ PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED For the Twelve Months Ended December 31, Reconciling Items Excluded from Continuing Operations to Compute Operating Earnings (Unaudited) |

72 Items Excluded from Income from Continuing Operations to Reconcile to Operating Earnings Please see Page 3 for an explanation of PSEG’s use of Operating Earnings as a non-GAAP financial measure and how it differs from Net Income. Pro-forma Adjustments, net of tax 2010 2009 Earnings Impact ($ Millions) Gain (Loss) on Nuclear Decommissioning Trust (NDT) Fund Related Activity 10 $ (23) $ Gain (Loss) on Mark-to-Market (MTM) 56 (15) Total Pro-forma adjustments 66 $ (38) $ Fully Diluted Average Shares Outstanding (in Millions) 507 507 Per Share Impact (Diluted) Gain (Loss) on NDT Fund Related Activity 0.02 $ (0.04) $ Gain (Loss) on MTM 0.11 (0.03) Total Pro-forma adjustments 0.13 $ (0.07) $ For the Three Months Ended March 31, PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED Reconciling Items Excluded from Continuing Operations (a) to Compute Operating Earnings (Unaudited) (a) Income from Continuing Operations for the three months ended March 31, 2010 and 2009 is equal to Net Income. |