- PEG Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Public Service Enterprise (PEG) DEF 14ADefinitive proxy

Filed: 16 Mar 20, 4:32pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under§240.14a-12 |

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required |

| ☐ | Fee computed on table below per Exchange Act Rules14a-6(i)(1) and0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

AND PROXY STATEMENT OF PSEG

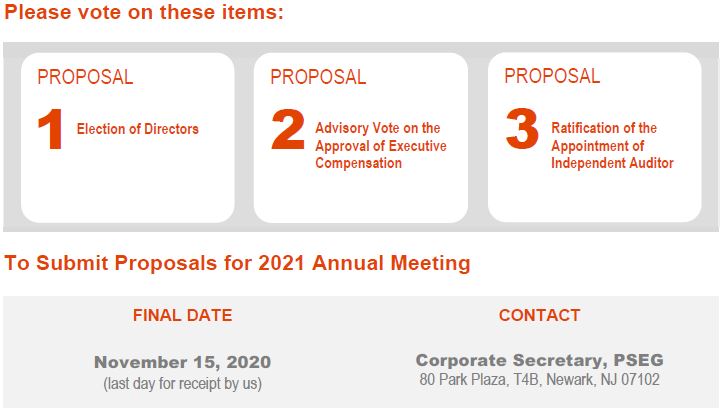

| DATE | At the Annual Meeting, you will be asked to: | |||||

April 21, 2020 at 1:00 P.M. |

| 1. Elect ten members of the Board of Directors (Board) to hold office until the Annual Meeting of Stockholders in 2021, or until each director’s respective successor is elected and qualified; | ||||

2. Approve on an advisory basis, our executive compensation; | ||||||

| LOCATION | 3. Ratify the appointment of Deloitte & Touche LLP (Deloitte) as independent auditor for 2020; and | |||||

Newark Museum 49 Washington Street Newark, NJ 07102 | 4. Transact any other business that is properly presented at the meeting.

By order of the Board of Directors, | |||||

Scan this QR code to access the 2020 PSEG Proxy Statement and 2019 Annual Report on your mobile device

RECORD DATE

Stockholders entitled to vote at the Annual Meeting are the holders of common stock of record on February 21, 2020 |

Michael K. Hyun

Secretary

March 16, 2020

| |||||

YOUR VOTE IS IMPORTANT,REGARDLESS OF THE NUMBER OF SHARES YOU OWN. PLEASE SIGN, DATE AND MAIL THE ACCOMPANYING PROXY CARD OR VOTING INSTRUCTION FORM PROMPTLY. YOU MAY ALSO VOTE VIA THE INTERNET OR BY TELEPHONE. PLEASE USE THE INTERNET ADDRESS OR TOLL-FREE NUMBER SHOWN ON YOUR PROXY CARD OR VOTING INSTRUCTION FORM.

| ||||||

IF YOU HAVE MULTIPLE ACCOUNTS, YOU MAY RECEIVE MORE THAN ONE PROXY CARD OR VOTING INSTRUCTION FORM AND RELATED MATERIALS. PLEASE VOTE EACH PROXY CARD AND VOTING INSTRUCTION FORM THAT YOU RECEIVE. THANK YOU FOR VOTING.

| ||||||

For shares held by a bank or broker, including those in the various stockholder and employee plans that we offer, please follow the voting instructions from your bank, broker or plan administrator. For more information, see pages67-71.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders to be held on April 21, 2020 (Annual Meeting).The Proxy Statement and Annual Report to Stockholders are available atwww.ezodproxy.com/pseg/2020/ar.

The approximate date on which this Proxy Statement and the accompanying proxy card were first sent or given to security holders and made available electronically via the Internet was March 16, 2020.

Public Service Enterprise Group Incorporated (we, us, our, PSEG or the Company) is distributing this Proxy Statement to solicit proxies in connection with our 2020 Annual Meeting of Stockholders.

|

Future Electronic Delivery

You can help us and the environment by choosing to receive future proxy statements and related documents such as the Annual Report and Form10-K by electronic delivery. You may sign up for future electronic delivery at the website below, depending on the nature of your ownership. Please note that these are not the same sites to use for voting. For further information about how to vote, see the Notice of Annual Meeting of Stockholders and page 67.

• If you are a stockholder of record, please go towww.proxyconsent.com/peg.

• For shares held in Employee Benefit Plans, please go towww.proxyconsent.com/peg.

• If your shares are held by a bank or broker, please go tohttps://enroll.icsdelivery.com/peg. |

PSEG 2020 Proxy Statement i

| 1 | ||||

| 6 | ||||

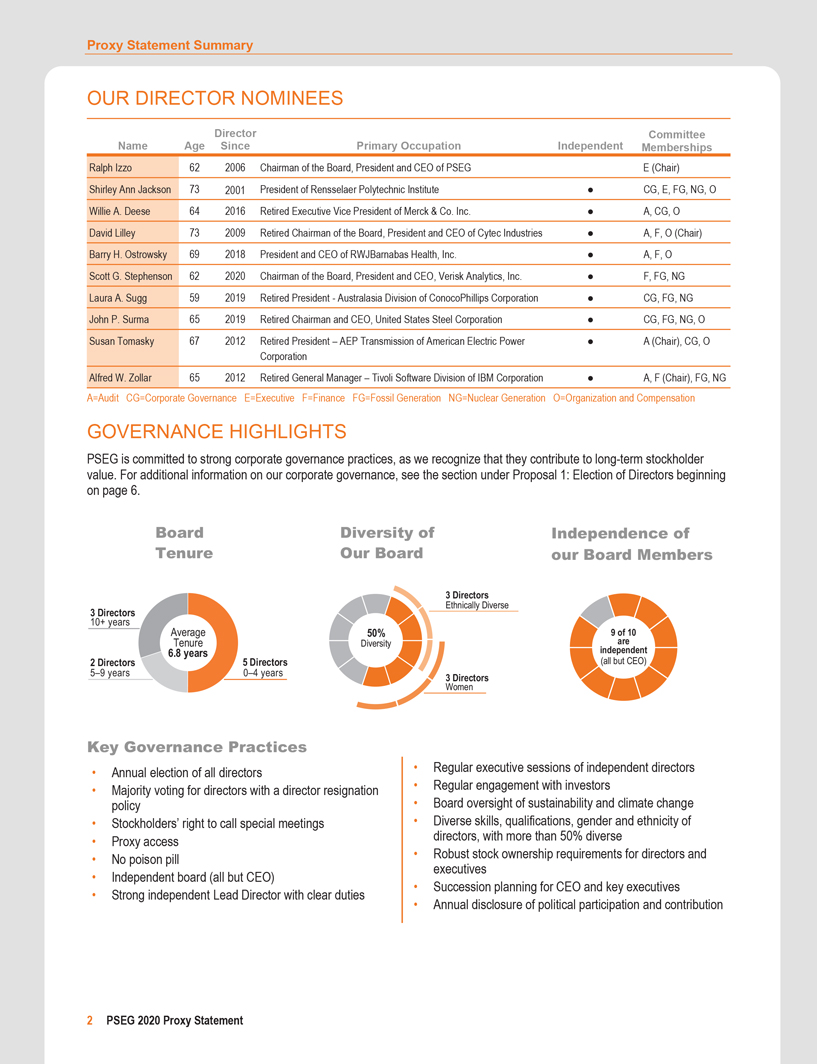

| OVERVIEW OF BOARD NOMINEES | 6 | |||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 8 | ||||

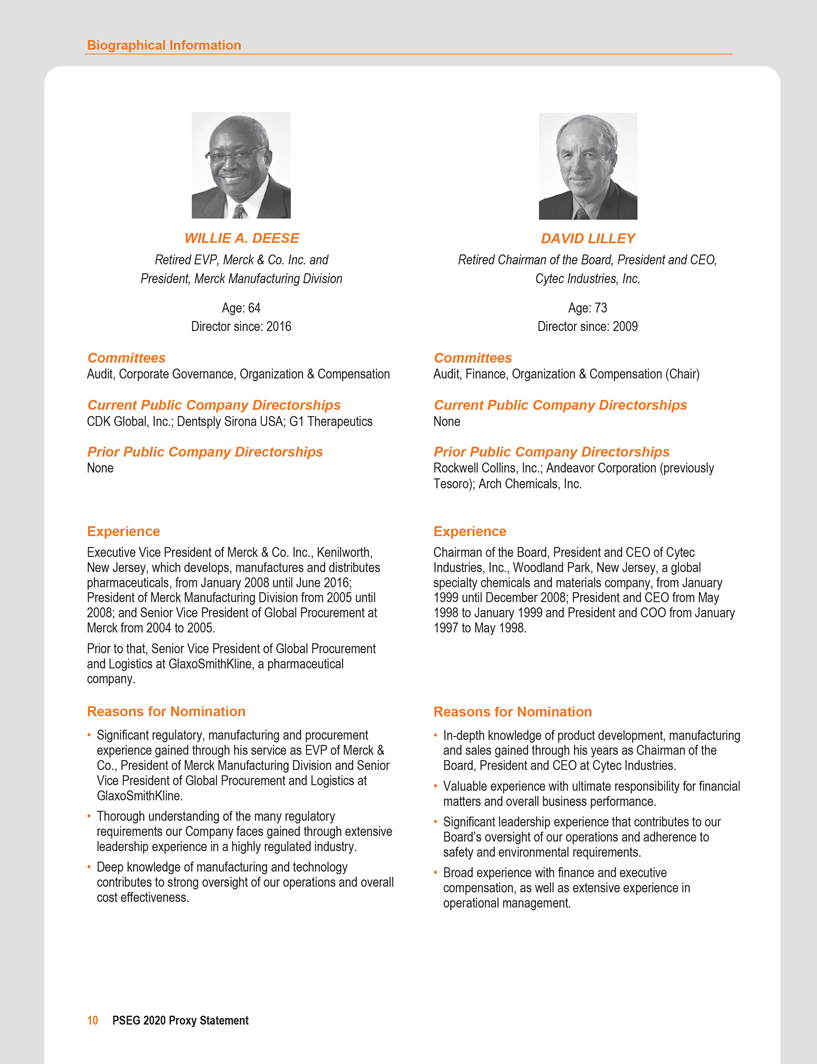

| NOMINEES FOR DIRECTOR | 8 | |||

| 9 | ||||

| CORPORATE GOVERNANCE | 14 | |||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 14 | ||||

| 15 | ||||

| 15 | ||||

| 16 | ||||

| 16 | ||||

| 16 | ||||

| 20 | ||||

| 21 | ||||

| 21 | ||||

| 23 | ||||

Transparency and Oversight of Political Participation and Spending | 25 | |||

| 25 | ||||

| 25 | ||||

| 26 | ||||

| SECURITY OWNERSHIP OF DIRECTORS, MANAGEMENT AND CERTAIN BENEFICIAL OWNERS | 27 | |||

| 28 | ||||

| DIRECTOR COMPENSATION | 28 | |||

| 29 | ||||

Proposal 2: ADVISORY VOTE ON THE APPROVAL OF EXECUTIVE COMPENSATION | 31 | |||

| EXECUTIVE COMPENSATION SUMMARY | 32 | |||

| 32 | ||||

| 32 | ||||

Forward-Looking Statements

The statements contained in this Proxy Statement that are not purely historical are “forward-looking statements” within the meaning of The Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those anticipated. Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements made by us herein are discussed in our Annual Report on Form10-K and subsequent reports on Form10-Q and Form8-K filed with the Securities and Exchange Commission (SEC) and available on our website:https://investor.pseg.com/financial-information/sec-filings. Readers are cautioned not to place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this Proxy Statement apply only as of the date hereof. We specifically disclaim any obligation to update these forward-looking statements unless required by applicable securities laws. Information on our website should not be deemed incorporated into, or as a part of, this report.

ii PSEG 2020 Proxy Statement

Corporate Governance –Role of the Board of Directors

Role of the Board of Directors

PSEG is governed by our Board and its committees that meet throughout the year. The Board is elected by our stockholders and is the ultimate decision-making body of the Company except for the items reserved to stockholders.

The Board provides direction and oversight by:

| • | Actively engaging in developing corporate strategy and approving major initiatives and significant investments; |

| • | Monitoring financial and business integrity and performance, including risk management; |

| • | Evaluating the performance of the CEO and approving succession plans for the CEO and other senior executives; |

| • | Selecting a diverse group of nominees for election to the Board; and |

| • | Evaluating Board and committee performance. |

The Board holds an annual strategy session in addition to its regular meetings, receives regular updates and actively engages in dialogue with our senior management. The Board has full and free access to all members of management and may hire its own consultants and advisors as it deems necessary.

The Board has determined that, at the present time, it is in the best interests of the Company and stockholders for all three positions of Chairman of the Board, President and CEO to be combined under the leadership of Ralph Izzo and that independent board member Shirley Ann Jackson serve as Lead Director. The Board believes that Mr. Izzo possesses the attributes of experience, judgment, vision, managerial skill and overall leadership ability essential for our continued success.

Shirley Ann Jackson has served as our Lead Director since April 2019. Our Lead Director is an independent director designated annually by the independent directors and typically serves in that capacity for four years. The Lead Director’s duties include:

| • Presiding over executive sessions of the independent directors

• Providing the independent directors with a key means for collaboration and communication

• Coordinating with the Chairs of our various Board committees to set agendas for committee meetings

• Leading CEO succession planning, CEO performance evaluations and compensation

• Ensuring a robust Board self-evaluation |

| ||

Our Lead Director complements the talents and contributions of Mr. Izzo and promotes confidence in our governance structure by providing an additional perspective to that of management.

Our Corporate Governance Principles

The Board has adopted and operates under ourBy-Laws and Governance Principles. The Governance Principles provide guidelines for directors and management to effectively pursue and support our business objectives. The Governance Principles govern our board structure, requirements of our directors, board operations and functioning of our Board committees and are reviewed periodically by the Corporate Governance Committee, which recommends any changes to the Board. OurBy-Laws and Governance Principles can be found on our website athttps://investor.pseg.com/governance/governance-overview.

14 PSEG 2020 Proxy Statement

Corporate Governance –Board and Committee Self-Assessment Process

Board and Committee Self-Assessment Process

Our Board and committees each have a robust annual process for self-assessment, as shown below.

Governance Enhancements from the 2019 Self-Assessment Process:

| • | Enhanced PSEG’s director education program by expanding internal and external learning opportunities for the directors as described below |

| • | Reviewed and updated board meeting agendas to facilitate robust executive session discussions led by Lead Director |

| • | Expanded opportunities for directors to meet and receive feedback from PSEG employees below the officer level |

| • | Enhanced risk update process for each committee |

Director Education and Orientation

In addition to our Board and committee meetings, members of our Board are offered and participate in a variety of learning opportunities.

Internal Educational Presentations | The Board is regularly offered educational presentations that comprise “deep dives” on specific topics presented by management with outside experts as needed. | |||

External Programs | Directors are encouraged to attend third-party programs; management regularly updates a list of recommended offerings. | |||

Outside Speakers | The Board regularly hears from outside experts on such topics as investor perspectives, strategy, cybersecurity, environmental, social and governance (ESG) issues, climate change, regulatory matters and business leadership. | |||

PSEG Site Visits | The Board periodically visits sites such as new facilities, nuclear plants and utility operational and monitoring sites. | |||

Orientations | New directors and new committee members receive comprehensive materials andin-house orientation sessions featuring presentations by key members of management and the independent auditor. These sessions cover such topics as strategic plans; operations; human capital management; ESG and climate change; significant financial, accounting and risk management issues; regulatory and governance practices and compliance programs and trends. |

| ||

PSEG 2020 Proxy Statement 15

Corporate Governance –Board and Committee Meetings and Attendance

Board and Committee Meetings and Attendance

In 2019, the Board met eight times, including six regular meetings, one strategy session and one special meeting. The PSE&G Board met seven times, including six regular meetings and one strategy session. During 2019, each director attended at least 75% of the aggregate number of meetings of the Board and the committees on which the director served with the exception of Thomas A. Renyi, who did not attend meetings immediately preceding his retirement. All of the directors who were elected in 2019 attended the 2019 Annual Meeting of Stockholders.

Our Governance Principles provide that each director is expected to attend all Board meetings, all meetings of committees of which the director is a member and the Annual Meeting of Stockholders. The Board encourages personal attendance, unless telephonic attendance is required by special circumstances.

The experience gained through other directorships provides our Board with a breadth of valuable knowledge and insight. The Corporate Governance Committee carefully monitors each director’s service on other boards. All of our nominees have successfully balanced other demands on their time and attention in meeting their obligations to PSEG.

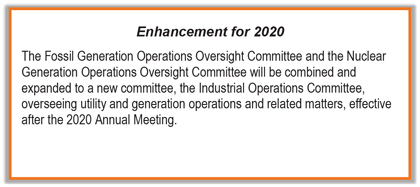

Our Board has seven standing Committees: Audit, Corporate Governance, Executive, Finance, Fossil Generation Operations Oversight, Nuclear Generation Operations Oversight and Organization and Compensation. A description of each Committee follows.

Committee assignments and Chairs are regularly reviewed and periodically changed to optimize the talents of our directors and meet the Company’s evolving needs.

Each committee has open and free access to all Company information, may require any of our officers or employees to furnish it with information, documents or reports, may investigate any matter involving us and has discretion to hire outside resources. Each committee, other than the Executive Committee, has a charter that defines its roles and responsibilities and annually conducts a performance evaluation of its activities and a review of its charter.

The Executive Committee consists of the Chairman of the Board, the Lead Director and at least one additional independent director. In 2019, the members of the Executive Committee were Ralph Izzo, Shirley Ann Jackson, Richard J. Swift and, until his retirement in April 2019, Thomas A. Renyi. The authority of the Executive Committee is set forth in ourBy-Laws. The committee charters and ourBy-Laws are posted on our website,

https://corporate.pseg.com/aboutpseg/leadershipandgovernance/boardofdirectors/committeedescriptions.

16 PSEG 2020 Proxy Statement

Corporate Governance –Board Committees

Audit Committee

| ||

| Chair:Susan Tomasky | ||

Members:Willie A. Deese, William V. Hickey, David Lilley, Barry H. Ostrowsky, Alfred W. Zollar | ||

| Meetings held in 2019:9 | ||

Key Responsibilities

| Ø | Oversees the quality and integrity of our accounting, auditing and financial reporting practices and financial statements; |

| Ø | Selects and evaluates the work of the independent auditor; |

| Ø | Oversees our internal audit functions, our environmental, health and safety audit functions and our legal and business compliance program; |

| Ø | Reviews our cybersecurity program, the status of material litigation matters and the guidelines, policies and processes of our risk management program; |

| Ø | Reviews disclosure controls and procedures and earnings press releases, financial information and earnings guidance; and |

| Ø | Recommends to the Board audited financial statements to be included in our Form10-K and report for inclusion in this Proxy Statement. |

The Audit Committee Report appears under Proposal 3: Ratification of the Appointment of Independent Auditor on page 64.

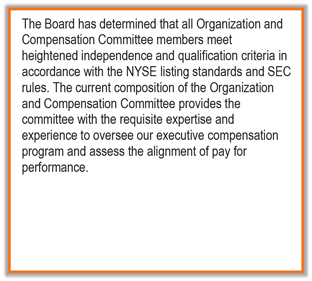

Organization and Compensation Committee | ||

| Chair:David Lilley | ||

Members:Willie A. Deese, Shirley Ann Jackson, Barry H. Ostrowsky, John P. Surma, Richard J. Swift, Susan Tomasky | ||

| Meetings held in 2019:6 | ||

Key Responsibilities

| Ø | Oversees our executive compensation policies, practices and plans; |

| Ø | Reviews the stockholder advisory vote onsay-on-pay and considers action in light of that vote; |

| Ø | Approves executive compensation targets and awards; |

| Ø | Monitors the risks associated with our compensation policies and practices and other talent management risks; |

| Ø | Selects and oversees the Board’s independent compensation consultant; |

| Ø | Evaluates the CEO’s performance and recommends approval of the CEO’s compensation to the Board; |

| Ø | Reviews the performance of certain other key members of management as well as key management succession and development plans; and |

| Ø | Reviews the Compensation Discussion and Analysis section of, and provides its report in, the annual Proxy Statement. |

The Organization and Compensation Committee Report on Executive Compensation appears under Proposal 2: Advisory Vote on the Approval of Executive Compensation on page 31.

PSEG 2020 Proxy Statement 17

Corporate Governance –Board Committees

| Finance Committee | Corporate Governance Committee | |||

Chair:Alfred W. Zollar

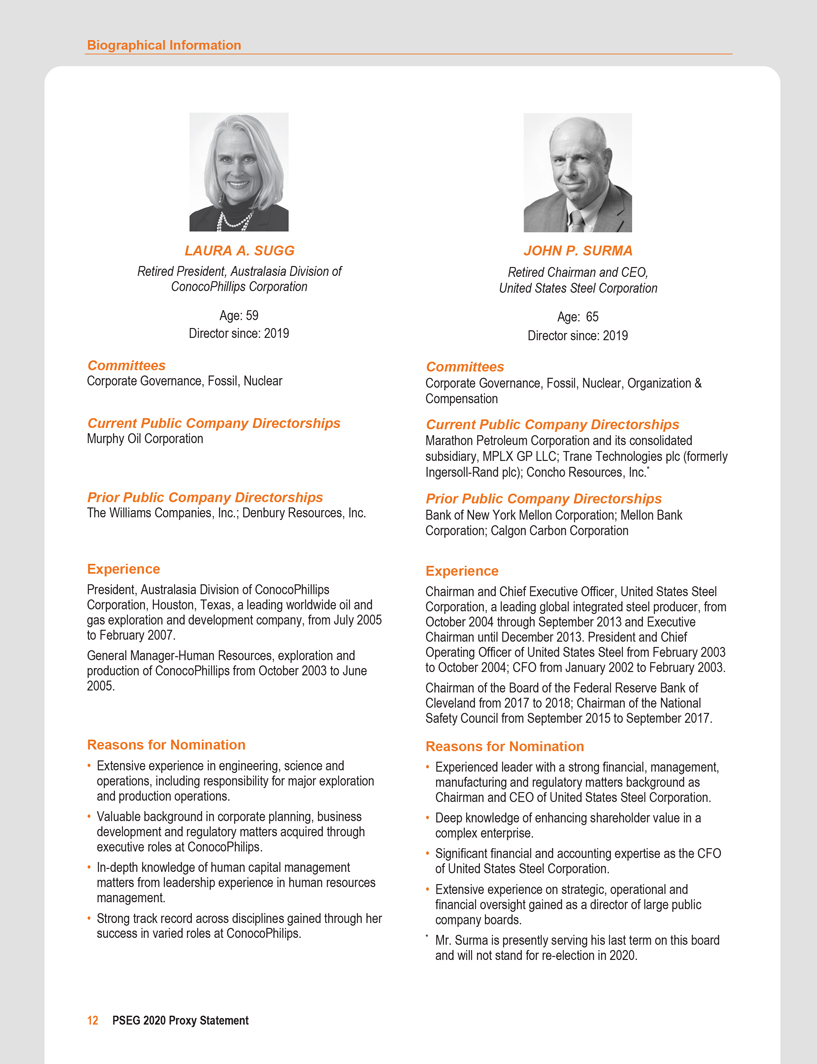

Members: William V. Hickey, David Lilley, Barry H. Ostrowsky, Scott G. Stephenson

Meetings held in 2019:4 | Chair:Richard J. Swift

Members: Willie A. Deese, Shirley Ann Jackson, Laura A. Sugg, John P. Surma, Susan Tomasky

Meetings held in 2019:6 | |||

| Key Responsibilities | Key Responsibilities | |||

Ø Oversees corporate financial policies and processes and significant financial decisions;

Ø Reviews annually our financial plan, dividend policy, capital structure and cash management policies and practices;

Ø Discusses with management our risk assessment and risk management policies;

Ø Oversees the investment guidelines for, and investment performance of, the Company’s pension plan trust funds and nuclear decommissioning trust funds; and

Ø Reviews with management credit agency ratings and analyses. |

Ø Oversees the Company’s corporate governance practices;

Ø Evaluates the composition and qualifications of the Board, its committees and prospective nominees, assesses the independence of each nominee and makes recommendations to the Board;

Ø Oversees the self-evaluation process of the Board and its committees and reviews the Governance Principles and committee charters and makes recommendations to the Board in order to improve effectiveness of the Board and its committees;

Ø Oversees sustainability efforts and initiatives, activities and disclosures related to climate change and our political participation activities and expenses;

Ø Oversees risk management guidelines, policies, processes and mapping and identifies risks to the Board and its committees;

Ø Reviews and approves transactions with related persons;

Ø Reviews and makes recommendations to the Board regarding compensation of directors; and

Ø Provides input to the Organization and Compensation Committee regarding the performance of the CEO as Chairman of the Board. | |||

| The nomination process and criteria used are described under Board Membership selection beginning on page 8. | ||||

18 PSEG 2020 Proxy Statement

Corporate Governance –Board Committees

Fossil Generation Operations Oversight Committee |

Chair:William V. Hickey

Members:Shirley Ann Jackson, Scott G. Stephenson, Laura A. Sugg, John P. Surma, Richard J. Swift, Alfred W. Zollar

Meetings held in 2019:4 |

| Key Responsibilities |

Ø Evaluates the effectiveness of our generation operations, focusing on safety, plant performance, regulatory matters, large construction projects and improvement in operations;

Ø Oversees labor and human relations, environmental, health and safety and legal and compliance issues;

Ø Reviews the results of major inspections, evaluations and audit findings by external oversight groups and management’s response; and

Ø Oversees management of risks related to the roles, duties and responsibilities of the Committee. |

Nuclear Generation Operations Oversight Committee |

Chair:William V. Hickey

Members:Shirley Ann Jackson, Scott G. Stephenson, Laura A. Sugg, John P. Surma, Richard J. Swift, Alfred W. Zollar

Meetings held in 2019:4 |

| Key Responsibilities |

Ø Evaluates the effectiveness of our nuclear operations, focusing on safety, plant performance, regulatory matters, large construction projects and improvement in operations;

Ø Oversees labor and human relations, environmental, health and safety and legal and compliance issues;

Ø Reviews the results of major inspections and evaluations by external oversight groups such as the NRC and the Institute of Nuclear Power Operations and management’s response to the findings and follow up on implementation plans.

Ø Reviews reports from the Chief Nuclear Officer; and

Ø Oversees management of risks related to the roles, duties and responsibilities of the Committee. |

PSEG 2020 Proxy Statement 19

Corporate Governance –Board and Committee Oversight of Risk Management

Board and Committee Oversight of Risk Management

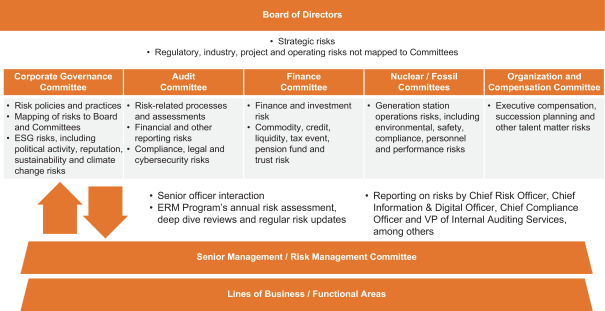

The objective of PSEG’s risk management program is to promote effective management of risk in order to support the achievement of growth and business objectives within acceptable risk levels. An important aspect of the program is promoting a risk-aware culture where all employees have a responsibility for identifying and communicating risks.

The Board has ultimate responsibility for the oversight of risk management at PSEG, overseeing the Company’s risk management program and reviewing the most significant risks facing the Company.

The Board interacts with senior management regarding assessment and mitigation of the most significant risks facing the Company, across a range of categories that includes strategic, financial, operational, environmental, health and safety, legal and compliance and reputational risks.

The Corporate Governance Committee reviews key enterprise risks and recommends to the Board the mapping of each risk to an appropriate committee or the full Board, in accordance with the allocation of risk categories reflected in the charter of each committee.

The Board’s oversight of risk management is supported by the Risk Management Committee, which consists of senior executives, and by the Enterprise Risk Management (ERM) team, led by PSEG’s Chief Risk Officer in collaboration with other assurance functions and management committees and councils, such as the Cybersecurity Council. Our cybersecurity risk management practices are fully integrated into our overall risk management program. At least annually, the Chief Risk Officer briefs the Corporate Governance Committee and the Audit Committee on enterprise-level risks and emerging risks. Throughout the year, the Board and each committee provide ongoing oversight of key enterprise risks through deep-dive risk reviews and risk updates presented by representatives of the relevant line of business and functional areas. The risk reviews include analyses of underlying risk causes, as well as reviews of current risk mitigation and response activities. The committees report out to the Board regarding their risk reviews and elevate risk issues to the Board as appropriate. Management integrates risk evaluation into business decisions and escalates to the committees and Board as appropriate.

20 PSEG 2020 Proxy Statement

Corporate Governance –Board Oversight of Cybersecurity

Board Oversight of Cybersecurity

Cybersecurity is a critical component of our risk management program. The Board, the Audit Committee and senior management receive frequent reports on such topics as personnel and resources to monitor and address cybersecurity threats, technological advances in cybersecurity protection, rapidly evolving cybersecurity threats that may affect our Company and industry, cybersecurity incident response and applicable cybersecurity laws, regulations and standards as well as collaboration mechanisms with intelligence and enforcement agencies and industry groups to assure timely threat awareness and response coordination.

Our cybersecurity program is focused on the following areas:

• | Governance:The Cybersecurity Council, which is comprised of members of senior management, meets regularly to discuss emerging cybersecurity issues, maintenance of a corporate cybersecurity scorecard that sets annual improvement targets to approximately 30 metrics and publication of security practices. The Cybersecurity Council ensures that senior management and ultimately, the Board, is informed of all information required to exercise proper oversight over cybersecurity risks and that escalation procedures are followed to promptly inform senior management and the Board of significant cybersecurity incidents and risks. |

• | Cybersecurity Awareness: Identifying and assessing cyber risks through partnerships with public and private entities and industry groups and disseminating electronic notices to, and conducting presentations for, company personnel. |

• | Training: Providing annual cybersecurity training for all personnel with network access, as well as additional education for personnel with access to industrial control systems or customer information systems; and conducting phishing exercises. Regular cybersecurity education is also provided to our Board through management reports and presentations by external subject matter experts. |

• | Technical Safeguards: Deploying measures to protect our network perimeter and internal Information Technology platforms, such as internal and external firewalls, network intrusion detection and prevention, penetration testing, vulnerability assessments, threat intelligence, anti-malware and access controls. |

• | Vendor Management: Maintaining a risk-based vendor management program, including the development of robust security contractual provisions. |

• | Incident Response Plans: Maintaining and updating incident response plans that address the life cycle of a cyber incident from a technical perspective (i.e., detection, response and recovery), as well as data breach response (with a focus on external communication and legal compliance); and testing those plans (both internally and through external exercises). |

• | Mobile Security:Deploying controls to prevent loss of data through mobile device channels. |

At PSEG, we know that our people are the most valuable source of energy powering our business. Our Board and its committees play a key role in the oversight of our talent management programs and culture initiatives. We strive to attract, develop and retain a high performing and diverse workforce and to foster a culture of collaboration, learning and comfort speaking up, where new ideas are welcome and all employees feel valued and enhance each other’s performance.

Talent Management

CEO and Executive Succession Planning: The Board is committed to its oversight of our succession planning process to ensure there is a strong, sustainable and diverse leadership pipeline. At least semi-annually, the Board engages with management in a comprehensive talent review of executive performance and potential and executive succession and development plans. The Board reviews key organizational design plans, meets with executive succession candidates and emerging high potential talent and is kept informed of talent metrics inclusive of workforce diversity, retention rates and pay equity analyses. The Organization and Compensation Committee and Corporate Governance Committee also annually review the CEO’s performance and make recommendations to the Board for approval.

Workforce Development:We firmly believe that strategic workforce planning and investments to develop and train our people are important to our success. We have a regular, disciplined workforce review process and link hiring plans and training needs to business objectives. We offer a People Strong curriculum, which is a suite of multi-media learning and development experiences tailored to enhancing employees’ skills and enabling their growth. Technical training supports the workforce maintaining job

PSEG 2020 Proxy Statement 21

Corporate Governance –Human Capital Management

qualifications or reskilling as technology and other factors change job requirements. We utilize talent analytics that enable us to project our future workforce needs and allow us to identify and mitigate talent risks proactively.

Total Rewards: We provide our employees a valuable Total Rewards package that includes market competitive pay, short-term incentives and stock programs. Our comprehensive benefits support employees’ physical, emotional, financial and social wellbeing. These programs include health care, life and disability insurance, retirement benefits, paid time off, flexible work options and a number of onsite programs to provide employees with the support they need to meet their health and wellness goals. We know that employees’ personal and professional needs are varied, so our program includes childcare and elder care resources, voluntary benefits for discounted services, tuition reimbursement and adoption assistance. We continually review our Total Rewards offerings to ensure that we not only remain competitive but are delivering programs in the most efficient manner to meet the needs of our employees.

Our Culture

Core Commitments:A great culture is more than a source of pride: it is critical to sustained trust in the marketplace, in the communities we serve and among current and potential employees. Our core commitments are the foundation of our culture that we leverage to build innovative, high-performing teams who deliver safe, reliable, economic and greener energy to our customers. In a changing business climate, we recognize the importance of consistently reinforcing the core commitments that we stand for and live by in all we do as a company, especially in the behaviors and actions of our approximately 13,000 employees.

| ||||||||

We put safety first.

We never sacrifice safety to achieve results. We stop the job and report unsafe conditions. We protect each other, our communities and our environment. We respect our training, equipment, procedures and tools. | We do what’s right.

We hold ourselves to the highest ethical standards, even in the most difficult situations. We speak up and encourage clear and honest communication. We accept our individual and team responsibilities and are accountable for our actions. We respect and adhere to all laws and company policies. We lead by example. | We aspire to achieve excellence.

We responsibly question the status quo and each other. We benchmark processes to streamline workflows and increase efficiency. We leverage teamwork to face complex issues and decisions. We take action to improve personal performance. We are accountable for our accomplishments and setbacks and learn from them to influence future decisions. | We treat all individuals with dignity and respect.

We assume positive intent. We create an environment and inclusive culture that respects unique perspectives, experiences and ways of thinking. We engage one another and encourage teamwork. We are accountable for making PSEG a great place to work for everyone. | We keep customers at the heart of everything we do.

We actively listen to and respect our internal and external customers. We are accountable for our customers’ needs. We engage and collaborate as a team with our communities and stakeholders. We solicit and use feedback to improve our business. We always ask, “What else can we do?” | ||||

Accountability: Our Board oversees the alignment of our culture with the strategic objectives of the Company and reviews culture risk mitigation plans. Management and our unions partner in initiatives to reinforce that all employees are accountable for the culture at PSEG. We engage councils throughout the Company to advance our core commitments and we solicit qualitative and quantitative feedback throughout the year through focus groups, surveys and other channels. Effective 2020, the Chief Diversity Officer role was elevated as a direct report to the CEO to further senior management accountability for a strong culture. Metrics linked to our core commitments are embedded in our performance, talent and incentive programs.

22 PSEG 2020 Proxy Statement

Corporate Governance –Our Approach to Sustainability

Our Approach to Sustainability

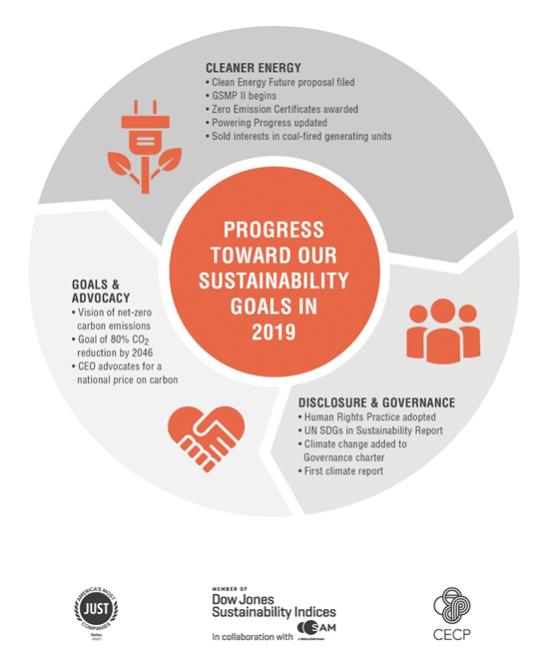

PSEG’s approach to sustainability reflects our goal of being a leader in building an economically strong, environmentally responsible energy future. Our Board takes an active role in overseeing sustainability, ESG and corporate citizenship issues including our climate strategy. As specified in its charter, the Corporate Governance Committee holds the primary responsibility for overseeing sustainability matters for our Company and will oversee our vision for a transition to a future ofnet-zero carbon emissions. In our shareholder engagement efforts, sustainability and ESG issues are among the more frequently discussed topics. Highlights of our recent sustainability achievements are below.

PSEG 2020 Proxy Statement 23

Corporate Governance –Our Approach to Sustainability

CLEANER ENERGY

Clean Energy Future

PSE&G’s $3.5 billion Clean Energy Future proposal calls for significant investments in energy efficiency, electric vehicle charging infrastructure, energy storage and advanced metering. The program is subject to approval by the New Jersey Board of Public Utilities (BPU).

ZECs to Preserve Nuclear

The BPU awarded Zero Emissions Certificates (ZECs) to all three New Jersey nuclear plants, recognizing their zero carbon benefits. The ZEC law demonstrates New Jersey’s intent to preserve nuclear plants for their clean air attributes and positive impact on jobs and on fuel diversity.

Gas System Modernization Continues

PSE&G completed Phase I of its Gas System Modernization Program (GSMP), which replaced approximately 450 miles of cast-iron and unprotected steel gas infrastructure over three years, avoiding approximately 75,000 tons of greenhouse gas (GHG) emissions. We began GSMP II, which calls for replacement of an additional 875 miles of aging gas mains through 2023.

Moving to a Cleaner, More Efficient Generating Portfolio

PSEG Power sold its776-megawatt interest in the coal-fired Keystone and Conemaugh generating facilities and related assets, leaving PSEG Power with one remaining coal asset, which is scheduled for retirement inmid-2021.

Evaluating Offshore Wind and Renewable Investments

PSEG exercised its option on Ørsted’s Ocean Wind Project, which begins a period of exclusive negotiation to potentially acquire a 25% equity interest in the offshore wind project.

“Climate change is the preeminent challenge of our time. How PSEG and others in our industry respond to this challenge will define our legacy.” |

Ralph Izzo, CEO

|

GOALS AND ADVOCACY

New, Updated Emissions Goals

As part of a major update to our Powering Progress Initiative, PSEG announced its goal to reduce GHG emissions from PSEG Power’s fleet by 80% from 2005 levels by 2046.

PSEG announced a vision fornet-zero emissions by 2050, assuming necessary advances in technology, public policy and consumer behavior, including preservation of existing nuclear fleet, continued investment in renewable energy sources, retirement or sale of coal assets and no plans to acquire or build new fossil units.

Advocating for a National Price on Carbon

Ralph Izzo joined the CEO Climate Dialogue, a cross-sectoral organization that seeks to leverage CEO voices to build support for a national price on carbon and whose guiding principles for federal action include economy-wide GHG emissions reductions of 80% or more by 2050. Mr. Izzo also testified before the Congressional Subcommittee on Energy during a hearing titled, “Building a 100 Percent Clean Economy: Solutions for the U.S. Power Sector.”

DISCLOSURE AND GOVERNANCE

Adopted a Human Rights Practice

PSEG published its Human Rights Practice using the United Nations’ Guiding Principles on Business and Human Rights, underscoring our commitment to minimize any adverse effects of our operations on people or communities.

2020 Climate Report

PSEG announced its commitment to reporting annually on sustainability and climate using the Task Force on Climate-related Financial Disclosures framework, starting in 2020.

Enhanced ESG Disclosure and Transparency

PSEG published its Sustainability report incorporating a comprehensive analysis of its contributions to the United Nations Sustainable Development Goals. ESG disclosures are featured on our website.

24 PSEG 2020 Proxy Statement

Corporate Governance –Transparency and Oversight of Political Participation and Spending

Transparency and Oversight of Political Participation and Spending

The Corporate Governance Committee oversees our political activities and contributions in accordance with our Corporate Political Participation Practice, which may be found at:https://s24.q4cdn.com/601515617/files/doc_downloads/corporate_responsibility/Practice_530-3_Corporate_Political_Participation.pdf

For purposes of transparency, we publish an annual political contributions report that includes our corporate contributions to candidates, trade associations and other political and social welfare organizations. PSEG requests that trade associations to which it paid total annual payments of $50,000 or more identify the portion of dues or payments received from PSEG that were used for expenditures or contributions that, if made directly by PSEG, would not have been deductible under Section 162(e)(1)(B) of the Internal Revenue Code (IRC). The report is available on our website.

What We Expect of Our Employees, Officers and Directors

We have a long-established corporate culture of emphasizing integrity, honesty and the highest ethical standards and require all to remain in compliance with our Standards of Conduct. Our Chief Compliance Officer has overall responsibility for administering the Standards of Conduct under the oversight of the Audit Committee of the Board.

The Standards of Conduct are posted on our website at:https://corporate.pseg.com/aboutpseg/leadershipandgovernance/standardsofconduct

Our Standards of Conduct:

• | Form an integral part of our business conduct compliance program and apply to all of our directors, employees and contractors, who are each responsible for understanding and complying with the Standards of Conduct; |

• | Establish a set of written common expectations for dealings with investors, customers, fellow employees, competitors, vendors, government officials and the media; and |

• | Provide procedures for seeking ethical guidance and reporting concerns, including a hotline. |

We require every employee annually to complete a training program on, and to certify compliance with, the Standards of Conduct.

We commit to post on our website:

• | Any amendment to the Standards of Conduct; and |

• | Any waiver from the Standards of Conduct that applies to any director, executive officer or person performing similar functions and that relates to any applicable SEC requirement. Waivers may be granted in exceptional circumstances only and must be made by the Board. |

In 2019, we did not grant any waivers to the Standards of Conduct.

Our Standards of Conduct, Compliance Program, Related Person Transactions Practice and Conflicts of Interest Practice described below, establish clear policies and procedures regarding personal and business conduct. Our written management practices provide that any capital investment with anon-PSEG entity or its affiliate, for which one of our directors or officers serves as a director or executive officer, must be approved by our Board. These are our only written policies and procedures regarding the review, approval or ratification of transactions with related persons.

Certain Relationships and Related Party Transactions

Under our Related Person Transactions Practice, which is administered by the Corporate Governance Committee, directors and executive officers must report any potential related person transactions.

For purposes of our Related Person Transactions Practice, a related person transaction includes transactions in which PSEG is a participant, the amount involved exceeds $120,000 and a “related person” has or will have a direct or indirect interest. Related persons of PSEG consist of directors (including director nominees), executive officers, stockholders beneficially owning more than 5% of PSEG’s voting securities and the immediate family members of these individuals.

PSEG 2020 Proxy Statement 25

Corporate Governance –Certain Relationships and Related Party Transactions

The Corporate Governance Committee reviews the facts and circumstances of each transaction and approves or ratifies related person transactions that it determines are in the best interests of PSEG and its stockholders. The Corporate Governance Committee’s consideration include:

• | Whether the transaction was in the ordinary course of business and at arm’s length, in accordance with the Company’s internal policies and procedures |

• | Whether the transaction involved any special treatment of the related person |

• | The purpose of the transaction and its potential benefits to PSEG |

• | The approximate dollar value of the transaction |

• | The related person’s interest in the transaction |

• | Any other information regarding the transaction or the related person that the Committee deems relevant |

PSEG Director Barry H. Ostrowsky is the President and CEO of RWJBarnabas Health (RWJBarnabas), anon-profit corporation incorporated in New Jersey.

• | In 2019, as part of the Company’s philanthropic activities and commitment to invest in the communities in which we do business, the Company, directly or through a subsidiary, donated approximately $58,450 to facilities affiliated with RWJBarnabas and the PSEG Foundation, a separate, 501(c)(3) organization that is funded by the Company but whose donations are not determined or influenced by the PSEG Board, donated approximately $135,000. It is expected that PSEG and the PSEG Foundation each will make future contributions to facilities affiliated with RWJBarnabas. |

• | Since 2013, the Company’s subsidiary, PSEG Services Corporation (Services), has had a contractual arrangement with an RWJBarnabas affiliate, Robert Wood Johnson University Hospital Hamilton (RWJ Hamilton), pursuant to which RWJ Hamilton provides medical care, medical testing and related services to the Company and its subsidiaries. In 2019, the Company paid a total of approximately $275,000 for services provided pursuant to this arrangement. The Company expects to pay a similar amount in 2020. |

• | Since 2008, the Company’s subsidiary, PSE&G, has engaged in an ongoing Hospital Energy Efficiency Program (HEE Program), through which PSE&G provides funds for energy efficiency upgrades to hospitals throughout the PSE&G service territory. The HEE Program was approved, and is overseen, by the BPU. PSE&G has committed to invest approximately $211.5 million through the HEE Program to a variety of hospitals over the course of several years. PSEG had made commitments of approximately $44.1 million to RWJBarnabas facilities. These projects are in various stages of completion, with several fully completed and others in progress or in the planning stage. The aggregate portion that RWJBarnabas facilities have committed to repay to PSE&G through utility bills in accordance with theBPU-approved terms of the program is equal to approximately $15.1 million. Because the HEE Program is ongoing, the investment and repayment figures are subject to change in the coming years. |

Christopher LaRossa, brother of Ralph A. LaRossa, Chief Operating Officer of PSEG and one of the Company’s Named Executive Officers, is an employee of, and receives compensation from, PSE&G. During 2019, Christopher LaRossa served and currently serves as District Manager – Regulatory Policy and Procedure. The approximate total compensation paid to Christopher LaRossa during 2019 was within the range set for employees with comparable qualifications and responsibilities who held similar positions at the Company (salary of $111,500 to $223,100 plus incentive compensation targeted at 20% of salary). He also received health insurance and other benefits available to all other employees in a similar position. His compensation was determined in accordance with our compensation practices applicable to employees who hold similar positions. Ralph A. LaRossa did not and does not have any direct responsibility for directing or reviewing his brother’s work or any influence over his brother’s compensation or the other terms of his employment.

The Corporate Governance Committee reviewed all of the transactions referenced above and determined that they are in the best interests of PSEG and its stockholders. We do not have any other related person transactions that meet the requirements for disclosure in this Proxy Statement.

The Governance Principles provide that a director must notify the Chair of the Corporate Governance Committee if the director encounters a conflict of interest or proposes to accept a position with a new entity so that potential conflicts of interest may be reviewed. Our Conflicts of Interest Practice applies to all employees, contractors, suppliers and any third party working on behalf of PSEG and covers situations where individual interests are or could be at odds or in conflict with PSEG’s interests. These situations are required to be reported to our Office of Ethics and Compliance, which may conduct an investigation or take actions it deems appropriate.

26 PSEG 2020 Proxy Statement

Security Ownership Table

SECURITY OWNERSHIP OF DIRECTORS, MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table shows, as of February 21, 2020, beneficial ownership of our common stock by the directors and nominees and the currently serving executive officers named in the 2019 Summary Compensation Table. None of these amounts exceeds one percent of our common stock outstanding. The table also shows as of February 21, 2020, beneficial ownership in shares by any person or group known to us to be the beneficial owner of more than five percent of our common stock. According to the Schedule 13G filed by each owner with the SEC, these securities were acquired and are held in the ordinary course of business and not for the purpose of changing or influencing the control of the Company.

| Name | Owned Shares (#)(1) | Restricted Stock (#)(2) | Stock Units/ RSUs (#)(3) | Phantom Shares (#)(4) | Deferred Equity Shares (#)(5) | Stock Options (#)(6) | Amount of Beneficial Ownership of Common Stock (#) | Percent of Class (%) | ||||||||||||||||||||||||

Directors: | ||||||||||||||||||||||||||||||||

Willie A. Deese | - | - | 11,830 | - | - | - | 11,830 | <1 | ||||||||||||||||||||||||

William V. Hickey | 6,332 | 9,600 | 48,398 | 24,005 | - | - | 88,335 | <1 | ||||||||||||||||||||||||

Shirley Ann Jackson | 5,604 | 9,600 | 48,398 | - | - | - | 63,602 | <1 | ||||||||||||||||||||||||

David Lilley | - | - | 41,065 | 31,441 | - | - | 72,506 | <1 | ||||||||||||||||||||||||

Barry H. Ostrowsky(7) | - | - | 5,107 | - | - | - | 5,107 | <1 | ||||||||||||||||||||||||

Scott G. Stephenson(8) | - | - | - | - | - | - | - | <1 | ||||||||||||||||||||||||

Laura A. Sugg(9) | 210 | - | 2,351 | - | - | - | 2,561 | <1 | ||||||||||||||||||||||||

John P. Surma(10) | 1,736 | - | - | - | - | - | 1,736 | <1 | ||||||||||||||||||||||||

Richard J. Swift | 304 | 14,400 | 48,398 | 59,224 | 122,326 | <1 | ||||||||||||||||||||||||||

Susan Tomasky | - | - | 27,391 | - | - | - | 27,391 | <1 | ||||||||||||||||||||||||

Alfred W. Zollar | - | - | 27,180 | - | - | - | 27,180 | <1 | ||||||||||||||||||||||||

NEOs: | ||||||||||||||||||||||||||||||||

Ralph Izzo(11) | 22,697 | - | 86,129 | - | 1,454,982 | - | 1,563,808 | <1 | ||||||||||||||||||||||||

Daniel J. Cregg(11) | 44,100 | - | 15,511 | - | 10,943 | - | 70,554 | <1 | ||||||||||||||||||||||||

Ralph A. LaRossa(11) | 8,534 | - | 49,317 | - | 143,731 | - | 201,582 | <1 | ||||||||||||||||||||||||

Tamara L. Linde(11) | 33,078 | - | 14,961 | - | - | - | 48,039 | <1 | ||||||||||||||||||||||||

David M. Daly(11)(12) | 27,732 | - | 11,583 | - | - | - | 39,315 | <1 | ||||||||||||||||||||||||

All Directors, NEOs and Executive Officers of the Company as a Group (18 Persons): |

| |||||||||||||||||||||||||||||||

| 221,061 | 33,600 | 447,277 | 114,670 | 1,609,656 | - | 2,426,264 | <1 | |||||||||||||||||||||||||

Certain Beneficial Owners: |

| |||||||||||||||||||||||||||||||

Blackrock, Inc.(13) | 43,370,761 | 8.60 | ||||||||||||||||||||||||||||||

Capital World Investors(14) | 29,647,312 | 5.80 | ||||||||||||||||||||||||||||||

State Street Corporation(15) | 28,543,311 | 5.64 | ||||||||||||||||||||||||||||||

Vanguard Group, Inc.(16) | 42,378,686 | 8.37 | ||||||||||||||||||||||||||||||

(1) | Includes all shares, if any, held directly, in brokerage accounts, under the Thrift andTax-Deferred Savings Plan (401(k) Plan), Enterprise Direct, Employee Stock Purchase Plan, shares owned jointly by or with a spouse and shares held in a trust or a custodial account. |

(2) | Includes restricted stock granted to directors under the former Stock Plan for Outside Directors. |

(3) | Includes vested and unvested RSUs granted to executive officers under the LTIP and stock units granted to directors under the Equity Compensation Plan for Outside Directors (Directors Equity Plan), with no voting rights. |

(4) | Includes phantom shares accrued under the Directors’ Deferred Compensation Plan for those individuals who have elected to have the earnings on their deferred payments calculated based upon the performance of our common stock, with no voting rights and all payouts in cash. |

(5) | Includes shares deferred under the Equity Deferral Plan, with no voting rights. |

(6) | Stock options granted under the LTIP, all of which have been exercised. There are no outstanding stock options. |

(7) | Mr. Ostrowsky joined the Board in February 2018 and has not yet met his ownership requirement. |

(8) | Mr. Stephenson joined the Board in February 2020 and has not yet met his ownership requirement. |

(9) | Ms. Sugg joined the Board in January 2019 and has not yet met her ownership requirement. |

PSEG 2020 Proxy Statement 27

Security Ownership Table –Delinquent Section 16(a) Reports

(10) | Mr. Surma joined the Board in November 2019 and has not yet met his ownership requirement. |

(11) | Address: 80 Park Plaza, Newark, NJ 07102 |

(12) | Mr. Daly was elected to his current position effective October 2, 2017 and has until January 2023 to meet his ownership requirement. |

(13) | As reported on Schedule 13G filed on February 5, 2020. Address: 55 East 52nd Street, New York, NY 10055. |

(14) | As reported on Schedule 13G filed on February 14, 2020. Address: 333 South Hope Street, Los Angeles, CA 90071. |

(15) | As reported on Schedule 13G filed on February 13, 2020. Address: One Lincoln Street, Boston, MA 02111. |

(16) | As reported on Schedule 13G filed on February 12, 2020. Address: 100 Vanguard Blvd., Malvern, PA 19355. |

Delinquent Section 16(a) Reports

The following information is based upon our review of Forms 3 and 4 filed in 2019 and Forms 5 filed with respect to 2019 with the SEC under Section 16(a) of the Securities Exchange Act of 1934, as amended, regarding transactions involving our common stock. During 2019, none of our directors was late in filing a Form 3, 4 or 5 in accordance with the applicable requirements of the SEC. For our Named Executive Officers, exceptions due to administrative oversight were: one Form 4 was filed late for Ralph A. LaRossa, reporting the sale of 1,650 shares per his10b5-1 Plan and one Form 4 was filed late for each of Ralph Izzo, Daniel J. Cregg, Ralph A. LaRossa, Tamara L. Linde and David M. Daly, reporting their annual awards of restricted units.

The table below reports 2019 compensation to directors except Mr. Izzo, as explained below, under How Our Directors Are Compensated.

Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | All Other Compensation ($)(3) | Total ($) | ||||||||||||||||

Willie A. Deese | 155,000 | 135,018 | - | - | - | 150 | 290,168 | |||||||||||||||

William V. Hickey | 158,333 | 135,018 | - | - | - | 150 | 293,501 | |||||||||||||||

Shirley Ann Jackson | 203,333 | 135,018 | - | - | - | 150 | 338,501 | |||||||||||||||

David Lilley(4) | 206,250 | 135,018 | - | - | - | - | 341,268 | |||||||||||||||

Barry H. Ostrowsky | 148,333 | 135,018 | - | - | - | 150 | 283,501 | |||||||||||||||

Thomas A. Renyi(5) | 65,000 | - | - | - | - | 10,150 | 75,150 | |||||||||||||||

Laura A. Sugg | 135,000 | 135,018 | - | - | - | - | 270,018 | |||||||||||||||

John P. Surma | 12,917 | - | - | - | - | - | 12,917 | |||||||||||||||

Richard J. Swift | 178,333 | 135,018 | - | - | - | - | 313,351 | |||||||||||||||

Susan Tomasky | 158,333 | 135,018 | - | - | - | 150 | 293,501 | |||||||||||||||

Alfred W. Zollar | 160,000 | 135,018 | - | - | - | - | 295,018 | |||||||||||||||

| (1) | Includes all meeting fees, chair/committee retainer fees and the annual retainer, as described below under How Our Directors Are Compensated, and reflects time served in a particular position throughout the year. Includes the following amounts deferred pursuant to the Directors’ Deferred Compensation Plan, described below. |

Deese ($) | Hickey ($) | Jackson ($) | Lilley ($) | Ostrowsky ($) | Renyi(5) ($) | Sugg ($) | Surma ($) | Swift ($) | Tomasky ($) | Zollar ($) | ||||||||||

| - | 158,333 | 203,333 | - | - | 65,000 | - | - | - | - | - |

| (2) | For each, the grant date fair value of the award on May 1, 2019, equated to 2,297 stock units, rounded up to the nearest whole share, based on the then current market price of the common stock of $58.78. In addition, each individual’s account is credited with additional stock units on the quarterly dividend dates at the then current dividend rate. The following table shows outstanding stock units granted under the Directors’ Equity Plan and restricted stock granted under the prior Stock Plan for Outside Directors, as of December 31, 2019: |

Deese (#) | Hickey (#) | Jackson (#) | Lilley (#) | Ostrowsky (#) | Renyi (#) | Sugg (#) | Surma (#) | Swift (#) | Tomasky (#) | Zollar (#) | |||||||||||||||||||||||||||||||||||||||||||||

Stock Units | 11,830 | 48,398 | 48,398 | 41,065 | 5,107 | - | 2,351 | - | 48,398 | 27,391 | 27,180 | ||||||||||||||||||||||||||||||||||||||||||||

Restricted Stock | - | 9,600 | 9,600 | - | - | - | - | - | 14,400 | - | - | ||||||||||||||||||||||||||||||||||||||||||||

| (3) | Consists of charitable contributions made by us on behalf of each individual, including a special contribution in honor of Mr. Renyi’s retirement. |

| (4) | Due to an administrative oversight, $41,250 that was payable in 2018 was delayed and paid in 2019. |

| (5) | Service on our Board ended in April 2019. |

28 PSEG 2020 Proxy Statement

Director Compensation –How Our Directors Are Compensated

How Our Directors Are Compensated

As provided in our Governance Principles, director compensation is reviewed periodically by the Corporate Governance Committee, which recommends approval to the Board. Our compensation tonon-management directors is comparable to median director compensation among our peer companies, in order to be able to attract and retain high quality Board members. This compensation includes a cash retainer, RSUs and reimbursement for expenses for attending Board and committee meetings and related functions. Ralph Izzo, who is compensated as our CEO does not receive any additional compensation for Board membership. His compensation as an employee is shown in this Proxy Statement in the executive compensation tables and the Executive Compensation section. In accordance with PSEG’s Certificate of Incorporation, the Company provides indemnity and reimbursement of expenses to the full extent permitted by law and provides directors’ and officers’ insurance.

Every two years, our independent compensation consultant, CAP, advises the Corporate Governance Committee on the competitiveness of our director compensation.

The independent directors are compensated according to the schedule shown below. All amounts are paid in cash, except the equity grant, which is paid in common stock units equal to the amount shown. All payments to the Chairs and committee members, as indicated, are per assignment and are in addition to the annual retainer and equity grant. Following a review of peer company market data conducted by CAP, the fee schedule was last revised effective May 1, 2016. The fee schedule, among other things, was last reviewed by CAP in 2019 and no changes were made to the fee schedule at that time.

Fee Schedule ($) | ||||

Annual Retainer | 95,000 | |||

Annual Equity Grant | 135,000 | |||

Lead Director | 40,000 | |||

Committee Chair: Audit; Organization and Compensation Committee (O&CC) | 30,000 | |||

Committee Chair: Corporate Governance; Finance | 25,000 | |||

Committee Chair: Fossil Generation; Nuclear Generation | 12,500 | |||

Committee Member: Audit | 20,000 | |||

Committee Member: Corporate Governance; Executive; Finance; O&CC | 20,000 | |||

Committee Member: Fossil Generation; Nuclear Generation | 10,000 | |||

Directors’ Stock Ownership Requirement

Our Governance Principles require that our directors own shares of our common stock (including any restricted stock, whether or not vested, any stock units under the Directors’ Equity Plan and any phantom stock under the Directors’ Deferred Compensation Plan) equal to six times the annual retainer (which is currently $95,000 for a total required ownership level of $570,000) before they may sell any PSEG stock. The Board raised the minimum ownership requirement in 2019 from five to six times the annual retainer to be aligned with market practice. All incumbent directors currently meet this stock ownership level except for our four newest directors: Barry H. Ostrowsky, who joined the Board in February 2018; Laura A. Sugg, who joined the Board in January 2019; John P. Surma, who joined the Board in November 2019 and Scott G. Stephenson who joined the Board in February 2020. Additional details can be found in the table under Security Ownership of Directors, Management and Certain Beneficial Owners on page 27.

Directors’ Equity Plan

The Directors’ Equity Plan is a deferred compensation plan and, under its terms, each of our outside directors is granted an award of stock unit equivalents each May 1st (in an amount determined fromtime-to-time by the Board) which is recorded in a bookkeeping account in the director’s name and accrues credits equivalent to the dividends on shares of our common stock. If a director does not remain a member of the Board (other than on account of disability or death) until the earlier of the succeeding April 30th or the next Annual Meeting of Stockholders, the award for that year will be prorated to reflect actual service. Distributions of all deferred equity under the Directors’ Equity Plan are made in shares of our common stock after the director terminates service on the Board in accordance with elected distributions, which may be either in alump-sum payment or, with respect to grants made prior to 2012, in annual payments over a period of up to ten years.

Under the Directors’ Equity Plan, beginning with grants made in 2012, directors may elect to receive distribution of a particular year’s deferrals either upon termination of service or after a specified number of years or, effective in 2020, directors who have met the stock ownership requirement may elect to receive distribution of shares upon vesting. A director may elect to receive distribution of such deferrals in the form of alump-sum payment or annual installments over a period of three to fifteen years. Distribution elections must be made prior to the date of the award.

PSEG 2020 Proxy Statement 29

Director Compensation –How Our Directors Are Compensated

Directors may make a distribution election for each year’s deferred compensation and may make changes regarding the timing of distribution elections with respect to prior deferred compensation as long as any new distribution election is made at least one year prior to the date that the distribution would otherwise have begun and the revised commencement date is at least five years later than the date that the distribution would otherwise have begun.

Directors’ Deferred Compensation Plan

Under the Directors’ Deferred Compensation Plan, directors may elect to defer any portion of their cash fees. Elections must be made in the calendar year prior to the year of payment. When deferral is elected, the director must make an election as to the timing of the distribution from the Directors’ Deferred Compensation Plan account. Distributions are made in cash.

For amounts deferred prior to 2012, distributions may begin (a) on the thirtieth day after the date of termination of service as a director or, in the alternative, (b) on January 15th of any calendar year following termination of service, but in any event no later than the later of (i) January of the year following the year of the director’s 71st birthday or (ii) January following termination of service. Directors may elect to receive the distribution of their Directors’ Deferred Compensation account in the form of onelump-sum payment or annual distributions over a period of up to ten years.

For compensation deferred beginning in 2012, directors may elect to begin distribution of a particular year’s deferrals, either (a) within 30 days of termination of service or (b) a specified number of years following termination of service. They may elect to receive distribution of such deferrals in the form of alump-sum payment or annual installments over a period of three to fifteen years.

Directors may make a distribution election for each year’s deferred compensation and may make changes regarding the timing of distribution elections with respect to prior deferred compensation as long as any new distribution election is made at least one year prior to the date that the distribution would otherwise have begun and the revised commencement date is at least five years later than the date that the distribution would otherwise have begun.

30 PSEG 2020 Proxy Statement

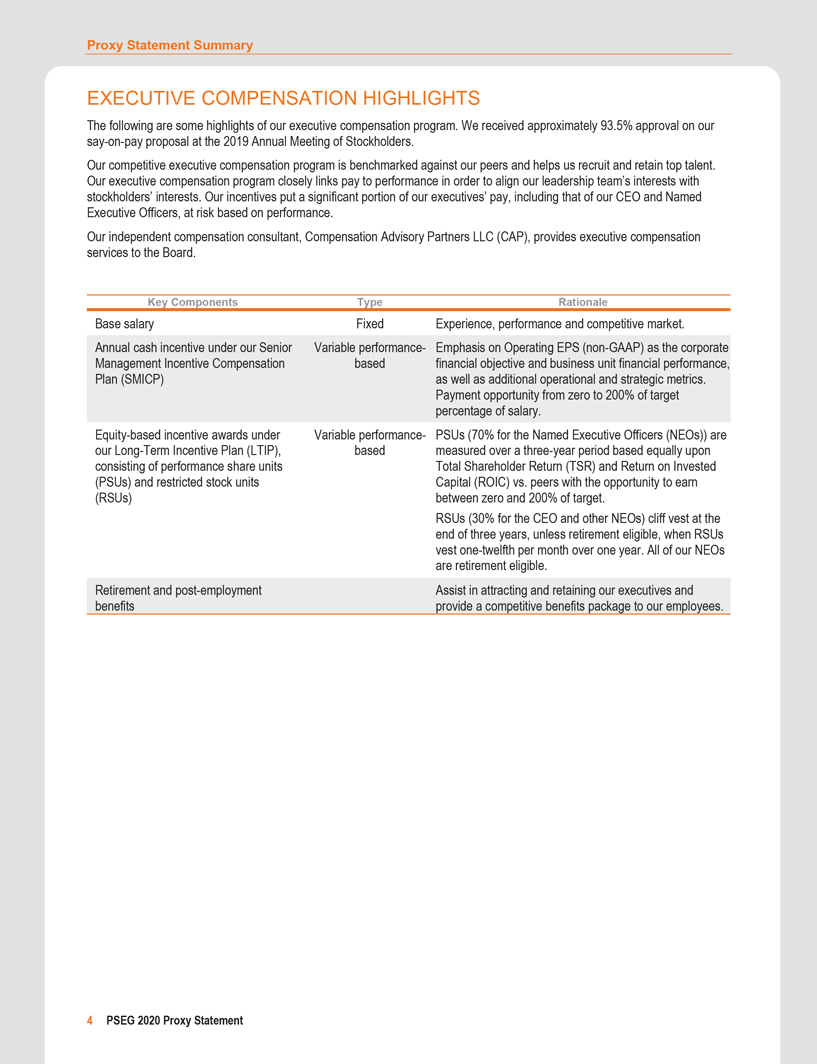

Compensation Discussion and Analysis

We recognize that executive compensation is an important matter for our stockholders. As required by Section 14A of the Exchange Act, we provide you with an opportunity to cast an advisory vote on our executive compensation programs as described in this Proxy Statement. This is commonly referred to assay-on-pay.

This vote is held annually and isnon-binding, but the Board, the Organization and Compensation Committee and management carefully review the voting results and take them into consideration when making future decisions regarding our executive compensation.

The nextsay-on-pay vote will occur at our 2021 Annual Meeting of Stockholders. The nextsay-on-frequency vote, which determines how often thesay-on-pay vote is to be held, will also occur at our 2021 Annual Meeting of Stockholders.

The Organization and Compensation Committee has approved the compensation arrangements discussed in the Report of our Organization and Compensation Committee, the Executive Compensation section and the compensation tables. We encourage you to read our Executive Compensation section, in which we explain the reasons supporting our executive pay decisions. We have summarized the highlights in our Executive Compensation Summary.

We believe our executive compensation is reasonable and appropriate, reflecting market conditions and performance. We are asking you to indicate your support of our executive compensation program as described in this Proxy Statement. This vote is not intended to address any specific item of compensation or any specific individual. Rather, it is an indication of your agreement with the overall philosophy, policies, practices and compensation of our Named Executive Officers as described in this Proxy Statement. Accordingly, as recommended by the Board, we ask for you to vote in favor of the following resolution:

Resolved, that the stockholders hereby approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2020 Annual Meeting of Stockholders pursuant to the applicable rules of the SEC, including the Compensation Discussion and Analysis, compensation tables and narrative discussion.

Vote required: We will tally the votes cast in person or by proxy, excluding abstentions and shares withheld or for which no instructions are given.

THE BOARD RECOMMENDS A VOTEFOR THE RESOLUTION IN THIS PROPOSAL.

THE BOARD RECOMMENDS A VOTEFOR THE RESOLUTION IN THIS PROPOSAL.

PSEG 2020 Proxy Statement 31

Compensation Discussion and Analysis– Executive Compensation Summary

EXECUTIVE COMPENSATION SUMMARY

TABLE OF CONTENTS

• 2019 Named Executive Officers

• 2019 Company Performance Overview

• Executive Compensation Philosophy and Pay for Performance

• Say-on-Pay and Shareholder Engagement

• Executive Compensation Best Practices

• Peer Comparison and Benchmarking

• How We Compensate Our Executives

• Our Compensation Elements Explained

• Executive Compensation Governance Features and Controls

• Accounting and Tax Implications

• Compensation Committee Interlocks and Insider Participation

• Executive Compensation Tables

| Ralph Izzo, Chairman of the Board, President & CEO | |

| Daniel J. Cregg, Executive Vice President (EVP) & CFO | |

| Ralph A. LaRossa, Chief Operating Officer (COO) - PSEG(1) | |

| Tamara L. Linde, EVP & General Counsel | |

| David M. Daly, President & COO - PSEG Utilities and Clean Energy Ventures(2) |

(1) | Mr. LaRossa was elected to the position of COO - PSEG, effective January 1, 2020. During 2019, he was President & COO of PSEG Power. He continues to hold the positions of President and COO of PSEG Power in addition to his current position. |

(2) | Mr. Daly was elected to the position of President & COO - PSEG Utilities and Clean Energy Ventures, effective January 1, 2020. During 2019, he was President & COO of PSE&G and Chairman of the Board (COB) of PSEG Long Island. He continues to hold the positions of President of PSE&G and COB of PSEG Long Island. |

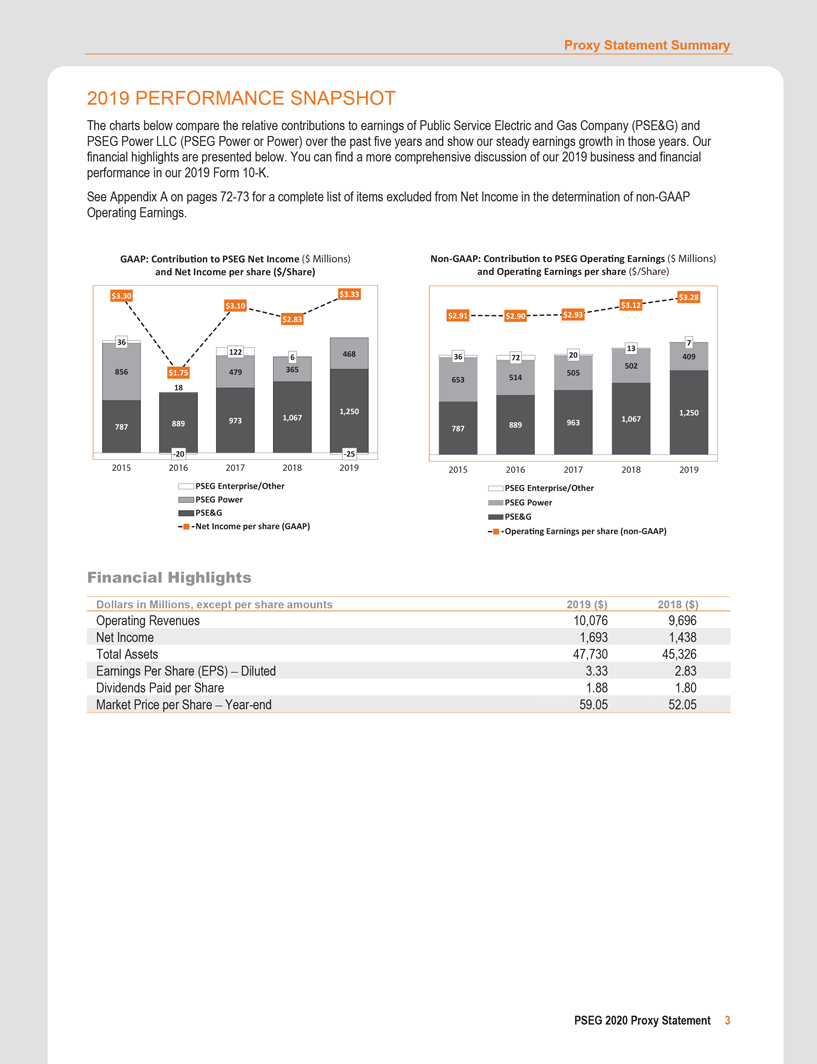

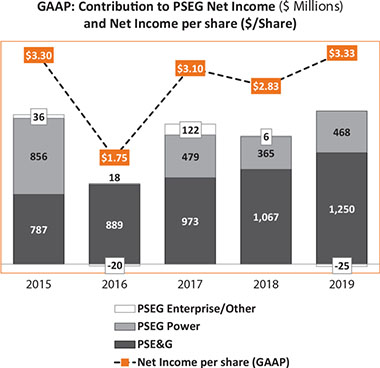

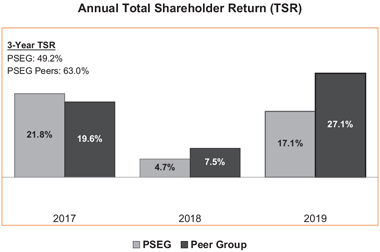

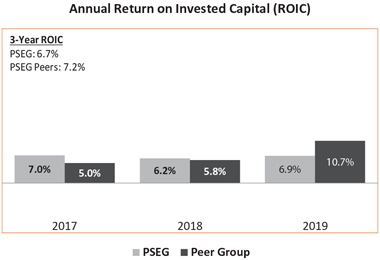

2019 Company Performance Overview

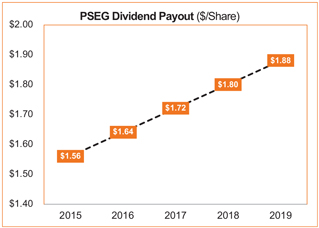

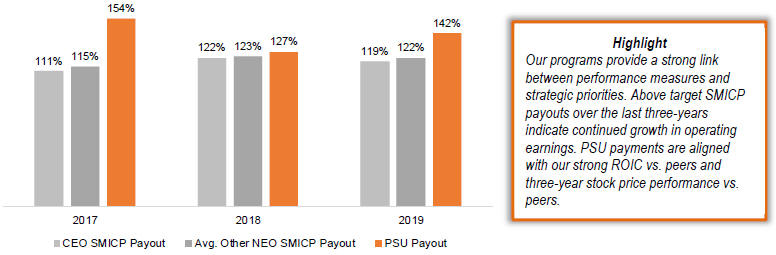

The charts below compare the relative contributions to earnings of PSE&G and PSEG Power over the past five years and show our steady earnings and consistent dividend growth in those years. This impact on our earnings is reflected in the realized pay of our Named Executive Officers, since our executive compensation program links incentive payouts to earnings measures over multiple time frames. Accordingly, we show below the annual TSR and ROIC in the last three years compared to our 2019 peer group. Our financial highlights are presented on page 3. You can find a more comprehensive discussion of our 2019 business and financial performance in our 2019 Form10-K.

32 PSEG 2020 Proxy Statement

Compensation Discussion and Analysis –2019 Company Performance Overview

See Appendix A on pages72-73 for a complete list of items excluded from Net Income in the determination ofnon-GAAP Operating Earnings.

|  |

PSEG 2020 Proxy Statement 33

Compensation Discussion and Analysis –Executive Compensation Philosophy and Pay for Performance

Executive Compensation Philosophy and Pay for Performance

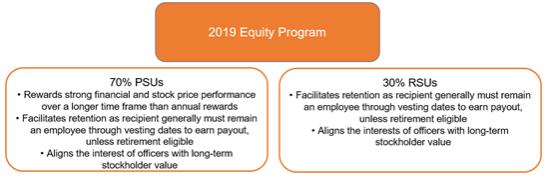

Our program aligns executive compensation to the successful execution of our strategic plans, meeting our financial and operational goals and delivering strong returns while balancing the interests of our multiple stakeholders. These include our stockholders, the customers we serve, our employees and the communities in which we operate. We attract and retain exceptional executive talent needed for long-term success by ensuring our compensation is market competitive with our peers.

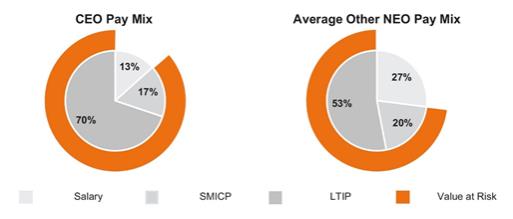

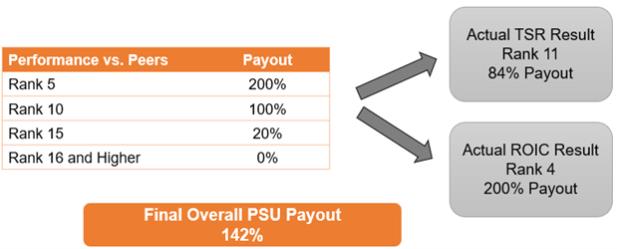

Our SMICP focuses on financial and operating performance over aone-year period while our LTIP, which includes our PSUs, focuses on outperforming our peers on a multi-year horizon. The goals of individual Named Executive Officers, including our CEO, place a high value on strategic initiatives, long-range planning, disciplined investments, ESG priorities and operational excellence that enhance value and our responsibilities as a public utility. The actual value of compensation, especially equity grants, reflect our Company’s performance over time.

For 2019, we set SMICP targets that were higher than actual 2018 results for the PSEG and PSE&G earnings components. Recognizing that our business is highly sensitive to factors outside our control, including energy prices and weather, in some years our goals in the SMICP may be below the prior year’s results, which is common among our peers. Accordingly, PSEG Power’s 2019 SMICP earnings component was set slightly below 2018 actual results.

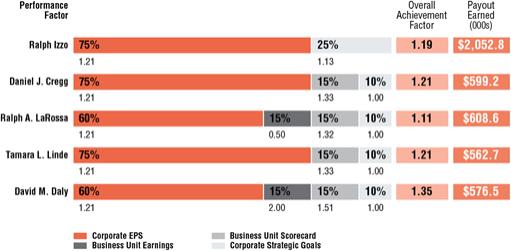

Actual Payout Compared to Target

The Organization and Compensation Committee annually reviews and evaluates our compensation program and maintains the flexibility to make decisions about actual compensation levels and awards based on achievement of our business objectives and relevant circumstances affecting our Company. In addition to the established performance measures, these may include economic, market and competitive conditions, regulatory and legal requirements, internal pay equity considerations, ESG priorities and peer group or market practices. The Organization and Compensation Committee and the Board align strong pay for performance with long-term stockholder value creation without encouraging excessive risk taking.

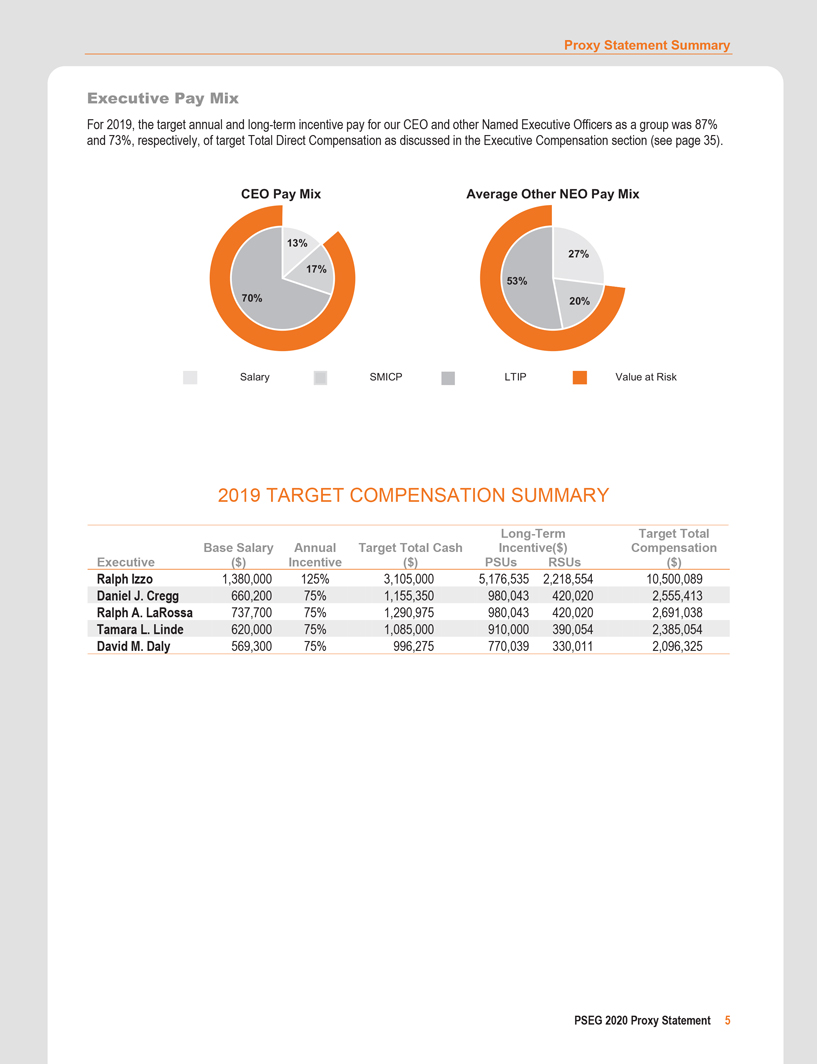

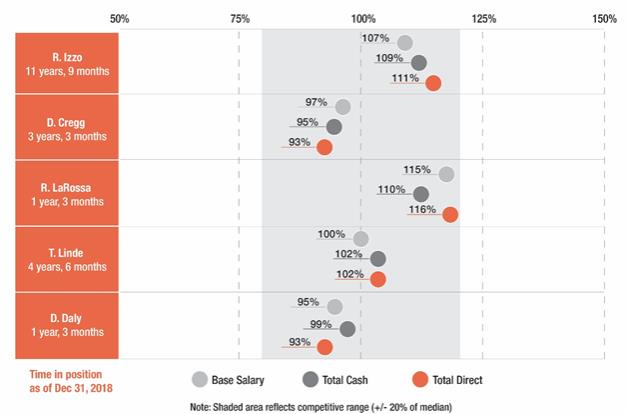

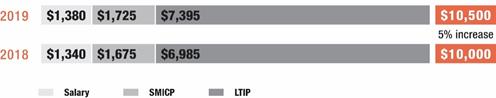

2019 Target Compensation Summary

Overall target compensation should be competitive compared to individuals in our peer group so that we can attract, engage, motivate and retain exceptional talent. The 2019 compensation decisions are reflective of each executive’s role, responsibilities, performance and time in position. Our 2019 target compensation is as follows:

| Target Total | Long-Term | Target Total | ||||||||||||||||||||||||||||

| Base Salary | Annual | Cash | Incentive($) | Compensation | ||||||||||||||||||||||||||

| Executive | ($) | Incentive | ($) | PSUs | RSUs | ($) | ||||||||||||||||||||||||

Ralph Izzo | 1,380,000 | 125% | 3,105,000 | 5,176,535 | 2,218,554 | 10,500,089 | ||||||||||||||||||||||||

Daniel J. Cregg | 660,200 | 75% | 1,155,350 | 980,043 | 420,020 | 2,555,413 | ||||||||||||||||||||||||

Ralph A. LaRossa | 737,700 | 75% | 1,290,975 | 980,043 | 420,020 | 2,691,038 | ||||||||||||||||||||||||

Tamara L. Linde | 620,000 | 75% | 1,085,000 | 910,000 | 390,054 | 2,385,054 | ||||||||||||||||||||||||

David M. Daly | 569,300 | 75% | 996,275 | 770,039 | 330,011 | 2,096,325 | ||||||||||||||||||||||||

The above values may not match the Summary Compensation Table due to timing of increases and accounting valuation of equity awards.

34 PSEG 2020 Proxy Statement

Compensation Discussion and Analysis –Say-on-Pay and Shareholder Engagement

Say-on-Pay and Shareholder Engagement

At the 2019 Annual Meeting, our stockholders voted approximately 93.5% in favor of oursay-on-pay proposal, demonstrating their concurrence that our programs reflect our strongpay-for-performance philosophy. We continuously review our executive compensation program in recognition of investor feedback and adjust, as appropriate, the compensation of our executives in light of their performance, our business results, our financial condition and the competitive market for the role.

93.5% of stockholders voted in favor of 2019 say-on-pay proposal |

We strongly encourage investor feedback and will continue to review and make changes to our executive compensation program in recognition of investor interests, evolving trends and best practices. |

In particular, the Organization and Compensation Committee, with input from our independent compensation consultant, CAP, considered the 2019say-on-pay vote result and current market practices as it evaluated our executive compensation program. During the past year, we actively reached out to many of our largest investors to advise them of recent compensation and governance actions we have taken and to listen to any concerns they may have. We always welcome stockholders’ comments and suggestions and continue to consider the outcome of thesay-on-pay vote on our program design.

Executive Compensation Best Practices

What We Do

|

What We Don’t Do

| |

✓ Pay for performance, with a significant portion of target compensation at risk

✓ Set stretch performance goals

✓ Competitive pay, targeted around the median

✓ Maximum payout cap for incentive plans

✓ Minimum vesting of three years for RSUs and PSUs

✓ Double trigger in the event of achange-in-control to receive severance benefits

✓ Clawback policy that applies to financial restatements or in the event of misconduct or material violations of our Standards of Conduct

✓ Robust stock ownership guidelines for executives

✓ Independent executive compensation consultant reviews executive compensation programs and practices

✓ Engage stockholders to solicit feedback on our compensation program

✓ Uniform retirement formulas for all employees | x No guaranteed incentive compensation

x No excise tax gross ups

x No hedging or pledging for any employee, including officers and directors

x No compensation plans that encourage or reward executives’ excessive risks

x No dividends paid on unearned awards

x No repricing or exchange of underwater stock options

x No excessive perks

x No longer offer additional service credit for pension calculation |

PSEG 2020 Proxy Statement 35

Compensation Discussion and Analysis –Peer Comparison and Benchmarking

Peer Comparison and Benchmarking

How We Choose Peers for Benchmarking

We evaluate and set executive compensation to be competitive within an identified peer group comprised of similarly sized energy companies. We consider our peers’ earnings, market capitalization and revenue. Because our revenue is driven by energy demand and prices that are outside the control of management, we emphasize earnings over revenue. We believe this approach is more reflective of the complexities of our business when comparing across companies.

Each year, were-evaluate the peer group to assess its appropriateness. We removed PG&E Corporation in early 2019 due to its bankruptcy announcement. Our peer companies for 2019 are listed below.

Peer Companies | ||||

Ameren Corporation | American Electric Power Co., Inc. | CenterPoint Energy, Inc. | ||

Consolidated Edison, Inc. | Dominion Resources, Inc. | DTE Energy Company | ||

Duke Energy Corporation | Edison International | Entergy Corporation | ||

Eversource Energy | Exelon Corporation | FirstEnergy Corp. | ||

NextEra Energy, Inc. | NRG Energy, Inc. | PPL Corporation | ||

Sempra Energy | Southern Company | Xcel Energy Inc. | ||

How We Use Peer Data

• | Reference point for setting 2019 pay levels |

• | Target the median (50th percentile) of the peer group for Total Direct Compensation |

• | Assess our performance under our LTIP and the alignment between pay and performance |

• | Review incentive plan design, equity usage and governance practices |

Pay Governance LLC assists in analyzing the annual Willis Towers Watson Energy Services Executive Compensation Survey–U.S. assessment of the market using the peer companies. We use the peer group data to the extent each position is reported in the survey data. The Organization and Compensation Committee’s independent consultant, CAP, reviews the outcome of the competitive assessment and provides supplemental data on the peer group as required.

36 PSEG 2020 Proxy Statement

Compensation Discussion and Analysis –Peer Comparison and Benchmarking

Compensation Benchmark

The Organization and Compensation Committee considers a range of approximately+/-20% of the 50th percentile of benchmark positions to be within the competitive range, with an emphasis on Total Direct Compensation.