Exhibit 99.1

Third Quarter 2019 Investor Update Third Quarter 2019 Investor Update Oglethorpe Power Corporation November 26, 2019

Third Quarter 2019 Investor Update Notice to Recipients Cautionary Note Regarding Forward Looking Statements Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe”), that are not historical facts are forward - looking statements. Although Oglethorpe believes that in making these forward - looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward - looking statements, which are not guarantees of future performance. Forward - looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward - looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward - looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD - LOOKING INFORMATION” in our Quarterly Report on Form 10 - Q for the fiscal quarter ended September 30, 2019, filed with the Securities and Exchange Commission on November 13, 2019, and “RISK FACTORS” in our Annual Report on Form 10 - K for the fiscal year ended December 31, 2018, filed with the Securities and Exchange Commission on March 29, 2019. This electronic presentation is provided as of November 26, 2019. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward - looking statements. 2

Third Quarter 2019 Investor Update • Vogtle 3 & 4 Update • Operations and P ower Supply Update • Financial and Liquidity Update Presenters and Agenda Mike Price Executive Vice President and Chief Operating Officer Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3

Third Quarter 2019 Investor Update Vogtle 3 & 4 Update 4 ‣ Oglethorpe Budget is $7.5 billion which includes a project - level contingency and a separate Oglethorpe - level contingency . • As of September 30, 2019, approximately $67 million of $800 million project - level contingency has been allocated (Oglethorpe share is $20 million). • Separate Oglethorpe - level contingency remains intact. ‣ Official Project Schedule has in - service (COD) dates of November 2021 & 2022. ‣ Site working towards a more aggressive schedule ( with margin to the official dates ). ‣ Started Integrated Flush activities on Unit 3 in August. • Integrated Flush is the cleaning and flushing of all system piping and mechanical components that feed into the reactor vessel and reactor coolant loops. It ensures systems can be tested without concern for damage from debris. ‣ Open Vessel Testing for Unit 3 has just begun. Cold Hydro Test and Hot Functional Test will follow in 2020.

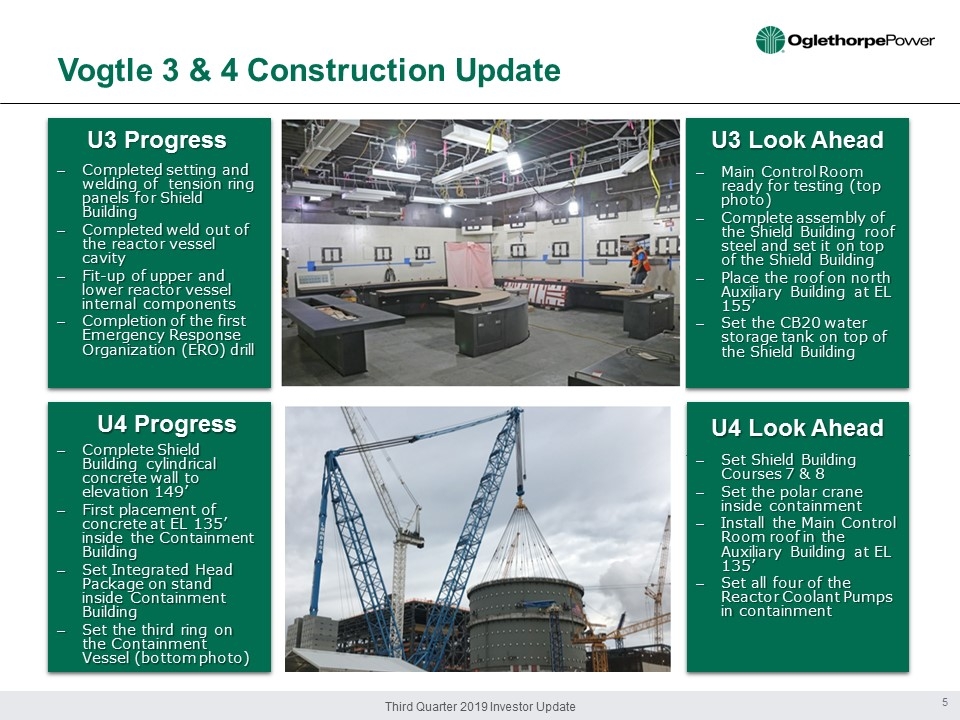

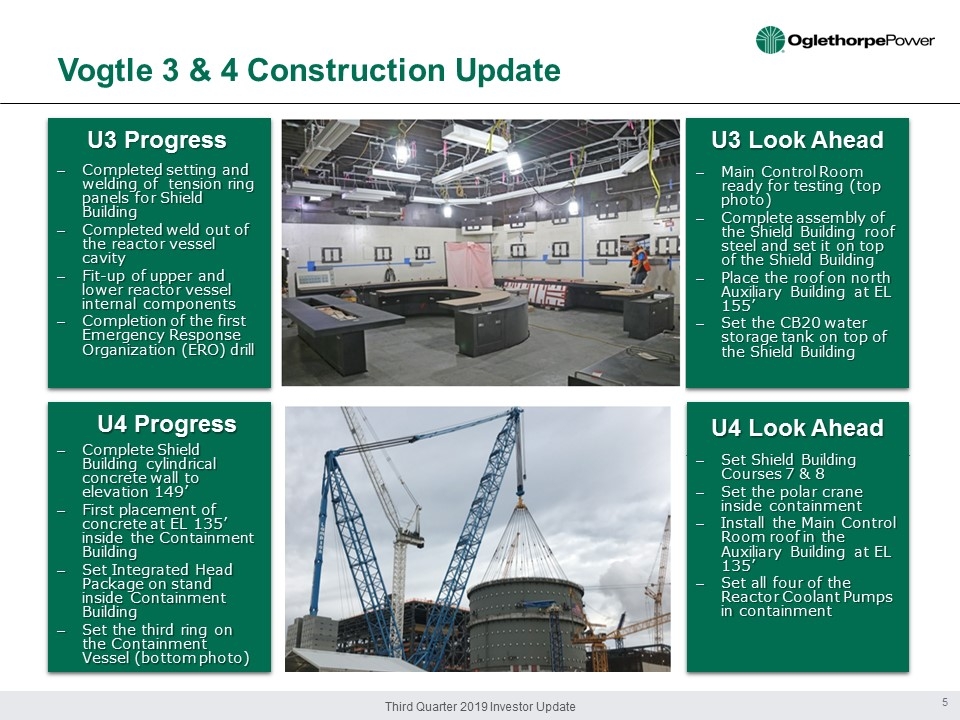

Third Quarter 2019 Investor Update U4 Look Ahead Vogtle 3 & 4 Construction Update – Main Control Room ready for testing (top photo) – Complete assembly of the Shield Building roof steel and set it on top of the Shield Building – Place the roof on north Auxiliary Building at EL 155’ – Set the CB20 water storage tank on top of the Shield Building – Completed setting and welding of tension ring panels for Shield Building – Completed weld out of the reactor vessel cavity – Fit - up of upper and lower reactor vessel internal components – Completion of the first Emergency Response Organization (ERO) drill U3 Progress – Complete Shield Building cylindrical concrete wall to elevation 149’ – First placement of concrete at EL 135’ inside the Containment Building – Set Integrated Head Package on stand inside Containment Building – Set the third ring on the Containment Vessel (bottom photo) U4 Progress U3 Look Ahead – Set Shield Building Courses 7 & 8 – Set the polar crane inside containment – Install the Main Control Room roof in the Auxiliary Building at EL 135’ – Set all four of the Reactor Coolant Pumps in containment 5

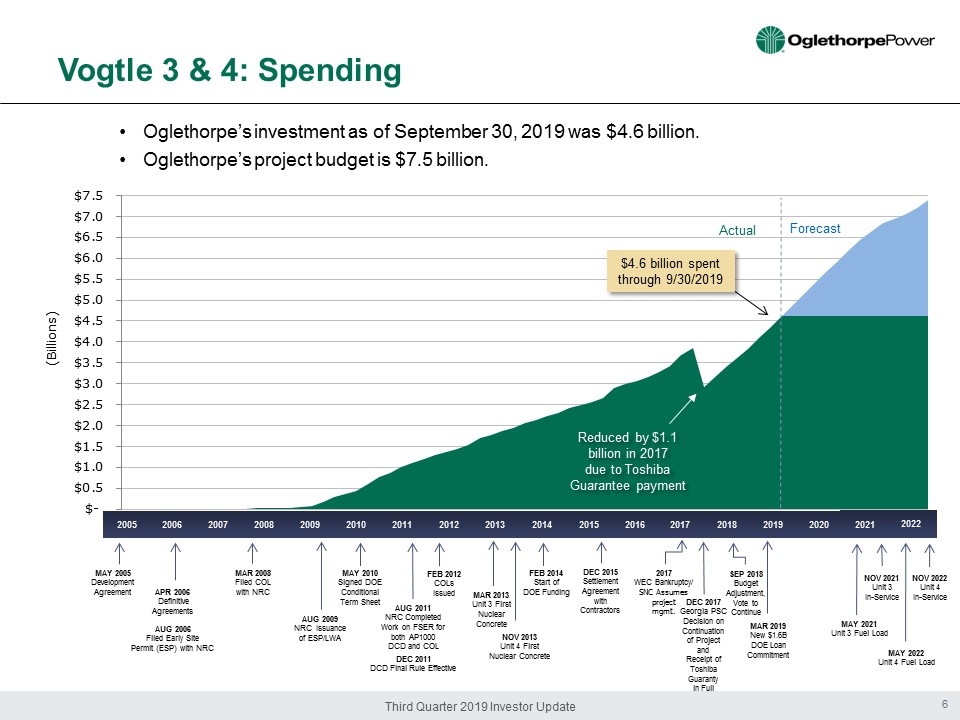

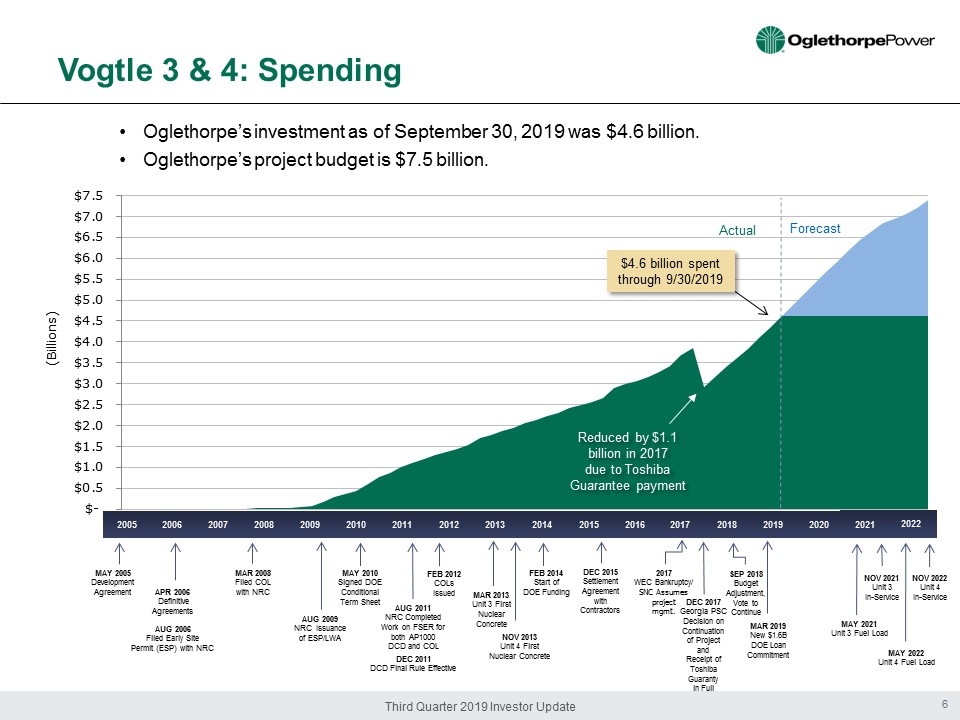

Third Quarter 2019 Investor Update $- $0.5 $1.0 $1.5 $2.0 $2.5 $3.0 $3.5 $4.0 $4.5 $5.0 $5.5 $6.0 $6.5 $7.0 $7.5 (Billions) • Oglethorpe’s investment as of September 30, 2019 was $4.6 billion. • Oglethorpe’s project budget is $7.5 billion. $4.6 billion spent t hrough 9/30/2019 Forecast DEC 2011 DCD Final Rule Effective MAY 2005 Development Agreement MAR 2008 Filed COL with NRC APR 2006 Definitive Agreements MAY 2010 Signed DOE Conditional Term Sheet AUG 2006 Filed Early Site Permit (ESP) with NRC AUG 2009 NRC Issuance of ESP/LWA AUG 2011 NRC Completed Work on FSER for both AP1000 DCD and COL FEB 2012 COLs Issued MAR 2013 Unit 3 First Nuclear Concrete FEB 2014 Start of DOE Funding NOV 2013 Unit 4 First Nuclear Concrete NOV 2022 Unit 4 In - Service DEC 2015 Settlement Agreement with Contractors MAY 2021 Unit 3 Fuel Load MAY 2022 Unit 4 Fuel Load NOV 2021 Unit 3 In - Service 2017 2016 2015 2014 2013 2012 2011 2010 2009 2018 2019 2020 2021 2022 2007 2008 2006 2005 2017 WEC Bankruptcy/ SNC Assumes project mgmt. Vogtle 3 & 4: Spending 6 SEP 2018 Budget Adjustment, Vote to Continue DEC 2017 Georgia PSC Decision on Continuation of Project and Receipt of Toshiba Guaranty in Full Reduced by $1.1 billion in 2017 due to Toshiba Guarantee payment Actual MAR 2019 New $1.6B DOE Loan Commitment

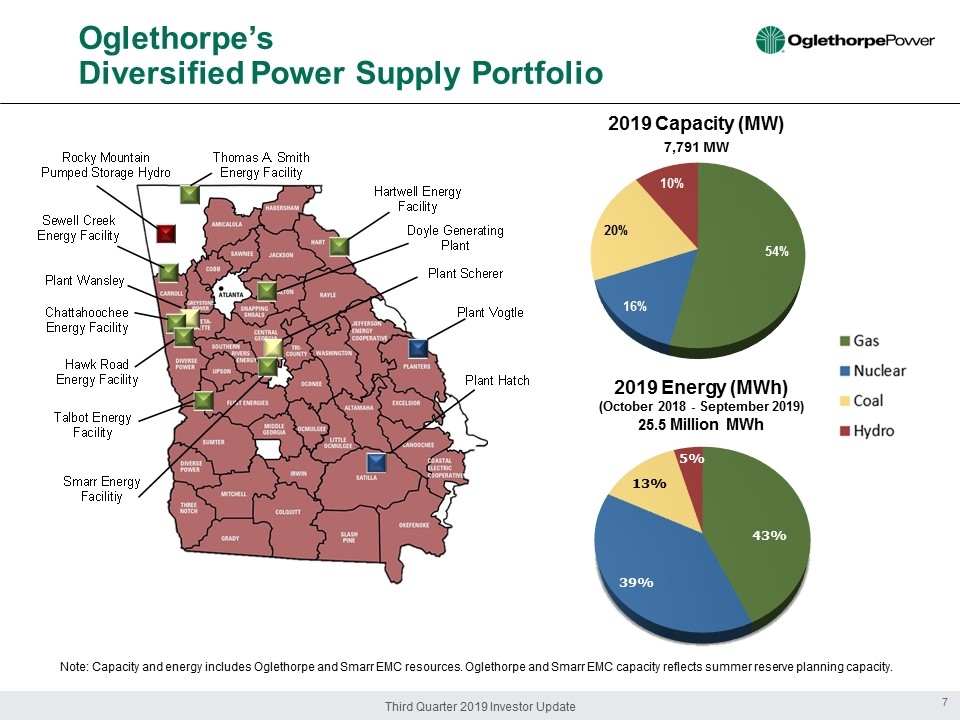

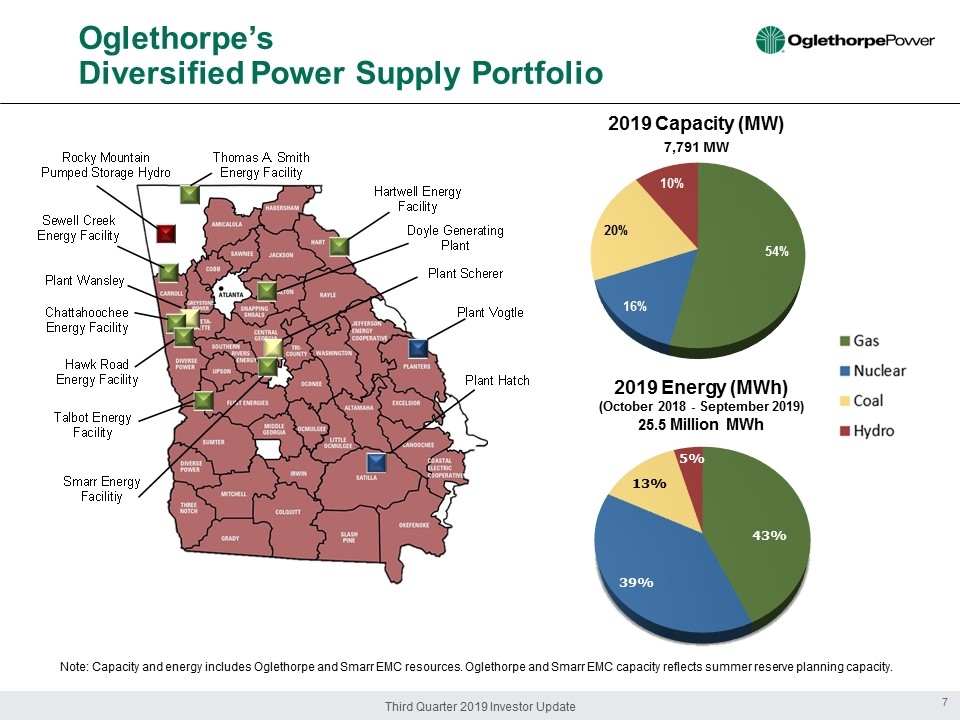

Third Quarter 2019 Investor Update Rocky Mountain Pumped Storage Hydro Sewell Creek Energy Facility Chattahoochee Energy Facility Hawk Road Energy Facility Plant Wansley Talbot Energy Facility Hartwell Energy Facility Plant Vogtle Plant Hatch Doyle Generating Plant Smarr Energy Facilitiy Plant Scherer Thomas A. Smith Energy Facility Oglethorpe’s Diversified Power Supply Portfolio Note: Capacity and energy includes Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. 2019 Energy (MWh) (October 2018 - September 2019) 25.5 Million MWh 2019 Capacity (MW) 7,791 MW 7 54% 16% 20% 10% 43% 39% 13% 5%

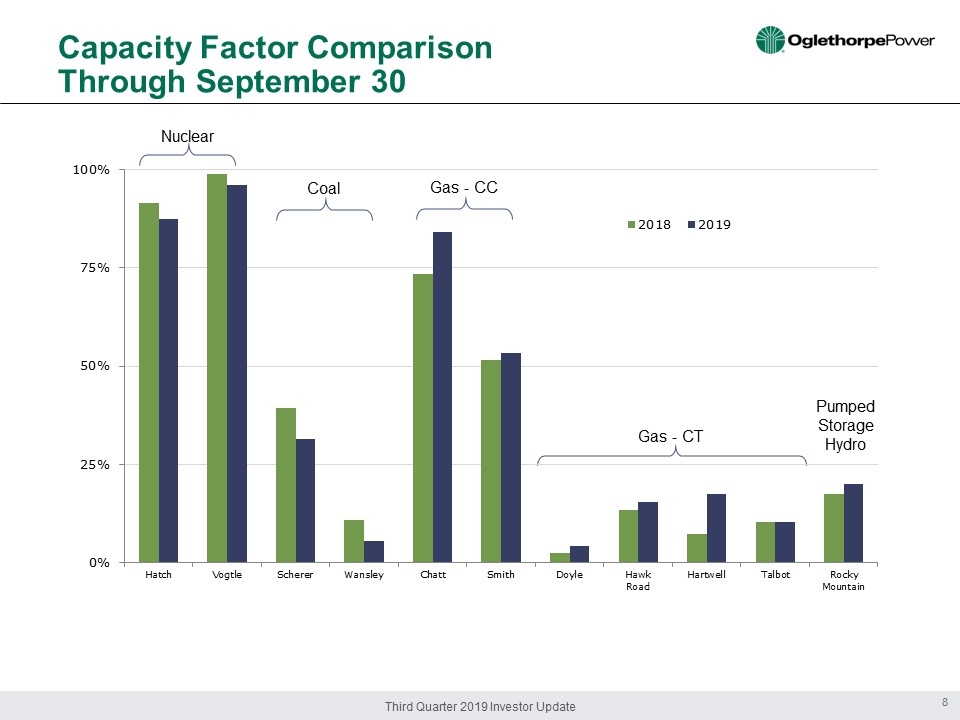

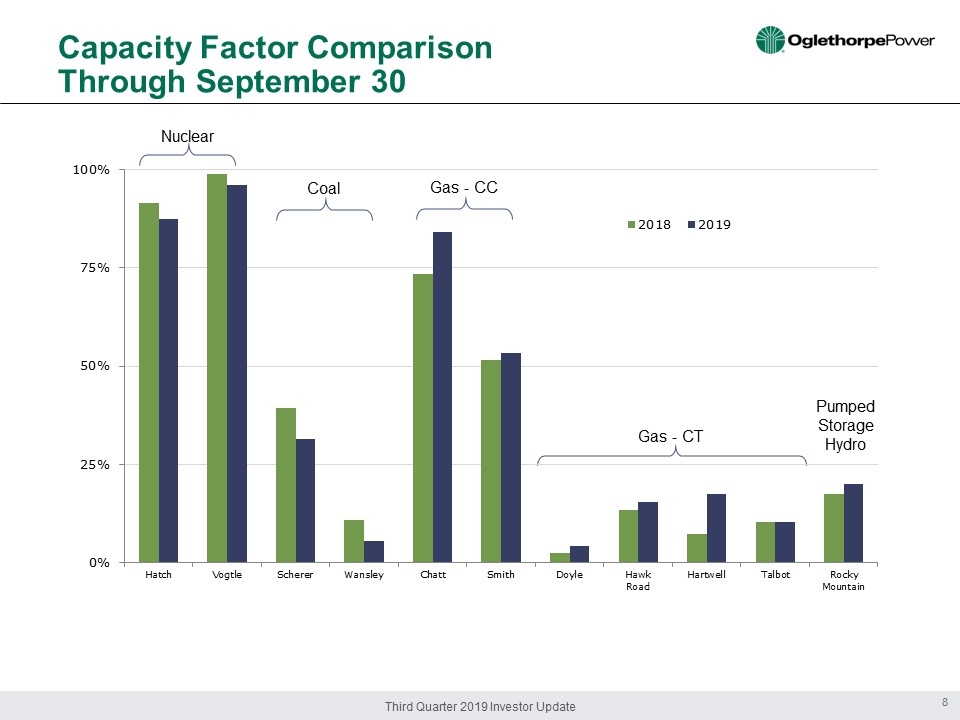

Third Quarter 2019 Investor Update Capacity Factor Comparison Through September 30 Nuclear Coal Gas - CC Gas - CT Pumped Storage Hydro 8 0% 25% 50% 75% 100% Hatch Vogtle Scherer Wansley Chatt Smith Doyle Hawk Road Hartwell Talbot Rocky Mountain 2018 2019

Third Quarter 2019 Investor Update - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2013 2014 2015 2016 2017 2018 2019 Winter Peak Summer Peak 2013 2014 2015 2016 2017 2018 2019 (Millions MWh) Members’ Historical Load 9 Member Demand Requirements Member Energy Requirements Percent Change - 0.2% 6.0% - 0.7% ( MW ) Percent Change in Overall Peak - 13.3% 15.3% - 4.2% Highest Summer/Overall Peak ( 2019) = 9,477 MW Highest Winter Peak (2014) = 9,354 MW Winter Peak ( 2019) = 7,846 MW Summer Peak ( 2019) = 9,477 MW 2.6% 3.5% 2013 2014 2015 2016 2017 2018 2019* Days ≥ 90 o 20 31 49 88 38 65 90 Days ≥ 95 o 0 1 3 22 0 2 33 Days ≥ 100 o 0 0 0 1 0 0 1 Days ≤ 25 o 2 19 10 5 3 10 3 - 5.2% - 4.5% 6.1% 1.6% 7.0% 1.2% YTD* Projected *As of November 22, 2019.

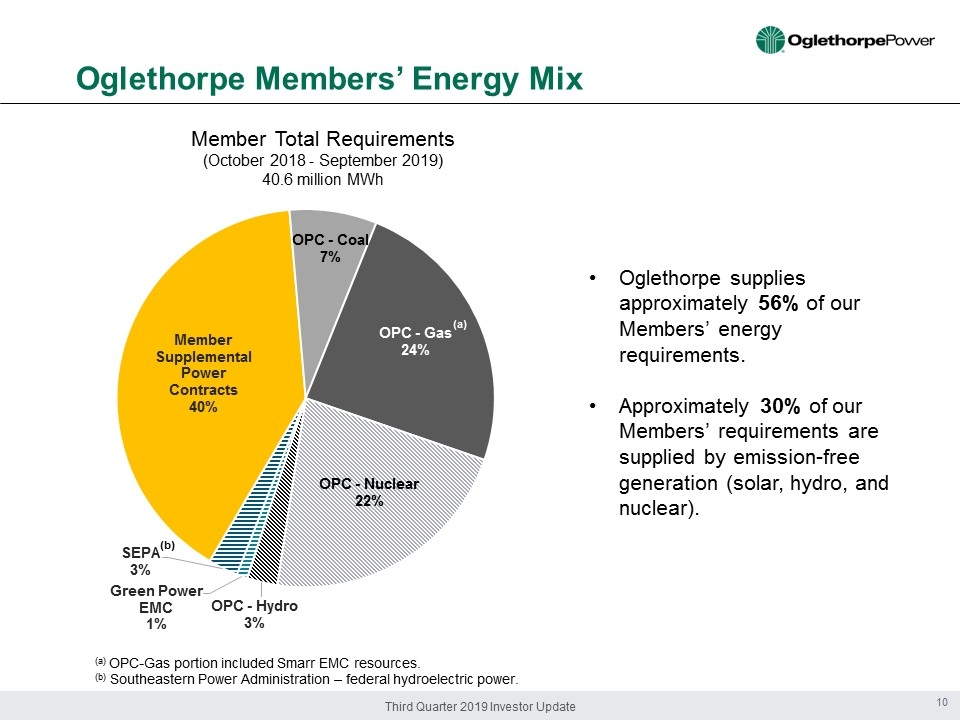

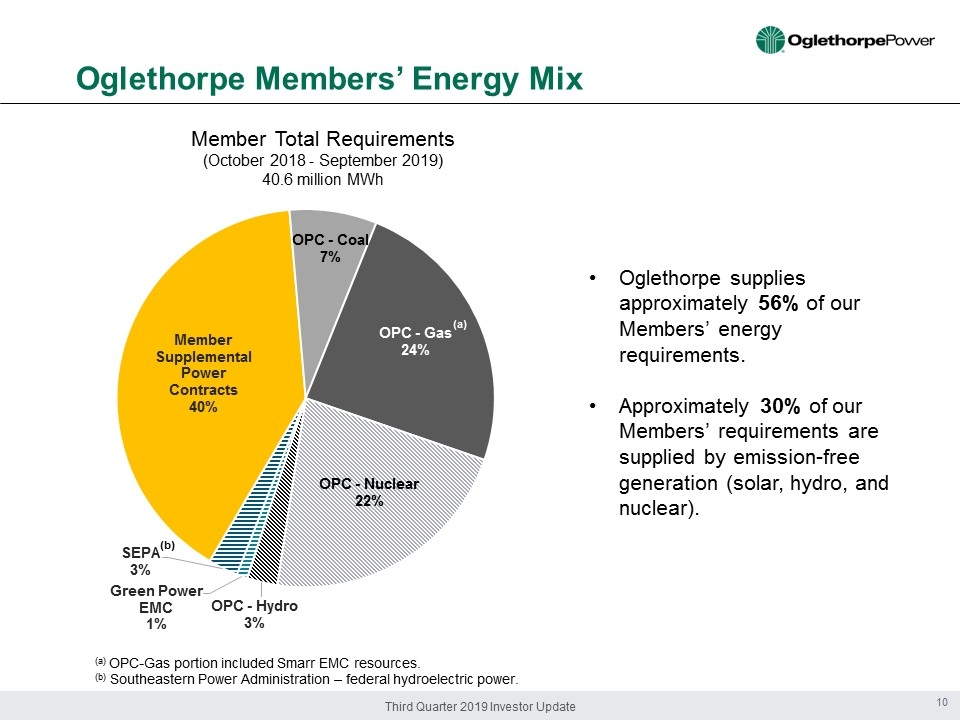

Third Quarter 2019 Investor Update Green Power EMC 1% SEPA 3% Member Supplemental Power Contracts 40% OPC - Coal 7% OPC - Gas 24% OPC - Nuclear 22% OPC - Hydro 3% Oglethorpe Members’ Energy Mix 10 Member Total Requirements (October 2018 - September 2019) 40.6 million MWh (a) OPC - Gas portion included Smarr EMC resources . (b) Southeastern Power Administration – federal hydroelectric power. • Oglethorpe supplies approximately 56% of our Members’ energy requirements. • Approximately 30% of our Members’ requirements are supplied by emission - free generation (solar, hydro, and nuclear). (a) (b)

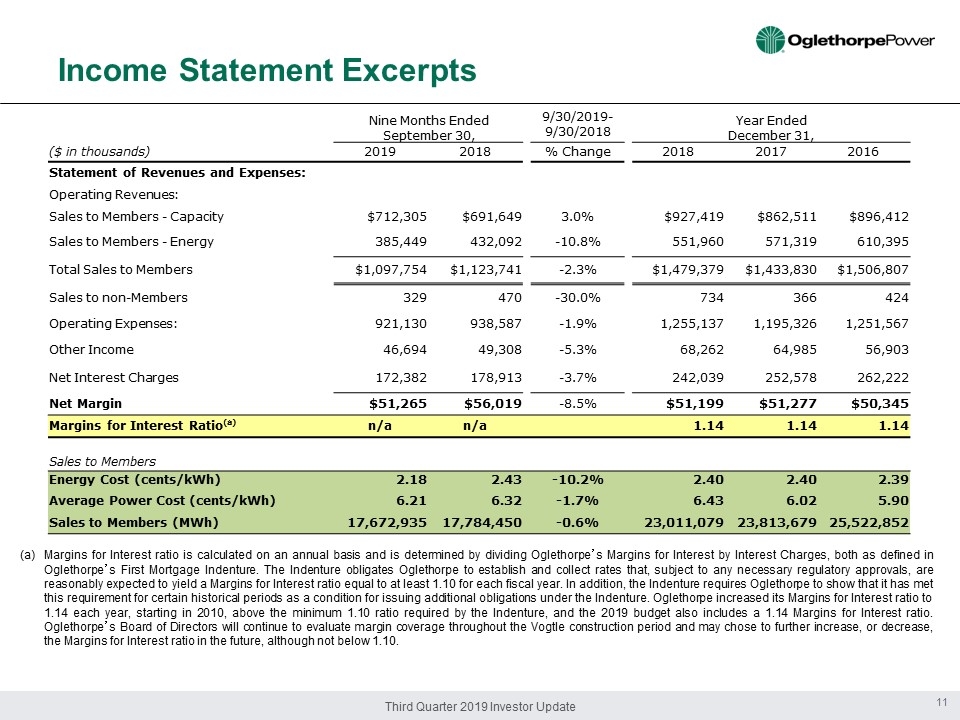

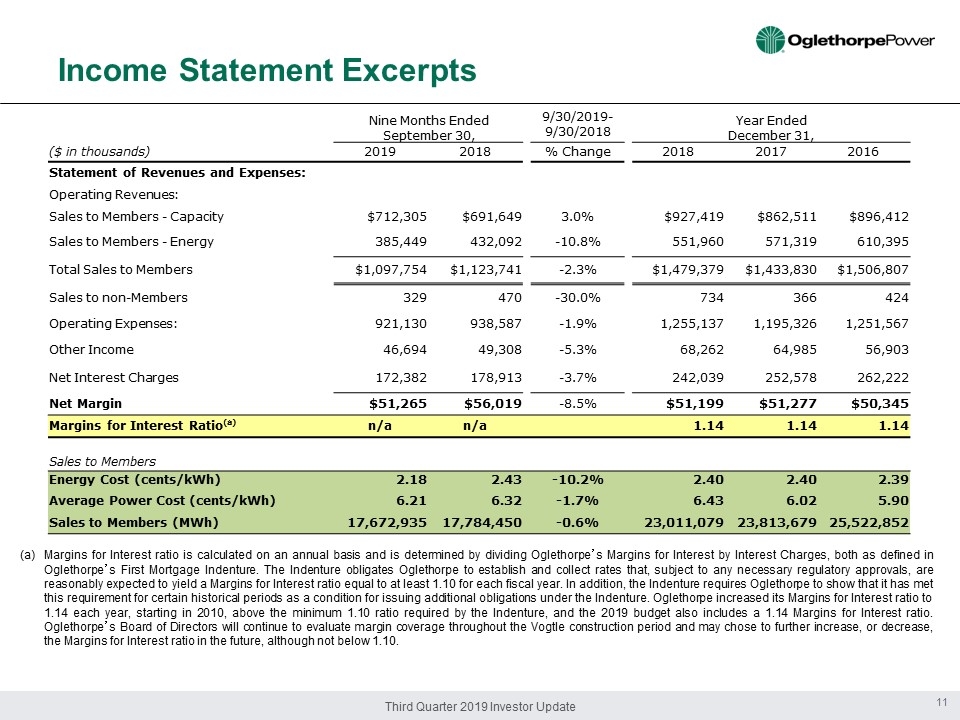

Third Quarter 2019 Investor Update Income Statement Excerpts 11 (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe ’ s Margins for Interest by Interest Charges, both as defined in Oglethorpe ’ s First Mortgage Indenture . The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1 . 10 for each fiscal year . In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture . Oglethorpe increased its Margins for Interest ratio to 1 . 14 each year, starting in 2010 , above the minimum 1 . 10 ratio required by the Indenture, and the 2019 budget also includes a 1 . 14 Margins for Interest ratio . Oglethorpe ’ s Board of Directors will continue to evaluate margin coverage throughout the Vogtle construction period and may chose to further increase, or decrease, the Margins for Interest ratio in the future, although not below 1 . 10 . Nine Months Ended September 30, 9/30/2019 - 9/30/2018 Year Ended December 31, ($ in thousands) 2019 2018 % Change 2018 2017 2016 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $712,305 $691,649 3.0% $927,419 $862,511 $896,412 Sales to Members - Energy 385,449 432,092 - 10.8% 551,960 571,319 610,395 Total Sales to Members $1,097,754 $1,123,741 - 2.3% $1,479,379 $1,433,830 $1,506,807 Sales to non - Members 329 470 - 30.0% 734 366 424 Operating Expenses: 921,130 938,587 - 1.9% 1,255,137 1,195,326 1,251,567 Other Income 46,694 49,308 - 5.3% 68,262 64,985 56,903 Net Interest Charges 172,382 178,913 - 3.7% 242,039 252,578 262,222 Net Margin $51,265 $56,019 - 8.5% $51,199 $51,277 $50,345 Margins for Interest Ratio (a) n/a n/a 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.18 2.43 - 10.2% 2.40 2.40 2.39 Average Power Cost (cents/kWh) 6.21 6.32 - 1.7% 6.43 6.02 5.90 Sales to Members (MWh) 17,672,935 17,784,450 - 0.6% 23,011,079 23,813,679 25,522,852

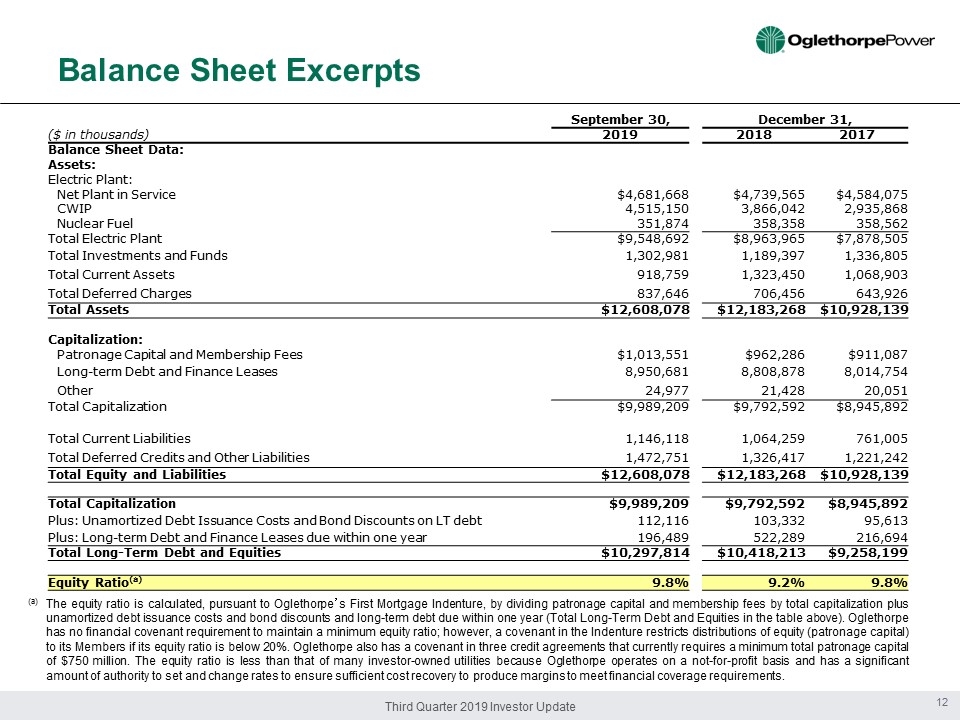

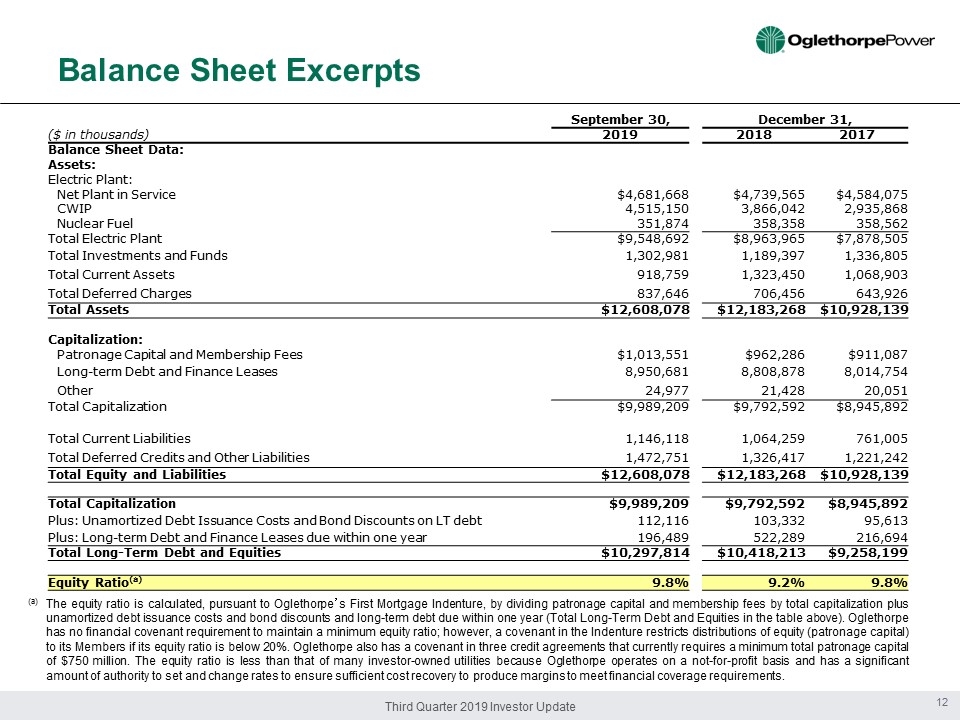

Third Quarter 2019 Investor Update Balance Sheet Excerpts (a) The equity ratio is calculated, pursuant to Oglethorpe ’ s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long - term debt due within one year (Total Long - Term Debt and Equities in the table above) . Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio ; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20 % . Oglethorpe also has a covenant in three credit agreements that currently requires a minimum total patronage capital of $ 750 million . The equity ratio is less than that of many investor - owned utilities because Oglethorpe operates on a not - for - profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements . 12 September 30, December 31, ( $ in thousands) 2019 2018 2017 Balance Sheet Data : Assets: Electric Plant: Net Plant in Service $ 4,681,668 $4,739,565 $4,584,075 CWIP 4,515,150 3,866,042 2,935,868 Nuclear Fuel 351,874 358,358 358,562 Total Electric Plant $ 9,548,692 $8,963,965 $7,878,505 Total Investments and Funds 1,302,981 1,189,397 1,336,805 Total Current Assets 918,759 1,323,450 1,068,903 Total Deferred Charges 837,646 706,456 643,926 Total Assets $ 12,608,078 $12,183,268 $10,928,139 Capitalization: Patronage Capital and Membership Fees $1,013,551 $962,286 $911,087 Long - term Debt and Finance Leases 8,950,681 8,808,878 8,014,754 Other 24,977 21,428 20,051 Total Capitalization $ 9,989,209 $9,792,592 $8,945,892 Total Current Liabilities 1,146,118 1,064,259 761,005 Total Deferred Credits and Other Liabilities 1,472,751 1,326,417 1,221,242 Total Equity and Liabilities $ 12,608,078 $12,183,268 $10,928,139 Total Capitalization $ 9,989,209 $9,792,592 $8,945,892 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 112,116 103,332 95,613 Plus: Long - term Debt and Finance Leases due within one year 196,489 522,289 216,694 Total Long - Term Debt and Equities $ 10,297,814 $10,418,213 $9,258,199 Equity Ratio (a) 9.8% 9.2% 9.8%

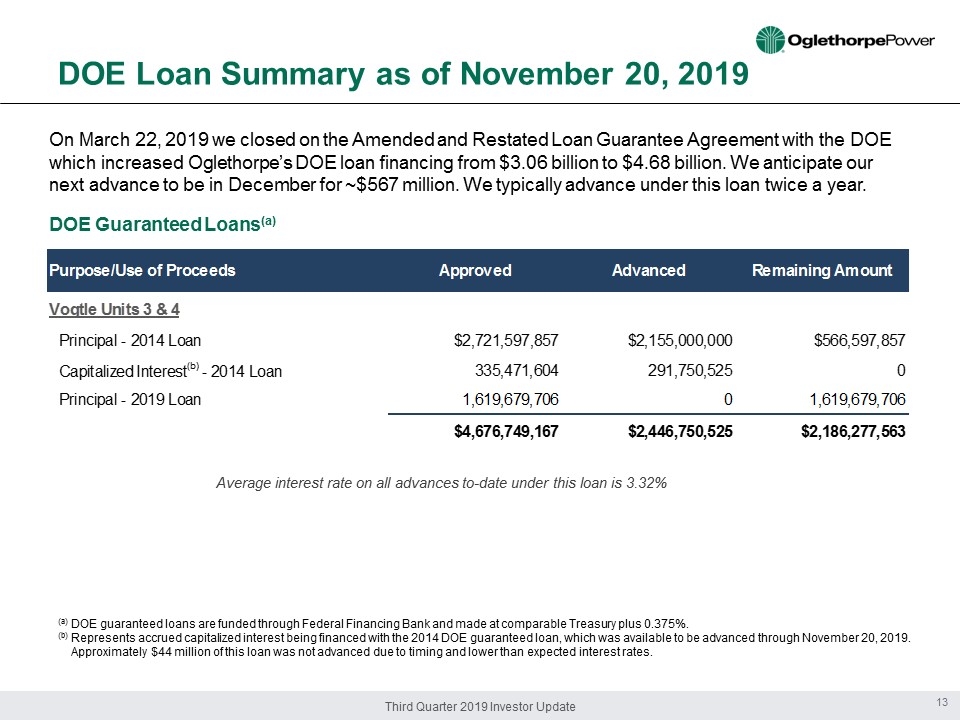

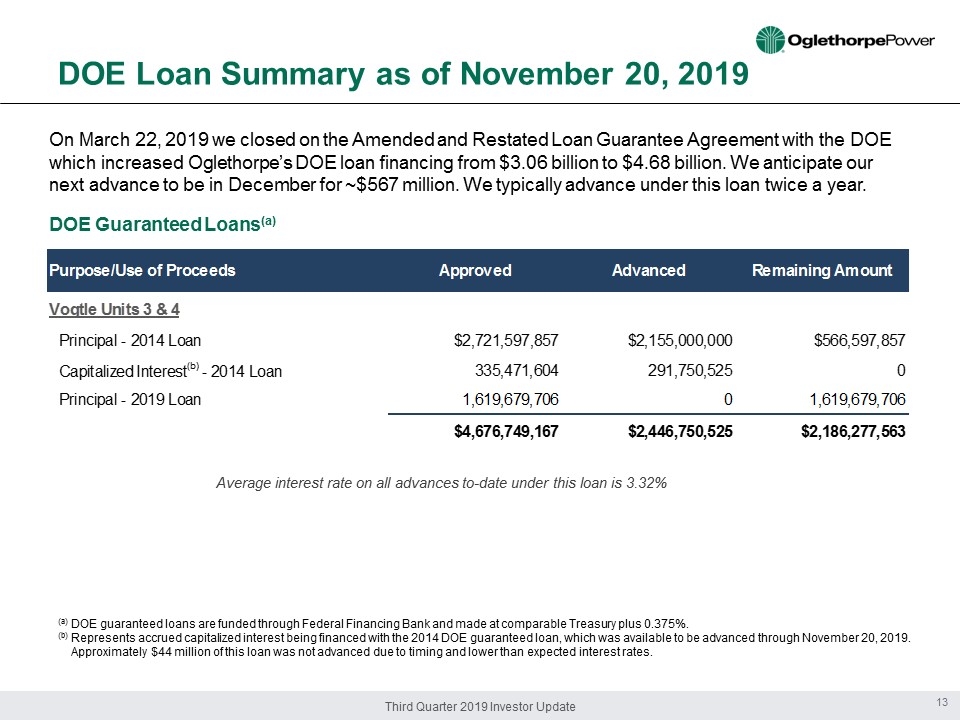

Third Quarter 2019 Investor Update On March 22, 2019 we closed on the Amended and Restated Loan Guarantee Agreement with the DOE which increased Oglethorpe’s DOE loan financing from $3.06 billion to $4.68 billion. We anticipate our next advance to be in December for ~$567 million. We typically advance under this loan twice a year. DOE Loan Summary as of November 20, 2019 DOE Guaranteed Loans (a ) Average interest rate on all advances to - date under this loan is 3.32% (a) DOE guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.375%. (b) Represents accrued capitalized interest being financed with the 2014 DOE guaranteed loan, which was available to be advanced th rough November 20, 2019. Approximately $44 million of this loan was not advanced due to timing and lower than expected interest rates. 13 Purpose/Use of Proceeds Approved Advanced Remaining Amount Vogtle Units 3 & 4 Principal - 2014 Loan $2,721,597,857 $2,155,000,000 $566,597,857 Capitalized Interest (b) - 2014 Loan 335,471,604 291,750,525 0 Principal - 2019 Loan 1,619,679,706 0 1,619,679,706 $4,676,749,167 $2,446,750,525 $2,186,277,563

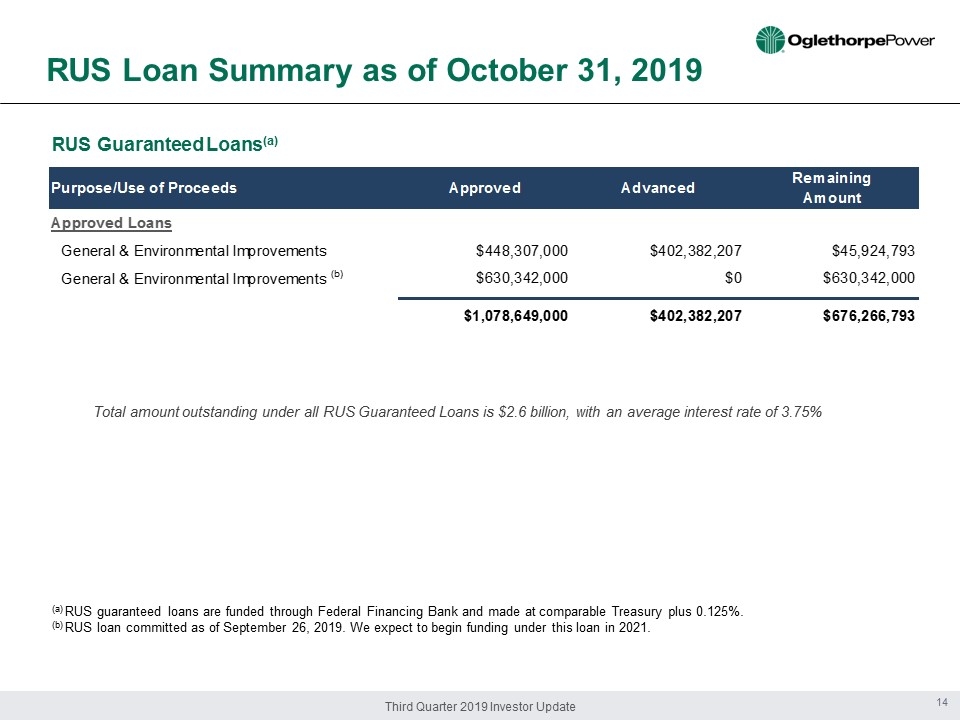

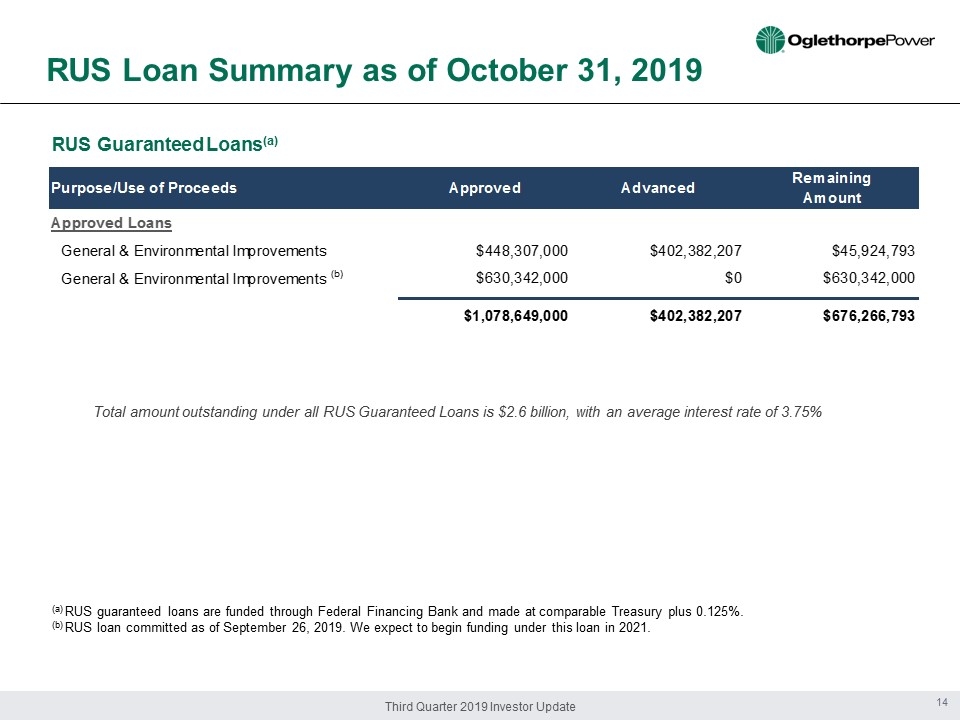

Third Quarter 2019 Investor Update Total amount outstanding under all RUS Guaranteed Loans is $2.6 billion, with an average interest rate of 3.75% RUS Guaranteed Loans (a) Purpose/Use of Proceeds Approved Advanced Remaining Amount Approved Loans General & Environmental Improvements $448,307,000 $402,382,207 $45,924,793 General & Environmental Improvements (b) $630,342,000 $0 $630,342,000 $1,078,649,000 $402,382,207 $676,266,793 (a) RUS guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.125%. (b) RUS loan committed as of September 26, 2019. We expect to begin funding under this loan in 2021. 14 RUS Loan Summary as of October 31, 2019

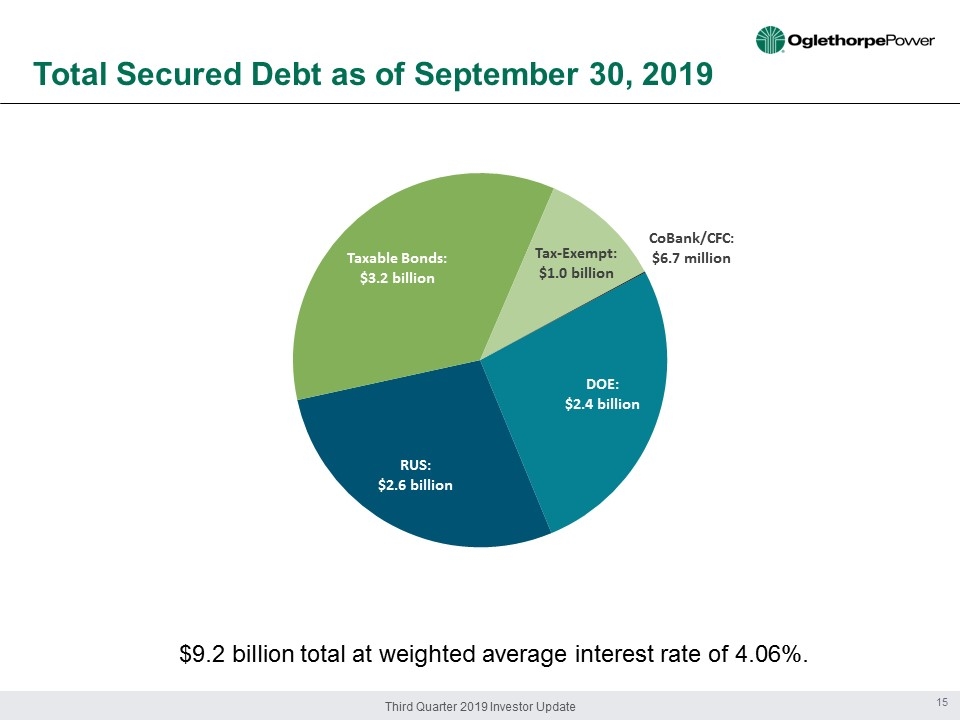

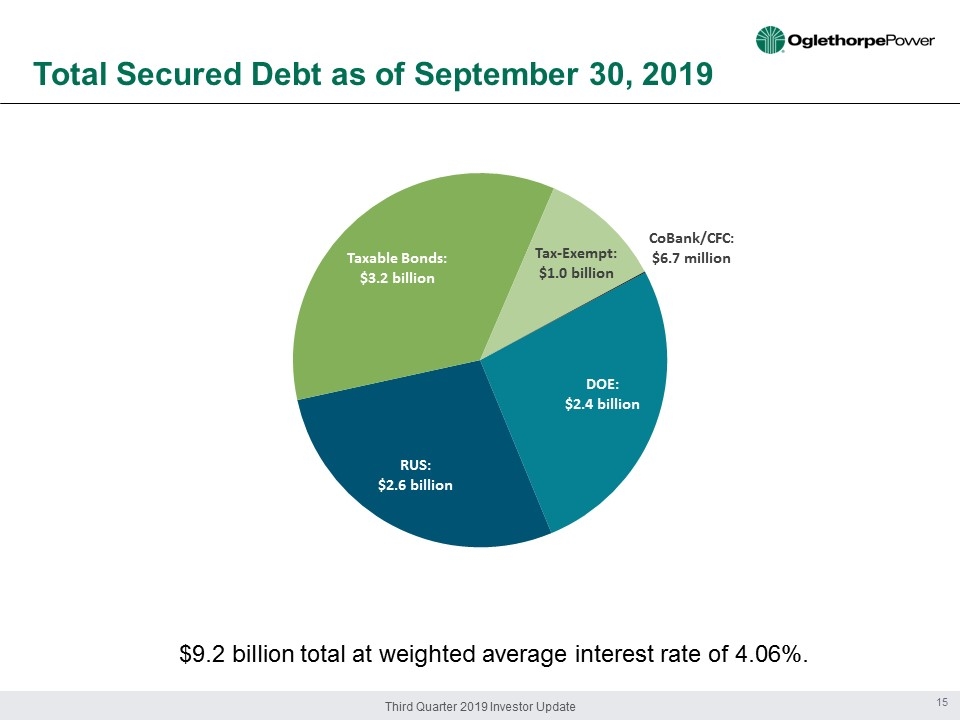

Third Quarter 2019 Investor Update Total Secured Debt as of September 30, 2019 $9.2 billion total at weighted average interest rate of 4.06%. 15 DOE: $2.4 billion RUS: $2.6 billion Taxable Bonds: $3.2 billion Tax - Exempt: $1.0 billion CoBank/CFC: $6.7 million

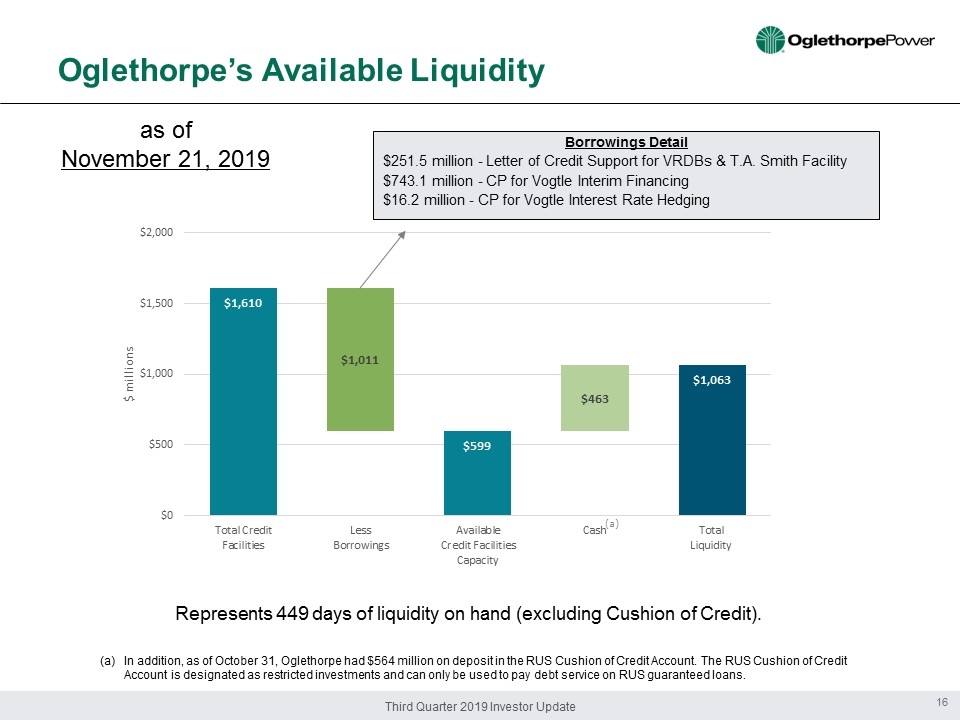

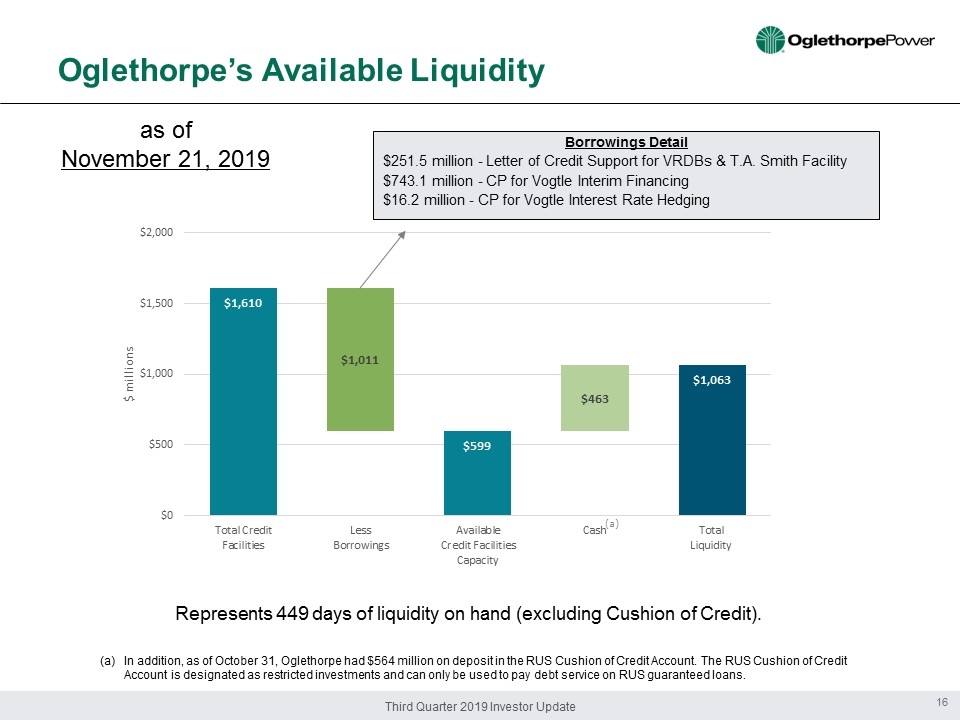

Third Quarter 2019 Investor Update $1,610 $1,011 $599 $463 $1,063 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ millions Oglethorpe’s Available Liquidity as of November 21, 2019 Borrowings Detail $251.5 million - Letter of Credit Support for VRDBs & T.A. Smith Facility $743.1 million - CP for Vogtle Interim Financing $16.2 million - CP for Vogtle Interest Rate Hedging Represents 449 days of liquidity on hand (excluding Cushion of Credit ). (a) In addition, as of October 31, Oglethorpe had $564 million on deposit in the RUS Cushion of Credit Account. The RUS Cushion of Credit Account is designated as restricted investments and can only be used to pay debt service on RUS guaranteed loans. (a) 16

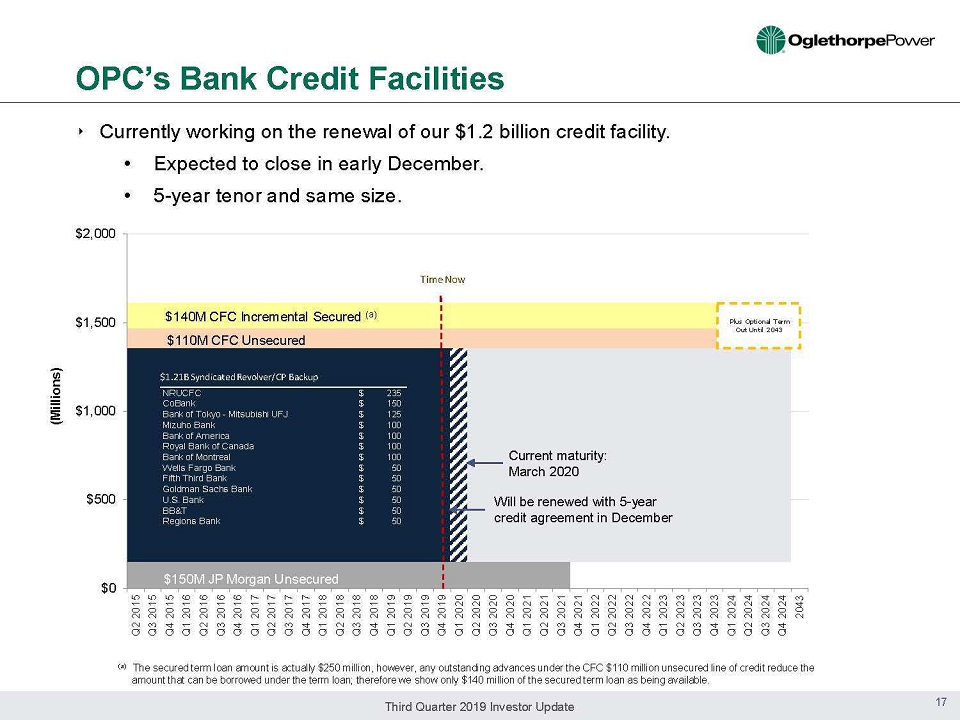

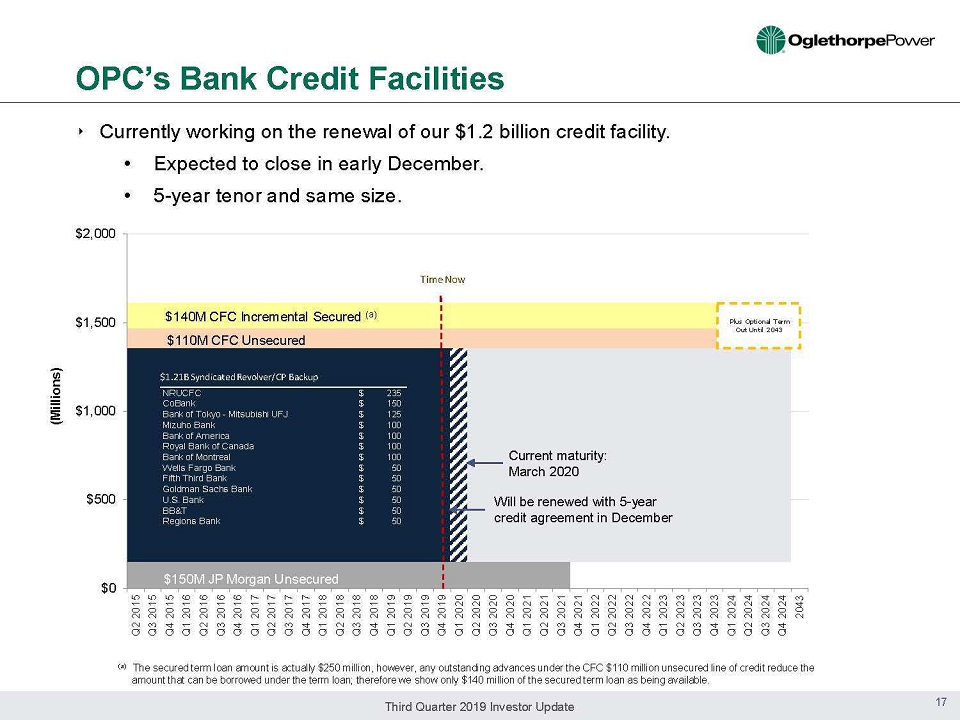

Third Quarter 2019 Investor Update OPC’s Bank Credit Facilities 17 (a) The secured term loan amount is actually $250 million, however, any outstanding advances under the CFC $110 million unsecured l ine of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being availa ble . $0 $500 $1,000 $1,500 $2,000 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q2 2018 Q3 2018 Q4 2018 Q1 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Q3 2020 Q4 2020 Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Q3 2022 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 2043 (Millions) $110M CFC Unsecured $140M CFC Incremental Secured (a) $150M JP Morgan Unsecured Time Now NRUCFC 235$ CoBank 150$ Bank of Tokyo - Mitsubishi UFJ 125$ Mizuho Bank 100$ Bank of America 100$ Royal Bank of Canada 100$ Bank of Montreal 100$ Wells Fargo Bank 50$ Fifth Third Bank 50$ Goldman Sachs Bank 50$ U.S. Bank 50$ BB&T 50$ Regions Bank 50$ Plus Optional Term Out Until 2043 $1.21B Syndicated Revolver/CP Backup ‣ Currently working on the renewal of our $1.2 billion credit facility. • Expected to close in early December. • 5 - year tenor and same size. Current maturity: March 2020 Will be renewed with 5 - year credit agreement in December

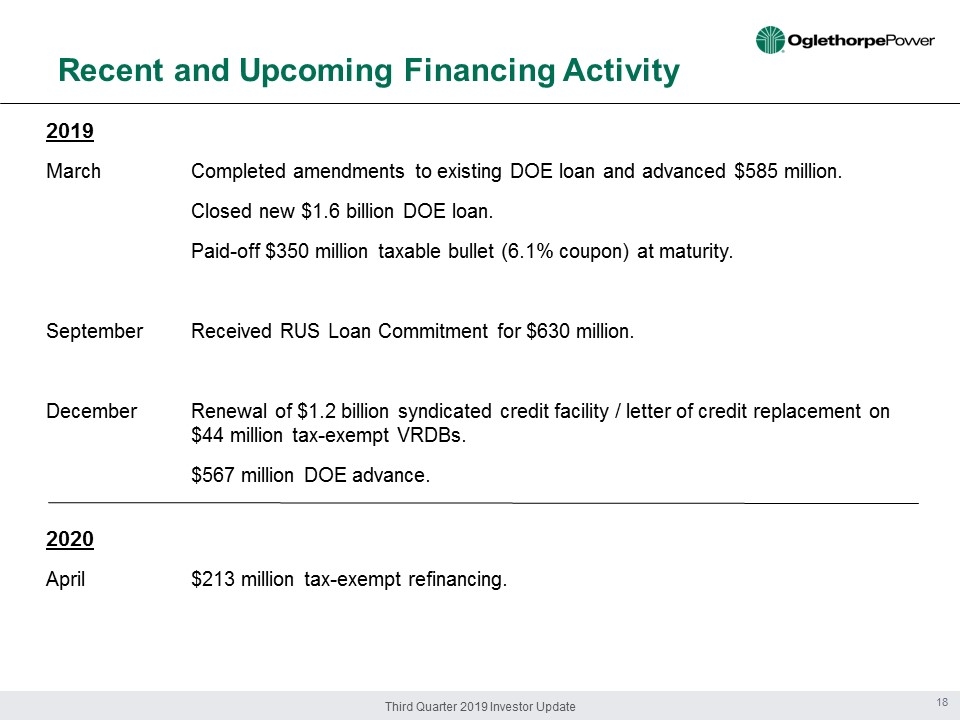

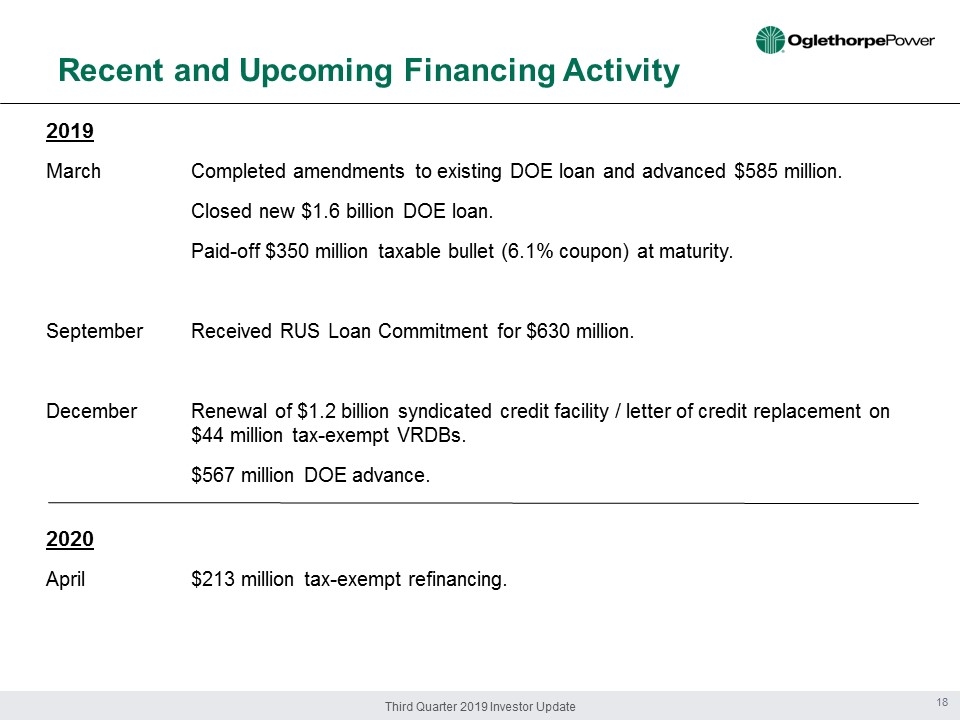

Third Quarter 2019 Investor Update Recent and Upcoming Financing Activity 2019 March Completed amendments to existing DOE loan and advanced $585 million. Closed new $1.6 billion DOE loan. Paid - off $350 million taxable bullet (6.1% coupon) at maturity . September Received RUS L oan Commitment for $630 million . December R enewal of $1.2 billion syndicated credit facility / letter of credit replacement on $44 million tax - exempt VRDBs. $567 million DOE advance. 2020 April $213 million tax - exempt refinancing. 18

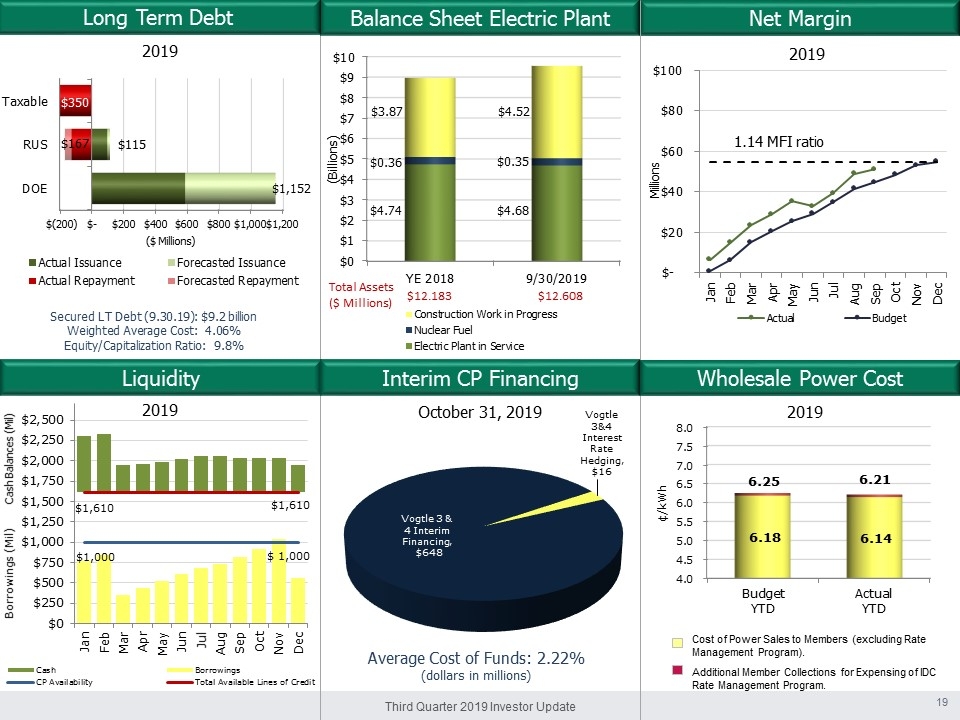

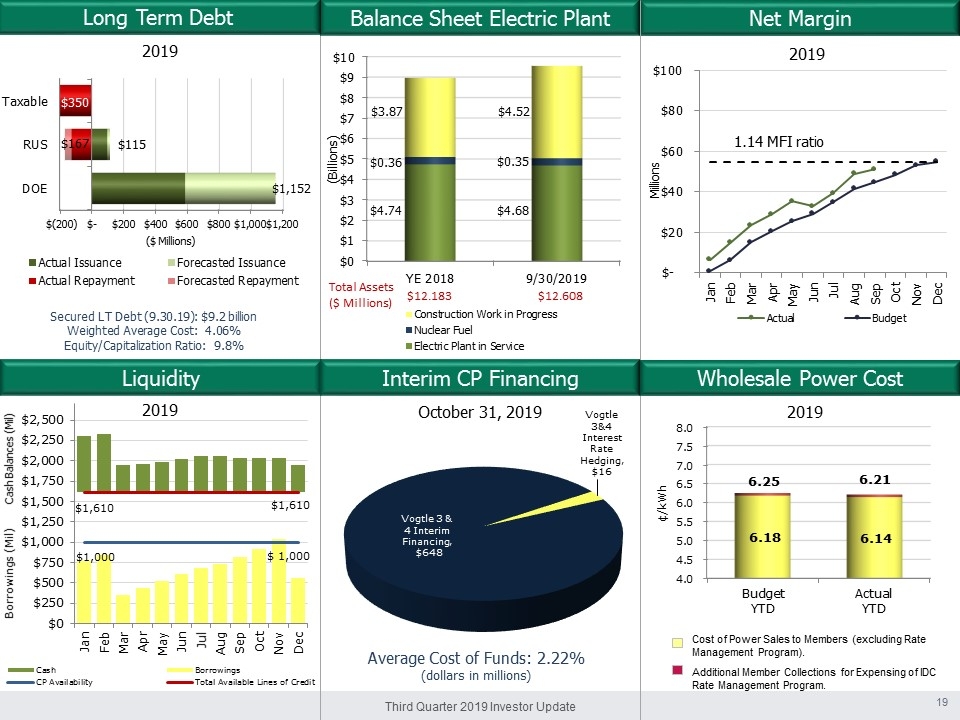

Third Quarter 2019 Investor Update $1,000 $ 1,000 $1,610 $1,610 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Borrowings (Mil) Cash Borrowings CP Availability Total Available Lines of Credit Cash Balances (Mil) Vogtle 3&4 Interest Rate Hedging , $16 Vogtle 3 & 4 Interim Financing , $648 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 YE 2018 9/30/2019 $4.74 $4.68 $0.36 $0.35 $3.87 $4.52 (Billions) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $12.183 $12.608 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Budget YTD Actual YTD 6.18 6.14 6.25 6.21 ¢/kWh Net Margin Liquidity Wholesale Power Cost Interim CP Financing Balance Sheet Electric Plant Average Cost of Funds : 2.22% (dollars in millions) Secured LT Debt (9.30.19): $9.2 billion Weighted Average Cost: 4.06% Equity/Capitalization Ratio: 9.8% 2019 October 31, 2019 2019 Cost of Power Sales to Members (excluding Rate Management Program). Additional Member Collections for Expensing of IDC Rate Management Program. 2019 2019 Long Term Debt 19 1.14 MFI ratio $- $20 $40 $60 $80 $100 Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Millions Actual Budget $(200) $- $200 $400 $600 $800 $1,000 $1,200 DOE RUS Taxable $1,152 $115 $350 $167 ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment

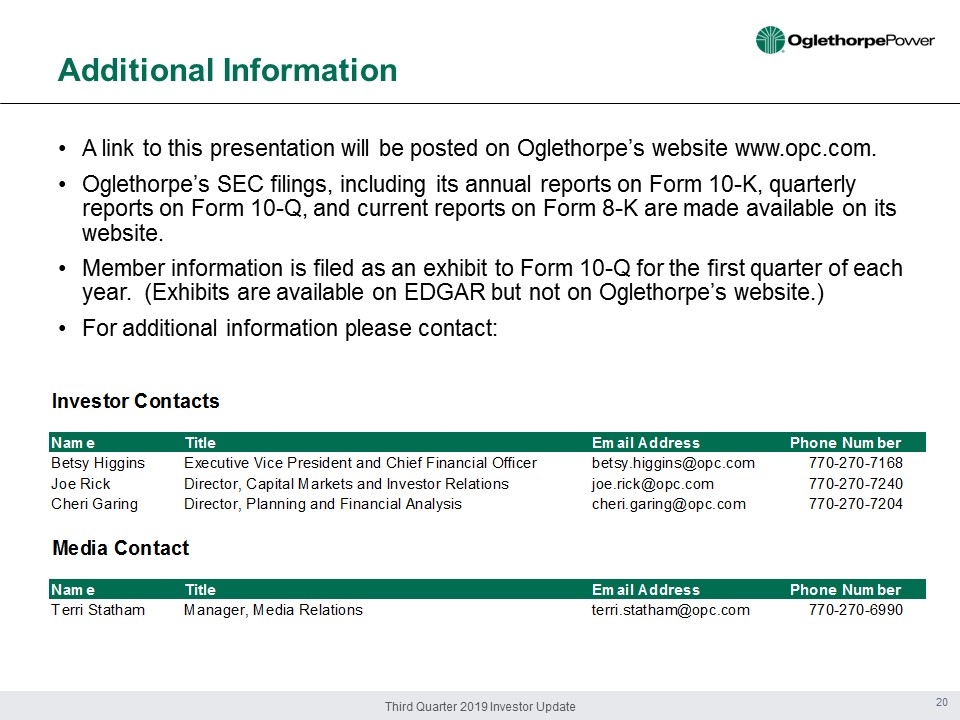

Third Quarter 2019 Investor Update • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10 - K, quarterly reports on Form 10 - Q, and current reports on Form 8 - K are made available on its website. • Member information is filed as an exhibit to Form 10 - Q for the first quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) • For additional information please contact: Additional Information 20 Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Director, Planning and Financial Analysis cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Terri Statham Manager, Media Relations terri.statham@opc.com 770-270-6990