Second Quarter 2021 Investor Briefing Second Quarter 2021 Investor Briefing August 26, 2021

Second Quarter 2021 Investor Briefing Notice to Recipients Risk Factors and Forward Looking Statements Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe” or “OPC”), that are not historical facts are forward-looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward- looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION” in our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2021, filed with the Securities and Exchange Commission on August 11, 2021, and “RISK FACTORS” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange Commission on March 19, 2021. This electronic presentation is provided as of August 26, 2021. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. 2

Second Quarter 2021 Investor Briefing ‣ Vogtle 3 & 4 Update ‣ Effingham Acquisition ‣ Operations Update ‣ Financial and Liquidity Update Presenters and Agenda Mike Price Executive Vice President and Chief Operating Officer Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3

Second Quarter 2021 Investor Briefing Vogtle 3&4 – Construction Overview 4 ‣ Oglethorpe is a 30% co-owner of the two new nuclear units under construction at Plant Vogtle. ‣ When these two units are complete, Plant Vogtle will be the largest producer of emission-free energy in the country. ‣ Unit 3 • Recently completed Hot Functional Testing – a significant milestone. • Work activities to complete prior to Fuel Load include completion of remediation work, system construction completion and paperwork, and submittal of inspections, tests, analyses and acceptance criteria (ITAAC). • The next significant milestone for Unit 3 is Fuel Load followed by Commercial Operation. • Current challenges include construction productivity, spent fuel pool repairs, and impacts from COVID-19. ‣ Unit 4 • Recently achieved the Initial Energization milestone. • The next significant milestone for Unit 4 is Open Vessel Testing followed by Cold Hydro Testing. • Current challenges include construction productivity as well as appropriate levels of electrical and pipefitter craft labor.

Second Quarter 2021 Investor Briefing Vogtle 3&4 – Oglethorpe Budget & Schedule 5 Previous Budget Revised Budget Change Assumed COD Unit 3 November-21 June-22 +7 Months Assumed COD Unit 4 November-22 June-23 +7 Months Latest potential COD within budget (Unit 3/Unit 4) Q1 2022 / Q1 2023 Q3 2022 / Q3 2023 +6 Months Construction Costs 5,614$ 6,013$ 399$ Financing Costs 1,592$ 1,735$ 143$ Total Costs 7,206$ 7,748$ 542$ Project-Level Contingency 90$ 78$ (12)$ Oglethorpe-Level Contingency 204$ 424$ 220$ Total Contingency 294$ 502$ 208$ Total Budget 7,500$ 8,250$ 750$ ‣ Southern Nuclear and Georgia Power recently updated the project budget to reflect updated construction costs and a revised extended schedule. ‣ This revised schedule assumed Commercial Operation Dates of Q2 2022 for Unit 3 and Q1 2023 for Unit 4. ‣ Our revised budget (which includes financing costs) assumes in-service dates of June 2022 and June 2023 for Unit 3 and Unit 4, respectively. ‣ Our budget also includes an additional “Oglethorpe contingency” expected to be sufficient to cover delays up to three months on each unit (into Q3 of 2022 and 2023, respectively), if necessary.

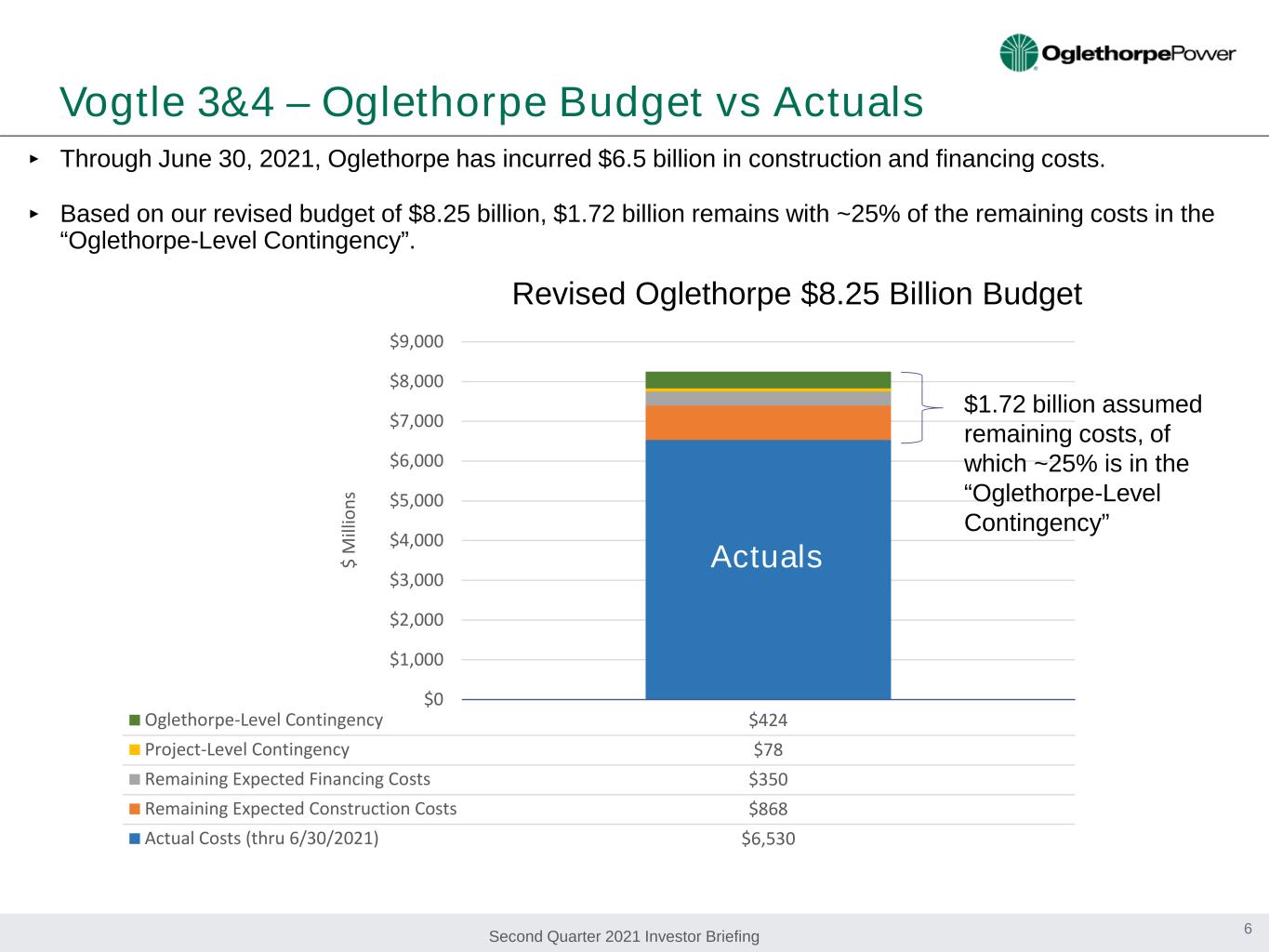

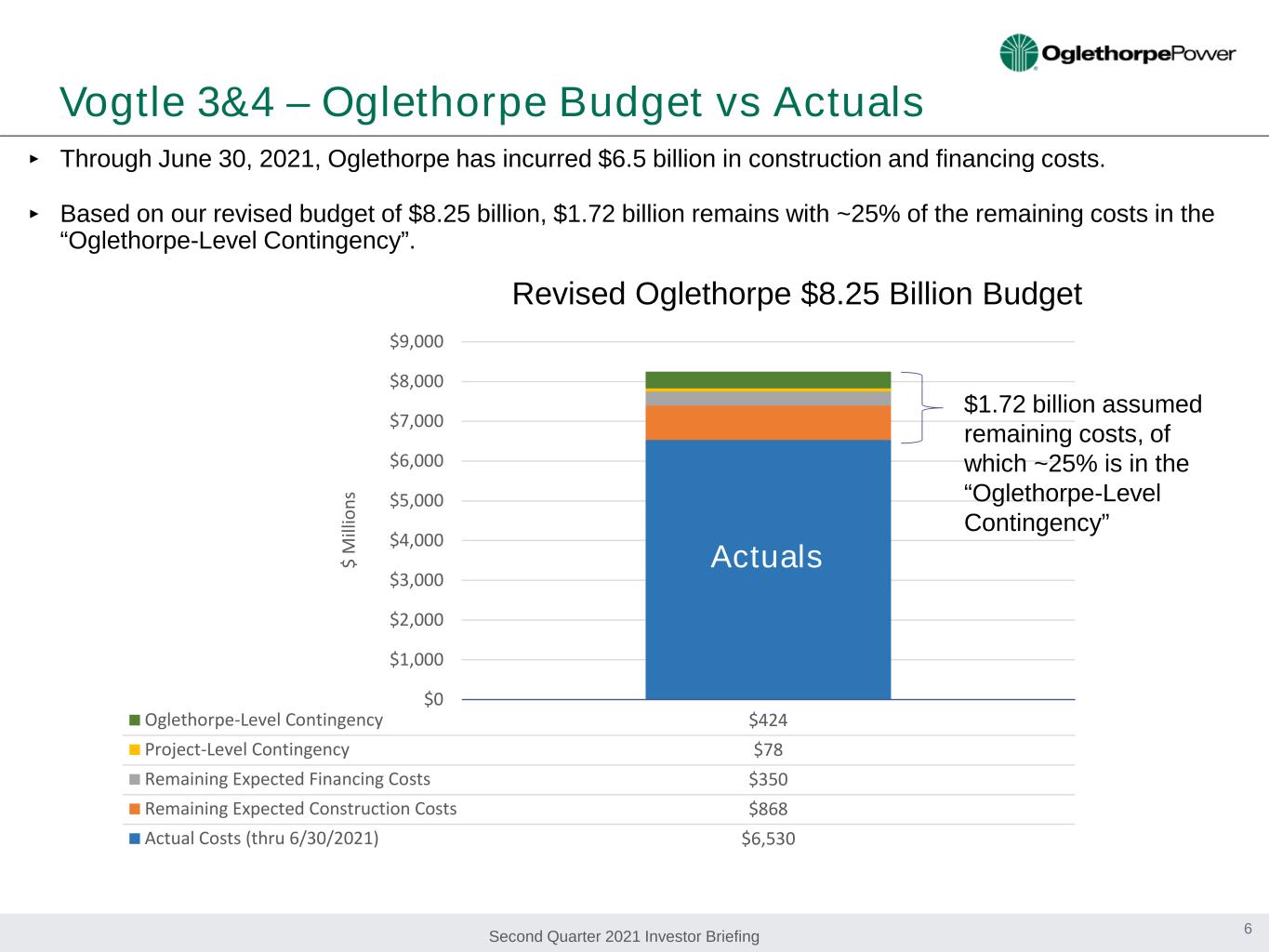

Second Quarter 2021 Investor Briefing Vogtle 3&4 – Oglethorpe Budget vs Actuals 6 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 Oglethorpe-Level Contingency $424 Project-Level Contingency $78 Remaining Expected Financing Costs $350 Remaining Expected Construction Costs $868 Actual Costs (thru 6/30/2021) $6,530 $ M ill io ns ‣ Through June 30, 2021, Oglethorpe has incurred $6.5 billion in construction and financing costs. ‣ Based on our revised budget of $8.25 billion, $1.72 billion remains with ~25% of the remaining costs in the “Oglethorpe-Level Contingency”. Revised Oglethorpe $8.25 Billion Budget Actuals $1.72 billion assumed remaining costs, of which ~25% is in the “Oglethorpe-Level Contingency”

Second Quarter 2021 Investor Briefing Vogtle 3&4 – Construction Progress 7

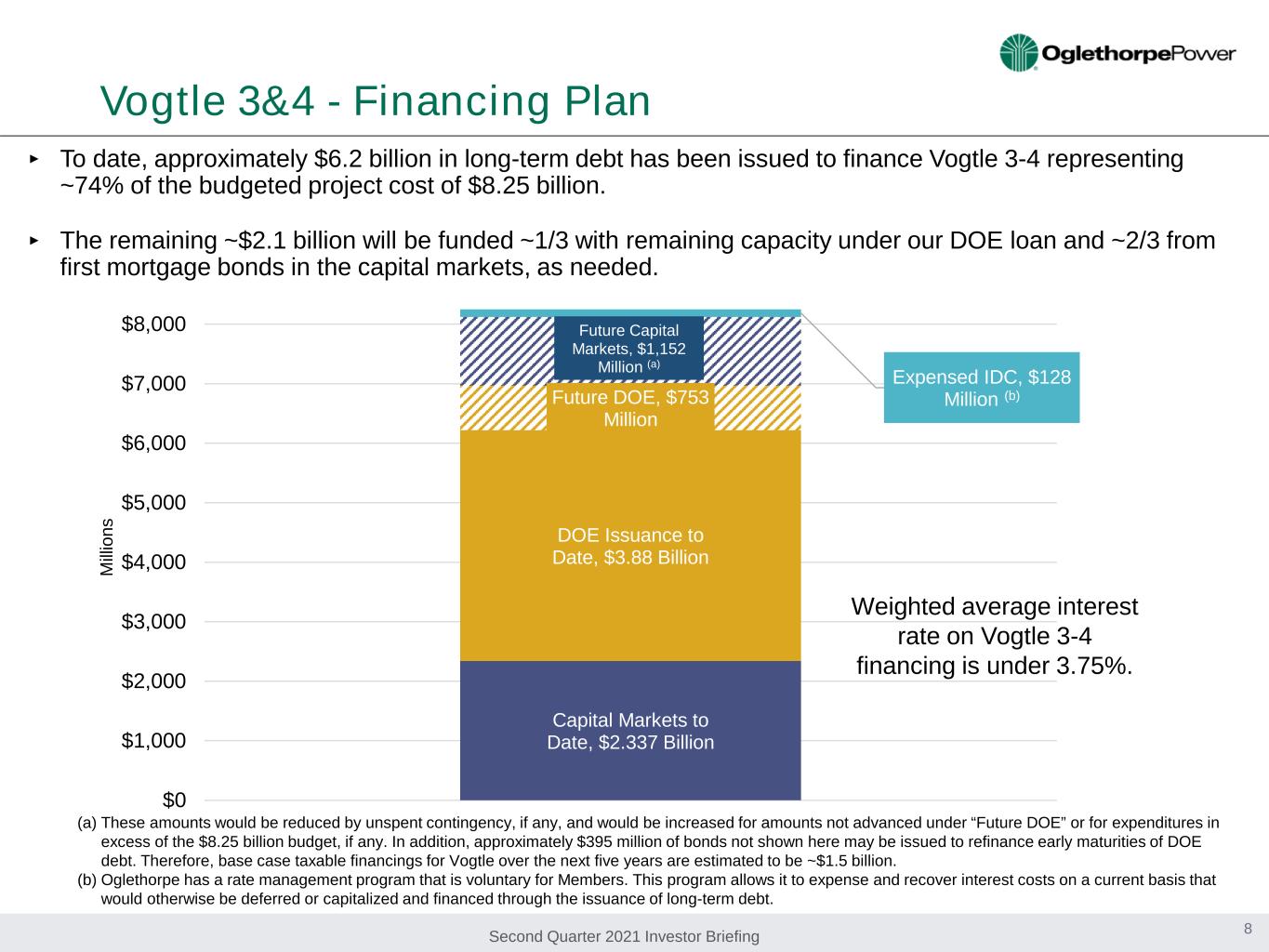

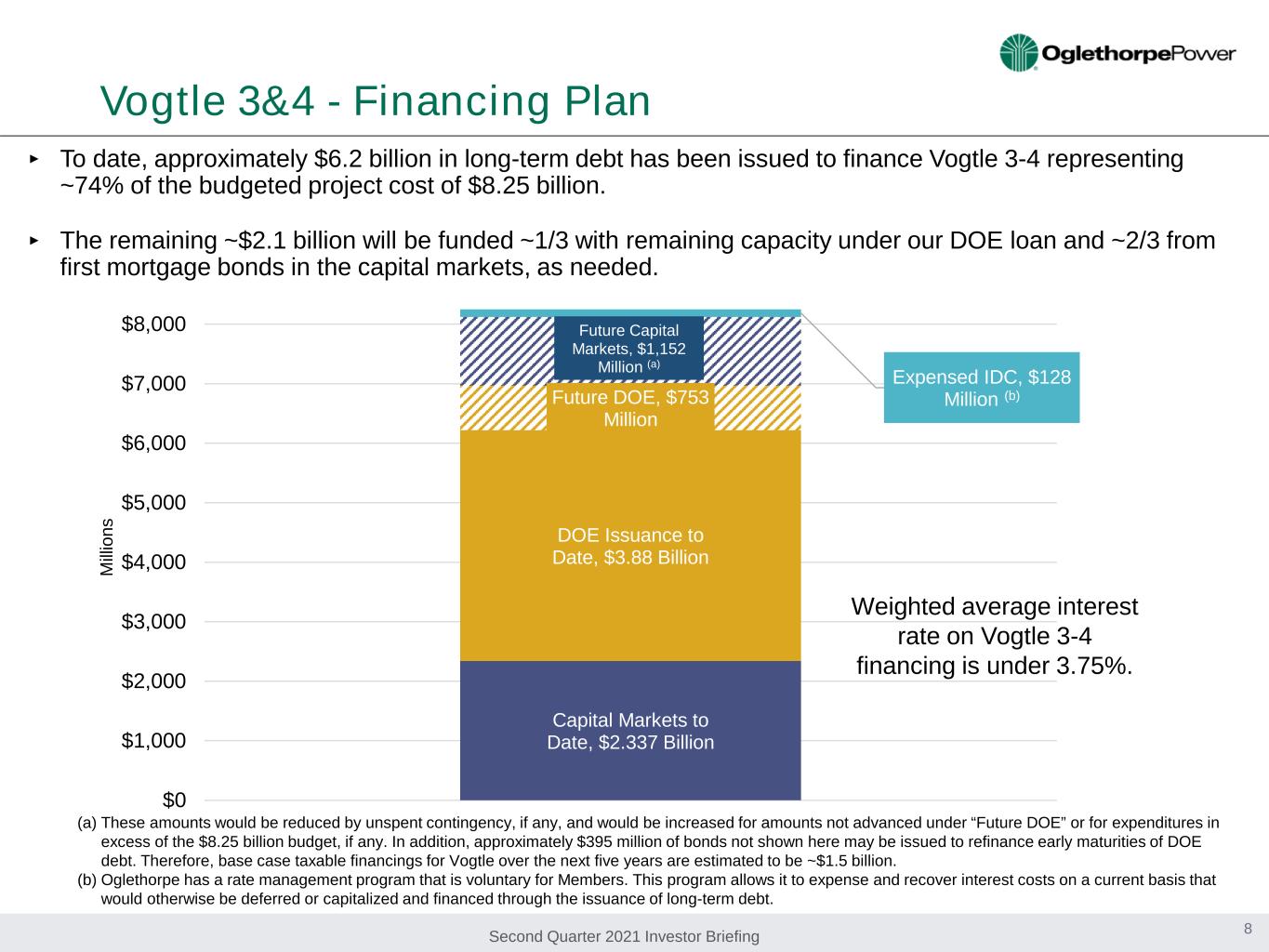

Second Quarter 2021 Investor Briefing Capital Markets to Date, $2.337 Billion DOE Issuance to Date, $3.88 Billion Future DOE, $753 Million Future Capital Markets, $1,152 Million (a) Expensed IDC, $128 Million (b) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 M illi on s Vogtle 3&4 - Financing Plan 8 (a) These amounts would be reduced by unspent contingency, if any, and would be increased for amounts not advanced under “Future DOE” or for expenditures in excess of the $8.25 billion budget, if any. In addition, approximately $395 million of bonds not shown here may be issued to refinance early maturities of DOE debt. Therefore, base case taxable financings for Vogtle over the next five years are estimated to be ~$1.5 billion. (b) Oglethorpe has a rate management program that is voluntary for Members. This program allows it to expense and recover interest costs on a current basis that would otherwise be deferred or capitalized and financed through the issuance of long-term debt. Weighted average interest rate on Vogtle 3-4 financing is under 3.75%. ‣ To date, approximately $6.2 billion in long-term debt has been issued to finance Vogtle 3-4 representing ~74% of the budgeted project cost of $8.25 billion. ‣ The remaining ~$2.1 billion will be funded ~1/3 with remaining capacity under our DOE loan and ~2/3 from first mortgage bonds in the capital markets, as needed.

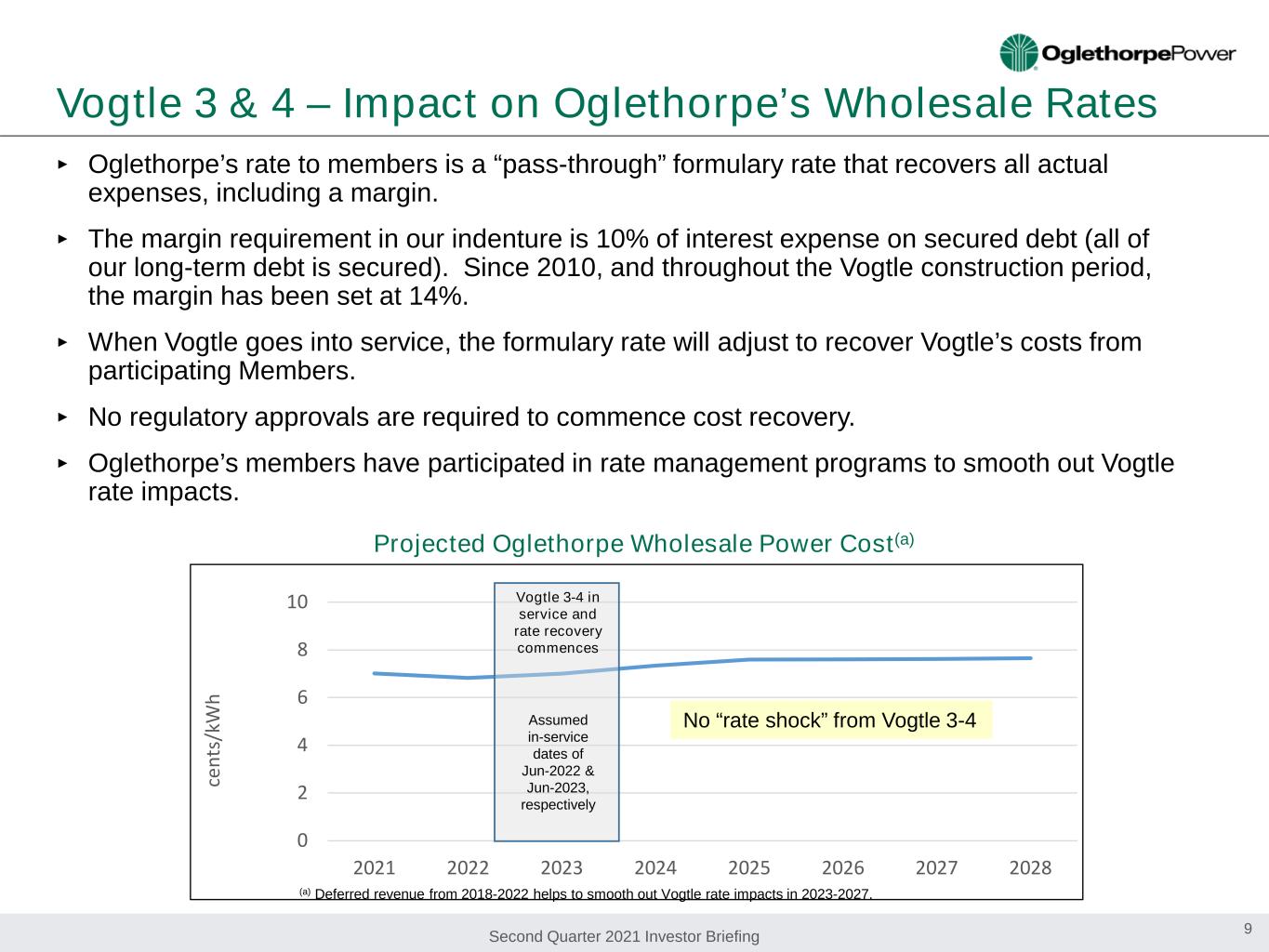

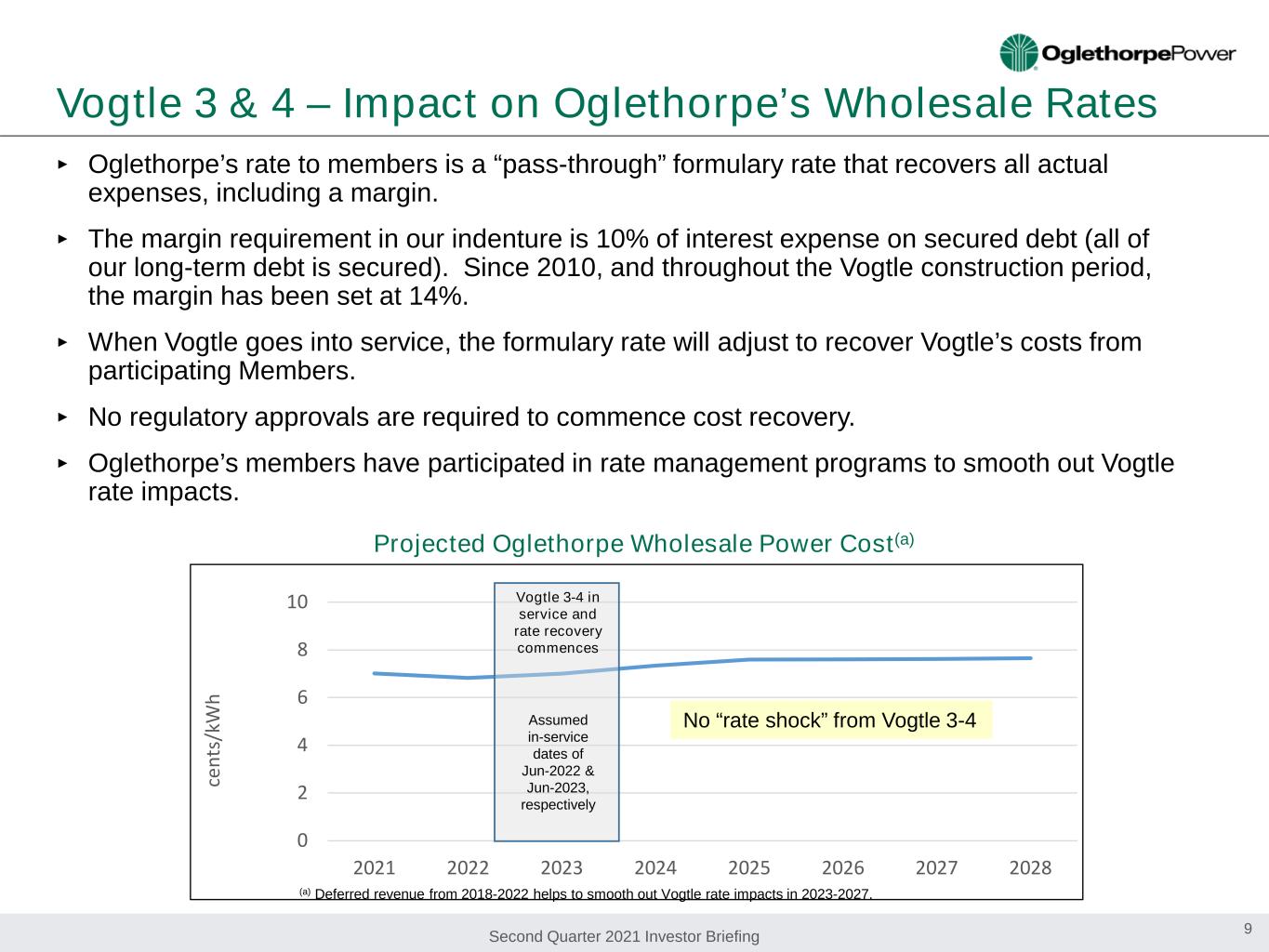

Second Quarter 2021 Investor Briefing Vogtle 3 & 4 – Impact on Oglethorpe’s Wholesale Rates 9 ‣ Oglethorpe’s rate to members is a “pass-through” formulary rate that recovers all actual expenses, including a margin. ‣ The margin requirement in our indenture is 10% of interest expense on secured debt (all of our long-term debt is secured). Since 2010, and throughout the Vogtle construction period, the margin has been set at 14%. ‣ When Vogtle goes into service, the formulary rate will adjust to recover Vogtle’s costs from participating Members. ‣ No regulatory approvals are required to commence cost recovery. ‣ Oglethorpe’s members have participated in rate management programs to smooth out Vogtle rate impacts. 0 2 4 6 8 10 2021 2022 2023 2024 2025 2026 2027 2028 ce nt s/ kW h Projected Oglethorpe Wholesale Power Cost(a) Assumed in-service dates of Jun-2022 & Jun-2023, respectively (a) Deferred revenue from 2018-2022 helps to smooth out Vogtle rate impacts in 2023-2027. Vogtle 3-4 in service and rate recovery commences No “rate shock” from Vogtle 3-4

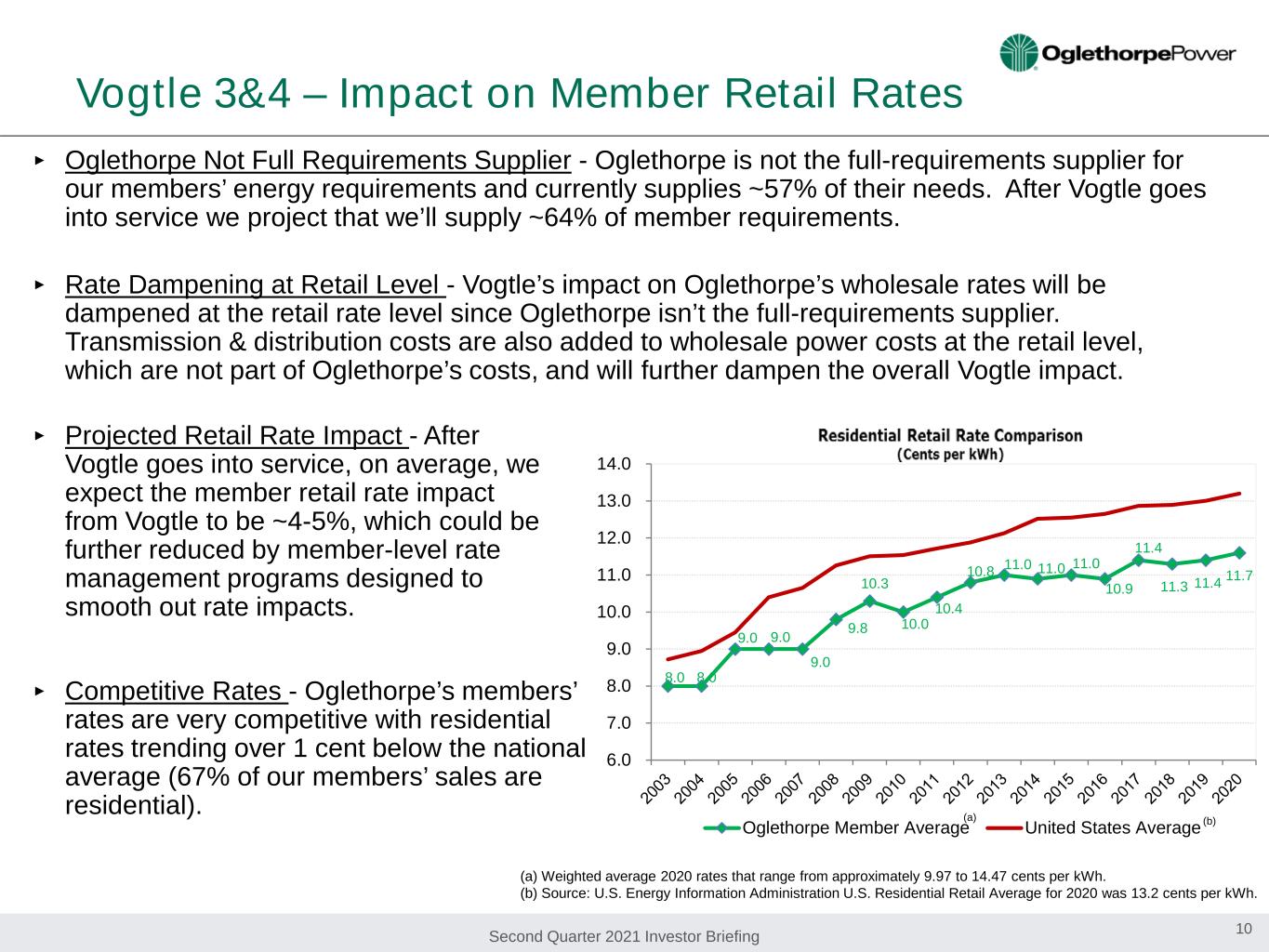

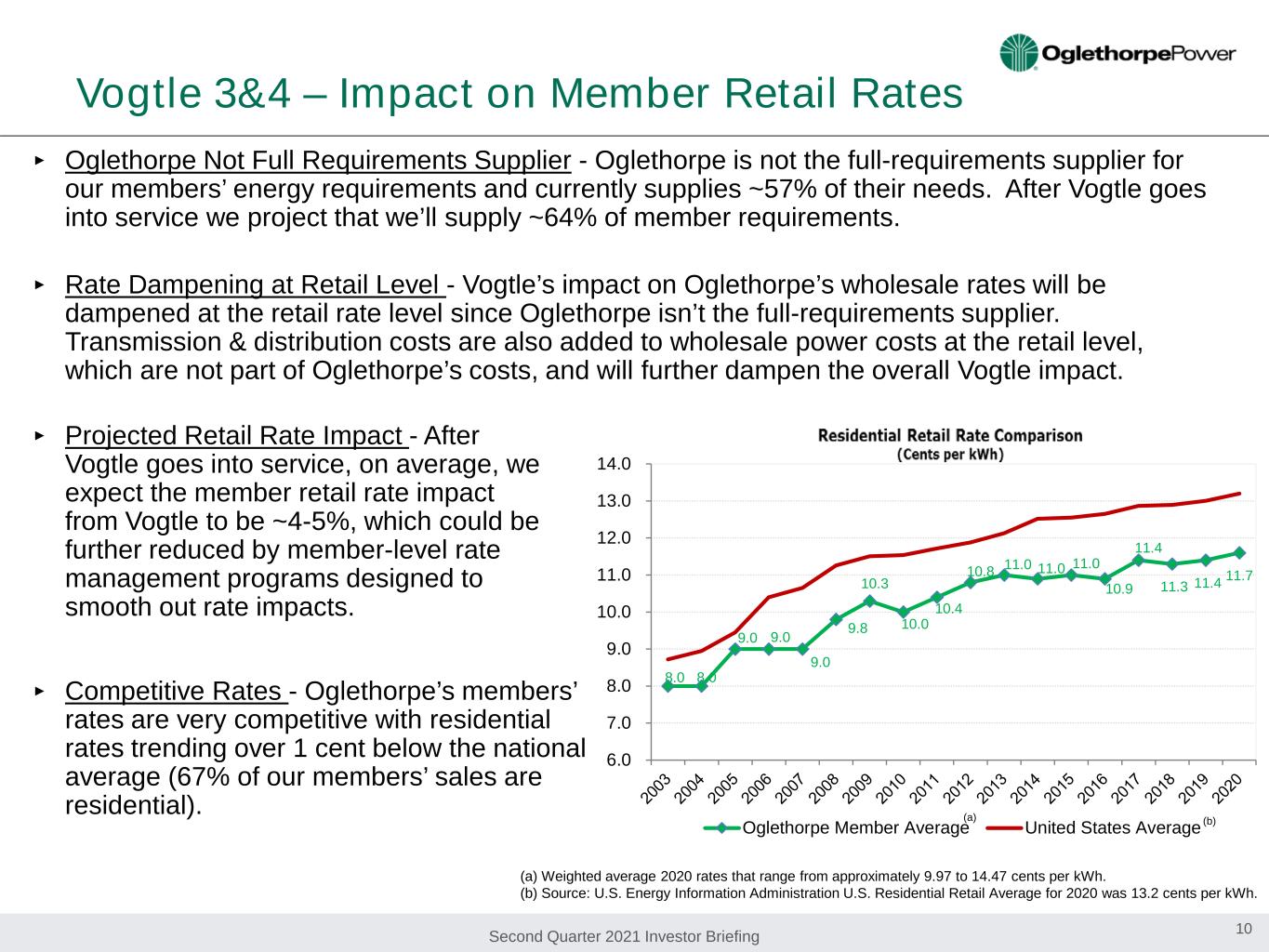

Second Quarter 2021 Investor Briefing Vogtle 3&4 – Impact on Member Retail Rates 10 ‣ Oglethorpe Not Full Requirements Supplier - Oglethorpe is not the full-requirements supplier for our members’ energy requirements and currently supplies ~57% of their needs. After Vogtle goes into service we project that we’ll supply ~64% of member requirements. ‣ Rate Dampening at Retail Level - Vogtle’s impact on Oglethorpe’s wholesale rates will be dampened at the retail rate level since Oglethorpe isn’t the full-requirements supplier. Transmission & distribution costs are also added to wholesale power costs at the retail level, which are not part of Oglethorpe’s costs, and will further dampen the overall Vogtle impact. (a) Weighted average 2020 rates that range from approximately 9.97 to 14.47 cents per kWh. (b) Source: U.S. Energy Information Administration U.S. Residential Retail Average for 2020 was 13.2 cents per kWh. (a) (b) 8.0 8.0 9.0 9.0 9.0 9.8 10.3 10.0 10.4 10.8 11.0 11.0 11.0 10.9 11.4 11.3 11.4 11.7 6.0 7.0 8.0 9.0 10.0 11.0 12.0 13.0 14.0 Oglethorpe Member Average United States Average ‣ Projected Retail Rate Impact - After Vogtle goes into service, on average, we expect the member retail rate impact from Vogtle to be ~4-5%, which could be further reduced by member-level rate management programs designed to smooth out rate impacts. ‣ Competitive Rates - Oglethorpe’s members’ rates are very competitive with residential rates trending over 1 cent below the national average (67% of our members’ sales are residential).

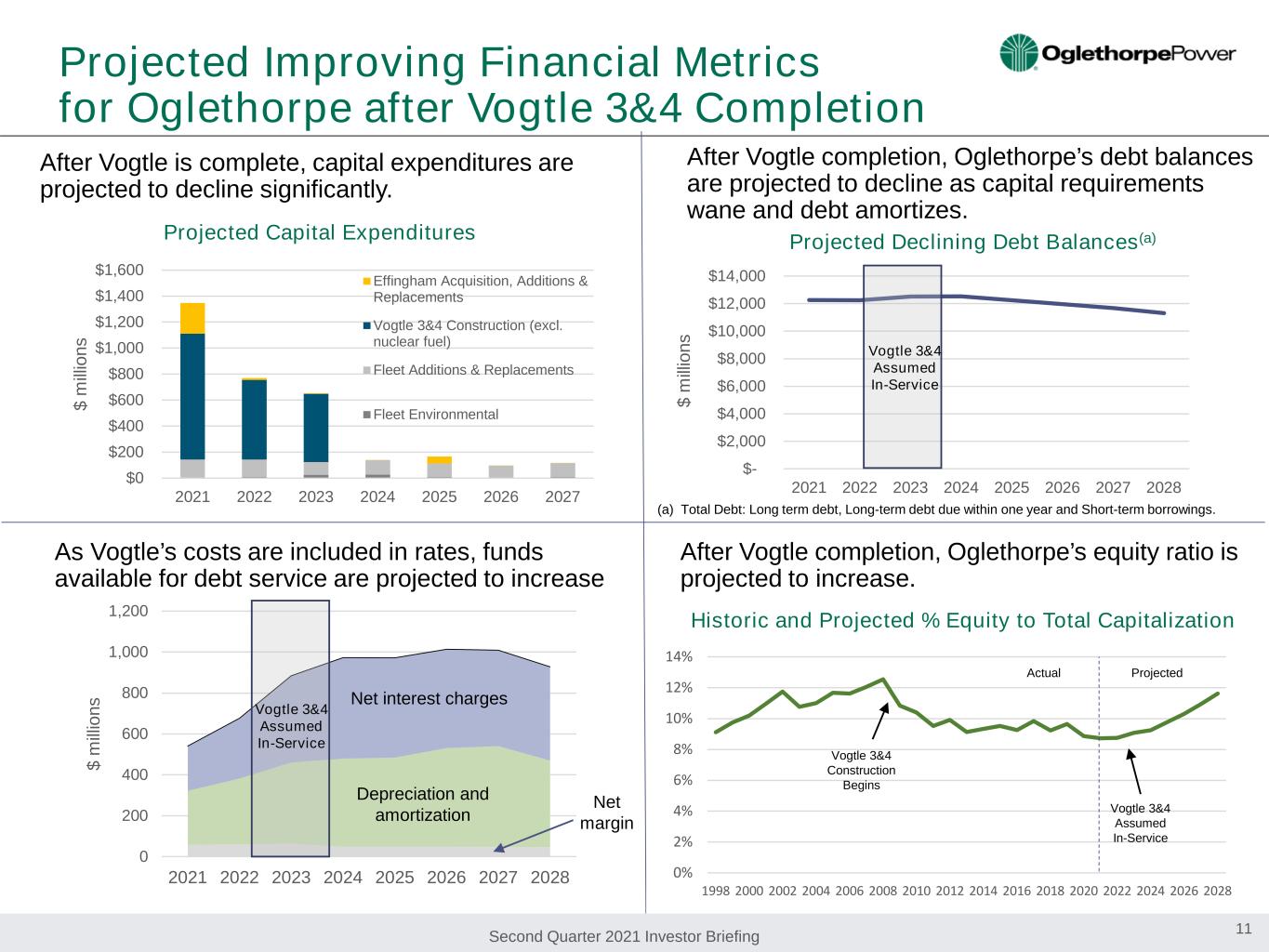

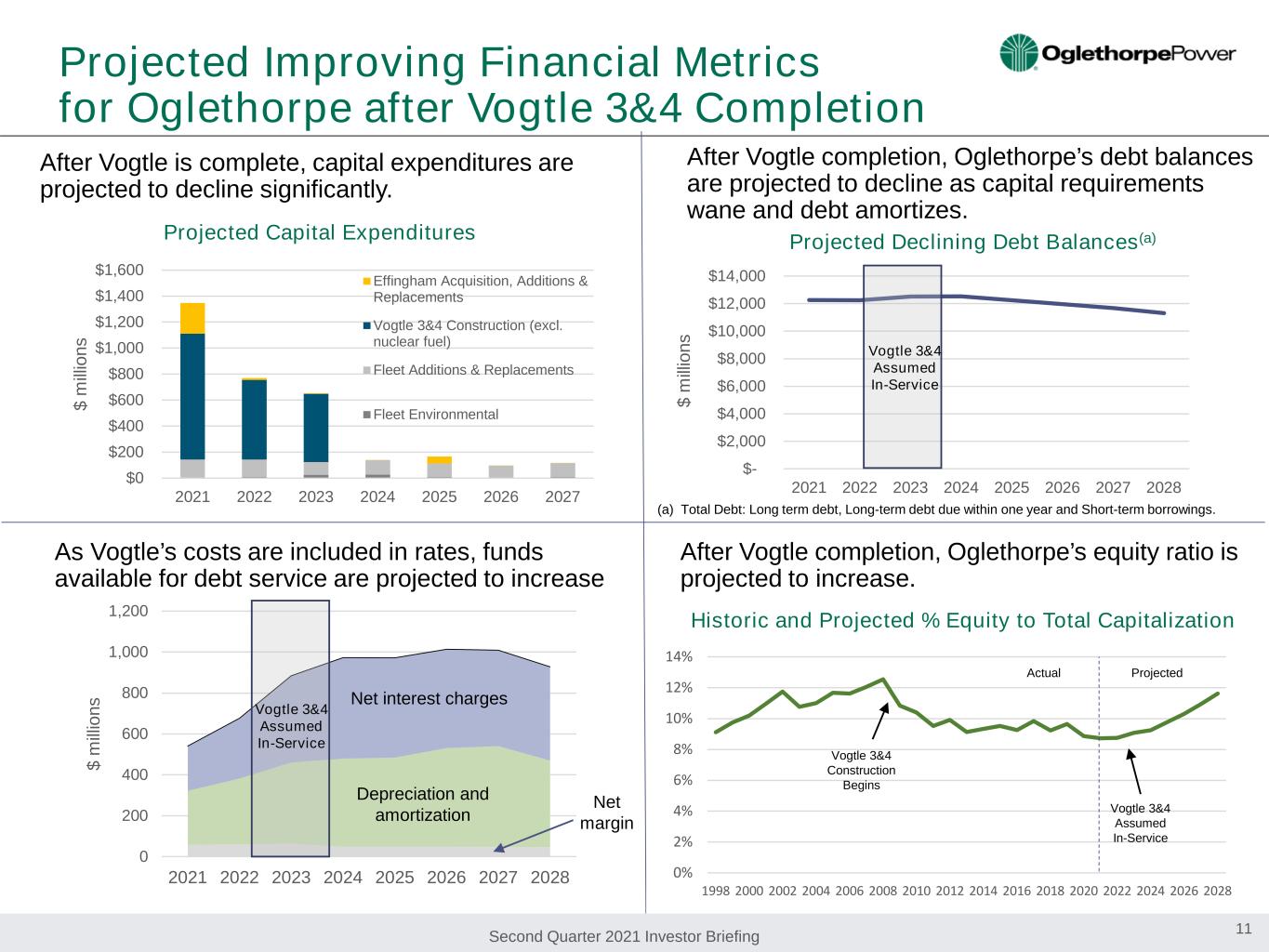

Second Quarter 2021 Investor Briefing 0 200 400 600 800 1,000 1,200 2021 2022 2023 2024 2025 2026 2027 2028 $ m illi on s Projected Improving Financial Metrics for Oglethorpe after Vogtle 3&4 Completion 11 After Vogtle is complete, capital expenditures are projected to decline significantly. $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 2021 2022 2023 2024 2025 2026 2027 $ m illi on s Effingham Acquisition, Additions & Replacements Vogtle 3&4 Construction (excl. nuclear fuel) Fleet Additions & Replacements Fleet Environmental Projected Capital Expenditures As Vogtle’s costs are included in rates, funds available for debt service are projected to increase After Vogtle completion, Oglethorpe’s equity ratio is projected to increase. Historic and Projected % Equity to Total Capitalization After Vogtle completion, Oglethorpe’s debt balances are projected to decline as capital requirements wane and debt amortizes. 0% 2% 4% 6% 8% 10% 12% 14% 1998 2000 2002 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024 2026 2028 Vogtle 3&4 Construction Begins Vogtle 3&4 Assumed In-Service Vogtle 3&4 Assumed In-Service Projected Declining Debt Balances(a) $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 2021 2022 2023 2024 2025 2026 2027 2028 $ m illi on s Vogtle 3&4 Assumed In-Service (a) Total Debt: Long term debt, Long-term debt due within one year and Short-term borrowings. Depreciation and amortization Net interest charges Net margin ProjectedActual

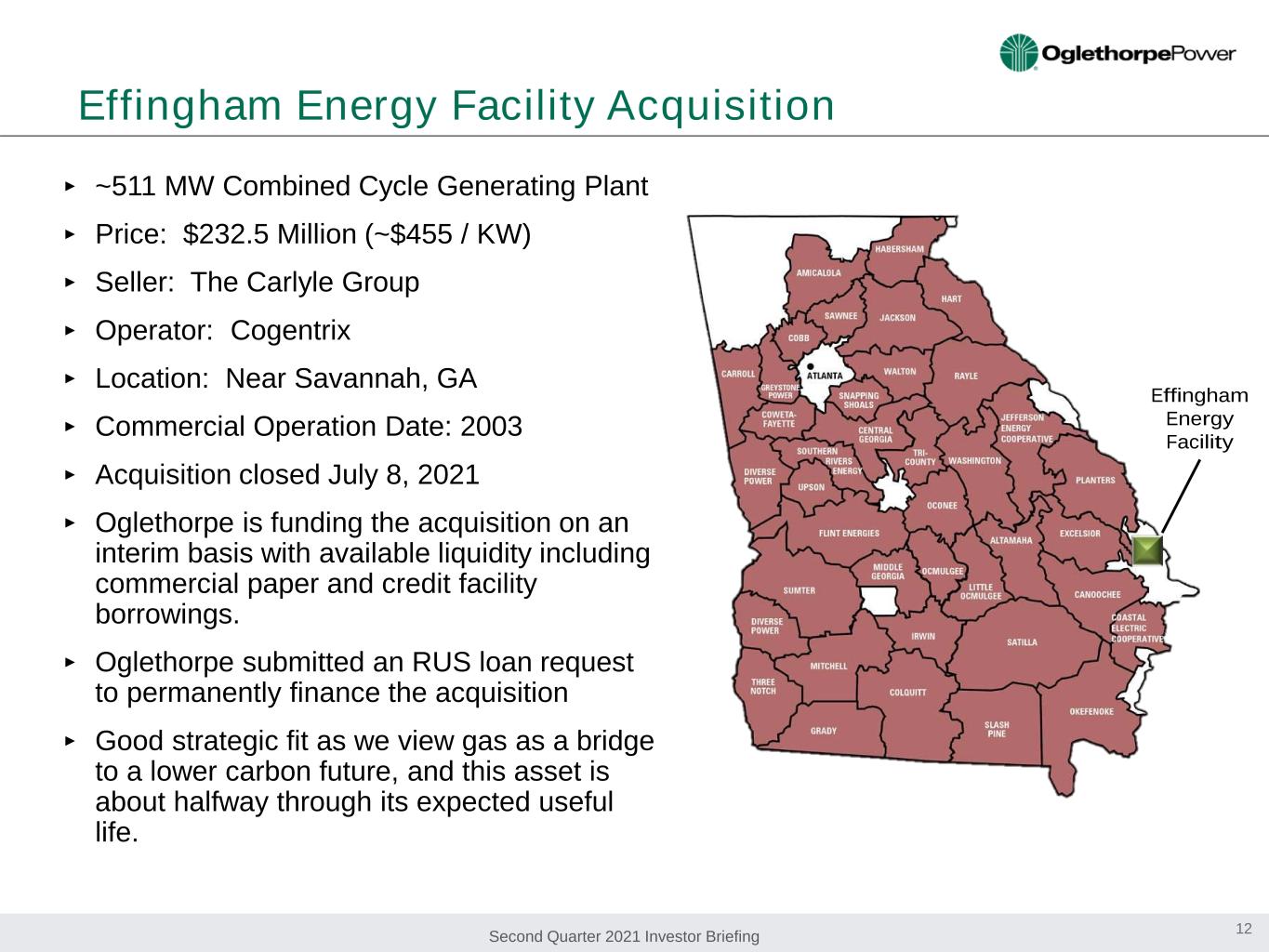

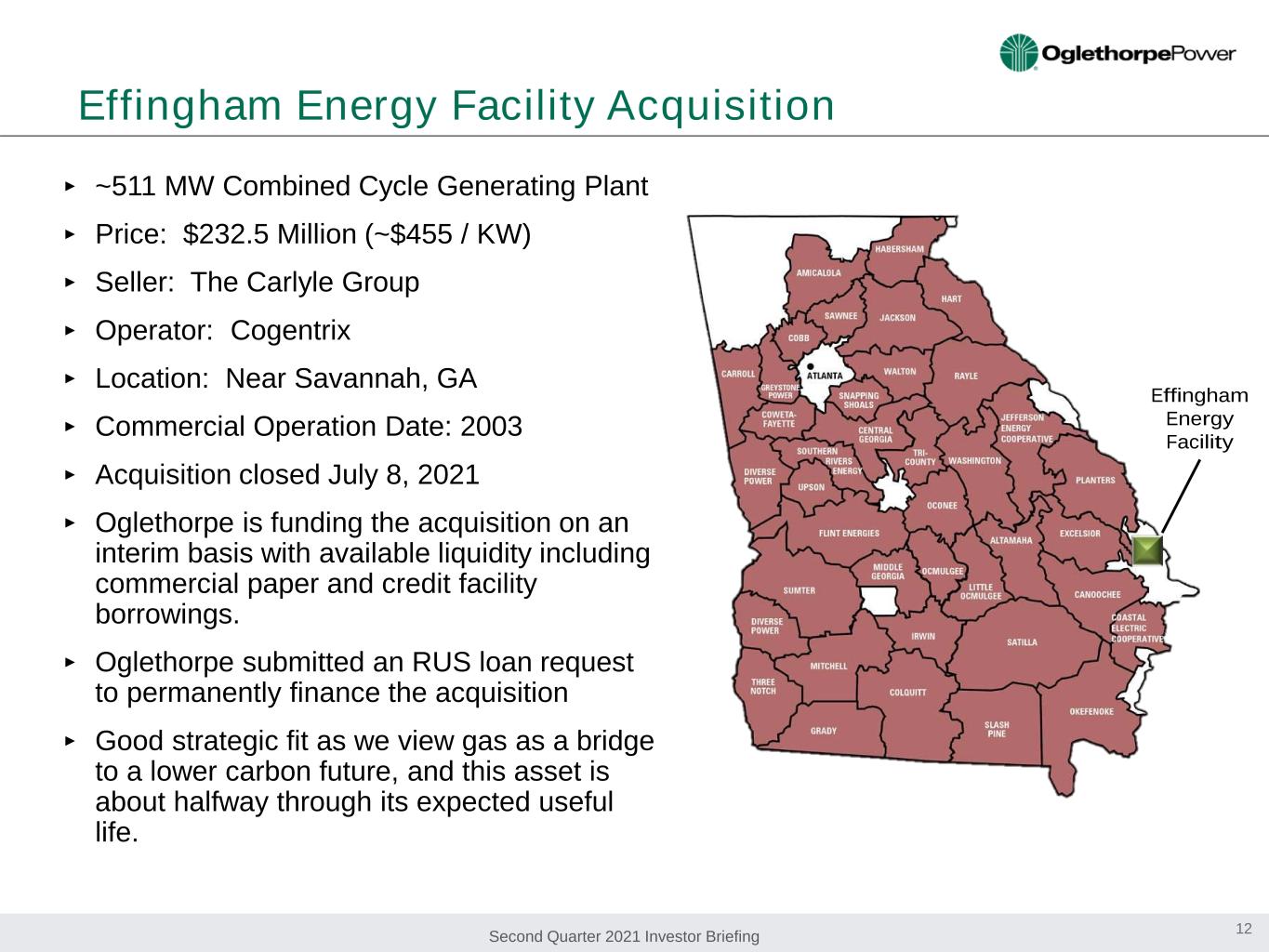

Second Quarter 2021 Investor Briefing Effingham Energy Facility Acquisition 12 ‣ ~511 MW Combined Cycle Generating Plant ‣ Price: $232.5 Million (~$455 / KW) ‣ Seller: The Carlyle Group ‣ Operator: Cogentrix ‣ Location: Near Savannah, GA ‣ Commercial Operation Date: 2003 ‣ Acquisition closed July 8, 2021 ‣ Oglethorpe is funding the acquisition on an interim basis with available liquidity including commercial paper and credit facility borrowings. ‣ Oglethorpe submitted an RUS loan request to permanently finance the acquisition ‣ Good strategic fit as we view gas as a bridge to a lower carbon future, and this asset is about halfway through its expected useful life. Effingham Energy Facility

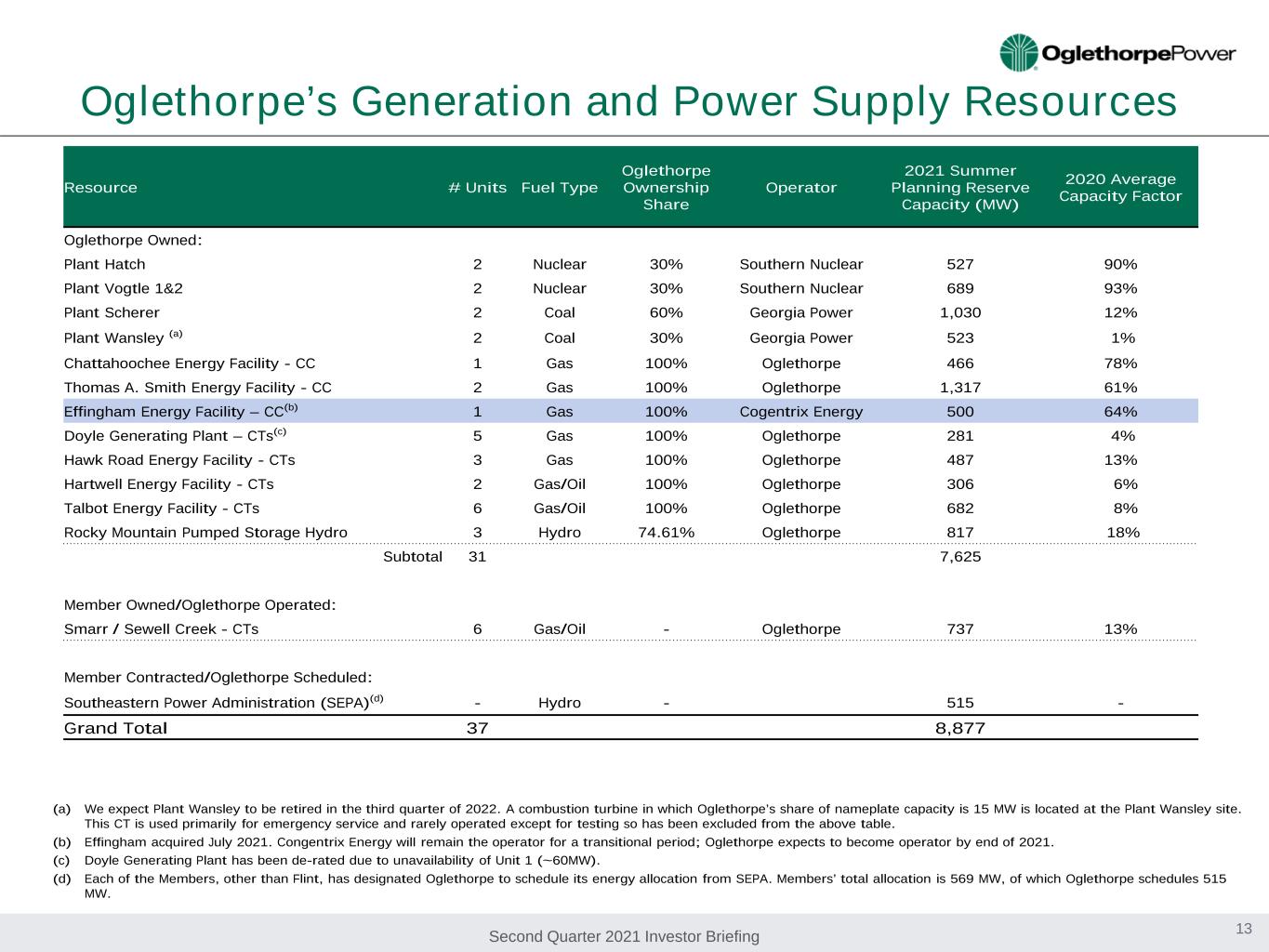

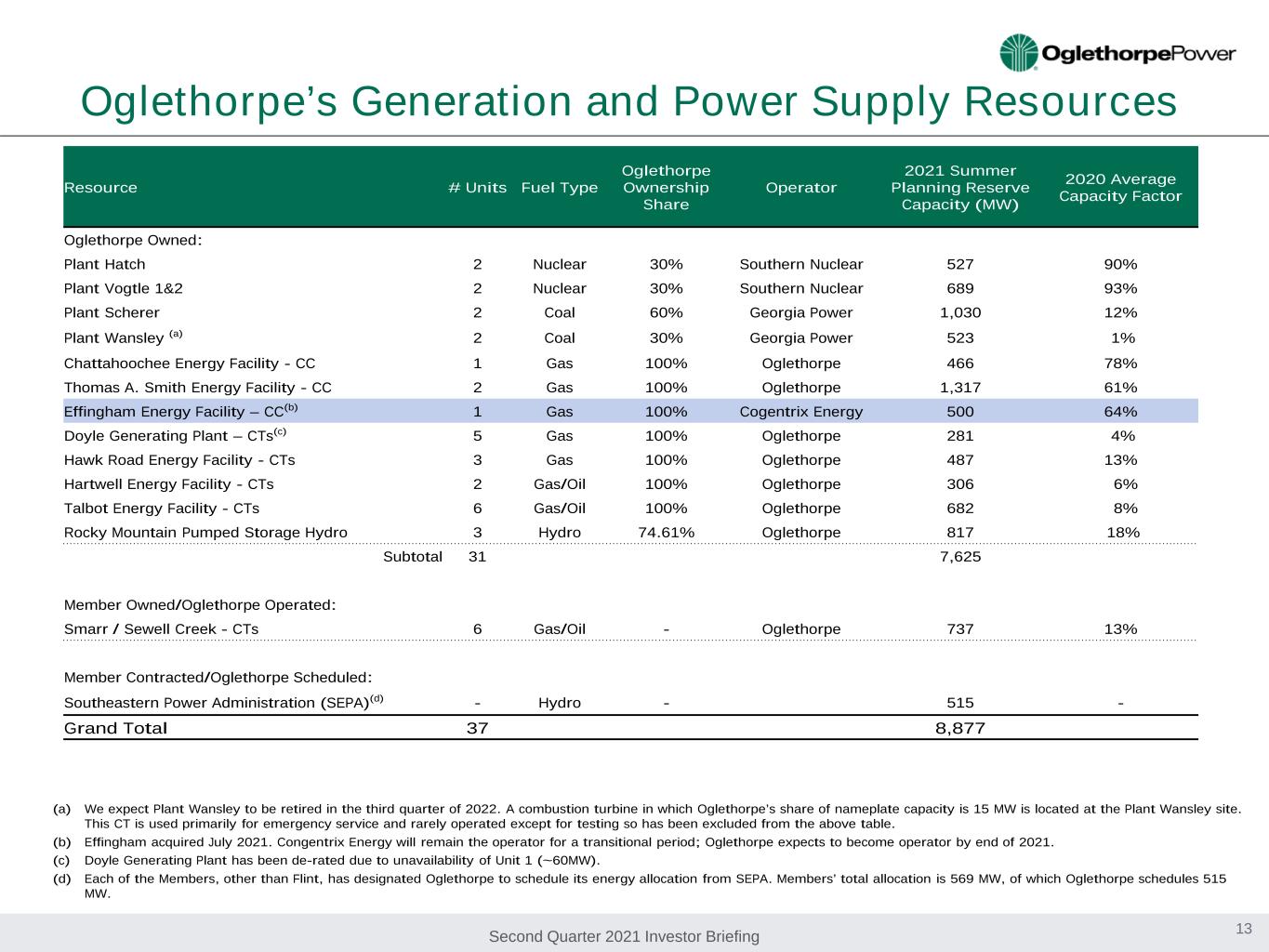

Second Quarter 2021 Investor Briefing Oglethorpe’s Generation and Power Supply Resources (a) We expect Plant Wansley to be retired in the third quarter of 2022. A combustion turbine in which Oglethorpe’s share of nameplate capacity is 15 MW is located at the Plant Wansley site. This CT is used primarily for emergency service and rarely operated except for testing so has been excluded from the above table. (b) Effingham acquired July 2021. Congentrix Energy will remain the operator for a transitional period; Oglethorpe expects to become operator by end of 2021. (c) Doyle Generating Plant has been de-rated due to unavailability of Unit 1 (~60MW). (d) Each of the Members, other than Flint, has designated Oglethorpe to schedule its energy allocation from SEPA. Members’ total allocation is 569 MW, of which Oglethorpe schedules 515 MW. Resource # Units Fuel Type Oglethorpe Ownership Share Operator 2021 Summer Planning Reserve Capacity (MW) 2020 Average Capacity Factor Oglethorpe Owned: Plant Hatch 2 Nuclear 30% Southern Nuclear 527 90% Plant Vogtle 1&2 2 Nuclear 30% Southern Nuclear 689 93% Plant Scherer 2 Coal 60% Georgia Power 1,030 12% Plant Wansley (a) 2 Coal 30% Georgia Power 523 1% Chattahoochee Energy Facility - CC 1 Gas 100% Oglethorpe 466 78% Thomas A. Smith Energy Facility - CC 2 Gas 100% Oglethorpe 1,317 61% Effingham Energy Facility – CC(b) 1 Gas 100% Cogentrix Energy 500 64% Doyle Generating Plant – CTs(c) 5 Gas 100% Oglethorpe 281 4% Hawk Road Energy Facility - CTs 3 Gas 100% Oglethorpe 487 13% Hartwell Energy Facility - CTs 2 Gas/Oil 100% Oglethorpe 306 6% Talbot Energy Facility - CTs 6 Gas/Oil 100% Oglethorpe 682 8% Rocky Mountain Pumped Storage Hydro 3 Hydro 74.61% Oglethorpe 817 18% Subtotal 31 7,625 Member Owned/Oglethorpe Operated: Smarr / Sewell Creek - CTs 6 Gas/Oil - Oglethorpe 737 13% Member Contracted/Oglethorpe Scheduled: Southeastern Power Administration (SEPA)(d) - Hydro - 515 - Grand Total 37 8,877 13

Second Quarter 2021 Investor Briefing Oglethorpe’s Diversified Power Supply Portfolio Notes: Capacity and energy include Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. Capacity includes Effingham Energy Facility that was acquired in July 2021. 2021 Capacity (MW) 8,362 MW 14 2021 Energy (MWh) (July 2020 – June 2021) 25.7 Million MWh 57% 14% 19% 10% 48% 40% 8% 4%

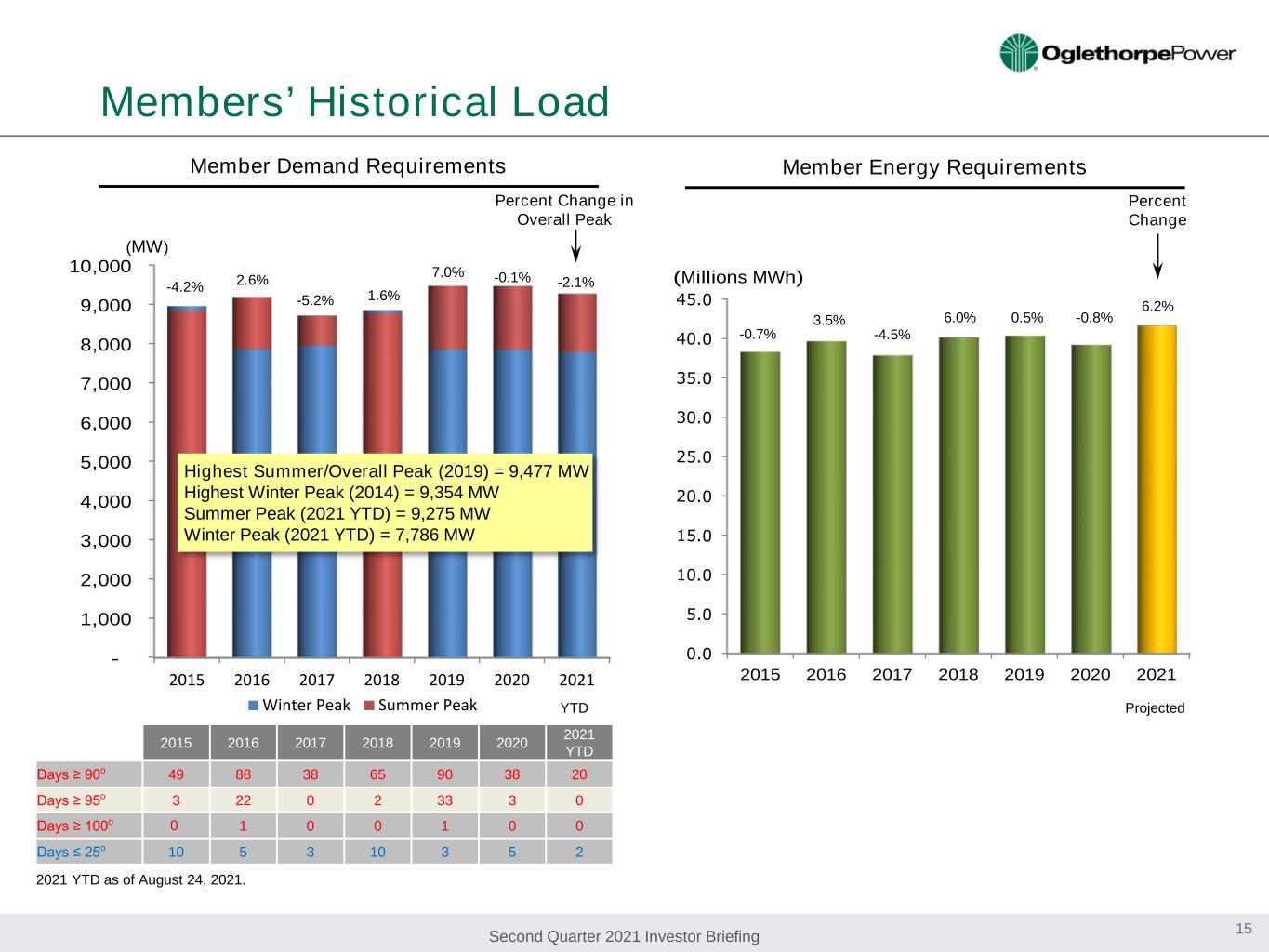

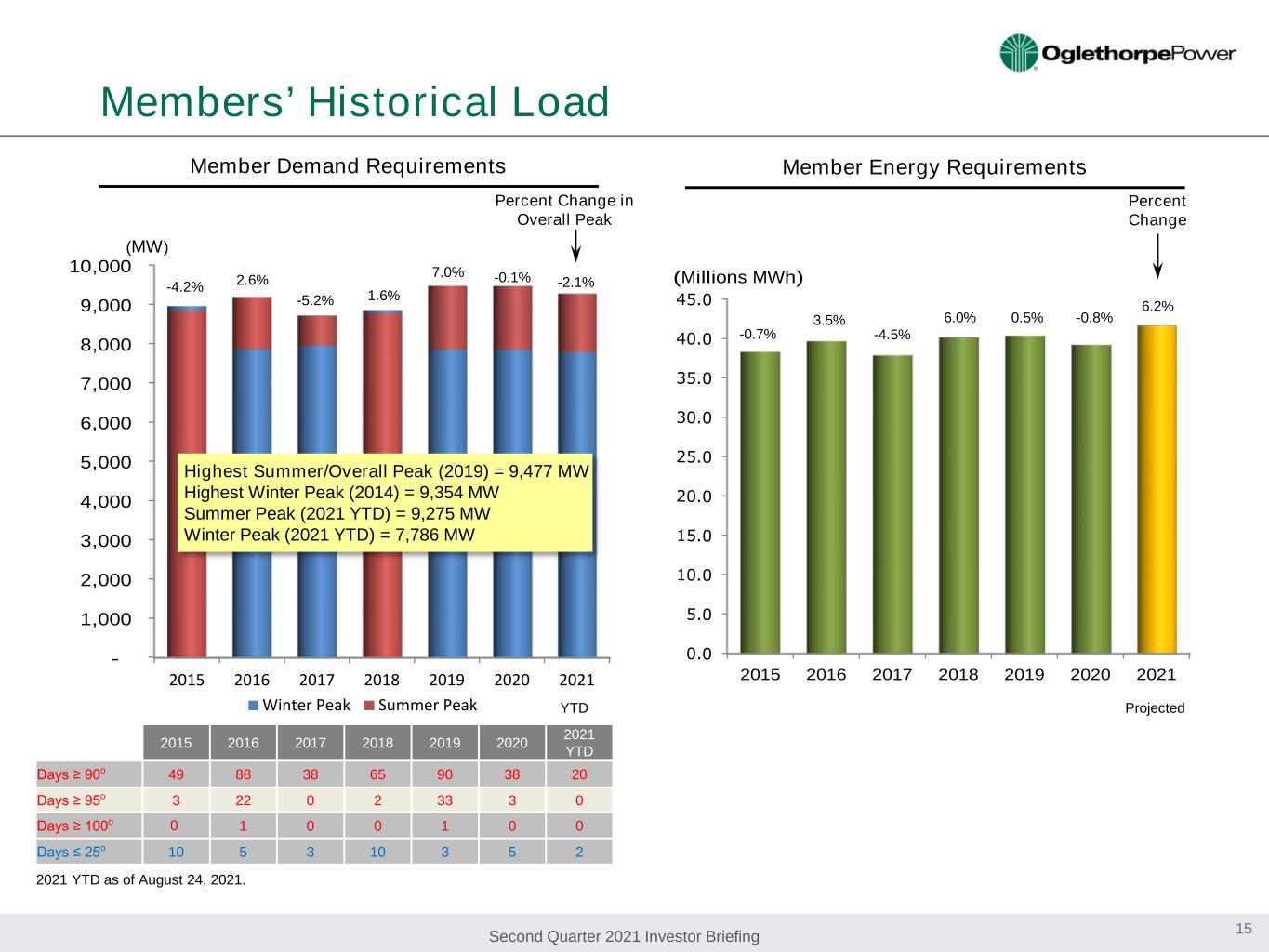

Second Quarter 2021 Investor Briefing 2015 2016 2017 2018 2019 2020 2021 (Millions MWh) - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2015 2016 2017 2018 2019 2020 2021 Winter Peak Summer Peak Members’ Historical Load 15 Member Demand Requirements Member Energy Requirements Percent Change -0.7% (MW) Percent Change in Overall Peak -4.2% Highest Summer/Overall Peak (2019) = 9,477 MW Highest Winter Peak (2014) = 9,354 MW Summer Peak (2021 YTD) = 9,275 MW Winter Peak (2021 YTD) = 7,786 MW 2.6% 3.5% 2015 2016 2017 2018 2019 2020 2021 YTD Days ≥ 90o 49 88 38 65 90 38 20 Days ≥ 95o 3 22 0 2 33 3 0 Days ≥ 100o 0 1 0 0 1 0 0 Days ≤ 25o 10 5 3 10 3 5 2 -5.2% -4.5% 6.0% 1.6% 7.0% 0.5% -0.8% -0.1% Projected 2021 YTD as of August 24, 2021. YTD -2.1% 6.2%

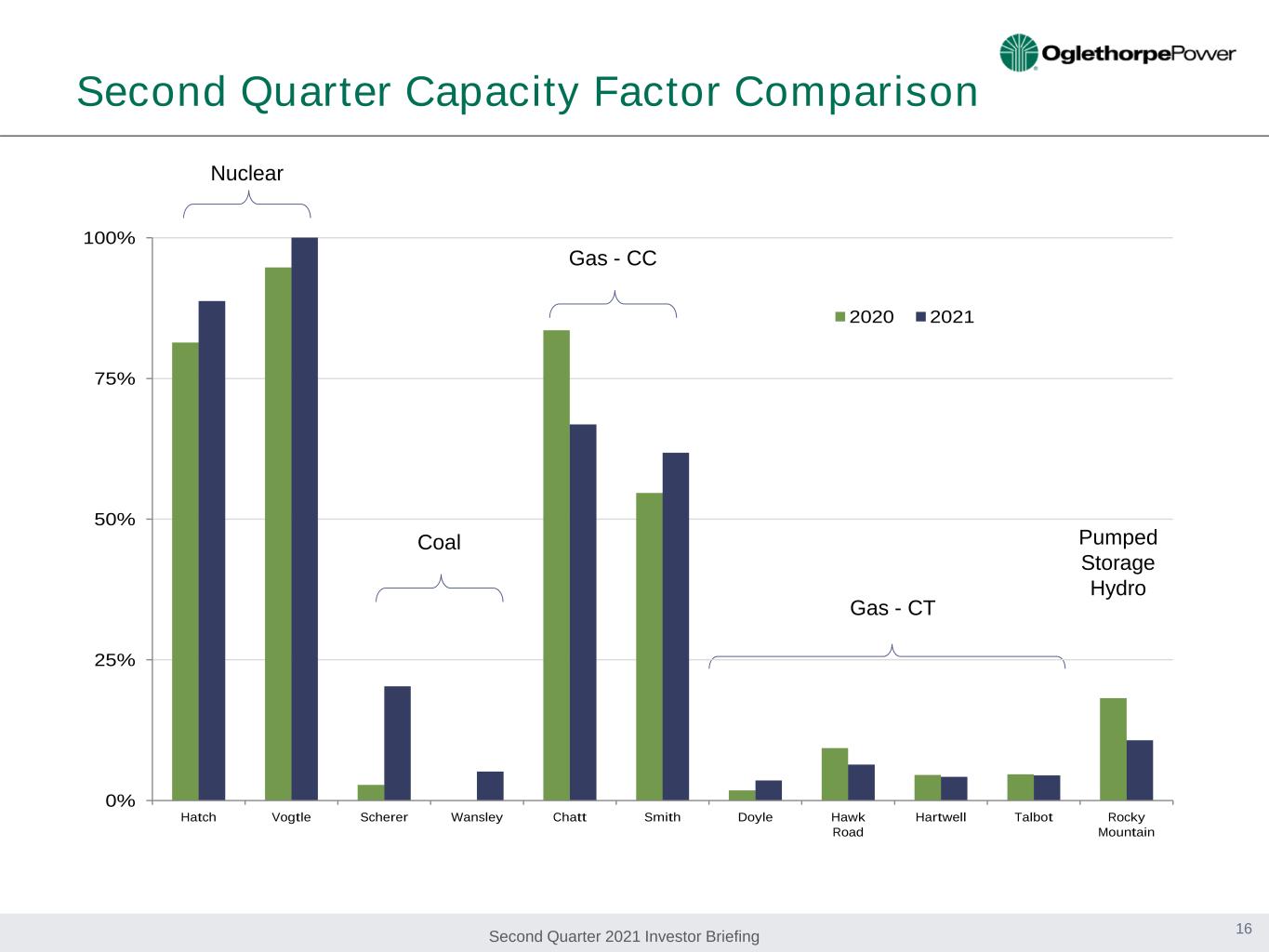

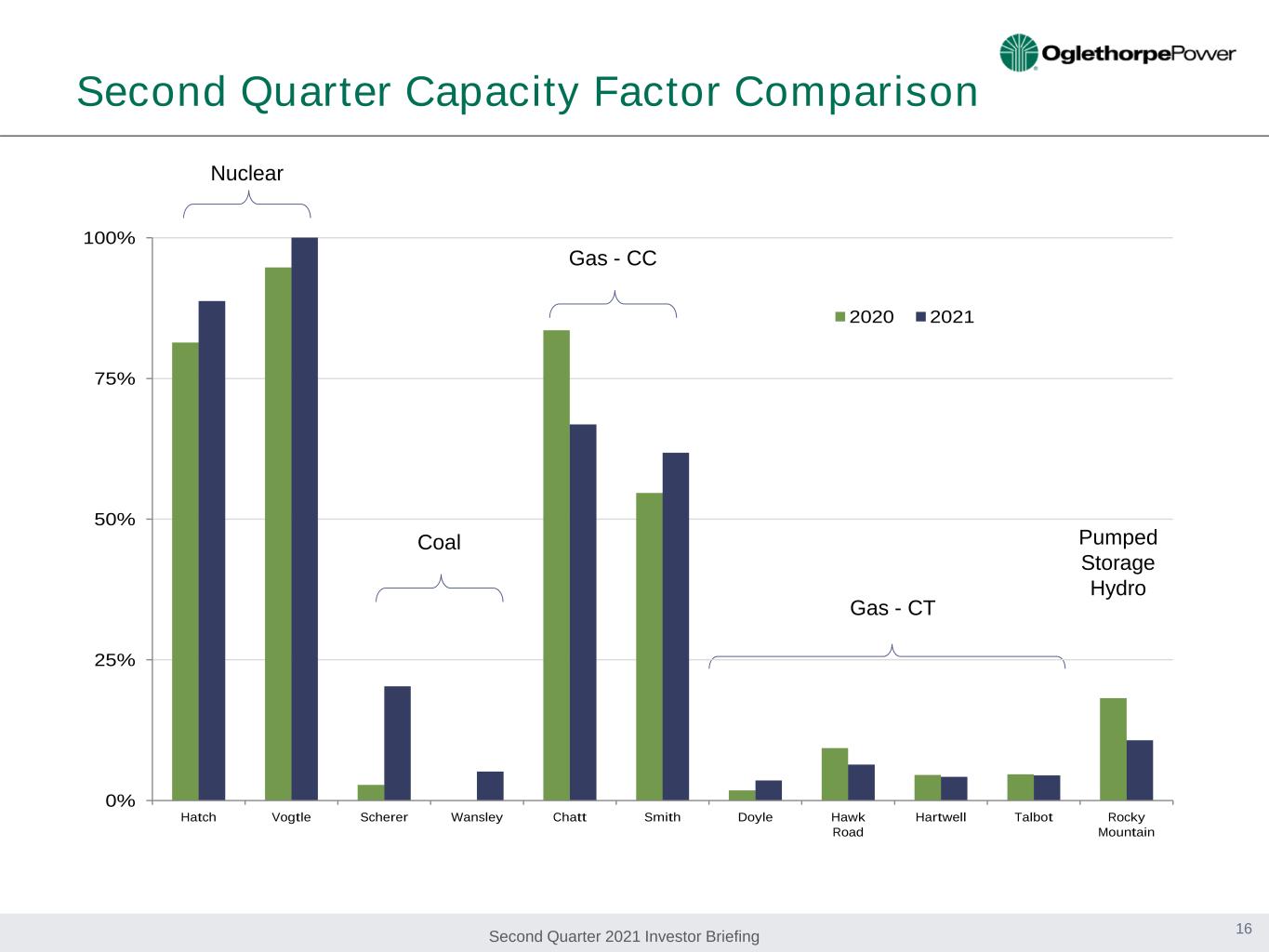

Second Quarter 2021 Investor Briefing Second Quarter Capacity Factor Comparison Nuclear Coal Gas - CC Gas - CT Pumped Storage Hydro 16 0% 25% 50% 75% 100% Hatch Vogtle Scherer Wansley Chatt Smith Doyle Hawk Road Hartwell Talbot Rocky Mountain 2020 2021

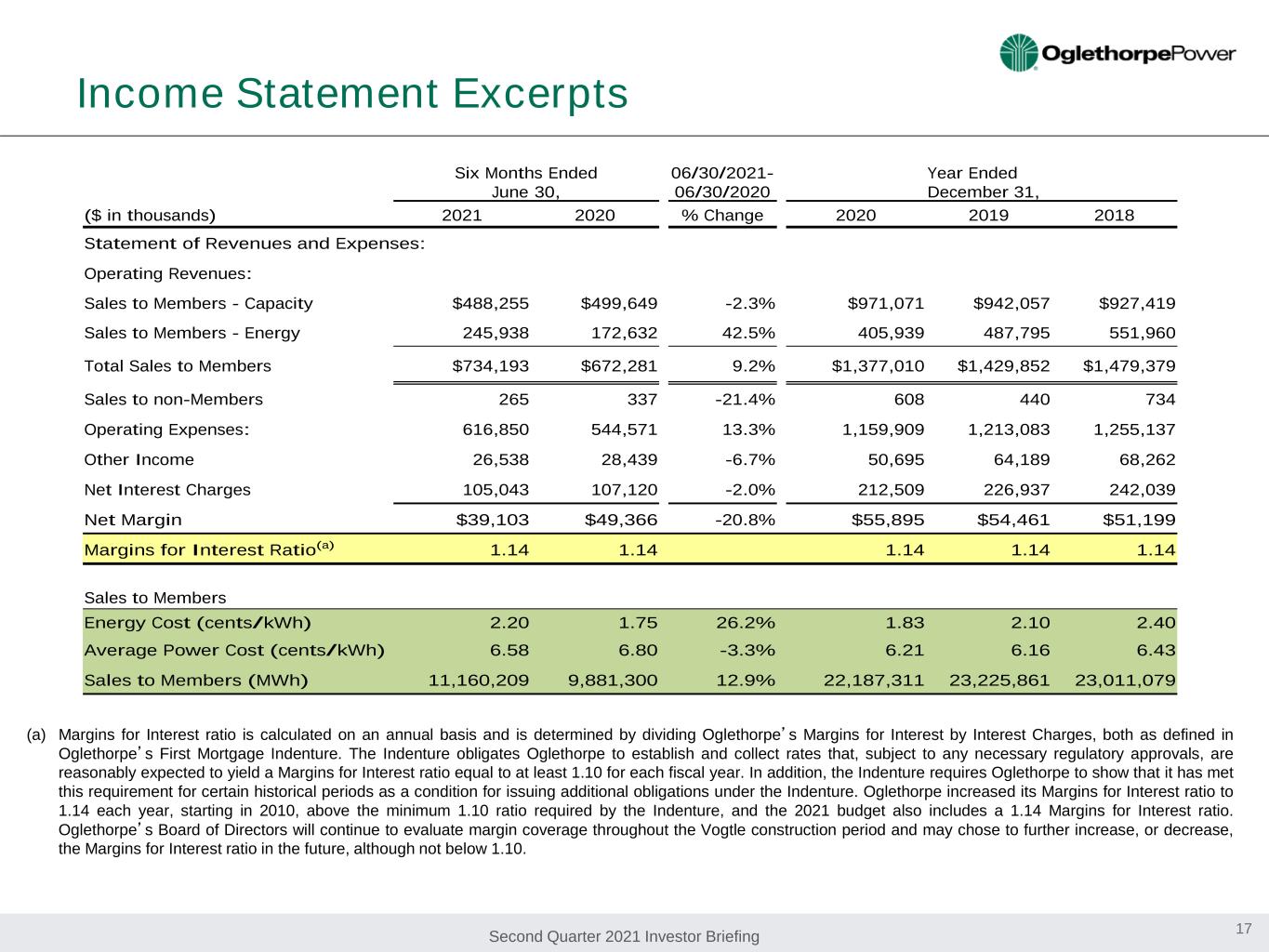

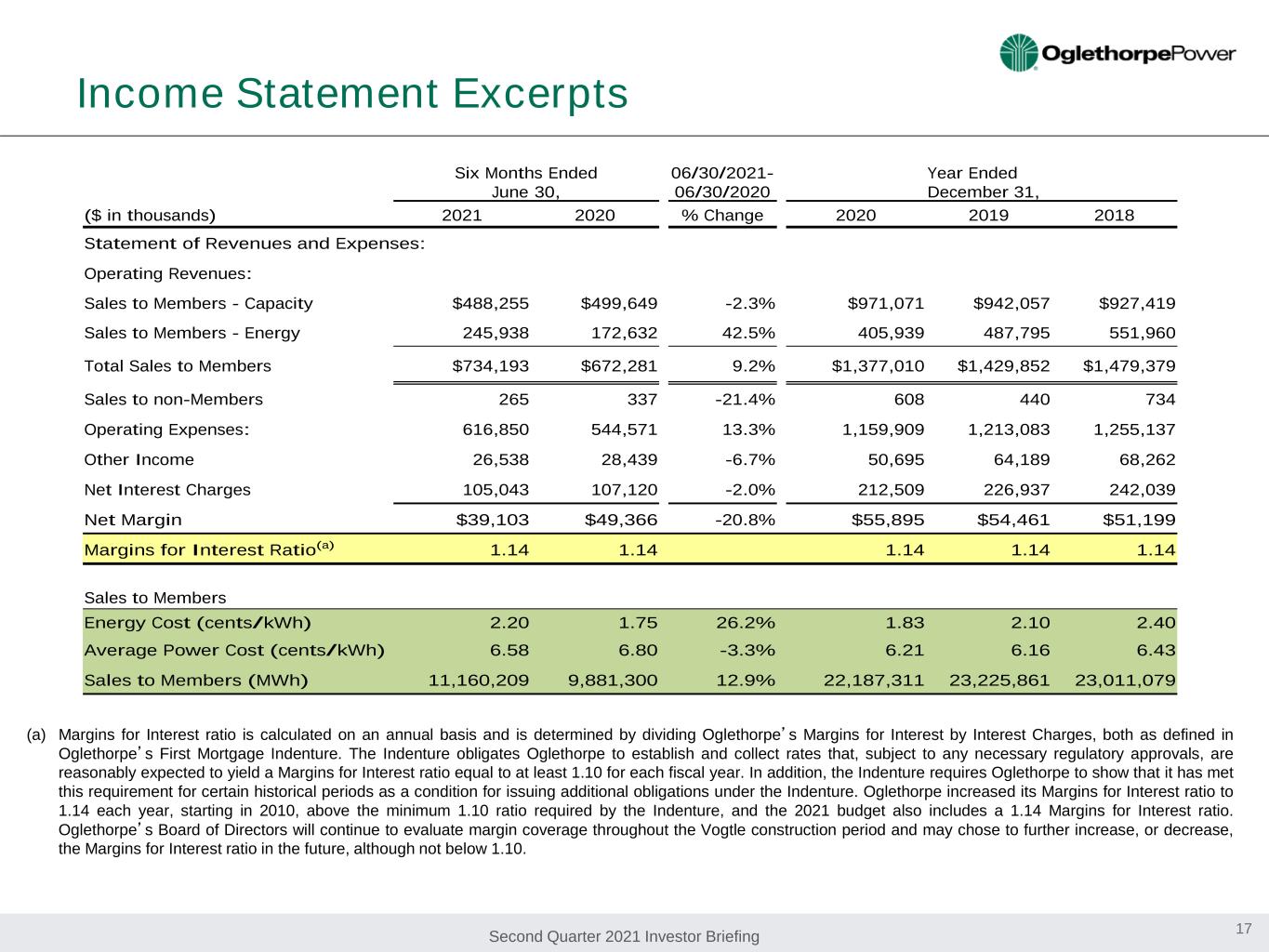

Second Quarter 2021 Investor Briefing Income Statement Excerpts 17 (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture, and the 2021 budget also includes a 1.14 Margins for Interest ratio. Oglethorpe’s Board of Directors will continue to evaluate margin coverage throughout the Vogtle construction period and may chose to further increase, or decrease, the Margins for Interest ratio in the future, although not below 1.10. Six Months Ended June 30, 06/30/2021- 06/30/2020 Year Ended December 31, ($ in thousands) 2021 2020 % Change 2020 2019 2018 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $488,255 $499,649 -2.3% $971,071 $942,057 $927,419 Sales to Members - Energy 245,938 172,632 42.5% 405,939 487,795 551,960 Total Sales to Members $734,193 $672,281 9.2% $1,377,010 $1,429,852 $1,479,379 Sales to non-Members 265 337 -21.4% 608 440 734 Operating Expenses: 616,850 544,571 13.3% 1,159,909 1,213,083 1,255,137 Other Income 26,538 28,439 -6.7% 50,695 64,189 68,262 Net Interest Charges 105,043 107,120 -2.0% 212,509 226,937 242,039 Net Margin $39,103 $49,366 -20.8% $55,895 $54,461 $51,199 Margins for Interest Ratio(a) 1.14 1.14 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.20 1.75 26.2% 1.83 2.10 2.40 Average Power Cost (cents/kWh) 6.58 6.80 -3.3% 6.21 6.16 6.43 Sales to Members (MWh) 11,160,209 9,881,300 12.9% 22,187,311 23,225,861 23,011,079

Second Quarter 2021 Investor Briefing Balance Sheet Excerpts (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has a covenant in three credit agreements that currently requires a minimum total patronage capital of $750 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. 18 June 30, December 31, ($ in thousands) 2021 2020 2019 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $4,560,782 $4,728,550 $4,679,690 CWIP 6,281,164 5,783,579 4,816,896 Nuclear Fuel 364,270 358,728 359,270 Total Electric Plant $11,206,216 $10,870,857 $9,855,856 Total Investments and Funds 1,743,130 1,526,880 1,327,700 Total Current Assets 1,147,587 1,053,091 974,465 Total Deferred Charges 871,281 789,328 832,092 Total Assets $14,968,214 $14,240,156 $12,990,113 Capitalization: Patronage Capital and Membership Fees $1,111,745 $1,072,642 $1,016,747 Long-term Debt and Finance Leases 10,688,743 10,367,261 9,479,496 Other 27,269 26,861 25,196 Total Capitalization $11,827,757 $11,466,764 $10,521,439 Total Current Liabilities 1,145,513 941,830 857,263 Total Deferred Credits and Other Liabilities 1,994,944 1,831,562 1,611,411 Total Equity and Liabilities $14,968,214 $14,240,156 $12,990,113 Total Capitalization $11,827,757 $11,466,764 $10,521,439 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 117,040 119,565 111,222 Plus: Long-term Debt and Finance Leases due within one year 269,602 208,649 217,440 Total Long-Term Debt and Equities $12,214,399 $11,794,978 $10,850,101 Equity Ratio(a) 9.1% 9.1% 9.4%

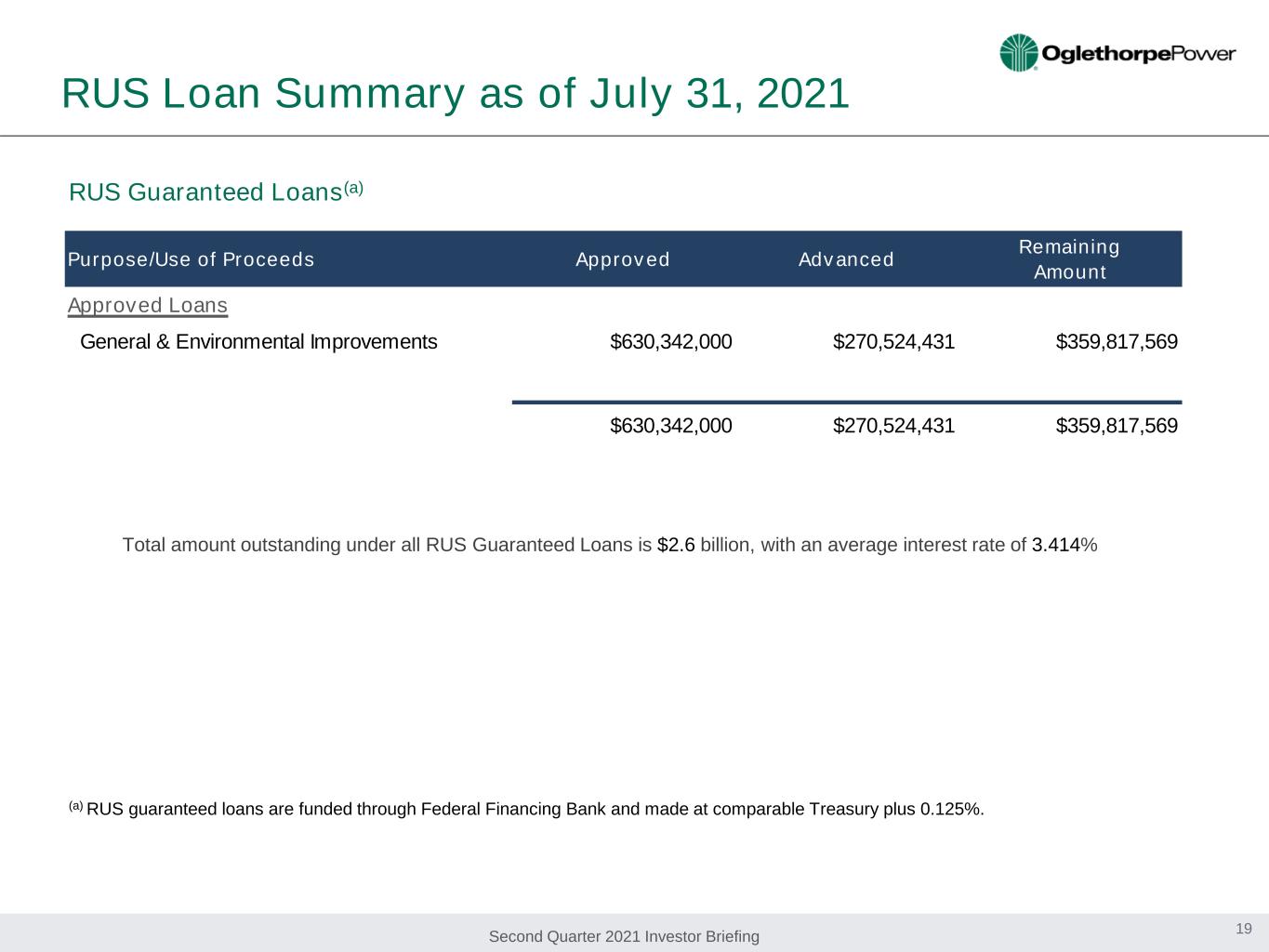

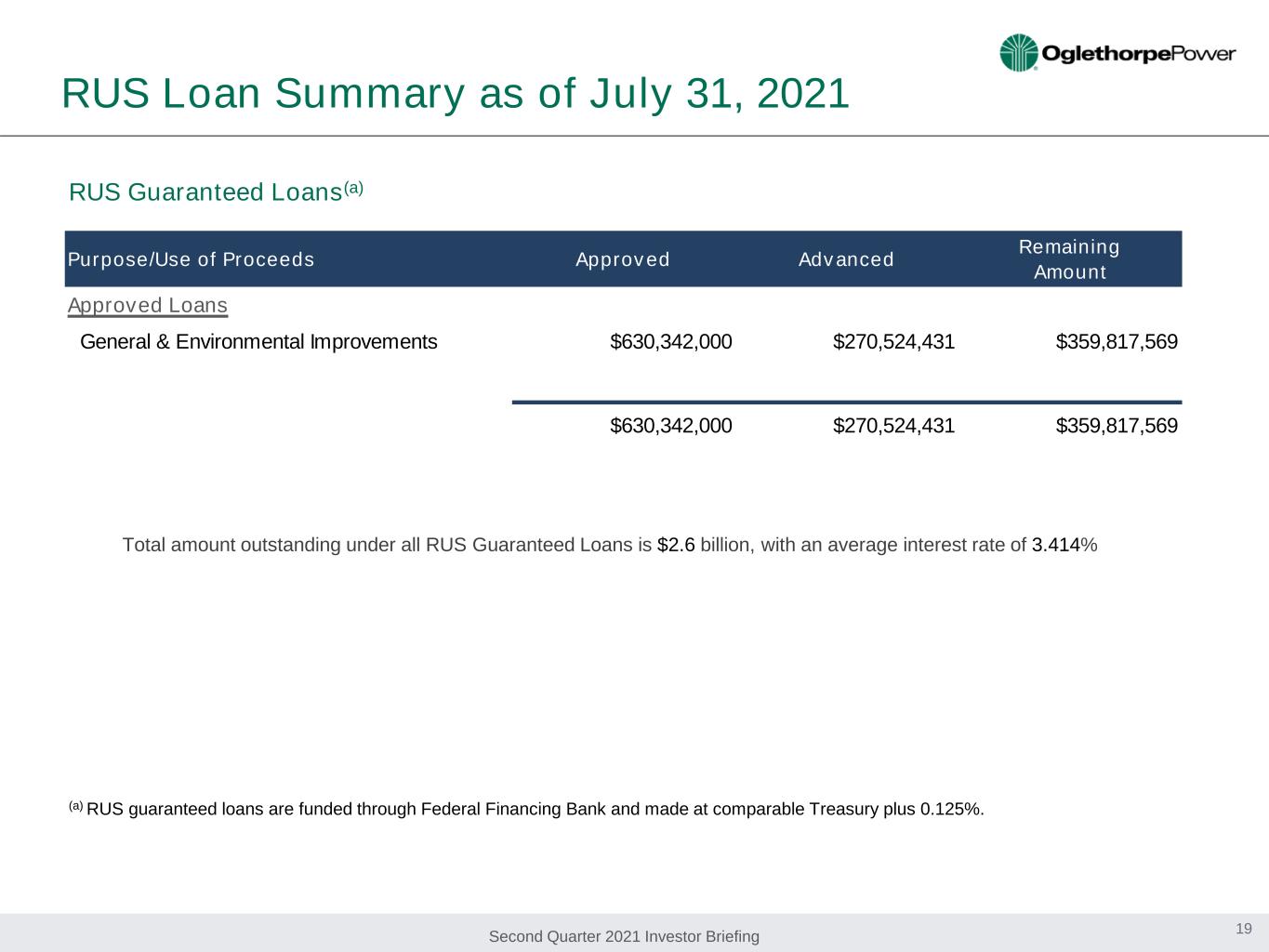

Second Quarter 2021 Investor Briefing Total amount outstanding under all RUS Guaranteed Loans is $2.6 billion, with an average interest rate of 3.414% RUS Guaranteed Loans(a) (a) RUS guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.125%. 19 RUS Loan Summary as of July 31, 2021 Purpose/Use of Proceeds Approved Advanced Remaining Amount Approved Loans General & Environmental Improvements $630,342,000 $270,524,431 $359,817,569 $630,342,000 $270,524,431 $359,817,569

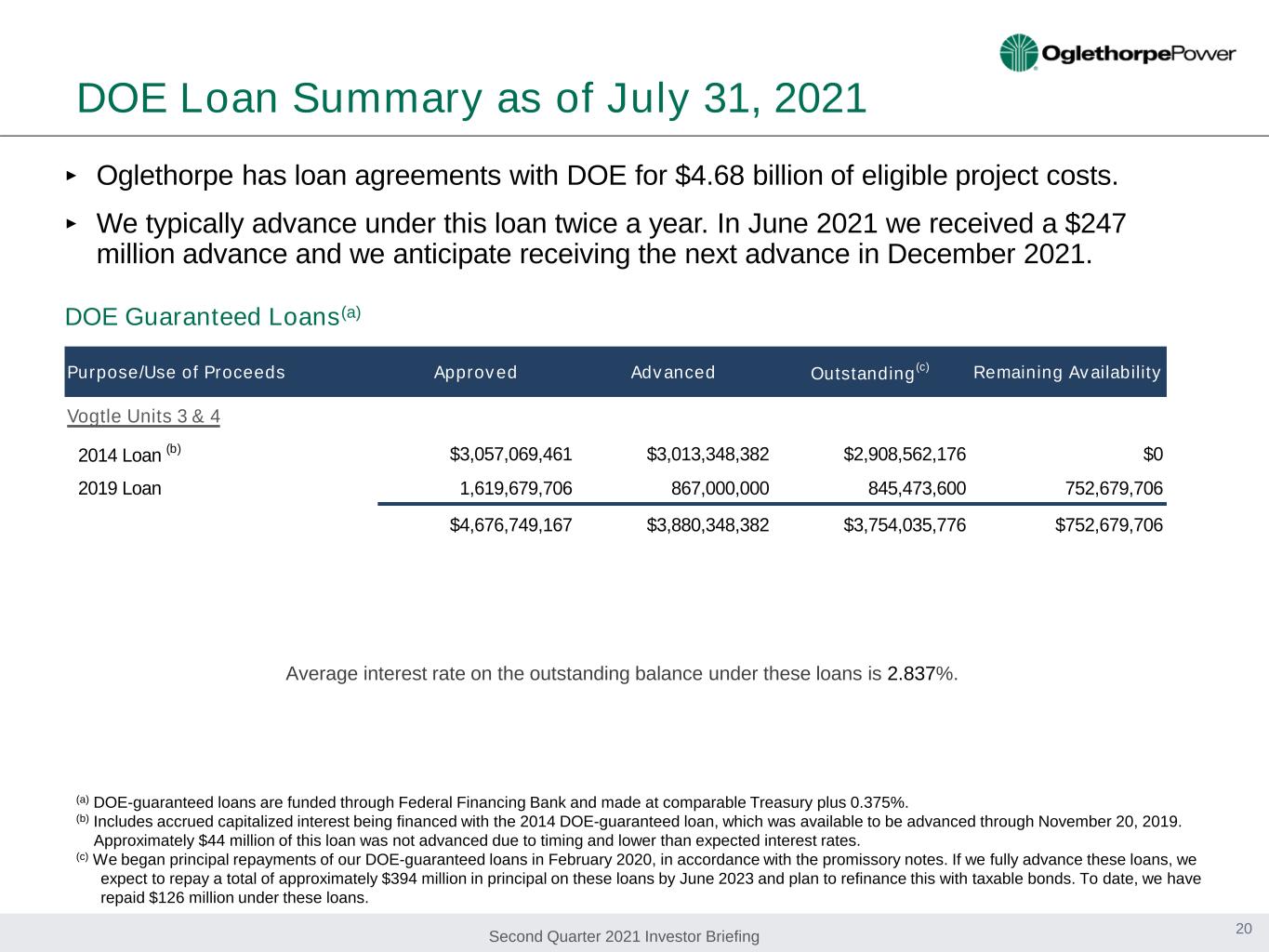

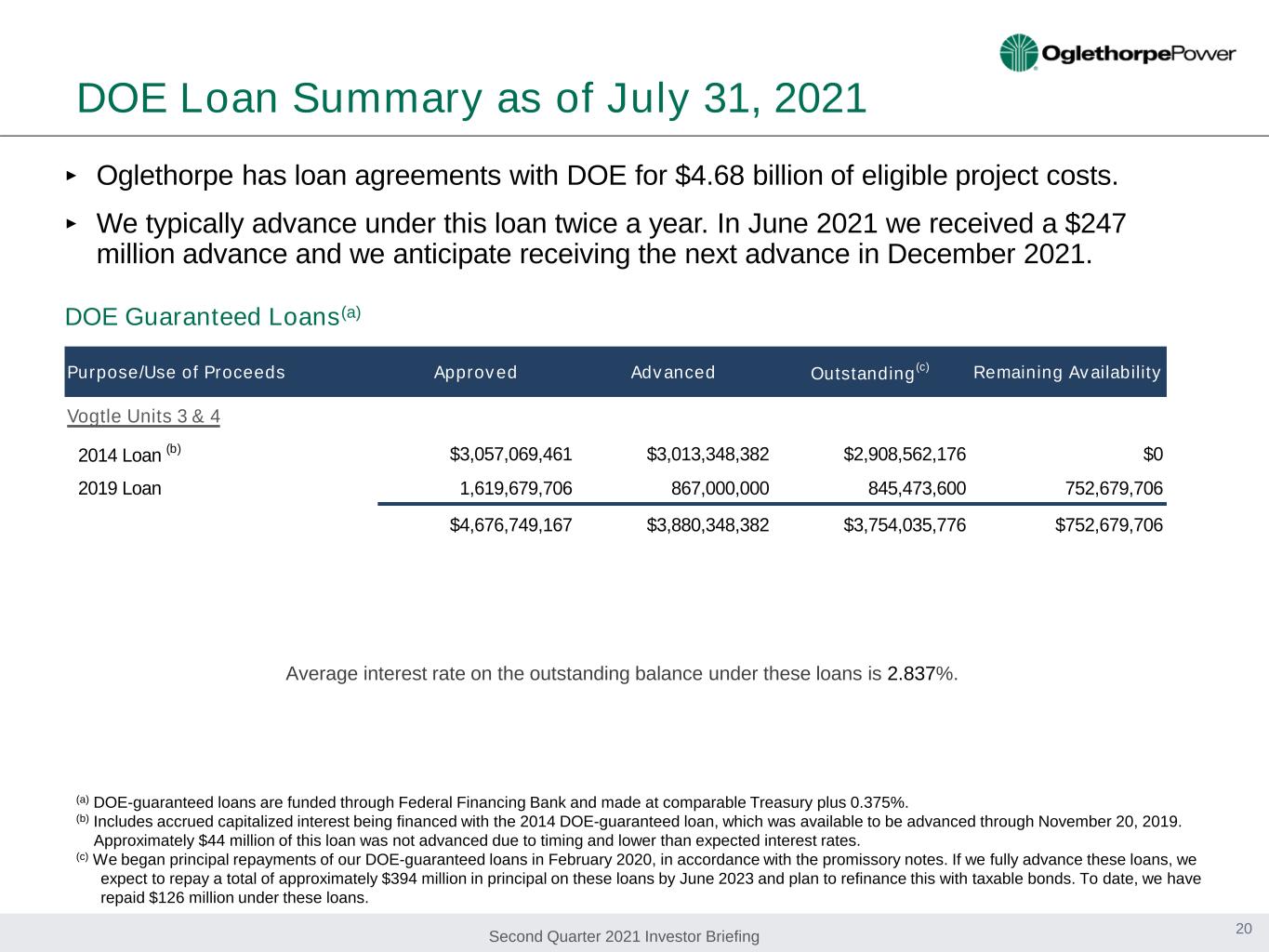

Second Quarter 2021 Investor Briefing ‣ Oglethorpe has loan agreements with DOE for $4.68 billion of eligible project costs. ‣ We typically advance under this loan twice a year. In June 2021 we received a $247 million advance and we anticipate receiving the next advance in December 2021. DOE Loan Summary as of July 31, 2021 DOE Guaranteed Loans(a) Average interest rate on the outstanding balance under these loans is 2.837%. (a) DOE-guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.375%. (b) Includes accrued capitalized interest being financed with the 2014 DOE-guaranteed loan, which was available to be advanced through November 20, 2019. Approximately $44 million of this loan was not advanced due to timing and lower than expected interest rates. (c) We began principal repayments of our DOE-guaranteed loans in February 2020, in accordance with the promissory notes. If we fully advance these loans, we expect to repay a total of approximately $394 million in principal on these loans by June 2023 and plan to refinance this with taxable bonds. To date, we have repaid $126 million under these loans. 20 Purpose/Use of Proceeds Approved Advanced Outstanding(c) Remaining Availability Vogtle Units 3 & 4 2014 Loan (b) $3,057,069,461 $3,013,348,382 $2,908,562,176 $0 2019 Loan 1,619,679,706 867,000,000 845,473,600 752,679,706 $4,676,749,167 $3,880,348,382 $3,754,035,776 $752,679,706

Second Quarter 2021 Investor Briefing $1,823 $1,018 $805 $551 $1,356 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ m ill io ns Oglethorpe’s Available Liquidity as of August 20, 2021 Borrowings Detail $2.7 million – Outstanding Letters of Credit for Operational Needs $484 million - CP for Vogtle Interim Financing $23 million - CP for Vogtle Hedging $274 million - CP for Vogtle DOE Loan Payments $234 - CP for Effingham Interim Financing Represents 581 days of liquidity on hand (excluding Cushion of Credit) (a) In addition, as of August 20, Oglethorpe had $378.3 million on deposit in the RUS Cushion of Credit Account. The RUS Cushion of Credit Account is designated as restricted investments and can only be used to pay debt service on RUS guaranteed loans. (a) 21

Second Quarter 2021 Investor Briefing $0 $500 $1,000 $1,500 $2,000 Q 1 20 20 Q 2 20 20 Q 3 20 20 Q 4 20 20 Q 1 20 21 Q 2 20 21 Q 3 20 21 Q 4 20 21 Q 1 20 22 Q 2 20 22 Q 3 20 22 Q 4 20 22 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 23 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 20 24 20 43 (M ill io ns ) Oglethorpe’s Bank Credit Facilities Time Now (a) The secured term loan amount is $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. Plus Optional Term Out Until 2043 NRUCFC 235$ CoBank 150$ MUFG 125$ Bank of America 100$ Mizuho Bank 100$ Regions Bank 100$ Royal Bank of Canada 100$ Truist Bank 100$ Fifth Third Bank 50$ Goldman Sachs Bank 50$ J.P. Morgan 50$ U.S. Bank 50$ $1.21B Syndicated Revolver / CP Backup $110M CFC Unsecured Bilateral $363M JP Morgan Bilateral 22 Anticipated renewal of this credit facility at approximately $350 million for 3-years to support interim liquidity needs stemming from Effingham acquisition. Anticipate downsizing after end of 2022 / early 2023. $140M CFC Incremental Secured Bilateral (a)

Second Quarter 2021 Investor Briefing Recent and Upcoming Financing Activity Completed in 2021 January $239 million of RUS advances June $247 million DOE advance for Vogtle 3&4 July Interim funding of Effingham Energy Facility with commercial paper and bank lines August “Early retirement” of $245.6 million in letter of credit backed variable rate pollution control bonds Upcoming in 2021 September 1st Oglethorpe ESG Report (EEI Template) October Renewal of ~$350 million bilateral credit facility December DOE advance for Vogtle 3&4 Upcoming in 2022 Second Quarter First mortgage bond issuance for Vogtle 3&4 23

Second Quarter 2021 Investor Briefing 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Budget YTD Actual YTD 6.44 6.51 6.51 6.58 ¢/ kW h $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 YE 2020 6/30/2021 $4.73 $4.56 $0.36 $0.36 $5.78 $6.28 (B illi on s) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $14,240 $14,968 Vogtle 3&4 Interest Rate Hedging, $23 DOE - Vogtle 3&4 P&I, $215 Effingham Acquisition, $234 Vogtle 3 & 4 Interim Financing, $412 Net Margin Liquidity Wholesale Power CostInterim CP Financing Balance Sheet Electric Plant Average Cost of Funds: 0.226% (dollars in millions) Secured LT Debt (6/30/21): $11.0 billion Weighted Average Cost: 3.65% (a) $245 million repayment of tax-exempt debt occurred 8/17/2021. This repayment is not reflected in Secured LT Debt as of 6/30/21. 2021 July 31, 2021 2021 Cost of Power Sales to Members (excluding Rate Management Program). Additional Member Collections for Expensing of IDC Rate Management Program. 2021 Secured Long Term Debt 24 1.14 MFI ratio $- $20 $40 $60 $80 Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c M illi on s Actual Budget $(300) $(100) $100 $300 $500 DOE Tax-Ex RUS $247 - $256 $103 $246 $113 ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment Actual Remarketed Forecasted Remarketing $227 $36 $1,210 $ 1,210 $1,823 $1,823 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 Ja n Fe b M ar A pr M ay Ju n Ju l A ug S ep O ct N ov D ec B or ro w in gs ( M il) Cash Borrowings CP Availability Total Available Lines of Credit Ca sh B al an ce s (M il) 2021 (a)

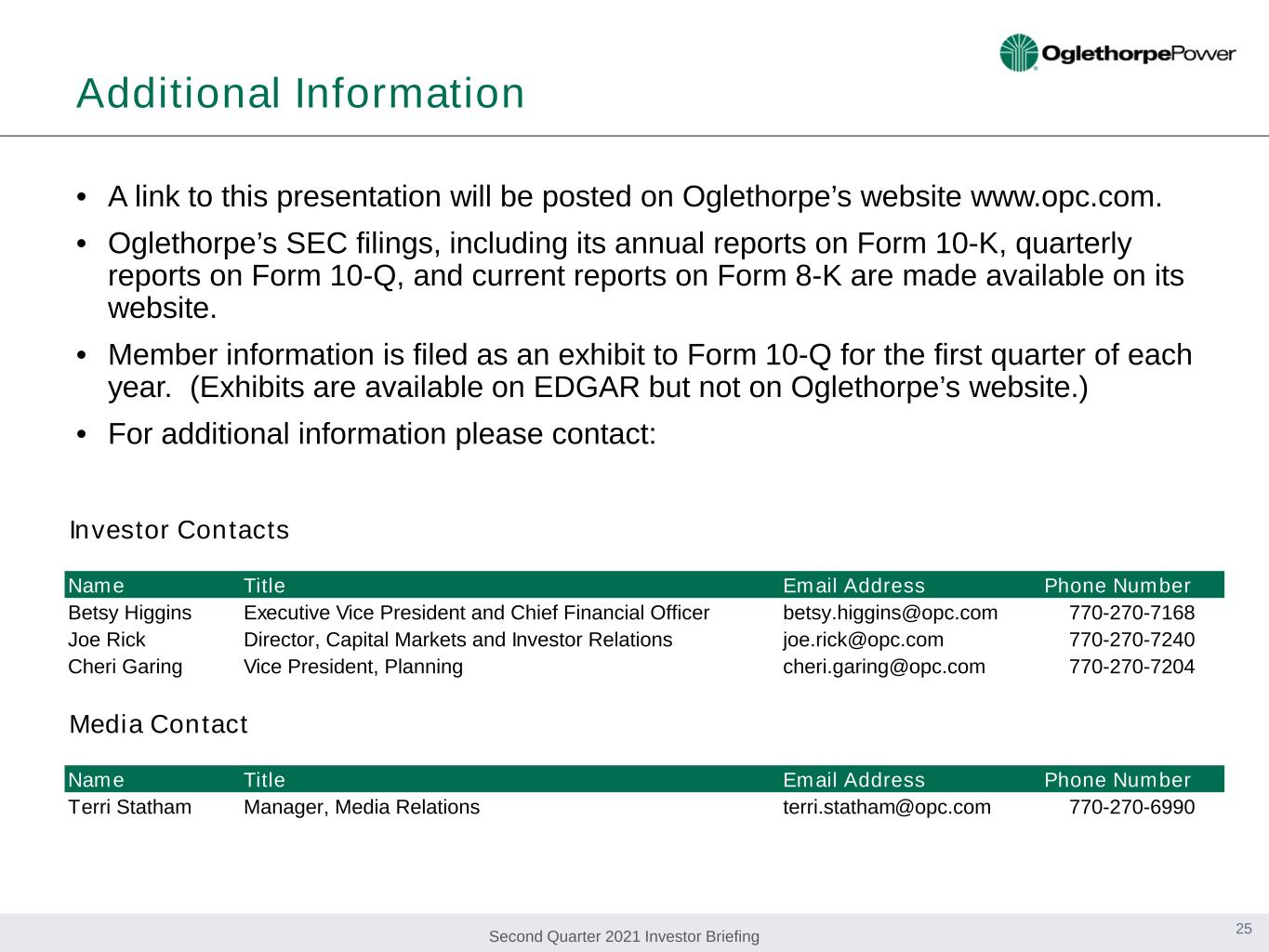

Second Quarter 2021 Investor Briefing • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Member information is filed as an exhibit to Form 10-Q for the first quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) • For additional information please contact: Additional Information 25 Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Terri Statham Manager, Media Relations terri.statham@opc.com 770-270-6990