Third Quarter 2021 Investor Briefing Third Quarter 2021 Investor Briefing November 23, 2021

Third Quarter 2021 Investor Briefing Notice to Recipients Risk Factors and Forward Looking Statements Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe” or “OPC”), that are not historical facts are forward-looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward- looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION” in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2021, filed with the Securities and Exchange Commission on November 12, 2021, and “RISK FACTORS” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the Securities and Exchange Commission on March 19, 2021. This electronic presentation is provided as of November 23, 2021. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. 2

Third Quarter 2021 Investor Briefing ‣ Vogtle 3 & 4 Update ‣ Operations Update ‣ ESG Update ‣ Financial and Liquidity Update Presenters and Agenda Mike Price Executive Vice President and Chief Operating Officer Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3

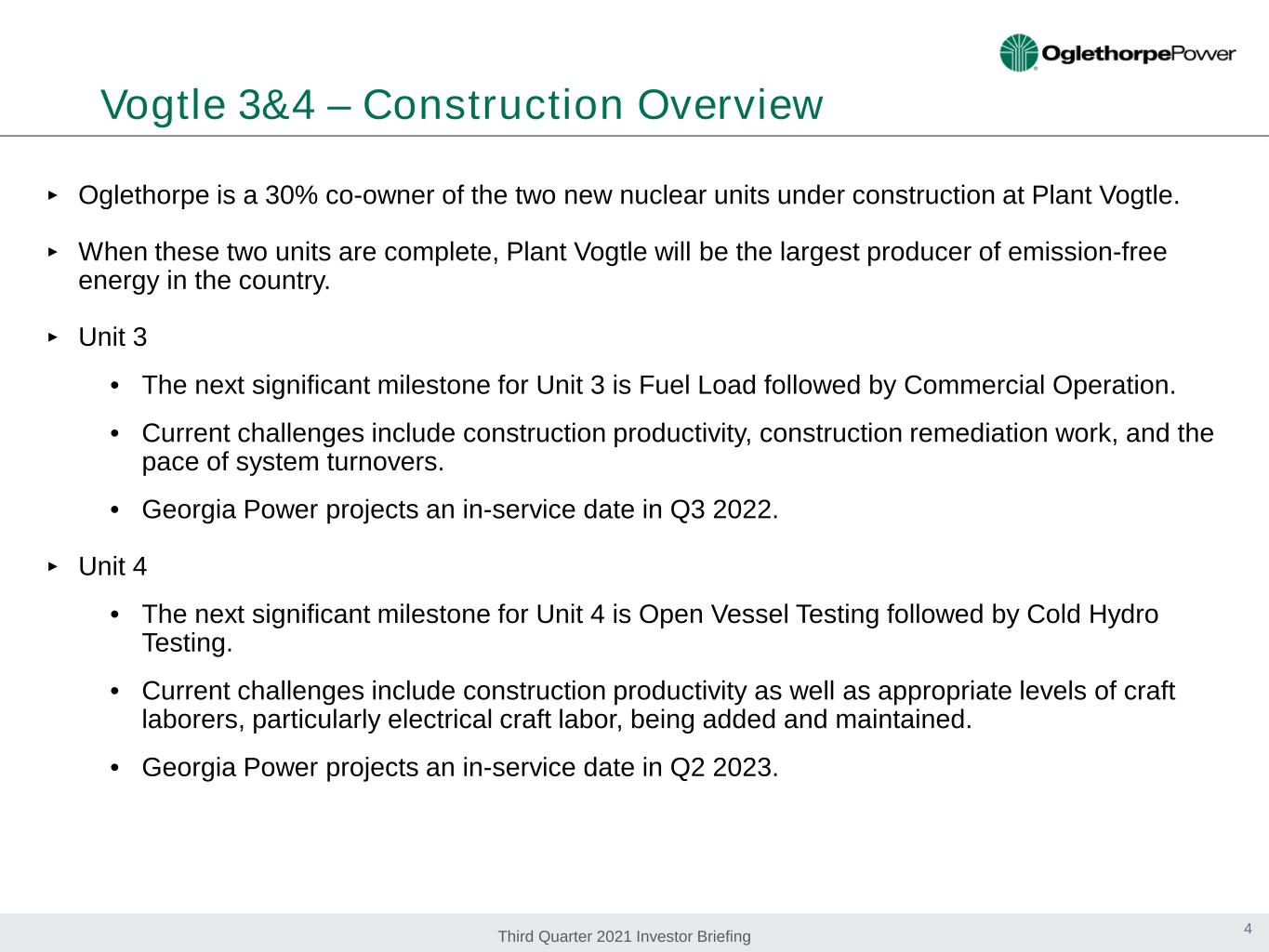

Third Quarter 2021 Investor Briefing Vogtle 3&4 – Construction Overview 4 ‣ Oglethorpe is a 30% co-owner of the two new nuclear units under construction at Plant Vogtle. ‣ When these two units are complete, Plant Vogtle will be the largest producer of emission-free energy in the country. ‣ Unit 3 • The next significant milestone for Unit 3 is Fuel Load followed by Commercial Operation. • Current challenges include construction productivity, construction remediation work, and the pace of system turnovers. • Georgia Power projects an in-service date in Q3 2022. ‣ Unit 4 • The next significant milestone for Unit 4 is Open Vessel Testing followed by Cold Hydro Testing. • Current challenges include construction productivity as well as appropriate levels of craft laborers, particularly electrical craft labor, being added and maintained. • Georgia Power projects an in-service date in Q2 2023.

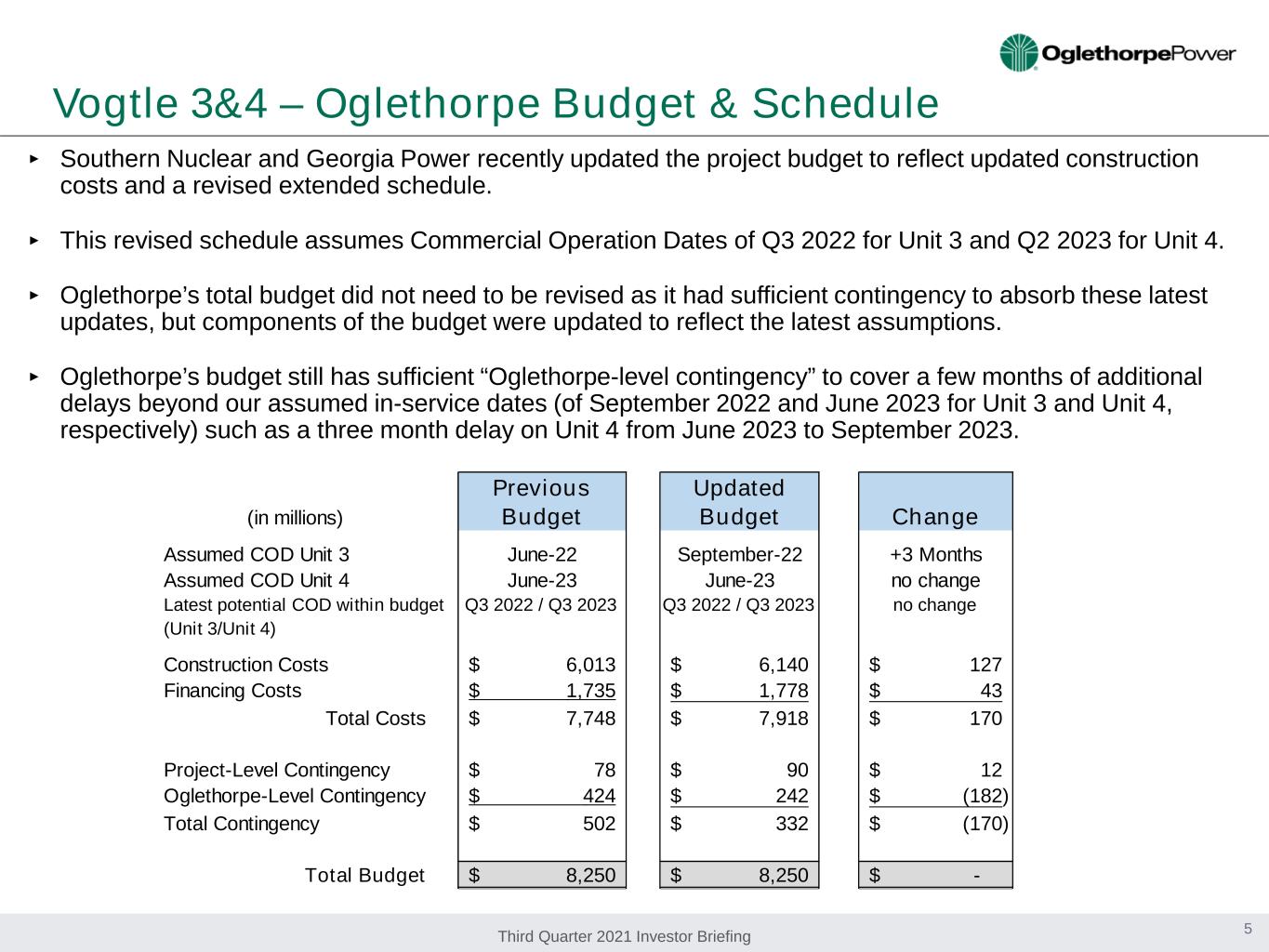

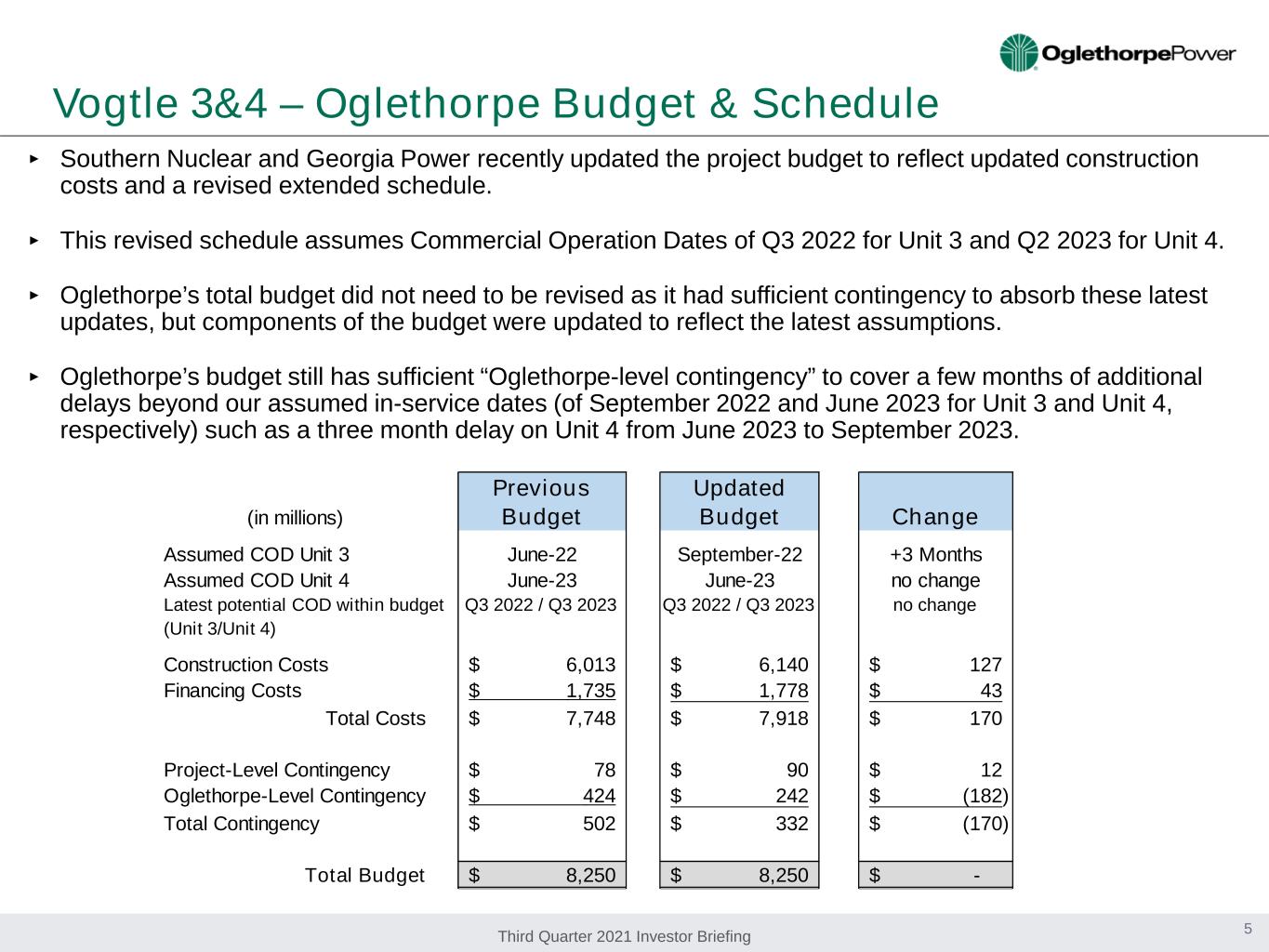

Third Quarter 2021 Investor Briefing Vogtle 3&4 – Oglethorpe Budget & Schedule 5 (in millions) Previous Budget Updated Budget Change Assumed COD Unit 3 June-22 September-22 +3 Months Assumed COD Unit 4 June-23 June-23 no change Q3 2022 / Q3 2023 Q3 2022 / Q3 2023 no change Construction Costs 6,013$ 6,140$ 127$ Financing Costs 1,735$ 1,778$ 43$ Total Costs 7,748$ 7,918$ 170$ Project-Level Contingency 78$ 90$ 12$ Oglethorpe-Level Contingency 424$ 242$ (182)$ Total Contingency 502$ 332$ (170)$ Total Budget 8,250$ 8,250$ -$ Latest potential COD within budget (Unit 3/Unit 4) ‣ Southern Nuclear and Georgia Power recently updated the project budget to reflect updated construction costs and a revised extended schedule. ‣ This revised schedule assumes Commercial Operation Dates of Q3 2022 for Unit 3 and Q2 2023 for Unit 4. ‣ Oglethorpe’s total budget did not need to be revised as it had sufficient contingency to absorb these latest updates, but components of the budget were updated to reflect the latest assumptions. ‣ Oglethorpe’s budget still has sufficient “Oglethorpe-level contingency” to cover a few months of additional delays beyond our assumed in-service dates (of September 2022 and June 2023 for Unit 3 and Unit 4, respectively) such as a three month delay on Unit 4 from June 2023 to September 2023.

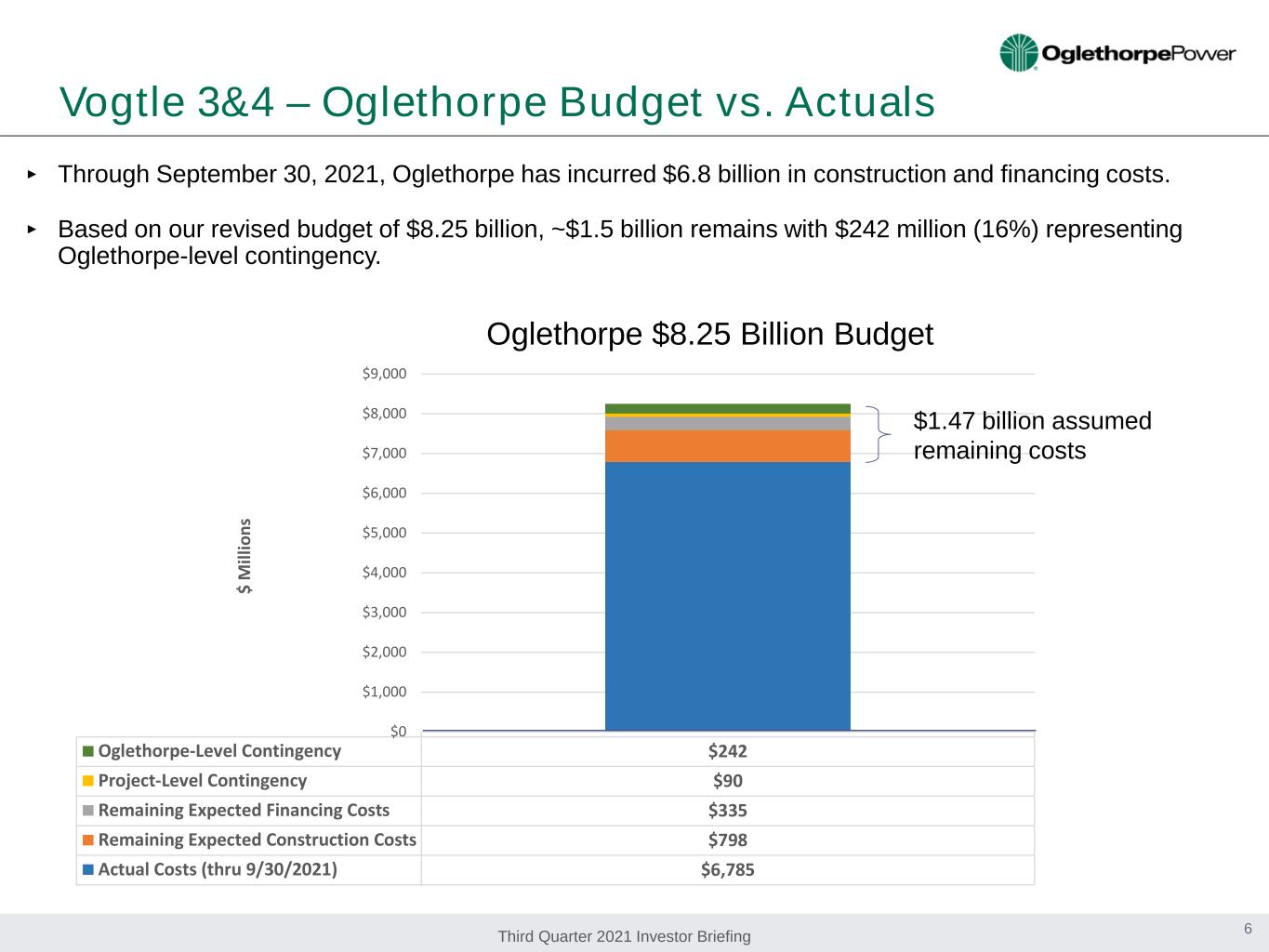

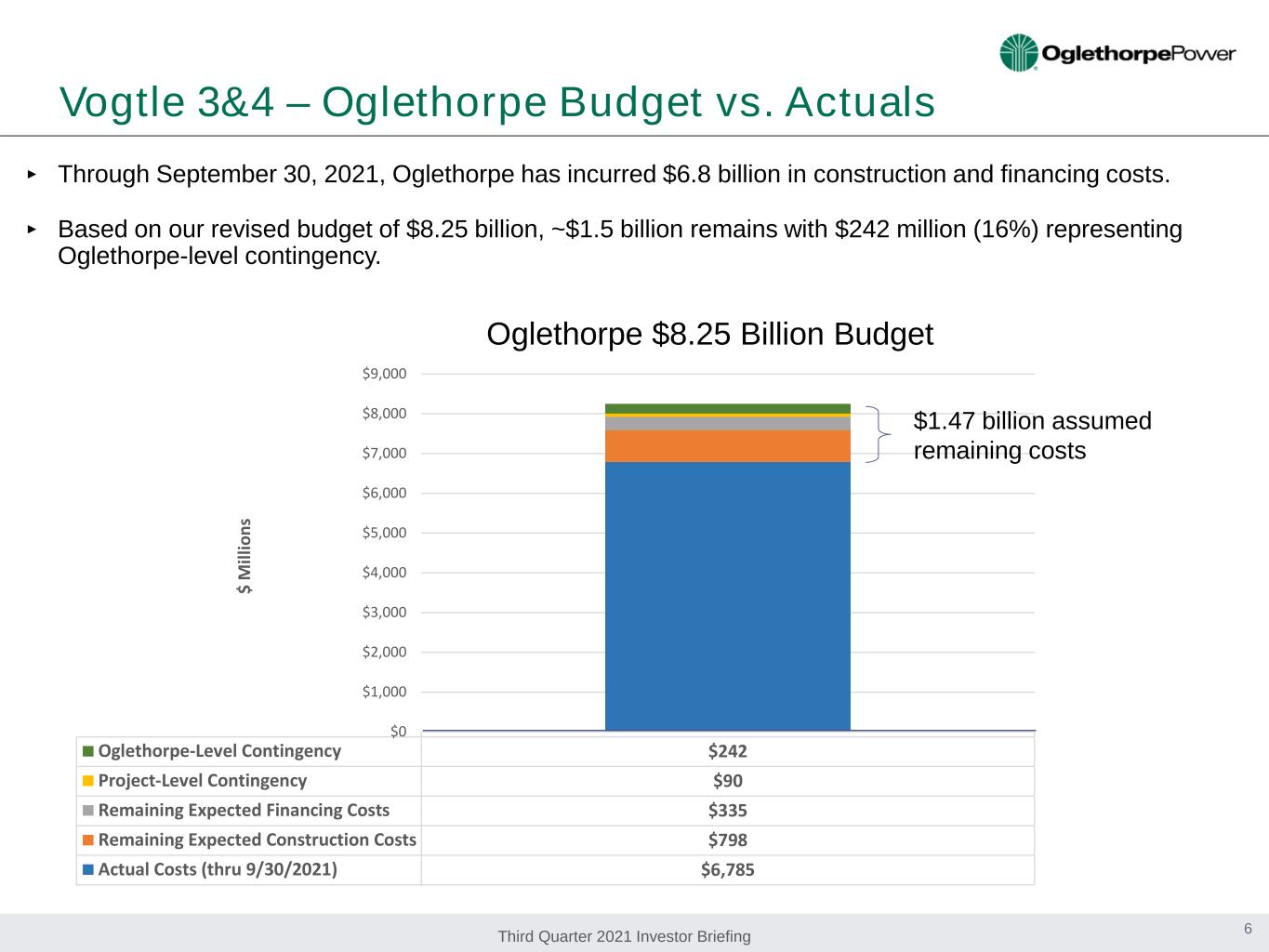

Third Quarter 2021 Investor Briefing Vogtle 3&4 – Oglethorpe Budget vs. Actuals 6 ‣ Through September 30, 2021, Oglethorpe has incurred $6.8 billion in construction and financing costs. ‣ Based on our revised budget of $8.25 billion, ~$1.5 billion remains with $242 million (16%) representing Oglethorpe-level contingency. Oglethorpe $8.25 Billion Budget Actuals Oglethorpe-Level Contingency $242 Project-Level Contingency $90 Remaining Expected Financing Costs $335 Remaining Expected Construction Costs $798 Actual Costs (thru 9/30/2021) $6,785 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $ M ill io ns $1.47 billion assumed remaining costs

Third Quarter 2021 Investor Briefing Vogtle 3&4 – Co-Owner Cost Sharing Agreement 7 • In September 2018, the Vogtle 3&4 co-owners agreed to an amendment to the ownership agreement that covered two concepts: cost sharing and a freeze option if total project costs reached certain levels. • The cost sharing bands are triggered off of total project costs at the time of the VCM 19 Georgia Public Service Commission filing, or $17.1 billion, and commence at VCM 19 + $800 million. • The amendment also provided each co-owner a one-time option to “freeze” their ownership interest at the time the total project cost forecast exceeds VCM 19 plus $2.1 billion, or $19.2 billion. • “Freeze” means to tender a portion of a co-owner’s interest in the project to Georgia Power in exchange for Georgia Power’s agreement to pay 100% of that co-owners remaining share of construction costs. • The freeze is implemented after the actual costs reach VCM 19 plus $2.1 billion (not when the budget first shows this amount). • If a co-owner elects the “freeze” option, their ownership share of the project will be adjusted and determined at the end of the project based on pro-rata contributions to construction costs.

Third Quarter 2021 Investor Briefing Vogtle 3&4 – Cumulative Project Cost Increases 8 ‣ The 19th VCM report total project cost is $17.1 billion as reflected in numerous Georgia Public Service Commission filings. ‣ Budget increases since the 19th VCM have reached $2.4 billion. Budget Update Total Project Cost (Excludes Non- Shareable Costs) Cumulative Increase Baseline - Fall 2018 (VCM 19) $17,104 Million N/A Fall 2020 (VCM 23) $17,429 Million $325 Million Spring 2021 (VCM 24) $17,814 Million $710 Million Fall 2021 (VCM 25) $18,926 Million $1,822 Million November 2021 $19,504 Million $2,400 Million Exceeds VCM 19 + $2.1 Billion

Third Quarter 2021 Investor Briefing Vogtle 3&4 - Cost Sharing Trigger Events 9 ‣ As a result of these increases, we believe the tender option will be triggered at the next co-owner construction budget vote scheduled for February 2022 and that Georgia Power’s obligation to contribute dollars to the co-owners under the cost sharing provisions will commence as early as the first half of 2022. ‣ Georgia Power and Oglethorpe do not agree on the following: • The starting dollar amount for each co-owner’s option to tender a portion of its ownership interest to Georgia Power under the freeze provision of the Global Amendments • The starting dollar amount and extent to which costs that are the result of a Force Majeure Event (such as COVID-19) are excluded from the calculation of the cost-sharing provisions ‣ Georgia Power and the other co-owners recently clarified the process for the freeze provision to provide for a decision between 120 and 180 days after the tender option is triggered which will provide additional time to resolve these matters.

Third Quarter 2021 Investor Briefing $14,000.00 $15,000.00 $16,000.00 $17,000.00 $18,000.00 $19,000.00 $20,000.00 $21,000.00 Ja n- 21 Fe b- 21 M ar -2 1 Ap r- 21 M ay -2 1 Ju n- 21 Ju l-2 1 Au g- 21 Se p- 21 O ct -2 1 N ov -2 1 De c- 21 Ja n- 22 Fe b- 22 M ar -2 2 Ap r- 22 M ay -2 2 Ju n- 22 Ju l-2 2 Au g- 22 Se p- 22 O ct -2 2 N ov -2 2 De c- 22 Ja n- 23 Fe b- 23 M ar -2 3 Ap r- 23 M ay -2 3 Ju n- 23 $ m ill io ns Actual Project Spending Forecasted Project Spending - Max $44 M in potential savings to OPC - Max $55 M in potential savings to OPC Band 2 - ($800 M) Band 3 - ($800 M) Band 4 - ($500 M) No change to cost sharing (45.7/30.0/22.7/1.6) (55.7/24.5/18.5/1.3) (65.7/19.0/14.3/1.0) (GPC/OPC/MEAG/Dalton) Projected to cross into cost sharing band. Projected to cross “freeze option” band in Q4 2022. Assumed U3 COD Freeze Option Exercise Window Vogtle 3&4 - Projected Timing of Triggers 10 Notes: 1) Amounts shown represent 100% ownership Vogtle 3&4 shareable capital project budget. 2) Force majeure clause of ownership agreement could impact what portion of allocations are eligible for cost sharing bands only; not relevant for freeze option. VCM 19 Baseline - $17.1 B

Third Quarter 2021 Investor Briefing Oglethorpe’s Diversified Power Supply Portfolio Notes: Capacity and energy include Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. Capacity includes Effingham Energy Facility that was acquired in July 2021. 2021 Capacity (MW) 8,362 MW 11 2021 Energy (MWh) (Oct 2020 – Sept 2021) 26.9 Million MWh 57% 14% 19% 10% * Approximately 4% (560,400 MWh) of the gas-generated energy is a result of off-system sales from Plant Effingham. 48%* 38% 10% 4%

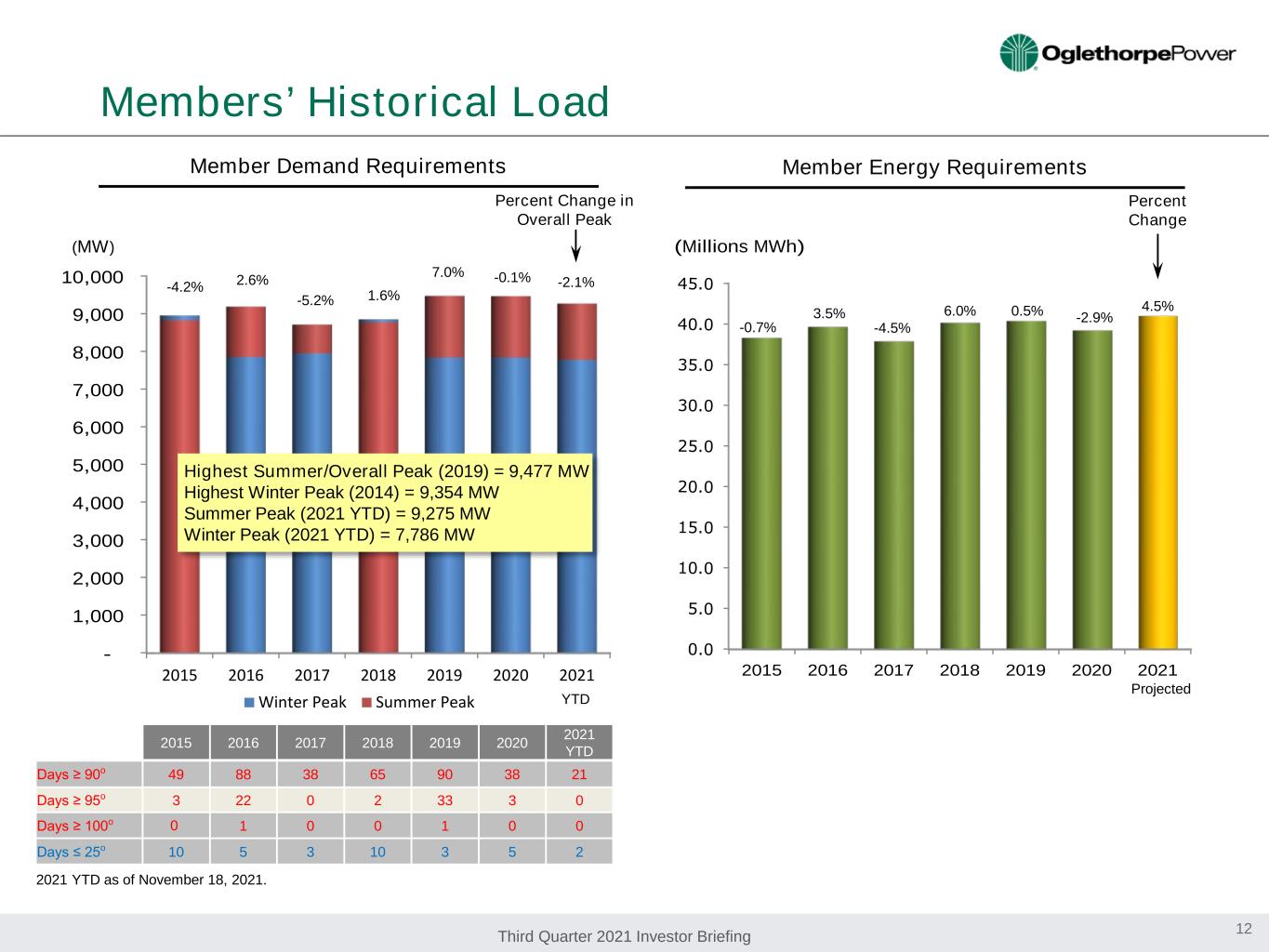

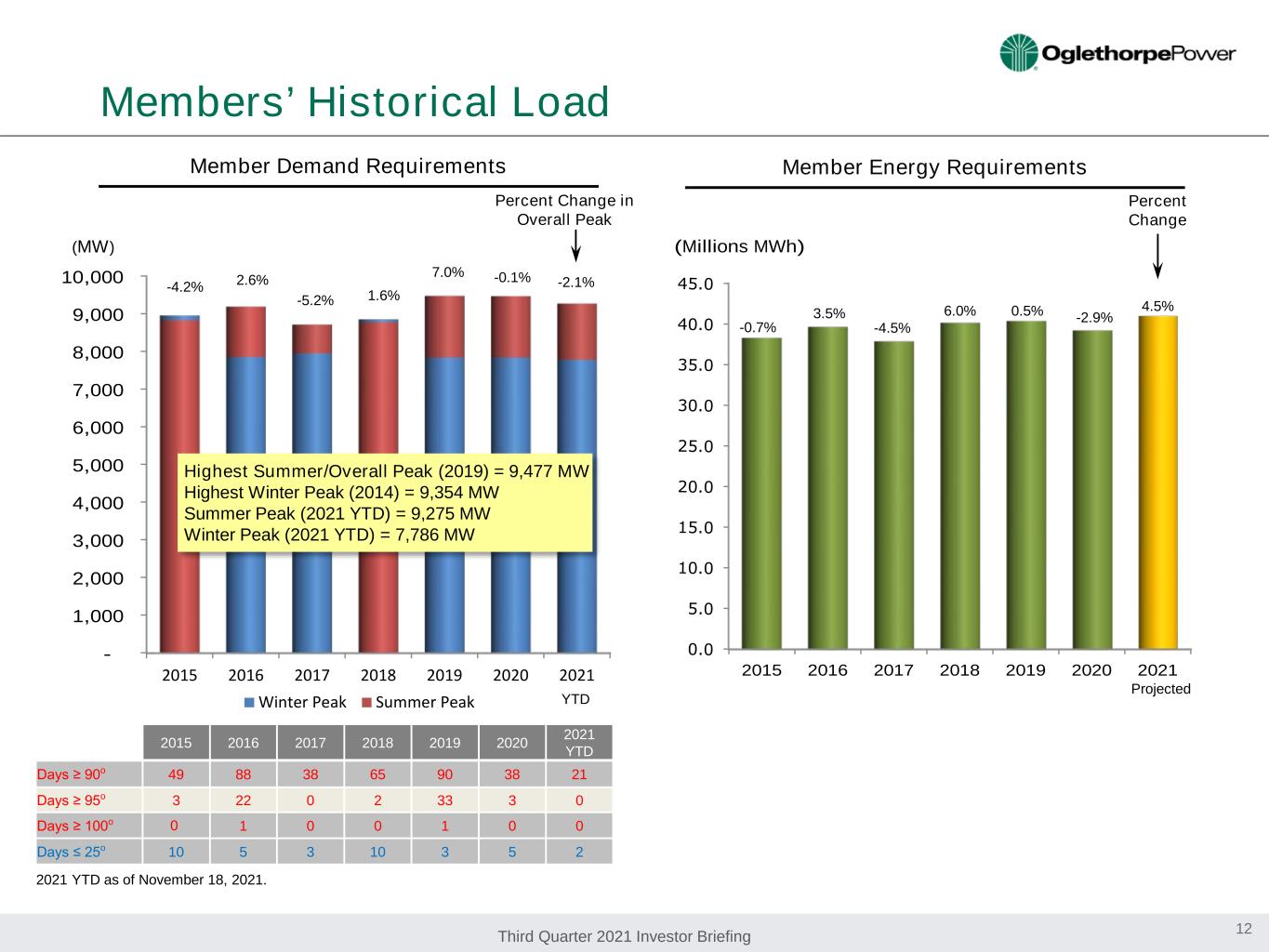

Third Quarter 2021 Investor Briefing 2015 2016 2017 2018 2019 2020 2021 (Millions MWh) - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2015 2016 2017 2018 2019 2020 2021 Winter Peak Summer Peak Members’ Historical Load 12 Member Demand Requirements Member Energy Requirements Percent Change -0.7% (MW) Percent Change in Overall Peak -4.2% Highest Summer/Overall Peak (2019) = 9,477 MW Highest Winter Peak (2014) = 9,354 MW Summer Peak (2021 YTD) = 9,275 MW Winter Peak (2021 YTD) = 7,786 MW 2.6% 3.5% 2015 2016 2017 2018 2019 2020 2021 YTD Days ≥ 90o 49 88 38 65 90 38 21 Days ≥ 95o 3 22 0 2 33 3 0 Days ≥ 100o 0 1 0 0 1 0 0 Days ≤ 25o 10 5 3 10 3 5 2 -5.2% -4.5% 6.0% 1.6% 7.0% 0.5% -2.9% -0.1% Projected 2021 YTD as of November 18, 2021. YTD -2.1% 4.5%

Third Quarter 2021 Investor Briefing 13 Oglethorpe’s 2021 ESG Report ‣ Oglethorpe developed its first ESG report which is available on our website (www.opc.com). ‣ Oglethorpe and our 38 Members have been working toward a cleaner energy path for many years. ‣ We are committed to making strides toward improving the environment through reducing greenhouse gas emissions, including carbon, so future generations can continue to thrive. ‣ We believe as technology evolves, we’ll be in a position to continue to transition our energy generation fleet to meet reasonable carbon reduction goals while providing cost-effective, reliable and resilient power to our consumers. ‣ We expect to update this report annually in the 3rd quarter. We have also completed the EEI ESG / Sustainability data template which is available on our website.

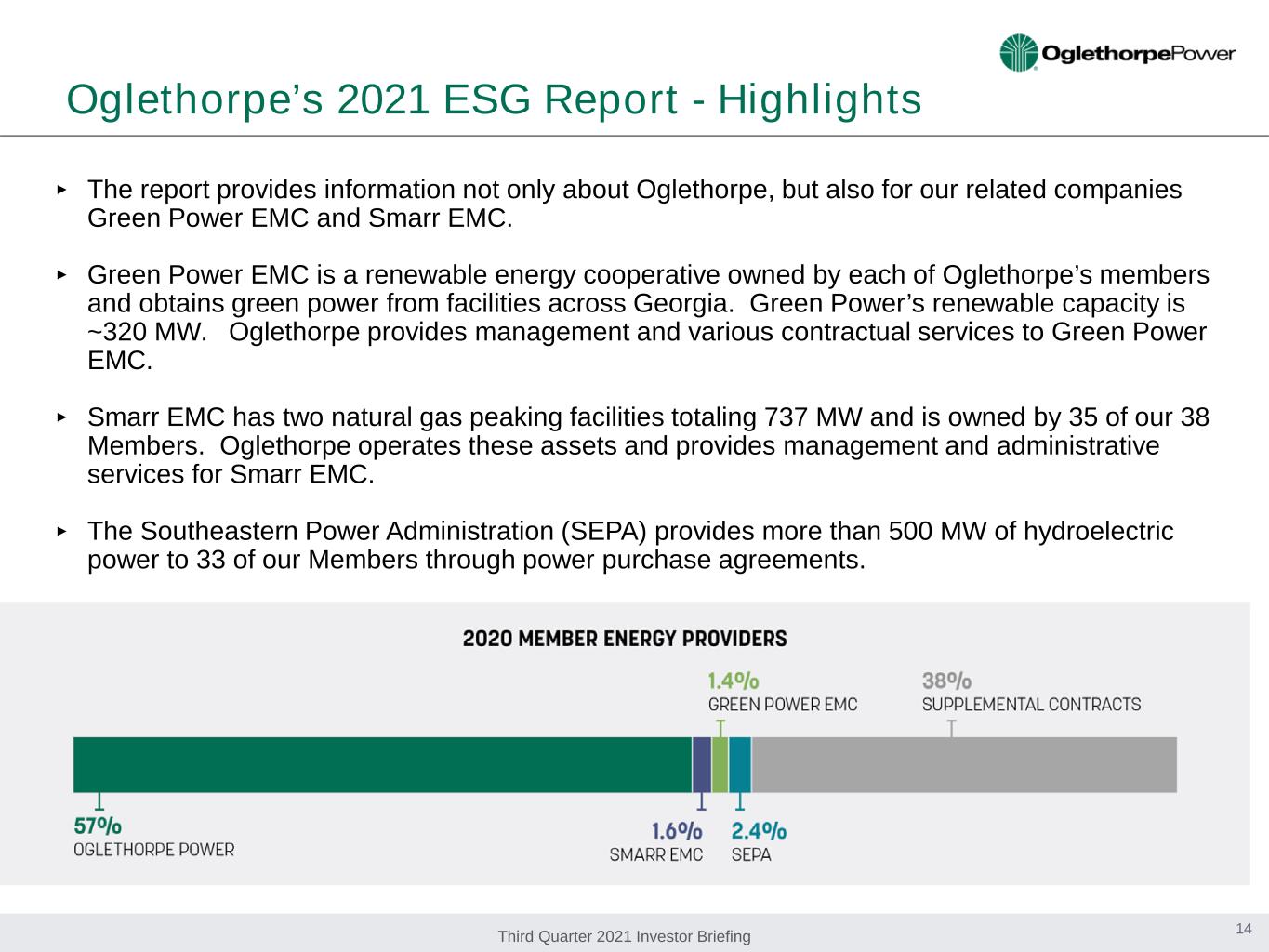

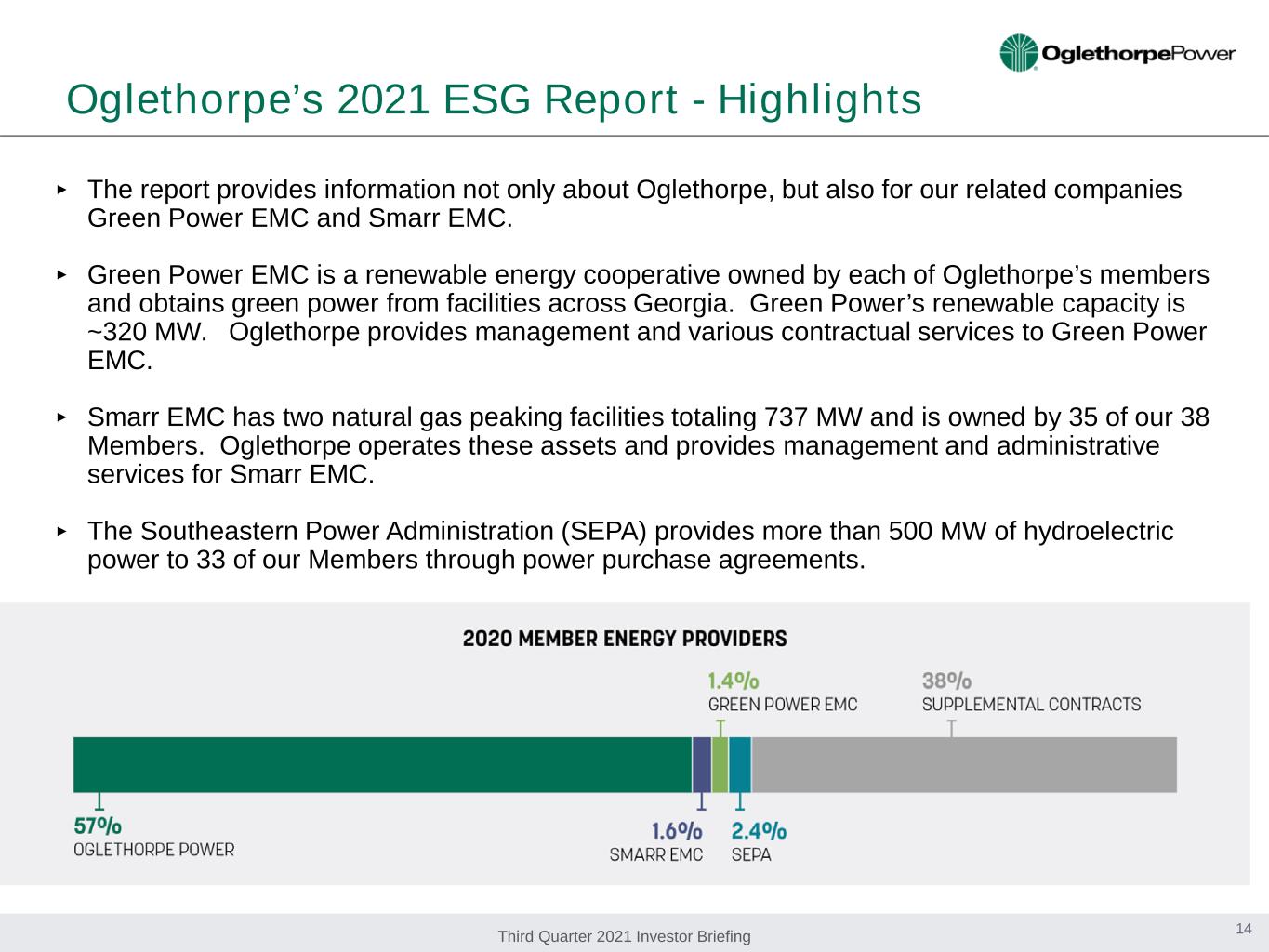

Third Quarter 2021 Investor Briefing 14 Oglethorpe’s 2021 ESG Report - Highlights ‣ The report provides information not only about Oglethorpe, but also for our related companies Green Power EMC and Smarr EMC. ‣ Green Power EMC is a renewable energy cooperative owned by each of Oglethorpe’s members and obtains green power from facilities across Georgia. Green Power’s renewable capacity is ~320 MW. Oglethorpe provides management and various contractual services to Green Power EMC. ‣ Smarr EMC has two natural gas peaking facilities totaling 737 MW and is owned by 35 of our 38 Members. Oglethorpe operates these assets and provides management and administrative services for Smarr EMC. ‣ The Southeastern Power Administration (SEPA) provides more than 500 MW of hydroelectric power to 33 of our Members through power purchase agreements.

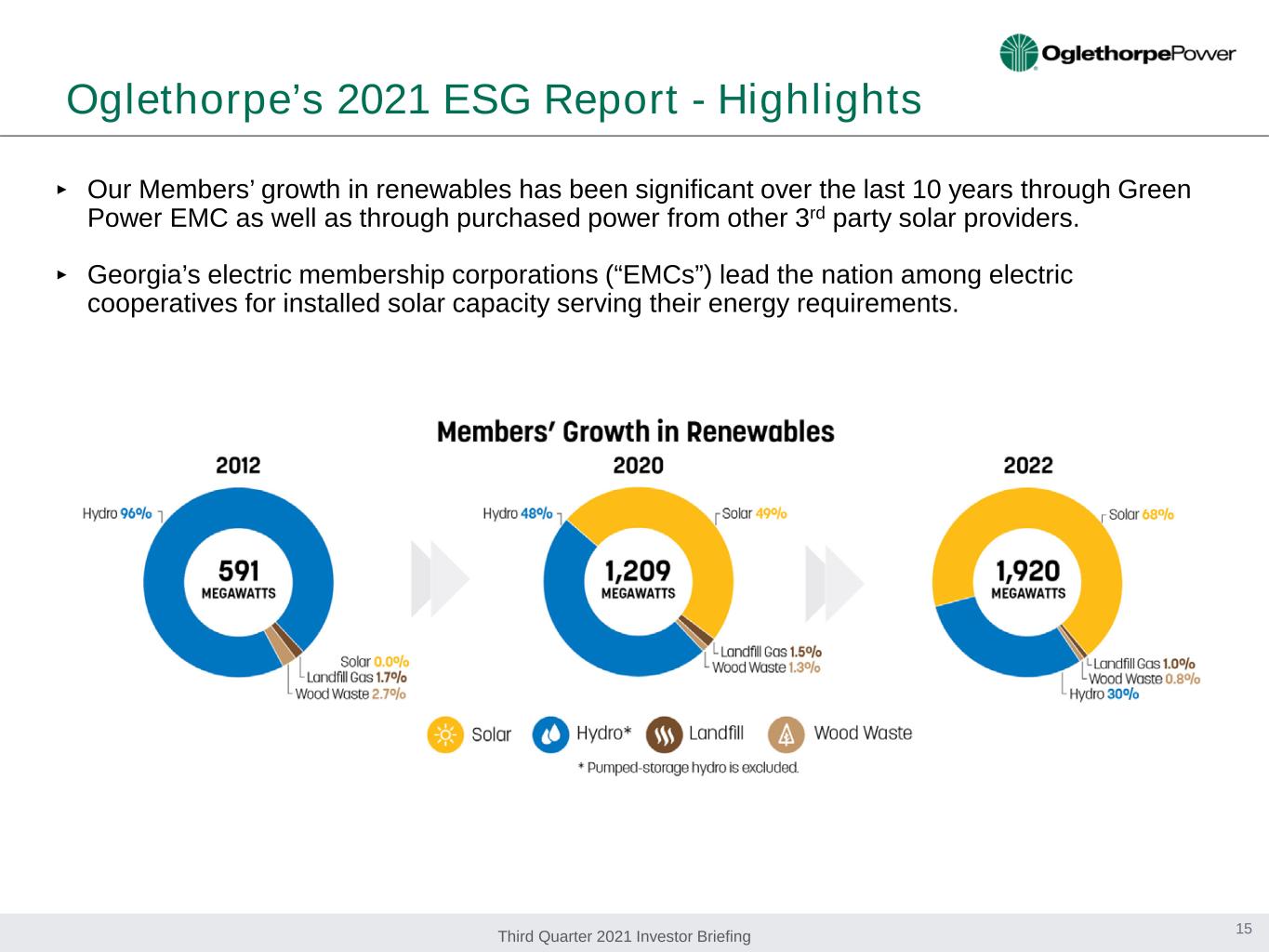

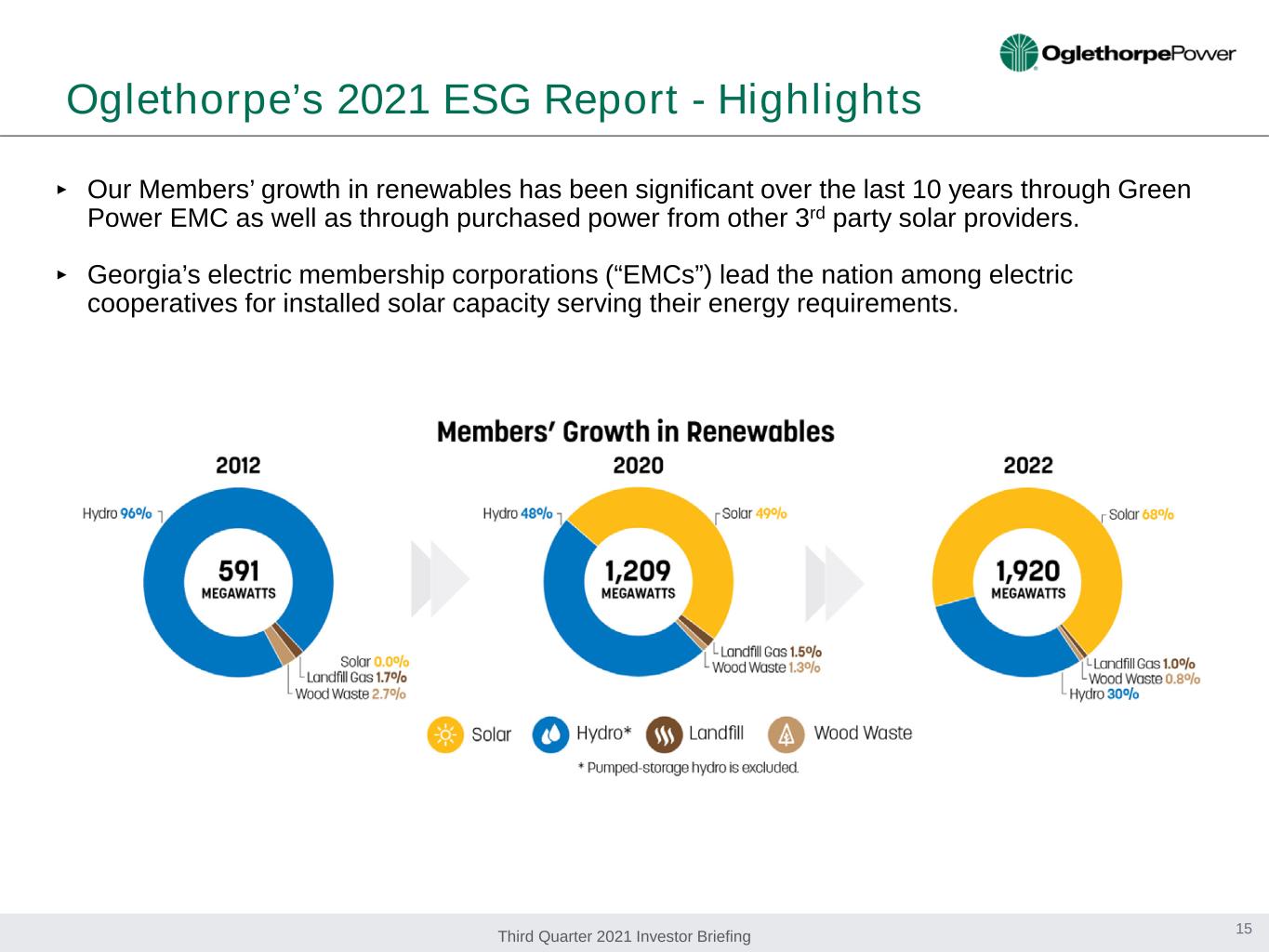

Third Quarter 2021 Investor Briefing 15 Oglethorpe’s 2021 ESG Report - Highlights ‣ Our Members’ growth in renewables has been significant over the last 10 years through Green Power EMC as well as through purchased power from other 3rd party solar providers. ‣ Georgia’s electric membership corporations (“EMCs”) lead the nation among electric cooperatives for installed solar capacity serving their energy requirements.

Third Quarter 2021 Investor Briefing 16 Oglethorpe’s 2021 ESG Report - Highlights

Third Quarter 2021 Investor Briefing 17 Oglethorpe’s 2021 ESG Report - Highlights Oglethorpe’s investment in Vogtle nuclear units 3 and 4 will help drive the projected carbon emission rate down by more than 55% in 2024 compared to 2005.

Third Quarter 2021 Investor Briefing 18 Oglethorpe’s 2021 ESG Report - Highlights ‣ As a member-owned cooperative, our organization is governed by a Board of Directors representative of our Members who are democratically elected from within the communities their EMC serves, as well as an independent Director. ‣ Out of our entire workforce, women represent 29% and minorities 18%. ‣ Four out of seven of our executive-level officers are women. ‣ Additionally, we are proud that 20% of our workforce is comprised of U.S. Military Veterans. * Currently, there is a vacant seat on our Board of Directors

Third Quarter 2021 Investor Briefing Income Statement Excerpts 19 (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture, and the 2021 budget also includes a 1.14 Margins for Interest ratio. Oglethorpe’s Board of Directors will continue to evaluate margin coverage throughout the Vogtle construction period and may chose to further increase, or decrease, the Margins for Interest ratio in the future, although not below 1.10. Nine Months Ended September 30, 09/30/2021- 09/30/2020 Year Ended December 31, ($ in thousands) 2021 2020 % Change 2020 2019 2018 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $716,303 $721,836 -0.8% $971,071 $942,057 $927,419 Sales to Members - Energy 455,130 316,382 43.9% 405,939 487,795 551,960 Total Sales to Members $1,171,433 $1,038,218 12.8% $1,377,010 $1,429,852 $1,479,379 Sales to non-Members 23,847 639 3631.9% 608 440 734 Operating Expenses: 1,031,647 862,948 19.5% 1,159,909 1,213,083 1,255,137 Other Income 41,353 41,943 -1.4% 50,695 64,189 68,262 Net Interest Charges 156,976 160,015 -1.9% 212,509 226,937 242,039 Net Margin $48,010 $57,837 -17.0% $55,895 $54,461 $51,199 Margins for Interest Ratio(a) 1.14 1.14 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.43 1.86 30.9% 1.83 2.10 2.40 Average Power Cost (cents/kWh) 6.26 6.10 2.6% 6.21 6.16 6.43 Sales to Members (MWh) 18,727,189 17,028,641 10.0% 22,187,311 23,225,861 23,011,079

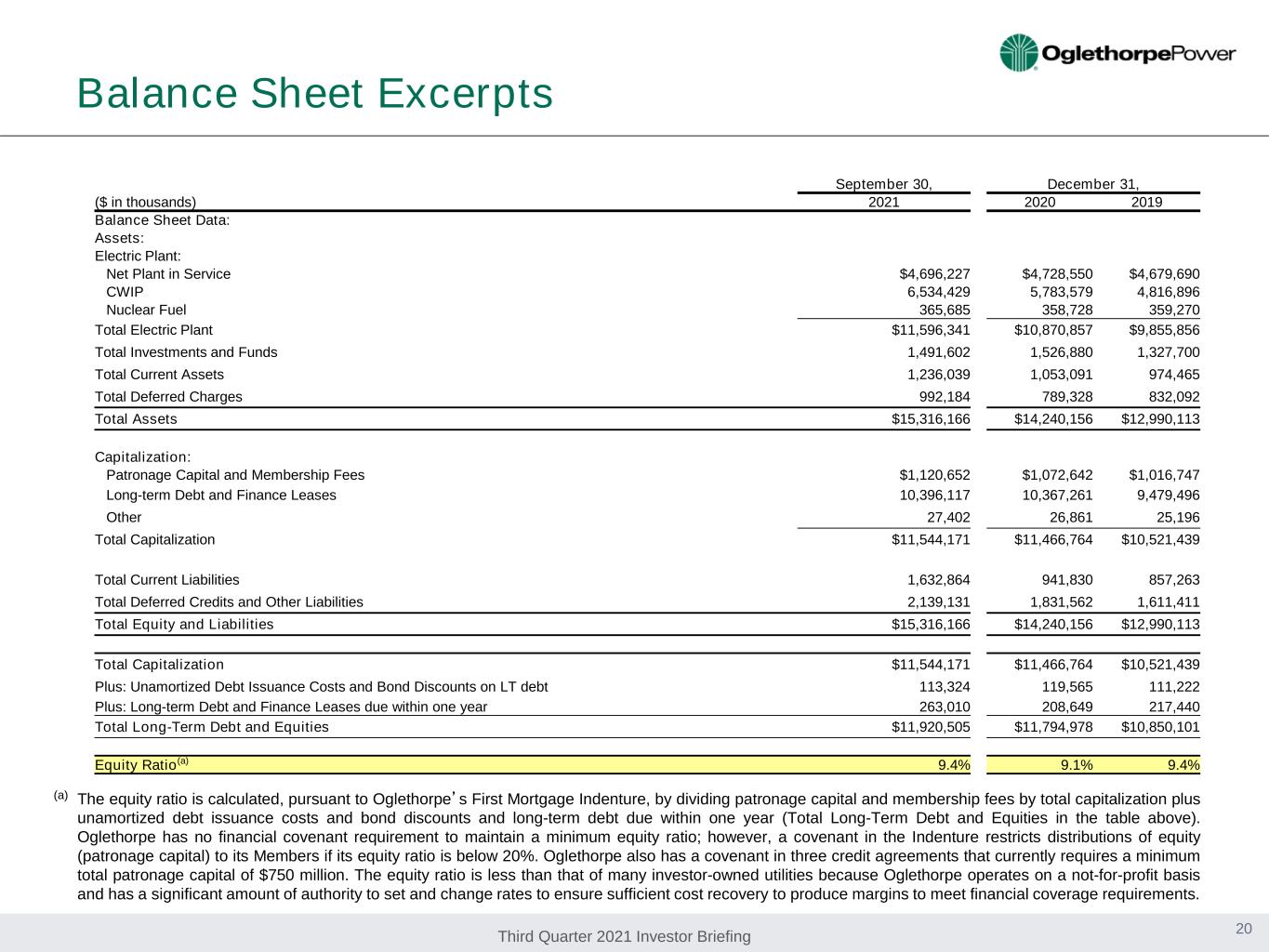

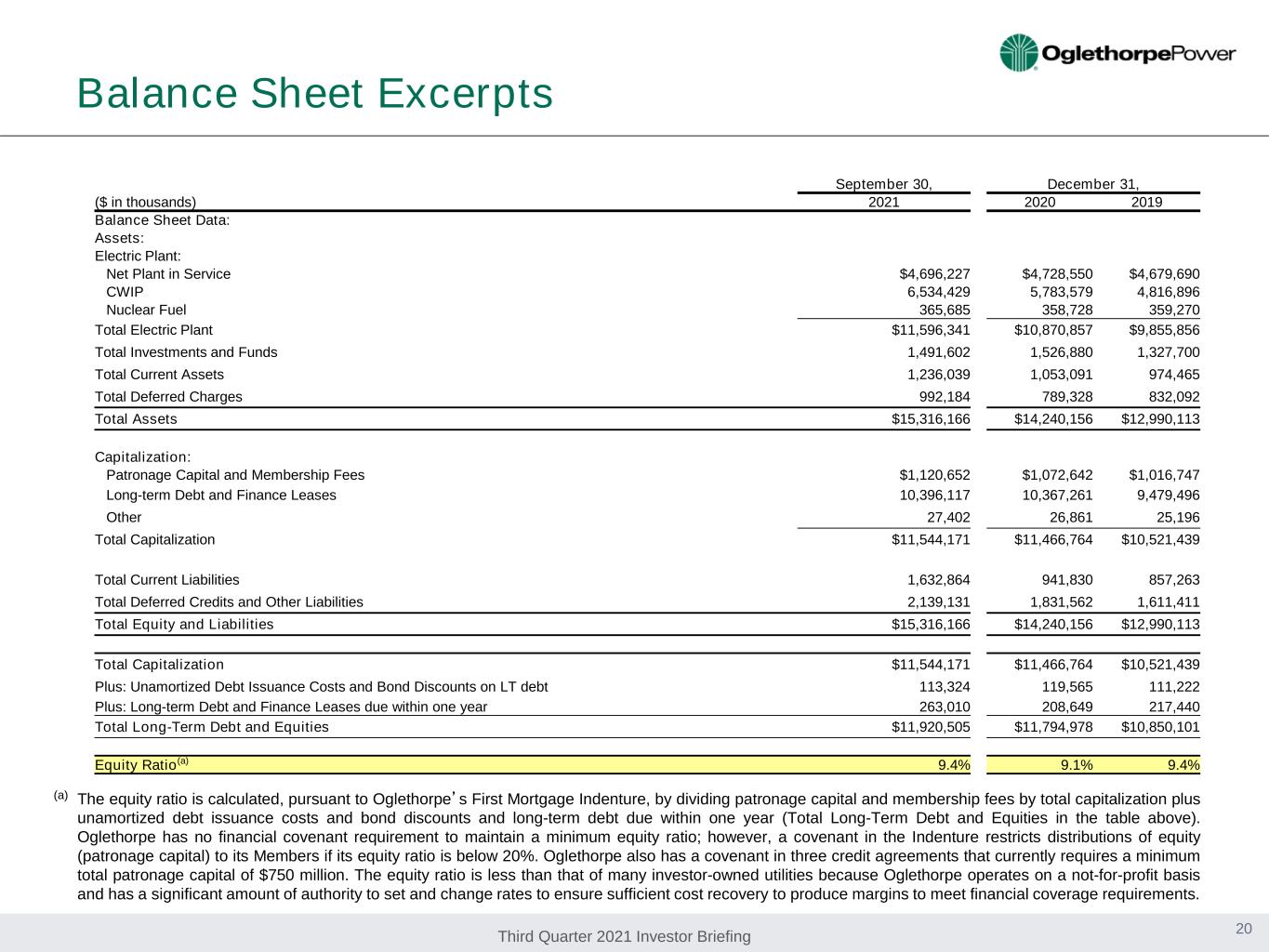

Third Quarter 2021 Investor Briefing Balance Sheet Excerpts (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has a covenant in three credit agreements that currently requires a minimum total patronage capital of $750 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. 20 September 30, December 31, ($ in thousands) 2021 2020 2019 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $4,696,227 $4,728,550 $4,679,690 CWIP 6,534,429 5,783,579 4,816,896 Nuclear Fuel 365,685 358,728 359,270 Total Electric Plant $11,596,341 $10,870,857 $9,855,856 Total Investments and Funds 1,491,602 1,526,880 1,327,700 Total Current Assets 1,236,039 1,053,091 974,465 Total Deferred Charges 992,184 789,328 832,092 Total Assets $15,316,166 $14,240,156 $12,990,113 Capitalization: Patronage Capital and Membership Fees $1,120,652 $1,072,642 $1,016,747 Long-term Debt and Finance Leases 10,396,117 10,367,261 9,479,496 Other 27,402 26,861 25,196 Total Capitalization $11,544,171 $11,466,764 $10,521,439 Total Current Liabilities 1,632,864 941,830 857,263 Total Deferred Credits and Other Liabilities 2,139,131 1,831,562 1,611,411 Total Equity and Liabilities $15,316,166 $14,240,156 $12,990,113 Total Capitalization $11,544,171 $11,466,764 $10,521,439 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 113,324 119,565 111,222 Plus: Long-term Debt and Finance Leases due within one year 263,010 208,649 217,440 Total Long-Term Debt and Equities $11,920,505 $11,794,978 $10,850,101 Equity Ratio(a) 9.4% 9.1% 9.4%

Third Quarter 2021 Investor Briefing Capital Markets to Date, $2.337 Billion DOE Issuance to Date, $3.88 Billion Future DOE, $753 Million Future Capital Markets, $1,152 Million (a) Expensed IDC, $128 Million (b) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 M illi on s Vogtle 3&4 - Financing Plan 21 (a) These amounts would be reduced by unspent contingency, if any, and would be increased for amounts not advanced under “Future DOE” or for expenditures in excess of the $8.25 billion budget, if any. In addition, approximately $395 million of bonds not shown here may be issued to refinance early maturities of DOE debt. Therefore, base case taxable financings for Vogtle over the next five years are estimated to be ~$1.5 billion. (b) Oglethorpe has a rate management program that is voluntary for Members. This program allows it to expense and recover interest costs on a current basis that would otherwise be deferred or capitalized and financed through the issuance of long-term debt. Weighted average interest rate on Vogtle 3&4 financing is under 3.75%. ‣ To date, approximately $6.2 billion in long-term debt has been issued to finance Vogtle 3&4 representing ~74% of the budgeted project cost of $8.25 billion. ‣ The remaining ~$2.1 billion will be funded ~1/3 with remaining capacity under our DOE loan and ~2/3 from first mortgage bonds in the capital markets, as needed.

Third Quarter 2021 Investor Briefing ‣ Oglethorpe has loan agreements with DOE for $4.68 billion of eligible project costs. ‣ We typically advance under this loan twice a year. In June 2021, we received a $247 million advance and we anticipate receiving the next advance in December 2021 of $227 million. DOE Loan Summary as of October 31, 2021 DOE Guaranteed Loans(a) Average interest rate on the outstanding balance under these loans is 2.838%. (a) DOE-guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.375%. (b) Includes accrued capitalized interest being financed with the 2014 DOE-guaranteed loan, which was available to be advanced through November 20, 2019. Approximately $44 million of this loan was not advanced due to timing and lower than expected interest rates. (c) We began principal repayments of our DOE-guaranteed loans in February 2020, in accordance with the promissory notes. If we fully advance these loans, we expect to repay a total of approximately $394 million in principal on these loans by June 2023 and plan to refinance this with taxable bonds. To date, we have repaid $158 million under these loans. 22 Purpose/Use of Proceeds Approved Advanced Outstanding(c) Remaining Availability Vogtle Units 3 & 4 2014 Loan (b) $3,057,069,461 $3,013,348,382 $2,890,365,335 $0 2019 Loan 1,619,679,706 867,000,000 831,669,750 752,679,706 $4,676,749,167 $3,880,348,382 $3,722,035,085 $752,679,706

Third Quarter 2021 Investor Briefing Total amount outstanding under all RUS Guaranteed Loans is $2.6 billion, with an average interest rate of 3.388% RUS Guaranteed Loans(a) (a) RUS guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.125%. 23 RUS Loan Summary as of October 31, 2021 Purpose/Use of Proceeds Approved Advanced Remaining Amount Approved Loans General & Environmental Improvements $630,342,000 $283,032,630 $347,309,370

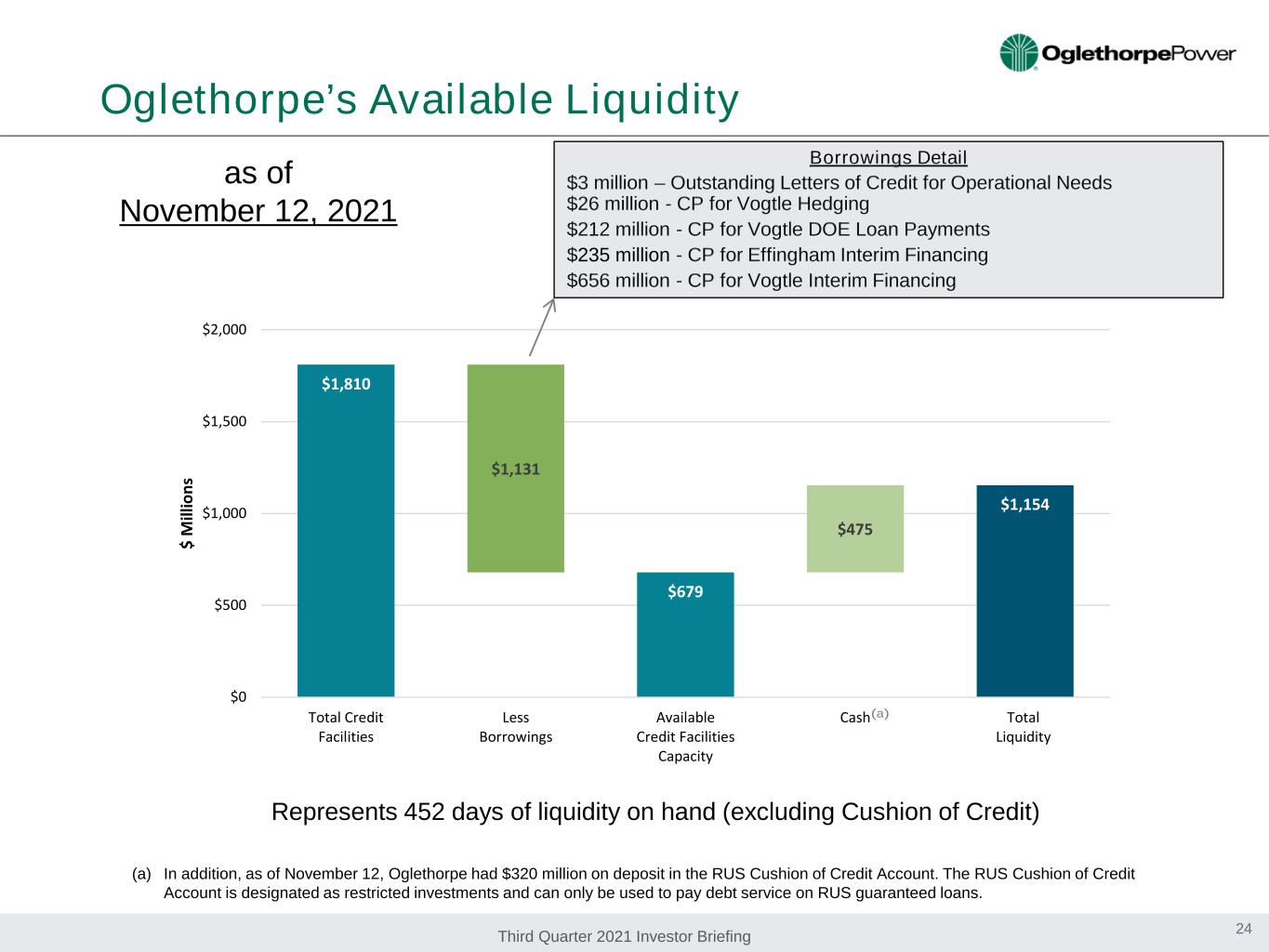

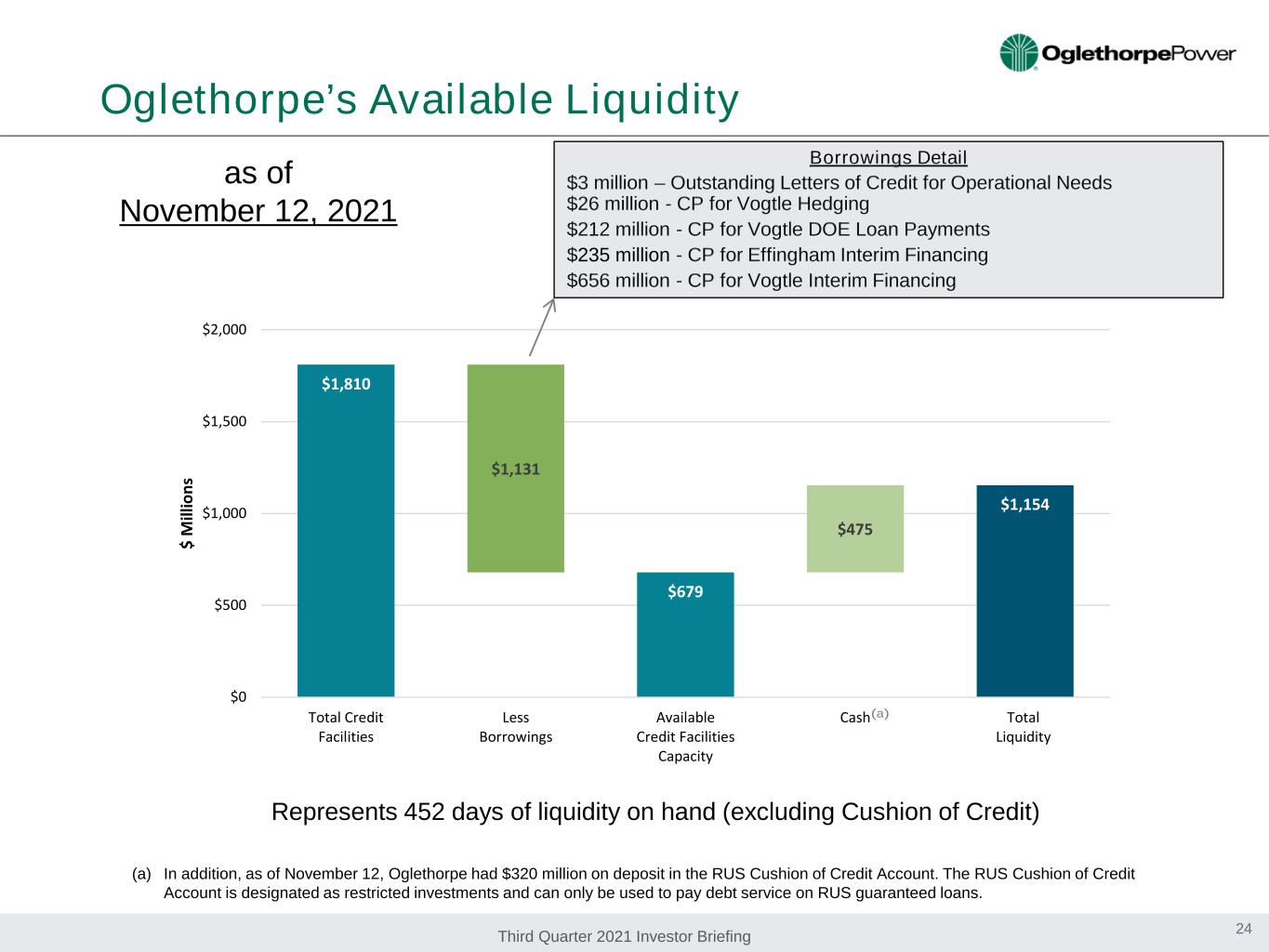

Third Quarter 2021 Investor Briefing $1,810 $1,131 $679 $475 $1,154 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ M ill io ns Oglethorpe’s Available Liquidity as of November 12, 2021 Borrowings Detail $3 million – Outstanding Letters of Credit for Operational Needs $26 million - CP for Vogtle Hedging $212 million - CP for Vogtle DOE Loan Payments $235 million - CP for Effingham Interim Financing $656 million - CP for Vogtle Interim Financing Represents 452 days of liquidity on hand (excluding Cushion of Credit) (a) In addition, as of November 12, Oglethorpe had $320 million on deposit in the RUS Cushion of Credit Account. The RUS Cushion of Credit Account is designated as restricted investments and can only be used to pay debt service on RUS guaranteed loans. (a) 24

Third Quarter 2021 Investor Briefing $0 $500 $1,000 $1,500 $2,000 Q 1 20 20 Q 2 20 20 Q 3 20 20 Q 4 20 20 Q 1 20 21 Q 2 20 21 Q 3 20 21 Q 4 20 21 Q 1 20 22 Q 2 20 22 Q 3 20 22 Q 4 20 22 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 23 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 20 24 20 43 $ M ill io ns Oglethorpe’s Bank Credit Facilities Time Now (a) The secured term loan amount is $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. Plus Optional Term Out Until 2043 NRUCFC 235$ CoBank 150$ MUFG 125$ Bank of America 100$ Mizuho Bank 100$ Regions Bank 100$ Royal Bank of Canada 100$ Truist Bank 100$ Fifth Third Bank 50$ Goldman Sachs Bank 50$ J.P. Morgan 50$ U.S. Bank 50$ $1.21B Syndicated Revolver / CP Backup $110M CFC Unsecured Bilateral $363M JPMorgan Bilateral 25 Renewed this credit facility at $350 million for 3-years to support interim liquidity needs stemming from Effingham acquisition. $140M CFC Incremental Secured Bilateral (a) Anticipate downsizing the JPMorgan credit facility after end of 2022 / early 2023. $350M JPMorgan Bilateral

Third Quarter 2021 Investor Briefing Recent and Upcoming Financial Activity Completed in 2021 January $239 million of RUS advances June $247 million DOE advance for Vogtle 3&4 July Interim funding of Effingham Energy Facility with commercial paper and bank lines August “Early retirement” of $245.6 million in letter of credit backed variable rate pollution control bonds October Renewal of JPMorgan bilateral credit facility for 3 years at $350 million Upcoming in 2021 December $227 Million DOE advance for Vogtle 3&4 Upcoming in 2022 Second Quarter First mortgage bond issuance for Vogtle 3&4 26

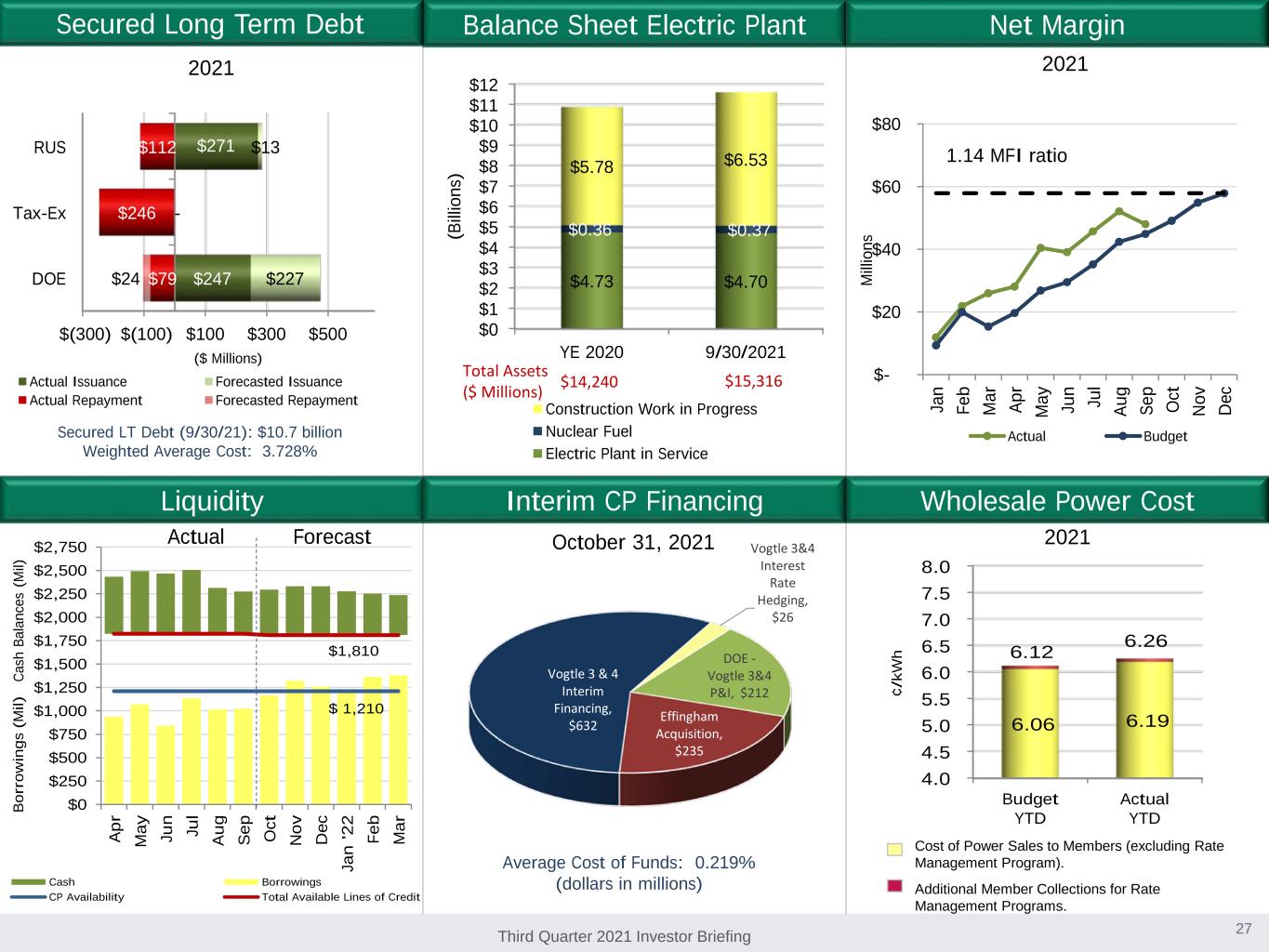

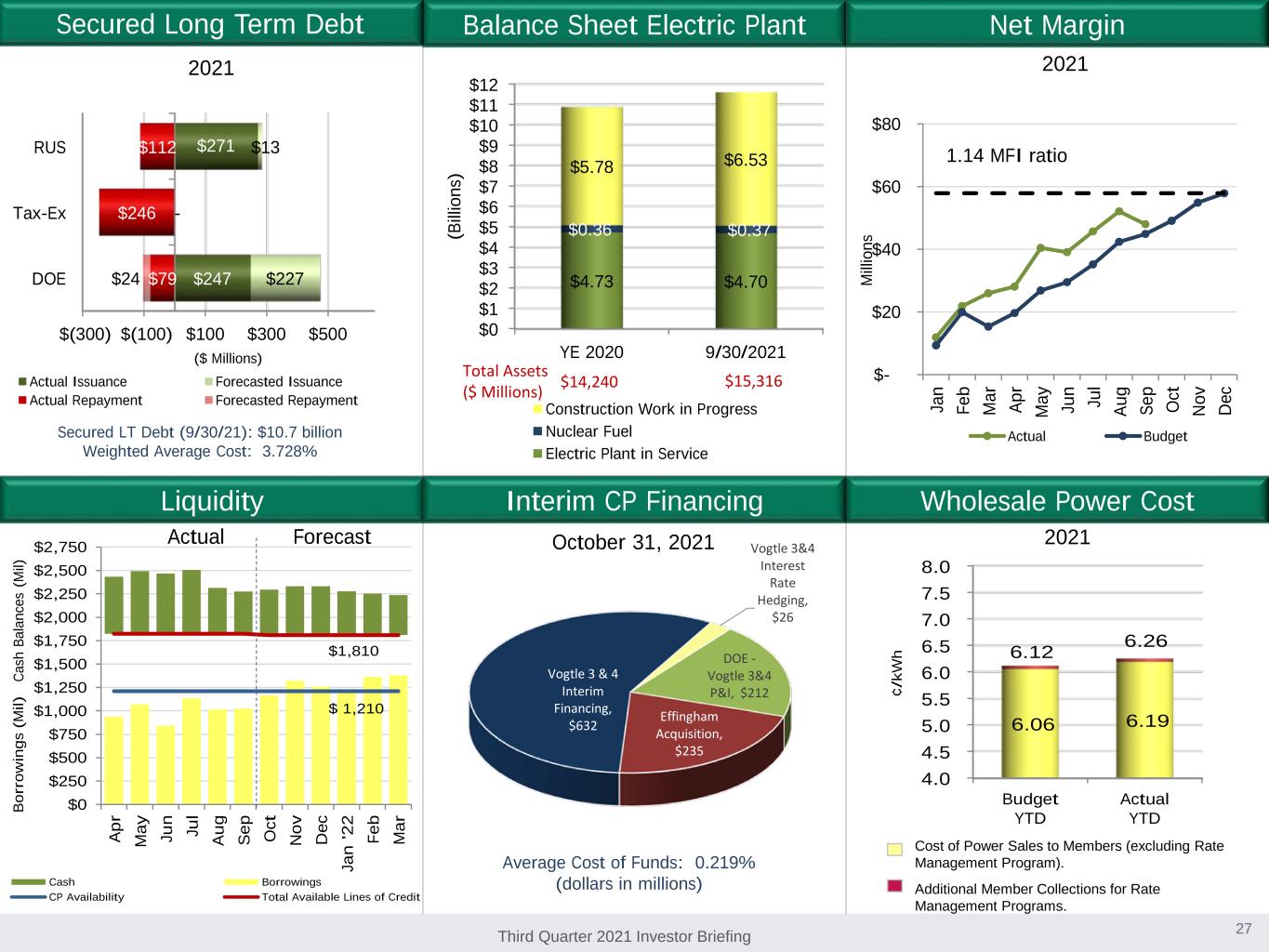

Third Quarter 2021 Investor Briefing $ 1,210 $1,810 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 A pr M ay Ju n Ju l A ug S ep O ct N ov D ec Ja n '2 2 Fe b M ar B or ro w in gs ( M il) Cash Borrowings CP Availability Total Available Lines of Credit Ca sh B al an ce s (M il) $(300) $(100) $100 $300 $500 DOE Tax-Ex RUS $247 $271 $227 $13 $79 $246 $112 $24 - ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment Net Margin Liquidity Wholesale Power CostInterim CP Financing Balance Sheet Electric Plant Average Cost of Funds: 0.219% (dollars in millions) Secured LT Debt (9/30/21): $10.7 billion Weighted Average Cost: 3.728% 2021 October 31, 2021 2021 Cost of Power Sales to Members (excluding Rate Management Program). Additional Member Collections for Rate Management Programs. 2021 Secured Long Term Debt 27 1.14 MFI ratio $- $20 $40 $60 $80 Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c M illi on s Actual Budget 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Budget YTD Actual YTD 6.06 6.19 6.12 6.26 ¢/ kW h $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 YE 2020 9/30/2021 $4.73 $4.70 $0.36 $0.37 $5.78 $6.53 (B illi on s) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $14,240 $15,316 Vogtle 3&4 Interest Rate Hedging, $26 DOE - Vogtle 3&4 P&I, $212 Effingham Acquisition, $235 Vogtle 3 & 4 Interim Financing, $632 Actual Forecast

Third Quarter 2021 Investor Briefing • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Member information is filed as an exhibit to Form 10-Q for the first quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) • For additional information please contact: Additional Information 28 Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Terri Statham Manager, Media Relations terri.statham@opc.com 770-270-6990