Fourth Quarter and Year-End 2021 Investor Briefing Fourth Quarter and Year-End 2021 Investor Briefing March 29, 2022

Fourth Quarter and Year-End 2021 Investor Briefing Notice to Recipients Risk Factors and Forward Looking Statements Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe”), that are not historical facts are forward-looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward- looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION ” and “RISK FACTORS” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the Securities and Exchange Commission on March 28, 2022. This electronic presentation is provided as of March 29, 2022. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. 2

Fourth Quarter and Year-End 2021 Investor Briefing ‣ Executive Overview ‣ Vogtle 3 & 4 Update ‣ Overview of 2021 ‣ Review of Operations Update ‣ Review of 2021 Financial Results and Condition Presenters and Agenda Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3 David Sorrick Executive Vice President and Chief Operating Officer

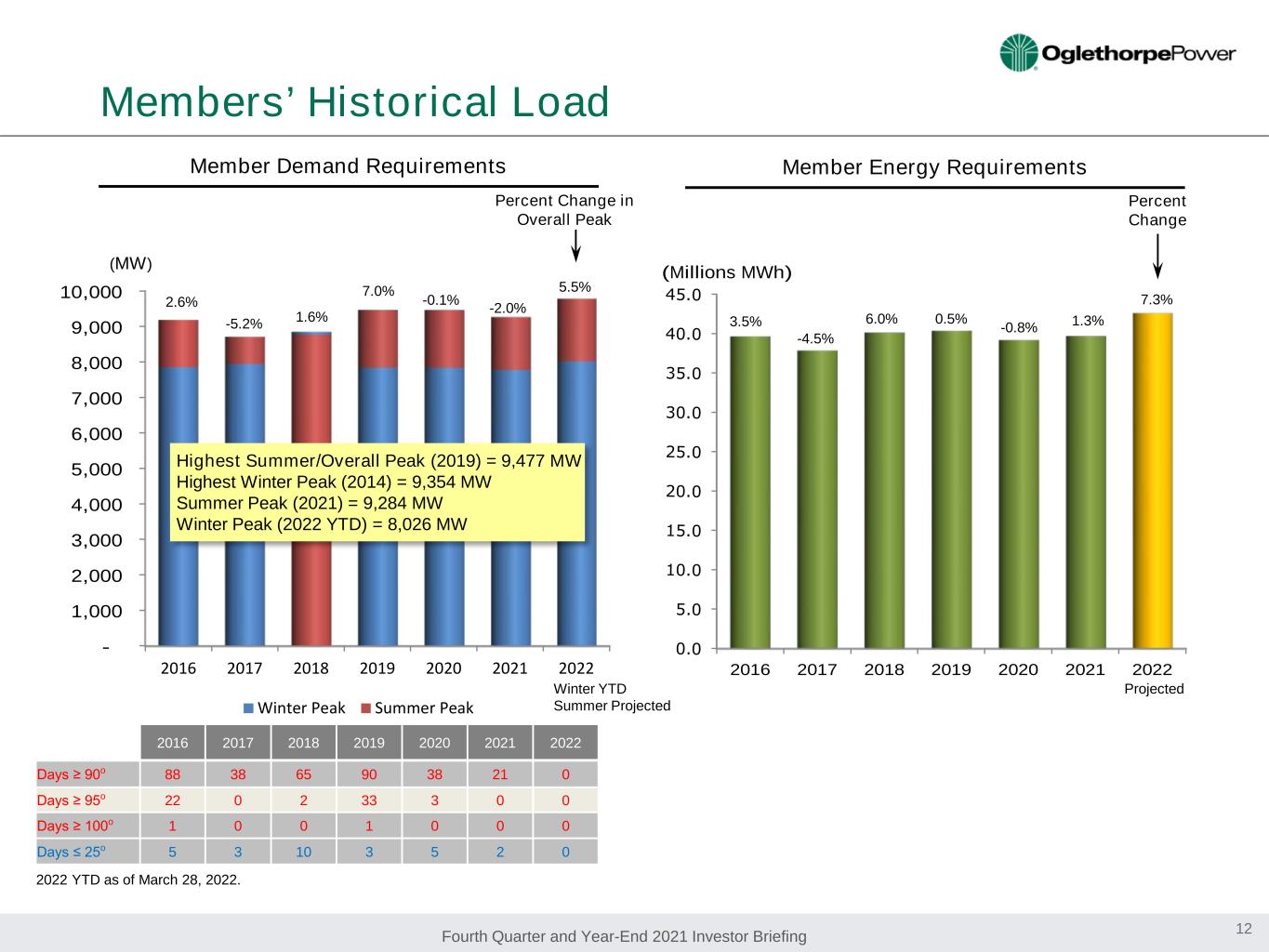

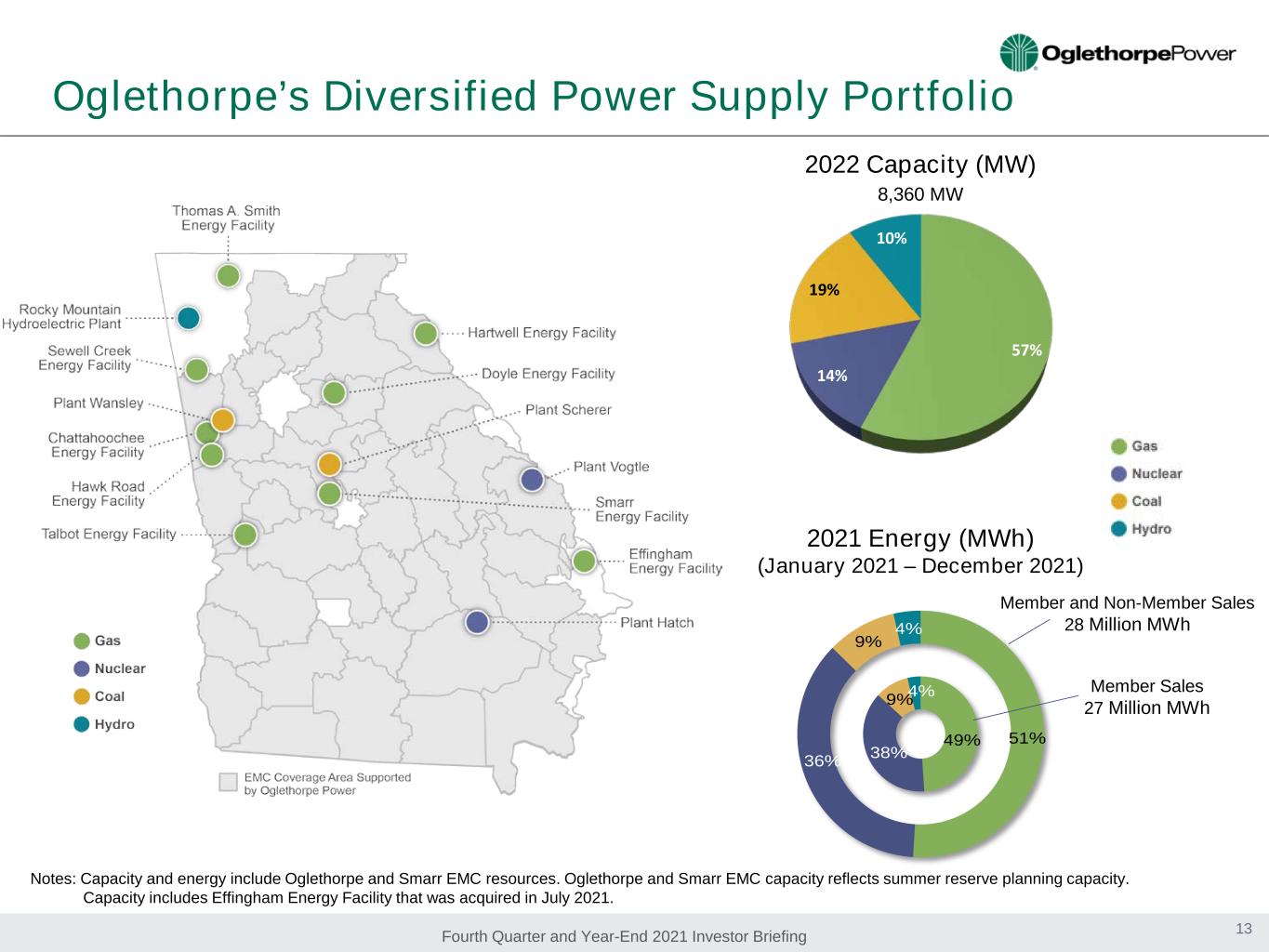

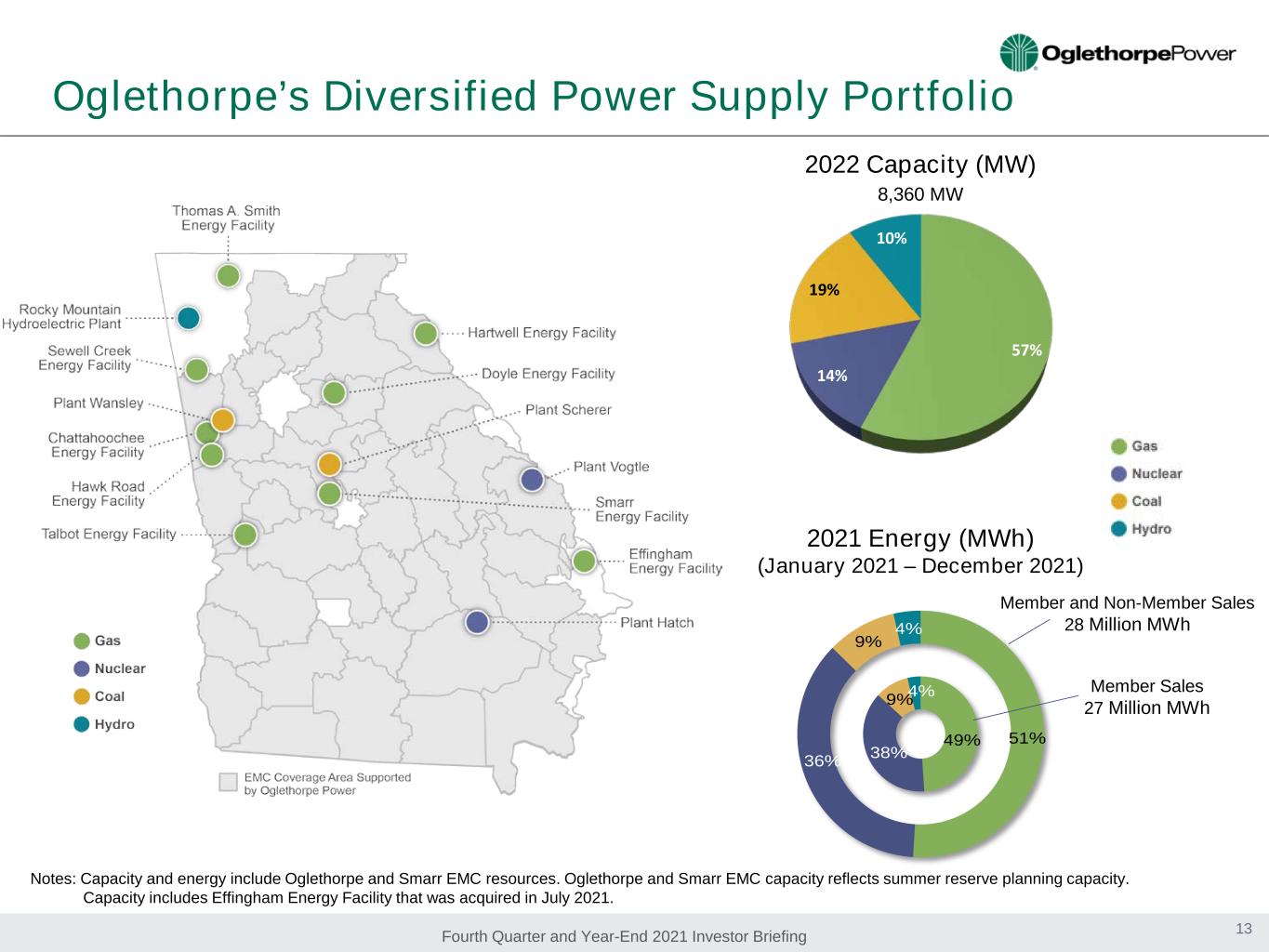

Fourth Quarter and Year-End 2021 Investor Briefing • Largest electric cooperative in the United States by assets, among other measures. • Generating assets total approximately 8,360 MW. — Includes 733 MW of Member- owned generation managed by us. • Members purchase 1,009 MW of renewables through Green Power EMC and 3rd parties, growing to over 1,500 MW by summer 2025. • Members schedule 515 MW of federal hydropower. • Vogtle 3&4 to expand generation by up to 660 MW in 2024. Senior Secured/ Outlook/ Short-Term Moody’s: Baa1/Stable/ P-2 S&P: BBB+/Negative/A-2 Fitch: BBB/Stable/F2 • 2021 revenues over $1.5 billion. • Total assets over $15 billion. • SEC filing company. • Member-owned not-for-profit Georgia electric membership corporation. • Wholesale electric provider to 38 Member distribution co-ops in Georgia. • Take or pay, joint and several Wholesale Power Contracts with Members through December 2050. — Allows for recovery of all costs, including debt service. • Members’ peak load: — 2022 Winter: 8,026 MW (January) — 2021 Summer: 9,285 MW (July) — Highest Peak load: 9,477 MW, Summer 2019 Overview of Oglethorpe Power Corporation Business Power Supply Resources Ratings Financial

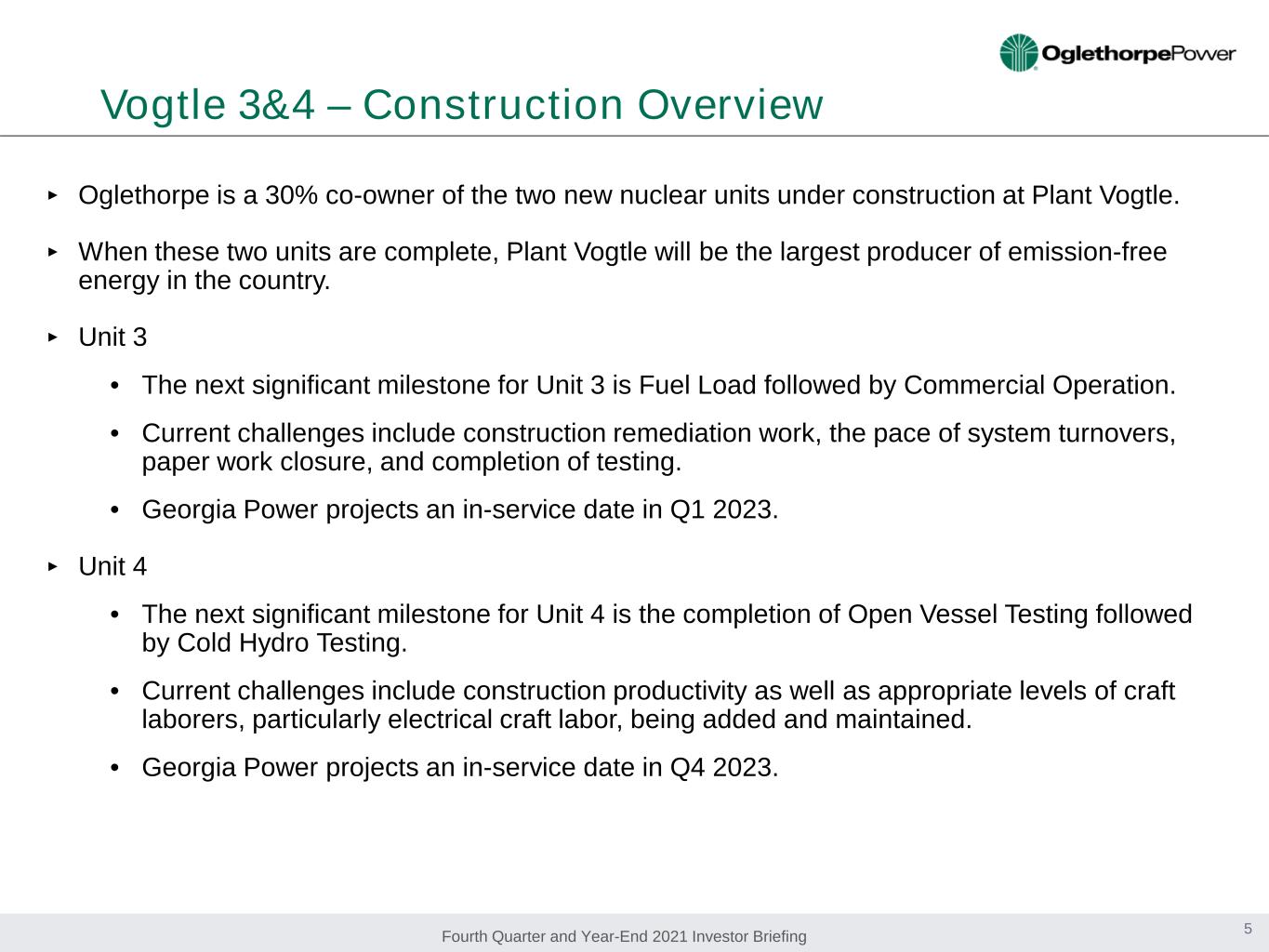

Fourth Quarter and Year-End 2021 Investor Briefing Vogtle 3&4 – Construction Overview 5 ‣ Oglethorpe is a 30% co-owner of the two new nuclear units under construction at Plant Vogtle. ‣ When these two units are complete, Plant Vogtle will be the largest producer of emission-free energy in the country. ‣ Unit 3 • The next significant milestone for Unit 3 is Fuel Load followed by Commercial Operation. • Current challenges include construction remediation work, the pace of system turnovers, paper work closure, and completion of testing. • Georgia Power projects an in-service date in Q1 2023. ‣ Unit 4 • The next significant milestone for Unit 4 is the completion of Open Vessel Testing followed by Cold Hydro Testing. • Current challenges include construction productivity as well as appropriate levels of craft laborers, particularly electrical craft labor, being added and maintained. • Georgia Power projects an in-service date in Q4 2023.

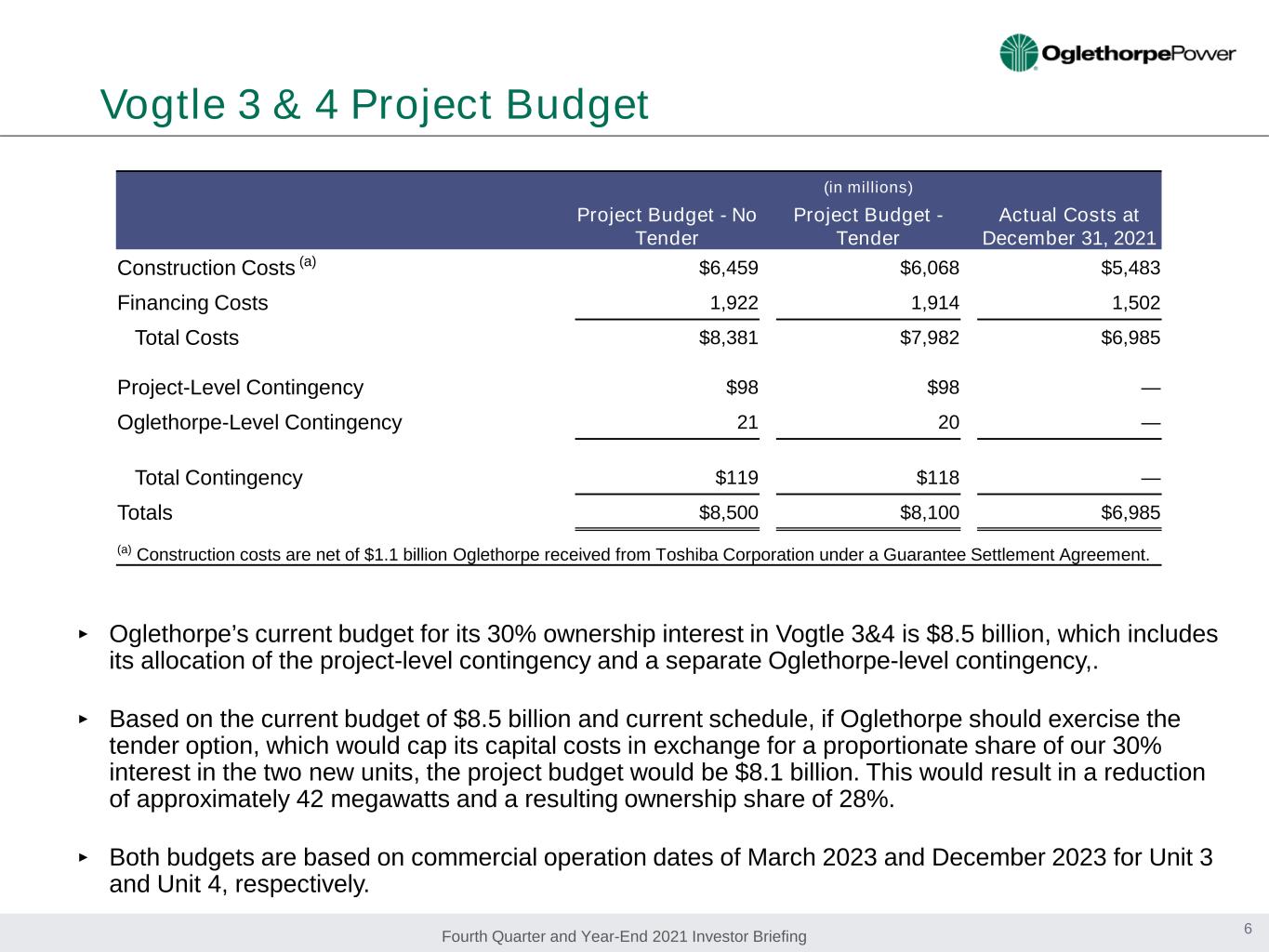

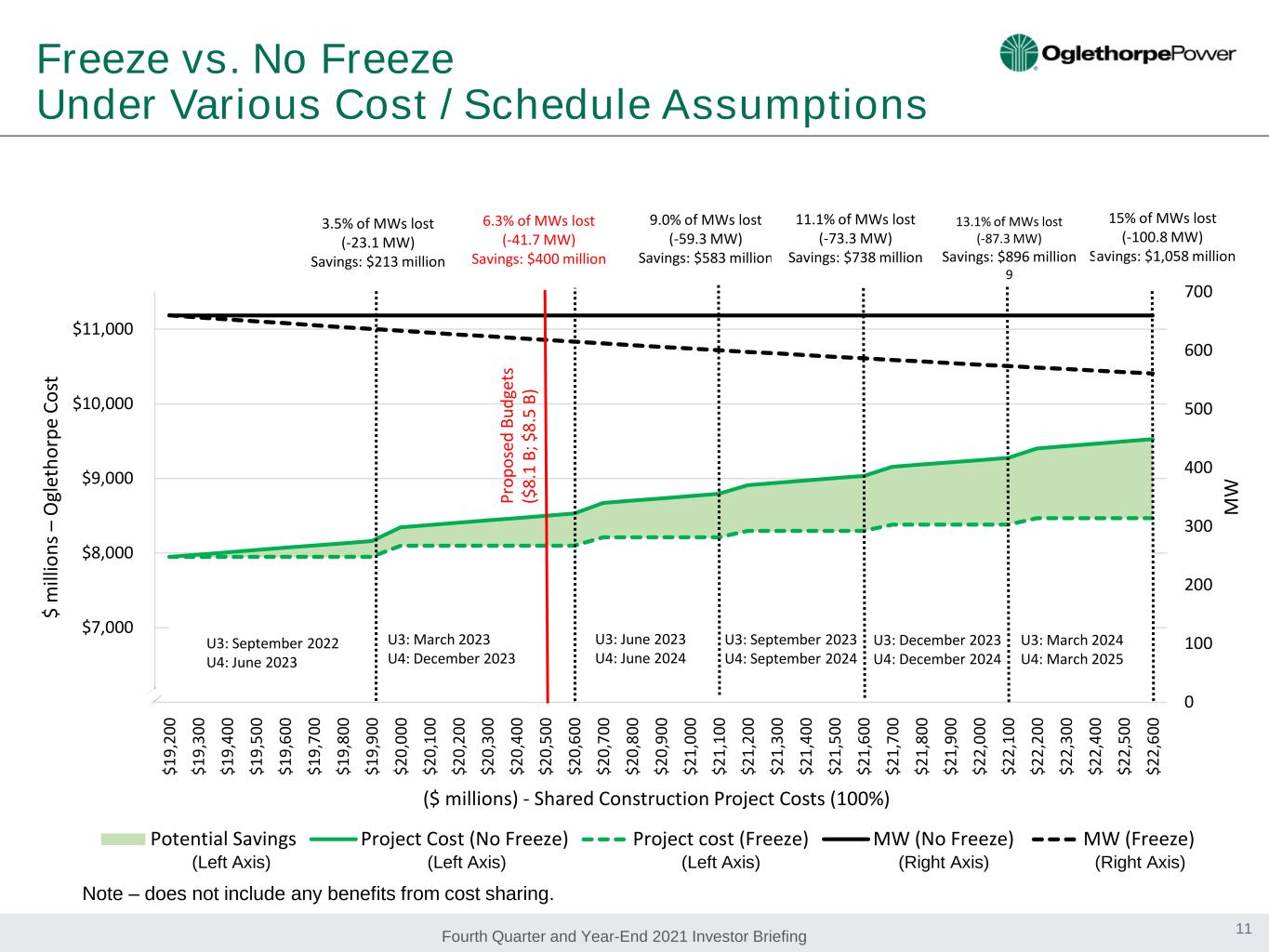

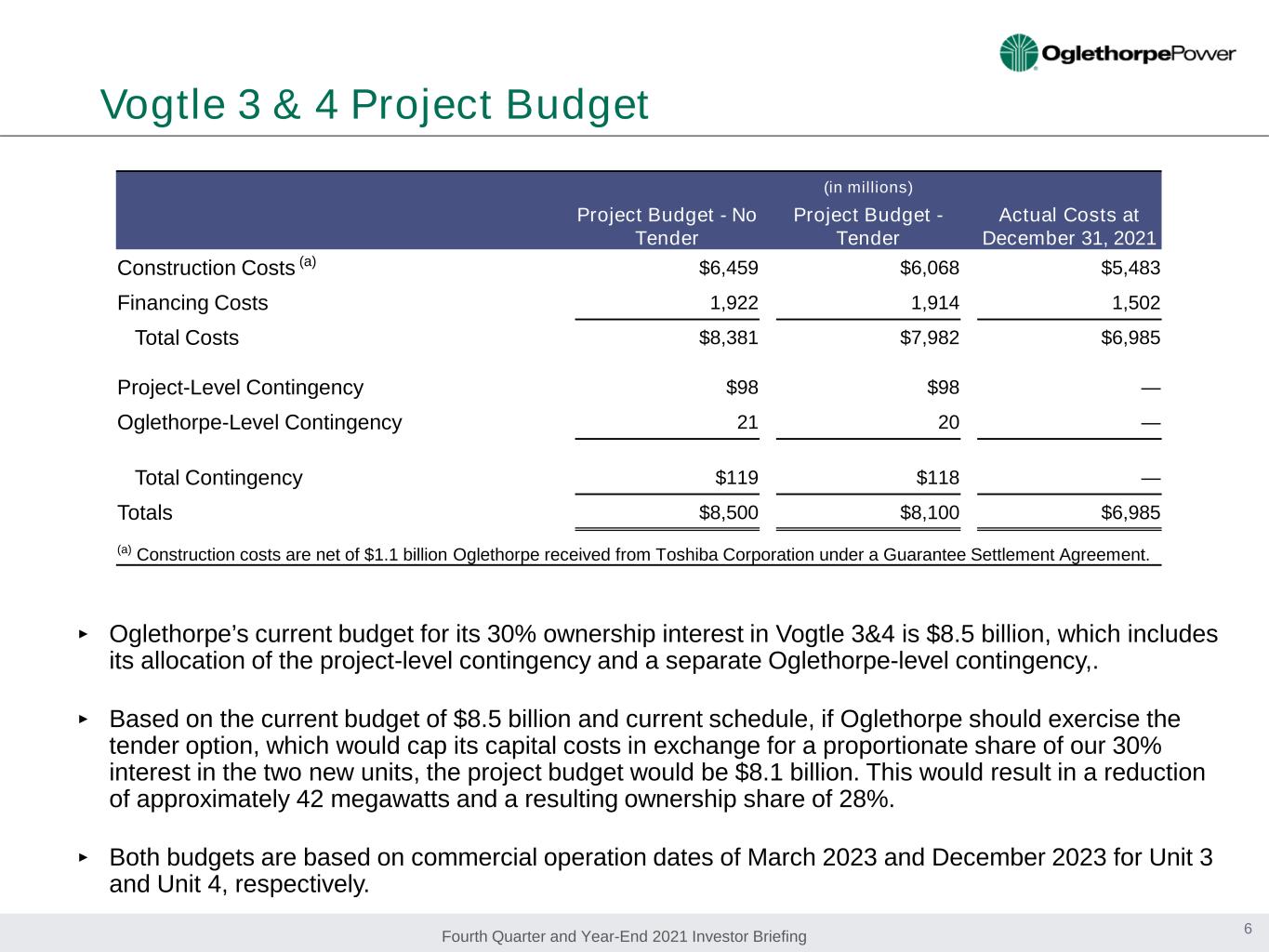

Fourth Quarter and Year-End 2021 Investor Briefing Vogtle 3 & 4 Project Budget 6 ‣ Oglethorpe’s current budget for its 30% ownership interest in Vogtle 3&4 is $8.5 billion, which includes its allocation of the project-level contingency and a separate Oglethorpe-level contingency,. ‣ Based on the current budget of $8.5 billion and current schedule, if Oglethorpe should exercise the tender option, which would cap its capital costs in exchange for a proportionate share of our 30% interest in the two new units, the project budget would be $8.1 billion. This would result in a reduction of approximately 42 megawatts and a resulting ownership share of 28%. ‣ Both budgets are based on commercial operation dates of March 2023 and December 2023 for Unit 3 and Unit 4, respectively. (in millions) Project Budget - No Tender Project Budget - Tender Actual Costs at December 31, 2021 Construction Costs (a) $6,459 $6,068 $5,483 Financing Costs 1,922 1,914 1,502 Total Costs $8,381 $7,982 $6,985 Project-Level Contingency $98 $98 — Oglethorpe-Level Contingency 21 20 — Total Contingency $119 $118 — Totals $8,500 $8,100 $6,985 (a) Construction costs are net of $1.1 billion Oglethorpe received from Toshiba Corporation under a Guarantee Settlement Agreement.

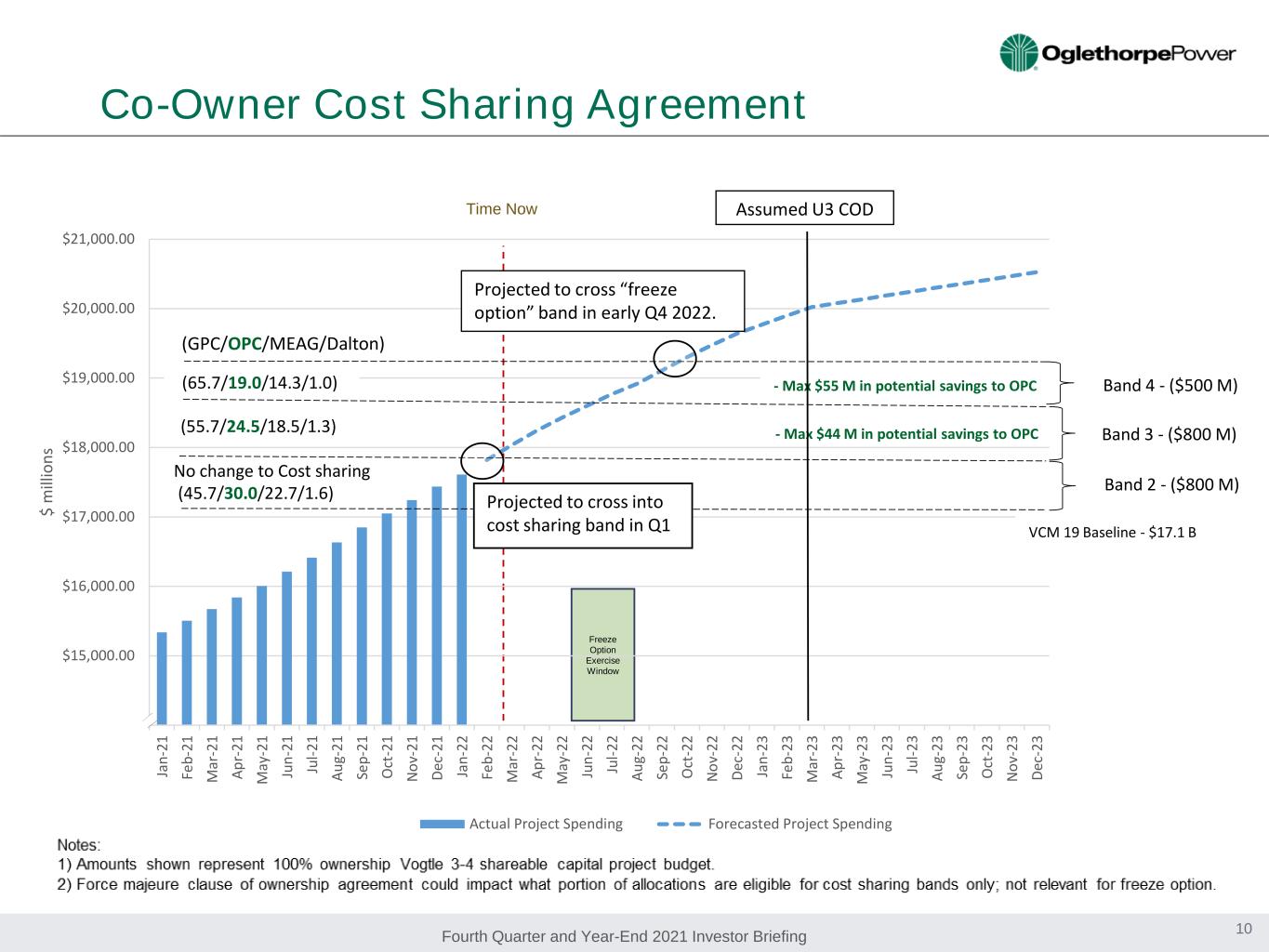

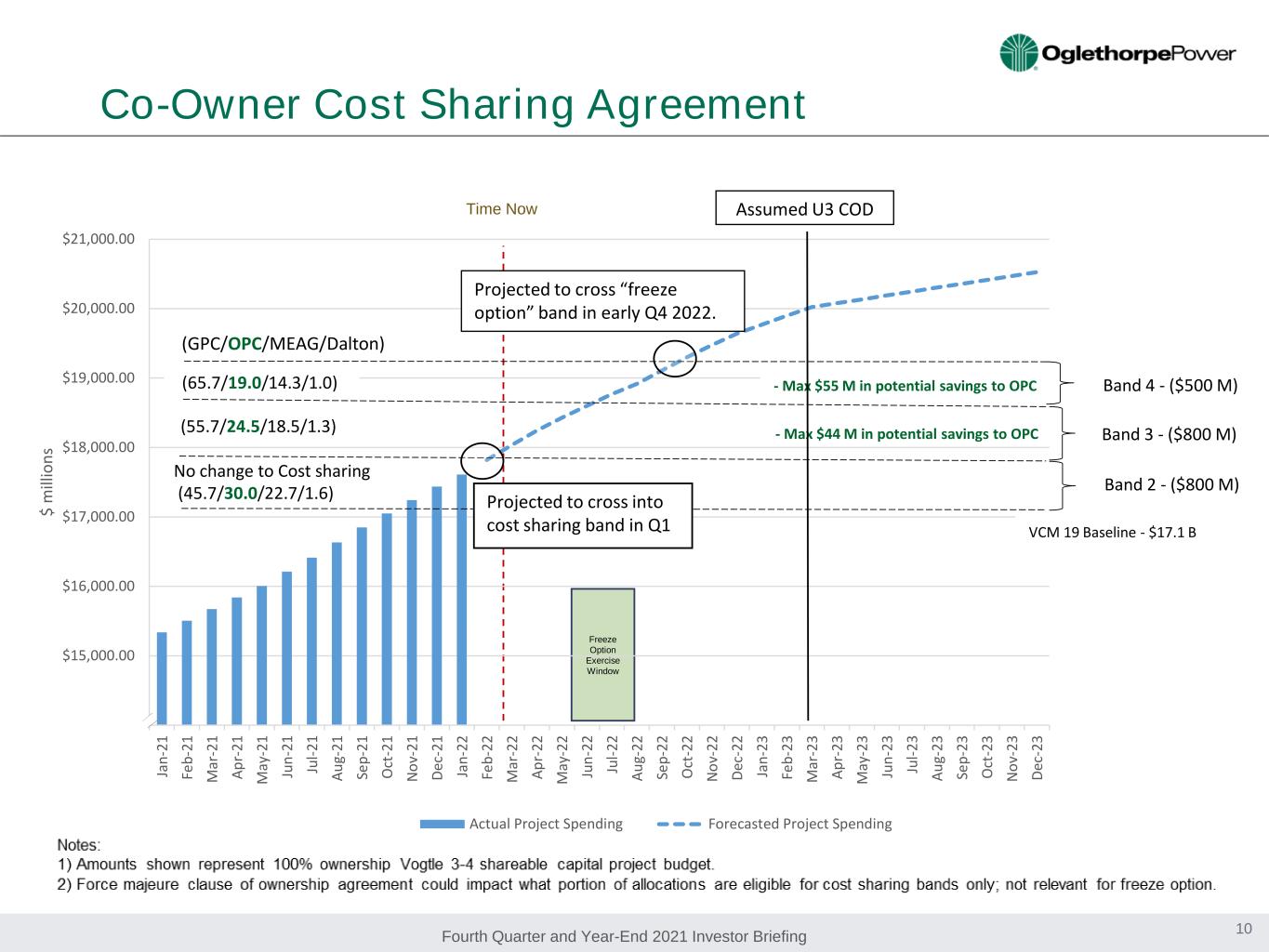

Fourth Quarter and Year-End 2021 Investor Briefing Vogtle 3&4 – Co-Owner Cost Sharing Agreement 7 • In September 2018, the Vogtle 3&4 co-owners agreed to an amendment to the ownership agreement that covered two concepts: cost sharing and a freeze option if total project costs reached certain levels. • The cost sharing bands are triggered off of total project costs at the time of the VCM 19 Georgia Public Service Commission filing, or $17.1 billion, and commence at VCM 19 + $800 million. • The amendment also provided each co-owner a one-time option to “freeze” their ownership interest at the time the total project cost forecast exceeds VCM 19 plus $2.1 billion, or $19.2 billion. • “Freeze” means to tender a portion of a co-owner’s interest in the project to Georgia Power in exchange for Georgia Power’s agreement to pay 100% of that co-owners remaining share of construction costs. • The freeze is implemented after the actual costs reach VCM 19 plus $2.1 billion (not when the budget first shows this amount). • If a co-owner elects the “freeze” option, their ownership share of the project will be adjusted and determined at the end of the project based on pro-rata contributions to construction costs.

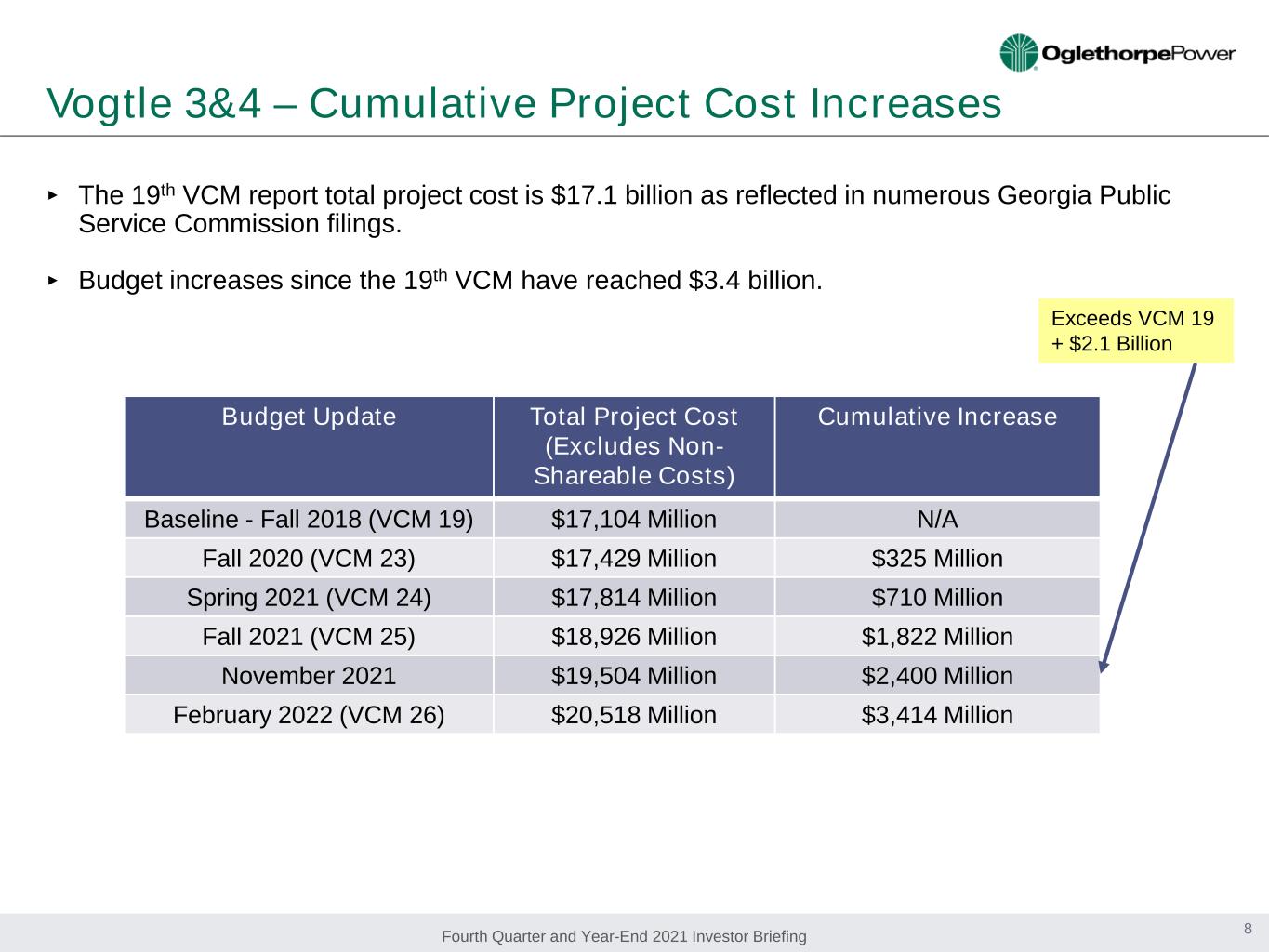

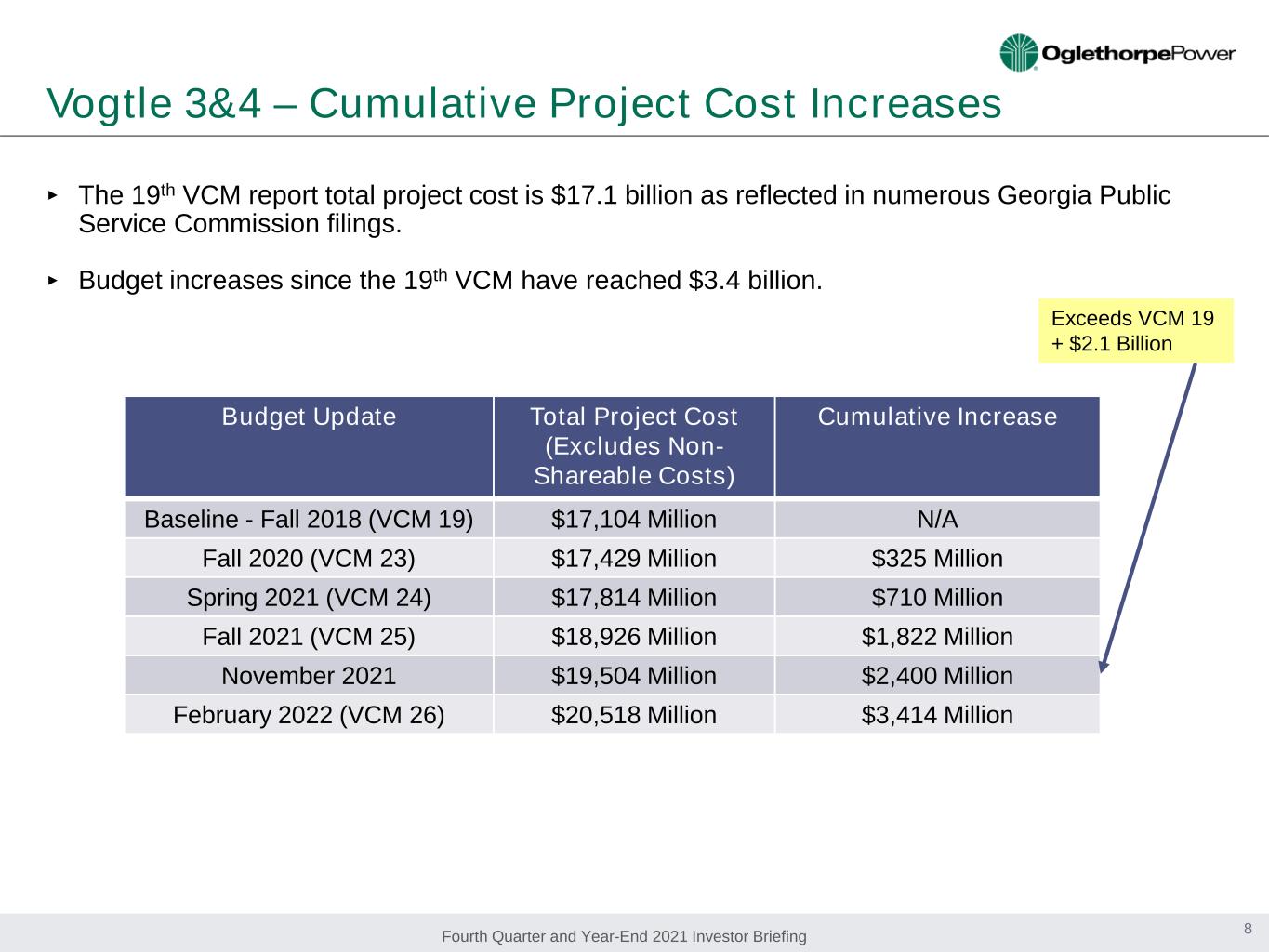

Fourth Quarter and Year-End 2021 Investor Briefing Vogtle 3&4 – Cumulative Project Cost Increases 8 ‣ The 19th VCM report total project cost is $17.1 billion as reflected in numerous Georgia Public Service Commission filings. ‣ Budget increases since the 19th VCM have reached $3.4 billion. Budget Update Total Project Cost (Excludes Non- Shareable Costs) Cumulative Increase Baseline - Fall 2018 (VCM 19) $17,104 Million N/A Fall 2020 (VCM 23) $17,429 Million $325 Million Spring 2021 (VCM 24) $17,814 Million $710 Million Fall 2021 (VCM 25) $18,926 Million $1,822 Million November 2021 $19,504 Million $2,400 Million February 2022 (VCM 26) $20,518 Million $3,414 Million Exceeds VCM 19 + $2.1 Billion

Fourth Quarter and Year-End 2021 Investor Briefing Vogtle 3&4 – Cost Sharing Trigger Events ‣ As a result of these increases, the tender option was triggered at the co-owner construction budget vote on February 14, 2022. ‣ Georgia Power and the other co-owners clarified the process for the freeze provision to provide for a decision between 120 and 180 days after the tender option is triggered resulting in a window from June 14 – August 13. ‣ Cost sharing is imminent, however, until the parties reach agreement, Oglethorpe will continue to pay its full share of the construction costs as billed by Georgia Power, but will do so under contractual protest. ‣ Georgia Power and Oglethorpe do not agree on the starting dollar amounts for: • Each co-owner’s option to tender a portion of its ownership interest to Georgia Power under the freeze provision of the Global Amendments. • Georgia Power’s increased responsibility for certain construction costs under the cost sharing provisions. ‣ Oglethorpe has commenced the dispute resolution procedures set forth in the Ownership Participation Agreement for the additional Vogtle units. 9

Fourth Quarter and Year-End 2021 Investor Briefing Co-Owner Cost Sharing Agreement 10 Freeze Option Exercise Window Time Now $14,000.00 $15,000.00 $16,000.00 $17,000.00 $18,000.00 $19,000.00 $20,000.00 $21,000.00 Ja n- 21 Fe b- 21 M ar -2 1 Ap r- 21 M ay -2 1 Ju n- 21 Ju l-2 1 Au g- 21 Se p- 21 O ct -2 1 N ov -2 1 De c- 21 Ja n- 22 Fe b- 22 M ar -2 2 Ap r- 22 M ay -2 2 Ju n- 22 Ju l-2 2 Au g- 22 Se p- 22 O ct -2 2 N ov -2 2 De c- 22 Ja n- 23 Fe b- 23 M ar -2 3 Ap r- 23 M ay -2 3 Ju n- 23 Ju l-2 3 Au g- 23 Se p- 23 O ct -2 3 N ov -2 3 De c- 23 $ m ill io ns Actual Project Spending Forecasted Project Spending VCM 19 Baseline - $17.1 B - Max $44 M in potential savings to OPC - Max $55 M in potential savings to OPC Band 2 - ($800 M) Band 3 - ($800 M) Band 4 - ($500 M) No change to Cost sharing (45.7/30.0/22.7/1.6) (55.7/24.5/18.5/1.3) (65.7/19.0/14.3/1.0) (GPC/OPC/MEAG/Dalton) Projected to cross into cost sharing band in Q1 Projected to cross “freeze option” band in early Q4 2022. Assumed U3 COD

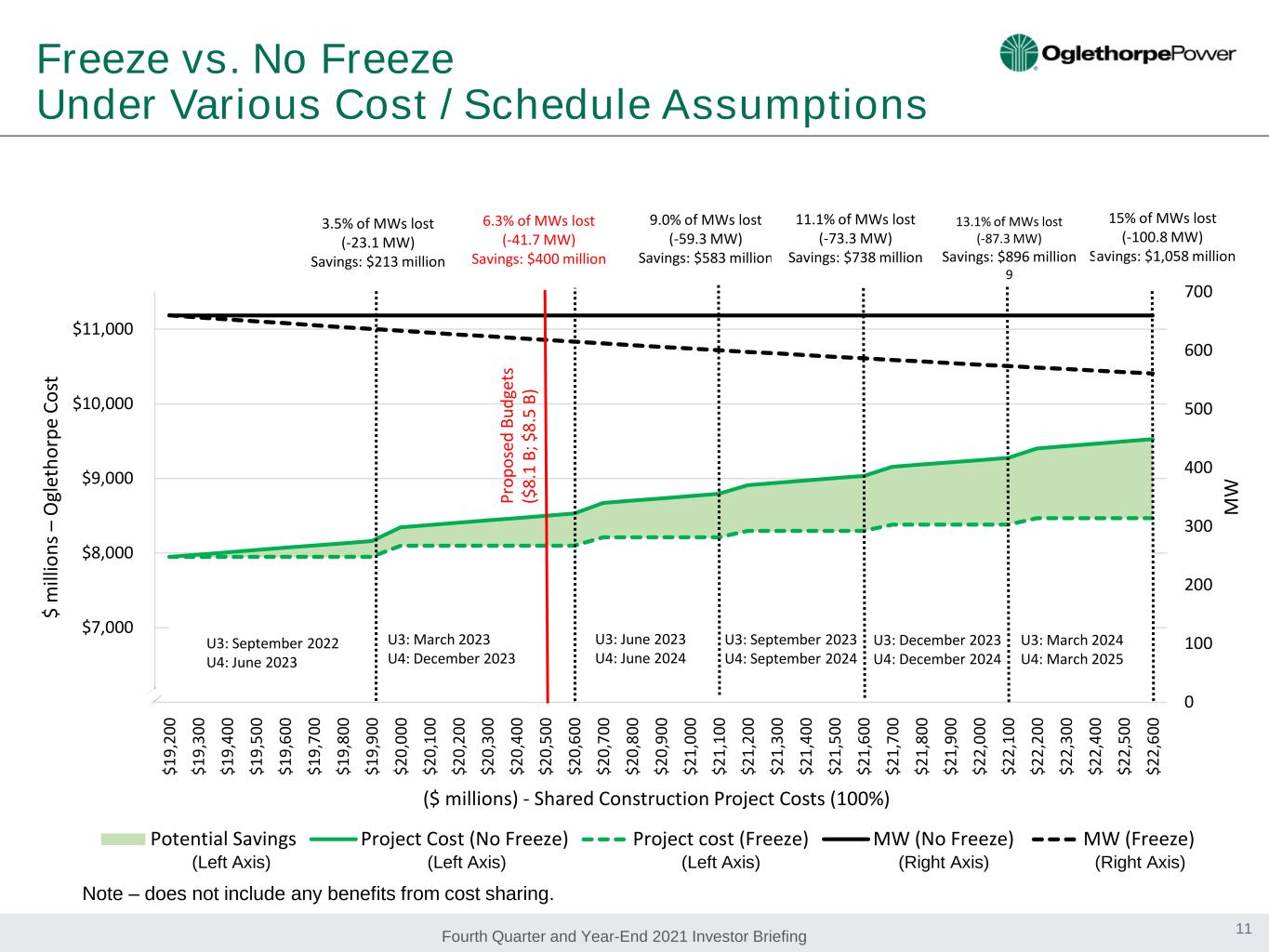

Fourth Quarter and Year-End 2021 Investor Briefing Freeze vs. No Freeze Under Various Cost / Schedule Assumptions 11 0 100 200 300 400 500 600 700 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 $ 19 ,2 00 $ 19 ,3 00 $ 19 ,4 00 $ 19 ,5 00 $ 19 ,6 00 $ 19 ,7 00 $ 19 ,8 00 $ 19 ,9 00 $ 20 ,0 00 $ 20 ,1 00 $ 20 ,2 00 $ 20 ,3 00 $ 20 ,4 00 $ 20 ,5 00 $ 20 ,6 00 $ 20 ,7 00 $ 20 ,8 00 $ 20 ,9 00 $ 21 ,0 00 $ 21 ,1 00 $ 21 ,2 00 $ 21 ,3 00 $ 21 ,4 00 $ 21 ,5 00 $ 21 ,6 00 $ 21 ,7 00 $ 21 ,8 00 $ 21 ,9 00 $ 22 ,0 00 $ 22 ,1 00 $ 22 ,2 00 $ 22 ,3 00 $ 22 ,4 00 $ 22 ,5 00 $ 22 ,6 00 M W $ m ill io ns – O gl et ho rp e Co st ($ millions) - Shared Construction Project Costs (100%) Potential Savings Project Cost (No Freeze) Project cost (Freeze) MW (No Freeze) MW (Freeze) U3: June 2023 U4: June 2024 U3: September 2023 U4: September 2024 U3: December 2023 U4: December 2024 U3: September 2022 U4: June 2023 15% of MWs lost (-100.8 MW) Savings: $1,058 million 6.3% of MWs lost (-41.7 MW) Savings: $400 million 9.0% of MWs lost (-59.3 MW) Savings: $583 million 13.1% of MWs lost (-87.3 MW) Savings: $896 million 9 Pr op os ed B ud ge ts ($ 8. 1 B; $ 8. 5 B) 11.1% of MWs lost (-73.3 MW) Savings: $738 million U3: March 2024 U4: March 2025 U3: March 2023 U4: December 2023 3.5% of MWs lost (-23.1 MW) Savings: $213 million Note – does not include any benefits from cost sharing. (Left Axis) (Left Axis) (Left Axis) (Right Axis) (Right Axis)

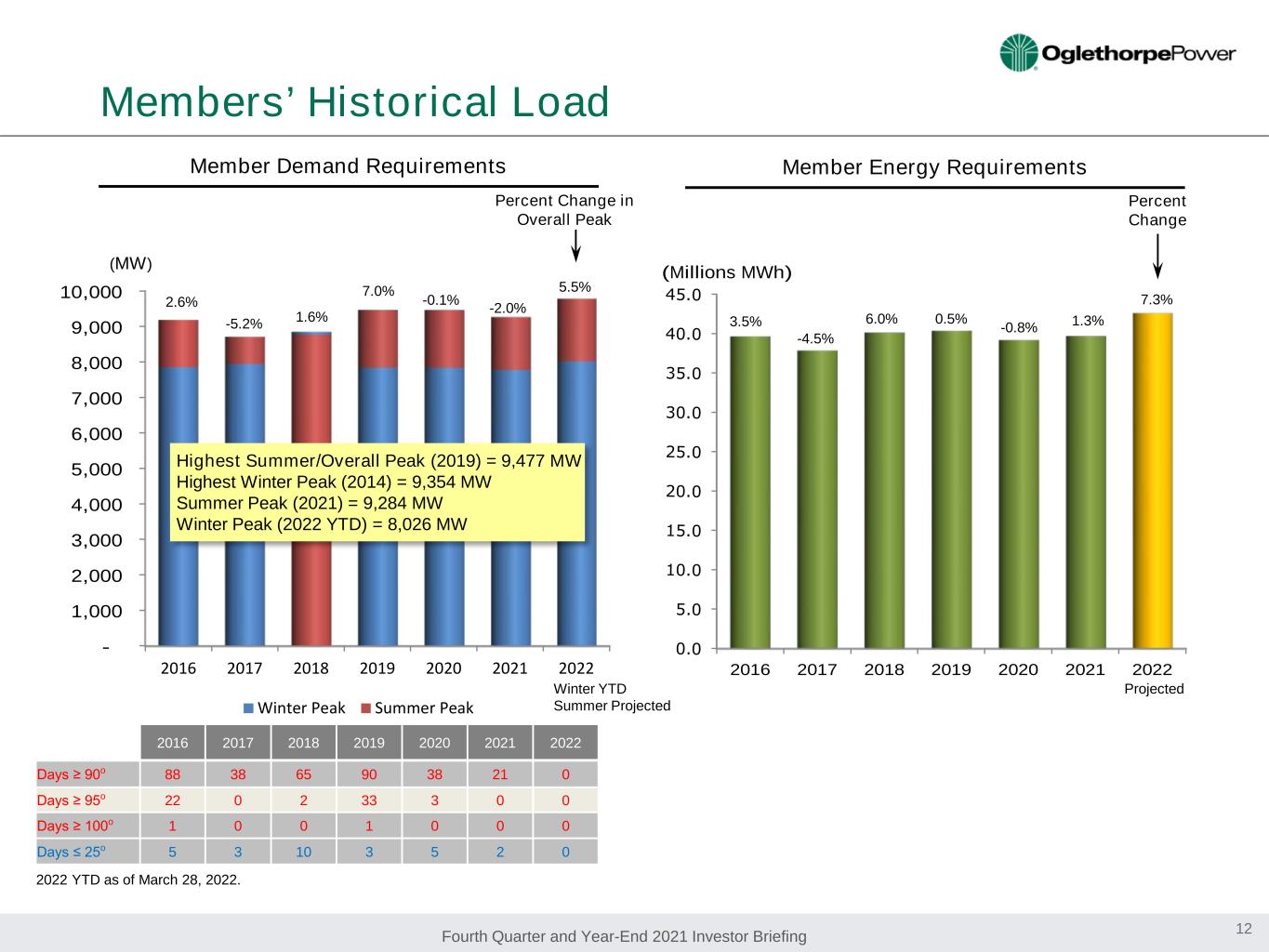

Fourth Quarter and Year-End 2021 Investor Briefing - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 10,000 2016 2017 2018 2019 2020 2021 2022 Winter Peak Summer Peak 2016 2017 2018 2019 2020 2021 2022 (Millions MWh) Members’ Historical Load 12 Member Demand Requirements Member Energy Requirements Percent Change (MW) Percent Change in Overall Peak Highest Summer/Overall Peak (2019) = 9,477 MW Highest Winter Peak (2014) = 9,354 MW Summer Peak (2021) = 9,284 MW Winter Peak (2022 YTD) = 8,026 MW 2.6% 3.5% 2016 2017 2018 2019 2020 2021 2022 Days ≥ 90o 88 38 65 90 38 21 0 Days ≥ 95o 22 0 2 33 3 0 0 Days ≥ 100o 1 0 0 1 0 0 0 Days ≤ 25o 5 3 10 3 5 2 0 -5.2% -4.5% 6.0%1.6% 7.0% 0.5% -0.8% -0.1% Projected 2022 YTD as of March 28, 2022. -2.0% 1.3% 7.3% 5.5% Winter YTD Summer Projected

Fourth Quarter and Year-End 2021 Investor Briefing Oglethorpe’s Diversified Power Supply Portfolio Notes: Capacity and energy include Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. Capacity includes Effingham Energy Facility that was acquired in July 2021. 2022 Capacity (MW) 8,360 MW 13 2021 Energy (MWh) (January 2021 – December 2021) 57% 14% 19% 10% 49% 38% 9%4% 51% 36% 9% 4% Member and Non-Member Sales 28 Million MWh Member Sales 27 Million MWh

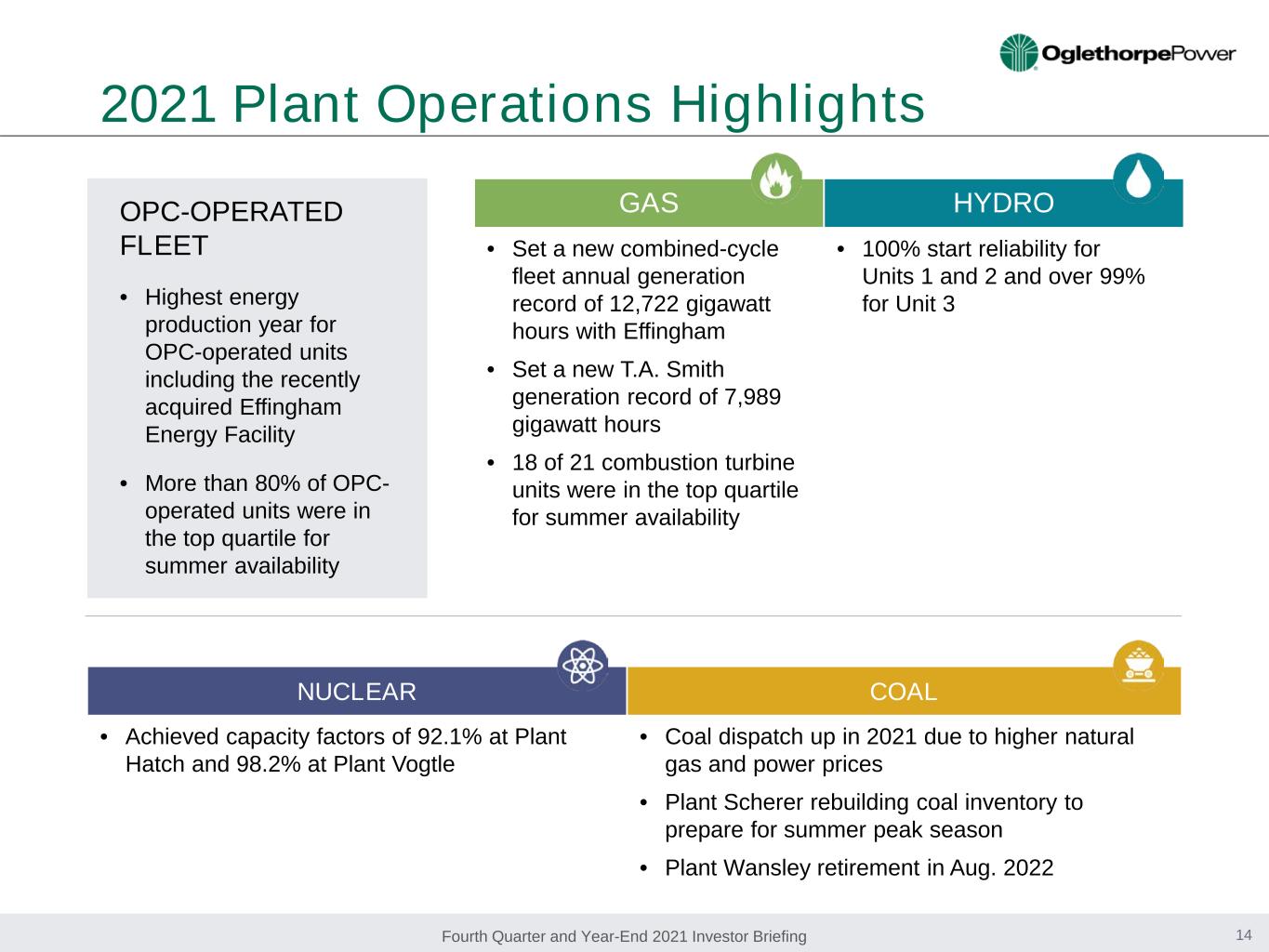

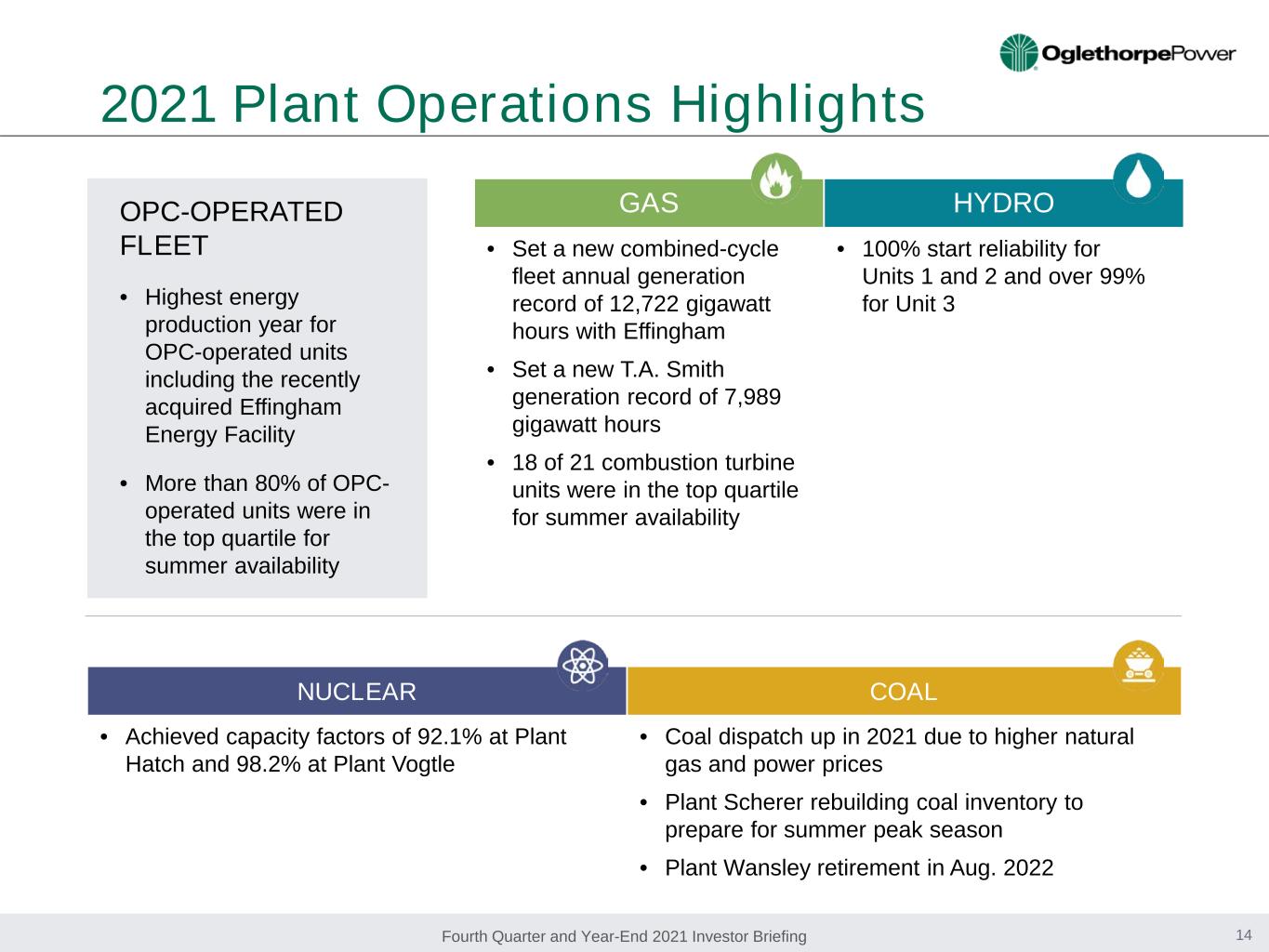

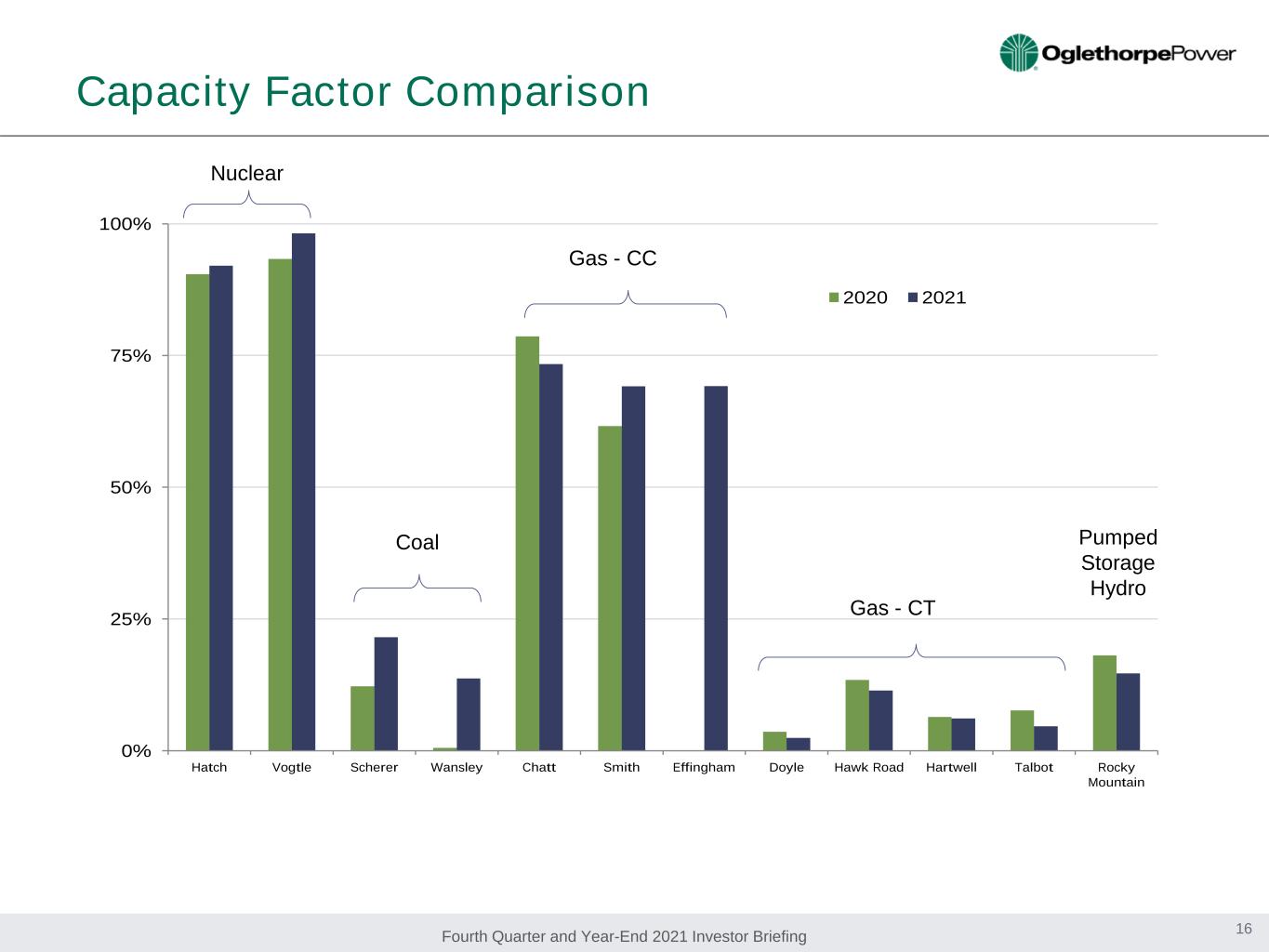

Fourth Quarter and Year-End 2021 Investor Briefing 2021 Plant Operations Highlights 14 OPC-OPERATED FLEET • Highest energy production year for OPC-operated units including the recently acquired Effingham Energy Facility • More than 80% of OPC- operated units were in the top quartile for summer availability GAS HYDRO • Set a new combined-cycle fleet annual generation record of 12,722 gigawatt hours with Effingham • Set a new T.A. Smith generation record of 7,989 gigawatt hours • 18 of 21 combustion turbine units were in the top quartile for summer availability • 100% start reliability for Units 1 and 2 and over 99% for Unit 3 NUCLEAR COAL • Achieved capacity factors of 92.1% at Plant Hatch and 98.2% at Plant Vogtle • Coal dispatch up in 2021 due to higher natural gas and power prices • Plant Scherer rebuilding coal inventory to prepare for summer peak season • Plant Wansley retirement in Aug. 2022

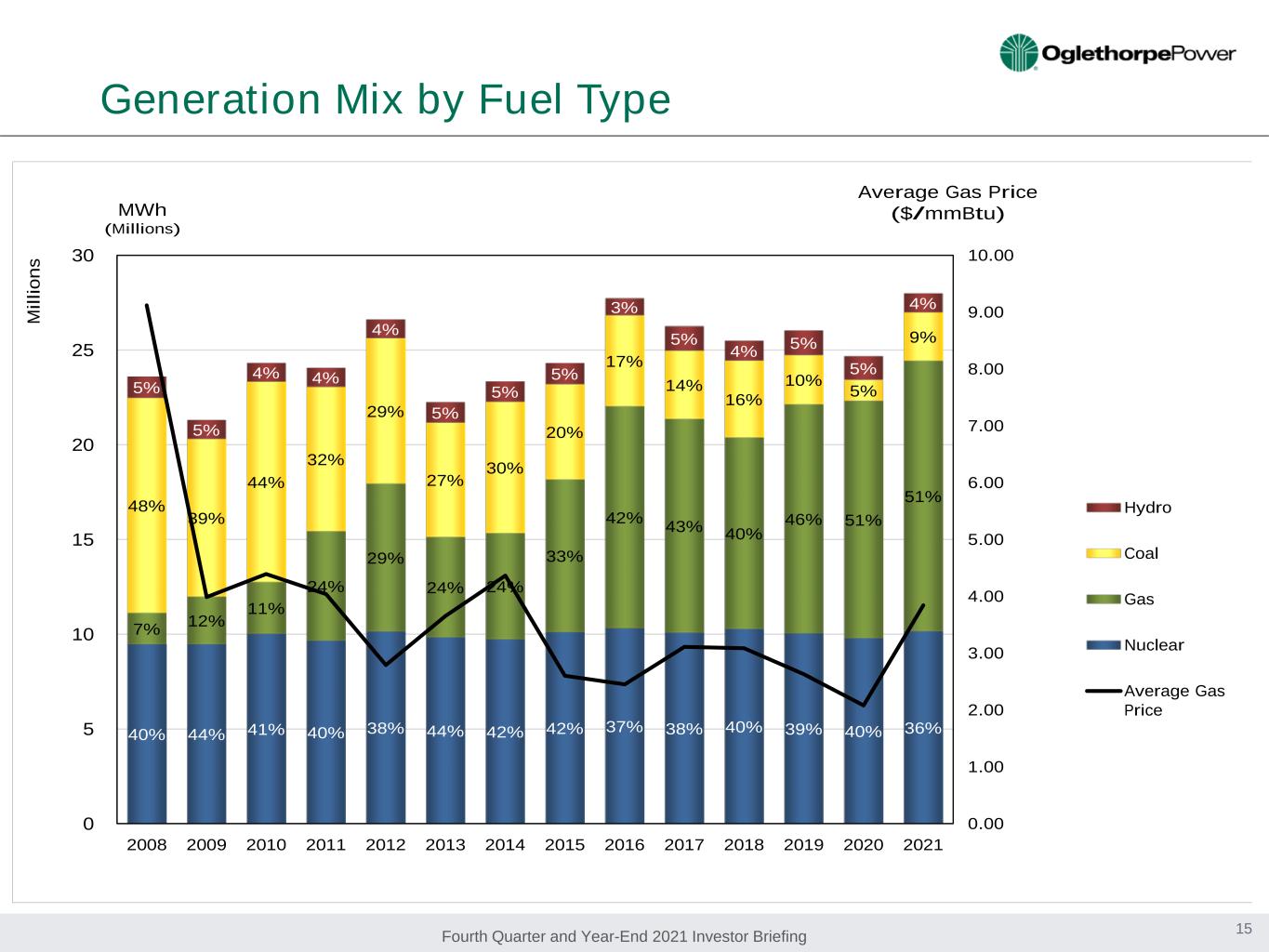

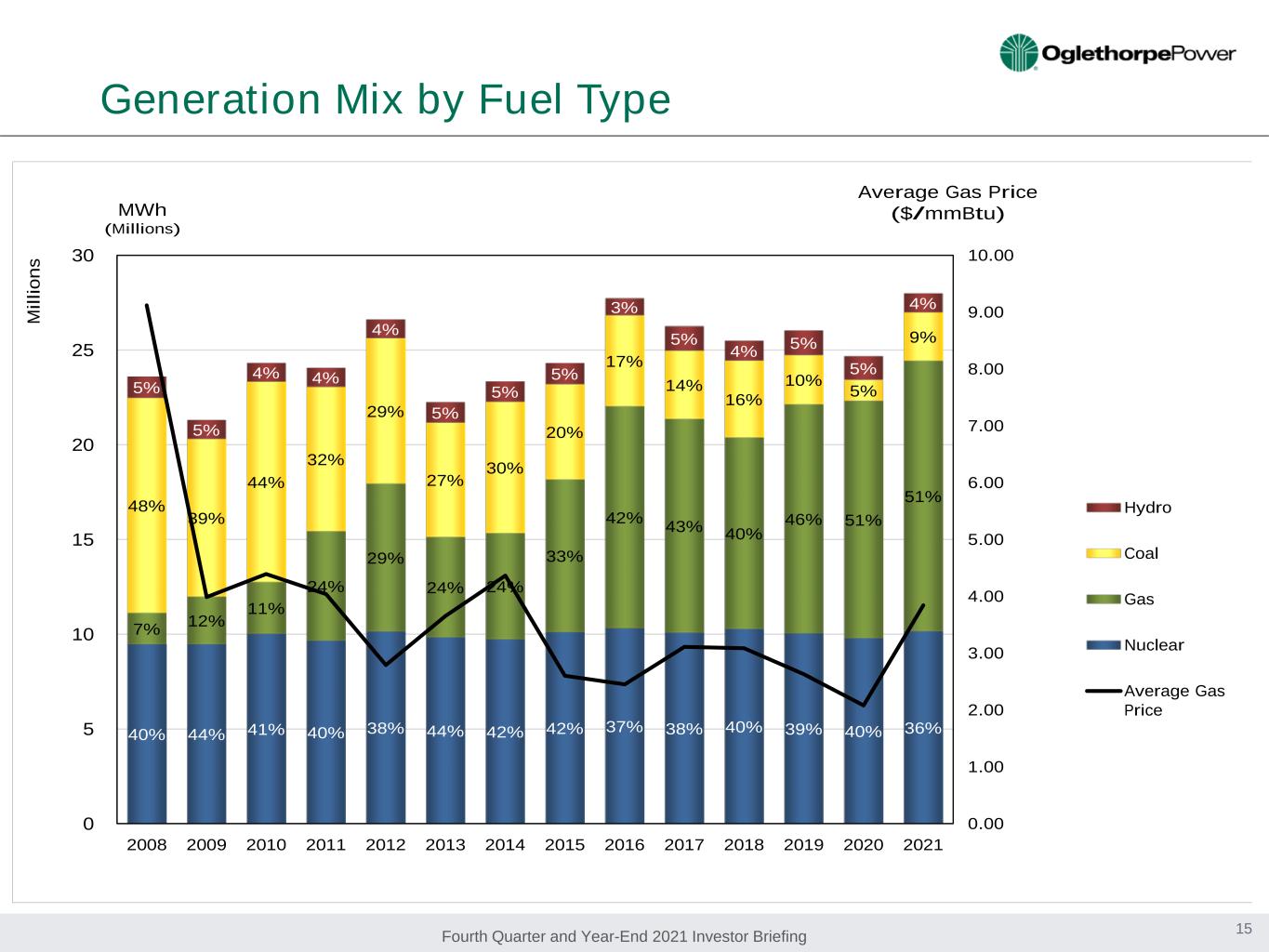

Fourth Quarter and Year-End 2021 Investor Briefing 40% 44% 41% 40% 38% 44% 42% 42% 37% 38% 40% 39% 40% 36% 7% 12% 11% 24% 29% 24% 24% 33% 42% 43% 40% 46% 51% 51%48% 39% 44% 32% 29% 27% 30% 20% 17% 14% 16% 10% 5% 9% 5% 5% 4% 4% 4% 5% 5% 5% 3% 5% 4% 5% 5% 4% 0.00 1.00 2.00 3.00 4.00 5.00 6.00 7.00 8.00 9.00 10.00 0 5 10 15 20 25 30 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Average Gas Price ($/mmBtu)MWh (Millions) M ill io ns Hydro Coal Gas Nuclear Average Gas Price Generation Mix by Fuel Type 15

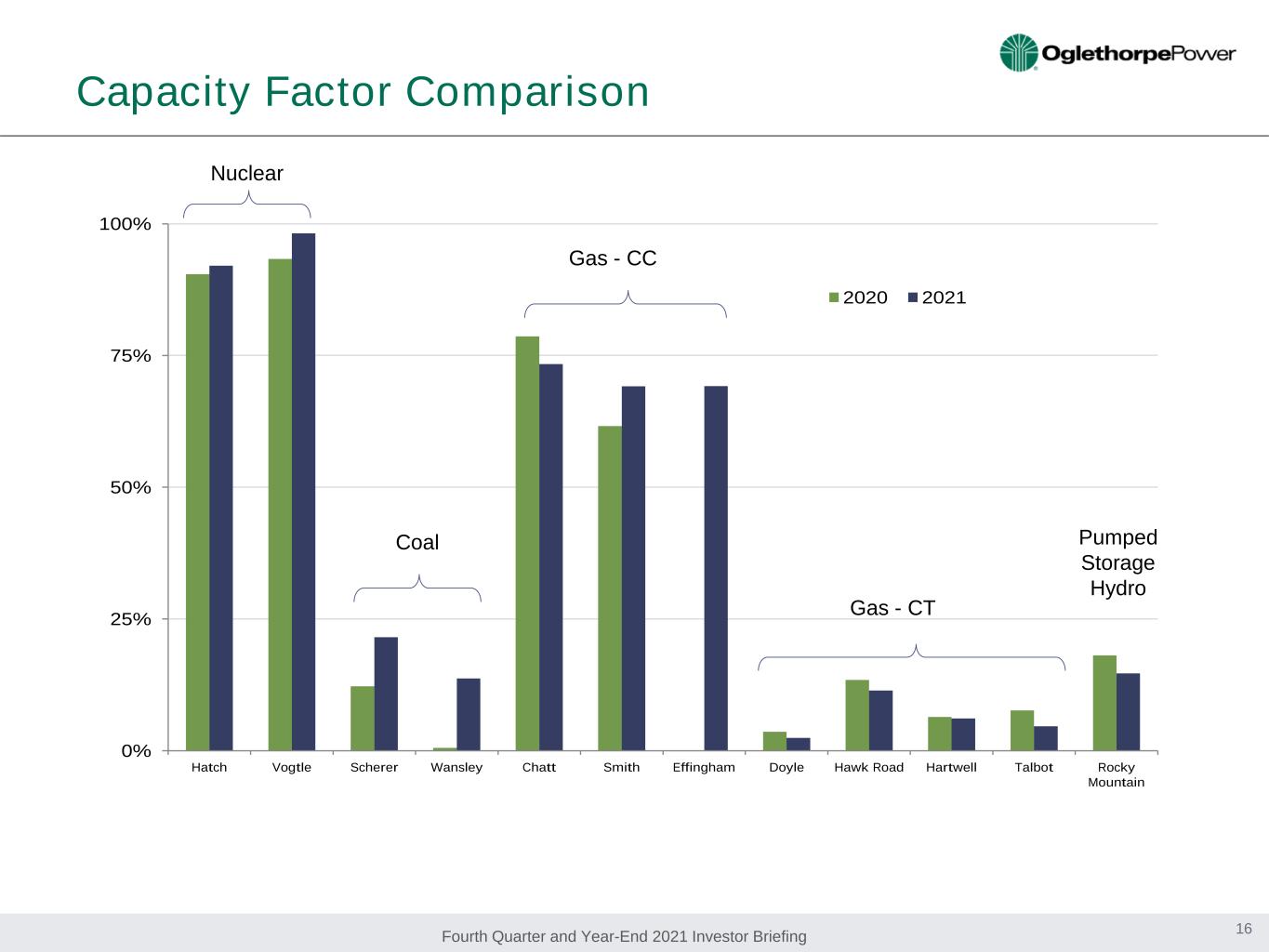

Fourth Quarter and Year-End 2021 Investor Briefing 0% 25% 50% 75% 100% Hatch Vogtle Scherer Wansley Chatt Smith Effingham Doyle Hawk Road Hartwell Talbot Rocky Mountain 2020 2021 Capacity Factor Comparison Nuclear Coal Gas - CC Gas - CT Pumped Storage Hydro 16

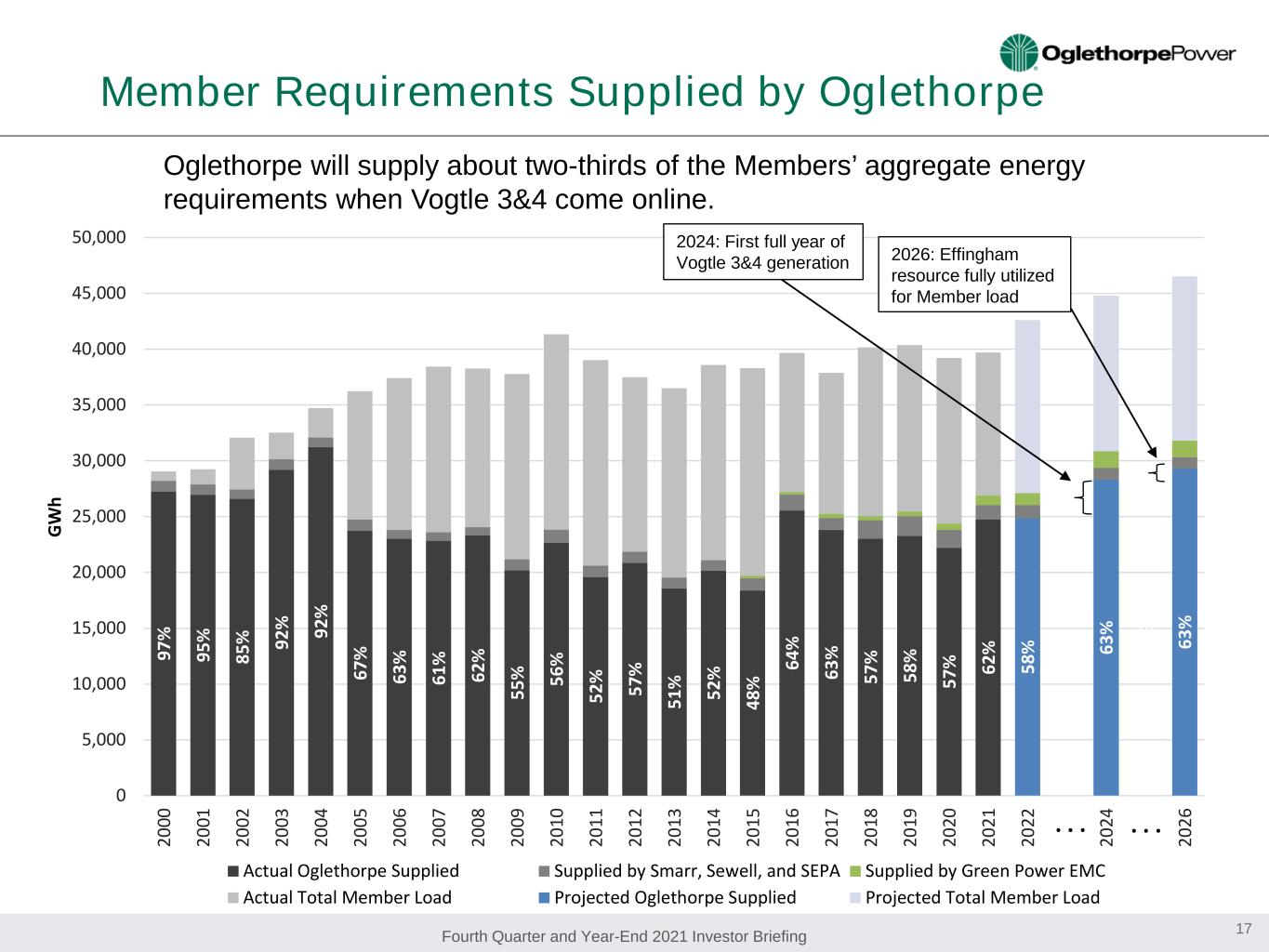

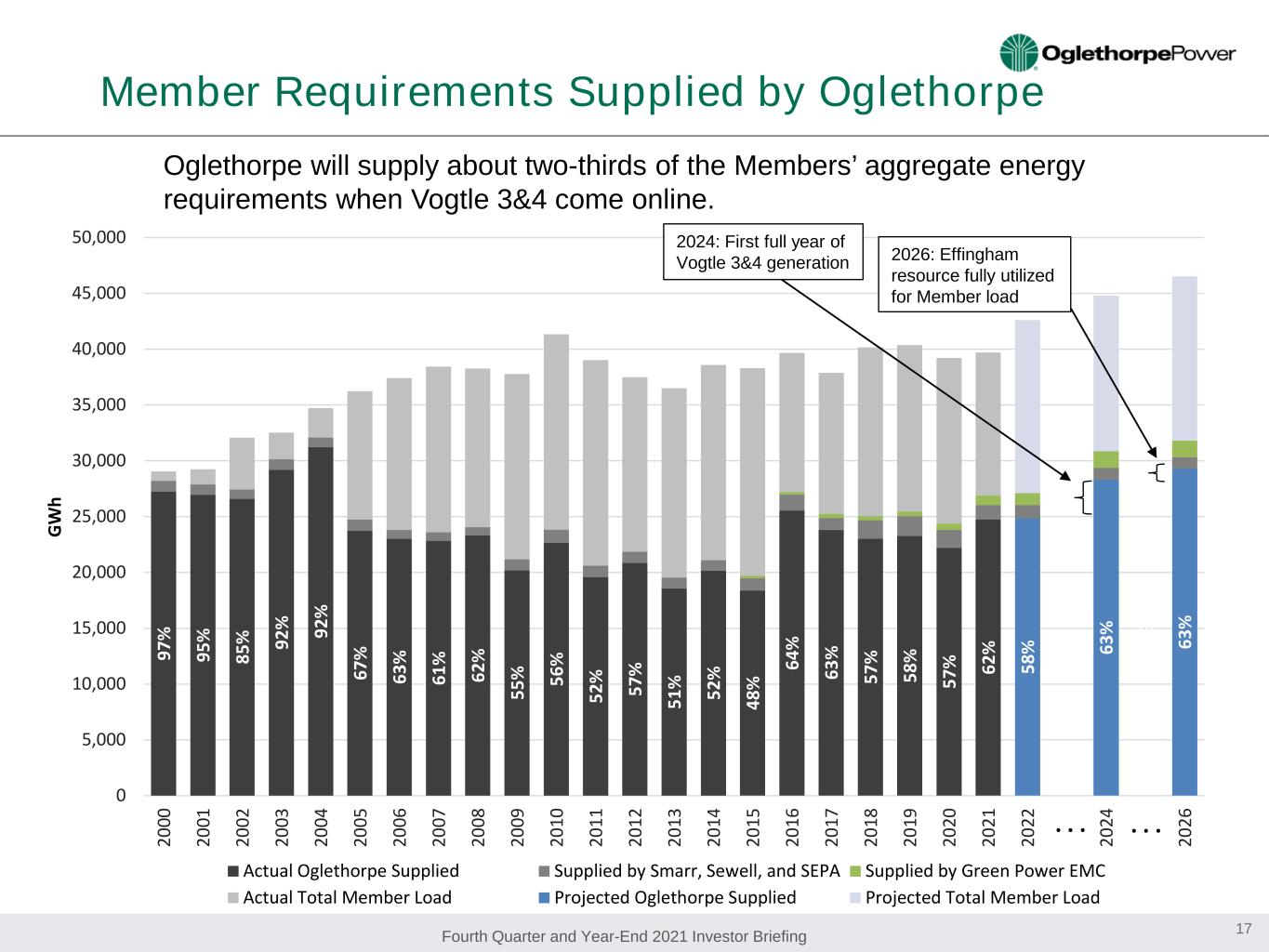

Fourth Quarter and Year-End 2021 Investor Briefing Member Requirements Supplied by Oglethorpe 17 97 % 95 % 85 % 92 % 92 % 67 % 63 % 61 % 62 % 55 % 56 % 52 % 57 % 51 % 52 % 48 % 64 % 63 % 57 % 58 % 57 % 62 % 58 % 58 % 63 % 60 % 63 % 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 20 00 20 01 20 02 20 03 20 04 20 05 20 06 20 07 20 08 20 09 20 10 20 11 20 12 20 13 20 14 20 15 20 16 20 17 20 18 20 19 20 20 20 21 20 22 20 24 20 26 G W h Actual Oglethorpe Supplied Supplied by Smarr, Sewell, and SEPA Supplied by Green Power EMC Actual Total Member Load Projected Oglethorpe Supplied Projected Total Member Load 2026: Effingham resource fully utilized for Member load . . . . . . 2024: First full year of Vogtle 3&4 generation Oglethorpe will supply about two-thirds of the Members’ aggregate energy requirements when Vogtle 3&4 come online.

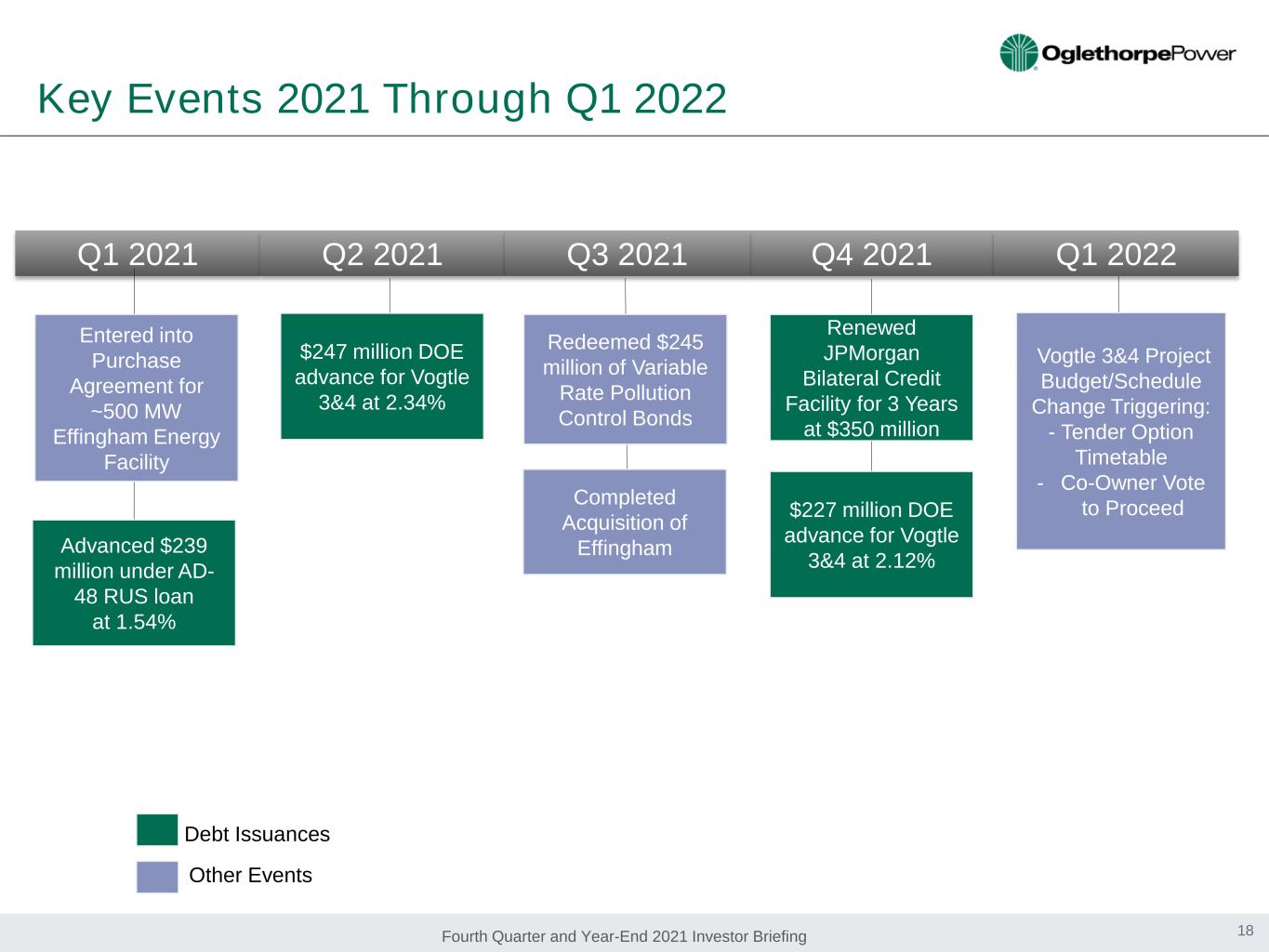

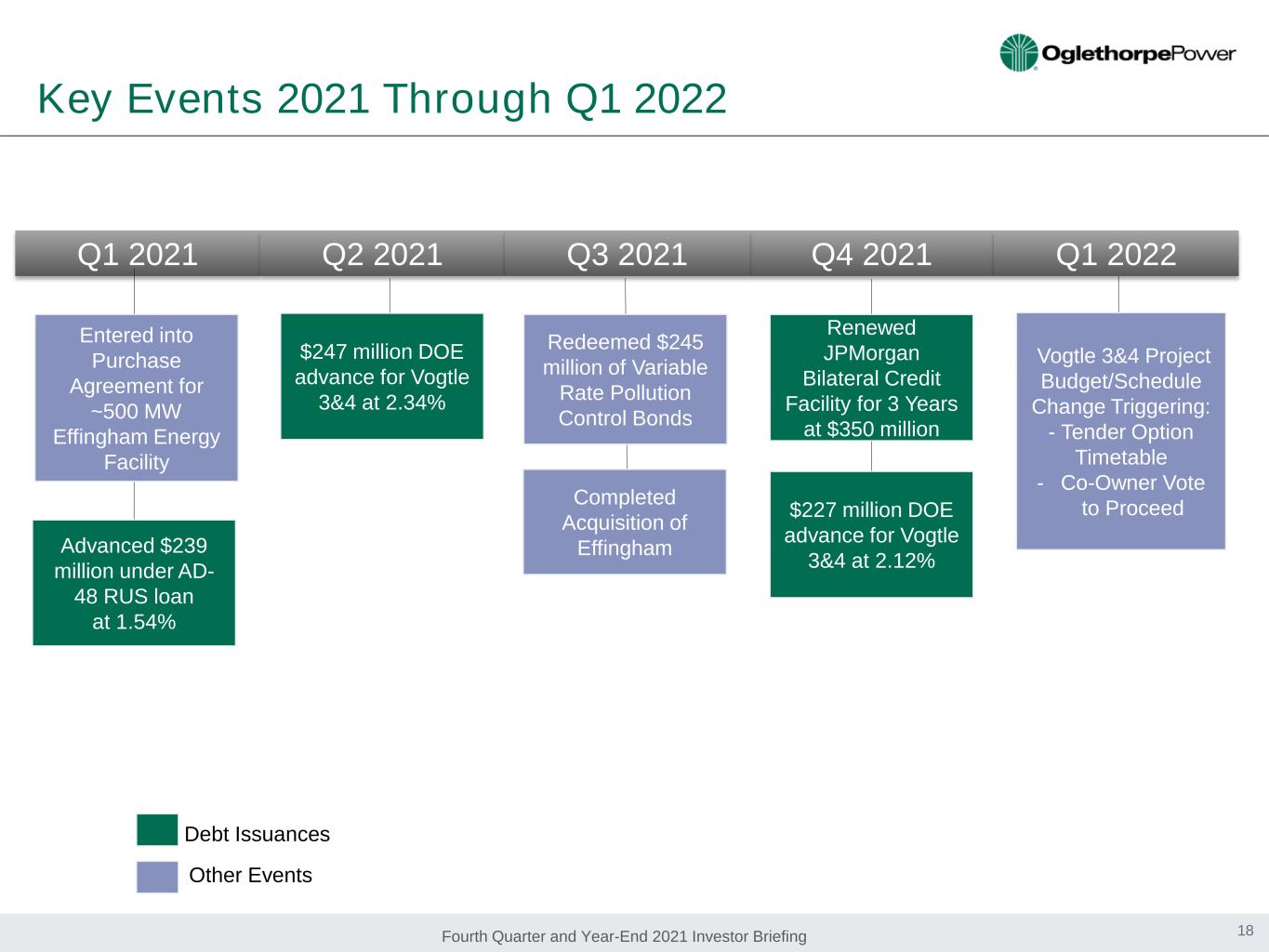

Fourth Quarter and Year-End 2021 Investor Briefing Key Events 2021 Through Q1 2022 Debt Issuances Other Events Q1 2021 Q4 2021Q2 2021 Q3 2021 18 Q1 2022 Redeemed $245 million of Variable Rate Pollution Control Bonds Renewed JPMorgan Bilateral Credit Facility for 3 Years at $350 million Entered into Purchase Agreement for ~500 MW Effingham Energy Facility Advanced $239 million under AD- 48 RUS loan at 1.54% Vogtle 3&4 Project Budget/Schedule Change Triggering: - Tender Option Timetable - Co-Owner Vote to Proceed $247 million DOE advance for Vogtle 3&4 at 2.34% $227 million DOE advance for Vogtle 3&4 at 2.12% Completed Acquisition of Effingham

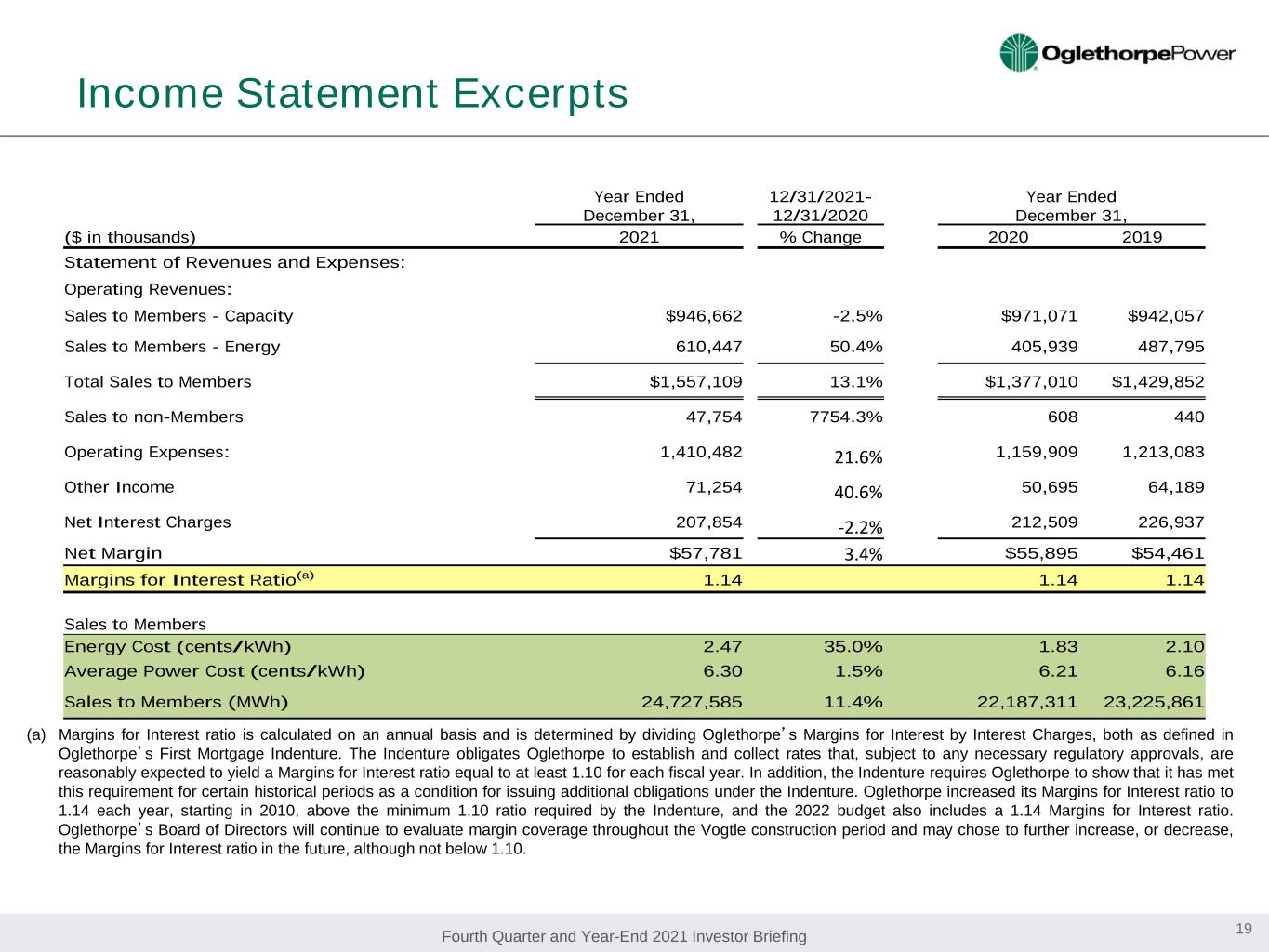

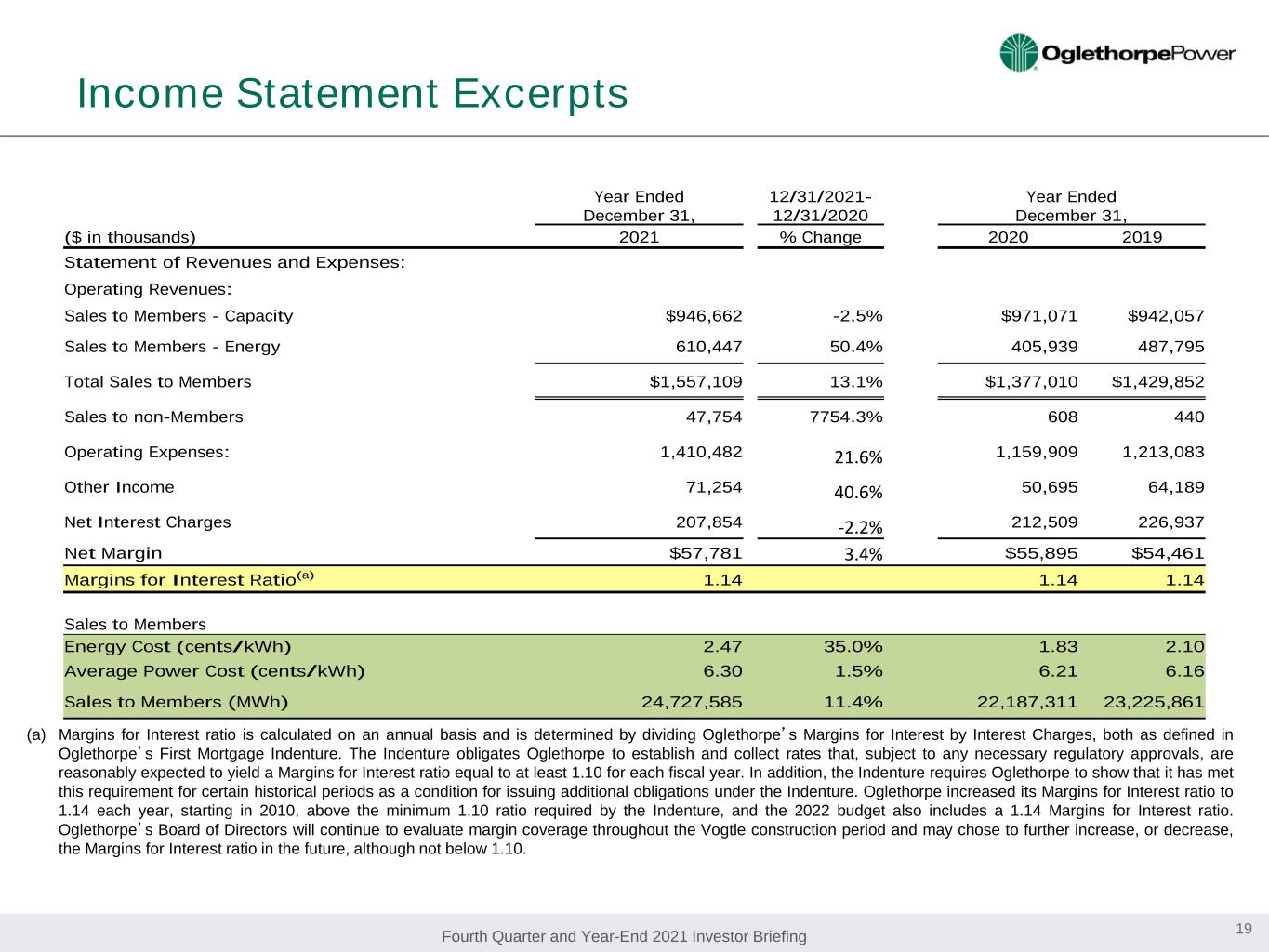

Fourth Quarter and Year-End 2021 Investor Briefing Income Statement Excerpts 19 (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture, and the 2022 budget also includes a 1.14 Margins for Interest ratio. Oglethorpe’s Board of Directors will continue to evaluate margin coverage throughout the Vogtle construction period and may chose to further increase, or decrease, the Margins for Interest ratio in the future, although not below 1.10. Year Ended December 31, 12/31/2021- 12/31/2020 Year Ended December 31, ($ in thousands) 2021 % Change 2020 2019 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $946,662 -2.5% $971,071 $942,057 Sales to Members - Energy 610,447 50.4% 405,939 487,795 Total Sales to Members $1,557,109 13.1% $1,377,010 $1,429,852 Sales to non-Members 47,754 7754.3% 608 440 Operating Expenses: 1,410,482 21.6% 1,159,909 1,213,083 Other Income 71,254 40.6% 50,695 64,189 Net Interest Charges 207,854 -2.2% 212,509 226,937 Net Margin $57,781 3.4% $55,895 $54,461 Margins for Interest Ratio(a) 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.47 35.0% 1.83 2.10 Average Power Cost (cents/kWh) 6.30 1.5% 6.21 6.16 Sales to Members (MWh) 24,727,585 11.4% 22,187,311 23,225,861

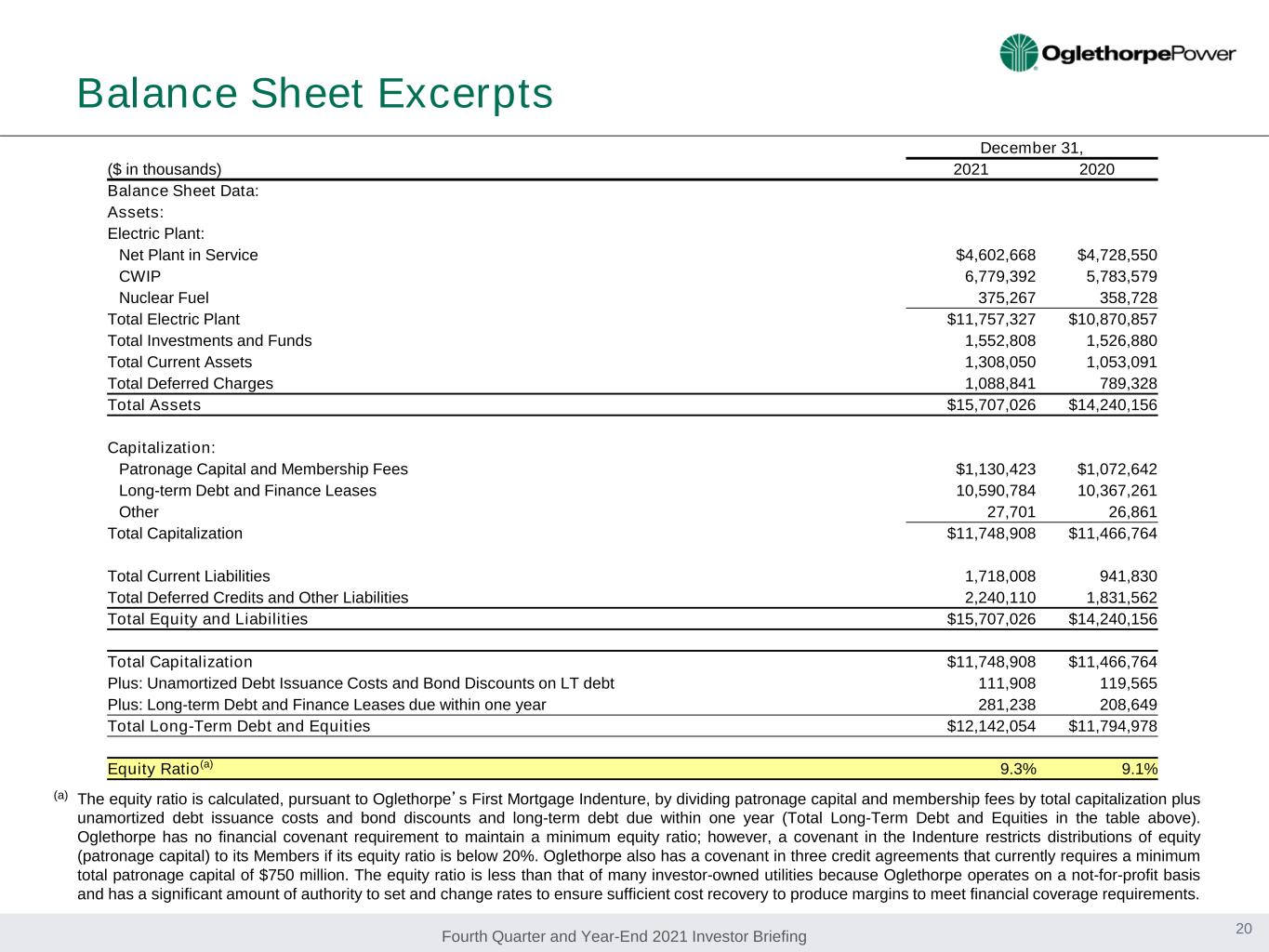

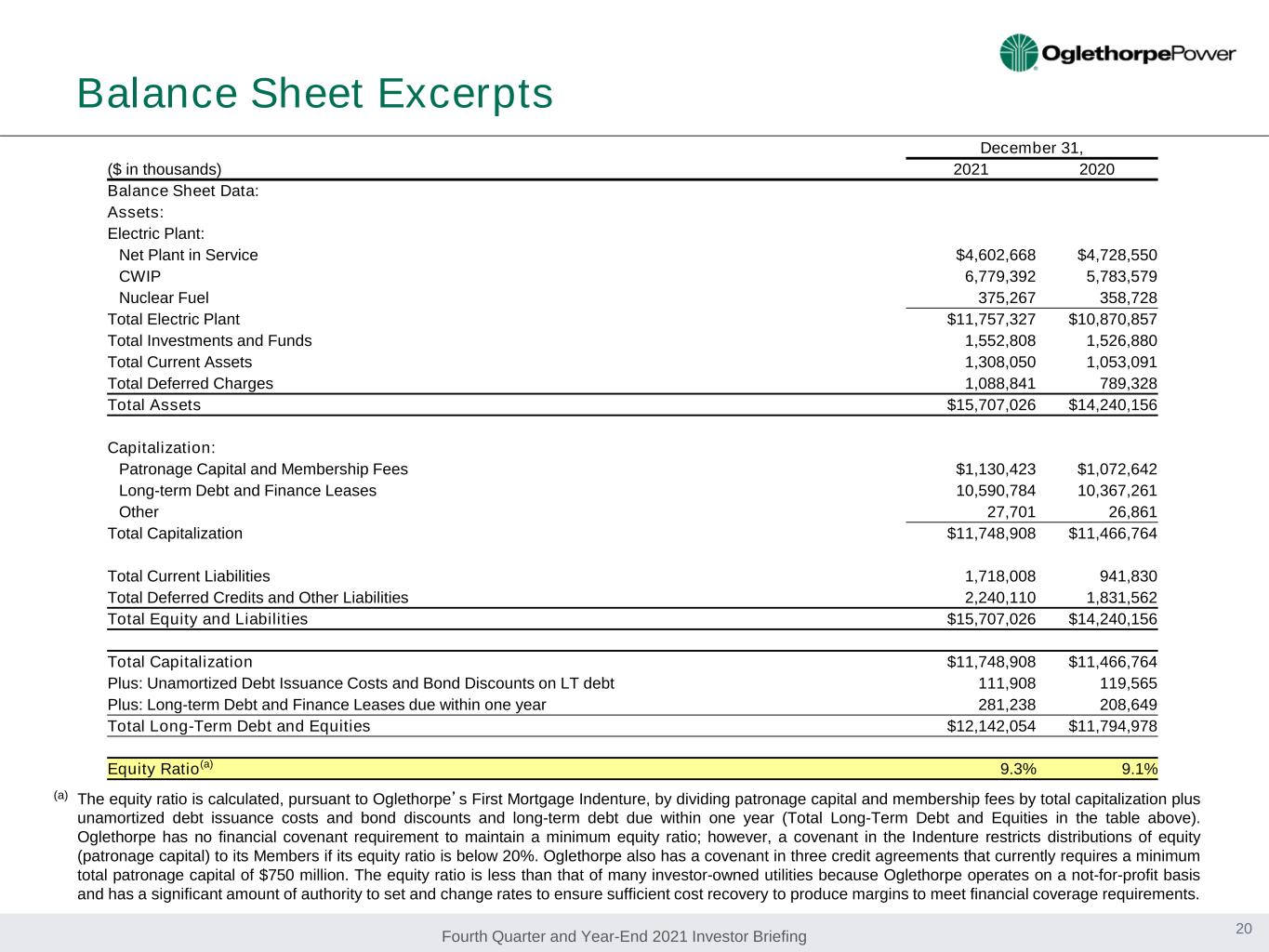

Fourth Quarter and Year-End 2021 Investor Briefing Balance Sheet Excerpts (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has a covenant in three credit agreements that currently requires a minimum total patronage capital of $750 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. 20 December 31, ($ in thousands) 2021 2020 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $4,602,668 $4,728,550 CWIP 6,779,392 5,783,579 Nuclear Fuel 375,267 358,728 Total Electric Plant $11,757,327 $10,870,857 Total Investments and Funds 1,552,808 1,526,880 Total Current Assets 1,308,050 1,053,091 Total Deferred Charges 1,088,841 789,328 Total Assets $15,707,026 $14,240,156 Capitalization: Patronage Capital and Membership Fees $1,130,423 $1,072,642 Long-term Debt and Finance Leases 10,590,784 10,367,261 Other 27,701 26,861 Total Capitalization $11,748,908 $11,466,764 Total Current Liabilities 1,718,008 941,830 Total Deferred Credits and Other Liabilities 2,240,110 1,831,562 Total Equity and Liabilities $15,707,026 $14,240,156 Total Capitalization $11,748,908 $11,466,764 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 111,908 119,565 Plus: Long-term Debt and Finance Leases due within one year 281,238 208,649 Total Long-Term Debt and Equities $12,142,054 $11,794,978 Equity Ratio(a) 9.3% 9.1%

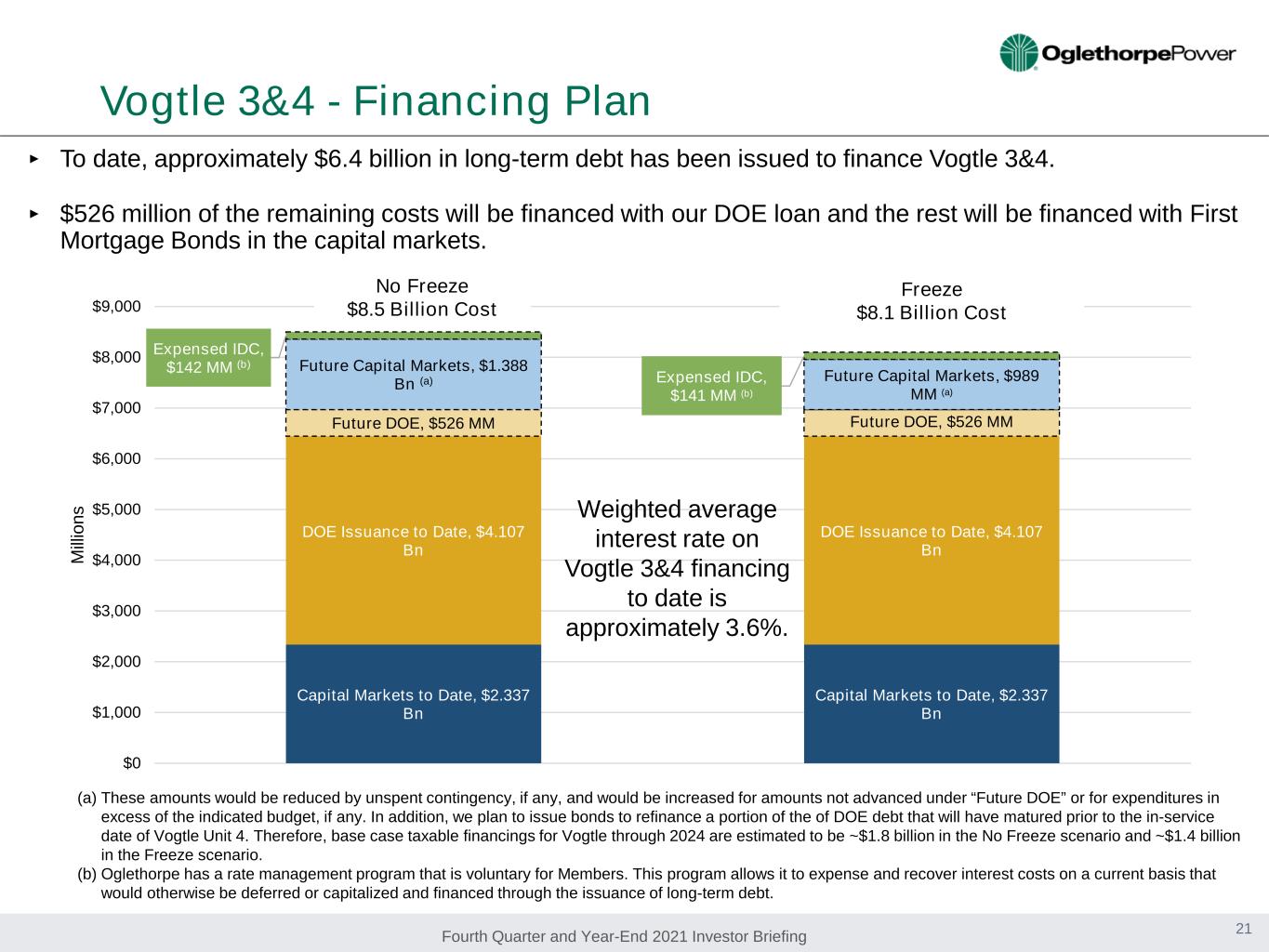

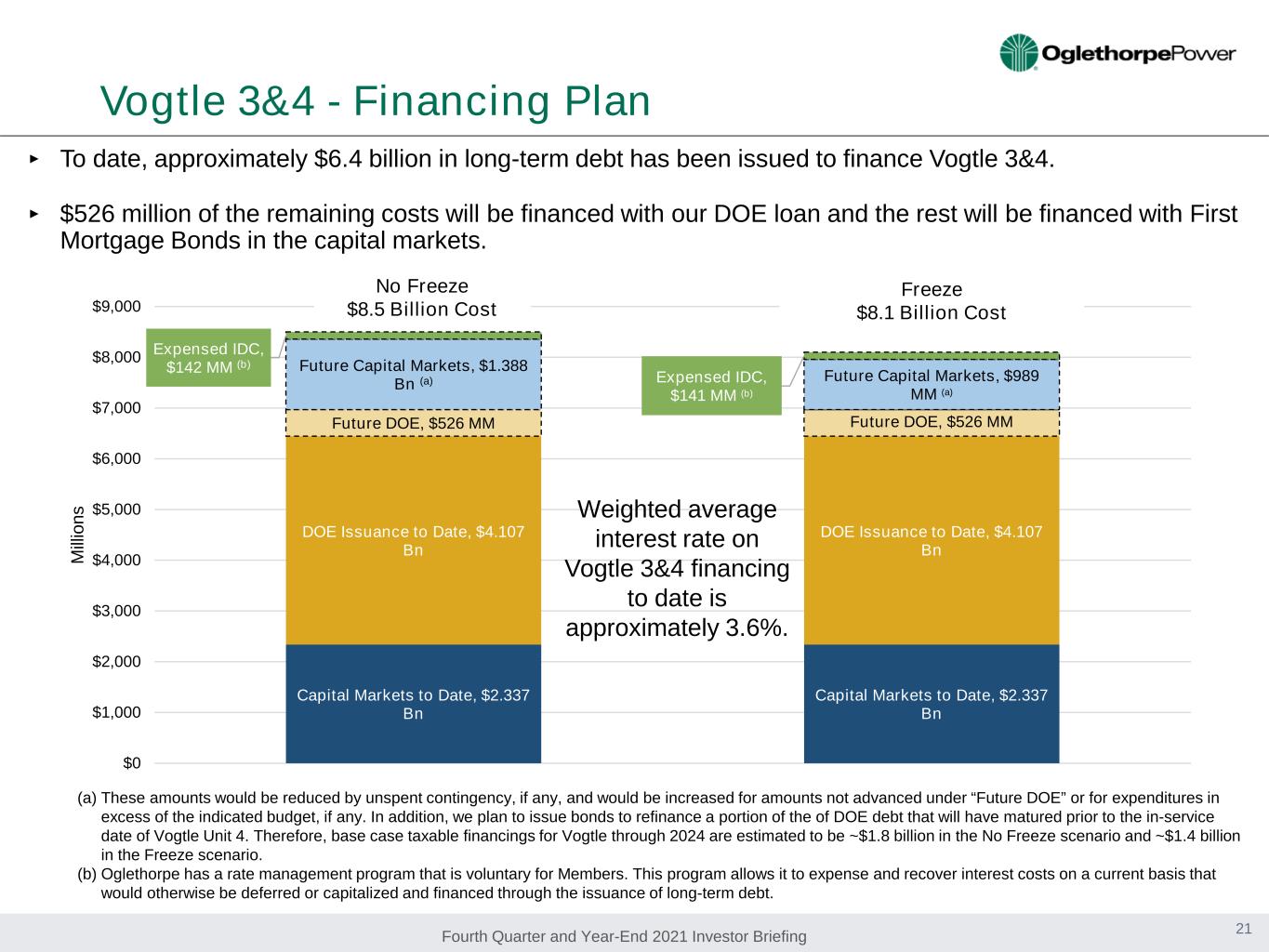

Fourth Quarter and Year-End 2021 Investor Briefing Capital Markets to Date, $2.337 Bn Capital Markets to Date, $2.337 Bn DOE Issuance to Date, $4.107 Bn DOE Issuance to Date, $4.107 Bn Future DOE, $526 MM Future DOE, $526 MM Future Capital Markets, $1.388 Bn (a) Future Capital Markets, $989 MM (a) Expensed IDC, $142 MM (b) Expensed IDC, $141 MM (b) $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 M illi on s Vogtle 3&4 - Financing Plan 21 (a) These amounts would be reduced by unspent contingency, if any, and would be increased for amounts not advanced under “Future DOE” or for expenditures in excess of the indicated budget, if any. In addition, we plan to issue bonds to refinance a portion of the of DOE debt that will have matured prior to the in-service date of Vogtle Unit 4. Therefore, base case taxable financings for Vogtle through 2024 are estimated to be ~$1.8 billion in the No Freeze scenario and ~$1.4 billion in the Freeze scenario. (b) Oglethorpe has a rate management program that is voluntary for Members. This program allows it to expense and recover interest costs on a current basis that would otherwise be deferred or capitalized and financed through the issuance of long-term debt. ‣ To date, approximately $6.4 billion in long-term debt has been issued to finance Vogtle 3&4. ‣ $526 million of the remaining costs will be financed with our DOE loan and the rest will be financed with First Mortgage Bonds in the capital markets. No Freeze $8.5 Billion Cost Freeze $8.1 Billion Cost Weighted average interest rate on Vogtle 3&4 financing to date is approximately 3.6%.

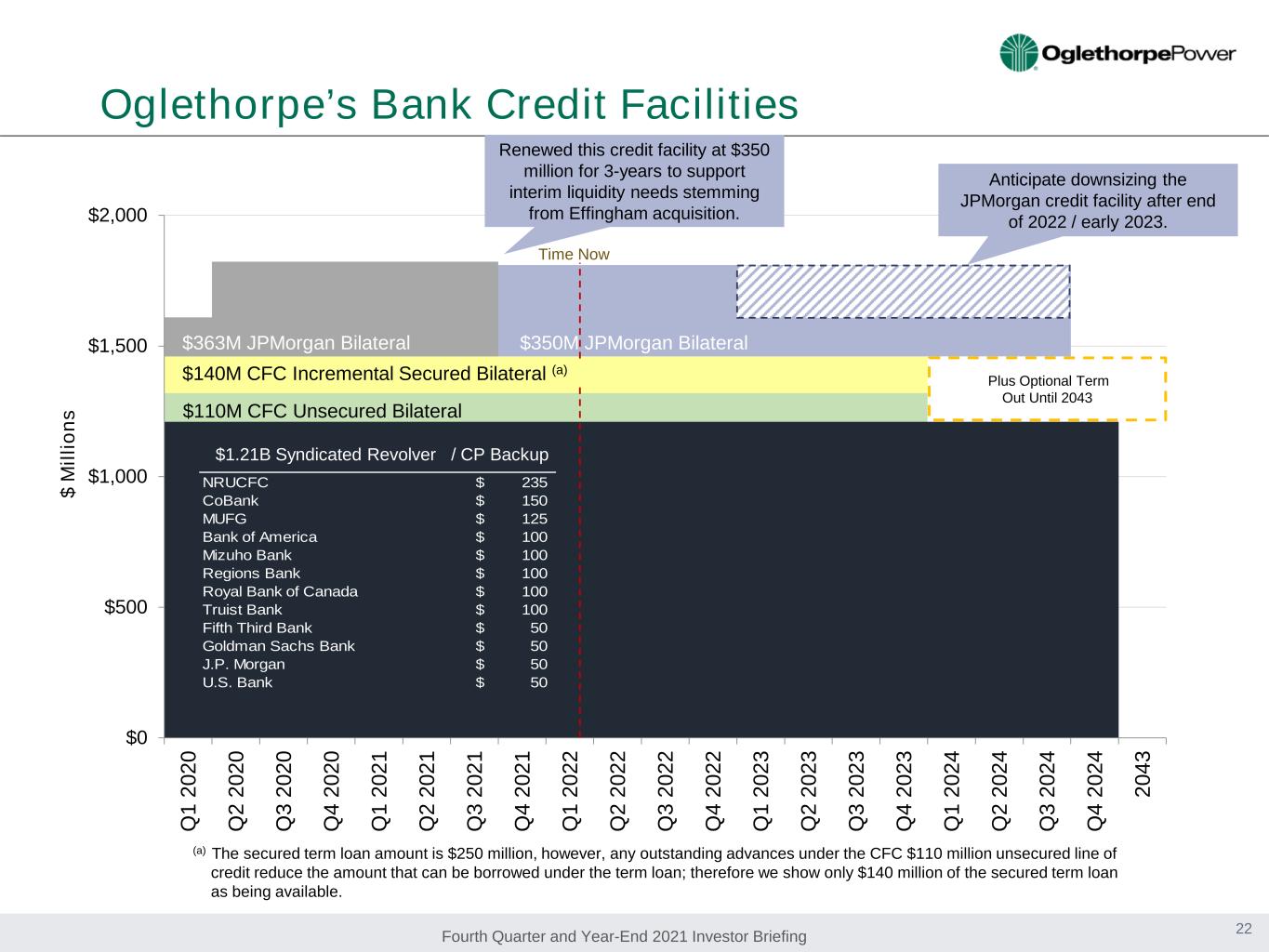

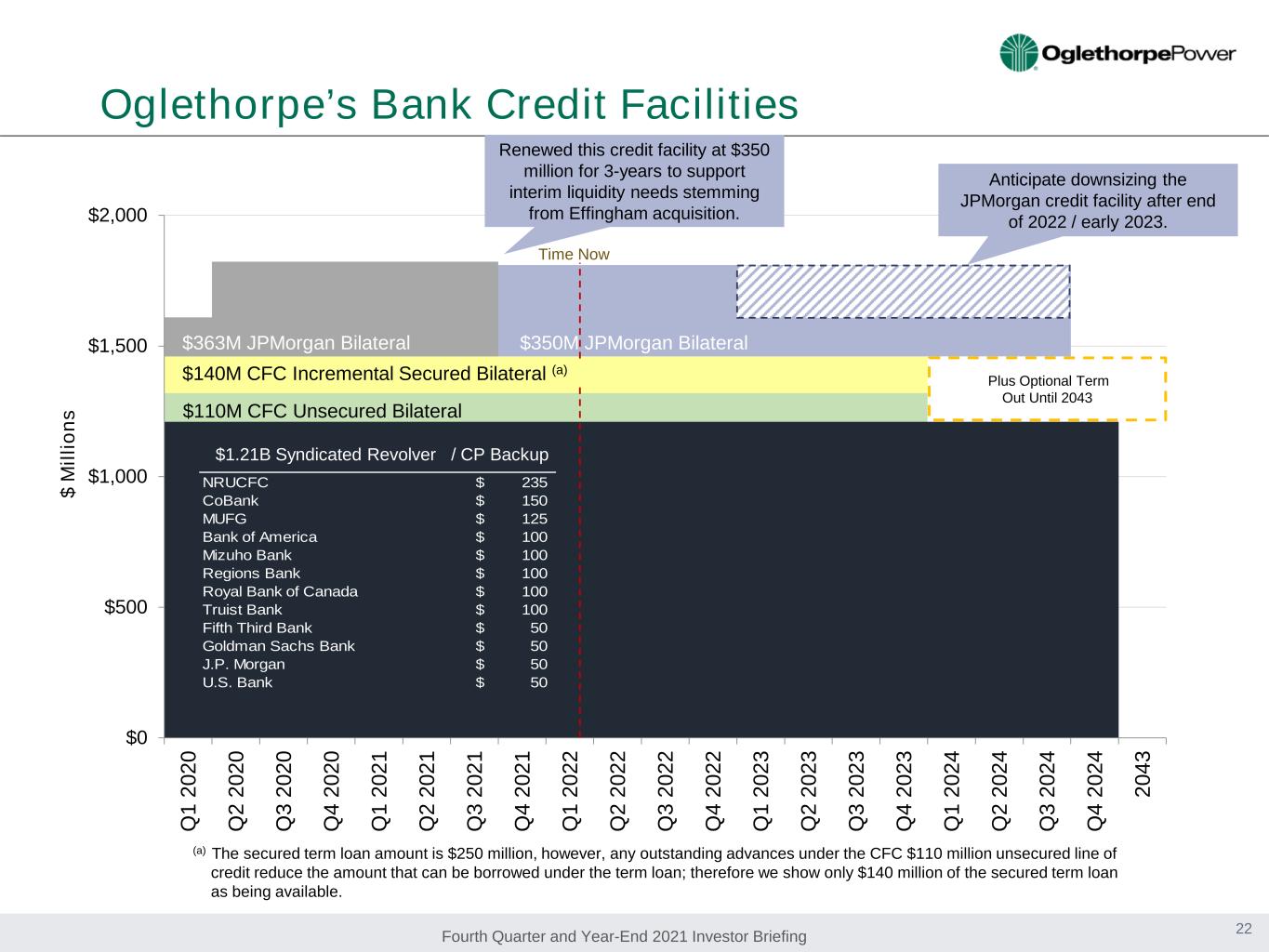

Fourth Quarter and Year-End 2021 Investor Briefing $0 $500 $1,000 $1,500 $2,000 Q 1 20 20 Q 2 20 20 Q 3 20 20 Q 4 20 20 Q 1 20 21 Q 2 20 21 Q 3 20 21 Q 4 20 21 Q 1 20 22 Q 2 20 22 Q 3 20 22 Q 4 20 22 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 23 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 20 24 20 43 $ M ill io ns Oglethorpe’s Bank Credit Facilities Time Now (a) The secured term loan amount is $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. Plus Optional Term Out Until 2043 NRUCFC 235$ CoBank 150$ MUFG 125$ Bank of America 100$ Mizuho Bank 100$ Regions Bank 100$ Royal Bank of Canada 100$ Truist Bank 100$ Fifth Third Bank 50$ Goldman Sachs Bank 50$ J.P. Morgan 50$ U.S. Bank 50$ $1.21B Syndicated Revolver / CP Backup $110M CFC Unsecured Bilateral $363M JPMorgan Bilateral 22 Renewed this credit facility at $350 million for 3-years to support interim liquidity needs stemming from Effingham acquisition. $140M CFC Incremental Secured Bilateral (a) Anticipate downsizing the JPMorgan credit facility after end of 2022 / early 2023. $350M JPMorgan Bilateral

Fourth Quarter and Year-End 2021 Investor Briefing $1,810 $1,274 $536 $447 $984 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ M ill io ns Oglethorpe’s Available Liquidity as of March 18, 2022 Borrowings Detail $3 million – Outstanding Letters of Credit for Operational Needs $26 million - CP for Vogtle Hedging $264 million - CP for Vogtle DOE Loan Payments $235 million – CP and Line of Credit Borrowings for Effingham Interim Financing $746 million - CP for Vogtle Interim Financing Represents 356 days of liquidity on hand (excluding Cushion of Credit) (a) In addition, as of March 18, Oglethorpe had $258 million on deposit in the RUS Cushion of Credit Account. The RUS Cushion of Credit Account is designated as restricted investments and can only be used to pay debt service on RUS guaranteed loans. (a) 23

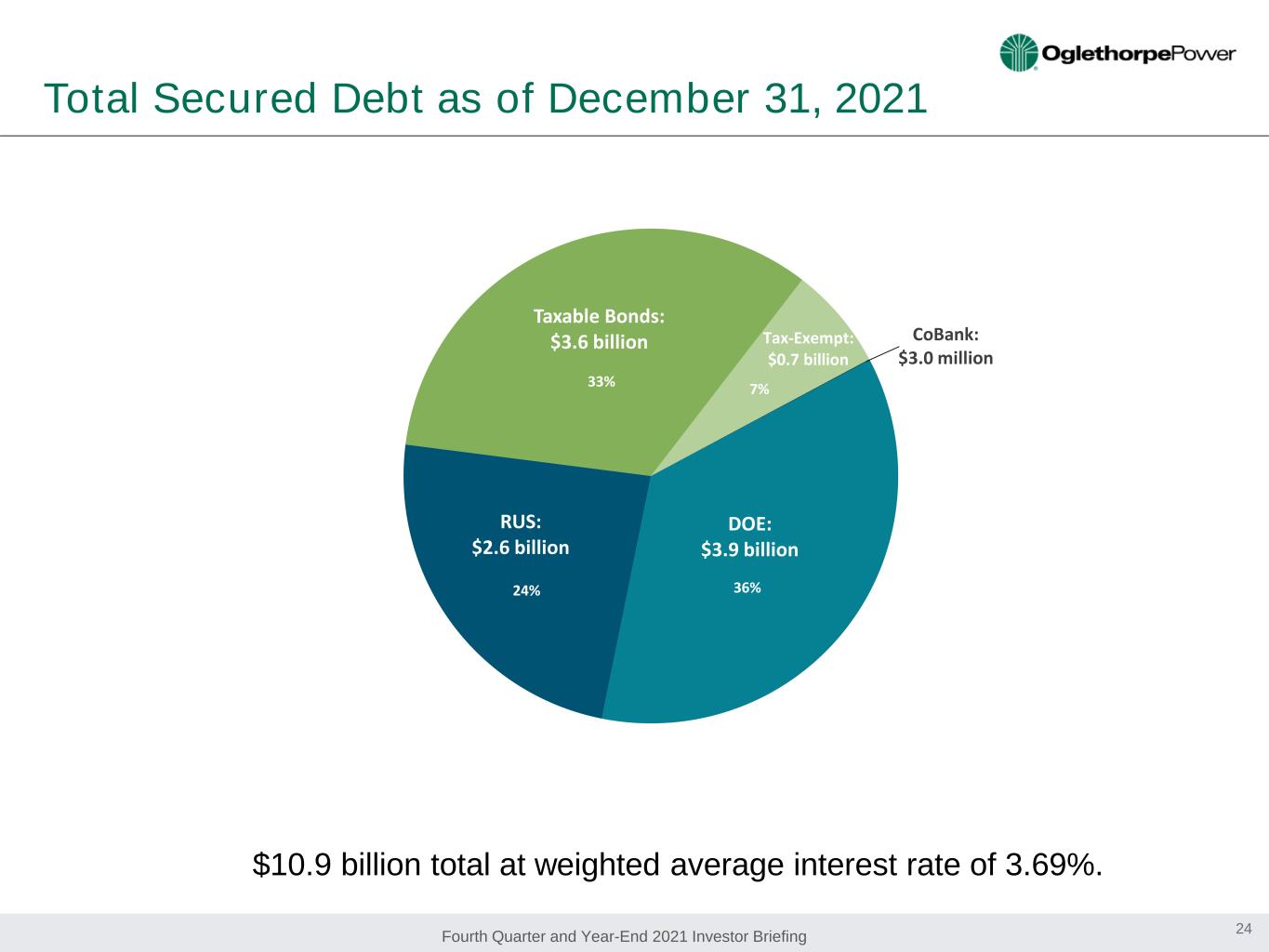

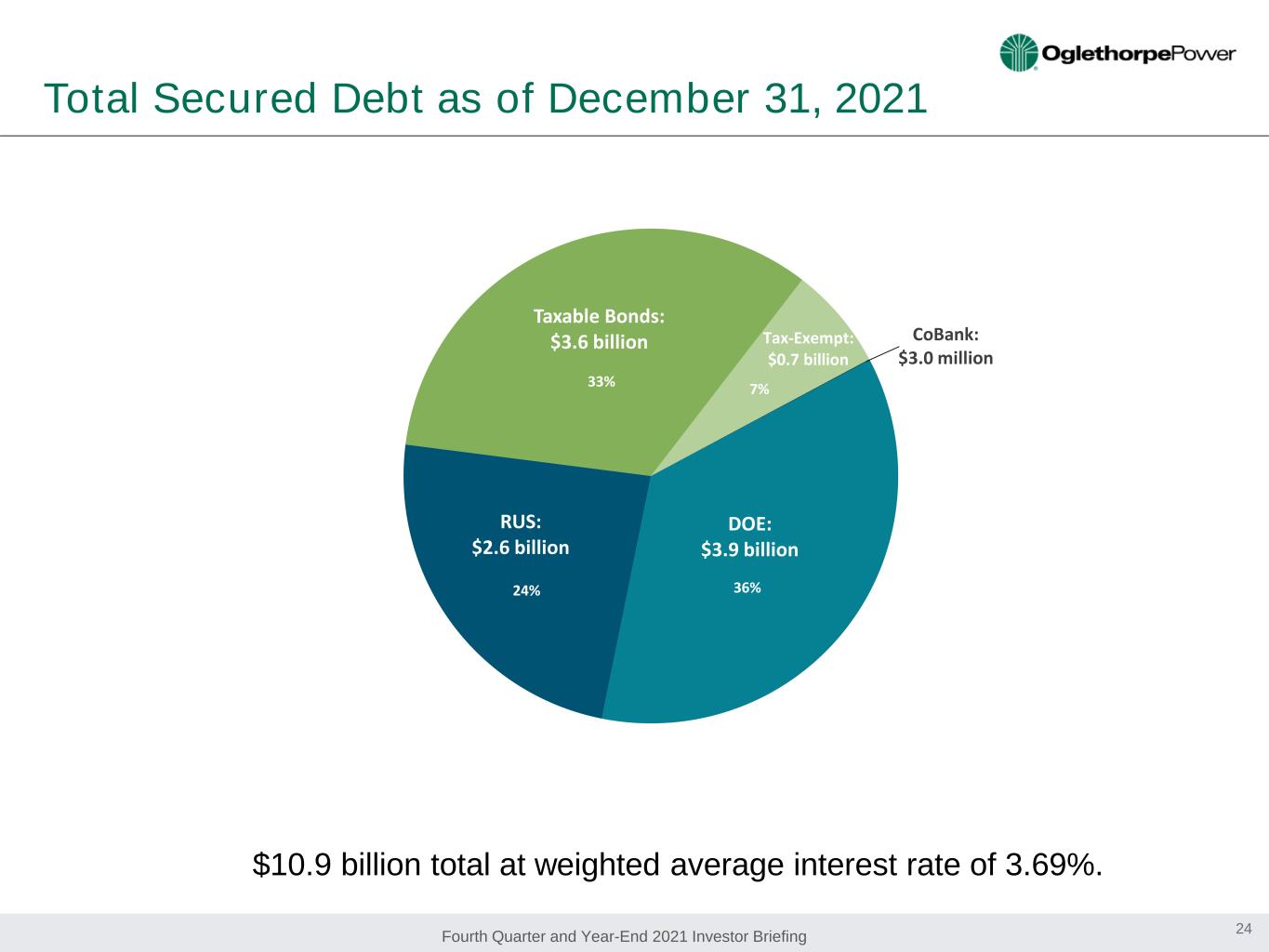

Fourth Quarter and Year-End 2021 Investor Briefing Total Secured Debt as of December 31, 2021 24 $10.9 billion total at weighted average interest rate of 3.69%. DOE: $3.9 billion RUS: $2.6 billion Taxable Bonds: $3.6 billion Tax-Exempt: $0.7 billion CoBank: $3.0 million 33% 24% 36% 7%

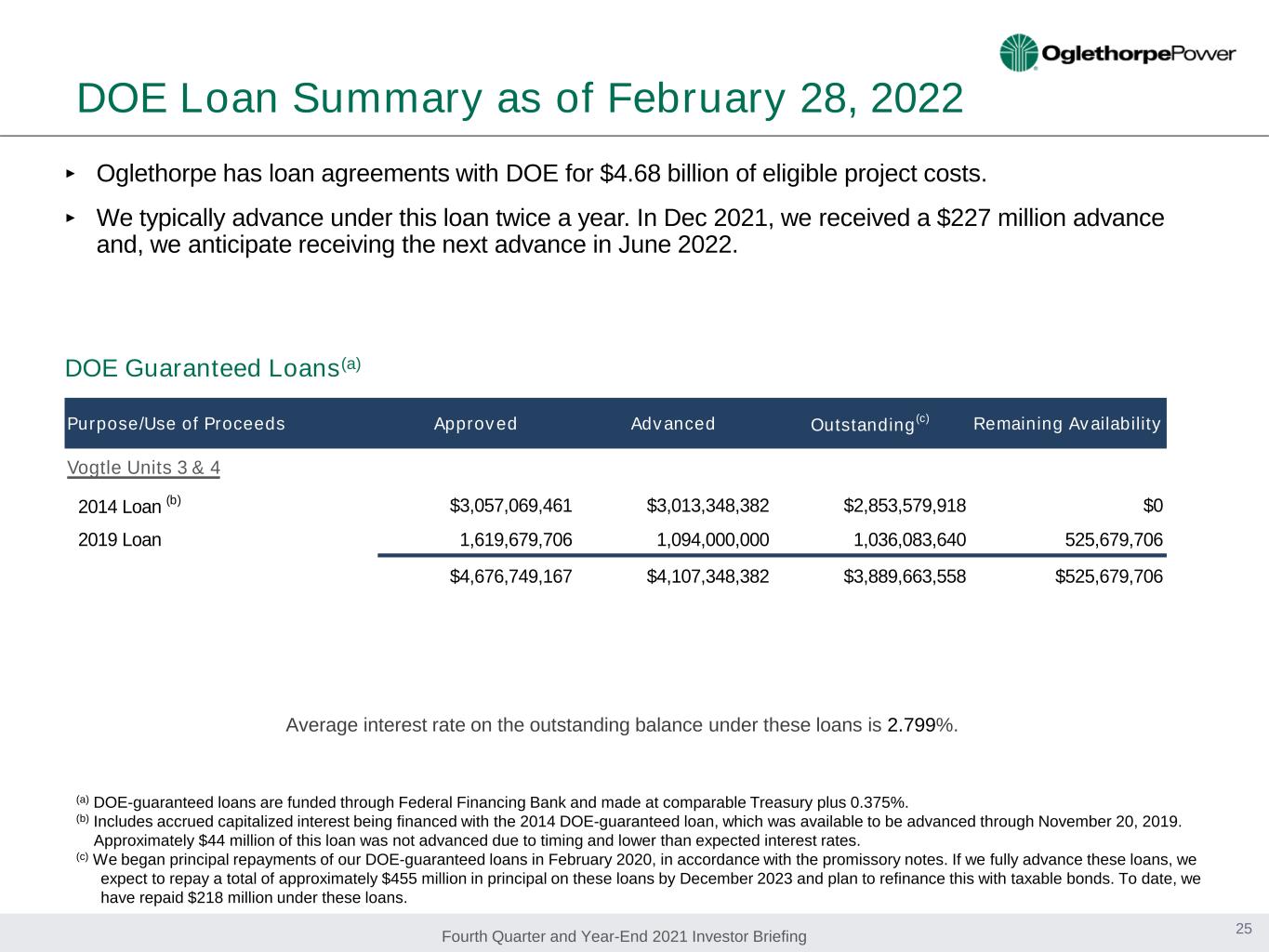

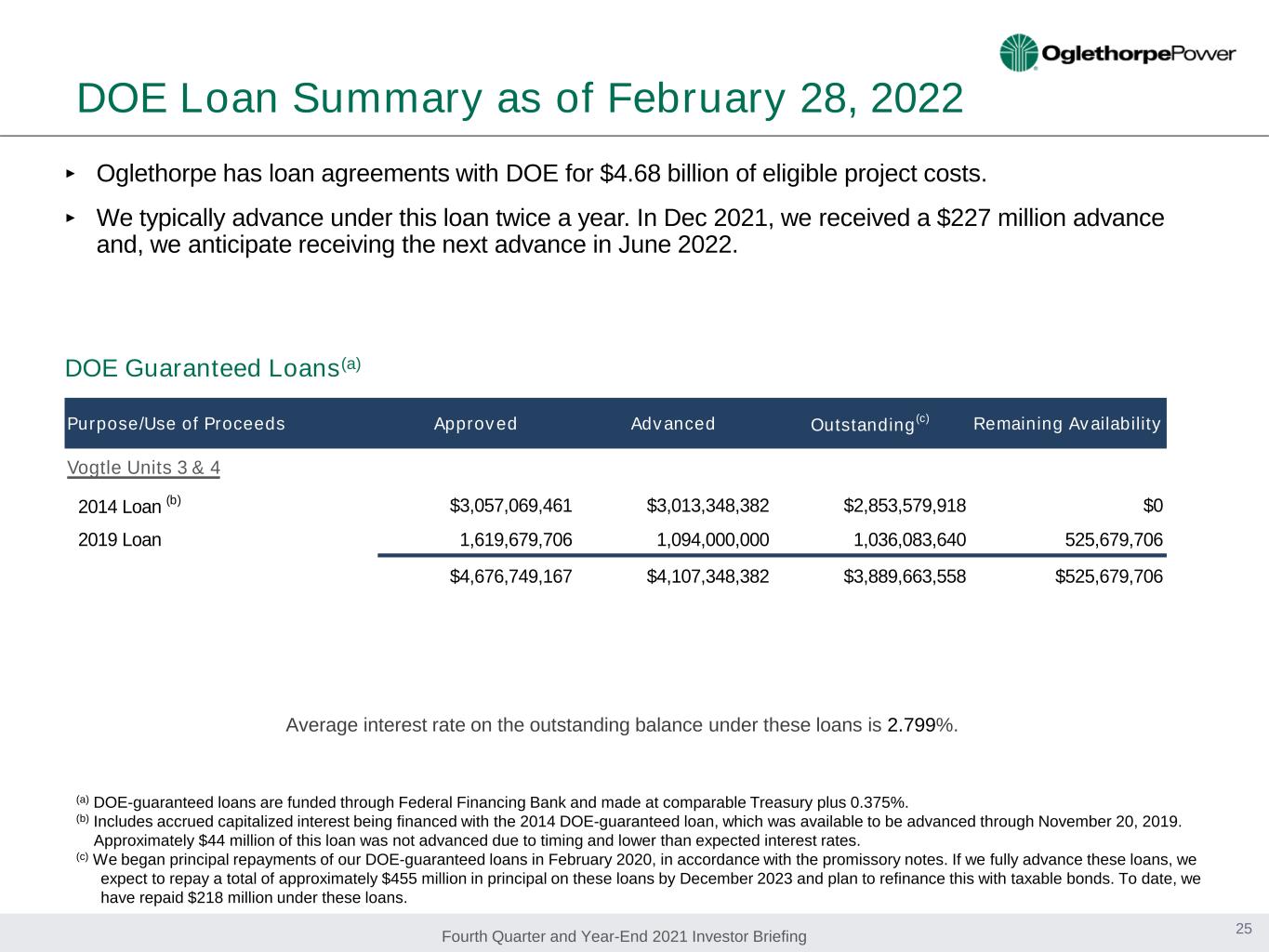

Fourth Quarter and Year-End 2021 Investor Briefing ‣ Oglethorpe has loan agreements with DOE for $4.68 billion of eligible project costs. ‣ We typically advance under this loan twice a year. In Dec 2021, we received a $227 million advance and, we anticipate receiving the next advance in June 2022. DOE Loan Summary as of February 28, 2022 DOE Guaranteed Loans(a) Average interest rate on the outstanding balance under these loans is 2.799%. (a) DOE-guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.375%. (b) Includes accrued capitalized interest being financed with the 2014 DOE-guaranteed loan, which was available to be advanced through November 20, 2019. Approximately $44 million of this loan was not advanced due to timing and lower than expected interest rates. (c) We began principal repayments of our DOE-guaranteed loans in February 2020, in accordance with the promissory notes. If we fully advance these loans, we expect to repay a total of approximately $455 million in principal on these loans by December 2023 and plan to refinance this with taxable bonds. To date, we have repaid $218 million under these loans. 25 Purpose/Use of Proceeds Approved Advanced Outstanding(c) Remaining Availability Vogtle Units 3 & 4 2014 Loan (b) $3,057,069,461 $3,013,348,382 $2,853,579,918 $0 2019 Loan 1,619,679,706 1,094,000,000 1,036,083,640 525,679,706 $4,676,749,167 $4,107,348,382 $3,889,663,558 $525,679,706

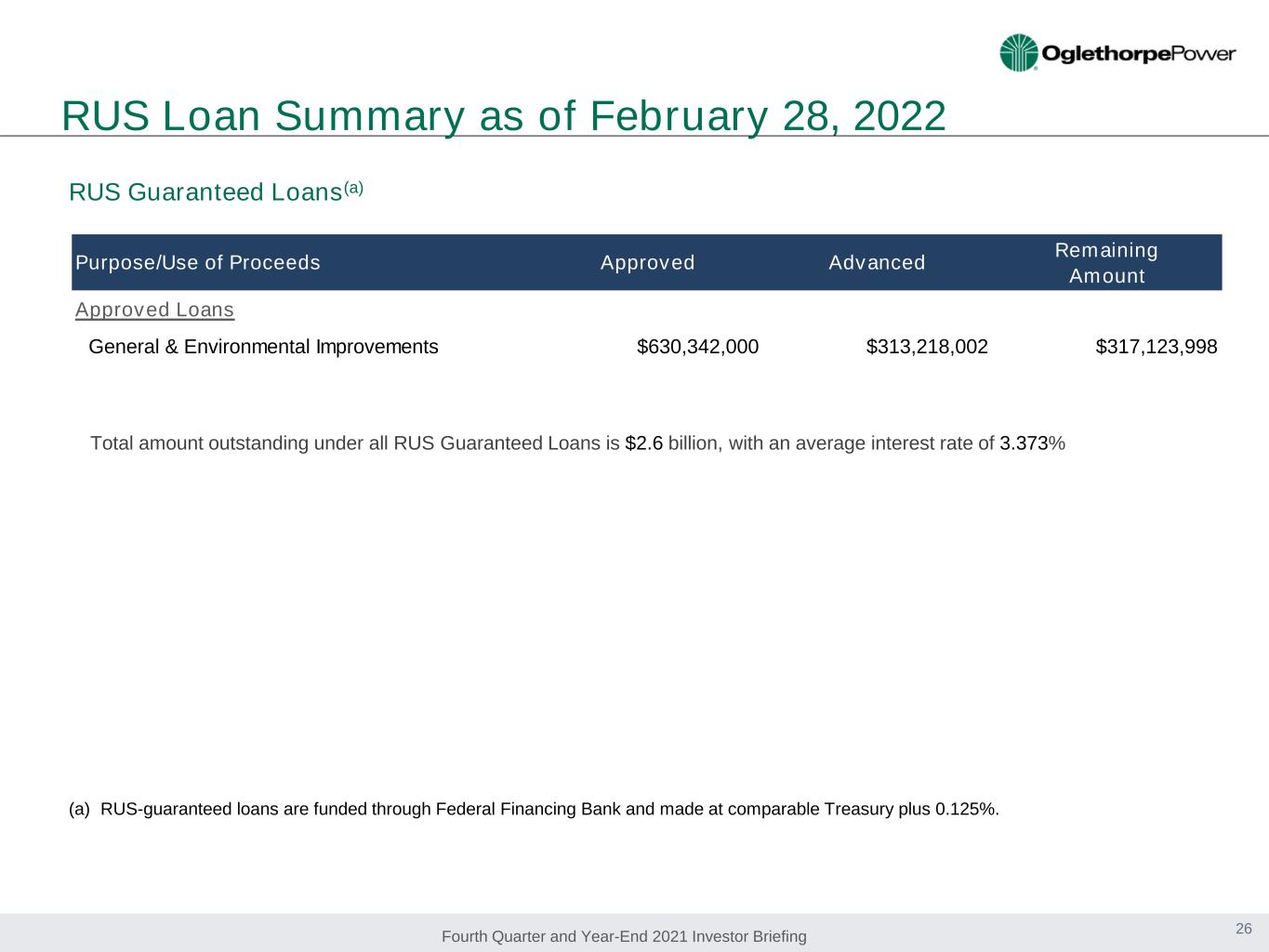

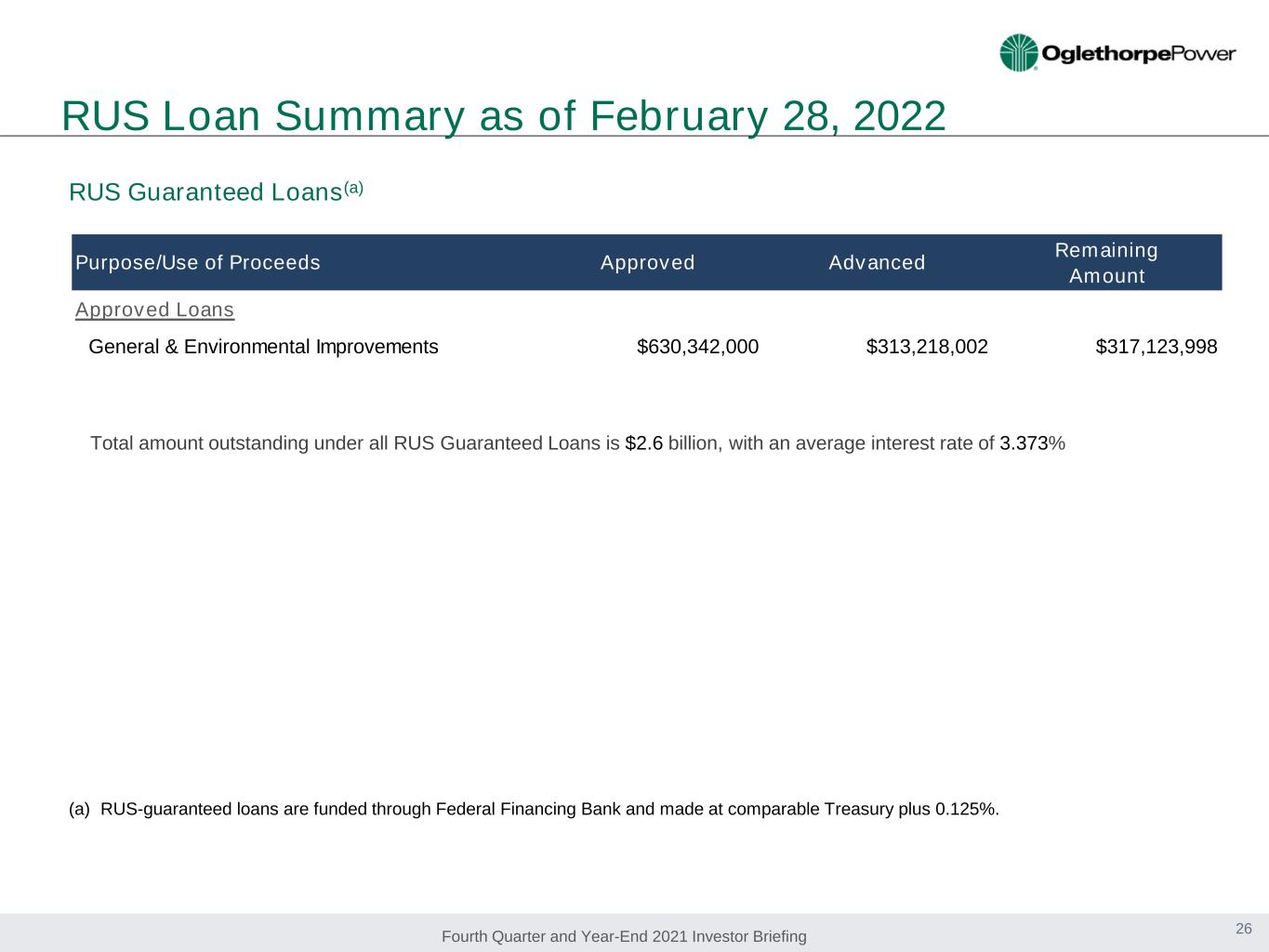

Fourth Quarter and Year-End 2021 Investor Briefing Total amount outstanding under all RUS Guaranteed Loans is $2.6 billion, with an average interest rate of 3.373% RUS Guaranteed Loans(a) (a) RUS-guaranteed loans are funded through Federal Financing Bank and made at comparable Treasury plus 0.125%. 26 RUS Loan Summary as of February 28, 2022 Purpose/Use of Proceeds Approved Advanced Remaining Amount Approved Loans General & Environmental Improvements $630,342,000 $313,218,002 $317,123,998

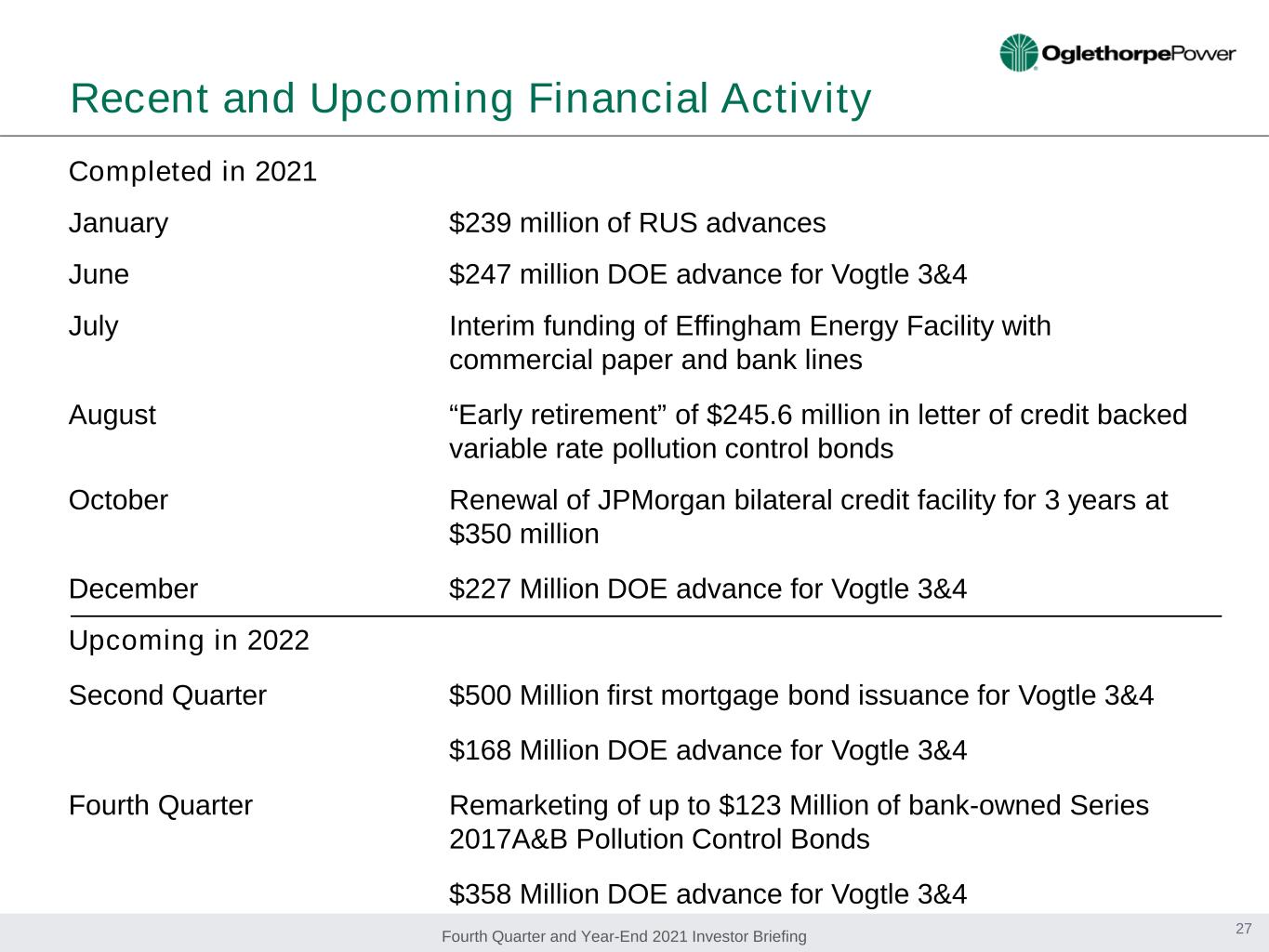

Fourth Quarter and Year-End 2021 Investor Briefing Recent and Upcoming Financial Activity Completed in 2021 January $239 million of RUS advances June $247 million DOE advance for Vogtle 3&4 July Interim funding of Effingham Energy Facility with commercial paper and bank lines August “Early retirement” of $245.6 million in letter of credit backed variable rate pollution control bonds October Renewal of JPMorgan bilateral credit facility for 3 years at $350 million December $227 Million DOE advance for Vogtle 3&4 Upcoming in 2022 Second Quarter $500 Million first mortgage bond issuance for Vogtle 3&4 $168 Million DOE advance for Vogtle 3&4 Fourth Quarter Remarketing of up to $123 Million of bank-owned Series 2017A&B Pollution Control Bonds $358 Million DOE advance for Vogtle 3&4 27

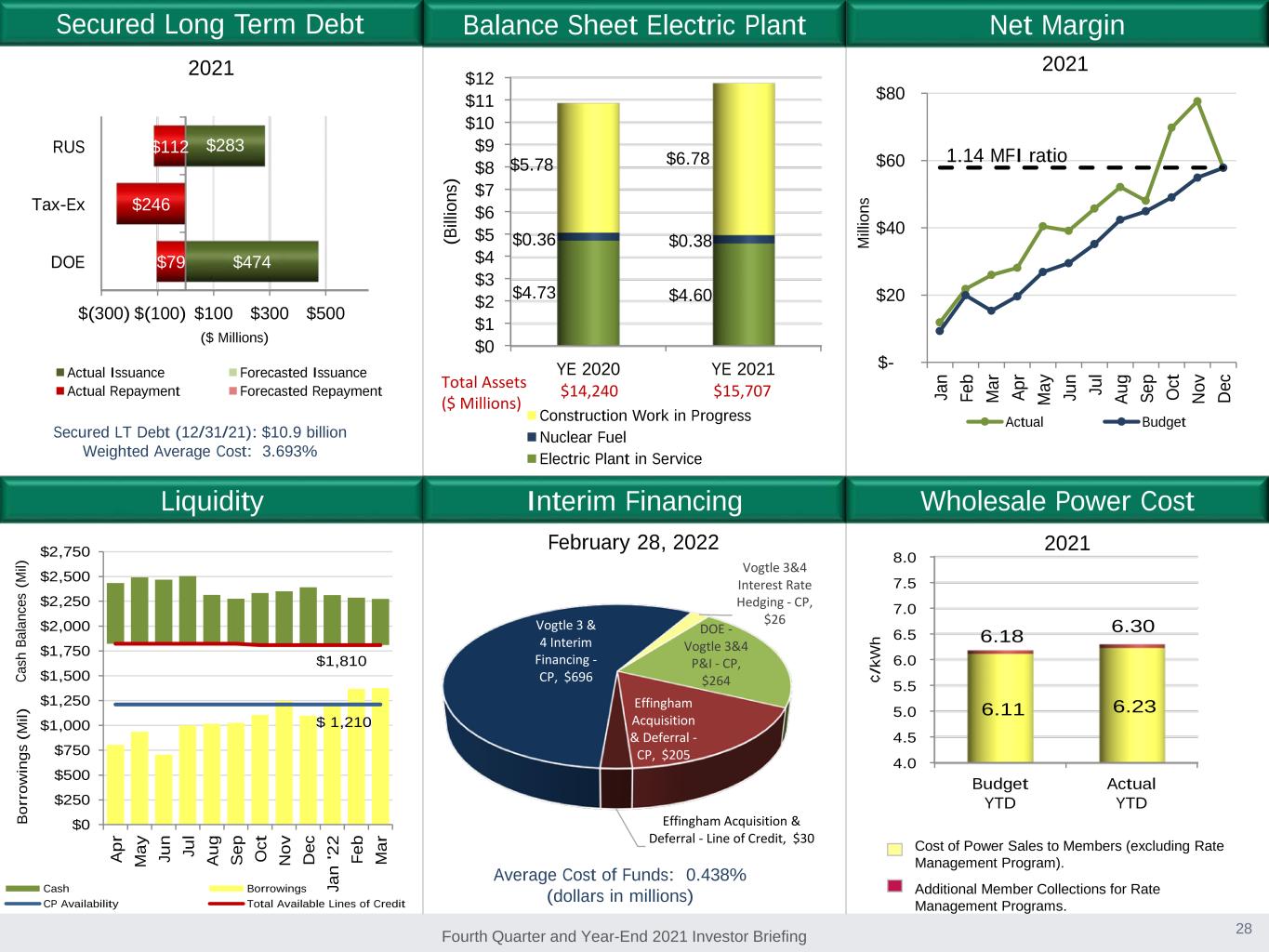

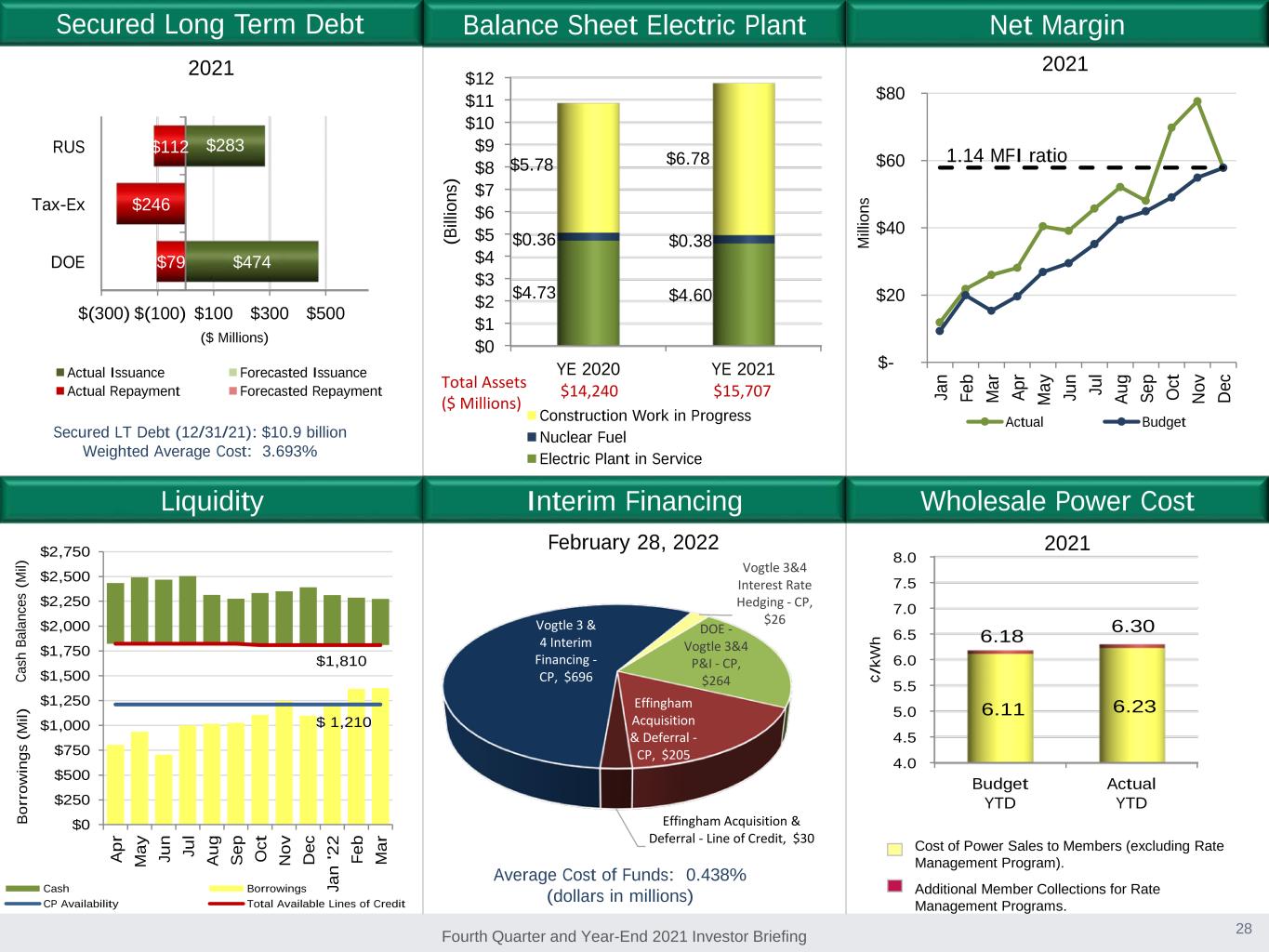

Fourth Quarter and Year-End 2021 Investor Briefing 4.0 4.5 5.0 5.5 6.0 6.5 7.0 7.5 8.0 Budget YTD Actual YTD 6.11 6.23 6.18 6.30 ¢/ kW h $ 1,210 $1,810 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 A pr M ay Ju n Ju l A ug S ep O ct N ov D ec Ja n '2 2 Fe b M ar B or ro w in gs ( M il) Cash Borrowings CP Availability Total Available Lines of Credit Ca sh B al an ce s (M il) $- $20 $40 $60 $80 Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c M illi on s Actual Budget Net Margin Liquidity Wholesale Power CostInterim Financing Balance Sheet Electric Plant Average Cost of Funds: 0.438% (dollars in millions) Secured LT Debt (12/31/21): $10.9 billion Weighted Average Cost: 3.693% 2021 February 28, 2022 2021 Cost of Power Sales to Members (excluding Rate Management Program). Additional Member Collections for Rate Management Programs. 2021 Secured Long Term Debt 28 1.14 MFI ratio Vogtle 3&4 Interest Rate Hedging - CP, $26 DOE - Vogtle 3&4 P&I - CP, $264 Effingham Acquisition & Deferral - CP, $205 Effingham Acquisition & Deferral - Line of Credit, $30 Vogtle 3 & 4 Interim Financing - CP, $696 $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 YE 2020 YE 2021 $4.73 $4.60 $0.36 $0.38 $5.78 $6.78 (B illi on s) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $14,240 $15,707 $(300) $(100) $100 $300 $500 DOE Tax-Ex RUS $474 $283 $79 $246 $112 ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment

Fourth Quarter and Year-End 2021 Investor Briefing Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Terri Statham Manager, Media Relations terri.statham@opc.com 770-270-6990 • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Oglethorpe’s ESG Report along with its qualitative and quantitative EEI ESG/Sustainability Reports are available on its website. • Member information is filed as an exhibit to Form 10-Q for the first quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) • For additional information please contact: Additional Information 29