Second Quarter 2024 Investor Briefing August 22, 2024

Second Quarter 2024 Investor Briefing Notice to Recipients Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe” or “OPC”), that are not historical facts are forward-looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward- looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION” and “RISK FACTORS” in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024, filed with the Securities and Exchange Commission on August 14, 2024, “RISK FACTORS” in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed with the Securities and Exchange Commission on May 13, 2024, and “ITEM 1A - RISK FACTORS” in our Annual Report on Form10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission on March 25, 2024. This electronic presentation is provided as of August 22, 2024. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. 2

Second Quarter 2024 Investor Briefing ‣ 50th Anniversary of Oglethorpe Power ‣ Future Generation ‣ Operations Update ‣ Financial and Liquidity Update Presenters and Agenda Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3 David Sorrick Executive Vice President and Chief Operating Officer

Second Quarter 2024 Investor Briefing 50th Anniversary of Oglethorpe Power ‣ Oglethorpe Power was founded on August 8, 1974 with a vision to provide reliable and affordable electricity to rural communities across Georgia. ‣ Today, serving our 38 Member EMCs, we are one of the largest energy producers in Georgia and the largest generation cooperative in the United States by assets, by ultimate number of consumers served and by kilowatt-hours of electricity generated. ‣ Our skilled workforce has adapted and thrived through decades of economic shifts and technological advancements. ‣ Over the years, we have made significant strides 4 in sustainability, financial and operational sophistication and technological innovation. ‣ As we look to the next 50 years, our strategic generation investments, commitment to reliable and affordable electric service and dedication to a cleaner energy future will ensure that we are well-positioned to meet our Members’ expanding and evolving energy needs.

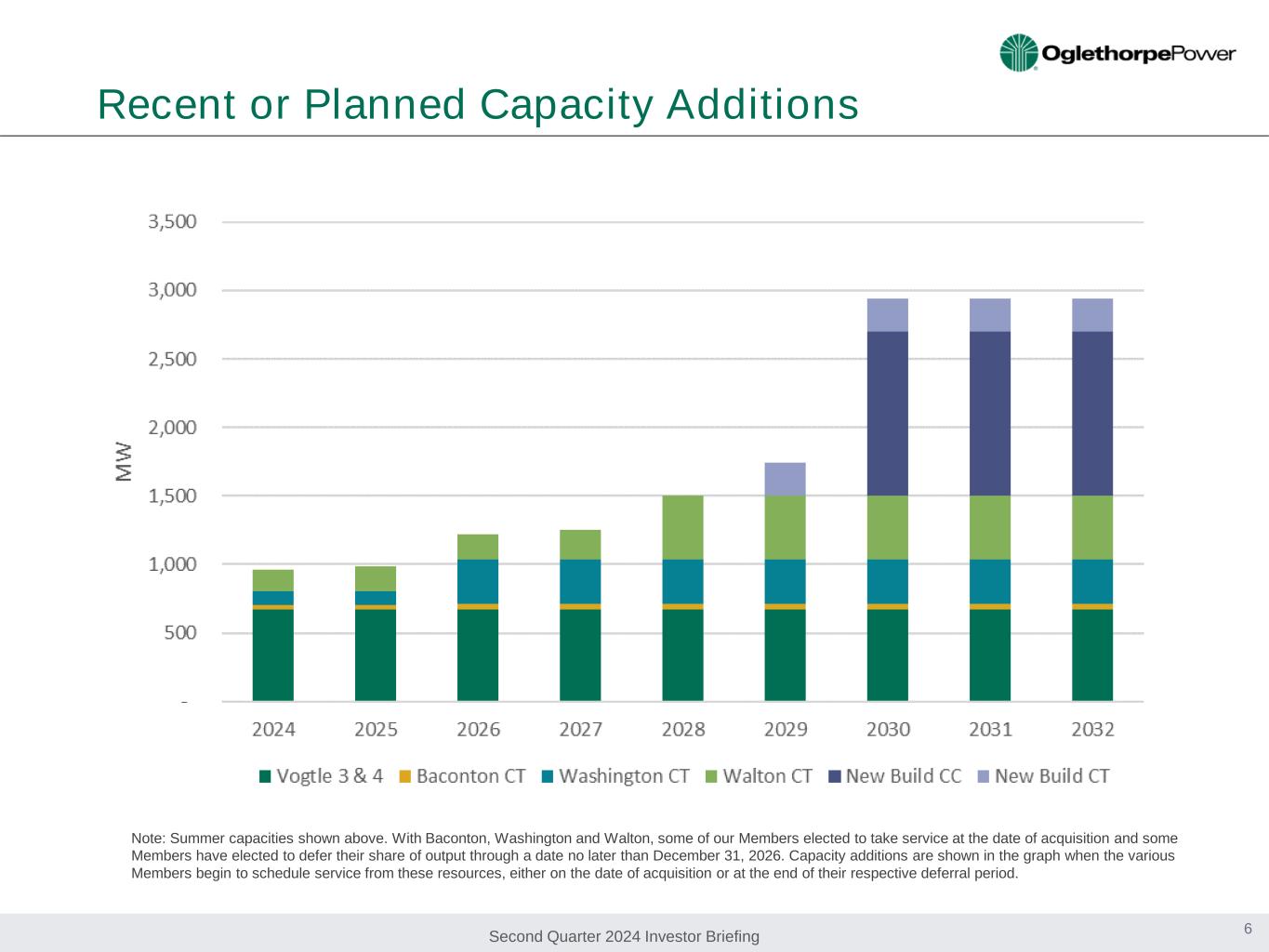

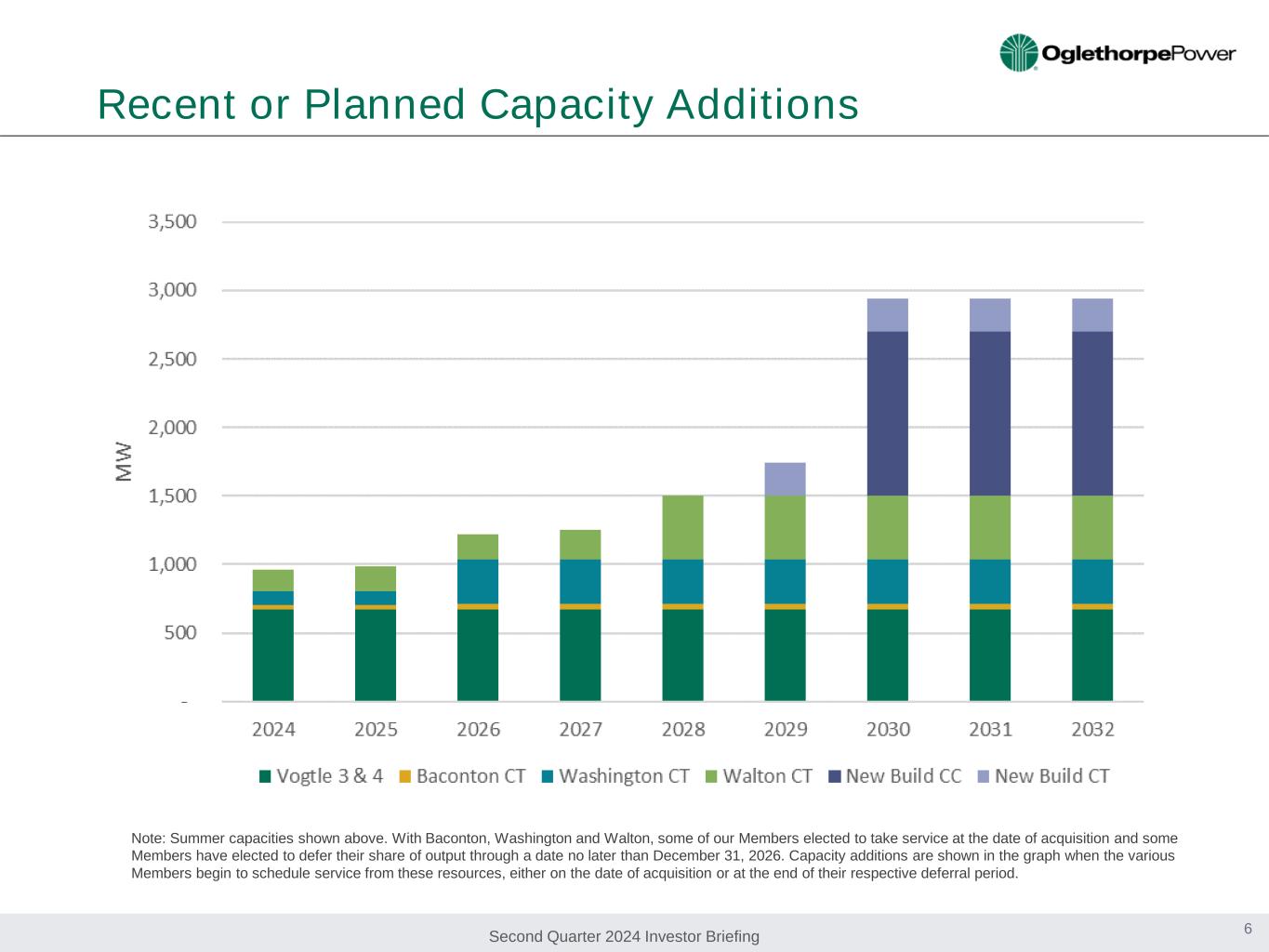

Second Quarter 2024 Investor Briefing Future Power Resources ‣ Oglethorpe and its Members plan to add approximately 1,500 megawatts of additional gas generation capacity through construction of new assets. • This will consist of approximately 1,200 MW of combined cycle units in Monroe County, Georgia and an approximately 240 MW combustion turbine unit in Talbot County, Georgia. • These new resources are fully subscribed by Oglethorpe’s Members and have been approved by its Members and Board of Directors. • These new units are projected to be online in 2029. • Construction costs are estimated to be $2.1 billion. ‣ Oglethorpe has also secured additional natural gas transportation through Southern Natural Gas to serve the new combined cycle units at Smarr and additional firm transportation for our BC Smith Energy Facility. ‣ Oglethorpe and its Members may also continue to evaluate and consider additional generation beyond these resources in the future. 5

Second Quarter 2024 Investor Briefing Recent or Planned Capacity Additions 6 Note: Summer capacities shown above. With Baconton, Washington and Walton, some of our Members elected to take service at the date of acquisition and some Members have elected to defer their share of output through a date no later than December 31, 2026. Capacity additions are shown in the graph when the various Members begin to schedule service from these resources, either on the date of acquisition or at the end of their respective deferral period.

Second Quarter 2024 Investor Briefing 46% 38% 12% 4% 48% 37% 11% 4% Oglethorpe’s Diversified Power Supply Portfolio (a) Capacity and energy include Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. (b) Capacity includes Walton County acquired June 2024. 2024 Capacity (MW) 9,325 MW (a) b) 7 2024 Energy (MWh) (July 2023 – June 2024) Member and Non-Member Sales 31.4 Million MWh Member Sales 30.7 Million MWh 60%20% 11% 9%

Second Quarter 2024 Investor Briefing 0% 25% 50% 75% 100% Hatch Vogtle 1&2 Vogtle 3&4 Scherer Chatt TASmith BCSmith Doyle Hawk Road Hartwell Talbot Baconton Washington Rocky Mountain 2023 2024 Capacity Factor Comparison Through June 30 Nuclear Coal Gas - CC Gas - CT Pumped Storage Hydro 8 (a) Vogtle Unit 3 was placed in service July 31, 2023, and Vogtle Unit 4 was placed in service on April 29, 2024. Therefore, neither unit was available in Q1 or Q2 2023. 2024 capacity factor represents the weighted average capacity factor for Unit 3 through June 30 and for Unit 4 from its in-service date through June 30. (b) Washington was acquired in December 2022 and its output was sold off-system under a tolling agreement with Georgia Power through May 31, 2024. Capacity factor for 2023 is therefore not shown. 2024 capacity factor shown is from January 1 through June 30. (a) (b)

Second Quarter 2024 Investor Briefing - 2,000 4,000 6,000 8,000 10,000 12,000 2018 2019 2020 2021 2022 2023 2024 Winter Peak Summer Peak 2018 2019 2020 2021 2022 2023 2024 (Millions MWh) Members’ Historical Load 9 Member Demand Requirements Member Energy Requirements Percent Change (MW) Percent Change in Overall Peak Highest Overall/Winter Peak (2022) = 10,810 MW Highest Summer Peak (2024 YTD) = 10,094 MW Summer Peak (2024 Forecast) = 10,376 MW Winter Peak (2024 YTD) = 10,236 MW 2.7% 9.6% 16.4% -1.9% 6.0% 1.6% 7.0% 0.5% -2.9% -0.1% Projected 2024 YTD July 29 -2.0% 1.3% 6.2% -6.7% 2018 2019 2020 2021 2022 2023 2024 Days ≥ 90o 65 90 38 21 44 54 30 Days ≥ 95o 2 33 3 0 8 16 13 Days ≥ 100o 0 0 0 0 0 0 0 Low ≤ 25o 10 3 5 2 4 0 5

Second Quarter 2024 Investor Briefing Oglethorpe’s Generation and Power Supply Resources (a) Vogtle 3&4 planning capacity includes Unit 4 which came online April 29, 2024. 2023 capacity factor is estimate for Unit 3 after its in-service date of July 31 through December 31. (b) Washington County was acquired in December 2022 and its output was sold off-system under a tolling agreement with Georgia Power through May 31, 2024. Capacity factor for 2023 is therefore not shown. (c) Acquisition of Walton County Energy Facility closed June 28, 2024. The facility is currently operated by Cogentrix, but Oglethorpe plans to take over operations later this year. (d) Each of the Members, other than Flint, has designated Oglethorpe to schedule its energy allocation from SEPA. Members’ total allocation is 570 MW, of which Oglethorpe schedules 515 MW. Resource # Units Fuel Type Oglethorpe Ownership Share Operator 2024 Summer Planning Reserve Capacity (MW) 2023 Average Capacity Factor Oglethorpe Owned: Plant Hatch 2 Nuclear 30% Southern Nuclear 527 93.1 Plant Vogtle Units 1&2 2 Nuclear 30% Southern Nuclear 689 92.7 Plant Vogtle Units 3&4 (a) 2 Nuclear 30% Southern Nuclear 670 99.1 Plant Scherer 2 Coal 60% Georgia Power 1,030 35.1 Chattahoochee Energy Facility 1 Gas- CC 100% Oglethorpe 485 81.6 Thomas A. Smith Energy Facility 2 Gas- CC 100% Oglethorpe 1,295 75.9 Bobby C. Smith Energy Facility 1 Gas- CC 100% Oglethorpe 500 55.6 Doyle Generating Plant 5 Gas – CT 100% Oglethorpe 273 2.2 Hawk Road Energy Facility 3 Gas – CT 100% Oglethorpe 487 12.8 Hartwell Energy Facility 2 Gas/Oil – CT 100% Oglethorpe 306 7.2 Talbot Energy Facility 6 Gas/Oil – CT 100% Oglethorpe 679 8.4 Washington County 2 Gas – CT 100% Cogentrix Energy 326 N/A(b) Baconton Energy Facility 1 Gas/Oil – CT 100% Oglethorpe 45 13.1 Walton Energy Facility (c) 3 Gas – CT 100% Cogentrix Energy 462 N/A Rocky Mountain Pumped Storage Hydro 3 Hydro 74.61% Oglethorpe 817 16.7 Subtotal 37 8,591 Member Owned/Oglethorpe Operated: Smarr / Sewell Creek 6 Gas - CTs - Oglethorpe 733 Member Contracted/Oglethorpe Scheduled: Southeastern Power Administration (SEPA) (d) - Hydro - 515 - Grand Total 43 9,839 10

Second Quarter 2024 Investor Briefing Acquisition of Walton County CTs 11 ‣ Owner: Carlyle Group ‣ Current Operator: Cogentrix ‣ Price: $75.4 million ‣ Nameplate Capacity: 465 MW ‣ Manufacturer: Siemens V84.3A(2) ‣ Number of Units: 3 ‣ Commercial Operation Date: 2001 ‣ Remaining Expected Useful Life: ~35 Years* ‣ Under tolling agreement with GPC through May 2024. ‣ Signed purchase agreement on August 22, 2023. ‣ Closed June 28, 2024. ‣ Applied for RUS financing for this asset. * Includes lifetime extension work in 2031

Second Quarter 2024 Investor Briefing Income Statement Excerpts (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture, and the 2024 budget also includes a 1.14 As our capital requirements continue to evolve, our board will continue to evaluate the level of margin coverage and may choose to change the targeted margins for interest ratio in the future, although not below 1.10. (b) Excludes test energy megawatt-hours from Plant Vogtle Units 3 and 4 supplied to members. Any revenues and costs associated with test energy were capitalized. Six Months Ended June 30, 6/30/2023- 6/30/2024 Year Ended December 31, ($ in thousands) 2024 2023 % Change 2023 2022 2021 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $757,428 $476,227 59.0% $1,082,368 $984,036 $946,662 Sales to Members - Energy 340,209 276,922 22.9% 599,198 990,647 610,447 Total Sales to Members $1,097,637 $753,149 45.7% $1,681,566 $1,974,683 $1,557,109 Sales to non-Members 2,767 25,693 -89.2% 58,619 155,454 47,754 Operating Expenses: 855,033 671,849 27.3% 1,463,119 1,936,086 1,410,482 Other Income 38,699 40,159 -3.6% 81,049 72,244 71,254 Net Interest Charges 217,780 104,328 108.7% 292,325 204,591 207,854 Net Margin $66,290 $42,824 54.8% $65,790 $61,704 $57,781 Margins for Interest Ratio(a) 1.14 1.14 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.36 2.16 9.2% 2.12 3.86 2.47 Average Power Cost (cents/kWh) 7.63 5.89 29.6% 5.94 7.70 6.30 Sales to Members (MWh) 14,391,964 12,795,892 12.5% 28,289,147 25,634,984 24,727,585 12

Second Quarter 2024 Investor Briefing Balance Sheet Excerpts (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has covenants in three credit agreements that require a minimum total patronage capital, with the highest such requirement being $900 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. June 30, December 31, ($ in thousands) 2024 2023 2022 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $12,261,075 $8,996,092 $4,385,770 CWIP 255,681 3,294,641 7,716,035 Nuclear Fuel 384,871 389,662 388,303 Total Electric Plant $12,901,627 $12,680,395 $12,490,108 Total Investments and Funds 1,437,426 1,449,689 1,321,693 Total Current Assets 1,057,250 1,191,687 1,330,889 Total Deferred Charges 1,207,528 1,203,080 1,346,680 Total Assets $16,603,831 $16,524,851 $16,489,370 Capitalization: Patronage Capital and Membership Fees $1,324,207 $1,257,917 $1,192,127 Long-term Debt and Finance Leases 11,795,081 11,644,503 11,565,450 Other 37,457 35,014 30,201 Total Capitalization $13,156,745 $12,937,434 $12,787,778 Total Current Liabilities 1,155,146 1,358,453 1,495,293 Total Deferred Credits and Other Liabilities 2,291,940 2,228,964 2,206,299 Total Equity and Liabilities $16,603,831 $16,524,851 $16,489,370 Total Capitalization $13,156,745 $12,937,434 $12,787,778 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 122,722 120,560 114,142 Plus: Long-term Debt and Finance Leases due within one year 386,954 384,426 322,102 Total Long-Term Debt and Equities $13,666,421 $13,442,420 $13,224,022 Equity Ratio(a) 9.7% 9.4% 9.0% 13

Second Quarter 2024 Investor Briefing Total amount outstanding under all RUS Guaranteed Loans is $2.6 billion, with an average interest rate of 3.372%. RUS Guaranteed Loans(a) (a) RUS guaranteed loans are funded through the Federal Financing Bank and made at comparable Treasury plus 0.125%. (b) A new loan application was submitted in June 2024 for the acquisition and general capital improvements for Walton County Power Plant. (c) RUS loans closed in May 2024. We expect funding under these loans in third quarter of 2024. (d) RUS loan closed in May 2024.. We expect to begin funding under this loan in fourth quarter of 2024. RUS Loan Summary as of July 31, 2024 Purpose/Use of Proceeds Approved Advanced Remaining Amount Approved Loans(b) General & Environmental Improvements - "AD48" $630,342,000 $455,304,453 $175,037,547 Washington Acquisition - "AF48" (c) $87,943,000 $0 $87,943,000 Baconton Acquisition - "AG48" (c) $17,515,000 $0 $17,515,000 General & Environmental Improvements - "AH48" (d) $755,208,000 $0 $755,208,000 $1,491,008,000 $455,304,453 $1,035,703,547 14

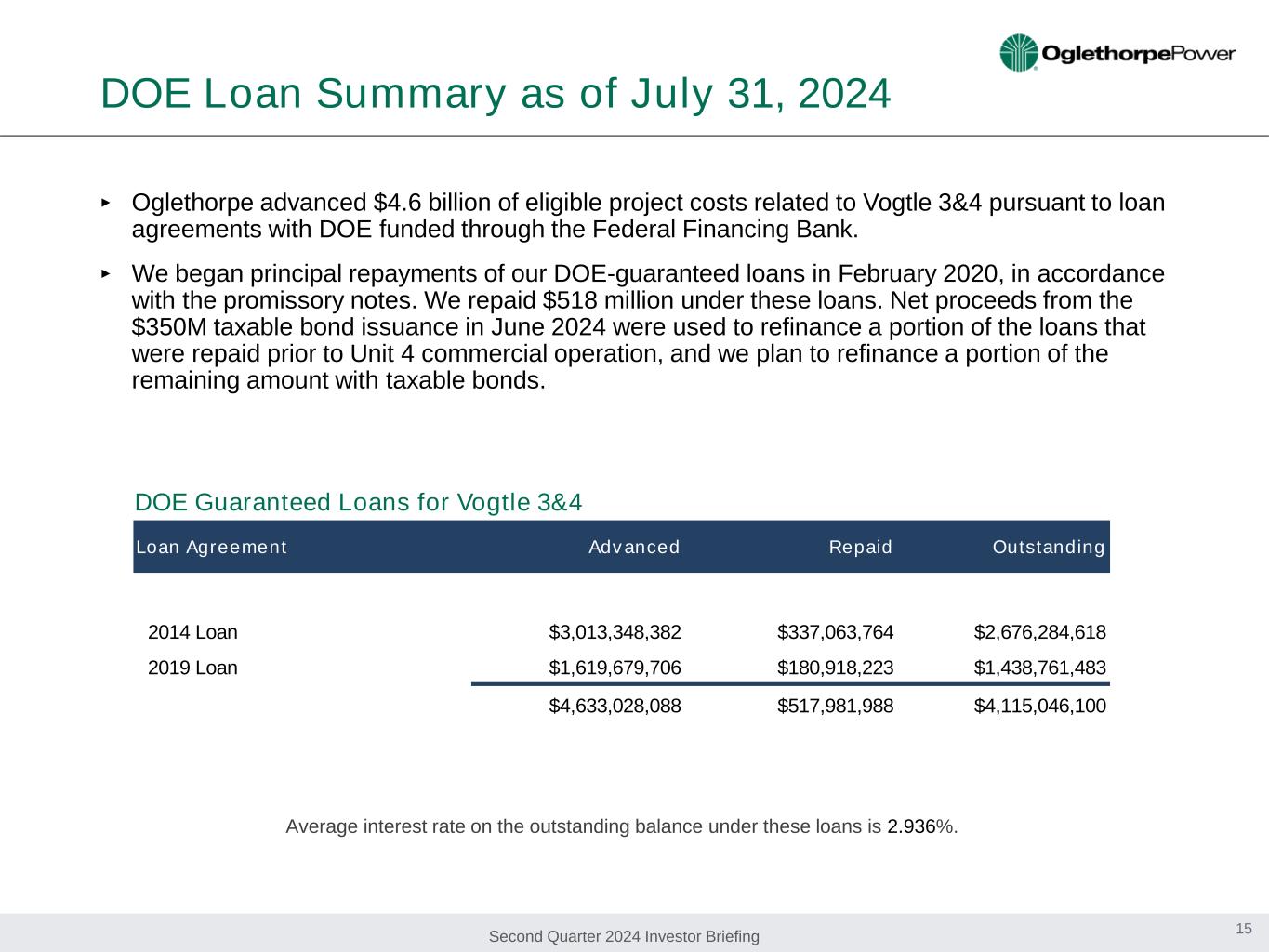

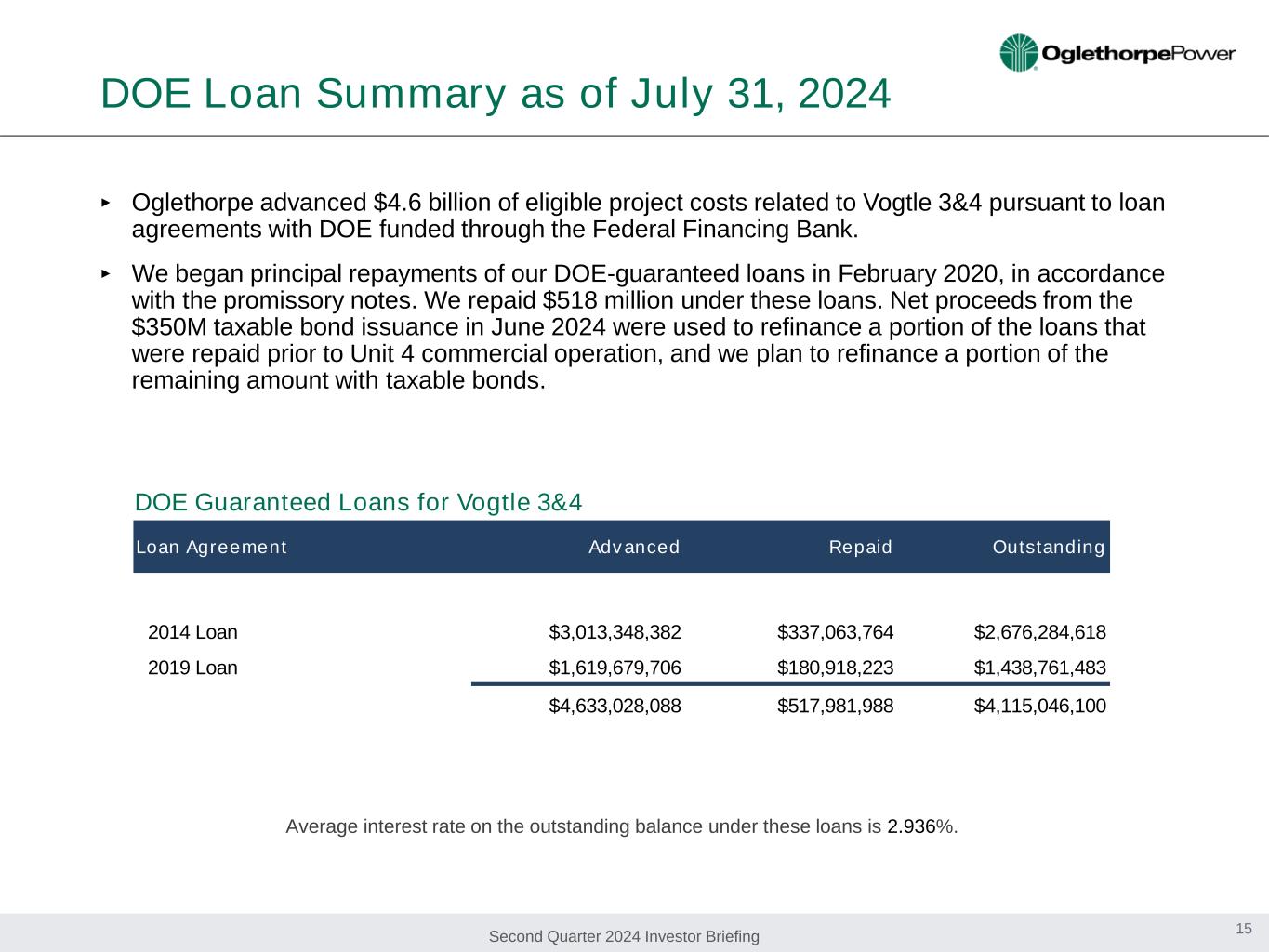

Second Quarter 2024 Investor Briefing DOE Loan Summary as of July 31, 2024 ‣ Oglethorpe advanced $4.6 billion of eligible project costs related to Vogtle 3&4 pursuant to loan agreements with DOE funded through the Federal Financing Bank. ‣ We began principal repayments of our DOE-guaranteed loans in February 2020, in accordance with the promissory notes. We repaid $518 million under these loans. Net proceeds from the $350M taxable bond issuance in June 2024 were used to refinance a portion of the loans that were repaid prior to Unit 4 commercial operation, and we plan to refinance a portion of the remaining amount with taxable bonds. DOE Guaranteed Loans for Vogtle 3&4 Average interest rate on the outstanding balance under these loans is 2.936%. Loan Agreement Advanced Repaid Outstanding 2014 Loan $3,013,348,382 $337,063,764 $2,676,284,618 2019 Loan $1,619,679,706 $180,918,223 $1,438,761,483 $4,633,028,088 $517,981,988 $4,115,046,100 15

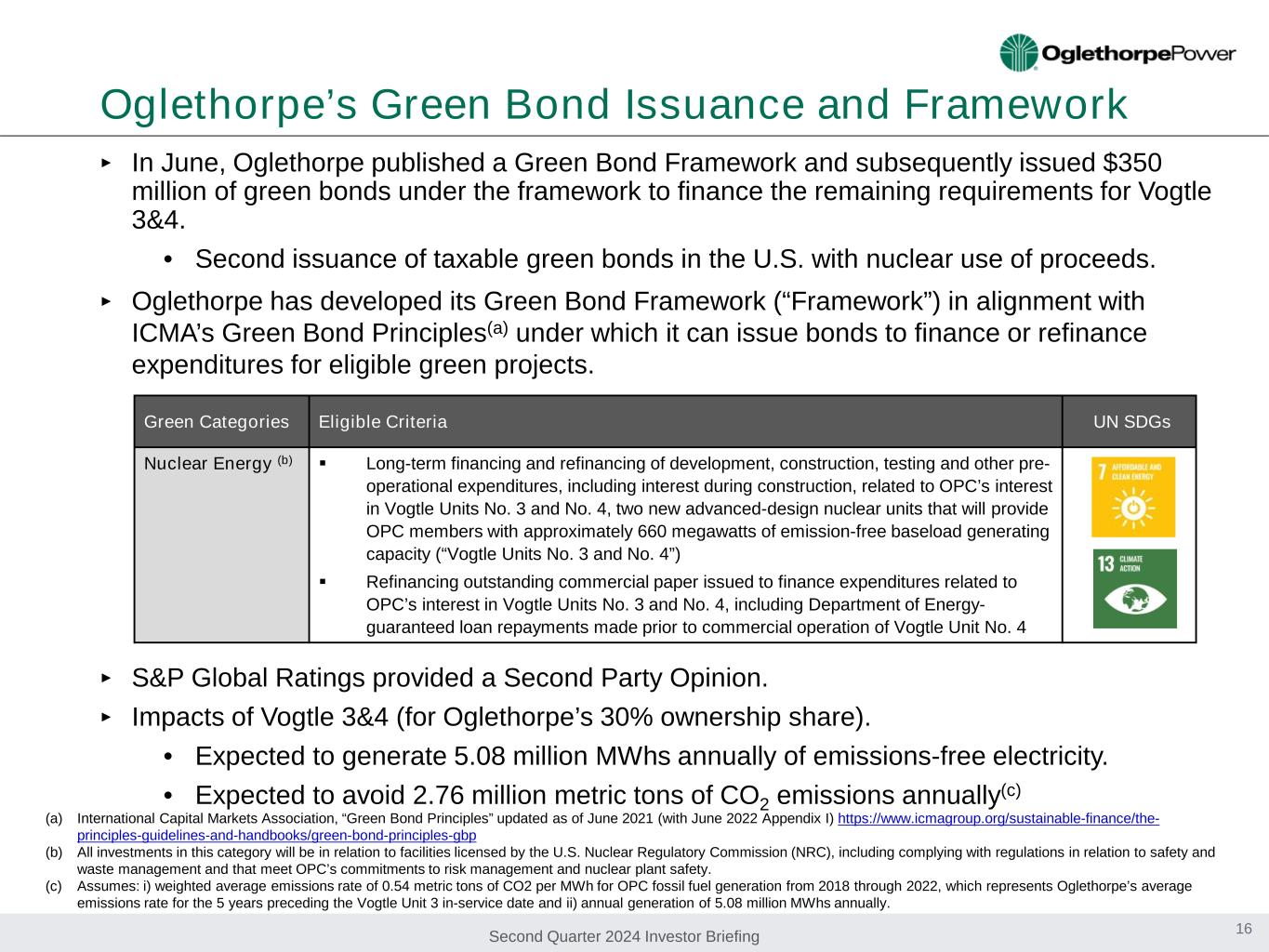

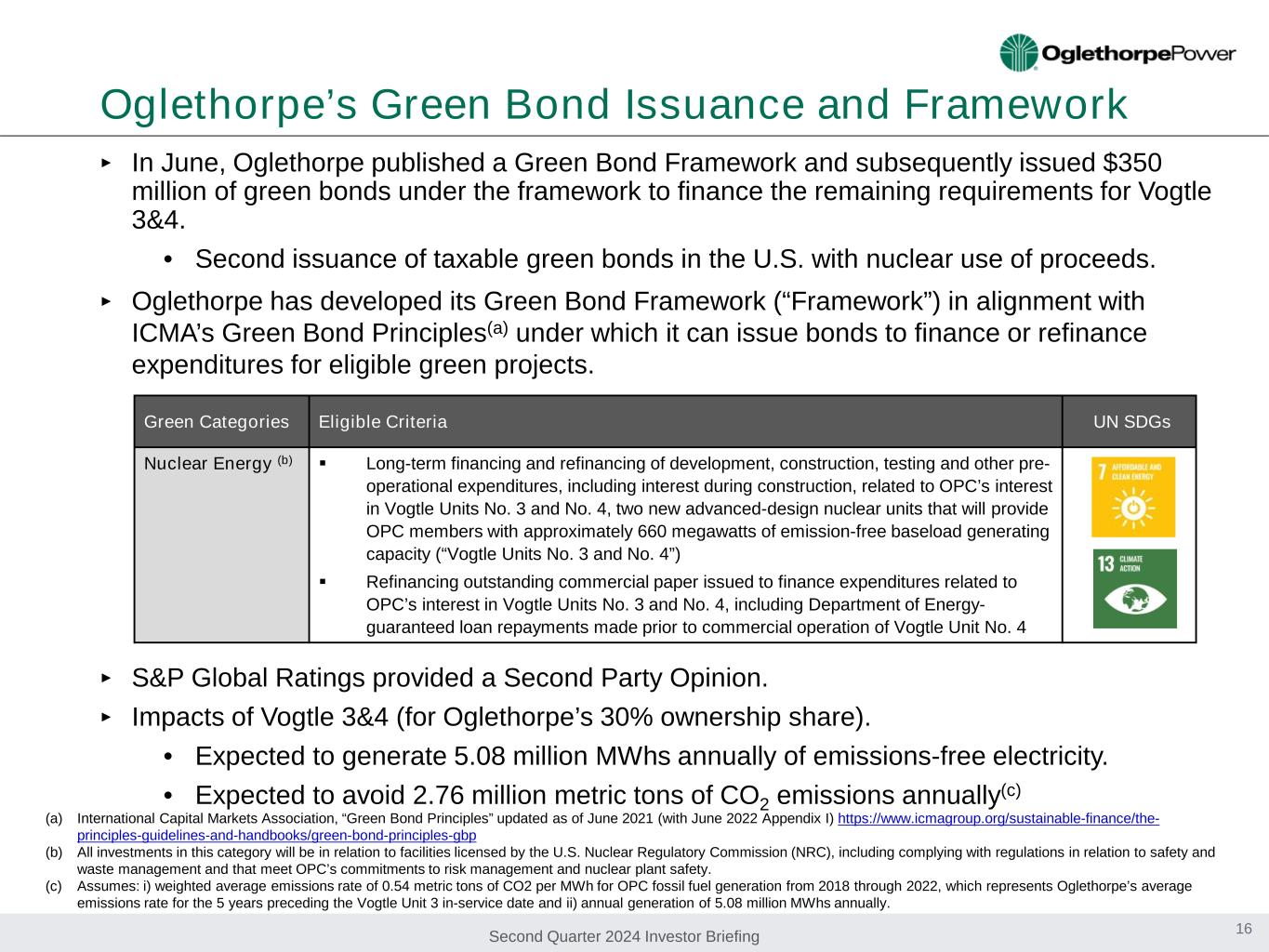

Second Quarter 2024 Investor Briefing Oglethorpe’s Green Bond Issuance and Framework ‣ In June, Oglethorpe published a Green Bond Framework and subsequently issued $350 million of green bonds under the framework to finance the remaining requirements for Vogtle 3&4. • Second issuance of taxable green bonds in the U.S. with nuclear use of proceeds. ‣ Oglethorpe has developed its Green Bond Framework (“Framework”) in alignment with ICMA’s Green Bond Principles(a) under which it can issue bonds to finance or refinance expenditures for eligible green projects. ‣ S&P Global Ratings provided a Second Party Opinion. ‣ Impacts of Vogtle 3&4 (for Oglethorpe’s 30% ownership share). • Expected to generate 5.08 million MWhs annually of emissions-free electricity. • Expected to avoid 2.76 million metric tons of CO2 emissions annually(c) 16 Green Categories Eligible Criteria UN SDGs Nuclear Energy (b) Long-term financing and refinancing of development, construction, testing and other pre- operational expenditures, including interest during construction, related to OPC’s interest in Vogtle Units No. 3 and No. 4, two new advanced-design nuclear units that will provide OPC members with approximately 660 megawatts of emission-free baseload generating capacity (“Vogtle Units No. 3 and No. 4”) Refinancing outstanding commercial paper issued to finance expenditures related to OPC’s interest in Vogtle Units No. 3 and No. 4, including Department of Energy- guaranteed loan repayments made prior to commercial operation of Vogtle Unit No. 4 (a) International Capital Markets Association, “Green Bond Principles” updated as of June 2021 (with June 2022 Appendix I) https://www.icmagroup.org/sustainable-finance/the- principles-guidelines-and-handbooks/green-bond-principles-gbp (b) All investments in this category will be in relation to facilities licensed by the U.S. Nuclear Regulatory Commission (NRC), including complying with regulations in relation to safety and waste management and that meet OPC’s commitments to risk management and nuclear plant safety. (c) Assumes: i) weighted average emissions rate of 0.54 metric tons of CO2 per MWh for OPC fossil fuel generation from 2018 through 2022, which represents Oglethorpe’s average emissions rate for the 5 years preceding the Vogtle Unit 3 in-service date and ii) annual generation of 5.08 million MWhs annually.

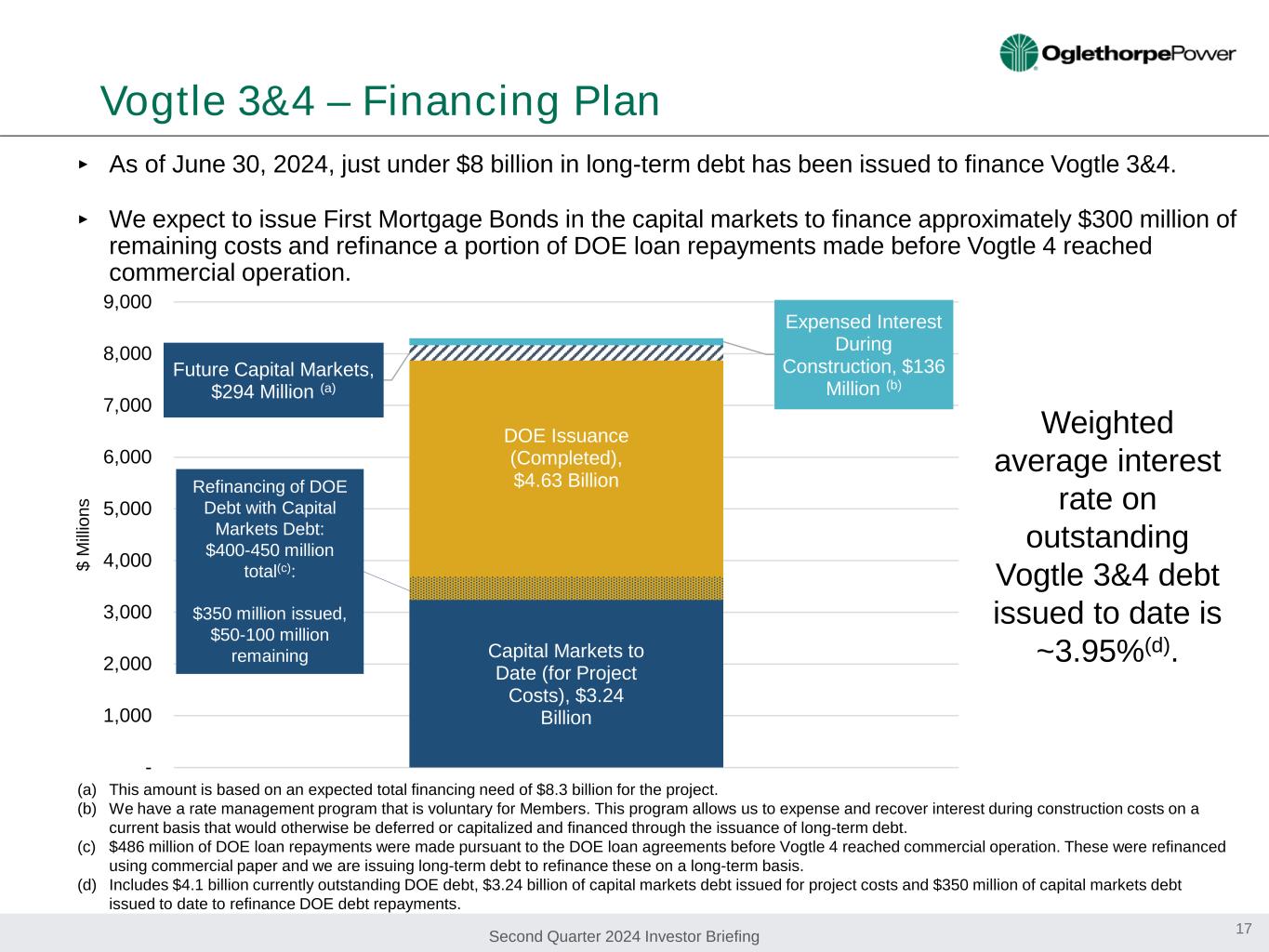

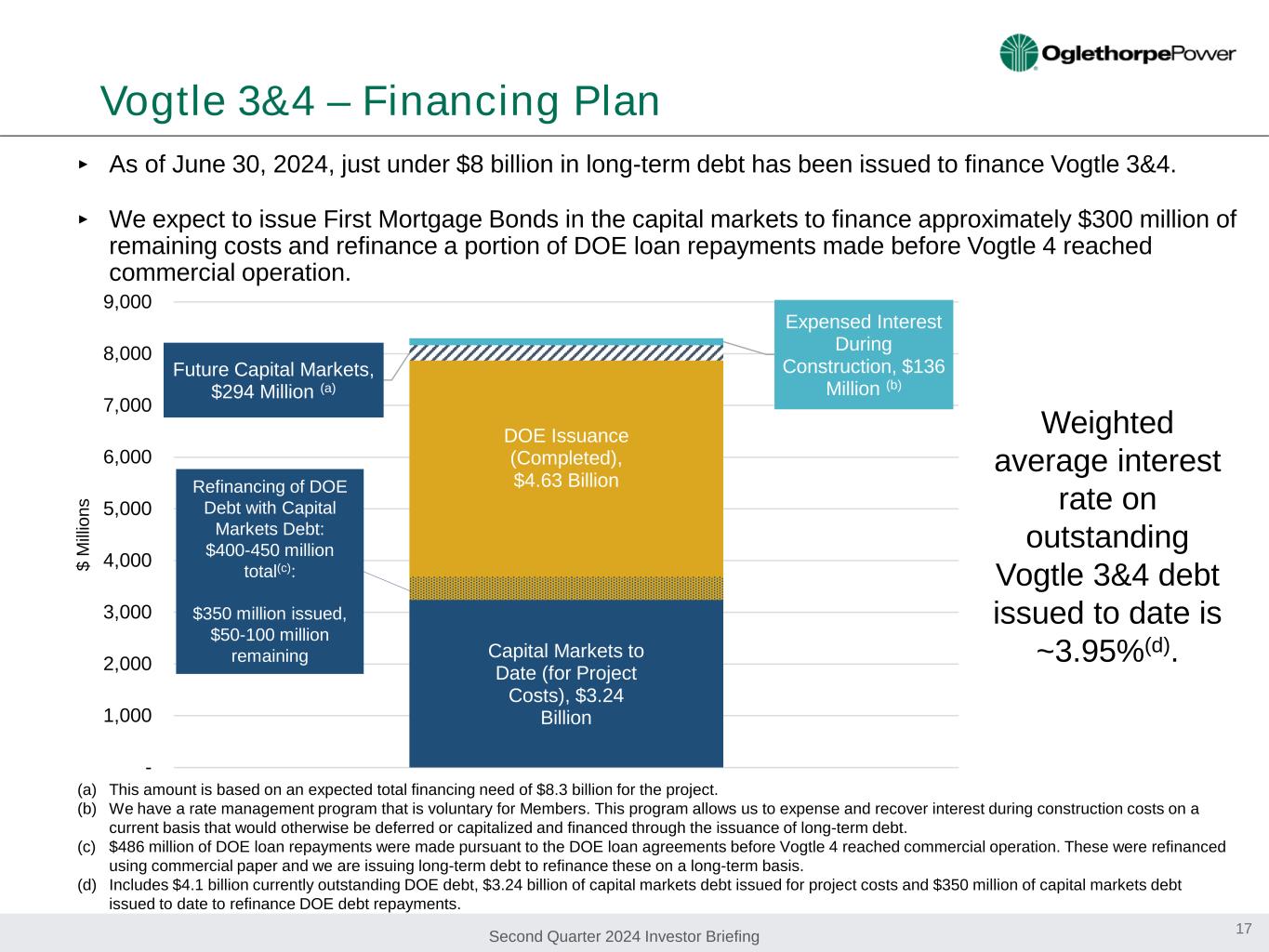

Second Quarter 2024 Investor Briefing Vogtle 3&4 – Financing Plan ‣ As of June 30, 2024, just under $8 billion in long-term debt has been issued to finance Vogtle 3&4. ‣ We expect to issue First Mortgage Bonds in the capital markets to finance approximately $300 million of remaining costs and refinance a portion of DOE loan repayments made before Vogtle 4 reached commercial operation. (a) This amount is based on an expected total financing need of $8.3 billion for the project. (b) We have a rate management program that is voluntary for Members. This program allows us to expense and recover interest during construction costs on a current basis that would otherwise be deferred or capitalized and financed through the issuance of long-term debt. (c) $486 million of DOE loan repayments were made pursuant to the DOE loan agreements before Vogtle 4 reached commercial operation. These were refinanced using commercial paper and we are issuing long-term debt to refinance these on a long-term basis. (d) Includes $4.1 billion currently outstanding DOE debt, $3.24 billion of capital markets debt issued for project costs and $350 million of capital markets debt issued to date to refinance DOE debt repayments. Capital Markets to Date (for Project Costs), $3.24 Billion DOE Issuance (Completed), $4.63 Billion Future Capital Markets, $294 Million (a) Expensed Interest During Construction, $136 Million (b) - 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 $ M illi on s Refinancing of DOE Debt with Capital Markets Debt: $400-450 million total(c): $350 million issued, $50-100 million remaining 17 Weighted average interest rate on outstanding Vogtle 3&4 debt issued to date is ~3.95%(d).

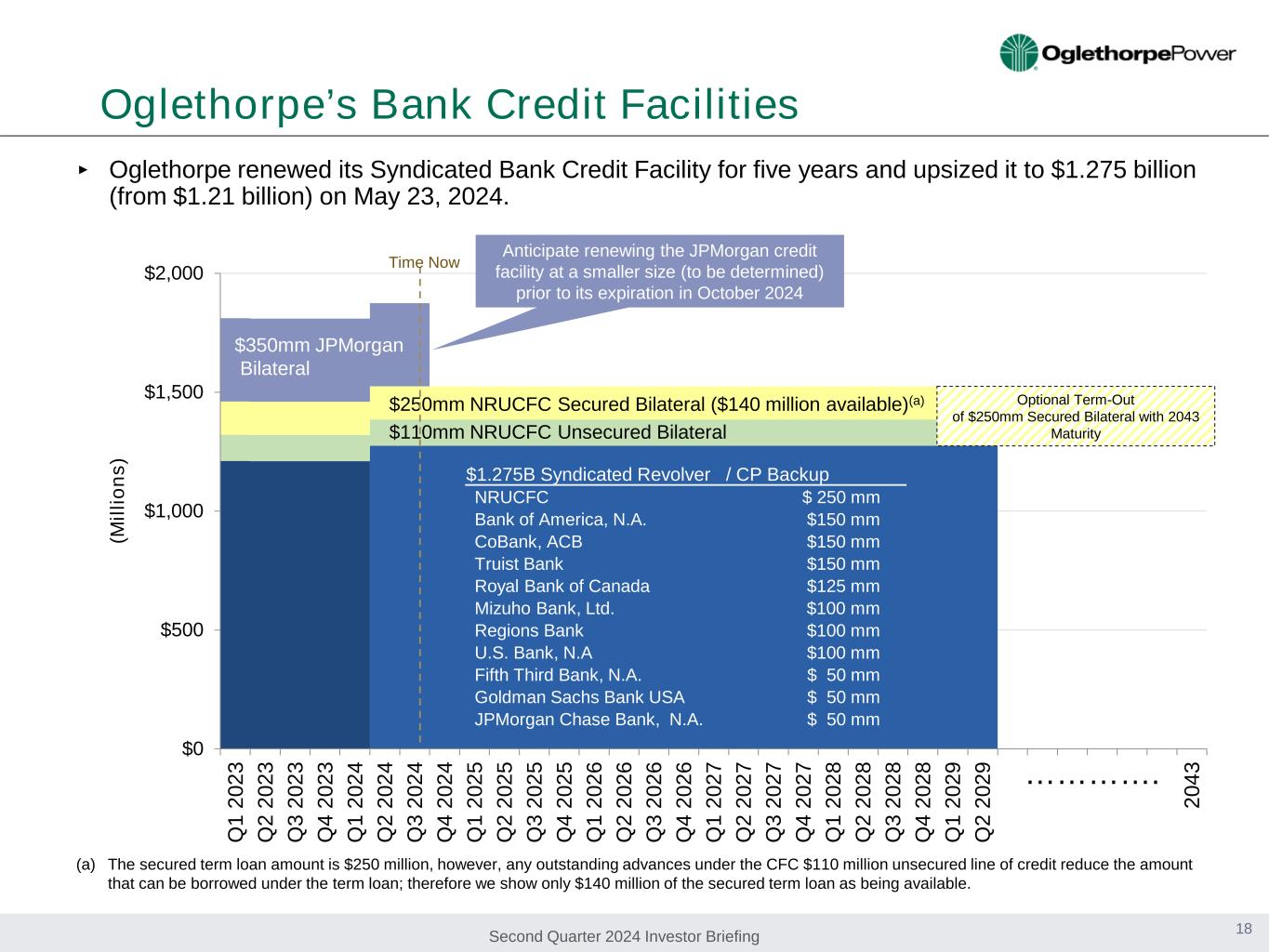

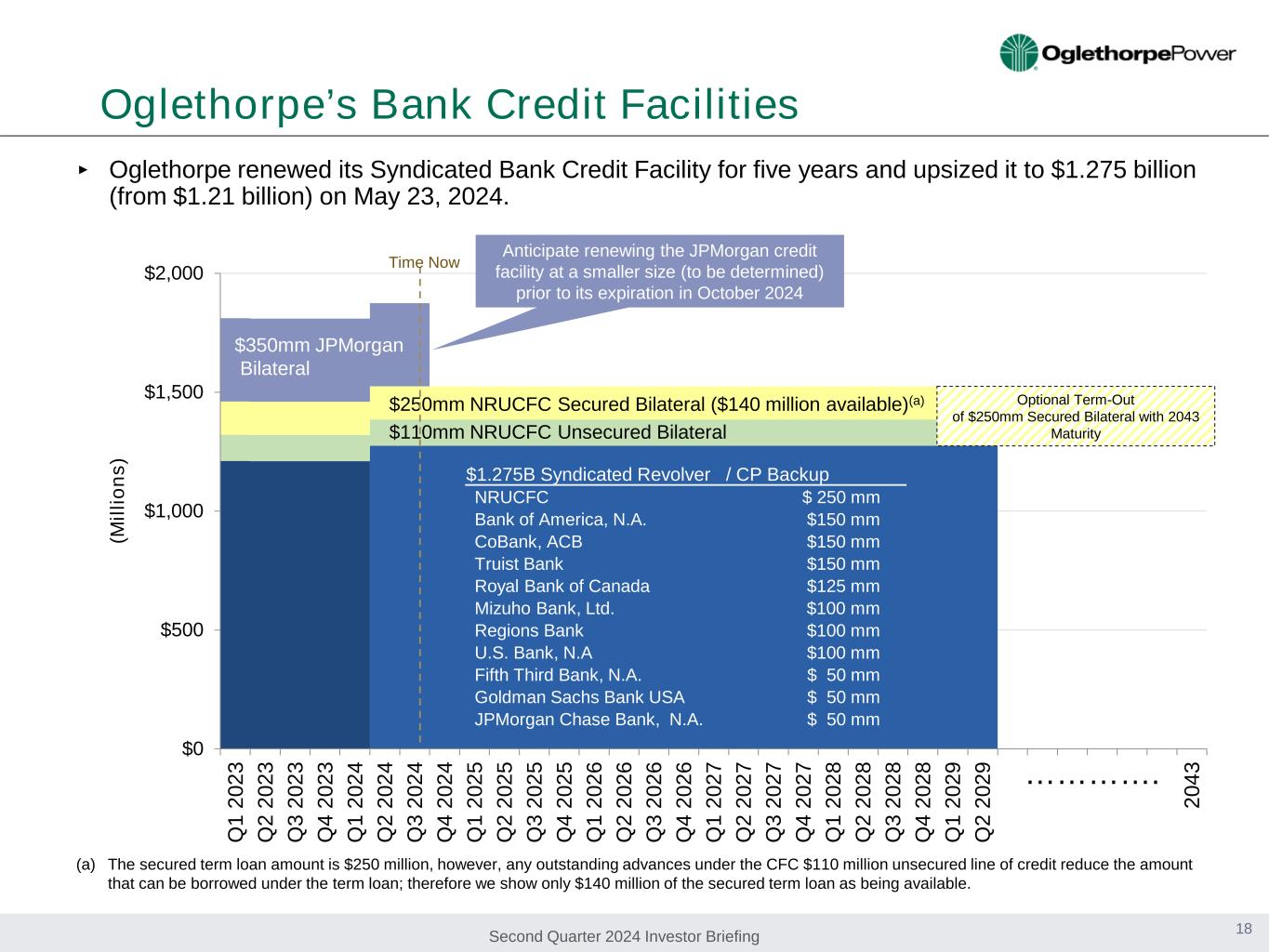

Second Quarter 2024 Investor Briefing Oglethorpe’s Bank Credit Facilities $0 $500 $1,000 $1,500 $2,000 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 23 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 20 24 Q 1 20 25 Q 2 20 25 Q 3 20 25 Q 4 20 25 Q 1 20 26 Q 2 20 26 Q 3 20 26 Q 4 20 26 Q 1 20 27 Q 2 20 27 Q 3 20 27 Q 4 20 27 Q 1 20 28 Q 2 20 28 Q 3 20 28 Q 4 20 28 Q 1 20 29 Q 2 20 29 20 43 (M ill io ns ) 18 $1.275B Syndicated Revolver / CP Backup NRUCFC $ 250 mm Bank of America, N.A. $150 mm CoBank, ACB $150 mm Truist Bank $150 mm Royal Bank of Canada $125 mm Mizuho Bank, Ltd. $100 mm Regions Bank $100 mm U.S. Bank, N.A $100 mm Fifth Third Bank, N.A. $ 50 mm Goldman Sachs Bank USA $ 50 mm JPMorgan Chase Bank, N.A. $ 50 mm $350mm JPMorgan Bilateral $250mm NRUCFC Secured Bilateral ($140 million available)(a) $110mm NRUCFC Unsecured Bilateral Optional Term-Out of $250mm Secured Bilateral with 2043 Maturity …………. Time Now (a) The secured term loan amount is $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. Anticipate renewing the JPMorgan credit facility at a smaller size (to be determined) prior to its expiration in October 2024 ‣ Oglethorpe renewed its Syndicated Bank Credit Facility for five years and upsized it to $1.275 billion (from $1.21 billion) on May 23, 2024.

Second Quarter 2024 Investor Briefing $1,875 $469 $1,406 $227 $1,632 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ M ill io ns Oglethorpe’s Available Liquidity As of August 16, 2024 Borrowings Detail $3 million – Outstanding Letters of Credit for Operational Needs $249 million – Vogtle 3&4 Costs / DOE Principal and Interest Refinancing $187 million – Washington, Baconton and Walton Acquisition Costs $31 million – B.C. Smith, Washington and Baconton Deferral Costs • Represents 531 days of liquidity on hand 19

Second Quarter 2024 Investor Briefing Recent and Upcoming Financial Activity Completed in 2024 Q2 Closed on $861 million of RUS loans Renewal of syndicated bank credit facility at $1.275 billion $350 million Green First Mortgage bond for Vogtle 3&4 Upcoming in 2024 Q4 Renewal of J.P. Morgan bilateral credit facility $350-450 million first mortgage bond issuance for Vogtle 3&4 20

Second Quarter 2024 Investor Briefing $(300) $(100) $100 $300 $500 DOE RUS Taxable $687 $714($63) ($127) ($191) ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment $0 $2 $4 $6 $8 $10 $12 $14 YE '23 Jun '24 $9.00 $12.26 $0.39 $0.38 $3.29 $0.26 (B illi on s) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $16,525 $16,604 $1,210 $ 1,210 $1,810 $1,810 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 Jan Feb M ar A pr M ay Jun Jul A ug S ep O ct N ov D ec B or ro w in gs ( M il) Cash Borrowings CP Availability Total Available Lines of Credit Ca sh B al an ce s (M il) Net Margin Liquidity Wholesale Power CostInterim CP Financing Balance Sheet Electric Plant Average Cost of Funds: 5.60% (dollars in millions) Secured LT Debt (7.31.24): $12.2 billion Weighted Average Cost: 3.93% 2024 July 31, 2024 2024 2024 2024 Secured Long Term Debt 21 1.14 MFI ratio Actual Forecast 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 Budget YTD Actual YTD 7.63 8.36 ¢/ kW h $- $20 $40 $60 $80 $100 Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c M illi on s Actual Budget Vogtle 3&4 Interest Rate Hedging - CP, $39 DOE - Vogtle 3&4 P&I - CP, $210 BCSmith Deferral - CP, $20 Walton Acquisition & Deferral - CP, $74 Baconton Acquisition & Deferral - CP, $20

Second Quarter 2024 Investor Briefing • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Oglethorpe’s ESG Report along with its qualitative and quantitative EEI ESG/Sustainability Reports are available on its website. • Member information is generally filed as an exhibit to Form 10-Q for the first or second quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) 2023 Member information was filed in an exhibit to Form 10-Q for the second quarter of 2024. • For additional information please contact: Additional Information 22 Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Blair Romero Director, Corporate Communications blair.romero@opc.com 770-270-7290