Third Quarter 2024 Investor Briefing November 21, 2024

Third Quarter 2024 Investor Briefing Notice to Recipients Certain of the information contained in this presentation, including certain of the statements made by representatives of Oglethorpe Power Corporation (An Electric Membership Corporation) (“Oglethorpe” or “OPC”), that are not historical facts are forward-looking statements. Although Oglethorpe believes that in making these forward-looking statements its expectations are based on reasonable assumptions, Oglethorpe cautions the reader not to put undue reliance on these forward-looking statements, which are not guarantees of future performance. Forward- looking statements involve uncertainties and there are important factors, many of which are outside management’s control, which could cause actual results to differ materially from those expressed or implied by these forward-looking statements. Some of the risks, uncertainties and assumptions that may cause actual results to differ from these forward-looking statements are described under the headings “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION” in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the Securities and Exchange Commission on November 13, 2024, “RISK FACTORS” in our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2024, and June 30, 2024, filed with the Securities and Exchange Commission on May 13, 2024, and August 14, 2024, respectively, and “ITEM 1A - RISK FACTORS” in our Annual Report on Form10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission on March 25, 2024. This electronic presentation is provided as of November 21, 2024. If you are viewing this presentation after that date, there may have been events that occurred subsequent to such date that could have a material adverse effect on the information that was presented. Oglethorpe undertakes no obligation to publicly update any forward-looking statements. 2

Third Quarter 2024 Investor Briefing ‣ Selection of President and Chief Executive Officer ‣ Hurricane Helene ‣ Future Generation ‣ Operations Update ‣ Financial and Liquidity Update Presenters and Agenda Betsy Higgins Executive Vice President and Chief Financial Officer Mike Smith President and Chief Executive Officer 3 David Sorrick Executive Vice President and Chief Operating Officer Annalisa Bloodworth Senior Vice President, General Counsel

Third Quarter 2024 Investor Briefing Oglethorpe New CEO Announcement 4 ‣ On November 6, 2024, Oglethorpe’s board of directors announced the selection of Annalisa Bloodworth as the new President and Chief Executive Officer, effective February 1, 2025. ‣ She succeeds current President and CEO Mike Smith who will retire from Oglethorpe Power on January 31, 2025. ‣ She currently serves as Oglethorpe’s Senior Vice President and General Counsel, a role she has held since 2017. In this role she has successfully led Oglethorpe through several crucial legal challenges and critical negotiations. ‣ Bloodworth has been at the company since 2010. Before joining Oglethorpe, Bloodworth was in private practice at Eversheds Sutherland (US) LLP.

Third Quarter 2024 Investor Briefing Hurricane Helene 5 ‣ In late September, Hurricane Helene caused extensive damage in the Southeast, including large areas of Georgia. ‣ The hurricane only resulted in minor impacts on our generation resources during the storm. ‣ The hurricane caused significant damage in several of our members’ service territories and to the electrical transmission and distribution systems across Georgia, including the distribution systems of a few of our members. ‣ All members have paid their bills in full after a few were given grace periods. ‣ We do not expect the hurricane to affect our financial condition or results of operations.

Third Quarter 2024 Investor Briefing Future Power Resources – New Gas-Fired Generation ‣ Oglethorpe and its Members plan to add two new natural gas-fired generation resources. • An approximately 1,200 to 1,500 MW two-unit combined cycle generation facility on land we own in Monroe County, Georgia and an approximately 240 MW combustion turbine unit to be constructed at our Talbot Energy Facility. • These new resources are fully subscribed by Oglethorpe’s Members and have been approved by its Members and Board of Directors. • These new units are projected to be online in 2029. • Preliminary cost estimate for these two projects is approximately $2.1 billion. ‣ We have the gas turbine equipment under reservation for both projects, we have firm gas supply for the combined cycle. We have made excellent progress on local community support. ‣ Oglethorpe and its Members may also continue to consider additional generation beyond these resources in the future. 6 Smarr CC 3D Rendering Talbot Unit 7 3D Model View

Third Quarter 2024 Investor Briefing Future Power Resources – Batteries ‣ Georgia Envrionmental Finance Authority, together with application partners Oglethorpe, Georgia Transmission and Georgia System Operations, was awarded a $250 million grant under the Department of Energy’s Grid Resilience and Innovation Partnerships (GRIP) Program. ‣ As part of the grant application, Oglethorpe plans to add an aggregate of 75 MWs of utility-scale battery storage projects. ‣ These projects will utilize approximately $80 million of the total award. ‣ The DOE GRIP program was funded through the bipartisan Infrastructure Investment and Jobs Act (IIJA), passed by Congress in 2021. 7

Third Quarter 2024 Investor Briefing 8 Note: Summer capacities shown above. With Baconton, Washington and Walton, some of our Members elected to take service at the date of acquisition and some Members have elected to defer their share of output through a date no later than December 31, 2026. Capacity additions are shown in the graph when the various Members begin to schedule service from these resources, either on the date of acquisition or at the end of their respective deferral period. Looking Forward Recent or Planned Capacity Additions

Third Quarter 2024 Investor Briefing 45% 42% 10% 3% 46% 41% 10% 3% Oglethorpe’s Diversified Power Supply Portfolio (a) Capacity and energy include Oglethorpe and Smarr EMC resources. Oglethorpe and Smarr EMC capacity reflects summer reserve planning capacity. 2024 Capacity (MW) 9,325 MW (a) 9 2024 Energy (MWh) (October 2023 – September 2024) Member and Non-Member Sales 33.4 Million MWh Member Sales 32.3 Million MWh 60%20% 11% 9%

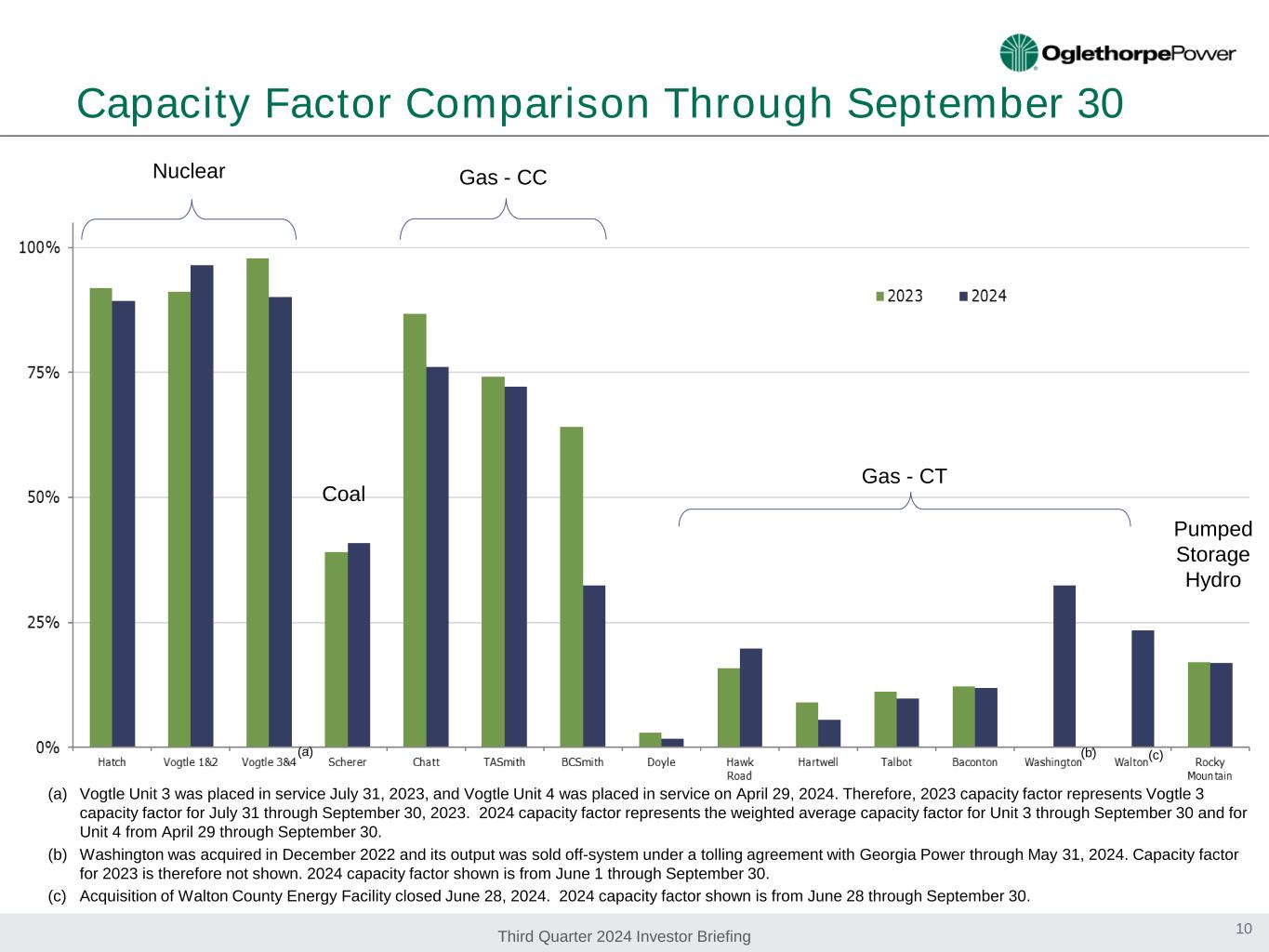

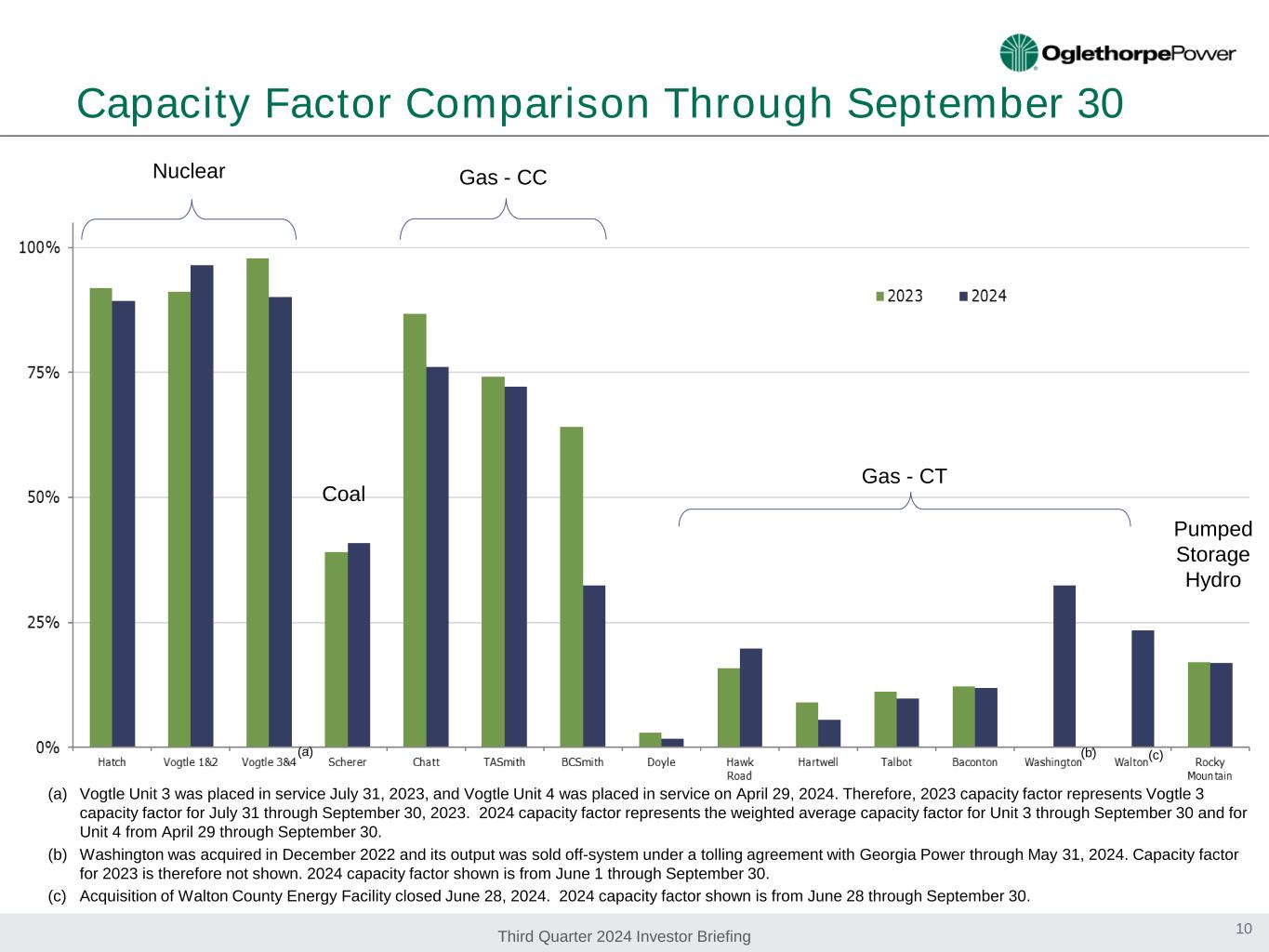

Third Quarter 2024 Investor Briefing Capacity Factor Comparison Through September 30 Nuclear Coal Gas - CC Gas - CT Pumped Storage Hydro 10 (a) Vogtle Unit 3 was placed in service July 31, 2023, and Vogtle Unit 4 was placed in service on April 29, 2024. Therefore, 2023 capacity factor represents Vogtle 3 capacity factor for July 31 through September 30, 2023. 2024 capacity factor represents the weighted average capacity factor for Unit 3 through September 30 and for Unit 4 from April 29 through September 30. (b) Washington was acquired in December 2022 and its output was sold off-system under a tolling agreement with Georgia Power through May 31, 2024. Capacity factor for 2023 is therefore not shown. 2024 capacity factor shown is from June 1 through September 30. (c) Acquisition of Walton County Energy Facility closed June 28, 2024. 2024 capacity factor shown is from June 28 through September 30. (a) (b) (c)

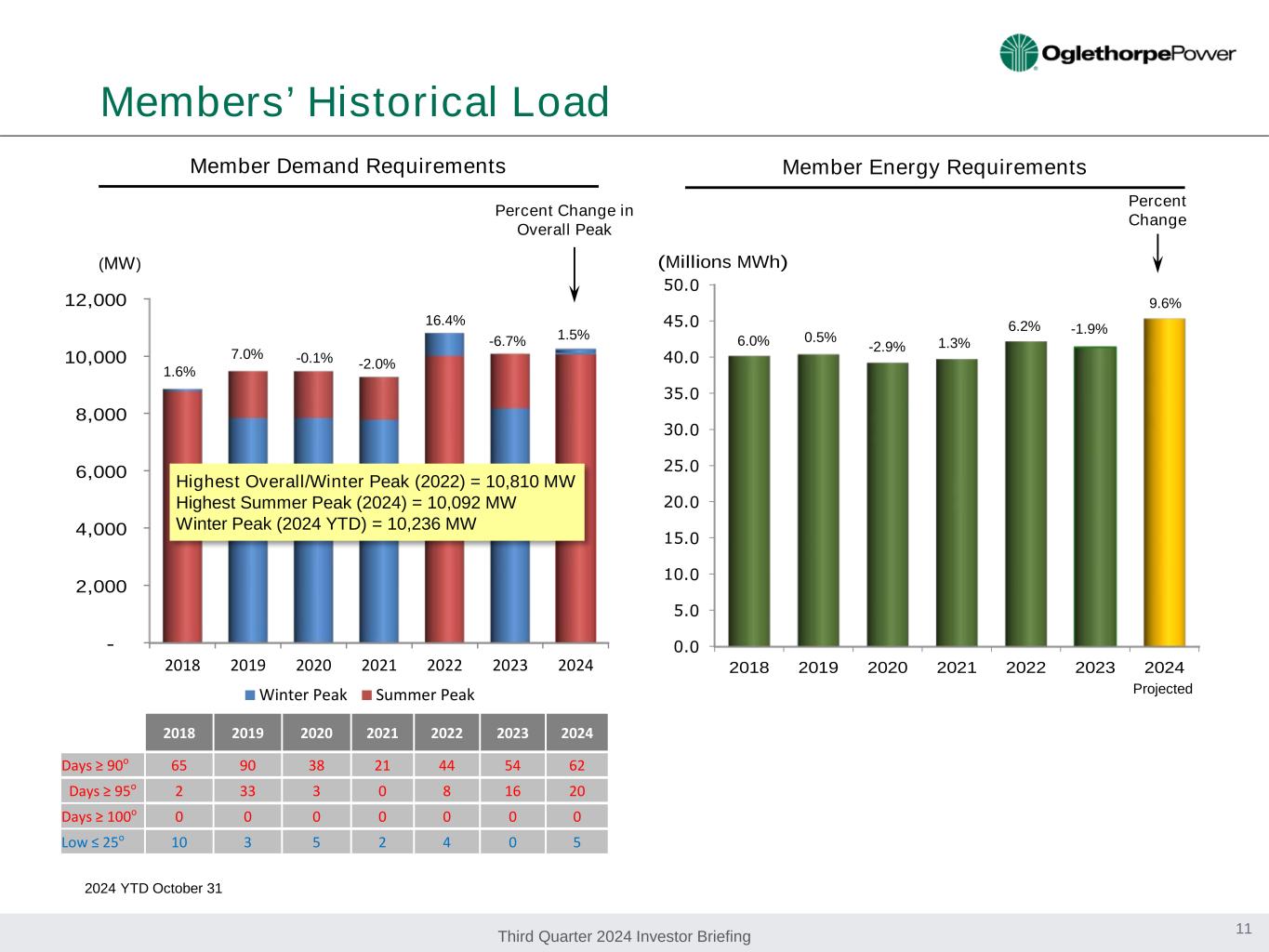

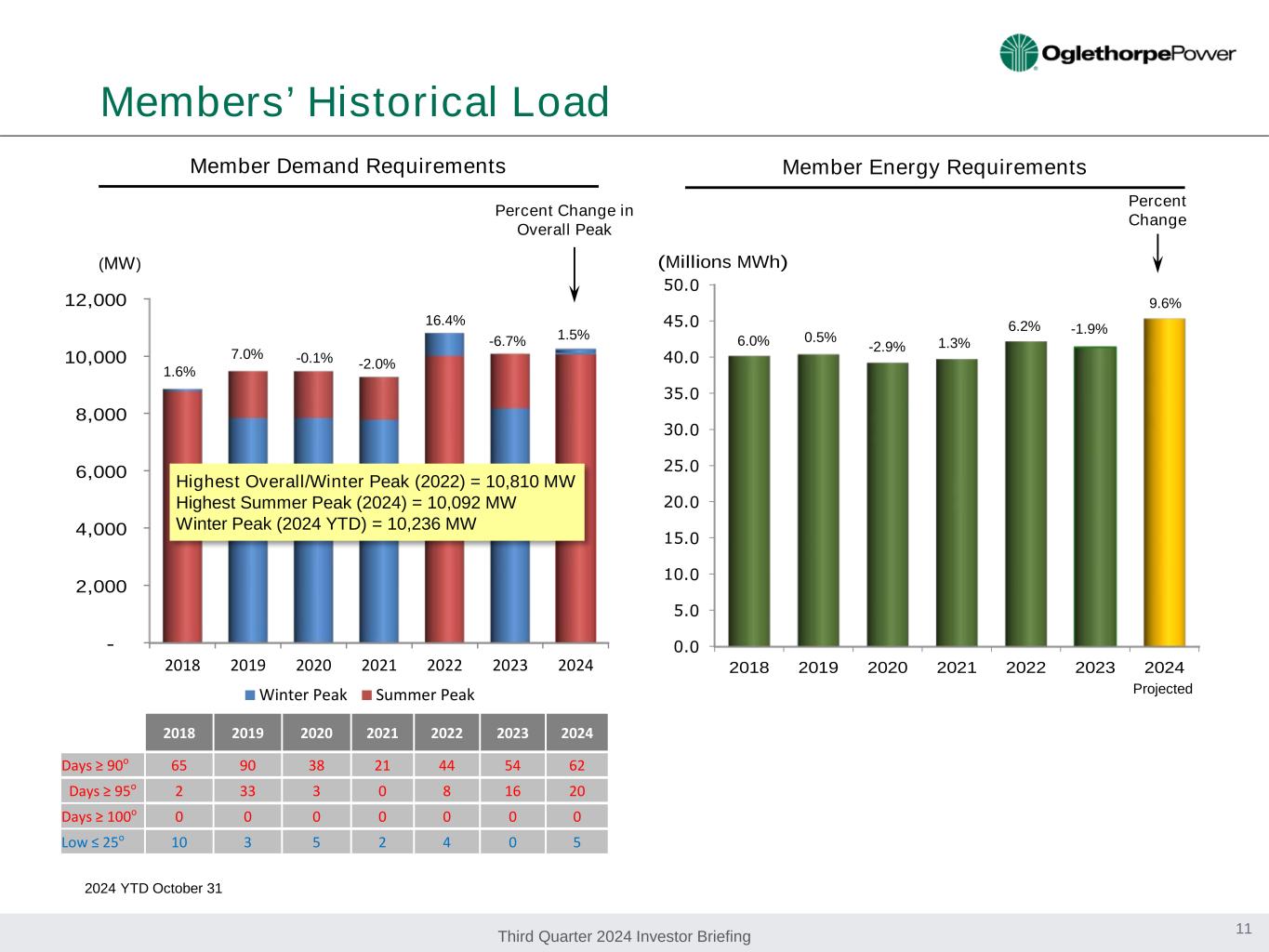

Third Quarter 2024 Investor Briefing - 2,000 4,000 6,000 8,000 10,000 12,000 2018 2019 2020 2021 2022 2023 2024 Winter Peak Summer Peak 2018 2019 2020 2021 2022 2023 2024 (Millions MWh) Members’ Historical Load 11 Member Demand Requirements Member Energy Requirements Percent Change (MW) Percent Change in Overall Peak Highest Overall/Winter Peak (2022) = 10,810 MW Highest Summer Peak (2024) = 10,092 MW Winter Peak (2024 YTD) = 10,236 MW 1.5% 9.6% 16.4% -1.9% 6.0% 1.6% 7.0% 0.5% -2.9% -0.1% Projected 2024 YTD October 31 -2.0% 1.3% 6.2% -6.7% 2018 2019 2020 2021 2022 2023 2024 Days ≥ 90o 65 90 38 21 44 54 62 Days ≥ 95o 2 33 3 0 8 16 20 Days ≥ 100o 0 0 0 0 0 0 0 Low ≤ 25o 10 3 5 2 4 0 5

Third Quarter 2024 Investor Briefing Oglethorpe’s Generation and Power Supply Resources (a) Vogtle 3&4 planning capacity includes Unit 4 which came online April 29, 2024. 2023 capacity factor for Unit 3 after its in-service date of July 31 through December 31. (b) Washington County was acquired in December 2022 and its output was sold off-system under a tolling agreement through May 31, 2024. Capacity factor for 2023 is therefore not shown. (c) Acquisition of Walton County Energy Facility closed June 28, 2024. (d) Each of the Members, other than Flint, has designated Oglethorpe to schedule its energy allocation from SEPA. Members’ total allocation is 570 MW, of which Oglethorpe schedules 515 MW. Resource # Units Fuel Type Oglethorpe Ownership Share Operator 2024 Summer Planning Reserve Capacity (MW) 2023 Average Capacity Factor Oglethorpe Owned: Plant Hatch 2 Nuclear 30% Southern Nuclear 527 93.1 Plant Vogtle Units 1&2 2 Nuclear 30% Southern Nuclear 689 92.7 Plant Vogtle Units 3&4 (a) 2 Nuclear 30% Southern Nuclear 670 99.1 Plant Scherer 2 Coal 60% Georgia Power 1,030 35.1 Chattahoochee Energy Facility 1 Gas- CC 100% Oglethorpe 485 81.6 Thomas A. Smith Energy Facility 2 Gas- CC 100% Oglethorpe 1,295 75.9 Bobby C. Smith Energy Facility 1 Gas- CC 100% Oglethorpe 500 55.6 Doyle Generating Plant 5 Gas – CT 100% Oglethorpe 273 2.2 Hawk Road Energy Facility 3 Gas – CT 100% Oglethorpe 487 12.8 Hartwell Energy Facility 2 Gas/Oil – CT 100% Oglethorpe 306 7.2 Talbot Energy Facility 6 Gas/Oil – CT 100% Oglethorpe 679 8.4 Washington County 2 Gas – CT 100% Cogentrix Energy 326 N/A(b) Baconton Energy Facility 1 Gas/Oil – CT 100% Oglethorpe 45 13.1 Walton Energy Facility 3 Gas – CT 100% Oglethorpe 462 N/A (c) Rocky Mountain Pumped Storage Hydro 3 Hydro 74.61% Oglethorpe 817 16.7 Subtotal 37 8,591 Member Owned/Oglethorpe Operated: Smarr / Sewell Creek 6 Gas - CTs - Oglethorpe 733 Member Contracted/Oglethorpe Scheduled: Southeastern Power Administration (SEPA) (d) - Hydro - 515 - Grand Total 43 9,839 12

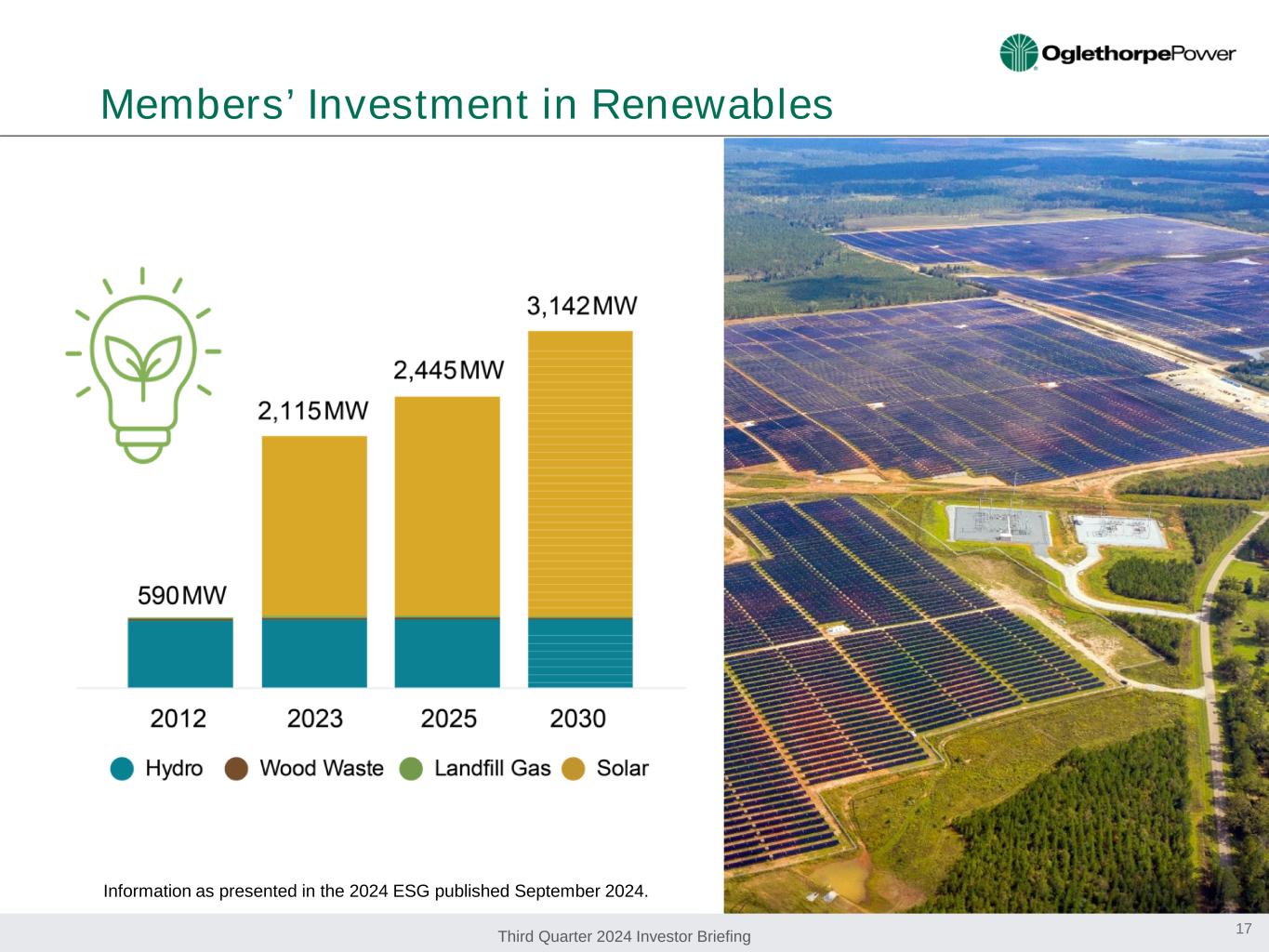

Third Quarter 2024 Investor Briefing Oglethorpe’s ESG Sustainability Path ‣ Oglethorpe and its members have been working towards a sustainable and cleaner energy path for many years. ‣ Oglethorpe, its members, and its related companies, Green Power EMC and Smarr EMC, for which Oglethorpe provides management services, are working together to provide clean and reliable energy for our members. • Green Power EMC is owned by each of Oglethorpe’s members and obtains green power from facilities across Georgia. Green Power’s and our members’ renewable capacity is expected to grow to more than 2,285 MW by 2027. Oglethorpe provides management, staffing and various contractual services to Green Power EMC. • Oglethorpe schedules power from the Southeastern Power Administration (SEPA) for our members. SEPA provides 570 MW of hydroelectric power to 33 of our members through power purchase agreements. ‣ Oglethorpe focuses on recruiting a talented and diverse workforce and is active in the communities it serves. ‣ Oglethorpe, as a cooperative, is governed under a democratic model, with leadership elected from within the communities our members serve. ‣ Oglethorpe is committed to transparency in ESG endeavors as in all business dealings. Starting in 2021, Oglethorpe began publishing an annual ESG report. Oglethorpe’s 2024 report was published in Q3 2024. 13 2024 2023 2022 2021

Third Quarter 2024 Investor Briefing Members’ Investment in Emissions-free Generation 14 44.0% 56.0% *Clean Energy Resources: includes nuclear and renewables (hydro; solar, and landfill gas facilities with capacities <25 MW) 1 Oglethorpe Power Energy Resources 2 Related Company Energy Resources Information as presented in the 2024 ESG published September 2024. More than 30% of our members’ requirements were supplied by emission-free generation in 2022. With Vogtle Units 3 and 4 now online, our members’ emission-free generation is expected to increase to 44% in 2025. Existing Nuclear (Hatch, Vogtle Units 1 and 2)*1 New Nuclear (Vogtle Units 3 and 4)*1 Other Renewables* Green Power EMC*2 SEPA* Coal1 Natural Gas1 Smarr EMC2 Supplemental Contracts 31.8% 68.2% 23.6% 4% 2.5% 1.6% 6.6% 30.4% 1.7% 29.5% 2022 21.3% 11% 5.3% 4.6% 1.6% 7.2% 32% 0.8% 16.2% 2025 32% EMISSION- FREE 44% EMISSION- FREE

Third Quarter 2024 Investor Briefing Transition to a Cleaner Energy Future Includes Smarr EMC and Green Power EMC. Output from pumped-storage hydro is excluded. 2030 projections are based on current assumptions, which are less certain than the nearer-term 2025 projections. Information as presented in the 2024 ESG published September 2024. In 2025, we project that coal will account for just 9% of our portfolio, down from 51% in 2005, while emission-free energy will account for nearly 50% of the energy generated by Oglethorpe Power and provided by our related companies. 15

Third Quarter 2024 Investor Briefing Significant Reduction in Carbon Emissions Includes Smarr EMC and Green Power EMC. Output from pumped-storage hydro is excluded. 2025 reduction is projected. 2030 projections are based on current assumptions, which are less certain than the nearer-term 2025 projections. Information as presented in the 2024 ESG published September 2024. Our CO2 emissions intensity rate is projected to decline by 41% by 2025, compared to 2005, while at the same time we anticipate a 68% increase in the energy we generate for our members. 16

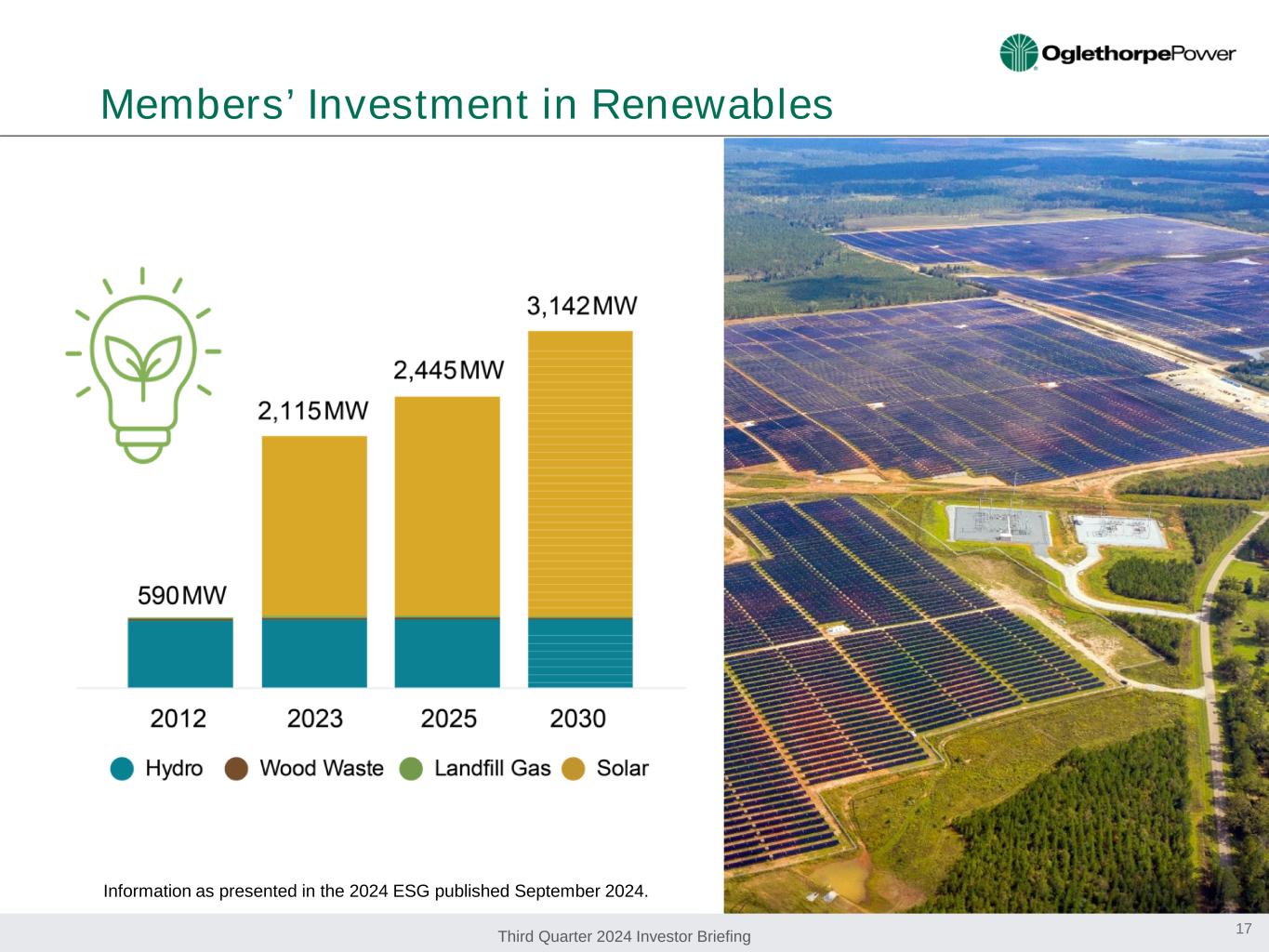

Third Quarter 2024 Investor Briefing 17 Members’ Investment in Renewables Information as presented in the 2024 ESG published September 2024.

Third Quarter 2024 Investor Briefing Rate Structure Assures Recovery of All Costs + Margin • Formulary Rate under Wholesale Power Contract • Minimum MFI ratio requirement of 1.10x under First Mortgage Indenture Expense Type Components Recovery Timeframe Variable Fuel, Variable O&M 30 – 60 days Fixed Margin, Interest, Depreciation, Fixed O&M, A&G • Billed on levelized annual budget • Trued up to actuals at year end • Oglethorpe budgets conservatively Key Points: • Cost inputs not subject to any regulatory approvals. • Formula changes subject to RUS & DOE approval but are infrequent. • Prior period adjustment mechanism covers any year-end shortfall below the required 1.10 MFI ratio (board approval not required; to date, has never needed to be used). • From 2010-2024, our board of directors increased our target margins for interest ratio to 1.14 to maintain margin coverage during development of construction of Vogtle 3 and 4 unit. Margin Coverage 18 BudgetProjections 1.10 1.12 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.14 1.10 $19.3 $26.4 $33.7 $37.7 $39.3 $41.5 $46.6 $48.3 $50.3 $51.2 $51.2 $52.6 $54.1 $56.0 $61.7 $65.8 $71.7 $55.4 $0.0 $20.0 $40.0 $60.0 $80.0 1.05 1.10 1.15 1.20 1.25 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 N et M ar gi n (M M ) M FI C ov er ag e

Third Quarter 2024 Investor Briefing Income Statement Excerpts (a) Margins for Interest ratio is calculated on an annual basis and is determined by dividing Oglethorpe’s Margins for Interest by Interest Charges, both as defined in Oglethorpe’s First Mortgage Indenture. The Indenture obligates Oglethorpe to establish and collect rates that, subject to any necessary regulatory approvals, are reasonably expected to yield a Margins for Interest ratio equal to at least 1.10 for each fiscal year. In addition, the Indenture requires Oglethorpe to show that it has met this requirement for certain historical periods as a condition for issuing additional obligations under the Indenture. Oglethorpe increased its Margins for Interest ratio to 1.14 each year, starting in 2010, above the minimum 1.10 ratio required by the Indenture. With the conclusion of Vogtle 3&4 construction, Margins for Interest ratio will be decreased back to the minimum 1.10 in the 2025 budget. (b) Excludes test energy megawatt-hours from Plant Vogtle Units 3 and 4 supplied to members. Any revenues and costs associated with test energy were capitalized. 19 Nine Months Ended Sept 30, 9/30/2023- 9/30/2024 Year Ended December 31, ($ in thousands) 2024 2023 % Change 2023 2022 2021 Statement of Revenues and Expenses: Operating Revenues: Sales to Members - Capacity $1,120,280 $763,294 46.8% $1,082,368 $984,036 $946,662 Sales to Members - Energy 492,854 461,343 6.8% 599,198 990,647 610,447 Total Sales to Members $1,613,134 $1,224,637 31.7% $1,681,566 $1,974,683 $1,557,109 Sales to non-Members 27,940 54,981 -49.2% 58,619 155,454 47,754 Operating Expenses: 1,270,158 1,080,308 17.6% 1,463,119 1,936,086 1,410,482 Other Income 55,337 60,954 -9.2% 81,049 72,244 71,254 Net Interest Charges 349,403 190,313 83.6% 292,325 204,591 207,854 Net Margin $76,850 $69,951 9.9% $65,790 $61,704 $57,781 Margins for Interest Ratio(a) 1.14 1.14 1.14 1.14 1.14 Sales to Members Energy Cost (cents/kWh) 2.09 2.18 -4.1% 2.12 3.86 2.47 Average Power Cost (cents/kWh) 6.84 5.79 18.2% 5.94 7.70 6.30 Sales to Members (MWh) 23,572,242 21,151,772 11.4% 28,289,147 25,634,984 24,727,585

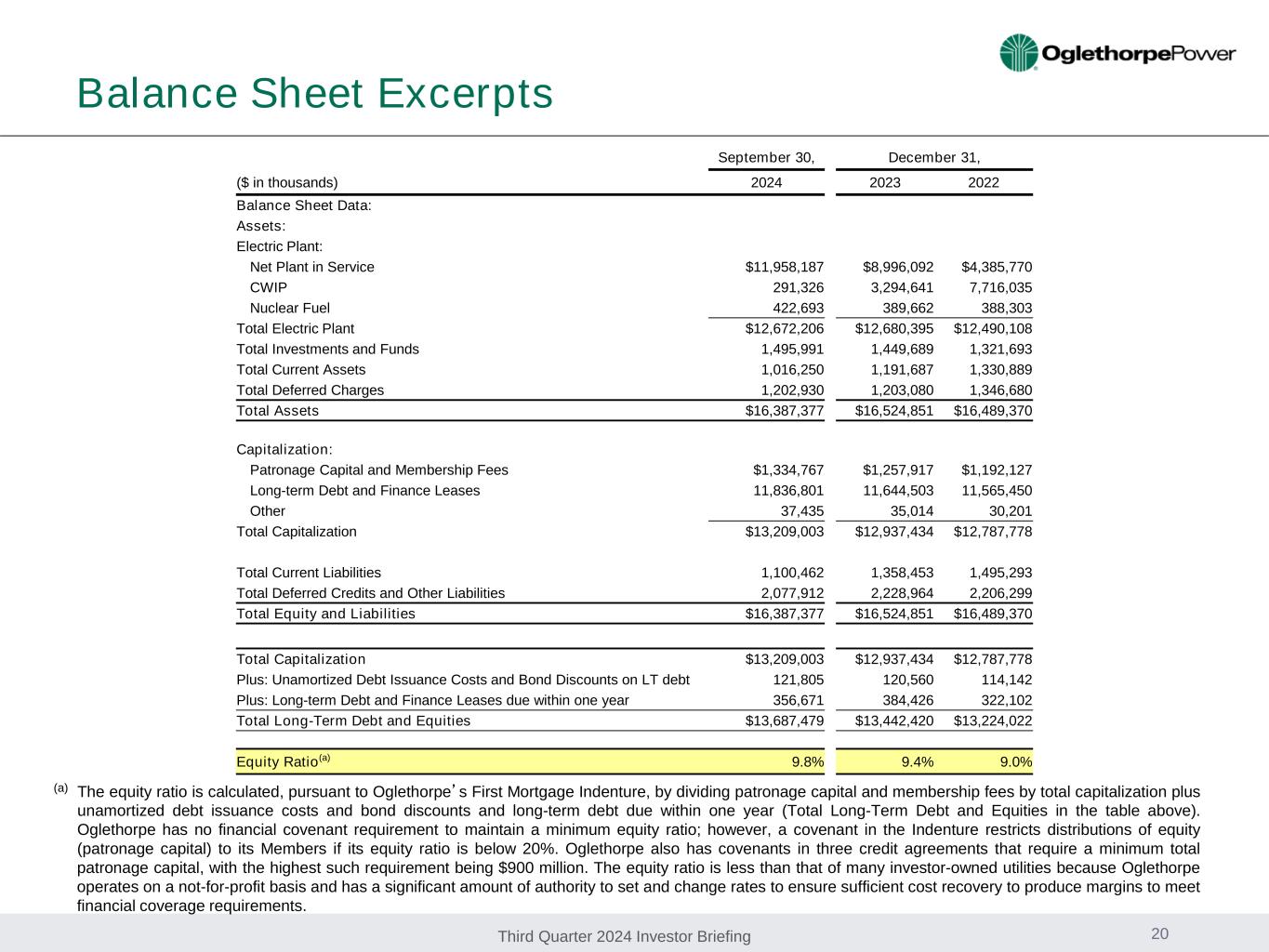

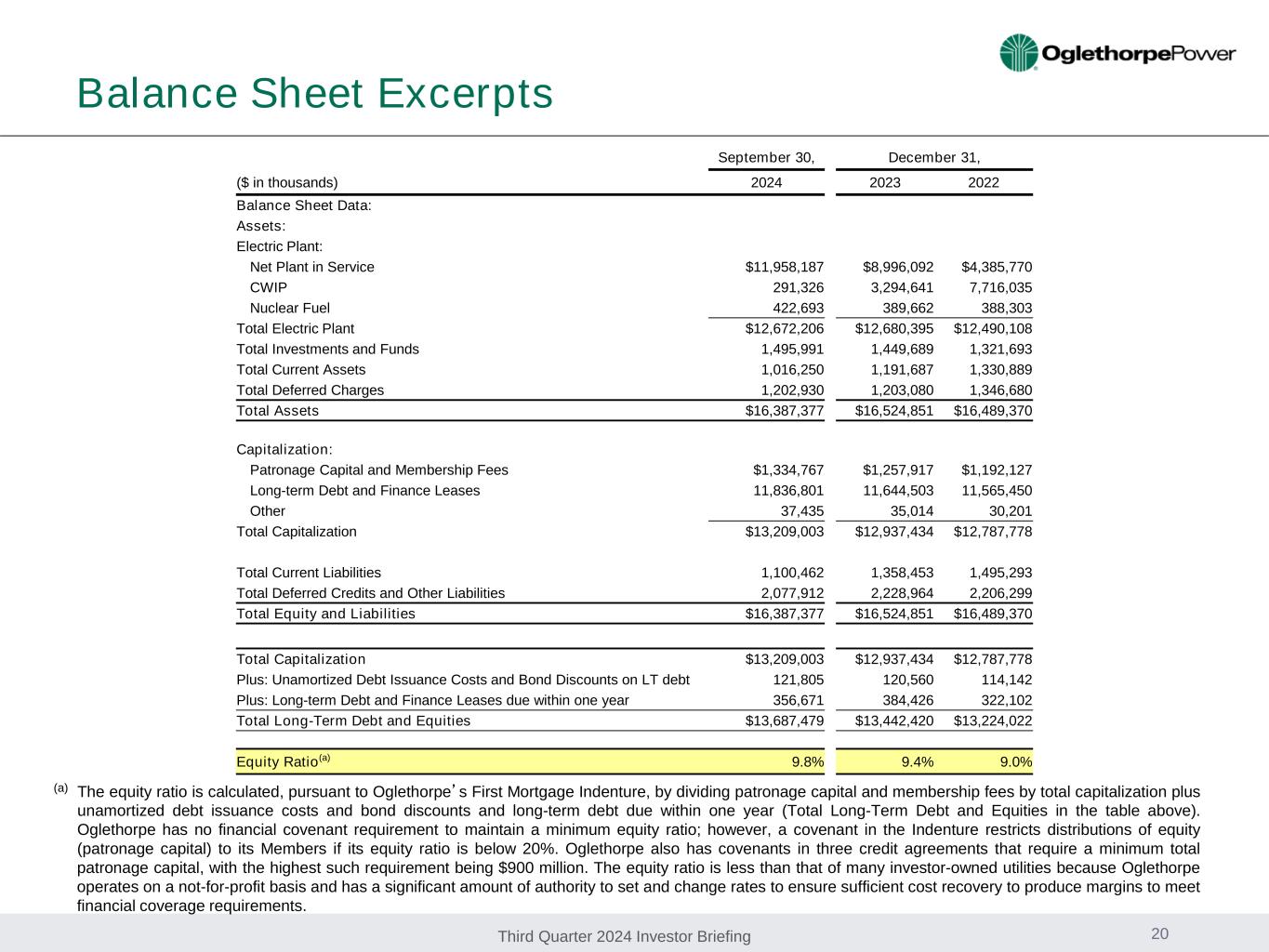

Third Quarter 2024 Investor Briefing Balance Sheet Excerpts 20 (a) The equity ratio is calculated, pursuant to Oglethorpe’s First Mortgage Indenture, by dividing patronage capital and membership fees by total capitalization plus unamortized debt issuance costs and bond discounts and long-term debt due within one year (Total Long-Term Debt and Equities in the table above). Oglethorpe has no financial covenant requirement to maintain a minimum equity ratio; however, a covenant in the Indenture restricts distributions of equity (patronage capital) to its Members if its equity ratio is below 20%. Oglethorpe also has covenants in three credit agreements that require a minimum total patronage capital, with the highest such requirement being $900 million. The equity ratio is less than that of many investor-owned utilities because Oglethorpe operates on a not-for-profit basis and has a significant amount of authority to set and change rates to ensure sufficient cost recovery to produce margins to meet financial coverage requirements. September 30, December 31, ($ in thousands) 2024 2023 2022 Balance Sheet Data: Assets: Electric Plant: Net Plant in Service $11,958,187 $8,996,092 $4,385,770 CWIP 291,326 3,294,641 7,716,035 Nuclear Fuel 422,693 389,662 388,303 Total Electric Plant $12,672,206 $12,680,395 $12,490,108 Total Investments and Funds 1,495,991 1,449,689 1,321,693 Total Current Assets 1,016,250 1,191,687 1,330,889 Total Deferred Charges 1,202,930 1,203,080 1,346,680 Total Assets $16,387,377 $16,524,851 $16,489,370 Capitalization: Patronage Capital and Membership Fees $1,334,767 $1,257,917 $1,192,127 Long-term Debt and Finance Leases 11,836,801 11,644,503 11,565,450 Other 37,435 35,014 30,201 Total Capitalization $13,209,003 $12,937,434 $12,787,778 Total Current Liabilities 1,100,462 1,358,453 1,495,293 Total Deferred Credits and Other Liabilities 2,077,912 2,228,964 2,206,299 Total Equity and Liabilities $16,387,377 $16,524,851 $16,489,370 Total Capitalization $13,209,003 $12,937,434 $12,787,778 Plus: Unamortized Debt Issuance Costs and Bond Discounts on LT debt 121,805 120,560 114,142 Plus: Long-term Debt and Finance Leases due within one year 356,671 384,426 322,102 Total Long-Term Debt and Equities $13,687,479 $13,442,420 $13,224,022 Equity Ratio(a) 9.8% 9.4% 9.0%

Third Quarter 2024 Investor Briefing Total amount outstanding under all RUS Guaranteed Loans is $2.8 billion, with an average interest rate of 3.483%. RUS Guaranteed Loans(a) (a) RUS guaranteed loans are funded through the Federal Financing Bank and made at comparable Treasury plus 0.125%. (b) Submitted application in June 2024 for the acquisition and general capital improvements at Walton County Power Plant. Loan application has been amended to include proceeds for acquisition and closing costs only. General capital improvements will be submitted in future loan application. RUS Loan Summary as of October 31, 2024 Purpose/Use of Proceeds Approved Advanced Remaining Amount Current Loans General & Environmental Improvements - "AD48" $630,342,000 $460,590,889 $169,751,111 Washington Acquisition - "AF48" $87,943,000 $87,943,000 $0 Baconton Acquisition - "AG48" $17,515,000 $17,515,000 $0 General & Environmental Improvements - "AH48" $755,208,000 $187,312,395 $567,895,605 $1,491,008,000 $753,361,284 $737,646,716 21

Third Quarter 2024 Investor Briefing DOE Loan Summary as of October 31, 2024 ‣ We advanced $4.6 billion of eligible project costs related to Vogtle 3&4 pursuant to loan agreements with DOE funded through the Federal Financing Bank. ‣ We began principal repayments of our DOE-guaranteed loans in February 2020. To date, we have repaid $550 million under these loans. Net proceeds from the $350 million taxable green bond issuance in June 2024 were used to refinance a portion of the loans that were repaid prior to Unit 4 commercial operation, and we plan to refinance the remaining with taxable green bonds. DOE Guaranteed Loans for Vogtle 3&4 Average interest rate on the outstanding balance under these loans is 2.936%. Loan Agreement Advanced Repaid Outstanding 2014 Loan $3,013,348,382 $357,940,935 $2,655,407,447 2019 Loan $1,619,679,706 $192,126,407 $1,427,553,299 $4,633,028,088 $550,067,342 $4,082,960,746 22

Third Quarter 2024 Investor Briefing Oglethorpe’s Bank Credit Facilities $0 $500 $1,000 $1,500 $2,000 Q 1 20 23 Q 2 20 23 Q 3 20 23 Q 4 20 23 Q 1 20 24 Q 2 20 24 Q 3 20 24 Q 4 20 24 Q 1 20 25 Q 2 20 25 Q 3 20 25 Q 4 20 25 Q 1 20 26 Q 2 20 26 Q 3 20 26 Q 4 20 26 Q 1 20 27 Q 2 20 27 Q 3 20 27 Q 4 20 27 Q 1 20 28 Q 2 20 28 Q 3 20 28 Q 4 20 28 Q 1 20 29 Q 2 20 29 20 43 (M ill io ns ) 23 $1.275B Syndicated Revolver / CP Backup NRUCFC $ 250 mm Bank of America, N.A. $150 mm CoBank, ACB $150 mm Truist Bank $150 mm Royal Bank of Canada $125 mm Mizuho Bank, Ltd. $100 mm Regions Bank $100 mm U.S. Bank, N.A $100 mm Fifth Third Bank, N.A. $ 50 mm Goldman Sachs Bank USA $ 50 mm JPMorgan Chase Bank, N.A. $ 50 mm $350mm JPMorgan Bilateral $250mm NRUCFC Secured Bilateral ($140 million available)(a) $110mm NRUCFC Unsecured Bilateral Optional Term-Out of $250mm Secured Bilateral with 2043 Maturity …………. Time Now (a) The secured term loan amount is $250 million, however, any outstanding advances under the CFC $110 million unsecured line of credit reduce the amount that can be borrowed under the term loan; therefore we show only $140 million of the secured term loan as being available. ‣ Renewed JPMorgan Bilateral credit facility at $200 million through March 2027. With this, Oglethorpe has renewed all of its credit facilities since Q4 2023. Total credit facilities total $1.725 billion. $200mm JPMorgan Bilateral Renewal $1.725 billion

Third Quarter 2024 Investor Briefing Credit Ratings ‣ Credit ratings or outlooks have been improving since the commercial operation of Vogtle Unit 3 in July 2023. Most recently: • Fitch’s rating was upgraded to BBB+ from BBB in June 2024 • Moody’s outlook was changed from Stable to Positive in October 2024 24 Moody’s Standard & Poor’s Fitch Baa1 Positive Outlook BBB+ Stable Outlook BBB+ Stable Outlook Current Credit Ratings for Secured Long-Term Debt

Third Quarter 2024 Investor Briefing $1,725 $364 $1,361 $309 $1,670 $0 $500 $1,000 $1,500 $2,000 Total Credit Facilities Less Borrowings Available Credit Facilities Capacity Cash Total Liquidity $ M ill io ns Oglethorpe’s Available Liquidity As of November 15, 2024 Borrowings Detail $3 million – Outstanding Letters of Credit for Operational Needs $253 million – Vogtle 3&4 Costs / DOE Principal and Interest Refinancing $74 million – Walton Acquisition Costs $33 million – B.C. Smith, Washington, Baconton and Walton Deferral Costs $2 million – New Generation: Smarr CC and Talbot CT • Represents 549 days of liquidity on hand 25

Third Quarter 2024 Investor Briefing Recent and Upcoming Financial Activity Completed in 2024 Q2 Closed on $861 million of RUS loans Renewed syndicated bank credit facility at $1.275 billion $350 million green first mortgage bond for Vogtle 3&4 Q3 Renewal of J.P. Morgan bilateral credit facility Upcoming in 2025 Q1 $350-450 million first mortgage bond issuance for Vogtle 3&4 $313 million tax-exempt remarketing 26

Third Quarter 2024 Investor Briefing $1,210 $ 1,210 $1,810 $1,810 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 Jan Feb M ar A pr M ay Jun Jul A ug S ep O ct N ov D ec B or ro w in gs ( M il) Cash Borrowings CP Availability Total Available Lines of Credit Ca sh B al an ce s (M il) Net Margin Liquidity Wholesale Power CostInterim CP Financing Balance Sheet Electric Plant Average Cost of Funds: 5.03% (dollars in millions) Secured LT Debt (10.31.24): $12.5 billion Weighted Average Cost: 3.94% 2024 October 31, 2024 2024 2024 2024 Secured Long Term Debt 27 1.14 MFI ratio Actual Forecast 2.0 3.0 4.0 5.0 6.0 7.0 8.0 9.0 10.0 Budget YTD Actual YTD 6.847.55 ¢/ kW h $- $20 $40 $60 $80 $100 Ja n Fe b M ar Ap r M ay Ju n Ju l Au g Se p Oc t No v De c M illi on s Actual Budget $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 $11 $12 $13 $14 YE '23 Sep '24 $9.00 $11.96 $0.39 $0.42 $3.29 $0.29 (B illi on s) Construction Work in Progress Nuclear Fuel Electric Plant in Service Total Assets ($ Millions) $16,525 $16,387 Vogtle 3&4 Interest Rate Hedging - CP, $40 DOE - Vogtle 3&4 P&I - CP, $212 BCSmith Deferral - CP, $21 Washington Acquisition & Deferral - CP, $10 Walton Acquisition & Deferral, $74 New Gas Generation, $2 $(300) $(100) $100 $300 $500 DOE RUS Taxable ($63) ($127) ($178) ($ Millions) Actual Issuance Forecasted Issuance Actual Repayment Forecasted Repayment

Third Quarter 2024 Investor Briefing • A link to this presentation will be posted on Oglethorpe’s website www.opc.com. • Oglethorpe’s SEC filings, including its annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K are made available on its website. • Oglethorpe’s ESG Report along with its qualitative and quantitative EEI ESG/Sustainability Reports are available on its website. • Member information is generally filed as an exhibit to Form 10-Q for the first or second quarter of each year. (Exhibits are available on EDGAR but not on Oglethorpe’s website.) 2023 Member information was filed in an exhibit to Form 10-Q for the second quarter of 2024. • For additional information please contact: Additional Information 28 Investor Contacts Name Title Email Address Phone Number Betsy Higgins Executive Vice President and Chief Financial Officer betsy.higgins@opc.com 770-270-7168 Joe Rick Director, Capital Markets and Investor Relations joe.rick@opc.com 770-270-7240 Cheri Garing Vice President, Planning cheri.garing@opc.com 770-270-7204 Media Contact Name Title Email Address Phone Number Heather Teilhet Sr. Vice President, External Affairs heather.teilhet@opc.com 770-270-7187