33

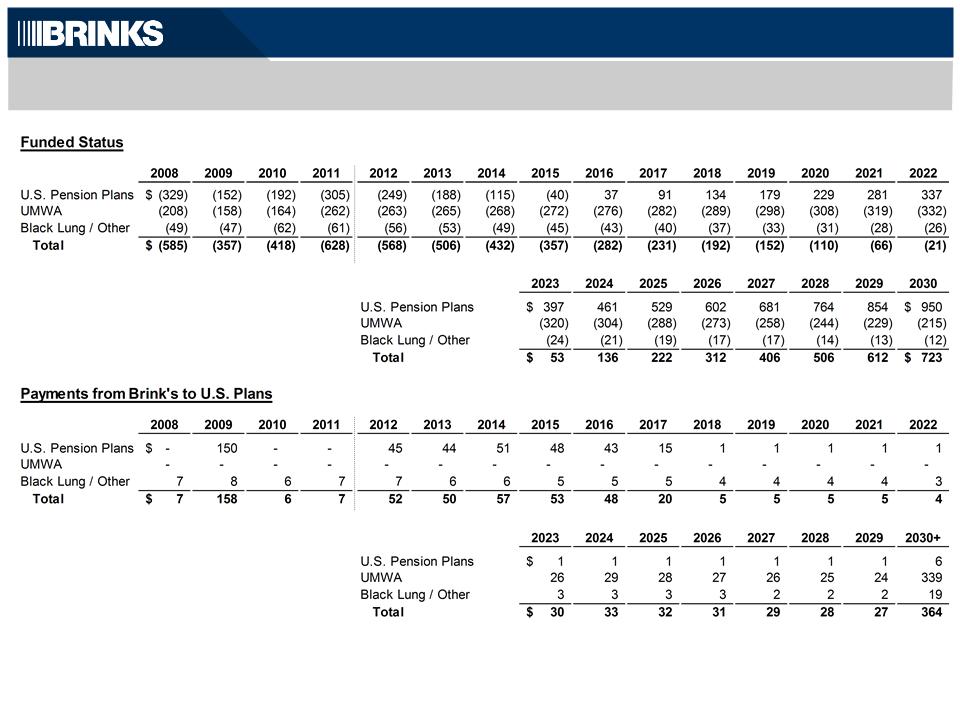

Non-GAAP Reconciliations - U.S. Retirement Plans Obligation

DISCOUNTED CASH FLOWS AT PLAN DISCOUNT RATES - RECONCILED TO AMOUNTS REPORTED UNDER U.S. GAAP |

| | | December 31, 2011 |

| | | | | Primary U.S.

pension plan

(b) | | UMWA plans

(c) | | Other unfunded

U.S. plans | | Total |

| | | | | | | | | | | |

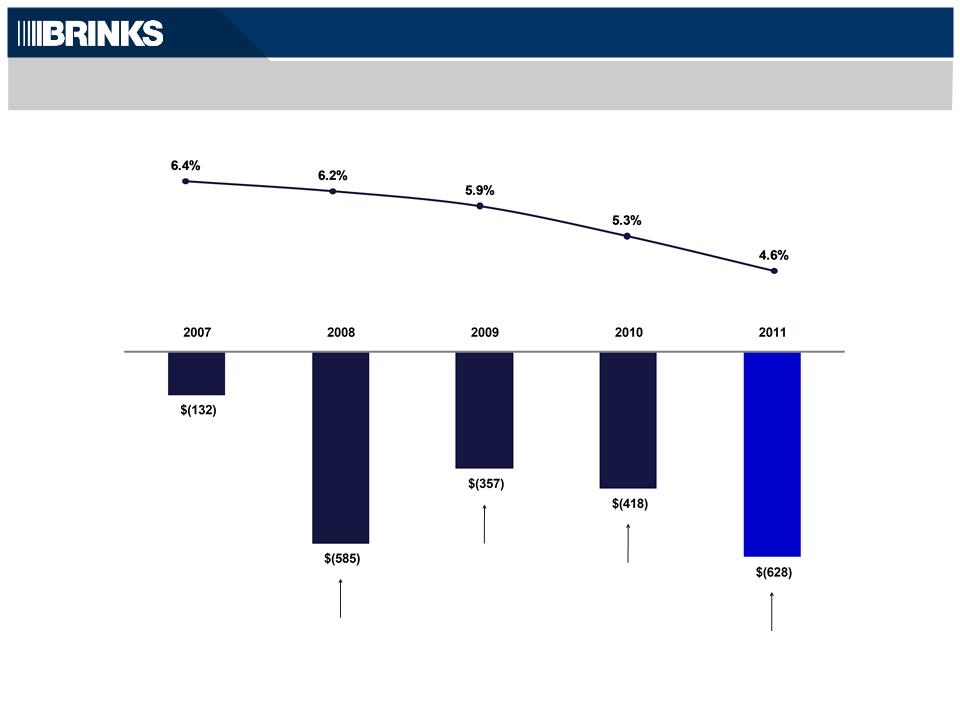

| Funded status of U.S. retirement plans - GAAP | | $ | 279 | | 262 | | 87 | | 628 |

| Present value of projected earnings of plan assets (a) | | | (82) | | (57) | | - | | (139) |

| | | | | | | | | | | |

| | Discounted cash flows at plan discount rates - Non-GAAP | | $ | 197 | | 205 | | 87 | | 489 |

| | | | | | | | | | | |

| | Plan discount rate | | | 4.60% | | 4.40% | | | | |

| | Expected return of assets | | | 8.25% | | 8.50% | | | | |

(a) Under GAAP, the funded status of a benefit plan is reduced by the fair market value of plan assets at the balance sheet date, and the present value

of the projected earnings on plan assets does not reduce the funded status at the balance sheet date. The non-GAAP measure presented above

additionally reduces the funded status as computed under GAAP by the present value of projected earnings of plan assets using the expected return

on asset assumptions of the respective plan.

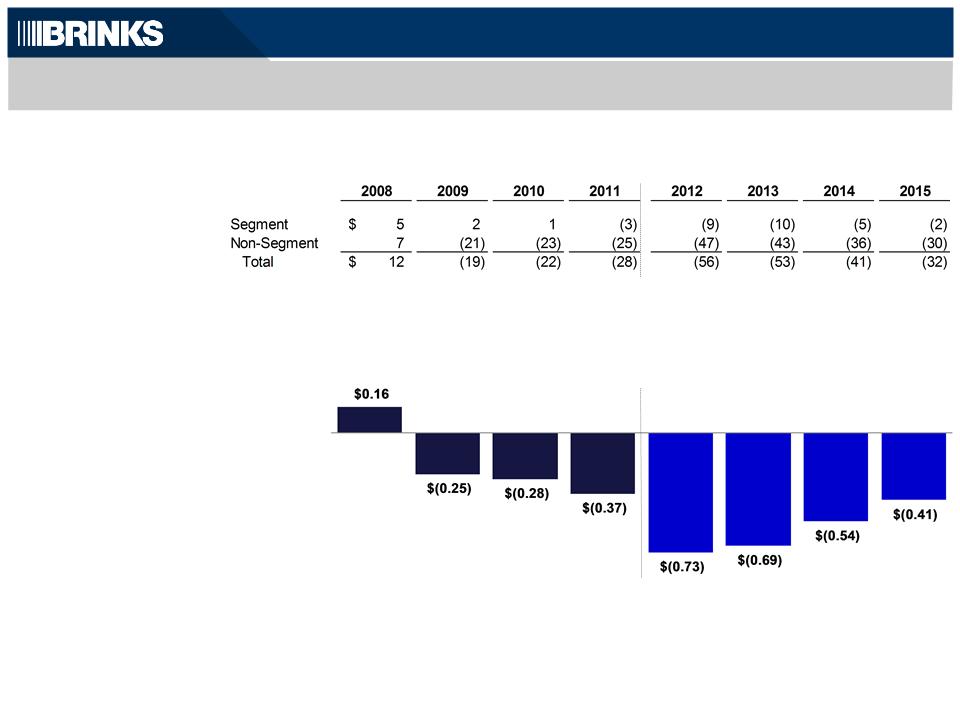

(b) For the primary U.S. pension plan, we are required by ERISA regulations to maintain minimum funding levels, and as a result, we estimate we will

be required to make minimum required contributions from 2012 to 2017. We have estimated that we will achieve the required funded ratio after the

2017 contribution.

(c) There are no minimum funding requirements for the UMWA plans because they are not covered by ERISA funding regulations. Using assumptions

at the end of 2011, we project that the plan assets plus expected earnings on those investments will cover the benefit payments for these plans until

2023. We project that Brink’s will be required to contribute cash to the plan beginning in 2023 to pay beneficiaries.

Discounted cash flows at plan discount rates are supplemental financial measures that are not required by, or presented in accordance with GAAP. The

purpose of the discounted cash flows at plan discount rate is to present our retirement obligations after giving effect to the benefit of earning a return on

plan assets. We believe this measure is helpful in assessing the present value of future funding requirements of the company in order to meet plan

benefit obligations. Discounted cash flows at plan discount rates should not be considered as an alternative to the funded status of the U.S. retirement

plans at December 31, 2011, as determined in accordance with GAAP and should be read in conjunction with our consolidated balance sheets.