(b) To eliminate settlement charge related to exit of Belgium cash-in-transit business.

(c) To eliminate employee benefit settlement loss related to Mexico. Portions of Brink’s Mexican subsidiaries’ accrued employee termination benefit were

paid in the second and third quarters of 2011. The employee termination benefit is accounted for under FASB ASC Topic 715, Compensation -

Retirement Benefits. Accordingly, the severance payments resulted in settlement losses.

(d) To eliminate the costs related to the retirement of the former CEO.

(e) To eliminate expenses related to U.S. retirement liabilities.

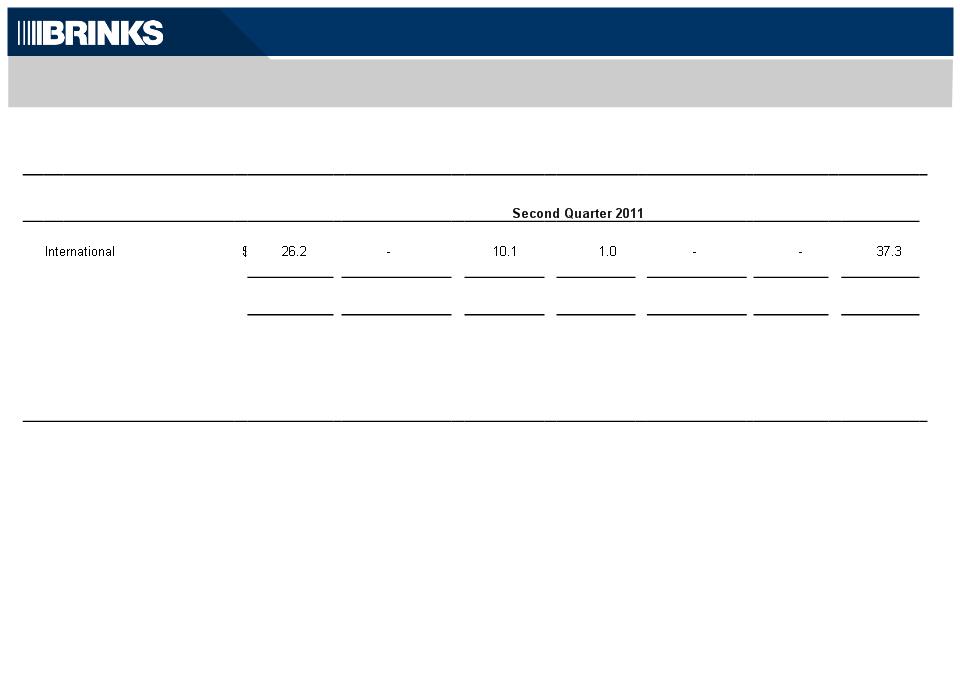

GAAP

Basis

Gains on

Acquisitions and

Asset Dispositions

(a)

Belgium

Settlement

Charge (b)

Mexico

Employee

Benefit

Settlement

Losses (c)

CEO

Retirement

Costs (d)

U.S.

Retirement

Plans (e)

Non-GAAP

Basis

Full Year 2011

Operating profit:

International

$

199.7

-

10.1

2.1

-

-

211.9

North America

31.4

-

-

-

-

3.2

34.6

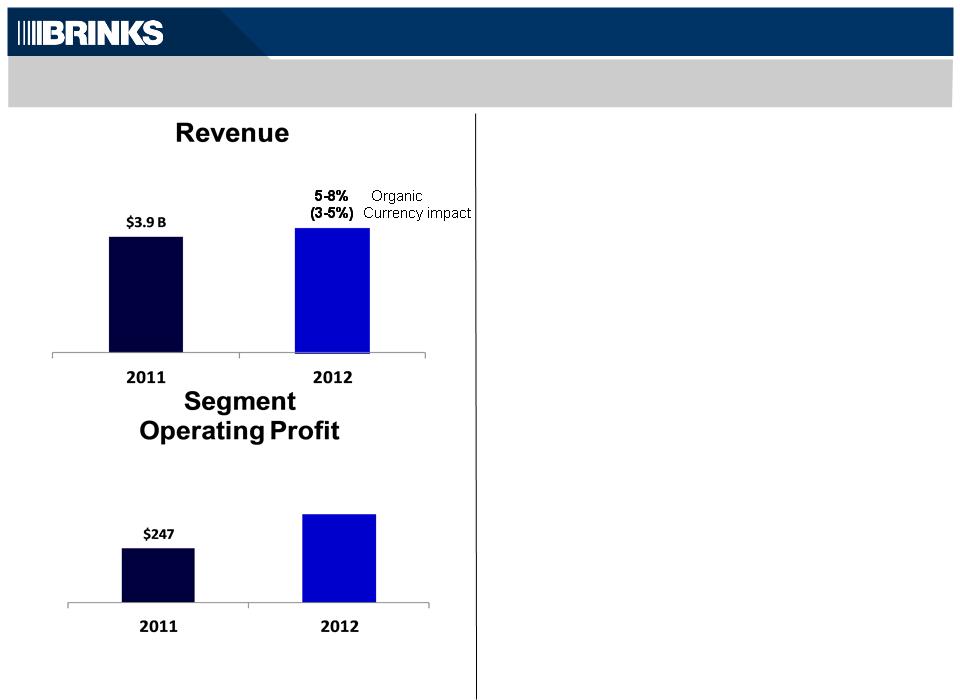

Segment operating profit

231.1

-

10.1

2.1

-

3.2

246.5

Non-segment

(59.8)

(9.7)

-

-

4.1

24.8

(40.6)

Operating profit

$

171.3

(9.7)

10.1

2.1

4.1

28.0

205.9

Amounts attributable to Brink’s:

Income from continuing operations

$

73.0

(9.6)

6.4

1.5

2.6

17.7

91.6

Diluted EPS - continuing operations

1.52

(0.20)

0.13

0.03

0.05

0.37

1.90

Amounts may not foot due to rounding

(a) To eliminate gain recognized on the sale of the U.S. document destruction business, gains on available-for-sale equity and debt securities, gains related

to acquisition of controlling interest in subsidiaries that were previously accounted for as equity or cost method investments, and gains on sales of former

operating assets, as follows:

Non-GAAP Reconciliations - Full-Year 2011

| | | Full Year 2011 | |

| | | Operating Profit | | EPS | |

| Sale of U.S. Document Destruction business | $ | (6.7) | | (0.09) | |

| Gains on available-for-sale equity and debt securities | | - | | (0.05) | |

| Acquisition of controlling interests | | (2.5) | | (0.05) | |

| Sale of former operating assets | | (0.5) | | (0.01) | |

| | $ | (9.7) | | (0.20) | |

20