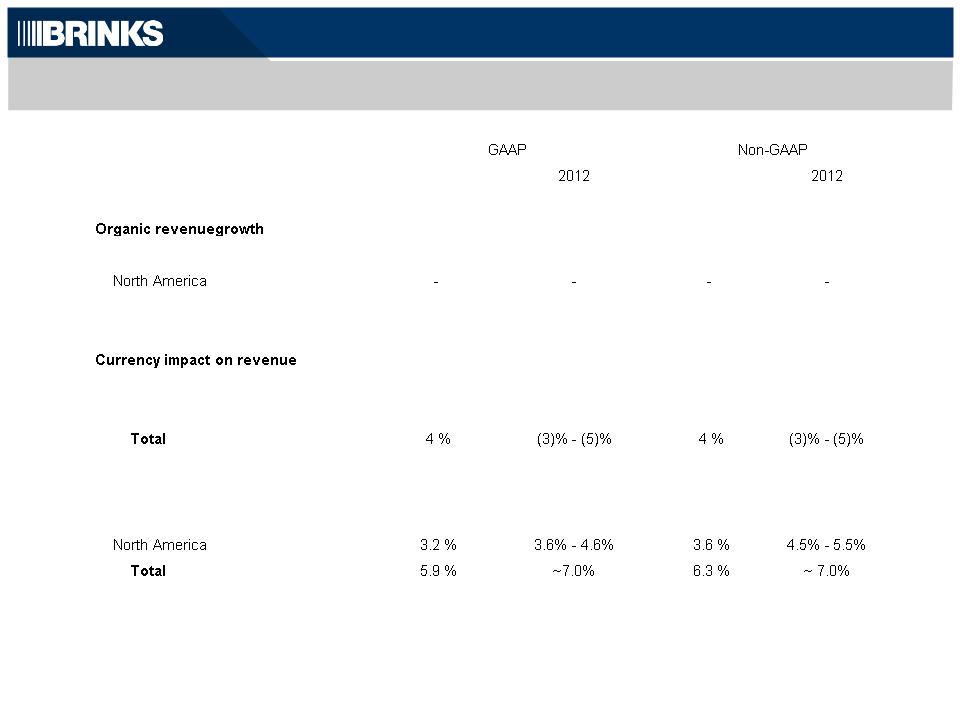

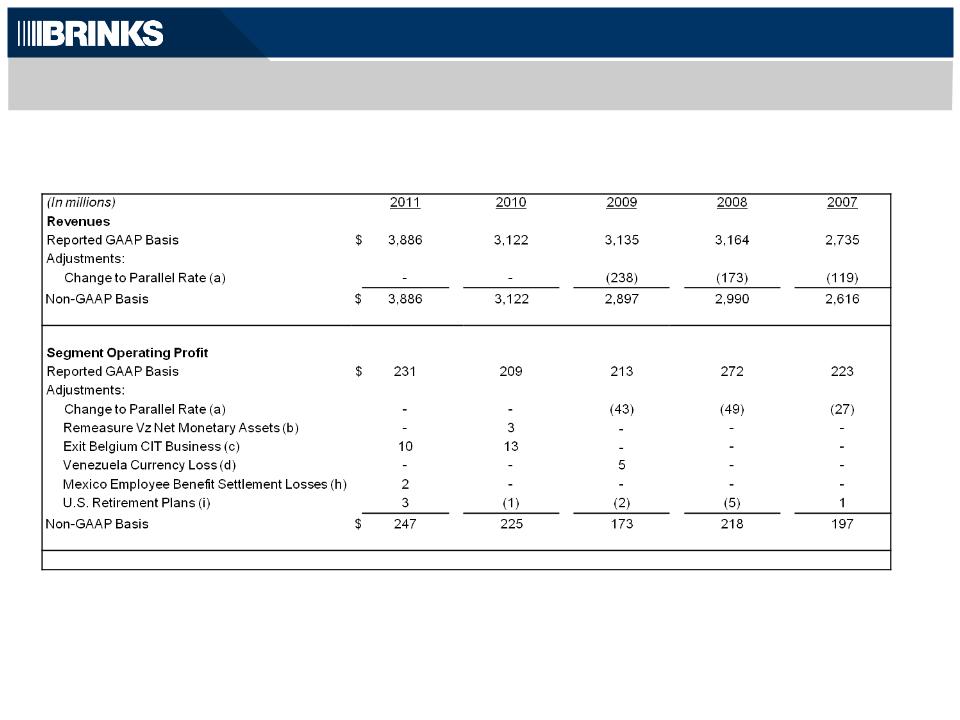

Non-GAAP Results - Reconciled to Amounts Reported under GAAP

Non-GAAP results described in this presentation are financial measures that are not required by, or presented in accordance with generally

accepted accounting principles (“GAAP”).

Purpose of Non-GAAP Information

The purpose of the non-GAAP information is to report our financial information

• without income and expense items described below in 2007, 2008, 2009, 2010 and 2011,

• as if our results from Venezuela had been translated at the less-favorable parallel exchange rate in 2007, 2008 and 2009, and

• after adjusting tax expense for items described below.

The non-GAAP information provides information to assist comparability and estimates of future performance. Brink’s believes these

measures are helpful in assessing operations and estimating future results and enable period-to-period comparability of financial

performance. Non-GAAP results should not be considered as an alternative to revenue or income amounts determined in accordance with

GAAP and should be read in conjunction with their GAAP counterparts.

a) To reduce revenues and segment operating income to reflect the 2009, 2008 and 2007 results of Venezuelan subsidiaries had they

been translated using the parallel currency exchange rate in effect at the time. The average parallel exchange rate used for the

2009 non-GAAP full-year earnings was 6.0 bolivar fuertes to the U.S. dollar, compared to an average rate of 2.2 bolivar fuertes to

the U.S. dollar that was used for the GAAP financial statements. The official rate of 2.15 bolivar fuertes to the U.S. dollar was used

for translation of Venezuela for most of 2009 until the parallel rate was adopted during December. The use of the weaker rate to

translate 2009 non-GAAP revenues and earnings of the Venezuelan subsidiaries decreased each measure by 63%.

b) To reverse remeasurement gains and losses in Venezuela. For accounting purposes, Venezuela is considered a highly inflationary

economy. Under GAAP, subsidiaries that operate in Venezuela record gains and losses in earnings for the remeasurement of

bolivar fuerte-denominated net monetary assets.

c) To eliminate charges related to exit of Belgium cash-in-transit (CIT) business.

d) To eliminate currency losses incurred in Venezuela related to increases in cash held in U.S. dollars by Venezuelan subsidiaries.

These losses would not have been incurred had the operations been translated at the parallel rate.

e) To eliminate gain recognized on the sale of the U.S. document destruction business, gains on available-for-sale equity and debt

securities, gains/losses related to acquisition of controlling interest in subsidiaries that were previously accounted for as equity or

cost method investments, and gains on sales of former operating assets.

f) To eliminate royalty income from Brink’s Home Security.

g) To eliminate the cost related to the retirement of the former CEO.

h) To eliminate employee benefit settlement loss related to Mexico. Portions of Brink’s Mexican subsidiaries’ accrued employee

termination benefit were paid in the second and third quarters of 2011. The employee termination benefit is accounted for under

FASB ASC Topic 715, Compensation - Retirement Benefits. Accordingly, the severance payments resulted in settlement losses.

i) To eliminate expenses related to U.S. retirement liabilities.

22