The Brink’s Company

First-Quarter 2013 Earnings

Conference Call

NYSE:BCO

April 25, 2013

Exhibit 99.2

Forward-Looking Statements

These materials contain forward-looking statements. Actual

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

results could differ materially from projected or estimated

results. Information regarding factors that could cause such

differences is available in today's release and in The Brink’s

Company’s most recent SEC filings.

Information discussed today is representative as of today

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

only and Brink's assumes no obligation to update any

forward-looking statements. These materials are

copyrighted and may not be used without written permission

from Brink's.

2

The Brink’s Company

Ed Cunningham

Director - Investor Relations

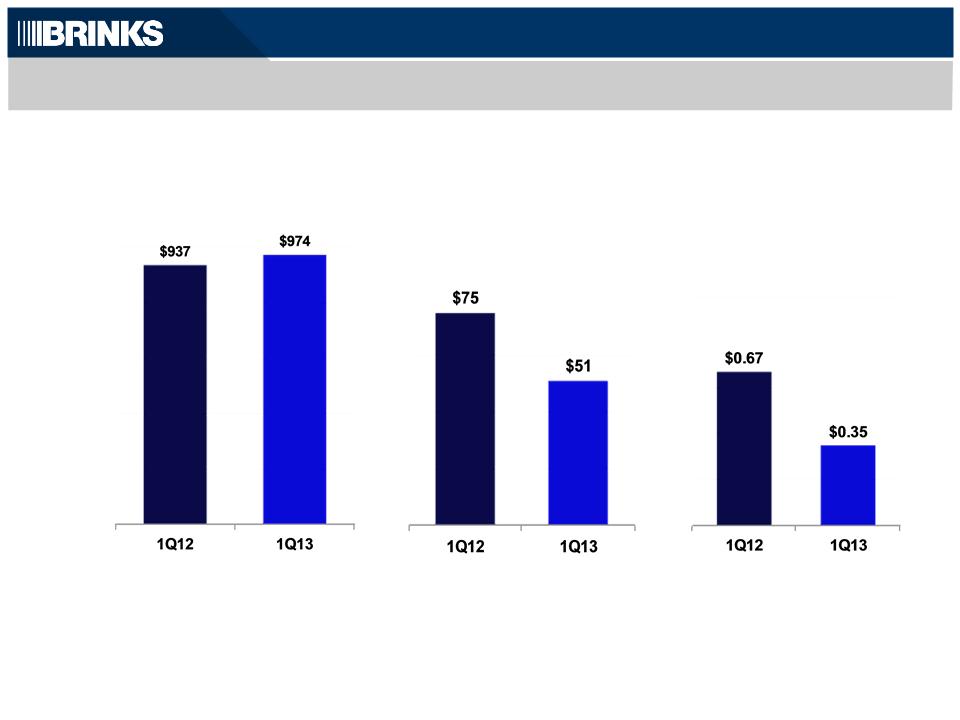

Highlights of First-Quarter Results

GAAP EPS $.04 vs $.43

• Includes theft loss ($.24 charge)

Non-GAAP Summary

• EPS $.35 vs $.67

• Includes theft loss ($.24 charge)

• Segment margin 5.2% vs 8% (7.2% ex theft loss)

• Revenue up 4% (6% organic growth)

Note: See reconciliation to GAAP results in Appendix

4

The Brink’s Company

Tom Schievelbein

Chairman, President and

Chief Executive Officer

CEO Overview

• International profits drive better-than-expected results

• Latin America, Asia-Pacific results offset theft loss and

North America profit decline

North America profit decline

• Full-year outlook affirmed

• Segment margin: 6% to 6.5%

• Organic revenue growth: 5% to 8%

6

Note: See reconciliation to GAAP results in Appendix

Strategy Update

• Maximize profits in North America and Europe

• North America guidance reduced

• Europe on track

• Grow Latin America

• Q1 stronger than expected

• Expect full-year profit growth

7

Strategy Update

• Exit underperforming markets

• Guarding operations in France and Morocco

• CIT markets in Germany, Poland and Turkey

• Acquisitions

• Chile - acquired remaining 26%

• Adjacencies

• Rede Trel acquisition complete

• Brink’s Money Card rollout

8

The Brink’s Company

Joe Dziedzic

Vice President and Chief

Financial Officer

Financial Officer

Review and Outlook

1Q13 Non-GAAP Results

($ millions, except EPS)

Segment

Operating Profit

Operating Profit

Revenue

Margin | 8.0% | 5.2% |

EPS

Note: See reconciliation to GAAP results in Appendix

10

Non-GAAP EPS: 1Q12 Versus 1Q13

Segment

Operating

Profit

Operating

Profit

Non-Segment

Expense

Expense

Interest

Expense,

Net

Expense,

Net

Non-

Controlling

Interest

Controlling

Interest

Tax

Rate/Diluted

Shares

Rate/Diluted

Shares

1Q12

1Q13

Note: See reconciliation to GAAP results in Appendix

$(0.03) Profit

decrease

excluding

items below

decrease

excluding

items below

$(0.24) Belgium theft

loss

$(0.04) Foreign

currency

Amounts may not add due to rounding

$(0.01) Tax rate

$(0.01) Diluted shares

11

$0.03 Reduction in

benefit costs

benefit costs

Organic | |||||

Growth | 10% | 6% |

Revenue

1Q13 Non-GAAP Segment Results

($ millions)

Revenue

Segment Operating Profit

Margin | 8.0% | 5.2% |

Segment Operating Profit

— 6% Organic growth, 2% unfavorable

currency impact

currency impact

— 8% Organic growth in International

— North America flat

— Unfavorable currency impact of $3

— North America down $8

— International down $17

— $19 Belgium loss impacts North America

segment by $4 and International by $15

segment by $4 and International by $15

12

Note: See reconciliation to GAAP results in Appendix

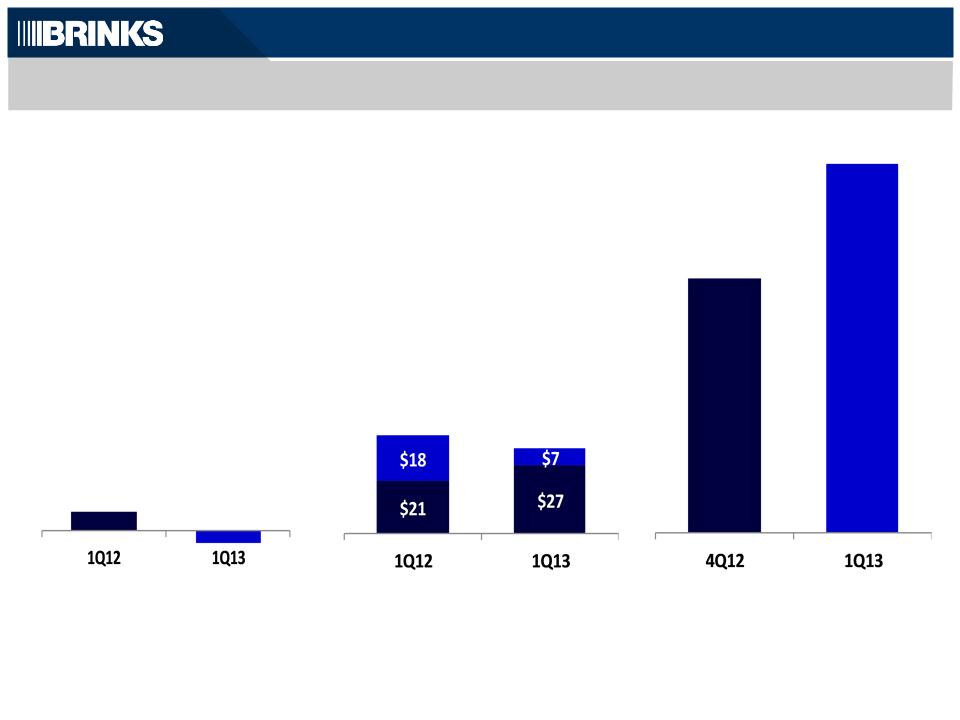

Capital

Expenditures

and Capital

Leases(b)

Expenditures

and Capital

Leases(b)

Non-GAAP Cash Flow, Capital Investment and Net Debt

13

($ millions)

(a) See reconciliation to GAAP results in Appendix

(b) From continuing operations

Non-GAAP

CFOA(a) (b)

CFOA(a) (b)

$34

$39

North

America

America

International

Net Debt (a)

13

$232

$(6)

$336

$9

2013 Outlook

— Organic growth 5% to 8%

— Unfavorable currency impact 2% to 4%

Assumptions vs 2012

14

April 25, 2013

Revenue

Non-GAAP Segment Margin Rate

— North America 2% to 3%

— International 7.0% to 8.0%

— Total segment 6.0% to 6.5%

Other Metrics

— Non-segment expense $41

— Interest expense $27 to $29

— Non-controlling interest $17 to $20

— Tax rate 36% to 39%

— Capital expenditures / leases flat at $205

— Growth in Latin America, North America and Europe flat

— Venezuela devaluation full year impact of $130 million,

3% of total revenue

3% of total revenue

— Continued price/volume pressure partially offset by cost

actions

actions

— Decline from productivity spend, Venezuela devaluation

and slight decline in Europe offset by Latin America

growth

and slight decline in Europe offset by Latin America

growth

— Slight decrease

— Increase from recent acquisitions

— Continued focus on returns

The Brink’s Company

First-Quarter 2013 Earnings

Conference Call

NYSE:BCO

April 25, 2013

Appendix - Legacy Liabilities

Legacy Liabilities at December 31, 2012

Estimated Contributions to U.S. Plans | ||||||||||||||

2012A | 2013 | 2014 | 2015 | 2016 | 2017 | |||||||||

US Pension | $ 37 | 14 | 29 | 42 | 44 | 38 | ||||||||

UMWA | 0 | 0 | 0 | 0 | 0 | 0 | ||||||||

Black Lung/Other | 7 | 5 | 5 | 5 | 4 | 4 | ||||||||

Total | $ 44 | 19 | 34 | 47 | 48 | 42 | ||||||||

($ millions)

$275

Under-

funding

Under-

funding

Note: Above amounts based on actuarial assumptions at December 31, 2012.

17

Under-

funding

funding

$257

Appendix

Non-GAAP Reconciliations

Non-GAAP Reconciliations

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet requirements to be classified as

discontinued operations.

discontinued operations.

(b) To eliminate a $1.1 million adjustment to the amount of gain recognized on a 2010 business acquisition in Mexico as a result of a favorable

adjustment to the purchase price received in the first quarter of 2013.

adjustment to the purchase price received in the first quarter of 2013.

(c) To eliminate currency exchange losses related to a 16% devaluation of the official exchange rate in Venezuela from 5.3 to 6.3 bolivar fuertes to the

U.S. dollar.

U.S. dollar.

(d) To eliminate employee benefit settlement losses in Mexico.

(e) To eliminate expenses related to U.S. retirement plans.

(f) To adjust effective income tax rate in the interim period to be equal to the midpoint of the estimated range of the full-year non-GAAP effective income

tax rate. The midpoint of the estimated range of the full-year non-GAAP effective tax rate for 2013 is 37.5%.

tax rate. The midpoint of the estimated range of the full-year non-GAAP effective tax rate for 2013 is 37.5%.

GAAP

Basis

Basis

Additional

European

Operations to

be Exited (a)

European

Operations to

be Exited (a)

Gains on

Acquisitions

and Asset

Dispositions (b)

Acquisitions

and Asset

Dispositions (b)

Monetary Asset Re

-measurement

losses in

Venezuela (c)

-measurement

losses in

Venezuela (c)

Employee

Benefit

Settlement &

Severance

Losses (d)

Benefit

Settlement &

Severance

Losses (d)

U.S.

Retirement

Plans (e)

Retirement

Plans (e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

First Quarter 2013

Revenue:

Latin America

$

412.9

−

−

−

−

−

−

412.9

EMEA

286.0

(3.9)

−

−

−

−

−

282.1

Asia Pacific

42.9

−

−

−

−

−

−

42.9

International

741.8

(3.9)

−

−

−

−

−

737.9

North America

235.6

−

−

−

−

−

−

235.6

Revenues

$

977.4

(3.9)

−

−

−

−

−

973.5

Operating profit:

International

$

35.6

1.2

−

13.4

0.3

−

−

50.5

North America

(2.4)

−

−

−

−

2.9

−

0.5

Segment operating profit

33.2

1.2

−

13.4

0.3

2.9

−

51.0

Non-segment

(17.0)

−

(1.1)

−

−

10.5

−

(7.6)

Operating profit

$

16.2

1.2

(1.1)

13.4

0.3

13.4

−

43.4

Amounts attributable to Brink’s:

Income from continuing operations

$

2.1

1.3

(1.1)

8.4

0.2

8.4

(2.2)

17.1

Diluted EPS - continuing operations

0.04

0.02

(0.02)

0.17

−

0.17

(0.04)

0.35

Non-GAAP Reconciliations - 1Q13

Amounts may not add due to rounding.

19

GAAP

Basis

Basis

Additional

European

Operations to

be Exited (a)

European

Operations to

be Exited (a)

Gains and Losses

on Acquisitions and

Dispositions (b)

on Acquisitions and

Dispositions (b)

Employee Benefit

Settlement &

Severance Losses (c)

Settlement &

Severance Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

First Quarter 2012

Revenue:

Latin America

$

386.3

−

−

−

−

−

386.3

EMEA

280.4

(3.8)

−

−

−

−

276.6

Asia Pacific

37.6

−

−

−

−

−

37.6

International

704.3

(3.8)

−

−

−

−

700.5

North America

236.4

−

−

−

−

−

236.4

Revenues

$

940.7

(3.8)

−

−

−

−

936.9

Operating profit:

International

$

65.2

1.2

−

0.8

−

−

67.2

North America

5.8

−

−

−

2.2

−

8.0

Segment operating profit

71.0

1.2

−

0.8

2.2

−

75.2

Non-segment

(24.3)

−

−

−

14.7

−

(9.6)

Operating profit

$

46.7

1.2

−

0.8

16.9

−

65.6

Amounts attributable to Brink’s:

Income from continuing operations

$

20.9

1.3

(1.2)

0.6

10.2

0.8

32.6

Diluted EPS - continuing operations

0.43

0.02

(0.02)

0.01

0.21

0.02

0.67

Non-GAAP Reconciliations - 1Q12

Amounts may not add due to rounding. See page 21 for notes.

20

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet requirements to be classified as discontinued operations.

(b) To eliminate:

• Gains related to the sale of investments in mutual fund securities ($1.9 million in the first quarter and $0.5 million in the third quarter). Proceeds from the sales were used to fund the settlement

of pension obligations related to our former chief executive officer and chief administrative officer.

of pension obligations related to our former chief executive officer and chief administrative officer.

• Gains and losses related to business acquisitions and dispositions. A $0.9 million gain was recognized in the second quarter and a $0.1 million loss was recognized in the third quarter. In the

fourth-quarter of 2012, tax expense included a benefit of $7.5 million related to a reduction in an income tax accrual established as part of the 2010 acquisition of subsidiaries in Mexico, and

pretax income included a $2.1 million favorable adjustment to the local profit sharing accrual as a result of the change in tax expectation.

fourth-quarter of 2012, tax expense included a benefit of $7.5 million related to a reduction in an income tax accrual established as part of the 2010 acquisition of subsidiaries in Mexico, and

pretax income included a $2.1 million favorable adjustment to the local profit sharing accrual as a result of the change in tax expectation.

• Third quarter gain on the sale of real estate in Venezuela ($7.2 million).

• Selling costs related to certain operations expected to be sold in the near term and costs related to an acquisition completed in first quarter 2013. A $0.8 million loss was recognized in the fourth

quarter.

quarter.

(c) To eliminate employee benefit settlement and acquisition-related severance losses (Mexico and Argentina). Employee termination benefits in Mexico are accounted for under FASB ASC

Topic 715, Compensation - Retirement Benefits.

Topic 715, Compensation - Retirement Benefits.

(d) To eliminate expenses related to U.S. retirement plans.

(e) To eliminate tax benefit related to change in retiree health care funding strategy.

(f) To adjust effective income tax rate in the interim period to be equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate for 2012 was 36.3%.

Non-GAAP Reconciliations - Full Year 2012

GAAP

Basis

Basis

Additional

European

Operations to

be Exited (a)

European

Operations to

be Exited (a)

Gains and

Losses on

Acquisitions &

Dispositions (b)

Losses on

Acquisitions &

Dispositions (b)

Employee Benefit

Settlement &

Severance

Losses (c)

Settlement &

Severance

Losses (c)

U.S.

Retirement

Plans (d)

Retirement

Plans (d)

Tax Benefit on

change in health

Care Funding

Strategy (e)

change in health

Care Funding

Strategy (e)

Adjust

Income Tax

Rate (f)

Income Tax

Rate (f)

Non-

GAAP

Basis

GAAP

Basis

Full Year 2012

Revenue:

Latin America

$

1,579.4

−

−

−

−

−

−

1,579.4

EMEA

1,158.4

(15.4)

−

−

−

−

−

1,143.0

Asia Pacific

158.9

−

−

−

−

−

−

158.9

International

2,896.7

(15.4)

−

−

−

−

−

2,881.3

North America

945.4

−

−

−

−

−

−

945.4

Revenues

$

3,842.1

(15.4)

−

−

−

−

−

3,826.7

Operating profit:

International

$

227.6

5.4

(8.5)

3.9

−

−

−

228.4

North America

32.5

−

−

−

8.8

−

−

41.3

Segment operating profit

260.1

5.4

(8.5)

3.9

8.8

−

−

269.7

Non-segment

(88.9)

−

(0.8)

−

47.4

−

−

(42.3)

Operating profit

$

171.2

5.4

(9.3)

3.9

56.2

−

−

227.4

Amounts attributable to Brink’s:

Income from continuing operations

$

106.8

5.7

(14.0)

2.8

33.8

(21.1)

−

114.0

Diluted EPS - continuing operations

2.20

0.12

(0.29)

0.06

0.70

(0.43)

−

2.35

Amounts may not add due to rounding.

21

Non-GAAP Reconciliations - Cash Flows

22

(a) To eliminate the change in the balance of customer obligations related to cash received and processed in certain of our secure Cash

Management Services operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to

customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our

liquidity and capital resources.

Management Services operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to

customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our

liquidity and capital resources.

(b) To eliminate cash flows related to our discontinued operations.

Non-GAAP cash flows from operating activities is a supplemental financial measure that is not required by, or presented in accordance with GAAP.

The purpose of the non-GAAP cash flows from operating activities is to report financial information excluding the impact of cash received and

processed in certain of our secure cash management service operations and without cash flows from discontinued operations. Brink’s believes

these measures are helpful in assessing cash flows from operations, enable period-to-period comparability and are useful in predicting future

operating cash flows. Non-GAAP cash flows from operating activities should not be considered as an alternative to cash flows from operating

activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows.

NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES - RECONCILED TO AMOUNTS REPORTED UNDER U.S. GAAP | ||||||

First Quarter | ||||||

2013 | 2012 | |||||

Cash flows from operating activities - GAAP | $ | 3.3 | $ | (16.4) | ||

Decrease (increase) in certain customer obligations (a) | (16.8) | 18.8 | ||||

Cash outflows (inflows) related to discontinued operations (b) | 7.1 | 6.6 | ||||

Cash flows from operating activities - Non-GAAP | $ | (6.4) | $ | 9.0 | ||

NET DEBT RECONCILED TO GAAP | March 31, | December 31, | ||||||

2013 | 2012 | |||||||

Debt: | ||||||||

Short-term debt | $ | 71.1 | 26.7 | |||||

Long-term debt | 438.6 | 362.6 | ||||||

Less: | ||||||||

Cash and cash equivalents | 234.8 | 201.7 | ||||||

Cash and cash equivalents available for general corporate purposes | 174.2 | 157.7 | ||||||

Net Debt | $ | 335.5 | 231.6 | |||||

(a) Title to cash received and processed in certain of our secure Cash Management Services operations transfers to us for a short period of

time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate

purposes in the management of our liquidity and capital resources and in our computation of Net Debt.

time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate

purposes in the management of our liquidity and capital resources and in our computation of Net Debt.

Net Debt is a supplemental financial measure that is not required by, or presented in accordance with GAAP. We use Net Debt as a measure of

our financial leverage. We believe that investors also may find Net Debt to be helpful in evaluating our financial leverage. Net Debt should not be

considered as an alternative to Debt determined in accordance with GAAP and should be reviewed in conjunction with our consolidated balance

sheets. Set forth above is a reconciliation of Net Debt, a non-GAAP financial measure, to Debt, which is the most directly comparable financial

measure calculated and reported in accordance with GAAP. Net Debt excluding cash and debt in Venezuelan operations was $395 million at

March 31, 2013, and $280 million at December 31, 2012.

Non-GAAP Reconciliations - Net Debt

23