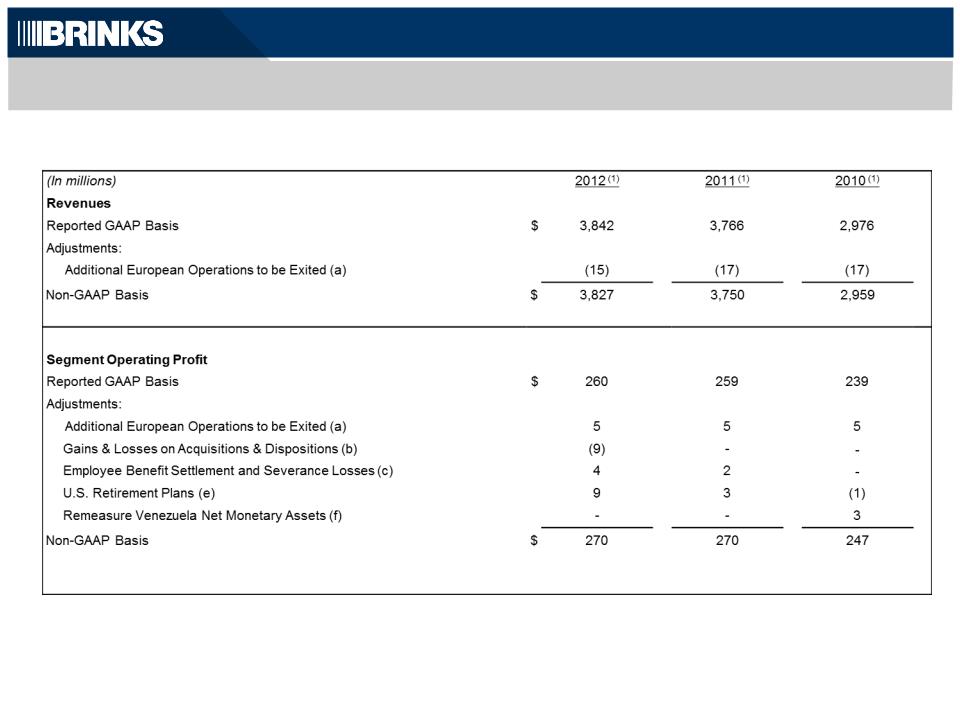

Non-GAAP Results - Reconciled to Amounts Reported under GAAP

20

Non-GAAP results described in this presentation are financial measures that are not required by, or presented in accordance with generally accepted accounting principles

(“GAAP”).

Purpose of Non-GAAP Information

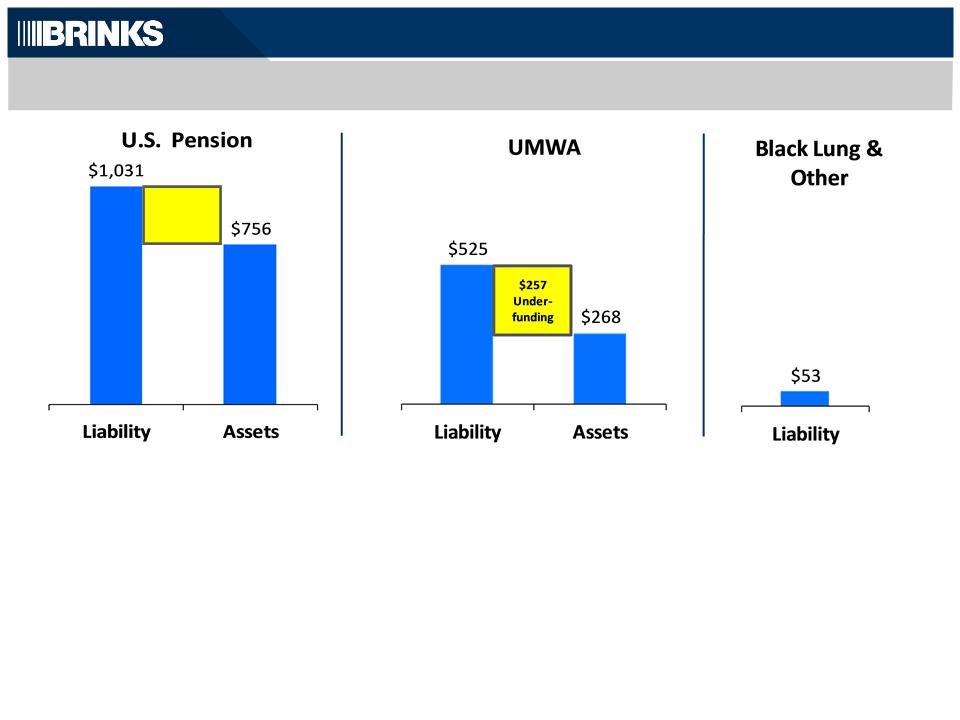

The purpose of the non-GAAP information is to report our financial information

• excluding retirement expenses related to frozen retirement plans and retirement plans from former operations, and

• without certain income and expense items described below in 2010, 2011 and 2012.

The non-GAAP information provides information to assist comparability and estimates of future performance. We believe these measures are helpful in assessing the

performance of our ongoing operations, estimating future results and enabling period-to-period comparability of financial performance. The valuation impact of our legacy

liabilities and related cash outflows can be assessed on a basis that is separate and distinct from ongoing operations. Non-GAAP results should not be considered as an

alternative to revenue, income or earnings per share amounts determined in accordance with GAAP and should be read in conjunction with their GAAP counterparts.

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet requirements to be classified as discontinued operations.

(b) To eliminate gains on acquisitions and dispositions as follows:

| | | 2012 | | 2011 | | 2010 | |

| Sale of real estate in Venezuela | $ | (7) | | - | | - | |

| Sale of U.S. Document Destruction business | | - | | (7) | | - | |

| Bargain Purchase of Mexican CIT business | | - | | (2) | | (5) | |

| Impairment of Cost Method Investment-Mexico | | - | | - | | 14 | |

| Other gains/losses on acquisitions/dispositions-

Segment | | (2) | | - | | - | |

| Other gains/losses on acquisitions/dispositions-

NonSegment | | (1) | | - | | - | |

| Selling costs related to acquisitions/dispositions | | 1 | | - | | - | |

| Sale of former operating assets | | - | | (1) | | - | |

| | $ | (9) | | (10) | | 9 | |

(c) To eliminate employee benefit settlement and acquisition-related severance losses (Mexico and Argentina). Employee termination benefits in Mexico are accounted for

under FASB ASC Topic 715, Compensation - Retirement Benefits.

(d) To eliminate the costs related to the retirement of the former chief executive officer.

(e) To eliminate expenses related to U.S. retirement plans.

(f) To reverse remeasurement gains and losses in Venezuela. For accounting purposes, Venezuela is considered a highly inflationary economy. Under U.S. GAAP,

subsidiaries that operate in Venezuela record gains and losses in earnings for the remeasurement of bolivar fuerte-denominated net monetary assets.

(g) To eliminate royalty income from former home security business.