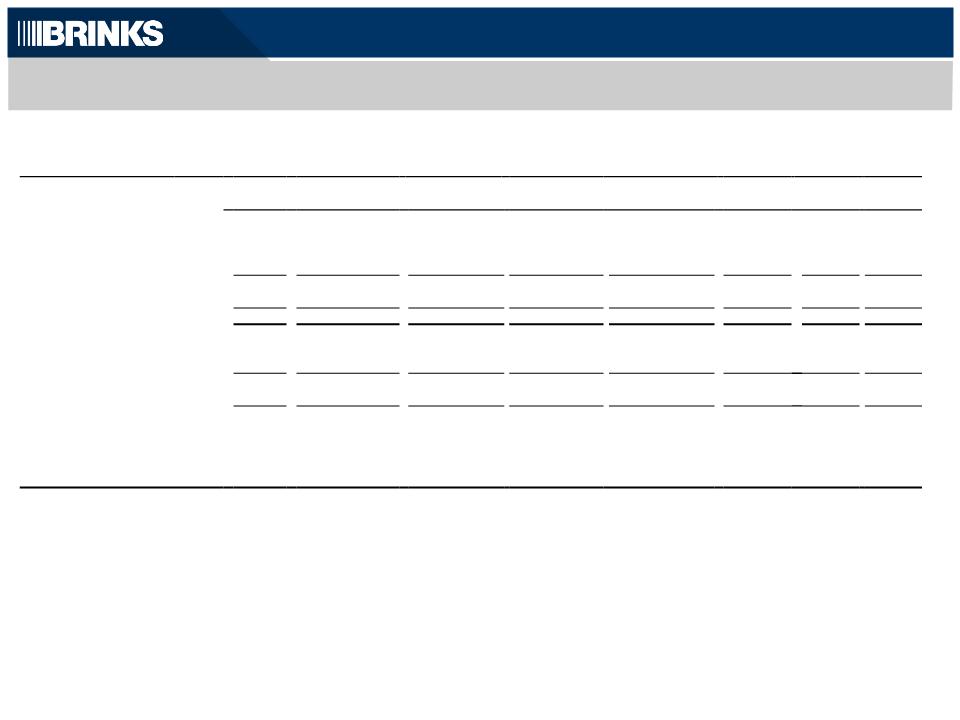

(a) To eliminate results of additional European operations we intend to exit in 2013. Operations do not currently meet requirements to be classified as discontinued operations.

(b) To eliminate:

• Gains related to the sale of investments in mutual fund securities ($1.9 million in the first quarter and $0.5 million in the third quarter). Proceeds from the sales were used to fund the settlement

of pension obligations related to our former chief executive officer, and former chief administrative officer.

• Gains and losses related to business acquisitions and dispositions. A $0.9 million gain was recognized in the second quarter and a $0.1 million loss was recognized in the third quarter. In the

fourth quarter of 2012, tax expense included a benefit of $7.5 million related to a reduction in an income tax accrual established as part of the 2010 acquisition of subsidiaries in Mexico, and

pretax income included a $2.1 million favorable adjustment to the local profit sharing accrual as a result of the change in tax expectation.

• Third-quarter gain on the sale of real estate in Venezuela ($7.2 million).

• Selling costs related to certain operations expected to be sold in the near term and costs related to an acquisition completed in first quarter 2013. A $0.8 million loss was recognized in the fourth

quarter.

(c) To eliminate employee benefit settlement and acquisition-related severance losses (Mexico and Argentina). Employee termination benefits in Mexico are accounted for under FASB ASC

Topic 715, Compensation - Retirement Benefits.

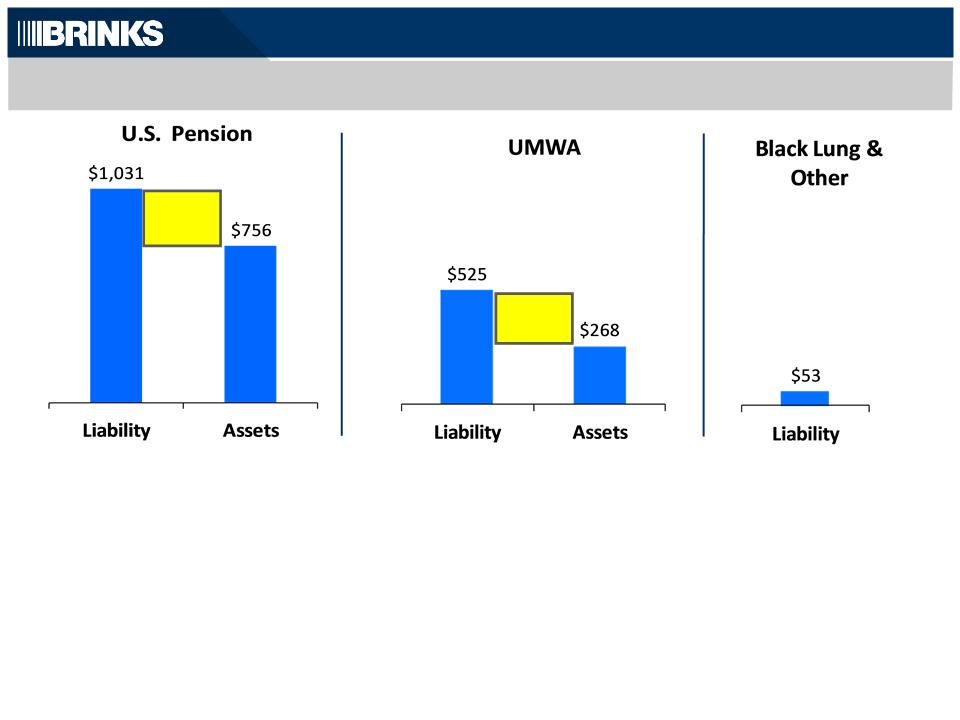

(d) To eliminate expenses related to U.S. retirement plans.

(e) To eliminate tax benefit related to change in retiree health care funding strategy.

(f) To adjust effective income tax rate in the interim period to be equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate for 2012 was 36.2%.

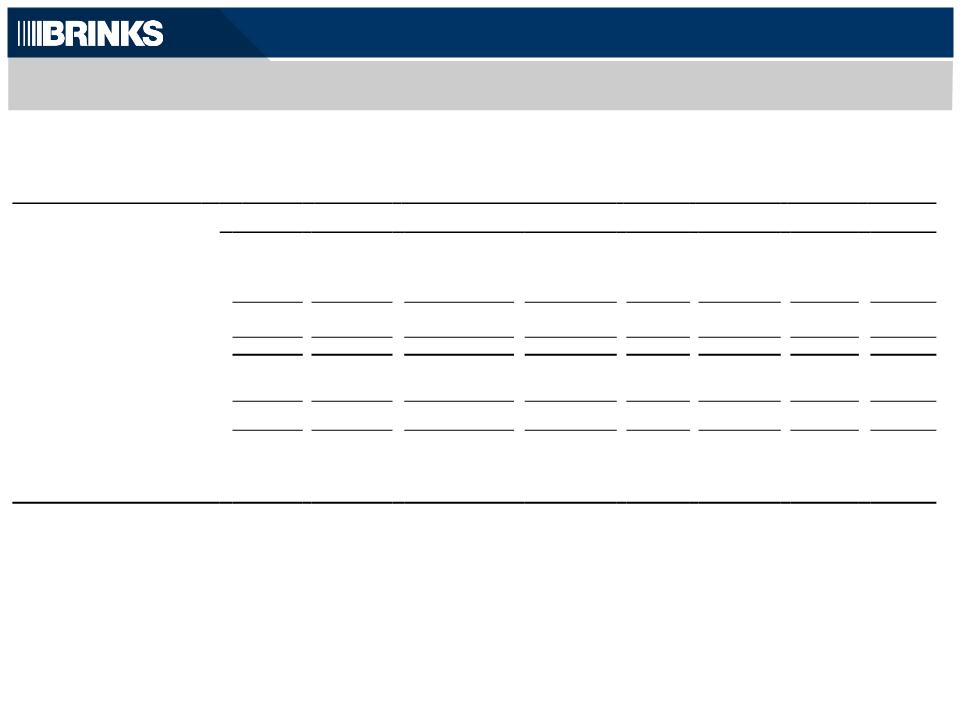

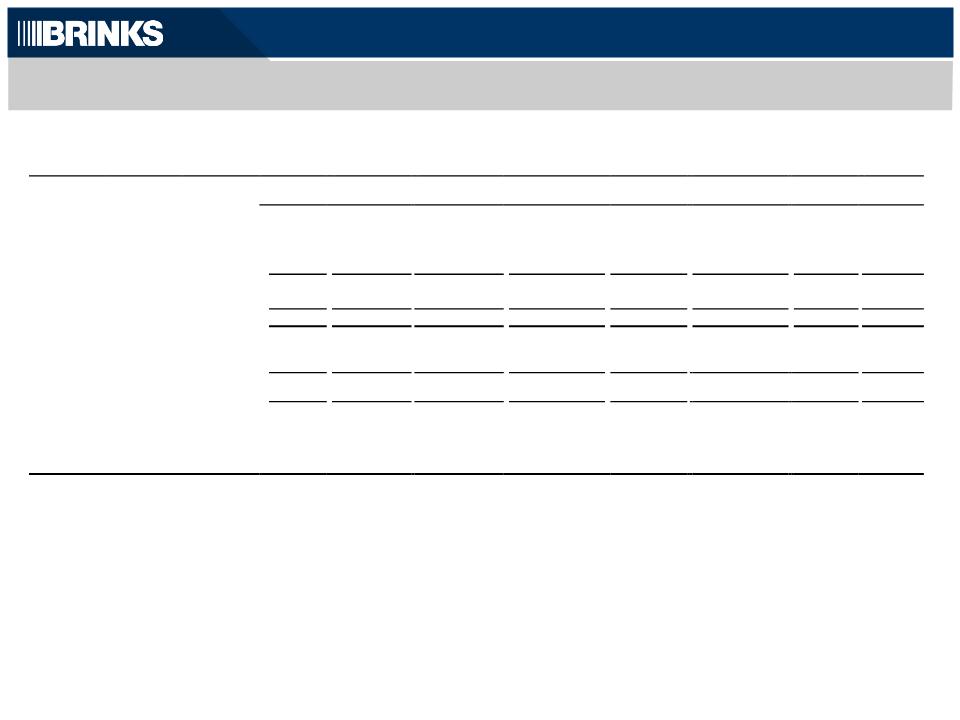

Non-GAAP Reconciliations - Full-Year 2012

GAAP

Basis

Additional

European

Operations to

be Exited (a)

Gains and

Losses on

Acquisitions &

Dispositions (b)

Employee Benefit

Settlement &

Severance

Losses (c)

U.S.

Retirement

Plans (d)

Tax Benefit on

change in Health

Care Funding

Strategy (e)

Adjust

Income Tax

Rate (f)

Non-

GAAP

Basis

Full Year 2012

Revenue:

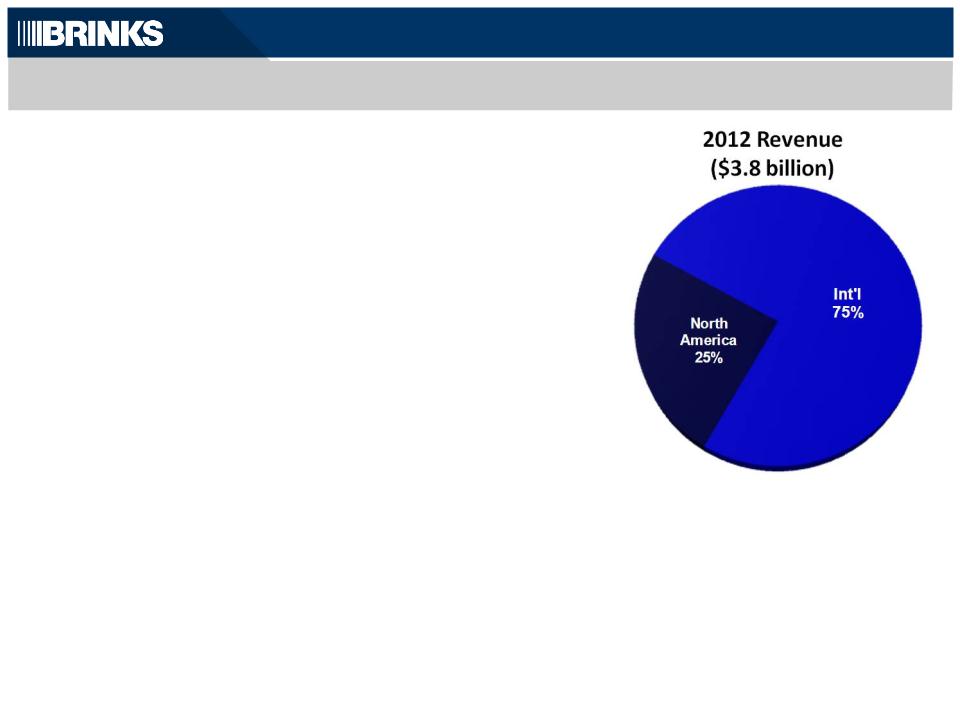

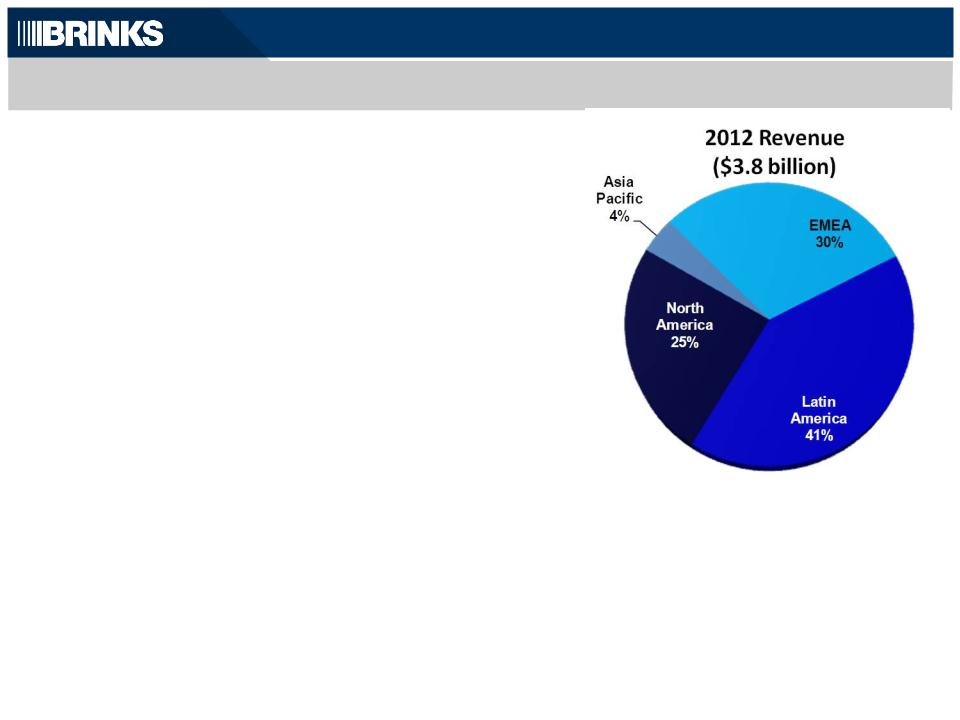

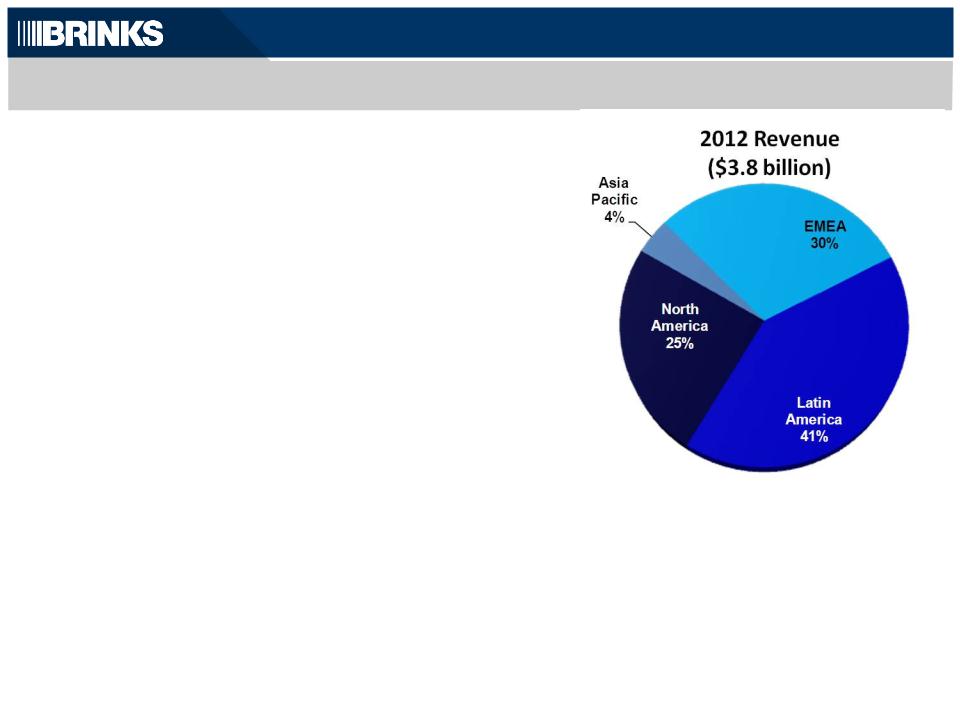

Latin America

$

1,579.4

−

−

−

−

−

−

1,579.4

EMEA

1,135.1

(9.2)

−

−

−

−

−

1,125.9

Asia Pacific

158.9

−

−

−

−

−

−

158.9

International

2,873.4

(9.2)

−

−

−

−

−

2,864.2

North America

945.4

−

−

−

−

−

−

945.4

Revenues

$

3,818.8

(9.2)

−

−

−

−

−

3,809.6

Operating profit:

International

$

229.8

3.6

(8.5)

3.9

−

−

−

228.8

North America

32.5

−

−

−

8.8

−

−

41.3

Segment operating profit

262.3

3.6

(8.5)

3.9

8.8

−

−

270.1

Non-segment

(88.9)

−

(0.8)

−

47.4

−

−

(42.3)

Operating profit

$

173.4

3.6

(9.3)

3.9

56.2

−

−

227.8

Amounts attributable to Brink’s:

Income from continuing operations

$

109.1

3.9

(14.0)

2.8

33.8

(21.1)

−

114.5

Diluted EPS - continuing operations

2.24

0.08

(0.29)

0.06

0.70

(0.43)

−

2.36

Amounts may not add due to rounding.

22